RISK MEASURE ESTIMATION ON FIEGARCH PROCESSES

Abstract

We consider the Fractionally Integrated Exponential Generalized Autoregressive Conditional Heteroskedasticity process, denoted by FIEGARCH, introduced by Bollerslev and Mikkelsen (1996). We present a simulated study regarding the estimation of the risk measure on FIEGARCH processes. We consider the distribution function of the portfolio log-returns (univariate case) and the multivariate distribution function of the risk-factor changes (multivariate case). We also compare the performance of the risk measures and MaxLoss for a portfolio composed by stocks of four Brazilian companies.

Mathematics Subject Classification (2000). Primary 60G10, 62G05, 62G35, 62M10, 62M15; Secondary 62M20.

Keywords. Long Memory Models, Volatility, Risk Measure Estimation, FIEGARCH Processes.

1 Introduction

In financial terms, risk is the possibility that an investment will have a return different from the expected, including the possibility of losing part or even all the original investment. A portfolio is a collection of investments maintained by an institution or a person. In this paper portfolio will be used to indicate a collection of stocks. The selection of an efficient portfolio is an important issue and it is discussed in Prass and Lopes (2009). The authors consider an approach based in the mean-variance (MV) method introduced by Markowitz (1952).

In finance one of the most important problems is risk management, which involves risk measures estimation. Among the applications of a risk measure we can say that it can be used to determine the capital in risk, that is, we can measure the exposure to the risks of a financial institution, in order to determine the necessary amount to honour possible unexpected losses. A more detailed study on quantitative risk management, including theoretical concepts and practical examples, can be found in MacNeil et al. (2005).

Financial time series present an important characteristic known as volatility, which can be defined in different ways but it is not directly observable. In financial terms, the volatility is associated to the risk of an asset. The volatility can be seen as the statistic measure of the possibility that the value of an asset will significantly increase or decrease, several times, in a given period of time. As a risk measure, the volatility can be calculated by different approaches. The most common one, but not unique, is to use the variance (or the standard deviation) of the historical rentability of a given investment.

In order to model time series, in the presence of volatility clusters, heteroskedastic models need to be considered. This class of models consider the variance as a function not only of the time but also of the past observations. The fitted models are then used to estimate the (conditional) mean and variance of the process and these values in turn are used in several risk measures estimation.

Among the most used non-linear models we find the ARCH-type model (Autoregressive Conditional Heteroskedasticity) and its extension. Such models are used to describe the conditional variance of a time series. The ARCH models were introduced by Engle (1982). The main assumption of the model is that the random variables are not correlated, but the conditional variance depends on the square of the past values of the process. This model was generalized by Bollerslev (1986) with the introduction of the GARCH models (Generalized ARCH). In this model the conditional variance depends not only on the past values of the process but also on the past values of the conditional variance.

ARCH and GARCH models appear frequently in the literature due to their easy implementation. However, this class of models present a drawback. These models do not take into account the signal of the process , since the conditional variance is a quadratic function of those values. In order to deal with this problem, Nelson (1991) introduced the EGARCH models (Exponential GARCH). As in the linear case, where the ARFIMA models are presented as a generalization of ARMA models, in the non-linear case the FIGARCH models (Fractionally Integrated GARCH), introduced by Baillie et al. (1996) and FIEGARCH models (Fractionally Integrated EGARCH), introduced by Bollerslev and Mikkelsen (1996), appear to generalize the GARCH and EGARCH models, respectively. A study on ARFIMA and FIEGARCH models, among other non-linear processes, can be found in Lopes (2008) and Lopes and Mendes (2006).

Lopes and Prass (2009) present a theoretical study on FIEGARH process and data analysis. The authors present several properties of these processes, including results on their stationarity and their ergodicity. It is shown that the process , in the definition of FIEGARCH processes, is a white noise and from this result the authors prove that if is a FIEGARCH process then, is an ARFIMA process. Also, under mild conditions, is an ARFIMA process with non-Gaussian innovations. Lopes and Prass (2009) also analyze the autocorrelation and spectral density functions decay of the process and the convergence order for the polynomial coefficients that describes the volatility.

The most used methodology to calculate risk measures is based on the assumption that the distribution of the data is Gaussian. A drawback present in this method is that the distribution function of financial series usually present tails heavier than the normal distribution. A very well known risk measure is the Value-at-Risk (. Nowadays it has being changed but the most used methods to estimate the consider the Gaussian assumption. Khindanova and Atakhanov (2002) present a comparison study on estimation. The authors consider the Gaussian, empirical and stable distributions. The study demonstrates that stable modeling captures asymmetry and heavy-tails of returns, and, therefore, provides more accurate estimates of . It is also known that, even considering heavier tail distributions, the risk measures are underestimated for events with small occurrence probability (extreme events). Embrechts et al. (1997) present ideas on the modeling of extremal events with special emphasis on applications to insurance and finance.

Another very common approach is to consider the scenario analysis. Usually one does not make any assumption on the data distribution. Since this analysis does not provide information on an event probability, it should be used as a complementary tool to other risk measure estimation procedures. Even though the scenarios need to be chosen in such a way that they are plausible and for that it is necessary to have an idea of the occurrence probability for each scenario. The maximum loss, denoted by MaxLoss, introduced by Studer (1997), can be viewed either as risk measure or as a systematic way to perform a stress test (scenario analysis). In a portfolio analysis, this risk measure can be interpreted as the worst possible loss in the portfolio value.

2 FIEGARCH Process

Financial time series present characteristic common to another time series such as, trend, seasonality, outliers and heteroskedasticity. However, empirical studies show that return (or log-return) series present some stylized facts. We can say that the return series are not i.i.d. although they show little serial correlation, while the series of absolute or squared returns show profound serial correlation, the conditional expected returns are close to zero, volatility appears to vary over time, return series are leptokurtic (or heavy-tailed) and extreme returns appear in clusters. Due to these characteristics, modeling these time series require considering a class of non-linear heteroskedastic models. In this section we present the Fractionally Integrated Exponential Generalized Autoregressive Conditional Heteroskedasticity process, denoted by FIEGARCH. This class of processes, introduced by Bollerslev and Mikkelsen (1996), describes the volatility varying on time, volatility clusters (known as ARCH and GARCH effects), volatility long-range dependence and also asymmetry.

Definition 2.1.

Let be a stochasric process. Then, is a Fractionally Integrated EGARCH process, denoted by FIEGARCH, if and only if,

| (2.1) | |||||

| (2.2) |

where , is a process of i.i.d. random variables with zero mean and variance equal to one, and are the polynomials defined by and with , , for all such that . The function is defined by

| (2.3) |

and the operator is defined as where and

Remark 2.1.

If , in expression (2.2), we have an EGARCH model.

Some properties of the process can be found in Lopes and Prass (2009). The authors present a theoretical study on the FIEGARCH process properties, including results on their stationarity and their ergodicity. The authors also show that the process is a white noise and use this result to prove that if is a FIEGARCH process then, is an ARFIMA process. Moreover, under mild conditions, is an ARFIMA process with non-Gaussian innovations. The autocorrelation and spectral density functions decay of the process and the convergence order for the polynomial coefficients that describes the volatility are also analyzed in Lopes and Prass (2009).

In the literature one can find different definitions of FIEGARCH processes. Definition 2.1 is the same as in Bollerslev and Mikkelsen (1996). In Zivot and Wang (2005), expression (2.2) is replaced by expression (2.4) in the definition of a FIEGARCH process. The following proposition shows that, under the restrictions given in (2.5), expressions (2.4) and (2.2) are equivalent. This result is crucial for a Monte Carlo simulation study (see Section 4).

Proposition 2.1.

| (2.4) |

| (2.5) |

Proof: See Lopes and Prass (2009).∎

Clearly the definition given by Zivot and Wang (2005) is more general than the one presented by Bollerslev and Mikkelsen (1996). In fact, in the definition given by Zivot and Wang (2005), the coefficients and , for , do not necessarily satisfy the restrictions given in (2.5).

3 Risk Measures

In this section we present the concept of risk factor, loss distribution and the definition of some risk measures and some approaches for estimating them. We also show that different approaches can lead to equivalent results depending on the assumptions made.

Risk measures are directly related to risk management. McNeil et al. (2005) classify the existing approaches to measuring the risk of a financial position in four different groups: Notional-amount approach, Factor-sensitivity measures, Risk measures based on loss distribution and Scenario-based risk measures (see McNeil et al., 2005, page 34). A frequent concept associated to risk is the volatility, which can have different definitions. The most common approach is to define the volatility as the variance (or the conditional variance) of the processes. In this paper we focus our attention to the variance, the Value-at-Risk ( and Expected Shortfall (, which are risk measures based on loss distributions, and the Maximum-loss, a scenario-based risk measure.

Risk Factors

Consider a given portfolio and denote its value at time by (we assume that is known at time ). For a given time horizon we denote by the loss of the portfolio in the period , that is, . The distribution of the random variables is termed loss distribution. In risk management, the main concern is to analyze the probability of large losses, that is, the right tail of the loss distribution.

The usual approach is to assume that the random variable , for all , is a function of time and an -dimensional random vector of risk factors, that is, , for some measurable function . Since we assume that the risk factors are observable, is known at time . The choice of the risk factors and of the function is a modeling issue and depends on the portfolio and on the desired level of accuracy.

Remark 3.1.

The random vector is also called a scenario which describes the situation of the market and, consequently, is referred to as the value of the portfolio under the scenario .

In some cases it is more convenient to consider instead the time series of risk-factors change . This time series is defined by , for all . For instance, if we consider a portfolio with stocks and , where is the price of the -th asset at time , then is the vector of log-returns. In this case, for , the value of the portfolio can be written as , where is known at time . The loss distribution is then determined by risk-factor change distribution.

3.1 Risk Measures Based on Loss Distributions

The variance of the loss distribution is one of the most used risk measures. However, as a risk measure, the variance presents two problems. First of all one needs to assume that the loss distribution has finite second moment. Moreover, this measure does not distinguish between positive and negative deviations of the mean. Therefore, the variance is a good risk measure only for distributions that are (approximately) symmetric, such as the Gaussian or t-Student (with finite variance) distributions.

Another common approach is the quantile analysis of the loss distribution. Consider a portfolio with some risky assets and a fixed time horizon . Let be the distribution of the associated loss. The main idea is to define a statistic based on capable of measuring the risk of the portfolio over a period . Since for several models the support of is unbounded, the natural candidate (which is the maximum possible loss), given by , is not the best choice. The idea is to consider instead the “maximum loss which is not exceeded with a high probability”. This probability is called confidence level.

Definition 3.1.

Let be a fixed portfolio. Given a confidence level p , the Value-at-Risk of the portfolio, denoted by , is defined as

| (3.1) |

In a probabilistic sense, is the p-quantile of the loss distribution function. For practical purposes, the most commonly used values are p and days.

As mentioned before, the risk analysis by considering the variance presents some drawbacks and so does the . Artzner et al. (1999) define coherent risk measures and show that the does not satisfy the subadditivity axiom. That is, given a fixed number of portfolios, the of the sum of the portfolios may not be bounded by the sum of the of the individual portfolios. This result contradicts the idea that the risks can be decreased by diversification, that is, by buying or selling financial assets.

In the following definition we present a coherent risk measure in the sense of Artzner et al. (1999) definition.

Definition 3.2.

Let be a loss with distribution function , such that . The Expected Shortfall, denoted by , at confidence level p , is defined as

where is the quantile function defined as .

The risk measures and are related by the expression

and it can be shown that, if is integrable, with continuous distribution function , then (see McNeil et al., 2005).

Remark 3.2.

In the literature one can find variations for the risk measure given in the Definition 3.2, such as tail conditional expectation (TCE), worst conditional expectation (WCE) and conditional VaR (CVaR). Besides having slightly different definitions, all these risk measures are equivalent when the distribution function is continuous.

In practice, in order to calculate the and values, one needs to estimate the loss distribution function . Obviously, the use of different methods to estimate will lead to different values of those measures. The most common approaches to calculate the are:

-

1.

Empirical VaR. This is a non-parametric approach. The empirical is the p-quantile of the empirical distribution function of the data. Under this approach, the of periods is the same as the of 1 period.

-

2.

Normal VaR or Variance-Covariance Method. Under this approach we assume that the data is normally distributed with mean and variance constants. The is then the p-quantile of the Gaussian distribution. The mean and the variance (or the covariance matrix if the data is multidimensional) are estimated by their sample counter parts. For this approach it is also very common to assume that the conditional distribution function of the data is Gaussian instead of the distribution function itself.

-

3.

RiskMetrics Approach. This methodology was developed by J.P. Morgan and it considers the conditional distribution function of the data. Consider first the case in which the portfolio has only one asset. Let be the return (or log-return) of the portfolio at time (the loss is then ). The methodology assumes that

where the conditional mean and variance are such that

(3.2) that is, follows an exponentially weighted moving average (EWMA) model (see Roberts, 1959). Then, the at time , is the p-quantile of the Gaussian distribution with mean and variance .

It can be shown that, using this method, the for a period is given by where is the standard Gaussian distribution function and is defined by the expression (3.2). It is easy to see that . However, if , in expression (3.2), this equality no longer holds.

The multivariate case assumes that the conditional distribution function of the data is a multivariate normal one and is estimated by the expression

For more details see Zangari (1996).

-

4.

Econometric Approach. This approach is similar to the RiskMetrics one. However, in this case, a more general class of models is considered. Generally, the time series mean is modeled by a linear model, such as the ARMA model, and the volatility is estimated by using a heteroskedastic model such as the FIEGARCH model defined in Section 2.

In the following proposition we present an expression for under the normality assumption.

Proposition 3.1.

Let be the random variable which represents the portfolio loss. If has Gaussian distribution function with mean and variance then,

where and are, respectively, the density and the distribution function of a standard normal random variable.

Proof: By setting and noticing that , the proof follows directly from the fact that and . ∎

3.2 A Scenario Based Risk Measure

The maximum loss, denoted by MaxLoss, introduced by Studer (1997), can be viewed either as a risk measure or as a systematic way of performing a stress test. This risk measure can be viewed as the worst possible loss. In many cases, the worst scenario may not exist since the function to calculate the value of a portfolio may be unbounded from below. It is known that the probability of scenarios occurrence which are very far away from the present market state is very low. Therefore, the idea is to restrict attention to scenarios under a certain admissibility domain, also denominated by confidence region, that is, a certain set of scenarios with high probability of occurrence. For example, if we assume that the data has an elliptic distribution function, such as the t-Student or the Gaussian distribution, then the admissibility domain is an ellipsoid (see Studer, 1997).

Definition 3.3.

Given an admissibility domain , the maximum loss of a portfolio contained in is given by

where is the function that determines the portfolio’s price and the vector represents the risk factors for the current market situation.

The maximum loss is a coherent risk measure in the same sense as defined by Artzner et al. (1999). Furthermore, the maximum loss gives not only the loss dimension but also the scenario in which this loss occurs.

Remark 3.3.

-

(i)

Note that, in order to compute the maximum loss, we need to set a closed confidence region , with a certain probability p of occurrence. Then, an equivalent definition of maximum loss is the following

-

(ii)

Since gives the portfolio value, the expression represents the loss (or if is measured previously to ) in the portfolio.

A portfolio is called linear if the loss is a linear function with respect to each one of the risk-factors change. The following theorem gives the expression of the MaxLoss for a linear portfolio with risk-factors change normally distributed.

Theorem 3.1.

Let be a linear portfolio and be the function that determines the portfolio value. Then, , where is a vector of real constants and , is the vector of risk-factors change. It follows that, given a confidence level p, the maximum loss of the portfolio is given by

| (3.3) |

where is the covariance matrix of the risk-factors change and is the p-quantile distribution function with degrees of freedom. Moreover, the worst scenario is given by

Proof: See Theorem 3.15 in Studer (1997). ∎

Remark 3.4.

Studer (1997) considers the Profit and Loss distribution (P&L), which is the distribution of the random variable , instead of the loss distribution. However, both analysis lead to similar results. The only difference is which tail of the distribution is being analyzed. Considering this fact, notice that expression (3.3) is very similar to the expression for the Normal which is ; the only difference lies in the scaling factor: is the p-quantile of a distribution with degrees of freedom, whereas is the p-quantile of a standard normal distribution. Contrary to the MaxLoss depends on the number of risk factors used in the model.

4 Simulation

In this section we present a simulation study related to the estimation of the volatility of the risk measures on FIEGARCH processes. A theoretical study related to the generation and the estimation of FIEGARCH processes, considering the same set of parameters used here, can be found in Lopes and Prass (2009).

The simulation study considers five different models and the generated time series are the same ones used in Lopes and Prass (2009). The representation of the FIEGARCH process is the one proposed by Bollerslev and Mikkelsen (1996), given in Definition 2.1, where , for . For each model we consider replications, with sample size . The value was chosen since this is the approximated size of the observed time series considered in Section 5 of this paper. The value was chosen to analyze the asymptotic properties for the estimators. In the following, M, for , denotes the simulated FIEGARCH model, that is,

| M1: FIEGARCH(0,0.45,1) | M2: FIEGARCH(1,0.45,1) | M3: FIEGARCH(0,0.26,4) |

| M4: FIEGARCH(0,0.42,1) | M5: FIEGARCH(0,0.34,1) |

The parameters of the models used in the simulation study, are given in Table 4.1. These values are similar to those found in the analysis of the observed time series (see Section 5).

| Model | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| M1 | 0.00 | 0.45 | - | - | - | - | -0.14 | 0.38 | 0.45 |

| M2 | 0.00 | 0.90 | - | - | - | 0.80 | 0.04 | 0.38 | 0.45 |

| M3 | 0.00 | 0.22 | 0.18 | 0.47 | -0.45 | - | -0.04 | 0.40 | 0.26 |

| M4 | 0.00 | 0.58 | - | - | - | - | -0.11 | 0.33 | 0.42 |

| M5 | 0.00 | 0.71 | - | - | - | - | -0.17 | 0.28 | 0.34 |

4.1 Volatility Estimation

In order to estimate the volatility Lopes and Prass (2009) used the fgarch function (from the S-Plus) to fit the FIEGARCH models to the generated time series. The S-Plus code consider the expression (2.4) instead. For each time series only the first values are considered, where is the sample size. The remaining final values are used to estimate the forecast error values. The mean square error () is defined by where is the number of replications and represents the estimation error for the parameter , where is any parameter given in Table 4.1. For each model, the final value was obtained from the expression where is the -th estimator for in the -th replication, for .

Lopes and Prass (2009) compare the mean of generated values of (a known parameter) and , with the mean of the -step ahead forecast values and , by calculating the mean square error () values, for , , and . The authors observed that the higher the sample size, the higher the mean square forecast error. For (the square root of the volatility) the mean square forecast error values vary from to and, for , they vary from to .

4.2 Estimation

In the following we present estimation results of the risk measure for the generated time series.

In order to calculate the conditional mean and the conditional variance we use the first values of the generated time series, where is the sample size. For each one of the replications we used the approaches described in Subsection 3.1 to obtain the estimated For the Econometric approach we consider EGARCH models, with and the FIEGARCH fitted to the time series in Lopes and Prass (2009), considering the same values of and used to generate the time series.

Remark 4.1.

Since , for , the true value of the , where stands for the model and for the period, is given by

| (4.1) |

where , is the standard normal distribution function and is the value of the conditional variance (volatility) generated by the model M, for .

Table 4.2 presents the true value, given by expression (4.1), and the estimated values of the risk measure for . The values in this table are the mean taken over 1000 replications and . The values for appear in parenthesis and represents the mean square error value. By comparing the different approaches, we observe that the mean of the estimated values are very close from each other. In all cases, the mean of the estimated values is higher than the mean for the true value of this risk measure, either for or . Also, there is little difference between the mean square error values when the sample size vary from to . In most cases, the empirical approach leads to estimators with higher mean square error values. However, there is little difference among the values from the Econometric and Normal approaches. Generally, those two approaches present better results than the RiskMetrics approach.

Lopes and Prass (2009) reported that the parameter estimation for the FIEGARCH models show coefficients with high mean square error values. The results presented in subsection 4.1, show a high mean square error value for the volatility estimation, which was expected since the volatility estimation depends on the parameter estimation value. As a consequence, although the underlying process is a FIEGARCH process, the Econometric approach using this model do not present better results.

| Approach | ||||

| M1; ; ; | ||||

| Empirical | 1.7996 (1.7967) | 0.1378 (0.1287) | 2.8355 (2.8577) | 0.5257 (0.5206) |

| Normal | 1.8458 (1.8433) | 0.1534 (0.1453) | 2.6108 (2.6072) | 0.3051 (0.2895) |

| Risk Metrics | 1.7159 (1.6912) | 0.2386 (0.2270) | 2.4370 (2.4029) | 0.4750 (0.4548) |

| EGARCH | 1.7707 (1.7533) | 0.1722 (0.1521) | 2.5044 (2.4797) | 0.3445 (0.3043) |

| FIEGARCH | 1.7759 (1.7567) | 0.1936 (0.1621) | 2.5117 (2.4845) | 0.3872 (0.3243) |

| M2; ; ; | ||||

| Empirical | 1.7773 (1.7689) | 0.1014 (0.1094) | 2.7020 (2.7229) | 0.3285 (0.3625) |

| Normal | 1.8004 (1.7938) | 0.1077 (0.1170) | 2.5462 (2.5369) | 0.2152 (0.2337) |

| Risk Metrics | 1.7287 (1.7192) | 0.1353 (0.1352) | 2.4425 (2.4291) | 0.2694 (0.2697) |

| EGARCH | 1.7494 (1.7342) | 0.0925 (0.0902) | 2.4743 (2.4527) | 0.1850 (0.1805) |

| FIEGARCH | 1.7499 (1.7439) | 0.1035 (0.1114) | 2.4749 (2.4664) | 0.2071 (0.2228) |

| M3; ; ; | ||||

| Empirical | 1.6852 (1.6968) | 0.0326 (0.0326) | 2.5002 (2.5208) | 0.0965 (0.0967) |

| Normal | 1.7028 (1.7129) | 0.0330 (0.0339) | 2.4086 (2.4224) | 0.0654 (0.0674) |

| Risk Metrics | 1.6864 (1.6805) | 0.0683 (0.0598) | 2.3858 (2.3778) | 0.1349 (0.1190) |

| EGARCH | 1.6886 (1.6976) | 0.0414 (0.0359) | 2.3882 (2.4009) | 0.0828 (0.0717) |

| FIEGARCH | 1.6895 (1.6950) | 0.0466 (0.0382) | 2.3894 (2.3973) | 0.0932 (0.0765) |

| M4; ; ; | ||||

| Empirical | 1.7643 (1.7967) | 0.1194 (0.1197) | 2.7593 (2.8391) | 0.4399 (0.4714) |

| Normal | 1.8064 (1.8383) | 0.1330 (0.1340) | 2.5549 (2.5998) | 0.4016 (0.2667) |

| Risk Metrics | 1.6987 (1.7078) | 0.1958 (0.1901) | 2.4115 (2.4250) | 0.3912 (0.3805) |

| EGARCH | 1.7478 (1.7610) | 0.1327 (0.1314) | 2.4719 (2.4906) | 0.2654 (0.2629) |

| FIEGARCH | 1.7546 (1.7656) | 0.1559 (0.1512) | 2.4816 (2.4971) | 0.3117 (0.3025) |

| M5; ; ; | ||||

| Empirical | 1.8038 (1.8001) | 0.1473 (0.1237) | 2.9232 (2.8391) | 0.6476 (0.5871) |

| Normal | 1.8672 (1.8593) | 0.1708 (0.1464) | 2.6411 (2.6298) | 0.3384 (0.2917) |

| Risk Metrics | 1.7402 (1.7078) | 0.2926 (0.2636) | 2.4790 (2.3665) | 0.5869 (0.5277) |

| EGARCH | 1.7863 (1.7200) | 0.1780 (0.1314) | 2.5264 (2.4906) | 0.3560 (0.2726) |

| FIEGARCH | 1.7959 (1.7242) | 0.2088 (0.1557) | 2.5400 (2.4386) | 0.4176 (0.3114) |

In the following we assume that the simulated time series represent log-returns and we denote by the time series generated from the model M, for where is the sample size.

In practice, the volatility is not observable. Therefore, it is not possible to calculate the true value of the risk measure and the mean square error value for its estimation. Recall that , , represents the maximum loss that can occur with a given probability p in the instant . Also, , can be understood as the loss at time . The usual approach is then to compare estimated values with the value of the observed log-returns (in our case, the simulated time series).

Table 4.3 presents the mean value of (which is known), for and the mean values of the estimated , for , where is the sample size and . We observe that, for each model and each p value, different approaches lead to similar results. In most cases, the value of the risk measure estimated under the RiskMetrics approach presents the smallest mean square error value. Also, the values estimated under this approach are closer to the observed values (the log-returns) than the ones estimated by the Empirical and Normal approaches. By comparing both, the RiskMetrics and Econometric approaches we observe almost no difference between the estimated values. As in the previous case, we need to take into account that the estimation of the FIEGARCH models has strong influence in the results.

| Approach | Empirical | Normal | RiskMetrics | EGARCH | FIEGARCH | |

|---|---|---|---|---|---|---|

| 0.0649 (-0.0185) | p = 0.95 | 4.5099 | 4.6781 | 4.4996 | 3.5713 | 3.6421 |

| (4.7085) | (4.8815) | (4.6719) | (4.8073) | (4.8570) | ||

| p = 0.99 | 4.5099 | 4.6781 | 4.4996 | 3.5713 | 3.6421 | |

| (4.7085) | (4.8815) | (4.6719) | (4.8073) | (4.8570) | ||

| -0.0015 (0.0424) | p = 0.95 | 4.4530 | 4.5403 | 4.5726 | 3.3268 | 3.3688 |

| (4.2751) | (4.3669) | (4.3423) | (4.3238) | (4.4094) | ||

| p = 0.99 | 4.5099 | 4.6781 | 4.4996 | 3.5713 | 3.6421 | |

| (4.7085) | (4.8815) | (4.6719) | (4.8073) | (4.8570) | ||

| -0.0380 (0.0353) | p = 0.95 | 4.0809 | 4.1427 | 4.1591 | 2.9299 | 2.9587 |

| (3.8915) | (3.9452) | (3.9260) | (3.9708) | (3.9892) | ||

| p = 0.99 | 4.5099 | 4.6781 | 4.4996 | 3.5713 | 3.6421 | |

| (4.7085) | (4.8815) | (4.6719) | (4.8073) | (4.8570) | ||

| -0.0369 (-0.0103) | p = 0.95 | 4.6457 | 4.8021 | 4.7666 | 3.4045 | 3.4854 |

| (4.6180) | (4.7760) | (4.7099) | (4.8067) | (4.8756) | ||

| p = 0.99 | 4.5099 | 4.6781 | 4.4996 | 3.5713 | 3.6421 | |

| (4.7085) | (4.8815) | (4.6719) | (4.8073) | (4.8570) | ||

| -0.0589 (0.0525) | p = 0.95 | 4.9339 | 5.1815 | 5.2978 | 3.6491 | 3.7537 |

| (4.3492) | (4.5625) | (4.3588) | (4.3689) | (4.4497) | ||

| p = 0.99 | 4.5099 | 4.6781 | 4.4996 | 3.5713 | 3.6421 | |

| (4.7085) | (4.8815) | (4.6719) | (4.8073) | (4.8570) | ||

Note: The mean square error value is measured with respect to the log-returns instead of the true .

5 Analysis of Observed Time Series

In this section we present the estimation and the analysis of risk measures for a portfolio of stocks. This portfolio is composed by stocks of four Brazilian companies. These assets are denoted by , , where:

: represents the Bradesco stocks. : represents the Brasil Telecom stocks.

: represents the Gerdau stocks. : represents the Petrobrás stocks.

These stocks are negotiated in the Brazilian stock market, that is, in the São Paulo Stock, Mercantile & Futures Exchange (Bovespa). The notation (or, equivalently, ) is used to denote the financial market. The market portfolio values are represented by the São Paulo Stock Exchange Index (Bovespa Index or IBovespa).

Prass and Lopes (2009) present a comparison study on risk analysis using CAPM model, and MaxLoss on FIEGARCH processes. They consider the same portfolio considered here and they also calculate the vector of weights for this portfolio. The same weights found by Prass and Lopes (2009) are considered in this paper, that is, .

In the following we fixed:

-

•

is the number of stocks of the asset , . It follows that , where is the initial capital invested in the portfolio, is the unitary price of the stock at the initial time, and are the weights of the assets. The value of the portfolio , at time , is then given by

where is the sample size;

-

•

for this portfolio we assume that the initial time is the day of the first observation;

-

•

the risk-factors for this portfolio are the logarithm of the prices of the assets. That is, the risk-factors vector is given by

where is the price of the asset , , at time . It follows that the risk-factors change is given by

where , is the log-return of the asset , , at time ;

-

•

the loss of the portfolio , at time , is the random variable given by

(5.1) where is the value of , at time , is the vector of weights, , is the log-return of the asset at time and is the log-return of the portfolio, at time ;

-

•

for and estimation, in all cases (univariate or multivariate), we assume normality (or conditional normality) of the data.

5.1 Characteristics of the Observed Time Series

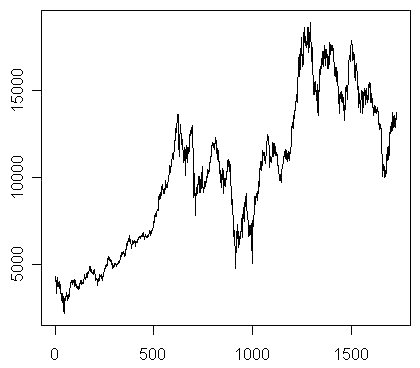

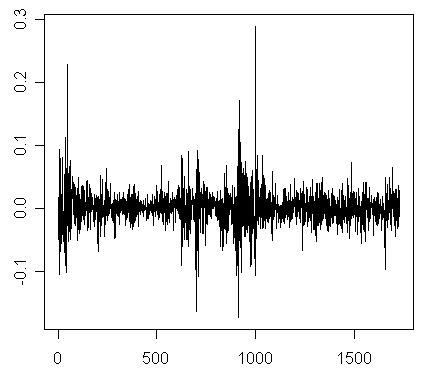

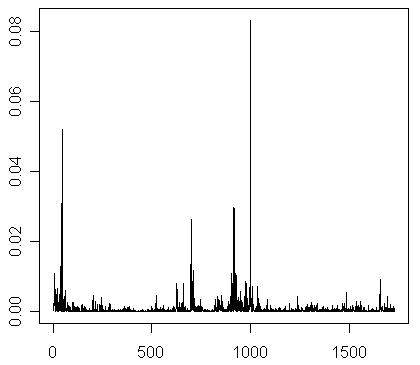

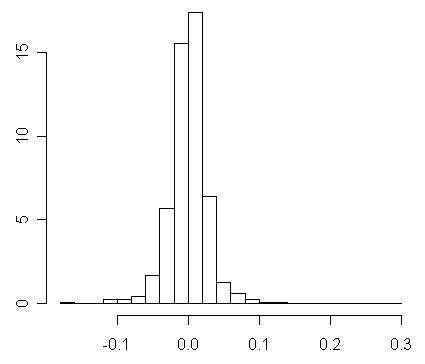

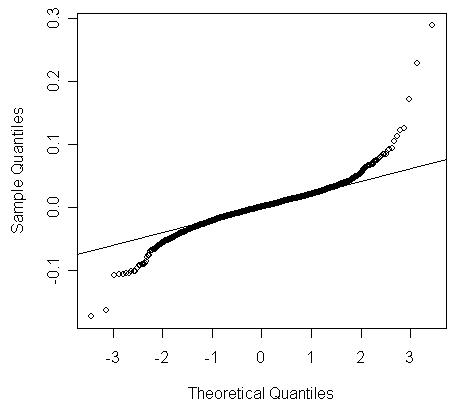

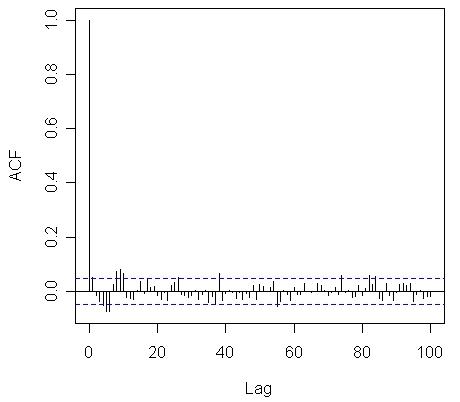

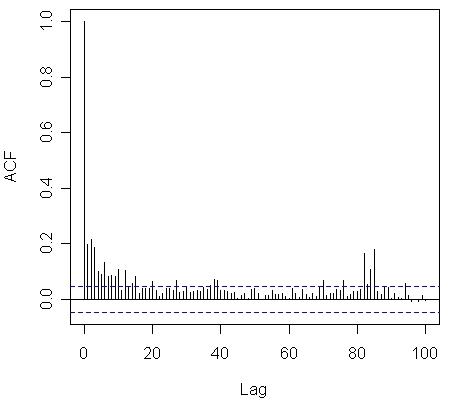

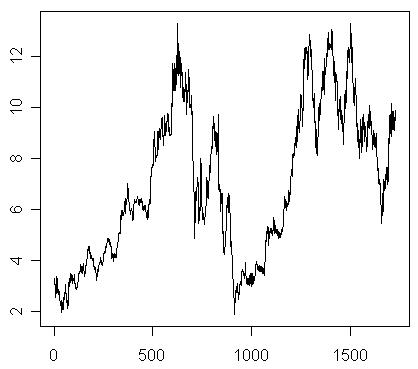

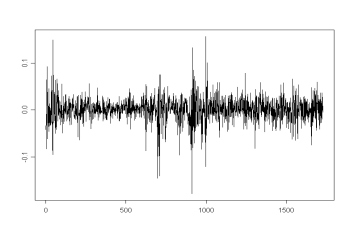

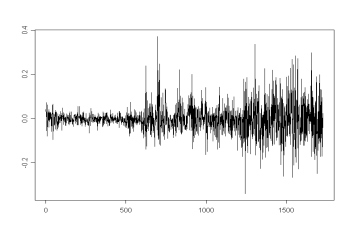

Figure 5.1 presents the time series with observations of the São Paulo Stock Exchange Index (Bovespa Index or IBovespa) in the period of January, 1995 to December, 2001, the IBovespa log-return series and the square of the log-return series. Observe that the log-return series presents the stylized facts mentioned in Section 2, such as apparently stationarity, mean around zero and clusters of volatility. Also, in Figure 5.2 we observe that, while the log-return series presents almost no correlation, the sample correlation of the square of the log-return series assumes high values for several lags, pointing to the existence of both heteroskedasticity and long memory characteristics. Regarding the histogram and the QQ-Plot, we observe that the distribution of the log-return series seems approximately symmetric and leptokurtic.

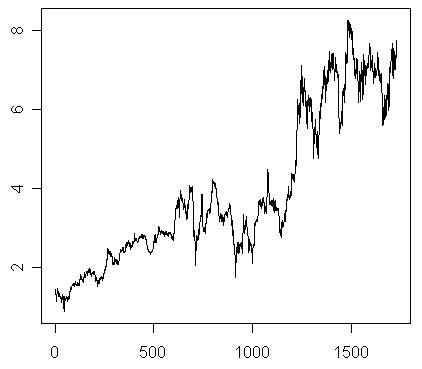

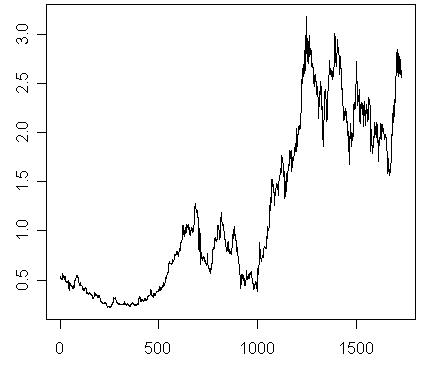

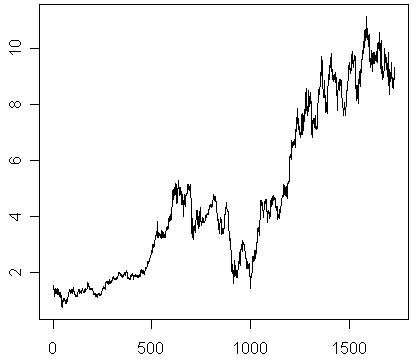

Figure 5.3 presents the stock prices of the companies Bradesco, Brasil Telecom, Gerdau and Petrobrás, in the period of January, 1995 to December, 2001, with observations. These time series present the same characteristics observed in the IBovespa time series (and log-return time series). In Figures 5.1 and 5.3 we observe that both, the market index and the stock prices, present a strong decay in their values close to (January 15, 1999). This period is characterized by the Real (the Brazilian currency) devaluation.

Remark 5.1.

The presence of long memory was also tested by analyzing the periodogram of the square of the log-return time series and by using some known hypothesis test such as GPH test, R/S, modified R/S, V/S and KPSS statistics. All these tests confirm the existence of long memory characteristics.

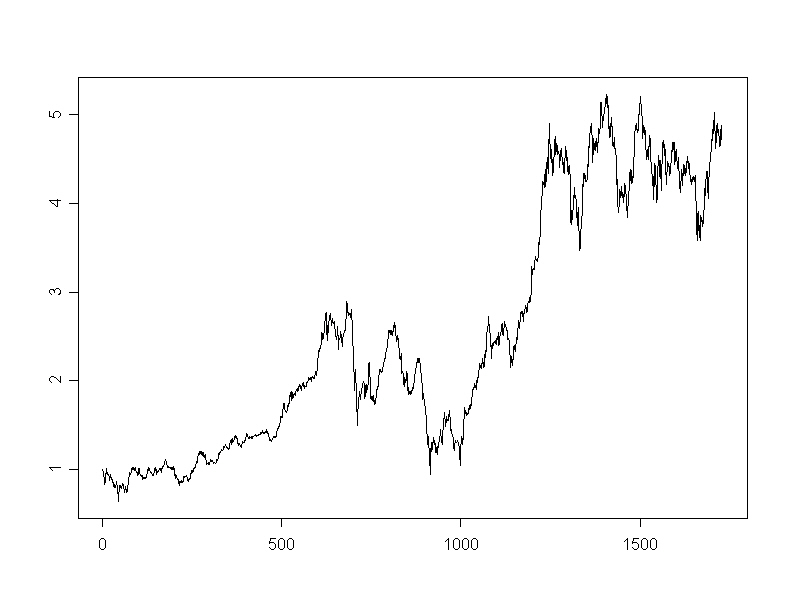

Figure 5.4 presents the time series of the values of the portfolio and the portfolio log-returns series in the period of January, 1995 to December, 2001. By comparing the portfolio values with the market index time series we observe a similar behaviour.

The time series of the portfolio loss is shown in Figure 5.4 (c). We observe that the highest loss occurred at ,with (this means that the highest earning value is approximately equal to R$ 0.37 per Real invested) and the smallest loss occurred at , with (that is, approximately R$ 0.34 per each Real invested). The highest loss corresponds to the change in the value of the portfolio from 10/24/1997 (Friday) to 10/27/1997 (Monday). In this period the Bovespa index changed from 11,545.20 to 9,816.80 points, which represents a drop of . In this same date we also observed high drops in the Dow Jones (7.18%) and SP 500 (6.87%) indexes. This period coincides with the crises in Asia. The highest earning in the portfolio corresponds to the change in the value of the portfolio from 01/13/2001 to 01/14/2001. The IBovespa showed an increasing of 2.08% in this period. In the date 01/14/2000 the Dow Jones index was 11,722.98 points. This value only was surpassed in 10/03/2006, when the index reached 11,727.34 points.

5.2 Fitting the FIEGARCH Models

In the following we present the models fitted to the observed time series. The selection of the class of models used, the ARMA-FIEGARCH models, was based on the analysis of the sample autocorrelation and on periodogram functions and results from the long memory tests. The fitted models are then used to estimate the volatility and consequently the risk measures for these processes.

In all cases considered, the analysis of the sample autocorrelation function suggests an ARMA-FIEGARCH model. The ARMA models are used to model the correlation among the log-returns while the FIEGARCH models take into account the long memory and the heteroskedasticity characteristics of the time series.

In order to estimate the parameters of the model we consider the fgarch function from S-PLUS software. We consider e . The selection of the final model was based on the values of the log-likelihood and on the AIC and BIC criteria. The residual analysis indicated that none of these models were adequated for the Gerdau log-return time series since the square of the log-returns still presented correlation. The problem was solved by choosing a FIEGARCH model with . After the residual analysis, the following models were selected:

-

•

For the IBovespa log-returns : ARMA-FIEGARCH,

-

•

For the Bradesco log-returns : ARMA-FIEGARCH,

-

•

For the Brasil Telecom log-returns : ARMA-FIEGARCH,

-

•

For the Gerdau log-returns : ARMA-FIEGARCH,

where .

-

•

For the Petrobrás log-returns : ARMA-FIEGARCH,

-

•

For the portfolio log-returns : ARMA-FIEGARCH,

5.3 Conditional Mean and Volatility Forecast

In order to estimate the risk measures presented in Section 3 we first consider the estimation of the conditional mean and the volatility, that is, the conditional standard deviation of the log-return time series. Theoretical results regarding forecast on ARMA and FIEGARCH models can be found, respectively, in Brockwell and Davis (1991) and Lopes and Prass (2009).

The forecast for the conditional mean, , and for the volatility, , for and are presented in Table 5.1. We observe that, for , the value of is constant, which does not occur for the assets , . Apparently, for and the forecast values increase, while for they decrease. For the behaviour seems to be random.

| 1 | -0.0012 | 0.0179 | 0.0031 | 0.0215 | -0.0030 | 0.0319 | -0.0041 | 0.0256 | 0.0019 | 0.0176 |

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | 0.0000 | 0.0182 | 0.0000 | 0.0221 | 0.0018 | 0.0219 | 0.0000 | 0.0248 | 0.0014 | 0.0179 |

| 3 | 0.0000 | 0.0182 | 0.0000 | 0.0226 | 0.0018 | 0.0194 | 0.0000 | 0.0195 | 0.0014 | 0.0185 |

| 4 | 0.0000 | 0.0182 | 0.0000 | 0.0230 | 0.0018 | 0.0181 | 0.0000 | 0.0293 | 0.0014 | 0.0190 |

| 5 | 0.0000 | 0.0182 | 0.0000 | 0.0233 | 0.0018 | 0.0175 | 0.0000 | 0.0235 | 0.0014 | 0.0194 |

| 6 | 0.0000 | 0.0182 | 0.0000 | 0.0236 | 0.0018 | 0.0171 | 0.0000 | 0.0219 | 0.0014 | 0.0197 |

| 7 | 0.0000 | 0.0182 | 0.0000 | 0.0238 | 0.0018 | 0.0169 | 0.0000 | 0.0280 | 0.0014 | 0.0200 |

| 8 | 0.0000 | 0.0182 | 0.0000 | 0.0239 | 0.0018 | 0.0168 | 0.0000 | 0.0219 | 0.0014 | 0.0202 |

| 9 | 0.0000 | 0.0182 | 0.0000 | 0.0241 | 0.0018 | 0.0169 | 0.0000 | 0.0233 | 0.0014 | 0.0204 |

| 10 | 0.0000 | 0.0182 | 0.0000 | 0.0242 | 0.0018 | 0.0170 | 0.0000 | 0.0261 | 0.0014 | 0.0206 |

The forecast for the conditional mean, , and for the volatility, , of the portfolio are presented in Table 5.2. Note that, while is constant for , is slowly increasing.

| 1 | 0.0001 | 0.0149 | 6 | -0.0010 | 0.0161 |

| 2 | -0.0008 | 0.0152 | 7 | -0.0010 | 0.0162 |

| 3 | -0.0010 | 0.0155 | 8 | -0.0010 | 0.0164 |

| 4 | -0.0010 | 0.0157 | 9 | -0.0010 | 0.0165 |

| 5 | -0.0010 | 0.0159 | 10 | -0.0010 | 0.0166 |

5.4 and Estimation

We considered two different approachs in the analysis of the risk measures. The first one considers the log-return series of the portfolio (see Palaro and Hotta, 2006) and its loss distribution. We consider either, the conditional (RiskMetrics approach) and the unconditional (variance-covariance method) distribution of the risk-factors change in order to estimate the risk measures and As a second approach we calculate the risk measures for each one of the assets in the portfolio. Since is a coherent risk measure and by calculating we found an upper bound for the of the portfolio .

Table 5.3 presents the estimated values of and for the portfolio log-return time series. The observed values, at time , of the assets log-returns are, respectively, , 0.0301, 0.0680 and 0.0021. Therefore, the portfolio log-return value, at this time, is 0.0259 (without loss of generality, we assume . The loss is then given by a ). By comparing this value with the estimated values given in the Table 5.3 we observe that the Econometric approach, using FIEGARCH model, presents the best performance.

| Approach | ||

|---|---|---|

| Empirical | 0.0369 (0.0703) | 0.0588 (0.0966) |

| Normal | 0.0398 (0.0566) | 0.0712 (0.0923) |

| RiskMetrics | 0.0321 (0.0461) | 0.0583 (0.0759) |

| EGARCH | 0.0353 (0.0499) | 0.0625 (0.0808) |

| FIEGARCH | 0.0247 (0.0349) | 0.0437 (0.0564) |

Table 5.4 presents the results obtained by considering the multivariate distribution function of the risk-factor changes . We consider the unconditional (Normal approach) and the conditional distribution (RiskMetrics approach). By comparing the results in Tables 5.3 and 5.4 we observe that while for the Normal approach the values are the same, for the RiskMetrics approach the estimated value obtained using the univariate distribution was closer to the negative value of the observed log-return.

| Approach | ||

|---|---|---|

| Normal | 0.0398 (0.0566) | 0.0712 (0.0923) |

| RiskMetrics | 0.2131 (0.3018) | 0.3788 (0.4898) |

Tables 5.5 and 5.6 present the estimated values of the risk measures and obtained by considering the univariate distribution function of each one of the risk-factor changes . Upon comparison of the values in Tables 5.5 and 5.6 we observe that, for this portfolio , both inequalities are satisfied:

Also, the estimated by Econometric approach using FIEGARCH processes were the ones closer to the observed loss , , given by 0.0026, , and . It is easy to see that, in all cases, the loss was superestimated. This fact is well known and discussed in the literature. This occurs because of the normality assumption in the risk measure estimation. Khindanova and Atakhanov (2002) presents a comparison study which demonstrate that stable modeling captures asymmetry and heavy-tails of returns, and, therefore, provides more accurate estimates of .

| Approach | |||||

|---|---|---|---|---|---|

| Empirical | 0.0427 | 0.0508 | 0.0494 | 0.0483 | 0.0472 |

| (0.0785) | (0.1023) | (0.0870) | (0.0905) | (0.0875) | |

| Normal | 0.0487 | 0.0582 | 0.0535 | 0.0539 | 0.0528 |

| (0.0693) | (0.0825) | (0.0761) | (0.0767) | (0.0750) | |

| RiskMetrics | 0.2648 | 0.3056 | 0.3024 | 0.2511 | 0.2814 |

| (0.3751) | (0.4327) | (0.4281) | (0.3557) | (0.3985) | |

| EGARCH | 0.0370 | 0.0633 | 0.0565 | 0.0342 | 0.0473 |

| (0.0536) | (0.0875) | (0.0783) | (0.0489) | (0.0666) | |

| FIEGARCH | 0.0385 | 0.0495 | 0.0380 | 0.0308 | 0.0390 |

| (0.0531) | (0.0712) | (0.0555) | (0.0428) | (0.0554) |

| Approach | |||||

|---|---|---|---|---|---|

| Empirical | 0.0672 | 0.0731 | 0.0623 | 0.0679 | 0.0669 |

| (0.1133) | (0.1163) | (0.1049) | (0.1202) | (0.1124) | |

| Normal | 0.0871 | 0.1037 | 0.0956 | 0.0964 | 0.0943 |

| (0.1128) | (0.1341) | (0.1238) | (0.1249) | (0.1221) | |

| RiskMetrics | 0.4707 | 0.5428 | 0.5370 | 0.4464 | 0.5001 |

| (0.6086) | (0.7017) | (0.6942) | (0.5771) | (0.6465) | |

| EGARCH | 0.0680 | 0.1085 | 0.0973 | 0.0616 | 0.0833 |

| (0.0887) | (0.1388) | (0.1246) | (0.0799) | (0.1074) | |

| FIEGARCH | 0.0658 | 0.0901 | 0.0706 | 0.0532 | 0.0695 |

| (0.0841) | (0.1172) | (0.0924) | (0.0682) | (0.0900) |

5.5 MaxLoss Estimation

Since the considered portfolio is linear, from Theorem 3.1, given a confidence level p, the MaxLoss is estimated by the expression (3.3).

Table 5.7 presents the MaxLoss values under different values of p and the scenarios under which this loss occurs. By definition, , is the log-return of the asset under the MaxLoss scenario. By comparing the values in Table 5.7 with those ones found in the previous analysis, we observe that the loss estimated under the scenario analysis approach is higher than the loss estimated by and (see Tables 5.5 and 5.6). For all values of p, the MaxLoss value is higher (in absolute value) than the observed loss.

| Scenario | |||||

|---|---|---|---|---|---|

| p | |||||

| 0.50 | -0.0453 | -0.0451 | -0.0460 | -0.0453 | -0.0449 |

| 0.55 | -0.0475 | -0.0473 | -0.0482 | -0.0475 | -0.0471 |

| 0.65 | -0.0521 | -0.0519 | -0.0529 | -0.0521 | -0.0517 |

| 0.75 | -0.0574 | -0.0572 | -0.0583 | -0.0574 | -0.0569 |

| 0.85 | -0.0642 | -0.0640 | -0.0652 | -0.0642 | -0.0637 |

| 0.95 | -0.0762 | -0.0759 | -0.0773 | -0.0762 | -0.0756 |

| 0.99 | -0.0901 | -0.0897 | -0.0915 | -0.0901 | -0.0894 |

6 Conclusion

Here we consider the same time series generated and analyzed in Lopes and Prass (2009) to estimate the risk measures and MaxLoss. For those time series we fit FIEGARCH models to estimate the conditional variances of the time series. We observe that the higher the sample size, the higher the mean square error value. We use the estimated variances to estimate the risk measure for the simulated time series under different approaches. Since the estimated values for this risk measure, under different approaches, are very close from one another, we cannot say that one method is better than the others. For this simulated study, the Econometric approach, considering FIEGARCH models, does not perform as well as one would expected. However, the results obtained by using these models have strong influence from the model parameter estimation, which is based on the quasi-likelihood method. Asymptotic properties of the quasi-likelihood estimator are still an open issue and it could explain the unexpected results.

Regarding the observed time series, we consider two different approaches for analyzing the portfolio risk. We consider the distribution function of the portfolio log-returns (univariate case) and the multivariate distribution function of the risk-factor changes (multivariate case). Also, we consider either, the conditional and the unconditional distribution functions in all cases.

In the and calculation, all approaches present similar results. By comparing the observed loss, the values estimated using the econometric approach (and FIEGARCH models) were the closest to the observed values. In all cases, the estimated loss was higher than the observed one. We also observe that the values estimated by considering the univariate distribution of the portfolio log-returns were smaller than the values estimated by considering the multivariate distribution of the risk-factor changes. By comparing the estimated values of and MaxLoss we observe that the loss estimated under the scenario analysis approach is higher than the loss estimated by and For all values of p, the MaxLoss value is higher (in absolute value) than the observed loss.

Acknowledgments

T.S. Prass was supported by CNPq-Brazil. S.R.C. Lopes research was partially supported by CNPq-Brazil, by CAPES-Brazil, by INTC in Mathematics and also by Pronex Probabilidade e Processos Estocásticos - E-26/170.008/2008 -APQ1.

References

- [1]

- [2] [] Artzner, P., F. Delbaen, J. Eber and D. Heath (1999). “Coherent Measures of Risk”. Math. Finance, Vol. 9, 203-228.

- [3]

- [4] [] Baillie, R., T. Bollerslev e H. Mikkelsen (1996). “Fractionally Integrated Generalised Autoregressive Conditional Heteroscedasticity”. Journal of Econometrics, Vol. 74, 3-30.

- [5]

- [6] [] Beran, J. (1994). Statistics for Long-Memory Processes. New York: Chapman & Hall.

- [7]

- [8] [] Billingsley, P. (1995). Probability and Measure. New York: John Wiley.

- [9]

- [10] [] Bollerslev, T. and H.O. Mikkelsen (1996). “Modeling and Pricing Long Memory in Stock Market Volatility”. Journal of Econometrics, Vol. 73, 151-184.

- [11]

- [12] [] Brockwell, P.J. and R.A. Davis (1991). Time Series: Theory and Methods. New York: Springer-Verlag.

- [13]

- [14] [] Embrechts, P., C. Klüppelberg and T. Mikosh (1997). Modeling Extremal Events. New York: Springer-Verlag.

- [15]

- [16] [] Engle, R.F. (1982). “Autoregressive Conditional Heteroskedasticity with Estimates of Variance of U.K. Inflation”. Econometrica, Vol. 50, 987-1008.

- [17]

- [18] [] Khindanova, I. and Z. Atakhanova (2002). “Stable Modeling in Energy Risk Management”. Mathematical Methods of Operations Research, Vol. 55(2), 225-245.

- [19]

- [20] [] Lopes, S.R.C. and T.S. Prass (2009). “Theoretical Results on FIEGARCH Processes”. Submitted.

- [21]

- [22] [] Lopes, S.R.C. (2008). “Long-range Dependence in Mean and Volatility: Models, Estimation and Forecasting”, In In and Out of Equilibrium 2 (Progress in Probability), V. Sidoravicius and M.E. Vares (eds.), Vol. 60, pp. 497-525, Birkhäuser.

- [23]

- [24] [] Lopes, S.R.C and B.V.M. Mendes (2006). “Bandwidth Selection in Classical and Robust Estimation of Long Memory”. International Journal of Statistics and Systems, Vol. 1(2), 177-200.

- [25]

- [26] [] Markowitz, H. (1952). “Portfolio Selection”. Journal of Finance, Vol. 7(1), 77-91.

- [27]

- [28] [] McNeil, A.J., R. Frey and P. Embrechts (2005). Quantitative Risk Manangement. New Jersey: Princeton University Press.

- [29]

- [30] [] Nelson, D.B. (1991). “Conditional Heteroskedasticity in Asset Returns: A New Approach”. Econometrica, Vol. 59, 347-370.

- [31]

- [32] [] Prass, T.S. and S.R.C. Lopes (2009). “Stress Tests, Maximum Loss and Value-at-Risk on FIEGARCH Process”. Submitted.

- [33]

- [34] [] Ruiz, E. and H. Veiga (2008). “Modelling long-memory volatilities with leverage effect: A-LMSV versus FIEGARCH”. Computational Statistics and Data Analysis, Vol. 52(6), 2846-2862.

- [35]

- [36] [] Roberts, S.W. (1959). “Control Charts Based on Geometric Moving Averages”. Technometrics, Vol. 1, 239-250.

- [37]

- [38] [] Zangari, P. (1996). “RiskMetrics Technical Document”. The URL address is http://www.riskmetrics.com/rmcovv.html.

- [39]