Automating the Dispute Resolution in a Task Dependency Network

Abstract

When perturbation or unexpected events do occur, agents need protocols for repairing or reforming the supply chain. Unfortunate contingency could increase too much the cost of performance, while breaching the current contract may be more efficient. In our framework the principles of contract law are applied to set penalties: expectation damages, opportunity cost, reliance damages, and party design remedies, and they are introduced in the task dependency model [14].

1 Introduction

The formation of the supply chain is grounded to three key technologies: a) the decision-making mechanism of an individual business entity; b) a coordination mechanism for the allocation of contracts; c) the representation of capabilities and services. In this paper we focus on the second aspect: contract allocation Flexibility and risk sharing in supply contracting is a main issue when confronted to the uncertain nature of the environment [12]. Contracts aim at improving flexibility, while preserving the interests of both parties. Our interest rely on remedies for breach of contracts. An economic analysis of remedies models their effects on behavior. The remedies imposed by low affect the agents’ behavior [3]: (1) searching for trading partners; (2) negotiating exchanges; (3) drafting the stipulations in contracts; (4) keeping or breaking promises; (5) taking precaution against breach causing events; (6) acting based on reliance on promises; (7) acting to mitigate damages caused by broken promises; (8) settle disputes caused by broken promises. In the supply chain context a contract breach can propagate over the entire chain. The damages imposed by legal institutions can positively influence breach propagation. Usually, a contract breach appears when some perturbation arises on the market111For instance, the market price of a raw material could rise so much that, for the agent who had planed to achieve it in order to produce an item, is more efficient to breach the contract with its buyer.. Therefore, proper rules imposed by the law help agents to manage perturbations in supply chain. Each agent has more than one way to respond to a perturbation. The question is how can we change the strategic environment such that the resulting behavior of the involved agents is efficient? More exactly, what types of contracts or market structure can impose this mutually acceptable solution if such a solution exists and, in the same time, these contracts do not have to force the agents to act irrationally when a mutual solution does not exist. Our goal is to find which of the following remedies are adequate for an efficient functionality of the supply chain: expectation damages , opportunity cost , reliance damages , and party designed damages .

The main contribution of this paper consists in introducing penalties in task dependency network model. It also investigates the agents’ decision to breach or perform the contract when they face different levels of information sharing.

In the next section we introduce contracts within the task dependency network model and in section 3 we describe the four types of remedies used in the market. The section 4 discusses how breach decision is influenced by information sharing between firms and in section 5 the functions used by the market for penalties are implemented. Sections 6 and 7 detail future experiments and related work.

2 Problem specification

2.1 Task Dependency Network

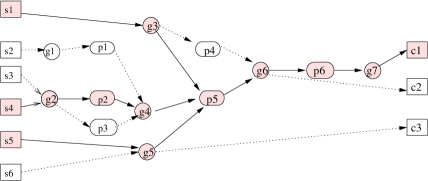

We adapted the task dependency network model [14] used in the analysis of the supply chain as follows: task dependency network is a directed, acyclic graph, (V,E), with vertices , where: = the set of goods, the set of agents, = the set of suppliers, = the set of producers, = the set of consumers, and a set of edges E connecting agents with their input and output goods.

With each agent we associate an input set and an output set : and . Agent is a supplier if , a consumer if , and a producer in all other cases. Without any generalization lost, we consider that a consumer needs a single item () and every supplier or producer build one single item ( and )

An agent must have a contract for all of its input goods in order to produce its output, named presumable222Note that when someone breaches a contract with a presumable agent it has to pay more damages. and denoted by . If we note , the agent has to sign 333Suppliers and consumers have to sign one contract only. contracts in order to be a member in the supply chain. For each input good the agent bids its own item valuation . The auction for the good sets the transaction price at . The agent’s investments are where are the winning input goods. We note by the agent’s investments but without considering the investments made for the current good . Similarly, we note all bids values submitted by the agent as and this value without considering the bid for good as . For the output good, the agent signs a contract at reliance price .

We consider that there are no production costs and when perturbation or unexpected events occur, agents need protocols for repairing or reforming the supply chain. "Allowing decommitment without remedies rises the question of how to enforce that agents decommit only when they are in dead ends, and also does not address the fact that unilateral decisions for decommitment can potentially break the (possibly desirable) contracts of many other downstream producers" [14]. Introducing remedies can reduce aggressive bidding and mitigate the potential problems.

2.2 Contracts

The goods are transacted using the (M+1)st price auction protocol [15], which has the property to balance the offer and the demand at each level in the supply chain (otherwise the supply demand equilibrium cannot be achieved globally). It provides a uniform price mechanism: all contracts determined by a particular clearing are signed at the same price. In the contract

represents the seller agent, the buyer agent, the good or the transaction subject, the contract price, is the time when the contract is signed and is the time when the transaction occurs. During experiments, a contract can be in one of the following states: active (between and and no breach), violated (at the time of breach ) or performed (if no party breaches until ).

3 Remedies

According to [13], there are five different philosophies of punishment from which all punishment policies can be derived: deterrence, retribution, incapacitation, rehabilitation and restoration. Retribution is most adequate for multi-agent systems [9], as it considers that the contract breach should be repaired by a remedy as severe as the wrongful act444Courts call a term ”liquidated damages” when it stipulates damages that do not exceed the actual harm. When the stipulates damages exceed the actual harm caused by breach, the remedies are called penalties.. The remedies described in this section try to equal the victim’s harm. In the first three cases555Expectation damages, reliance damages and opportunity cost are analyzed from an economical point of view in [3, 6]., the system estimates the harm according to current market conditions, while in the last case, the agents themselves compute the damages and generate their own penalties.

3.1 Expectation Damages

The courts reward damages that place the victim of breach in the position he or she would have been in if the other party had performed the contract [3]. Therefore, in an ideal situation, the expectation damages does not affect the potential victims whether the contract is performed or breached. Ideal expectation damages remain constant when the promisee relies on the performance of the contract more than it is optimal.

3.2 Reliance Damages

Reliance increases the loss resulting from the breach of the contract. Reliance damages put the victim in the same position after the breach as if he had not signed a contract with the promisor or anyone else [3]. In an ideal situation, the reliance damages do not affect the potential victims whether the contract is breached or there was no initial contract. No contract provides a baseline for computing the injury. Using this baseline, the courts may reward damages that place victims of breach in the position that they would have been, if they had never contracted with another agent. Reliance damages represent the difference between profit if there is no contract and the current profit.

3.3 Opportunity Cost

Signing a contract often entails the loss of an opportunity to make an alternative. The lost opportunity provides a baseline for computing the damage. Using this baseline, the courts reward damages that place victims of breach in the position that they would have been if they had signed the contract that would have been the best alternative to the one that was breached [3]. In the ideal situation, the opportunity cost damages does not affect the potential victims whether the contract is breached or the best alternative contract is performed666Opportunity cost and expectation damages approach equality as markets approach perfect competition.. If breach causes the injured party to purchase a substitute item, the opportunity cost formula equals the difference between the best alternative contract price available at the time of contracting and the price of the substitute item obtained after the breach.

3.4 Party-Designed Remedies

The contract might stipulate a sum of money that the breaker will pay to the party without guilt. These "leveled commitment contracts" [10] allow self-interested agents to face the events that unfolded since the contract started. A rational person damages others whenever the benefit is large enough to pay an ideal compensation and have some profit, as required to increase efficiency. Game theoretic analysis has shown that leveled committed contracts increase the Pareto efficiency of contracts. One contract may charge a high price and offer to pay high damages if the seller fails to deliver the goods, while another contract may charge a low price and offer to pay low damages, the types of contracts separating the set of buyers and allowing "price discrimination."

4 Efficient breach

Breaching is more efficient than performing when the costs of performing exceed the benefits to all parties. The costs of performing exceed the benefits when a contingency materializes so that it makes the needed resources for performance more valuable in an alternative usage. Two types of contingencies reorder the value of resources: unfortunate contingency increases the cost of performance (an unpredictable strike) or fortunate contingency makes nonperformance even more profitable than performance (the seller discovers a buyer who values the product even more).

The literature distinguishes between and decided sanctions. According to [9], we consider that a posteriori decided penalties should be avoided in agent-based modeling, since they do not allow agents to reason about when to respect their commitments. Therefore, all the above remedies , , , and are common knowledge and settled a priori. Nevertheless, only penalty fully reveals the amount of money the agents will pay in case of breach. In the other cases, more information is needed for an agent in order to anticipate how high remedies he or she has to pay. Hence, the potential victim could advertise how much he or she will lose depending on the types of remedies imposed by the market (see table 1).

| Remedy | Information shared |

|---|---|

| expected profit | |

| provided by the market | |

| investments made | |

| known from contract |

This approach stresses the relation between legal rules, communication and common knowledge. We define three levels of information sharing as in [17] (no share, share to each neighbor, and broadcast sharing) and we will analyze the social welfare in each case. The market should provide incentives for information sharing. In our case, hiding such information in order to collect more penalties should not be encourage by the remedies rules.

5 Case Analysis

The conclusions from the last sections are: (i) The amount of expectation damages must place the victim in the same position as if the actual contract had been performed 777We assume that the rate of breach is low. Otherwise, it can be anticipated to some extent, and so the promisee can plan for breach, just as airlines and hotels plan for ”no-shows [3].”(ii) The amount of reliance damages must place the victim in the same position as if no contract had been signed; (iii) The amount of opportunity-cost damages must place the victim in the same position as if the best alternative contract had been performed; (iv) Party designed remedies specify themselves the amount of damages in case of a breach.

5.1 No substitute

5.1.1 Supplier-Consumer:

First, we analyze the easiest case in which a contract is signed between a supplier and a client. Recall that a supplier is an agent who does not have any input good in task dependency network model, while the consumer is an agent who does not have any output good.

The consumer breaches the contract:

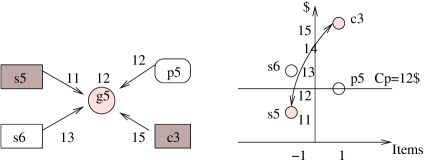

In fig. 2a) the suppliers and

want to sell good at price 11 and respectively 13,

while the agents , and try to buy it at prices 12 and

15. According to (M+1)st price protocol the transaction price is

. The auction clears at every round. In

fig. 2b) a single contract is signed:

Consider that breaches the contract. In this case, the

remedies will be:

Expectation damages:

if the agent performs, the ’s estimated profit is the difference between the contract price and its own valuation888(M+1)st price auction has the following property: the dominant strategy for each agent is to reveal its real valuation.

(victim valuation).

The remedies compensate this value:

Opportunity damages: first, the auctioneer has to compute the opportunity cost , which is the transaction cost in case the breacher was absent from the auction. In fig. 2, if agent is not present . The ’s bid is one who wins. The contract would be and the agent’s profit would be . But, when there is no contract for agent , his profit would be null. The opportunity damages should reflect this. We define opportunity cost damage which is received by the agent as:

Reliance damages: if the victim does not have any input

good, the supplier’s investments in performing are null: .

Party-designed remedies: the remedies may be a fraction from the contract price () or a fraction from the expected profit () or constant (.

In each of the following cases, this type of remedies is computed in the same manner.

The supplier breaches the contract:

Consider that breaches contract .

Expectation damages:

.

Opportunity damages: if the breacher had not bid and the victim had signed a contract at the opportunity price , than it’s profit would have been .

If the victim has no contract when the breacher is not bidding, it receives no damages.

Hence

In the depicted case, if the agent had not existed, would have signed a contract with for an opportunity cost . Therefore, .

Reliance damages: because the client does not produce any output goods,

it’s reliance is null: .

5.1.2 Supplier-Producer

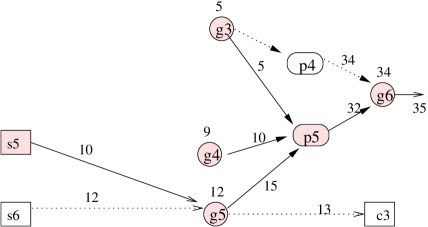

The supplier breaches the contract:

Consider from fig. 3.

Expectation damages:

Observe that the victim is a presumable agent because it has contracts for all its input goods.

Its investments are and .

The producer has also a contract for its output item, so .

Its profit is .

When bad contracts have been signed this value can be negative, therefore no damages are imposed.

Otherwise, expectation damages equals the difference between its bid and the contract price:

Recall means that agent is presumable.

Opportunity cost: one seller less implies .

which is equivalent to:

Reliance damages:

Here is the output good of the agent and represents all contracts signed for input goods, where . In the depicted case is presumable and there is a contract with a buyer. Therefore, it has to receive, as a victim, the next reliance damages .

In some cases damages can be higher than the contract value itself (). According to current practice in law, these damages are the right ones if the victim gives a previous notification about the risks faced by the potential breacher. This a clear situation when information propagation improves the supply chain performance. In the light of the above facts, their reliance damages should remain the mentioned ones if the victim has notified its partner, but should be maxim otherwise. Hence, we define :

5.1.3 Producer-Consumer

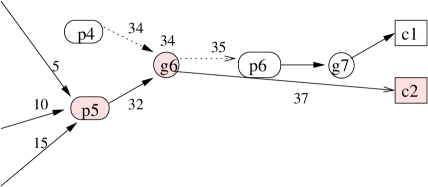

The consumer breaches the contract:

Consider the contract from fig. 4, where breaches.

Expectation damages:

In this case, is presumable and .

Suppose the agent does not have any contract for one input good.

Therefore, it is not presumable and it will receive .

Opportunity cost: one buyer less implies

which is equivalent to:

Reliance damages: .

5.2 Substitute

The common law requires the promisee to mitigate damages.

Specifically, the promisee must take reasonable actions to reduce losses occurred by the promisor’s breach.

The market can force the victim to find substitute items, in this case the imposed damages reflect only the difference between original contract and substitute contract.

With a substitute contract, the victim signs for the identical item, with the same deadline or , but at a different price.

Let be the value of the substitute contract999 comes from ”spot market” while the original contract value refers to ”future market”..

For the general case Producer-Producer, when the buyer breaches the contract, the equations become:

Expectation damages:

Opportunity cost:

Reliance damages:

6 Planned experiments

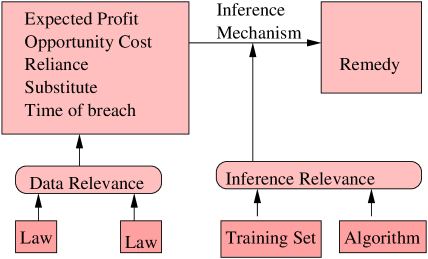

First, the framework can be used as a tool for automated online dispute resolution (ODR). There are three situations: (i) The market may have substantial authority, hence one remedy is imposed to all agents. In this case, the amount of penalties can be automatically computed with this framework. (ii) Consistent with party autonomy, the agents may settle on different remedies at contracting time. This approach increases the flexibility and efficiency, because the agents are the ones who know what type of remedy protects better their interests. (iii) All the above remedies influence the amount of penalties: in this approach the role of the framework is to monitor the market and collect data such as: the expected profit, the opportunity cost, the amount of investments made, if there is a substitute at . All these information are used as arguments when the dispute is arbitrated [11] in an architecture which combine rule base reasoning (laws) and case base reasoning (training set) as fig 5.

Second, knowing the bids, the actual contracts, the amount of potential remedies, and the available offers on the market, the framework can identify situations in which for both agents is more profitable to breach the contract when a fortunate or an unfortunate contingency appears. It computes pairs of suggestions, helping to increase total welfare towards Pareto frontier.

Third, as a simulation tool, the market designer may obtain results regarding the following questions: what types of remedies assured flexibility in the supply chain? or how information sharing influences total revenues or can be use to compute optimum reliance? In the prototype developed we are currently making experiments with different types of agents: low-high reliance, breach often-seldom, sharing information-don’t share, risk seeking-averse (when they are risk averse, the penalties do not need to be so high to make breachers behave appropriately).

7 Related Work

The task dependency network model was proposed [14] as an efficient market mechanism in achieving supply chain coordination. However, this approach is rather a timeless-riskless economy. On real markets a firm seldom signs contracts with its buyers and its suppliers simultaneously. Moreover, the breach of a contract implies no penalties, which is an unrealistic assumption in real world. In contrast, in our model we used auctions, which end independently, and we introduce penalties in case of contract breaching. We have made less strictly the assumption that the producer places its first output offer only after receiving the first price quotes for all its inputs. One objective is to compute how high these penalties should be in order to maintain efficiency of the supply chain.

Whether selfish companies have individual incentive to use information sharing for reducing the bull-whip effect [8] has been studied considering three levels of information sharing: not share, share to each neighbor, and broadcast sharing. Instead, we have used the same levels of information sharing in order to help agents decide when to breach. The agents in our framework sign simple formal contracts, but more complex contracts need semantic interpretation for automated ODR [7].

The role of sanctions in multi-agent systems [9] is the enforcement of a social control mechanism for the satisfaction of commitments. We focus only on material sanctions and we do not include social sanctions which affect trust, credibility or reputation. Moreover, we have applied four types of material remedies in a specific domain. In the same spirit of computing penalties according to the level of harm produced, the amount of remedies may depend on the time when the contract was breached [5]. Expectation damages, reliance damages, and opportunity have also been studied [4, 3, 6] and how contracts influence the supply chain coordination or strategic breach appear in [2, 10].

The Toulmin argument structure was used in a framework for computing the distribution of matrimonial property [1]. The domain was modelled by extracting the relevant variables with the help of experts and a neuronal network was used as inference mechanism. We apply principles of contract law to determine the amount of remedies and, in our business scenario, data used for argumentation can be automatically extracted from the task dependency network.

8 Conclusions

The design of punishment policies applied to specific domains linking agents actions to material penalties is an open research issue [9]. The contribution of this paper contains two ideas: On the one hand, we apply the principles of contract law in the task dependency network model [14]. As a result, we enrich that model by including different types of penalties when agents breach, thus bringing the model closer to the real world.

On the other hand, in our work we consider penalties that ensure a higher welfare for the supply chains affected by perturbations, with three levels of information sharing for each type of remedy. This framework is useful for automated ODR. The data obtained can be used as arguments in a mediated dispute or the remedies can be computed in real time in case the agents agreed with the market policy.

References

- [1] E. Bellucci and J. Zeleznikow. The conflict between negotiation and litigation when building mediation decision support systems. In ICAIL 2003 ODRWorkshop, pages 51–60, Edinburgh, Scotland, UK, June 28, 2003.

- [2] G. Cachon and M. Lariviere. Supply chain coordination with revenue sharing contracts: strengths and limitations. Technical report, The Kellogg Graduate School of Management, Northwestern University, 2000.

- [3] R. Cooter and T. Ulen. Law and economics. Addison Wesley, Boston, 2004.

- [4] R. Craswell. Contract law: General theories. In B. Bouckaert and G. D. Geest, editors, Encyclopedia of Law and Economics, Volume III. The Regulation of Contracts, pages 1–24. Cheltenham, 2000.

- [5] C. B. Excelente-Toledo, R. A. Bourne, and N. R. Jennings. Reasoning about commitments and penalties for coordination between autonomous agents. In Proceedings of the Fifth International Conference on Autonomous Agents, pages 131–138, New York: ACM Press, 2001.

- [6] D. D. Friedman. Law’s Order. Princeton University Press, 2000.

- [7] B. N. Grosof and T. C. Poon. Representing agent contracts with exception using XML rules, ontologies, and process descriptions. In International Workshop on Rule markup Languages for Business Rules on the Semantic Web, Sardinia, Italy, June 2002.

- [8] T. Moyaux, B. Chaib-draa, and S. D’Amours. Multi-agent simulation of collaborative strategies in a supply chain. In C. Sierra and L. Sonenberg, editors, 3rd International Joint Conference on Autonomous Agents and Multiagent Systems, New York, NY, USA, 2004.

- [9] P. Pasquier, R. A. Flores, and B. Chaib-draa. Modelling flexible social commitments and their enforcement. In Engineering Societies in the Agents World, Toulouse, France, 2004.

- [10] T. W. Sandholm and V. R. Lesser. Leveled commitment contracts and strategic breach. Games and Economic Behavior, 35:212–270, 2001.

- [11] S. Toulmin. The Uses of Argument. Cambridge University Press, 1958.

- [12] C. Van Delft and J.-P. Vial. Quantitative analysis of multi-periodic supply chain contracts with options via stochastic programming. Technical report, Groupe HEC, Sept. 2001.

- [13] G. Vold, T. Bernanrd, and J. Snipes. Theoretical Criminology. Oxford University Press, fifth edition 2002.

- [14] W. Walsh and E. Wellman. Decentralized supply chain formation: A market protocol and competitive equilibrium analysis. Journal of Artificial Intelligence Research, 19:513–567, 2003.

- [15] P. Wurman, W. Walsh, and M. Wellman. Flexible double auctions for electronic commerce: Theory and implementation. Decision Support Systems, 24:17–27, 1998.