Volatility Inference in the Presence of Both Endogenous Time and Microstructure Noise

Abstract

In this article we consider the volatility inference in the presence of both market microstructure noise and endogenous time. Estimators of the integrated volatility in such a setting are proposed, and their asymptotic properties are studied. Our proposed estimator is compared with the existing popular volatility estimators via numerical studies. The results show that our estimator can have substantially better performance when time endogeneity exists.

keywords:

Itô Process , Realized Volatility , Integrated Volatility , Time Endogeneity , Market Microstructure NoiseMSC:

: 60F05 , 60G44 , 62M091 Introduction

In recent years there has been growing interest in the inference for asset price volatilities based on high-frequency financial data. Suppose that the latent log price follows an Itô process

| (1) |

where is a standard Brownian motion, and the drift and volatility are both stochastic processes. Econometric interests are usually in the inference for the integrated volatility, i.e., quadratic variation, of the log price process

A classical estimator from probability theory (see, for example, Jacod and Protter (1998), Barndorff-Nielsen and Shephard (2002)) for this quantity is the realized volatility (RV) based on the discrete time observations

where ’s may be a sequence of stopping times. The RV is defined as the sum of squared log returns

where for . Under mild conditions, when the observation frequency goes to infinity, . Furthermore, when the observation times are independent of , a complete asymptotic theory for the estimator is available, which says that is asymptotically a mixture of normal whose mixture component is the variance equal to , where is the “quadratic variation of time” process provided that the following limit exists (see Mykland and Zhang (2006) or Mykland and Zhang (2012))

where “plim” stands for limit in probability. The quantity can be consistently estimated by the quarticity .

The above provides a foundation for estimating the integrated volatility based on high frequency data. However, when it comes to the practical side, the assumptions for RV are often violated. Two aspects are of great importance. They are

-

(a)

Market microstructure noise; and

-

(b)

Endogeneity in the price sampling times.

For the first issue, recently there has seen a large literature on estimating quantities of interest with prices observed with microstructure noise. One commonly used assumption is that the noises are additive and one observes

| (2) |

It is often assumed that the noise is an independent sequence of white noise and the sampling times are independent of . Various estimators of integrated volatility have been proposed. See, for example, two scales realized volatility of Zhang, Mykland and Aït-Sahalia (2005), multi-scale realized volatility by Zhang (2006), realized kernels of Barndorff-Nielsen et al. (2008), pre-averaging method by Jacod et al. (2009) and QMLE method by Xiu (2010). Related works include Aït-Sahalia, Mykland and Zhang (2005), Bandi and Russell (2006), Fan and Wang (2007), Hansen and Lunde (2004a), Kalnina and Linton (2008), Li and Mykland (2007), Phillips and Yu (2007) among others.

In contrast, issue (b) has only recently been brought to researchers’ attention. The case when the sampling times are irregular or random but (conditionally) independent of the price process has been studied by Aït-Sahalia and Mykland (2003), Duffie and Glynn (2004), Meddahi, Renault and Werker (2006), Hayashi, Jacod and Yoshida (2011) among others. A recent work of Renault and Werker (2011) provides a detailed discussion on the issue of possible endogenous effect that stems from the price sampling times in a semi-parametric context. Li et al. (2009) further investigate the time endogeneity effect on volatility estimation in a nonparametric setting. Volatility estimation in the presence of endogenous time in some special situations like when the observation times are hitting times has been studied in Fukasawa (2010a) and Fukasawa and Rosenbaum (2012), and in a general situation has also been studied in Fukasawa (2010b). In Li et al. (2009), the analysis was carried out by considering the time endogeneity effect which is reflected by

| (3) |

where is the tricity. Interestingly, the literature usually neglects the important information one could draw from the quantity , which can be interpreted as a measure of the covariance between the price process and time as shown in Li et al. (2009). Li et al. (2009) also conducted empirical work that provides compelling evidence that the endogenous effect does exist in financial data, i.e.,

Although individually each issue (a) or (b) has been studied in the literature, there is a lack of studies that take both the microstructure noise and time endogeneity effect into consideration. Robert and Rosenbaum (2012) study the estimation of the integrated (co-)volatility for an interesting model where the observation times are triggered by exiting from certain “uncertainty zones”, in which case both microstructure noise and time endogeneity may exist. In this paper, we consider the presence of both microstructure noise and time endogeneity in a general setting.

The paper is organized as follows. The setup and assumptions are given in Section 2. The main results are given in Section 3. In Section 4, simulation studies are performed in which our proposed estimator is compared with several existing popular estimators. Section 5 concludes. The proofs (except that of Proposition 1 below) are given in the Appendix; the proof of Proposition 1 is given in the supplementary article Li, Zhang and Zheng (2013).

2 Setup and assumptions

Assumption 1.

In the Introduction, we adopted the notation for the number of observed prices over time interval Here, we generalize this and denote

In developing limiting results, one should be able to rely on some index variable approaching infinity/zero. In our context, we assume that is driven by some underlying force, for instance, where (non-random) characterizes the sampling frequency over time interval

We aim at effectively estimating based on our general setup. A local averaging approach is adopted. We consider the time endogeneity on the sub-grid level. Take the single sub-grid case for illustration, the sub-sample is constructed by choosing every th observation (starting from the th observation) from the complete grid. Here is the number of observations that we take in constructing local average, is the size of blocks, and both are non-random numbers just as . Define

| (4) |

which satisfies that , and as shall be taken as , as . As measures the sampling frequency of the complete grid, measures that of the sub-grid . Moreover, for notational ease, for , we define

| (5) |

and let

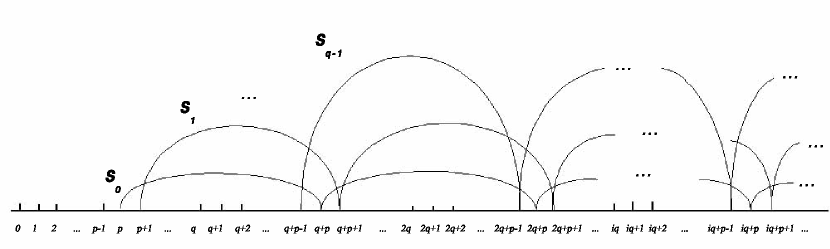

Analogous to (3), we consider the quantity . The superscript indicates the calculation being performed is based on the designated sub-grid. This convention applies to other sub-grids. Moving the sub-grid one step forward forms sub-grid , continuing this process gives sub-grid and so on till the th sub-grid . Figure 1 provides a graphical demonstration of our grid allocation. Further, on the sub-grid , we define the number of observations up to time in sub-grid as

Naturally, and satisfy

3 Main results

We start with results based on a single sub-grid and then proceed to the multiple sub-grids case.

3.1 Single sub-grid: Local Averaging

A natural and effective way of reducing the effect of microstructure noise in estimating is averaging, see, e.g., Jacod et al. (2009) and Podolskij and Vetter (2009). Following Jacod et al. (2009), we average every observations that precede each observation in the sub-sample to obtain a new sequence of observations, which we denote by Based on this sequence of observations, we obtain a single-grid biased local averaging estimator. To be specific,

The RV based on the sequence is denoted by

where for . After correcting the bias due to noise, the single-grid local averaging estimator is defined as

| (6) |

where

| (7) |

is an estimator of , see Lemma 1 in A.1, and is the RV based on all observations up to time . We now state conditions that lead to the theorem for the single sub-grid case:

-

C(1).

and are integrable and locally bounded;

-

C(2).

;

-

C(3).

for some nonnegative constant ;

-

C(4).

where is an adapted integrable process (and hence in particular, );

-

C(5).

The microstructure noise sequence consists of independent random variables with mean 0, variance , and common finite third and forth moments, and is independent of .

The following theorem characterizes the asymptotic property of the estimator (6).

Theorem 1.

Assume Assumption 1 and conditions C(1) C(5). Suppose that , and and for some and positive constants and , and also that

| (8) | |||

| (9) |

where , and and are both integrable. Then, stably in law,

where is a standard Brownian motion independent of .

Proof of the theorem is given in A.2.

In the literature it is often assumed that the mesh , in other words, in Condition C(4). In this case, the convergence rate in Theorem 1 can be arbitrarily close to

Remark 1.

Unlike in the full grid setting where a nonzero limit of tricity can be easily generated by letting the sampling times be hitting times of asymmetric barriers (see for instance Examples 4 & 5 of Li et al. (2009)), in the subgrid case a nonzero limit of tricity is far less common, and in particular under the settings of both Examples 4 & 5 of Li et al. (2009), the limit in vanishes. However as we found in simulation studies (not all reported), even in these situations, adopting the (finite sample) bias correction discussed in Section 3.3 below can substantially reduce the (finite sample) bias. Similar remark applies to the estimator in Theorem 2 below.

3.2 Multiple sub-grids: Moving Average

We show in this subsection that for any , rate consistency can be achieved by using moving average based on multiple sub-grids. For that purpose, we need such notations as , i.e. the RV of locally averaged process over the th sub-grid, for the same operations that are performed over the th sub-grid being adjusted to the th sub-grid . To be specific, we take for example; other notation with superscript or has similar interpretation. Similar to the definition of (i.e. ), we first define

where, recall that denotes the th observation time on the th sub-grid. The RV of locally averaged process over the th sub-grid is defined as follows

where for . Assume the following conditions that lead to the asymptotic result on multiple sub-grids:

-

C(6).

for every , where is integrable;

-

C(7).

for every , where is integrable.

Define

Under the conditions of Theorem 2 below,

Theorem 2.

Assume Assumption 1 and conditions C(1) to C(7). Suppose that , and and for some and positive constants and . Then, stably in law,

where is a standard Brownian motion that is independent of .

Proof of the theorem is given in A.3.

If one assumes that , then , and the convergence rate in the above theorem can be arbitrarily close to

Remark 2.

If times are exogenous, Condition C(6) can be reduced to a similar assumption as (48) on p.1401 of Zhang, Mykland and Aït-Sahalia (2005). The limit is then related to quarticity and can be consistently estimated, see, e.g., Jacod et al. (2009), Barndorff-Nielsen et al. (2008). In general, when observation times can be endogenous, the limit is expected to be different.

3.3 Bias Correction

Since the estimator constructed based on multiple grids achieves a better rate of convergence, below we shall mainly focus on the moving average setting. Based on the above result, we have the following (infeasible) unbiased estimator:

The following Corollary describes the asymptotic property for this estimator.

Corollary 1.

Under the assumptions of Theorem 2, stably in law,

where is a standard Brownian motion that is independent of .

Proof.

This is just a rearrangement of the convergence in Theorem 2.

To improve over and build a feasible unbiased estimator, a consistent estimator for the bias term is needed. This is the issue that we deal with next. Define

| (10) | ||||

For a given partition over , we define

| (11) |

We then have that stably in law,

Define

And assume

-

C(7’)

in for a (nonrandom) sequence with and .

We have the following

Proposition 1.

Assume the conditions of Theorem 2, C(7’) and with Suppose is a.s. continuous and bounded on for . Moreover, define a partition which is a block of time intervals over the complete grid with , and ; and let

Then

According to the above proposition, a consistent estimator for the bias is given by

Finally, we define our feasible unbiased estimator as

The following theorem gives the CLT for our final estimator.

Theorem 3.

Under the assumptions of Theorem 2 and Proposition 1, stably in law,

where is a standard Brownian motion independent of .

4 Simulation studies

In this section, we conduct simulation studies. We investigate the performance of our proposed estimator compared with existing popular estimators in both endogenous and non-endogenous cases. We shall use two data generating mechanisms for : (1) a constant volatility Brownian bridge; and (2) a stochastic volatility Heston bridge. In each case, we start the latent process at , let the standard deviation of the noise be and simulate 1,000 sample paths for observed price process .

4.1 Estimators used for comparison

Below we briefly recall four commonly used volatility estimators: the two scales realized volatility (TSRV) of Zhang, Mykland and Aït-Sahalia (2005), the multi-scale realized volatility (MSRV) of Zhang (2006), the Realized Kernel estimator of Barndorff-Nielsen et al. (2008), and the Pre-averaging estimator of Jacod et al. (2009).

The (small-sample adjusted) TSRV estimator is given by

where the data is divided into non-overlapping sub-grids and is the RV on the th sub-grid. Zhang, Mykland and Aït-Sahalia (2005) provided a guideline on the choice of the grid allocation. If we pretend that the volatility were constant, then the optimal choice for grid allocation is where, in practice, one can set where is the RV based on sparse sampling. Here, we implement at 5 minutes frequency.

The MSRV estimator, which is a rate-optimal extension to TSRV, is given as follows

where , and for with for where and . The optimal choice of when the volatility is constant is

where , , and .

The Realized Kernel estimator is defined as

where and is a kernel function. We choose the Parzen kernel:

Under constant volatility, the optimal choice for in practice is given by

where , and .

The Pre-averaging estimator is as follows:

where and

with The optimal choice of when the volatility is constant is

Remark 3.

The grid allocation schemes in constructing the above estimators are optimal in the sense of achieving efficient asymptotic variance bound when is constant. However, in practice there is no optimal choice since, for instance, is random and time dependent. See Remarks 2 and 3 in Jacod et al. (2009) for related discussions on this. In our case, due to the more complex model assumptions, i.e. data with time endogeneity and noise, and grid allocation scheme, i.e. bivariate setting in contrast to the existing univariate cases, we do not provide a theoretical optimal choice but rather give below some practical guidelines.

Back to our estimator , there are several tuning parameters ( and ) that one has to determine. Regarding which characterizes the sampling frequency, one can use the average number of transactions per day for the past, say 30, days as an approximation. About , notice that Theorem 2 suggests (hence ) and . On the one hand, one should choose as large as possible in order to have higher convergence rate. On the other hand, large induces small and hence small (recall ) and the main role that plays is to reduce the microstructure noise. Hence, one should also be aware of the magnitude of the microstructure noise when choosing appropriate , and can not be too small when prices are heavily contaminated. Under the simulation setting below, the sampling frequency is around , and the standard deviation of the noise is . We choose which is found to be good enough to reduce the microstructure noise effect. In practice, one can use (7) to estimate the standard deviation of the noise and come up with a reasonable choice of . The block size should be larger than and is chosen as 20 (and ). As to , this depends on, for example, how volatile the volatility process is, which one can get some rough idea by looking at a suitable estimate of the spot volatilities. If the volatility process is more volatile, one should divide the whole time interval into shorter time periods, i.e., choose a smaller . In our simulation, we choose , i.e. dividing the complete grid into around 20 blocks.

We next present our three simulation designs and the corresponding results.

4.2 Design I: Brownian bridge with hitting times

We first consider the case when the latent price process follows a Brownian bridge with (constant) volatility that starts at and ends at . can be expressed as (see pp.358 of Karatzas and Shreve (1991))

where is a standard Brownian motion. In this study, we set The sampling times are generated as follows: let , , , (roughly ), and . Then

-

(1)

For

-

(2)

For ,

-

Sparse sampling: ;

-

Intensive sampling: for .

-

The mean observation duration when sampling sparsely is about , roughly 3 times of the observation duration when sampling intensively. If as , grows in the rate of , then actually the limit in C(7) vanishes, however, as one can see from the simulation results below, (finite sample) bias correction as discussed in Subsection 3.3 can substantially reduce the (finite sample) bias.

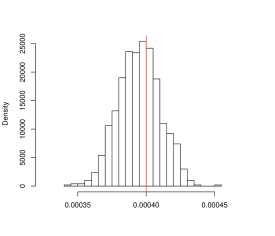

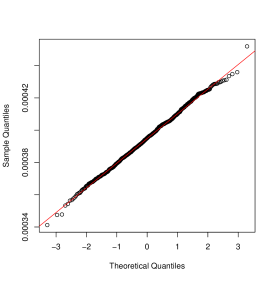

Figure 2 displays the histogram and normal Q-Q plot for the estimator based on the 1,000 simulated samples. The plots show that the finite sample behavior of our CLT works well. In Table 1 we compare the performances of the four estimators that we discussed in Section 4.1, the “Uncorrected” estimator defined in (10), and our final estimator . From the table one can see that our estimator provides the smallest RMSE and has substantially smaller bias than the others (reduced by more than 80%) while maintains similar efficiency (standard deviation).

TSRV MSRV Kernel Pre-averaging Uncorrected RMSE 3.734e-05 3.553e-05 3.810e-05 3.340e-05 3.300e-05 1.621e-05 sample bias 3.300e-05 3.163e-05 3.454e-05 2.927e-05 2.911e-05 -4.997e-06 sample s.d. 1.748e-05 1.619e-05 1.609e-05 1.609e-05 1.555e-05 1.543e-05

4.3 Design II: Heston Bridge with hitting times

In order to further investigate the performance of our estimator under more complex situations, in this subsection, we consider the following stochastic volatility model

where and are standard Brownian motions with instantaneous correlation coefficient , and and are positive constants. We consider the situation when starts at and ends at . In the simulation, we set , and Here, we choose a moderate value for to represent the leverage effect. The leverage effect can be bigger for indices as studied by Aït-Sahalia and Kimmel (2007) and Aït-Sahalia et al. (2012). Times are generated according to the same hitting rule as in Design I. We can see from Table 2 that in this more complex situation, our estimator again has substantially smaller bias and RMSE than the others. We did not include the sample standard deviation here since the integrated volatility to be estimated in this case depends on the sample path and is random.

TSRV MSRV Kernel Pre-averaging Uncorrected RMSE 3.824e-05 3.579e-05 3.835e-05 3.387e-05 3.375e-05 1.636e-05 sample bias 3.393e-05 3.175e-05 3.463e-05 2.965e-05 2.974e-05 -4.215e-06

4.4 Design III: Brownian Bridge with independent Poisson times

The goal of this design is to check the performance of our estimator when the sampling times are not endogenous. We again assume the Brownian bridge dynamic for as in Design I. The observation times are now generated from an independent Poisson process with rate 46,800. Table 3 reports the result of performance comparison, and we can see that our estimator performs similarly as the other estimators in this case.

TSRV MSRV Kernel Pre-averaging Uncorrected RMSE 1.486e-05 1.375e-05 1.434e-05 1.373e-05 1.312e-05 1.568e-05 sample bias 2.643e-06 1.584e-06 4.144e-06 -2.847e-07 -1.274e-06 -7.723e-06 sample s.d. 1.463e-05 1.367e-05 1.374e-05 1.373e-05 1.307e-05 1.365e-05

In summary, one observes from Tables 1-3 that when sampling times are endogenous (Designs I and II), one can have substantial reductions in RMSE and bias by using our estimator. When there is no endogeneity (Design III), our estimator performs comparably to others.

5 Concluding remarks

In this paper, we establish a theoretical framework for dealing with effects of both the endogenous time and microstructure noise in volatility inference. An estimator that can accommodate both issues is proposed. Numerical studies are performed. The results show that our proposed estimator can substantially outperform existing popular estimators when time endogeneity exists, while has a comparable performance to others when there is no endogeneity.

Acknowledgements

We thank Rainer Dahlhaus, Jean Jacod, Per Mykland and Nakahiro Yoshida for this special issue, and we are very grateful to an anonymous referee for very careful reading of the paper and constructive suggestions.

Appendix A Proofs

Throughout the proofs, etc. denote generic constants whose values may change from line to line. Moreover, since we shall establish stable convergence, by a change of measure argument (see e.g. Proposition 1 of Mykland and Zhang (2012)) we can suppress the drift and assume that

-

1.

.

Moreover, because of the local boundedness condition on , by standard localization arguments we can assume without loss of generality that

-

2.

where and are nonrandom numbers,

see e.g. Mykland and Zhang (2009) and Mykland and Zhang (2012). Similarly, we can without loss of generality strengthen the assumption on and in C(2) – C(4) as follows:

-

3.

; and

-

4.

A.1 Prerequisites

In the proofs, we shall repeatedly use the following inequalities.

Burholder-Davis-Gundy (BDG) inequality with random times:

First, if ’s are stopping times and is adapted with , then by the Burholder-Davis-Gundy inequality with random times (see, e.g., p. 161 of Revuz and Yor (1999)), for any exponent ,

Doob’s inequality:

Second, for any process , which is either a continuous time martingale or a positive submartingale, Doob’s inequality (see p.54 of Revuz and Yor (1999)) states that, for any and any

and for ,

Therefore, if we can establish a bound order for ( in our case), then the same bound order applies in .

We will also use the following results about the convergence of to .

Lemma 1.

For defined in (7), one has .

Proof.

First, notice that

By C(2) and the fact that ,

As to we treat it as follows,

We have

by again C(2) and . The same argument applies to the other term. Hence, . For the last term we rewrite it as

Similarly as above, we have

and and , completing the proof.

Next, as we will deal with sums of a random number of random variables repeatedly, the following simple lemma turns out to be very useful.

Lemma 2.

Suppose that is a random variable taking values in nonnegative integers, and are nonnegative random variables satisfying

Then

Proof.

The conclusion follows from the fact that and the Monotone Convergence Theorem.

A.2 Proof of Theorem 1: single sub-grid case

The basic idea is to decompose

into existing familiar quantities and other negligible terms. The proof is divided into three steps.

Step 1: Introducing

The local average can be decomposed as follows

where

which is a sequence of independent random variables with common mean , variance and Motivated by the above decomposition, we introduce the new process as follows

The strategy is that if the difference , where similarly to the definition of

is of a negligible order, then one needs only to deal with .

Step 2: Determining the order of

For notational convenience, we define for ,

| (A.1) |

and let

Adopting the above notation, we can write

| (A.2) |

By Cauchy-Schwartz inequality, for any ,

By the BDG inequality and the strong markov property of ,

By Lemma 2 and the fact that and hence we then obtain

| (A.3) |

Next we study term In fact,

| (A.4) |

Hence, it follows from (A.3) that .

Finally we deal with term .

Claim 1.

Proof of the Claim. First notice that

where, by BDG inequality and (A.3), we have that

| (A.5) |

and hence Next define . Then

| (A.6) | ||||

By BDG inequality, ; moreover, by BDG inequality again,

hence, applying once more the BDG inequality one obtains that

| (A.7) |

It follows that and moreover,

To summarize,

| (A.8) |

Remark 4.

In the proof for Theorem 2 below, we will analyze in more detail. Notice that , where the end effect terms and are and by BDG inequality, is . Hence, from (A.2) and the analysis of terms , and ,

| (A.9) |

Moreover,

| (A.10) |

Step 3: CLT for

We first notice that

| (A.11) | ||||

Hence, we have the following decomposition

| (A.12) |

Recall that and . Then by (A.8), is . As to the term in (A.12), by Lemma 1 together with C(2) and C(4), we have that

Therefore, in order to prove the asymptotic property of one only needs to prove the FCLT for the following quantity

| (A.13) |

Firstly, notice that

Note that , hence , and so is . Moreover,

Note that and so is . We are hence led to study the following martingales

Then (A.13) can be rewritten as

| (A.14) |

Simple calculation gives the corresponding predictable variation processes as follows

where in the last convergence we used the fact that in since it is a martingale with predictable variation

Furthermore, the predictable covariation processes of and are

where the last order follows from the fact that by considering its predictable variation process similarly to the way that we treat . The Lindeberg type condition can be easily verified by using the same calculations as above and the assumption that is an independent sequence with finite forth moment. Therefore, the usual martingale central limit theorem gives

| (A.15) |

where and are independent standard Brownian motions and the limiting covariance matrix process is given by

| (A.19) |

A.3 Proof of Theorem 2: multiple sub-grids case

We shall establish the following stable in law convergence

Similar to the convention of using notation to denote RV of local averaged process computed based on the th sub-grid all subsequent notations in the proof with superscript or indicate that the same operation as performed on the sub-grid is applied to the th sub-grid.

The proof for Theorem 2 also proceeds in three steps. Similar to the proof of Theorem 1, the proof for Theorem 2 is based on the following decomposition

Assuming and with assumptions made in the theorem on and , we shall show in Step 1 that ; in Step 2 that satisfies a martingale CLT; in Step 3 a CLT with asymptotic bias decomposition for term ; and, finally, sum up in Step 4 .

Step 1

To show , we consider the difference

| (A.21) |

adopting the previous notational convention for the single sub-grid case, where and are defined in (A.1). Roughly speaking, recall (A.9) and (A.10) of Remark 4 from the end of Step 2 in the proof for Theorem 1, we expect the difference (A.21) to be

| (A.22) |

It is easy to see that . Hence if we can show that (A.22) holds.

We start with Notice that on each sub-grid

Therefore, term can be rewritten as follows

| (A.23) | |||

It is easy to see that the edge term . We shall further show that is negligible. To see that, notice that its expected predictable variation satisfies

which follows from the fact that

Therefore,

Next we estimate It can be rearranged as

We denote the above quantity as Similar to the treatment for ,

Therefore,

Now we study Noticing that the estimate in (A.4) holds uniformly for sub-grids , hence by Cauchy-Schwartz inequality we obtain that

Now we come to By Cauchy-Schwartz inequality again, as the estimate in (A.5) holds uniformly for sub-grids , we have

Step 2

Now we deal with the term , starting with . Denote

Combining terms with common factor and ordering them chronologically (according to the sequence ) we get

where the remainder term is a sum similar as above over the ’s smaller than , and can be easily shown to be . We shall further show that the first summand is also negligible, as follows

| (A.24) | ||||

| (A.25) |

We have, firstly, by applying Lemma 2 and using the fact that for all

This, together with the Cauchy-Schwartz inequality, imply that Finally, using the Cauchy-Schwartz inequality again we have

Second, for , following the way the terms of were rearranged, we have

where the term is again due to the end effect.

We first deal with . We need the following notation

Let and be the largest element in . Moreover, denote the following weight function

Notice that for all . is a martingale with quadratic variation that can then be represented as

where the last line follows from the assumption that and the third equality is explained as follows. We take the third term on the RHS of the second equality for example while the second term can be treated more easily by a similar argument. Notice that this term can be rewritten as

where Hence by Lemma 2, the BDG inequality, the boundedness of function and the fact that the cardinality of set is of order , we have

Hence .

Therefore, based on our moment assumption for , satisfies a CLT where the limiting distribution is a mixture of normal and the mixture component is the variance equal to ; in other words,

| (A.26) |

where is a standard Brownian motion that is independent of .

As to it follows from Lemma 1 and C(4) that

Step 3

Finally, we prove a CLT for term . We have

where

and is the largest time smaller than or equal to on the th sub-grid. Therefore

where

is a martingale with quadratic variation Since ,

| (A.27) |

Hence, we need to only consider , i.e., By Itô’s formula,

Hence

| (A.28) |

We first prove the second term on the RHS of (A.28) is negligible. In fact, by the BDG inequality,

| (A.29) |

uniformly in . Hence

| (A.30) |

and Now we deal with the first term in (A.28). We shall only focus on the integral on where is the largest ; the remainder term is negligible. We then have

By the BDG inequality and Lemma 2, Moreover, for term , by computing its quadratic variation and using (A.29) we get

As to term , we treat it in the same fashion as above by defining for ,

Then

which is again an term by noting that (1) ; and (2) . Finally, by assumption C(6) we get the convergence of term and hence

Next, we estimate the quadratic covariation between and . To do so, we first notice that, by Itô’s formula,

| (A.31) |

where

We next show that the martingale term in (A.31) is negligible. Rearranging terms the same way as we did for , we have

where

Observe that by the Cauchy-Schwartz inequality and the BDG inequality,

Hence, uniformly in and , Therefore, by the BDG inequality again,

and hence Therefore, Assumption C(7) and (A.31) imply that

Step 4

References

- Aït-Sahalia and Kimmel (2007) Aït-Sahalia, Y., and Kimmel, R. (2007) Maximum Likelihood Estimation of Stochastic Volatility Models. Journal of Financial Economics, 83 413–452.

- Aït-Sahalia et al. (2012) Aït-Sahalia, Y., Fan, J., and Li, Y. (2012) The Leverage Effect Puzzle: Disentangling Sources of Bias at High Frequency. Journal of Financial Economics, forthcoming.

- Aït-Sahalia and Mykland (2003) Aït-Sahalia, Y., and Mykland, P.A. (2003) The Effects of Random and Discrete Sampling When Estimating Continuous Time Diffusions. Econometrica, 71 483–549.

- Aït-Sahalia, Mykland and Zhang (2005) Aït-Sahalia, Y., Mykland, P. A., and Zhang, L. (2005) How Often to Sample a Continuous-Time Process in the Presence of Market Microstructure Noise. Review of Financial Studies, 18 351–416.

- Bandi and Russell (2006) Bandi, F. M., Russell, J. R., 2006. Separating microstructure noise from volatility. Journal of Financial Economics, 79 655–692.

- Barndorff-Nielsen et al. (2008) Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A., and Shephard, N. (2008) Designing Realized Kernels to Measure the ex post Variation of Equity Prices in the Presence of Noise. Econometrica, 76 1481–1536.

- Barndorff-Nielsen and Shephard (2002) Barndorff-Nielsen, O.E., and Shephard, N. (2002) Econometric Analysis of Realized Volatility and Its Use in Estimating Stochastic Volatility Models. J. Roy. Statist. Soc. Ser. B, 64 253–280.

- Duffie and Glynn (2004) Duffie, D., and Glynn, P. (2004) Estimation of Continuous-Time Markov Processes Sampled at Random Times. Econometrica, 72 1773–1808.

- Fan and Wang (2007) Fan, J., Wang, Y., 2007. Multi-scale jump and volatility analysis for high-frequency financial data. Journal of the American Statistical Association, 102 1349–1362.

- Fukasawa (2010a) Fukasawa, M. (2010a) Central limit theorem for the realized volatility based on tick time sampling, Finance and Stochastics, 14 (2010), 209-233.

- Fukasawa (2010b) Fukasawa, M. (2010b) Realized volatility with stochastic sampling, Stochastic Processes and Their Applications, 120, 829–552.

- Fukasawa and Rosenbaum (2012) Fukasawa, M., and Rosenbaum, M. (2012) Central Limit Theorems for Realized Volatility under Hitting Times of an Irregular Grid. Stochastic Processes and Their Applications, 122 3901–3920.

- Hansen and Lunde (2004a) Hansen, P. R., and Lunde, A. (2004a) Realized Variance and IID Market Microstructure Noise. Technical report, Brown University, Dept. of Economics.

- Hayashi, Jacod and Yoshida (2011) Hayashi, T., Jacod, J., and Yoshida, N. (2011) Irregular Sampling and Centeral Limit Theorems for Power Variations: The Continuous Case. Ann. Inst. H. Poincar Probab. Statist, 47 1197–1218.

- Jacod and Protter (1998) Jacod, J., and Protter, P. (1998) Asymptotic Error Distributions for the Euler Method for Stochastic Differential Equations. The Annals of Probability, 26, 267–307.

- Jacod et al. (2009) Jacod, J., Li, Y., Mykland, P. A., Prodolskij, M., and Vetter, M. (2009) Microstructure Noise in the Continuous case: The Pre-averaging Approach. Stochastic Processes and Their Applications, 119 2249–2276.

- Karatzas and Shreve (1991) Karatzas, I., and Shreve, S. E. (1991) Brownian Motion and Stochastic Calculus. Springer.

- Kalnina and Linton (2008) Kalnina, I., Linton, O., 2008. Estimating quadratic variation consistently in the presence of endogenous and diurnal measurement error. Journal of Econometrics, 147 47–59.

- Li and Mykland (2007) Li, Y., Mykland, P. A., 2007. Are volatility estimators robust with respect to modeling assumptions? Bernoulli, 13 601–622.

- Li et al. (2009) Li, Y., Renault, E., Mykland, P. A., Zhang, L., and Zheng, X. (2009) Realized Volatility When Sampling Times are Possibly Endogenous. Manuscript. Available at SSRN: http://ssrn.com/abstract=1525410.

- Li, Zhang and Zheng (2013) Li, Y., Zhang, Z., and Zheng, X. (2013) Supplement to “Volatility Inference in The Presence of Both Endogenous Time and Microstructure Noise”.

- Meddahi, Renault and Werker (2006) Meddahi, N., Renault, E., and Werker, B. (2006) GARCH and Irregularly Spaced Data. Economics Letters, 90 200–204.

- Mykland and Zhang (2006) Mykland, P. A. and Zhang, L. (2006), ANOVA for Diffusions and Itô Processes, Annals of Statistics, 34, 1931–1963.

- Mykland and Zhang (2009) Mykland, P.A., and Zhang, L. (2009) Inference for Continuous Semimartingales Observed at High Frequency. Econometrica, 77 1403–1455.

- Mykland and Zhang (2012) Mykland, P.A., and Zhang, L. (2012) The Econometrics of High Frequency Data. (to appear in Statistical Methods for Stochastic Differential Equations, M. Kessler, A. Lindner, and M. Sørensen, eds., Chapman and Hall/CRC Press), p. 109-190.

- Phillips and Yu (2007) Phillips, P. C. B., and Yu, J. (2007) Information Loss in Volatility Measurement with Flat Price Trading. working paper.

- Podolskij and Vetter (2009) Podolskij, M., and Vetter, M. (2009) Estimation of Volatility Functionals in the Simultaneous Presence of Microstructure Noise and Jumps. Bernoulli, 15 634–658.

- Renault and Werker (2011) Renault, E., and Werker, B. J. (2011) Causality Effects in Return Volatility Measures With Random Times. Journal of Econometrics, 160 272–279.

- Revuz and Yor (1999) Revuz, D., and Yor, M. (1999) Continuous Martingales and Brownian Motion. Springer-Verlag, Berlin.

- Robert and Rosenbaum (2012) Robert, C.Y., and Rosenbaum, M. (2012) Volatility and Covariation Estimation When Microstructure Noise and Trading Times are Endogenous. Mathematical Finance, 22 133–164.

- Xiu (2010) Xiu, D. (2010) Quasi-Maximum Likellihood Estimation of Volatility with High Frequency Data. Journal of Econometrics, 159 235–250.

- Zhang, Mykland and Aït-Sahalia (2005) Zhang, L., Mykland, P. A., and Aït-Sahalia, Y. (2005) A Tale of Two Time Scales: Determining Integrated Volatility with Noisy High-Frequency Data. Journal of the American Statistical Association, 100 1394–1411.

- Zhang (2001) Zhang, L. (2001), From Martingales to ANOVA: Implied and Realized Volatility, Ph.D. thesis, The University of Chicago, Department of Statistics.

- Zhang (2006) Zhang, L. (2006) Efficient Estimation of Stochastic Volatility Using Noisy Observations: A Multi-Scale Approach. Bernoulli, 12 1019–1043.