Information content of financial markets: a practical approach based on Bohmian quantum mechanics

Abstract

The Bohmian quantum approach is implemented to analyze the financial markets. In this approach, there is a wave function that leads to a quantum potential. This potential can explain the relevance and entanglements of the agent’s behaviors with the past. The light is shed by considering the relevance of the market conditions with the previous market conditions enabling the conversion of the local concepts to the global ones. We have shown that there are two potential limits for each market. In essence, these potential limits act as a boundary which limits the return values inside it. By estimating the difference between these two limits in each market, it is found that the quantum potentials of the return time series in different time scales, possess a scaling behavior. The slopes of the scaling behaviors in mature, emerging and commodity markets show different patterns. The emerge market having a slope greater than 0.5, has a higher value compared to the corresponding values for the mature and commodity markets which is less than 0.5. The cut-off observed in the curve of the commodity market indicates the threshold for the efficiency of the global effects. While before the cut-off, local effects in the market are dominant, as in the case of the mature markets. The findings could prove adequate for investors in different markets to invest in different time horizons.

I Introduction

In the mainstream economy, the cornerstone for mathematical modeling of financial markets is the efficient market hypothesis (EMH)Campbell ; Harrison . A market is said to be efficient if all the existing information has affected the prices and any new random information influences the asset prices randomly Campbell . The EMH hypothesis is based on some assumptions such as rationality of the investors. Empirical studies have shown that the real prices do not completely follow a random walk which is the criterion of EMH Mantegna . Some methods such as behavioral models, try to explain the real behavior of asset prices. On the other hand, one of the behavioral aspects of markets is the entanglement of their conditions that lead to converting the local concepts to the global ones. For example, the today market conditions have a dependency to the previous conditions. So, researchers try to use new methods in order to model the behavior of the markets that consider the coupling structure of them. One of the latest and most powerful approaches for this purpose is implementation of the concepts of quantum mechanics. The previous studies have shown the usefulness of this approach for analyzing the financial markets. Application of quantum formalism in Finance and economy has been shown by Seagal et.al Seagal where they used quantum mechanics for option pricing. The work was completed by the paper of Accardi et al Accardi . Baaquie has used the quantum concepts in different domains of finance Baaquie ; Baaquie1 ; Baaquie2 ; Baaquie3 ; Baaquie4 ; Baaquie5 ; Pedram.

Haven has embedded the Black- Scholes option pricing model in a quantum physics settingHaven ; Haven1 ; Haven2 ; Haven3 . One of the latest quantum formalisms for analyzing the financial markets is using the concept of Bohmian mechanicsChoustova ; Choustova1 ; Choustova2 .

In the Bohmian framework, there is a potential quantum term that shows entanglements and interactions between particles very well. So, this potential term is beneficiary for presenting the structure of the coupled systems such as financial markets that have different participant agents. Choustova Choustova ; Choustova1 ; Choustova2 presented a model for describing the structure of the financial markets based on the Bohmian mechanics.

The model can describe the complexity of the financial markets by considering the psychology of agents of these markets in an information field. In essence, this model can explain the behavioral aspects of markets by using the Bohmian quantum mechanics Choustova ; Choustova1 ; Choustova2 ; Choustova3 . In this paper, we have applied the Chostova’s proposed method in order to extract the information content of financial return time series. We have used different databases; covering securities from the Tehran stock exchange (TSE) as an emerge market TSE , Dow Jones Industrial Average (DJIA30), Standard and Poor’s 500 (SPX) indices from a mature market, and gold & west Texas intermediate oil prices as commodity markets. We have analyzed the daily change of these markets from the 1st of Jan 1996 until 1st of Jan 2011.

The paper is organized as follows: In section II we explain the relation between the Bohmian mechanics and finance theory. In section III we present our findings before stating our conclusions in section IV.

II Finance and Bohmian Quantum Mechanics

Bohemian quantum mechanics is a special point of view to quantum theory with a causal interpretation. This view was first presented by Louis de Broglie in 1927, which was later rediscovered by David Bohm in 1952 Bohm ; Bohm1 . In Bohmian mechanics, a system of particles is described by a wave function that evolves according to Schrdinger’s equation and a deterministic motion part Bohm . The essential part of Bohmian quantum is based on two special assumptions names as the non-locality and the deterministic trajectory. This deterministic trajectory means that there is a guiding equation stemmed from Newton equation that presents the actual positions of the particles. The non-locality means that the behavior of any particle through the wave function which depends on the whole configuration of the universe relates to the other particles statues. This property is equivalent to the notion of the entanglement which plays an important role in financial markets.

The bohemian wave function is as of the form

| (1) |

where is the amplitude of the wave function and is its phase. Substituting in the Schrdinger’s equation before differentiating twice, two equations for can be obtained:

| (2) |

The second term in Eq. 2 contains an additional potential term besides the classical potential () which was named by Bohm as a quantum potential Bohm ; Choustova1 .

| (3) |

The hard financial conditions of markets such as natural resources and hard relations between traders can be described by the classical potential Choustova1 .

Choustova used the quantum potential as a method for describing the mental factors or psychological aspects of the markets Choustova ; Choustova1 ; Choustova2 ; Choustova3 . Traders at the financial market behave stochastically due to free wills of individuals, where the combinations of a huge number of free wills lead to an additional stochastic term at the market that could not be described by classical potential.

In the following section, by applying Bohmian approach to financial markets and finding the quantum potential of the market returns, we try to find the psychological aspects of the markets. This means that the today market return is entangled by the previous returns, where by considering this relationship, we obtain fine information about the market conditions.

III Practical use of Bohmian quantum

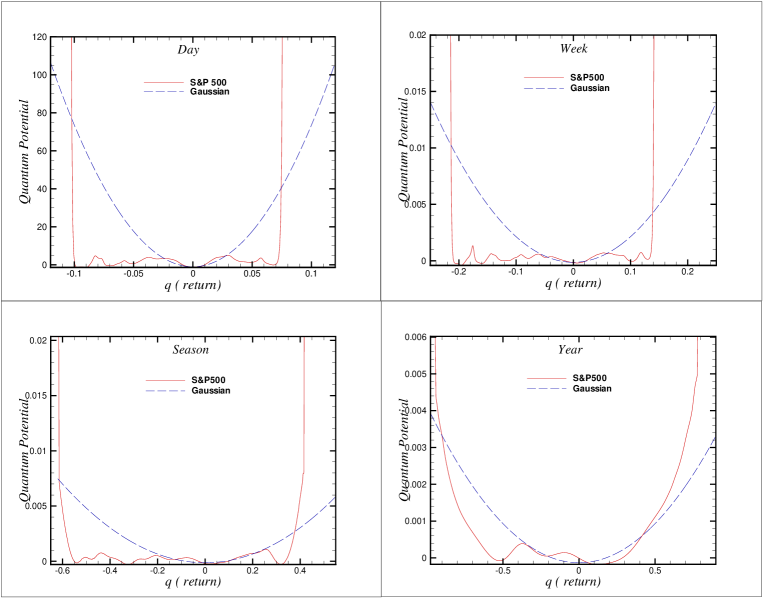

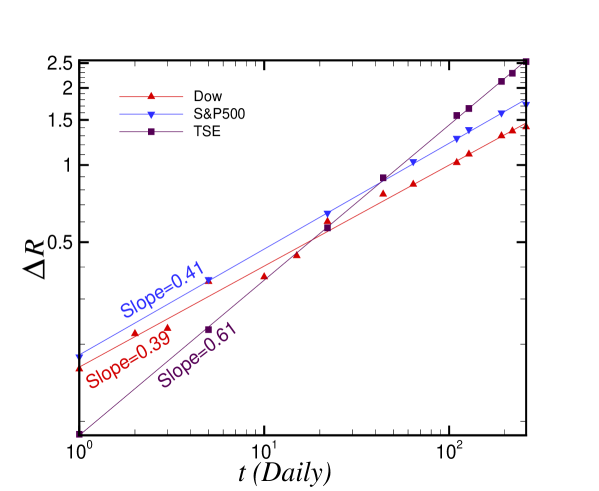

The quantum potentials of different markets have been found by assuming based on the statistical inference of the probability density functions of the markets. Fig.1 shows the quantum potential of return time series of S&P500 index in different time scales. As we can see in daily scale, the maximum probable increase in returns is almost 7 percent. On the other hand, the maximum probable decrease in returns is about . In order to compare these data with real data, it is interesting to mention that there are three days that their returns are much more greater than the maximum limit () and only there is one day (Black Monday- 19 Oct 1987) that its return is smaller than . As we can see for each market, there are two potential limits where the probability of occurrence of any returns outside these limits is very low. In essence, these limits act as boundary to prevent the change of return time series. Based on the previous formulas, the quantum potential has an inverse relation with the probability distribution functions of the time series of returns. By comparing the behavior of a white noise with SPX index, it is obvious that between the two limits, the real market has much higher probability for occurrence. This phenomenon is stemmed from the fat-tail of the distributions of real markets. On the other hand, outside of these limits, the probability of occurrences for the white noise is much more than the SPX. In Fig . 2, we have depicted the differences between two extreme limits for some mature and emerging markets during different time scales. It is obvious that the slope of the scaling behaviors in the mature market indices (SPX and DJIA) vs. scale approximately is about 0.4. On the other hand, the value of the slope for the emerge market index (TSE) is greater than 0.5. This behavior reminds us about the behavior of the Hurst exponent in emerging and matures markets. As shown in previous studies, the Hurst values for emerge and mature markets are greater and less than 0.5 respectively.

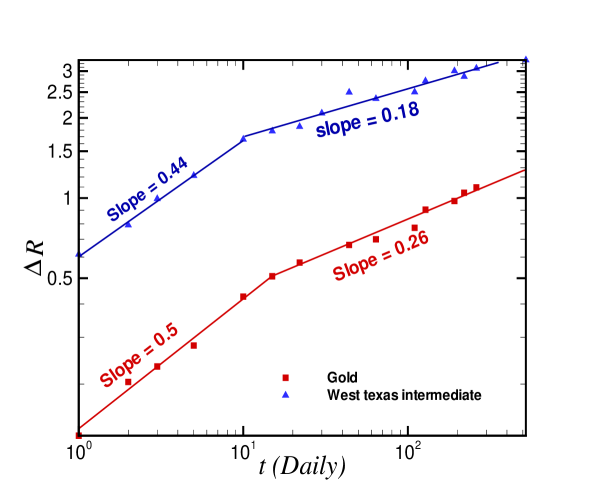

Fig .3 shows that there is a cut-off in the slopes of the commodity markets (oil and gold). The slopes of these markets have two different values where they are the same as mature markets. Before the cut-off points, in short scales the important factor that affects the structure of the markets is the competing nature of the firms in terms of supply and demand. So, the commodity markets in this region have the same nature as the mature markets. But, on the other hand in the large scales the most influential parameters that shape the behavior of the markets are the political and macro subjects. So, the behavior of the commodity markets in large scales is different from the short scales.

IV Conclusion

In this paper, we have used the Bohmian quantum approach to analyze the financial markets. By using this approach we can describe the behavioral aspects of the market indices such as the coupling structure of markets returns during different times in terms of a quantum potential. One of the important findings of this work is that the probable returns for each market lay in specific boundaries during different time scales.

Also, by comparing the real market with a white noise, it is obvious that a real fat-tail distribution has a much more probability for occurrence within the boundaries. On the other hand, for a white noise, the occurrence for any return could be made possible by increasing the quantum potential, while for the real market this issue is out of the question.

By estimating the differences between maximum and minimum returns for some markets, it is found that the quantum potentials of the return series possess scaling behaviors. Also, the slopes of this scaling behavior in the mature and commodity markets are less than 0.5 and on the other hand, the slope of the emerge market (TSE) is greater than 0.5.

In addition, the cut-off observed in the curves of the commodity markets indicates the different efficiency of local and global effects.

The finding would remind us about the behavior of the Hurst exponent, that was shown in previous work for mature markets, where the values where greater than 0.5 for emerge markets and less than 0.5 for mature markets.

Based on the conclusions of this work, the Bohmian quantum approach is a useful technique for analyzing the financial markets.

V Acknowledgement

The authors would like to thank Sara Zohoor and Dr. S. Vasheghani Farahani for helping to edit the manuscript.

References

- (1) J.Y. Campbell, A.S. Low, and A.C. Mackinlay, The Econometrics of Financial Markets. Princeton Unoversity Press (1997).

- (2) J.M. Harrison and S. pliska, Martingales and Stochastic Integrals in the Theory of Countinous Trading, Stochastic Process and their Applications, 11 (1981).

- (3) R.N. Mantegna, H.E. Stanley, Introduction to Econophysics, Cambridge University Press, Cambridge (2000).

- (4) W. Seagal, I.E. Seagal, The black-Scholes pricing formula in the quantum context. Proceeding of National Academy of Sciences of the USA 95 (1998) 4072-4075.

- (5) L. Accardi, A.Boukas, The quantum Black- Scholes equation, GJPAM 2(2) (2007) 155-170.

- (6) B.E. Baaquie, Quantum Finance, Cambridge University Press, Cambridge, (2007).

- (7) B.E. Baaquie, M.Srikant, and M. Warachka, ’A quantum Field Theory Term structure Model Applied to Hedging’, International Journal of Theoretical and Applied Finance 6(5) (2003) 443.

- (8) B.E. Baaquie and S. Marakani, ’Finite Hedging in Field Theory Models of Interest rates’, Physical Review E 69 (2004) 036130.

- (9) B.E. Baaquie and M. Srikant,’ Comparison of Field Theory Models of Interest rates with Market Data’, Physical Review E 69 (2004) 036129.

- (10) B.E. Baaquie, C. Coriano, and M. Srikant, ’Hamiltonian and Potentials in Derivative Pricing Models: Exact Results and Latice Simulations’, Physica A 334 (2004) 531-557.

- (11) B.E. Baaquie, ’Quantum Field Theory of Forward rates with Stochastic Volatility’, Physical Review E 65 (2002) 056122. Pouria Pedram, The minimal length uncertainty and the quantum model for the stock market, Physica A 391 (2012) 2100-2105.

- (12) E. Haven, A discussion on embedding the Black- Scholes option pricing model in a quantum physics setting, Physica A 304 (2002) 507-524.

- (13) E. Haven, A Black-Scholes Shrodinger Option Price: ’bit’ versus ’qubit’, Physica A 324 (2003) 201-206.

- (14) E. Haven, An ’ h-Brownian motion ’ of stochastic option prices, Physica A 344 (2003) 151-155.

- (15) E. Haven, Pilot-wave theory and financial option pricing, International Journal of theoretical Physics 44 (11) (2005) 1957-1962.

- (16) O. Choustova, Quantum Bohmian model for financial markets, Physica A 347 (2006) 304-314.

- (17) O. Choustova, Quantum Probability and financial market, Information Sciences 179 (2009) 478-484.

- (18) O. Choustova, Quantum model for the price dynamics: the problem of smoothness of trajectories, J. Math. Anal. Appl. 346 (2008) 296-304.

- (19) O. Choustova ,Bohmian mechanics for financial process, J. Modern Optics 51 (2004) 1111.

- (20) P. Norouzzadeh, G. R. Jafari, Physica A 356 (2005) 609-627; G. R. Jafari, A. Bahraminasab, P. Norouzzadeh, International Journal of Modern Physics C 18 (2007) 1223-1230.

- (21) D. Bohm, Quantum Theory, Prentice-Hall, Englewood Cliffs, New Jersey (1952).

- (22) D. Bohm, B. Hiley, The Undivided Universe: An Ontological Interpretation of Quantum mechanics, Routledge and Kegan Paul, London (1993).