Asymptotics of forward implied volatility

Abstract.

We prove here a general closed-form expansion formula for forward-start options and the forward implied volatility smile in a large class of models, including the Heston stochastic volatility and time-changed exponential Lévy models. This expansion applies to both small and large maturities and is based solely on the knowledge of the forward characteristic function of the underlying process. The method is based on sharp large deviations techniques, and allows us to recover (in particular) many results for the spot implied volatility smile. In passing we show (i) that the small-maturity exploding behaviour of forward smiles depends on whether the quadratic variation of the underlying is bounded or not, and (ii) that the forward-start date also has to be rescaled in order to obtain non-trivial small-maturity asymptotics.

Key words and phrases:

Stochastic volatility, time-changed exponential Lévy, forward implied volatility, asymptotic expansion2010 Mathematics Subject Classification:

60F10, 91G99, 91G601. Introduction

Consider an asset price process with , paying no dividend, defined on a complete filtered probability space with a given risk-neutral measure , and assume that interest rates are zero. In the Black-Scholes-Merton (BSM) model, the dynamics of the logarithm of the asset price are given by

| (1.1) |

where is the instantaneous volatility and a standard Brownian motion. The no-arbitrage price of the call option at time zero is then given by the famous BSM formula [11, 47]: , with , where is the Gaussian distribution function. For a given market price of the option at strike and maturity we define the spot implied volatility as the unique solution to the equation .

For any and , we define [10, 44] a Type-I forward-start option with forward-start date , maturity and strike as a European option with payoff where pathwise. In the BSM model (1.1) its value is simply worth . For a given market price of the option at strike , forward-start date and maturity we can define the forward implied volatility smile as the unique solution to . A second type of forward-start option exists [44] and corresponds to a European option with payoff . In the BSM model (1.1) the value of the Type-II forward-start option is worth [52]. Again, for a given market price of such an option, we define the Type-II forward implied volatility smile as the unique solution to . Both definitions of the forward smile are generalisations of the spot implied volatility smile since they reduce to the spot smile when .

The literature on implied volatility asymptotics is extensive and has been using a diverse range of mathematical techniques. In particular, small-maturity asymptotics have historically received wide attention due to earlier results from the 1980s on expansions of the heat kernel [6]. PDE methods for continuous-time diffusions [9, 32, 51], large deviations [15, 18], saddlepoint methods [20], Malliavin calculus [7, 41] and differential geometry [26, 33] are among the main methods used to tackle the small-maturity case. Extreme strike asymptotics arose with the seminal paper by Roger Lee [43] and have been further extended by Benaim and Friz [4, 5] and in [30, 31, 23, 15]. Comparatively, large-maturity asymptotics have only been studied in [55, 19, 36, 35, 21] using large deviations and saddlepoint methods. Fouque et al. [22] have also successfully introduced perturbation techniques in order to study slow and fast mean-reverting stochastic volatility models. Models with jumps (including Lévy processes), studied in the above references for large maturities and extreme strikes, ‘explode’ in small time, in a precise sense investigated in [1, 2, 54, 49, 48, 17].

A collection of implied volatility smiles over a time horizon is also known to be equivalent to the marginal distributions of the asset price process over . Implied volatility asymptotics have therefore provided a set of tools to analytically understand the marginal distributions of a model and their relationships to market observable quantities such as volatility smiles. However many models can calibrate to implied volatility smiles (static information) with the same degree of precision and produce radically different prices and risk sensitivities for exotic securities. This can usually be traced back to a complex and often non-transparent dependence on transitional probabilities or equivalently on model-generated dynamics of the smile. The dynamics of the smile is therefore a key model risk associated with these products and any model used for pricing and risk management should produce realistic dynamics that are in line with trader expectations and historical dynamics. One metric that can be used to understand the dynamics of implied volatility smiles ([10] calls it a ’global measure’ of the dynamics of implied volatilities) is to use the forward smile defined above. The forward smile is also a market-defined quantity and naturally extends the notion of the spot implied volatility smile. Forward-start options also serve as natural hedging instruments for several exotic securities (such as Cliquets, Ratchets and Napoleons; see [25, Chapter 10]) and are therefore worth investigating.

Despite significant research on implied volatility asymptotics, there are virtually no results on the asymptotics of the forward smile: Glasserman and Wu [28] introduced different notions of forward volatilities to assess their predictive values in determining future option prices and future implied volatility, Keller-Ressel [40] studies a very specific type of asymptotic (when the forward-start date becomes large), and empirical results have been carried out by practitioners in [10, 12, 25]. Recently, in [37] the authors proved that for fixed the Heston forward smile (corresponding to ) explodes (except at-the-money) as tends to zero.

We consider here a continuous-time stochastic process and prove—under some assumptions on its characteristic function—an expansion for European option prices on of the form

as , for some (explicit) functions and a residue term (Theorem 2.4 and Corollary 2.5). Here is a continuous function satisfying as , and can be interpreted as a large deviations rate function. Setting and or and yields ‘diagonal’ small-maturity (Corollary 2.6) and large-maturity (Corollary 2.9) expansions of forward-start option prices. The diagonal small-maturity re-scaling results in non-degenerate small-maturity asymptotics that are far more accurate than the small-maturity asymptotic in [37]. This result also applies when , and generalises the results in [21], [19], [36]. We also translate these results into closed-form asymptotic expansions for the forward implied volatility smile (Type I and Type II). In Section 3, we provide explicit examples for the Heston and time-changed exponential Lévy processes. Section 4 provides numerical evidence supporting the practical relevance of these results and we leave the proofs of the main results to Section 5.

Notations: shall represent the Gaussian distribution with mean and variance . Furthermore and shall always denote expectation and variance under a risk-neutral measure given a priori. We shall refer to the standard (as opposed to the forward) implied volatility as the spot smile and denote it . The (Type-I) forward implied volatility will be denoted as above. In the remaining of this paper will always denote a strictly positive (small) quantity, and we let and . For two functions we use the notation to mean and we let if and otherwise. For a sequence of sets in , we may, for convenience, use the notation , by which we mean the following (whenever both sides are equal): Finally, for a given set , we let denote its interior (in ) and and denote the real and imaginary parts of a complex number .

2. General Results

This section gathers the main notations of the paper as well as the general results. The main result is Theorem 2.4, which provides an asymptotic expansion—up to virtually any arbitrary order—of option prices on a given process , as tends to zero. This general formulation allows us, by suitable scaling, to obtain both small-time (Section 2.2.1) and large-time (Section 2.2.2) expansions.

2.1. Notations and main theorem

2.1.1. Notations and preliminary results

Let be a stochastic process with re-normalised logarithmic moment generating function (lmgf)

| (2.1) |

We further define and now introduce the main assumptions of the paper.

Assumption 2.1.

-

(i)

Expansion property: For each the following Taylor expansion holds as tends to zero:

(2.2) -

(ii)

Differentiability: There exists such that the map is of class on ;

-

(iii)

Non-degenerate interior: ;

-

(iv)

Essential smoothness: is strictly convex and essentially smooth111[14, Definition 2.3.5]. A convex function is essentially smooth if is non-empty, if is differentiable in , and if is steep, e.g. for every sequence in that converges to a boundary point of . on ;

-

(v)

Tail error control: For any fixed ,

-

(a)

, for any ;

-

(b)

the function has a unique maximum at zero and is bounded away from as tends to infinity;

-

(c)

there exist such that for all and there exists (independent of and ) such that .

-

(a)

Assumption 2.1(i) implies that the functions exist on for . Assumption 2.1(ii) could be relaxed to , but this hardly makes any difference in practice and does, however, render some formulations awkward. If the expansion (2.2) holds up to some higher order , one can in principle show that both forward-start option prices and the forward implied volatility expansions below hold to order as well. However expressions for the coefficients of higher order are extremely cumbersome and scarcely useful in practice. Assumption 2.1(v) is a technical condition (readily satisfied by practical models) required to show that the dependence of option prices on the tails of the characteristic function of the asset price is exponentially small (see Appendix A and C for further details). We do not require this condition to be satisfied at since this corresponds to an option strike at which our main result does not hold anyway ( in Theorem 2.4 below). We note that this assumption is not required if one is only interested in the leading-order behaviour of option prices and forward implied volatility. Assumption 2.1(iv) is the key property that needs to be checked in practical computations and can be violated by well-known models under certain parameter configurations (see Section 3.1.2 for an example).

Define now the function as the Fenchel-Legendre transform of :

| (2.3) |

For ease of exposition in the paper we will use the notation

| (2.4) |

The following lemma gathers some immediate properties of the functions and which will be needed later.

Lemma 2.2.

Under Assumption 2.1, the following properties hold:

-

(i)

For any , there exists a unique such that

(2.5) (2.6) -

(ii)

is strictly convex and differentiable on ;

-

(iii)

if such that , then for all and .

Proof.

-

(i)

By Assumption 2.1 is a strictly increasing differentiable function from to on .

-

(ii)

By (i), for all . In particular is strictly increasing on .

- (iii)

∎

Remark 2.3.

The saddlepoint is not always available in closed-form, but can be computed via a simple root-finding algorithm. Furthermore, a Taylor expansion around any point can be computed iteratively in terms of the derivatives of . For instance, around , we can write . A precise example can be found in the proof of Corollary 3.2.

The last tool we need is a (continuous) function such that there exists for which

| (2.7) |

This function will play the role of rescaling the strike of European options and will give us the flexibility to deal with both small-and large-time behaviours. Finally, for any we now define the functions by

where is given by

| (2.8) | ||||

For ease of notation we write and in place of and . The domains of definition of and excludes the set . For all in this domain, by Assumption 2.1(iv), so that and are both well-defined real-valued functions.

2.1.2. Main theorem and corollaries

The following theorem on asymptotics of option prices is the main result of the paper.

A quick glimpse at the proof of Theorem 2.4 in Section 5.1

shows that this result can be extended to any arbitrary order.

Theorem 2.4.

Using Put-Call parity, the theorem can also be read as an expansion for European Call options (or for Put options) for all strikes, except at the two points and :

Corollary 2.5.

Under the assumptions of Theorem 2.4, we have, for , as :

2.2. Forward-start option asymptotics

We now specialise Theorem 2.4 to forward-start option asymptotics. For a stochastic process , we define (pathwise), for any , the process by

| (2.9) |

2.2.1. Diagonal small-maturity asymptotics

We first consider asymptotics when both and are small, which we term diagonal small-maturity asymptotics. Set and . Then and the following corollary follows from Theorem 2.4:

Corollary 2.6.

If satisfies Assumption 2.1, then the following holds for , as :

In the Black-Scholes model, all the quantities above can be computed explicitly and we obtain:

Corollary 2.7.

In the BSM model (1.1) the following expansion holds for all , as :

Proof.

For the rescaled (forward) process in the BSM model (1.1) we have for , where and . It follows that , and . For any , is the unique solution to the equation and . is essentially smooth and strictly convex on and the BSM model satisfies the other conditions in Assumption 2.1. Since , the result follows from Corollary 2.6. ∎

It is natural to wonder why we considered diagonal small-maturity asymptotics and not the small-maturity asymptotic of for fixed . In this case it turns out that in many cases of interest (stochastic volatility models, time-changed exponential Lévy models), the forward smile blows up to infinity (except at-the-money) as tends to zero. However under the assumptions given above, this degenerate behaviour does not occur in the diagonal small-maturity regime (Corollary 2.6). In the Heston case, this explosive behaviour has been studied in [37]. More generally, we can provide a preliminary conjecture explaining the origin of this behaviour. Consider a two-state Markov-chain , starting at , where is a standard Brownian motion and where is independent of and takes value with probability and value with probability . Conditioning on and by the independence assumption, we have

Consider now the small-maturity regime where , and for a fixed . In this case an expansion for the re-scaled lmgf in (2.2) as tends to zero is given by

Since the remainder tends to zero exponentially fast as . The assumptions of Theorem 2.4 are clearly satisfied and a simple calculation shows that . This example naturally extends to -state Markov chains, and a natural conjecture is that the small-maturity forward smile does not blow up if and only if the quadratic variation of the process is bounded. In practice, most models have unbounded quadratic variation (see examples in Section 3), and hence the diagonal small-maturity asymptotic is a natural scaling.

2.2.2. Large-maturity asymptotics

We now consider large-maturity asymptotics, when is large and is fixed. Consider , and (so that ). Proposition 2.4 then applies and we obtain the following expansion for forward-start options:

Corollary 2.8.

If satisfies Assumption 2.1 with and , then the following expansion holds for all as :

In the Black-Scholes model, all the quantities above can be computed in closed form, and we obtain:

Corollary 2.9.

In the BSM model (1.1) the following expansion holds for all as :

2.3. Forward smile asymptotics

We now translate the forward-start option expansions above into asymptotics of the forward implied volatility smile , which was defined in the introduction.

2.3.1. Diagonal small-maturity forward smile

We first focus on the diagonal small-maturity case. For we define the functions by

| (2.10) |

where , , , are defined in (2.3) (2.5), (2.4), (2.8). The diagonal small-maturity forward smile asymptotic is now given in the following proposition, proved in Section 5.1.

Proposition 2.10.

Remark 2.11.

- (i)

-

(ii)

The condition is equivalent to , which imposes some regularity on the paths of the process at . Diffusion processes seem more readily able to satisfy this condition as opposed to jump processes where it is well-known that implied volatility asymptotics explode in small-time (see [54]). Under this condition the zeroth-order term in (2.10) has a well-defined limit at the origin.

-

(iii)

Using Taylor expansions in a neighbourhood of it can be shown that has a well-defined limit at if and only if and has a well-defined limit at if and only if and are well-defined and . Interestingly, these conditions can be written in similar ways to (ii). For example, the condition is equivalent to imposing a constraint on the mean and variance of at . Most models used in practice (and in particular those in Section 3) satisfy these properties and we leave the precise study of this phenomenon for future work.

2.3.2. Large-maturity forward smile

In the large-maturity case, define for , the functions by

| (2.12) |

, , , are defined in 2.3, (2.5), (2.4), (2.8). The large-maturity forward smile asymptotic is given in the following proposition, proved in Section 5.1. When in (2.11) and (2.13) below, we recover—and improve—the asymptotics in [16], [18], [19], [20], [21]. It is interesting to note that the (strict) martingale property () is only required in Proposition 2.12 below and not in Proposition 2.10 and Theorem 2.4.

Proposition 2.12.

Since and , we always have from Lemma 2.2(iii). One can also check that for and for . This implies that the functions () are always well-defined. By Assumption 2.1 and Lemma 2.2(iii) we have . Again from Lemma 2.2(iii) this implies that . Hence is continuous on with and . The functions and are undefined on . However, it can be shown that since is strictly convex (Assumption 2.1) and all limits are well-defined and hence both functions can be extended by continuity to . For example, using Taylor expansions in neighbourhoods of these points yields:

which, for , agrees with [21, equation 19] for the specific case of the Heston model (Section 3.1).

2.3.3. Type-II forward smile

As mentioned in the introduction, another type of forward-start option has been considered in the literature. We show here that the forward implied volatility expansions proved above carry over in this case with some minor modifications. For the -martingale price (under ) define the stopped process for any . Following [44] define a new measure by

| (2.14) |

The stopped process is a -martingale and (2.14) defines the stopped-share-price measure . The following proposition shows how the Type-II forward smile can be incorporated into our framework.

Proposition 2.13.

Proof.

We can write the value of our Type-II forward-start call option as

Proposition 2.4 and Corollaries 2.6, 2.8 hold in this case with all expectations (and the lmgf in (2.1)) calculated under the stopped measure . An easy calculation shows that under , the forward BSM lmgf remains the same as under . Thus all the previous results carry over and the proposition follows. ∎

3. Applications

3.1. Heston

In this section, we apply our general results to the Heston model, in which the (log) stock price process is the unique strong solution to the following SDEs:

| (3.1) |

with , , and and and are two standard Brownian motions. We shall also define . The Feller SDE for the variance process has a unique strong solution by the Yamada-Watanabe conditions [38, Proposition 2.13, page 291]). The process is a stochastic integral of the process and is therefore well-defined. The Feller condition, , ensures that the origin is unattainable. Otherwise the origin is regular (hence attainable) and strongly reflecting (see [39, Chapter 15]). We do not require the Feller condition in our analysis since we work with the forward lmgf of which is always well-defined.

3.1.1. Diagonal Small-Maturity Heston Forward Smile

The objective of this section is to apply Proposition 2.10 to the Heston forward smile, namely

This proposition is proved in Section 5.2.1, and all the functions therein are defined as follows:

| (3.2) |

and the functions are defined as

| (3.3) |

with

For any the functions and are well-defined real-valued functions for all (see Remark 5.7 for technical details). Also since , is well-defined at . In order to gain some intuition on the role of the Heston parameters on the forward smile we expand (2.11) around the at-the-money point in terms of the log strike :

Corollary 3.2.

The following expansion holds for the Heston forward smile as and tend to zero:

The corollary is proved in Section 5.2.1, and the functions appearing in it are defined as follows:

| (3.4) |

Remark 3.3.

The following remarks should convey some practical intuition about the results above:

-

(i)

For this expansion perfectly lines up with Corollary 4.3 in [20].

-

(ii)

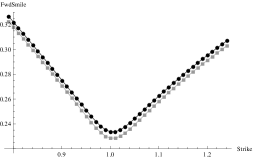

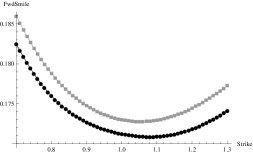

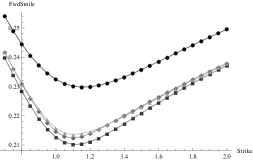

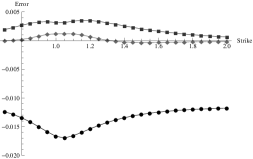

Corollary 3.2 implies , as . For small enough , the spot at-the-money volatility is higher than the forward if and only if . In particular, when , the difference between the forward at-the-money volatility and the spot one is increasing in the forward-start dates and volatility of variance . In Figure 2 we plot this effect using and . The relative values of and impact the level of the forward smile vs spot smile.

-

(iii)

For practical purposes, we can deduce some information on the forward skew by loosely differentiating Corollary 3.2 with respect to :

-

(iv)

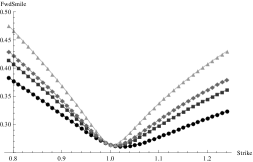

Likewise an expansion for the Heston forward convexity as tends to zero is given by

and in particular . For fixed maturity the forward convexity is always greater than the spot implied volatility convexity (see Figure 2) and this difference is increasing in the forward-start dates and volatility of variance. At zeroth order in the wings of the forward smile increase to arbitrarily high levels with decreasing maturity. (see Figure 1(a)) This effect has been mentioned qualitatively by practitioners [12]. As it turns out for fixed the Heston forward smile blows up to infinity (except at-the-money) as the maturity tends to zero, see [37] for details.

In the Heston model, is a true martingale [3, Proposition 2.5]. Applying Proposition 2.13 with Lemma 5.9, giving the Heston forward lmgf under the stopped-share-price measure, we derive the following asymptotic for the Type-II Heston forward smile :

Corollary 3.4.

The diagonal small-maturity expansion of the Heston Type-II forward smile as and tend to zero is the same as the one in Corollary 3.2 with , and replaced by , and , where

Its proof is analogous to the proofs of Proposition 3.1 and Corollary 3.2, and is therefore omitted. Note that when or , (), and the Heston forward smiles Type-I and Type-II are the same.

3.1.2. Large-maturity Heston forward smile

Our main result here is Proposition 3.5, which is an application of Proposition 2.12 to the Heston forward smile. We shall always assume here that . When this condition fails, moments of the stock price process (3.1) strictly greater than one cease to exist for large enough time, and consequently the limiting lmgf is not essentially smooth on its effective domain and Assumption 2.1(iv) is violated. This a standard assumption in the large-maturity implied volatility asymptotics literature [19, 21, 36], but bears no consequences in markets where the implied volatility skew is downward sloping, such as equity markets, where the correlation is negative. Define the quantities

| (3.5) |

as well as the interval by

| (3.6) |

Details about each case are given in Lemma 5.11. We define the functions and from to by

| (3.7) | ||||

| (3.8) |

From the proof of Proposition 5.12, one can see that and are always well-defined real-valued functions on . Finally we define the functions and by

| (3.9) |

The following proposition gives the large-maturity forward Heston smile in Case (iii) in (3.6), and its proof is postponed to Section 5.2.2.

Remark 3.6.

-

(i)

Note that is nothing else than the Fenchel-Legendre transform of , and the corresponding saddlepoint (see [19] for computational details).

- (ii)

- (iii)

- (iv)

-

(v)

For practical purposes, note that is always satisfied under the assumptions of the proposition.

-

(vi)

Even though the function does not depend on , and the function do (see the at-the-money example below). That said, to zeroth order and correlation close to zero, the large-maturity forward smile is the same as the large-maturity spot smile. This is a very different result compared to the Heston small-maturity forward smile (see Remark 3.3(iv)), where large differences emerge between the forward smile and the spot smile at zeroth order.

We now give an example illustrating some of the differences between the Heston large-maturity forward smile and the large-maturity spot smile due to first-order differences in the asymptotic (2.13). This ties in with Remark 3.6(vi). Specifically we look at the forward at-the-money volatility which, when using Proposition 3.5 with , satisfies , as tends to infinity, with

is defined in (3.5) and . To get an idea of the -dependence of the at-the-money forward volatility we set (since Proposition 3.5 is valid for correlations near zero) and perform a Taylor expansion of around : When then at this order the large -maturity forward at-the-money volatility is lower than the corresponding large -maturity at-the-money implied volatility and this difference is increasing in and in the ratio . This is similar in spirit to Remark 3.3(ii) for the small-maturity Heston forward smile.

3.2. Time-changed exponential Lévy

It is well known [13, Proposition 11.2] that the forward smile in exponential Lévy models is time-homogeneous in the sense that does not depend on , (by stationarity of the increments). This is not necessarily true in time-changed exponential Lévy models as we shall now see. Let be a Lévy process with lmgf given by for and . We consider models where pathwise and the time-change is given by with being a strictly positive process independent of . We shall consider the two following examples:

| (3.10) | ||||

| (3.11) |

with and . Here is a standard Brownian motion and is a compound Poisson subordinator with exponential jump size distribution and Lévy exponent for all with and . In (3.10), is a Feller diffusion and in (3.11), it is a -OU process. We now define the functions and from to , and the functions and from to by

| (3.12) | |||

| (3.13) |

where we set

| (3.14) |

is the Lévy exponent of and and are defined in (5.35). The following proposition—proved in Section 5.3—is the main result of the section.

Proposition 3.7.

Remark 3.8.

- (i)

-

(ii)

The zeroth order large-maturity forward smile is the same as its corresponding zeroth order large-maturity spot smile and differences only emerge at first order. It seems plausible that this will always hold if there exists a stationary distribution for and if is independent of the Lévy process ;

-

(iii)

Case (iii) in the proposition corresponds to the standard exponential Lévy case (without time-change).

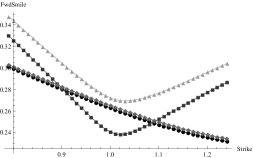

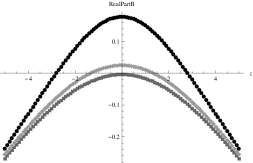

We now use Proposition 3.7 to highlight the first-order differences in the large-maturity forward smile (2.13) and the corresponding spot smile. If follows (3.10) then a Taylor expansion of in (2.12) around gives

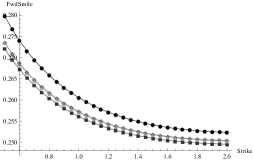

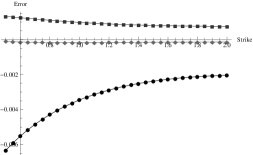

Using simple properties of and we see that the large-maturity forward smile is lower than the corresponding spot smile for (which always include the at-the-money) if . The forward smile is higher than the corresponding spot smile for (OTM options) if , and these differences are increasing in and . This effect is illustrated in Figure 3 and corresponds to strikes in the region in the figure.

If follows (3.11) then a simple Taylor expansion of in (2.12) around gives

Similarly we deduce that the large-maturity forward smile is lower than the corresponding spot smile for if . The forward smile is higher than the corresponding spot smile for (OTM options) if , and these differences are increasing in .

If follows (3.10)((3.11)) then the stationary distribution is a gamma distribution with mean (), see [13, page 475 and page 487]. The above results seem to indicate that the differences in level between the large-maturity forward smile and the corresponding spot smile depend on the relative values of and the mean of the stationary distribution of the process . This is also similar to Remark 3.3(ii) and the analysis below Remark 3.6 for the Heston forward smile. These observations are also independent of the choice of indicating that the fundamental quantity driving the non-stationarity of the large-maturity forward smile over the corresponding spot implied volatility smile is the choice of time-change.

In the Variance-Gamma model [46], , for , with , , and ensures that is a true martingale (). Clearly is essentially smooth, strictly convex and infinitely differentiable on with ; therefore Proposition 3.7 applies. For Proposition 3.7(iii), the solution to is and

The sign condition imposes for all . Hence (continuous on the whole real line) is the only valid solution and the rate function is then given in closed-form as for all real .

4. Numerics

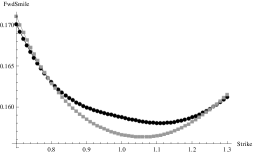

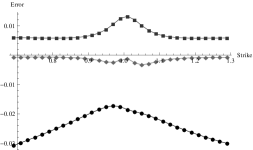

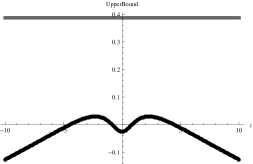

We compare here the true forward smile in various models and the asymptotics developed in Propositions 2.10 and 2.12. We calculate forward-start option prices using the inverse Fourier transform representation in [42, Theorem 5.1] and a global adaptive Gauss-Kronrod quadrature scheme. We then compute the forward smile and compare it to the zeroth, first and second order asymptotics given in Propositions 2.10 and 2.12 for various models. In Figure 4 we compare the Heston diagonal small-maturity asymptotic in Proposition 3.1 with the true forward smile. Figure 5 tests the accuracy of the Heston large-maturity asymptotic from Proposition 3.5. In order to use this proposition we require with defined in (3.5). For the parameter choice in the figure we have and the condition is satisfied. Finally in Figure 6 we consider the Variance Gamma model time-changed by a -OU process using Proposition 3.7. Results are in line with expectations and the higher the order of the asymptotic the closer we match the true forward smile.

5. Proofs

5.1. Proofs of Section 2

5.1.1. Proof of Theorem 2.4

Our proof relies on several steps and is based on so-called sharp large deviations tools. We first —as in classical large deviations theory—define an asymptotic measure-change allowing for weak convergence of a rescaled version of . In Lemma 5.1 we derive the asymptotics of the characteristic function of this rescaled process under this new measure. The limit is a Gaussian characteristic function making all forthcoming computations analytically tractable. We then write the option price as an expectation of the rescaled process under the new measure (see (5.5)), and prove an inverse Fourier transform representation (Lemma 5.3) for sufficiently small . Splitting the integration domain (Equation (5.11)) of this inverse Fourier transform in two (compact interval and tails), (a) we integrate term by term the compact part, and (b) we show that Assumption 2.1(v) implies that the tail part is exponentially small (Lemma A.1). We now start the analysis and define such a change of measure by

| (5.1) |

with defined in (2.5). By Lemma 2.2(i), for all and so is finite for small enough since . Also is almost surely strictly positive and hence . Therefore (5.1) is a valid measure change for all . We define the random variable

| (5.2) |

and set the characteristic function of in the -measure as follows

| (5.3) |

Recall from Section 2 that and ; we first start with the following important technical lemma.

Lemma 5.1.

The expansion holds as , with the functions , defined in (5.4).

Remark 5.2.

Proof.

Since is analytic [45, Theorem 7.1.1] on the set for small enough, holds as . By [50, Theorem 1.8.5.] the asymptotic for in 2.2 can be differentiated with respect to due to Assumption 2.1(ii). This allows us to write , and hence

Writing out the first few terms of this expression and using (2.5) we find that

where we define the functions

| (5.4) |

∎

With these preliminary results, we can now move on to the actual proof of Theorem 2.4. For , let us define the functions by

Using the definition of the -measure in (5.1) the option prices in Theorem 2.4 can be written as

| (5.5) | ||||

By the expansion in Assumption 2.1(i) and Equality (2.6) we immediately have

| (5.6) |

From the definition of the random variable in (5.2) we obtain

where for , we define the modified payoff functions by Assuming (for now) that , we have for any ,

For ease of notation define the function by

| (5.7) |

For we can write

which is valid for . For sufficiently small and by the definition of in (2.7) this holds for . For we can write

which is valid for as tends to zero. Finally, for we have

which is valid for . For sufficiently small and by the assumption on in (2.7) this is true for . In this context comes out naturally in the analysis as a classical dampening factor. Note that in order for these strips of regularity to exist we require that , as assumed in the theorem. By the strict convexity and essential smoothness property in Assumption 2.1(iv) we have

| (5.8) |

The following technical lemma allows us to write the transformed option price as an inverse Fourier transform.

Lemma 5.3.

There exists such that for all and all , we have ( denoting the complex conjugate of )

| (5.9) |

We note in passing that

| (5.10) |

We now consider the integral appearing in Lemma 5.3. For small enough, we can split the integral as

| (5.11) | ||||

for some by Lemma A.1, and using also Lemma 5.1 for the first integral. The function is defined as , with () defined in (5.4). A Taylor expansion of around for yields

where we define the following functions:

| (5.12) | ||||

with the for , defined in (5.4). A (tedious) Taylor expansion of around for yields

We will shortly be integrating against a zero-mean Gaussian characteristic function over and as such all odd powers of will have a null contribution. In particular note that the polynomials

are odd functions of and hence have zero contribution. The major quantity is , which we can rewrite as , where

Let

Using simple properties of moments of a Gaussian random variable we finally compute the following

The third line follows from the Laplace method: in particular the tail estimate () for an integral over the Gaussian characteristic function is exponentially small, and hence is absorbed in the term. Combining this with (5.11), Lemma 5.3 and (5.6) with the property (5.8), the theorem follows.

5.1.2. Proof of the forward implied volatility expansions (Propositions 2.10, 2.12)

Gao and Lee [24] have obtained representations for asymptotic implied volatility for small and large-maturity regimes in terms of the assumed asymptotic behaviour of certain option prices, outlining the general procedure for transforming option price asymptotics into implied volatility asymptotics. The same methodology can be followed to transform our forward-start option asymptotics (Corollary 2.6 and Corollary 2.8) into forward smile asymptotics. In the proofs of Proposition 2.10 and Proposition 2.12 we hence assume for brevity the existence of an ansatz for the forward smile asymptotic and solve for the coefficients. We refer the reader to [24] for the complete methodology.

Proof of Proposition 2.10.

Proof of Proposition 2.12.

Substituting the ansatz

| (5.13) |

into Corollary 2.9 we obtain the following asymptotic expansions for forward-start options:

for all , where

| (5.14) |

We obtain the expressions for and by equating orders with the formula in Corollary 2.8. Choosing the correct root for the zeroth order term is now classical in this literature (this is an argument by contradiction), and we refer the reader to [21] for details. ∎

5.2. Proofs of Section 3.1

We now let be the Heston process satisfying the SDE (3.1). The tower property for expectations yields the forward lmgf:

| (5.15) |

defined for all such that the rhs exists and where

| (5.16) |

and , and were introduced in (3.8). In the next two subsections we develop the tools needed to apply Propositions 2.10 and 2.12 to the Heston model.

5.2.1. Proofs of Section 3.1.1

We consider here the Heston diagonal small-maturity process with defined in (3.1) and in (2.9). The forward rescaled lmgf in (2.1) is easily determined from (5.15).

In this subsection, we prove Proposition 3.1. For clarity, the proof is divided into the following steps:

Lemma 5.4.

Proof.

For any , the random variable in (3.1) is distributed as times a non-central chi-square random variable with degrees of freedom and non-centrality parameter . It follows that the corresponding lmgf is given by

| (5.17) |

The re-normalised Heston forward lmgf is then computed as

which agrees with (5.15). This only makes sense in some effective domain . The lmgf for is well-defined in , and hence , where is the effective domain of the (spot) Heston lmgf. Consider first for small . From [3, Proposition 3.1] if then the explosion time of the Heston lmgf is

Recall the following Taylor series expansions, for close to zero:

As tends to zero is satisfied since and hence

Therefore, for small enough, we have for all , where

So as tends to zero, shrinks to . Regarding , we have (see (5.21) for details on the expansion computation) for any , with defined in (3.2). Therefore and hence . It is easily checked that is strictly positive except at where it is zero, for , for and that tends to infinity as approaches . Since and are strictly positive and it follows that with equality only if . So is an open interval around zero and the lemma follows with . ∎

Remark 5.5.

For the inequality is equivalent to . In Lemma 5.6 below we show that is the limiting lmgf of the rescaled Heston forward lmgf and so the condition for the limiting forward domain is equivalent to ensuring that the limiting forward lmgf does not blow up and is strictly positive except at where it is zero.

Lemma 5.6.

Remark 5.7.

Proof.

All expansions below for , and defined in (3.8) hold for any :

| (5.18) |

where

| (5.19) |

and where if , otherwise. From the definition of in (5.16) we obtain

| (5.20) |

where is defined in (3.3). Substituting the asymptotics for and above we further obtain

and therefore using the definition of in (5.16) we obtain

| (5.21) |

with defined in (3.3) and in (3.2). Combining (5.18) and (5.21) we deduce

| (5.22) |

and therefore as tends to zero,

| (5.23) |

Again using (5.22) we have

| (5.24) |

Recalling that

Proof.

As detailed in the beginning of this subsection, this concludes the proof of Proposition 3.1. We now prove the forward implied volatility expansions, namely Corollaries 3.2 and 3.4.

Proof of Corollary 3.2.

We first look for a Taylor expansion of around using . Differentiating this equation iteratively and setting (and using ) gives an expansion for in terms of the derivatives of . In particular, and , which implies that and . From the explicit expression of in (3.2), we then obtain

Using this series expansion and the fact that , the corollary follows from tedious but straightforward Taylor expansions of and defined in (2.10). ∎

Corollary 3.4 on the Type-II diagonal small-maturity Heston forward smile follows from the following lemma:

Lemma 5.9.

Proof.

Under the stopped-share-price measure (2.14) the Heston dynamics are given by

Using the tower property for expectations, it is now straightforward to compute

where for all , with . ∎

5.2.2. Proofs of Section 3.1.2

In this section, we prove the large-maturity asymptotics for the Heston model, and we shall use the standing assumption . Let and consider the Heston process with defined in (3.1) and defined in (2.9). Specifically defined in (2.1) is then given by , and for ease of notation we set

| (5.25) |

We prove here Proposition 3.5 in several steps:

The following lemma recalls some elementary facts about the function in (3.7), which will be used throughout the section. We then proceed with a technical result needed in the proof of Proposition 5.12.

Lemma 5.10.

Lemma 5.11.

Let be defined as in (3.5), in (3.8), and recall the standing assumption . Assume further that and define the functions and by

-

(i)

The inequalities and always hold; if and , then ; finally (and ) if and only if ;

-

(ii)

the inequality holds if and only if and ;

-

(iii)

the inequality holds if and only if ;

-

(iv)

let be as in (3.5) and . Then if , and if .

Proof.

We first prove Lemma 5.11(i). The double inequality is equivalent to

The upper bound clearly holds, and the lower bound follows from the identity

We now prove that . From (3.5) this is equivalent to The result follows by rearranging the left-hand side as

Assume now . The inequality is equivalent to , or

| (5.26) |

This statement is true if and if the rhs is positive, which follow from the obvious inequalities .

We now prove Lemma 5.11(ii). The equation implies (by squaring and rearranging the terms):

The roots of this equation are and defined in (3.5). The two possible positive roots are and the two possible negative ones are . Clearly . Straightforward computations show that and . Since is continuous on with , it cannot have a single root in this interval, and (by Lemma 5.11(i)) is hence not a valid root. Consider now . From Lemma 5.11(i) the only possible roots are and . Now . If then and hence is the unique root of in . Assume now that , which implies . Either or . Since , the first case implies that has zero or more than two roots in . If it has zero root, then clearly for . More than two roots yields a contradiction with the fact that is the only possible root on . Now, Inequality (5.26) implies that if and only if , which is equivalent to . Therefore in the case , the only possible scenario is , where has a unique root . In summary, on the interval , if and only if and . The proof of (iii) is analogous to the proof of (ii) and we omit it for brevity.

We now prove Lemma 5.11(iv). From (3.5) write , where . The two numbers and in (3.5) are well-defined in if and only if and . The two roots of this polynomial are given by . We now claim that and . From the expression of given in (3.5), the inequality can be rearranged as

The claim then follows from the identity

Analogous manipulations imply , and hence is a well-defined real number for .

The claim is equivalent to , which holds as soon as , or . Therefore for any , if and only if . This simplifies to , which also reads

and this is clearly true. Now straightforward manipulations show that the inequality is equivalent to

which is true if or . And of course the claim holds if

| (5.27) |

The first inequality, which can be re-written as

holds if , or Quick manipulations turn the second inequality in (5.27) into

Again this trivially holds if , which is in turn equivalent to Since is clearly true, it follows that for any valid choice of parameters either inequality (or both) in (5.27) holds, and the claim follows. ∎

We now use Lemma 5.11 to compute the large-maturity lmgf effective limiting domain for the forward price process . This is of fundamental importance since in the large-maturity case (unlike the diagonal small-maturity case) we need to find conditions on the parameters of the model such that the limiting lmgf is essentially smooth (Assumption 2.1(iv)) on the interior of its effective domain.

Proposition 5.12.

Proof.

The tower property yields

with and defined in (5.16). For any fixed we require that

| (5.28) |

Andersen and Piterbarg [3, Proposition 3.1] proved that if the following conditions are satisfied

| (5.29) |

then the explosion time is infinite and (5.28) is satisfied. In [19] the authors proved that these conditions are equivalent to and , with and ( defined in (3.5)). Further we require that

| (5.30) |

Now denote . Then if , the domain of the limiting forward lmgf is given by . Condition (5.30) is equivalent to for all . A simple calculation gives for all . Furthermore for , and given Conditions (5.29), we have and . This implies that for and . In particular (martingale condition). For fixed ,

so that for any , is strictly increasing. Therefore

| (5.31) |

We have . So the condition is equivalent to If () and () then , and the condition in (5.31) is always satisfied. So if , If (), then (), and hence contains (). Now suppose that and . The condition in (5.31) ( given in (3.7)) is equivalent to . From Lemma 5.10, on , the function attains its maximum at . Using the properties in Lemma 5.10, there exists solving the equation

| (5.32) |

if and only if ( defined in Lemma 5.11), which is equivalent (see Lemma 5.11) to and . The solution to (5.32) has two roots and defined in (3.5), and the correct solution here is by Lemma 5.11(iv). So if then . If and then . Analogous arguments show that for , we have . If , and then , with . ∎

Lemma 5.13.

Proof of Lemma 5.13.

From the definition of in (5.25) and the Heston forward lmgf given in (5.15) we immediately obtain the following asymptotics as tends to infinity:

where and are defined in (5.16), in (3.7) and and in (3.8). In particular this implies that and , which are well-defined for all . We therefore obtain

and the lemma follows from straightforward simplifications. Note in passing that for any . ∎

5.3. Proofs of Section 3.2

Let be the Lévy exponent of the Lévy process . If follows (3.10), a straightforward application of the tower property for expectations yields the forward lmgf:

| (5.33) |

defined for all such that the rhs exists and where

| (5.34) | ||||

| (5.35) |

Similarly if follows (3.11) the forward lmgf is given by

| (5.36) |

defined for all such that the rhs exists and where

| (5.37) |

Proof of Proposition 3.7.

We show that Proposition 2.12 is applicable given the assumptions of Proposition 3.7. Consider case (i). The expansion for defined in (5.25) is straightforward and analogous to Lemma 5.13. In particular we establish that

where the functions , , and the domain are defined in (3.12), (5.35) and (3.14). Since is essentially smooth and strictly convex on and , then the limiting lmgf is essentially smooth and strictly convex on . The map (defined in (5.25)) is of class on since is of class on and Assumption 2.1(v) is also satisfied. Since we have that and . It remains to be checked that the limiting domain is in fact given by . We first note that that by conditioning on and using the independence of the time-change and the Lévy process we have and so any in the limiting domain must satisfy . Using [13, page 476] and the tower property we compute

| (5.38) |

with and given in (5.34). Further from (5.17) we have , for all . Following a similar argument to the proof of Proposition 5.12 we can show that for any , is always satisfied for each . This follows from the independence of the Lévy process and the time-change. We also require that for any , for every . Here we use [3, Corollary 3.3] with zero correlation to find that we require . It follows that .

Regarding case (ii), arguments analogous to case (i) hold and we focus on showing that the limiting domain is . Using [13, page 488] Equality (5.38) also holds with and defined in (5.37). Since we require that for any , , for every we have . Using [13, page 482] we also have

But it is straightforward to show that implies for any and it follows that . Case (iii) is straightforward and omitted. ∎

Appendix A Tail Estimates

The purpose of this appendix is to prove that under Assumption 2.1(v) the tail integral is exponentially small, where is defined in (5.3) and is given in (5.7). This is required in the proof of Theorem 2.4. Now we recall (5.10) that

and one can easily check that, for ,

| (A.1) |

Further by definition, and for fixed , the ridge property for characteristic functions [45, Theorem 7.1.2] implies for all and . Therefore the tail estimate

| (A.2) |

is finite for sufficiently small since . We proceed now to show that Assumption 2.1(v) allows us to further conclude that this term is in fact exponentially small:

Lemma A.1.

There exists such that the following tail estimate holds for all as :

Proof.

By Definition 5.3, Let , with and . Then

as . Set . Using (A.1) the tail estimate is then given by

as tends to zero. We deal with the case . We note that

where the first integral on the rhs follows from the extreme value theorem which implies that the integrand attains its maximum on at some point and the inequality for the second integral on the rhs follows since the integrand is positive. Using Assumption 2.1(v)(c), for there exists and (independent of ) such that for . In particular for we have

Note Assumption 2.1(i) implies that and are both quantities. By a similar argument to (A.2) the integral on the rhs is finite and we now use the Laplace method. Since is continuous, has a unique maximum at and is bounded away from zero as tends to infinity (Assumption 2.1(v)(b)) there exists such that for . We now write

where again the final step follows from the extreme value theorem: if the integrand attains its maximum on at . Since the contribution of the last integral is centered around as , the Laplace method yields

A similar argument holds for and the result follows. ∎

Appendix B Proof of Lemma 5.3

The proof of Lemma 5.3 proceeds in two steps: we first prove that the integrand in the right-hand side of Equality (5.9) belongs to (and hence the integral is well-defined), and we then prove that this very equality holds. The first step is contained in the following lemma.

Lemma B.1.

There exists such that for all and .

Proof.

We denote by the characteristic function of the Gaussian with mean zero and variance . Since converges pointwise to by Lemma 5.1, then, for any , it converges uniformly to in every compact set as tends to zero (see [45, Corollary 1, page 50]). Furthermore since is continuous and bounded on , then also converges uniformly to on , and hence there exist and such that for all :

| (B.1) |

Following an analogous argument to the proof of Lemma A.1 we know that is exponentially small as tends to zero. Thus there exist and and such that for all

where the inequality for the first integral follows from the simple bound

The quantity on the rhs is finite for small enough since , , . Using (B.1), fix some and ; then for any , . This quantity is finite since the Gaussian characteristic function is in , and the lemma follows. ∎

We now move on to the proof of Lemma 5.3. We only look at the case , the other cases being completely analogous. We denote the convolution of two functions by , and recall that . For such functions, we denote the Fourier transform by and the inverse Fourier transform by

With defined on page 5.1.1, the -measure in (5.1) and the random variable in (5.2), we have

with and denoting the density of . On the strips of regularity derived on page 5.1.1 we know there exists such that for . Since is a density, , and therefore

| (B.2) |

We note that and hence

| (B.3) |

Thus by Lemma B.1 there exists an such that for . By the inversion theorem [53, Theorem 9.11] this then implies from (B.2) and (B.3) that for :

Remark B.2.

There exists such that for the strips of regularity derived on page 5.1.1, the modified payoffs are in for . If there further exists such that for then we can directly apply Parseval’s Theorem [29, Theorem 13E] for and we obtain the same result as in Lemma 5.3. This requires though a stronger tail assumption compared to 2.1(v)(c).

Appendix C Verification of Assumption 2.1(v)

The tail assumption 2.1(v) needs to be verified in order to apply Theorem 2.4. It is readily satisfied by most models used in practice. Its verification is tedious but straightforward, and we give here an outline for the time-changed exponential Lévy case where the time-change is given by an integrated Feller process (3.10), i.e. Proposition 3.7(i). Analogous arguments hold for all other models in the paper.

We recall that the forward lmg is given in (5.33) and the limiting lmgf ((3.12),(3.14)) is given by with and is the Lévy exponent. Straightforward computations yield Assumption 2.1(v)(a). For fixed denote by and by . Then . Similarly we define and such that . From [16, Lemma A.1, page 10] we know that has a unique maximum at zero and is bounded way from zero as tends to infinity. Now and Since we certainly have

with equality only if . Since has a unique maximum at zero we have and further with equality only if . Since it follows that is the unique minimum of . Since is bounded away from as tends to infinity there exists a and such that for we have that . But then for we certainly have

This proves Assumption 2.1(v)(b). The proof of Assumption 2.1(v)(c) involves tedious but straightforward computations and we only highlight the main steps. Let and define with given in (5.34). From the analysis above we know that the map has a unique minimum at . Also we recall that and straightforward calculations show that with and given in (5.35). Using the triangle and reverse triangle inequality we have for all and that

| (C.1) |

Tedious computations (see Figure 7 for a visual help) also reveal that ( given in (5.34)): for all and . Consider the second and third terms in (5.33). For all and :

| (C.2) |

where we note in the last inequality that . We also compute

and hence using we see that for all and :

| (C.3) |

where the last inequality follows since the term in the second inequality is strictly increasing in . Combining (C.1), (C.2) and (C.3) we see that as tends to infinity:

where the remainder does not depend on . This proves Assumption 2.1(v)(c).

References

- [1] E. Alòs, J. León and J. Vives. On the short-time behavior of the implied volatility for jump-diffusion models with stochastic volatility. Finance & Stochastics, 11: 571-589, 2007.

- [2] L.B.G. Andersen and A. Lipton. Asymptotics for exponential Lévy processes and their volatility smile: survey and new results. Forthcoming in International Journal of Theoretical and Applied Finance.

- [3] L. Andersen and V. Piterbarg. Moment Explosions in Stochastic Volatility Models. Finance & Stochastics, 11 (1): 29-50, 2007.

- [4] S. Benaim and P. Friz. Smile asymptotics II: models with known moment generating functions. Journal of Applied Probability, 45: 16-32, 2008.

- [5] S. Benaim and P. Friz. Regular Variation and Smile Asymptotics. Mathematical Finance, 19 (1): 1-12, 2009.

- [6] G. Ben Arous. Développement asymptotique du noyau de la chaleur hypoelliptique hors du cut-locus. Annales Scientifiques de l’Ecole Normale Supérieure, 4 (21): 307-331, 1988.

- [7] E. Benhamou, E. Gobet and M. Miri. Smart expansions and fast calibration for jump diffusions. Finance and Stochastics, 13: 563-589, 2009.

- [8] B. Bercu and A. Rouault. Sharp large deviations for the Ornstein-Uhlenbeck process. Theory Probab. Appl., 46 (1): 1-19, 2002.

- [9] H. Berestycki, J. Busca, and I. Florent. Computing the implied volatility in stochastic volatility models. Communications on Pure and Applied Mathematics, 57 (10): 1352-1373, 2004.

- [10] L. Bergomi. Smile Dynamics I. Risk, September, 2004.

- [11] F. Black and M. Scholes. The pricing of options and corporate liabilities. Journal of Political Economy, 81 (3): 637-659, 1973.

- [12] H. Bühler. Applying Stochastic Volatility Models for Pricing and Hedging Derivatives. Available at quantitative-research.de/dl/021118SV.pdf, 2002.

- [13] R. Cont and P. Tankov. Financial Modelling with Jump Processes. Chapman and Hall/CRC, 2007.

- [14] A. Dembo and O. Zeitouni. Large deviations techniques and applications. Jones and Bartlet Publishers, Boston, 1993.

- [15] J.D. Deuschel, P.K. Friz, A. Jacquier and and S. Violante. Marginal density expansions for diffusions and stochastic volatility, Part II: Applications. Forthcoming in Communications on Pure and Applied Mathematics.

- [16] J. Figueroa-López, M. Forde and A. Jacquier. The large-maturity smile and skew for exponential Lévy models. Preprint, 2011.

- [17] J. Figueroa-López, R. Gong and C. Houdré. Small-time expansions of the distributions, densities, and option prices of stochastic volatility models with Lévy jumps. Stochastic Processes and their Applications, 122: 1808-1839, 2012.

- [18] M. Forde and A. Jacquier. Small-time asymptotics for implied volatility under the Heston model. International Journal of Theoretical and Applied Finance, 12 (6), 861-876, 2009.

- [19] M. Forde and A. Jacquier. The large-maturity smile for the Heston model. Finance & Stochastics, 15 (4): 755-780, 2011.

- [20] M. Forde, A. Jacquier and R. Lee. The small-time smile and term structure of implied volatility under the Heston model. SIAM Journal on Financial Mathematics, 3 (1): 690-708, 2012.

- [21] M. Forde, A. Jacquier and A. Mijatović. Asymptotic formulae for implied volatility in the Heston model. Proceedings of the Royal Society A, 466 (2124): 3593-3620, 2010.

- [22] J.P. Fouque, G. Papanicolaou, R. Sircar and K. Solna. Multiscale Stochastic Volatility for Equity, Interest Rate, and Credit Derivatives. CUP, 2011.

- [23] P. Friz, S. Gerhold, A. Gulisashvili and S. Sturm. Refined implied volatility expansions in the Heston model. Quantitative Finance, 11 (8): 1151-1164, 2011.

- [24] K. Gao and R. Lee. Asymptotics of Implied Volatility to Arbitrary Order. Forthcoming in Finance & Stochastics.

- [25] J. Gatheral. The Volatility Surface: A Practitioner’s Guide. John Wiley & Sons, 2006.

- [26] J. Gatheral, E.P Hsu, P. Laurence, C. Ouyang, T-H. Wong. Asymptotics of implied volatility in local volatility models. Mathematical Finance, 22 591-620, 2012.

- [27] J. Gatheral and A. Jacquier. Convergence of Heston to SVI. Quantitative Finance, 11 (8): 1129-1132, 2011.

- [28] P. Glasserman and Q. Wu. Forward and Future Implied Volatility. Internat. Journ. of Theor. and App. Fin., 14 (3), 2011.

- [29] R.R. Goldberg. Fourier Transforms. CUP, 1970.

- [30] A. Gulisashvili. Asymptotic formulas with error estimates for call pricing functions and the implied volatility at extreme strikes. SIAM Journal on Financial Mathematics, 1: 609-641, 2010.

- [31] A. Gulisashvili and E. Stein. Asymptotic Behavior of the Stock Price Distribution Density and Implied Volatility in Stochastic Volatility Models. Applied Mathematics & Optimization, 61 (3): 287-315, 2010.

- [32] P. Hagan and D. Woodward. Equivalent Black volatilities. Applied Mathematical Finance, 6: 147-159, 1999.

- [33] P. Henry-Labordère. Analysis, geometry and modeling in finance. Chapman and Hill/CRC, 2008.

- [34] S. Heston. A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies, 6 (2): 327-342, 1993.

- [35] A. Jacquier and A. Mijatović. Large deviations for the extended Heston model: the large-time case. arXiv:1203.5020, 2012.

- [36] A. Jacquier, M. Keller-Ressel and A. Mijatović. Implied volatility asymptotics of affine stochastic volatility models with jumps. Stochastics, 85 (2): 321-345, 2013.

- [37] A. Jacquier and P. Roome. The small-maturity Heston forward smile. Forthcoming in SIAM Journal on Financial Mathematics.

- [38] I. Karatzas and S.E. Shreve. Brownian Motion and Stochastic Calculus. Springer-Verlag, 1997.

- [39] S. Karlin and H. Taylor. A Second Course in Stochastic Processes. Academic Press, 1981.

- [40] M. Keller-Ressel. Moment Explosions and Long-Term Behavior of Affine Stochastic Volatility Models. Mathematical Finance, 21 (1): 73-98, 2011.

- [41] N. Kunitomo and A. Takahashi. Applications of the Asymptotic Expansion Approach based on Malliavin-Watanabe Calculus in Financial Problems. Stochastic Processes and Applications to Mathematical Finance, World Scientific, 195-232, 2004.

- [42] R.W. Lee. Option Pricing by Transform Methods: Extensions, Unification and Error Control. Journal of Computational Finance, 7 (3): 51-86, 2004.

- [43] R.W. Lee. The Moment Formula for Implied Volatility at Extreme Strikes. Mathematical Finance, 14 (3), 469-480, 2004.

- [44] V. Lucic. Forward-start options in stochastic volatility models. Wilmott Magazine, September, 2003.

- [45] E. Lukacs. Characteristic Functions. Griffin, Second Edition, 1970.

- [46] D.B. Madan and E. Seneta. The Variance Gamma (V.G.) Model for Share Market Returns. Journal of Business, 63 (4): 511-524, 1990.

- [47] R. Merton. The Theory of Rational Option Pricing. Bell Journal of Economics and Management Science, 4(1): 141-183, 1973.

- [48] A. Mijatović and P. Tankov. A new look at short-term implied volatility in asset price models with jumps. Forthcoming in Mathematical Finance.

- [49] J. Muhle-Karbe and M. Nutz. Small-time asymptotics of option prices and first absolute moments. Journal of Applied Probability, 48: 1003-1020, 2011.

- [50] J.A. Murdock. Perturbations: Theory and Methods. John Wiley and Sons, 1991.

- [51] S. Pagliarani, A. Pascucci and C. Riga. Adjoint expansions in local Lévy models. SIAM Journal on Financial Mathematics, 4 (1): 265-296, 2013.

- [52] M. Rubinstein. Pay now, choose later. Risk, 4 (13), 1991.

- [53] W. Rudin. Real and complex analysis, third edition. McGraw-Hill, 1987.

- [54] P. Tankov. Pricing and hedging in exponential Lévy models: review of recent results. Paris-Princeton Lecture Notes in Mathematical Finance, Springer, 2010.

- [55] M. R. Tehranchi. Asymptotics of implied volatility far from maturity. Journal of Applied Probability, 46: 629-650, 2009.

- [56] D. Williams. Probability With Martingales. CUP, 1991.