Simultaneous adjustment of bias and coverage probabilities for confidence intervals

P. Menéndez

111

School of Mathematics and Physics,

University of Queensland, St Lucia, 4072, AUSTRALIA

Y. Fan,

222

School of Mathematics and Statistics,

University of New South Wales, Sydney, 2052, AUSTRALIA

P. H. Garthwaite

333Department of Mathematics and Statistics, Open University, Milton Keynes, MK7 6AA, U.K.

and

S. A. Sisson 2

Abstract

A new method is proposed for the correction of confidence intervals when the original interval does not have the correct nominal coverage probabilities in the frequentist sense. The proposed method is general and does not require any distributional assumptions. It can be applied to both frequentist and Bayesian inference where interval estimates are desired. We provide theoretical results for the consistency of the proposed estimator, and give two complex examples, on confidence interval correction for composite likelihood estimators and in approximate Bayesian computation (ABC), to demonstrate the wide applicability of the new method. Comparison is made with the double-bootstrap and other methods of improving confidence interval coverage.

Keywords: Confidence interval correction; Coverage probability; Composite likelihood; Approximate Bayesian computation.

1 Introduction

Interval estimates are typically intended to have a specified level of coverage. This is true, for example, of both frequentist confidence intervals and Bayesian credible intervals. However, for many problems the coverage of a confidence or credible interval will only equal its nominal value asymptotically, and coverage can be poor even for quite large samples in some situations.

In many complex problems, there can be inherent bias which can be difficult to quantify or calculate. This can arise, for example, in composite likelihood problems \shortcitevarin2011overview and approximate Bayesian computation \shortcitesisson+f11.

In this paper we propose a novel procedure for adjusting interval estimates that has wide application and will typically reduce the bias in their coverage.

The procedure assumes that the mechanism that generated the sample data could be simulated if population parameters were known. These parameters are estimated by sample statistics derived from real data, and then pseudo-samples are drawn from the estimated population distribution. From each pseudo-sample a confidence/credible interval is determined for the quantity of interest. The frequentist bias in these intervals is calculated and then used to adjust the interval estimate given by the real data.

The method has similarities to the double-bootstrap [\citeauthoryearDavison and HinkleyDavison and

Hinkley1997], in which a bias correction is applied to a bootstrap interval by re-sampling from a bootstrap distribution. A difference in our method is that it involves only one level of sample generation, which makes it computationally less demanding, although the saving may dissipate if computationally demanding methods (such as Markov chain Monte Carlo) are used to obtain the interval estimates from sample data.

Several authors have looked at the problem of computing confidence intervals with the correct coverage properties. Much of this work is based on variations of bootstrap procedures.

In particular,

\citeNhall1986bootstrap considered the bootstrap in terms of Edgeworth expansions, and \citeNberan1987prepivoting provided a method for approximate confidence sets, by using the bootstrap (or asymptotic theory) to estimate the relevant quantiles. This so-called pre-pivoting, based on an estimated bootstrap cumulative distribution function, is iterated to produce improved coverage.

\citeNefron1987better introduced a method to correct the coverage of a bootstrap confidence interval within the bootstrap itself, and \citeNmartin1990bootstrap proposed an iterated bootstrap procedure to obtain better bootstrap coverage.

The so called double bootstrap, where one or more additional levels of bootstrap are conducted to adjust confidence limits, was disccussed by \shortciteNdiciccio1992fast. In a non-bootstrap procedure, \citeNgarthwaite1992generating proposed a method to compute confidence intervals based on Monte Carlo simulations of the Robbins-Monro search process. In the context of autoregressive models, \citeNhansen1999grid presented a method based on bootstrap replications over a grid to compute confidence intervals in situations where standard bootstrap methods fail. There are also several approaches for computing confidence intervals in the presence of nuisance parameters [\citeauthoryearKabailaKabaila1993, \citeauthoryearKabaila and LloydKabaila and

Lloyd2000, \citeauthoryearLloydLloyd2011].

In some of our examples, we apply our procedure to reduce bias in the coverage of Bayesian credible intervals.

This may not seem intuitive, since coverage is a frequentist property while a Bayesian interval may reflect personal probabilities.

However, there are many situations where posterior distributions should preferably be well calibrated. These include inference with objective or probability matching prior distributions, the verification of Bayesian simulation software \shortcitecook+gr06 and techniques and diagnostics in likelihood-free Bayesian inference \shortcitefearnhead+p12,prangle+bps12.

In Section 2 we describe the proposed method and give theoretical results related to it, illustrating them through simulated examples and comparing the resulting intervals with bootstrap intervals. In Section 3 we apply our method to two more complex, real analyses. One of these involves estimation with composite likelihoods, which is known to produce confidence intervals that are too narrow, and the other involves approximate Bayesian computation, which typically gives larger posterior credibility intervals than desired. Some concluding comments are given in Section 4.

2 Coverage correction for confidence intervals

Suppose we are interested in estimating an equal-tailed confidence interval for some parameter . Thus for observed data , we seek an estimate , such that

where denotes the lower limit of the interval. Similarly for the upper limit, we seek an estimate , such that,

In the frequentist setting, the parameter is considered a fixed quantity and the expressions above are written in terms of pivotal functions of the data, . In the Bayesian setting, the credible interval is computed from the quantiles of the posterior distribution of .

In an abuse of notation, we will use the above notations

in both frequentist and Bayesian cases.

Suppose that we have a method of obtaining estimates, and , of the correct lower and upper interval bounds, and . We do not assume that these estimates produce the correct coverage probability. However, we do assume that the population parameters, , can be well approximated from the data. Our goal is to provide a method that gives adjustments to and that improve the interval’s coverage. We first give theoretical results for the proposed methodology, and then give details of its implementation.

2.1 Theoretical results

Assumption 1

We suppose that the observed data come from the model given by , . For any , we assume that it is possible to simulate from .

Assumption 2

Given and data there exists a consistent estimator of .

Assumption 1 requires that we are able to simulate replicate data from the model given the values of the parameters.

Assumption 2 requires that we have a good estimator for , so that interval estimates obtained using converge to those estimates obtained using the population parameter , as the amount of data gets large.

In the following, we only require the lengths of the intervals to be consistent. Consequently, Assumption 2 is not always necessary. For example, this occurs if represents a location parameter whose

confidence interval has a length that is independent of (see later example). In the frequentist setting, the maximum likelihood estimator of is consistent and unbiased in many finite sample situations.

In the Bayesian setting, the posterior distribution is consistent under mild assumptions, and the posterior mean estimate of is asymptotically unbiased. However, in both cases, finite sample bias in may render our method less accurate.

Theorem 2.1

For some and , let be an estimator of the lower limit of a level confidence interval, and suppose that

Let denote the distribution function of a random variable . Consider the new estimator

| (1) |

where is the -th quantile of the distribution function , so that . Then the new estimator, , will have the correct coverage probability

Proof: See Appendix.

From the above theorem, it can then be seen that for the estimator of the upper limit of a confidence interval, , we can write

| (2) |

where is the -th quantile of the distribution function , so that . In this case, we then have that

Theorem 2.2

For some and observed data , suppose the lower limit of a confidence interval can be obtained, and that this estimate does not necessarily give the correct coverage probability. Suppose that is a consistent estimator of , evaluated using the data . Let be replicate datasets simulated independently from , and denote the corresponding lower confidence limits by , obtained in the same manner as . Define

as the empirical distribution of based on the observed values of . If we define

| (3) |

where , then is a consistent estimator of , as defined in Equation (1).

Proof: See Appendix.

In combination, Theorems 2.1 and 2.2 state that if we simulate data and subsequently obtain the confidence limits in the same way as for the original data , then we can correct the bias in the original lower limit estimate, , by addition of the -th sample quantile of .

Corollary 1

Under the assumptions in Theorem 2.2, a central limit theorem holds for . Specifically, for all , and , we have that

as , where , and is the -th quantile of .

Proof: The result follows immediately from Equation (7) of the proof for Theorem 2.2 (see Appendix).

The above theoretical results provide a simple way of estimating corrections to the lower and upper confidence limits that will produce the correct nominal coverage probability. In addition, these estimators are consistent and asymptotically normal.

2.2 Correction procedure

In summary, the correction algorithm has the following steps:

- Step 1

-

Obtain and , the upper and lower limits of the desired confidence interval for the parameter , for an observed dataset .

- Step 2

-

Evaluate and generate independent datasets from the model.

- Step 3

-

For each dataset , compute the lower and upper confidence limits, and , for the parameter , using the same method as in Step 1.

- Step 4

-

Set the corrected lower and upper limits to

where denotes the -th sample quantile of the random variable .

2.3 Simple examples

We illustrate the above procedure with two simple examples. In the first, we consider confidence interval correction for the mean parameter of a normal distribution with known variance. In the second example, it is assumed that the mean is known and that we are interested in the variance parameter.

Example 1: Normal distribution with known variance

Suppose that is the location parameter of a Normal distribution with unit variance, so that where . In this case, the maximum likelihood estimator is .

For illustration, we suppose that the confidence interval we obtain for does not have the correct coverage, in that we obtain the equivalent confidence interval when data are generated from with . The value of controls the amount of error in the coverage probability.

Following the usual frequentist approach,

the confidence interval for

is given by and , where is the -th quantile of the standard normal distribution.

Clearly the correction for the interval when is

and

.

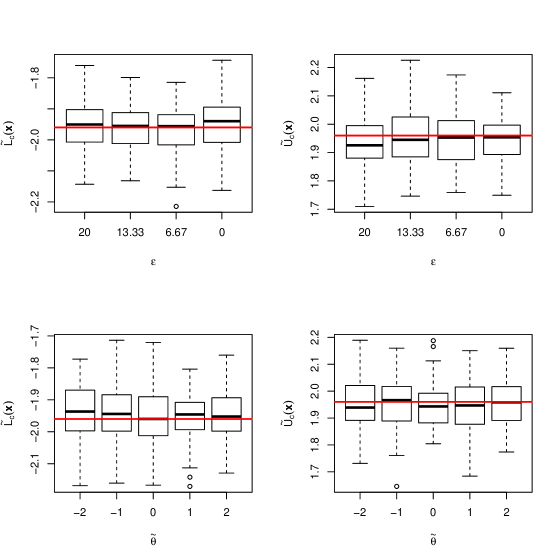

Figure 1 displays the results of the correction procedure for a 95% confidence interval based on 100 replicate analyses. Each analysis is based on samples of size with , so that , and replicated samples with elements drawn from

.

Figure 1 (top plots) illustrates the corrected confidence limits and for a range of error term values, . Clearly the correction produces an unbiased adjustment, as the boxplots are centred on the true confidence bounds (the horizontal line) in each case. Further, the performance of the method produces qualitatively the same corrected interval limits, irrespective of the value of .

The bottom plots display the corrections and with fixed, for a range of values of .

For this example, choosing to be any arbitrary value will result in the same quality of unbiased correction. This arises as the distributions of and do not change with , so that the confidence intervals all have the same width as varies. As this is a location parameter only analysis, this is one case where Assumption 2 is not required to produce a consistent adjustment (see Section 2.1).

Example 2: Normal distribution with known mean

Suppose now that is the scale (variance) parameter of a Normal distribution with mean zero, so that .

Here we specify as the sample variance.

In this setting, suppose that the regular confidence limits for are biased downwards by a constant value .

Specifically, the confidence interval for is given by and , where

denotes the -th percentile of a distribution with degrees of freedom.

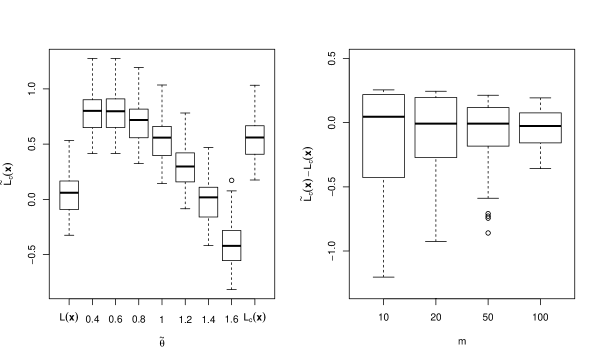

Figure 2 shows the results of the correction procedure for the lower limit of a 95% confidence interval based on 100 replicate analyses. Each analysis uses samples of size with , so that , and replicated samples with elements drawn from

.

Figure 2 (left panel) illustrates the corrected lower confidence limit, , based on a sample of size , for a range of fixed values of . The extreme left and right boxplots correspond to the raw biased () and true unbiased () limits respectively. Clearly, as changes, then so does the location of the adjusted limits. This occurs as, in contrast with the above example, the distributions of and clearly do change with . When , then the correction procedure produces the correct adjusted limits, as indicated by the rightmost boxplot. Hence, it is necessary to use the right value for when making the correction.

Assumption 2 requires that is a consistent estimator of . Hence we can be sure that as , and as a result that the distribution of approaches that of , so that our correction procedure will perform correctly for large enough . In practice, the required value of can be moderate.

Figure 2 (right panel) shows how the correction error, , varies as a function of . Clearly, the median error is close to zero even for small sample sizes. However, there is some asymmetry for small , which is also visible in the left panel (e.g. compare the differences in the bias in the boxplots with and ), although this is eliminated as increases.

| Example 1: | Example 2: | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| P | CP | B | CB | DB | P | CP | B | CB | DB | ||

| 0.956 | 0.951 | – | – | – | 0.954 | 0.954 | – | – | – | ||

| 1.000 | 0.954 | – | – | – | 0.939 | 0.952 | – | – | – | ||

| – | – | – | 0.946 | 0.949 | 0.952 | – | – | – | 0.918 | 0.956 | 0.964 |

| Time (s) | 0.09 | 0.21 | 4.53 | 6.70 | 0.17 | 0.27 | 7.31 | 8.16 | |||

Finally, Table 1 compares the empirical coverage probabilities for 95% confidence intervals for both and in Examples 1 and 2, using our correction procedure and the parametric bootstrap (e.g. \citeNPdavison1997bootstrap).

Where there is no error in the construction of the pivot-based confidence intervals (column P) i.e. for , the corrected intervals (column CP) retain the same correct coverage properties as before the correction. However, we note that as the corrected intervals are estimated by Monte Carlo, for finite numbers of generated datasets, , there will be some non-zero adjustment of each individual confidence interval, even when no systematic error is present. In Table 1, datasets were used for each corrected interval. However, in spite of this random adjustment, the correct coverage is retained over multiple replicates. This point is discussed further in Section 4.

The second row of Table 1, shows the same information as the first row, except with a non-zero error, (for ) and (for ). Clearly the adjusted intervals have the correct nominal coverage.

The third row in Table 1 illustrates the empirical coverage probabilites of 95% confidence intervals based on using the parametric bootstrap (B), our correction of the parametric bootstrap (CB) and the double-bootstrap (DB). Each bootstrap (B) interval was based on 2,000 bootstrap samples, 2,00044 samples for the double bootstrap (DB) (following \citeNPmccullough1998implementing,booth1994monte), 99 samples for our correction of the bootstrap (CB), and datasets, , for our correction procedure. These numbers were chosen to provide broadly comparable algorithmic overheads for each method. The bootstrap calculations were implemented using the R package boot, and the double bootstrap confidence intervals were computed as in \citeNmccullough1998implementing.

The parametric bootstrap has previously been observed to have lower than nominal coverage (e.g. \citeNPschenker85,buckland84). In Table 1 this is particularly apparent for . Both our correction and the double bootstrap produce improved coverage in each case, although the double bootstrap requires different specification (i.e. the number of bootstrap replicates at each of two levels) than our approach, which alternatively requires the number of auxiliary datasets, , and a consistent estimator of . While it is difficult to provide similar algorithmic specifications to permit speed comparisons between the double bootstrap and our correction procedure, in that they possess different algorithm structures, the recorded times for each method were broadly similar (Table 1, bottom row), with our procedure slightly faster in both current examples. However, the double bootstrap algorithm has a number of optimisations available (e.g. \citeNPnankervis2005computational), whereas our procedure was implemented with unoptimised code. Broadly, the two approaches are comparable in the present analyses.

3 Real examples

We now consider interval estimation in two real, complex modelling situations.

The first is an application of composite likelihood techniques in the modelling of spatial extremes. With composite likelihoods, deriving unbiased confidence intervals can require a large amount of algebra, whereas biased intervals that are typically too narrow are easily computable.

The second is an application of approximate Bayesian computation (ABC) methods in the modelling of a time series of -and- distributed observations. In most practical settings the mechanism behind the model fitting process within the ABC framework typically gives posterior credible intervals that are too large.

In both analyses, the parameter is a vector of dimensions. However, our coverage correction procedure is a univariate method as it is based on quantiles. As such, after obtaining the consistent vector estimator , we correct the coverage probabilities of each element of the parameter vector in turn, and obtain confidence intervals that achieve the correct nominal marginal coverage probabilities.

3.1 Spatial extremes via composite likelihoods

In the context of analysing spatial extremes, \shortciteNpadoan2010likelihood developed a pairwise composite likelihood model, for inference using max-stable stationary processes. Specifically, for annual maximum daily rainfall observations, at each of spatial locations, the pairwise composite likelihood was specified as

where and ,

is a known bivariate density function with parameter vector evaluated at spatial locations and , and

are weights such that .

Under the usual regularity conditions, the maximum composite likelihood estimator, , can provide asymptotically unbiased and normally distributed parameter estimates when standard likelihood estimators are unavailable (e.g. \shortciteNPvarin2011overview).

Specifically, we have (e.g. \citeNPhuber1967behavior) that , with

| (4) |

where and are respectively the expected information matrix and the covariance matrix of the score vector. In the ordinary maximum likelihood setting, .

In the max-stable process framework, \shortciteNpadoan2010likelihood provided an analytic expression for for a particular (Gaussian) spatial dependence model. Combined with the standard numerical estimates of , this allowed for the construction of standard confidence intervals for .

However, for composite likelihood techniques in general, obtaining analytic expressions or numerical estimates of can be challenging, whereas estimates of are readily available.

In this example, we demonstrate how our proposed method can be employed to correct the too narrow confidence intervals that result from using

.

We then compare our results with those derived from the known maximum composite likelihood information matrix (4).

We considered four spatial models for stationary max-stable processes that describe different degrees of extremal dependence, with parameter inference based on observations at each of randomly generated spatial locations. Each model expresses the degree of extremal dependence via the covariance matrix

where the values for each parameter for each model are given in Table 2. Model has an additional non-stationary spatial component that is modelled by the extra marginal parameters and (corresponding to location, scale and shape parameters) through the response surface

where and denote latitude and longitude coordinates.

| Model | |||

|---|---|---|---|

| 9/8 | 0 | 9/8 | |

| 2000 | 1200 | 2800 | |

| 25 | 35 | 14 |

Tables 3 and 4 summarise the empirical coverage probabilities for nominal confidence intervals for models based on 500 replicate analyses.

Columns provide the interval coverage using the

standard Hessian matrix , and columns provide the same using the composite likelihood information matrix (4) following \shortciteNpadoan2010likelihood.

Columns correspond to our correction procedure when applied to the intervals in column using the standard Hessian matrix. For the correction procedure we used , the maximum composite likelihood estimate, and simulated datasets to perform the adjustment.

From Table 3, clearly confidence interval coverage based on the standard Hessian matrix () is too low. The coverage using the sandwich information matrix () is very good, with all the reported values close to 0.95. The coverage values obtained using our adjustment procedure, which is based on the intervals in column , are also very close to , and mostly closer than with the sandwich information matrix. Similar results are obtained for model in Table 4. Taken together, these results indicate that our adjustment procedure can successfully modify the upper and lower limits of a confidence interval to achieve comparable results to established methods in complex settings. However, it does not make use of the algebraic representation of in this case, and so is more easily extended to alternative models (e.g. where is not available), albeit at a moderate computational cost.

| 0.428 | 0.960 | 0.960 | 0.098 | 0.947 | 0.950 | 0.092 | 0.939 | 0.944 | |

| 0.518 | 0.940 | 0.960 | 0.122 | 0.955 | 0.956 | 0.154 | 0.921 | 0.960 | |

| 0.468 | 0.930 | 0.936 | 0.092 | 0.955 | 0.938 | 0.102 | 0.940 | 0.952 | |

| 0.372 | 0.544 | 0.388 | 0.114 | 0.122 | 0.098 | 0.108 | 0.140 | 0.104 | |

| 0.930 | 0.925 | 0.945 | 0.935 | 0.945 | 0.945 | 0.935 | 0.940 | 0.910 | |

| 0.924 | 0.924 | 0.958 | 0.950 | 0.940 | 0.944 | 0.944 | 0.952 | 0.952 |

3.2 Exchange rate analysis using approximate Bayesian computation

Approximate Bayesian computation (ABC) describes a family of methods of approximating a posterior distribution when the likelihood function is computationally intractable, but where sampling from the likelihood is possible (e.g. \shortciteNPbeaumont2002approximate,sisson+f11).

These methods can be thought of as constructing a conditional density estimate of the posterior [\citeauthoryearBlumBlum2010], where the scale parameter, , of the kernel density function controls both the level of accuracy of the approximation, and the computation required to construct it. Lower results in more accurate posterior approximations, but in return requires considerably more computation. As such, moderate values of the scale parameter are often used in practice. Accordingly, this typically results in oversmoothed estimates of the posterior, and in turn, credible intervals that are too wide.

We consider an analysis of daily exchange rate log returns of the British pound to the Australian dollar between 2005 and 2007. \shortciteNdrovandi2011likelihood developed an MA(1) type model for these data where the individual log returns were modelled by a -and- distribution [\citeauthoryearRayner and MacGillivrayRayner and MacGillivray2002]. The -and- distribution is typically defined through it’s quantile function

| (5) |

where are parameters controlling location, scale, skewness and kurtosis, and is the -quantile of a standard normal distribution. The parameter is typically fixed.

We used the sequential Monte Carlo-based ABC algorithm in \shortciteNdrovandi2011likelihood, based on 2,000 particles, to fit the MA(1) model.

The data-generation process, used in both ABC and our correction procedure, consists of drawing dependent quantiles for , where for , and then substituting in (5).

Table 5 shows the estimated 95% central credible intervals, and their widths, for each model parameter based on the ABC kernel scale parameter (following \citeNPdrovandi2011likelihood) and also the lower value of .

Also shown are the intervals obtained after performing a local-linear, ridge regression-adjustment \shortciteblum+nps12,beaumont2002approximate on the posterior obtained with . The regression-adjustment is a standard ABC technique for improving the precision of an ABC posterior approximation, which aims to estimate the posterior at based on an assumed regression model.

Clearly the parameter credible intervals obtained with are narrower than those obtained with , indicating that the larger intervals indeed have greater than 95% coverage. The regression-adjusted intervals generally have widths somewhere between the intervals constructed with and . The suggestion from Table 5 is that even narrower (i.e. more accurate) credible intervals may result if it were possible to reduce further.

Table 6 shows the corrected 95% central credible interval estimates, obtained from the ABC posterior approximations with kernel scale parameter and . The correction was based on simulated datasets and using the posterior mean as the estimate of .

The results of the correction across the three kernel scale parameter values are similar, suggesting potential computational savings in the ABC posterior simulation stage, as one may perform the analysis with larger values of .

All parameters achieve equivalent or improved precision compared to the most precise ABC posterior estimate obtained with .

While for a standard Bayesian analysis, the posterior mean is a consistent estimator of , this may not be true in the case of the ABC approximate posterior for , as the location and shape of the ABC posterior can change with . However, the posterior mean is a consistent estimator for for . As such, some care may be needed when specifying as the posterior mean in the ABC setting. In the current analysis, a preliminary investigation suggested that estimates of the posterior mean stabilised below , which suggest that the posterior mean is approximately consistent for . While this determination is slightly ad-hoc, it is practically viable, and an intuitively sensible way of determining whether the computed posterior mean is a consistent estimator of . As such, we are confident that the posterior mean produces an effectively consistent estimate of in this case.

| Width | Width | Reg. Adj. () | Width | |||

|---|---|---|---|---|---|---|

| (-0.0006, 0.0002) | 0.0008 | (-0.0004, 0.0001) | 0.0005 | (-0.0006, 0.0002) | 0.0008 | |

| (0.0018, 0.0028) | 0.0010 | (0.0019, 0.0026) | 0.0007 | (0.0018, 0.0027) | 0.0009 | |

| (-0.0267, 0.2573) | 0.2840 | (-0.0044, 0.2138) | 0.2182 | (-0.0286, 0.2505) | 0.2791 | |

| (0.2024, 0.5061) | 0.3037 | (0.2607, 0.5322) | 0.2715 | (0.2148, 0.5092) | 0.2944 | |

| (0.1413, 0.2713) | 0.1300 | (0.1491, 0.2771) | 0.1280 | (0.1489, 0.2742) | 0.1253 |

| Width | Width | Width | ||||

|---|---|---|---|---|---|---|

| (-0.0003, 0.0000) | 0.0003 | (-0.0003, 0.0000) | 0.0003 | (-0.0004, -0.0001) | 0.0005 | |

| (0.0020, 0.0024) | 0.0004 | (0.0021, 0.0025) | 0.0004 | (0.0021, 0.0024) | 0.0003 | |

| (0.0303, 0.2156) | 0.1853 | (0.0173, 0.1818) | 0.1645 | (0.0204, 0.1957) | 0.1753 | |

| (0.2769, 0.4099) | 0.1330 | (0.2909, 0.4235) | 0.1326 | (0.2768, 0.4129) | 0.1362 | |

| (0.1430, 0.2659) | 0.1229 | (0.1335, 0.2708) | 0.1373 | (0.1513, 0.2714) | 0.1201 |

4 Discussion

In this article we have introduced a method of adjusting confidence interval estimates to have a correct nominal coverage probability. This method was developed in the frequentist framework, but may be equally applied to ensure that Bayesian credible intervals possess the (frequentist) coverage property.

Our approach is general and makes minimal assumptions: namely that it is possible to generate data under the same procedure (model) that produced the observed data, and that a consistent estimator is available for the parameter of interest. The correction is asymptotically unbiased, although it can work well for moderate sample sizes (), and there is a central limit theorem for the corrected interval limits in terms of the number () of auxiliary samples used to implement the correction.

As the correction is estimated by Monte Carlo, when there is no bias present, so that ,

for finite numbers of replicate datasets ,

finite sample estimates of may be non-zero. This will result in small, non-zero adjustments to intervals that already have the correct nominal coverage. In practice, for moderate , this is likely to have negligible effect (e.g. see the results in Table 1). However, in this and other settings where there is low bias, the central limit theorem of Corollary 1

describes the precision of the finite sample adjustment as a function of , thereby providing a guide as to when the Monte Carlo variability of will be an improvement over the bias of .

As constructed in Theorems 2.1 and 2.2, our proposed correction is for univariate parameters, , as it is based on quantiles.

For multivariate , from the perspective of adjusting any given margin,

the impact of the remaining (nuisance) parameters is controlled through the estimate of .

Asymptotically, the consistency of means that as the sample size , from which Theorems 2.1 and 2.2 will then hold for the margin of interest. However, sub-asymptotically this is not the case, and the performance of the adjustment of any margin will depend on the quality of the estimate of (this is also true in the univariate setting). The results of our analyses in Sections 2.3 and 3 suggest that the procedure can work well, even for moderate .

In practice, in the examples that we have considered, we have found that our method can produce confidence intervals which perform comparably to existing gold standard approaches – though with greater scope for extension to more complicated models – and provide a reliable method of adjusting approximately obtained credible intervals in challenging settings.

One potential criticism of our approach is that it requires the construction of a large number () of confidence or credible intervals in order to correct one interval. In the case where constructing a single interval is computationally expensive, implementing the correction procedure in full can result in a large amount of computation. This was the case in our exchange rate data analysis using ABC methods, where using an alternative ABC algorithm such as regression-adjustment (based on a single large number of model simulations) would have been more efficient. However, regression-adjustment can itself perform poorly if the assumed regression model is incorrect, while as our correction procedure makes minimal assumptions, we may still have good confidence in the resulting adjusted intervals it provides.

Acknowledgements

We are grateful to Chris Drovandi and Tony Pettitt for kindly allowing us to use their Matlab codes for the ABC analysis. Financial support for this research was provided by the Australian Research Council Discovery Project scheme (DP1092805) and the University of New South Wales.

Appendix: Proofs

Proof of Theorem 2.1

Writing , then

Hence, by definition, if , where is the -th quantile of the distribution of .

Proof of Theorem 2.2

Let

be the distribution function of , which has positive first derivatives so that for all .

Also let be the empirical distribution of based on the samples , .

From Theorem 2.1 we have that

for some , where .

Let be the empirical estimate of .

If we define , then for any , we have

where the last equality follows from a first order Taylor expansion of at .

If represents the number of times that is smaller than , then since , we have . Hence

| (6) |

in distribution as [\citeauthoryearder Vaartder

Vaart2000].

Let be the integer rank of the -th quantile from a data set of length , such that . If we assume that as , then from (6) we have

| (7) | |||||

It then follows that the consistency of the estimator can be established as

by the Markov inequality [\citeauthoryearAsh and Doleans-DadeAsh and Doleans-Dade2000].

References

- [\citeauthoryearAsh and Doleans-DadeAsh and Doleans-Dade2000] Ash, R. B. and C. Doleans-Dade (2000). Probability and Measure theory. Academic Press.

- [\citeauthoryearBeaumont, Zhang, and BaldingBeaumont et al.2002] Beaumont, M. A., W. Zhang, and D. J. Balding (2002). Approximate Bayesian computation in population genetics. Genetics 162(4), 2025–2035.

- [\citeauthoryearBeranBeran1987] Beran, R. (1987). Prepivoting to reduce level error of confidence sets. Biometrika 74(3), 457–468.

- [\citeauthoryearBlumBlum2010] Blum, M. G. B. (2010). Approximate Bayesian computation: a nonparametric perspective. Journal of the American Statistical Association 105, 1178–1187.

- [\citeauthoryearBlum, Nunes, Prangle, and SissonBlum et al.2013] Blum, M. G. B., M. A. Nunes, D. Prangle, and S. A. Sisson (2013). A comparative review of dimension reduction methods in approximate Bayesian computation. Statistical Science 28, 189–208.

- [\citeauthoryearBooth and HallBooth and Hall1994] Booth, J. G. and P. Hall (1994). Monte Carlo approximation and the iterated bootstrap. Biometrika 81, 331–340.

- [\citeauthoryearBucklandBuckland1984] Buckland, S. T. (1984). Monte Carlo confidence intervals. Biometics 40, 811–817.

- [\citeauthoryearCook, Gelman, and RubinCook et al.2006] Cook, S., A. Gelman, and D. Rubin (2006). Validation of software for Bayesian models using posterior quantiles. Journal of Computational and Graphical Statistics 15, 675–692.

- [\citeauthoryearDavison and HinkleyDavison and Hinkley1997] Davison, A. C. and D. V. Hinkley (1997). Bootstrap methods and their application. Cambridge University Press.

- [\citeauthoryearder Vaartder Vaart2000] der Vaart, A. W. V. (2000). Asymptotic statistics. Cambridge University Press.

- [\citeauthoryearDiCiccio, Martin, and YoungDiCiccio et al.1992] DiCiccio, T. J., M. A. Martin, and G. A. Young (1992). Fast and accurate approximate double bootstrap confidence intervals. Biometrika 79(2), 285–295.

- [\citeauthoryearDrovandi and PettittDrovandi and Pettitt2011] Drovandi, C. C. and A. N. Pettitt (2011). Likelihood-free Bayesian estimation of multivariate quantile distributions. Computational Statistics & Data Analysis 55, 2541–2556.

- [\citeauthoryearEfronEfron1987] Efron, B. (1987). Better bootstrap confidence intervals. Journal of the American Statistical Association 82(397), 171–185.

- [\citeauthoryearFearnhead and PrangleFearnhead and Prangle2012] Fearnhead, P. and D. Prangle (2012). Constructing summary statistics for approximate Bayesian computation: semi-automatic approximate Bayesian computation (with discussion). Journal of the Royal Statistical Society: Series B 74, 419–474.

- [\citeauthoryearGarthwaite and BucklandGarthwaite and Buckland1992] Garthwaite, P. H. and S. T. Buckland (1992). Generating Monte Carlo confidence intervals by the Robbins-Monro process. Applied Statistics, 159–171.

- [\citeauthoryearHallHall1986] Hall, P. (1986). On the bootstrap and confidence intervals. The Annals of Statistics, 1431–1452.

- [\citeauthoryearHansenHansen1999] Hansen, B. E. (1999). The grid bootstrap and the autoregressive model. Review of Economics and Statistics 81(4), 594–607.

- [\citeauthoryearHuberHuber1967] Huber, P. J. (1967). The behavior of maximum likelihood estimates under nonstandard conditions. In Proceedings of the fifth Berkeley Symposium on Mathematical Statistics and Probability, Volume 1, pp. 221–33.

- [\citeauthoryearKabailaKabaila1993] Kabaila, P. (1993). Some properties of profile bootstrap confidence intervals. Australian Journal of Statistics 35(2), 205–214.

- [\citeauthoryearKabaila and LloydKabaila and Lloyd2000] Kabaila, P. and C. J. Lloyd (2000). A computable confidence upper limit from discrete data with good coverage properties. Statistics & probability letters 47(2), 189–198.

- [\citeauthoryearLloydLloyd2011] Lloyd, C. (2011). Computing highly accurate confidence limits from discrete data using importance sampling. http://works.bepress.com/chris_lloyd/23.

- [\citeauthoryearMartinMartin1990] Martin, M. A. (1990). On bootstrap iteration for coverage correction in confidence intervals. Journal of the American Statistical Association 85(412), 1105–1118.

- [\citeauthoryearMcCullough and VinodMcCullough and Vinod1998] McCullough, B. and H. D. Vinod (1998). Implementing the double bootstrap. Computational Economics 12(1), 79–95.

- [\citeauthoryearNankervisNankervis2005] Nankervis, J. C. (2005). Computational algorithms for double bootstrap confidence intervals. Computational Statistics & Data Analysis 49, 462–475.

- [\citeauthoryearPadoan, Ribatet, and SissonPadoan et al.2010] Padoan, S. A., M. Ribatet, and S. A. Sisson (2010). Likelihood-based inference for max-stable processes. Journal of the American Statistical Association 105, 263 – 277.

- [\citeauthoryearPrangle, Blum, Popovic, and SissonPrangle et al.2012] Prangle, D., M. G. B. Blum, G. Popovic, and S. A. Sisson (2012). Diagnostic tools for approximate Bayesian computation using the coverage property. Tech Report, http://arxiv.org/abs/1301.3166.

- [\citeauthoryearRayner and MacGillivrayRayner and MacGillivray2002] Rayner, G. D. and H. L. MacGillivray (2002). Numerical maximum likelihood estimation for the -and- and generalized -and- distributions. Statistics and Computing 12(1), 57–75.

- [\citeauthoryearSchenkerSchenker1985] Schenker, N. (1985). Qualms about bootstrap confidence intervals. Journal of the American Statistical Association 390, 360–361.

- [\citeauthoryearSisson and FanSisson and Fan2011] Sisson, S. A. and Y. Fan (2011). Likelihood-free Markov chain Monte Carlo. In S. P. Brooks, A. Gelman, G. Jones, and X.-L. Meng (Eds.), Handbook of Markov Chain Monte Carlo, pp. 319–341. Chapman and Hall/CRC Press.

- [\citeauthoryearVarin, Reid, and FirthVarin et al.2011] Varin, C., N. Reid, and D. Firth (2011). An overview of composite likelihood methods. Statistica Sinica 21(1), 5–42.