Modify the Improved Euler scheme to integrate stochastic differential equations

Abstract

A practical and new Runge–Kutta numerical scheme for stochastic differential equations is explored. Numerical examples demonstrate the strong convergence of the method. The first order strong convergence is then proved using Itô integrals for both Itô and Stratonovich interpretations. As a straightforward modification of the deterministic Improved Euler/Heun method, the method is a good entry level scheme for stochastic differential equations, especially in conjunction with Higham’s introduction [SIAM Review, 43:525–546, 2001].

1 Introduce a modified integration

Nearly twenty years ago Kloeden and Platen [3] described schemes for numerically integrating stochastic differential equations (sdes). Intervening research led to recent developments of useful Runge–Kutta like methods for Itô sdes by Andreas Rossler [11, 10] and for Stratonovich sdes by Yoshio Komori [6, 4, 5]. These numerical integration schemes for sdes are quite complicated, and typically do not easily reduce to accurate deterministic schemes. This short article introduces a Runge–Kutta scheme for sdes that does straightforwardly reduce to a well known deterministic scheme—the variously called Improved Euler, Heun, or Runge–Kutta 2 scheme.

As well as being a novel practical scheme for the numerical integration of sdes, because of the strong connection to a well known deterministic integration scheme, the scheme proposed here serves as an entry level scheme for teaching stochastic dynamics. One could use this scheme together with Higham’s [1] introduction to the numerical simulation of sdes. Section 2 on the method applied to examples assumes a background knowledge of basic numerical methods for ordinary differential equations and deterministic calculus as typically taught in early years at university. Section 3 on the underlying theory assumes knowledge of stochastic processes such as continuous time Markov Chains, and, although not essential, preferably at least a formal introduction to stochastic differential equations (such as the book [9] or article [1] with material that is successfully taught at second/third year university).

Consider the vector stochastic process that satisfies the general Itô sde

| (1) |

where drift and volatility are sufficiently smooth functions of their arguments. The noise is represented by the differential which symbolically denotes infinitesimal increments of the random walk of a Wiener process . The symbolic form of the sde (1) follows from the most basic approximation to an evolving system with noise that over a time step the change in the dependent variable is

where symbolises some ‘random’ effect. This basic approximation is low accuracy and needs improving for practical applications, but it does form a basis for theory, and it introduces the noise process , called a Wiener process. We use to denote the realisation of the noise. Such a Wiener process is defined by and that the increment is distributed as a zero-mean, normal variable, with variance , and independent of earlier times. Consequently, crudely put, then is a ‘white noise’ with a flat power spectrum. The sde (1) may then be interpreted as a dynamical system affected by white noise.

The proposed modified Runge–Kutta scheme for the general sde (1) is the following. Given time step , and given the value , estimate by for time via

| (2) |

-

•

where for normal random ;

-

•

and where , each alternative chosen with probability .

The above describes only one time step. Repeat this time step times in order to integrate an sde (1) from time to .

The appeal of the scheme (2) as an entry to stochastic integrators is its close connection to deterministic integration schemes. When the stochastic component vanishes, , the integration step (2) is precisely the Improved Euler, Heun, or Runge–Kutta 2 scheme that most engineering, science and mathematics students learn in undergraduate coursework.

This connection has another useful consequence in application: for systems with small noise we expect that the integration error of the sde is only a little worse than that of the deterministic system. Although Section 3 proves the typical error of the stochastic scheme (2), as demonstrated in the examples of the next Section 2, when the noise is small expect the error to be practically better than the order of error suggests.

Section 3 also proves that the scheme (2) integrates Stratonovich sdes to provided one sets throughout (instead of choosing ).

An outstanding challenge is to generalise this method (2) to multiple noise sources.

2 Examples demonstrate error is typical

This section applies the scheme (2) to three example sdes for which, for comparison, we know the analytic solution from Kloeden and Platen [3]. Two of the examples exhibit errors , as is typical, whereas the third exhibits a error , which occurs for both deterministic odes and a class of sdes. These errors are ‘pathwise’ errors which means that for any one given realisation of the noise process we refer to the order of error as the time step for a fixed realisation .

2.1 Autonomous example

Consider the ‘autonomous’ sde

| (3) |

for some Wiener process . The sde is not strictly autonomous because the noise introduces time dependence; we use the term ‘autonomous’ to indicate the drift and volatility are independent of time. For the sde (3), Kloeden and Platen [3] list the analytic solution as .

Such analytic solutions are straightforwardly checked via the basic version of Itô’s formula,

| (4) |

which may be understood as the usual deterministic derivative rule with the extra term arising from a formal multi-variable Taylor series in the infinitesimals and , recognising formally that in effect, and all remaining infinitesimal products negligible [1, 9, e.g.].

|

|

|

|---|---|

| time |

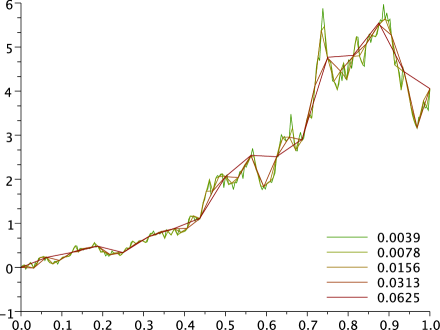

The proposed numerical scheme (2) was applied to integrate the sde (3) from to end time with a time step of for steps. For each of realisations of the noise , the Wiener increments, , were generated on the finest time step, and subsequently aggregated to the corresponding increments for each realisation on the coarser time steps. Figure 1 plots the predicted obtained from the numerical scheme (2) for just one realisation using different time steps. The predictions do appear to converge to a well defined stochastic process as the step size is repeatedly halved.

|

rms error |

|

|---|---|

| time step |

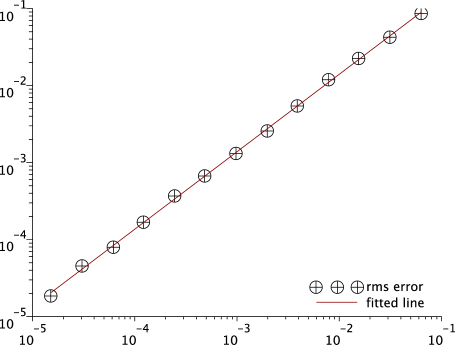

For each size of time step, Figure 2 uses the analytic solution to find the rms error of the predicted , averaged over realisations . This rms error estimates the square-root of the expectation . Figure 2 uses a log-log plot to show that the rms error decreases linearly with time step size (over four orders of magnitude in time step). That is, empirically we see the scheme (2) has rms error .

2.2 Non-autonomous example

Consider the ‘non-autonomous’ sde

| (5) |

with initial condition that , for some Wiener process . Here both the drift and the volatility have explicit time dependence. Itô’s formula (4) confirms that the analytic solution to this sde (3) is .

|

rms error |

|

|---|---|

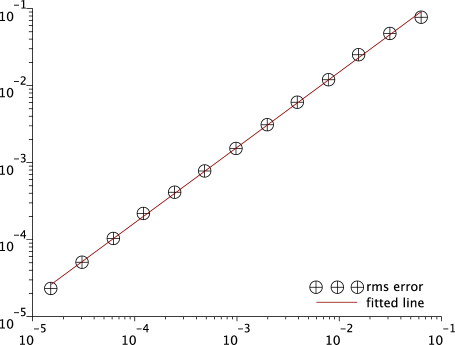

| time step |

2.3 Example with second order error

Consider the following sde linear in :

| (6) |

for some Wiener process . Itô’s formula (4) confirms that the analytic solution to this sde (6) is .

|

rms error |

|

|---|---|

| time step |

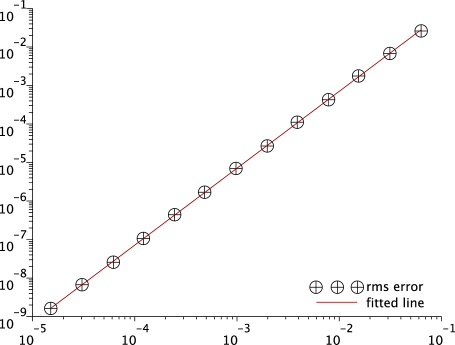

To determine the order of error of the scheme (2), the same approach was adopted here as described in Section 2.1. The difference is that the slope of the log-log plot in Figure 4 shows that here the rms error of the predicted is . There appears to be some sdes for which the error of the scheme (2) is quadratic in the time step rather than linear.

Exercise 1.

Use Itô’s formula (4) to confirm the solutions given below satisfy the corresponding given sde. Apply the scheme (2) to some of the following sdes and compare the predictions, for different time steps sizes, to the given analytic solution. Perhaps adapt some of the code given by Higham [1, Listing 6].

-

1.

, ; solution .

-

2.

, ; solution .

-

3.

, ; solution .

-

4.

, ; solution .

-

5.

, ; solution .

For which sdes is the error ?

3 Prove global error in general

This section uses stochastic integration to establish the general order of accuracy of the proposed numerical integration scheme.

Proofs that numerical schemes do indeed approximate sde solutions are often complex. My plan here is to elaborate three successively more complicated cases, with the aim that you develop a feel for the analysis before it gets too complex. Lemma 1 first proves that the Runge–Kutta like scheme (2) approximates the simplest Itô integrals to first order in the time step. Second, section 3.2 identifies a class of linear sdes with additive noise when the scheme (2) is of second order. Third, section 3.3 proves the first order global error of scheme (2) when applied to general sdes. Those familiar with stochastic Itô integration could proceed directly to the third section 3.3.

One outcome of this section is to precisely ‘nail down’ the requisite properties of the choice of signs in the scheme (2).

3.1 Error for Itô integrals

This subsection establishes the order of error in computing the Itô integral if one were to invoke the scheme (2) on the scalar sde . Before proceeding, recall that two fundamental properties on the expectation and variance of Itô integrals are widely useful [2, p.2] [9, pp.101–3]:

| (7) | ||||

| (8) |

These empower us to quantify errors in the integrals that approximate solutions of sdes as in the following lemma.

Lemma 1.

The Runge–Kutta like scheme (2) has global error when applied to for functions twice differentiable.

Proof.

Without loss of generality, start with the time step from to . Applied to the very simple sde one step of the scheme (2) computes

and then estimates the change in as

| (9) |

where the integrand values and . The classic polynomial approximation theorem [7, p.800, e.g.] relates this estimate (9) to the exact integral. Here write the integrand as the linear interpolant with remainder:

for some . Then the exact change in is

| (10) |

The error in one step of the scheme (2) is the difference between the changes (9) and (10). That is, the true integral change where the error

| (11) |

How big is this error? First take expectations, invoke the martingale property (7) for the two stochastic integrals, and see that provided . Thus the signs must be chosen with mean zero.

Second compute the variance of the error to see the size of the fluctuations in the error. Since the expectation , the variance . Look at various contributions in turn. The first term in the error (11) has variance provided the signs have bounded variance. Choosing the signs independently of the noise there are then no correlations between the terms and the other two terms. The second term in the error (11) has variance

The third term in the error (11), by the Itô isometry (8), has variance

| (12) |

when the second derivative is bounded, . Lastly, the correlation between these previous two integrals is small as, by a slightly more general version of the Itô isometry (8),

Hence the local, one step, error is dominated by the first two contributions and has variance .

To estimate the global integral, , we take time steps. With steps the global error is the sum of local errors: the scheme (2) approximates the correct solution with global error . Firstly, as for all time steps. Secondly, as the errors on each time step are independent, the variance

Thus, for the sde , the scheme (2) has global error of size . ∎

3.2 Error for linear SDEs with additive noise

This second lemma addresses somewhat more general scalar sdes. It not only serves as a ‘stepping stone’ to a full theorem, but illustrates two other interesting properties. Firstly, we identify a class of sdes for which the scheme (2) is second order accurate in the time step as seen in Example 2.3. Secondly, the proof suggests that the sign in the scheme (2) relates to sub-step properties of the noise that are independent of the increment .

Lemma 2.

The Runge–Kutta like scheme (2) has global error when applied to the additive noise, linear sde for functions and twice differentiable. Further, in the exact differential case when (a solution to the sde is then ) the global error is .

Proof.

In this case, straightforward algebra shows the first step in the scheme (2) predicts the change

| (13) |

where the coefficient values , , and . We compare this approximate change over the time step with the true change using iterated integrals. For simplicity we also use subscripts to denote dependence upon ‘time’ variables , and . Start by writing the sde as an integral over the first time step:

| [substituting inside the first integral] | ||||

| [substituting inside the second integral] | ||||

| (14) |

For the last part of the lemma on the case of higher order error, we need to expand to this level of detail in six integrals. Of these six integrals, some significantly match the components of the numerical step (13) and some just contribute to the error. Recall that the proof of Lemma 1 identified that errors had both mean and variance. To cater for these two characteristics of errors, and with perhaps some abuse of notation, I introduce the notation to denote quantities with mean and variance . For example, classifies deterministic quantities , whereas characterises zero mean stochastic quantities of standard deviation scaling like . The previous proof looked closely at the variances of error terms; here we simplify by focussing only upon their order of magnitude. In particular, let’s show that the six integrals in (14) match the numerical step (13) to an error .

Consider separately the integrals in (14).

-

•

Firstly, by the classic trapezoidal rule. This matches the first component in the numerical (13).

-

•

Secondly, using the linear interpolation , where as usual , the double integral

Multiplied by , this double integral matches the second term in the numerical (13).

-

•

Thirdly, the triple integral

because, as seen in the previous two items, each ordinary integration over a time of multiplies the order of the term by a power of .

-

•

Fourthly, look at the single stochastic integral in (14), the last term. From the proof of the previous lemma, equations (10) and (12) give

(15) The first term here matches the third term in the numerical (13). The second term on the right-hand side is an integral remainder that will be dealt with after the next two items.

-

•

Fifthly, change the order of integration in the double integral

[by the martingale property (7) and Itô isometry (8)] The first term here matches the first part of the fourth term in the numerical (13). The second term on the right-hand side is an integral remainder that will be dealt with after the last item.

- •

Hence we now identify that the difference between the Runge–Kutta like step (13) and the change (14) in the true solution is the error

| (16) |

Two cases arise corresponding to the main and the provisional parts of lemma 2.

-

•

In the general case, the factor in square brackets, , in (16) determines the order of error. Choosing the signs randomly with mean zero then . Recall the integral also. Thus the leading error is then . This is the local one step error. Summing over time steps gives that the global error is . That is, the error due to the noise dominates, variance , and is generally first order in as the standard deviation of the error is of order .

But as the noise decreases to zero, , the factor in curly braces, , goes to zero. In this decrease the order of error (16) transitions smoothly to the deterministic case of local error and hence global error .

-

•

The second case is when the factor in braces in (16) is small: this occurs for the integrable case as then the term in braces is so that the whole error (16) becomes . Again this is the local one step error. Summing over time steps gives that the global error is . That is, in this case the error is of second order in time step , both through the deterministic error and the variance of the stochastic errors. Figure 4 shows another case when the error is second order.

This concludes the proof. ∎

Interestingly, we would decrease the size of the factor in brackets in the error (16) by choosing the sign to cancel as much as possible the integral . This sub-step integral is one characteristic of the sub-step structure of the noise, and is independent of . If we knew this integral, then we could choose the sign to cause some error cancellation; however, generally we do not know the sub-step integral. But this connection between the signs and the integral does suggest that the sign relates to sub-step characteristics of the noise process .

For example, if one used Brownian bridges to successively refine the numerical approximations for smaller and smaller time steps, then it may be preferable to construct a Brownian bridge compatible with the signs used on the immediately coarser step size.111The Brownian bridge stochastically interpolates a Wiener process to half-steps in time if all one knows is the increment over a time step . The Brownian bridge asserts that the change over half the time step, , is for some ; the change over the second half of the time step is correspondingly . Factoring out the half, these sub-steps are which match the factors used by the scheme (2): the discrete signs have mean zero and variance one just like the normally distributed of the Brownian bridge.

3.3 Global error for general SDEs

The previous section 3.2 established the order of error for a special class of linear sdes. The procedure is to repeatedly substitute integral expressions for the unknown whereever it appears (analogous to Picard iteration). In section 3.2 each substitution increased the number of integrals in the expression by two. For general sdes, this subsection employs the same procedure, but now the number of integrals doubles in each substitution. The rapid increase in the number of integrals is a major complication, so we only consider the integrals necessary to establish that the global error is .

Further, the following theorem is also proven for vector sdes in , whereas the previous two subsection sections only considered special scalar sdes.

Theorem 3.

Proof.

The proof has two parts: the first is the well known, standard, expansion of the solution of the general sde (1) by iterated stochastic integrals leading to the Milstein scheme [1, 2, e.g.]; the second shows how the scheme (2) matches the integrals to an order of error.

First look at the repeated integrals for one time step; without loss of generality, start with a time step from to as the analysis for all other time steps is identical with minor shifts in the times of evaluation and integration. The stochastic ‘Taylor series’ analysis starts from the integral form of Itô formula (4): for a stochastic process satisfying the general Itô sde (1), for operators , any smooth function of the process satisfies

| (17) | ||||

| where |

For conciseness we use subscripts , , and to denote evaluation at these times, and similarly , and use subscripts and to denote components of a vector, with the Einstein summation convention for repeated indices. As you would expect, when stochastic effects are absent, , the integral formula (17) reduces, through the first two components of , to an integral version of the well known deterministic chain rule: . Now turn to the sde (1) itself: it is a differential version of an integral equation which over the first time step gives

| (18) |

-

•

Simplify the first line in this last expression (18) for using the well known integrals , and [1, (3.6), e.g.]. The last of these three integrals follow from applying Itô’s formula applied to to deduce , and integrating a rearrangement gives . Also simplify the first line by defining the matrix so that .

-

•

The three integrals above in square brackets in expression (18) all have expectation zero and variance . Recall that with two arguments denotes quantities with mean and variance . Thus these three integrals in square brackets are .

-

•

The two integrals above in curly braces in expression (18) are all in magnitude and hence are .

Combining all these leads to the well established Milstein scheme for the change in over one time step from to as

| (19) |

Second, we proceed to show the scheme (2) matches this Milstien scheme (19). Note so the product and so on. Hence, by Taylor series in the arguments of the smooth drift and volatility ,

where denotes the tensorial double sum , and where the overdot denotes the partial derivative with respect to time, . Combining and , the corresponding first step in the scheme (2) predicts the change

| (20) |

Provided the first lines match to : normally as specified in (2). Other terms detailed in (20) are provided : normally set to be zero as specified in (2). Hence one step of the scheme (2) matches the solution to . The local error over one step of leads to, over steps, a global error of . ∎

This proof confirms the order of error seen in the earlier examples. Further, because we can readily transform between Itô and Stratonovich sdes, we now prove that a minor variation of the numerical scheme applies to Stratonovich sdes.

Corollary 4 (Stratonovich SDEs).

Proof.

Interpreting the sde (1) in the Stratonovich sense implies solutions are the same as the solutions of the Itô sde

Apply the scheme (2) (with as appropriate to an Itô sde), or the analysis of the previous proof, to this Itô sde. Then, for example, the one step change (20) becomes

The component of the deterministic drift term that involves cancel leaving, in terms of the coefficient functions of the Stratonovich sde,

| (21) |

Now apply the scheme (2) with to the Stratonovich sde: Taylor series expansions obtain the one step numerical prediction as (20) upon setting . This one step numerical prediction is the same as (21) to the same order of errors. Thus the scheme (2) with solves the Stratonovich interpretation of the sde (1). ∎

Exercise 2 (iterated integrals).

Consider the scalar sde . This sde is shorthand for the Itô integral . Over a small time interval this integral gives . Use this as the start of an iteration to provide successively more accurate approximations to : successive approximations are successive truncations of

Determine the integral remainders for each of the approximations.

4 Conclusion

A good basic numerical scheme for integrating Itô sdes is the Runge–Kutta like scheme (2) (set to integrate Stratonovich sdes). A teacher could introduce it in the context of the introduction to numerical sdes outlined by Higham [1].

One of the appealing features of the scheme (2) is that it reduces, for small noise, to a well known scheme for deterministic odes. Consequently, we expect the global error for some norms of the drift and volatility. Such more general expressions of the error should be useful in multiscale simulations where the strength of the noise depends upon the macroscale time step, such as in the modelling of a stochastic Hopf bifurcation [8, §5.4.2].

One required extension of the scheme (2) is to generalise it, if possible, to the case of multiple independent noises. I am not aware of an attractive generalisation to this practically important case.

References

- [1] Desmond J. Higham. An algorithmic introduction to numerical simulation of stochastic differential equations. SIAM Review, 43(3):525–546, 2001.

- [2] P. E. Kloeden. A brief overview of numerical methods for stochastic differential equations. Technical report, Fachberiech Mathematik, Johann Wolfgang Goethe Universitat, August 2001.

- [3] P. E. Kloeden and E. Platen. Numerical solution of stochastic differential equations, volume 23 of Applications of Mathematics. Springer–Verlag, 1992.

- [4] Yoshio Komori. Multi-colored rooted tree analysis of the weak order conditions of a stochastic runge–kutta family. Applied Numerical Mathematics, 57(2):147–165, 2007.

- [5] Yoshio Komori. Weak order stochastic runge–kutta methods for commutative stochastic differential equations. Journal of Computational and Applied Mathematics, 203(1):57–79, 2007.

- [6] Yoshio Komori. Weak second-order stochastic runge–kutta methods for non-commutative stochastic differential equations. Journal of Computational and Applied Mathematics, 206(1):158—173, 2007.

- [7] E. Kreyszig. Advanced engineering mathematics. Wiley, 9th edition, 2006.

- [8] A. J. Roberts. Normal form transforms separate slow and fast modes in stochastic dynamical systems. Physica A, 387:12–38, 2008. doi:10.1016/j.physa.2007.08.023.

- [9] A. J. Roberts. Elementary calculus of financial mathematics, volume 15 of Mathematical Modeling and Computation. SIAM, Philadelphia, 2009. Appeared twice (two printings) in SIAM’s top-25 best sellers for the year ending April, 2010.

- [10] Andreas Rossler. Second order runge–kutta methods for ito stochastic differential equations. SIAM Journal on Numerical Analysis, 47(3):1713–1738, 2009.

- [11] Andreas Rossler. Runge–kutta methods for the strong approximation of solutions of stochastic differential equations. SIAM Journal on Numerical Analysis, 48(3):922–952, 2010.