Model selection and estimation

of a component in additive regression

Abstract

Let be a random vector with mean and covariance matrix where is some known -matrix. We construct a statistical procedure to estimate as well as under moment condition on or Gaussian hypothesis. Both cases are developed for known or unknown . Our approach is free from any prior assumption on and is based on non-asymptotic model selection methods. Given some linear spaces collection , we consider, for any , the least-squares estimator of in . Considering a penalty function that is not linear in the dimensions of the ’s, we select some in order to get an estimator with a quadratic risk as close as possible to the minimal one among the risks of the ’s. Non-asymptotic oracle-type inequalities and minimax convergence rates are proved for . A special attention is given to the estimation of a non-parametric component in additive models. Finally, we carry out a simulation study in order to illustrate the performances of our estimators in practice.

1 Introduction

1.1 Additive models

The general form of a regression model can be expressed as

| (1) |

where is the -dimensional vector of explanatory variables that belongs to some product space , the unknown function is called regression function, the positive real number is a standard deviation factor and the real random noise is such that and almost surely.

In such a model, we are interested in the behavior of in accordance with the fluctuations of . In other words, we want to explain the random variable through the function . For this purpose, many approaches have been proposed and, among them, a widely used is the linear regression

| (2) |

where and the ’s are unknown constants. This model benefits from easy interpretation in practice and, from a statistical point of view, allows componentwise analysis. However, a drawback of linear regression is its lack of flexibility for modeling more complex dependencies between and the ’s. In order to bypass this problem while keeping the advantages of models like (2), we can generalize them by considering additive regression models of the form

| (3) |

where the unknown functions will be referred to as the components of the regression function . The object of this paper is to construct a data-driven procedure for estimating one of these components on a fixed design (i.e. conditionally to some realizations of the random variable ). Our approach is based on nonasymptotic model selection and is free from any prior assumption on and its components. In particular, we do not make any regularity hypothesis on the function to estimate except to deduce uniform convergence rates for our estimators.

Models (3) are not new and were first considered in the context of input-output analysis by Leontief [23] and in analysis of variance by Scheffé [35]. This kind of model structure is widely used in theoretical economics and in econometric data analysis and leads to many well known economic results. For more details about interpretability of additive models in economics, the interested reader could find many references at the end of Chapter 8 of [18].

As we mention above, regression models are useful for interpreting the effects of on changes of . To this end, the statisticians have to estimate the regression function . Assuming that we observe a sample obtained from model (1), it is well known (see [37]) that the optimal convergence rate for estimating is of order where is an index of smoothness of . Note that, for large value of , this rate becomes slow and the performances of any estimation procedure suffer from what is called the curse of the dimension in literature. In this connection, Stone [37] has proved the notable fact that, for additive models (3), the optimal convergence rate for estimating each component of is the one-dimensional rate . In other terms, estimation of the component in (3) can be done with the same optimal rate than the one achievable with the model .

Components estimation in additive models has received a large interest since the eighties and this theory benefited a lot from the the works of Buja et al. [15], Hastie and Tibshirani [19]. Very popular methods for estimating components in (3) are based on backfitting procedures (see [12] for more details). These techniques are iterative and may depend on the starting values. The performances of these methods deeply depends on the choice of some convergence criterion and the nature of the obtained results is usually asymptotic (see, for example, the works of Opsomer and Ruppert [30] and Mammen, Linton and Nielsen [26]). More recent non-iterative methods have been proposed for estimating marginal effects of the on the variable (i.e. how fluctuates on average if one explanatory variable is varying while others stay fixed). These procedures, known as marginal integration estimation, were introduced by Tjøstheim and Auestad [38] and Linton and Nielsen [24]. In order to estimate the marginal effect of , these methods take place in two times. First, they estimate the regression function by a particular estimator , called pre-smoother, and then they average according to all the variables except . The way for constructing is fundamental and, in practice, one uses a special kernel estimator (see [34] and [36] for a discussion on this subject). To this end, one needs to estimate two unknown bandwidths that are necessary for getting . Dealing with a finite sample, the impact of how we estimate these bandwidths is not clear and, as for backfitting, the theoretical results obtained by these methods are mainly asymptotic.

In contrast with these methods, we are interested here in nonasymptotic procedures to estimate components in additive models. The following subsection is devoted to introduce some notations and the framework that we handle but also a short review of existing results in nonasymptotic estimation in additive models.

1.2 Statistical framework

We are interested in estimating one of the components in the model (3) with, for any , . To focus on it, we denote by the component that we plan to estimate and by the other ones. Thus, considering the design points , we observe

| (4) |

where the components are unknown functions, in an unknown real number, is a positive factor and is an unobservable centered random vector with i.i.d. components of unit variance.

Let be a probability measure on , we introduce the space of centered and square-integrable functions

Let be probability measures on , to avoid identification problems in the sequel, we assume

| (5) |

This hypothesis is not restrictive since we are interested in how fluctuates with respect to the ’s. A shift on the components does not affect these fluctuations and the estimation proceeds up to the additive constant .

The results described in this paper are obtained under two different assumptions on the noise terms , namely

() the random vector is a standard Gaussian vector in ,

and

() the variables satisfy the moment condition

| (6) |

Obviously, () is weaker than (). We consider these two cases in order to illustrate how better are the results in the Gaussian case with regard to the moment condition case. From the point of view of model selection, we show in the corollaries of Section 2 that we are allowed to work with more general model collections under () than under () in order to get similar results. Thus, the main contribution of the Gaussian assumption is to give more flexibility to the procedure described in the sequel.

So, our aim is to estimate the component on the basis of the observations (4). For the sake of simplicity of this introduction, we assume that the quantity is known (see Section 3 for unknown variance) and we introduce the vectors and defined by, for any ,

| (7) |

Moreover, we assume that we know two linear subspaces such that , and . Of course, such spaces are not available to the statisticians in practice and, when we handle additive models in Section 4, we will not suppose that they are known. Let be the projection onto along , we derive from (4) the following regression framework

| (8) |

where belongs to .

The framework (8) is similar to the classical signal-plus-noise regression framework but the data are not independent and their variances are not equal. Because of this uncommonness of the variances of the observations, we qualify (8) as an heteroscedastic framework. The object of this paper is to estimate the component and we handle (8) to this end. The particular case of equal to the unit matrix has been widely treated in the literature (see, for example, [10] for () and [4] for ()). The case of an unknown but diagonal matrix has been studied in several papers for the Gaussian case (see, for example, [16] and [17]). By using cross-validation and resampling penalties, Arlot and Massart [3] and Arlot [2] have also considered the framework (8) with unknown diagonal matrix . Laurent, Loubes and Marteau [21] deal with a known diagonal matrix for studying testing procedure in an inverse problem framework. The general case of a known non-diagonal matrix naturally appears in applied fields as, for example, genomic studies (see Chapters 4 and 5 of [33]).

The results that we introduce in the sequel consider the framework (8) from a general outlook and we do not make any prior hypothesis on . In particular, we do not suppose that is invertible. We only assume that it is a projector when we handle the problem of component estimation in an additive framework in Section 4. Without loss of generality, we always admit that . Indeed, if does not belong to , it suffices to consider the orthogonal projection onto and to notice that is not random. Thus, replacing by leads to (8) with a mean lying in . For general matrix , other approaches could be used. However, for the sake of legibility, we consider because, for the estimation of a component in an additive framework, by construction, we always have as it will be specified in Section 4.

We now describe our estimation procedure in details. For any , we define the least-squares contrast by

Let us consider a collection of linear subspaces of denoted by where is a finite or countable index set. Hereafter, the ’s will be called the models. Denoting by the orthogonal projection onto , the minimum of over is achieved at a single point called the least-squares estimator of in . Note that the expectation of is equal to the orthogonal projection of onto . We have the following identity for the quadratic risks of the ’s,

Proposition 1.1.

Let , the least-squares estimator of in satisfies

| (9) |

where is the trace operator.

Proof.

By orthogonality, we have

| (10) |

Because the components of are independent and centered with unit variance, we easily compute

We conclude by taking the expectation on both side of (10). ∎

A “good” estimator is such that its quadratic risk is small. The decomposition given by (9) shows that this risk is a sum of two non-negative terms that can be interpreted as follows. The first one, called bias term, corresponds to the capacity of the model to approximate the true value of . The second, called variance term, is proportional to and measures, in a certain sense, the complexity of . If , for some , then the variance term is small but the bias term is as large as is far from the too simple model . Conversely, if is a “huge” model, whole for instance, the bias is null but the price is a great variance term. Thus, (9) illustrates why choosing a “good” model amounts to finding a trade-off between bias and variance terms.

Clearly, the choice of a model that minimizes the risk (9) depends on the unknown vector and makes good models unavailable to the statisticians. So, we need a data-driven procedure to select an index such that is close to the smaller -risk among the collection of estimators , namely

To choose such a , a classical way in model selection consists in minimizing an empirical penalized criterion stochastically close to the risk. Given a penalty function , we define as any minimizer over of the penalized least-squares criterion

| (11) |

This way, we select a model and we have at our disposal the penalized least-squares estimator . Note that, by definition, the estimator satisfies

| (12) |

To study the performances of , we have in mind to upperbound its quadratic risk. To this end, we establish inequalities of the form

| (13) |

where and are numerical terms that do not depend on . Note that if the penalty is proportional to , then the quantity involved in the infimum is of order of the -risk of . Consequently, under suitable assumptions, such inequalities allow us to deduce upperbounds of order of the minimal risk among the collection of estimators . This result is known as an oracle inequality

| (14) |

This kind of procedure is not new and the first results in estimation by penalized criterion are due to Akaike [1] and Mallows [25] in the early seventies. Since these works, model selection has known an important development and it would be beyond the scope of this paper to make an exhaustive historical review of the domain. We refer to the first chapters of [28] for a more general introduction.

Nonasymptotic model selection approach for estimating components in an additive model was studied in few papers only. Considering penalties that are linear in the dimension of the models, Baraud, Comte and Viennet [6] have obtained general results for geometrically -mixing regression models. Applying it to the particular case of additive models, they estimate the whole regression function. They obtain nonasymptotic upperbounds similar to (13) on condition admits a moment of order larger than 6. For additive regression on a random design and alike penalties, Baraud [5] proved oracle inequalities for estimators of the whole regression function constructed with polynomial collections of models and a noise that admits a moment of order 4. Recently, Brunel and Comte [13] have obtained results with the same flavor for the estimation of the regression function in a censored additive model and a noise admitting a moment of order larger than 8. Pursuant to this work, Brunel and Comte [14] have also proposed a nonasymptotic iterative method to achieve the same goal. Combining ideas from sparse linear modeling and additive regression, Ravikumar et al. [32] have recently developed a data-driven procedure, called SpAM, for estimating a sparse high-dimensional regression function. Some of their empirical results have been proved by Meier, van de Geer and Bühlmann [29] in the case of a sub-Gaussian noise and some sparsity-smoothness penalty.

The methods that we use are similar to the ones of Baraud, Comte and Viennet and are inspired from [4]. The main contribution of this paper is the generalization of the results of [4] and [6] to the framework (8) with a known matrix under Gaussian hypothesis or only moment condition on the noise terms. Taking into account the correlations between the observations in the procedure leads us to deal with penalties that are not linear in the dimension of the models. Such a consideration naturally arises in heteroscedastic framework. Indeed, as mentioned in [2], at least from an asymptotic point of view, considering penalties linear in the dimension of the models in an heteroscedastic framework does not lead to oracle inequalities for . For our penalized procedure and under mild assumptions on , we prove oracle inequalities under Gaussian hypothesis on the noise or only under some moment condition.

Moreover, we introduce a nonasymptotic procedure to estimate one component in an additive framework. Indeed, the works cited above are all connected to the estimation of the whole regression function by estimating simultaneously all of its components. Since these components are each treated in the same way, their procedures can not focus on the properties of one of them. In the procedure that we propose, we can be sharper, from the point of view of the bias term, by using more models to estimate a particular component. This allows us to deduce uniform convergence rates over Hölderian balls and adaptivity of our estimators. Up to the best of our knowledge, our results in nonasymptotic estimation of a nonparametric component in an additive regression model are new.

The paper is organized as follows. In Section 2, we study the properties of the estimation procedure under the hypotheses () and () with a known variance factor . As a consequence, we deduce oracle inequalities and we discuss about the size of the collection . The case of unknown is presented in Section 3 and the results of the previous section are extended to this situation. In Section 4, we apply these results to the particular case of the additive models and, in the next section, we give uniform convergence rates for our estimators over Hölderian balls. Finally, in Section 6, we illustrate the performances of our estimators in practice by a simulation study. The last sections are devoted to the proofs and to some technical lemmas.

Notations: in the sequel, for any , we define

We denote by the spectral norm on the set of the real matrices as the norm induced by ,

For more details about the properties of , see Chapter 5 of [20].

2 Main results

Throughout this section, we deal with the statistical framework given by (8) with and we assume that the variance factor is known. Moreover, in the sequel of this paper, for any , we define as the number of models of dimension in ,

We first introduce general model selection theorems under hypotheses () and ().

Theorem 2.1.

Assume that () holds and consider a collection of nonnegative numbers . Let , if the penalty function is such that

| (15) |

then the penalized least-squares estimator given by (11) satisfies

| (16) |

where we have set

and and are constants that only depend on .

If the errors are not supposed to be Gaussian but only to satisfy the moment condition (), the following upperbound on the -th moment of holds.

Theorem 2.2.

Assume that () holds and take such that . Consider and some collection of positive weights. If the penalty function is such that

| (17) |

then the penalized least-squares estimator given by (11) satisfies

| (18) |

where we have set equal to

and , are positive constants.

The proofs of these theorems give explicit values for the constants that appear in the upperbounds. In both cases, these constants go to infinity as tends to or increases toward infinity. In practice, it does neither seem reasonable to choose close to 0 nor very large. Thus this explosive behavior is not restrictive but we still have to choose a “good” . The values for suggested by the proofs are around the unity but we make no claim of optimality. Indeed, this is a hard problem to determine an optimal choice for from theoretical computations since it could depend on all the parameters and on the choice of the collection of models. In order to calibrate it in practice, several solutions are conceivable. We can use a simulation study, deal with cross-validation or try to adapt the slope heuristics described in [11] to our procedure.

For penalties of order of , Inequalities (16) and (18) are not far from being oracle. Let us denote by the remainder term or according to whether () or () holds. To deduce oracle inequalities from that, we need some additional hypotheses as the following ones:

() there exists some universal constant such that

() there exists some constant such that

() there exists some constant such that

Thus, under the hypotheses of Theorem 2.1 and these three assumptions, we deduce from (16) that

where is a constant that does not depend on , and . By Proposition 1.1, this inequality corresponds to (14) up to some additive term. To derive similar inequality from (18), we need on top of that to assume that in order to be able to take .

Assumption () is subtle and strongly depends on the nature of . The case of oblique projector that we use to estimate a component in an additive framework will be discussed in Section 4. Let us replace it, for the moment, by the following one

() there exists that does not depend on such that

By the properties of the norm , note that always admits an upperbound with the same flavor

In all our results, the quantity stands for a dimensional term relative to . Hypothesis () formalizes that by assuming that its order is the dimension of the model up to the norm of the covariance matrix .

Let us now discuss about the assumptions () and (). They are connected and they raise the impact of the complexity of the collection on the estimation procedure. Typically, condition () will be fulfilled under () when is not too “large”, that is, when the collection does not contain too many models with the same dimension. We illustrate this phenomenon by the two following corollaries.

Corollary 2.1.

Assume that () and () hold and consider some finite such that

| (19) |

Let , and be some positive numbers that satisfy

Then, the estimator obtained from (11) with penalty function given by

is such that

where only depends on , and .

For errors that only satisfy moment condition, we have the following similar result.

Corollary 2.2.

Assume that () and () hold with and let and such that

| (20) |

Consider some positive numbers , and that satisfy

then, the estimator obtained from (11) with penalty function given by

is such that

where only depends on , , , and .

Note that the assumption () guarantees that is not smaller than and, at least for the models with positive dimension, this implies . Consequently, up to the factor , the upperbounds of given by Corollaries 2.1 and 2.2 are of order of the minimal risk . To deduce oracle inequalities for from that, () needs to be fulfilled. In other terms, we need to be able to consider some independently from the size of the data. It will be the case if the same is true for the bounds .

Let us assume that the collection is small in the sense that, for any , the number of models is bounded by some constant term that neither depends on nor . Typically, collections of nested models satisfy that. In this case, we are free to take equal to some universal constant. So, () is true for and oracle inequalities can be deduced for . Conversely, a large collection is such that there are many models with the same dimension. We consider that this situation happens, for example, when the order of is . In such a case, we need to choose of order too and the upperbounds on the risk of become oracle type inequalities up to some logarithmic factor. However, we know that in some situations, this factor can not be avoided as in the complete variable selection problem with Gaussian errors (see Chapter 4 of [27]).

As a consequence, the same model selection procedure allows us to deduce oracle type inequalities under ( and (). Nevertheless, the assumption on in Corollary 2.2 is more restrictive than the one in Corollary 2.1. Indeed, to obtain an oracle inequality in the Gaussian case, the quantity is limited by while the bound is only polynomial in under moment condition. Thus, the Gaussian assumption () allows to obtain oracle inequalities for more general collections of models.

3 Estimation when variance is unknown

In contrast with Section 2, the variance factor is here assumed to be unknown in (8). Since the penalties given by Theorems 2.1 and 2.2 depend on , the procedure introduced in the previous section does not remain available to the statisticians. Thus, we need to estimate in order to replace it in the penalty functions. The results of this section give upperbounds for the -risk of the estimators constructed in such a way.

To estimate the variance factor, we use a residual least-squares estimator that we define as follows. Let be some linear subspace of such that

| (21) |

where is the orthogonal projection onto . We define

| (22) |

First, we assume that the errors are Gaussian. The following result holds.

Theorem 3.1.

Assume that () holds. For any , we define the penalty function

| (23) |

Then, for some positive constants , and that only depend on , the penalized least-squares estimator satisfies

| (24) |

where we have set

If the errors are only assumed to satisfy a moment condition, we have the following theorem.

Theorem 3.2.

Assume that () holds. Let , we consider the penalty function defined by

| (25) |

For any such that , the penalized least-squares estimator satisfies

where and are positive constants, is equal to

with defined as in Theorem 2.2, is a sequence of positive numbers that tends to as increases toward infinity and

Penalties given by (23) and (25) are random and allow to construct estimators when is unknown. This approach leads to theoretical upperbounds for the risk of . Note that we use some generic model to construct . This space is quite arbitrary and is pretty much limited to be an half-space of . The idea is that taking as some “large” space can lead to a good approximation of the true and, thus, is not far from being centered and its normalized norm is of order . However, in practice, it is known that the estimator inclined to overestimate the true value of as illustrated by Lemmas 8.4 and 8.5. Consequently, the penalty function tends to be larger and the procedure overpenalizes models with high dimension. To offset this phenomenon, a practical solution could be to choose some smaller when is unknown than when it is known as we discuss in Section 6.

4 Application to additive models

In this section, we focus on the framework (4) given by an additive model. To describe the procedure to estimate the component , we assume that the variance factor is known but it can be easily generalized to the unknown factor case by considering the results of Section 3. We recall that , , and we observe

| (26) |

where the random vector is such that () or () holds and the vectors and are defined in (7).

Let be a linear subspace of and, for all , be a linear subspace of . We assume that these spaces have finite dimensions and such that

We consider an orthonormal basis (resp. ) of (resp. ) equipped with the usual scalar product of (resp. of ). The linear spans are defined by

and

Let , we also define

where is added to the ’s in order to take into account the constant part of (4). Furthermore, note that the sum defining the space does not need to be direct.

We are free to choose the functions ’s and ’s. In the sequel, we assume that these functions are chosen in such a way that the mild assumption is fulfilled. Note that we do not assume that belongs to neither that belongs to . Let be the space , we obviously have and we denote by the projection onto along . Moreover, we define and as the orthogonal projections onto and respectively. Thus, we derive the following framework from (26),

| (27) |

where we have set

Let be a finite collection of linear subspaces of , we apply the procedure described in Section 2 to given by (27), that is, we choose an index as a minimizer of (11) with a penalty function satisfying the hypotheses of Theorems 2.1 or 2.2 according to whether () or () holds. This way, we estimate by . From the triangular inequality, we derive that

As we discussed previously, under suitable assumptions on the complexity of the collection , we can assume that () and () are fulfilled. Let us suppose for the moment that () is satisfied for some . Note that, for any , is an orthogonal projection onto the image set of the oblique projection . Consequently, we have and Assumption () implies () with . Since, for all ,

we deduce from Theorems 2.1 or 2.2 that we can find, independently from and , two positive numbers and such that

| (28) |

To derive an interesting upperbound on the -risk of , we need to control the remainder term. Because is a norm on , we dominate the norm of by

Note that, for any , and so, . Thus, Inequality (28) leads to

| (29) |

The space has to be seen as a large approximation space. So, under a reasonable assumption on the regularity of the component , the quantity could be regarded as being neglectable. It mainly remains to understand the order of the multiplicative factor .

Thus, we now discuss about the norm and the assumption (). This quantity depends on the design points and on how we construct the spaces and , i.e. on the choice of the basis functions and . Hereafter, the design points will be assumed to be known independent realizations of a random variable on with distribution . We also assume that these points are independent of the noise and we proceed conditionally to them. To discuss about the probability for () to occur, we introduce some notations. We denote by the integer

and we have . Let be a real matrix, we define

Moreover, we define the matrices and by

for any . Finally, we introduce the quantities

and

Proposition 4.1.

Consider the matrix defined in (27). We assume that the design points are independent realizations of a random variable on with distribution such that we have and almost surely. If the basis is such that

| (30) |

then, there exists some universal constant such that, for any ,

As a consequence of Proposition 4.1, we see that () is fulfilled with a large probability since we choose basis functions in such a way to keep small in front of . It will be so for localized bases (piecewise polynomials, orthonormal wavelets, …) with of order of , for some , once we consider and of order of (this is a direct consequence of Lemma in [8]). This limitation, mainly due to the generality of the proposition, could seem restrictive from a practical point of view. However the statistician can explicitly compute with the data. Thus, it is possible to adjust and in order to keep small in practice. Moreover, we will see in Section 6 that, for our choices of and , we can easily consider and of order of as we keep small (concrete values are given in the simulation study).

5 Convergence rates

The previous sections have introduced various upperbounds on the -risk of the penalized least-squares estimators . Each of them is connected to the minimal risk of the estimators among a collection . One of the main advantages of such inequalities is that it allows us to derive uniform convergence rates with respect to many well known classes of smoothness (see [7]). In this section, we give such results over Hölderian balls for the estimation of a component in an additive framework. To this end, for any and , we introduce the space of the -Hölderian functions with constant on ,

In order to derive such convergence rates, we need a collection of models with good approximation properties for the functions of . We denote by any oblique projector defined as in the previous section and based on spaces and that are constructed as one of the examples given in Section 2 of [9]. In particular, such a construction allows us to deal with approximation spaces and that can be considered as spaces of piecewise polynomials, spaces of orthogonal wavelet expansions or spaces of dyadic splines on . We consider the dimensions and, for any , . Finally, we take a collection of models that contains subspaces of as Baraud did in Section 2.2 of [5].

Proposition 5.1.

Consider the framework (4) and assume that () or () holds with . We define in (27) with . Let and be the estimator selected by the procedure (11) applied to the collection of models with the penalty

Suppose that () is fulfilled, we define

For any and , the penalized least-squares estimator satisfies

| (31) |

where is the expectation on and on the random design points and only depends on , , , , , and (under () only).

Note that the supremum is taken over Hölderian balls for all the components of the regression function, i.e. the regression function is itself supposed to belong to an Hölderian space. As we mention in the introduction, Stone [37] has proved that the rate of convergence given by (31) is optimal in the minimax sense.

6 Simulation study

In this section, we study simulations based on the framework given by (4) with components and Gaussian errors. First, we introduce the spaces and , and the collections of models that we handle. Next, we illustrate the performances of the estimators in practice by several examples.

6.1 Preliminaries

To perform the simulation study, we consider two collections of models. In both cases, we deal with the same spaces and defined as follows. Let be the Haar wavelet’s mother function,

For any and , we introduce the functions

It is clear that these functions are orthonormal in for the usual scalar product. Let be some positive integer, we consider the space generated by the functions such that and . The dimension of this space is . In the sequel, we denote by the set of all the allowed pairs ,

Moreover, for any such that with , we denote .

Let be an other positive integer, the spaces are all supposed to be generated by the functions defined on by

for any and . Thus, we have and .

As previously, we define as the oblique projector onto along . The image set is generated by the vectors

Let be a subset of , the model is defined as the linear subspace of generated by the vectors with .

In the following simulations, we always take and close to , i.e.

where, for any , denotes the largest integer not greater than . For such choices, basic computations lead to of order of in Proposition 4.1. As a consequence, this proposition does not ensure that () is fulfilled with a large probability. However, remains small in practice as we will see and it allows us to deal with larger collections of models.

6.2 Collections of models

The first collection of models is the smaller one because the models are nested. Let us introduce the index subsets, for any ,

Thus, we define as

This collection has a small complexity since, for any , . According to Corollary 2.1, we can consider the penalty function given by

| (32) |

for some . In order to compute the selected estimator , we simply compute in each model of and we take the one that minimizes the penalized least-squares criterion.

The second collection of models is larger than . Indeed, we allow to be any subset of and we introduce

The complexity of this collection is large because, for any ,

So, we have and, according to Corollary 2.1, we take a penalty function as

| (33) |

for some . The large number of models in leads to difficulties for computing the estimator . Instead of exploring all the models among , we break the penalized criterion down with respect to an orthonormal basis of and we get

In order to minimize the penalized least-squares criterion, we only need to keep the coefficients that are such that

This threshold procedure allows us to compute the estimator in reasonable time.

6.3 Numerical simulations

We now illustrate our results and the performances of our estimation procedure by applying it to simulated data

where is an integer that will vary from an experiment to an other, the design points are known independent realizations of an uniform random variable on and the errors are i.i.d. standard Gaussian random variables. We handle this framework with known or unknown variance factor according to the cases and we consider a design of size . The unknown components are either chosen among the following ones, or set to zero in the last subsection,

where the constants , and are such that for any .

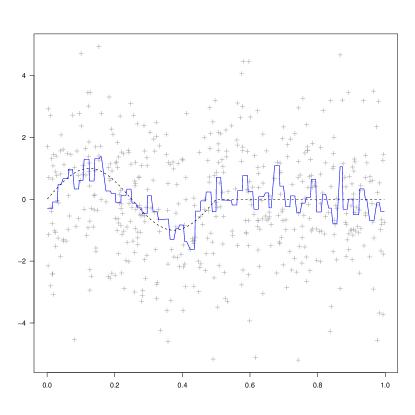

The first step of the procedure consists in computing the oblique projector and taking the data . Figure 1 gives an example by representing the signal , the data and the projected data for , and , . In particular, for this example, we have . We see that we actually get reasonable value of with our particular choices for and .

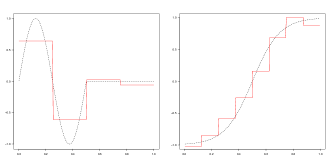

In order to estimate the component , we choose by the procedure (11) with penalty function given by (32) or (33) according to the cases. The first simulations deal with the collection of nested models. Figure 2 represents the true and the estimator for parasitic components given by and or . The penalty function (32) has been used with a constant .

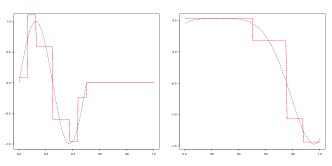

The second set of simulations is related to the large collection and to the penalty function (33) with . Figure 3 illustrates the estimation of and with parasitic components .

In both cases, we see that the estimation procedure behaves well and that the norms are close to one in spite of the presence of the parasitic components. Moreover, note that the collection allows to get estimators that are sharper because they detect constant parts of . This advantage leads to a better bias term in the quadratic risk decomposition at the price of the logarithmic term in the penalty (33).

6.4 Ratio estimation

In Section 4, we discussed about assumptions that ensure a small remainder term in Inequality (29). This result corresponds to some oracle type inequality for our estimation procedure of a component in an additive framework. We want to evaluate how far is from the oracle risk. Thus, we estimate the ratio

by repeating times each experiment for various values of and . For each set of simulations, the parasitic components are taken such that , the values of are given and the variance is either assumed to be known or not.

Table 1 (resp. Table 2) gives the values of obtained for (resp. ) with the collection and the penalty (32). We clearly see that taking close to zero or too large is not a good thing for the procedure. In our examples, give good results and we get reasonable values of for other choices of between 1 and 3 for known or unknown variance. As expected, we also note that the values of and tend to increase when goes up but remain acceptable for .

| 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 5.0 | |

| , | 2.41 | 1.36 | 1.15 | 1.13 | 1.11 | 1.10 | 1.09 | 1.08 | 1.08 | 1.08 | 1.08 |

| 1.46 | 1.29 | 1.19 | 1.14 | 1.10 | 1.09 | 1.09 | 1.09 | 1.08 | 1.08 | 1.08 | |

| , | 2.47 | 1.37 | 1.16 | 1.14 | 1.13 | 1.12 | 1.11 | 1.09 | 1.09 | 1.09 | 1.09 |

| 1.55 | 1.26 | 1.18 | 1.14 | 1.12 | 1.12 | 1.11 | 1.10 | 1.09 | 1.09 | 1.09 | |

| , | 2.48 | 1.39 | 1.15 | 1.13 | 1.12 | 1.10 | 1.09 | 1.08 | 1.08 | 1.08 | 1.08 |

| 2.34 | 1.26 | 1.16 | 1.13 | 1.11 | 1.10 | 1.09 | 1.09 | 1.08 | 1.08 | 1.08 | |

| , | 2.65 | 1.41 | 1.17 | 1.14 | 1.13 | 1.11 | 1.09 | 1.08 | 1.08 | 1.08 | 1.08 |

| 1.46 | 1.27 | 1.16 | 1.13 | 1.11 | 1.10 | 1.09 | 1.09 | 1.08 | 1.08 | 1.08 | |

| , | 2.97 | 1.62 | 1.27 | 1.19 | 1.15 | 1.12 | 1.10 | 1.09 | 1.08 | 1.07 | 1.07 |

| 1.63 | 1.38 | 1.26 | 1.19 | 1.13 | 1.11 | 1.09 | 1.08 | 1.08 | 1.08 | 1.07 | |

| , | 3.14 | 1.77 | 1.29 | 1.21 | 1.17 | 1.13 | 1.12 | 1.10 | 1.10 | 1.09 | 1.09 |

| 1.66 | 1.40 | 1.26 | 1.18 | 1.14 | 1.13 | 1.11 | 1.11 | 1.10 | 1.10 | 1.09 |

| 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 5.0 | |

| , | 4.08 | 1.52 | 1.22 | 1.20 | 1.27 | 1.35 | 1.45 | 1.56 | 1.64 | 1.70 | 1.79 |

| 3.44 | 1.58 | 1.36 | 1.26 | 1.30 | 1.37 | 1.45 | 1.55 | 1.64 | 1.72 | 1.81 | |

| , | 4.07 | 1.66 | 1.28 | 1.26 | 1.32 | 1.40 | 1.49 | 1.57 | 1.66 | 1.74 | 1.82 |

| 2.29 | 1.69 | 1.36 | 1.32 | 1.36 | 1.44 | 1.53 | 1.60 | 1.65 | 1.73 | 1.82 | |

| , | 4.17 | 1.65 | 1.36 | 1.34 | 1.42 | 1.50 | 1.60 | 1.67 | 1.77 | 1.89 | 2.01 |

| 2.24 | 1.70 | 1.41 | 1.41 | 1.48 | 1.55 | 1.61 | 1.71 | 1.80 | 1.92 | 2.01 | |

| , | 4.42 | 1.88 | 1.43 | 1.34 | 1.36 | 1.45 | 1.53 | 1.61 | 1.69 | 1.77 | 1.86 |

| 3.80 | 1.75 | 1.51 | 1.42 | 1.44 | 1.50 | 1.56 | 1.66 | 1.75 | 1.84 | 1.93 | |

| , | 4.57 | 1.82 | 1.43 | 1.37 | 1.39 | 1.46 | 1.53 | 1.60 | 1.67 | 1.76 | 1.83 |

| 2.33 | 1.77 | 1.51 | 1.43 | 1.44 | 1.50 | 1.54 | 1.64 | 1.74 | 1.82 | 1.89 | |

| , | 4.98 | 2.08 | 1.59 | 1.47 | 1.45 | 1.49 | 1.57 | 1.66 | 1.77 | 1.86 | 1.96 |

| 2.57 | 1.91 | 1.62 | 1.52 | 1.54 | 1.57 | 1.65 | 1.73 | 1.84 | 1.93 | 2.02 |

In the same way, we estimate the ratio for and with the collection and the penalty (33). The results are given in Table 3 and Table 4. We obtain reasonable values of for choices of larger than what we took in the nested case. This phenomenon is related to what we mentioned at the end of Section 2. Indeed, for large collection of models, we need to overpenalize in order to keep the remainder term small enough. Moreover, because tends to overestimate (see Section 3), we see that we can consider smaller values for when the variance is unknown than when it is known for obtaining equivalent results.

| 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 5.0 | |

| , | 1.54 | 1.49 | 1.44 | 1.40 | 1.36 | 1.33 | 1.31 | 1.30 | 1.28 | 1.27 | 1.25 |

| 1.50 | 1.44 | 1.39 | 1.35 | 1.32 | 1.30 | 1.28 | 1.26 | 1.25 | 1.24 | 1.23 | |

| , | 1.60 | 1.53 | 1.48 | 1.45 | 1.40 | 1.37 | 1.34 | 1.32 | 1.29 | 1.28 | 1.26 |

| 1.54 | 1.48 | 1.42 | 1.38 | 1.35 | 1.32 | 1.29 | 1.28 | 1.27 | 1.25 | 1.24 | |

| , | 1.56 | 1.50 | 1.46 | 1.42 | 1.38 | 1.35 | 1.32 | 1.30 | 1.28 | 1.27 | 1.26 |

| 1.51 | 1.45 | 1.41 | 1.37 | 1.34 | 1.31 | 1.29 | 1.27 | 1.25 | 1.24 | 1.23 | |

| , | 1.61 | 1.54 | 1.48 | 1.42 | 1.39 | 1.36 | 1.34 | 1.31 | 1.29 | 1.28 | 1.27 |

| 1.51 | 1.44 | 1.40 | 1.36 | 1.32 | 1.31 | 1.28 | 1.27 | 1.26 | 1.25 | 1.24 | |

| , | 1.68 | 1.61 | 1.54 | 1.48 | 1.44 | 1.41 | 1.37 | 1.34 | 1.32 | 1.30 | 1.28 |

| 1.56 | 1.49 | 1.43 | 1.39 | 1.36 | 1.31 | 1.29 | 1.27 | 1.27 | 1.26 | 1.25 | |

| , | 1.78 | 1.70 | 1.63 | 1.57 | 1.53 | 1.48 | 1.44 | 1.42 | 1.39 | 1.35 | 1.34 |

| 1.61 | 1.55 | 1.48 | 1.44 | 1.40 | 1.37 | 1.34 | 1.32 | 1.30 | 1.28 | 1.28 |

| 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 5.0 | |

| , | 2.01 | 1.92 | 1.86 | 1.80 | 1.76 | 1.74 | 1.70 | 1.70 | 1.68 | 1.67 | 1.68 |

| 2.03 | 1.93 | 1.87 | 1.81 | 1.77 | 1.72 | 1.68 | 1.65 | 1.65 | 1.66 | 1.67 | |

| , | 2.02 | 1.93 | 1.85 | 1.79 | 1.75 | 1.71 | 1.68 | 1.66 | 1.66 | 1.66 | 1.66 |

| 1.95 | 1.88 | 1.82 | 1.78 | 1.75 | 1.71 | 1.68 | 1.67 | 1.65 | 1.64 | 1.64 | |

| , | 2.04 | 1.93 | 1.86 | 1.81 | 1.76 | 1.71 | 1.68 | 1.64 | 1.62 | 1.62 | 1.62 |

| 1.96 | 1.87 | 1.80 | 1.74 | 1.68 | 1.66 | 1.63 | 1.63 | 1.61 | 1.62 | 1.62 | |

| , | 2.12 | 2.00 | 1.90 | 1.81 | 1.73 | 1.67 | 1.64 | 1.62 | 1.60 | 1.61 | 1.60 |

| 1.99 | 1.90 | 1.80 | 1.73 | 1.68 | 1.65 | 1.62 | 1.60 | 1.60 | 1.60 | 1.60 | |

| , | 2.47 | 2.34 | 2.23 | 2.17 | 2.10 | 2.05 | 1.99 | 1.95 | 1.91 | 1.88 | 1.86 |

| 2.30 | 2.20 | 2.11 | 2.03 | 1.97 | 1.92 | 1.88 | 1.83 | 1.82 | 1.80 | 1.80 | |

| , | 2.45 | 2.32 | 2.21 | 2.11 | 2.03 | 1.99 | 1.95 | 1.91 | 1.89 | 1.86 | 1.84 |

| 2.17 | 2.06 | 1.99 | 1.94 | 1.89 | 1.85 | 1.84 | 1.80 | 1.79 | 1.79 | 1.75 |

6.5 Parasitic components equal to zero

We are now interested in the particular case of parasitic components equal to zero in (4), i.e. data are given by

If we know that these components are zero and if we deal with the collection and a known variance , we can consider the classical model selection procedure given by

| (34) |

Then, we can define the estimator . This procedure is well known and we refer to [27] for more details. If we do not know that the parasitic components are null, we can use our procedure to estimate by . In order to compare the performances of and with respect to the number of zero parasitic components, we estimate the ratio

for various values of and by repeating 500 times each experiment.

The obtained results are given in Tables 5 and 6 for and respectively. Obviously, the ratio is always larger than one because the procedure (34) makes good use of its knowledge about nullity of the . Nevertheless, we see that our procedure performs nearly as well as (34) even for a large number of zero components. Indeed, for , do not assuming that we know that the are zero only implies a loss between and for the risk. Such a loss remains acceptable in practice and allows us to consider more general framework for estimating .

| 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 5.0 | |

| 1.11 | 1.11 | 1.09 | 1.06 | 1.04 | 1.03 | 1.03 | 1.02 | 1.01 | 1.02 | 1.02 | |

| 1.12 | 1.08 | 1.08 | 1.06 | 1.04 | 1.03 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | |

| 1.13 | 1.09 | 1.07 | 1.07 | 1.05 | 1.03 | 1.01 | 1.01 | 1.02 | 1.02 | 1.02 | |

| 1.08 | 1.08 | 1.06 | 1.05 | 1.04 | 1.02 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | |

| 1.10 | 1.05 | 1.06 | 1.06 | 1.03 | 1.02 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | |

| 1.08 | 1.07 | 1.06 | 1.05 | 1.03 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | 1.01 | |

| 1.11 | 1.09 | 1.08 | 1.05 | 1.03 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | 1.01 | |

| 1.09 | 1.06 | 1.08 | 1.05 | 1.04 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | 1.01 | |

| 1.10 | 1.08 | 1.07 | 1.05 | 1.03 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | 1.01 |

| 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | 4.0 | 4.5 | 5.0 | |

| 1.08 | 1.09 | 1.07 | 1.07 | 1.09 | 1.09 | 1.08 | 1.07 | 1.06 | 1.09 | 1.07 | |

| 1.09 | 1.05 | 1.08 | 1.09 | 1.09 | 1.08 | 1.08 | 1.08 | 1.06 | 1.06 | 1.05 | |

| 1.12 | 1.12 | 1.11 | 1.07 | 1.09 | 1.10 | 1.09 | 1.08 | 1.07 | 1.06 | 1.07 | |

| 1.09 | 1.11 | 1.08 | 1.10 | 1.10 | 1.09 | 1.07 | 1.06 | 1.07 | 1.06 | 1.07 | |

| 1.10 | 1.08 | 1.09 | 1.09 | 1.09 | 1.06 | 1.06 | 1.06 | 1.07 | 1.07 | 1.05 | |

| 1.08 | 1.04 | 1.06 | 1.07 | 1.08 | 1.07 | 1.07 | 1.09 | 1.06 | 1.06 | 1.06 | |

| 1.06 | 1.05 | 1.07 | 1.08 | 1.10 | 1.09 | 1.07 | 1.09 | 1.08 | 1.07 | 1.06 | |

| 1.08 | 1.13 | 1.08 | 1.09 | 1.09 | 1.08 | 1.06 | 1.07 | 1.07 | 1.06 | 1.06 | |

| 1.13 | 1.05 | 1.09 | 1.09 | 1.07 | 1.07 | 1.07 | 1.06 | 1.07 | 1.07 | 1.06 |

7 Proofs

In the proofs, we repeatedly use the following elementary inequality that holds for any and ,

| (35) |

7.1 Proofs of Theorems 2.1 and 2.2

7.1.1 Proof of Theorem 2.1

By definition of , for any , we can write

Let , since , this identity and (12) lead to

Consider an arbitrary such that , we define

| (37) |

Thus, (7.1.1) gives

Take that we specify later and we use the inequality (35),

We choose but for legibility we keep using the notation . Let us now introduce two functions that will be specified later to satisfy, for all ,

| (40) |

We use this bound in (7.1.1) to obtain

Taking the expectation on both sides, it leads to

Because the choice of is arbitrary among , we can infer that

| (41) | |||||

We now have to upperbound and in (41). Let start by the first one. If , then and suffices to ensure that . So, we can consider that the dimension of is positive and . The Lemma 8.2 applied with gives, for any ,

| (42) |

because . Let , (35) and (42) lead to

| (43) |

Let , we set

and (43) implies

| (44) | |||||

We now focus on . The random variable is a centered Gaussian variable with variance . For any , the standard Gaussian deviation inequality gives

that is equivalent to

| (45) |

We set

and (45) leads to

| (46) | |||||

7.1.2 Proof of Theorem 2.2

In order to prove Theorem 2.2, we show the following stronger result. Under the assumptions of the theorem, there exists a positive constant that only depends on and , such that, for any ,

| (47) |

where the quantity is defined by

and we have set equal to

Thus, for any such that , we integrate (47) via Lemma 8.1 to get

| (48) | |||||

where we have set

Since

it follows from Minkowski’s Inequality when or convexity arguments when that

| (49) |

We now turn to the proof of (47). Inequality (7.1.1) does not depend on the distribution of and we start from here. Let , for any we have

where is defined by (37). Use again (35) with to obtain

Let us now introduce two functions that will be specified later and that satisfy,

| (51) |

Thus, Inequality (7.1.2) implies

Because the choice of is arbitrary among , we can infer that, for any ,

| (52) | |||||

We first bound . For such that (i.e. ), leads obviously to . Thus, it is sufficient to bound for such that is not null. This ensures that the symmetric nonnegative matrix lies in . Thus, under hypothesis (6), Corollary of [4] gives us, for any ,

where is a constant that only depends on . The properties of the norm imply

| (53) |

By the inequalities (53) and (35) with , we obtain

| (54) |

We take but for legibility we keep using the notation . Moreover, we choose

and

Thus, Inequality (54) leads to

| (55) | |||||

We now focus on . Let be some positive real number, the Markov Inequality leads to

| (56) |

Since , the quantity is lower bounded by ,

| (57) |

Moreover, we can apply the Rosenthal inequality (see Chapter 2 of [31]) to obtain

| (58) |

where is a constant that only depends on . Since , we have

Thus, the Inequality (58) becomes

and, putting this inequality in (56), we obtain

| (59) |

We take

and

Finally, (59) gives

| (60) | |||||

Taking

and putting together Inequalities (52), (55) and (60) lead us to

For , take to obtain (47). We conclude the proof by computing the lowerbound (51) on the penalty function,

Since , the penalty given by (17) satisfies the condition (51).

7.2 Proofs of Theorems 3.1 and 3.2

7.2.1 Proof of Theorem 3.1

Given , we can find two positive numbers and such that . Thus we define

On , we know that

Taking care of the random nature of the penalty, we argue as in the proof of Theorem 2.1 with to get

| (61) |

where is defined by

We use Lemma 8.3 and (21) to get an upperbound for ,

The Proposition 1.1 and (61) give

| (62) |

where .

7.2.2 Proof of Theorem 3.2

Given , we can find two positive numbers and such that . Thus we define

On , we know that

Let be any element of that minimize among . Taking care of the random nature of the penalty, we argue as in the proof of Theorem 2.2 with to get

where is equal to

Since , by a convexity argument and Jensen’s inequality we deduce

| (64) |

Thus, by the definition of and Proposition 1.1, (64) becomes

| (65) |

7.3 Proofs of Corollaries and Propositions

7.3.1 Proof of Corollary 2.1

7.3.2 Proof of Corollary 2.2

Since , we can take and apply Theorem 2.2 with constant weights to get

| (68) |

To upperbound the remainder term, we use Assumption () and bounds on and to get

The last bound is clearly finite and we denote it by . Thus, as we did in the previous proof, we derive from (68) and ()

Since , the announced result follows.

7.3.3 Proof of Proposition 4.1

The design points are all assumed to be independent realizations of a random variable in with distribution . We denote by the unit matrix and, for any , we define the usual norm

We also consider and . The quantities and are random and only depend on the ’s and not on the ’s.

The space is generated by the vectors , for . Let be an orthonormal basis of and be an orthonormal basis of . In the basis of given by the ’s, the ’s and the ’s, the projection onto along can be expressed as

Considering the matrix that transforms into the canonical basis, we can decompose . By the properties of the norm , we get

For any , we deduce from the previous inequality that

| (69) |

Note that for any invertible matrix and , if , then . Thus, Inequality (69) leads to

| (70) | |||||

Let us denote by the Gram matrix associated to the vectors . If we define the matrix by

then we can write the following decomposition by blocks,

Consequently, by the definition of , we obtain

| (71) |

where we have set

| (72) |

First, we upperbound . Let , we consider the event

Because is symmetric, we know that, on the event ,

Thus, for any such that

| (73) |

we deduce

| (74) | |||||

The choice satisfies (73) and we apply Bernstein Inequality (see Lemma 8 of [8]) to the terms of the sum in (74) to obtain

| (75) |

It remains to upperbound the probability . Let , we consider the event

By definition of the norm , we know that, on the event ,

Thus, for any such that

| (76) |

we apply Bernstein Inequality conditionally to the ’s to deduce

| (77) | |||||

where is the conditional probability given the ’s. Indeed, under and (30), the variables are centered with unit variance. The choice

satisfies (76) and (77) leads to

| (78) | |||||

7.3.4 Proof of Proposition 5.1

The collection is nested and, for any , the quantity is bounded independently from . Consequently, Condition (19) is satisfied in the Gaussian case and (20) is fulfilled under moment condition. In both cases, we are free to take and () is true for . Assumption () is fulfilled with and, since for any , we can apply Corollary 2.1 or 2.2 according to whether () or () holds. Moreover, we denote by (resp. ) the expectation on (resp. the design points). So .

We argue in the same way than in Section 4 and we use () to get

The definition of the norm implies that, for any ,

Since , it is easy to see that this function lies in a Besov ball. Thus, we can apply Theorem 1 of [9] and we get, for any ,

Arguing in the same way for the and, since , we obtain

Consequently, for any , we obtain

Since , we can consider some model in with dimension of order and derive that

8 Lemmas

This section is devoted to some technical results and their proofs.

Lemma 8.1.

Let be two real numbers such that . For any , the following inequality holds

where .

Proof.

By splitting the integral around , we get

∎

The next lemma is a variant of a lemma due to Laurent and Massart.

Lemma 8.2.

Let and be a standard Gaussian vector of . For any , we have

| (79) |

and

| (80) |

Proof.

It is known that is a centered Gaussian vector of of covariance matrix given by the positive symmetric matrix . Let us denote by the eigenvalues of the . Thus, the distribution of is the same as the one of . We have

Because the ’s are nonnegative,

and we can apply the Lemma 1 of [22] to obtain the announced inequalities. ∎

We now introduce some properties that are satisfied by the estimator defined in (22).

Lemma 8.3.

In the Gaussian case or under moment condition, the estimator satisfies

Proof.

We have the following decomposition

| (81) |

The components of are independent and centered with unit variance. Thus, taking the expectation on both side, we obtain

∎

Lemma 8.4.

Consider the estimator defined in the Gaussian case. For any ,

where only depends on .

Proof.

Let such that , we set

We have

and we deduce from (81)

| (82) | |||||

where is the orthogonal projection onto . Consequently,

| (83) | |||||

The Inequality (80) and (21) give us the following upperbound for ,

| (84) |

By the properties of the norm , we deduce that

| (85) |

where we have defined as the orthogonal projection onto . We now apply (79) with to obtain, for any ,

Obviously, this inequality can be extended to ,

| (86) |

and we take

Finally, we get

| (87) | |||||

Lemma 8.5.

Consider the estimator defined under moment condition. For any , there exists a sequence of positive numbers that tends to a positive constant as tends to infinity, such that

Proof.

We define the vector and the projection matrix as we did in the proof of Lemma 8.4. The lowerbound (82) does not depend on the distribution of and gives

| (88) |

Since the matrix is symmetric, we have the following decomposition

Thus, (88) leads to

| (89) |

where we have set

and

Note that concerns a sum of independent centered random variables. By Markov’s inequality and (21), we get

| (90) | |||||

If then we use the Rosenthal Inequality (see Chapter 2 of [31]) and (57) to obtain

Since, for any , , by a convexity argument, we get

If , we refer to [39] for the following inequality

In both cases, (90) becomes

| (91) |

with .

Let us now bound . By Chebyshev’s inequality, we get

Note that, by independence between the components of , the expectation in the last sum is not null if and only if and (in this case, its value is ). Thus, we have

| (92) | |||||

References

- [1] H. Akaike. Statistical predictor identification. Annals of the Institute for Statistical Mathematics, 22:203–217, 1970.

- [2] S. Arlot. Choosing a penalty for model selection in heteroscedastic regression. Arxiv preprint arXiv:0812.3141v2, 2010.

- [3] S. Arlot and P. Massart. Data-driven calibration of penalties for least-squares regression. Journal of Machine Learning Research, 10:245–279, 2009.

- [4] Y. Baraud. Model selection for regression on a fixed design. Probability Theory and Related Fields, 117:467–493, 2000.

- [5] Y. Baraud. Model selection for regression on a random design. ESAIM: Probability and Statistics, 6:127–146, 2002.

- [6] Y. Baraud, F. Comte, and G. Viennet. Adaptive estimation in autoregression or -mixing regression via model selection. Annals of Statistics, 29(3):839–875, 2001.

- [7] L. Birgé and P. Massart. From model selection to adaptive estimation. Festschrift for Lucien Lecam: Research Papers in Probability and Statistics, pages 55–87, 1997.

- [8] L. Birgé and P. Massart. Minimum contrast estimators on sieves: exponential bounds and rates of convergence. Bernoulli, 4:329–375, 1998.

- [9] L. Birgé and P. Massart. An adaptive compression algorithm in Besov spaces. Constructive Approximation, 16:1–36, 2000.

- [10] L. Birgé and P. Massart. Gaussian model selection. Journal of the European Mathematical Society, 3(3):203–268, 2001.

- [11] L. Birgé and P. Massart. Minimal penalties for gaussian model selection. Probability Theory and Related Fields, 138:33–73, 2007.

- [12] L. Breiman and J.H. Friedman. Estimating optimal transformations for multiple regression and correlations (with discussion). Journal of the American Statistical Association, 80(391):580–619, 1985.

- [13] E. Brunel and F. Comte. Adaptive nonparametric regression estimation in presence of right censoring. Mathematical Methods of Statistics, 15(3):233–255, 2006.

- [14] E. Brunel and F. Comte. Model selection for additive regression models in the presence of censoring, chapter 1 in “Mathematical Methods in Survival Analysis, Reliability and Quality of Life”, pages 17–31. Wiley, 2008.

- [15] A. Buja, T.J. Hastie, and R.J. Tibshirani. Linear smoothers and additive models (with discussion). Annals of Statistics, 17:453–555, 1989.

- [16] F. Comte and Y. Rozenholc. Adaptive estimation of mean and volatility functions in (auto-)regressive models. Stochastic Processes and Their Applications, 97:111–145, 2002.

- [17] X. Gendre. Simultaneous estimation of the mean and the variance in heteroscedastic gaussian regression. Electronic Journal of Statistics, 2:1345–1372, 2008.

- [18] W. Härdle, M. Müller, S. Sperlich, and A. Werwatz. Nonparametric and Semiparametric Models. Springer, 2004.

- [19] T.J. Hastie and R.J. Tibshirani. Generalized additive models. Chapman and Hall, 1990.

- [20] R.A. Horn and C.R. Johnson. Matrix analysis. Cambridge University Press, 1990.

- [21] B. Laurent, J.M. Loubes, and C. Marteau. Testing inverse problems: a direct or an indirect problem? Journal of Statistical Planning and Inference, 141:1849–1861, 2011.

- [22] B. Laurent and P. Massart. Adaptive estimation of a quadratic functional by model selection. Annals of Statistics, 28(5):1302–1338, 2000.

- [23] W. Leontief. Introduction to a theory of the internal structure of functional relationships. Econometrica, 15:361–373, 1947.

- [24] O. Linton and J.P. Nielsen. A kernel method of estimating structured nonparametric regression based on marginal integration. Biometrika, 82:93–101, 1995.

- [25] C.L. Mallows. Some comments on . Technometrics, 15:661–675, 1973.

- [26] E. Mammen, O. Linton, and J.P. Nielsen. The existence and asymptotic properties of a backfitting projection algorithm under weak conditions. Annals of Statistics, 27:1443–1490, 1999.

- [27] P. Massart. Concentration inequalities and model selection, volume 1896 of Lecture Notes in Mathematics. Springer, Berlin, 2007. Lectures from the 33rd Summer School on Probability Theory held in Saint-Flour, July 6-23, 2003.

- [28] A.D.R. McQuarrie and C.L. Tsai. Regression and times series model selection. River Edge, NJ, 1998.

- [29] L. Meier, S. van de Geer, and P. Bühlmann. High-dimensional additive modeling. Annals of Statistics, 37:3779–3821, 2009.

- [30] J. Opsomer and D. Ruppert. Fitting a bivariate additive model by local polynomial regression. Annals of Statistics, 25:186–211, 1997.

- [31] V.V. Petrov. Limit theorems of probability theory: sequences of independent random variables. Oxford Studies in Probability 4, 1995.

- [32] P.D. Ravikumar, H. Liu, J.D. Lafferty, and L.A. Wasserman. Sparse additive models. Journal of the Royal Statistical Society, 71:1009–1030, 2009.

- [33] S. Robin, F. Rodolphe, and S. Schbath. DNA, Words and Models. Cambridge University Press, 2005.

- [34] D. Ruppert and M.P. Wand. Multivariate locally weighted least squares regression. Annals of Statistics, 22(3):1346–1370, 1994.

- [35] H. Scheffé. The analysis of variance. Wiley-Interscience, 1959.

- [36] E. Severance-Lossin and S. Sperlich. Estimation of derivatives for additive separable models. Statistics, 33:241–265, 1999.

- [37] C.J. Stone. Additive regression and other nonparametric models. Annals of Statistics, 14(2):590–606, 1985.

- [38] D. Tjøstheim and B. Auestad. Nonparametric identification of nonlinear time series: Selecting significant lags. Journal of the American Statistical Association, 89:1410–1430, 1994.

- [39] B. von Bahr and C.G. Esseen. Inequalities for the th absolute moment of a sum of random variables . Annals of Mathematical Statistics, 36:299–303, 1965.