Sparse Vector Autoregressive Modeling

Abstract

The vector autoregressive (VAR) model has been widely used for modeling temporal dependence in a multivariate time series. For large (and even moderate) dimensions, the number of AR coefficients can be prohibitively large, resulting in noisy estimates, unstable predictions and difficult-to-interpret temporal dependence. To overcome such drawbacks, we propose a 2-stage approach for fitting sparse VAR (sVAR) models in which many of the AR coefficients are zero. The first stage selects non-zero AR coefficients based on an estimate of the partial spectral coherence (PSC) together with the use of BIC. The PSC is useful for quantifying the conditional relationship between marginal series in a multivariate process. A refinement second stage is then applied to further reduce the number of parameters. The performance of this 2-stage approach is illustrated with simulation results. The 2-stage approach is also applied to two real data examples: the first is the Google Flu Trends data and the second is a time series of concentration levels of air pollutants.

Keywords: vector autoregressive (VAR) model, sparsity, partial spectral coherence (PSC), model selection.

1 Introduction

The vector autoregressive (VAR) model has been widely used for modeling the temporal dependence structure of a multivariate time series. Unlike univariate time series, the temporal dependence of a multivariate series consists of not only the serial dependence within each marginal series, but also the interdependence across different marginal series. The VAR model is well suited to describe such temporal dependence structures. However, the conventional VAR model can be saturatedly-parametrized with the number of AR coefficients prohibitively large for high (and even moderate) dimensional processes. This can result in noisy parameter estimates, unstable predictions and difficult-to-interpret descriptions of the temporal dependence.

To overcome these drawbacks, we propose a 2-stage approach for fitting sparse VAR (sVAR) models in which many of the autoregression (AR) coefficients are zero. Such sVAR models can enjoy improved efficiency of parameter estimates, better prediction accuracy and more interpretable descriptions of the temporal dependence structure. In the literature, a class of popular methods for fitting sVAR models is to re-formulate the VAR model as a penalized regression problem, where the determination of which AR coefficients are zero is equivalent to a variable selection problem in a linear regression setting. One of the most commonly used penalties for the AR coefficients in this context is the Lasso penalty proposed by Tibshirani1996 and its variants tailored for the VAR modeling purpose, e.g., see Sosa2005; Hsu2008; Arnold2008; Lozano2009; Haufe2010; Michailidis2010; Song2011. The Lasso-VAR modeling approach has the advantage of performing model selection and parameter estimation simultaneously. It can also be applied under the “large-p-small-n” setting. However, there are also disadvantages in using this approach. First, Lasso has a tendency to over-select the order of the autoregression model and this phenomenon has been reported in various numerical results, e.g., see Arnold2008; Lozano2009; Michailidis2010. Second, in applying the Lasso-VAR approach, the VAR model is re-formulated as a linear regression model, where current values of the time series are treated as the response variable and lagged values are treated as the explanatory variables. Such a treatment ignores the temporal dependence in the time series. Song2011 give a theoretical discussion on the consequences of applying Lasso directly to the VAR model without taking into account the temporal dependence between the response and the explanatory variables.

In this paper, we develop a 2-stage approach of fitting sVAR models. The first stage selects non-zero AR coefficients by screening pairs of distinct marginal series that are conditionally correlated. To compute the conditional correlation between component series, an estimate of the partial spectral coherence (PSC) is used in the first stage. PSC is a tool in frequency-domain time series analysis that can be used to quantify direction-free conditional dependence between component series of a multivariate time series. An efficient way of computing a non-parametric estimate of PSC is based on results of Brillinger1981 and Dahlhaus2000. In conjunction with the PSC, the Bayesian information criterion (BIC) is used in the first stage to determine the number of non-zero off-diagonal pairs of AR coefficients. The VAR model fitted in stage 1 may contain spurious non-zero coefficients. To further refine the fitted model, we propose, in stage 2, a screening strategy based on the -ratios of the coefficient estimates as well as BIC.

The remainder of this paper is organized as follows. In Section 2, we review some results on the VAR model for multivariate time series. In Section 3, we describe a 2-stage procedure for fitting a sparse VAR model. Connections between our first stage selection procedure with Granger causal models are give in Section 3.1. In Section 4.1, simulation results are presented to compare the performance of the 2-stage approach against the Lasso-VAR approach. In Section LABEL:section_real the 2-stage approach is applied to fit sVAR models to two real data examples: the first is the Google Flu Trends data (Ginsberg2009) and the second is a time series of concentration levels of air pollutants (Songsiri2009). Further discussion is contained in Section LABEL:section_discussion_conclusion. Supplementary material is given in the Appendix.

2 Sparse vector autoregressive models

2.1 Vector autoregressive models (VAR)

Suppose is a vector autoregressive process of order (VAR()), which satisfies the recursions,

| (2.1) |

where are real-valued matrices of autoregression (AR) coefficients; are -dimensional iid Gaussian noise with mean and non-degenerate covariance matrix . 111In this paper we assume that the VAR() process is Gaussian. When is non-Gaussian, the 2-stage model fitting approach can still be applied, where now the Gaussian likelihood is interpreted as a quasi-likelihood. We further assume that the process is causal, i.e., , for , e.g., see Davis1991 and Reinsel1997, which implies that is independent of for . Without loss of generality, we also assume that the vector process has mean , i.e., in (2.1).

2.2 Sparse vector autoregressive models (sVAR)

The temporal dependence structure of the VAR model (2.1) is characterized by the AR coefficient matrices . Based on observations from the VAR model, we want to estimate these AR matrices. However, a VAR() model, when fully-parametrized, has AR parameters that need to be estimated. For large (and even moderate) dimension , the number of parameters can be prohibitively large, resulting in noisy estimates, unstable predictions and difficult-to-interpret descriptions of the temporal dependence. It is also generally believed that, for most applications, the true model of the series is sparse, i.e., the number of non-zero coefficients is small. Therefore it is preferable to fit a sparse VAR (sVAR) model in which many of its AR parameters are zero. In this paper we develop a 2-stage approach of fitting sVAR models. The first stage selects non-zero AR coefficients by screening pairs of distinct marginal series that are conditionally correlated. To compute direction-free conditional correlation between components in the time series, we use tools from the frequency-domain, specifically the partial spectral coherence (PSC). Below we introduce the basic properties related to PSC.

Let and () denote two distinct marginal series of the process , and denote the remaining -dimensional process. To compute the conditional correlation between two time series and , we need to adjust for the linear effect from the remaining marginal series . The removal of the linear effect of from each of and can be achieved by using results of linear filters, e.g., see Brillinger1981 and Dahlhaus2000. Specifically, the optimal linear filter for removing the linear effect of from is given by the set of -dimensional constant vectors that minimizes the expected squared error of filtering,

| (2.2) |

The residual series from the optimal linear filter is defined as,

Similarly, we use and to denote the optimal linear filter and the corresponding residual series for another marginal series . Then the conditional correlation between and is characterized by the correlation between the two residual series and . In particular, two distinct marginal series and are conditionally uncorrelated after removing the linear effect of if and only if their residual series and are uncorrelated at all lags, i.e., , for . In the frequency domain, and are uncorrelated at all lags is equivalent to the cross-spectral density of the two residual series, denoted by , is zero at all frequencies . Here the residual cross-spectral density is defined by,

| (2.3) |

where . The cross-spectral density reflects the conditional (or partial) correlation between the two corresponding marginal series and , given . This observation leads to the definition of partial spectral coherence (PSC), e.g., see Brillinger1981; Davis1991, between two distinct marginal series and , which is defined as the scaled cross-spectral density between the two residual series and , i.e.,

| (2.4) |

Brillinger1981 showed that the cross-spectral density can be computed from the spectral density of the process via,

| (2.5) |

which involves inverting a dimensional matrix, i.e., . Using (2.5) to compute the PSCs for all pairs of distinct marginal series of requires such matrix inversions, which can be computationally challenging for a large dimension . Dahlhaus2000 proposed a more efficient method to simultaneously compute the PSCs for all pairs through the inverse of the spectral density matrix, which is defined as : Let , and denote the th diagonal, the th diagonal and the th entry of , respectively; Then the partial spectral coherence between and can be computed as follows,

| (2.6) |

The computation of all PSCs using (2.6) requires only one matrix inversion of the dimensional matrix . It then follows that,

| (2.7) | |||

In other words, the inverse spectral density matrix encodes the pairwise conditional correlation between the component series of . This generalizes the problem of covariance selection in which independent samples are available, e.g., see Dempster1972; Friedman2008. Covariance selection is concerned about the conditional relationship between dimensions of a multivariate Gaussian distribution by locating zero entries in the inverse covariance matrix. For example, suppose follows a -dimensional Gaussian . It is known that two distinct dimensions, say and (), are conditionally independent given the other dimensions , if and only if the th entry in the inverse covariance matrix is zero, i.e.,

| (2.8) |

If the process were independent replications of a Gaussian distribution N(0, ), then its spectral density matrix remains constant over and (2.7) becomes,

| (2.9) |

which coincides with (2.8). Therefore selection of conditionally uncorrelated series using the inverse of spectral density contains the covariance selection problem as a special case.

3 A 2-stage approach of fitting sVAR models

In this section, we develop a 2-stage approach of fitting sVAR models. The first stage of the approach takes advantage of (2.7) and screens out the pairs of marginal series that are conditionally uncorrelated. For such pairs we set the corresponding AR coefficients to zero for each lag. However, the model fitted in stage 1 may still contain spurious non-zero AR coefficient estimates. To address this possibility, a second stage is used to refine the model further.

3.1 Stage 1: selection

As we have shown in Section 2.2, a zero PSC indicates that the two corresponding marginal series are conditionally uncorrelated. In the first stage of our approach, we use the information of pairwise conditional uncorrelation to reduce the complexity of the VAR model. In particular, we propose to set the AR coefficients between two conditionally uncorrelated marginal series to zero, i.e.,

| (3.1) | |||

where the latter is equivalent to for . From (3.1) we can see that the modeling interest of the first stage is whether or not the AR coefficients belonging to a pair of marginal series at all lags are selected, rather than the selection of an individual AR coefficient. We point out that our proposed connection from zero PSCs to zero AR coefficients, as described by (3.1), may not be exact for some examples. However, numerical results suggest that our 2-stage approach is still able to achieve well-fitted sVAR models for such examples. We will return to this point in Section LABEL:section_discussion_conclusion.

In order to set a group of AR coefficients to zero as in (3.1), we need to find the pairs of marginal series for which the PSC is identically zero. Due to sampling variability, however, the estimated PSC, denoted by for series and , will not be exactly zero even when the two corresponding marginal series are conditionally uncorrelated. In other words, we need to rank the estimated PSC based on their evidence to be non-zero and decide a cutoff point that separates non-zero PSC from zero PSC. Since the estimate depends on the frequency , we need a quantity to summarize its departure from zero over different frequencies. As in Dahlhaus2000; Dahlhaus1997, we use the supremum of the squared modulus of the estimated PSC, i.e.,

| (3.2) |

as the summary statistic, where the supremum is taken over the Fourier frequencies . A large value of indicates that the two marginal series are likely to be conditionally correlated. Therefore we can create a sequence of the pairs of distinct marginal series by ranking each pair’s summary statistic (3.2) from highest to lowest. This sequence prioritizes the way in which non-zero coefficients are added into the VAR model. Based on the sequence , we need two parameters to fully specify the VAR model: the order of autoregression and the number of top pairs in , denoted by , that are selected into the VAR model. For the pairs not selected, their corresponding groups of AR coefficients are set to zero. The two parameters control the complexity of the VAR model as the number of non-zero AR coefficients is . We use the BIC, see Schwarz1978, to simultaneously choose the values of these two parameters. The BIC is computed as,

| (3.3) |

where is the maximized likelihood of the VAR model. To compute the maximized likelihood , we use results on the constrained maximum likelihood estimation of VAR models as given in Helmut1991. Details of this estimation procedure can be found Appendix LABEL:sVARest.

Restricting the two parameters and to take values in pre-specified ranges and , respectively, the steps of stage 1 can be summarized as follows.

Stage 1 1. Estimate the for all pairs of distinct marginal series by inverting a non-parametric estimate of the spectral density matrix 222In this paper we use the periodogram smoothed by a modified Daniell kernel, e.g., see Davis1991, as the non-parametric estimate of the spectral density. Alternative spectral density estimates, such as the shrinkage estimate proposed by Bohm2009, can also be adopted. and applying equation (2.6). 2. Construct a sequence of the pairs of distinct marginal series by ranking each pair’s summary statistic (3.2) from highest to lowest. 3. For each , set the order of autoregression to and select the top pairs in the sequence into the VAR model, which specifies the parameter constraint on the AR coefficients. Conduct parameter estimation under this constraint using the results in Appendix LABEL:sVARest and compute the corresponding according to equation (3.3). 4. Choose that gives the minimum BIC value over .

The model obtained in the first stage contains non-zero AR coefficients. If only a small proportion of the pairs of marginal series are selected, i.e., , can be much smaller than , which is the number of AR coefficients in a fully-parametrized VAR() model.

In the first stage we execute group selection of AR coefficients by using PSC together with BIC. This use of group structure of AR coefficients effectively reduces the number of candidate models to be examined in the first stage. Similar use of the group structure of AR coefficients has also been employed in other settings, one of which is to determine the Granger causality between time series. This concept was first introduced by Granger1969 in econometrics. It is shown that, e.g., see Helmut1991, a Granger causal relationship can be examined by fitting VAR models to the multivariate time series in question, where non-zero AR coefficients indicate Granger causality between the corresponding series. In the literature, -penalized regression (Lasso) has been widely used to explore sparsity in Granger causal relationships by shrinking AR coefficients to zero, e.g., see Arnold2008; Michailidis2010. In particular, Lozano2009; Haufe2010 proposed to penalize groups of AR coefficients simultaneously, in which their use of the group structure of AR coefficients is similar to (3.1). In spite of their common purpose of fitting sparse models, simulation results in Section 4.1 will demonstrate the advantage of using PSC in conjunction with BIC over Lasso in discovering sparsity in AR coefficients. For detailed discussion on using VAR models to determine Granger causality, readers are referred to Granger1969; Helmut1991; Arnold2008.

3.2 Stage 2: refinement

Stage 1 selects AR parameters related to the most conditionally correlated pairs of marginal series according to BIC. However, it may also have introduced spurious non-zero AR coefficients in the stage 1 model: As PSC can only be evaluated for pairs of series, we cannot select diagonal coefficients in , nor can we select within the group of coefficients corresponding to one pair of component series. We therefore apply a second stage to further refine the stage 1 model. To eliminate these possibly spurious coefficients, the non-zero AR coefficients of the stage 1 model are ranked according to the absolute values of their -statistic. The -statistic for a non-zero AR coefficient estimate , ( and ) is,

| (3.4) |

Here the standard error of is computed from the asymptotic distribution of the constrained maximum likelihood estimator of the stage 1 model, which is, e.g., see Helmut1991,

| (3.5) |

where is the vector obtained by column stacking the AR coefficient matrices ; , and are the maximum likelihood estimators of , and , respectively; and is the constraint matrix, defined by equation (LABEL:sVARequation) in Appendix LABEL:sVARest, of the stage 1 model. Therefore we can create a sequence of the triplets by ranking the absolute values of the -ratios (3.4) from highest to lowest. The AR coefficients corresponding to the top triplets in are more likely to be retained in the model because of their significance. In the second stage, there is only one parameter, denoted by , controlling the complexity of the model, which is the number of non-zero AR coefficients to be retained. And BIC is used to select the complexity of the final sVAR model. The steps of stage 2 are as follows.

Our 2-stage approach in the end leads to a sVAR model that contains non-zero AR coefficients corresponding to the top triplets in . We denote this sVAR model by sVAR(), where is the order of autoregression and is the number of non-zero AR coefficients.

Stage 2 1. Compute the -statistic (3.4) for each of the non-zero AR coefficient estimates of the stage 1 model. 2. Create a sequence of the triplets by ranking from highest to lowest. 3. For each , consider the model that selects the non-zero AR coefficients corresponding to the top triplets in the sequence . Under this parameter constraint, execute the constrained parameter estimation using results in Appendix LABEL:sVARest and compute the corresponding BIC according to . 4. Choose that gives the minimum BIC value.

4 Numerical results

In this section, we provide numerical results on the performance of our 2-stage approach of fitting sVAR models. In Section 4.1, simulation results are presented to compare the performance of the 2-stage approach against competing Lasso-type methods of fitting sVAR models. In Section LABEL:section_real, the 2-stage approach is applied to two real data examples. The first is the Google Flu Trends data and the second is a time series of concentration levels of air pollutants.

4.1 Simulation

Simulation results are presented to demonstrate the performance of our 2-stage approach of fitting sVAR models. We compare the 2-stage approach with Lasso-VAR methods. To apply Lasso-VAR methods, the VAR model is re-formulated as a linear regression problem, where current values of the time series are treated as the response variable and lagged values are treated as the explanatory variables. Then Lasso can be applied to select the AR coefficients and fit sVAR models, e.g., see Sosa2005; Hsu2008; Arnold2008; Lozano2009; Haufe2010; Michailidis2010; Song2011. The Lasso method shrinks the AR coefficients towards zero by minimizing a target function, which is the sum of a loss function and a penalty on the AR coefficients. Unlike linear regression models, the choice of the loss function between the sum of squared residuals and the minus log likelihood will affect the resulted Lasso-VAR models even if the multivariate time series is Gaussian. This is because the noise covariance matrix is taken into account in the likelihood function of a Gaussian VAR process but not in the sum of squared residuals. In general, this distinction will lead to different VAR models unless the unknown covariance matrix equals to a scalar multiple of the identity matrix, e.g., see Appendix LABEL:lassoToVAR. We notice that this issue of choosing the loss function has not been addressed in the literature of Lasso-VAR models. For example, Arnold2008; Lozano2009; Haufe2010; Michailidis2010; Song2011 all used the sum of squared residuals as the loss function and did not consider the possibility of choosing the minus log likelihood as the loss function. The simulation setups in these papers all assume, either explicitly or implicitly, that the covariance matrix is diagonal or simply the identity matrix. Therefore in our simulation we apply Lasso to VAR modeling under both cases: in the first case we choose the sum of squared residuals as the loss function and denote it as the Lasso-SS method; in the second case we use the minus log likelihood as the loss function and denote it as the Lasso-LL method. Details of fitting these two Lasso-VAR models are given in Appendix LABEL:lassoToVAR.

The Lasso-VAR approach simultaneously performs model selection and parameter estimation, which is usually considered as an advantage of the approach. However, our simulation results suggest that simultaneous model selection and parameter estimation can weaken the performance of the Lasso-VAR approach. This is because Lasso-VAR methods, such as Lasso-SS and Lasso-LL, have a tendency to over-select the autoregression order of VAR models, a phenomenon reported by many, see Arnold2008; Lozano2009; Michailidis2010. This over-specified model complexity potentially increases the mean squared error of the AR coefficient estimates of Lasso-VAR models. On the contrary, simulation results show that our 2-stage approach is able to identify the correct set of non-zero AR coefficients more often and it also achieves better parameter estimation efficiency than the two competing Lasso-VAR methods. In addition, simulation results also suggest that the Lasso-SS method, which does not take into account the noise covariance matrix in its model fitting, performs the worst among the three.

Here we describe the simulation example used to compare the performance of our 2-stage approach, the Lasso-SS and the Lasso-LL methods of fitting sVAR models. Consider the -dimensional VAR(1) process given by,

| (4.1) |

where are iid Gaussian noise with mean 0 and covariance matrix . The order of autoregression in (4.1) is and there are 6 non-zero AR coefficients, so (4.1) specifies a sVAR model. The covariance matrix of the Gaussian noise is,

We can see that the marginal series is related to all other series via . And we can change the value of to compare the impact of the variability of on the performance of the three competing methods. We compare the three methods according to five metrics: (1) the selected order of autoregression ; (2) the number of non-zero AR coefficient estimates ; (3) the squared bias of the AR coefficient estimates,

;

(4) the variance of the AR coefficient estimates,

;

and (5) the mean squared error (MSE) of the AR coefficient estimates,

,

where and for any triplet such that and . The first two metrics show the model selection performance and the latter three metrics reflect the efficiency of parameter estimates of each method. The pre-specified range of the autoregression order is . Selection of the tuning parameter for the two Lasso-VAR methods is based on ten-fold cross validations, as described in Appendix LABEL:lassoToVAR. We let in take values from . The sample size is 100 and results are based on 500 replications.

The five metrics for comparison are summarized in Table 1. The column shows that the 2-stage approach is able to correctly select the autoregression order while the two Lasso-VAR methods over-select the autoregression order. Furthermore, the true number of non-zero AR coefficients is . As shown by the column, the average number of non-zero AR coefficient estimates from the 2-stage approach is very close to 6. At the same time, this number from either the Lasso-SS or the Lasso-LL method is much larger than 6, meaning that the two Lasso-VAR methods lead to a lot of spurious non-zero AR coefficients. Second, we compare the efficiency of parameter estimates. The column shows that the 2-stage approach has much smaller estimation bias than the two Lasso-VAR methods. This is because the penalty is known to produce large estimation bias for large non-zero coefficients, see Fan2001. In addition, the large number of spurious non-zero AR coefficients also increases the variability of the parameter estimates from the two Lasso-VAR methods. This is reflected in the column, showing that the variance of the AR coefficient estimates from the Lasso-SS and the Lasso-LL methods are larger than that from the 2-stage approach. Therefore the 2-stage approach has a much smaller MSE than the two Lasso-VAR methods. And this difference in MSE becomes more notable as the marginal variability increases.

| bias | variance | MSE | ||||

| 2-stage | 1.000 | 5.854 | 0.021 | 0.092 | 0.113 | |

| Lasso-LL | 1.208 | 17.852 | 0.060 | 0.099 | 0.159 | |

| Lasso-SS | 1.218 | 17.156 | 0.054 | 0.092 | 0.146 | |

| 2-stage | 1.000 | 6.198 | 0.006 | 0.087 | 0.093 | |

| Lasso-LL | 1.150 | 17.254 | 0.046 | 0.103 | 0.149 | |

| Lasso-SS | 1.246 | 16.478 | 0.053 | 0.136 | 0.188 | |

| 2-stage | 1.000 | 6.190 | 0.002 | 0.073 | 0.075 | |

| Lasso-LL | 1.179 | 17.275 | 0.042 | 0.274 | 0.316 | |

| Lasso-SS | 1.364 | 14.836 | 0.094 | 0.875 | 0.969 | |

| 2-stage | 1.000 | 6.260 | 0.003 | 0.175 | 0.178 | |

| Lasso-LL | 1.203 | 17.464 | 0.056 | 0.769 | 0.825 | |

| Lasso-SS | 1.392 | 11.108 | 0.298 | 2.402 | 2.700 | |

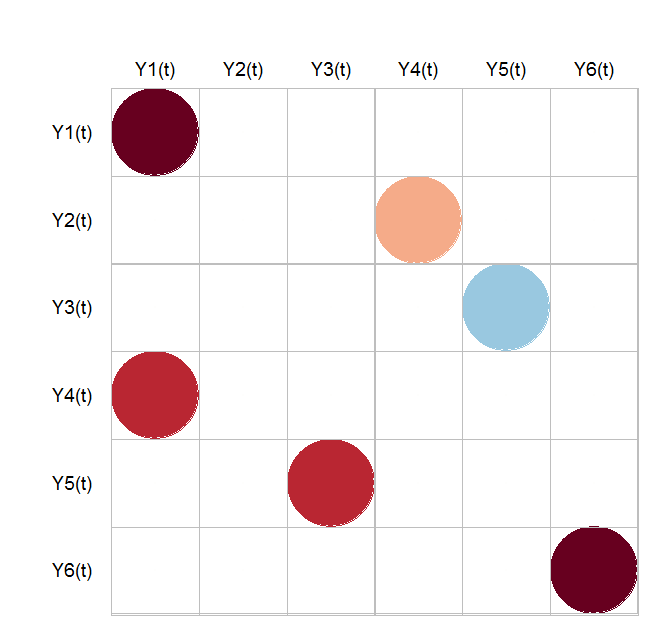

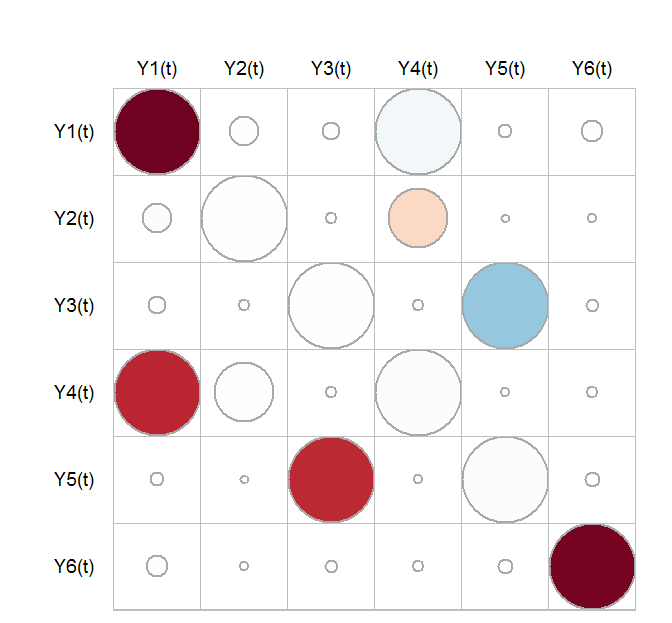

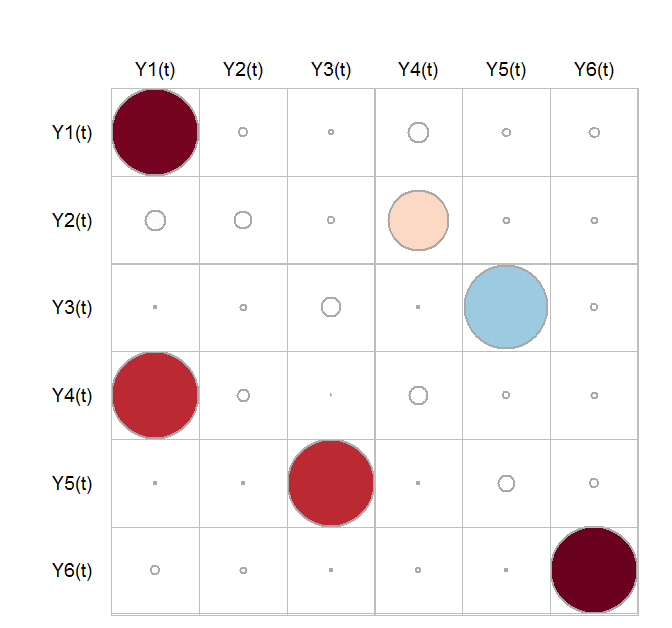

A comparison of the AR coefficient estimation performance when is displayed in Figure LABEL:sim1_MatrixGraph_true_stage1_stage2_LassoSS_LassoLL_delta1. Panels (b) and (c) of Figure LABEL:sim1_MatrixGraph_true_stage1_stage2_LassoSS_LassoLL_delta1 show the AR coefficient estimates from stages 1 and 2 of the 2-stage approach. The size of each circle is proportional to the percent of times (out of 500 replications) the corresponding AR coefficient is selected and the color of each circle shows the average of the 500 estimates of that AR coefficient. For comparison, panel (a) displays the true AR coefficient matrix , where the color of a circle shows the true value of the corresponding AR coefficient. We can see from panel (b) that the first stage is able to select the AR coefficients belonging to pairs of conditionally correlated marginal series. But the stage 1 model contains spurious non-zero AR coefficients, as indicated by the presence of 6 dominant white circles in panel (b) at 4 diagonal positions, i.e., , and 2 off-diagonal positions, i.e., . These white circles effectively disappear in panel (c) due to the second stage refinement. This observation demonstrates the effectiveness of the second stage refinement. In addition, the similarity between panel (a) and panel (c) has two implications: first, the presence of 6 dominant color circles in both panels suggests that the 2-stage approach is able to select the true non-zero AR coefficients with high probabilities; second, the other tiny circles in panel (c) indicate that the 2-stage approach leads to only a small number of spurious AR coefficients. These two implications together show that the 2-stage approach is able to correctly select the non-zero AR coefficients for this sVAR model. On the other hand, panels (e) and (f) display the estimated AR coefficients from the Lasso-LL and the Lasso-SS methods, respectively. The most notable aspect in these two panels is the prevalence of medium-sized white circles. The whiteness of these circles indicates that the corresponding AR coefficient estimates are unbiased. However, according to the legend panel, the size of these circles corresponds to an approximate 50 chance that each of these truly zero AR coefficients is selected by the Lasso-VAR methods. As a result, both two Lasso-VAR methods lead to a large number of spurious non-zero AR coefficients and their model selection results are highly variable. Consequently, it is more difficult to interpret these Lasso-VAR models. This observed tendency for Lasso-VAR methods to over-select the non-zero AR coefficients is consistent with the numerical findings in Arnold2008; Lozano2009; Michailidis2010.