European Option Pricing with Liquidity Shocks

Abstract.

We study the valuation and hedging problem of European options in a market subject to liquidity shocks. Working within a Markovian regime-switching setting, we model illiquidity as the inability to trade. To isolate the impact of such liquidity constraints, we focus on the case where the market is completely static in the illiquid regime. We then consider derivative pricing using either equivalent martingale measures or exponential indifference mechanisms. Our main results concern the analysis of the semi-linear coupled HJB equation satisfied by the indifference price, as well as its asymptotics when the probability of a liquidity shock is small. We then present several numerical studies of the liquidity risk premia obtained in our models leading to practical guidelines on how to adjust for liquidity risk in option valuation and hedging.

Key words and phrases:

Keywords: liquidity shock; indifference price; exponential utility maximization1. Introduction

The traditional option pricing theory relies on a key assumption: that markets are always liquid and agents can trade whenever they wish. However, this is not generally true in real financial markets [16]. There is increasingly a common phenomenon of liquidity crises in even well-established securities markets, where liquidity dries out or trading is virtually impossible for a number of reasons, such as political turmoil, war, and financial crises. Two prominent examples include the terrorist attacks of 9/11 which closed all US security exchanges for four days, and the “flash crash” of May 6, 2010 [14] when numerous stocks experienced extreme price swings (up to 99% of value) coupled with minimal trading volume during the course of several hours.

In recent years a number of approaches for dealing with market illiquidity within optimal investment frameworks have been developed. Schwartz and Tebaldi [21] considered the optimal portfolio problem with permanent trading interruptions; Diesinger et al. [5] addressed terminal wealth maximization for CRRA utilities. Ludkovski and Min [17] and Gassiat et al. [9] analyzed the impact of illiquidity on optimal consumption strategies. In this paper we extend this analysis to the problem of pricing of derivative securities. To our knowledge, there is no previous analysis for effect of illiquidity on option prices.

In this paper, we define illiquidity as the inability to trade in a timely way. While liquidity crises involve a host of phenomena that affect the market environment, including downward jumps in asset prices, modified asset dynamics and restrictions on trading strategies, here we concentrate on the last item. Namely, to isolate the impact of liquidity shocks, we consider the extreme scenario whereby (i) trading in assets is completely suspended during the shock and (ii) the underlying asset price remains frozen while the shock is ongoing.

We adopt a regime-switching description of market liquidity which is modeled through a separate Markovian liquidity factor. This aspect of our model connects with the growing literature on Markov-modulated financial markets driven by the recognition that the economic environment is not stable. Some of the pertinent analyses include [3, 6, 11, 15, 23]. The model of Blanchet et al. [3] effectively corresponded to the case where the liquidity shock was permanent, while Siu et al. [23] and Leung [15] studied valuation of options using Esscher and minimal entropy martingale measures, respectively.

The main rationale for our choices is to have a well-understood benchmark for comparing derivative valuations and to focus on the effect of trading suspension. In particular, thanks to the special form of liquidity shocks, we can directly compare to the classical frictionless Black-Scholes model, specifically linking to the options’ time-decay. Indeed, a liquidity shock induces an instantaneous (in terms of business-time) jump in the option’s Delta, making perfect hedging impossible and exposing investors to charm risk, namely the dependence of Delta on time-to-maturity. In reality, asset valuations continue to change (often in an unfavorable way to the investor) and some form of trading may still be possible (e.g., only a short-selling restriction). However, the resulting model is simply somewhere between the classical textbook description and the one considered herein; similarly, incorporating other features, such as jumps in asset prices, only obscures the final conclusions.

Potential liquidity shocks introduce a new non-traded source of risk and make the asset market incomplete. Derivative pricing in incomplete markets largely follows two main approaches. First, one may fix an equivalent martingale measure (EMM) and calculate option prices as expectations under . Some of the common candidates for EMMs include minimal martingale measure [7], minimal entropy martingale measure [8, 19], variance-optimal martingale measure [22], and empirical martingale measure [3]. Second, one may use a utility maximization criterion to obtain indifference prices that take into account the risk aversion of the investor [2, 10, 11, 12, 15, 20, 26]. Given the widely reported crash-o-phobia of liquidity crises, this is a useful nonlinear pricing rule complementing the classical expectations-based approach. In this paper we compare both approaches for determining the option’s liquidity premia, with a special focus on exponential utility valuation, which leads to wealth-independent indifference prices and natural connections to the minimal entropy measure.

Our main contributions concern the analysis of the Hamilton-Jacobi-Bellman (HJB) equations satisfied by the indifference prices, including explicit asymptotics in terms of the two main model parameters: level of risk-aversion and probability of liquidity shock. We also present a detailed comparative analysis between the model prices and the classical Black-Scholes prices with the aim of providing rules of thumb for incorporating liquidity shock risk into the valuations. For this purpose, we introduce the new concepts of implied and adjusted time to maturity that allow translation of liquidity risk premia into the Black-Scholes language.

The rest of paper is organized as follows: in Section 2 we setup the probabilistic model. In Section 3 we summarize the EMM approach to pricing under liquidity shocks; Section 4 then describes the utility indifference approach to derivative valuation. Section 5 discusses asymptotic analysis of the utility-based pricing mechanism to gain further insight into our formulas; in Section 6 we present a handy interpretation of the liquidity premium through implied time-to-maturity. All these results are illustrated in Section 7 with numerical experiments. Most proofs are delegated to the Appendix.

2. The Market Model

In this section, we describe the market model in the presence of potential liquidity shocks. Fix a complete probability space (), where is the real-world probability. We consider a finite investment time horizon , which is chosen to coincide with the expiration date of all securities in our model, and a financial market which consists of a stock and a risk-free asset (cash), and is subject to the liquidity shocks. We use defined on to denote the total wealth, stock holdings as proportion of total wealth, and the stock price at time , respectively.

2.1. Market Dynamics

We assume the market has two states, liquid (0) and illiquid (1). We use a continuous-time Markov chain to represent the changing liquidity of the financial market with state space . The Markov chain is a proxy for the fluctuating market liquidity and modulates asset dynamics. Its infinitesimal generator is

| (2.1) |

where and are for simplicity constants. Associated with are two counting processes and with intensity rates of and , respectively counting the transitions and .

We assume that the market value of the stock follows a Markov-modulated Geometric Brownian motion (GBM) model. Without loss of generality, we assume a zero interest rate which is equivalent to working with discounted price processes. In the liquid state () the market dynamics follow the classical Black-Scholes model, and the stock can be traded continuously and frictionlessly. More precisely, we take

| (2.2a) | ||||

| (2.2b) | ||||

where and denote the stock drift and volatility and is a standard one-dimensional Brownian motion under , which is assumed to be independent of the Markov chain . In the illiquid state () the market is static and trading in stock is not permitted:

As can be seen, this market model has two sources of uncertainty, one generated by and the other by . The liquidity constraint is captured by our set of admissible trading strategies. Namely, letting , a strategy is admissible if it is self-financing, -progressively measurable, satisfies the integrability condition , and the constraint on .

We focus on pricing European contingent claims with maturity date and payoff . For simplicity, we assume that the terminal payoff does not depend on ; it would be straightforward to incorporate liquidity penalties for option exercise. For later use we recall the complete Black-Scholes market counterpart which has the unique martingale measure with

| (2.3) |

and where contingent claim prices are given by the classical no-arbitrage formula (note that we use the time-to-maturity parametrization)

| (2.4) |

where .

Remark 2.1.

More generally (see [5, 17]) the market need not be static during the illiquid periods. Thus, one may postulate modified dynamics for the stock during the liquidity shock and also include instantaneous price drops when the liquidity regime changes. For instance, assuming that when the stock follows a GBM with drift and volatility and that it experiences a fixed drop of at the beginning of each liquidity shock, the analogue of (2.2) would be , , and whenever and

| (2.5a) | ||||

| (2.5b) | ||||

| (2.5c) | ||||

However, the resulting model is significantly more complex due to the fact that is changing during the illiquid regime and hence remains part of the system state. In other words, the state variables when are introducing an extra state dimension. We further discuss the resulting pricing equations in Remark 4.8.

Notations

We use to denote expectation taken under the measure with starting values . We also let

| (2.6) | ||||

| (2.7) |

so that ’s are the Sharpe ratios in each state (note: the zero risk-free rate).

3. Option Pricing via Martingale Measures

In this section, we summarize the option valuation problem in the context of the EMM methodology. We mainly follow Leung [15] who considered a related regime-switching market. We begin by characterizing the set of all equivalent local martingale measures (EMMs) in this liquidity switching market. A probability measure in , equivalent to , should be regarded as a risk neutral measure with respect to both asset price and the liquidity risk. Using Girsanov’s Theorem for the Wiener process , and the Markov Chain we obtain (cf. Theorem 7 in Leung [15]):

Proposition 3.1.

The set of all possible EMMs is given by

| (3.1) | ||||

| (3.3) |

In Proposition 3.1, the exponential martingale is the Girsanov transform that makes a -martingale, while is the exponential martingale that transforms the generator of . To preserve the Markovian property of under the new measure , we henceforth require that all be Markovian. Then, under , the generator matrix of is . The collection can be considered as the risk premium factors for the liquidity switching risk [15].

Using the law of iterated expectations by expressing the price as a discounted risk neutral expectation over all possible paths of the liquidity state we obtain

Proposition 3.2.

Given a measure , the option price is given by

| (3.4) |

where , .

In the special case where is a unity transformation, we obtain the Minimal Martingale Measure (MMM) (with ) [6, 3], which corresponds to a zero risk premium associated with the liquidity risk. By Girsanov’s theorem, under , follows

| (3.5) |

where is a standard Brownian motion under and the -generator of remains . We use to denote the price under MMM conditional on . Another special case is furnished by the minimal entropy martingale measure (MEMM), .

Definition 3.3.

The minimal entropy martingale measure, , minimizes the relative entropy with respect to over the set of EMMs :

| (3.6) | |||

| (3.9) |

Definition 3.4.

Consider the ODE system , with and . The solutions are explicitly given by

| (3.10) | ||||

| (3.11) | ||||

| (3.12) | ||||

Remark 3.5.

Let . Through simple algebra, we have , which leads to , .

Applying Theorem 9 in Leung [15] we immediately obtain the following characterization of .

Proposition 3.6.

The MEMM is , where the minimal entropy risk factor is given by . Thus, under the Markov chain becomes a time-inhomogeneous Markov chain with transition intensities

| (3.13) |

4. Exponential Indifference Pricing

To account for investor risk preferences, we next investigate a nonlinear pricing mechanism in the presence of liquidity shocks. In this section, we derive the exponential indifference price of using methods of stochastic control and nonlinear partial differential equations. Throughout this analysis, the exponential utility function is used:

| (4.1) |

where is the investor’s risk aversion parameter. Exponential utility has various advantages, such as yielding prices that are wealth independent, and being related via the dual representation to the minimal entropy martingale measure.

A starting point for the approach of utility-based pricing are the value functions for the optimal investment problem in the presence of a contingent claim,

| (4.2) |

Standard stochastic control methods imply the following:

Proposition 4.1.

The optimal value functions with for a holder of a bounded contingent claim paying off at terminal time are given by

where are the unique viscosity solutions of the coupled semi-linear system

| (4.3) |

with the terminal conditions , .

As a Corollary, taking , we recover the value functions , for the Merton problem of optimal investment in the liquidity switching market.

Corollary 4.2.

The value function for optimal investment subject to illiquidity shocks is

| (4.4) |

where and are given in (3.4).

Proof.

This is a special case of Proposition 4.1 with zero options. We observe that if the terminal condition is zero, the solutions of (4.3) are independent of , . Substituting and simplifying then yields (3.4) which are easily seen to be smooth. The link between the Merton problem and relative entropy minimization that was originally used to derive ’s in (3.4) is well-known, see e.g. [15, Theorem 11]. ∎

Remark 4.3.

Recall that without liquidity shocks, i.e., , the Merton value function is The possibility of illiquidity increases the risk associated with the investment behavior. As one would expect, the discount rate has to be therefore increased relative to the perfectly liquid case, , see Remark 3.5.

4.1. Iterative Approximation

Since we are unable to provide an a priori regularity estimate on in (4.3), we instead pursue a decoupling approach. The main idea is to approximate and through a fixed-point iterative scheme yielding smooth approximations , , . We show that converge to uniformly on compacts, and provide a characterization of as a unique classical solution of the corresponding (de-coupled) HJB equations. The following Theorem summarizes our results, with the proof in B.

Theorem 4.4.

There exist functions , , such that:

-

(1)

are classical solutions of the HJB equations (B);

-

(2)

admit the control representation

(4.5) -

(3)

For any compact subsets and we have

(4.6)

4.2. Indifference Prices

Using and , the buyer’s indifference prices (initial state 0) and (initial state 1) are defined via

| (4.7) | ||||

As is well known, under exponential utility the indifference price is wealth independent, , and . We know the value functions from (4.4) and from Theorem 4.4, so combining these with the indifference price definition and simplifying equation (4.3), we obtain the following PDEs for and :

Proposition 4.5.

The option buyer’s prices are the unique viscosity solutions of the semi-linear elliptic PDEs

| (4.8) |

with terminal conditions .

We note that all the terms involving in (4.8) are bounded on .

Remark 4.6.

One can similarly consider the writer’s indifference price and , which then solve

| (4.9) |

with terminal condition: .

The utility indifference pricing procedure also provides an explicit identification of the hedging position, which is found naturally as part of the optimization problem, namely through a maximizer of (4.2). In an incomplete market perfect hedging is not possible, but this utility indifference hedging strategy provides a dynamic optimal adjustment of the portfolio strategy for an investor who holds the contingent claim. For exponential utility, the optimal trading strategy satisfies

| (4.10) |

in which the first term is exactly from the classical Merton problem, and the second term is the counterpart of the classical Delta to account for hedging motives of by the risk-averse investor. We discuss (4.10) in Section 7.3.

Remark 4.7 (Duality Representation).

Recall relative entropy defined in (3.9). One obtains (see equation (4.6) in [4]) the following indifference price expression:

| (4.11) |

The representation (4.11) shows that the indifference price is decreasing in , and yields the risk aversion asymptotics (see Proposition (1.3.4) in [1]) :

| (4.12) | ||||

| (4.13) |

This implies that when the risk aversion vanishes, the indifference price converges to the MEMM price. When the risk aversion goes to infinity (total risk aversion), we obtain the super-replication price.

Remark 4.8.

Continuing Remark 2.1 one could consider indifference pricing of assuming more general dynamics in the illiquid regime. However as mentioned before, this would require adding as a state variable when (i.e. for the -value function in (4.8)). We present details of the corresponding generalizations of (4.8) in D.

5. Asymptotic Analysis

The indifference prices from (4.8) do not have a closed-form analytical solution. To gain further insight, in this section we perform regular perturbations of (4.8) in terms of a small risk aversion parameter or a small probability of liquidity shock .

5.1. Small Risk Aversion Asymptotics

For the asymptotic case , we can reduce the non-linear reaction-diffusion indifference price equation (4.8) to a linear one, obtaining a closed-form representation for the limiting price.

We apply the formal asymptotic expansion

Theorem 5.1.

Proof.

Formally matching terms in powers of in the PDE (4.8) yields the following equations:

| (5.3a) | |||

| (5.3b) | |||

| (5.3c) | |||

| (5.3d) | |||

with boundary conditions:

The equations for and are typical Cauchy problems described in [13, Ch. 5.7]. Since we have constant diffusion and volatility terms, and the source and the terminal condition functions are bounded, there exists a unique solution to (5.3) by a direct application of the Feynman-Kac representation in Theorem 7.6 in [13], leading to (5.1)-(5.2). Finally, the equations for and are linear first-order ODEs that have an explicit solution using an integrating factor. ∎

5.2. Small Probability of Liquidity Shocks

Under normal conditions, the likelihood of a liquidity shock is small (typically caused by a natural or geopolitical catastrophe that is rare by definition). In terms of our model, the transition probability is small under this scenario and we may view the resulting option price as a perturbation of the classical Black-Scholes price corresponding to . In particular, for a given option maturity , the probability of more than one liquidity shock is exceedingly small, .

In light of these considerations, we analyze the asymptotic case of at most a single liquidity shock. Such a restricted model may be obtained by redefining the state-space of as . As before, we assume the market starts with the regular liquid state (0). Due to the unpredictable illiquidity shock, the market is susceptible to transiting to the illiquid state (1), and before the terminal time it may come back to the absorbing liquid state (2) which is now immunized from any further illiquidity shocks. The corresponding infinitesimal generator is

| (5.4) |

Similarly, we define the regime-dependent discounting factors to the utility functions in Merton’s problem, denoted by , and .

| (5.5a) | ||||

| (5.5b) | ||||

| (5.5c) | ||||

which are the solutions of the ODE system

Note that , the discount factor in the classical Merton’s problem. This is not a surprise considering the state (2) in this three-state liquidity switching case is in fact the classical complete market. In addition, we have , and . We obtain that the MEMM in the single-shock market above is given by , where the minimal entropy risk factor is , . Thus, under the Markov chain has transition intensities

| (5.6) |

Let us denote , and .

Corollary 5.2.

Using the pricing formula in Proposition 3.2, the MEMM price of a contingent claim with payoff in the single-shock market is

| (5.7) | ||||

| (5.8) |

Next, the corresponding indifference buyer’s price assuming initial regime is the unique classical solution of the semi-linear PDE

| (5.9) |

with terminal condition and the explicit source term

As in last subsection, we can further expand in to obtain , with

| (5.10) | ||||

| (5.11) |

Compared to the original model we not only have a single semi-linear PDE for the indifference price but also explicit expansion terms and . The zero-order term can be expressed as the weighted average of the Black-Scholes prices of options with same initial condition but varying maturities,

| (5.12) |

for a probability measure on defined implicitly in (5.2) via the transition intensities . Similarly, is clearly negative and is a weighted average of squared differences with same weights on as in (5.12).

6. Implied Time-to-Maturity

In our liquidity switching model, the random trading interruption is the only extra risk in comparison to the Black-Scholes model. As the market is static during the no-trading time periods, one could naturally regard the model as a stochastically shortened time-to-maturity Black-Scholes model. In this subsection, we accordingly define the concept of implied time-to-maturity as the measure of the investor’s view of effective time horizon based on her pricing approach. Let us first define the realized time-to-maturity ,

| (6.1) |

Then is a bounded -measurable random variable. Due to the independence of and and using the strong Markov property of Brownian motion, we can view the stock as following (2.3), and the contingent claim as paying at the random terminal date .

Definition 6.1.

The Adjusted TTM under a measure is defined as

| (6.2) |

i.e., the original maturity subtracted by the expected no-trading time duration.

Assuming a time-stationary generator as in (2.1), standard analysis of the sojourn times of the 2-state Markov chain yields

Corollary 6.2.

The adjusted time-to-maturity under the minimal EMM is given explicitly by

| (6.3) |

Simple algebra arguments lead to . The adjusted TTM simply subtracts the expected period of market freeze, without regard for when it will occur. Thus, it does not account for option-specific features whereby the timing of the shock is also important, as the option time-decay depends on . This motivates the following definition (compare to the popular concept of implied volatility).

Definition 6.3.

Given model-based price , the implied time-to-maturity is defined implicitly via

| (6.4) |

In other words, is defined as the time-to-maturity that equalizes with the classical Black-Scholes price.

Remark 6.4.

Certainly this implied TTM concept is meaningful only when (6.4) has a unique solution, i.e. when the time value of an option is meaningful, such as for Calls and Puts. In such cases, we could use to parameterize model option prices. However, for options, such as digital Calls, whose Black-Scholes price is not monotone in , there is no unique implied TTM and thus this concept should not be used.

The implied TTM can be used to explain the spread between the Black-Scholes price and the liquidity-adjusted valuation. Recall that the option value may be decomposed into intrinsic value (payment an agent would gain if the option is exercised immediately) and time value (the value of delaying exercise until maturity). Typically, the time value is increasing in time-to-maturity. Consequently, since a potential liquidity shock shrinks the expected TTM, the option price decreases (note that the intrinsic value is unaffected due to our assumption that is static during the shock) due to the extra time-decay.

7. Numerical Examples

In this section we present a series of numerical experiments to illustrate our derivations in the liquidity switching model. Recall that we have obtained three main types of prices, the indifference price from (4.8), the MEMM price in Theorem 3.7 (equivalent to in Theorem 5.1), and the minimal martingale measure price . The indifference price is obtained through utility maximization arguments, while the other two are from special martingale measures. Both and are easily computed from the generic formula (3.1) using the explicit descriptions of the corresponding transition intensities of . We compute by solving the corresponding semi-linear PDE using a mixed implicit-explicit finite difference scheme, see C for details.

Table 1 summarizes the parameter values used. Note that with and we assume that liquidity shocks occur at a rate of once per year and last an average of one month. As two representative types of European options we consider vanilla Calls with payoff and digital Calls with payoff .

| Parameter | Meaning | Value |

|---|---|---|

| Growth rate of the stock | 0.06 | |

| Volatility of the stock | 0.3 | |

| Transition rate from state | 1 | |

| Transition rate from state | 12 | |

| Strike Price | 10 | |

| Option’s maturity in years | 1 | |

| Risk aversion parameter | 1 |

7.1. Price Comparison

We first discuss the observed relations between the different model prices , , and . As the MMM price assigns zero illiquidity risk premium, we have , see Proposition 3.6. Also due to risk aversion, , so that we have

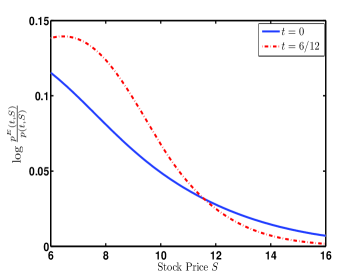

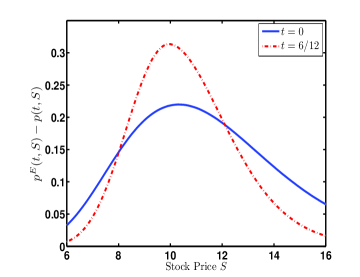

Numerically, we find that at the given frequency of liquidity shocks, the difference between the MMM and MEMM prices, vs. , is negligible across all option types we tried, showing that the entropic liquidity risk premium is generally very small. Next, our numerical results confirm that . However, the magnitude of the price spread varies for different types of options. For Call options, there is no significant difference (less than in all cases we tried); while significant spread is found for digital options, see Figure 1. In absolute terms, the spreads are largest at-the-money (right panel of Figure 1), however since the Call price is increasing with respect to , the percent difference is generally decreasing in (left panel of Figure 1).

Regarding the price spreads versus time-to-maturity (TTM), intuitively, as TTM shrinks, there is less chance to have liquidity shocks, thus smaller spreads should be expected. This pattern is observed for Call options. However, for digital Calls, the effect of TTM on is ambiguous. This is due to the digital Call’s large Theta () around the strike. Hence, for short-maturity ATM digital Calls a large liquidity cost is observed, see the hump at in the right panel of Figure 1. Moreover, out-of-the-money, the digital Call B-S price is not monotone in time-to-maturity. Therefore, the shorter TTM (), the smaller , and thus the highest percent spread happens at the deep OTM case, see left panel of Figure 1.

Remark 7.1.

In this paper we have chosen a probabilistic description of liquidity shocks through the Markov chain . An alternative formulation could focus on worst-case analysis, treating the shock interval as unknown constants ,see [18]. In such min-max setting, the liquidity spread could be large even as if the option time-decay is strong.

|

|

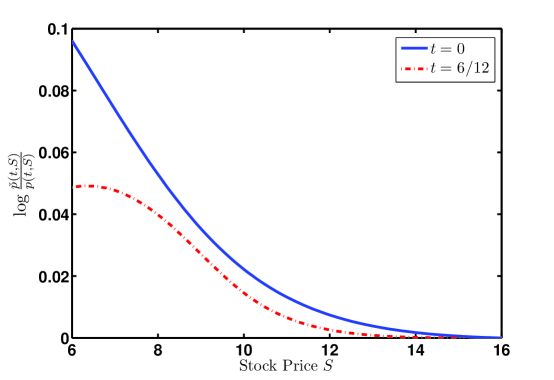

Next, we study the quality of the asymptotic expansion in in Section 5.2 by comparing the indifference option price and its approximation from (5.9). Recall that corresponds to the price assuming at most one liquidity shock on and is therefore the first-order term in the asymptotics using . We find that this first-order approximation explains over 50% of the spread across most stock prices (see Figure 2) and can therefore provide a useful rule-of-thumb without the need to solve any nonlinear PDEs.

|

| Indifference Price per Contract | ||||||

|---|---|---|---|---|---|---|

| # of Contracts | Call Option | Digital Call Option | ||||

| in Possession | ||||||

| 10 | 0.2875 | 1.0720 | 2.4476 | 0.1655 | 0.4229 | 0.6705 |

| 5 | 0.3128 | 1.1264 | 2.4872 | 0.1751 | 0.4370 | 0.6826 |

| 1 | 0.3222 | 1.1442 | 2.5014 | 0.1793 | 0.4433 | 0.6883 |

| -1 | 0.3253 | 1.1496 | 2.5060 | 0.1811 | 0.4461 | 0.6909 |

| -5 | 0.3296 | 1.1573 | 2.5124 | 0.1856 | 0.4535 | 0.6980 |

| -10 | 0.3333 | 1.1635 | 2.5178 | 0.1967 | 0.4723 | 0.7155 |

| Risk Neutral Price | ||||||

| MEMM | 0.3235 | 1.1466 | 2.5034 | 0.1801 | 0.4447 | 0.6897 |

| MMM | 0.3236 | 1.1467 | 2.5035 | 0.1801 | 0.4447 | 0.6897 |

| Adj B-S | 0.3247 | 1.1496 | 2.5053 | 0.1798 | 0.4425 | 0.6865 |

| B-S | 0.3534 | 1.1924 | 2.5441 | 0.1857 | 0.4404 | 0.6764 |

To understand the nonlinear nature of the indifference pricing rule, Table 2 summarizes the per-contract prices as we vary the quantity of contracts to purchase/sell. As expected, the indifference price decreases as the number of contract grows due to the increasing risk of holding more options. Also, the linear risk neutral prices (MEMM, MMM and adjusted B-S) are between the buyer and writer’s prices for (recall that MEMM is the limiting per-contract price as ). Recall that with exponential utility contract volume and risk-aversion asymptotics are equivalent, so Table 2 can also be interpreted in terms of modifying the risk-aversion of the investor.

7.2. Implied Time To Maturity

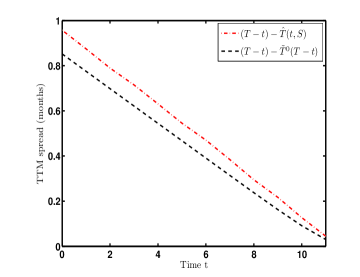

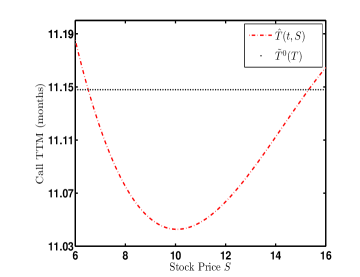

As we discussed in Section 6, it is tempting to characterize the model prices using the Black-Scholes equivalent (i.e. implied) time-to-maturity defined in (6.4). As the Black-Scholes digital option price is not a monotone function of TTM, it will only make sense to discuss Call/Put options’ implied TTM. The left panel of Figure 3 shows the adjusted and implied TTM as we vary the overall time-to-maturity . We observe that is almost linear in and provides a reasonable approximation to the indifference TTM . This implies that using an adjusted TTM within the classical Black-Scholes formula can be used as a simple correction to take into account liquidity risk.

The adjusted TTM is generally larger than the implied due to the risk aversion and non-constant option time-decay. However, we find that this relationship is not universal; in fact for deep ITM or OTM options it may be reversed. This is illustrated in the right panel of Figure 3 that shows dependence of the implied TTM on the initial stock price . We observe a “smile” shape such that the most time-value lost is for at-the-money options. This is consistent with intuition that liquidity risk is related to the Charm and Gamma greeks which are largest at-the-money.

|

|

7.3. Hedging

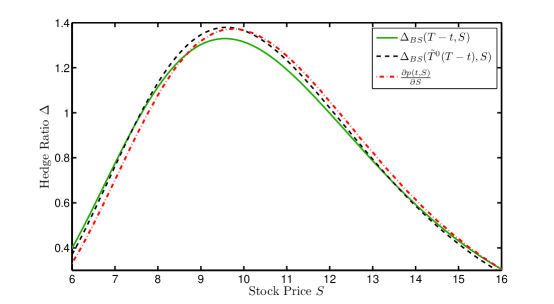

Recall that in the problem defining , the optimal stock holding in dollars is . The first term is the constant arising in the Merton’s hedging problem, and the second term is the Delta hedge analogous to the classical Black-Scholes case except the price is the indifference price . Figure 4 compares this indifference hedge to the classical B-S Delta using the original time-to-maturity , or the adjusted time-to-maturity from (6.3).

Using to denote the classical Delta in the Black-Scholes model, and recalling that we decompose

The three terms in the above comparison between the classical Black-Scholes Delta and the indifference hedge correspond to adjusting for expected time-value loss, further correcting for timing of the shocks and the risk-aversion (by using implied TTM ) and finally a remainder term due to the fact that itself depends on . Using , we may then relate the Delta spread to the joint effect of the charm (or Delta decay, measuring the instantaneous rate of change of delta over the passage of time) and the TTM spread. Since we have that and the digital Call charm is positive unless the option is deep ITM/deep OTM, we have

The sign of is more complicated, since implied TTM is ill-defined for digital options due to the changing sign of Theta. Overall, we observe that liquidity shocks make the hedges more extreme; thus for OTM options, the risk-averse investor tends to hold fewer shares of stock; for ITM options the investor tends to hold more. An intuitive understanding is that the illiquidity shock reduces variance of , so starting in-the-money one is more likely to end ITM, and hence the investor should hold more shares there, and vice versa.

8. Conclusion

In this paper, we considered the valuation and hedging problem of European options in a regime-switching market subject to liquidity shocks. Investors exposed to such illiquidity risk will generally demand a positive risk premium (i.e. offer to pay less to purchase options). Our numerical experiments suggest that the entropic risk premium associated with the MEMM is negligible in our model. On the other hand, indifference prices may impose significant liquidity premia depending on the option type. While these are small for vanilla Calls and Puts, we observed up to 10% price differences for digital options (namely OTM digital Call). For options with monotone time-value a simple way to adjust for liquidity risk is available through the adjusted TTM formalism which allows continued use of the Black-Scholes formulas after modifying the option’s time-to-maturity. We believe this idea is a useful guide for traders who want a transparent rule to adjust their valuations from the base-case. In terms of the resulting hedging adjustments, the illiquidity threat causes the investor to hold more shares in-the-money and fewer shares out-of-the-money due to the reduced time-to-maturity; this correction can be approximated using adjusted Delta as well, and more generally by looking at the resulting TTM impact and the option Charm.

Even after several simplifying assumptions, our model remains complex. In D we revisit a more general formulation of the impact of liquidity on asset dynamics; as can be seen in such generality little can be said beyond numerical studies. Consequently, we recommend to start with a well-understood model (e.g. Black-Scholes) and then incrementally adjust for other risks (such as risk aversion, jump risk, illiquidity risk, etc.); in that case our analysis here, isolating impact of trading interruptions, can be used as one of such steps in obtaining the final risk-adjusted option value.

Appendix A Proof of Proposition 3.2

Under a general EMM , at time , we prove that the risk neutral price with initial state can be written in the form (3.2). Similar arguments for will be omitted.

Let be the transition rates of under . Denote by (resp. ) the first transitioning time from liquid state 0 to illiquid state 1 (resp. from state 1 to state 0), which have intensities and . Therefore, starting with , we have two possible cases, represented by , and leading to the following expansion of the price

where the last equality is due to the independence of and and is the density of . Substituting and

yields (3.2).

Appendix B Proof of Proposition 4.1 and Theorem 4.4

Let us first sketch out the main four steps of the proof. First, through the standard stochastic control arguments, we derive the following HJB equation for ,

| (B.1) | ||||

with terminal condition . Using the scaling properties of exponential utility, we consider a candidate solution of the form . Substituting into (B.1) yields that must satisfy the equation (4.3). The difficulty arises due to the coupled form of (4.3) which poses several technical challenges.

To circumvent this problem, in our second step, we consider an approximation scheme defined in (B) for and show that the corresponding functions are bounded and are classical solutions of the respective PDEs. This is the longest part of the proof and relies on a doubly-iterative setup. Third, we provide a stochastic control representation for which shows the convergence . Finally, using the properties of we establish a verification theorem for .

To introduce our iterative scheme, we consider a model with at most liquidity shocks on (a similar strategy is used in [5]). Formally, let

denote the number of liquidity shocks by time . Then we define a counting process with intensity and use the superscript to denote the resulting wealth process and stock process . In analogue to the original we then consider the value functions defined in (4.5).

Step 1: Control Representation

Usual arguments imply that from (4.5) satisfy (in viscosity sense)

| (B.2) |

where the terminal condition is , .

Making the ansatz

| (B.3) |

and substituting the candidate optimizer into equation (B), we are led to consider the following iterative equations for ’s,

| (B.4a) | |||

| (B.4b) | |||

| (B.4c) | |||

where and

| (B.5) |

Step 2: Classical Solutions

The present step is to prove that equations (B.4) have bounded classical smooth solutions ’s for , , , and .

By assumption, is bounded, so there exist constants such that , for all . It follows that , for all and . Being related to the classical B-S price, is in and satisfies

Next, follows a linear ODE in (B.4b), thus we have explicitly

It is easy to see that .

We now use induction to show that there exists a series of smooth and bounded functions and , , which are the solutions to equations (B.4). To apply the inductive argument it is sufficient to show that there exists a classical solution to the semi-linear parabolic PDE (B.4c) such that (same argument as for will then take care of ). Typical existence and uniqueness results for solutions to semi-linear parabolic equations, such as [1], do not apply here because they require that the non-linear term be uniformly Hölder-continuous on the domain. In our equation, however, the non-linear function is not globally Hölder continuous in variable . We therefore follow Zhou [26] to resolve this difficulty through a further iterative argument. The main idea is to convert (B.4c) into a series of linear PDEs, and using the comparison principle prove that the linear PDEs solutions converge to the solution of the original semi-linear PDE.

First, we prove that if the solution exists, then it is bounded. Let us define

Then

| (B.6) | |||

| (B.7) |

So by the comparison principle stated in section (i) in the Appendix of [26], we have if it exists. Note that is not globally Hölder continuous, but it is locally Lipschitz continuous in when . Therefore, there exist positive constants and such that

| (B.8) |

for and . Note that and are independent of , , and .

Next, we construct the sequence via and for ,

| (B.9) | ||||

with terminal condition . The PDE (B.9) is linear, so classical existence and uniqueness results guarantee we have a series of smooth solutions . Next we use induction to prove that .

On the other hand, similarly, we have

Therefore, by the comparison principle, we have . Now we assume , and prove that .

By (B.9), we obtain

On the other hand, we have

So, by the comparison principle again, we have , completing the induction on .

Lastly, we prove that the sequence converges to the solution of (B.4c) for as . Notice that is a monotone decreasing sequence, bounded below by , for all , hence, it converges to some pointwise. Using the fact that are bounded, it follows that is of at most exponential growth in so by Appendix A in [26] we obtain that is in and hence is the unique classical solution of (B.4c) for . This completes the inductive step in .

Step 3: Convergence

To establish the uniform convergence in (4.6), we apply Theorem 3.2 in [5] since the exponential utility is polynomially bounded at 0. It follows that for large enough, is arbitrarily close to which is intuitive since the probability of more than shocks is exponentially small in . However, since we do not have control on the rate of convergence, we cannot establish such properties for the corresponding controls so it is not clear whether the hedging strategies also converge.

Step 4: Verification Theorem

We are finally in position to provide a verification theorem for the original PDE (4.3). Similar arguments to those below also provide a verification theorem for the iterative (B) and are omitted.

Lemma B.1.

Proof.

Given an arbitrary admissible strategy , we define the process as the solution to the equation . Applying Ito’s formula to (B), we obtain

| (B.10) |

Note: for notational convenience, we omitted the parameters in .

Then, in the above equation we replace with , where is the compensated Poisson process associated with . Thanks to the integrability assumptions, the stochastic differentials in (B.10) are stochastic differentials of -martingales. Therefore, by using the boundary conditions of the HJB equations (B), integrating up to the first liquidity shock instant , and taking expectations on both sides under measure, we have

| (B.11) |

The parameters in -functions in the integral are in the right hand side of equations. Since the ’s satisfy the HJB equations (B), the term inside the expectation on the RHS is negative a.s., and therefore

| (B.12) |

Using the fact that are static on , so that

and applying the strong Markov property of at we obtain

By induction on the transition times it follows that

| (B.13) |

Since a.s., and using the fact that is bounded from below, we conclude using the dominated convergence theorem that

| (B.14) |

Appendix C Numerical Scheme

To solve for the indifference price , we apply implicit finite-difference scheme to the system (4.8). Working with the log-price , we use an equally spaced mesh , with grid points , , , and , , with

| (C.1) |

Letting denote the option price on the grid, and similarly for , we use the standard second-order centered finite-difference approximation (see e.g. [25]) for all the first and second derivatives of and use one-sided approximations at the boundaries and . To avoid the difficulty of the nonlinear term in the -PDE, the following first order approximation is used

| (C.2) |

The resulting implicit tri-diagonal system for is solved using the Thomas algorithm, see [24, Ch 3.5]. In the second half-step, we apply an explicit Euler scheme for the -ODE (second line of (4.8)) using the just-computed ,

| (C.3) |

which can be explicitly solved for .

Appendix D General Illiquid Dynamics

One could choose to work with (2.5), the general case when , , and . In that case the redefined value functions and still allow separation of wealth, however since is non-constant during the liquidity shock, solves a two-dimensional PDE in that in turn creates further -dependence in the HJB equation satisfied by . With the extra state variable , we no longer have a closed-form solution for the Merton problem (i.e. when ) either. In analogue to the indifference price definition in (4.7) we can show that the indifference prices satisfy the HJB equations (cf. (4.8))

| (D.1) | ||||

with terminal condition: . No analytic insights into (D.1) seem possible. If we assume a static illiquid state (), but , then the resulting is independent of (because ), and the price equations (D.1) can be simplified to

| (D.2) |

In (D) the Merton terms and are free of as well, and are given implicitly via

| (D.3) |

We hope these derivations convince the reader that this more general route is fraught with tedious complexity and hence provide intuition for the use of our main model in Section 2.

References

- [1] D. Becherer, Rational hedging and valuation with utility-based preferences, Ph.D. thesis, Technical University of Berlin, 2001.

- [2] by same author, Utility–indifference hedging and valuation via reaction–diffusion systems, Proceedings of the Royal Society of London. Series A: Mathematical, Physical and Engineering Sciences 460 (2004), no. 2041, 27–51.

- [3] C. Blanchet-Scalliet, N. El Karoui, and L. Martellini, Dynamic asset pricing theory with uncertain time-horizon, Journal of Economic Dynamics and Control 29 (2005), no. 10, 1737–1764.

- [4] F. Delbaen, P. Grandits, T. Rheinlander, D. Samperi, M. Schweizer, and C. Stricker, Exponential hedging and entropic penalties, Mathematical Finance 12 (2002), no. 2, 99–123.

- [5] P. Diesinger, H. Kraft, and F. Seifried, Asset allocation and liquidity breakdowns: what if your broker does not answer the phone?, Finance and Stochastics 14 (2010), no. 3, 343–374.

- [6] R.J. Elliott, L. Chan, and T.K. Siu, Option pricing and Esscher transform under regime switching, Annals of Finance 1 (2005), no. 4, 423–432.

- [7] H. Föllmer and M. Schweizer, Hedging of contingent claims under incomplete information, Applied Stochastic Analysis, Stochastics Monographs (M.H.A. Davis and R.J. Elliott, eds.), vol. 5, Gordon and Breach, London/New York, 1991, pp. 389–414.

- [8] M. Frittelli, The minimal entropy martingale measure and the valuation problem in incomplete markets, Mathematical Finance 10 (2000), no. 1, 39–52.

- [9] P. Gassiat, F. Gozzi, and H. Pham, Investment/consumption problem in illiquid markets with regimes switching, 2011, Arxiv preprint arXiv:1107.4210.

- [10] V. Henderson and D. Hobson, Utility indifference pricing–an overview, Indifference Pricing: Theory and Applications (R Carmona, ed.), Princeton University Press, 2009.

- [11] R. Houssou and O. Besson, Indifference of defaultable bonds with stochastic intensity models, Arxiv preprint arXiv:1003.4118 (2010).

- [12] A. Ilhan, M. Jonsson, and R. Sircar, Portfolio optimization with derivatives and indifference pricing, Indifference Pricing: Theory and Applications (R Carmona, ed.), Princeton University Press, 2009.

- [13] I. Karatzas and S.E. Shreve, Brownian motion and stochastic calculus, vol. 113, Springer-Verlag, 1991.

- [14] A. Kirilenko, A.P. Kyle, M. Samadi, and T. Tuzun, The flash crash: The impact of high frequency trading on an electronic market, Tech. report, Available on SSRN http://papers.ssrn.com/sol3/papers.cfm?abstract-id=1686004, 2011.

- [15] T.S.T. Leung, A Markov-modulated stochastic control problem with optimal multiple stopping with application to finance, Decision and Control (CDC), 2010 49th IEEE Conference, IEEE, pp. 559–566.

- [16] F.A. Longstaff, Financial claustrophobia: Asset pricing in illiquid markets, Tech. report, National Bureau of Economic Research, 2004.

- [17] M. Ludkovski and H. Min, Illiquidity effects in optimal consumption-investment problems, Arxiv preprint arXiv:1004.1489 (2010).

- [18] O. Menkens, Crash hedging strategies and worst–case scenario portfolio optimization, International Journal of Theoretical and Applied Finance 9 (2006), no. 4, 597–618.

- [19] Y. Miyahara, Canonical martingale measures of incomplete assets markets, Probability theory and mathematical statistics (Tokyo, 1995) (1996), 343–352.

- [20] R. Rouge and N. El Karoui, Pricing via utility maximization and entropy, Mathematical Finance 10 (2000), no. 2, 259–276.

- [21] E.S. Schwartz and C. Tebaldi, Illiquid assets and optimal portfolio choice, Tech. report, National Bureau of Economic Research, 2006.

- [22] M. Schweizer, Approximation pricing and the variance-optimal martingale measure, The Annals of Probability 24 (1996), no. 1, 206–236.

- [23] T.K. Siu and H. Yang, Option pricing when the regime-switching risk is priced, Acta Mathematicae Applicatae Sinica (English Series) 25 (2009), no. 3, 369–388.

- [24] J.C. Strikwerda, Finite difference schemes and partial differential equations, 2 ed., SIAM, Philadelphia, 2004.

- [25] P. Wilmott, S. Howison, and J. Dewynne, The mathematics of financial derivatives, Cambridge University Press, Cambridge, 1995, A student introduction.

- [26] T. Zhou, Indifference valuation of mortgage-backed securities in the presence of prepayment risk, Mathematical Finance 20 (2010), no. 3, 479–507.