Maximum likelihood approach for several stochastic volatility models

Abstract

Volatility measures the amplitude of price fluctuations. Despite it is one of the most important quantities in finance, volatility is not directly observable. Here we apply a maximum likelihood method which assumes that price and volatility follow a two-dimensional diffusion process where volatility is the stochastic diffusion coefficient of the log-price dynamics. We apply this method to the simplest versions of the expOU, the OU and the Heston stochastic volatility models and we study their performance in terms of the log-price probability, the volatility probability, and its Mean First-Passage Time. The approach has some predictive power on the future returns amplitude by only knowing current volatility. The assumed models do not consider long-range volatility auto-correlation and the asymmetric return-volatility cross-correlation but the method still arises very naturally these two important stylized facts. We apply the method to different market indexes and with a good performance in all cases.

pacs:

89.65.Gh, 02.50.Ey, 05.40.Jc, 05.45.TpI Introduction

Volatility is a magnitude aiming to capture how big is the amplitude of price return fluctuations hull ; bouchaud2003theory . It is associated with the risk of holding an asset stating that the higher the volatility the riskier the market price. Investors pay sometimes more attention to volatility than to the price level or the current trend of a stock. The role of volatility becomes even more crucial when trading with financial derivatives like options since the value of volatility almost fully determines the price of this sort of contracts hull ; bouchaud2003theory . However, the volatility itself is not directly observed and the financial markets and their actors lack of an unique consensus for providing its value.

Therefore, there is no other choice than trying to infer in some way or another the value of volatility from price time series. In practice, this means that it is necessary to first assume a model governing financial asset dynamics and second to extract volatility value from data time series under the perspective of the model dynamics considered.

The physicist Osborne proposed the Geometric Brownian Motion model (GBM) in 1959 osborne1959brownian . The GBM difussion process drives the logarithmic price changes with a constant diffusion coefficient typically called volatility. In this case, computing market volatility first means to calculate the standard deviation of the logarithmic price changes over time periods of length . And, secondly, volatility would then be the ratio between the standard deviation and the square root of since we are implicitly assuming the GBM difussion model.

Further studies in financial data have led to establish that the GBM is very incomplete bouchaud2003theory and it appears to be unable to explain quite a long list of stylized facts observed in financial markets bouchaud2003theory ; cont2001empirical . Specially during the last two decades, several models have been proposed with the aim of capturing (i) the existence of fatter tails in the log-price fluctuations, and (ii) the presence of non-trivial memory in the market dynamics bouchaud2003theory . A very natural improvement of the GBM is to consider volatility as a random process following another continuous time diffusion process hullpaper ; scott ; wiggins ; Barndorff ; saichev ; bacry ; calvet ; delpini . The price and the hidden Markov process for the volatility therefore configure a two-dimensional difussion process and the approach belongs to the so-called stochastic volatility (SV) modeling Ghysels ; fouque2000derivatives . The approach is analogous to random diffusion modeling which describes dynamics of particles in random media and applicable to a large variety of phenomena in statistical physics and condensed matter ben-avraham .

Among the existing SV models Ghysels ; fouque2000derivatives ; perello2004comparison ; delpini , the most basic ones are the Ornstein-Uhlenbeck (OU) stein ; perelloijtaf ; bormettiijtaf , the Heston model heston1993closed ; dragulescu ; bormetti2010 being in fact a Feller process, and the exponential Ornstein-Uhlenbeck (expOU) masoliver2006multiple ; sircar ; bormetti2008 . With the aim of extracting volatility from financial markets data, the current work develops much further the maximum likelihood (ML) estimation applied to the expOU model in Ref. eisler2007volatility by one of us. We here extend the methodology to the OU and Heston SV models but we also study some of the most important statistical features observed in financial markets bouchaud2003theory ; cont2001empirical ; delpini : the return and volatility probability densities (pdf’s), the volatility auto-correlation and the leverage correlation, and the Mean First-Passage Time. For doing all these, we use eight daily indexes: Dow Jones Industrial Average (DJI), Standard and Poor’s-500 (S&P), German index DAX, Japanese index NIKKEI, American index NASDAQ, British index FTSE-100, Spanish index IBEX-35 and French index CAC-40. We also provide the method abilities of predicting future absolute value of price returns knowing today’s volatility.

II The stochastic volatility market models and basic volatility estimators

The starting point of any SV model is the GBM model osborne1959brownian

| (1) |

where corresponds to a Wiener noise (i.e., a zero mean and unit variance Gaussian process), is a financial price or the value of an index, is the drift and is the volatility.

If we define the zero-mean return as

| (2) |

where is the initial time. Let us note that assumes independent and stationary increments in the financial time series since Osborne’s work in 1959 osborne1959brownian . We can however rewrite Eq. (1) as follows

| (3) |

The term was initially considered to be constant. However, most of the existing market models nowadays assumes that the term –also called volatility– is a time varying variable.

SV models assume that the volatility is a hidden Markov process where obeys a subordinated diffusive stochastic differential equation. Under this perspective, the two-dimensional dynamics reads fouque2000derivatives

| (4) | |||

| (5) |

where are Wiener processes that may or not be independent. As is always defined as a monotonically increasing function, is sometimes also called volatility. As shown in Tab. 1, each model has its own expressions of , and . The proposed models in the literature change in terms of these functions but in general there is a wide consensus to consider process with a (negative) mean reverting force that leads the probability density function of the volatility to a stationary solution when time is sufficiently large.

Let us focus on the volatility estimation procedures. As a first approximation and as mentioned in the introduction, the volatility can be viewed as the standard deviation of the empirical daily zero-mean return changes

As we are considering daily data, we are assuming discrete time increments and discrete return increments . In such a case, we are implicitly assuming the GBM provided by Eq. (3) with constant volatility in daily units.

As a second level of approximation we allow for time varying volatility. Observing Eq. (3), we now define volatility as

| (6) |

and we have different volatility for different days. However, the volatility obtained has a skewed stationary probability density inconsistent with volatility modeling as discussed in Refs. bouchaud2003theory ; masoliver2006multiple .

A third possibility is to compute a deconvoluted volatility masoliver2006multiple

| (7) |

which does not show a skewed probability density for the volatility but its greatest drawback is that estimated volatility appears to be a very noisy signal (see for instance Refs. bouchaud2003theory ; masoliver2006multiple ; silva ; stanley for alternative approaches and further discussions).

| expOU | OU | Heston | |

|---|---|---|---|

III Maximum likelihood approach

We here briefly present the methodology proposed in Ref. eisler2007volatility that allows us to have some criteria for choosing the best values of the random realization . Naively speaking, the method represents an improvement of the deconvoluted volatility estimator using a ML methodology.

To explain the procedure it is more convenient to work with the discrete time version of the model. To this end, suppose that is a small time step and that the driving noises in Eqs. (4)-(5) can be approximated by

| (8) |

where are independent standard Gaussian processes with zero mean and unit variance. The discrete time equations of the model describing increments of and thus read

| (9) | |||||

| (10) |

where and . From Eqs. (9)–(10), we can get

| (11) | |||||

| (12) |

For simplicity we assume that and are independent standard Gaussians. We will discuss in Section IV.4 that our methodology does not need to consider negative cross-correlation among these two Gaussian variables as discussed for instance by the models studied in Refs.delpini ; leverage ; bormetti2008 . Hence,

and this finally can be transformed into the conditional probability density function (pdf)

| (13) |

by including the Jacobian of the transformation defined by Eqs. (9)-(10).

For a given number of realizations, the probability of the set for the period can be easily obtained. The Markov property of the process ensures that one can decompose the joint pdf of this set as a chain of products between conditional pdf’s

| (14) |

Substituting Eqs. (11)-(12) into Eq. (13) and inserting them into Eq. (14), we apply the chain of products between conditional pdf’s and we finally get the joint pdf

| (15) |

We remind that our aim is to find a proper realization of the volatility given a return and this will be done by applying a ML procedure to variable . For this reason, we will be able to omit three terms in Eq. (15). The first summand comes from the normalization constant of the Gaussian distribution (13). It appears in every conditional probability density and this is the reason for the factor , which is the number of time steps between and . The resulting term does not depend on the realization, so that we can neglect it for a maximization with respect to the set of realizations . The second summand is mostly the sum of the Jacobian transformations of each transition probability. Stochastic volatility models assume that these and are continuous and monotonically increasing functions or even constants. Because of this, we can also neglect this term in the maximization procedure. The term is fixed by the initial conditions of the process. We could here assume a known initial return – which can be set to zero – and take a random following its stationary distribution. Therefore we would have . Had we taken another initial condition, the technique would have given equivalent results (we have checked this by using several initial distributions). For this reason and in order to improve the convergence of the ML estimate we have neglected also this contribution.

We can therefore write

| (16) |

and omit the other three terms for the reasons summarized above (cf. Eq. (15)). Further details can be found in Ref. eisler2007volatility .

Let us finally briefly provide an interpretation for the two remaining terms in Eq. (16). The first term of Eq. (16) measures the return variations with respect to the volatility. We notice that the higher the fluctuations are, the lower the contribution to the probability is. The second term computes the fluctuations of the volatility with respect to the volatility of the volatility. Again, the bigger this term, the lower the contribution.

III.1 The Algorithm

As mentioned above, our goal is to find a proper realization of the volatility series given return series which is directly observed and taken from empirical data. We then should however consider the following conditional probability of a single event

| (17) |

And as we solely want to maximize this probability for a fixed set of returns configuring a path, the second term can be neglected and therefore maximizing Eq. (17) is equivalent to maximizing Eq. (16). In practice, the method therefore computes different realizations of volatility variable for a given return path and ML estimation dictates that we should take the realization that makes bigger the probability given by Eq. (16). The method filters the Wiener noise and let us obtain an estimation of the hidden volatility for a given price return evolution.

Specifically, we have implemented an algorithm which sequentially follows the four steps:

-

1.

Looking at Eq. (4), we generate a simple realization of Y by taking

(18) where , with taken from data, and being a zero mean and unit variance Gaussian realization.

-

2.

We substitute and into Eq. (16) and we then compute the probability.

-

3.

We iterate times the steps 1 and 2. We finally keep the realization that brings a higher probability in Eq. (16) and define it as .

-

4.

Finally, the estimator of the volatility at time is

(19)

We observe that this procedure depends on and . We have implemented the algorithm with and . We have used these values because larger time window and a larger number of iterations do not improve the quality of our estimation.

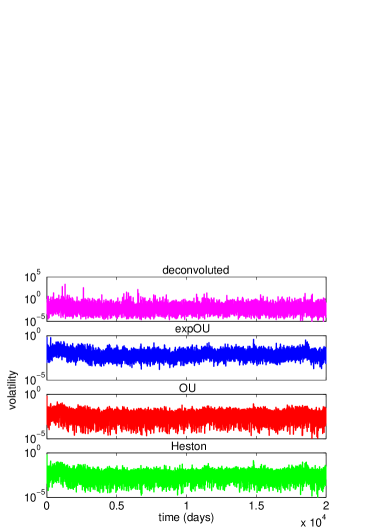

We observe that (cf. Eq. (7)) is calculated with a single computed random value while chooses an optimal value after iterations. As observed in Fig. 1, with Dow Jones daily data from October 1928 to July 2011 and in all studied models is less noisy than . The fluctuation values of the deconvoluted is three or four orders of magnitude larger than the fluctuation values of the three ML algorithms herein proposed.

We also stress the fact that the SV model jointly with their parameters are chosen before starting the computation. The parameters can however be easily estimated beforehand using historical data eisler2007volatility . See for instance Refs. Shephard ; barucci ; comte ; griffin ; jongbloed ; morimune ; todorov ; andresen ; asai for alternative procedures for reconstructing volatility being more or less dependent on the volatility model chosen. Some of these approaches also include the parameter estimation procedure within the volatility estimation. Others are mainly devoted to capture the long term memory of the volatility.

IV Results and comparison between models

We here study the probability density of the volatility, the conditional return, the Mean First Passage Time (MFPT) and the two most important correlations with time (volatility auto-correlation and return-volatility asymmetric correlation or leverage effect) along the three different SV models. Data to perform comparisons across the different models described in Sections IV.1-IV.4 corresponds to the Dow Jones daily data from October 1928 to July 2011 but Section IV.5 extends the survey to other financial market indices.

The parameters we use for the numerical calculations are those given in literature to reproduce the DJI dragulescu ; masoliver2006multiple ; perelloijtaf and they are summarized in Tab. 2.

| OU | |||

|---|---|---|---|

| Heston | |||

| ExpOU |

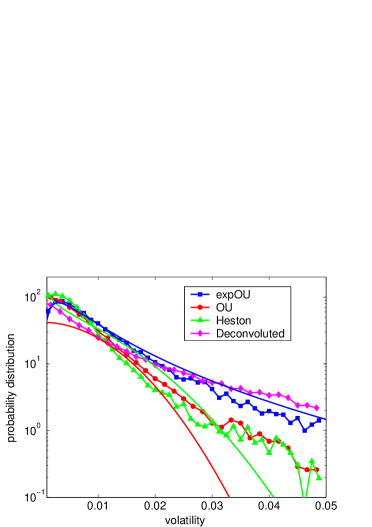

IV.1 Behavior of our estimator

In order to compare how our algorithm works on each model, we have first calculated the probability distribution of the different volatilities. Just for the sake of completeness we represent the stationary volatility probability density function (pdf) in Fig. 2 thus showing, as expected, that the form of the curves depends on the model choice. It should be noticed that we have used the absolute value of the volatility in the case of the OU model for the whole paper. Figure 2 also shows that best agreement between theoretical curve and empirical data points corresponds to the expOU case. Several studies in the literature have measured volatility stationary pdf bouchaud2003theory ; masoliver2006multiple ; silva ; stanley and all of them suggest an exponential decay corresponding to a log-normal curve masoliver2006multiple ; stanley or an inverse gamma distribution bouchaud2003theory at least with low frequency data. It shall however be noted that a very recent model with a two-dimensional diffusion process succeeds to provide an inverse gamma distribution delpini and it can be indeed interesting to apply the methodology to this new model.

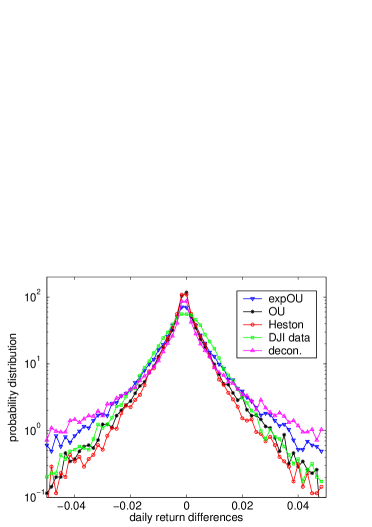

We also compute artificial return fluctuations for each model by multiplying with a Wiener noise realization as given by Eq. (3). Doing that, we can somehow compare the daily zero-mean return pdf of the three SV models with the empirical data of daily returns . In Fig. 3, we observe that the peak of empirical data is not reproduced by any model. In Fig. 3 we see that the tails of the real are similar to empirical data in all models. The differences among the models can be explained by the fact that the parameter estimation in each model has not been systematically optimized. We observe that the expOU model is the one that provides worse agreement with empirical data. A possible reason for that might be due to the fact that the expOU model has a multiplicative relation with the underlying random process with and therefore needs a really accurate calibration (cf. Tab. 1).

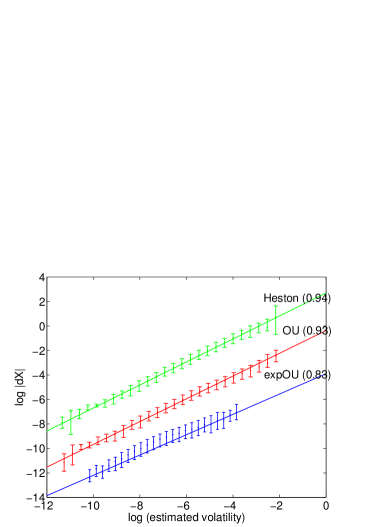

IV.2 Predictive power of the method

This section aims to look for some inferred behavior in future absolute value zero-mean return based on the estimation of current value of volatility. We first consider the logarithm of Eq. (3)

| (20) |

and we can now obtain the conditional median of the empirical given we know through our ML method. In such a case, we should have the following linear regression for the conditional median

| (21) |

where is a constant. In Fig. 4 we plot this relationship using the three different models. We there however observe the slopes are not equal to 1. In this sense, Heston and OU model have the best performance although we should take into account that the performance might be very sensitive to the efficiency of the parameter estimation procedure.

| expOU | expOU | OU | OU | Heston | |

|---|---|---|---|---|---|

| -0.12 | -0.064 | -0.15 | -0.064 | -0.048 | |

| 0.82 | 0.72 | 0.85 | 0.67 | 0.63 |

In any case, we still have a linear regression measuring how big is going to be price fluctuation today based on yesterday’s volatility level. One can go one step further and use the observed relationship between price fluctuations and volatility to forecast price changes amplitude at a longer time based on volatility at time . A reasonable modification of the conditional median given by Eq. (21) is

| (22) |

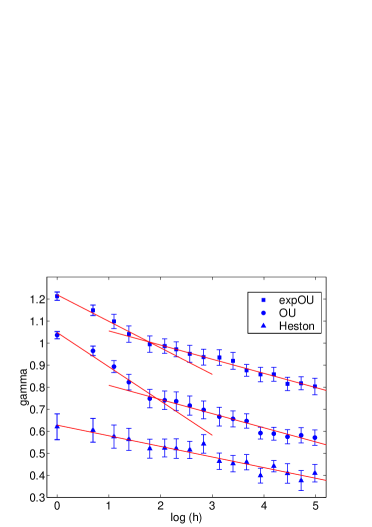

which was already proposed in Ref. eisler2007volatility but solely applied to the expOU case. We here therefore calculate in terms of time horizon for the expOU, the OU and the Heston cases. Figure 5 shows a linear relation between and for the three cases. We therefore propose the heuristic formula

| (23) |

where and are the coefficients of the regression. Table 3 shows the empirical values of the regression. Since we also observe a distinct behavior between short and long time horizon in the cases of the expOU and the OU models, we also provide two different regression parameters and .

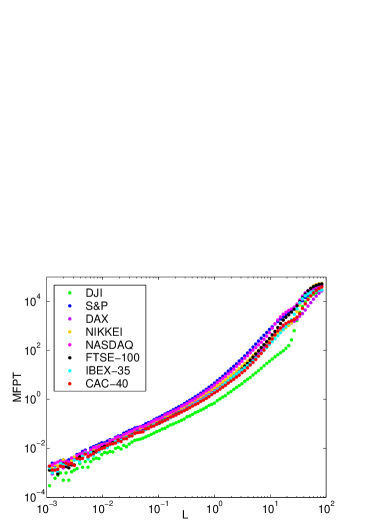

IV.3 Mean First-Passage Time

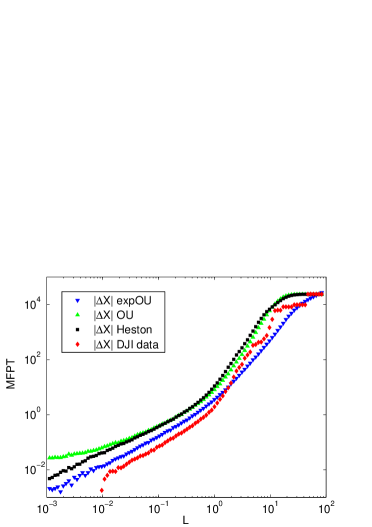

First-passage and extreme value studies have a long tradition of applications to physics, biology, chemistry, and engineering, all of them related to non equilibrium processes. This sort of events appear also to be important in the financial markets context as a valuable tool to calibrate risk in a more sophisticate manner than just providing the standard deviation. It also does represent an alternative and, in a way, improved method masoliver to the so-called Value at Risk embrechts . First-passage and other extreme value have already been analytically and empirically studied under the perspective of the here presented SV modeling masoliver2007extreme ; masoliver ; mario . In this section, we focus on the Mean First-Passage Time (MFPT) of the volatility which provides the average time spent by price fluctuations to cross a certain value . See Ref. masoliver2007extreme for a further theoretical input concerning the MFPT and the SV models herein studied.

We here want to extend the analysis with the use of our ML method instead of simply taking the absolute value of price returns as was done in Ref. masoliver2007extreme . In order to compare different models, we have to work with the dimensionless magnitude where is the mean of the estimated volatility in the stationary limit (). The expected stationary volatility masoliver2007extreme for the expOU model is

for the OU model is , and for the Heston model is

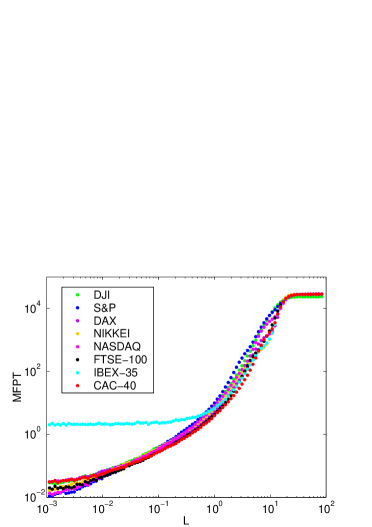

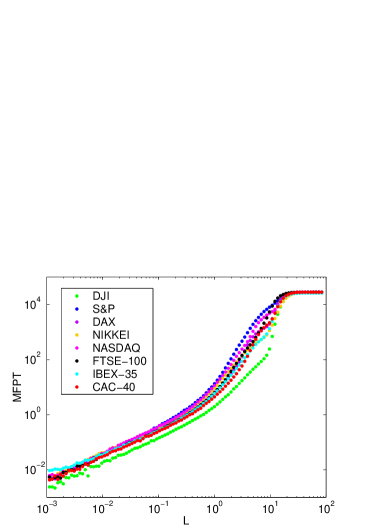

The MFPT of the three models is computed with their own volatility estimation multiplied by an artificial Wiener random realization . Figure 6 compares the different results with a qualitative agreement with empirical data in all three cases. The expOU case appears to be the closest to the empirical MFPT curve. Figure 6 shows that the empirical MFPT results and the three artificial ones can all of them be roughly described by

| (24) |

with exponent and coefficient that changes depending whether or as also shown in Ref. masoliver2007extreme . Their values are shown in Tab. 4.

| expOU | OU | Heston | DJI data | |

|---|---|---|---|---|

| 1.1 | 0.8 | 1.0 | 1.3 | |

| 2.4 | 3.1 | 2.9 | 2.9 |

IV.4 Correlations

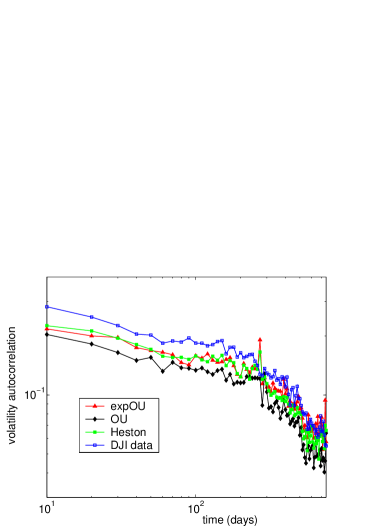

We now study how the ML approach keeps the main market time correlations that deeply and non-trivially involves volatility dynamics bouchaud2003theory . It is well-known that the volatility fluctuations have long memory correlation (over a year) and that volatility also shows negative and asymmetric cross-correlation with return changes (over several weeks), i.e. the leverage effect bouchaud2003theory . However, it is not clear whether the proposed method is able to provide these two different correlations.

Figure 7 shows how the volatility autocorrelation

| (25) |

of each estimator is still significant for up to hundreds of days. It is important to stress that the OU and Heston models by themselves do not have this long range correlation since their mathematical expressions give an exponential decay for the volatility in terms of a characteristic time scale (see Ref. perello2004comparison and Tab. 1 for the meaning of this parameter). The expOU model is the only one that explains this long range effect with a cascade of exponentials masoliver2006multiple . Therefore, it can be said that the long-term memory is preserved due to the ML algorithmic method herein proposed. This feature manifests the robustness and effectiveness of the proposed method beyond the choice of the SV models been used.

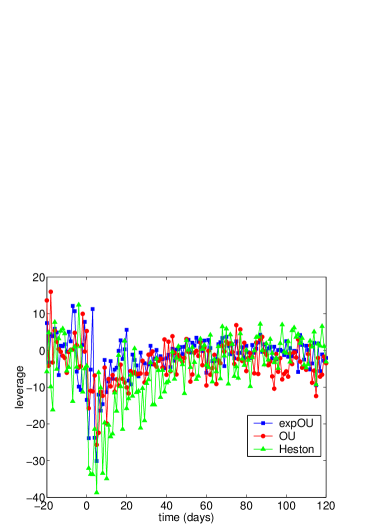

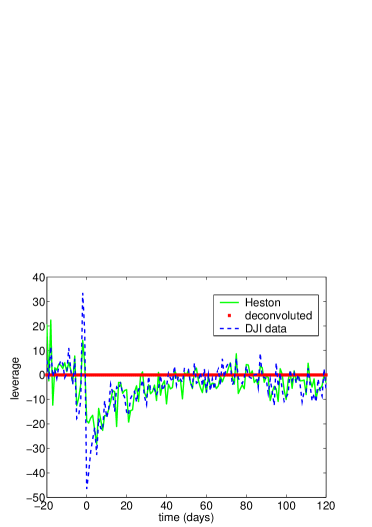

We now focus on another important correlation with time. The so-called leverage effect bouchaud2003theory defined by

| (26) |

measures the negative cross-correlation between price return fluctuations and volatility. Reference leverage shows that the three models are able to mathematically describe the empirical observation only if a non-zero and negative cross-correlation between and is considered (cf. Eq. (5)). Figure 8 shows the leverage correlation by first obtain the estimated volatility (26) and afterward compute the artificial return change by multiplying the estimated volatility by random realizations of . We remind that the current ML algorithmic method has not considered correlation. However, the iterative procedure of the ML method is able to naturally provide the leverage effect in the three models as shown. It is important to stress the fact that we do not need to sophisticate our models by including the cross-correlation coefficient between and since the same ML procedure naturally includes the negative correlation between these random sources. Adding the effect of correlation between and represents adding more terms in Eq. (16) and making the ML approach much less efficient in computational terms. The addition of this extra term would in any case provide redundant information to the maximization process.

Figure 9 shows the leverage correlation of the Heston model as an illustrative example. It compares ML approach with other ways of extracting volatility from data. Figure 9 demonstrates that ML approach gets same results as by using given by Eq. (6) but it also shows how we lose the correlation if we take the deconvoluted given by Eq. (7). Again, the result can be considered as a proof that our methodology is coherent and self-consistent. The other two models show very similar results as can be intuited in Fig. 8.

IV.5 Different market indexes

We have studied how our ML approach affects different SV models and we here would also like to verify if there is any difference between working with one stock market or another. Concretely, we have computed our estimation of the volatility for the following indexes: Dow Jones Industrial Average (DJI) (1928-2011), Standard and Poor’s-500 (S&P) (1950-2011), German index DAX (1990-2011), Japanese index NIKKEI (1984-2011), American index NASDAQ (1985-2011), British index FTSE-100 (1984-2011), Spanish index IBEX-35 (1993-2011) and French index CAC-40 (1990-2011). It is also important to stress that parameters used in each model are the ones from Dow Jones data and provided in Tab. 2 so in some sense there is now no over fitting due to the fact of extracting the parameter from the same data series we are analyzing. In all cases, the resulting time series satisfies the stylized facts that most of financial markets have in common cont2001empirical ; bouchaud2003theory .

We first observe that all markets show an estimated volatility considerably less noisy than the deconvoluted one (cf. Eqs. (19) and (7)). The reduction of the oscillations can be quantified by the coefficient

| (27) |

whose order of magnitude depends on the stock data as shown in Tab. 5.

| expOU | OU | Heston | |

|---|---|---|---|

| DJI | |||

| S&P | |||

| DAX | |||

| NIKKEI | |||

| NASDAQ | |||

| FTSE-100 | |||

| IBEX-35 | |||

| CAC-40 |

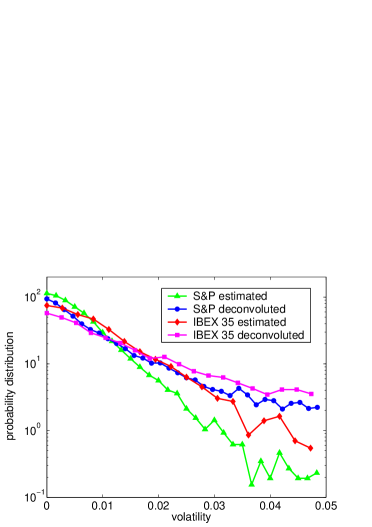

In Fig. 10, we plot the volatility pdf given by the Heston model for two different indexes. We notice the different width of the probability distribution of the two stocks because each market has a different volatility’s range of values. We can again appreciate the reduction of the fluctuations achieved with our estimated volatility when compared with the deconvoluted volatility (7).

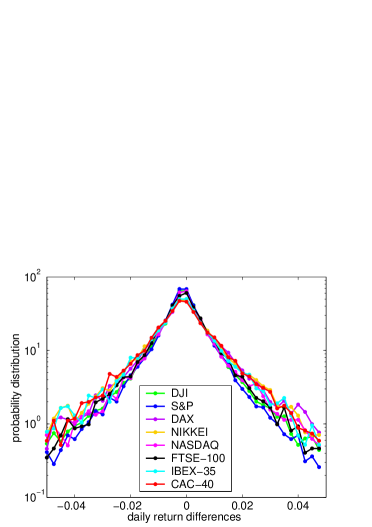

Figure 11 shows the probability distribution of the artificially computed return differences with the estimated volatility of each stock. In this case, we have used the expOU model. As we expected, we see that the width of the curves depend on the stock market but behavior is qualitatively similar. This also similarly occurs to the Heston and OU models.

In order to study the extreme values of the indexes, we have calculated the MFPT for the absolute value of returns calculated using the estimated volatility. In top Fig. 12 we have plotted the evolution of this MFPT when the model used is the expOU. We observe the clear coincidence of all the stocks except the Dow Jones which has slightly smaller MFPT which is incidentally the market from where parameters are extracted. If we look at the the OU case as shown in Fig. 13 it is the IBEX stock index that shows a different behavior specially to the range of small threshold . This can be justified by the fact that OU model allows for negative values of volatility while ML is just considering positive values of volatility. And the results for small will be the ones that can be more sensitive to this fact. Additionally the IBEX market is the one with smallest amount of data available. The Heston case shown in Fig. 14 recovers the nice collapse provided by the expOU model where the DJI again appears slightly shifted. In any case, and for the IBEX with the OU model single exception, a common pattern is observed.

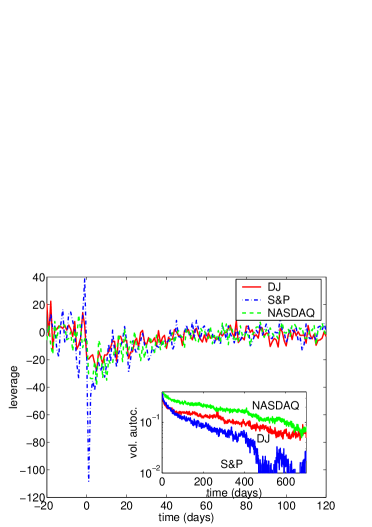

Finally, we show in Fig. 15 that there are some stocks which manifest more leverage than others. As an example, the S&P has bigger anti correlation than the Dow Jones. However, the important fact is that we find leverage in all markets. The same happens with the volatility autocorrelation because although the NASDAQ decays more slowly, all the stocks manifest significant autocorrelation for hundreds of days as expected bouchaud2003theory . Same results are found when we take the OU and expOU models instead of the Heston one.

V Conclusions

It is fairly known that the volatility is one of the main quantities in finance because it is a measure of price fluctuations and it gives information related to the risk of holding an asset. However, volatility is a magnitude which is not directly observable and one then needs to assume a given market model in order to infer the volatility value. Basic volatility estimation procedures have been presented and we have used a ML method that improves them since it is able to reduce noise and avoid bias in volatility signal.

We have applied the ML method by considering the most basic version of the expOU, the OU and the Heston SV uncorrelated models and we have compared them with the deconvoluted volatility showing big improvement in many aspects. We have observed that the fluctuations of the estimated volatility are smaller in all the models than in the deconvoluted estimation. The three models preserve the desired stationary volatility pdf for the volatility and keep the fat tail distribution for the price return changes. We have also found that all three models allow us to forecast future absolute value of returns with actual volatilities. We have also observed that the loss of forecast information has a double time scale in the expOU and the OU models.

Concerning the study of extreme events, we have found that our ML approach shows a nice concordance between the volatility MFPT estimated with the three SV models and the empirical MFPT. We have also focused on volatility’s time correlations and we have observed that all the three models show the existence of significant volatility autocorrelation for hundreds of days although Heston and OU models does not include this property beforehand. The leverage correlation that crosses volatility and price return fluctuations is also nicely described by all three models even though the ML method is not considering correlation between returns and volatility fluctuations beforehand. All of these confirm the fact that methodology is robust enough without needing to improve the SV models or to provide more efficient ways of estimating the parameters of the model. However, ML approach with alternative models with same level of sophistication like the recent model by Delpini and Bormetti delpini deserves attention in future research.

Finally, we have applied same method to other stock indexes. Volatility’s noise has been strongly reduced in all cases and we have corroborated that all the markets describe the several properties described before for the Dow Jones. The methodology therefore seems to be valid in a wide collection of financial market data.

Acknowledgements.

Financial support from Dirección General de Investigación under Contract No. FIS2009-09689 is acknowledged.References

- (1) J.C. Hull, Options, Futures, and Other Derivatives, Prentice-Hall, London, 2000.

- (2) J. Bouchaud and M. Potters. Theory of Financial Risk and Derivative Pricing: From Statistical Physics to Risk Management. (Cambridge University Press, Cambridge, 2003).

- (3) M. F. M. Osborne, Operations Research 7 (1959) 145–173.

- (4) R. Cont. Empirical properties of asset returns: stylized facts and statistical issues, Quantitative Finance 1 (2001) 223–236.

- (5) J.C. Hull and A. White, The pricing of options on assets with stochastic volatilities, The Journal of Finance 42 (1987) 281–300.

- (6) L. Scott, Option Pricing when the Variance changes randomly: Theory, Estimation, and an Application, J. Financial and Quantitative Analysis 22 (1987) 419–438.

- (7) J. Wiggins, Option values under stochastic volatility: Theory and empirical estimates, Journal of Financial Economics 19 (1987) 351–372.

- (8) O. E. Barndorff-Nielsen, and N. Shephard, Non-Gaussian Ornstein-Uhlenbeck-based models and some of their uses in financial economics, Journal of the Royal Statistical Society: Series B (Statistical Methodology) 63 (2001) 167–241.

- (9) A. Saichev and D. Sornette, Generic multifractality in exponentials of long memory processes, Physical Review E 74 (2006) 011111.

- (10) E. Bacry, J. Delour, and J. F. Muzy, Multifractal random walk, Physical Review E 64 (2001) 026103.

- (11) L. Calvet and A. Fisher, Multifractality in asset returns: theory and evidence, Review of Economics and Statistics 84 (2002) 381–406.

- (12) D. Delpini and G. Bormetti, Minimal model of financial stylized facts, Physical Review E 83, 041111 (2011).

- (13) E. Ghysels, A.C. Harvey and E. Renault, Stochastic Volatility, in C.R. Rao and G.S. Maddala (eds.), Statistical Methods in Finance (Amsterdam, North-Holland) (1996) pp. 119–191.

- (14) J. Fouque, G. Papanicolaou, and K. Sircar, Derivatives in financial markets with stochastic volatility (Cambridge University Press, Cambridge, 2000).

- (15) D. Ben-Avraham and S. Havlin, Diffusion and Reactions in Fractals and Disordered Systems (Cambridge University Press, Cambridge, 2000).

- (16) J. Perelló, J. Masoliver, and N. Anento, A comparison between several correlated stochastic volatility models, Physica A 344 (2004) 134–137.

- (17) E.M. Stein and J.C. Stein, Stock Price Distributions with Stochastic Volatility: An Analytic Approach, Review of Financial Studies 4 (1991) 727–752.

- (18) J. Masoliver and J. Perelló, A correlated stochastic volatility model measuring leverage and other stylized facts, International Journal of Theoretical and Applied Finance 5 (2002) 541–562.

- (19) G. Bormetti, V. Cazzola and D. Delpini, Option Pricing Under Ornstein-Uhlenbeck Stochastic Volatility, International Journal of Theoretical and Applied Finance 13 (2010) 1047–1063.

- (20) S. Heston, A closed-form solution for options with stochastic volatility with applications to bond and currency options, Review of Financial Studies 6 (1993) 327–343.

- (21) A. Dragulescu and V. Yakovenko, Probability distribution of returns in the Heston model with stochastic volatility, Quantitative Finance 2 (2002) 443–453.

- (22) G. Bormetti, V. Cazzola, G. Livan, G. Montagna, and O. Nicrosini, A generalized Fourier transform approach to risk measures, Journal of Statistical Mechanics (2010) P01005.

- (23) J. Masoliver and J. Perelló, Multiple time scales and the exponential Ornstein-Uhlenbeck stochastic volatility model, Quantitative Finance 6 (2006) 423–433.

- (24) J. Perelló, R. Sircar, J. Masoliver, Option pricing under stochastic volatility: the exponential Ornstein-Uhlenbeck model, Journal of Statistical Mechanics (2008) P06010.

- (25) G. Bormetti, V. Cazzola, G. Montagna, and O. Nicrosini, The probability distribution of returns in the exponential Ornstein Uhlenbeck model, Journal of Statistical Mechanics (2008) P11013.

- (26) Z. Eisler, J. Perelló, and J. Masoliver, Volatility: a hidden markov process in financial time series, Physical Review E 76 (2007) 056105.

- (27) A. C. Silva and V. M. Yakovenko, Stochastic volatility of financial markets as the fluctuating rate of trading: An empirical study, Physica A 382 (2007) 278–285.

- (28) Y. Liu, P. Gopikrishnan, P. Cizeau, M. Meyer, C.-K. Peng, and H. E. Stanley, The Statistical Properties of the Volatility of Price Fluctuations, Physical Review E 60 (1999) 1390–1400.

- (29) J. Masoliver and J. Perelló, Random diffusion and leverage effect in financial markets, Physical Review E 67 (2003) 037102.

- (30) O. E. Barndorff-Nielsen and N. Shephard, Econometric analysis of realized volatility and its use in estimating stochastic volatility models, Journal of the Royal Statistical Society: Series B (Statistical Methodology) 64 (2002) 253–280.

- (31) E. Barucci and R. Reno, On measuring volatility of diffusion processes with high frequency data, Economics Letters 74 (2002) 371–378.

- (32) F. Comte and V. Genon-Catalot, Penalized Projection Estimator for Volatility Density Scandinavian Journal of Statistics 33 (2006) 875–893.

- (33) J. E. Griffin and M. F. J. Steel, Inference with non-Gaussian Ornstein-Uhlenbeck processes for stochastic volatility, Journal of Econometrics 134 (2006) 605–644.

- (34) G. Jongbloed and F. H. V. der Meulen, Parametric estimation for subordinators and induced OU processes Scandinavian Journal of Statistics 33 (2006) 825–847.

- (35) K. Morimune, Volatility Models, Japanese Economic Review 58 (2007) 1–23.

- (36) V. Todorov, Estimation of Continuous-Time Stochastic Volatility Models with Jumps Using High-Frequency Data, Journal of Econometrics 148 (2009) 131–148.

- (37) T.G. Andersen, T. Bollerslev, and F.X. Diebold, Parametric and Nonparametric Volatility Measurement, in: L.P. Hansen and Y. Aït-Sahalia (eds.), Handbook of Financial Econometrics, Amsterdam: North-Holland (2010) pp. 67–138.

- (38) M. Asai, M. McAleer and M. Medeiros (2011), Modelling and forecasting noisy realized volatility, Computational Statistics and Data Analysis 56 (2012) 217–230.

- (39) J. Masoliver and J. Perelló, First-passage and risk evaluation under stochastic volatility, Physical Review E 80 (2009) 016108.

- (40) P. Embrechts, C. Klippelberg, and T. Mikosch, in Modelling Extremal Events, edited by I. Karatzas and M. Yor (Springer, Berlin, 1997).

- (41) J. Masoliver and J. Perelló, Extreme times for volatility processes, Physical Review E, 75 (2007) 046110.

- (42) J. Perelló, Mario Gutiérrez-Roig, and Jaume Masoliver, Scaling properties and universality of first-passage-time probabilities in financial markets, Physical Review E 84 (2011) 066110.