The Variance of Standard Option Returns

Abstract

The vast majority of works on option pricing operate on the assumption of risk neutral valuation, and consequently focus on the expected value of option returns, and do not consider risk parameters, such as variance. We show that it is possible to give explicit formulae for the variance of European option returns (vanilla calls and puts, as well as barrier options), and that for American options the variance can be computed using a PDE approach, involving a modified Black-Scholes PDE. We show how the need to consider risk parameters, such as the variance, and also the probability of expiring worthless (PEW), arises naturally for individual investors in options. Furthermore, we show that a volatility smile arises in a simple model of risk-seeking option pricing.

1 Introduction

Options are utilized by different investors for different goals. On the one hand options are often used for hedging, eliminating the risk of extreme downside events at the expense of forfeiting (some of) the gain of upside events. On the other hand, options are used for speculation, to increase the leverage of an investor that has strong convictions about the direction of the market and is willing to expose herself to substantial risk, with the potential of very large gains if the scenarios she anticipates are realized. Other uses are discussed in [18]-[19].

Regardless of the strategy in which they are being used, an option should be considered as a risky asset, with a distribution of returns determined by the distribution of returns of the underlying asset, but typically far more extreme, usually with significant probability of total loss or a gain of hundreds of percent. In this context it is bizarre that the most common piece of quantitative data given about options is the Black-Scholes price, which represents the current value of the expected value of the return of the option (under suitable assumptions about the distribution of returns of the underlying asset). Given that the distribution of the returns of the option is extreme, knowing its expected value is of limited significance, except maybe for the largest investors who are making many purchases and sales, and even these investors should be interested in knowing the relevant law of large numbers for their situation, and must take into account strong correlations. More information about the distribution of option returns is surely needed in order to make rational investment decisions.

Rather remarkably, we have not succeded in finding any literature examining the full distribution of the returns from options, even on the assumption of a lognormal distribution of returns of the underlying asset, beyond acknowledgment that this distribution is extreme, and, of course, calculation of its expected value. In part this can be attributed to the fact that seminal papers such as Black and Scholes [1], Merton [17], Cox, Ross and Rubinstein [6], all emphasize that any deviation of an option price from its risk-neutral valuation creates an arbitrage opportunity that cannot exist in a rational market. In addition, much literature focuses on the variation of returns from options due to lack of complete knowledge about the distribution of underlying assets, their rates of return and (particularly) their volatilities, see for example Coval and Shumway [5], Liu and Pan [16] and Goyal and Saretto [12]. It is not the intention of this paper to question the rationality assumptions behind risk-neutral option valuation. The thrust of this paper is to show that mathematically it is possible to compute different parameters describing the distribution of returns from an option, assuming a lognormal distribution of returns of the underlying asset, with known parameters. We focus on two (related) measures of risk: the variance and the probability of expiring worthless (PEW). In the case of vanilla European call and put options these parameters are straightforward to compute analytically, and we do this in section 2. Analytic expressions can also be given for European options with barriers and we illustrate this in section 3. For American options, things are more complicated. Analytic expressions cannot be found, but the moments of the distribution from which the variance and PEW can be derived satisfy modified Black-Scholes partial differential equations (PDEs) giving numerical schemes for computation. This is described in section 4.

In section 5 we give some simple examples of the use of the risk parameters we compute in individual investment decisions. In section 6, we use the variance parameter to build a simple model describing risk-averse or risk-seeking market pricing of options; we show that such a model is equivalent to the standard model with a volatility smile. Finally, section 7 contains closing comments and suggestions for further research.

2 European options

Assuming an underlying with a lognormal distribution with parameters and current price , the current value of the return on European call and put options with strike at time are

where in both formulas is a standard normal variable. A simple computation gives the expected values

where

These formulae are the Black-Scholes prices for calls and puts respectively. Note both and satisfy the Black-Scholes PDE

| (1) |

It is a straightforward calculation to find the variance of and . We find

The variances are then computed using and . By the Feynmann-Kac formula, both and satisfy the modified Black-Scholes PDE

| (2) |

The factor before the last term arises as the discount factor in and is . The relevant final condition and boundary conditions for the modified Black-Scholes PDE (for both call and put) are obtained be requiring that the variance should vanish as the final time is approached, and as .

In greater generality it is also possible to compute formulae for the th moments and , . The th moments satisfy the modified Black-Scholes PDE

due to the discount factor . There does not appear to be an explicit closed form for the moment generating functions of and , but it can be shown that these also satisfy a suitably modified Black-Scholes PDE.

Both the random variables and have a mixed discrete-continuous distribution, with a finite probability of being zero, and a continuous range of values above zero. For such distributions there are two possible ways of defining the zeroth order moment, either as or as the probability to be nonzero. For options, the probability of expiring worthless (PEW) is a quantity of interest. Clearly we have

Thanks to the relation of these quantities with zeroth order moments, they too solve a modified Black-Scholes PDE

| (3) |

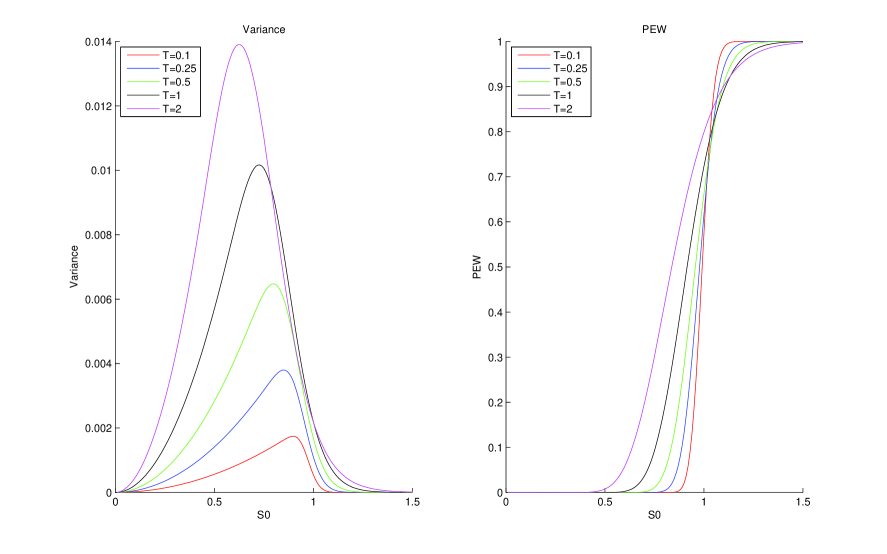

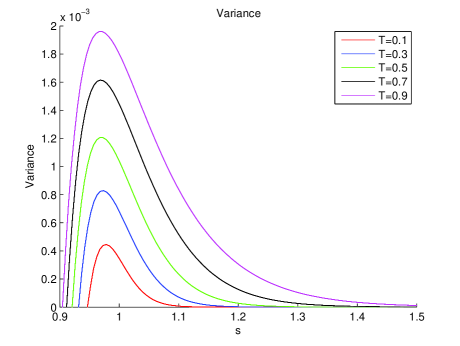

In Figure 1 we show the variance and PEW of a put option with , , as a function of and for a variety of different times . As expected, the variance is small for both low and high values of , and in general increases with . The location of the maximum variance falls as increases. The PEW tends to a step function for small times.

3 A down-and-out put option

The variance and the PEW can also be computed analytcially for European barrier options. We illustrate this in this section by considering the case of a down-and-out put; that is, a European put option with the usual 5 parameters and an additional “barrier” ; if at any time during the life of the option the price of the underlying falls below , then the value of the option is knocked to zero (irrespective of how the price develops after hitting the barrier).

We use the following result proven in [11]: if is a Weiner process with drift then

| (4) |

where

Note that if the RHS in (4) is simply . If or then the requirement that is automatically satisfied, as starts from and ends at . This is why in these cases. Remarkably the correction factor does not depend on . It is straightforward to verify that the probability density in (4), in both regions, satisfies the forward Kolmogorov equation

The current value of a put option can be written in the form

where is a Weiner process with drift . To avoid hitting the barrier we need where . To obtain a nonzero return from the option we need . Putting this all together we deduce that in the presence of the knock-out barrier at

where we have written

Throughout we are assuming . All the integrals are Gaussian, and the calculations are straightforward though tedious. The final results are as follows:

| (5) |

where

| (6) | |||||

where

| (7) | |||||

where

Formulae (5), (6) and (7) are of limited importance in themselves. Their significance lies more in the fact that, as can be readilly verified using a symbolic manipulator, Formulae (5), (6) and (7) satisfy the (modified) Black-Scholes equations (3), (1) and (2) respectively. As we shall see in the next section, this can provide a numerical procedure to determine the quantities we need even when analytic expressions are not available.

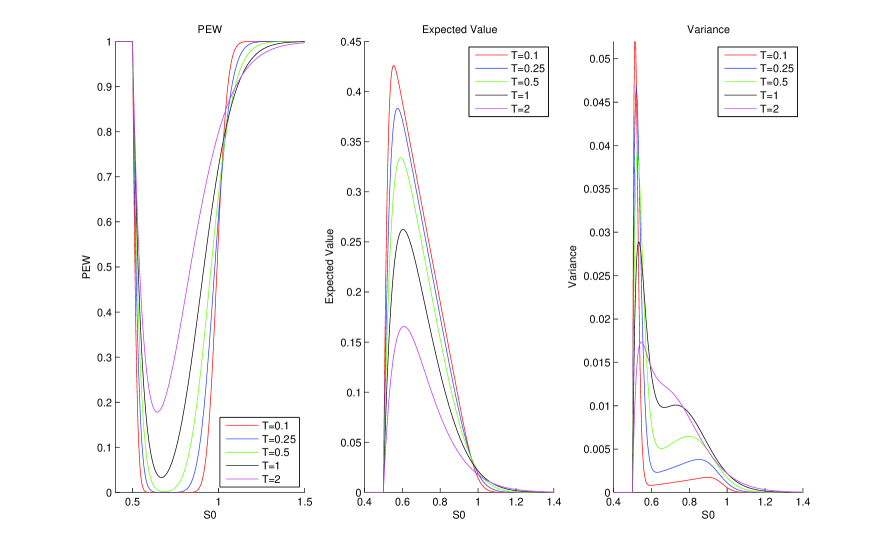

We conclude this section by presenting plots of the PEW, expected value and variance of a down-and-out put option with the same parameters as the European option considered in section 2, but with a barrier at . See Figure 2. For well above the barrier the results are similar to those for the option without a barrier. But as decreases towards the barrier, the PEW increases towards , the expected value drops and the variance increases rapidly, before dropping again to when .

4 American options

For the case of American options there is no analytic expression for the Black-Scholes price, and we do not expect there to be analytic expressions for the variance or the PEW. (We limit the discussion here to American puts on non-dividend paying stocks; if no dividends are paid then for call options there is no added value in the early exercise feature [21]. The discussion can be extended to the case of continuous-dividend paying stocks.) The preferred approach for pricing American options (on a single underlying asset) is by numerical solution of a free boundary problem for the Black-Scholes PDE. For an option with strike and expiration on an underlying with volatility , the Black-Scholes price (as a function of the underlying price and time ) should satisfy the PDE

| (8) |

on the domain , , where is the unknown early exercise price. should satisfy the Dirichlet boundary conditions

and the final time condition

The early exercise price is determined by the smooth pasting condition

along with the final time condition . See [21] for a full exposition.

Completely analogously to our findings in the previous 2 sections, the expectation of the square of the current value of the option should obey the modified Black-Scholes equation

| (9) |

on the same domain, with boundary conditions

and final time condition

These conditions enforce vanishing variance at all boundaries. Note that there is no reason to expect the variance to have zero derivative at the early exercise boundary — thus it need not paste smoothly onto the variance below the early exercise boundary, which vanishes.

Similarly, the PEW should obey

| (10) |

with boundary conditions

and final time condition

Note that for the PEW there is a discontinuity in the boundary data at , .

Note that the early exercise price is determined by the free boundary problem for the standard Black-Scholes equation (8), and this is then taken as input to solve the relevant problems for (9) and (10). In practice we solve all 3 PDEs using a front-fixing technique [22, 9]. Define new dimensionless coordinates via

and rescale the unknown functions via

The system of equations becomes

| (11) | |||||

| (12) | |||||

| (13) |

all on the fixed domain , , with initial conditions

Dirichlet boundary conditons

and

and finally the Neumann condition

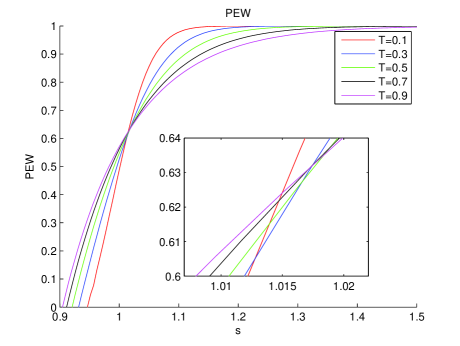

We solve this system using the Crank-Nicolson scheme to advance ; the simplest first order discretization is used to approximate , and a 3-point, second order approximation is used for . At each time step the Newton-Raphson method is used to update in a manner that the Neumann boundary condition holds. Results are displayed in Figure 3 for an option , , . By construction the variance and PEW go to zero on the early exercise boundary. The variance apparently increases uniformly with (for fixed ), which makes good sense — but note this was not exactly the case for the European option (see Figure 1). As tends to zero the PEW tends to a step function, as expected.

A few notes on numerical aspects of the above calculations: The discontinuity in the derivative of the PEW at the early exercise boundary did not interfere with convergence of the Crank-Nicolson method, but the usual error behavior was reduced to . The variance calculation was verified using a Monte-Carlo technique; once the early exercise curve has been calculated, standard Monte-Carlo techniques can be used to get the distribution (and in particular the mean and variance) of the return from the option. These results confirmed the PDE calculations, but a “barrier correction” following [4] was needed to compensate for discrete-time observation of whether the stock hits the early exercise price in the Monte-Carlo simulation. There are also Monte-Carlo techniques for pricing American options that do not depend on knowing the early exercise price, for example the method of [2, 3] uses a tree approach to compute two estimates which are lower and upper bounds for the option price. The variances of the lower and upper bounds computed in this approach were found to be substantially lower than the option variance computed by PDE methods. This is perfectly reasonable, the choices made to obtain bounds eliminate a lot of the variation of the option price.

5 Variance and PEW in Investment Decisions.

Consider an investor buying a put option on a stock. The investor faces the problem of selecting from a universe of options indexed by their strike and time to expiration , with prices increasing as functions of both and . Assuming the options are priced by the classical Black-Scholes formula (for European puts), how is the investor to make this decision?

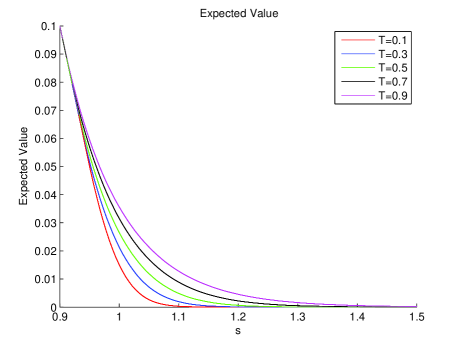

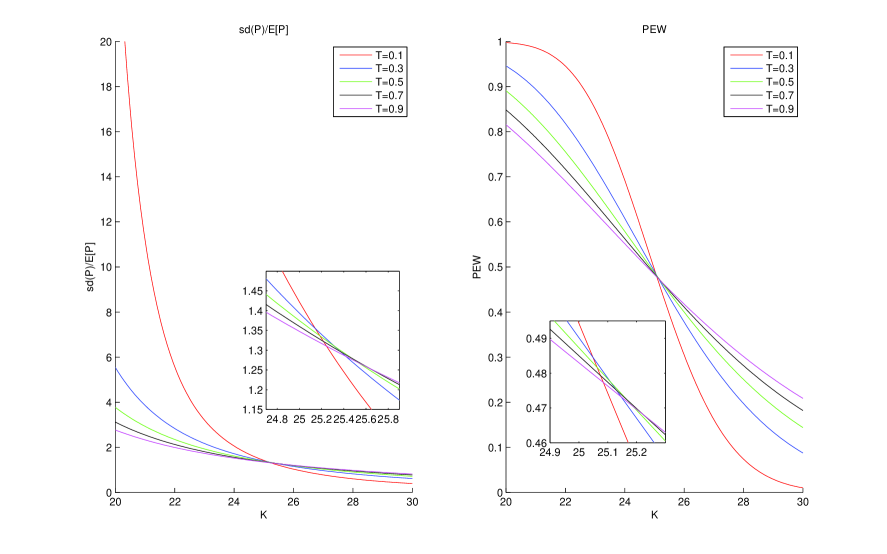

The expected rate of return does not depend which options the investor buys (and for that matter is the same as that for a direct investment in the stock). Ignoring possible external constraints on time frames and margin requirements, this question is entirely a question of the risk profile the investor wishes to assume. As a first quantitative measure of the risk we would suggest to look at , i.e. the standard deviation of the option value per unit price. In the first graph in Figure 4 we plot this, for a stock with , , , as a function of and for a range of values of . As we might expect, out-of-the-money options () are apparently much more risky than in-the-money options (), and whereas for deep in-the-money options shorter term means lower risk, for deep out-of-the-money shorter term means greater risk. (The behavior close-to-the-money is interesting, as the insert in the figure illustrates.)

From the exact formulae for the variance of the European put option it can be shown that as tends to infinity the variance tends to , which is the variance of the stock price (discounted to current values). Thus the first plot in Figure 4 shows the evidently sensible result that for fixed the risk associated with buying put options decreases with the strike , ultimately decreasing to the risk of the stock itself.

Another quantity the investor may wish to look at is the PEW. This is also displayed in Figure 4. In fact we see that PEW behaves very similarly to . Indeed, by Chebyshev’s inequality

and thus

In practice, as usual with Chebyshev’s inequality, this is not a very useful inequality quantitatively, but it does, however, correctly indicate that the general trends of PEW and are similar.

It should be emphasized that the risk we are discussing here is risk as viewed from the buyer’s side. For PEW this is clear; for the buyer of the option, high PEW means a high probability of losing 100% of the investment, which is an uncontroversial, if rather naive, measure of risk. For the seller the opposite is true; high PEW is a measure of safety for the seller. This reflects the general asymmetry between buyer and seller in matters of risk — a buyer prefers to buy low risk, a seller prefers to sell away high risk. For things are a little less clear. If we are discussing an options trader, who is buying (or selling) an option, say, to add to (or remove from) a portfolio, then indeed, , which measures the spread of the return from the option, is a measure of buyer’s risk, and the same asymmetry between buyer and seller exists. (Note, however, that if the trader holds other options on the same underlying then it is of course a mistake to consider just the risk on an individual asset in the portfolio and ignore correlations.) The potentially confusing situation comes in considering an investor who wishes to write, say, a single in-the-money put option, with a view to actually owning the stock at a later date when the option is assigned. Despite being a seller of the option, this investor may well prefer lower . For this seller, the sale does not eliminate risk, but adds to it — so the considerations of a buyer may be more appropriate.

6 Risk-averse/Risk-seeking Option Pricing.

The previous section concerns the use of risk measures of options in individual investment decisions. In this section we consider the following question: Is it possible that the market incorporates a measure of risk in option prices? The simplest imaginable way to incorporate risk premium is to consider a pricing formula of the form

| (14) |

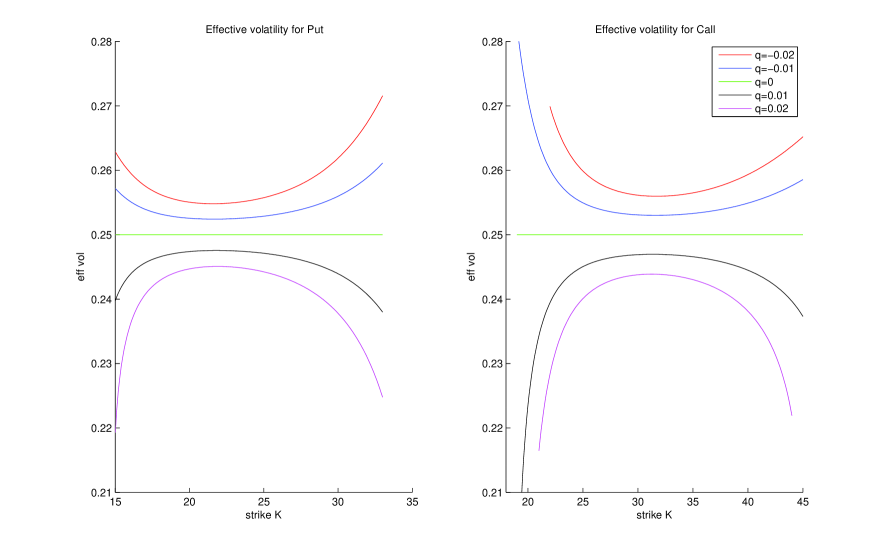

where is a parameter quantifying the average risk aversion of option buyers. Since in the classical Black-Scholes formulas option prices are monotonic increasing functions of volatility, we can translate the above change in option prices into effective volatility values. Note that for (net risk aversion) the above formula gives prices below classical Black-Scholes, and hence effective volatility is lower than input volatility. For (net risk seeking) the reverse is true. In Figure 5 we plot the effective volatility of European call and put options as a function of for a few values of . We assume an underlying with , , and look at options with expiration .

We see that for our model predicts a volatility smile and for a volatility frown. The plots in Figure 5 are somewhat misleading, as very large ranges of strikes are shown (differing in the 2 subplots). For deep out-of-the-money and deep-in-the-money options, the classical Black-Scholes price is very insenstive to the volatility. Thus a small change in price requires a substantial change in volatility. This is the reason for the sharp upturns and downturns in effective volatility, particularly noticeable in the case of the call. Nevertheless, it seems that Equation (14) provides a 1-parameter extension of the Black-Scholes model which can explain a volatility smile. The standard extensions — local volatility models [7, 10] and stochastic volatility models [15, 14, 13] — typically need at least 3 parameters.

The term structure of effective volatility implied by Equation (14) is complicated and we do not describe it here. However, we note that since is a parameter quantifying risk aversion, it is quite reasonable to take to depend on the timeframe , thereby allowing any desired term structure to be built into the model. As of yet we have not tested to see whether the model can provide a reasonable fit to data.

7 Concluding remarks

In this paper we have explained methods to calculate the variance (and the PEW) of standard options, and outlined potential applications. Despite the fact that we have not yet performed comprehensive empirical studies, we think the potential usefulness of the variance and/or the PEW is self-evident. A further point may help to make this clear: In the classical Black-Scholes option formulas, the price of an option depends on 5 parameters . By rescaling units of time and money 2 of these parameters can be eliminated. By moving to a frame in which all money accumulates at a rate , dependence on can be eliminated. Thus there is only non-trivial dependence on 2 effective parameters, which are typically taken to be the combinations and . If an option is priced using the classical Black-Scholes formulas, then two pieces of data are being compressed into one — in other words, information is being lost. By also looking at the variance we take all information into account.

In addition to empirical studies and investigation of potential applications, there are many extensions of the current work that come to mind, and we mention just a few:

-

•

The variance formulas for European options in this paper should be extended to cover the case of options on (continuous) dividend-paying stocks, for which exact formulas should still be available.

- •

-

•

Similarly for options on multiple assets, asymptotic approximations should be available. Good methods for options on multiple assets should involve incoporating asymptotic results into numerical schemes to have the best of both worlds.

Acknowledgements. We thank Yaniv Zaks and Evgenia Apartsin for useful conversations. This work includes material included in the M.Sc. thesis of the first author.

References

- [1] Black, F., and Scholes, M. The pricing of options and corporate liabilities. The Journal of Political Economy (1973), 637–654.

- [2] Broadie, M., and Glasserman, P. Pricing American-style securities using simulation. Journal of Economic Dynamics and Control 21, 8-9 (1997), 1323–1352.

- [3] Broadie, M., Glasserman, P., and Jain, G. Enhanced Monte Carlo estimates for American option prices. The Journal of Derivatives 5, 1 (1997), 25–44.

- [4] Broadie, M., Glasserman, P., and Kou, S. A continuity correction for discrete barrier options. Mathematical Finance 7, 4 (1997), 325–349.

- [5] Coval, J., and Shumway, T. Expected option returns. The Journal of Finance 56, 3 (2001), 983–1009.

- [6] Cox, J., Ross, S., and Rubinstein, M. Option pricing: A simplified approach. Journal of Financial Economics 7, 3 (1979), 229–263.

- [7] Derman, E., and Kani, I. Riding on a smile. Risk 7, 2 (1994), 32–39.

- [8] Duck, P., Yang, C., Newton, D., and Widdicks, M. Singular perturbation techniques applied to multiasset option pricing. Mathematical Finance 19, 3 (2009), 457–486.

- [9] Duffy, D. Finite Difference Methods in Financial Engineering: A Partial Differential Equation Approach. Wiley, 2006.

- [10] Dupire, B. Pricing with a smile. Risk 7, 1 (1994), 18–20.

- [11] Etheridge, A., and Baxter, M. A course in financial calculus. Cambridge University Press, 2002.

- [12] Goyal, A., and Saretto, A. Cross-section of option returns and volatility. Journal of Financial Economics 94, 2 (2009), 310–326.

- [13] Hagan, P., Lesniewski, A., and Woodward, D. Probability distribution in the SABR model of stochastic volatility. Preprint (2005).

- [14] Heston, S. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Review of Financial Studies 6, 2 (1993), 327–343.

- [15] Hull, J., and White, A. The pricing of options on assets with stochastic volatilities. Journal of Finance (1987), 281–300.

- [16] Liu, J., and Pan, J. Dynamic derivative strategies. Journal of Financial Economics 69, 3 (2003), 401–430.

- [17] Merton, R. Theory of rational option pricing. The Bell Journal of Economics and Management Science (1973), 141–183.

- [18] Merton, R., Scholes, M., and Gladstein, M. The returns and risk of alternative call option portfolio investment strategies. Journal of Business (1978), 183–242.

- [19] Merton, R., Scholes, M., and Gladstein, M. The returns and risks of alternative put-option portfolio investment strategies. Journal of Business (1982), 1–55.

- [20] Widdicks, M., Duck, P., Andricopoulos, A., and Newton, D. The Black-Scholes equation revisited: Asymptotic expansions and singular perturbations. Mathematical Finance 15, 2 (2005), 373–391.

- [21] Wilmott, P., Howison, S., and Dewynne, J. The mathematics of financial derivatives: a student introduction. Cambridge University Press, 1995.

- [22] Wu, L., and Kwok, Y. A front-fixing finite difference method for the valuation of American options. Journal of Financial Engineering 6, 4 (1997), 83–97.