Strong convergence and stability of implicit numerical methods for stochastic differential equations with non-globally Lipschitz continuous coefficients.

Abstract

We are interested in the strong convergence and almost sure stability of Euler-Maruyama (EM) type approximations to the solutions of stochastic differential equations (SDEs) with non-linear and non-Lipschitzian coefficients. Motivation comes from finance and biology where many widely applied models do not satisfy the standard assumptions required for the strong convergence. In addition we examine the globally almost surely asymptotic stability in this non-linear setting for EM type schemes. In particular, we present a stochastic counterpart of the discrete LaSalle principle from which we deduce stability properties for numerical methods.

Key words: Dissipative model, super-linear growth, stochastic differential equation, strong convergence, backward Euler-Maruyama scheme, implicit method, LaSalle principle, non-linear stability, almost sure stability.

AMS Subject Clasification: 65C30, 65L20, 60H10

1 Introduction

Throughout this paper, let be a complete probability space with a filtration satisfying the usual conditions (that is to say, it is right continuous and increasing while contains all -null sets). Let be a -dimensional Brownian motion defined on the probability space, where denotes the transpose of a vector or a matrix. In this paper we study the numerical approximation of the stochastic differential equations (SDEs)

| (1.1) |

Here for each and and . For simplicity we assume that is a deterministic vector. Although the method of Lyapunov functions allows us to show that there are solutions to a very wide family of SDEs (see e.g. [24, 34]), in general, both the explicit solutions and the probability distributions of the solutions are not known. We therefore consider computable discrete approximations that, for example, could be used in Monte Carlo simulations. Convergence and stability of these methods are well understood for SDEs with Lipschitz continuous coefficients: see [26] for example. Our primary objective is to study classical strong convergence and stability questions for numerical approximations in the case where and are not globally Lipschitz continuous. A good motivation for our work is an instructive conditional result of Higham et al. [18]. Under the local Lipschitz condition, they proved that uniform boundedness of moments of both the solution to (1.1) and its approximation are sufficient for strong convergence. That immediately raises the question of what type of conditions can guarantee such a uniform boundedness of moments. It is well known that the classical linear growth condition is sufficient to bound the moments for both the true solutions and their EM approximation [26, 34]. It is also known that when we try to bound the moment of the true solutions, a useful way to relax the linear growth condition is to apply the Lyapunov-function technique, with . This leads us to the monotone condition [34]. More precisely, if there exist constants such that the coefficients of equation (1.1) satisfy

| (1.2) |

then

| (1.3) |

Here, and throughout, denotes both the Euclidean vector norm and the Frobenius matrix norm and denotes the scalar product of vectors . However, to the best of our knowledge there is no result on the moment bound for the numerical solutions of SDEs under the monotone condition (1.2). Additionally, Hutzenthaler et al. [23] proved that in the case of super-linearly growing coefficients, the EM approximation may not converge in the strong -sense nor in the weak sense to the exact solution. For example, let us consider a non-linear SDE

| (1.4) |

where and . In order to approximate SDE (1.4) numerically, for any , we define the partition of the time interval , where and . Then we define the EM approximation of (1.4) by

| (1.5) |

where . It was shown in [23] that

On the other hand, the coefficients of (1.4) satisfy the monotone condition (1.2) so (1.3) holds. Hence, Hutzenthaler et al. [23] concluded that

It is now clear that to prove the strong convergence theorem under condition (1.2) it is necessary to modify the EM scheme. Motivated by the existing works [18] and [21] we consider implicit schemes. These authors have demonstrated that a backward Euler-Maruyama (BEM) method strongly converges to the solution of the SDE with one-sided Lipschitz drift and linearly growing diffusion coefficients. So far, to the best of our knowledge, most of the existing results on the strong convergence for numerical schemes only cover SDEs where the diffusion coefficients have at most linear growth [5, 39, 17, 22, 26]. However, the problem remains essentially unsolved for the important class of SDEs with super-linearly growing diffusion coefficients. We are interested in relaxing the conditions for the diffusion coefficients to justify Monte Carlo simulations for highly non-linear systems that arise in financial mathematics, [1, 8, 2, 9, 14, 29], for example

| (1.6) |

where , or in stochastic population dynamics [35, 3, 36, 41, 11], for example

| (1.7) |

where , and matrix is such that , where . The only results we know, where the strong convergence of the numerical approximations was considered for super-linear diffusion, is Szpruch et al. [43] and Mao and Szpruch [37]. In [43] authors have considered the BEM approximation for the following scalar SDE which arises in finance [2],

In [37], this analysis was extended to the multidimensional case under specific conditions for the drift and diffusion coefficients. In the present paper, we aim to prove strong convergence under general monotone condition (1.2) in a multidimensional setting. We believe that this condition is optimal for boundedness of moments of the implicit schemes. The reasons that we are interested in the strong convergence are: a) the efficient variance reduction techniques, for example, the multi-level Monte Carlo simulations [12], rely on the strong convergence properties; b) both weak convergence [26] and pathwise convergence [25] follow automatically.

Having established the strong convergence result we will proceed to the stability analysis of the underlying numerical scheme for the non-linear SDEs (1.1) under the monotone-type condition. The main problem concerns the propagation of an error during the simulation of an approximate path. If the numerical scheme is not stable, then the simulated path may diverge substantially from the exact solution in practical simulations. Similarly, the expectation of the functional estimated by a Monte Carlo simulation may be significantly different from that of the expected functional of the underlying SDEs due to numerical instability. Our aim here is to investigate almost surely asymptotic properties of the numerical schemes for SDEs (1.1) via a stochastic version of the LaSalle principle. LaSalle, [27], improved significantly the Lyapunov stability method for ordinary differential equations. Namely, he developed methods for locating limit sets of nonautonomous systems [13, 27]. The first stochastic counterpart of his great achievement was established by Mao [33] under the local Lipschitz and linear growth conditions. Recently, this stochastic version was generalized by Shen et al. [42] to cover stochastic functional differential equations with locally Lipschitz continuous coefficients. Furthermore, it is well known that there exists a counterpart of the invariance principle for discrete dynamical systems [28]. However, there is no discrete stochastic counterpart of Mao’s version of the LaSalle theorem. In this work we investigate a special case, with the Lyapunov function , of the LaSalle theorem. We shall show that the almost sure global stability can be easily deduced from our results. The primary objectives in our stability analysis are:

-

•

Ability to cover highly nonlinear SDEs;

-

•

Mild assumption on the time step - -stability concept [15].

Results which investigate stability analysis for numerical methods can be found

in Higham [16, 15] for the scalar

linear case, Baker et al. [4] for the global Lipschitz and

Higham et al. [19] for one-sided

Lipschitz and the linear growth condition.

At this point, it is worth mentioning how our

work compares with that of Higham et al. [18].

Theorem 3.3 in their paper is a very important contribution to the numerical SDE theory.

The authors proved strong convergence results for one-sided Lipschitz

and the linear growth condition on drift and diffusion coefficients, respectively.

What differentiates our work from [18] are:

a) We significantly relax the linear growth constraint on the diffusion coefficient and

we only ask for very general monotone type growth;

b) Our analysis is based on a more widely applied BEM scheme

in contrast to the split-step scheme introduced in their paper.

An interesting alternative to the implicit schemes for numerical approximations of SDEs

with non-globally Lipschitz drift coefficient recently appeared in [22].

However the stability properties of this method are not analysed.

In what follows, for notational simplicity, we use the convention that represent a generic positive constant independent of , the value of which may be different for different appearances.

The rest of the paper is arranged as follows. In section 2, we introduce the monotone condition under which we prove the existence of a unique solution to equation (1.1), along with appropriate bounds that will be needed in further analysis. In Section 3 we propose the -EM scheme, which is known as the BEM when , to approximate the solution of equation (1.1). We show that the moment of the -EM, can be bounded under the monotone condition plus some mild assumptions on and . In Section 4 we introduce a new numerical method, which we call the forward-backward Euler-Maruyama (FBEM). The FBEM scheme enables us to overcome some measurability difficulties and avoid using Malliavin calculus. We demonstrate that both the FBEM and the -EM do not differ much in the -sense. Then we prove a strong convergence theorem on a compact domain that is later extended to the whole domain. We also perform a numerical experiment that confirms our theoretical results. Section 5 contains the stability analysis, where we prove a special case of the stochastic LaSalle theorem for discrete time processes.

2 Existence and Uniqueness of Solution

We require the coefficients and in (1.1) to be locally Lipschitz continuous and to satisfy the monotone condition, that is

Assumption 2.1.

Both coefficients and in (1.1) satisfy the following conditions:

Local Lipschitz condition.

For each integer , there is a positive constant such

that

for those with

Monotone condition. There exist constants and such that

| (2.1) |

for all .

It is a classical result that under Assumption 2.1, there exists a unique solution to (1.1) for any given initial value , [10, 34]. The reason why we present the following theorem with a proof here is that it reveals the upper bound for the probability that the process stays on a compact domain for finite time . The bound will be used to derive the main convergence theorem of this paper.

Theorem 2.2.

Proof.

It is well known that under Assumption 2.1, for any given initial value there exists a unique solution to the SDE (1.1), [friedman1975stochastic, 34]. Therefore we only need to prove that (2.2) and (2.3) hold. Applying the Itô formula to the function , we compute the diffusion operator

By Assumption 2.1

| (2.5) |

Therefore

The Gronwall inequality gives

| (2.6) |

Hence

Next, letting in (2.6) and applying Fatou’s lemma, we obtain

which gives the other assertion (2.2) and completes the proof. ∎

3 The -Euler-Maruyama Scheme

As indicated in the introduction, in order to approximate the solution of (1.1) we will use the -EM scheme. Given any step size , we define a partition of the half line , and define

| (3.1) |

where and . The additional parameter allows us to control the implicitness of the numerical scheme, that may lead to various asymptotic behaviours of equation (3.1). For technical reasons we always require .

Since we are dealing with an implicit scheme we need to make sure that equation (3.1) has a unique solution given . To prove this, in addition to Assumption 2.1, we ask that function satisfies the one-sided Lipschitz condition.

Assumption 3.1.

One-sided Lipschitz condition. There exists a constant such that

It follows from the fixed point theorem that a unique solution to equation (3.1) exists given , provided , (see [37] for more details). From now on we always assume that . In order to implement numerical scheme (3.1) we define a function as

| (3.2) |

Due to Assumption 3.1, there exists an inverse function and the solution to (3.1) can be represented in the following form

Clearly, is -measurable. In many applications, the drift coefficient of the SDEs has a cubic or quadratic form, whence the inverse function can be found explicitly. For more complicated SDEs we can find the inverse function using root-finding algorithms, such as Newton’s method.

3.1 Moment Properties of -EM

In this section we show that the second moment of the -EM (3.1) is bounded (Theorem 3.6). To achieve the bound we employ the stopping time technique, in a similar way as in the proof of Theorem 2.2. However, in discrete time approximations for a stochastic process, the problem of overshooting the level where we would like to stop the process appears, [7, 6, 32].

Due to the implicitness of scheme (3.1), an additional but mild restriction on the time step appears. That is, from now on, we require , where with and defined in Assumptions 2.1 and 3.1, respectively.

The following lemma shows that in order to guarantee the boundedness of moments for defined by (3.1) it is enough to bound the moments of , where is defined by (3.2).

Lemma 3.2.

Let Assumption 2.1 hold. Then for we have

Proof.

We define the stopping time by

| (3.3) |

We observe that when , , but we may have , so the following lemma is not trivial.

Lemma 3.3.

Proof.

The proof is given in the Appendix. ∎

For completeness of the exposition we recall the discrete Gronwall inequality, that we will use in the proof of Theorem 3.6.

Lemma 3.4 (The Discrete Gronwall Inequality).

Let M be a positive integer. Let and be non-negative numbers for k=0,1,…,M. If

then

The proof can be found in Mao et al. [38]. To prove the boundedness of the second moment for the -EM (3.1), we need an additional but mild assumption on the coefficients and .

Assumption 3.5.

The coefficients of equation (1.1) satisfy the polynomial growth condition. That is, there exists a pair of constants and such that

| (3.4) |

Let us begin to establish the fundamental result of this paper that reveals the boundedness of the second moments for SDEs (1.1) under Assumptions 2.1 and 3.5.

Theorem 3.6.

Proof.

By definition (3.2) of function , we can represent the -EM scheme (3.1) as

Consequently writing and utilizing Assumption 2.1 we obtain

| (3.5) | ||||

where

is a local martingale. By Assumption 2.1 and the fact that ,

| (3.6) |

Let be any nonnegative integer such that . Summing up both sides of inequality (3.6) from to , we get

| (3.7) |

Applying Lemma 3.3, Assumption 3.5 and noting that and are -measurable while is independent of , we can take expectations on both sides of (3.1) to get

By Lemma 3.2

By the discrete Gronwall inequality

| (3.8) |

where we use the fact that . Thus, letting in (3.8) and applying Fatou’s lemma, we get

By Lemma 3.2, the proof is complete. ∎

4 Forward-Backward Euler-Maruyama Scheme

We find in our analysis that it is convenient to work with a continuous extension of a numerical method. This continuous extension enables us to use the powerful continuous-time stochastic analysis in order to formulate theorems on numerical approximations. We find it particularly useful in the proof of forthcoming Theorem 4.2. Let us define

One possible continuous version of the -EM is given by

| (4.1) |

Unfortunately, this is not -adapted whence it does not meet the fundamental requirement in the classical stochastic analysis. To avoid using Malliavin calculus, we introduce a new numerical scheme, which we call the Forward-Backward Euler-Maruyama (FBEM) scheme: Once we compute the discrete values from the -EM, that is

we define the discrete FBEM by

| (4.2) |

where , and the continuous FBEM by

| (4.3) |

Note that the continuous and discrete BFEM schemes coincide at the gridpoints; that is, .

4.1 Strong Convergence on the Compact Domain

It this section we prove the strong convergence theorem. We begin by showing that both schemes of the FBEM (4.2) and the -EM (3.1) stay close to each other on a compact domain. Then we estimate the probability that both continuous FBEM (4.3) and -EM (3.1) will not explode on a finite time interval.

Lemma 4.1.

Proof.

Summing up both schemes of the FBEM (4.2) and the -EM (3.1), respectively, we obtain

By Hölder’s inequality, Lemma 3.3 and Assumption 3.5, we then see easily that there exists a constant , such that

| (4.4) |

as required. Next, using inequality with we arrive at

∎

The following Theorem provides us with a similar estimate for the distribution of the first passage time for the continuous FBEM (4.3) and -EM (3.1) as we have obtained for the SDEs (1.1) in Theorem 2.2. We will use this estimate in the proof of forthcoming Theorem 4.4.

Theorem 4.2.

Proof.

The proof is given in the Appendix. ∎

4.2 Strong Convergence on the Whole Domain

In this section we present the main theorem of this paper, the strong convergence of the -EM (3.1) to the solution of (1.1). First, we will show that the continuous FBEM (4.3) converges to the true solution on the compact domain. This, together with Theorem 4.2, will enable us to extend convergence to the whole domain. Let us define the stopping time

where and are defined in Theorems 2.2 and 4.2, respectively.

Lemma 4.3.

Proof.

The proof is given in the Appendix. ∎

Theorem 4.4.

Proof.

Let

Applying Young’s inequality

leads us to

First, let us observe that by Lemma 4.1 we obtain

Given an , by Hölder’s inequality and Theorems 2.2 and 3.6 , we choose such that

Now by (2.3) there exists such that for

and finally by Lemmas 4.1, 4.3 and Theorem 4.2 we choose sufficiently small, such that

which completes the proof. ∎

Theorem 4.4 covers many highly non-linear SDEs, though it might be computationally expensive to find the inverse of the function . For example, lets consider equation (1.4) with , , that is

| (4.7) |

where . This type of SDE could be used to model electricity prices where we need to account for a seasonality pattern, [31]. In this situation, it is useful to split the drift coefficient in two parts, that is

| (4.8) |

This allows us to introduce partial implicitness in the numerical scheme. In the case of (4.7) we would take and . Then a new partially implicit -EM scheme has the following form

| (4.9) |

It is enough that satisfies Assumption 3.1 in order for scheme (4.9) to be well defined. Its solution can be represented as

where

| (4.10) |

All results from Sections 3 and 4 hold, once we replace condition (2.1) in Assumption 2.1 and Assumption 3.1 by (4.11) (4.12)), respectively.

Theorem 4.5.

Proof.

In order to prove Theorem 4.5 we need to show that results from sections 3 and 4, proved for (3.1), hold for (4.9) under modified assumptions. The only significant difference is in the proof of Theorem 3.6 for (4.9). Due to condition (4.11) we can show that Lemma 3.2 holds for function . Then by the definition of function in (4.10), we can represent the -EM scheme (4.9) as

Consequently writing we obtain

| (4.14) | ||||

where

Due to condition (4.12) we have

The proof can be completed by analogy to the analysis for the -EM scheme (3.1). Having boundedness of moments for (4.9) we can show that (4.13) holds in exactly the same way as for -EM scheme (3.1). ∎

4.3 Numerical Example

In this section we perform a numerical experiment that confirms our theoretical results. Since Multilevel Monte-Carlo simulations provide excellent motivation for our work [12], here we consider the measure of error (4.13) with . Although, the case is not covered by our analysis, the numerical experiment suggests that Theorem 4.4 still holds. In our numerical experiment, we focus on the error at the endpoint , so we let

We consider the SDE (1.4)

where . The assumptions of Theorem 4.4 hold. The -EM (3.1) with , applied to (1.4) writes as

| (4.15) |

Since we employ the BEM to approximate (1.4), on each step of the numerical simulation we need to find the inverse of the function . In this case we can find the inverse function explicitly and therefore computational complexity is not increased. Indeed, we observe that it is enough to find the real root of the cubic equation

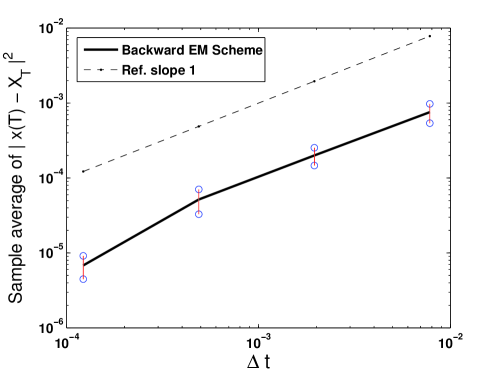

In Figure 1 we plot against on a log-log scale. Error bars representing confidence intervals are denoted by circles.

Although we do not know the explicit form of the solution to (1.4), Theorem 4.4 guarantees that the BEM (4.15) strongly converges to the true solution. Therefore, it is reasonable to take the BEM with the very small time step as a reference solution. We then compare it to the BEM evaluated with timesteps in order to estimate the rate of convergence. Since we are using Monte Carlo method, the sampling error decays with a rate of , - is the number of sample paths. We set . From Figure 1 we see that there appears to exist a positive constant such that

Hence, our results are consistent with a strong order of convergence of one-half.

5 Stability Analysis

In this section we examine the globally almost surely asymptotic stability of the -EM scheme (3.1). The stability conditions we derive are more related to the mean-square stability, [20, 40]. First, we give some preliminary analysis for the SDEs (1.1). We give conditions on the coefficients of the SDEs (1.1) that are sufficient for the globally almost surely asymptotic stability. Later we prove that the -EM scheme (3.1) reproduces this asymptotic behavior very well.

5.1 Continuous Case

Here we present a simplified version of the stochastic LaSalle Theorem as proved in [42], using the Lyapunov function .

5.2 Almost Sure Stability

We begin this section with the following Lemma.

Lemma 5.2.

Let be a nonnegative stochastic process with the Doob decomposition , where and are a.s. nondecreasing, predictable processes with , and is local -martingale with . Then

The original lemma can be found in Liptser and Shiryaev [30]. The reader can notice that this lemma combines the Doob decomposition and the martingales convergence theorem. Since we use the Lyapunov function , our results extend the mean-square stability for linear systems, Higham [15, 16], to a highly non-linear setting. The next theorem demonstrates that there exists a discrete counterpart of Theorem 5.1 for the -EM scheme (3.1).

Theorem 5.3.

Proof.

By (3.5) we have

where

so is a local martingale due to Assumption 3.5 and Lemma 3.3. Hence, we have obtained the decomposition required to apply Lemma 5.2, that is

where

| (5.6) |

By condition (5.2), is nondecreasing. Hence by Lemma 5.2 we arrive at

| (5.7) |

Consequently, by Lemma 3.2 we arrive at

By Lemma 5.2,

which implies

Appendix A Proof of Lemma 3.3

Proof.

By (3.6) we obtain

where

Using the basic inequality , where , we obtain

| (A.1) |

As a consequence

Due to Assumption 2.1 we can bound and for . Whence, there exists a constant , such that

By Hölder’s inequality

Hence

Since there exists a positive constant , such that , we obtain

We conclude the assertion by applying Lemma 3.2. ∎

Appendix B Proof of Theorem 4.2

Proof.

By the Itô formula

By Assumption 2.1, for

| (B.1) |

| (B.2) |

and

Using the basic inequality and the fact that , we obtain

| (B.3) |

Since a.s., Lemma 4.1 gives the following bound

| (B.4) |

To bound the term in (B), first we observe that

| (B.5) |

where is constant. Combining (B.4) and (B.5) leads us to

| (B.6) |

Therefore

By Gronwall’s inequality

| (B.7) |

Now we will find the lower bound for . From the definition of the stopping time , if then . In the alternative case, where , we have . From Lemmas 3.2 and 4.1 we arrive at

Hence there exist positive constants and such that

We have

which implies that

Now, for any given , we choose such that for any

Then, we can choose , such that for any

whence as required. ∎

Appendix C Proof of Lemma 4.3

Proof.

It is useful to observe that since the constant in (4.5) depends on , we can prove the theorem in a similar way as in the classical case where coefficients and in (1.1) obey the global Lipschitz condition [18, 26]. Nevertheless, for completeness of the exposition we present the sketch of the proof. For any , by Hölder’s and Burkholder-Davis-Gundy’s inequalities

By Assumption 2.1 there exists a constant

By the same reasoning which gave estimate (B.6), we can deduce that

Hence

The statement of the theorem holds by the Gronwall inequality. ∎

References

- [1] D.H. Ahn and B. Gao. A parametric nonlinear model of term structure dynamics. Review of Financial Studies, 12(4):721, 1999.

- [2] Y. Ait-Sahalia. Testing continuous-time models of the spot interest rate. Review of Financial Studies, 9(2):385–426, 1996.

- [3] A. Bahar and X. Mao. Stochastic delay population dynamics. International Journal of Pure and Applied Mathematics, 11:377–400, 2004.

- [4] C.T.H. Baker and E. Buckwar. Exponential stability in p-th mean of solutions, and of convergent Euler-type solutions, of stochastic delay differential equations. Journal of Computational and Applied Mathematics, 184(2):404–427, 2005.

- [5] A. Berkaoui, M. Bossy, and A. Diop. Euler scheme for SDEs with non-Lipschitz diffusion coefficient: strong convergence. ESAIM: Probability and Statistics, 12:1–11, 2007.

- [6] M. Broadie, P. Glasserman, and S. Kou. A continuity correction for discrete barrier options. Mathematical Finance, 7(4):325–349, 1997.

- [7] F.M. Buchmann. Simulation of stopped diffusions. Journal of Computational Physics, 202(2):446–462, 2005.

- [8] J.Y. Campbell, A.W. Lo, A.C. MacKinlay, and R.F. Whitelaw. The econometrics of financial markets. Macroeconomic Dynamics, 2(04):559–562, 1998.

- [9] K.C Chan, G.A. Karolyi, F.A. Longstaff, and A.B. Sanders. An empirical comparison of alternative models of the short-term interest rate. The journal of finance, 47(3):1209–1227, 1992.

- [10] A. Friedman. Stochastic differential equations and applications. Academic Press, 1976.

- [11] T.C. Gard. Introduction to Stochastic Differential Equations. Marcel Dekker, New York, 1988.

- [12] M.B. Giles. Multilevel monte carlo path simulation. Operations Research-Baltimore, 56(3):607–617, 2008.

- [13] J.K. Hale and S.M.V. Lunel. Introduction to Functional Differential Equations. Springer Verlag, 1993.

- [14] S.L. Heston. A simple new formula for options with stochastic volatility. Course notes of Washington University in St. Louis, Missouri, 1997.

- [15] D.J. Higham. A-stability and stochastic mean-square stability. BIT Numerical Mathematics, 40(2):404–409, 2000.

- [16] D.J. Higham. Mean-square and asymptotic stability of the stochastic theta method. SIAM Journal on Numerical Analysis, pages 753–769, 2001.

- [17] D.J. Higham and X. Mao. Convergence of Monte Carlo simulations involving the mean-reverting square root process. Journal of Computational Finance, 8(3):35, 2005.

- [18] D.J. Higham, X. Mao, and A.M. Stuart. Strong convergence of Euler-type methods for nonlinear stochastic differential equations. SIAM Journal on Numerical Analysis, 40(3):1041–1063, 2002.

- [19] D.J. Higham, X. Mao, and A.M. Stuart. Exponential mean-square stability of numerical solutions to stochastic differential equations. LMS J. Comput. Math, 6:297–313, 2003.

- [20] D.J. Higham, X. Mao, and C. Yuan. Almost sure and moment exponential stability in the numerical simulation of stochastic differential equations. SIAM Journal on Numerical Analysis, 45(2):592–609, 2008.

- [21] Y. Hu. Semi-implicit Euler-Maruyama scheme for stiff stochastic equations. Progress in Probability, pages 183–202, 1996.

- [22] M. Hutzenthaler, A. Jentzen, and P.E. Kloeden. Strong convergence of an explicit numerical method for sdes with non-globally lipschitz continuous coefficients. to appear in The Annals of Applied Probability, 2010.

- [23] M. Hutzenthaler, A. Jentzen, and P.E. Kloeden. Strong and weak divergence in finite time of Euler’s method for stochastic differential equations with non-globally Lipschitz continuous coefficients. Proceedings of the Royal Society A: Mathematical, Physical and Engineering Science, 467(2130):1563, 2011.

- [24] R.Z. Khasminski. Stochastic Stability of Differential Equations. Kluwer Academic Pub, 1980.

- [25] P.E. Kloeden and A. Neuenkirch. The pathwise convergence of approximation schemes for stochastic differential equations. Journal of Computation and Mathematics, 10:235–253, 2007.

- [26] P.E. Kloeden and E. Platen. Numerical Solution of Stochastic Differential Equations. Springer, 1992.

- [27] J.P. LaSalle. Stability theory for ordinary differential equations. J. Differential Equations, 4(1):57–65, 1968.

- [28] J.P. LaSalle and Z. Artstein. The Stability of Dynamical Systems. Society for Industrial Mathematics, 1976.

- [29] A.L. Lewis. Option Valuation Under Stochastic Volatility. Finance Press, 2000.

- [30] R.S. Liptser and A.N. Shiryayev. Theory of Martingales. Kluwer Academic Publishers, 1989.

- [31] J.J. Lucia and E.S. Schwartz. Electricity prices and power derivatives: Evidence from the nordic power exchange. Review of Derivatives Research, 5(1):5–50, 2002.

- [32] R. Mannella. Absorbing boundaries and optimal stopping in a stochastic differential equation. Physics Letters A, 254(5):257–262, 1999.

- [33] X. Mao. Stochastic versions of the LaSalle theorem. Journal of Differential Equations, 153(1):175–195, 1999.

- [34] X. Mao. Stochastic Differential Equations and Applications. Horwood Pub Ltd, 2007.

- [35] X. Mao, G. Marion, and E. Renshaw. Environmental Brownian noise suppresses explosions in population dynamics. Stochastic Process. Appl, 97(1):95–110, 2002.

- [36] X. Mao, S. Sabanis, and E. Renshaw. Asymptotic behaviour of the stochastic Lotka–Volterra model. Journal of Mathematical Analysis and Applications, 287(1):141–156, 2003.

- [37] X. Mao and L. Szpruch. Strong convergence rates for backward Euler Maruyama method for non-linear dissipative-type stochastic differential equations with super-linear diffusion coefficients. to appear in Stochastics, 2012.

- [38] X. Mao and C. Yuan. Stochastic Differential Equations with Markovian Switching. Imperial College Press, 2006.

- [39] X. Mao, C. Yuan, and G. Yin. Approximations of Euler–Maruyama type for stochastic differential equations with Markovian switching, under non-Lipschitz conditions. Journal of Computational and Applied Mathematics, 205(2):936–948, 2007.

- [40] J.C. Mattingly, A.M. Stuart, and DJ Higham. Ergodicity for sdes and approximations: locally lipschitz vector fields and degenerate noise. Stochastic processes and their applications, 101(2):185–232, 2002.

- [41] S. Pang, F. Deng, and X. Mao. Asymptotic properties of stochastic population dynamics. Dynamics of Continuous, Discrete and Impulsive Systems Series A, 15:603–620, 2008.

- [42] Y. Shen, Q. Luo, and X. Mao. The improved LaSalle-type theorems for stochastic functional differential equations. Journal of Mathematical Analysis and Applications, 318(1):134–154, 2006.

- [43] L. Szpruch, X. Mao, D.J. Higham, and J. Pan. Numerical simulation of a strongly nonlinear Ait-Sahalia-type interest rate model. BIT Numerical Mathematics, pages 1–21.