From Minimax Shrinkage Estimation to Minimax Shrinkage Prediction

Abstract

In a remarkable series of papers beginning in 1956, Charles Stein set the stage for the future development of minimax shrinkage estimators of a multivariate normal mean under quadratic loss. More recently, parallel developments have seen the emergence of minimax shrinkage estimators of multivariate normal predictive densities under Kullback–Leibler risk. We here describe these parallels emphasizing the focus on Bayes procedures and the derivation of the superharmonic conditions for minimaxity as well as further developments of new minimax shrinkage predictive density estimators including multiple shrinkage estimators, empirical Bayes estimators, normal linear model regression estimators and nonparametric regression estimators.

doi:

10.1214/11-STS383keywords:

., and

1 The Beginning of the Hunt for Minimax Shrinkage Estimators

Perhaps the most basic estimation problem in Statistics is the canonical problem of estimating a multivariate normal mean. Based on the observation of a -dimensional multivariate normal random variable

| (1) |

the problem is to find a suitable estimator of . The celebrated result of Stein (1956) dethroned , the maximum likelihood and best location invariant estimator for this problem, by showing that, when , is inadmissible under quadratic loss

| (2) |

From a decision theory point of view, an important part of the appeal of was the protection offered by its minimax property. The worst possible risk incurred by was no worse than the worst possible risk of any other estimator. Stein’s result implied the existence of even better estimators that offered the same minimax protection. He had begun the hunt for these better minimax estimators.

In a remarkable series of follow-up papers Stein proceeded to set the stage for this hunt. James and Stein (1961) proposed a new closed-form minimax shrinkage estimator

| (3) |

the now well-known James–Stein estimator, andshowed explicitly that its risk was less than for every value of when , that is, it uniformly dominated . The appeal of under was compelling. It offered the same guaranteed minimax protection as while also offering the possibility of doing much better.

Stein (1962), though primarily concerned with improved confidence regions, described a parametric empirical Bayes motivation for (3), describinghow could be seen as a data-based approximation to the posterior mean

| (4) |

the Bayes rule which minimizes the average risk when . He here also proposed the positive-part James–Stein estimator, a dominating improvementover , and commented that “it would be even better to use the Bayes estimate with respect to a reasonable prior distribution.” These observations served as a clear indication that the Bayesian paradigm was to play a major role in the hunt for these new shrinkage estimators, opening up a new direction that was to be ultimately successful for establishing large new classes of shrinkage estimators.

Dominating fully Bayes shrinkage estimators soon emerged. Strawderman (1971) proposed , a class of Bayes shrinkage estimators obtained as posterior means under priors for which

| (5) |

Strawderman explicitly showed that uniformly dominated and was proper Bayes, when and or when and . This was especially interesting because any proper Bayes was necessarily admissible and so could not be improved upon.

Then, Stein (1974, 1981) showed that , the Bayes estimator under the harmonic prior

| (6) |

dominated when . A special case of when , was only formal Bayes because is improper. Undeterred, Stein pointed out that the admissibility of followed immediately from the general conditions for the admissibility of generalized Bayes estimators laid out by Brown (1971). A further key element of the story was Brown’s (1971) powerful result that all such generalized Bayes rules (including the proper ones of course) constituted a complete class for the problem of estimating multivariate normal mean under quadratic loss. It was now clear that the hunt for new minimax shrinkage estimators was to focus on procedures with at least some Bayesian motivation.

Perhaps even more impressive than the factthat dominated was the way Stein proved it. Making further use of the rich results in Brown (1971), the key to his proof was the fact that any posterior mean Bayes estimator under a prior can be expressed as

| (7) |

where

| (8) |

is the marginal distribution of under . [Here is the familiar gradient.]

At first glance it would appear that (7) has little to do with the risk. However, Stein noted that insertion of (7) into , followed by expansion and an integration-by-parts identity, now known as one of Stein’s Lemmas, yields the following general expression for the difference between the risks of and :

| (9) | |||

| (10) |

(Here is the familiar Laplacian.)

Because the bracketed terms in (1) and (10) do not depend on (they are unbiased estimators of the risk difference), the domination of by would follow whenever was such that these bracketed terms were nonnegative. As Stein noted, this would be the case in (1) whenever was superharmonic, , and in (10) whenever was superharmonic, , a weaker condition.

The domination of by was seen now to be attributable directly to the fact that the marginal (8) under , a mixture of harmonic functions, is superharmonic when . However, such an explanation would not work for the domination of by , because the marginal (8) under in (5) is not superharmonic for any . Indeed, as was shown later by Fourdrinier, Strawderman and Wells (1998), a superharmonic marginal cannot be obtained with any proper prior. More importantly, however, they were able to establish that the domination by was attributable to the superharmonicity of under when (and Strawderman’s conditions on ). In fact, it also followed from their results that is superharmonic when and , further broadening the class of minimax improper Bayes estimators.

Prior to the appearance of (1) and (10), minimaxity proofs, though ingenious, had all been tailored to suit the specific estimators at hand. The sheer generality of this new approach was daunting in its scope. By restricting attention to priors that gave rise to marginal distributions with particular properties, the minimax properties of the implied Bayes rules would be guaranteed.

2 The Parallels in the Predictive Estimation Problem Emerge

The seminal work of Stein concerned the canonical problem of how to estimate based on an observation of . A more ambitious problem is how to use such an to estimate the entire probability distribution of a future from a normal distribution with this same unknown mean , the so-called predictive density of . Such a predictive density offers a complete description of predictive uncertainty.

To conveniently treat the possibility of different variances for and , we formulate the predictive problem as follows. Suppose and are independent -dimensional multivariate normal vectors with common unknownmean but known variances and . Letting denote the density of , the problem is to find an estimator of based on the observation of only. Such a problem arises naturally, for example, for predicting based on the observation of which is equivalent to observing . This is exactly our formulation with and .

For the evaluation of as an estimator of , the analogue of quadratic risk for the mean estimation problem is the Kullback–Leibler (KL) risk

| (11) |

where denotes the density of , and

| (12) |

is the familiar KL loss.

For a (possibly improper) prior distribution on , the average risk is minimized by the Bayes rule

the posterior mean of under (Aitchison, 1975). It follows from (2) that is a proper probability distribution over whenever the marginal density of is finite for all (integrate w.r.t. and switch the order of integration). Furthermore, the mean of (when it exists) is equal to , the Bayes rule for estimating under quadratic loss, namely the posterior mean of . Thus, also carries the necessary information for that estimation problem. Note also that unless is a trivial point prior, such will not be of the form of for any . The range of the Bayes rules here falls outside the target space of the densities which are being estimated.

A tempting initial approach to this predictive density estimation problem is to use the simple plug-in estimator to estimate , the so-called estimative approach. This was the conventional wisdom until the appearance of Aitchison (1975). He showed that the plug-in estimator is uniformly dominated under by

the posterior mean of with respect to the uniform prior , the so-called predictive approach. In a related vein, Akaike (1978) pointed out that, by Jensen’s inequality, the Bayes rule would dominate the random plug-in estimator when is a random draw from . Strategies for averaging over were looking better than plug-in strategies. The hunt for predictive shrinkage estimators had turned to Bayes procedures.

Distinct from , was soon shown to be the best location invariant predictive density estimator; see Murray (1977) and Ng (1980). That is best invariant and minimax also follows from the more recent general results of Liang and Barron (2004), who also showed that is admissible when . The minimaxity of was also shown directly by George, Liang and Xu (2006). Thus, , rather than , here plays the role played by in the mean estimation context. Not surprisingly, , the posterior mean under the uniform prior is identical to in that context.

The parallels between the mean estimation problem and the predictive estimation problem came into sharp focus with the stunning breakthrough result of Komaki (2001). He proved that when , itself is dominated by the Bayes rule

| (15) |

under the harmonic prior in (6) used by Stein (1974). Shortly thereafter Liang (2002) showedthat is dominated by the proper Bayes rule under for which

| (16) |

when , and when and or and , the same conditions that Strawderman had obtained for his estimator. Notethat in (16) is an extension of (5) which depends on the constant . As before, is the special case of when . Note that is now playing the “straw-man” role that was played by in the mean estimation problem.

3 A Unified Theory for Minimax Predictive Density Estimation

The proofs of the domination of by in Komaki (2001) and by in Liang (2002) were both tailored to the specific forms of the dominating estimators. They did not make direct use of the properties of the induced marginal distributions of and . From the theory developed by Brown (1971) and Stein (1974) for the mean estimation problem, it was natural to ask if there was a theory analogous to (7)–(10) which would similarly unify the domination results in the predictive density estimation problem.

As it turned out, just such a theory was established in George, Liang and Xu (2006), the main results of which we now proceed to describe. The story begins with a representation, analogous to Brown’s representation in (7), that is available for posterior mean Bayes rules in the predictive density estimation problem. A key element of the representation is the form of the marginal distributions for our context which we denote by

| (17) |

for and a prior . In terms of our previous notation (8), .

Lemma 1

Lemma 1 shows how the form of is determined entirely by and the form of and . The essential step in its derivation is to factor the joint distribution of and into terms including a function of the sufficient statistic . Inserting the representation (18) into the risk leads immediately to the following unbiased estimate for the risk difference between and :

As one can see from (3) and the fact that , would be uniformly dominated by whenever is decreasing in . As if by magic, the sign of turned out to be directly linked to the same unbiased risk difference estimates (1) and (10) of Stein (1974).

Lemma 2

| (20) | |||

| (21) |

The proof of Lemma 2 relies on Brown’s representation, Stein’s Lemma, and the fact that any normal marginal distribution satisfies

| (22) |

the well-known heat equation which has a long history in science and engineering; for example, see Steele (2001). Combining (3) and Lemma 2 with the fact that is minimax yields the following general conditions for the minimaxity of a predictive density estimator, conditions analogous to those obtained by Stein for the minimaxity of a normal mean estimator.

Theorem 1

If is finite for all , then will be minimax if either of the following hold for all : {longlist}[(ii)]

is superharmonic.

is superharmonic.

Although condition (i) implies the weaker condition (ii) above, it is included because of its convenience when it is available. Since a superharmonic prior always yields a superharmonic for all , the following corollary is immediate.

Corollary 1

If is finite for all , then will be minimax if is superharmonic.

Because is superharmonic, it is immediate from Corollary 1 that is minimax. Because is superharmonic for all (under suitable conditions on ), it is immediate from Theorem 1 that is minimax. It similarly follows that any of the improper superharmonic -priors of Faith (1978) or any of the proper generalized -priors of Fourdrinier, Strawderman and Wells (1998) yield minimax Bayes rules.

The connections between the unbiased risk difference estimates for the KL risk and quadratic risk problems ultimately yields the following identity:

| (23) | |||

explaining the parallel minimax conditions in both problems. Brown, George and Xu (2008) used this identity to further draw out connections to establish sufficient conditions for the admissibility of Bayes rules under KL loss, conditions analogous to those of Brown (1971) and Brown and Hwang (1982), and to show that all admissible procedures for the KL risk problems are Bayes rules, a direct parallel of the complete class theorem of Brown (1971) for quadratic risk.

4 The Nature of Shrinkage in Predictive Density Estimation

The James–Stein estimator in (3) provided an explicit example of how risk improvements for estimating are obtained by shrinking toward 0 by the adaptive multiplicative factor . Similarly, under unimodal priors, posterior mean Bayes rules shrink toward the center of , the mean of when it exists. (Section 6 will describe how multimodal priors yield multiple shrinkage estimators.) As we saw earlier, here plays the role both of and of the formal Bayes estimator .

The representation (18) reveals how analogously “shrinks” the formal Bayes estimator , but not , by an adaptive multiplicative factor

| (24) |

However, because must be a proper probability distribution (whenever is always finite), it cannot be the case that for all at any . Thus, “shrinkage” here really refers to a reconcentration of the probability distribution of . Furthermore, since the mean of is , this reconcentration, under unimodal priors, is toward the center of , as in the mean estimation case.

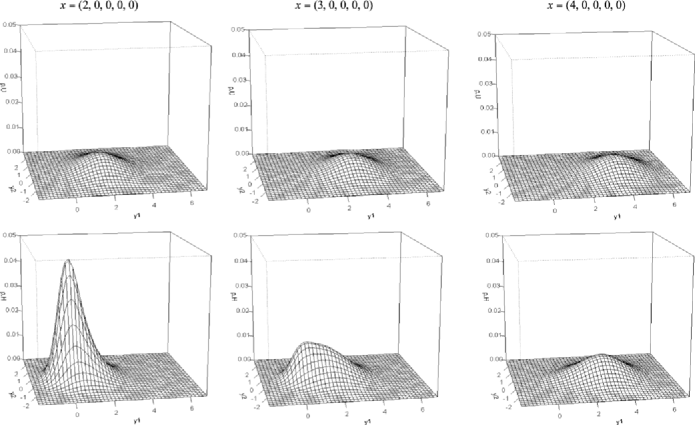

Consider, for example, what happens under which is symmetric and unimodal about 0. Figure 1 illustrates how this shrinkage occurs for for various values of when . Figure 1 plots and as functions of when and . Note first that is always the same symmetric shape centered at . When , shrinkage occurs by pushing the concentration of = toward 0. As moves further from to and this shrinkage diminishes as becomes more and more similar to .

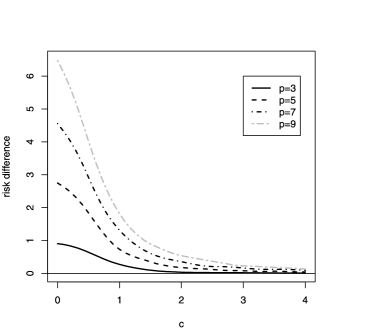

As in the problem of mean estimation, the shrinkage by manifests itself in risk reduction over . To illustrate this, Figure 2 displays the risk difference at , when and for dimensions . Paralleling the risk reduction offered by in the mean estimation problem, the largest risk reduction offered by occurs close to and decreases rapidly to 0 as increases. [ is constant as a function of .] At the same time, the risk reduction by is larger for larger at each fixed .

5 Many Possible Shrinkage Targets

By a simple shift of coordinates, the modified James–Stein estimator,

| (25) |

remains minimax, but now shrinks toward where its risk function is smallest. Similarly, minimax Bayes shrinkage estimators of a mean or of a predictive density can be shifted to shrink toward , by recentering the prior to . These shifted estimators are easily obtained by inserting the

corresponding translated marginal

| (26) |

into (7) to obtain

| (27) |

and into (18) to obtain

| (28) |

Recentered unimodal priors such as and yield estimators that now shrink and toward rather than toward 0. Since the superharmonic properties of are inherited by , the minimaxity of such estimators will be preserved.

In his discussion of Stein (1962), Lindley (1962) noted that the James–Stein estimator could be modified to shrink toward ( is the mean of the components of ), by replacing and in (25) by and , respectively. The resulting estimator remains minimax as long as and offers smallest risk when is close to the subspace of with identical coordinates, the subspace spanned by the vector . Note that is the projection of into this subspace.

More generally, minimax Bayes shrinkage estimators of a mean or of a predictive density can be similarly modified to obtain shrinkage toward any (possibly affine) subspace , whenever they correspond to spherically symmetric priors. Such priors, which include and , are functions of only through . Such a modification is obtained by recentering the prior around via

| (29) |

where is the projection of onto . Effectively, puts a uniform prior on and applies a suitably modified version of to . Note that the dimension of , namely , must be taken into account when determining the appropriate modification for . For example, recentering the harmonic prior around the subspace spanned by yields

| (30) |

where . Here, the uniform prior is put on , and the harmonic prior in dimension (which is different from the harmonic prior in ) is put on , the orthogonal complement of .

The marginal corresponding to the recentered in (29) can be directly obtained by recentering the spherically symmetric marginal corresponding to , that is,

| (31) |

where is the projection of onto . Analogously to , is uniform on and applies a suitably modified version of to . Here, too, the dimension of , namely , must be taken into account when determining the appropriate modification for . For example, recentering the marginal around the subspace spanned by would entail replacing by , where , and appropriately modifying to apply to .

Applying the recentering (29) to priors such as and , which are unimodal around 0, yields priors and and hence marginals and , which are unimodal around . Such recentered marginals yield mean estimators

| (32) |

and predictive density estimators

| (33) |

that now shrink and toward rather than toward 0. Shrinkage will be largest when , and will diminish as moves away from . These estimators offer smallest risk when , but do not improve in any important way over and when is far from .

A superharmonic will lead to a superharmonic as long as is large enough. For example, the recentered marginal will be superharmonic only when . In such cases, the minimaxity of both and will be preserved.

6 Where to Shrink?

Stein’s discovery of the existence of minimax shrinkage estimators such as in (25) demonstrated that costless improvements over the minimax were available near any target preselected by the statistician. As Stein (1962) put it when referring to the use of such an estimator to center a confidence region, the target “should be chosen… as one’s best guess” of . That frequentist considerations had demonstrated the folly of ignoring subjective input was quite a shock to the perceived “objectivity” of the frequentist perspective.

Although the advent of minimax shrinkage estimators of the form in (32) and in (33) opened up the possibility of small risk near any preselected (affine) subspace (this includes the possibility that is a single point), it also opened up a challenging new problem, how to best choose such a . From the vast number of possible choices, the goal was to choose close to the unknown , otherwise risk reduction would be negligible. To add to the difficulties, low-dimensional , which offered the greatest risk reduction, were also the most difficult to get close to .

When faced with a number of potentially good target choices, say , rather than choose one of them and proceed with or , an attractive alternative is to use a minimax multiple shrinkage estimator; see George (1986a, 1986b, 1986c). Such estimators incorporate all the potential targets by combining them into an adaptive convex combination of for mean estimation, and of for predictive density estimation. By adaptively shrinking toward the more promising targets, the region of potential risk reduction is vastly enlarged while at the same time retaining the safety of minimaxity.

The construction of these minimax multiple shrinkage estimators proceeds as follows, again making fundamental use of the Bayesian formulation. For a spherically symmetric prior , a set of subspaces of , and a set of nonnegative weights such that , consider the mixture prior

| (34) |

where each is a recentered prior as in (29). To simplify notation, we consider the case whereeach is a recentering of the same , although in principle such a construction could be applied with different priors. The marginal corresponding to the mixture prior in (34) is then simply

| (35) |

where are the recentered marginals corresponding to the as given by (31).

Applying Brown’s representation from (7) with in (35) immediately yields the multiple shrinkage estimator of ,

| (36) |

where

| (37) |

Similarly, applying the representation from (18) with immediatelyyields the multiple shrinkage estimator of ,

| (38) |

where

| (39) |

The forms (36) and (38) reveal and to be adaptive convex combination of the individual posterior mean estimators and , respectively. The adaptive weights in (37) and (39) are the posterior probabilities that is contained in each of the , effectively putting increased weight on those individual estimators which are shrinking most. Note that the uniform prior estimates and are here doubly shrunk by and ; in addition to the individual estimator shrinkage they are further shrunk by the posterior probability .

The key to obtaining and which are minimax is simply to use priors which yield superharmonic . If such is the case, then trivially from (35)

| (40) |

so that will be superharmonic, and the minimaxity of and will follow immediately. Note that marginals whose square root is superharmonic will not be adequate, as this argument will fail.

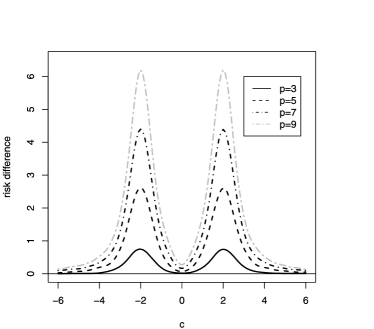

The adaptive shrinkage behavior of and manifests itself as substantial risk reduction whenever is near any of . Let us illustrate how that happens for the predictive density estimator , the multiple shrinkage version of . Figure 3 illustrates the risk reduction at various obtained by which adaptively shrinks toward the closer of the two points and using equal weights . As in Figure 2, we considered the case for . As the plot shows, maximum risk reduction occurs when is close to or , and goes to 0 as moves away from either of these points. At the same time, for each fixed , risk reduction by is larger for larger . It is impressive that the size of the risk reduction offered by is nearly the same as each of its single target counterparts. The cost of multiple shrinkage enhancement seems negligible, especially compared to the benefits.

7 Empirical Bayes Constructions

Beyond their attractive risk properties, the James–Stein estimator and its positive-part counterpart are especially appealing because of their simple closed forms which are easy to compute. As shown by Xu and Zhou (2011), similarly appealing simple closed-form predictive density shrinkage estimators can be obtained by the same empirical Bayes considerations that motivate and .

The empirical Bayes motivation of , alluded to in Section 1, simply entails replacing in (4) by , its unbiased estimate under the marginal distribution of when . The positive-part is obtained by using the truncated estimate which avoids an implicitly negative estimate of the prior variance .

Proceeding analogously, Xu and Zhou considered the Bayesian predictive density estimate,

| (41) | |||

when and are independent, and . Replacing by its truncated unbiased estimate under the marginal distribution of , they obtained the empirical Bayes predictive density estimate

| (42) | |||

where , an appealing simple closed form. Centered at , converges to the best invariant procedure as , and converges to as . Thus, can be viewed as a shrinkage predictive density estimator that “pulls” toward , its shrinkage adaptively determined by the data.

To assess the KL risk properties of such empirical Bayes estimators, Xu and Zhou considered the class of estimators of the form (7) with replaced by a constant , a class of simple normal forms centered at shrinkage estimators of with data-dependent variances to incorporate estimation uncertainty. For this class, they provided general sufficient conditions on and the dimension for to dominate the best invariant predictive density and thus be minimax. Going further, they also established an “oracle” inequality which suggests that the empirical Bayes predictive density estimator is asymptotically minimax in infinite-dimensional parameter spaces and can potentially be used to construct adaptive minimax estimators. It appears that these minimax empirical Bayes predictive densities may play the same role as the James–Stein estimator in such problems.

It may be of interest to note that a particular pseudo-marginal empirical Bayes construction that works fine for the mean estimation problem appears not to work for the predictive density estimation problem. For instance, the positive-part James–Stein estimator can be expressed as , where is the function

with (see Stein, 1974). We refer to as a pseudo-marginal because it is not a bona fide marginal obtained by a real prior. Nonetheless, it plays the formal role of a marginal in the mean estimation problem, and can be used to generate further innovations such as minimax multiple shrinkage James–Stein estimators (see George, 1986a, 1986b, 1986c).

Proceeding by analogy, it would seem that could be inserted into the representation (18) from Lemma 1 to obtain similar results under KL loss. Unfortunately, this does not yield a suitable minimax predictive estimator because is not a proper probability distribution. Indeed, and varies with . What has gone wrong? Because they do not correspond to real priors, such pseudo-marginals are ultimately at odds with the probabilistic coherence of a valid Bayesian approach. In contrast to the mean estimation framework, the predictive density estimation framework apparently requires stronger fidelity to the Bayesian paradigm.

8 Predictive Density Estimation for Classical Regression

Moving into the multiple regression setting, Stein (1960) considered the estimation of a -dimensional coefficient vector under suitably rescaled quadratic loss. He there established the minimaxity of the maximum likelihood estimators, and then proved its inadmissibility when , by demonstrating the existence of a dominating shrinkage estimator.

In a similar vein, as one might expect, the theory of predictive density estimation presented in Sections 2 and 3 can also be extended to the multiple regression framework. We here describe the main ideas of the development of this extension which appeared in George and Xu (2008). Similar results, developed independently from a slightly different perspective, appeared at the same time in Kobayashi and Komaki (2008).

Consider the canonical normal linear regression setup:

| (43) |

where is a full rank, fixed , is a fixed matrix, and is a common unknown regression coefficient. The error variance is assumed to be known, and set to be without loss of generality. The problem is to find an estimator of of the predictive density , evaluating its performance by KL risk

| (44) |

where is the KL loss between the density and its estimator

The story begins with the result, analogous to Aitchison’s (1975) for the normal mean problem, that the plug-in estimator , where is the least squares estimate of based on , is dominated under KL risk by the posterior mean of , the Bayes rule under the uniform prior

Here, too, is minimax (Liang, 2002; Liang and Barron, 2004) and plays the straw-man role of the estimator to beat. The challenge was to determine which priors would lead to Bayes rules which dominated , and hence would be minimax. Analogously to the representation (18) in Lemma 1 for the normal mean problem, the following representation for a Bayes rule here, was the key to meeting this challenge.

Lemma 3

The Bayes rule can be expressed as

| (46) |

where , is the least squares estimates of based on , and based on and , and is the marginal distribution of under .

The representation (46) leads immediately to the following analogue of (3) for the KL risk difference between and :

| (47) | |||

The challenge thus became that of finding conditions on to make this difference positive, a challenge made more difficult than the previous one for (3) because of the complexity of and . Fortunately this could be resolved by rotating the problem as follows to obtain diagonal forms. Since and are both symmetric and positive definite, there exists a full rank matrix , such that

Because where is nonnegative definite, it follows that for all with at least one . Thus, the parameters for the rotated problem become

Letting for , the risk difference (8) could be reexpressed as

| (50) | |||

where and . The minimaxity of would now follow from conditions on such that for all and The following substantial generalizations of Theorem 1 and Corollary 1 provide exactly those conditions.

Theorem 2

Suppose is finite for all with the invertible matrix defined as in (8). Let be the Hessian matrix of . {longlist}[(ii)]

If for all , then is minimax.

If for all , then is minimax.

Corollary 2

Suppose is finitefor all . Then is minimax if

As a consequence of Corollary 2, the scaled harmonic prior can be shown to yield minimax predictive density estimators for the regression setting.

Going further, George and Xu (2008) went on to show that the minimax Bayes estimators here can be modified to shrink toward different points and subspaces as in Section 5, and that the minimax multiple shrinkage constructions of Section 6 apply as well. In particular, they obtained minimax multiple shrinkage estimators that naturally accommodate variable selection uncertainty.

9 Predictive Density Estimation for Nonparametric Regression

Moving in another direction, Xu and Liang (2010) considered predictive density estimation in the context of modern nonparametric regression, a context in which the James–Stein estimator has turned out to play an important asymptotic minimaxity role; see Wasserman (2006). Their results pertain to the canonical setup for nonparametric regression:

| (51) |

where is an unknown smooth function in , , and ’s are i.i.d. . A central problem here is to estimate or various functionals of based on observing . Transforming the problem with an orthonormal basis, (51) is equivalent to estimating the ’s in

| (52) |

known as the Gaussian sequence model. The model above is different from the ordinary multivariate normal model in two aspects: (1) the model dimension is increasing with the sample size, and (2) under function space assumptions on , the ’s lie in a constrained space, for example, an ellipsoid .

A large body of literature has been devoted to minimax estimation of under risk over certain function spaces; see, for example, Johnstone (2003), Efromovich (1999), and the references therein. As opposed to the ordinary multivariate normal mean problem, exact minimax analysis is difficult for the Gaussian sequence model (52) when a constraint on the parameters is considered. This difficulty has been overcome by first obtaining the minimax risk of a subclass of estimators of a simple form, and then showing that the overall minimax risk is asymptotically equivalent to the minimax risk of the subclass. For example, an important result from Pinsker (1980) is that when the parameter space is constrained to an ellipsoid, the nonlinear minimax risk is asymptotically equivalent to the linear minimax risk, namely the minimax risk of the subclass of linear estimators of the form .

For nonparametric regression, the following analogue between estimation under risk and predictive density estimation under KL risk was established in Xu and Liang (2010). The prediction problem for nonparametric regression is formulated as follows. Let be future observations arising at a set of dense () and equally spaced locations . Given , the predictive density is just a product of Gaussians. The problem is to find an estimator of , where performance is measured by the averaged KL risk

| (53) |

In this formulation, densities are estimated at the locations simultaneously by . As it turned out, the KL risk based on the simultaneous formula-tion (53) is the analog of the risk for estimation. Indeed, under the KL risk (53), the prediction problem for a nonparametric regression model can be converted to the one for a Gaussian sequence model.

Based on this formulation of the problem, minimax analysis proceeds as in the general framework for the minimax study of function estimation used by, for example, Pinsker (1980) and Belitser and Levit (1995, 1996). The linear estimators there, which play a central role in their minimax analysis, take the same form as posterior means under normal priors. Analogously, predictive density estimates under the same normal priors turned out to play the corresponding role in the minimax analysis for prediction. (The same family of Bayes rules arises from the empirical Bayes approach in Section 7.) Thus, Xu and Liang (2010) were ultimately able to show that the overall minimax KL risk is asymptotically equivalent to the minimax KL risk of this subclass of Bayes rules, a direct analogue of Pinker’s Theorem for predictive density estimation in nonparametric regression.

10 Discussion

Stein’s (1956) discovery of the existence of shrinkage estimators that uniformly dominate the minimax maximum likelihood estimator of the mean of a multivariate normal distribution under quadratic risk when was the beginning of a major research effort to develop improved minimax shrinkage estimation. In subsequent papers Stein guided this effort toward the Bayesian paradigm by providing explicit examples of minimax empirical Bayes and fully Bayes rules. Making use of the fundamental results of Brown (1971), he developed a general theory for establishing minimaxity based on the superharmonic properties of the marginal distributions induced by the priors.

The problem of predictive density estimation of a multivariate normal distribution under KL risk has more recently seen a series of remarkably parallel developments. With a focus on Bayes rules catalyzed by Aitchison (1975), Komaki (2001) provided a fundamental breakthrough by demonstrating that the harmonic prior Bayes rule dominated the best invariant uniform prior Bayes rule. These results suggested the existence of a theory for minimax estimation based on the superharmonic properties of marginals, a theory that was then established in George, Liang and Xu (2006). Further developments of new minimax shrinkage predictive density estimators now abound, including, as described in this article, multiple shrinkage estimators, empirical Bayes estimators, normal linear model regression estimators, and nonparametric regression estimators. Examples of promising further new directions for predictive density estimation can be found in the work of Komaki (2004, 2006, 2009) which included results for Poisson distributions, for general location-scale models and for Wishart distributions, in the work of Ghosh, Mergel and Datta (2008) which developed estimation under alternative divergence losses, and in the work of Kato (2009) which established improved minimax predictive domination for the multivariate normal distribution under KL risk when both the mean and the variance are unknown. Minimax predictive density estimation is now beginning to flourish.

Acknowledgments

This work was supported by NSF Grants DMS-07-32276 and DMS-09-07070. The authors are grateful for the helpful comments and clarifications of an anonymous referee.

References

- Aitchison (1975) {barticle}[mr] \bauthor\bsnmAitchison, \bfnmJames\binitsJ. (\byear1975). \btitleGoodness of prediction fit. \bjournalBiometrika \bvolume62 \bpages547–554. \bidissn=0006-3444, mr=0391353 \bptokimsref \endbibitem

- Akaike (1978) {barticle}[mr] \bauthor\bsnmAkaike, \bfnmHirotugu\binitsH. (\byear1978). \btitleA new look at the Bayes procedure. \bjournalBiometrika \bvolume65 \bpages53–59. \bidissn=0006-3444, mr=0501450 \bptokimsref \endbibitem

- Belitser and Levit (1995) {barticle}[mr] \bauthor\bsnmBelitser, \bfnmE. N.\binitsE. N. and \bauthor\bsnmLevit, \bfnmB. Y.\binitsB. Y. (\byear1995). \btitleOn minimax filtering over ellipsoids. \bjournalMath. Methods Statist. \bvolume4 \bpages259–273. \bidissn=1066-5307, mr=1355248 \bptokimsref \endbibitem

- Brown (1971) {barticle}[mr] \bauthor\bsnmBrown, \bfnmL. D.\binitsL. D. (\byear1971). \btitleAdmissible estimators, recurrent diffusions, and insoluble boundary value problems. \bjournalAnn. Math. Statist. \bvolume42 \bpages855–903. \bidissn=0003-4851, mr=0286209 \bptokimsref \endbibitem

- Belitser and Levit (1996) {barticle}[mr] \bauthor\bsnmBelitser, \bfnmE. N.\binitsE. N. and \bauthor\bsnmLevit, \bfnmB. Y.\binitsB. Y. (\byear1996). \btitleAsymptotically minimax nonparametric regression in . \bjournalStatistics \bvolume28 \bpages105–122. \biddoi=10.1080/02331889708802553, issn=0233-1888, mr=1405604 \bptokimsref \endbibitem

- Brown, George and Xu (2008) {barticle}[mr] \bauthor\bsnmBrown, \bfnmLawrence D.\binitsL. D., \bauthor\bsnmGeorge, \bfnmEdward I.\binitsE. I. and \bauthor\bsnmXu, \bfnmXinyi\binitsX. (\byear2008). \btitleAdmissible predictive density estimation. \bjournalAnn. Statist. \bvolume36 \bpages1156–1170. \biddoi=10.1214/07-AOS506, issn=0090-5364, mr=2418653 \bptokimsref \endbibitem

- Brown and Hwang (1982) {bincollection}[mr] \bauthor\bsnmBrown, \bfnmLawrence D.\binitsL. D. and \bauthor\bsnmHwang, \bfnmJiunn Tzon\binitsJ. T. (\byear1982). \btitleA unified admissibility proof. In \bbooktitleStatistical Decision Theory and Related Topics, III, Vol. 1 (West Lafayette, Ind., 1981) (\beditorS. S. Gupta and \beditorJ. O. Berger, eds.) \bpages205–230. \bpublisherAcademic Press, \baddressNew York. \bidmr=0705290 \bptokimsref \endbibitem

- Efromovich (1999) {bbook}[mr] \bauthor\bsnmEfromovich, \bfnmSam\binitsS. (\byear1999). \btitleNonparametric Curve Estimation: Methods, Theory, and Applications. \bpublisherSpringer, \baddressNew York. \bidmr=1705298 \bptokimsref \endbibitem

- Faith (1978) {barticle}[mr] \bauthor\bsnmFaith, \bfnmRay E.\binitsR. E. (\byear1978). \btitleMinimax Bayes estimators of a multivariate normal mean. \bjournalJ. Multivariate Anal. \bvolume8 \bpages372–379. \biddoi=10.1016/0047-259X(78)90060-X, issn=0047-259X, mr=0512607 \bptokimsref \endbibitem

- Fourdrinier, Strawderman and Wells (1998) {barticle}[mr] \bauthor\bsnmFourdrinier, \bfnmDominique\binitsD., \bauthor\bsnmStrawderman, \bfnmWilliam E.\binitsW. E. and \bauthor\bsnmWells, \bfnmMartin T.\binitsM. T. (\byear1998). \btitleOn the construction of Bayes minimax estimators. \bjournalAnn. Statist. \bvolume26 \bpages660–671. \biddoi=10.1214/aos/1028144853, issn=0090-5364, mr=1626063 \bptokimsref \endbibitem

- George (1986a) {barticle}[mr] \bauthor\bsnmGeorge, \bfnmEdward I.\binitsE. I. (\byear1986a). \btitleMinimax multiple shrinkage estimation. \bjournalAnn. Statist. \bvolume14 \bpages188–205. \biddoi=10.1214/aos/1176349849, issn=0090-5364, mr=0829562 \bptokimsref \endbibitem

- George (1986b) {barticle}[mr] \bauthor\bsnmGeorge, \bfnmEdward I.\binitsE. I. (\byear1986b). \btitleCombining minimax shrinkage estimators. \bjournalJ. Amer. Statist. Assoc. \bvolume81 \bpages437–445. \bidissn=0162-1459, mr=0845881 \bptokimsref \endbibitem

- George (1986c) {barticle}[mr] \bauthor\bsnmGeorge, \bfnmEdward I.\binitsE. I. (\byear1986c). \btitleA formal Bayes multiple shrinkage estimator. \bjournalComm. Statist. A—Theory Methods \bvolume15 \bpages2099–2114. \biddoi=10.1080/03610928608829237, issn=0361-0926, mr=0851859 \bptokimsref \endbibitem

- George, Liang and Xu (2006) {barticle}[mr] \bauthor\bsnmGeorge, \bfnmEdward I.\binitsE. I., \bauthor\bsnmLiang, \bfnmFeng\binitsF. and \bauthor\bsnmXu, \bfnmXinyi\binitsX. (\byear2006). \btitleImproved minimax predictive densities under Kullback–Leibler loss. \bjournalAnn. Statist. \bvolume34 \bpages78–91. \biddoi=10.1214/009053606000000155, issn=0090-5364, mr=2275235 \bptokimsref \endbibitem

- George and Xu (2008) {barticle}[mr] \bauthor\bsnmGeorge, \bfnmEdward I.\binitsE. I. and \bauthor\bsnmXu, \bfnmXinyi\binitsX. (\byear2008). \btitlePredictive density estimation for multiple regression. \bjournalEconometric Theory \bvolume24 \bpages528–544. \biddoi=10.1017/S0266466608080213, issn=0266-4666, mr=2391619 \bptokimsref \endbibitem

- Ghosh, Mergel and Datta (2008) {barticle}[mr] \bauthor\bsnmGhosh, \bfnmMalay\binitsM., \bauthor\bsnmMergel, \bfnmVictor\binitsV. and \bauthor\bsnmDatta, \bfnmGauri Sankar\binitsG. S. (\byear2008). \btitleEstimation, prediction and the Stein phenomenon under divergence loss. \bjournalJ. Multivariate Anal. \bvolume99 \bpages1941–1961. \biddoi=10.1016/j.jmva.2008.02.002, issn=0047-259X, mr=2466545 \bptokimsref \endbibitem

- James and Stein (1961) {bincollection}[mr] \bauthor\bsnmJames, \bfnmW.\binitsW. and \bauthor\bsnmStein, \bfnmCharles\binitsC. (\byear1961). \btitleEstimation with quadratic loss. In \bbooktitleProc. 4th Berkeley Sympos. Math. Statist. and Prob., Vol. I \bpages361–379. \bpublisherUniv. California Press, \baddressBerkeley, CA. \bidmr=0133191 \bptokimsref \endbibitem

- Johnstone (2003) {bmisc}[auto:STB—2012/01/04—15:28:23] \bauthor\bsnmJohnstone, \bfnmI. M.\binitsI. M. (\byear2003). \bhowpublishedFunction estimation and Gaussian sequence models. Draft of a Monograph, Dept. Statistics, Stanford Univ. \bptokimsref \endbibitem

- Kato (2009) {barticle}[mr] \bauthor\bsnmKato, \bfnmKengo\binitsK. (\byear2009). \btitleImproved prediction for a multivariate normal distribution with unknown mean and variance. \bjournalAnn. Inst. Statist. Math. \bvolume61 \bpages531–542. \biddoi=10.1007/s10463-007-0163-z, issn=0020-3157, mr=2529965 \bptokimsref \endbibitem

- Kobayashi and Komaki (2008) {barticle}[mr] \bauthor\bsnmKobayashi, \bfnmKei\binitsK. and \bauthor\bsnmKomaki, \bfnmFumiyasu\binitsF. (\byear2008). \btitleBayesian shrinkage prediction for the regression problem. \bjournalJ. Multivariate Anal. \bvolume99 \bpages1888–1905. \biddoi=10.1016/j.jmva.2008.01.014, issn=0047-259X, mr=2466542 \bptokimsref \endbibitem

- Komaki (2001) {barticle}[mr] \bauthor\bsnmKomaki, \bfnmFumiyasu\binitsF. (\byear2001). \btitleA shrinkage predictive distribution for multivariate normal observables. \bjournalBiometrika \bvolume88 \bpages859–864. \biddoi=10.1093/biomet/88.3.859, issn=0006-3444, mr=1859415 \bptokimsref \endbibitem

- Komaki (2004) {barticle}[mr] \bauthor\bsnmKomaki, \bfnmFumiyasu\binitsF. (\byear2004). \btitleSimultaneous prediction of independent Poisson observables. \bjournalAnn. Statist. \bvolume32 \bpages1744–1769. \biddoi=10.1214/009053604000000445, issn=0090-5364, mr=2089141 \bptokimsref \endbibitem

- Komaki (2006) {barticle}[mr] \bauthor\bsnmKomaki, \bfnmFumiyasu\binitsF. (\byear2006). \btitleShrinkage priors for Bayesian prediction. \bjournalAnn. Statist. \bvolume34 \bpages808–819. \biddoi=10.1214/009053606000000010, issn=0090-5364, mr=2283393 \bptokimsref \endbibitem

- Komaki (2009) {barticle}[mr] \bauthor\bsnmKomaki, \bfnmFumiyasu\binitsF. (\byear2009). \btitleBayesian predictive densities based on superharmonic priors for the 2-dimensional Wishart model. \bjournalJ. Multivariate Anal. \bvolume100 \bpages2137–2154. \biddoi=10.1016/j.jmva.2009.04.014, issn=0047-259X, mr=2560359 \bptokimsref \endbibitem

- Liang (2002) {bmisc}[mr] \bauthor\bsnmLiang, \bfnmFeng\binitsF. (\byear2002). \bhowpublishedExact minimax procedures for predictive density estimation and data compression. Ph.D. thesis, Dept. Statistics, Yale Univ. \bidmr=2703233 \bptokimsref \endbibitem

- Liang and Barron (2004) {barticle}[mr] \bauthor\bsnmLiang, \bfnmFeng\binitsF. and \bauthor\bsnmBarron, \bfnmAndrew\binitsA. (\byear2004). \btitleExact minimax strategies for predictive density estimation, data compression, and model selection. \bjournalIEEE Trans. Inform. Theory \bvolume50 \bpages2708–2726. \biddoi=10.1109/TIT.2004.836922, issn=0018-9448, mr=2096988 \bptnotecheck year\bptokimsref \endbibitem

- Lindley (1962) {bmisc}[auto:STB—2012/01/04—15:28:23] \bauthor\bsnmLindley, \bfnmD. V.\binitsD. V. (\byear1962). \bhowpublishedDiscussion of “Confidence sets for the mean of a multivariate normal distribution” by C. Stein. J. Roy. Statist. Soc. Ser. B 24 285–287. \bptokimsref \endbibitem

- Murray (1977) {barticle}[mr] \bauthor\bsnmMurray, \bfnmGordon D.\binitsG. D. (\byear1977). \btitleA note on the estimation of probability density functions. \bjournalBiometrika \bvolume64 \bpages150–152. \bidissn=0006-3444, mr=0448690 \bptokimsref \endbibitem

- Ng (1980) {barticle}[mr] \bauthor\bsnmNg, \bfnmVee Ming\binitsV. M. (\byear1980). \btitleOn the estimation of parametric density functions. \bjournalBiometrika \bvolume67 \bpages505–506. \biddoi=10.1093/biomet/67.2.505, issn=0006-3444, mr=0581751 \bptokimsref \endbibitem

- Pinsker (1980) {barticle}[auto:STB—2012/01/04—15:28:23] \bauthor\bsnmPinsker, \bfnmM. S.\binitsM. S. (\byear1980). \btitleOptimal filtering of square integrable signals in Gaussian white noise. \bjournalProblems Inform. Transmission \bvolume2 \bpages120–133. \bptokimsref \endbibitem

- Steele (2001) {bbook}[mr] \bauthor\bsnmSteele, \bfnmJ. Michael\binitsJ. M. (\byear2001). \btitleStochastic Calculus and Financial Applications. \bseriesApplications of Mathematics (New York) \bvolume45. \bpublisherSpringer, \baddressNew York. \bidmr=1783083 \bptokimsref \endbibitem

- Stein (1956) {binproceedings}[mr] \bauthor\bsnmStein, \bfnmCharles\binitsC. (\byear1956). \btitleInadmissibility of the usual estimator for the mean of a multivariate normal distribution. In \bbooktitleProceedings of the Third Berkeley Symposium on Mathematical Statistics and Probability, 1954–1955, Vol. I \bpages197–206. \bpublisherUniv. California Press, \baddressBerkeley. \bidmr=0084922 \bptokimsref \endbibitem

- Stein (1960) {bincollection}[mr] \bauthor\bsnmStein, \bfnmCharles\binitsC. (\byear1960). \btitleMultiple regression. In \bbooktitleContributions to Probability and Statistics (\beditorI. Olkin, ed.) \bpages424–443. \bpublisherStanford Univ. Press, \baddressStanford, Calif. \bidmr=0120718 \bptokimsref \endbibitem

- Stein (1962) {barticle}[mr] \bauthor\bsnmStein, \bfnmC. M.\binitsC. M. (\byear1962). \btitleConfidence sets for the mean of a multivariate normal distribution (with discussion). \bjournalJ. Roy. Statist. Soc. Ser. B \bvolume24 \bpages265–296. \bidissn=0035-9246, mr=0148184 \bptnotecheck related\bptokimsref \endbibitem

- Stein (1974) {binproceedings}[mr] \bauthor\bsnmStein, \bfnmCharles\binitsC. (\byear1974). \btitleEstimation of the mean of a multivariate normal distribution. In \bbooktitleProceedings of the Prague Symposium on Asymptotic Statistics (Charles Univ., Prague, 1973), Vol. II \bpages345–381. \bpublisherCharles Univ., \baddressPrague. \bidmr=0381062 \bptokimsref \endbibitem

- Stein (1981) {barticle}[mr] \bauthor\bsnmStein, \bfnmCharles M.\binitsC. M. (\byear1981). \btitleEstimation of the mean of a multivariate normal distribution. \bjournalAnn. Statist. \bvolume9 \bpages1135–1151. \bidissn=0090-5364, mr=0630098 \bptokimsref \endbibitem

- Strawderman (1971) {barticle}[mr] \bauthor\bsnmStrawderman, \bfnmWilliam E.\binitsW. E. (\byear1971). \btitleProper Bayes minimax estimators of the multivariate normal mean. \bjournalAnn. Math. Statist. \bvolume42 \bpages385–388. \bidissn=0003-4851, mr=0397939 \bptokimsref \endbibitem

- Wasserman (2006) {bbook}[mr] \bauthor\bsnmWasserman, \bfnmLarry\binitsL. (\byear2006). \btitleAll of Nonparametric Statistics. \bpublisherSpringer, \baddressNew York. \bidmr=2172729 \bptokimsref \endbibitem

- Xu and Liang (2010) {barticle}[mr] \bauthor\bsnmXu, \bfnmXinyi\binitsX. and \bauthor\bsnmLiang, \bfnmFeng\binitsF. (\byear2010). \btitleAsymptotic minimax risk of predictive density estimation for non-parametric regression. \bjournalBernoulli \bvolume16 \bpages543–560. \biddoi=10.3150/09-BEJ222, issn=1350-7265, mr=2668914 \bptokimsref \endbibitem

- Xu and Zhou (2011) {barticle}[auto:STB—2012/01/04—15:28:23] \bauthor\bsnmXu, \bfnmX.\binitsX. and \bauthor\bsnmZhou, \bfnmD.\binitsD. (\byear2011). \btitleEmpirical Bayes predictive densities for high-dimensional normal models. \bjournalJ. Multivariate Anal. \bvolume102 \bpages1417–1428. \bptokimsref \endbibitem