Instrumental Variable Bayesian Model Averaging via Conditional Bayes Factors

Abstract

We develop a method to perform model averaging in two-stage linear regression systems subject to endogeneity. Our method extends an existing Gibbs sampler for instrumental variables to incorporate a component of model uncertainty. Direct evaluation of model probabilities is intractable in this setting. We show that by nesting model moves inside the Gibbs sampler, model comparison can be performed via conditional Bayes factors, leading to straightforward calculations. This new Gibbs sampler is only slightly more involved than the original algorithm and exhibits no evidence of mixing difficulties. We conclude with a study of two different modeling challenges: incorporating uncertainty into the determinants of macroeconomic growth, and estimating a demand function by instrumenting wholesale on retail prices.

Keywords: Endogeneity; Bayesian Instrumental Variable Estimation; Gibbs Sampling; Bayesian Model Determination; Bayesian Model Averaging; Conditional Bayes Factors; MCMC Model Composition

1 Introduction

We consider the problem of incorporating instrument and covariate uncertainty into the Bayesian estimation of an instrumental variable (IV) regression system. The concepts of model uncertainty and model averaging have received widespread attention in the economics literature for the standard linear regression framework (see, e.g. Fernández

et al. (2001), Eicher

et al. (2011) and references therein). However, these frameworks do not directly address endogeneity and only recently has attention been paid to this important component. Unfortunately, the nested nature of IV estimation renders direct model comparison exceedingly difficult.

This has led to a number of different approaches. Durlauf

et al. (2008), Cohen-Cole et al. (2009) and Durlauf

et al. (2011) consider approximations of marginal likelihoods in a framework similar to two-stage least squares. Lenkoski

et al. (2011) continues this development with the two-stage Bayesian model averaging (2SBMA) methodology, which uses a framework developed by Kleibergen and

Zivot (2003) to propose a two-stage extension of the unit information prior (Kass and

Wasserman, 1995). Similar approaches in closely related models have been developed by Morales-Benito (2009) and Chen

et al. (2009).

Koop

et al. (2012) develop a fully Bayesian methodology that does not utilize approximations to integrated likelihoods. They develop a reversible jump Markov chain Monte Carlo (RJMCMC) algorithm (Green, 1995), which extends the methodology of Holmes

et al. (2002). The authors then show that the method is able to handle a variety of priors, including those of Drèze (1976), Kleibergen and van

Dijk (1998) and Strachan and

Inder (2004). However, the authors note that direct application of RJMCMC leads to significant mixing difficulties and rely on a complicated model move procedure that has similarities to simulated tempering to escape local model modes.

We propose an alternative solution to this problem, which we term Instrumental Variable Bayesian Model Averaging (IVBMA). Our method builds on a Gibbs sampler for the IV framework, discussed in Rossi

et al. (2006). While direct model comparisons are intractable, we introduce the notion of a conditional Bayes factor (CBF), first discussed by Dickey and

Gunel (1978). The CBF compares two models in a nested hierarchical system, conditional on parameters not influenced by the models under consideration. We show that the CBF for both first and second-stage models is exceedingly straightforward to calculate and essentially reduces to the normalizing constants of a multivariate normal distribution.

This leads to a procedure in which model moves are embedded in a Gibbs sampler, which we term MC3-within-Gibbs. Based on this order of operations, IVBMA is then shown to be only trivially more difficult than the original Gibbs sampler that does not incorporate model uncertainty. A three-step procedure is updated to a five-step procedure and as such, IVBMA appears to have limited issues regarding mixing. Furthermore, the routines discussed here are contained in the R package ivbma, which can be freely downloaded from the Comprehensive R Archive Network (CRAN).

The article proceeds as follows. The basic framework we consider, and the Gibbs sampler ignoring model uncertainty is discussed in Section 2. Section 3 reviews the concept of model uncertainty, introduces the notion of CBFs and derives the conditional model probabilities used by IVBMA. In Section 4 we conclude with two data analyses. The first is the classic problem of modeling uncertainty in macroeconomic growth determinants, which has proven a testing-ground for BMA in economics. Second, we consider the problem of modeling an uncertain demand function, in particular the volume of demand for margarine in Denver, Colorado, between January 1993 and March 1995. In Section 5 we conclude. Appendices give details of the calculations outlined in Sections 2 and 3.

2 Methodology

2.1 Description of the Model

We consider the classic, two-stage endogenous variable model:

| Y | (2.1) | |||

| (2.2) |

with

| (2.3) |

and

In what follows we restrict the response variable and the endogenous explanatory factor to be 222In the Conclusions section we outline the straightforward steps necessary to incorporate multiple endogenous variables.. W denotes an matrix of further explanatory variables with parameter vectors and . The instrumental variables are described by the matrix with a parameter vector. The coefficient is a scalar.

Due to (2.3) the error terms are homoscedastic and correlated in each component, since for all observations, requiring joint estimation of the system (2.1) and (2.2) in order to draw appropriate inference for the parameters in the outcome equation (2.1). The assumption of bivariate normality in is helpful in deriving a fast algorithm for posterior determination; in the Conclusions section we discuss how this may be relaxed.

2.2 Calculation of the Conditional Posterior Distributions

In this paper we focus solely on the Bayesian estimation of the IV framework detailed above. We consider a prior framework detailed in Rossi

et al. (2006)–extended to the multivariate setting–as it lends itself to quick posterior estimation through Gibbs sampling.

In order to adequately explain the CBF calculations we perform in Section 3, it is helpful to review the derivation of the conditional posterior distributions. The following three subsections will present the calculation of the posterior distribution of the parameter vector of our model (2.1)-(2.3), conditional on the data .

The Gibbs sampler we outline below divides into three subvectors, , and

with , , and , where denotes the cone of positive definite matrices. Appendix A gives full details of the conditional distributions derived below.

2.2.1 Step 1: The Conditional Posterior Distribution of

Assuming a standard normal prior for the second stage regressors we have

| (2.4) |

where , with , and . Details are given in Appendix A.

2.2.2 Step 2: The Conditional Posterior Distribution of

Assuming a standard normal prior for the first stage regressors , we have

| (2.5) |

where . Here, is a matrix formed from and and is a matrix formed from , and , whose construction is outined in Appendix A.

2.2.3 Step 3: The Conditional Posterior Distribution of

Finally, to determine we use an inverse-Wishart prior (e.g. Anderson, 1984). Thus, and as the inverse-Wishart is conjugate we have

| (2.6) |

where .

3 Incorporating Model Uncertainty

We outline our method for incorporating model uncertainty into the estimation of the framework (2.1) and (2.2). In order to explain the motivation behind our CBF approach, we first review some basic results from classic model selection problems. We then show how the concept of Bayes Factors can be usefully embedded in a Gibbs sampler yielding CBFs. These CBFs are then shown to yield straightforward calculations. The section concludes with an overview of the full IVBMA procedure.

3.1 Bayes Factors

In a general framework, incorporating model uncertainty involves considering a collection of candidate models , using the data . Each model consists of a collection of probability distributions for the data , where denotes the parameter space for the parameters of model and is a subset of the full parameter space .

By letting the model become an additional parameter to be assessed in the posterior, we aim to calculate the posterior model probabilities given the data . By Bayes’ rule

| (3.1) |

where , denotes the prior probability for model .

The integrated likelihood , is defined by

| (3.2) |

where is the prior for under model , which by definition has all its mass on .

One possibility for pairwise comparison of models is offered by the Bayes factor (BF), which is in most cases defined together with the posterior odds (Kass and

Raftery, 1995).

Definition 1 (Posterior odds and Bayes factor)

The posterior odds of model versus model is given by

where

denote the Bayes factor and the prior odds of versus , respectively.

When the integrated likelihood (3.2) and thus the BF can be computed directly, a straightforward method for exploring the model space, Markov Chain Monte Carlo Model Composition (MC3), was developed by Madigan

et al. (1995).

MC3 determines posterior model probabilities by generating a stochastic process that moves through the model space and has equilibrium distribution . Given the current state , MC3 proposes a new model according to a proposal distribution , calculates

and sets with probability otherwise setting .

3.2 Model Determination for Two-Staged Problems

We now consider the incorporation of model uncertainty into the system (2.1) and (2.2). We follow the notation of Lenkoski

et al. (2011). Associated with the outcome equation we consider a collection of models . Each consists of a different restriction on the parameter and we denote this restricted space. Similarly in the instrument equation (2.2) we consider a collection which impose restrictions on the vector and associate with each a space .

Ideally, we would be able to incorporate model uncertainty into this system in a manner analogous to that described above. Unfortunately,

cannot be directly calculated in any obvious manner. Therefore an implementation of MC3 on the product space of is infeasible. What we show below, however, is that embedding MC3 within the Gibbs sampler, and therefore calculation using CBFs to move between models, offers an extremely efficient solution. CBFs were originally discussed in Dickey and Gunel (1978) and for the IV framework are defined below.

Definition 2 (Conditional Bayes factor)

Considering , we can see that it relies on determining the quantity

which is, in essence, an integrated likelihood for model conditional on fixed values of and . In Appendix B we show that

| (3.3) |

Where and are defined in Appendix B, but are exactly analogous to the and discussed in section 2.2.1, restricted to the subset of and included in model .

Similarly, in Appendix B we show that

| (3.4) |

where and are again defined in Appendix B, but are analogous333However, as noted in the Appendix, when , and thus the endogenous variable is not included in (2.1), the update is altered and resembles a seemingly unrelated regression update. to the similar quantities discussed in Section 2.2.2.

Equations (3.3) and (3.4) show that both and can be calculated directly. Furthermore, these calculations are extremely straightforward, and involve computing little more than the parameters necessary for sampling in the Gibbs sampler.

3.3 Model Space Priors

Setting a prior on models in the IVBMA framework necessitates–at a minimum–some subtlety in order to guarantee the pair constitute an IV specification. Let such that if and only if . We therefore are only interested in considering model pairs in the collection .

In what follows, we assume

In other words, we assume a uniform prior on the space of models in . Other priors on the model space (e.g. Brock et al., 2003; Scott and Berger, 2006; Durlauf et al., 2008; Ley and Steel, 2009) could easily be accommodated.

3.4 The IVBMA Algorithm

Building upon the original Gibbs sampler discussed in Section 2.2, and the derivations in Section 3.2 we now outline the IVBMA algorithm, which relies on an MC3-within-Gibbs sampler444In reality, this is simply a special case of the Metropolis-within-Gibbs algorithm (see Chib and Greenberg, 1995), since the MC3 step can be considered a Metropolis-Hastings step in the space of models.. IVBMA creates a sequence where

with , and . Given the current state and the data , IVBMA proceeds as follows

-

1.

Update : First, sample from the neighborhood of (i.e. uniformly on those models that differ from by only one variable). Then calculate

using Equation (3.3). With probability set , otherwise set .

-

2.

Update : Sample as discussed in Appendix B.

-

3.

Update : Sample from the neigborhood of , then calculate

using Equation (3.4). With probability set , otherwise set .

-

4.

Update : Sample as discussed in Appendix B.

-

5.

Update : Use and to calculate and and sample

where

This constitutes the entire IVBMA algorithm. The appeal of the procedure is that it is hardly more involved than the original Gibbs sampler discussed in Section 2.2.

4 Empirical Analysis

4.1 Determinants of Macroeconomic Growth

Modeling uncertainty in macroeconomic growth determinants has proven a testing ground for BMA, see Eicher

et al. (2011) and the extensive references therein. We consider the dataset used in Lenkoski

et al. (2011) which builds on that of Rodrik

et al. (2004). These data juxtapose the most prominent development theories and their associated candidate regressors in one comprehensive approach. The data have two endogenous variables, a proxy for institutions (rule of law) and economic integration. There are four potential instruments and 18 additional covariates. Table 1 summarizes the variables included in this study. See Lenkoski

et al. (2011) for a detailed description of the dataset and the modeling background.

| Variable Name | Description |

|---|---|

| Area | Land area (thousands sq. mt.) |

| Catholic | Dummy variable taking value 1 if the country’s population is predominantly catholic |

| EastAsia | Dummy variable taking value 1 if a country belongs to South-East Asia, 0 otherwise |

| EngFrac | Fraction of the population speaking English. |

| TradeShares | Natural logarithm of predicted trade shares computed from a bilateral trade equation with “pure geography” variables. |

| FrostArea | Proportion of land with 5 frost-days per month in winter. |

| FrostDays | Average number of frost-days per month in winter. |

| Integration | Natural logarithm of openness. Openness is given by the ratio of (nominal) imports plus exports to GDP (in nominal US dollars). |

| LatinAmerica | Dummy variable taking value 1 if a country belongs to Latin America or the Caribbean, 0 otherwise |

| Latitude | Distance from Equator of capital city measured as abs(Latitude)/90 |

| LegalOrigFr | variable taking a value of 1 if a country has a legal system deriving from that in France |

| LegalOrigSocialist | variable taking a value of 1 if a country has a socialist legal system |

| Malaria94 | Malaria index, year 1994. |

| MeanTemp | Average temperature (Celsius). |

| Muslim | Dummy variable taking value 1 if the country’s population is predominantly muslim |

| Oil | variable taking value 1 for a country being major oil exporter, 0 otherwise. |

| PolicyOpenness | Dummy variable that indicates if a country has sufficiently market oriented policies |

| PopGrowth | population growth |

| Protestant | variable taking value 1 if the country’s population is predominantly protestant |

| RuleofLaw | Rule of Law index. Refers to 2001 and approximates for 1990’s institutions |

| SeaAccess | Dummy variable taking value 1 for countries without access to the sea, 0 otherwise. |

| SettlerMortality | Natural logarithm of estimated European settlers’ mortality rate |

| SubSaharaAfrica | taking value 1 if a country belongs to Sub-Saharan Africa, 0 otherwise |

| Tropics | Percentage of tropical land area. |

We took the dataset of Lenkoski

et al. (2011) and ran IVBMA for 200,000 iterations, discarding the first 20,000 as burn-in. This took approximately 10 minutes to run. By contrast, the 2SBMA analysis conducted by Lenkoski

et al. (2011) on the same data took over 15 hours of computing time. The extreme difference in computing time results from the style of the two approaches. The 2SBMA methodology of Lenkoski

et al. (2011) was designed to mimic the 2SLS estimator. It first ran a separate BMA analysis for each first-stage regression. All models returned from these two runs were paired and a subsequent BMA was run on the outcome equation for each pair. This led to an extremely large number of second-stage BMA runs and thus considerable computing time. By contrast, IVBMA models the entire system jointly and this joint approach leads to a dramatic improvement in computational efficiency.

Table 2 shows the resulting posterior estimates. We see a picture similar to that reported by Lenkoski

et al. (2011), although with somewhat fewer included determinants. In particular, similar to Lenkoski

et al. (2011) English and European fractions serve as the two best instruments of Rule of Law, while neither settler mortality nor trade receive high inclusion probabilities. Further, Integration is well-instrumented by trade shares, which receives an inclusion probability of . These results are essentially the same as those reported in Lenkoski

et al. (2011).

In the second stage, we see a similar, but markedly sparser conclusion as Lenkoski

et al. (2011). Both rule of law and integration are given strong support by the data, with inclusion probabilities of essentially . Beyond these two factors only the intercept, an indicator for Latin America and an indicator of whether the country has market oriented policies are given inclusion probabilities above 0.5 in the second stage. In contrast to 2SBMA, which gave evidence to religious and geographic issues as determinants of macroeconomic growth, IVBMA points strongly to institutions and integration as the leading determinants.

| Rule | Trade | Outcome | |||||||

| Variable | Prob | Mean | sd | Prob | Mean | sd | Prob | Mean | sd |

| RuleofLaw | – | – | – | – | – | – | 0.999 | 1.073 | 0.224 |

| Integration | – | – | – | – | – | – | 1 | 0.992 | 0.164 |

| SettlerMortality | 0.11 | -0.009 | 0.035 | 0.097 | -0.006 | 0.028 | – | – | – |

| TradeShares | 0.111 | 0.007 | 0.037 | 1 | 0.532 | 0.088 | – | – | – |

| EnglishFrac | 0.91 | 1.13 | 0.592 | 0.539 | 0.244 | 0.302 | – | – | – |

| EuropeanFrac | 0.667 | 0.459 | 0.455 | 0.16 | -0.012 | 0.087 | – | – | – |

| Intercept | 0.271 | 0.061 | 0.278 | 0.999 | 2.303 | 0.343 | 0.546 | 0.362 | 0.793 |

| Dist_Equ | 0.016 | 0 | 0.002 | 0.007 | 0 | 0.001 | 0.015 | 0 | 0.002 |

| Lat_Am | 0.539 | -0.297 | 0.371 | 0.163 | -0.017 | 0.077 | 0.981 | 1.018 | 0.271 |

| Sub_Africa | 0.207 | -0.029 | 0.114 | 0.184 | 0.027 | 0.099 | 0.233 | -0.034 | 0.133 |

| E_Asia | 0.415 | 0.152 | 0.269 | 0.957 | 0.671 | 0.261 | 0.381 | 0.126 | 0.288 |

| Legor_fr | 0.157 | 0.008 | 0.067 | 0.122 | 0.008 | 0.045 | 0.366 | 0.101 | 0.173 |

| Catholic | 0.007 | 0 | 0.001 | 0.003 | 0 | 0 | 0.031 | 0 | 0.002 |

| Muslim | 0.002 | 0 | 0 | 0.002 | 0 | 0 | 0.017 | 0 | 0.001 |

| Protestant | 0.008 | 0 | 0.001 | 0.021 | 0 | 0.001 | 0.011 | 0 | 0.001 |

| Tropics | 0.939 | -0.607 | 0.24 | 0.338 | 0.095 | 0.177 | 0.381 | -0.131 | 0.263 |

| SeaAccess | 0.165 | -0.012 | 0.075 | 0.119 | 0.001 | 0.046 | 0.158 | -0.005 | 0.085 |

| Oil | 0.344 | -0.108 | 0.212 | 0.881 | 0.402 | 0.21 | 0.387 | 0.145 | 0.266 |

| Frost_Day | 0.04 | 0.001 | 0.006 | 0.022 | 0 | 0.002 | 0.03 | 0 | 0.005 |

| Frost_Area | 0.465 | 0.194 | 0.289 | 0.376 | 0.133 | 0.24 | 0.341 | 0.071 | 0.253 |

| Malaria94 | 0.242 | -0.042 | 0.136 | 0.301 | -0.076 | 0.152 | 0.243 | -0.035 | 0.149 |

| MeanTemp | 0.021 | 0 | 0.004 | 0.017 | 0 | 0.002 | 0.026 | 0 | 0.005 |

| Area | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Population | 0.037 | -0.001 | 0.011 | 0.042 | 0 | 0.009 | 1 | 0.235 | 0.04 |

| PolicyOpen | 0.37 | 0.118 | 0.236 | 0.228 | 0.021 | 0.132 | 0.511 | 0.249 | 0.345 |

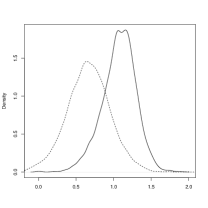

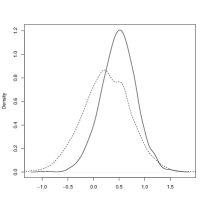

Figure 1 shows the posterior distribution of the second-stage coefficients for the four variables with the highest inclusion probabilities under IVBMA. We also include the posterior distribution of these covariates under an approach that does not incorporate model uncertainty (which we refer to as IV), and uses the algorithm discussed in Section 2.2. Several interesting aspects are clear in Figure 1. Inspecting panel (b), we see that IVBMA has led to a posterior distribution on integration with essentially the same mode as that of IV. However, the IVBMA distribution is considerably more focused, indicating a reduction in parameter variance that results from using parsimonious models.

The other three panels also have the feature of tighter posterior distributions under IVBMA versus IV. However, what is potentially more interesting is that the distributions are also centered in slightly different locations. The effect is particularly large for the Latin America indicator, which is tightly centered about its median of under IVBMA, while more diffuse about the median of under IV. The respective posterior standard deviations of these two estimates are and under IVBMA and IV respectively.

This effect is also evident for the rule of law parameter estimate. Under IVBMA, this parameter has a median of and posterior standard deviation of , while under IV this parameter has a median of and an standard deviation of . We note that in Lenkoski

et al. (2011), three increasingly larger runs of 2SBMA were conducted. As the size of the considered covariates rose, the posterior estimate on rule of law went from 1.276 (with a standard deviation 0.1772) down to an estimate of (). Therefore, our results are in line with those of Lenkoski

et al. (2011), however it appears evident that IVBMA has introduced additional parsimony into resulting models than the nested approach of 2SBMA.

4.2 Estimating a Demand Function

4.2.1 Description of the Data Set

We use the data provided by Chintagunta

et al. (2005) (CDG) that had been collected by AC Nielsen and follow the approach outlined in Conley

et al. (2008). CDG examined the purchase of margarine in Denver, Colorado, in a time period of 117 weeks, from January 1993 until March 1995. The sample consists of weekly prices and purchase data for the four main brands of margarine. CDG differentiate between 992 households purchasing margarine whereas following Conley

et al. (2008) we will not account for heterogeneity but focus on the total number of weekly purchases per brand. Furthermore, the data set offers weekly information on feature ads and display conditions for each of the four brands. For detailed descriptive statistics and marketing conditions of the single brands see Chintagunta

et al. (2005).

Since retail price is influenced by unobserved characteristics likely to be correlated with sales, it is an endogenous variable. CDG claim that wholesale prices serve as reliable instruments as they should not be sensitive to retail demand shocks. Their results show that wholesale prices alone explain nearly 80% of the variation in margarine retail prices. Moreover, it is often the case that products with considerable shelf-life such as magarine are not sold to the consumer within the same week as they are bought at the wholesale establishment. Thus, CDG added the wholesale prices of up to six weeks before the purchase week to the matrix of instruments.

Besides these variables we entertain two more candidate instruments. We include the Consumer Price Index (CPI) for all urban consumers of Colorado and the CPI for food in the United States, using the data provided by the U.S. Bureau of Labor Statistics (BLS). Since the BLS reports only monthly data, we use the same value for all weeks in the respective month. Weeks being part of two months are assigned to the month the majority of their days belong to. We do not expect these variables to perform as well as wholesale prices because they are not collected at a brand level. However, we think it is reasonable (or at least vaguely plausible) that overall price levels should influence the price of margarine. Our matrix therefore consists of nine candidate instrumental variables (see table 3 for an overview).

In addition to feature ads and display conditions, we entertain several additional variables with potential effect on both demand and retail price. Our hypothesis is that holidays could positively affect the demand for margarine. We therefore collected data from the Denver Public Schools showing the days free of school for the school years 1992/93, 1993/94 and 1994/95. Differing between whole weeks of holiday and weeks containing only one or two free days, we created two dummy variables and added them to the matrix .

We also consider the Local Area Unemployment Statistics (LAUS) of Colorado. These monthly data provided by the BLS are again adapted to our weekly setup in the manner described above.

Moreover, we entertain the possibility that temperature might also have explanatory power for the purchase of margarine. We therefore collected historical temperature data for the Denver area from January 1993 until March 1995. Finally, we add four fixed variables to for distinguishing between brands. Table 3 summarizes the different regressors by short descriptions.

Following Conley

et al. (2008), we examine the logarithm of each brand’s weekly share of sales instead of the absolute sales figures. Additionally, we use the logarithm of retail prices as endogenous regressors, yielding the regression system

These transformations are clearly performed in order to use the framework (2.1) and (2.2). A more involved specification would directly assess the discrete choice nature of the dataset; we discuss this feature in the Conclusions section.

| Variable Name | Description |

|---|---|

| WP | weekly wholesale prices for the four different brands for margarine |

| lag1 WP | wholesale prices one week before sale to consumer |

| lag2 WP | wholesale prices two weeks before sale to consumer |

| lag3 WP | wholesale prices three weeks before sale to consumer |

| lag4 WP | wholesale prices four weeks before sale to consumer |

| lag5 WP | wholesale prices five weeks before sale to consumer |

| lag6 WP | wholesale prices six weeks before sale to consumer |

| CPI Food | CPI for food in general in the U.S. |

| CPI UrbCol | CPI for all urban consumers of Colorado |

| Feature Ad | variable indicating the existance and degree of feature ads at the product shelfs |

| Display | variable describing the display conditions |

| Intercept | vector with value 1, reference point for brand indicators |

| Brand2 | dummy variable indicating brand 2 |

| Brand3 | dummy variable indicating brand 3 |

| Brand4 | dummy variable indicating brand 4 |

| WeekHol | dummy variable taking value 1 if the whole week was free at Denver Public Schools |

| InterHol | dummy variable taking value 1 if the week had only one or two free days at DPSs |

| Temp | variable showing the average weekly temperature at Denver, Colorado (in Celsius) |

| Unemploy | Local Area Unemployment Statistics for Colorado |

4.2.2 Results - Factors influencing the Demand for Margarine

For the margarine data we considered 19 potential influencing factors in the first stage, amongst them 9 instruments. In the second stage, we chose 10 variables to predict the log shares of sales.

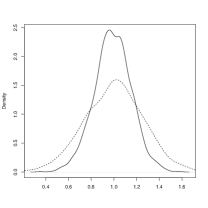

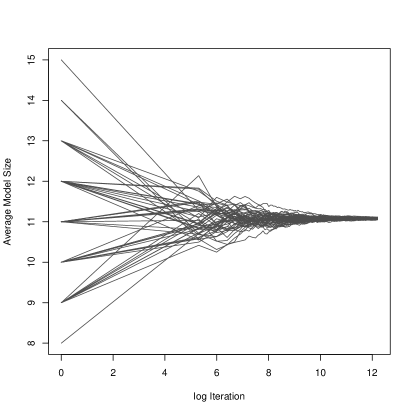

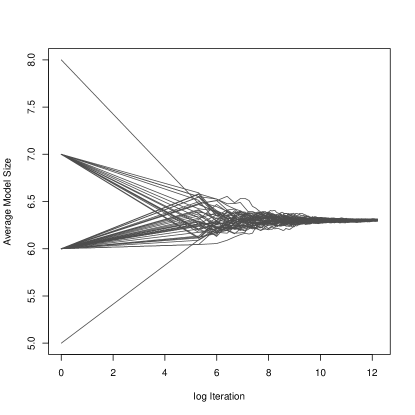

We ran IVBMA for 250,000 iterations and discarded the first 50,000 as burn-in. In order to examine the mixing properties of IVBMA, we ran 50 independent instances of the algorithm initialized at different random starting points and using different random seeds. On average, each run took approximately 5 minutes on the hardware discussed above and all instances returned identical posterior estimates, indicating convergence and no issues regarding mixing. Figure 2 shows a rough diagnostic of this convergence. In it, we show the average first stage (Equation 2.2) and second stage (Equation 2.1) model size by log iteration for each of the chains. As we can see, the figure shows a rapid agreement across chains, with an average model size of in the first (instrument) stage and in the second (outcome) stage. While this visual display is only a rough diagnostic, it gives an idea of the quick convergence and lack of mixing difficulties of IVBMA. Indeed, it appears that iterations may have been unnecessary as all chains agree within the first post burn-in iterations.

Columns 1 and 5 of Table 4 show the inclusion probabilities of both stages returned by IVBMA. We note that the log price, the endogenous factor, is given an inclusion probability of 1. The other columns in Table 4 provide the lower, median, and upper bounds (the 2.5%, 50% and 97.5% quantiles respectively) of the resulting parameter samples. The posterior distribution of has a median of -2.161 with a small range, confirming the expectation that higher retail price of margarine diminishes quantity sold.

Regarding the results for members of , we see that in both stages the feature ad and display variables have inclusion probabilities of more than 95%. The median parameter values in Table 4, columns 3 and 6, indicate that feature ads and display conditions have a negative effect on price but simultaneously a positive influence on the volume of demand.

With regard to variables we have added, temperature proves to affect neither prices nor sales figures. In our mind this shows the utility of IVBMA, as we were able to entertain this additional factor and the method promptly rejected its inclusion. Similar results are found for both holiday variables, which have an inclusion probability of less than 6% and therefore little influence in either stage.

However, the unemployment rate for Colorado offers an unexpected surprise. This variable has an impressively high inclusion probability of 87% in the first stage and a negligible influence at the second stage. Therefore, it seems that unemployment could serve as an instrument for the endogenous price variable. We feel this could be reasonable, largely because our dependent variable is share and not quantity sold. Thus, we can imagine declining economic conditions to induce retailers to lower the price of consumer staples, but these conditions may have potentially less effect on the overall product mix sold once price adjustments are accounted for. As we can see in column 2 of Table 4 this factor is a negatively directed factor, i.e. the higher the unemployment rate in Colorado the lower the price for margarine.

Use of wholesale prices as instruments is confirmed, but not wholeheartedly. These variables’ inclusion probabilities ranged between 48% and 66% (column 1, Table 4). Interestingly, the effect of wholesale prices increases with the weekly time-lags, which is also reflected in the posterior medians of the regression coefficients in column 3 of Table 4. As already reasoned above, this could be grounded in the fact retailers often buy their products from the wholesalers some time before they are sold to the consumer. Besides wholesale prices, the CPI variables also seem to have some, albeit limited, influence on the retail price of margarine. The CPI for food and the CPI of urban consumers are given inclusions probabilities of 30% and 13%, respectively.

| First Stage | Second Stage | |||||||

| Variable | Prob | Lower | Median | Upper | Prob | Lower | Median | Upper |

| log price | – | – | – | – | 1 | -2.839 | -2.161 | -1.637 |

| feat.W1 | 0.965 | -0.069 | -0.046 | 0 | 0.995 | 0.182 | 0.375 | 0.559 |

| disp.W2 | 0.97 | -0.306 | -0.195 | 0 | 0.997 | 0.678 | 1.508 | 2.311 |

| Int | 0.999 | -2.603 | -1.417 | -1.261 | 1 | -5.508 | -4.556 | -3.86 |

| Brand2 | 1 | 0.245 | 0.338 | 0.426 | 1 | 0.831 | 1.031 | 1.33 |

| Brand3 | 1 | 0.119 | 0.141 | 0.163 | 0.997 | 0.152 | 0.267 | 0.408 |

| Brand4 | 1 | 0.172 | 0.198 | 0.222 | 0.137 | -0.014 | 0 | 0.19 |

| InterHol | 0.006 | 0 | 0 | 0 | 0.057 | -0.009 | 0 | 0.009 |

| WeekHol | 0.012 | 0 | 0 | 0 | 0.059 | 0 | 0 | 0.044 |

| Temp | 0 | 0 | 0 | 0 | 0.007 | 0 | 0 | 0 |

| Unemploy | 0.869 | -0.031 | -0.022 | 0 | 0.054 | -0.036 | 0 | 0 |

| lag6.Z6 | 0.654 | -0.503 | 0.447 | 2.68 | – | – | – | – |

| lag5.Z5 | 0.603 | -0.657 | 0.047 | 2.487 | – | – | – | – |

| lag4.Z4 | 0.548 | -0.842 | 0 | 2.246 | – | – | – | – |

| lag3.Z3 | 0.529 | -0.926 | 0 | 2.115 | – | – | – | – |

| lag2.Z2 | 0.509 | -1.073 | 0 | 1.94 | – | – | – | – |

| lag1.Z1 | 0.485 | -1.193 | 0 | 1.765 | – | – | – | – |

| WP.Z0 | 0.5 | -1.097 | 0 | 1.841 | – | – | – | – |

| CPIFood | 0.302 | -0.682 | 0 | 0.503 | – | – | – | – |

| CPIUrb | 0.135 | 0 | 0 | 0.008 | – | – | – | – |

5 Conclusion

We have proposed a computationally efficient solution to the problem of incorporating model uncertainty into IV estimation. The IVBMA method leverages an existing Gibbs sampler and shows that by nesting model moves inside this framework, model averaging can be performed with minimal additional effort. In contrast to the approximate solution proposed by Lenkoski

et al. (2011), our method yields a theoretically justified, fully Bayesian procedure. The applied examples shows the utility the method offers, by enabling additional factors to be entertained by the researcher, which are either incorporated where appropriate or promptly dropped.

The RJMCMC methodology proposed by Koop

et al. (2012) constitutes an alternative approach to this problem. Their method is considerably more flexible; it allows a range of different prior distributions to be entertained and simultaneously addresses hypotheses related to identification in the IV system. At the same time, this flexibility comes at a cost. Koop

et al. (2012) note that their method may exhibit difficulties in mixing and are required to consider a complicated model proposal system involving “hot”,“cold”, and “super-hot” models which has similarities to simulated tempering. In contrast IVBMA appears to exhibit few difficulties in mixing, which derives from the simplicity of the algorithm. We feel that, at the very least, IVBMA offers a useful methodology for the applied researcher, who may be willing to accept the priors we propose in order to quickly obtain useful insight and parameter estimates.

In the IV framework we develop, we consider only one endogenous variable for clarity of exposition. Multiple endogenous variables pose no significant additional difficulties. The Gibbs sampler in Section 2.2 requires repeated evaluations of a slightly modified Step 2. The IVBMA framework simply consists of different first-stage models for each endogenous variable. The CBFs are hardly changed. This generalization of our framework has already been incorporated into the R package ivbma.

One assumption that is crucial to the functioning of the Gibbs sampler is the bivariate normality of the residuals in (2.3). Conley

et al. (2008) discuss how the algorithm of Rossi

et al. (2006) can be extended to handle deviations from normality using a Dirichlet process mixture (DPM). We note that the IVBMA methodology can readily be incorporated into the DPM framework of Conley

et al. (2008) simply by replacing the IV kernel distributions of Rossi

et al. (2006) with IVBMA kernel distributions.

A critical feature that has not been addressed in IVBMA is that of instrument validity. Lenkoski

et al. (2011) propose an approximate test of instrument validity by directly embedding the test of Sargan (1958) into a model averaging framework. While this appears to work well, we are currently researching a “fully-Bayesian” version of the Sargan test which is based on the CBF of regressing the instrument set on the residuals of (2.1). Subsequent research will develop this test and incorporate it into the IVBMA method. A proto-type of this diagnostic is already implemented in ivbma.

Finally, as we note, the margarine dataset is a simplification, as it ignores the aspect of multinomial choice and significantly reduces the household information collected. Following Conley

et al. (2008), log shares were used to fit the data into the framework (2.1) and (2.2). However, we feel that IVBMA has the potential to be extended to more complicated likelihood frameworks. Since discrete choice models may be represented in a generalized linear model (GLM) framework with latent Gaussian factors (for instance via a multinomial probit), a promising next step will be to consider embedding IVBMA in a GLM model and operating on these latent factors. In our mind, this indicates the true potential benefit of IVBMA. Since the entire method uses a Gibbs framework, it may be incorporated in any setting where endogeneity, model uncertainty and latent Gaussianity are present.

6 Acknowledgements

The authors would like to thank Pradeep Chintagunta for supplying the margarine dataset, Theo S. Eicher for several helpful comments and Andreas Neudecker for support organizing the software associated with this work. Alex Lenkoski gratefully acknowledges support from the German Science Foundation (DFG), grant GRK 1653.

References

- Anderson (1984) Anderson, T. W. (1984). An Introduction to Multivariate Statistical Analysis. New York.: Wiley.

- Brock et al. (2003) Brock, W., S. N. Durlauf, and K. West (2003). Policy evaluation in uncertain economic environments. Brookings Papers on Economic Activity 1, 235–322.

- Chen et al. (2009) Chen, H., A. Mirestean, and C. Tsangarides (2009). Limited information Bayesian model averaging for dynamic panels with short time periods. IMF Working Paper WP/09/74.

- Chib and Greenberg (1995) Chib, S. and E. Greenberg (1995). Understanding the Metroplis-Hastings algorithm. Journal of the American Statistical Association 49, 327–335.

- Chintagunta et al. (2005) Chintagunta, P. K., J. P. Dubé, and K. Y. Goh (2005). Beyond the endogeneity bias: The effect of unmeasured brand characteristics on household-level brand choice models. Management Science 51, 832–849.

- Cohen-Cole et al. (2009) Cohen-Cole, E., S. Durlauf, J. Fagan, and D. Nagin (2009). Model uncertainty and the deterrent effect of capital punishment. American Law and Economics Review 11, 335–369.

- Conley et al. (2008) Conley, T. G., C. Hansen, and P. E. Rossi (2008). Plausibly exogenous. Review of Economics and Statistics, Forthcoming.

- Conley et al. (2008) Conley, T. G., C. B. Hansen, R. E. McCulloch, and P. E. Rossi (2008). A semi-parametric Bayesian approach to the instrumental variable problem. Journal of Econometrics 144, 276–305.

- Dickey and Gunel (1978) Dickey, J. M. and E. Gunel (1978). Bayes factors from mixed probabilities. J. R. Statist. Soc. B 40, 43–46.

- Drèze (1976) Drèze, J. H. (1976). Bayesian limited information analysis of the simulataneous equations model. Econometrica 44, 1045–1075.

- Durlauf et al. (2008) Durlauf, S., A. Kourtellos, and C. M. Tan (2008). Are any growth theories robust? Economic Journal 118, 329–346.

- Durlauf et al. (2011) Durlauf, S. N., A. Kourtellos, and C. M. Tan (2011). Is God in the details? a reexamination of the role of religion in economic growth. Journal of Applied Econometrics, Forthcoming.

- Eicher et al. (2011) Eicher, T. S., C. Papageorgiou, and A. E. Raftery (2011). Default priors and predictive performance in Bayesian model averaging, with application to growth determinants. Journal of Applied Econometrics 26, 30–55.

- Fernández et al. (2001) Fernández, C., E. Ley, and M. Steel (2001). Benchmark priors for Bayesian model averaging. Journal of Econometrics 100, 381–427.

- Green (1995) Green, P. J. (1995). Reversible jump Markov chain Monte Carlo computation and Bayesian model determination. Biometrika 82, 711–732.

- Holmes et al. (2002) Holmes, C., D. Denison, and B. Mallick (2002). Bayesian model order determination and basis selection for seemingly unrelated regression. Journal of Computational and Graphical Statistics 11, 533–551.

- Kass and Raftery (1995) Kass, R. E. and A. E. Raftery (1995). Bayes factors. Journal of the American Statistical Association 90, 773–795.

- Kass and Wasserman (1995) Kass, R. E. and L. Wasserman (1995). A reference test for nested hypotheses with large samples. Journal of the American Statistical Association 90, 928–934.

- Kleibergen and van Dijk (1998) Kleibergen, F. and H. van Dijk (1998). Bayesian simultaneous equations analysis using reduced rank structures. Econometric Theory 111, 223–249.

- Kleibergen and Zivot (2003) Kleibergen, F. and E. Zivot (2003). Bayesian and classical approaches to instrumental variable regression. Journal of Econometrics 114, 29–72.

- Koop et al. (2012) Koop, G., R. Léon-Gonzalez, and R. Strachan (2012). Bayesian model averaging in the instrumental variable regression model. Journal of Econometrics, Forthcoming.

- Lenkoski et al. (2011) Lenkoski, A., T. S. Eicher, and A. E. Raftery (2011). Two-stage Bayesian model averaging in endogenous variable models. Econometric Reviews, Forthcoming.

- Ley and Steel (2009) Ley, E. and M. Steel (2009). Journal of Applied Econometrics 24, 651–674.

- Madigan et al. (1995) Madigan, D., J. York, and D. Allard (1995). Bayesian graphical models for discrete data. International Statistical Review 63, 215–232.

- Morales-Benito (2009) Morales-Benito, E. (2009). Predetermined variables: Likelihood-based estimation and Bayesian averaging. CEMFI working paper.

- Rodrik et al. (2004) Rodrik, D., A. Subramanian, and F. Trebbi (2004). Institutions rule: The primacy of institutions over geography and integration in economic development. Journal of Economic Growth 9, 131–165.

- Rossi et al. (2006) Rossi, P. E., G. M. Allenby, and R. McCulloch (2006). Bayesian Statistics and Marketing. New York: Wiley.

- Sargan (1958) Sargan, J. D. (1958). The estimation of economic relationships with instrumental variables. Econometrica 26, 393–415.

- Scott and Berger (2006) Scott, J. G. and J. O. Berger (2006). An exploration of aspects of Bayesian multiple testing. J. Statist. Plan. Infer. 136, 2144–2162.

- Strachan and Inder (2004) Strachan, R. and B. Inder (2004). Bayesian analysis of the error correction model. Journal of Econometrics 123, 307–325.

Appendix A

Details of the determination of

Our derivation follows Rossi

et al. (2006) closely–extended to the multivariate setting. Set . Then, conditional on and we have

where is derived from and and where .

Replacing by yields.

We now compute

Setting and , this becomes

Thus, we conclude

which confirms (2.4).

Details of the determination of

We now provide a detailed derivation of (2.5).

Inserting (2.2) into (2.1) leads to

Conditioning on and we set and obtain with . Further , with .

We can now write this as a regression system in which the number of observations has been doubled to ,

| (A-1) |

with

Let be the Cholesky decomposition of . We then post-multiply two copies of each component in Equation (A-1) by , to obtain a regression system with unit covariance matrix for the error terms.

Let

This yields

Set and . The posterior distribution of is determined by the same logic as in Step 1 and gives

where and .

Appendix B

Calculation of

Note that it is immediate from the work above that

with

where is the size of model , and and denote the columns of the matrices and contained in the model .

Now, consider . Note that

Following the calculation in Appendix A, we have

Substituting this above leads to

which can be expanded to

| (B-1) |

In this form, the integral in (B-1) represents the normalizing constant of a distribution, i.e.

Thus,

Calculation of

Provided that is not required to be zero (thus, the endogenous variable is included in model ), we have that

where

where is the size of model and is the matrix defined above, but restricted to those variables contained in .

When , equivalently the endogenous variable is not contained in the model , the approach is altered and essentially becomes a seemingly unrelated regression. Let , then we have

where, with . Setting we have

and by analogy to the steps in Appendix A we see that in this case

Regardless of how and are calculated, the steps in outlining the determination of may be followed in this case as well and we see that

Supplementary Simulation Study

We conduct a simulation study to evaluate the properties of IVBMA and compare its performance to the Gibbs sampler discussed in Section 2.2 that does not incorporate model uncertainty (which we refer to as IV). Our study is similar to that of Lenkoski

et al. (2011).

| First Stage | Second Stage | ||||||

|---|---|---|---|---|---|---|---|

| Variable | IV | IVBMA | True | IV | IVBMA | True | |

| – | – | – | 1.498 | 1.497 | 1.5 | ||

| -0.015 | -0.003 | 0 | 1.986 | 1.991 | 2 | ||

| 2.476 | 2.480 | 2.5 | -0.007 | -0.002 | 0 | ||

| 0.008 | 0.002 | 0 | 0.001 | 0.000 | 0 | ||

| -0.008 | 0.001 | 0 | 1.379 | 1.384 | 1.4 | ||

| -0.007 | 0.001 | 0 | -0.001 | 0.000 | 0 | ||

| 0.004 | 0.000 | 0 | 0.004 | 0.000 | 0 | ||

| 0.000 | 0.000 | 0 | -0.006 | -0.001 | 0 | ||

| -0.020 | -0.005 | 0 | 2.663 | 2.669 | 2.7 | ||

| 1.682 | 1.684 | 1.7 | 1.226 | 1.230 | 1.25 | ||

| -0.004 | -0.003 | 0 | 0.010 | 0.002 | 0 | ||

| -0.002 | 0.000 | 0 | 0.006 | 0.003 | 0 | ||

| -0.004 | -0.002 | 0 | -0.017 | -0.001 | 0 | ||

| 0.789 | 0.792 | 0.8 | 3.265 | 3.268 | 3.3 | ||

| -0.001 | 0.000 | 0 | -0.010 | 0.001 | 0 | ||

| -0.003 | 0.000 | 0 | -0.004 | 0.000 | 0 | ||

| 0.011 | 0.001 | 0 | – | – | – | ||

| -0.001 | -0.002 | 0 | – | – | – | ||

| 4.056 | 4.060 | 4 | – | – | – | ||

| -0.004 | 0.001 | 0 | – | – | – | ||

| 0.002 | 0.000 | 0 | – | – | – | ||

| 0.002 | 0.001 | 0 | – | – | – | ||

| 1.193 | 1.195 | 1.2 | – | – | – | ||

| 2.977 | 2.976 | 3 | – | – | – | ||

| 0.002 | 0.002 | 0 | – | – | – | ||

| 0.894 | 0.896 | 0.9 | – | – | – | ||

| MSE | 991.92 | 541.14 | – | 943.79 | 541.14 | – | |

Using the framework in (2.1)-(2.3), we consider variables in , possible instruments in and a univariate endogenous regressor . For simulating data we use . These sizes approximately resemble the structure of the data set we will examine in Section LABEL:sec:margarine. In each synthetic dataset we construct, the values in and are individually sampled from a .

The variables and are determined by

Hence, besides five regressors of the vector have an influence on . Two of these variables also have explanatory power on , which is in addition dependent on one further component of , namely . Finally, only four out of ten candidate variables in serve as instruments for , while the rest have no explanatory power.

Finally, we sample the error terms and from a multivariate normal distribution with a non-diagonal covariance matrix ,

In the following, we use as the number of iterations for both methods and discard the first samples as burn-in. The results are averaged over replications. Each replication took approximately 45 seconds, on a quad-core 2.8 gHz desktop computer with GB RAM running Linux.

Table 5 displays the results of parameter estimation for the two methods. For each replicate we calculate the posterior expected values and . The table then reports the median of these estimates for each variable across the replicates. Finally, for each replicate we computed the mean squared error (MSE) of the posterior expectations and and report the average of this over all replicates. We can see that for each stage the median of both IVBMA and IV of the posterior expectations are close to the true parameter values. However, based on the MSE reported in the last row of Table 5 we see that IVBMA leads to considerably lower deviation from the true value than IV estimation. This is because model determination provides a better focus on the variables that have explanatory power on the outcome, which can be seen from the inclusion probabilities shown in Table 6. This table shows the median and interquartile range of the inclusion probabilities over all replications. We see that variables which are included the model are almost always given inclusion probabilities near , while those not in the model typically have very low inclusion probabilities.

| First Stage | Second Stage | ||||

|---|---|---|---|---|---|

| Variable | Median | IQR | Median | IQR | |

| – | – | 1.000 | (1.000,1.000) | ||

| 0.115 | (0.072,0.493) | 0.999 | (0.993,1.000) | ||

| 1.000 | (0.991,1.000) | 0.124 | (0.083,0.430) | ||

| 0.107 | (0.066,0.569) | 0.105 | (0.069,0.406) | ||

| 0.110 | (0.074,0.446) | 0.999 | (0.997,1.000) | ||

| 0.110 | (0.065,0.371) | 0.098 | (0.069,0.469) | ||

| 0.101 | (0.068,0.599) | 0.102 | (0.066,0.518) | ||

| 0.101 | (0.064,0.435) | 0.101 | (0.068,0.403) | ||

| 0.115 | (0.074,0.560) | 1.000 | (0.995,1.000) | ||

| 0.999 | (0.991,1.000) | 0.999 | (0.993,1.000) | ||

| 0.106 | (0.067,0.521) | 0.107 | (0.069,0.507) | ||

| 0.102 | (0.067,0.516) | 0.111 | (0.070,0.447) | ||

| 0.104 | (0.067,0.464) | 0.101 | (0.070,0.458) | ||

| 0.999 | (0.995,1.000) | 1.000 | (0.996,1.000) | ||

| 0.101 | (0.070,0.475) | 0.099 | (0.070,0.458) | ||

| 0.096 | (0.068,0.313) | 0.101 | (0.073,0.308) | ||

| 0.103 | (0.065,0.403) | – | – | ||

| 0.105 | (0.071,0.507) | – | – | ||

| 0.999 | (0.987,1.000) | – | – | ||

| 0.109 | (0.071,0.569) | – | – | ||

| 0.097 | (0.065,0.483) | – | – | ||

| 0.100 | (0.068,0.722) | – | – | ||

| 0.999 | (0.984,1.000) | – | – | ||

| 0.999 | (0.988,1.000) | – | – | ||

| 0.104 | (0.070,0.532) | – | – | ||

| 0.999 | (0.985,1.000) | – | – | ||