Geometric Pricing: How Low Dimensionality Helps in Approximability

Consider the following toy problem. There are rectangles and points on the plane. Each rectangle is a consumer with budget , who is interested in purchasing the cheapest item (point) inside R, given that she has enough budget. Our job is to price the items to maximize the revenue. This problem can also be defined on higher dimensions. We call this problem the geometric pricing problem.

In high dimensions, the above problem is equivalent to the unlimited-supply profit-maximizing pricing problem, which has been studied extensively in approximation algorithms and algorithmic game theory communities. Previous studies suggest that the latter problem is too general to obtain a sub-linear approximation ratio (in terms of the number of items) even when the consumers are restricted to have very simple purchase strategies.

In this paper, we study a new class of problems arising from a geometric aspect of the pricing problem. It intuitively captures typical real-world assumptions that have been widely studied in marketing research, healthcare economics, etc. It also helps classify other well-known pricing problems, such as the highway pricing problem and the graph vertex pricing problem on planar and bipartite graphs. Moreover, this problem turns out to have close connections to other natural geometric problems such as the geometric versions of the unique coverage and maximum feasible subsystem problems.

We show that the low dimensionality arising in this pricing problem does lead to improved approximation ratios, by presenting sublinear-approximation algorithms for two central versions of the problem: unit-demand uniform-budget min-buying and single-minded pricing problems. Our algorithm is obtained by combining algorithmic pricing and geometric techniques. These results suggest that considering geometric aspect might be a promising research direction in obtaining improved approximation algorithms for such pricing problems. To the best of our knowledge, this is one of very few problems in the intersection between geometry and algorithmic pricing areas. Thus its study may lead to new algorithmic techniques that could benefit both areas.

1 Introduction

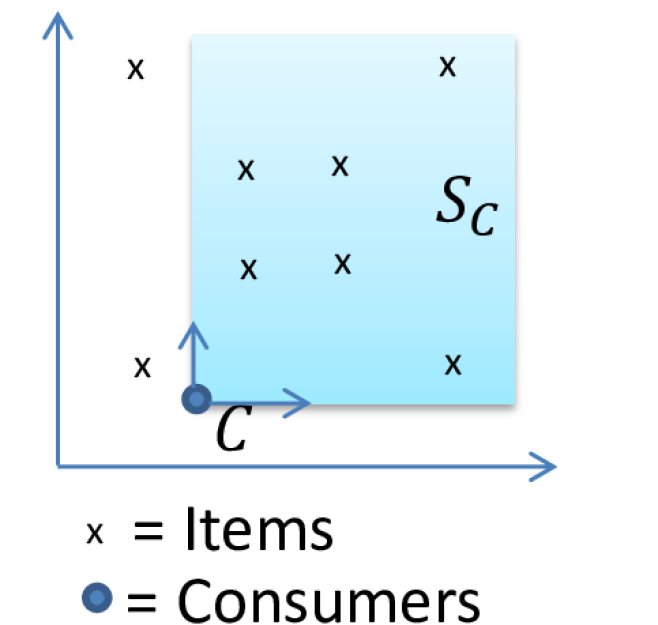

This paper studies a geometric version of two central unlimited-supply pricing problems. We are given a set of consumers and a set of items. Every item is represented by a point , where denotes the set of non-negative reals and expresses the quality of item in the -th attribute. Every consumer is represented by a point , where is the criterion of consumer in the -th attribute. Each consumer is additionally equipped with budget and a consideration set

| (1) |

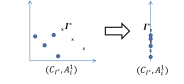

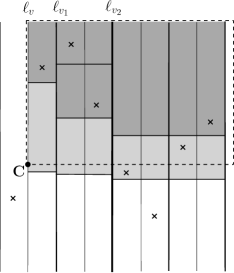

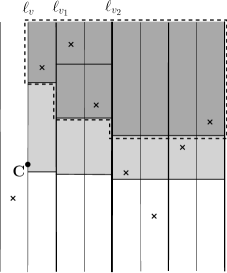

In the -dimensional uniform-budget unit-demand min-buying pricing problem (-UUDP-MIN), once we assign prices to items, each consumer will buy the cheapest item in if the price of item is at most . In the -dimensional single-minded pricing problem (-SMP), consumer will buy the all items in if the total price of those items is at most . The objective is to set the price of items in in order to maximize the revenue. That is, we want to find that maximizes in the case of -UUDP-MIN and in the case of -SMP. Fig. 1 illustrates the problem: Each item corresponds to a point in the plane. The consideration set of each consumer is represented by an (unbounded) axis-parallel rectangle with point as a lower-left corner.

The above problems when is unbounded (called UUDP-MIN and SMP) have been widely studied recently (e.g., [44, 32, 45, 14, 15, 1, 6]) and are known to be -approximable [1]; so we have a reasonable approximation guarantee when there are not many consumers. However, in many cases, one would expect the number of consumers to be much larger than the number of items . In this case, we are still stuck at the trivial approximation ratio, and there are evidences that suggest that getting a sub-linear approximation ratios might be impossible: Unless , these problem are hard to approximate within a for any constant [15]. Moreover, assuming a stronger (but still plausible) assumption, these problems are hard to approximate to within a factor of for some [14].

Motivated by various types of assumptions, the pricing problems with special structures have been studied (e.g., when there is a price-ladder constraint [44, 1, 45, 46, 14], consideration sets are small [6, 14] or consideration sets correspond to paths on graphs [6, 23, 31, 22, 27]). In these cases, better approximation ratios are usually possible.

In this paper we consider the geometric structure of pricing problems arising naturally from real-world scenarios, which turns out to be quite general. Our motivation is two-fold: We hope that the geometric structures will lead to better approximation algorithms, and we found these problems interesting on their own as they have connections to other pricing and geometric problems.

Our problems are motivated by the following simple observation on the consumers’ behavior. Consider a setting where we sell cars. If a consumer has car with horse power HP in her consideration set, she would not mind buying car with horse power HP. Maybe she does not want because it is less energy-efficient or has lower reputation. But, if we list all attributes of the cars that people care about and it happens that is not worse than in all other aspects, then should also be in the list.

In particular, instead of looking at a full generality where each consumer considers any set of items , it is reasonable to assume that each consumer has some criterion in mind for each attribute of the cars, and her consideration set consists of any car that passes all her criteria, i.e. consumers judge items according to their attributes. This natural assumption has been a model of study in other fields such as marketing research, healthcare economics and urban planning. It is referred to as the attribute-based screening process. In particular, using criteria to define consideration sets as in Eq. (1) is called conjunctive screening rule. Besides being natural, this assumption has been supported by a number of studies where it is concluded that consumers typically use a conjunctive screening rule in obtaining their consideration sets (see further detail in Section 1.2).

It is also interesting that -SMP captures many previously studied problems as special cases. For example, -SMP generalizes the highway pricing problem [32, 6, 23, 31] and thus our algorithmic results on -SMP can immediately be applied to this problem. Moreover, -SMP generalizes the upward case of the tollbooth pricing problem [22, 40] as well as the graph vertex pricing problem on planar graphs [6, 16]. -SMP generalizes the unlimited-supply version of the exhibition problem [19], the graph vertex pricing problem on bipartite graphs [6, 39], and the “rectangle version” of the unique coverage problem (UC) [20], which are the geometric variants of UC studied recently in [24, 37].

Moreover, SMP is a special case of the maximum feasible subsystem with 0/1 coefficients problem (Mrfs) [22]. Elbassioni et al. [22] showed that a very special geometric version of Mrfs (the “interval version”) admits much better approximation ratios than the general one. A geometric Mrfs can be seen as a special case of “-Mrfs” in our terminologies, and it is thus interesting whether “-Mrfs” is easier than general Mrfs for other values of . Our geometric SMP is a special case of -Mrfs. Thus, solving -SMP serves as the first step towards solving -Mrfs.

1.1 Our Results and Techniques

We show that geometric structures lead to breaking the linear-approximation barrier: While the pricing problems are likely to be hard to approximate within a factor of in the general cases, we obtain an -approximation algorithms in the geometric setting, as follows.

Theorem 1.1.

For any , there is an -approximation algorithm for -UUDP-MIN and -SMP where function and treats as a constant and hides a factor.

The essential idea behind our algorithm is to partition the problem instance into sub-instances without decreasing the optimal revenue (we call this consideration-preserving decomposition). This is done by using Dilworth’s Theorem (partitioning items into chains and anti-chains) and epsilon-nets to find subsets of items satisfying certain structural properties. Subsequently, we show that the dimensions of these sub-instances can be reduced through the notion of consideration-preserving embedding. In the end of our algorithm, we are left with a sub-linear number of sub-instances, each of which can be solved almost optimally in polynomial time. Returning the best solution among the solutions of these sub-instances guarantees a sub-linear approximation ratio.

The spirit of our technique is in some sense in a similar flavor to Chan’s algorithm [17] which computes a conflict-free coloring of -dimensional points (w.r.t. rectangle ranges) using colors. In particular, in the 2-dimensional cases of both our geometric pricing and Chan’s conflict-free coloring problems, the upper bounds of can be obtained by a simple application of Dilworth’s theorem (Ajwani et al. [3] obtained a better bound in this case for the latter problem). However, the techniques of the two results are different in higher dimensions.

QPTASs

We also obtain QPTASs for -UUDP-MIN and -SMP. We present this in Appendix B and C. These results, together with a widely-believed assumption that the existence of a QPTAS for any problem implies that PTAS exists for the same problem (e.g., [9, 23]), imply that the value of in Theorem 1.1 could be improved slightly to . As a by-product of these results, we show a QPTAS for -SMP which subsumes the previous QPTAS for highway pricing [23].

Hardness

We also study the hardness of approximation of our problems. We show that -UUDP-MIN and -SMP are NP-hard, and -UUDP-MIN and -SMP are APX-hard. Hence, our problem is already non-trivial for small . Our hardness proofs establish a cute connection between our problem and the vertex cover problem on graphs of low order dimensions [47, 48]. Moreover, we show that the hardness of our problem tends to increase as we increase , and the whole generality is captured when . In particular, we show that when the dimension is sufficiently high (i.e. ), the problems are hard to approximate to within a factor of for any . Table 1 concludes our results for -UUDP-MIN and -SMP.

| Problem | large {range } | |||||

|---|---|---|---|---|---|---|

| -UUDP-MIN | Upper bound | Polytime | QPTAS | {constant } | ||

| Lower bound | NP-hard | APX-hard | {} | |||

| -SMP | Upper bound | Polytime | QPTAS | {constant } | ||

| Lower bound | NP-hard | APX-hard | {} |

1.2 Related Work

Rusmevichientong et al. [44, 45, 46] defined the non-parametric multi-product pricing problem, motivated by the possibility that the data about consumers’ preferences and budgets can be predicted based on previous data, which can be gathered and mined by web sites designed for this purpose, e.g., [33, 46]. This problem is what we call uniform-budget unit-demand pricing problem (UUDP). Rusmevichientong et al. proposed many decision rules such as min-buying, max-buying and rank-buying and showed that UUDP-MIN allows a polynomial-time algorithm, assuming the price-ladder constraint, i.e., a predefined total order on the prices of all products. Aggarwal et al. [1] later showed that the price ladder constraint also leads to a -approximation algorithm for the max-buying case, even in the case of limited supply.

We note that the price ladder constraint is closely related to our notion of attributes in the following sense. It can be shown that -UUDP-MIN satisfies the price ladder constraint (this is the reason we can solve it in polynomial time). Moreover, although -UUDP-MIN does not satisfy this constraint, it partially satisfies the constraint in the sense that if one item is better than another item in all attributes then we can assume that it has a higher price. This property plays an important role in obtaining QPTAS for -UUDP-MIN and also holds for general .

Other variants defined later include non-uniform and utility-maximizing unit-demand, single-minded (SMP), tollbooth and highway models [1, 32]. These problems were later found to have important connections to algorithmic mechanism design [2, 7, 32] and online pricing problems [6, 13]. As we mentioned in the introduction, many problems can be approximated within the factor of and , and these seem to be tight.

The observation that consumers make decisions based on attributes has been used in other areas outside computer science. For example, most pricing models are captured by the two-stage consider-then-choose model (e.g., [29, 42, 43, 30, 33, 38, 34, 41]) in marketing research: Each consumer first screens out some undesirable items (screening process) and is left with the consideration set which is used to make a final decision. Pricing problems such as UUDP-MIN are the case where consideration sets are arbitrary (as defined in, e.g. [50, 35]) while the final decision is simplified to, e.g., buying the cheapest item.

The idea of using the consideration sets defined from attributes is called attribute-based screening process [30] in marketing research where it was shown to be a rational choice for trading off between accuracy and cognitive effort [10, 11, 12, 51]. Our model is equivalent to the attribute-based screening process with conjunctive screening rules (e.g., [30, 41]). This type of rules was justified by many studies that it is what consumers typically use when making decisions (e.g., [10, 30, 34]).

2 Sub-linear Approximation Algorithm (Proof of Theorem 1.1)

To simplify the presentation, we present the algorithm for -UUDP-MIN in this section. The algorithm for -SMP is almost identical. Let and be the set of points in , where every consumer has budget and consideration set which is specified by coordinates of the input point. For any subset and , let be the -UUDP-MIN problem with input and . Moreover, for any and , we use to express the optimal revenue of the instance . At a high level, our algorithm proceeds in an inductive manner and obtains a solution of -UUDP-MIN problem by invoking the algorithms for -UUDP-MIN and -UUDP-MIN as a subroutine. Our result is summarized in the following theorem.

Theorem 2.1.

For any , if there is an -approximation algorithm for -UUDP-MIN then there is an -approximation algorithm for -UUDP-MIN as well.

Theorem 1.1 then follows from the fact that -UUDP-MIN can be solved optimally in polynomial time (see Appendix A.5). As we noted earlier, it can be improved slightly since -UUDP-MIN admits QPTAS (see Appendix B).

2.1 Consideration-preserving Decomposition

Our algorithm partitions the input instance into many subinstances and tries to collect the profit from some of them. The notion of consideration-preserving decomposition, defined below, allows us to do so without losing revenue.

Definition 2.2.

We call a collection a consideration-preserving decomposition of the problem if and only if for any and , there exists (not necessarily unique) such that and .

By definition, for any consumer and item the fact that consumer considers item is preserved by at least one instance . The following lemma says that this decomposition preserves the total revenue.

Lemma 2.3.

For any consideration-preserving decomposition of , it holds that Moreover, any price function for can be extended to a price function for the original problem that gives revenue at least .

This is simply by applying the optimal price function of one problem to the other (see Appendix A.1 for the full proof). In the rest of our discussion, we mainly use two different types of consideration-preservation decomposition, as explained in the following observation.

Observation 2.4.

Given an input instance , let . Then , , is a consideration-preserving decomposition of . Similarly, if , then we have that is a consideration-preserving decomposition of .

2.2 Algorithm

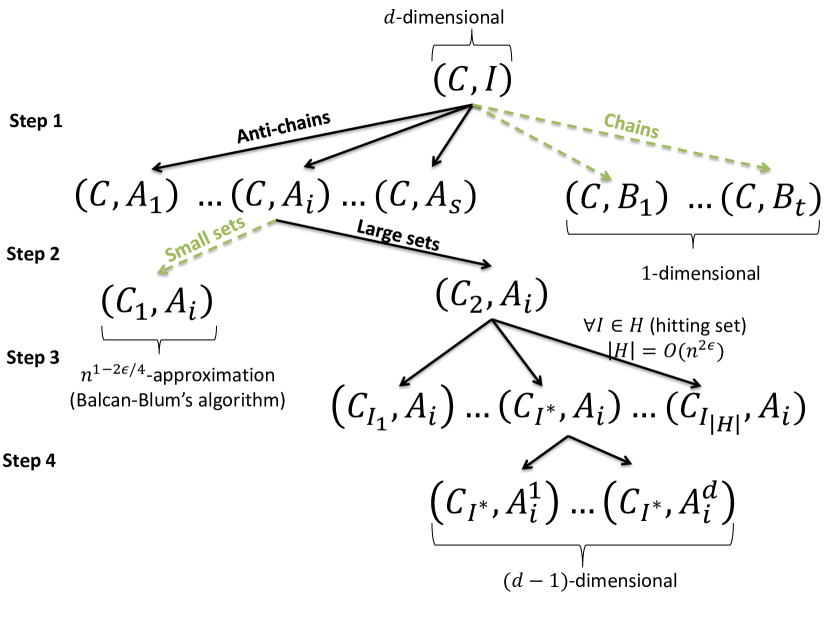

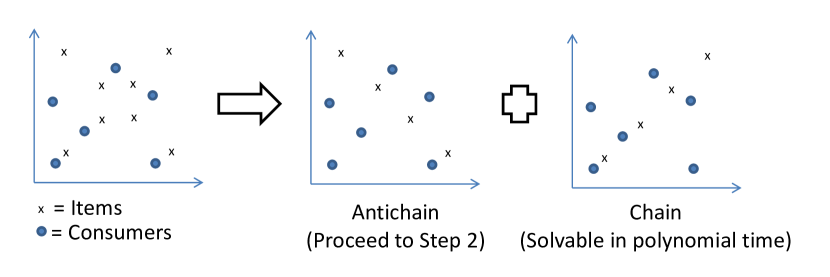

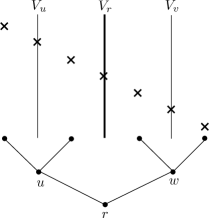

At a high level, the algorithm proceeds in four steps where each step involves consideration-preserving decomposition (see Fig. 2 for an overview). In Step 1, we partition into different subsets where every subset satisfies certain properties, i.e. the elements in each subset either form a chain or an antichain. The problem on those subsets in which elements form a chain can be solved easily, and we deal with the antichains in later steps. In Step 2, we partition consumers in into two types, those with large and small consideration sets. We use the algorithm of [6, 14] to deal with consumers with small consideration sets and handle the rest consumers in later steps. In Step 3, we find a subset of items, i.e. a “hitting set”, and partition consumers further into several sets. Each set of consumers has the following property: There is some item desired by all consumers in the set. Using this property, we show in Step 4 that the problem can be further partitioned into a few problems where each of them can be viewed as a -UUDP-MIN problem. (We call this a “consideration-preserving embedding”.)

Step 1: Partitioning items into chains and antichains

Let be an input of -UUDP-MIN. First we define a partially ordered set on the item set as follows. We say that if and only if has a lower quality than in every attribute, i.e. for all . We say that a subset is a chain if can be written as such that for all . We say that is an antichain if and only if for any pair of items , neither nor .

Lemma 2.5.

For any and any , we can partition into and in polynomial-time. Moreover, each is an antichain and each is a chain.

Proof Idea.

(See Section A.2 for detailed definitions and proofs.) By Dilworth’s theorem [21, 26], the minimum chain decomposition equals to the maximum antichain size. We will use the fact that both minimum chain decomposition and maximum-size antichain can be computed in polynomial time as follows: As long as the maximum-size antichain is bigger than , we repeatedly extract such an antichain out of the input; otherwise, we would have the decomposition into at most chains, so we stop. ∎

By Observation 2.4, the collection is a consideration-preserving decomposition of . It follows by Lemma 2.3 that Further, observe that if there exists such that , then we would be done: the -UUDP-MIN problem can be seen as a -UUDP-MIN problem (since is a chain) and hence can be solved optimally! (See Lemma 2.11 for detailed analysis) Otherwise for every . Therefore If this is not the case then we know that there must be an antichain such that

Step 2: Dealing with small consideration sets

For simplicity, let us assume that we know such that . Now we focus on collecting revenue from the subproblem . Let be the set of consumers who are interested in at most items in , i.e. , and define . Since is a consideration-preserving decomposition of , we have Now we need an algorithm of [6, 14]. Balcan and Blum give an approximation algorithm for SMP whose approximation guarantee depends on the sizes of consideration sets. Briest and Krysta, by using a slight modification of this algorithm, give an approximation algorithm with the same guarantee for UDP-MIN. Their result, stated in terms of UUDP-MIN, is summarized in the following theorem. (For completeness, we provide the proof in Appendix A.3.)

Theorem 2.6.

We remark that we extend this technique to deal with any pricing problem with subadditive revenue in the full version of this paper.

If , then we could invoke the algorithm in Theorem 2.6 on to get a solution with approximation ratio This yields a solution that gives a desired revenue of Otherwise we have . Then We will deal with this case in the next steps.

Step 3: Partitioning consumers using a small hitting set

Lemma 2.7.

We can find a set of size in randomized polynomial time such that for any , there exists such that .

Proof.

The instance defines a set system over , where . We note that each set has descriptive complexity at most , i.e. set can be described by linear inequalities of the form . In this case, this set system has VC dimension , c.f. [49]. More specifically, it is well known (e.g., [5]) that any collection of -dimensional axis-parallel boxes has VC dimension . We will not formally define VC-dimension here. The following theorem is all we need.

Theorem 2.8.

Using the theorem with , we can find a set of size at most , and since we have for all , we are guaranteed that for all . ∎

We call a hitting set of since intersects for all . We use to decompose into a small number of subproblems and show in Step 4 that each of these problems can be viewed as a -UUDP-MIN problem.

For each , let , i.e., consists of all consumers in that consider item . Observe that , and therefore by Lemma 2.3, we have Since , there exists such that

Now we, again, assume that we know and turn our focus to the subproblem .

Step 4: Reducing the dimension

We have now reached the most crucial step. We will (crucially) rely on the fact that all consumers in consider item , and that is an antichain. For each , define as the set of items in that are at least as good as in the -th coordinate, i.e., . See Fig. 4 for an example in the case of -UUDP-MIN.

Lemma 2.9.

.

This lemma holds simply because is an antichain (in any antichain, no item can completely dominate the others, so at least one coordinate of any has to be at least as good as ; see detailed proof in Appendix A.4). Then is a consideration-preserving decomposition of and thus there exists such that Observe that, for all and , . This implies that we can ignore the -th coordinate when we solve . (In particular, for any , the consideration set remains the same even when we drop the -th coordinate of all points.) In other words, the problem can be viewed as a -UUDP-MIN problem (see Fig. 4 for an idea). We defer the formal statement and proof of this claim to Section 2.3. Finally, we can invoke the -approximation algorithm for -UUDP-MIN to collect the revenue of Therefore we obtain an approximation ratio of in all cases. Algorithm 1 summaries our algorithm for solving -UUDP-MIN.

2.3 Consideration-preserving Embedding

To formally discuss the reduction of dimensions, we introduce the notion of consideration-preserving embedding. For any , let be any instance of -UUDP-MIN. For any , consider one-to-one functions and that map points in to the ones in . We say that is a consideration-preserving embedding if, for any item and consumer , we have that if and only if . That is, the fact that consumer is considering or not considering item must be preserved in and .

Given a consideration-preserving embedding , we can naturally define a -UUDP-MIN problem where , and the budget is for any .

Observe that, although and correspond to points on different spaces, they represent the same pricing problem (i.e., the consumers’ consideration sets and budgets are exactly the same). Thus, we sometimes say that and are equivalent. The following observation follows trivially.

Observation 2.10.

For any instance , let be a consideration-preserving embedding of into . Then we have that Moreover, if and are polynomial-time computable then a solution for can be efficiently transformed into one for that gives the same revenue.

The transformation in the above lemma is trivial: For any price function for , we simply price item to . Observe that we will receive the same revenue from both problems using this pricing strategy.

In Step 1, we claimed that when the items form a chain, our instance would be equivalent to -UUDP-MIN. Now we prove this fact formally below.

Lemma 2.11.

Let be a -UUDP-MIN instance where is a chain. Then is equivalent to a -UUDP-MIN instance. Moreover, the corresponding consideration-preserving embedding can be computed in polynomial time.

Proof.

Order items in by . Now map each item into a one-dimensional point: . Moreover, map each consumer according to , where is the minimum number such that . Observe that is a consideration-preserving embedding since while for any . (Note that this embedding might create redundancy since it is possible that for some . This can be fixed easily by slightly perturbing the points.) ∎

In Step 4, we also claimed the dimension reduction of sub-instances , and we now prove the claim formally. Recall that the item has the property that for all and for all .

Lemma 2.12.

The instance is equivalent to a -UUDP-MIN instance. Moreover, the corresponding consideration-preserving embedding can be computed in polynomial time.

Proof.

Consider “ignoring” the -th coordinate as follows. For any and , let and Observe that for any and , trivially implies that . Conversely, if then since . Thus, is a consideration-preserving embedding. ∎

3 Hardness

We provide hardness results in both scenarios when the number of attributes is small and when is large. We sketch our results here. More details can be found in Appendix D.

Few attributes

First we discuss the NP-hardness of -UUDP-MIN and APX-hardness of -UUDP-MIN. These hardness results hold even when the consumer budgets are either 1 or 2. We perform a reduction from Vertex Cover [28, 4], essentially using the same ideas as in [32], except for the fact that we use Schnyder’s result [47, 48] to “embed” the instance into posets of low order dimensions.

First, let us recall the reduction in [32]. We start from a graph , which is an input instance of Vertex Cover. We create two types of consumers: (i) poor consumer for each edge with budget and (ii) rich consumer for each vertex with budget . The items are . Each poor consumer has a consideration set containing two items and where and each rich consumer considers only one item . Using the analysis essentially the same as [32], one can show that the problem is NP-hard if we start from Vertex Cover on planar graphs and APX-hard if we start from Vertex Cover on cubic graphs.

Therefore, it only remains to map consumers and items to points in (where ) such that for each consumer , the set of items that pass her criteria (i.e., ) is exactly her consideration set. The main idea is to first embed the problem into an adjacency poset of the input graph. Then, we invoke Schnyder’s theorem [47, 48] to again embed this poset into a Euclidean space.

An adjacency poset of a graph can be constructed as follows. First we construct a -layer poset with minimal elements in the first layer and maximal elements in the second layer. For each edge , we have a minimal element in the poset corresponding to (for convenience, we also denote the poset element by ). For each vertex , we have a maximal poset element corresponding to . There is a relation if and only if vertex is an endpoint of .

The last task is to “embed” poset elements into points in the Euclidean space in such a way that, for any poset elements and , if and only if for all where and are points that and are mapped to, respectively. If we can do this, we would be done, simply by defining the coordinates of each consumer to be , and the coordinates of each consumer to be . Similarly, we define the coordinates of each item as . In order to obtain such an embedding, we use part of Schnyder’s theorem [47] which states that any planar graph has an adjacency poset of dimension three, and any -colorable graph (including cubic graphs) has an adjacency poset of dimension four. Moreover, embedding these graphs into Euclidean spaces can be done in polynomial time [48].

Finally we note that -SMP is strongly NP-hard and -SMP is APX-hard. The proof follows from the fact that these problems generalize Highway pricing and graph vertex pricing on bipartite graphs, respectively, and can be found in the full version.

Many attributes

We establish a connection between the UUDP-MIN with bounded-size consideration sets and our problem. This connection immediately implies hardness results for -UUDP-MIN when is at least poly-logarithmic in . Our main result in this section is the following:

Theorem 3.1.

(Informal) Let be an instance of UUDP-MIN where . We can (with high probability of success) create an instance of -UUDP-MIN, where , that is “equivalent” to .

In other words, the above theorem shows that any UUDP-MIN instance with consideration sets of size bounded by , can be realized by a -UUDP-MIN instance for . Combining this with the result in [15], we have a hardness of for any .

We remark that our reduction here in fact works independently of the decision model, so this result works for SMP and UDP-Util as well.

4 Open Problems

Several interesting problems are open. The most important problem is whether we can obtain better approximation factors for -UUDP-MIN and -SMP. We tend to believe that there is an -approximation algorithm for -UUDP-MIN and -SMP where is a function that depends on only. However, it seems to be a very challenging task to obtain approximation ratio like or , for some constant depending on .

One promising direction in attacking the above problems is to improve Theorem 2.1, e.g., getting for -UUDP-MIN using a -approximation algorithm of -UUDP-MIN as a blackbox. A positive resolution to this problem would imply -approximation algorithm for -UUDP-MIN. We believe that, even resolving this problem would require some new insights on geometric and poset structures.

There are two special cases that can be thought of as barriers in dealing with standard versions of SMP and UUDP-MIN, and we believe that these two special cases serve as good starting points in attacking our problems. The first problem is the geometric version of the Maximum Expanding Subsequence (Mes) problem which is the key problem to show the hardness of UUDP-MIN [14]. The second problem is the Unique Coverage problem [20] when the sets have constant VC-dimension. Another interesting problem is to obtain PTASs for -UUDP-MIN and -SMP (e.g., by extending the techniques in [31]).

References

- [1] Gagan Aggarwal, Tomás Feder, Rajeev Motwani, and An Zhu. Algorithms for Multi-product Pricing. In ICALP, pages 72–83, 2004.

- [2] Gagan Aggarwal and Jason D. Hartline. Knapsack auctions. In SODA, pages 1083–1092, 2006.

- [3] Deepak Ajwani, Khaled M. Elbassioni, Sathish Govindarajan, and Saurabh Ray. Conflict-free coloring for rectangle ranges using o(n .382) colors. Discrete & Computational Geometry, 48(1):39–52, 2012. Also in SPAA’07.

- [4] Paola Alimonti and Viggo Kann. Hardness of approximating problems on cubic graphs. In CIAC, pages 288–298, 1997.

- [5] Boris Aronov, Esther Ezra, and Micha Sharir. Small-size -nets for axis-parallel rectangles and boxes. SIAM J. Comput., 39(7):3248–3282, 2010. Also in STOC’09.

- [6] Maria-Florina Balcan and Avrim Blum. Approximation Algorithms and Online Mechanisms for Item Pricing. Theory of Computing, 3(1):179–195, 2007. Also in EC’06.

- [7] Maria-Florina Balcan, Avrim Blum, Jason D. Hartline, and Yishay Mansour. Mechanism Design via Machine Learning. In FOCS, pages 605–614, 2005.

- [8] Maria-Florina Balcan, Avrim Blum, and Yishay Mansour. Item pricing for revenue maximization. In ACM Conference on Electronic Commerce, pages 50–59, 2008.

- [9] Nikhil Bansal, Amit Chakrabarti, Amir Epstein, and Baruch Schieber. A quasi-PTAS for unsplittable flow on line graphs. In STOC, pages 721–729, 2006.

- [10] James R. Bettman. An Information Processing Theory of Consumer Choice. Addison-Wesley, Reading, MA, 1979.

- [11] James R. Bettman, Eric J. Johnson, and John W. Payne. A componential analysis of cognitive effort in choice. Organizational Behavior and Human Decision Processes, 45(1):111–139, 1990.

- [12] James R. Bettman and C Whan Park. Effects of prior knowledge and experience and phase of the choice process on consumer decision processes: A protocol analysis. Journal of Consumer Research, 7(3):234–48, 1980.

- [13] Avrim Blum and Jason D. Hartline. Near-optimal online auctions. In SODA, pages 1156–1163, 2005.

- [14] Patrick Briest and Piotr Krysta. Buying cheap is expensive: Approximability of combinatorial pricing problems. SIAM J. Comput., 40(6):1554–1586, 2011. Also in SODA’07 and ICALP’08.

- [15] Parinya Chalermsook, Julia Chuzhoy, Sampath Kannan, and Sanjeev Khanna. Improved hardness results for profit maximization pricing problems with unlimited supply. APPROX, 2012 (to appear).

- [16] Parinya Chalermsook, Shiva Kintali, Richard Lipton, and Danupon Nanongkai. Graph pricing problem on bounded tree-width, bounded genus and k-partite graphs. Manuscript, 2011.

- [17] Timothy M. Chan. Conflict-free coloring of points with respect to rectangles and approximation algorithms for discrete independent set. In Proceedings of the 2012 symposuim on Computational Geometry, SoCG ’12, pages 293–302, New York, NY, USA, 2012. ACM.

- [18] Bernard Chazelle. The discrepancy method: randomness and complexity. Cambridge University Press, New York, NY, USA, 2000.

- [19] George Christodoulou, Khaled M. Elbassioni, and Mahmoud Fouz. Truthful Mechanisms for Exhibitions. In WINE, pages 170–181, 2010.

- [20] Erik D. Demaine, Uriel Feige, MohammadTaghi Hajiaghayi, and Mohammad R. Salavatipour. Combination Can Be Hard: Approximability of the Unique Coverage Problem. SIAM J. Comput., 38(4):1464–1483, 2008. Also in SODA’06.

- [21] Robert P. Dilworth. A Decomposition Theorem for Partially Ordered Sets. Annals of Mathematics, 51 (1):161–166, 1950.

- [22] Khaled M. Elbassioni, Rajiv Raman, Saurabh Ray, and René Sitters. On the approximability of the maximum feasible subsystem problem with 0/1-coefficients. In SODA, pages 1210–1219, 2009.

- [23] Khaled M. Elbassioni, René Sitters, and Yan Zhang. A Quasi-PTAS for Profit-Maximizing Pricing on Line Graphs. In ESA, pages 451–462, 2007.

- [24] Thomas Erlebach and Erik Jan van Leeuwen. Approximating geometric coverage problems. In Shang-Hua Teng, editor, SODA, pages 1267–1276. SIAM, 2008.

- [25] Guy Even, Oded Goldreich, Michael Luby, Noam Nisan, and Boban Velickovic. Efficient approximation of product distributions. Random Struct. Algorithms, 13(1):1–16, 1998. Also in STOC’92.

- [26] D.R. Fulkerson. Note on Dilworth s decomposition theorem for partially ordered sets. Proceedings of the American Mathematical Society, 7 (4):701–702, 1956.

- [27] Iftah Gamzu and Danny Segev. A Sublogarithmic Approximation for Highway and Tollbooth Pricing. In ICALP (1), pages 582–593, 2010.

- [28] M. R. Garey, David S. Johnson, and Larry J. Stockmeyer. Some simplified NP-complete graph problems. Theor. Comput. Sci., 1(3):237–267, 1976.

- [29] Dennis H. Gensch. A two-stage disaggregate attribute choice model. Marketing Science, 6(3):223–239, 1987.

- [30] Timothy J. Gilbride and Greg M. Allenby. A Choice Model with Conjunctive, Disjunctive, and Compensatory Screening Rules. Marketing Science, 23(3):391–406, 2004.

- [31] Fabrizio Grandoni and Thomas Rothvoß. Pricing on Paths: A PTAS for the Highway Problem. In SODA, pages 675–684, 2011.

- [32] Venkatesan Guruswami, Jason D. Hartline, Anna R. Karlin, David Kempe, Claire Kenyon, and Frank McSherry. On profit-maximizing envy-free pricing. In SODA, pages 1164–1173, 2005.

- [33] Gerald Haübl and Valerie Trifts. Consumer Decision Making in Online Shopping Environments: The Effects of Interactive Decision Aids. Marketing Science, 19(1):4–21, 2000.

- [34] John R. Hauser, Olivier Toubia, Theodoros Evgeniou, Rene Befurt, and Daria Silinskaia. Disjunctions of Conjunctions, Cognitive Simplicity and Consideration Sets. J. Marketing Res., 47(3):485–496, 2010.

- [35] John R Hauser and Birger Wernerfelt. An evaluation cost model of consideration sets. Journal of Consumer Research, 16(4):393–408, 1990.

- [36] David Haussler and Emo Welzl. epsilon-Nets and Simplex Range Queries. Discrete & Computational Geometry, 2:127–151, 1987.

- [37] Takehiro Ito, Shin-Ichi Nakano, Yoshio Okamoto, Yota Otachi, Ryuhei Uehara, Takeaki Uno, and Yushi Uno. A polynomial-time approximation scheme for the geometric unique coverage problem on unit squares. In Fedor V. Fomin and Petteri Kaski, editors, SWAT, volume 7357 of Lecture Notes in Computer Science, pages 24–35. Springer, 2012.

- [38] Kamel Jedidi and Rajeev Kohli. Probabilistic Subset-Conjunctive Models for Heterogeneous Consumers. J. Marketing Res., 42(4):483–495, 2005.

- [39] Rohit Khandekar, Tracy Kimbrel, Konstantin Makarychev, and Maxim Sviridenko. On hardness of pricing items for single-minded bidders. In APPROX-RANDOM, pages 202–216, 2009.

- [40] Guy Kortsarz, Harald Racke, and Rajiv Raman. Gap between unpward and tolbooth instances. Manuscript, 2011.

- [41] Qing Liu and Neeraj Arora. Efficient Choice Designs for a Consider-Then-Choose Model. Marketing Science, 30(2):321–338, 2011.

- [42] John W. Payne. Contingent decision behavior. Psychological Bulletin, 92(2):382–402, 1982.

- [43] John W. Payne, James R. Bettman, and Eric J. Johnson. Adaptive strategy selection in decision making. Journal of Experimental Psychology: Learning, Memory, and Cognition, 14(3):534–552, 1988.

- [44] Paat Rusmevichientong. A non-parametric approach to multi-product pricing: Theory and application. Ph. D. thesis, Stanford University, 2003.

- [45] Paat Rusmevichientong, Benjamin Van Roy, and Peter W. Glynn. A Nonparametric Approach to Multiproduct Pricing. Operations Research, 54(1):82–98, 2006.

- [46] Paat Rusmevichientong, Joyce A Salisbury, Lynn T Truss, Benjamin Van Roy, and Peter W. Glynn. Opportunities and challenges in using online preference data for vehicle pricing: A case study at General Motors. Journal of Revenue and Pricing Management, 5:45–61, 2006.

- [47] Walter Schnyder. Planar graphs and poset dimension. Order, 5:323–343, 1989.

- [48] Walter Schnyder. Embedding planar graphs on the grid. In SODA, pages 138–148, 1990.

- [49] Micha Sharir and Pankaj K. Agarwal. Davenport-Schinzel Sequences and Their Geometric Applications. Cambridge University Press, New York, NY, USA, 1995.

- [50] Allan D. Shocker, Moshe Ben-Akiva, Bruno Boccara, and Prakash Nedungadi. Consideration set influences on consumer decision-making and choice: Issues, models, and suggestions. Marketing Letters, 2(3):181–197, 1991.

- [51] Steven M. Shugan. The cost of thinking. Journal of Consumer Research, 7:99–111, 1980.

Appendix

Appendix A Proof Omitted from Section 2

A.1 Proof of Lemma 2.3

Let be the optimal price function for . For each , we define by

Let be the total revenue made by in . We argue below that

| (2) |

Let be the set of consumers who make a positive payment with respect to . For each consumer , denote by the item that consumer buys with respect to the price . So we can write as

| (3) |

For each , let be the set of consumers such that . That is, is a set of consumers whose item she bought in is in . Notice that

| (4) |

Since is a consideration-preserving decomposition, we have that

| (5) |

since for any , we must have for some . By summing Eq.(4) over all , we have

| (by Eq.(4)) | ||||

| (by Eq.(5)) | ||||

| (by Eq.(3)) |

This proves Eq.(2) and thus the first claim.

Now suppose we have a price that collects revenue in . We define a function by for and otherwise. We can use to obtain a revenue of from . This proves the second claim.

A.2 Decomposing items into small number of chains and antichains

We will use the following theorem, first proved by Dilworth [21], and its polynomial computability follows from the equivalence between Dilworth’s theorem and König’s theorem [26].

Theorem A.1.

Let be a partially ordered set, and be the maximum number of elements in any antichain of . Then there is a polynomial-time algorithm that produces a partition of into chains .

We now use the theorem to prove Lemma 2.5.

of Lemma 2.5.

Initially, let . In iteration , we check if the size of maximum antichain in is at least . If so, we find the maximum antichain , update , and proceed to the next iteration; otherwise, we stop the iterations. Notice that the number of iterations is at most , and when the iteration stops, the size of maximum-size antichain is at most . We apply the above theorem to compute a decomposition of into chains, denoted by . This concludes the proof of Lemma 2.5. ∎

A.3 Proof of Balcan-Blum Theorem for UUDP-MIN (cf. Theorem 2.6)

We first explain a randomized algorithm, and then we discuss how to derandomize it. This part is essentially the same as [6, 14]. First, we randomly construct a set where each item is independently added to with probability (recall that ). Then let be a set of consumer such that (i.e. consumers who care about exactly one item in ). We show that the problem has expected revenue at least .

Let be the optimal price function for and be a function that maps each consumer to the item she buys with respect to (let if consumer buys nothing and ). Therefore, we have that . We denote by the price function restricted to . For each , if and , the revenue created by in would be at least . Therefore,

Notice that, for any and ,

which implies that .

Derandomization: First, note that we can assume that . Otherwise, we can use the result of [1, 32, 8] (see [8, Section 4] for the result in a general setting) to obtain approximation algorithm for UUDP-MIN, which will also be -approximation.

Now, assuming that , we follow the argument of Balcan and Blum [6]. In particular, we observe that we need only -wise independence among the events of the form “ and ”, for any and , in order to get the above expectation result. In this case, we can use the tools from Even et al [25] to derandomize the above algorithm while blowing up the running time by a factor of . For more details, we refer the readers to [6].

A.4 Proof of Lemma 2.9

Recall that each is an antichain, i.e., for any distinct , there exists such that and . In particular, if , then we have that for any , there exists coordinate such that . This means that . The lemma follows.

A.5 Polynomial-Time Algorithm for -UUDP-MIN

We provide a polynomial-time algorithm for solving -UUDP-MIN. Let be a sequence of items ordered non-increasingly by their coordinates. We can assume without loss of generality that their coordinates are different (by slightly perturbing their values), and we say that consumer is at level if her coordinate lies between and . Notice that, for any consumer at level , we have .

Claim A.2.

Let be an optimal price. Then we can assume that .

Proof.

Suppose that for some . Recall that , so for each consumer such that , we know that does not buy item with respect to this solution. Thus, we can reduce slightly, while maintaining the same revenue. ∎

The claim will ensure that consumers at level only buy item but not any other items in , and this allows us to solve the problem by dynamic programming. For each , for each price we have a table entry that keeps the maximum revenue achievable from consumers at levels and items where the price of is set to . Notice that it is easy to compute the profit from consumers at level if we know . Denote such value by . Then we have that . Finally, we note that there are at most possibilities of prices because one can assume without loss of generality that, for UUDP-MIN, the prices always belong to .

Appendix B QPTAS for -UUDP-MIN

We note that we will write instead of since we assume that in this paper. (Otherwise, we already have approximation ratio of .)

We explain the main idea first. The intuition can be realized by solving the following simple case: Assume for now that we have items, which form a set . In this case it is possible to have two different consumers at the same coordinate, i.e. , while there is exactly one item at each point . Assume further that each consumer has budget either or . We show below how to solve this case in polynomial time.

Note that there is an optimal solution such that each item is priced either or : otherwise we could increase the price by small amount to collect more revenue. Now, for any item point and any price assignment , define

to be the minimum price among the items dominating . This quantity immediately tells us how much revenue we will get from consumers at point : each consumer will buy an item at price if and only if she has budget at least .

By the definition of , we know that for any fixed value , is non-decreasing in terms of . In other words, for any pricing and integer , there exists a “threshold” such that for all and for all . Additionally, for any , . Using these observations, we are ready to define the dynamic programming table. The table entry is defined to be the maximum revenue we can get among the price assignment such that for all and for all . The table can be computed as follows.

| (6) |

where is the number of consumers of the form for with budget and is the number of consumers of the form for with budget . Moreover, let for all . The optimal solution is then .

The above discussion captures almost all the key ideas for solving the general -UUDP-MIN problem. To get a QPTAS in the general case, we extend these ideas in the following way.

-

Consider a slight generalization when there is only one item in each column and row of grid cells (cf. Lemma B.1) while each budget is still and . In this case, we cannot pick arbitrary value of when we compute as in Eq.(6) since it might not correspond to any pricing. Through some additional observations, table can be computed as follows: Let be the item whose -coordinate is . If then we can use Eq.(6); otherwise, . This algorithm runs in time.

-

When there are different budgets, say , we can solve the problem in time. This is done by defining to be the maximum revenue we can get among the price assignment such that, for all , for all (where we let and ).

-

Finally, we obtain a QPTAS by “discretizing” the prices so that there are not many choices of item prices (cf. Lemma B.2). This enables us to assume that the prices are in where , and we can get the algorithm running in time .

B.1 Preprocessing

The following lemma says that we can assume the input lies on the grid where each row and column of the grid contains exactly one item.

Lemma B.1.

We are given an instance of -UUDP-MIN. Then we can, in polynomial time, transform into an “equivalent” instance such that

-

•

Each consumer has even coordinates for .

-

•

Each item has odd coordinate for .

-

•

For each odd number , , there is exactly one item with and exactly one item with .

Proof.

We sweep the horizontal line from top to bottom, and whenever the line meets the items such that with the same -coordinate , we break ties as follows. Let be the vertical distance from the line to the next item point below the line. We set the new -coordinates of these items to . Notice that some consumers whose -coordinates lie in get affected by this move. We also change the -coordinates of those consumers to . Then we add the horizontal grid lines between the space of every consecutive items, while making sure that consumer points are on the line passing . It is easy to see that this process preserves the consideration set of every consumer. We repeat the above steps until the sweeping line passes the bottommost item.

We do a similar sweep of vertical line from right to left, inserting the grid lines along the way. In the end, each consumer lies on the intersection of the grid lines and each item in its cell, which guarantees that no two items appear in the same row or column of the grid. ∎

B.2 Detail of QPTAS for UUDP-MIN

First, we can make the following simple assumption.

Lemma B.2.

We can assume that the prices are in the form or zero where by sacrificing in the approximation factor.

Proof.

We use the following standard arguments. Consider an optimal price . For each item , if the price is non-zero, we round down the price to the nearest scale of , so the price of each item gets decreased by at most a factor of . Consider a consumer who bought with price . After the rounding, she can still afford , so we can still collect at least from . ∎

Now, assuming that the optimal price has the above structure, we show how to solve the problem in quasi-polynomial time. First, we reorder the items based on their -coordinates in descending order, so we have . A consumer is said to belong to level if it lies between the row of and that of , so each consumer belongs to exactly one level. Moreover, observe that a consumer at level is only interested in (a subset of) items in (since for any ). We define a subproblem as the pricing problem with items and consumers at levels . We use the dynamic programming technique to solve this problem.

Profiles

We will remember the profile for each subproblem . A profile of consists of item indices . Each value is supposed to tell us the index of the item of price with maximum value . That is, we say that a price for is consistent with profile if, for each , the item has the highest value in the first coordinate among the items with price at most , i.e., for all ,

Since for any ,

Observe that if two prices and have the same profile, then consumers at level see no difference between these two prices, as shown formally by the following lemma. We say that an item is a profile item for profile if and only if for some .

Lemma B.3.

Let be a profile for subproblem , and let be any price function for that is consistent with profile . Then we can assume without loss of generality that every consumer at level only purchases profile items.

Proof.

Suppose that a consumer buys an item in with which is not a profile item. Then consider the profile item , which satisfies , so we must have . We can therefore assume that consumer buys instead of . ∎

Let be a profile for and be a profile for . We say that is consistent with if for any price that is consistent with , we can extend to by assigning value such that is consistent with . Notice that consistency between any two profiles can be checked in polynomial time by trying all possibilities of prices.

We recall that we use to denote the optimal price.

Lemma B.4.

There are profiles for respectively such that for each , is consistent with . Moreover, all such profiles are consistent with price .

Proof.

For each subproblem , we define the profile based on the price (there is only one possible profile consistent with ). It is clear that is always consistent with . ∎

Dynamic Programming Table

For each and for each profile of , we use a table entry to store the maximum revenue achievable among the price function for that is consistent with the profile . Since there are possibilities for the profile , the table size is . We now show the computation of the table. To compute , we recall that given the profile , the revenue from consumers at level can be computed efficiently. Denote such revenue by . The following equation holds:

Computing the Solution

For each table entry , we can keep track of the profile such that is the entry that is used to compute . Let be the entry that contains the maximum value over all . The value in this entry represents the revenue we can get from the optimal pricing , so it is enough to reconstruct the price function . We first obtain a sequence of profiles such that is a profile for and that is consistent with for any . This sequence allows us to reconstruct a price function that is consistent with all the profiles in polynomial time.

Appendix C QPTAS for -SMP

In this section, we show that QPTAS for -SMP.

C.1 Overview

We sketch the key ideas here and leave the details in next sections. First, consider the special case where each consumer has budget or and each item must be priced either or . The exact optimal solution of this case can be found in time. We later show how to extend the idea to the general cases, which turns out to be easy for the case of highway problem but need a few more ideas for the case of -SMP.

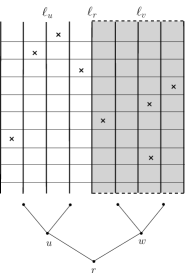

Algorithm for highway pricing problem reviewed:

Let us first start with the highway pricing problem which can be casted as a special case of -SMP where items are in the form . The main idea used in [23], casted in our language of “partition tree” (for convenience in explaining our -SMP algorithm later) is the following.

We first construct a balanced binary tree called a partition tree and denoted by . We define the vertical gridline in the middle to be a level- line, denoted by , dividing the items equally to left and right sides. This line corresponds to the root node of the tree. We also assign the consumers whose consideration set contains items on both sides to the root node. Then we recursively define the subtrees on the subproblems on the two sides of line as shown in Figure 5 until we reach the subproblem containing only one item. For any node , let be the set of consumers assigned to , and be the line associated with node .

Now we show a top-down recursive algorithm to solve this problem. This algorithm can be converted to a dynamic program by working bottom-up instead. At the root node of , we would like to compute which is defined to be the optimal revenue that we can collect from consumers in when we price the items in such a way that , and (, and , respectively) are the first, second, and third closest items on the left (respectively, right) of that have price . To avoid long notation, let us denote by and by . If we can compute for all then the optimal revenue can be obtained via the following formula.

| Optimal revenue | (7) |

where, for any node , is the number of consumers in whose consideration sets contain exactly one item in , and is the number of consumers in with budget whose consideration sets contain exactly two items in . The point is that we can calculate the revenue from consumers in as and use to compute the revenue obtained from the rest of the consumers.

It is left to compute . Let and be the left and right children of , respectively. In order to compute , we will compute which is the maximum revenue we can collect from consumers assigned to the descendants of (excluding ) where is the set of six items of price that are closest to as defined earlier. And, similarly, is the set of six items of price that are closest to . Moreover, we require that must be consistent with in the sense that there is some price assignment such that items in are the items closest to of price and items in are the items closest to of price as well. (For example, if we let then an item with property cannot be in since this item must have price .) We use to denote “ is consistent with ”. We define in a similar way.

Once we have and for all and , we can compute :

| (8) |

The main point here is that there is no consistency requirement between and so we have two independent subproblems. We define the function , for all nodes in similarly: Let , , , …, be the ancestors of and . We have to compute for all such that for all .

The computation of is done in the same way as Eq.(8) for every non-leaf node . At leaf node , can also be easily computed: .

Observe that and there are choices for each . Therefore, we can precompute for all combinations of . By working bottom-up from the leaf nodes, the running time becomes .

Algorithm for -SMP (special case):

To solve the special case of -SMP defined above, we need to modify a few definitions in a right way. Let us again consider the top-down algorithm and start at the root node of the partition tree . (Recall that we can assume that there is at most one item in each row and column so we can still define the paritition tree by drawing the vertical line through the point in the middle when sorted by the first dimension.)

One problem immediately appears: cannot be used to compute the optimal revenue as we did in Eq.(7). The reason is that we cannot compute the revenue from using anymore. To fix this, we have to redefine in the following way: We assign all consumers lying on the left (respectively, right) of to the left (respective, right) child and keep only those consumers lying exactly on the vertical line going through in .

Now we can compute the revenue from the newly defined and a function that computes the total revenue. To do this, we define to be the total revenue we can get from consumers in by pricing the items in such a way that, among the items on the right side of , items , , and are the items with price that have the highest, second highest, and third highest values in the second dimension, respectively. Again, let denote a possible choice of and write instead of . If we can compute then we can get the optimal revenue by Eq.(7), where and is as defined earlier (with the new definition of ).

Some more complications lie in computing , for any . As before, we will compute and where and are the left and right children of , respectively. Howerver, we have to carefully define and , in a different way.

We define , for any , to be the maximum revenue from the consumers assigned to the descendants of when we price the items in such a way that, among the items lying on the right side of and left side of , items , , and are the items with price that have the highest, second highest, and third highest values in the second dimension, respectively. Note that we do not need to check any consistency between and : For any choice of and , there is always a price assignment such that items in and are the items of price that have the highest values in the second dimension in their respective regions. In this case, we say that is always true for any and .

On the other hand, we define , for any , to be the maximum revenue from the consumers assigned to the descendants of when we price the items in such a way that, among the items lying on the right side of , items , , and are the items with price that have the highest, second highest, and third highest values in the second dimension, respectively. In this case, we have to make sure that is consistent with , i.e., there is some price assignment such that items in and are the items of price that have the highest values in the second dimension in their respective regions.

Now we have defined and , we compute using Eq.(8). As in the case of the highway pricing problem, we can extend the definition to other nodes. In particular, at a leaf node we have to compute where . Hence, this case can be solved in time.

Algorithm for general -SMP:

We now remove the restrictions that each item must be priced or and each budget must be or . The removal of the restriction on item price does not affect the case of highway pricing problem since this can be easily assumed (see, e.g., [31]). Moreover, we can still assume that the maximum budget is . Now we can deal with the general highway problem by redefining : Let where . For any , we want to price in such a way that is the item closest to on the left such that the sum of the price of all items between and is at least . Computing can be done in the same manner as before and consistency checking is easy to deal with. Function , for any node at level in , can be defined in a similar manner.

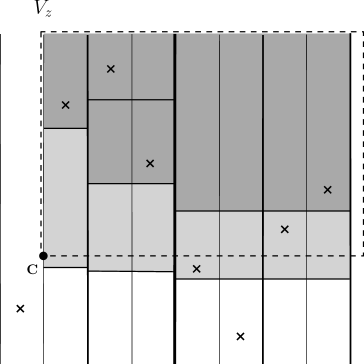

For -SMP, we may not in general assume the item prices to be . Instead, we show that it can be assumed that each item must have price , or , for any . A natural extension of the above idea is to define the notion of “volume of regions”: For each item , let and denote the horizontal and vertical line cutting through item , respectively. Any rectangle resulting from drawing some horizontal and vertical lines through some items are called regions and the regions that do not contain other regions are called minimal regions. For any price assignment, we define the volume of a region to be the sum of the price of all items within the region.

Now, similar to the highway problem, we define (note that ) as the “region guess”: We define to be the maximum revenue from when we price in such a way that, for any , item is the highest item (in the second dimension) such that the volume of the region on the right of the vertical line and above the horizontal line (including ) is at least . Using these volume guesses, we can approximate the upper and lower bounds of the revenue from each consumer at node by looking at for all ancestors of . This is because each consumer’s consideration set will contain some set of regions with volume guesses , respectively (such as the blue regions in Figure 6). Also, this consideration set will also be contained in some set of regions with volume guesses (such as the blue and red regions together in Figure 6).

However, in contrast to the case of highway problem, the consistency between the guesses (e.g., between and its children and ) is harder to guarantee. In order to guarantee the consistency, we add another parameter, denoted by (recall that ). is used as a “volume guess”. That is, we define to be the maximum revenue from when we price in such a way that the restriction on is as before and, additionally, the volumn of the -th minimal region is exactly (where we make any order of the minimal regions). We can now guarantee the consistency by making sure that the sum of the volume guesses in smaller regions defined by and (as well as and ) is exactly the volume guesses in the bigger regions defined by and .

For any node , we also define a function where are ancestors of and . In this case, we consider the minimal regions obtained by drawing vertical lines and horizontal lines for , for all . We use to store the numbers that are the “volume guesses” of all these regions. We also check the consistency in terms of volume, i.e., is consistent with if the volume guesses of the smaller regions defined by lines in add up to the volume guesses of the bigger regions defined by lines in .

C.2 Preprocessing

Fix some . Given an instance , our goal is to compute a price that collects a revenue of at least . Recall that we can assume that the consumers are on the intersection of grid lines, and the items are in the grid cells (cf. Lemma B.1). First we process the input so that the budgets and prices are polynomially bounded. Moreover, the optimal solution only assigns prices of the form for some . The proof of this fact only uses standard arguments (along the same line as in [6]).

Lemma C.1.

Let . The input instance can be reduced to with the following properties.

-

For each consumer , the budget of in is between and .

-

Any price that -approximates the optimal pricing of can be transformed in polynomial time into another price that gives -approximation for .

-

There is a -approximate solution satisfying the following: For all , , and is in the form for some .

Proof.

Let be the maximum budget among all consumers. We first remove all consumers whose budgets are less than . Notice that we only lose the revenue of at most by this removal. We denote the new set of consumers by . Now look at the optimal price for the resulting instance. If for some , the price is less than , we change its price to and remove item completely from the instance. Again, since each such item can only be sold to at most consumers, discarding it only decreases the revenue by . There are at most such items, so we lose a revenue of at most in total. Let denote the resulting set of items.

Next we scale each consumer budget by to get a new budget, i.e. . Now we have a complete description of the instance in which consumer budgets are between and . Let be the optimal value of the new instance. First we try to lower bound the value of . Consider the same price scaled up by a factor of . The revenue from this price is at least , so we have that .

We are now ready to prove the second part. Assume that we have a price that gives -approximation for , so the revenue collected by is at least . We construct the price by scaling down the price of by . Notice that for each consumer who can afford his consideration set in with price , he can also afford his set in with price . Therefore, the revenue collected by is at least . This argument also implies that .

Finally we show that there is a good solution that only assigns prices in the form , as follows. We round down the price of to the nearest scale of for some . For each consumer who purchases item w.r.t. price , by scaling down every item price, she can still afford her consideration set , whose new price is at least . ∎

From now on, we assume that our input instance and its optimal price are in such format. Our goal is to devise a QPTAS for this instance. We note here that in some special cases of single-minded pricing problems, especially the Highway problem, an even stronger statement can be assumed; namely, that the optimal price is integral [32]. It seems that such a nice property may not hold in our case, and we anyway do not need it.

C.3 Partition tree

We first construct a (almost balanced) binary tree where each node in is associated with a rectangular region in the plane (from now on, whenever we talk about region, we always mean a rectangular one). We call this tree the partition tree. It can be constructed recursively as follows. In the beginning, we have where is the root of the tree whose region is the whole grid. We repeat the following process: For each leaf , if the region of contains at least two items, we choose a vertical grid line dividing the items in a balanced manner to the left and right side. We then add the left child of with the region being the region of on the left side of . We also add the right child of associated with the region on the right side of . We repeat the process until every leaf is associated with a region containing only one item; see Figure 7(a).

For each node , we define the item set to be the set of all items in the region . Fix a price . For any region , we define the “volume” to be the total price among all items in the region, i.e. . The following simple claim is crucial in designing our algorithm.

Claim C.2.

Let be an optimal price. Then for any region , there are only possible values of .

Proof.

Let denote the number of items in with price . Notice that we can write the volume of as where only takes non-negative integer values at most . So we have at most possibilities for the volume. ∎

C.4 Horizontal partition and local profile

From the construction, each node of the partition tree, is associated with a vertical line which divides the plane into two region. We further partition the right region using vertical line, as follows.

Consider a non-leaf node with left child and right child . A horizontal partition for node , denoted by , is a collection of (not-necessarily distinct) horizontal lines , partitioning the region of into many pieces; note that the left endpoints of these lines are on . The line is supposed to mark the highest -coordinate such that the volume inside above is at least . Notice that each node has at most feasible partitions since there are at most possibilities for the choice of each .

Now if we fix a horizontal partition of every non-leaf node in the partition tree, we can define minimal regions for each non-leaf node as follows. For each node , we consider all vertical and horizontal lines associated with and all its ancestors (i.e., all lines in and where or is an ancestor of ). Let denote the set of these lines. naturally defines minimal regions: We say that a region is minimal with respect to if and only if is a rectangle whose four boundaries are the lines in , and there is no line in that intersects with the interior of .

Now, we define a local profile of a node . It consists of (i) horizontal partitions for and for all its ancestors, and (ii) numbers on every minimal region resulting from vertical and horizonal lines. The numbers are supposedly the “volume guesses” of every minimal region of .

Now we try to guess the “right” local profile of every node in the partition tree. We show that if this guess is right, then we get a good approximation of the optimal solution. Moreover, we can use dynamic programming to make the right guess.

C.5 Dynamic Programming Solution

A global profile (or just profile in short) of a node consists of the local profile of and all its ancestors in such a way that the volumes of minimal regions of is consistent with its ancestors. More formally, fix a node . A profile for consists of, for any ancestor of , which is the local profile that node wants its ancestor to have (we also think of has an ancestor of itself for convenience). As a reminder, for each ancestor of , local profile some horizontal partition and the “volume guess”of each minimal region of . In addition, we restrict that these local profiles have to be consistent in themselves in the following sense. For each vertex , for any minimal region of that is further partitioned into minimal regions of for some descendant of , the number at is equal to the sum of the numbers of .

We argue that the number of global profiles for each node is not too large, i.e. only . There are horizontal partitions for each ancestor of , making a total of possibilities of the lines . Now fix a choice of such horizontal partitions. If we draw all lines involved in the global profiles, we will see a number of regions formed by intersections between these lines and the vertical lines . Since there are such horizontal lines and vertical lines involved, we have at most minimal rectangular regions. Each region has at most possible volumes, so there are at most global profiles for each node .

Now we define a valid tree profile for as the set of global profiles such that is a global profile for node . Moreover, for every parent-child pair where is a parent of in , the profile agrees with . That is, all profiles about ancestors of in and are exactly the same.

Given a valid tree profile , we have the notion of cost of the profile (denoted by ) which is supposed to approximate the total revenue we can collect by a price function consistent with . The cost of a profile can be computed as follows. For each node , let be the set of all consumers on line . For each consumer , the rectangular region enclosed by horizontal line and vertical line is the actual amount the consumer needs to pay. This is the amount we do not know, but we can approximate: We let be a sequence of ancestors of such that is on the left subtree of (in the order from to the root), where . And we let for each , be the maximum number such that does not lie below . The cost of consumer is just the sum if and zero otherwise. The cost at node is just the total cost of all consumers in , and the cost of the profile is the sum of the cost over all nodes .

Lemma C.3.

There is a valid tree profile such that the cost is at least .

Proof.

We start from the optimal price and construct the valid profile as follows. For each node , we define a feasible partition of by choosing the line to be at the highest -coordinate such that the total volume enclosed is at least . Then we create a profile for each node according to the actual volume of each minimal region. Notice that this gives a valid tree profile. ∎

Our goal now is to compute the valid profile of maximum cost by dynamic programming, and the profile will automatically suggest a near-optimal pricing.

Computing the Solution:

Let . We say that a price is consistent with global profile if and only if for every minimal region of that is completely contained in , we have . The minimum cost profile can be computed in a bottom-up fashion, as follows. For a leaf node , a global profile for automatically determines the price of the only item in ; discard a profile which does not have consistent price.

The following lemma shows that a price consistent with a valid tree profile can be computed from .

Lemma C.4.

For each node with left child and right child , let and be the prices that are consistent with the profile and respectively. Then the price defined to agree with on and with on , is consistent with .

Proof.

Consider a minimal region and a volume guess in . If where is the union of minimal regions of (similar argument can be made in case ), then by assumption that is consistent with , we know that the total value . Since is consistent with the profile , we have that as desired. ∎

We have shown that a valid tree profile always has a price consistent with it. The following lemma basically says that this price gives a revenue close to the cost of the profile, which will in turn imply that the maximum cost profile gives the revenue of at least .

Lemma C.5.

For any valid tree profile , let be a price consistent with and let . Then collects revenue at least fraction of the profile cost.

Appendix D Omitted hardness results

D.1 Hardness of 3-UUDP-MIN and 4-UUDP-MIN

In this section we show that -UUDP-MIN is NP-hard, and -UUDP-MIN is APX-hard by a reduction from Vertex Cover. Our reduction relies on the concepts of adjacency poset and its embedding into Euclidean space. We describe basic terminologies here. Given a graph , an adjacency poset of graph can be constructed as follows: First we define a poset with its maximal elements corresponding to vertices in and its minimal elements corresponding to edges . For each vertex and each edge , we have the relation if and only if vertex is an endpoint of . We say that a map is an embedding of adjacency poset into if and only if it preserves the relations , i.e., for any two elements , we have that iff for all coordinates .

Now we describe our reductions. Since two reductions are essentially the same, we give a general procedure which will imply both results. Given an instance of Vertex Cover, we first construct an adjacency poset for , and then we compute the embedding of this poset into Euclidean space . We will use the graph , as well as the embedding , to define the instance of -UUDP-MIN as follows:

-

•

Consumers: We have two types of consumers, i.e. the rich consumers and the poor ones. For each vertex , we create a rich consumer with budget at coordinates . For each edge , we create a poor consumer with budget at coordinates .

-

•

Items: For each vertex , we create item at coordinates .

Note that for each , each poor consumer has , while each rich consumer has . We denote the resulting instance by .

The following lemma gives a characterization of the optimal solution for . It says that we may assume without loss of generality that every poor consumer gets some item.

Lemma D.1.

For any price that is a solution for constructed above, we can transform to such that every poor consumer buys some item with respect to , and the revenue of is at least as much as the revenue of .

Proof.

Consider edge . Suppose poor consumer does not get any item, so it implies that both items and have price (recall that, since budgets are or , the optimal prices would never set prices that are not in ). We define the price function by setting while for all other vertices . The only rich consumer that gets affected is , whose payment may decrease by one. However, we earn the revenue of one back from poor consumer . For , poor consumer is never affected because his budget is one. Overall, changing the price from to never decreases revenue. ∎

Let be the optimal price for and denote the size of minimum vertex cover of . We show the following connection between the size of minimum vertex cover and the optimal revenue collected by .

Theorem D.2.

The optimal revenue collected by is exactly .

Proof.

From the previous lemma, we can assume that the pricing sells items to every poor consumer. In other words, if , it must be the case that is a vertex cover: otherwise, let be an edge which is not covered by any vertex in , so is only interested in items with price , which he cannot afford. This contradicts the assumption that sells items to every poor consumer.

The revenue collected from poor consumers is exactly . Each rich consumer in the vertex cover gets the item with price while others get the items with price , so the total revenue is . ∎

This theorem immediately implies the gap between Yes-Instance and No-Instance for -UUDP-MIN. The only detail we left out is the computation of the embedding , and this is where the hardness proofs of -UUDP-MIN and -UUDP-MIN depart (other steps are exactly the same). For -dimensional case, we start from planar graphs whose adjacency poset can be embedded into . Since planar vertex cover has a polynomial-time approximation scheme, we only get NP-hardness here. For -dimensional case, we start from vertex cover in cubic graphs, which is known to be APX-hard, but unfortunately we can only embed its adjacency poset into , thus obtaining the hardness of -UUDP-MIN.

NP-Hardness of -UUDP-MIN

To show the NP-hardness, we start from Vertex Cover in planar graphs, which is known to be NP-complete [28]. We will use the following theorem, due to Schnyder [47].

Theorem D.3.

Let be an incident poset of planar graph . Then there exists an embedding from the poset into .

Schnyder shows later that the crucial step in the theorem can be computed in polynomial time [48], which immediately implies the following theorem.

Theorem D.4.

-UUDP-MIN is NP-hard even when the consumer budgets are either or .

APX-Hardness of -UUDP-MIN

We will be using the fact that Vertex Cover in cubic graphs is APX-hard [4], stated in the language convenient for our use below.

Theorem D.5.

For some , it is NP-hard to distinguish between (i) the graph that has a vertex cover of size at most , and (ii) the graph whose minimum vertex cover is at least .

Now we assume that our input graph is a cubic graph and use the following theorem to embed the adjacency poset of into .

Theorem D.6 (Schnyder).

An adjacency poset of any -colorable graph can be embedded into . Moreover, the embedding is computable in polynomial time.

It only requires a straightforward computation to prove the following theorem.

Theorem D.7.

-UUDP-MIN is APX-hard even when the consumer budgets are either or .

Proof.

In the Yes-Instance, we can collect the revenue of . However, in the No-Instance, the revenue is at most . Since the graph is cubic, we may assume that for some . Hence we have a gap of . ∎

D.2 NP-hardness of -SMP