Impact of meta-order in the Minority Game

Abstract

We study the market impact of a meta-order in the framework of the Minority Game. This amounts to studying the response of the market when introducing a trader who buys or sells a fixed amount for a finite time . This perturbation introduces statistical arbitrages that traders exploit by adapting their trading strategies. The market impact depends on the nature of the stationary state: we find that the permanent impact is zero in the unpredictable (information efficient) phase, while in the predictable phase it is non-zero and grows linearly with the size of the meta-order. This establishes a quantitative link between information efficiency and trading efficiency (i.e. market impact). By using statistical mechanics methods for disordered systems, we are able to fully characterize the response in the predictable phase, to relate execution cost to response functions and obtain exact results for the permanent impact.

keywords:

Minority Game; Market Impact; Meta-order; Market Microstructure.1 Introduction

Market impact is the effect on the price caused by an order, and it measures the tendency of prices to move up (down) subsequent to a buy (sell) trade of a given size (Bouchaud 2010). Understanding market impact is a fundamental problem in financial markets, and it has recently been the subject of several studies, both empirical (Hasbrouck and Seppi 2010, Plerou et al. 2002, Lyons and Evans 2002, Lillo et al. 2003, Almgren et al. 2005, Moro et al. 2009, Tóth, Eisler et al. 2011) and theoretical (Torre 1997, Grinold and Kahn 2000, Farmer et al. 2005, Gabaix et al. 2005, Bouchaud et al. 2008, Tóth, Lempérière et al. 2011). From a theoretical perspective, market impact is related to the problem of understanding how information is incorporated into security prices (Bouchaud et al. 2008, Kyle 1985, Glosten and Milfrom 1985, Hasbrouck 1991).

For practitioners, controlling market impact is essential in order to limit execution costs, which arise because each trade impacts adversely on the price. In addition, traders often face the problem of executing orders whose volume is much larger than the outstanding liquidity which is available for trading at each moment in time, which is typically a factor smaller than the volumes exchanged daily (Bouchaud et al. 2008). A common strategy consists in splitting large orders in a sequence of child orders that are executed incrementally. This sequence of trades is commonly called meta-order. The trading activity generated by meta-orders has been argued to be one of the origins of long range auto-correlation in the flow of orders in financial markets (Bouchaud et al. 2008), and generates market impact which extends beyond that of single orders. One robust empirical finding is the fact that market impact is a concave function of the order size both for individual orders (Bouchaud et al. 2008) and for meta-orders (Moro et al. 2009, Tóth, Lempérière et al. 2011), in contrast with early models (e.g. Kyle 1985) which predict a linear impact.

Understanding market impact requires addressing the strategic interaction between liquidity providers and liquidity takers, and in particular modeling how the former exploit the predictable trading patterns of the latter. Kyle’s seminal paper (Kyle 1985) and its most recent extension to meta-orders (Farmer et al. 2011) build on this key ingredient, but are limited to simple (representative) agent settings. In addition, the assumption of perfectly informed agents hardly suits to realistic settings111Typically, liquidity takers are perfectly informed on how much they need to trade, but not on the future price of assets.. More recent theoretical studies on market impact have been done within the framework of order-book models (Slanina 2008), which provide an accurate description of the market microstructure. We take a complementary approach by using a coarse-grained description of the market, focusing on the collective behavior of a set of heterogeneous adaptive market participants.

The natural framework for addressing this issue is the Minority Game (MG) (Challet and Zhang 1997, Challet et al. 2005, Coolen 2005), which is a paradigmatic model of heterogeneous adaptive agents who repeatedly interact in a market setting using simple “trading strategies” to either buy or sell an asset, with the objective of being in the minority side (i.e. selling when the majority buys or vice-versa). In spite of its simplicity, the MG offers a picture of a financial market as a many-agent interacting system where speculators “predate” on predictable patterns introduced by other agents, much as in real financial markets. As such, the MG shows, in a simplified setting, how markets aggregate information as a result of speculative activity. In brief, one can distinguish an “asymmetric” phase, characterized by the presence of statistical arbitrages when speculative pressure is low, from a “symmetric” phase, when there are many speculators and the market is unpredicable (Challet and Marsili 1999). Close to the transition between the two regimes several stylized facts observed in financial markets can be successfully described by slightly generalizing the original MG problem (Challet et al. 2001, Bouchaud et al. 2001, Challet and Marsili 2003).

The MG is the appropriate setting for studying the market impact of meta-orders, because it reproduces the response of adaptive traders to perturbations introduced by the persistent activity of meta-orders. A meta-order is introduced in the MG by adding an extra agent that consistently buys (or sells) for a finite time period, after which the extra agent is removed, and the meta-order finishes. In order to analyze how this perturbation affects the price, one needs to make an assumption on how the price is related to excess demand. Here we assume a market clearing mechanism (Marsili 2001) taking a linear relation between them. Alternative approaches are discussed in Sec. 4. This allows us to estimate the impact of the meta-order on price, during and after its execution. Our main findings are: i) in the predictable phase the permanent impact is nonzero, while in the unpredictable phase there is no permanent impact; ii) the permanent impact can be computed analytically, relating it to response functions. Finally, iii) we find that the market impact is linear with the size of the order, as a consequence of the assumed linear relation between price and excess demand.

The organization of the paper is as follows. In the next section we define the model, discuss its phase transition and explain how the meta-order is introduced. In Sec. 3 we present our results and in Sec. 4 we draw the main conclusions. Furthermore, we add appendices with the calculations used to obtain the analytical results.

2 Grand-canonical Minority Game

2.1 Model definition

The MG describes a set of agents interacting in a market over a sequence of periods labeled by a discrete time variable . Each period corresponds to the trading activity in a time window . A realistic value for must be much larger than inter-trade times, e.g. s, and can be thought as being the typical time over which meaningful information accumulates, e.g. few minutes222One method to estimate time-scales over which information flows is that of studying the dynamics of cross-correlations between different stock prices. On very liquid stocks, Mastromatteo et al. (2011) show that for min price dynamics is dominated by noise, whereas Borghesi et al. (2007) show that the structure of correlations of daily returns can be recovered already from the analysis of returns over minutes. Similar results have been discussed in Tóth et al. (2006).. Speculators act in the market by using trading strategies that process the value of a public information signal and submit orders accordingly. In practice, a number of trading strategies is constantly being evaluated and the most profitable are used. Profitable strategies are those that dictate to buy when the majority is selling or vice-versa, i.e. that place the trader in the minority side as frequently as possible. This captures in a simple manner the market making activity of liquidity providers.

Formally, we consider the grand-canonical MG setup (Challet et al. 2005). The information to which traders react can take values, labeled by . Every time step a new signal is drawn at random. We suppose there are two types of traders: liquidity takers – also called producers in Challet et al. (2005) – and speculators or liquidity providers. There are producers and speculators and their only difference is that while the former react to information signals in a deterministic manner, the latter are adaptive.

Specifically, each agent is endowed with a trading strategy , that dictates whether to buy () or to sell () when public information is . These strategies are independently drawn for each player, uniformly in the set of all possible binary functions . However, while producers always trade according to their strategy, speculators may choose to trade or not, adapting their behavior to the profitability of their strategy. This choice is encoded in a dynamical variable , which takes the value if agent decides to trade, and otherwise. The profitability of a strategy is quantified by a score that is updated according to

| (1) |

where the excess demand is given by

| (2) |

and is the sum of the contributions from producers when . The decision of playing or not is taken in accordance to the score of the speculator. In the simplest case, agent does not trade if whereas she trades if the score is positive333This rule can be generalized using a stochastic choice model (Challet et al. 2005), without changing the main results presented in this paper.. In summary, a time-step iteration of the model is realized in the following way:

2.2 Phase transition in MG

As discussed in Challet and Marsili (2003) this model has a very rich phenomenology. In the limit of large markets, analog to the thermodynamic limit in physics, the non-trivial regime arises when , while and remain finite. A central role in the characterization of the collective behavior is played by the quantity

| (3) |

where

| (4) |

denotes the average of conditional on . detects the presence of statistical arbitrages, in that if there is at least one value of which allows for a statistical prediction of the excess demand when . For this reason is called predictability. A remarkable feature of the MG is that the dynamics converges to states of minimal predictability (Challet et al. 2005). This is not only appealing conceptually, as it says that speculators leave the market as unpredictable as possible given their strategies, but it also opens the possibility for analytic approaches to the MG. Indeed, it turns the study of the stationary state of the MG into the analysis of the minima of , as a function of the variables . This is akin to studying the ground state properties of a disordered system in physics, a problem for which a plethora of powerful tools has been developed in recent years (Challet et al. 2005, Coolen 2005). In Appendix 5 we show how this is done by calculating the critical line and the predictability in the asymmetric phase. In brief, one finds that

| (5) |

where is given in Eq. (26) in the Appendix 5 and

| (6) |

can be interpreted as an agent susceptibility, as it measures the response of agents’ behavior to a change in their strategies444This is a standard result (Mézard et al. 1987), see e.g. Appendix A1.1 in Marsili (2009) for an explicit derivation in an interacting agents’ context. In the dynamic theory of MG (Coolen 2005), emerges as the integrated response of an instantaneous perturbation. Loosely speaking, it measures the time over which agents’s behavior maintains memory of perturbations.. The relation between and on and is discussed in the appendix, here we focus on the resulting picture of the behavior of the MG, which can be summarized as follows. For a fixed value of , if is small enough the market is predictable () and the susceptibility is finite. In words, the number of speculators is not enough to exploit the amount of statistical arbitrages introduced by producers. When increases, decreases whereas increases, in agreement with Eq. (5). Beyond a critical value the susceptibility diverges () and the market is unpredictable (). The point marks a phase transition in that it separates two regions with distinctly different features. In this paper we focus on the case , for which the critical value is .

2.3 Meta-orders in the Minority Game

In order to introduce a meta-order in the grand-canonical MG we add a fixed buyer to the system. That is, we add one extra producer that always buys independently of the public information pattern. This extra producer buys a quantity of assets at each time, for time steps. This models a meta-order of duration , and total size . Since typical relaxation times in the MG are proportional to , we’ll consider proportional to in what follows, which might correspond to time-scales of one trading day. Note that turning on the meta-order corresponds to changing the excess demand to

| (7) |

where for and otherwise. This way of modeling the unwinding of a meta-order is reminiscent of a very common scheduling strategy (the TWAP scheme), in which the trader’s target is to execute a quantity of shares which grows linearly in time (Berkowitz et al. 1988).

It can be shown that, imposing a market clearing condition (see Marsili 2001, De Martino and Marsili et al. 2006), the quantity is proportional to the return of the logarithm of the price, which is given by

| (8) |

Different market mechanisms can imply a different relation between price change and excess demand . This relation has implications in how the market impact depends on the order size, which is of central importance in market impact studies. Our definition is likely to be appropriate at large time scales (say, between one day and a week), in which one expects stochasticity not to play a dominant role in the description of the market clearing mechanism. We shall return to this point in the conclusions. We define the price impact as the averaged log-price change in presence of the meta-order, minus the trend component which would have been present in the unperturbed case. This corresponds to the quantity

| (9) |

where corresponds to the beginning of the meta-order, the average over the stationary state distribution is denoted with and the one over the possible choices of the fixed strategies555The strategies are fixed in the sense that they do not change during the whole evolution of the system, i.e. before the beginning of the order, during the order and after its completion. In physical jargon such variables would be called quenched strategies. However, for the sake of clarity, we will continue to refer to them as fixed strategies. has been written as . This averaging procedure mimics the averages in empirical studies, which are on different orders at different times, as well as on different markets (Moro et al. 2009, Tóth, Eisler et al. 2011, Tóth, Lempérière et al. 2011). Notice that is expected to be zero only after averaging over the fixed strategies, as in the asymmetric phase its value is finite, and fluctuates from realization to realization.666It can be estimated (Challet et al. 2005) that is finite for any realization of the MG, and it is described by a Gaussian random variable of mean zero and variance . The averages in Eq. (9) are numerically estimated according to the following procedure. Initially all the scores are set to zero and the model is run until it relaxes to the stationary state. In this initial phase of the evolution speculators adapt to the information injected by producers in the absence of a meta-order. Then we compute taking a time average in the stationary state777The average has to be taken on times much longer than those over which we observe the impact .. After that the meta-order is turned on and we start measuring the impact. Finally the average over the fixed strategies is computed by repeating this procedure for a large number of realizations.

We will also consider for , since we are interested in the response of the system after the meta-order is turned-off. Of particular interest is the permanent impact, which reads , and the average execution cost

| (10) |

which measures the mean price increment incurred during the meta-order. In particular, it is a simple exercise to show that the cost of an execution for a trader is related to the maximum price increment as

| (11) |

The estimation of the above quantity provides a practical mean to evaluate the concavity of price impact: for a market impact of the form , one finds that , which indicates that concave impact functions have to be associated with a value of , while for convex impact functions a value smaller than has to be expected.

3 Results

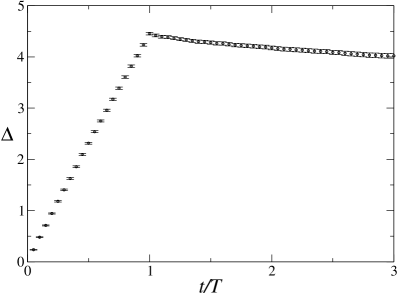

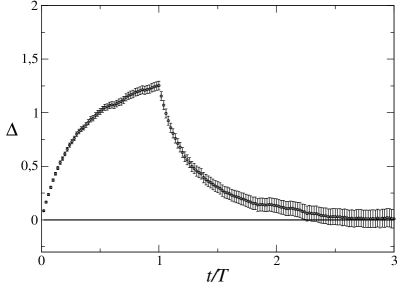

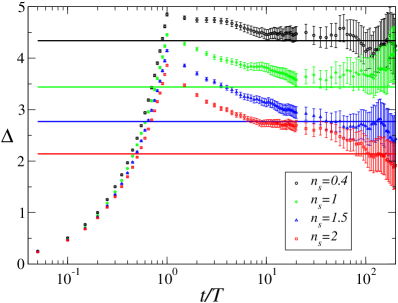

Let us first analyze how the impact changes depending on whether the model is in the symmetric or the asymmetric phase. In Fig. 1 we plot the impact , obtained from numerical simulations, as a function of time for (predictable phase) and (unpredictable phase). In the predictable phase the impact grows linearly during the meta-order. After the meta-order finishes, it decays to a constant faster than a power law, but with a long relaxation time. In the unpredictable phase the situation is rather different. During the meta-order the impact grows initially very fast and then it reaches a saturation value. After the meta-order is finished the impact quickly relaxes back to zero. Therefore, as a main result of this paper, we find that if the market is unpredictable () the permanent impact is zero and if the market is predictable () the permanent impact is non-zero. We point out that the permanent impact is zero in the symmetric phase as long as the the duration of the meta-order is big enough such that the impact saturates before the end of the meta-order. If is much smaller than the time for saturation to set in, the permanent impact in the symmetric phase is non-zero.

In terms of the excess demand we have the following picture: immediately after the order is turned on, the (average) excess demand jumps from to . During the execution of the meta-order it relaxes to a value smaller than . In the unpredictable phase, this value is zero, whereas in the predictable phase it is finite, implying a linear growth of the impact. At the end of the meta-order () the excess demand suddenly drops by , thus becoming negative. Finally it relaxes back to zero, regardless of the phase.

This result can be explained in the following way. If predictability is zero, it means that the market is information free and the system is able to absorb the extra information of the extra fixed buyer. Therefore, the value of the excess demand relaxes back to zero during the meta-order. On the other hand, when the market is predictable the number of speculators is not enough to consume all the information available. Hence, when the perturbation is added, the system reaches a new stationary state where the value of the excess demand is non-zero.

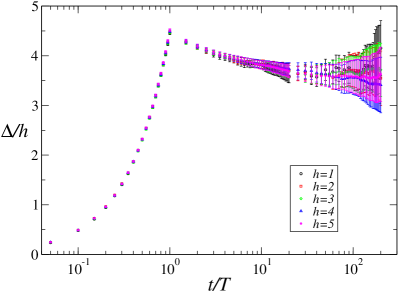

Fig. 2 shows that the impact grows linearly with the order size . Indeed the rescaled impact collapses on the same curve, when plotted against . This is a consequence of the assumed market mechanism and of linear response theory, as we shall see, and it contrasts with results of empirical (e.g. Tóth, Lempérière et al. 2011) which find a square root law . We will come back to this issue in the concluding section.

These results are fully consistent with the theoretical predictions. As we show in Appendix 6, the stationary state of the system in the presence of the meta-order can be calculated by minimizing the predictability with the modified excess demand (7). This allows us to calculate the saturation value of the excess demand before the meta-order is finished, which is given by

| (12) |

In order to obtain it numerically we calculate the slope of the curves of when the linear growth of the impact sets in, after some initial transient. In Fig. 3 we can see that the numerical results are in full agreement with the exact calculation.

It is worth noticing that , which measures the response of the market to a perturbation , is inversely proportional to the susceptibility of agents’ behavior. The market impact is larger when agents are not very susceptible to perturbations, whereas it is minimal in the symmetric phase (), when agents respond strongly to any perturbation.

In order to address the dynamic effects of market impact, it is necessary to reformulate the dynamics in a continuum time description which acknowledges the fact that characteristic times in the MG are of order (Challet et al. 2005, Coolen 2005). As long as the perturbation is much smaller than , linear response theory holds, i.e.,

| (13) |

where is the perturbation and is a kernel that contains the relaxation dynamics. Note that if we expect to recover the stationary value of Eq. (12), hence . Also causality requires for . We remark that in order to reproduce the small time behavior of the model (i.e. for small ), the function must have the form

| (14) |

where is non-singular in zero, causal ( for ) and . in Eq. (14) captures how adaptive traders detect the statistical arbitrage introduced by the meta-order and react to it, by removing it as a result of their activity. If in addition we assume that decays fast enough when , then within linear response theory, we show in Appendix 7 that the permanent impact is

| (15) |

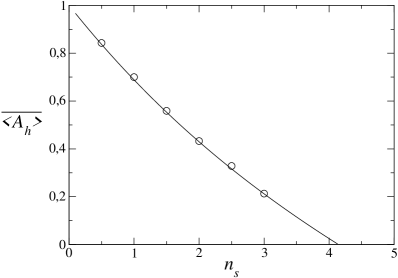

The assumption on is fully consistent with simulations, where the excess demand is found to relax faster than a power-law, which is expected since we are not considering the model at criticality. In Fig. 4 we see agreement between Eq. (15) and numerical results. However, relaxation times are rather long even for values of considerably far from the critical value , making the error bars become very large before is saturated.

Finally, the average execution cost, which is derived in Appendix 8, is given by

| (16) |

For a kernel of the form (14) and execution times much smaller than the characteristic relaxation time of , this quantity is well approximated by

| (17) |

while at large times we obtain a value which signals a linear impact. This should be compared with reported in empirical studies (e.g. Farmer et al. 2011, Tóth, Lempérière et al. 2011), and with the arguments in Tóth, Lempérière et al. (2011).

4 Conclusion

The market impact has been the subject of intense discussion recently. Proposals of universal laws have been put forward (Farmer et al. 2011, Tóth, Lempérière et al. 2011) on the basis of empirical analysis and simple models. Here we address this issue within the framework of the Minority Game. At odds with zero-intelligence (or -intelligence (Tóth, Lempérière et al. 2011)) models, the MG retains a level of rationality of the agents without making strong assumptions on their information on future returns (as in Farmer et al. 2011). Rather, traders learn adaptively on the profitability of their strategies. In addition, the minority rule is rather appropriate if one focuses on market making activity, where the profit of agents comes from matching imbalances in demand. Finally, the MG is the ideal platform to address how markets digest information on order imbalances from meta-orders and to address the issue of the market impact beyond its immediate consequences.

We have shown that the MG provides realistic curves for the market impacts and sheds light on the mechanisms which are responsible for it. Most interesting, we derive a relation between market impact and information efficiency, whereby the permanent impact of a meta-order is smaller the more the market is free of statistical arbitrages. For a perfectly “symmetric” market where returns are statistically unpredictable, prices should revert to the values before the order started, and hence the permanent impact should be zero. Understanding whether this relation extends to other modeling frameworks or whether it is confirmed by empirical data, is a very interesting issue for future research.

A noticeable shortcoming of our analysis pertains the prediction of a linear impact with order size ( in our notations), which contradicts the observed concave behavior , with . It is easy to identify the origin of this behavior within the MG, in the assumed market mechanism. This assumes a matching of orders at a single deterministic price, fixed by market clearing. Indeed, the price itself does not enter into the definition of the MG. Strictly speaking the MG describes the dynamics of the excess demand, and how this is determined by market makers who adaptively respond to it, in their effort to match it dynamically. Therefore, on one side this suggest to look for alternative definitions of the price in the MG, capturing more faithfully the dynamics of the order book. On the other, this suggest to look at empirical measures of the market impact in terms of the demand imbalance itself.

The analysis of the more realistic case in which the size of the orders is Pareto distributed would also be a relevant extension of the present work, and could allow the model to describe persistence of the order flow (see Farmer et al. (2011) and Tóth, Lempérière et al. (2011)). There are two possible choices: either can be Pareto distributed and fixed, or, vice versa, is Pareto distributed and fixed. In the former case it would not be possible to apply linear response theory, since there will be realizations with , which is not a small perturbation. In the latter case it must be considered that when one measures the market impact averaged over orders of different volumes for a given value of volume , only the orders whose volume is larger than or equal to are taken into account. If the difference in volume depends only on the difference in the length of the order then, at a given time, only the orders which are still standing are taken into the average. As a consequence, it is easy to show that, at least during the execution of the meta-order, the market impact is still linear with respect to the volume. Alternatively, it would be very interesting to study a Pareto distributed order flow for the environment (i.e. by assigning to the producers strategies which lead to large fluctuations of the excess demand ). In this case the market stationary properties should be different, and an anomalous response to a meta-order could emerge. It is not easy to anticipate what the behavior of the system would be as the problem becomes harder to solve analytically.

Finally, as discussed in Tóth, Lempérière et al. (2011), the market impact is expected to cross-over to a linear behavior for times longer than few days. This supports the view that the MG provides a description of market activity on intermediate time-scales, with representing a time-scale between one day and a week.

Acknowledgements

We gratefully acknowledge discussions with J.-P. Bouchaud, F. Lillo, R. Mantegna, B. Toth, and M.A. Virasoro.

5 The stationary state of the grand-canonical Minority Game with replica symmetric approach

The problem of calculating the macroscopic observables of the grand-canonical MG in the stationary state can be solved by finding the minimum (also referred as ground state) of a Hamiltonian function, which is precisely the Lyapunov function minimized by the dynamics of the grand-canonical MG (De Martino and Marsili et al. 2006)

| (18) |

where

| (19) |

and . Each of the is the average value of in the stationary state, and is a Gaussian variable with zero mean and unit variance. For convenience we are considering an Hamiltonian that is different from the predictability . Therefore, in order to recover the free energy associated with , one has simply to multiply the free energy obtained with by .

Let us define the partition function

| (20) |

where we have used the Hubbard-Stratonovich trick in the second equality and

| (21) |

The minimum of averaged over the fixed strategies can be obtained from the partition function in the limit of . It is given by

| (22) |

where the over-bar denotes an average over the fixed strategies and the variable was introduced in order to calculate the average through the one of , a strategy known as replica trick (Mézard et al. 1987). We now proceed calculating .

It is a simple exercise (see De Martino and Marsili et al. 2006) to show that after averaging out the fixed strategies we obtain

| (23) |

where the indices run over the replicas.

Introducing the overlap matrix and the response matrix (see De Martino and Marsili et al. 2006, for details), it follows that

| (24) |

where

| (25) | |||||

We now take the ansatz (known as the replica symmetric ansatz) and . Note that in terms of the original variables

| (26) |

In this way the free energy becomes

| (27) | |||||

where . In the limit of the free energy is dominated by its minimum and the saddle-point equations are

| (28) |

where , , and . Rearranging these equations we obtain the following recipe to calculate the macroscopic observables. First one should solve the following transcendental equation in order to obtain as a function of the control parameters and ,

| (29) |

After that, one can express the macroscopic observables as function of by using the saddle point equations. For example, it is easy to calculate the minimum of the free energy to obtain the predictability as

| (30) |

where is the free energy at the saddle point. Moreover the susceptibility is written as

| (31) |

6 Perturbing the Hamiltonian

We now consider the perturbed Hamiltonian

| (32) |

This corresponds to the Lyapunov function that is minimized by the dynamics when the meta-order is turned-on. Therefore, it gives the stationary state measure for the case with an extra buyer.

The calculations in the present case are analogous to the calculations in Appendix 5. For example, with the perturbation, Eq. (23) changes to

| (33) |

where the indicates the partition function associated with . This leads to the following free energy

| (34) |

where and is the free energy given by (27). With the replica symmetric ansatz we have , leading to

| (35) |

Hence, we have obtained the free energy for the perturbed case. Moreover, if we write

| (36) |

we get

| (37) |

This gives

| (38) |

Finally, from Eq. (35) we obtain Eq. (12), where is given by Eq. (31), after numerically solving Eq. (29).

7 Permanent impact

In the following we show how the permanent impact relates to the stationary state quantities of the model calculated above. We will consider the continuous time description of the dynamics (Challet et al. 2005) as justified in Sec. 3, and define accordingly the quantities and

| (39) |

Within linear response theory, Eq. (13) yield the response at time of the system due to a perturbation , in terms of the kernel . Note that and that causality requires for . From Eq. (9) the permanent impact is given by

| (40) |

Assuming that is an integrable function, we have

| (41) |

Therefore, the expression for the permanent impact can be written as

| (42) | |||||

The value of this integral is determined by the value of the residues of the integrand on the plane , provided that for . If has no poles on such domain, which corresponds to the assumption of causality for , the only contribution to the integral comes from a second-order pole in . Hence, using we obtain our final formula

| (43) |

8 Average execution cost

We calculate in the following the expression for the average execution cost as defined in Eq. (11), and compare it with the maximum price increment . To calculate those quantities it is sufficient to assume linear response by plugging Eq. (13) into the definitions of and . The former quantity can be obtained straightforwardly integrating by parts, and results

| (44) | |||||

where the averages have been defined in Eq. (16). The expression of the average execution cost is analogously derived by using integration by parts

| (45) | |||||

By taking the ratio of those expressions one obtains Eq. (16). The functions can formally be computed by inserting the expression (14) into their definition. In particular we obtain the series expansion

| (46) |

where is the -th derivative of the function evaluated in zero. Such expansion allows to calculate Eq. (17) which is obtained in the limit of small .888 We stress that the presence of a delta function in the kernel is crucial to obtain a non-convex impact in the small time limit, because for a function of the type one would obtain as a consequence of the scaling . The execution cost in the limit of much larger than the characteristic relaxation time can be estimated by noting the scaling

| (47) |

so that just the terms contributes to Eq. (16). This implies that in this limit tends to the value of .

References

- Almgren et al. (2005) Almgren R., Thum C., Hauptmann E. and Li H., Direct estimation of equity market impact, Risk, 2005, 18, 5762.

- Berkowitz et al. (1988) Berkowitz S., Logue D. and Noser E., The total cost of transacting on the NYSE, J. Financ., 1988, 41, 97–112.

- Borghesi et al. (2007) Borghesi C., Marsili M., Micciché S., Emergence of time-horizon invariant correlation structure in financial returns by subtraction of the market mode, Phys. Rev. E, 2007, 76, 026104.

- Bouchaud et al. (2001) Bouchaud J.-P., Giardina I. and Mézard M., On a universal mechanism for long-range volatility correlations, Quant. Fin., 2001, 1, 212–216.

- Bouchaud et al. (2008) Bouchaud J.-P., Farmer J. D. and Lillo F., How Markets Slowly Digest Changes in Supply and Demand, Handbook of Financial Markets: Dynamics and Evolution, pp. 57–156, 2008 (Elsevier: Academic Press).

- Bouchaud (2010) Bouchaud J.-P., Price Impact. Encyclopedia of Quantitative Finance, 2010 (New York: John Wiley & Sons).

- Challet and Zhang (1997) Challet D. and Zhang Y.-C., Emergence of cooperation and organization in an evolutionary game, Physica A, 1997, 246, 407–418.

- Challet and Marsili (1999) Challet D. and Marsili M., Phase transition and symmetry breaking in the minority game, Phys. Rev. E, 1999, 60, R6271.

- Challet et al. (2001) Challet D., Chessa A., Marsili M. and Zhang Y.-C., From Minority Games to real markets, Quant. Fin., 2001, 1, 168–176.

- Challet and Marsili (2003) Challet D. and Marsili M., Criticality and market efficiency in a simple realistic model of the stock market, Phys. Rev. E, 2003, 68, 036132.

- Challet et al. (2005) Challet D., Marsili M. and Zhang Y.-C., Minority Games, 2005 (Oxford: Oxford University Press).

- Coolen (2005) Coolen A. C. C., The mathematical theory of Minority Games, 2005 (Oxford: Oxford University Press).

- De Martino and Marsili et al. (2006) De Martino A. and Marsili M., Statistical mechanics of socio-economic systems with heterogeneous agents, J. Phys. A, 2006, 39, R465.

- Farmer et al. (2005) Farmer J. D., Patelli P. and Zovko I., The predictive power of zero intelligence in financial markets, PNAS, 2005, 102, 2254–2259.

- Farmer et al. (2011) Farmer J. D., Gerig A., Lillo F. and Waelbroeck H., How efficiency shapes market impact, arXiv:1102.5457, 2011.

- Gabaix et al. (2005) Gabaix X., Gopikrishnan P., Plerou V. and Stanley H., Institutional Investors and Stock Market Volatility, Q. J. Econ., 2006, 121, 461–504.

- Glosten and Milfrom (1985) Glosten L. and Milgrom P., Bid, ask and transaction prices in a specialist market with heterogeneously informed traders, J. Financ. Econ., 1985, 14, 71–100.

- Grinold and Kahn (2000) Grinold R. and Kahn R., Active portfolio management: a quantitative approach for providing superior returns and controlling risk, 2000 (New York: McGraw-Hill).

- Hasbrouck (1991) Hasbrouck J., Measuring the Information Content of Stock Trade, J. Financ., 1991, 46, 179–207.

- Hasbrouck and Seppi (2010) Hasbrouck J. and Seppi D., Common factors in prices, order flows, and liquidity, J. Financ. Econ., 2001, 59, 383–411.

- Kyle (1985) Kyle A., Continuous Auctions and Insider Trading, Econometrica, 1985, 53, 1315–1335.

- Lillo et al. (2003) Lillo F., Farmer J. D., and Mantegna R., Econophysics: Master curve for price-impact function, Nature, 2003, 421, 176–190.

- Lyons and Evans (2002) Lyons R. and Evans M., Order flow and exchange rate dynamics, J. Polit. Econ., 2002, 110, 170–180.

- Marsili (2001) Marsili M., Market mechanism and expectations in minority and majority games, Physica A, 2001, 299, 93–103.

- Marsili (2009) Marsili M., Complexity and Financial Stability in a Large Random Economy, 2009, SSRN: http://ssrn.com/abstract=1415971.

- Mastromatteo et al. (2011) Mastromatteo I., Marsili M. and Zoi P., Financial correlations at ultra-high frequency: theoretical models and empirical estimation, Eur. Phys. J. B, 2011, 80, 243–253.

- Mézard et al. (1987) Mézard M., Parisi G. and Virasoro M. A., Spin Glass theory and beyond, 1987 (Singapore: World Scientific).

- Moro et al. (2009) Moro E,. Vicente J., Moyano L., Gerig A., Farmer J. D., Vaglica G., Lillo F. and Mantegna R., Market impact and trading profile of hidden orders in stock markets, Phys. Rev. E, 2009, 80, 066102.

- Plerou et al. (2002) Plerou V., Gopikrishnan P., Gabaix X. and Stanley H., Quantifying stock-price response to demand fluctuations, Phys. Rev. E, 2002, 66, 027104.

- Slanina (2008) Slanina F., Critical comparison of several order-book models for stock-market fluctuations, Eur. Phys. J. B, 2008, 61, 225–240.

- Torre (1997) Torre N., BARRA Market Impact Model Handbook, 1997 (Berkeley: BARRA Inc.).

- Tóth et al. (2006) Tóth B. and Kertész J., Increasing market efficiency: Evolution of cross-correlations of stock returns, Physica A, 2006, 360, 505–515.

- Tóth, Eisler et al. (2011) Tóth B, Eisler Z, Lillo F, Bouchaud J, Kockelkoren J. and Farmer J. D., How does the market react to your order flow?, arXiv:1104.0587, 2011.

- Tóth, Lempérière et al. (2011) Tóth B., Lempérière Y., Deremble J., de Lataillade J., Kockelkoren J. and Bouchaud J.-P., Anomalous price impact and the critical nature of liquidity in financial markets, Phys. Rev. X, 2011, 1, 021006.