Intermittency in Quantitative Finance

Laurent Schoeffel

CEA Saclay, Irfu/SPP, 91191 Gif/Yvette Cedex,

France

Factorial moments are convenient tools in nuclear physics to characterize the multiplicity distributions when phase-space resolution () becomes small. For uncorrelated particle production within , Gaussian statistics holds and factorial moments are equal to unity for all orders . Correlations between particles lead to a broadening of the multiplicity distribution and to dynamical fluctuations. In this case, the factorial moments increase above with decreasing . This corresponds to what can be called intermittency. In this letter, we show that a similar analysis can be developed on financial price series, with an adequate definition of factorial moments. An intermittent behavior can be extracted using moments of order (), illustrating a sensitivity to non-Gaussian fluctuations within time resolution below hours. This confirms that correlations between price returns start to play a role when the time resolution is below this threshold.

1 Introduction

In this letter, we intend to show that returns of financial price series can be analyzed using standard techniques of nuclear physics. We are interested in the multiplicity of positive or negative returns in a given time window . Indeed, sequences of positive and negative returns are much indicative of the statistical nature of fluctuations in the price series. The idea is then to extract a quantitative information from these sequences. First, in this section, we present the situation in nuclear physics, that will be extended to finance in a second part.

At nuclear or sub-nuclear energies, the number of hadrons created during inelastic collisions varies from one event to another. The distribution of the number of produced hadrons, namely the multiplicity distribution, provides a basic means to characterize the events. The multiplicity distribution contains information about multi-particle correlations in an integrated form, providing a general and sensitive means to probe the dynamics of the interaction. Particle multiplicities can be studied in terms of the normalized factorial moments

| (1) |

for a specified phase-space region of size . The number, , of particles is measured inside and angled brackets denote the average over all events. The factorial moments are convenient tools to characterize the multiplicity distributions when becomes small. For uncorrelated particle production within , Poisson or Gaussian statistics holds and for all . Correlations between particles lead to a broadening of the multiplicity distribution and to dynamical fluctuations. In this case, the normalized factorial moments increase with decreasing . The idea is then to divide the factorial moment defined in Eq. (1) in more and more bins.

We can thus compute the related moment following Eq. (1) as

| (2) |

where is the average number of particles in the full phase space region accepted (), denotes the number of bins in this region and is the multiplicity in -th bin.

The behavior of factorial moments plotted as a function of the number of bins (which means decreasing bin sizes) provides information about the character of multiplicity fluctuations among different bins. Rising of with rising (decreasing bin size) generally signalizes deviation from purely Gaussian distribution of fluctuations. The linear growth of with was defined as intermittency in [1]. See also [2, 3, 4, 5]. In the following, the term is used for any type of growth of observed.

2 Application to financial price series

The analogy with returns of financial price series is immediate. If we divide the price series in consecutive time windows of lengths , we define like this a set of events. In each window, we have a certain number of positive returns , where , and similarly of negative returns . If the sequence of returns is purely uncorrelated, following a Gaussian statistics at all scales, we expect for all .

However, correlations between returns may lead to a broadening of the multiplicity distributions ( or or even a combination of both) and to dynamical fluctuations. In this case, the factorial moments may increase with decreasing , or increasing the number of bins that divide , as in Eq. (2). In the following, we consider only the factorial moment of second order . We can write

| (3) |

where is the average number of positive returns in the full time window (), denotes the number of bins in this window and is the number of positive returns in -th bin.

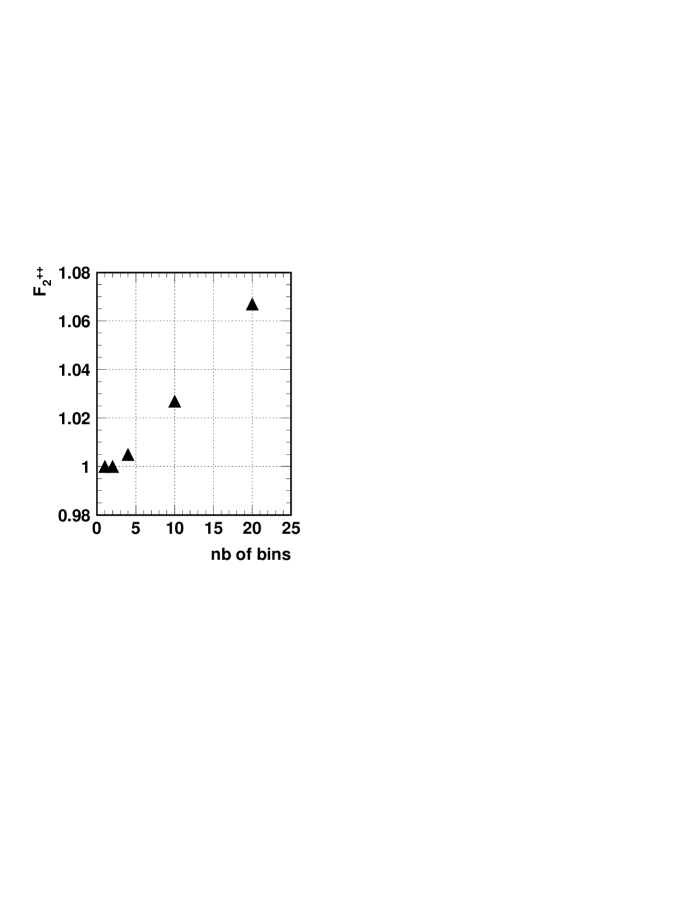

We consider the data series on the Euro future contract, sampled in 5 minutes units from may 2001 till August 2011, which counts 688k quotes. We present calculations for a time window 200 times units, that we divide in , , , or bins. This means that the time resolution extends from hours to hours. Note that with a time window of 200 time units, we set up an ensemble of more that 3400 events. The statistical precision of the following analysis is then ensured. Results are presented in Fig. 1 for positive returns. Factorial moments are displayed for , , , or bins. As mentioned above, this gives a time resolution ranging from hours for bins till hours for bin. The statistical precision is of %. We can define a systematical uncertainty by shifting the time window of units by or units, which means that we define a different set of events among the price series. Variations in the calculations of are lower that %. Fig. 1 displays the full uncertainty of these quantities.

In Fig. 1, we observe that for and bins segmentation is found to be equal to . As expected, for the larger resolution, positive returns appear as completely uncorrelated. When the number of bins is increased, we observe the phenomenon described in section 1, with an enhanced sensitivity of to non-Gaussian fluctuations. This confirms that correlations between positive returns start to play a role when the resolution is below hours. Thus, Fig. 1 exhibits a clear feature of intermittency. As in nuclear reactions, an increase of the resolution to a certain extend leads to a broadening of the multiplicity distribution and to super-diffusive fluctuations. Let us note that this is a feature that can be approached in the context of non-extensive statistics [6, 7, 8].

Similar results can be obtained for , defined for negative returns distribution.

| (4) |

where is the average number of negative returns in the full time window (), denotes the number of bins in this window and is the number of negative returns in -th bin. For all values displayed in Fig. 1 for , we derive the same result for up to %, which makes and indistinguishable.

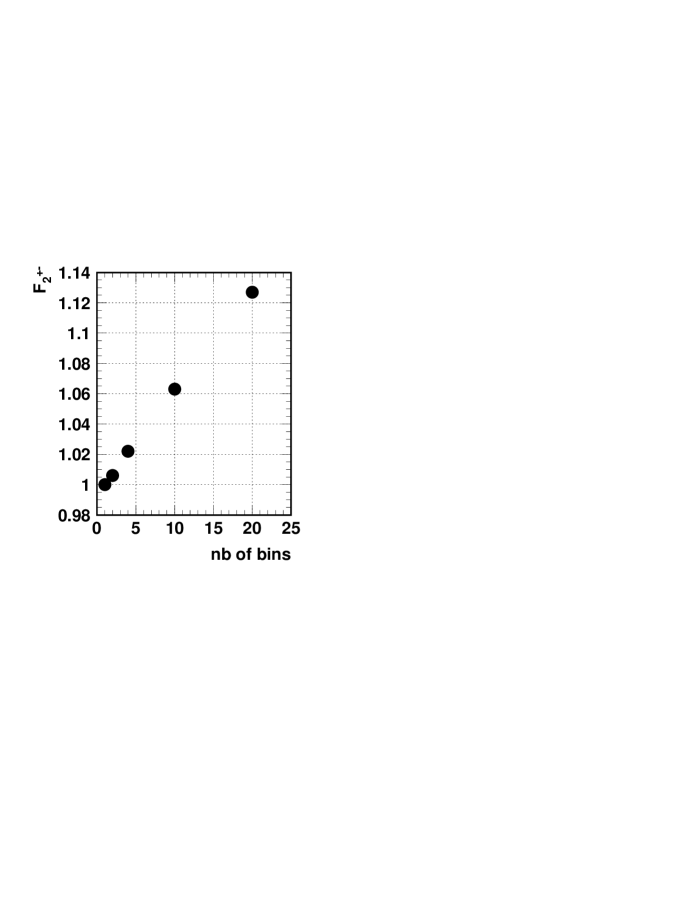

A direct extension of the above study can be obtained if we examine moments for like-sign and unlike-sign combinations of returns separately. The like-sign factorial moment of order is defined by Eq. (4). The unlike-sign can be expressed as

| (5) |

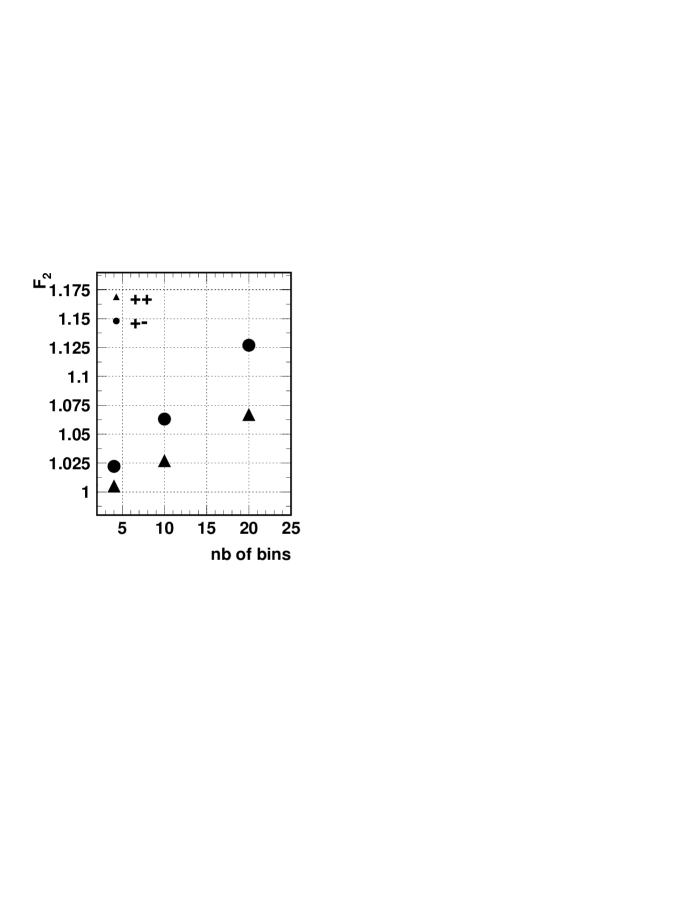

Results are presented in Fig. 2 for . Here again, we observe intermittency, with an increase of as a function of the number of bins. Also, this increase is larger than for like-sign calculations. In order to illustrate this point more clearly, a combination of values from Fig. 1 and 2 is presented in Fig. 3 for a number of bins larger than . The sensitivity to non-Guassian fluctuations in the returns sequence is thus enhanced with the definition of d to . This is also an effect observed in nuclear interactions [3, 4, 5].

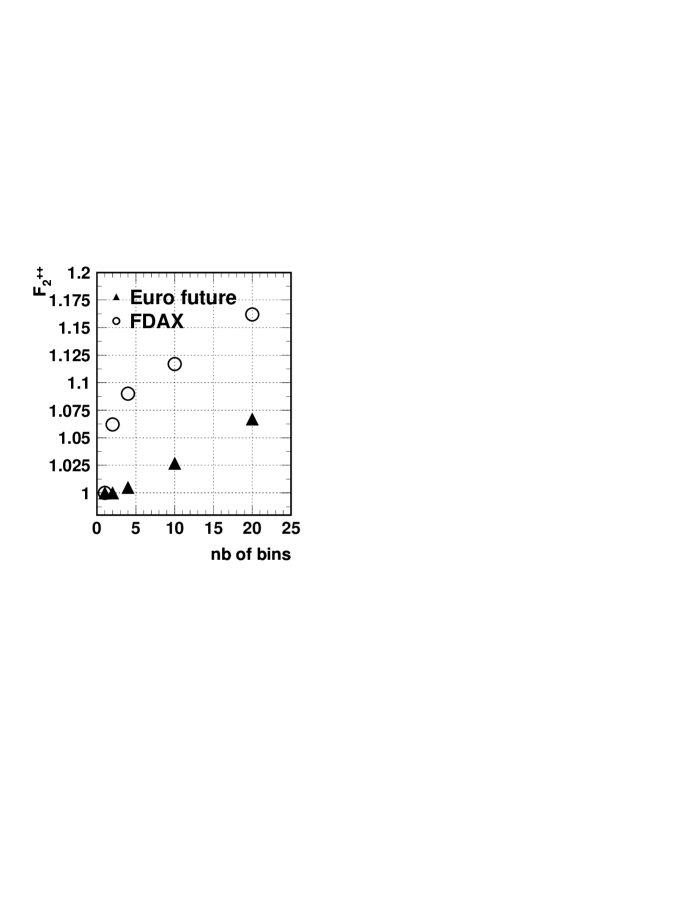

A final comment is in order. This analysis has been illustrated on the Euro future contract. However, we have found that a similar intermittent behavior is observed on other futures, like the DAX future (FDAX) and the Pound future and commodities. For each series, the values of the like-sign and unlike-sign factorial moments of order vary compared to results exhibited for the Euro future. But the rise of the as a function of the number of bins is an invariant property, with always and equal to unity for a time window of order hours. For some series, like FDAX, the intermittent behavior already prevails for a time resolution of order hours, with an increase of from (, h) to (, h). This is shown in Fig. 4. This growth with is faster than the Euro future. However, the key feature is always the same. For a sufficiently fine resolution in time, more precisely for a resolution smaller than to hours depending of the financial product, intermittency is observed.

3 Conclusion

Factorial moments are convenient tools in nuclear physics to characterize the multiplicity distributions when phase-space resolution becomes small. In particular, correlations between particles lead to a broadening of the multiplicity distribution and to dynamical fluctuations. In this case, the factorial moments increase above with decreasing resolution. This corresponds to what can be called intermittency.

A similar property has been illustrated on financial price series, by extending the concepts from nuclear physics to quantitative finance. An intermittent behavior has been extracted for different price series on future contracts, using moments of order (). This illustrates a sensitivity to non-Gaussian fluctuations within time resolution smaller than to hours. This confirms that correlations between price returns start to play a role when the time resolution is below a threshold of a few hours.

Clearly, this technique can be used as a global classification of financial products as a function of the strength of the intermittency. This can be seen as a prerequisite to more involved analysis of these time series [9].

References

- [1] A. Bialas and R. Peschanski, Nucl. Phys. B273 (1986) 703; Nucl. Phys. B308 (1986) 857.

- [2] P. Lipa et al., Phys. Lett B285 (1992) 300.

- [3] I. M. Dremin, V. Arena, G. Boca, G. Gianini, S. Malvezzi, M. Merlo, S. P. Ratti, C. Riccardi et al., Phys. Lett. B336 (1994) 119-124. [hep-ex/9405007].

- [4] I. M. Dremin, R. C. Hwa, Phys. Rev. D49 (1994) 5805-5811.

- [5] J. Rames, arXiv:hep-ph/9411349.

- [6] C. Tsallis, Braz. J. Phys. 29 (1999) 1.

- [7] D. Prato and C. Tsallis, Phys. Rev. E 60 (1999) 2398.

- [8] A. Rapisarda, A. Pluchino and C. Tsallis, arXiv:cond-mat/0601409.

- [9] L. Schoeffel, arXiv:1108.3155.