An Optimal Execution Problem with a Geometric Ornstein–Uhlenbeck Price Process

This Version: July 29, 2014 )

Abstract

000Mathematical Subject Classification (2010) 91G80, 93E20, 49L20000JEL Classification (2010) G33, G11

We study an optimal execution problem in the presence of market impact

where the security price follows a geometric Ornstein–Uhlenbeck process, which implies the mean-reverting property,

and show that the optimal strategy is a mixture of

initial/terminal block liquidation and gradual intermediate liquidation.

The mean-reverting property describes a price recovery effect

that is strongly related to the resilience of market impact,

as described in several papers that have studied optimal execution in a limit order book (LOB) model.

It is interesting that despite the fact that the model in this paper is different from the LOB model,

the form of our optimal strategy is quite similar to those obtained for an LOB model.

Moreover, we discuss what properties cause gradual liquidation as an optimal strategy

by studying various cases

and find out that not only “convexity of market impact function” but also “price recovery effect”

(or, in other words, transience of market impact) are essential to make a trader

execute the security gradually to mitigate the effect of market impact.

Keywords : Optimal execution, Market impact, Liquidity problems, Ornstein–Uhlenbeck process,

Gradual liquidation

1 Introduction

The basic framework of the optimal execution (liquidation) problem was established in Bertsimas and Lo [7], and the theory of optimal execution has been developed by Almgren and Chriss [4], He and Mamaysky [13], Huberman and Stanzl [15], Subramanian and Jarrow [26], and many others (see also Gatheral and Schied [11], in which we survey dynamic models of execution problems). Optimal execution problems arise naturally in trading operations, such as when a trader tries to execute a large trade for a security. In these cases, the trader should take care about liquidity problems and, in particular, should not neglect market impact (MI), which plays an important role in execution cost. Here, MI means the effect that a trader’s investment behavior has on security prices.

To study the MI of a trader’s execution policy, we consider a case where a trader sells held shares of the security after predicting a decrease in the price of the security. In a frictionless market, a risk-neutral trader should sell all shares as soon as possible, and so the optimal strategy is block liquidation at the initial time. However, in real markets, traders tend to liquidate a position over time. The factors that lead to gradual liquidation are therefore important.

Convexity of MI is one factor that would dissuade traders from block liquidation. As shown in examples in Kato [16], a risk neutral trader in a market of the Black–Scholes type will gradually liquidate if MI follows a quadratic function; in contrast, block liquidation is optimal when MI is linear. However, many traders in the real market execute their sales over time despite recognizing that MI is not always convex.

Risk aversion also will affect a trader’s execution policy, providing an incentive to trade over a longer period. Schied and Schöneborn [24] consider the optimal strategies when the utility function rewards risk aversion and clarify the relation between the degree of risk aversion and the form of the optimal strategy. Additionally, He and Mamaysky [13] treat execution problems in a Black–Scholes-type model with a linear MI function and numerically derive some no-trading regions of optimal strategies; in such regions the optimal strategies are not all block liquidation. Howoever, from Lions and Lasry [20] and Kato [16], we know that the optimal strategy under a linear MI function is not gradual in several cases: it is block liquidation at the initial time even when the trader is risk averse so long as the risk-adjusted drift coefficient of the security price is nonpositive.

Another important motive for liquidation over time is that, due to the effect of MI, a security price may recover after a downward movement in price. Such a phenomenon is called a “price recovery effect,” and such effects implicitly describe transient MI (see Gatheral and Schied [11] for details). In this paper, to consider a price recovery effect, we focus on the case where the process of a security price has the mean-reverting property, and, in particular, we focus on when it follows a geometric Ornstein–Uhlenbeck (OU) process. We explicitly solve the optimization problem with static execution strategy for a linear MI and show that the optimal strategy is a mixture of initial/terminal block liquidation and gradual intermediate liquidation. Our study in this paper is also shown to be a representative case of when gradual liquidation is necessary in the framework of Kato [16] even with a linear MI and risk-neutral trader.

Our results are related to those of studies of execution problems in limit order book (LOB) models. In a LOB model, sales by a trader decrease buy limit orders, thereby temporarily expanding the bid–ask spread, and new buy limit orders appear over time, causing the bid–ask spread to shrink as time passes. The problem of minimizing expected execution cost in a block-shaped LOB model with exponential resilience of MI is studied in Obizhaeva and Wang [22]. A mathematical generalization of the results of Obizhaeva and Wang [22] is given in Alfonsi et al. [1] and Predoiu et al. [23]. Additionally, Makimoto and Sugihara [21] treat a model of optimal execution under stochastic liquidity. It is interesting that despite the fact that the model in this paper is different from the LOB model, the form of optimal execution strategies in our model become quite similar to the optimal strategies found in papers focusing on an LOB model. Indeed, when the security price process has no volatility, the form of our optimal strategy coincides with those in Alfonsi et al. [1] and Obizhaeva and Wang [22]: the rate of intermediate liquidation is constant. When the volatility is larger than zero, the rate decreases over time, as is found in Makimoto and Sugihara [21].

This paper is organized as follows. In Section 2, we introduce our model settings. In Section 3, we explicitly solve our optimization problem and give the forms of optimal strategies. We additionally discuss essential properties of MI that induce gradual liquidation. Section 4 summarizes our study. Section A is an appendix, where the derivation of our model from discrete-time models (Section A.1) and the proofs of our results (Section A.2) are given.

2 The Model

Our model is based on that of Kato [16]. Let be a filtered space satisfying the usual conditions (i.e., is right continuous and contains all -null sets), and let be a standard one-dimensional -Brownian motion. We consider a simple market model in which there are only two financial assets: cash and a security. We assume that the risk-free rate of return is zero, so the price of cash is always . We study the execution problem of a single trader who has shares of the security.

First, we prepare the class of admissible execution strategies. Let be a time horizon. We assume without loss of generality that . We denote by the set of Borel-measureable functions such that

-

(a.)

for each , and

-

(b.)

.

Here, is regarded as the execution speed at time : hence, at time , the instantaneous sales volume is . Condition (a.) means that the trader executes only sell orders. Moreover, by (b.), the trader cannot sell more than shares, and so short selling is prohibited in our model (see also Section 2 in [16]).

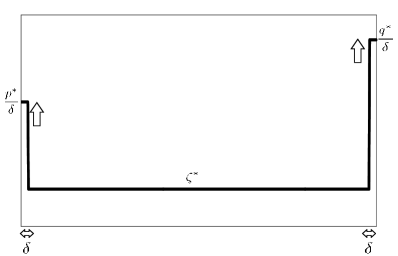

Now, we define a value function that corresponds to the trader’s optimization problem. In this paper, we treat mainly optimization of the expected cost; that is, the trader tries to maximize expected proceeds. For , we define

| (2.1) |

subject to

| (2.2) | |||||

| (2.3) | |||||

| (2.4) |

and

| (2.5) |

(When , we have and .) Note that the set of admissible strategies is defined in the same manner as is defined. Here, , , and denote, respectively, the trader’s cash holdings, the security’s price at time , and the security’s log-price at time . A risk-neutral trader is assumed to have utility function . The parameter characterizes a linear permanent MI: when the trader sells at time , the log-price decreases by . When , there is no MI; follows the OU process with mean-reversion speed and volatility . We remind the reader that the transient MI is described by the mean-reverting property of . Here, we can write down the explicit form of the solution of (2.3):

| (2.6) |

Remark 1.

As in [16], we restrict neither the security price process nor the MI function to specific forms such as the OU process and the linear MI, respectively. In general, the process is given as the solution of the following stochastic differential equation:

| (2.7) |

where are Lipschitz-continuous functions and is a convex function. Moreover, the set of admissible strategies is generalized to the set of adaptive strategies (see Section A.1). Our model is just an example of a model from [16], but there are some technical gaps: in [16], and are assumed to be bounded, whereas, in (2.3) is not bounded. However, results similar to those in [16] will still be obtained; these are derived in Section A.1.

Remark 2.

When considering optimal execution problems for a risk-neutral trader, that is, when the trader’s purpose is to maximize the expected proceeds of execution (equivalently, to minimize the expected execution cost), adaptive (stochastic) optimal strategies often become static (deterministic) strategies (see Alfonsi et al. [1], Kato [16], Kuno and Ohnishi [19], and Schied and Zhang [25], for instance). Moreover, there are several papers that study the optimal execution problem with static strategies (Almgren and Chriss [4], Bertsimas and Lo [7], Konishi and Makimoto [18], and Makimoto and Sugihara [21], etc.). In these cases, the trader predetermine a strategy before starting execution at . Such a static optimal strategy is often called an Implementation Shortfall (IS) strategy. Following the above circumstances, we treat mainly optimal execution problems with static strategies in this paper, except for in Section A.1.

3 Main Results

In this section, we give explicit forms for the value function and the optimal strategies when the security holdings is small enough or large enough. Further, we discuss which properties will cause gradual execution to be optimal under MI. For brevity, we set and . We assume so that the security price falls to the fundamental value as time passes.

3.1 No MI case

First, we introduce the forms of optimal strategies when there is no MI (i.e., when ).

Theorem 1.

If , then .

In this case, the trader’s (nearly) optimal strategy is given by

| (3.1) |

with . More precisely, if we denote by the corresponding process of cash holdings, it follows that

| (3.2) |

We call such a strategy an “almost block liquidation” at the initial time (see also Remark 5.3 in [16]).

Remark 3.

We can solve the optimization problem even when . Indeed, if , then an optimal strategy is given by , which is the almost block liquidation at time , where . Moreover, if , then the optimal strategy is the terminal almost block liquidation . Therefore, in each case when the market is fully liquid, the optimal strategy is block liquidation.

3.2 The case of small

For the remainder of the paper, we assume that the MI function is non-trivial and linear; that is, we assume that . In this subsection, we study cases where is small. In the previous subsection, we see that a trader in a fully liquid market (i.e., ) should sell all securities at the initial time. In fact, when is small enough, the trader’s optimal policy is almost the same as initial block liquidation.

Theorem 2.

If , then

| (3.3) |

3.3 The case of large

When is not small, the assertion of Theorem 2 fails. The trader’s selling accelerates the speed of decrease of the security price, and so a quick liquidation may be non-optimal because of the effect of MI. Moreover, if the trader’s execution makes the price drop below , then the price will recover to by delaying the sale. This gives the trader an incentive to liquidate gradually. Our purpose in this subsection is to derive an explicit (nearly) optimal execution strategy.

3.3.1 No volatility case

Firstly, we study the special case where . This setting gives a price model that is unrealistic and not meaningful in an actual market because the random fluctuation of the security price is ignored. However, doing so yields an interesting similarity to the results of other studies of optimal execution.

Let . Since the function is strictly decreasing on , we can define its inverse function as .

We assume that the security holdings is larger than . We define the function , as

Since is strictly increasing and , the equation has a unique solution . Then, we can show that the following theorem is true.

Theorem 3.

If , then it holds that

| (3.4) |

where and are given by

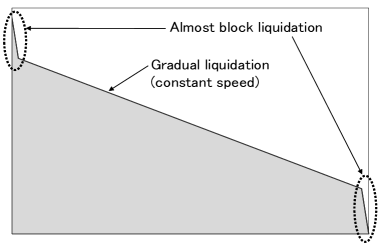

Note that one can easily check that . We can then construct a nearly optimal strategy as follows (with ):

| (3.5) |

The strategy consists of three terms. The first term in the right-hand side of (3.5) corresponds to initial (almost) block liquidation. The trader should sell shares of the security at the initial time by selling infinitesimal pieces at infinitesimal intervals to avoid a decrease in the execution proceeds. The second term corresponds to gradual liquidation. The trader executes the selling gradually until the time horizon at constant speed . Finally, the trader completes liquidation by selling the remaining shares by terminal (almost) block liquidation, which corresponds to the third term. So, the nearly optimal strategy is a mixture of both block liquidation and gradual liquidation. We point out, in particular, that gradual liquidation is necessary for optimality in this case. Figure 1 shows an image representing the form of the optimal strategy. In fact, the security price on the interval is equal to a constant .

This result is quite similar to that of Alfonsi et al. [1] and Obizhaeva and Wang [22], despite the fact that there are some mathematical differences between their models and ours. We consider the geometric OU process for a security price. In contrast, Alfonsi et al. [1] and Obizhaeva and Wang [22] assume that the process of a security price follows arithmetic Brownian motion (or a martingale) and that there is exponential (or some more general shape of) resilience for MI in an LOB model. The relation between the mean-reverting property of the OU process and the resilience of MI causes this interesting similarity in results.

3.3.2 The general case

In this subsection, we consider the general case, where . We assume the following condition:

| (3.6) |

This condition means that the amount of the trader’s security holdings is larger than that in the case of Section 3.3.1. We define the function on by

Note that is nonincreasing on . Moreover, (3.6) implies that

and so the equation has the unique solution . The next theorem is the main result in this section.

Theorem 4.

Let and assume that is true. Then,

| (3.7) | |||||

where .

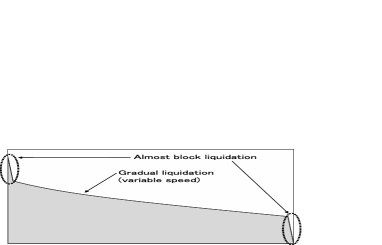

We can construct a nearly optimal strategy as follows (with ):

| (3.8) |

where and

Here, the second equality of the definition of comes from . By the inequalities (3.6), , and , we see that each of , , and is positive.

Similarly to in the previous subsection, also consists of three terms: initial (almost) block liquidation, gradual intermediate liquidation, and terminal (almost) block liquidation. However, unlike the case where , the speed of execution becomes slower as time passes when . This is result is similar to that of Makimoto and Sugihara [21], in which the optimal execution problem in an LOB market model with stochastic liquidity is studied.

Figure 2 shows a representation of an optimal strategy. We can rewrite the value function (3.7) as the sum of an initial cash amount and the proceeds of initial/intermediate/terminal liquidation:

| (3.9) | |||||

where . Note that and .

3.4 When does MI cause gradual liquidation? Case studies

In this subsection, we briefly discuss the properties of MI functions that incentivize gradual liquidation of the security and give some examples.

First, as a benchmark model, we consider the execution problem with risk-neutral trader in a Black–Scholes-type model with no MI:

subject to , (2.2), (2.4), and

| (3.10) |

where and are constants. For the sake of simplicity, we assume that . In this case, an optimal strategy is initial block liquidation: since the expected security price decreases as time passes, a risk-neutral trader will sell the security as soon as possible. Then, we see that .

Now, we introduce MI functions. We define , where the log-price fluctuates according to

| (3.11) |

Note that holds in this case by Proposition 5.1 of [16]; will be defined in Section A.1. One of the simplest example is the linear MI function . However, Theorem 5.2 in Kato [16] tells us that , and the optimal strategy is (almost) initial block liquidation (3.1). This implies that a linear MI is not sufficient to describe all situations in which a trader will gradually liquidate. On the other hand, Theorem 5.4 of that paper shows that the optimal strategy is gradual liquidation when is quadratic; in particular, the optimal strategy with small is a time-weighted average price (TWAP) strategy, that is, liquidation with constant speed (the same result can be obtained when is S-shaped; see [17]). Note that TWAP strategies are equivalent to volume-weighted average price (VWAP) strategies with the time parameter measuring volume time (see Remark 22.7 in [11]).

Here, Theorems 3–4 from the previous subsections give another source of gradual liquidation. In our model framework, a price-recovery effect also causes gradual intermediate liquidation when is large enough, even when the MI function is linear.

Therefore, the convexity of MI functions and price-recovery effects are essential properties in the study of execution problems. Note that a price-recovery effect can be identified with market resilience or, in other words, a transient MI function.

Remark 4.

Linearity of MI functions is also discussed from another point of view. In several studies of execution problems, a permanent MI function is often assumed to be linear. One of the reasons is that this accords with results from empirical studies. For example, Almgren et al. [5] estimate the form of MI functions in the real market and find that permanent MI function is approximated by a linear function. Another reason is the absence of price manipulation: Forsyth et al. [9], Gatheral [10], and Huberman and Stanzl [14] assert that we can construct a price manipulation strategy when the permanent MI function is nonlinear. That is, in such cases a trader can earn money by unscrupulously utilizing the effect of MI.

In contrast, in the LOB markets, nonlinear MI functions are often observed in empirical studies (see Bouchard et al. [8], Weber and Rosenow [27], and Zovko and Farmer [28], for instance). Moreover, Alfonsi and Schied [2] and Alfonsi et al. [1, 3] show that the opportunity for price manipulation is not present even when the MI function is convex under some technical conditions. Therefore, nonlinearity of the MI function is not necessarily inappropriate.

In this paper, we mainly treat the case of a linear MI function , but we can also study the case of nonlinear in a similar way. It is meaningful to study the execution problem with both convex MI function and a price-recovery effect in our framework and to investigate topics related to the opportunity for price manipulation (the unaffected price, given by (2.3)–(2.4) with , is not a martingale; nevertheless, similarity to the results of LOB models may ensure the absence of price manipulation in some sense).

4 Concluding Remarks

In this paper, we solved the optimal execution problem in the case where the security price follows a geometric Ornstein–Uhlenbeck process and the MI function is linear. This case is important because it covers cases where the security price has a mean-reverting property. We showed that an optimal static strategy is a mixture of initial/terminal block liquidation and gradual intermediate liquidation when the initial amount of the security holdings is large. When the volatility parameter is equal to zero, the optimal strategy has the same form as the strategies found in Alfonsi et al. [1] and Obizhaeva and Wang [22]. In this case, a trader should sell at a constant speed during the time horizon. When the volatility is positive, the speed of gradual liquidation is not constant; instead, the speed is decaying and the form of the optimal strategy is similar to that found in Makimoto and Sugihara [21].

Our result demonstrates a case in which MI causes gradual liquidation. In a real market, traders sell shares of a security gradually to avoid costs due to MI because price recovery is expected. As noted in Section 3.4, our results combined with findings from [16] imply that convexity (or nonlinearity) of MI functions and price-recovery effects (or resilience) are important factors in the construction of an MI model.

Appendix A Appendix

A.1 Derivation of the continuous-time value function

In this subsection, we study the derivation of the continuous-time model of an optimal execution problem by following the arguments in Appendix A of Kato [16]. We characterize our continuous-time value function as a limit of discrete-time models in more general settings.

We define a discrete-time version of the value function with time intervals of width as follows:

| (A.1) |

subject to

| (A.2) | |||

| (A.3) |

and , where is a nondecreasing and continuous function with polynomial growth rate in each of , and , is a nondecreasing and continuously differentiable function that satisfies , is a solution of the stochastic differential equation

| (A.6) |

and are Lipschitz-continuous functions. Here, is the set of stochastic processes such that is -measurable, for each , and . See [16] for the precise definitions and financial implications of (A.1). Note that and are assumed to be bounded in [16], but here we only assume that and have linear growth. Because of this, the OU case (2.3) is included in our settings (i.e., uniqueness and existence of the solution is guaranteed for each and ).

We consider the limit as .

Let be a nondecreasing continuous function.

We quote the condition assumed in [16]:

.

Now, we define for .

This function corresponds to an MI function in a continuous-time model.

We define

| (A.7) |

subject to (2.2)–(2.6) and . Here, denotes the set of admissible adaptive strategies, that is, is an -progressively measurable process such that

-

(a’.)

for each almost surely,

-

(b’.)

almost surely, and

-

(c’.)

.

Note that condition (c’.) is a technical condition; see Appendix A of [16] for the details.

Here, we make a further assumption:

For each ,

there is a constant such that

.

This condition does not seem to be natural in general, but our main model in Section 2 satisfies [B].

The following is a generalization of Theorem A.1 of [16].

Theorem 5.

Assume that – hold. For each , and ,

| (A.8) |

where is the greatest integer less than or equal to .

By this theorem, we can characterize (A.7) as the limit of a sequence of discrete-time value functions (A.1). Note that we can also obtain a similar convergence result by restricting the classes of admissible strategies to classes of static strategies (Proposition 1 below).

To prove Theorem 5, we introduce the following lemma:

Lemma 1.

Let , , , and let be given by . Then, there is a constant , depending on only and , such that

| (A.9) | |||||

for each .

The proof of Theorem 5 is given in almost the same way as the proofs of Propositions B.24–B.25, but we apply condition [B] and Lemma 1 instead of Lemmas B.1 and B.3, respectively, from [16].

Unlike the case where is bounded, the right hand side of (A.9) depends on . However, this does not change the essential method of proving the statements analogous to Theorems 3.1–3.2 and 4.1–4.2 of [16], except for the continuity of the continuous-time value function at when . We omit the details here.

A.2 Proofs

For brevity, we assume until the end of this section. We define

| (A.10) |

Here, is the set of admissible deterministic strategies. That is,

, , is defined by

and . Since the function is nondecreasing in , we can replace in (A.10) with

The following proposition holds.

Proposition 1.

-

, , where

(A.11) -

.

Proof.

An argument analogous to the proof of Proposition B.24–25 in Kato [16] yields assertion (i). Assertion (ii) can be obtained by straightforward calculation. ∎

A.2.1 Proof of Theorems 1–2

We give the proof of only Theorem 2 because the proof of Theorem 1 is essentially the same. By straightforward calculation, we obtain

where is defined as (3.1). On the other hand, for any , we have

where . From the relation , we have that

Thus,

Therefore, we get , and this completes the proof of Theorem 2. ∎

A.2.2 Proof of Theorems 3–4

Because Theorem 3 is a corollary of Theorem 4 (a small technical argument is necessary to generalize the assumption (3.6)), we present the proof of only Theorem 4.

Let . Note that . We set and .

Lemma 2.

as on .

Proof.

It suffices to show that . Choose any . Let be such that . Then, it holds that

| (A.12) |

From (A.12) with and the equality , we observe

| (A.13) |

By (A.13) and (A.12) with , we have

Inductively,

| (A.14) |

for , where .

By (A.12) and (A.14) with , we have . Similarly, by (A.12) and (A.14) with , we have . By an inductive calculation, we arrive at for some . Combining this with the relation , we also see that for some .

The above arguments tell us the following: if a sequence satisfies , then is bounded. The desired assertion follows by contradiction. ∎

Lemma 3.

as on .

Proof.

Let , . This gives

for any , where . We easily see that the function has an upper bound . Hence, it holds that

Since , we have the desired assertion by the above inequality and Lemma 2. ∎

A straightforward calculation gives

Lemma 4.

For each , it holds that

where

| (A.15) | |||||

| (A.16) |

Formally, the Taylor expansion of is given by

The following lemma gives higher-order estimates of the above calculation.

Lemma 5.

It holds that

for each compact set , where,

Proof.

Using (A.15) and Taylor’s theorem, we have

Thus, it holds that

Since we have as and

| (A.17) |

we have obtained the desired assertion. ∎

Because is nonincreasing on , we can define the (nonincreasing) inverse function on , where

We consider an analogous approximation of , such as Lemma 5. For this, we let

Lemma 6.

It holds that

,

as for each .

Proof.

Assertion (i) is a direct consequence of assertion (ii), so we will prove only (ii). Take any and let . Since is nondecreasing with respect to and for each fixed , we get for any and , where

Let . From the relation

we have

| (A.18) |

Applying to both sides and subtracting , we obtain

where we denote as for brevity. Therefore,

| (A.19) | |||||

Because Lemma 5 implies

| (A.20) |

we can see that

| (A.21) |

for large enough and . Combining the inequality

with (A.19) and (A.21), we obtain

Now, we complete the proof of the assertion (ii) by combining the above inequality with Lemma 5, (A.17), and (A.20). ∎

Note that Lemma 6 guarantees that the following expansion is valid and that convergence occurs:

Here, we study a discretization of the function . Let

Lemma 6 immediately implies the following proposition.

Proposition 2.

converges uniformly to on any compact subset of .

By Proposition 2 and the fact that is strictly decreasing on , we can choose an large enough that there is a unique solution of on . Moreover, it follows that converges to as .

From now, we construct an optimizer to for large enough . Set , , where

The following lemma is obtained from Lemma 6, the convergences and as , and the finiteness of

for each compact subset of .

Lemma 7.

It holds that

Lemma 7 and the relations , , and together imply the following lemma.

Lemma 8.

It holds that , for sufficiently large values of ; thus, .

Now, we define an -variable function by

Then, we have the following.

Lemma 9.

When is large enough, a solution of

| (A.23) |

coincides with .

Proof.

Now, we arrive at the following proposition.

Proposition 3.

It holds that for sufficiently large values of .

Proof.

By Lemma 3, we can find an large enough so that holds for when . Then, has at least one local maximum on , which we denote by . By the Lagrange multiplier method, we see that there is a such that (A.23) holds at . Then, Lemma 9 implies for . This means that is the unique local maximum, which also becomes the global maximum of on . ∎

Now, we prove Theorem 4. We write as the following three parts:

where , , and are defined in the obvious way. By Lemma 7, we easily have

| (A.25) |

Using the relation (A.24) and Lemmas 6–7, we have

| (A.26) | |||||

as . To calculate the limit of , we set

Then, we have

| (A.27) |

by virtue of (A.24) and Lemmas 6–7. Moreover, we have

By (A.25)–(A.2.2), we see that converges to the right-hand side of (3.9). Then, we obtain the desired assertion by Propositions 1 and 3. ∎

References

- [1] A. Alfonsi, A. Fruth and A. Schied, Optimal execution strategies in limit order books with general shape functions, Quant. Finance, 10(2010), pp. 143–157.

- [2] A. Alfonsi and A. Schied, Optimal trade execution and absence of price manipulations in limit order book models, SIAM J. Finan. Math. 1(1)(2010), pp. 490–522.

- [3] A. Alfonsi, A. Schied and A. Slynko, Order book resilience, price manipulation, and the positive portfolio problem, SIAM J. Finan. Math. 3(1)(2012), pp. 511–523.

- [4] R. Almgren and N. Chriss, Optimal execution of portfolio transactions, J. Risk, 3(2000), pp. 5–39.

- [5] Almgren, R., C. Thum, E. Hauptmann and H. Li, H., Direct estimation of equity market impact, Preprint (2005).

- [6] D. P. Bertsekas and S. E. Shreve, Stochastic optimal control: the discrete-time case, Athena Scientific, Orlando, FL, 1996.

- [7] D. Bertsimas and A.W. Lo, Optimal control of execution costs, J. Fin. Markets, 1(1998), pp. 1–50.

- [8] J. P. Bouchaud, M. Mezard and M. Potters, Statistical properties of stock order books: empirical results and models, Quantitative Finance, 2(4) (2002), pp. 251–256.

- [9] P. A. Forsyth, J. Kennedy, , S. T. Tse and H. Windcliff, H., Optimal trade execution: a mean-quadratic-variation approach, Journal of Economic Dynamics and Control, 36(12) (2012), pp. 1971–1991.

- [10] J. Gatheral, No-dynamic-arbitrage and market impact, Quant. Finance, 10(2010), pp. 749–759.

- [11] J. Gatheral and A. Schied, Dynamical models of market impact and algorithms for order execution, In: Fouque, J. P. and Langsam, J., (eds.): Handbook on Systemic Risk, pp. 579–602, Cambridge University Press, New York, 2013.

- [12] J. Gatheral, A. Schied and A. Slynko, Exponential resilience and decay of market impact, In: Abergel, F., Chakrabarti, B.K., Chakraborti, A., Mitra, M., (eds.): Econophysics of Order-driven Markets, Proceedings of Econophys-Kolkata V., pp. 225–236. Springer, Berlin, 2011.

- [13] H. He and H. Mamaysky, Dynamic trading policies with price impact, J. Econ. Dynamics and Control, 29(2005), pp. 891–930.

- [14] G. Huberman and W. Stanzl, Price manipulation and quasi-arbitrage, Econometrica, 74-4(2004), pp. 1247–1276.

- [15] G. Huberman and W. Stanzl, Optimal liquidity trading, Review of Finance, 9-2(2005), pp. 165–200.

- [16] T. Kato, An optimal execution problem with market impact, Finance and Stoch., 18(3) (2014), pp. 695–732.

- [17] T. Kato, Non-linearity of market impact functions: empirical and simulation-based studies on convex/concave market impact functions and derivation of an optimal execution model, Transactions of the Japan Society for Industrial and Applied Mathematics, 24(3) (2014) (in Japanese).

- [18] H. Konishi and N. Makimoto, Optimal slice of a block trade, Journal of Risk, 2001-01(2001).

- [19] S. Kuno and M. Ohnishi, Optimal execution strategies with price impact, RIMS Kokyuroku, 1675(2010), pp. 234–247.

- [20] P.-L. Lions and J.-M. Lasry, Large investor trading impacts on volatility, In: Paris–Princeton Lectures on Mathematical Finance 2004, Lecture Notes in Mathematics Vol. 1919, pp. 173–190. Springer, Berlin, 2007.

- [21] N. Makimoto and Y. Sugihara, Optimal execution of multiasset block orders under stochastic liquidity, IMES Discussion Paper Series http://www.imes.boj.or.jp/research/papers/english/10-E-25.pdf, 2010.

- [22] A. Obizhaeva and J. Wang, Optimal trading strategy and supply/demand dynamics, Journal of Financial Markets, 16(1) (2013), pp. 1–32.

- [23] S. Predoiu, G. Shaikhet and S. Shreve, Optimal execution in a general one-sided limit-order book, SIAM J. Financial Math., 2(2011), pp. 183–212.

- [24] A. Schied and T. Schöneborn, Risk aversion and the dynamics of optimal liquidation strategies in illiquid markets, Finance Stoch., 13-2(2008), pp. 181–204.

- [25] A. Schied and T. Zhang, A hot potato game under transient price impact and some effects of a transaction tax, preprint (2013).

- [26] A. Subramanian and R. Jarrow, The liquidity discount, Math. Finance, 11(2001), pp. 447–474.

- [27] P. Weber and B.Rosenow, Order book approach to price impact, Quantitative Finance, 5(2005), pp. 357–364.

- [28] I. Zovko and J. D. Farmer, The power of patience: a behavioural regularity in limit-order placement, Quantitative Finance, 2(2002), pp. 387–392.