Extreme-Value Theorems for Optimal Multidimensional Pricing

Abstract

We provide a near-optimal, computationally efficient algorithm for the unit-demand pricing problem, where a seller wants to price items to optimize revenue against a unit-demand buyer whose values for the items are independently drawn from known distributions. For any chosen accuracy and item values bounded in , our algorithm achieves revenue that is optimal up to an additive error of at most , in polynomial time. For values sampled from Monotone Hazard Rate (MHR) distributions, we achieve a -fraction of the optimal revenue in polynomial time, while for values sampled from regular distributions the same revenue guarantees are achieved in quasi-polynomial time.

Our algorithm for bounded distributions applies probabilistic techniques to understand the statistical properties of revenue distributions, obtaining a reduction in the search space of the algorithm through dynamic programming. Adapting this approach to MHR and regular distributions requires the proof of novel extreme value theorems for such distributions.

As a byproduct, our techniques establish structural properties of approximately-optimal and near-optimal solutions. We show that, when the buyer’s values are independently distributed according to MHR distributions, pricing all items at the same price achieves a constant fraction of the optimal revenue. Moreover, for all , at most distinct prices suffice to obtain a -fraction of the optimal revenue, where is a quadratic function of that does not depend on the number of items. Similarly, for all and , at most distinct prices suffice if the values are independently distributed according to regular distributions, where is a polynomial function. Finally, if the values are i.i.d. from some MHR distribution, we show that, as long as the number of items is a sufficiently large function of , a single price suffices to achieve a -fraction of the optimal revenue.

1 Introduction

We study the following pricing problem. A seller has items to sell to a buyer who is looking to buy a single item. The seller wants to maximize profit from the sale, leveraging stochastic knowledge she has about the buyer to achieve this goal. In particular, we assume that the seller has access to a distribution from which the values of the buyer for the items are drawn. Given this information, the seller wants to compute prices for the items to maximize her revenue, assuming that the buyer is quasi-linear—i.e. will buy the item maximizing , as long as this difference is positive. That is, the seller’s expected revenue from a price vector is

| (1) |

where we assume that the breaks ties in favor of a single item, when there are multiple maximizers. A more sophisticated seller could try to improve her revenue by pricing lotteries over items, that is also price randomized allocations of items [BCKW10], albeit this may be less natural than item pricing, and we will not study it extensively in this paper.

While our problem has a simple statement, it exhibits rich behavior depending on the nature of . For example, if assigns the same value to all the items with probability , i.e. when the buyer always values all items equally, the problem becomes single-dimensional. In this setting, it is clear that lotteries do not improve the revenue and that the optimal price vector can assign the same price to all the items. This observation is a special case of the more general, celebrated result of Myerson [Mye81] on optimal mechanism design, i.e. the multi-buyer version of our problem, and generalizations thereof. Myerson’s result provides a closed-form solution to the multi-buyer problem in a single sweep that covers many settings, but only works under the same limiting assumption that every buyer is single-dimensional, i.e. receives the same value from all the items. (More generally, every buyer receives the same value from all outcomes of the mechanism that provide her service.)

Following Myerson, a large body of research in both Economics and Engineering has been devoted to extending his result to the multi-dimensional setting, where the buyers’ values come from general distributions. And, while there has been sporadic progress (see survey [MV07] and its references), an optimal multi-dimensional mechanism, generalizing Myerson’s result, does not seem to be in sight. Indeed, there is not even an optimal solution known for the single-buyer item pricing problem. Even the ostensibly easier version of that problem, where the values of the buyer for the items are independent and supported on a set of cardinality is unresolved.333Incidentally, the problem is trickier than it originally seems, and various intuitive properties that one would expect from the optimal solution fail to hold. See Appendix J for an interesting example. Our main contribution in this paper is to develop near-optimal polynomial-time algorithms for this problem, when the buyer’s values for the items are independent.

1.1 Main Results

We partition our results into algorithmic and structural. The former provide efficient algorithmic procedures for computing near-optimal price vectors. The latter shed light into the structure of optimal solutions.

Algorithmic Results.

Previous work on the item pricing problem has provided constant factor approximation algorithms. The best known polynomial-time algorithm obtains revenue that is at least of the revenue of the optimal price vector [CHK07, CHMS10]. We discuss these approaches in Section 1.3, also noting that they are limited to constant factor approximations. We are aiming instead for item pricing mechanisms that come arbitrarily close to the optimal revenue, obtaining the following results. Their proofs are overviewed in Sections 4 through 9, while complete details are provided in the appendix.

Theorem 1 (Main Algorithmic Result: Additive PTAS for Bounded Distributions).

Suppose that the values of the buyer for items are independent and normalized to lie in . Then, for all , there exists an algorithm that computes a price vector whose revenue is within an additive of optimal, and whose running time is polynomial in .

Theorem 2 (General Algorithm).

Suppose that the values of the buyer for items are independent and supported on some interval for some and . Then, for all , there is an algorithm that computes a price vector whose revenue is at least a -fraction of the optimal revenue, and whose running time is polynomial in .444We note that a natural approach for computing approximately optimal price vectors is to discretize the domain of price vectors and show that searching over the discretized domain suffices for approximating the optimal revenue. However, a straightforward application of the discretizations proposed by Nisan [CHK07] and Hartline and Koltun [HK05] to our problem would result in running time of . The purpose of our theorem is to remove the exponential dependence of the running time on the number of items .

Theorem 3 (Multiplicative PTAS for MHR Distributions).

There is a Polynomial-Time Approximation Scheme555A Polynomial-Time Approximation Scheme (PTAS) is a family of algorithms , indexed by the accuracy parameter , such that for every fixed , runs in time polynomial in the size of its input. See Section 2 for a formal definition. for computing an optimal price vector, when the values of the buyer are independently drawn from Monotone Hazard Rate distributions.666Monotone Hazard Rate (MHR) distributions are a commonly studied class of distributions that contain such familiar distributions as the Uniform, Gaussian and Exponential distributions. See Section 2 for a formal definition.

For any accuracy , the algorithm runs in time polynomial in , and outputs a price vector whose revenue is at least a -fraction of the optimal revenue, where is the number of items.

Theorem 4 (Multiplicative Quasi-PTAS for Regular Distributions).

There is a Quasi-Polynomial-Time Approximation Scheme777A Quasi-Polynomial-Time Approximation Scheme (Quasi-PTAS) is a family of algorithms , indexed by the accuracy parameter , such that for every fixed , runs in time quasi-polynomial in the size of its input. See Section 2 for formal definition. for computing an optimal price vector, when the values of the buyer are independent and drawn from regular distributions.888Regular distributions are another widely studied class of distributions that contain MHR distributions. See Section 2 for a formal defintion.

For any accuracy , the algorithm runs in time polynomial in , and outputs a price vector whose revenue is at least a -fraction of the optimal revenue, where is the number of items.

Discussion of Algorithmic Results.

Prior to our work, there were no (near-)optimal algorithms known for multi-dimensional auction problems without special structure. In particular, only constant factor approximation algorithms were known for the item pricing problems addressed by Theorems 1 through 4. (For an extensive discussion of related work, we refer the reader to Section 1.3.) Our results are the first to obtain near-optimal solutions for these problems in polynomial time. We view the main contribution of our results not to be the practicality of our algorithms, but establishing that there is no lingering constant inapproximability results for item pricing. In particular, our results show that, for any desired accuracy , there are polynomial-time algorithms that compute -optimal solutions. Complemented with the NP-hardness result for the item pricing problem discussed in Section 1.3, what is left open by our work is obtaining faster near-optimal algorithms.

Structural Results.

Our algorithms are obtained by studying the distribution of the optimal revenue, as a function of the buyer’s values (which are random) and the optimal price vector (which is unknown), as overviewed in Section 1.2. As a byproduct of our techniques, we deduce the following structural properties of optimal solutions, whose proofs are given in Appendix I. Theorem 5 states that, when the values are independently distributed according to monotone hazard rate distributions, then pricing all items at the same price guarantees a constant fraction of the optimal revenue. Theorem 6 generalizes this to showing that only the desired approximation dictates the number of distinct prices that are necessary to achieve a -fraction of the optimal revenue, and not the number of items or the size of the support of the distributions, as long as they are monotone hazard rate. Theorem 7 generalizes this result to a mild dependence on for regular distributions.

Theorem 5 (Structural 1 (MHR): Constant Factor Approximation from a Single Price).

If the buyer’s values for the items are independently distributed according to MHR distributions, there exists a price such that pricing all items at guarantees a constant fraction of the optimal revenue. Price can be computed efficiently from the value distributions.

Theorem 6 (Structural 2 (MHR): A Constant Number of Distinct Prices Suffice for Near-Optimal Revenue).

There exists a quasi-quadratic999A function is quasi-quadratic iff it satisfies , for some absolute constant . For the meaning of the notation please refer to Section 2. function such that, for all and all , distinct prices suffice to achieve a -fraction of the optimal revenue, when the buyer’s values for the items are independently distributed according to MHR distributions. These distinct prices can be computed efficiently from the value distributions.

Theorem 7 (Structural 3 (Regular): A Polylogarithmic Number of Distinct Prices Suffice for Near-Optimal Revenue).

There exists a polynomial function such that, for all and , distinct prices suffice to achieve a -fraction of the optimal revenue, when the buyer’s values for the items are independently distributed according to regular distributions. These prices can be computed efficiently from the value distributions.

Finally, it seems intuitive that, when the value distributions are not widely different, a single price might suffice for extracting a -fraction of the optimal revenue, as long as there is a sufficient number of items for sale. We show such a result for the case where the buyer’s values are i.i.d. according to a MHR distribution. See Appendix I.1 for the proof of this theorem.

Theorem 8 (Structural 4 (i.i.d. MHR): A Single Price Suffices for Near-Optimal Revenue).

There is a function such that, for all , if the number of items is larger than then pricing all the items at the same price obtains a -fraction of the optimal revenue, if the buyer’s values are i.i.d. according to a MHR distribution.

Extreme Value Theorems.

Establishing the above structural properties relies on understanding the tails of MHR and regular distributions. For this purpose, we develop extreme value theorems for these classes of distributions. We state our extreme value theorems informally below, referring the reader to Theorems 19 and 21 (in Sections 8 and 9 respectively) for formal statements.

Informal Theorem 9.

[Extreme Values of MHR Distributions] Let be a collection of independent random variables whose distributions are MHR, and let . Then, for all sufficiently small, at least a -fraction of is contributed to by the event

Informal Theorem 10.

[Extreme Values of Regular Distributions] Let be a collection of independent random variables whose distributions are regular, and let . Then the tail of is eventually not fatter than the tail of the equal revenue distribution.101010The equal revenue distribution is supported on and has cumulative density function . Notice that, if a buyer’s value for a single item is distributed according to this distribution, the buyer’s expected value for the item is . However, if the item is priced at any price , the expected revenue is , hence the name “equal revenue.” The equal revenue distribution is itself a regular distribution. So our theorem says that the fattest the tail of the maximum of regular distributions can eventually be is that of a regular distribution.

Bounding the size of the tail of the maximum of independent random variables, which are MHR or regular respectively, is instrumental in establishing the following truncation property: restricting all item prices into an interval of the form in the MHR case, and in the regular case, for some that depends on the value distributions, only loses an -fraction of the optimal revenue. This is quite remarkable, especially when the value distributions are non-identical or have large tails. How is it possible to restrict the prices into a bounded interval, when the underlying value distributions may concentrate on different supports, or even worse when they do not exhibit good concentration at all as when they are power law distributions? 111111A power law distribution is a distribution whose probability density function where and is a slowly varying function, that is, for any , . It usually has large or even unbounded variance. Many power law distributions are also regular, for example when equals some constant . To establish the truncation properties claimed above, we follow a different approach depending on whether the underlying distributions are MHR or regular. In the MHR case, we argue (using Theorem 9) that even if we could extract full surplus in the event that , the revenue would only increase by a tiny factor. Thus, to obtain nearly-optimal revenue, it suffices to only consider item prices in a bounded range of the form . When the distributions are regular, this approach fails, simply because the expectation could be infinite. We bypass this issue by arguing (using Theorem 10) that the tail of eventually becomes no heavier than the tail of the equal revenue distribution. Intuitively, this means that varying the extremely high item prices barely affects the revenue. Formally, we prove that, whenever some item price is set higher than some large enough threshold, then bringing it down to the threshold has little effect on revenue.

Besides enabling the aforementioned structural results for our problem, we expect that our extreme value theorems will find applications in future work, and indeed they have already been used in followup research. In [DW12, CDW12a], our theorem is used to convert nearly-optimal multi-item multi-bidder mechanisms for distributions with bounded support to nearly-optimal mechanisms for MHR distributions. For the same setting, [CH13] use our theorem to show that relatively simple auctions can extract near-optimal revenue when the bidders are identical, by showing that the welfare is highly-concentrated. We also note that extreme value theorems have been obtained in Statistics for large classes of distributions [dHF06], and indeed such theorems have been applied to optimal mechanism design prior to our work [BH08]. Nevertheless, the known extreme value theorems are typically asymptotic, only hold for maxima of i.i.d. random variables, and are not known to hold for all MHR or regular distributions. We can instead handle the non-i.i.d. case, maxima of a finite number of random variables, and the full spectrum of MHR and regular distributions.

1.2 Algorithmic Ideas: Covers of Revenue Distributions

We overview our approach for Theorem 1. A natural strategy for reducing the search space for an approximately optimal price vector is to discretize the set of possible prices into a finite set, whose size scales mildly with the number of items, , and the approximation accuracy, . Of course, even with discretization the number of possible price vectors is exponential in the number of items, and it is not clear how to search this set efficiently. A natural idea to shortcut the search further is to cluster the value distributions into a small number of buckets, containing distributions with similar statistical properties, and proceed to treat all items in a bucket as essentially identical. However, the expected revenue is not sufficiently smooth for us to perform such bucketing. We do obtain a delicate discretization of the supports of the value distributions (Corollary 16), but cannot discretize the probabilities used by these distributions into a coarse-enough accuracy to allow for polynomial-time solvability of the problem.

Our main algorithmic idea is to shift the focus of attention from the space of value distributions, which is inherently exponential in the number of items, to the space of all possible revenue distributions, which are single-dimensional distributions. The revenue from a given price vector can be viewed as a random variable that depends on the (random) values of the items. So, there is still an exponential number of possible revenue distributions, corresponding to all possible price vectors. Nevertheless, we can exploit the single-dimensional nature of these distributions to construct a polynomial-size -cover of the set of all possible revenue distributions under the total variation distance between distributions. That is, for every possible revenue distribution, there exists a distribution in our cover that is within in total variation distance from it.

Our cover is implicit, i.e. we do not provide a closed-form description for it. We show instead that it can be constructed efficiently using dynamic programming. Our algorithm iteratively considers prefixes of the items and, for each prefix , constructs a cover of all possible revenue distributions from only pricing items . For the next iteration, we show that the cover for items can be easily computed from the cover for items and the distribution of . In the end of our iterations we obtain a polynomial-size -cover of all possible revenue distributions, and we argue that only a -fraction of revenue is lost if we replace the optimal revenue distribution with its closest one in our cover. And, because the cover has polynomial size, we can exhaustively try every distribution in the cover and its associated price vector to pick the one with the highest expected revenue. A more detailed description of our algorithm is given in Section 4, and complete details are provided in Section 5. Theorem 1 follows then easily in Section 6.

Theorem 2 follows similarly, except we employ a stronger discretization (Theorem 17) before using dynamic programming to obtain a cover of all possible revenue distributions. Finally, our algorithms for MHR and regular distributions (Theorems 3 and 4 respectively) are corollaries of Theorem 2, except they require some extra work for restricting the value distributions into a bounded range. This is achieved in Sections 8 (for MHR distributions) and 9 (for regular distributions) using our extreme value theorems (Theorems 19 and 21). The detailed proofs of Theorems 3 and 4 are provided in Appendix H.

1.3 Related and Future Work

The focus of this paper is the multidimensional item pricing problem for a unit-demand buyer whose values for the items are independent. This problem is related to the celebrated multidimensional mechanism design problem, but it is restricted in two ways. First, there is a single bidder who is unit-demand. Second, we are interested in coming close to the revenue of the optimal deterministic—i.e. item pricing—mechanism and not the optimal unrestricted mechanism, which may also price lotteries over items. While it is unclear whether the restriction to deterministic mechanisms should make the problem easier or harder computationally, the restriction to a single unit-demand bidder should make the problem easier compared to having many bidders with arbitrary valuations.

Despite the apparent simplicity of the item pricing problem, (near-)optimal polynomial-time algorithms for it were not known prior to our work. Chawla et al. [CHK07] provide a -approximation algorithm, computing a price vector whose revenue is at least a third of the optimal revenue. Their technique is quite elegant, connecting the item pricing problem to a related, single-dimensional mechanism design problem, which can be analyzed using Myerson’s result [Mye81]. Using the same approach, the approximation factor is improved to in [CHMS10], and the result is generalized to the multi-bidder setting, albeit with a worse approximation factor. Different work [BGGM10, Ala11] obtains polynomial-time constant factor approximations for additive bidders, using convex programming relaxations of the problem.

However, all these approaches are limited to constant factor approximations, as ultimately the attained revenue is compared to the optimal revenue in a related single-dimensional setting [CHK07, CHMS10], or a convex programming relaxation of the problem [BGGM10, Ala11]. In particular, the limitation of these approaches comes from avoiding a direct comparison of the attained revenue to the optimal revenue in the actual problem, comparing it instead to the optimal revenue in a related problem. Our work provides instead near-optimal algorithms, using a direct comparison to the real optimum via covers of revenue distributions.

Our work leaves several directions open for exploration and some have already been studied following the announcement of our results [CD11]. We classify them into three categories discussed below.

-

•

Unit-demand Bidders: Can our near-optimal algorithms be improved to be exactly optimal? Recent work has shown that the answer is no, namely that there are no exactly optimal polynomial-time algorithms for product value distributions, unless [CDP+14]. Still there is room for improving the dependence of our running times on the approximation parameter . E.g., is there an algorithm that runs in time polynomial in and when the item values are bounded in ?

And how about correlated distributions over item values? Here, it had already been known that computing an optimal price vector is highly inapproximable in polynomial-time [BK07]. So there cannot even be a polynomial-time constant factor approximation in this case.

Beyond item pricing, it is important to understand the complexity of optimal randomized mechanisms, which may increase revenue by also pricing lotteries over items [Tha04, BCKW10]. For product distributions, Chawla et al. [CMS10] show that randomization does not increase revenue by more than a factor of 4, thus extending the constant-factor approximation algorithms of [CHK07, CHMS10] to the randomized multi-bidder setting, except with worse approximation guarantees. Is there a polynomial-time optimal mechanism for this setting? No computational lower bound is known at the time of writing of this paper.

For correlated distributions over item values, Cai et al. [CDW12b] obtain near-optimal, randomized mechanisms for multi-bidder multi-item settings with unit-demand bidders. For any desired accuracy , they compute a mechanism whose revenue is within an additive error of from optimal in time polynomial in and the size of the support of each bidder’s distribution over valuations, when these distributions are discrete. (When they are continuous, they are handled via fine enough discretization.) This algorithm is clearly also applicable when every bidder’s values for the items are independent (i.e. the setting discussed in the previous paragraph). However, the dependence of the running time on the support of the product distribution may be unreasonable computationally. Indeed, a discrete product distribution can be described by specifying all of its marginals, with description complexity logarithmic in the size of its support.

-

•

Additive Bidders: Can our algorithms be extended to additive bidders? Here, an optimal mechanism may increase revenue by pricing bundles of items [MV06], or (if randomization is allowed) lotteries over bundles of items. Exploiting our extreme value theorems for MHR distributions, Cai and Huang [CH13] provide near-optimal polynomial-time mechanisms for multiple i.i.d. bidders, whose values for the items are independently distributed according to MHR distributions. Moreover, Daskalakis et al. [DDT14] show that this result cannot be made exact for general product distributions. They show that, subject to widely held complexity theoretic beliefs—in particular that ,121212 would imply that there are randomized polynomial-time algorithms for -complete problems, which is widely believed to be unlikely. computing and implementing an exactly optimal mechanism cannot be done computationally efficiently. Indeed, this is true even in the ostensibly simple setting where there is a single additive bidder whose values for the items are independently distributed on two rational numbers with rational probabilities.

For correlated distributions, Cai et al. [CDW12a] obtain (exactly) optimal mechanisms for multi-bidder multi-item settings with additive bidders, in time polynomial in the size of the support of each bidder’s distribution over valuations.

On a different vein, Daskalakis et al. [DDT13] study the structure (rather than the computational complexity) of optimal mechanisms, following earlier work on the topic by Economists, e.g. [Roc85, Arm00, MV06, MV07, Pav11]. They provide a duality framework based on Monge-Kantorovich duality for characterizing the structure of the optimal mechanism of selling multiple items to a single additive bidder.

-

•

General Settings: It is important to understand the computational complexity of mechanism design in general settings: multiple bidders, general valuations (beyond unit-demand and additive), general constraints on what allocations of items to bidders are feasible, and general objectives, potentially going beyond the familiar objectives of revenue and welfare.131313A general objective takes as input the valuations of the bidders and a randomized allocation and price vector and outputs a real number . In recent work, Cai et al. [CDW13] provide a computational black-box reduction from mechanism design for maximizing an arbitrary concave objective 141414An objective function is called concave iff, for all bidder valuations , and all and , it holds that , where denotes uniformly randomizing between and . Clearly, revenue and welfare satisfy this condition with equality, but several other objectives are concave, such as the max-min fairness objective considered in [CDW13]. under arbitrary allocation constraints and an arbitrary family of bidder valuations (e.g. submodular, supermodular, etc.) to algorithm design for that same objective , modified by an additive virtual welfare and virtual revenue term, and under the same allocation constraints and family of allowed valuations. Roughly speaking, they show that, whenever the algorithmic problem is polynomial-time solvable (exactly or approximately), the mechanism design problem also becomes solvable (exactly or approximately) in time polynomial in the size of the support of each bidder’s distribution over valuations. It is important to find applications of this reduction to settings of interest beyond optimizing fractional max-min fairness for additive bidders, which was done in [CDW13].

2 Preliminaries

Computational Problems.

We define three variants of the item pricing problem. AdditivePrice and Price are the main computational problems that we aim to solve, but RestrictedPrice is an auxiliary one that is helpful in the analysis. For the value distributions that we consider, it can be shown that all three problems have finite optimal solutions.

AdditivePrice: Input: A collection of mutually independent random variables , and some . Output: A vector of prices such that the expected revenue from using , defined as in Eq. (1), is within an additive of the optimal revenue achieved by any price vector.

Price: Input: A collection of mutually independent random variables , and some . Output: A vector of prices such that the expected revenue from using , defined as in Eq. (1), is within a -factor of the optimal revenue achieved by any price vector.

RestrictedPrice: Input: A collection of mutually independent random variables supported on a common discrete set , and a discrete set of possible prices. Output: A vector of prices such that the expected revenue from using is optimal among all vectors in .

Computational Efficiency.

Throughout the paper we use the standard convention of identifying “computational efficiency” with polynomial-time computation. Namely, we will say that an algorithm is “computationally efficient” iff its running time is polynomial in the number of bits required to describe the input to the algorithm.

Reductions Between Computational Problems.

We provide several reductions between different flavors of the item pricing problem. Formally, a (polynomial-time) reduction from a computational problem (e.g. Price) to a computational problem (e.g. RestrictedPrice) is a pair of (polynomial-time) algorithms and satisfying the following properties. For all inputs to :

-

•

is a valid input to ;

-

•

if is a solution to then is a solution to .

For example, a polynomial-time reduction from Price to RestrictedPrice would allow us to convert (in polynomial time) any input to Price to a valid input to RestrictedPrice so that, if we found a solution to the latter, we would also be able to compute (in polynomial time) a solution to the former.

Approximation Algorithms.

Our algorithmic results use the concept of a Polynomial-Time Approximation Scheme, or PTAS. A PTAS for a computational problem such as Price is a collection of algorithms , indexed by the approximation parameter , such that, for all and for any given input to the algorithm, Algorithm computes an -optimal solution to in time , where is the number of bits required to describe problem and is some increasing function of , which does not depend on or its description complexity. The algorithms in the collection are called polynomial-time because for all fixed , e.g. , the running time of is polynomial in the description of the problem. A quasi-polynomial-time approximation scheme, or Quasi-PTAS is a similar concept, except that running time is for some function instead of as in a PTAS.

Distributions.

For a random variable we denote by the cumulative distribution function of , and by its probability density function. We also let and . may be , but we assume that , since our distributions represent value distributions. We drop the subscript/superscript of , if is clear from context.

We proceed with a precise definition of Monotone Hazard Rate (MHR) and Regular distributions, which are two commonly studied families of distributions.

Definition 11 (Monotone Hazard Rate Distribution).

We say that a one-dimensional differentiable distribution has Monotone Hazard Rate if is non-decreasing in . We call such a Monotone Hazard Rate, or MHR, distribution.

Definition 12 (Regular Distribution).

A one-dimensional differentiable distribution is called regular if is non-decreasing in .

It is worth noting that all MHR distributions are also regular distributions, but there are regular distributions that are not MHR. The family of MHR distributions includes such familiar distributions as the Normal, Exponential, and Uniform distributions. The family of regular distributions contains a broader range of distributions, including fat-tail distributions for (which are not MHR). In Appendices F.1 and G.1 we establish important properties of MHR and regular distributions. These properties are instrumental in establishing our extreme value theorems for these distributions (Theorems 19 and 21 in Sections 8 and 9).

To formally study the complexity of the item pricing problem, we need to pay attention to how value distributions are described as part of the input to the problem. We discuss this technical issue in Appendix B, entertaining three types of access to a distribution. Maybe we are given an explicit description of the distribution, specifying its support and the probabilities assigned to every value in the support. Such explicit description is appropriate if the distribution is discrete and has finite support. Alternatively, we may have more limited access to the distribution. E.g., we may only have sample access to the distribution via a procedure that generates independent samples from it. Or, we may have oracle access to the cumulative distribution function via a procedure that returns its value at any queried point. We formally discuss these types of access to a distribution in Appendix B, also defining precisely what it means for an algorithm who takes as input a distribution or outputs a distribution to be “computationally efficient” in each case.

Order Notation.

Throughout the text we use the , and notation. Let , be two positive functions defined on some infinite subset of . Then:

-

•

we write iff there exist some positive reals and such that , for all ;

-

•

we write iff there exist some positive reals and such that , for all ; and

-

•

we write iff and .

Other Notation.

Whenever we write in an expression providing a bound to some quantity, we mean that there exists some positive polynomial which can replace “” so that the bound is true. Whenever we write in some expression without specifying the base of the logarithm, any constant base that is larger than works. For some positive rational number , we write to denote the bit complexity of , i.e. the number of bits required to specify the numerator and denominator of an irreducible fraction representing .

3 Paper Organization

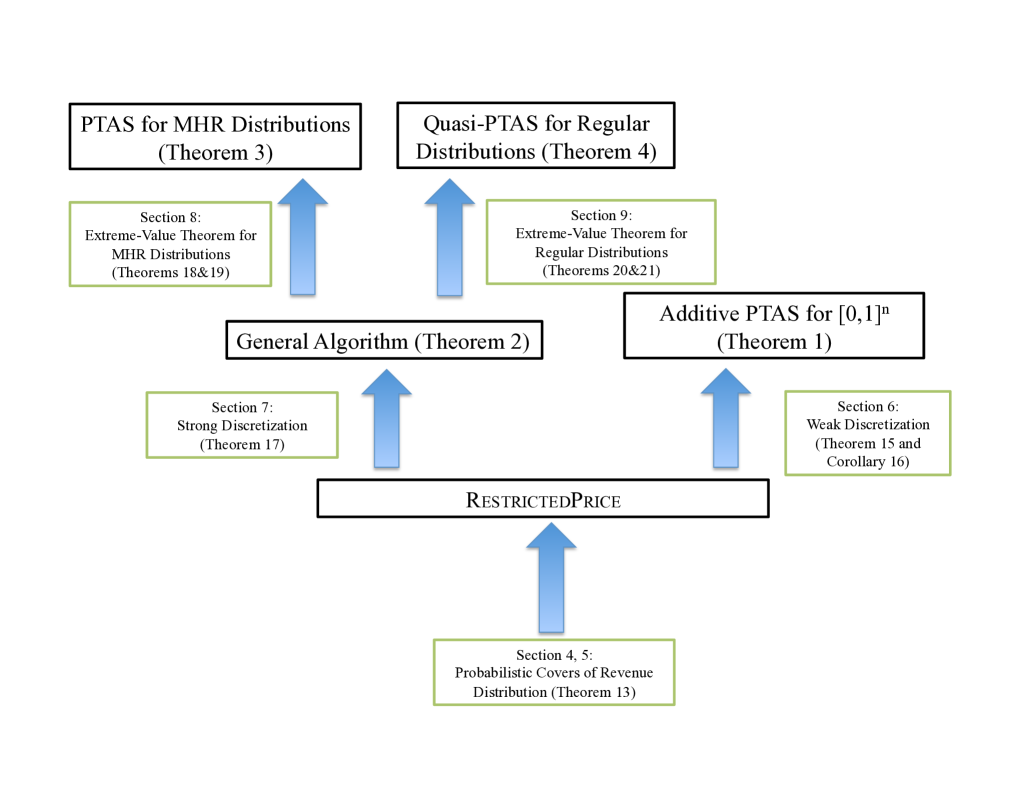

We provide a roadmap to the paper and a high-level description of our approach. We first study RestrictedPrice. Despite its input/output restrictions, it addresses the major algorithmic challenges of the item pricing problem. Our approach to RestrictedPrice is to first design a dynamic programming algorithm that produces a cover of all possible revenue distributions arising from price vectors in , where is the set of possible prices specified in the input to the problem. Using the cover it is then easy to obtain a near-optimal algorithm for RestrictedPrice, which is not necessarily polynomial-time. Section 4 provides an intuitive description of the dynamic programming approach for producing the cover, and Section 5 describes our algorithm for RestrictedPrice formally. This algorithm serves as the main algorithmic tool of this paper, and is at the root of the tree structure of Figure 1, summarizing our results and proofs.

In Section 6, we obtain Theorem 1 by reducing AdditivePrice for value distributions supported on to RestrictedPrice. The reduction is obtained by showing a discretization result, establishing that the supports of the value distributions as well as the candidate prices can be discretized without too much loss in revenue. The reduction is summarized by Corollary 16, which together with our algorithm for RestrictedPrice immediately shows Theorem 1.

In Section 7, we move on to multiplicative approximations, establishing Theorem 2. The approach is similar, reducing Price to RestrictedPrice by discretizing the supports of the value distributions as well as the set of available prices. However, Theorem 15, the discretization result at the heart of Corollary 16 (our reduction from Section 6), is not strong enough for our purposes here. We establish instead a stronger discretization (Theorem 17) that is sufficiently powerful for our reduction.

In Sections 8 and 9, we establish our algorithms for MHR and regular distributions. In Section 8, we present an extreme value theorem for MHR distributions (Theorem 19). This theorem enables us to obtain a polynomial-time reduction from Price where the value distributions are MHR to Price where the value distributions are supported on a common range of the form , where the multiplier is independent of the number of items . Our reduction is summarized by Theorem 18. Theorem 3 follows then as a corollary of Theorem 18 and Theorem 2. Our algorithm for regular distributions follows similarly in Section 9. We show an extreme value theorem for regular distributions (Theorem 21), enabling a reduction from Price with regular distributions to Price with distributions supported on a common range of the form , except that now the multiplier depends polynomially on the number of items . Our reduction is summarized in Theorem 20. Theorem 4 follows then as a corollary of Theorem 20 and Theorem 2.

Reading the paper.

4 Probabilistic Covers of Revenue Distributions

In this section, we discuss our algorithmic approach to RestrictedPrice, postponing the description of our algorithm for it to Section 5. As we have already discussed in Section 3, although seemingly restricted this problem captures the main algorithmic challenges underlying problems Price and AdditivePrice. In particular, our algorithm for RestrictedPrice will become a central building block in all our algorithmic results (Theorems 1 through 4).

For convenience, throughout this section we will take to be a collection of distributions supported on a discrete set , and to be a collection of mutually independent random variables distributed according to the ’s. We will then assume that the input to RestrictedPrice comprises the ’s and a finite set of prices .

The obvious algorithmic challenge in RestrictedPrice is that, even though the set of possible prices is finite, there are still exponentially many (namely ) possible price vectors that we need to choose from for an optimal one. If were a constant and the items were i.i.d., then we could decrease the possible vectors to a polynomial number by exploiting the symmetry of the items.151515A broader exposition of the role of symmetries in mechanism design can be found in [DW12]. Similarly, we can obtain polynomial-time algorithms for the case where there is only a constant number of possible value distributions and a constant number of possible prices. However, when all the ’s may be different, the problem looks inherently exponential, even if both and are absolute constants, e.g., even when the value distributions are supported on possible values and there are possible prices available.

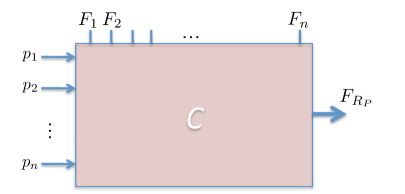

Our algorithmic approach is enabled by a shift in perspective, which may be applicable to other problems with a similar structure. To illustrate the approach, let us view our problem in the graphical representation of Figure 2. is a function that takes as input a price vector and outputs the distribution of the revenue of the seller under this price vector. Indeed, the revenue of the seller is a random variable that depends on the random variables . So in order to compute the distribution of the revenue, also takes as input the distributions . What we are aiming at maximizing is the expectation of .

Given our restriction of the prices to a finite set , there are possible inputs to the function, and at most possible revenue distributions that the function can output. Our main conceptual idea is the following:

Instead of searching the space of possible price vectors that can be input to , we search the space of possible outputs of , i.e. the space of all possible revenue distributions resulting from different price vectors, for one with maximum expectation.

Moreover, to efficiently search the space of all possible revenue distributions, we construct an appropriately small subset of it and only search the distributions in that subset.

The subset we construct is a probabilistic cover (under some appropriate metric) of the space of all possible revenue distributions.161616A -cover of a set of distributions with metric is a subset such that for all there exists some such that . The properties of our cover that are crucial for our algorithmic applications are the following: (a) the cover has small cardinality, and (b) for any possible revenue distribution that the function may output, there exists a revenue distribution in our cover whose expectation is close.

Constructing the Cover.

At a high level, we construct our cover using dynamic programming (henceforth DP for short), whose steps are interleaved with coupling arguments that prune the size of the DP table before proceeding to the next step.

Intuitively, our DP algorithm sweeps the items from through , maintaining a cover of the revenue distributions produced by all possible price vectors on every prefix of the items. More precisely, for each prefix of the items, our DP table keeps track of all possible feasible collections of probability values, where , , denotes the probability that the item with the largest value-minus-price gap (i.e. the item that would have been sold in a sale that only sells items through ) has value for the buyer and is assigned price by the seller. I.e. we store in our DP table all possible (winning-value, winning-price) distributions that can arise from a price vector on every prefix of the items. The reasons we store these distributions are the following:

-

•

First, if we have all possible (winning-value, winning-price) distributions for the full set of items, we can search for the one with the highest expected revenue. For every distribution we will also maintain in our DP table a price vector resulting in that distribution. So, once we have found the distribution with the optimal expected revenue, we will also find the price vector with that optimal revenue.

-

•

Second, we can construct the set of all possible (winning-value, winning-price) distributions for the full set of items, by considering one prefix at a time. In particular, suppose that we have all possible (winning-value, winning-price) distributions for the prefix of items . By combining every such distribution with all possible prices for item , we can compute all possible (winning-value, winning-price) distributions for the prefix of items . That is, if we have these distributions for a prefix of items, we do not need any other information to extend the prefix by one item. For this scheme to work, observe that it is crucial to maintain the joint distribution of both the winning-value and the winning-price, rather than just the distribution of the winning-price.

Clearly, the dynamic programming approach that we just outlined for computing a cover of all possible revenue distributions achieves nothing in terms of reducing the number of distributions. Indeed, there could be one (winning-value, winning-price) distribution for every price vector, so that the total number of distributions that we need to store in our DP table is exponential. To control the size of our cover from exploding, we show that we can be coarse in our bookkeeping of the (winning-value, winning-price) distributions, without sacrificing much revenue. Indeed, it is here where viewing our problem in the “upside-down” manner illustrated in Figure 2 (i.e. targeting a cover of the output of ) is important. We show that we can discretize the probabilities used by the distributions stored in the DP table into multiples of some fraction without losing much revenue. In particular, after a prefix of items is processed by the algorithm, we show that we can discretize the probabilities in all distributions in the table before considering the next item. That the loss due to coarsening the probabilities is not significant follows from coupling arguments interleaved with the steps of dynamic programming.

In the next section we make our ideas precise, obtaining our algorithm for RestrictedPrice.

5 The Algorithm for the Discrete Problem

In this section, we formalize our ideas from the previous section, describing our main algorithmic result for RestrictedPrice. We use the same notation as in Section 4, namely we assume that the input distributions are supported on a common set of cardinality and the prices are restricted to a set of cardinality . We also denote by the optimal expected revenue for the input value distributions when the prices are restricted to .

The Algorithm.

As a first step we discretize the probabilities used by the input distributions. We prove a discretization lemma that provides a polynomial-time reduction from our problem into a new one, where additionally the probabilities that the value distributions assign to each point in their support are integer multiples of , for some integer that is a free parameter in our algorithm. We show that the loss in revenue resulting from our reduction is at most an additive in the following sense: for any price vector , the expected revenue from the original value distributions and the expected revenue from the discretized distributions are within an additive . Moreover, the construction of Lemma 23 is explicit, so from now on we can assume that we know the explicitly, regardless of what type of access we have to the (see Appendix B).

The second phase of our algorithm is the dynamic programming algorithm outlined in Section 4. We provide some further details on this now. Our algorithm computes a Boolean function , whose arguments lie in the following range: and , where each is an integer multiple of . The function is stored in a table that has one cell for every setting of and , and the cell contains a or a depending on the value of at the corresponding input. In the terminology of the previous section, argument indexes the last item in a prefix of items and defines a (winning-value, winning-price) distribution whose probabilities are integer multiples of . If can arise from some pricing of the items (up to discretization of probabilities into multiples of ), we intend to store ; otherwise we store . For each cell of the table such that , we also store a price vector on the corresponding prefix of items consistent with .

For conciseness, we give next a high-level description of the dynamic programming algorithm, postponing its full details to Appendix C.1. The table is filled in a bottom-up fashion from through . At the end of the -th iteration, we have computed all feasible “discretized” (winning-value,winning-price) distributions for the prefix of items , where “discretized” means that all probabilities have been rounded into multiples of . For the next iteration, we try all possible prices for item and compute how each of the feasible discretized (winning-value,winning-price) distributions for the prefix evolves into a discretized distribution for the prefix , setting the corresponding cell of layer of the DP table to . Notice, in particular, that we lose accuracy in every step of the dynamic programming algorithm, as each step involves computing how a discretized distribution for items evolves into a distribution for items and then rounding the latter back into multiples of . We show in the analysis of our algorithm that the error accumulating from these roundings can be controlled via coupling arguments.

After computing the truth-table of function , we look at all cells such that and evaluate the expected revenue resulting from the distribution , i.e.

Having located the cell whose is the largest, we output the price vector stored in that cell.

Running Time and Correctness.

Next we bound the algorithm’s running time and revenue.

Theorem 13.

Given an instance of RestrictedPrice, where the value distributions are supported on a discrete set of cardinality and the prices are restricted to a discrete set of cardinality , and for any choice of discretization accuracy , the algorithm described in this section produces a price vector with expected revenue at least

where is the maximum element in and the optimal expected revenue. The running time of the algorithm is polynomial in the size of the input and .

The proof of the theorem is given in Appendix C. Intuitively, if we did not perform any rounding of distributions, our algorithm would have been exact, outputting an optimal price vector in . What we show is that the roundings performed at the steps of the dynamic programming algorithm are fine enough that do not become detrimental to the revenue. To show this, we use coupling arguments, invoking the coupling lemma and the optimal coupling theorem after each step of the algorithm. (See Lemma 22 in Appendix C.2.) This way, we show that the rounded (winning-value,winning-price) distributions maintained by the algorithm for each price vector are close in total variation distance to the corresponding exact distributions arising from these price vectors, culminating in Theorem 13.

6 Additive PTAS for values distributed in

In this section, we provide a polynomial-time reduction from AdditivePrice, for value distributions supported on , to -approximating RestrictedPrice, where is a collection of mutually independent random variables supported on a common set of cardinality and . A PTAS for AdditivePrice then follows from Theorem 13 with an appropriate choice of the discretization .

As a first step, we reduce AdditivePrice to AdditivePrice, where the random variables are independently distributed in . The reduction is quite straightforward, replacing all sampled values that are smaller than some with and keeping the rest unchanged. We argue that a nearly optimal price vector for the new value distributions is also nearly optimal for the original value distributions. Formally,

Lemma 14.

Let be a collection of mutually independent random variables supported on . For any , there is a polynomial-time reduction from AdditivePrice to AdditivePrice, where is a collection of mutually independent random variables supported on .

The proof can be found in Appendix D.4.

Next we want to discretize the problem AdditivePrice. As alluded to in Section 1, the expected revenue can be sensitive even to small perturbations of the prices and the probability distributions. So our discretization, summarized in the next theorem, must be done delicately.

Theorem 15 (Price/Value Discretization for Additive Approximation).

Let be a collection of mutually independent random variables supported on a bounded set , and let For any , there is a reduction from AdditivePrice to approximating RestrictedPrice to within an additive error of , where

-

•

is a collection of mutually independent random variables that are supported on a common set of cardinality ;

-

•

and .

Moreover, if and are given explicitly as input to the reduction,171717This requirement is only relevant if we have oracle access to the distributions of the ’s, as if we are given the distributions explicitly we immediately also know and . the running time of the reduction is polynomial in the description of , , , and .

That the prices can be restricted to a discrete set without hurting the revenue too much follows immediately from a discretization lemma attributed to Nisan [CHK07]. (See also [HK05] for a related discretization.) Our price discretization result is summarized in Lemma 25 of Appendix D.2. The discretization of the support of the value distributions is inspired by Nisan’s lemma, and our corresponding discretization result is summarized in Lemma 31.

Corollary 16.

Let be a collection of mutually independent random variables supported on . For any , there is a polynomial-time reduction from AdditivePrice to approximating RestrictedPrice to within an additive error of , where is a collection of mutually independent random variables supported on a common set of cardinality , and .

We are now ready to prove Theorem 1, using the reduction of Corollary 16 and our algorithm from Section 5.

Proof of Theorem 1: We first perform the reduction of Corollary 16. In the resulting instance of RestrictedPrice both the cardinality of the support of the value distribution and the number of available prices are . Using we can solve the resulting instance of RestrictedPrice to within additive error using the algorithm of Theorem 13. The running time of the algorithm is polynomial in the input and .

7 Multiplicative PTAS

For the remainder of our main exposition, we move on to multiplicative approximations to the item pricing problem, obtaining algorithms for Price. In this section, we study the general problem where the values are independently distributed on a bounded range according to arbitrary distributions, proving Theorem 2.

Notice that, using our results from the previous sections, we can already get an algorithm for Price. We can first apply our reduction from Theorem 15 to discretize the prices and the supports of the value distributions. Then we can use our algorithm from Theorem 13 to solve the discretized problem. However to convert the additive approximation of this algorithm to a multiplicative one, we need to choose the approximation to be no worse than . This requirement forces the support of the discretized value distributions to be and the discrete set of prices to also have cardinality . Hence, the algorithm has running time polynomial in .

In this section, we present a stronger discretization result, reducing the size of the support of the value distributions and the cardinality of the price set to linear in . With this new discretization, we can speed up the running time of our algorithm to . Our improved discretization reduction is presented below, and proved in Appendix D.5.

Theorem 17 (Price/Value Distribution Discretization).

Let be a collection of mutually independent random variables supported on a bounded range , and let For any , there is a reduction from Price to the problem of approximating RestrictedPrice to within a factor of , where

-

•

is a collection of mutually independent random variables that are supported on a common set of cardinality ;

-

•

.

Moreover, if and are given explicitly as input to the reduction,181818This requirement is only relevant if we have oracle access to the distributions of the ’s, as if we are given the distributions explicitly we immediately also know and . the running time of the reduction is polynomial in the description of , , , and .

Combining our discretization from Theorem 17 with our algorithm from Theorem 13, it is easy to show Theorem 2. We only sketch the proof here, providing a formal proof in Appendix E.

Proof of Theorem 2: (sketch) We first perform the reduction of Theorem 17 to get an instance of RestrictedPrice where both the values and the prices come from discrete sets of cardinality . Using the algorithm of Theorem 13, we can then approximately solve this instance to within a factor of in time polynomial in the input and .

8 Extreme Values of MHR Distributions

We reduce the problem of finding a near-optimal price vector for value distributions that are MHR to finding a near-optimal price vector for value distributions that are supported on a bounded range , where is only a function of the desired approximation . More precisely, we establish the following reduction.

Theorem 18 (From MHR to Bounded Distributions).

Let be a collection of mutually independent MHR random variables. Then there exists some such that for all , there is a reduction from Price to Price, where is a collection of mutually independent random variables supported on the set , and is some absolute constant.191919Clearly, by plugging into our reduction, we obtain a reduction from Price to Price, for any desired . We phrased our theorem as a reduction from Price to Price only to have better expressions in the supports of the ’s.

Moreover, is efficiently computable from the distributions of the ’s, and, for all , the running time of the reduction is polynomial in the size of the input and .

We discuss the essential elements of our reduction below. Most crucially, the reduction is enabled by the following theorem, characterizing the extreme values of a collection of independent MHR distributions.

Theorem 19 (Extreme Values of MHR distributions).

Let be a collection of independent random variables whose distributions are MHR. Then there exists some anchoring point such that and

| (2) |

where is the probability density function of . Moreover, is efficiently computable from the distributions of the ’s.

Theorem 19, whose proof is given in Appendix F.2, implies that, for sufficiently small, at least a -fraction of is contributed to by values that are no larger than Our result is quite surprising, especially for the case of non-identically distributed MHR random variables. Why should most of the contribution to come from values that are close (within a function of only) to the expectation, when the underlying random variables may concentrate on widely different supports? To obtain the theorem one needs to understand how the tails of the distributions of a collection of independent MHR random variables contribute to the expectation of their maximum. Our proof technique is intricate, defining a tournament between the tails of the distributions. Each round of the tournament ranks the remaining distributions according to the size of their tails, and eliminates the lightest half of the distributions. The threshold is then obtained by some side-information that the algorithm records in every round.

Given our understanding of the extreme values of MHR distributions, our reduction of Theorem 18 from MHR to bounded distributions proceeds in the following steps:

-

•

We start with the computation of the threshold specified by Theorem 19. This computation can be done efficiently, as stated in the statement of the theorem. Given that is bounded away from , the revenue from pricing every item at is , hence the optimal revenue is also . See Appendix F.3.1 for the precise lower bound we obtain. Such lower bound is useful as it implies that, if our transformation loses revenue that is a small fraction of , this corresponds to a small fraction of optimal revenue lost.

- •

-

•

Finally, we show that we can efficiently transform the given MHR random variables into a new collection of random variables that take values in and satisfy the following: a near-optimal price vector for the setting where the buyer’s values are distributed as can be efficiently transformed into a near-optimal price vector for the original setting, i.e. where the buyer’s values are distributed as . This step is detailed in Appendix F.3.3.

9 Extreme Values of Regular Distributions

We reduce the problem of finding a near-optimal price vector for value distributions that are regular to finding a near-optimal price vector for value distributions that are supported on a bounded range satisfying , where is the number of distributions and is the desired approximation. It is important to notice that our bound on the ratio does not depend on the distributions at hand, just their number and the required approximation. We also emphasize that the given regular distributions may be supported on , so it is a priori not clear if we can truncate these distributions to any finite set without losing substantial revenue. Our reduction is the following.

Theorem 20 (Reduction from Regular to -Bounded Distributions).

Let be a collection of mutually independent regular random variables. Then there exists some such that, for any , there is a reduction from Price to Price, where is a collection of mutually independent random variables that are supported on .

Moreover, is efficiently computable from the distributions of the ’s, and, for all , the running time of the reduction is polynomial in the size of the input and .

Our reduction is based on the following extreme value theorem for regular distributions, whose proof is provided in Appendix G.2. Immediately following the statement of the theorem we sketch how it is used to establish our reduction, whose detailed proof is in Appendix G.3. Section 9.1 gives other example applications of the theorem to illustrate its usefulness in bounding extreme values of regular distributions.

Theorem 21 (Homogenization of the Extreme Values of Regular Distributions).

Let be a collection of mutually independent regular random variables, where . Then there exists some such that:

-

1.

has the following “anchoring” properties:

-

•

for all , , for all ;

-

•

, where is an absolute constant.

-

•

-

2.

For all , the tails beyond can be “homogenized”, i.e.

-

•

for any integer , thresholds , and index set :

-

•

Furthermore, is efficiently computable from the distributions of the ’s.

Given our homogenization theorem, our reduction of Theorem 20 is obtained as follows.

-

•

First, we compute the threshold specified in Theorem 21. This can be done efficiently as stated in Theorem 21. Now given the second anchoring property of , we obtain an lower bound to the optimal revenue. Such a lower bound is useful as it implies that we can ignore prices below some , without losing more than an -fraction of revenue.

- •

-

•

Finally, we show that we can efficiently transform the input regular random variables into a new collection of random variables that are supported on and satisfy the following: a near-optimal price vector for when the buyer’s values are distributed as can be efficiently transformed into a near-optimal price vector for when the buyer’s values are distributed as . This step is detailed in Appendix G.3.2, and Appendix G.3.3 concludes the proof of Theorem 20.

Theorem 4 is established by combining the reduction of Theorem 20 with our algorithm for bounded distributions of Theorem 2. See Appendix H.

9.1 Discussion of Theorem 21

We give a couple of applications of Theorem 21 to gain some intuition about its content:

-

•

Suppose that we set all the ’s equal to . In this case, the homogenization property of Theorem 21 implies that the union bound is essentially tight for large enough, as in the following calculation gets arbitrary close to :

This is not surprising, since for all , the event only happens with tiny probability, by the anchoring property of .

-

•

Now let’s try to set all the ’s to the same value . The homogenization property can be used to show that the probability of the event scales inverse proportionally with . Essentially this says that the tails of are not fatter than those of the equal revenue distribution.202020Recall that the equal revenue distribution is supported on and has cumulative density function .

A similar bound would follow from Markov’s inequality, if the expression inside the brackets were within a constant factor of . The result is interesting as it is possible for that expression to be much smaller than . For example, if and is distributed according to the equal revenue distribution, the expectation of is , while the expression inside the brackets is .

Appendix

Appendix A Roadmap to the Appendix

Appendix B describes several computational models of accessing a value distribution, explaining what it means for an algorithm with each type of access to be “computationally efficient” or “take time polynomial in the input.”

Appendix C contains a formal description and analysis of our dynamic programming approach for RestrictedPrice, culminating in the proof of Theorem 13.

Appendix D provides several reductions among item pricing problems, whose goal is to discretize some aspect of the problem such as the support of the value distributions, the probabilities they assign to their support, or the set of available prices. The appendix culminates in the reductions of Theorems 15 and 17.

The rest of the appendix is dedicated to our treatment of MHR and regular distributions. Appendix F provides the proof of our extreme value theorem for MHR distributions (Theorem 19), as well as our reduction from item pricing problems with MHR distributions to item pricing problems with bounded distributions (Theorem 18). Similarly, Appendix G provides the proof of our extreme value theorem for regular distributions (Theorem 21), as well as our reduction from item pricing problems with regular distributions to item pricing problems with bounded distributions (Theorem 20). The proofs of our algorithmic results for MHR and regular distributions (Theorems 3 and 4) are provided in Appendix H. The proofs of our structural results for independent MHR and regular distributions (Theorems 5, 6 and 7) are provided in Appendix I. Finally, Appendix I.1 contains the proof of our structural result for i.i.d. MHR distributions (Theorem 8).

Appendix B Access to Value Distributions, and Computational Complexity

We consider three ways in which a distribution may be input to an algorithm, as well as what it means for the algorithm to run in time “polynomial in the description of the distribution” in each case.

-

•

Explicitly: In this case, the distribution has to be discrete, and we are given its support (as a list of numbers), and the probabilities that the distribution places on every element in its support. If a distribution is explicitly input to an algorithm, the algorithm is computationally efficient if it runs in time polynomial in its other inputs and the bit-complexity of the numbers required to specify the distribution, i.e. the numbers in the support of the distribution and the probabilities assigned to them.

-

•

As an Oracle: In this case, we are given (potentially black-box) access to a subroutine, called an oracle, that answers queries about the value of the cumulative distribution function on a queried point. In particular, a query to the oracle consists of a point and a precision , and the oracle outputs a value of bit-complexity polynomial in the bit-complexity of and , which is within from the value of the cumulative distribution function at point . Moreover, we assume that we are given an anchoring point such that the value of the cumulative distribution at that point is between two a priori known absolute constants and , such that . Having such a point is necessary, as otherwise it would be computationally impossible to find any interesting point in the support of the distribution (i.e. any point where the cumulative is different than or ).

If a distribution is provided to an algorithm as an oracle, the algorithm is computationally efficient if it runs in time polynomial in its other inputs and the bit complexity of , ignoring the time spent by the oracle to answer queries (since this is not under the algorithm’s control).

If, as it so happens in practice, we have a closed-form description of our input distribution, e.g. if our distribution is , we think of it as given to us as an oracle, answering queries of the form as specified above. In most common cases, such an oracle can be implemented so that it also runs efficiently in the bit-complexity of the query to the oracle.

-

•

Sample Access: In this case, our only access to the distribution is our ability to take samples from it. It is easy to see that sample access to a distribution can be reduced to oracle access as follows. Suppose we have an algorithm designed to work with oracle access to a distribution, and let be a bound on the total number of queries that the algorithm may make to the oracle. ( is always upper bounded by the running time of the algorithm.) Suppose now that instead of oracle access we have sample access to the distribution. Here is how we can fix this: For any query that needs to make to the oracle, we can simply take samples from the distribution to estimate the cumulative distribution function at . By Chernoff bounds, our estimate will have error greater than with probability at most . So a union bound shows that all (at most ) queries of the algorithm will have error smaller than with probability at least . (We can tune this probability to be as close to one as we want at a cost of a factor of in the running time.) It is also easy to find an anchoring point. If we take many samples from the distribution and pick the median as the anchoring point, with very high probability the value of the cumulative distribution at this point is between and .

Given the above, whenever we have sample access to a distribution we will pretend to have instead oracle access to it, and we will say that an algorithm is computationally efficient using the same criterion we used for oracle access.

Polynomial-Time Reductions Involving Value Distributions.

This paper provides several polynomial-time reductions among item pricing problems. Recall from Section 2 that a reduction contains an algorithm that takes as input an instance of the item pricing problem, comprising distributions (and sometimes a restricted set of prices), and outputs another instance of the item pricing problem, comprising potentially different distributions (and prices). But what do we mean when we say that “an algorithm outputs a distribution ?” The algorithm may either output an explicit description of the distribution or an oracle for it.212121Our reductions never output a distribution by providing sample access to it. In the former case, must enumerate the support of the distribution and specify the probabilities assigned to every point in the support, as required by the first bullet above. In the latter case, outputs an oracle for , i.e. the description of an algorithm that satisfies the requirements of the second bullet above. This oracle may use as subroutines the oracles of the distributions provided in the input to , if any. We will then say that “ runs in polynomial time” if two properties are satisfied: 1. ’s running time is polynomial in its input; and 2. if outputs an oracle for some distribution , this oracle must run in time polynomial in the description of the oracle and the input to the oracle, excluding the time spent in oracles (from the input to ) that the oracle may use as subroutines.

Appendix C The Algorithm for Discrete Distributions

C.1 The Generic DP Step: Add an Item and Discretize Probabilities

In Section 5, we described our intended meaning for the Boolean function . Here we explain how to compute using dynamic programming. Our algorithm works bottom-up (i.e. from smaller to larger ’s), filling in ’s table so that the following recursive conditions are met.

If , we set iff there is a price and a distribution so that the following hold:

-

1.

.

-

2.

Suppose that is the price vector stored at cell of the table, namely that under price vector the (winning-value, winning-price) distribution for the prefix of the items is . What would happen if we assigned price to the -th item? If the gap between the winning-value and winning-price among the first items is larger than the gap between the value and price for the i-th item, the winning-value and winning-price would remain the same. Otherwise, they will become the value and price for the i-th item. Based on this, we can compute the resulting (winning-value, winning-price) distribution for the prefix from just and the distribution of item . Indeed:

(3) We require that is a rounded version of computed as above, where all the probabilities are integer multiples of . The rounding should be of the following canonical form. Setting , and we will round the first probabilities in in some fixed lexicographic order up to the closest multiple of , and round the rest down to the closest multiple of .222222Any rounding would work. We use this one just to make the description of our algorithm explicit.

If Conditions 1 and 2 are met, we also store price vector in cell of the table.

To fill in the first slice of the table corresponding to , we use the same recursive definition given above, imagining that there is a slice , whose cells are all except for those corresponding to the distributions that satisfy: , for all , , except for the lexicographically smallest , where .

While we decribed the function recursively above, we compute it iteratively from through .

C.2 Proof of Theorem 13

In this appendix, we prove the correctness and running time of the algorithm presented in Section 5, providing a proof of Theorem 13. Intuitively, if we did not perform any rounding of distributions, our algorithm would have been exact, outputting an optimal price vector in . We show next that the rounding is fine enough that it does not become detrimental to our revenue. To show this, we use the probabilistic concepts of total variation distance and coupling of random variables. Recall that the total variation distance between two distributions and over a finite set is defined as follows

Similarly, if and are two random variables ranging over a finite set, their total variation distance, denoted is defined as the total variation distance between their distributions.

Proceeding to the correctness of our algorithm, let be an arbitrary price vector. We can use this price vector to select cells of our dynamic programming table, picking one cell per layer. The cells are those that the algorithm would have traversed if it made the decision of assigning price to item , for all . Let us call the resulting cells .

For all , we intend to compare the distributions and , which are respectively the (winning-value,winning-price) distribution:

-

•

arising when the prefix of items with distributions is priced according to price vector ;

-

•

stored in of the DP table.

The following lemma shows that these distributions have small total variation distance.

Lemma 22.

For all ,

Proof.

At a high level, our argument shows two properties for every : (1) if rounding was not performed at step of the DP algorithm, the distance between and would not increase compared to the distance between and ; (2) after the rounding is performed the distance increases by at most . Combining the two properties, we can prove the lemma.

Formally, we prove the lemma by induction. The base case is trivially true as is just a rounding of into probabilities that are multiples of , whereby the probability of every point in the support is modified by no more than an additive .

We proceed to show the inductive step. For convenience, for all , let be a random variable distributed according to , i.e. for all , and let be a random variable distributed according to .

Now suppose that the claim is true for . We want to show that it holds for . For this purpose we define an auxiliary random variable . is a function of the random variable and an independent random variable distributed according to . If , we set , otherwise we set . Clearly, if we replaced by in this definition, we would get a random variable with the same distribution as .

Now consider the following coupling of and . Use the optimal coupling of and . Then generate both and using the above procedure with the same sample for . It is clear then that, conditioning on , with probability . So

| (4) |

where the first inequality is true under any coupling, the second inequality is true for our particular coupling, and the last equality is true because we assumed an optimal coupling of and .

On the other hand, we know that, if we round the distribution of into integer multiples of , we will get the distribution of . Therefore,

| (5) |

Proof of Theorem 13: Correctness: Let be an optimal price vector for the instance of RestrictedPrice resulting after the reduction of Lemma 23 is applied to discretize the ’s into ’s. Let be the cell at layer of the DP table corresponding to the price vector . Lemma 22 implies that

where is the true (winning-value,winning-price) distribution corresponding to price vector and is the distribution stored in cell . Clearly, the expected revenues and from these two distributions are related, as follows

Now let be the cell at layer of the DP table that has the highest expected revenue, and let be the price vector stored in . Using the same notation as above, call the revenue from the distribution stored at and the revenue from price vector . Then we have the following:

| (6) | ||||

| (7) |

Putting all the above together, we obtain that

| (8) |

Hence, the price vector output by our algorithm achieves revenue that is close to the optimal revenue for the discretized distributions . We now have to relate this revenue to the optimal revenue for the distributions . So let us define the following quantities:

-

•

: the revenue achieved by price vector in the original instance ;

-

•

: the revenue achieved by price vector in the original instance .

Using Lemma 23 we easily see the following:

-

•

;

-

•

-

•

Combining these with (8), we get

Running Time: Recall that both the support of the value distributions and the set of prices are explicitly part of the input to our algorithm.