The small-maturity smile for exponential Lévy models

Abstract

We derive a small-time expansion for out-of-the-money call options under an exponential Lévy model, using the small-time expansion for the distribution function given in Figueroa-López&Houdré[FLH09], combined with a change of numéraire via the Esscher transform. In particular, we find that the effect of a non-zero volatility of the Gaussian component of the driving Lévy process is to increase the call price by as , where is the Lévy density. Using the small-time expansion for call options, we then derive a small-time expansion for the implied volatility at log-moneyness , which sharpens the first order estimate given in [Tnkv10]. Our numerical results show that the second order approximation can significantly outperform the first order approximation. Our results are also extended to a class of time-changed Lévy models. We also consider a small-time, small log-moneyness regime for the CGMY model, and apply this approach to the small-time pricing of at-the-money call options; we show that for , and the corresponding at-the-money implied volatility satisfies , where is a symmetric -stable random variable under and is the usual parameter for the CGMY model appearing in the Lévy density of the process.

1 Introduction

Lévy processes have played an important role in the development of financial models which can accurately approximate the so-called stylized features of historical asset prices and option prices. In the “statistical world”, financial asset prices exhibit distributions with heavy tails and high kurtosis as well as other dynamical features such as volatility clustering and leverage. In the “risk-neutral world”, market prices of vanilla options exhibit “skewed” implied volatilities (relative to changes in the strike), contradicting the classical Black-Scholes model which predicts a flat implied volatility smile. The smile phenomenon has been more pronounced after the 1987 market crash. Concretely, out-of-the-money equity put options typically bear a higher risk-premium (larger implied volatilities) than in-the-money puts. This effect is more dramatic as the time-to-maturity decreases. As explained in [CT04] (see Section 1.2.2), the latter empirical fact is viewed by many as a clear indication that a jump risk is recognized by the participants in the option market, and stochastic volatility models are, in general, not able to reproduce the pronounced implied volatility skew of short-term option prices unless the “volatility of volatility” is forced to take high values.

The literature on small-time asymptotics for option prices and implied volatilities has grown significantly during the last decade. For recent accounts of the subject in the case of stochastic volatility models, we refer the reader to [GHLOW09] for local volatility models, [FJL10] for the Heston model, [Forde09] for a general uncorrelated local-stochastic volatility model and [Forde10] for SABR type models. We concentrate here on asset price models with jumps. For an Itô semimartingale model for the underlying price process , Carr&Wu[CW03] argued, by partially heuristic arguments, that the price of an out-of-the-money call option converges to zero at sharply different speeds depending on whether the underlying asset price process is purely continuous, purely discontinuous, or a combination of both. For instance, in the presence of jumps, they argue that the

| (1) |

for some constant , as the time-to-maturity tends to 111Actually, [CW03] wrote , even though in their empirical analysis they are assuming a stronger statement such as (1)., while the call price converges at the rate for a purely-continuous model. These statements were subsequently exploited in [CW03] to investigate which kind of model is more adequate to describe the observed market option prices near to expiration. They concluded the necessity of both a continuous and a jump component to describe the implied volatility of S&P 500 index options and argued, based on simulation experiments, that the theoretical asymptotic behavior is usually manifested by options maturing within 20 days. We also refer the reader to [AS02] for further empirical evidence on the presence of both a continuous and jump component.

Using the closed-form expressions for call option prices, Boyarchenko&Levendorksii[BL02] (see also [Lev04a], [Lev04b], [Lev04c]) establish the following small-time asymptotic behaviour

| (2) |

for several popular exponential Lévy models , where is the log-moneyness and is the Lévy measure of the underlying Lévy process . Subsequently, Levendorskii [Lev08] obtained (2) under certain technical conditions (see Theorem 2.1 therein), namely that for some , and exists in the “out-of-the-money region”. More recently, Roper[Rop10] and Tankov [Tnkv10] prove that (2) holds for a general Lévy process under mild conditions, using the first-order small-time moment asymptotic result

| (3) |

valid for functions that converges to as at an appropriate rate (see, e.g. Figueroa-López[FL08] for details). In particular, it suffices that . [Lev08] also provides a natural generalization of (2) for a wide class of multi-factor Lévy and Markov models.

As a corollary of (2), [Rop10] and [Tnkv10] prove independently that the implied volatility for exponential Lévy models explodes near expiration for out-of-the-money vanilla options. This is a very peculiar feature of financial models with jumps (see Remark 2.6 below for a brief discussion about its meaning). [Tnkv10] goes one step further and shows that

| (4) |

as . For at-the-money call option prices, [Rop10] also shows that the leading order term is and does not depend on the jump component of the model. Moreover, the at-the-money implied volatility converges to the volatility of the Gaussian component of the driving Lévy process, and the limit is zero if the Lévy process has no Gaussian part. For bounded variation Lévy processes and for certain tempered-stable like Lévy processes, [Tnkv10] gives also the first-order asymptotic behavior of at-the-money implied volatilities. The asymptotic behavior (4) is in sharp contrast with a pure-continuous stochastic volatility model, where the implied volatility converges to a non-negative constant which depends on the shortest distance from zero to the vertical line with -coordinate equal to the log-moneyness of the call option, under the Riemmanian metric induced by the diffusion coefficient for the model (see, e.g. [GHLOW09], [FJL10], [Forde09], [Forde10]).

In this article, we extend previous results by computing the second order correction term in the call option price approximation:

| (5) |

An important component in our proofs is played by the recent higher order small-time expansions for the distribution function of a Lévy process obtained in Figueroa-López&Houdré[FLH09]. In the spirit of the Black-Scholes formula and the classical change of numéraire, our approach exploits an appealing representation of the prices of out-of-the money options in terms of the tail distribution functions of the underlying Lévy process under both the original risk-neutral probability measure and under the martingale probability measure obtained when we take the stock as the numéraire; i.e. (see e.g. Chapter 26 in [Bjr09] and references therein). The latter measure is sometimes called Share measure (see e.g Carr&Madan[CM09]). Our results allow us to quantify precisely the effects of a non-zero Gaussian-component in the call option prices near expiration. We find that a continuous-component volatility of will result in an call price increase of (per each dollar of the underlying spot price), where is the Lévy density and is the log-moneyness.

We also derive the corresponding small-time asymptotic behaviour for implied volatility, showing precisely how the implied volatility diverges to (see Section 2). We find that the dimensionless implied variance does tend to zero as we would expect, but very slowly; in fact slower than for any , and consequently the implied volatility explodes in the small-time limit. Furthermore, we characterize the asymptotic behavior of the relative error of the first order approximation, which is then used to obtain a second-order approximation for the implied volatility of out-of-the money call options. According to our numerical results (see Section 6 for the details), the second order approximation significantly reduces the error compared to that of the first order approximation, achieving up to a two-fold relative error reduction in some cases.

We later extend our analysis to the case of a time-changed exponential Lévy model with an independent absolutely-continuous time change satisfying some mild moment conditions (see Section 3). The time-changed Lévy model was proposed in [CGMY03] to incorporate the volatility clustering and leverage effects commonly exhibited by financial price processes. We show that the small-time behavior of call option prices depends not only on the triplet of the underlying Lévy process but also on the time-zero first and second moments of the speed process and the quantity

which is assumed to exist. In some sense, measures the current average acceleration of the random clock. Under mild conditions, we show that

where are the first and second order terms appearing in the pure-Lévy option price approximation (5). For a Cox-Ingersoll-Ross (CIR) speed process

the current acceleration of the process is and, hence, call option prices will exhibit the following small-maturity asymptotic behavior:

As seen from this expression, a mean reversion speed of will increase (resp., decrease) the call option price when the current volatility is above (resp. below) the long-run mean volatility value .

In Section 4, we also consider a small-time, small log-moneyness regime for the CGMY model of [CGMY02]. The CGMY model is a particular case of the more general KoBoL class of models, named after the authors [Kop95] (who first introduced the symmetric version of the model under the name of “truncated Lévy flights”) and [BL02]. Using the fact that converges weakly to a symmetric alpha-stable distribution with as , we show that

for , where is a symmetric -stable random variable under . We then apply this result to small-time pricing of at-the-money call options for the CGMY model. Our method of proof is new and based on the following representation by Carr&Madan[CM09]

| (6) |

where is an independent exponential random variable under with parameter 1. As a corollary, we conclude that the corresponding at-the-money implied volatility satisfies . [Tnkv10] obtains a similar result in a more general model using a different approach based on a Fourier-type representation for call option prices. Let us also remark that the method of proof introduced here can be applied to a large class of Lévy processes whose Lévy densities are symmetric and dominated by stable Lévy densities, and behave like a symmetric -stable process in the small-time limit (see Remark 4.3 for the details).

In section 5, we derive a similar small-time estimate for variance call options using the well known fact that the quadratic variation of a Lévy process is itself a Lévy process. Using the main result in [FL08], we find that an out-of-the-money variance call option which pays at time is worth the same as a European-style contract paying at time as , irrespective of the Lévy measure . The diffusion component of does not show up at leading order for small . See also [KRMK11] for a related discussion on the difference between the small-time behaviour of variance call options on the exact quadratic variation and its discretely sampled approximation for Lévy driven models.

2 Small-time asymptotics for exponential Lévy models

Consider an exponential Lévy model for a stock price process

| (7) |

where is a Lévy process defined on a complete probability space with generating triplet . We are assuming zero interest rate and dividend yield for simplicity 222For a non-zero constant interest rate and dividend rate , the results in this paper will not be qualitatively any different, because we can just replace the stock price process with the forward price process , which is a martingale (see, e.g. Chapter 11 in [CT04]). and that represents a risk-neutral pricing measure. We assume that and that the following condition is satisfied

| (8) |

so that is indeed a -martingale relative to its own filtration.

Throughout the paper, we also assume that the Lévy measure admits a positive density, denoted , and that this density is in satisfying for every . The choice between the Lévy measure and density should be clear from the context. Under the previous standing condition, Figueroa-López&Houdré [FLH09] show the following result (see Remark 3.3 and Proposition 3.4 therein):

Theorem 2.1

[FLH09]. Let be fixed. Then, we have the following small-time behaviour for the distribution function of :

where

| (9) | |||||

Furthermore, if the pure-jump component of has finite variation, i.e. , then simplifies to

| (10) |

where is the drift of the pure-jump component of defined by .

Remark 2.1

The double integrals in (9) and (10) are well-defined. For instance, by the symmetry of about the line ,

| (11) | ||||

which is finite because (being a bounded variation process). To obtain the bound on the first integral (11), we used the fact that the range for is from to and, hence, the maximal range for u in the inner integral is . Similarly, by Fubini’s theorem,

In the following proposition, we use Theorem 2.1 to establish a small-time estimate for the price of an out-of-the-money call option under the model in (7):

Proposition 2.2

Assume that

| (12) |

for any . Then we have the following small-time expansion for the price of a call option with strike

| (13) |

where is the log-moneyness and with and given by

| (14) |

Remark 2.2

This result sharpens the asymptotic behavior (2), established by Levendorskii [Lev08] for a class of multi-factor Lévy and Markov models under certain technical conditions. As explained in the introduction, for a Lévy model, these conditions were relaxed by Roper[Rop10] and Tankov [Tnkv10]. Note also that, by imposing that has a positive Lévy density, we are precluding the Black-Scholes case where there is a non-zero diffusion component with volatility and zero jump component, for which the implied volatility is just constant and equal to .

Proof.

Without loss of generality, we assume that is the canonical process defined on (the space of right-continuous functions with left limit ) and equipped with the field and the right-continuous filtration . Following the density transformation construction of Sato[Sat99] (see Definition 33.4 and Example 33.4 therein) and using the martingale condition (8), we define on such that

| (15) |

for any and . As explained in the introduction, we can interpret as the martingale measure associated with using the stock price as the numéraire.

Let us first note that the price of a call option can be decomposed as follows:

| (16) | |||||

One can check that is a Lévy process under with characteristic triplet . For this result see the more general Theorem 33.1 in Sato[Sat99]. Finally, applying Theorem 2.1 to the probabilities under and in (16), we have

| (17) |

which simplifies to (13). ∎

Remark 2.3

Let us note that for a bounded variation process, the drift of under the Share measure is the same as the drift under the measure . Indeed, denoting the drift under , we have that

Also, note that the call price approximation (13) is independent of . Indeed, let

which depends only on as seen from the expression of in (9). Then, using (14), the second order term in (13) can be simplified as follows

which does not depend on . The previous expression also shows that

and, hence, a non-zero volatility of has the effect of increasing the call price approximation by .

2.1 Implied volatility

Let denote the Black-Scholes implied volatility at log-moneyness and maturity with zero interest rates, and let denote the dimensionless implied variance. Let

| (18) |

denote the (normalized) leading order and correction terms in (13). By put-call parity, the dominated convergence theorem, and the stochastic continuity of the Lévy process , we have

and from this we can show that as . The following corollary shows more precisely how as and, hence, sharpening a result in Tankov [Tnkv10] (Proposition 4 therein):

Theorem 2.3

For the exponential Lévy model in (7), we have the following small-time behavior for the implied variance for

| (19) |

where

| (20) |

Proof.

See Appendix A.∎

Remark 2.4

Multiplying (19) by , we have the following expansion for the implied volatility

| (21) |

and we see that as , as is well documented in e.g. Carr&Wu[CW03] (see also Roper[Rop10] and [Tnkv10]). The leading order term agrees with that obtained in Tankov[Tnkv10] and, moreover, we see that

so the (re-scaled) leading order implied volatility smile is V-shaped and independent of , except that we require to be non-zero.

Remark 2.5

, so but slowly; in fact slower than for any . In particular, for a given desired “precision” bound , we will need to ensure that and for the error term in (19) to be . For this reason, the call option estimate (13) is more useful than the implied volatility estimate (21) in practice. We remark that in Corollary 8.3 of the very recent article by Gao&Lee[GL11], the authors give an expansion which sharpens (19), but proving their result is more involved and requires several preliminary lemmas

Remark 2.6

Based on high-frequency statistical methods for Itô semimartingales, several empirical studies have statistically rejected the null hypothesis of either a purely-jump or a purely-continuous model (see, e.g., [AJ09b], [AJ10], [BNS06]). If this really is the case, then our results show that theoretically, the small-maturity smile must tend to infinity, if put/call options are priced correctly. Nevertheless, this effect is often obscured in reality by market practicalities - high bid/offer spreads, daycount/settlement conventions, and times when the market is closed. However, even if we cannot trade an option with infinitesimally small maturity in practice, we can still look at rate at which the implied volatility smile steepens as the maturity goes small; typically it is difficult to fit the one of the fashionable class of purely continuous models (e.g. Heston, SABR, and other local-stochastic volatility hybrid models) to this kind of data, with realistic parameters. Carr&Wu[CW03]’s study of S&P 500 option price data (in contrast to the previous statistical approaches) also suggests that the sample path of the index contains both continuous and discontinuous martingale components (working under a risk neutral measure), and that, while the presence of the jump component varies strongly over time, the continuous component is omnipresent.

In the same vein, Aït-Sahalia&Jacod[AJ09a] define a jump activity index to test for the presence of jumps, which for a Lévy process coincides with the Blumenthal-Getoor index of the process. [AJ09a] also proposes estimators of this index for a discretely sampled process and derive the estimators’ properties.

These estimators are applicable despite the presence of a Brownian component

in the process, which makes it more challenging to infer the characteristics

of the small, infinite activity jumps. When the method is applied to high frequency

stock returns, [AJ09a] found evidence of infinitely active jumps in the data

and they were able to estimate the index of activity.

3 Time-changed Lévy processes

3.1 A formula for out-of-the-money call option prices

In addition to the Lévy process of Section 2, we now consider a random clock defined on and independent of . A random clock is a right-continuous non-decreasing process such that . We consider a time-changed Lévy model of the form

| (22) |

As explained in the introduction, this type of model is important because it can incorporate volatility clustering effects.

Given that is a martingale under (relative to the natural filtration generated by ), it is known that above is a martingale under relative to the natural filtration generated by the random clock and the time-changed process (see Lemma 15.2 in [CT04]). Note also that our simplifying assumption (8) implies that

| (23) |

because . [CGMY03] (Section 4.2) shows that the price process (23) is free of static arbitrage opportunities. Furthermore, under certain conditions (e.g. if has infinite jump activity and is continuous), (see, e.g., Theorem 1 in [Win01]), and hence (22) will be a martingale relative to the filtration generated by only the time-changed process or, equivalently, the filtration generated by the stock-price process . In that case, the model (22) will be free of dynamic arbitrage opportunities by the sufficiency part of the First Fundamental Theorem of Asset Pricing.

Let be the set of -null sets of and define a probability measure on such that, for any ,

| (24) |

whenever . We note that is well defined since is a -martingale relative to . The following proposition will play a key role in the sequel:

Proposition 3.1

Proof.

Fix and . Then, using the independence between and ,

The last expression corresponds to the characteristic function of a process of the form , where is a Lévy process with triplet defined on and independent of the random clock . ∎

In light of the previous result, we have the following representation for call option prices:

| (25) | |||||

We emphasize again that, under , has the same distribution as a Lévy process with characteristic triplet evaluated at an independent random clock . Hence, as for the pure-Lévy model case, the problem of finding small-time expansions for out-the-money option prices reduces to finding small-time asymptotics of the corresponding distribution functions.

3.2 Small-time asymptotics for the time-changed Lévy model

In this section, we determine the asymptotic behavior of out-the-money call option prices. We consider random clocks that are absolutely continuous with non-negative rate process (i.e. ) such that . We will also refer to the following conditions in the sequel:

| (26) | ||||

| (27) |

In the case that is a stationary process with finite moment of third order, is constant for and (i)-(iv) are automatically satisfied. Also, if and (iv) are satisfied, then (v) holds true with . Indeed, note first that since are uniformly integrable for small enough by (iv) above. Also, since (by Jensen’s inequality) and , so the dominated convergence theorem implies that

The following result gives the small-time asymptotic behavior of the tail distributions of time-changed Lévy models:

Theorem 3.2

Proof.

See Appendix A.∎

Remark 3.1

A very popular rate process in applications is the Cox-Ingersoll-Ross (CIR) diffusion process, defined by

| (30) |

where is a standard Brownian motion, is an integrable positive random variable independent of , and are such that (which ensures that is an inaccessible boundary). If , the proces is stationary and is finite and constant in for any . In particular, (i)-(v) are satisfied with . In the non-stationary case, it is known that and (i) & (iii) are satisfied with . The other conditions in (26-27) will also hold true. Thus we conclude that the time-changed Lévy model with CIR speed process satisfies:

We are now ready to give the small-time asymptotic behavior of out-the-money call option prices and the corresponding implied volatility:

Corollary 3.3

Proof.

Remark 3.2

As it was indicated before, the time-changed Lévy model (22) was introduced to account for the volatility clustering exhibited by financial time series. Indeed, the process controls the speed of the random clock so that when is high, the random clock runs faster and, hence, the price process exhibits more variability. Another approach to incorporate stochastic volatility is via stochastic integration along the lines of the following jump-diffusion model

| (34) |

where and are two (possibly correlated) Brownian motions and is a pure-jump process. For a comparison of these two methods, we refer the reader to Chapter 15 of [CT04]. Recently, [FLGH11] have provided small-time expansions for vanilla option prices under the stochastic model (34) when is a pure-jump Lévy process independent of .

4 Small-time, small log-moneyness asymptotics

In this section, we survey the behavior of for a Lévy process , when and also converges to zero at an appropriate rate. We can think of this scaling as a small-time, small log-moneyness regime. As an application, we deduce the asymptotic behavior of at-the-money call option prices for a CGMY model.

4.1 Lévy models with non-zero Brownian component

Several financial models in the literature consist of a Lévy model with non-zero Brownian component. The most popular models of this kind are the Merton model and Kou model determined by the characteristic functions

It turns out that, for a general Lévy process with ,

(see e.g. pp. 40 in [Sat99] for a formal proof). The right-hand side is the characteristic function of a Normal random variable , thus converges weakly to a Normal distribution with variance and

4.2 The CGMY model and other tempered stable models

The so-called CGMY model is a pure-jump Lévy process determined by a Lévy density of the form

| (35) |

for and . As explained in the introduction, the CGMY model is a particular case of the more general KoBoL class of models, named after the authors [Kop95] (who first introduced the symmetric version of the model under the name of “truncated Lévy flights”) and [BL02]. The term CGMY was introduced later on by Carr et al. [CGMY02]. This process is a tempered stable process (see Section 4.5 in Cont&Tankov[CT04]), and its characteristic function is given as

| (36) |

for and some constant (see [CT04] for the formula when ). We note that we must have for (12) to be satisfied, and under this condition, is again a CGMY process under with parameters , , , and . In the bounded variation case (), coincides with the drift .

The following result characterizes the small-time behavior of with small log-moneyness .

Proposition 4.1

For the CGMY model with , converges weakly to a symmetric -stable distribution as . Concretely,

where is a symmetric -stable random variable with scale parameter ; i.e. has characteristic function

Remark 4.1

Note that has infinite variance because . The stable distribution was famously used by Mandelbrot[Man63] to model power-like tails and self-similar behaviour in cotton price returns.

Proof.

Let

| (37) |

denote the characteristic exponent for the CGMY process. Then we have

where we used that . is continuous at zero and we recognize as the characteristic function of a symmetric alpha-stable distribution. Thus, by Lévy’s convergence theorem (see Theorem 18.1 in Williams[Will91]), the sequence of random variables converges weakly to . The second result follows from the Lemma on page 181, chapter 17 in [Will91]. ∎

Remark 4.2

Proposition 4.1 is a particular case of a result shown in Rosiński [Ros07] where a more general class of tempered Lévy measures is considered. Concretely, [Ros07] considers Lévy measures of the form

| (38) |

for a measure such that and . The CGMY model is recovered by taking . In light of Rosiński’s Theorem 3.1, it follows that Proposition 4.1 also holds true for (finite-variation case) provided that is driftless, i.e. in (36) must be (otherwise, we have to replace by ). Note that under , is also driftless (see Remark 2.3).

Another well-know class of Lévy processes is the Normal Inverse Gaussian (NIG) model, introduced in Barndorff-Nielsen[Bar97], for which the characteristic function is given by

The Lévy density of the NIG model takes the form where is the modified Bessel function of second kind and ,, and are certain positive constants (see [CT04] for their expressions). Hence, one can view the NIG process as an improper tempered stable process in the sense of Rosiński [Ros07]. It is also easy to see that

The right-hand side is the characteristic function of a symmetric alpha-stable random variable with and scale parameter i.e. a Cauchy distribution; thus by the same argument we see that converges weakly to a symmetric Cauchy distribution:

4.3 At-the-money call option prices for the CGMY model

Our approach to deal with at-the-money call option prices is based on the following result from Carr&Madan[CM09]:

| (39) |

where is an independent exponential random variable under with parameter 1. Now set . Consider the CGMY model with . The idea is to use the small-time, small log-moneyness result in the previous section. Indeed, note that

| (40) |

From our Proposition 4.1,

for any , where is a symmetric -stable r.v. under . The previous fact suggests the following result:

Proposition 4.2

Suppose that is a CGMY process under with . Then, the at-the-money call option price has the following asymptotic behavior:

| (41) |

where is a symmetric -stable r.v. as in Proposition 4.1.

Proof.

See Appendix A.∎

In order to justify the previous argument, we will need the following estimate:

Lemma 4.3

Let denote a symmetric CGMY process under (hence ) with , , and . Then, there exists a universal constant such that

| (42) |

for any and satisfying

Proof.

See Appendix A.∎

Remark 4.3

As seen in the proof of Lemma 4.3, the estimate (42) is valid for any pure-jump Lévy process admitting a symmetric Lévy density such that

for some , , and . Moreover, as seen in the proofs of Proposition 4.2 if we further assume that

| (43) |

as under (for a symmetric -stable process ), then the asymptotic behavior (41) will also hold. Condition (43) holds for a wide range of processes (see, for instance, Proposition 1 in [RT11] for relatively mild conditions).

4.4 At-the-money implied volatility

Proposition 4.4

For the CGMY model with in Proposition 4.2, we have the following small-time behaviour for the at-the-money implied volatility

Proof.

We first recall that the dimensionless implied variance as . Equating prices under the the Lévy model and the Black-Scholes model, we know that for any , there exists a such that for all we have

Re-arranging, we see that

We proceed similarly for the upper bound. ∎

5 Robust pricing of variance call options at small maturities

Let denote the general Lévy process defined in section 2. The quadratic variation process is a subordinator and has Lévy density given by

(see e.g. [CGMY05]). The function for satisfies the conditions of Theorem 1.1 in Figueroa-López[FL08], so we have

| (44) | ||||

| (45) | ||||

From this we see that an out-of-the-money variance call option of strike which pays at time is worth the same as a European-style contract paying at time as , irrespective of . Note that the diffusion component of does not show up at leading order for small . We also remark that the higher order terms in (44) and (45) can be obtained by using the expansions in Theorem 2.1 and the following identities:

6 Numerical examples

In their seminal work, Carr et al.[CGMY02] calibrated the CGMY model and the Variance Gamma (VG) model to option closing prices of several stocks and indices. In this section, we shall use some of their calibrated parameters to illustrate the approximation proposed in this paper. As in Section 2, we are assuming below that the risk-free rate and the dividend rate are both set to be zero.

Using IBM closing option prices on February 10th, 1999 and maturities of 1 and 2 months, [CGMY02] report the following calibrated parameters for the VG model:

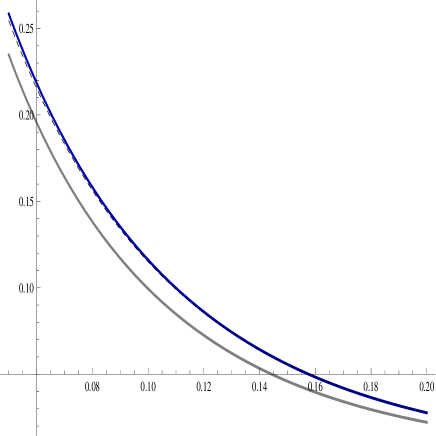

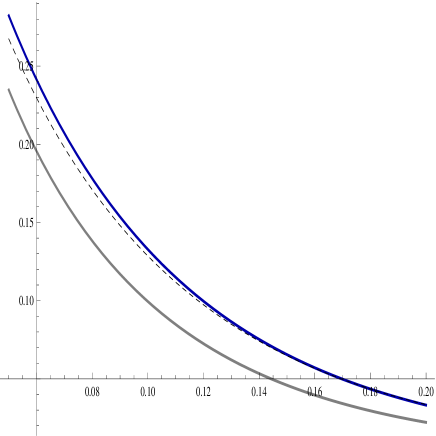

where , , and are the three parameters characterizing the VG process (see e.g. [CT04]), and is the volatility of an additional independent Wiener component. In order to assess the accuracy of the call price approximation (13), we have plotted (in Figure 1) the first and second order approximations of as a function of the log moneyness for and time-to-maturities and (in years). We have also plotted the “true” option prices obtained via an inverse Fourier Transform (IFT) method (see Theorem 5.1 in [Lee04] for the case corresponding to the call option payoff with ). Table 1 also shows the numerical approximations for corresponding to four maturities, together with the numerical values obtained via the IFT. Note that the first order approximation (i.e. ) is independent of time-to-maturity . The graphs show that the second order approximation significantly outperforms the first order approximation. The corresponding table shows that the second order approximation is quite good for maturities of 5 to 10 days and logmoneyness values larger than .

The numerical values via the IFT method were implemented in Mathematica, while the coefficient (9) was computed using numerical integration routines of Mathematica. This computation is typically slow due to the singularity of the Lévy density and the cumbersome double integrals. A much faster numerical method, valid for bounded variation Lévy processes, is described in [FL10] (see below for an illustration of this method).

| Time-to-mat. t | 1/252 | 5/252 | 10/252 | 20/252 | |||||

| x | 1st | 2nd | IFT | 2nd | IFT | 2nd | IFT | 2nd | IFT |

| 0.05 | 234.6977 | 239.4463 | 239.2843 | 258.4404 | 254.5295 | 282.1831 | 267.3434 | 329.6684 | 277.3445 |

| 0.06 | 195.4777 | 200.0560 | 199.9317 | 218.3694 | 215.3264 | 241.2611 | 229.5224 | 287.0445 | 244.4061 |

| 0.07 | 163.8997 | 168.2079 | 168.1131 | 185.4408 | 183.0887 | 206.9820 | 197.7644 | 250.0643 | 215.6399 |

| 0.08 | 138.1606 | 142.1521 | 142.0805 | 158.1182 | 156.3154 | 178.0757 | 170.8989 | 217.9909 | 190.4486 |

| 0.09 | 116.9799 | 120.6392 | 120.5857 | 135.2765 | 133.9099 | 153.5732 | 148.0422 | 190.1665 | 168.3418 |

| 0.1 | 99.4165 | 102.7465 | 102.7072 | 116.0661 | 115.0451 | 132.7157 | 128.5074 | 166.0149 | 148.9089 |

| 0.11 | 84.7611 | 87.7748 | 87.7466 | 99.8297 | 99.0818 | 114.8984 | 111.7494 | 145.0357 | 131.8027 |

| 0.12 | 72.4675 | 75.1840 | 75.1644 | 86.0500 | 85.5170 | 99.6325 | 97.3285 | 126.7974 | 116.7270 |

| 0.13 | 62.1087 | 64.5497 | 64.5368 | 74.3137 | 73.9493 | 86.5186 | 84.8855 | 110.9285 | 103.4274 |

| 0.14 | 53.3465 | 55.5346 | 55.5269 | 64.2872 | 64.0541 | 75.2279 | 74.1246 | 97.1093 | 91.6844 |

| 0.15 | 45.9096 | 47.8674 | 47.8636 | 55.6984 | 55.5669 | 65.4873 | 64.7996 | 85.0649 | 81.3079 |

| 0.16 | 39.5787 | 41.3278 | 41.3269 | 48.3238 | 48.2701 | 57.0689 | 56.7045 | 74.5590 | 72.1326 |

| 0.17 | 34.1752 | 35.7358 | 35.7372 | 41.9783 | 41.9835 | 49.7815 | 49.6660 | 65.3878 | 64.0145 |

| 0.18 | 29.5521 | 30.9433 | 30.9463 | 36.5080 | 36.5571 | 43.4639 | 43.5376 | 57.3758 | 56.8280 |

| 0.19 | 25.5884 | 26.8275 | 26.8317 | 31.7841 | 31.8651 | 37.9799 | 38.1947 | 50.3714 | 50.4628 |

| 0.2 | 22.1834 | 23.2864 | 23.2913 | 27.6985 | 27.8019 | 33.2136 | 33.5313 | 44.2438 | 44.8227 |

In order to illustrate the performance of the approximations for larger volatility values, we now consider the parameters:

which were calibrated to fit INTEL option data as reported in [CGMY02]. The results are shown in Figure 1 for and time-to-maturities and (in years). Table 2 shows the numerical approximations for corresponding to four maturities. We also show the numerical values obtained via the IFT. The second order approximation is again quite good for mid-range log-moneyness values and no noticeable difference is observed even though is significantly larger.

| Time-to-mat. t | 1/252 | 5/252 | 10/252 | 20/252 | |||||

| x | 1st | 2nd | IFT | 2nd | IFT | 2nd | IFT | 2nd | IFT |

| 0.05 | 12.7382 | 13.6052 | 13.6253 | 17.0732 | 17.5978 | 21.4081 | 23.7455 | 30.0780 | 36.6508 |

| 0.06 | 8.3203 | 8.8906 | 8.9038 | 11.1717 | 11.5085 | 14.0232 | 15.4255 | 19.7261 | 24.6815 |

| 0.07 | 5.4984 | 5.8797 | 5.8887 | 7.4046 | 7.6352 | 9.3108 | 10.2499 | 13.1232 | 16.7357 |

| 0.08 | 3.6672 | 3.9249 | 3.9312 | 4.9559 | 5.1175 | 6.2446 | 6.9034 | 8.8221 | 11.4468 |

| 0.09 | 2.4641 | 2.6398 | 2.6443 | 3.3426 | 3.4572 | 4.2212 | 4.6912 | 5.9782 | 7.8929 |

| 0.1 | 1.6660 | 1.7865 | 1.7897 | 2.2687 | 2.3504 | 2.8714 | 3.2090 | 4.0769 | 5.4783 |

| 0.11 | 1.1323 | 1.2154 | 1.2177 | 1.5479 | 1.6063 | 1.9635 | 2.2067 | 2.7947 | 3.8216 |

| 0.12 | 0.7730 | 0.8306 | 0.8322 | 1.0608 | 1.1027 | 1.3485 | 1.5239 | 1.9241 | 2.6763 |

| 0.13 | 0.5298 | 0.5698 | 0.5709 | 0.7297 | 0.7598 | 0.9297 | 1.0562 | 1.3295 | 1.8801 |

| 0.14 | 0.3643 | 0.3922 | 0.3930 | 0.5037 | 0.5252 | 0.6430 | 0.7343 | 0.9216 | 1.3240 |

| 0.15 | 0.2513 | 0.2708 | 0.2714 | 0.3486 | 0.3641 | 0.4460 | 0.5119 | 0.6406 | 0.9344 |

| 0.16 | 0.1738 | 0.1875 | 0.1879 | 0.2420 | 0.2531 | 0.3101 | 0.3577 | 0.4464 | 0.6607 |

| 0.17 | 0.1205 | 0.1301 | 0.1304 | 0.1683 | 0.1763 | 0.2161 | 0.2504 | 0.3117 | 0.4679 |

| 0.18 | 0.0837 | 0.0905 | 0.0907 | 0.1173 | 0.1231 | 0.1509 | 0.1757 | 0.2181 | 0.3318 |

| 0.19 | 0.0583 | 0.0630 | 0.0632 | 0.0819 | 0.0861 | 0.1056 | 0.1234 | 0.1528 | 0.2356 |

| 0.2 | 0.0407 | 0.0440 | 0.0441 | 0.0573 | 0.0603 | 0.0740 | 0.0869 | 0.1073 | 0.1675 |

For the case of Microsoft option prices on December 9th, 1999 and maturities of 1 and 2 months, [CGMY02] report the following parameters for a CGMY model:

Table 3 shows the numerical approximations for corresponding to four maturities, together with the numerical values obtained via the IFT (computed using Mathematica). As before, the approximations perform quite well and we are able to attain a decent approximation even for a maturity of 20 days. To compute the second order approximations (or more specifically, to compute the coefficient (9)), we have employed the method in [FL10].

| Time-to-mat. t | 1/252 | 5/252 | 10/252 | 20/252 | |||||

| x | 1st | 2nd | IFT | 2nd | IFT | 2nd | IFT | 2nd | IFT |

| 0.05 | 118.8662 | 120.2883 | 120.5386 | 125.9768 | 125.9179 | 133.0875 | 131.5844 | 147.3088 | 139.5891 |

| 0.06 | 99.6004 | 100.8808 | 101.1351 | 106.0023 | 106.0868 | 112.4042 | 111.5177 | 125.2081 | 119.9024 |

| 0.07 | 84.3149 | 85.4610 | 85.7023 | 90.0455 | 90.1924 | 95.7760 | 95.2726 | 107.2372 | 103.5827 |

| 0.08 | 71.9095 | 72.9321 | 73.1727 | 77.0226 | 77.2339 | 82.1358 | 81.9201 | 92.3620 | 89.9114 |

| 0.09 | 61.7191 | 62.6303 | 62.8747 | 66.2750 | 66.5275 | 70.8309 | 70.8150 | 79.9426 | 78.3608 |

| 0.1 | 53.2682 | 54.0799 | 54.3141 | 57.3264 | 57.5892 | 61.3846 | 61.4910 | 69.5011 | 68.5328 |

| 0.11 | 46.1664 | 46.8892 | 47.1192 | 49.7805 | 50.0626 | 53.3947 | 53.6011 | 60.6229 | 60.1205 |

| 0.12 | 40.1763 | 40.8204 | 41.0433 | 43.3967 | 43.6782 | 46.6171 | 46.8806 | 53.0579 | 52.8833 |

| 0.13 | 35.0705 | 35.6445 | 35.8690 | 37.9408 | 38.2302 | 40.8111 | 41.1241 | 46.5517 | 46.6292 |

| 0.14 | 30.7034 | 31.2154 | 31.4361 | 33.2632 | 33.5566 | 35.8230 | 36.1693 | 40.9425 | 41.2037 |

| 0.15 | 26.9570 | 27.4140 | 27.6311 | 29.2418 | 29.5285 | 31.5266 | 31.8864 | 36.0962 | 36.4806 |

| 0.16 | 23.7163 | 24.1244 | 24.3391 | 25.7565 | 26.0433 | 27.7968 | 28.1703 | 31.8772 | 32.3565 |

| 0.17 | 20.9085 | 21.2731 | 21.4858 | 22.7315 | 23.0167 | 24.5545 | 24.9355 | 28.2005 | 28.7454 |

| 0.18 | 18.4722 | 18.7982 | 19.0082 | 20.1025 | 20.3798 | 21.7327 | 22.1107 | 24.9933 | 25.5756 |

| 0.19 | 16.3432 | 16.6349 | 16.8407 | 17.8017 | 18.0761 | 19.2602 | 19.6377 | 22.1771 | 22.7868 |

| 0.2 | 14.4852 | 14.7463 | 14.9482 | 15.7910 | 16.0580 | 17.0968 | 17.4672 | 19.7084 | 20.3280 |

| 0.21 | 12.8531 | 13.0870 | 13.2891 | 14.0226 | 14.2859 | 15.1920 | 15.5580 | 17.5310 | 18.1563 |

| 0.22 | 11.4193 | 11.6289 | 11.8268 | 12.4672 | 12.7267 | 13.5150 | 13.8752 | 15.6108 | 16.2344 |

| 0.23 | 10.1595 | 10.3474 | 10.5434 | 11.0990 | 11.3517 | 12.0385 | 12.3891 | 13.9176 | 14.5312 |

| 0.24 | 9.0459 | 9.2145 | 9.4085 | 9.8885 | 10.1371 | 10.7310 | 11.0744 | 12.4161 | 13.0193 |

| 0.25 | 8.0621 | 8.2133 | 8.4040 | 8.8179 | 9.0625 | 9.5737 | 9.9096 | 11.0853 | 11.6753 |

| 0.26 | 7.1931 | 7.3287 | 7.4365 | 7.8714 | 8.1099 | 8.5498 | 8.8759 | 9.9065 | 10.4792 |

| 0.27 | 6.4212 | 6.5430 | 6.7291 | 7.0301 | 7.2645 | 7.6389 | 7.9573 | 8.8567 | 9.4132 |

| 0.28 | 5.7374 | 5.8468 | 5.8054 | 6.2842 | 6.5132 | 6.8309 | 7.1400 | 7.9243 | 8.4622 |

| 0.29 | 5.1285 | 5.2267 | 5.4878 | 5.6194 | 5.8445 | 6.1103 | 6.4118 | 7.0920 | 7.6128 |

| 0.3 | 4.5867 | 4.6749 | 4.8038 | 5.0275 | 5.2487 | 5.4683 | 5.7624 | 6.3499 | 6.8534 |

| 0.31 | 4.1050 | 4.1842 | 3.4559 | 4.5009 | 4.7173 | 4.8968 | 5.1826 | 5.6886 | 6.1739 |

| 0.32 | 3.6746 | 3.7457 | 3.7292 | 4.0301 | 4.2427 | 4.3856 | 4.6643 | 5.0966 | 5.5652 |

| 0.33 | 3.2905 | 3.3543 | 3.6098 | 3.6097 | 3.8185 | 3.9289 | 4.2006 | 4.5673 | 5.0195 |

| 0.34 | 2.9479 | 3.0053 | 3.2470 | 3.2346 | 3.4391 | 3.5212 | 3.7855 | 4.0944 | 4.5299 |

| 0.35 | 2.6410 | 2.6925 | 2.8716 | 2.8983 | 3.0991 | 3.1555 | 3.4134 | 3.6701 | 4.0903 |

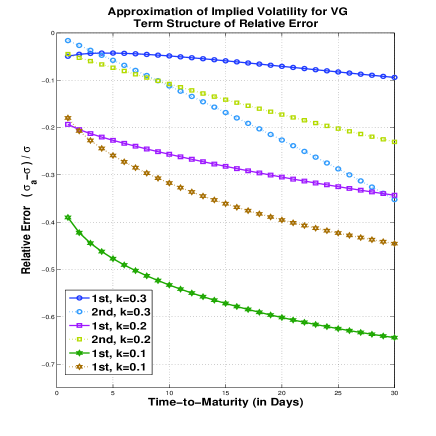

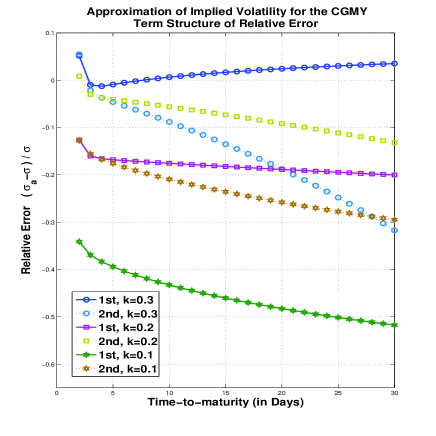

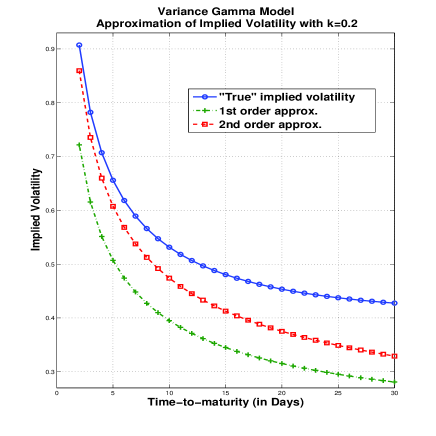

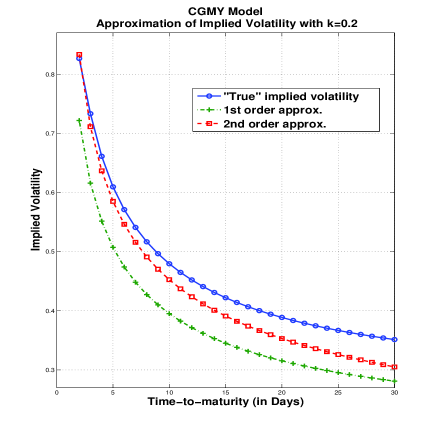

We now proceed to illustrate the performance of the implied volatility approximations described in Section 2.1. Concretely, we analyze the relative error of the approximations

| (46) |

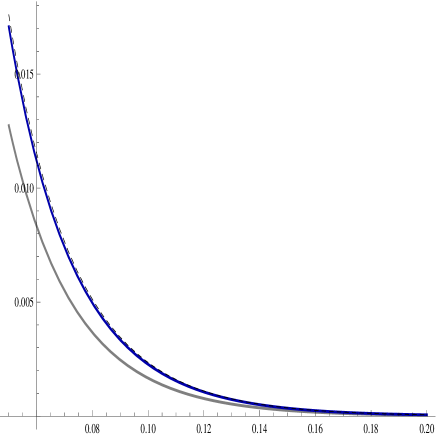

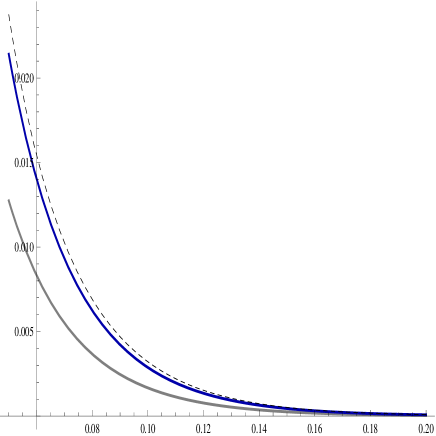

Let us first analyze the Variance Gamma model with parameter values as above. The left panel of Figure 3 shows the relative errors and as a function of time-to-maturity for values of ranging from to . Note that both and consistently underestimate the true implied volatility. For , the first order approximation is actually quite good with a relative error of about uniformly in and it is only for very small values (less than days) when is better than . However, for the other values of , significantly outperforms . For instance, for , the relative error of ranges from to with a mean absolute error of , while the relative error of rages from to with a mean absolute error of . The left panel of Figure 4 compares the term structure of the approximated implied volatilities to the “true” implied volatility333The “true” implied volatility is actually an approximation as we apply numerical integration to compute using the closed-form density of the VG process. This approximation seems not to be very accurate for smaller than days.. The right panel of Figure 3 shows the analog results for the CGMY with parameter values as above. The results are qualitatively similar to those of the Variance Gamma model. However, all the approximations seem to perform better in terms of error stability in time and accuracy. For , the relative error of ranges from to with a mean absolute error of , while the relative error of ranges from to with a mean absolute error of . The right panel of Figure 4 compares the term structure of the approximated implied volatilities to the “true” implied volatility444The true implied volatility is computed by integrating numerically the the density of the CGMY model, which itself is obtained by Fast Fourier methods..

Acknowledgments: It is a pleasure to thank Michael Roper for pointing up several notational mistakes and other helpful comments. We would also like to thank Peter Tankov for providing us with his manuscript.

References

- [AS02] Aït-Sahalia, Y., “Telling from discrete data whether the underlying continuous-time model is a diffusion”, Journal of Finance, 57, 2075-2113, 2002.

- [1]

- [AJ09a] Aït-Sahalia, Y. and J.Jacod, “Estimating the Degree of Activity of Jumps in High Frequency Data”, Annals of Statistics, 2009, 37, 2202-2244.

- [AJ09b] Aït-Sahalia, Y. and J. Jacod, “Testing for jumps in a discretely observed process”, Annals of Statistics, 37:184-222, 2009.

- [AJ10] Aït-Sahalia, Y. and J. Jacod, “Is Brownian motion necessary to model high frequency data?”, Annals of Statistics, 38, 3093-3128, 2010.

- [BNS06] Barndorff-Nielsen, O. and N. Shephard, “Econometrics of testing for jumps in financial economics using bipower variation”, Journal of Financial Econometrics, 4(1):1-30, 2006.

- [Bar97] Barndorff-Nielsen, O., “Normal inverse Gaussian distributions and stochastic volatility modelling”, Scand. J. Statist., 24, 1-13, 1997.

- [Ber96] Bertoin, J., “Lévy processes”, Cambridge University Press, 1996.

- [Bjr09] Björk, T., “Arbitrage Theory in Continuous Times”, Oxford University Press, 2009.

- [BL02] Boyarchenko, S.I., and S.Z. Levendorksii, “Non-Gaussian Merton-Black- Scholes theory”, Adv. Ser. Stat. Sci. Appl. Probab. 9. World Scienti c Publish- ing Co., Inc., River Edge, NJ, 2002.

- [CM09] Carr, P., and D. Madan, “Saddlepoint methods for option pricing”, The Journal of Computational Finance, 13(1), 49-61, 2009.

- [CGMY02] Carr, P., H. Geman, D. Madan and M. Yor, “The fine structure of asset returns: An empirical investigation”, Journal of Business, 75, 303-325, 2002.

- [CGMY03] Carr, P., H. Geman, D. Madan and M. Yor, “Stochastic volatility for Lévy processes”, Mathematical Finance, 13, 345-382, 2003.

- [CGMY05] Carr, P., H. Geman, D. Madan and M. Yor (2005), “Pricing Options on Realized Variance”, Finance and Stochastics, 9, 453-475.

- [CT04] Cont, R. and P. Tankov, “Financial modelling with Jump Processes”, Chapman & Hall, 2004.

- [CW03] Carr, P. and L. Wu, “What type of process underlies options? A simple robust test”, Journal of Finance, 58, no. 6, 2581-2610, 2003.

- [FL08] Figueroa-López, J., “Small-time moment asymptotics for Lévy processes”, Statistics and Probability Letters, 78, 3355-3365, 2008.

- [FL10] Figueroa-López, J., “Approximations for the distributions of bounded variation Lévy processes”, Statistics and Probability Letters, 80, 1744-1757, 2010.

- [FLGH11] Figueroa-López, J., R. Gong, and C. Houdré, “Small-time expansions for the distributions, densities, and option prices of stochastic volatility models with Lévy jumps”, Preprint 2011. Available at http://arxiv.org/abs/1009.4211.

- [FLH09] Figueroa-López, J. and C. Houdré, “Small-time expansions for the transition distribution of Lévy processes”, Stochastic Processes and their Applications, 119 pp. 3862-3889, 2009. DOI: 10.1016/j.spa.2009.09.002.

- [Forde09] Forde, M., “Small-time asymptotics for a general local-stochastic volatility model, using the heat kernel expansion”, Preprint 2009.

- [Forde10] Forde, M., “Exact pricing and large-time asymptotics for the modified SABR model and the Brownian exponential functional”, Preprint 2010.

- [FJL10] Forde, M., A.Jacquier and R.Lee, “The small-time smile and term structure of implied volatility under the Heston model”, Preprint 2010.

- [GL11] Gao, K., and R. Lee, “Asymptotics of Implied Volatility in Extreme Regimes”, Preprint 2011. Available at http://papers.ssrn.com/.

- [GHLOW09] Gatheral, J., E. Hsu, P. Laurence, C. Ouyang, and T. Wang, “Asymptotics of implied volatility in local volatility models”, to appear in Mathematical Finance, 2011.

- [Hou02] Houdré, C., “Remarks on deviation inequalities for functions of infinitely divisible random vectors”, The Annals of Probability, 30(3):1223–1237, 2002.

- [Kop95] Koponen, I. (1995). “Analytic approach to the problem of convergence of truncated Lévy flights towards the Gaussian stochastic process”, Physical Review E, 52, 1197-1199.

- [Lee04] Lee, R.W., “Option Pricing by Transform Methods: Extensions, Unification, and Error Control”, Journal of Computational Finance, 7(3):51-86, 2004.

- [Lev04a] Levendorskii, S., “American and European options near expiry, under Lévy processes”, Tech. report, The University of Texas, 2004. Available at SSRN.

- [Lev04b] Levendorskii, S., “Pricing of the American put under Lévy processes”, International Journal of Theoretical and Applied Finance, 7:303 -335, 2004.

- [Lev04c] Levendorskii, S., “Early exercise boundary and option pricing in Lévy driven models”, Quantitative Finance, 4:525- 547, 2004.

- [Lev08] Levendorskii, S., “American and European Options in Multi-Factor Jump-Diffusion Models Near Expiry”, Finance and Stochastics, 12:4 (2008), pp.541-560.

- [Man63] Mandelbrot, B., “The variation of certain speculative prices”, Journal of Business, 36:394-419, 1963.

- [KRMK11] Keller-Ressel, M. and J. Muhle-Karbe, “Asymptotic and Exact Pricing of Options on Variance”, 2011, to appear in Finance and Stochastics.

- [Olv74] Olver, F.W., “Asymptotics and Special Functions“, Academic Press, 1974.

- [Rop10] Roper, M., “Implied volatility: small time to expiry asymptotics in exponential Lévy models”, Thesis, University of New South Wales, 2009.

- [RT11] Rosenbaum, M., and P. Tankov, “Asymptotic results for time-changed Lévy processes sampled at hitting times”, Preprint. To appear in Stochastic processes and their applications, 2011.

- [Ros07] Rosiński, J., “Tempering stable processes”, Stochastic processes and their applications, 117: 677-707, 2007.

- [Sat99] Sato, K., “Lévy Processes and Infinitely Divisible Distributions”, Cambridge studies in advance mathematics, 1999.

- [Tnkv10] Tankov, P., “Pricing and hedging in exponential Lévy models: review of recent results”, Prepint 2010. To appear in the Paris-Princeton Lecture Notes in Mathematical Finance, Springer 2010.

- [Will91] Williams, D., “Probability with Martingales”, Cambridge Mathematical Textbooks, 1991.

- [Win01] Winkel, M., “The recovery problem for time-changed Lévy processes”, Oxford University, 2001.

Appendix A Proofs

Proof of Theorem 2.3.

We know that . Equating call prices in the small-time limit under the exponential Lévy model (using Proposition 2.2), and the Black-Scholes model with zero interest rates and implied variance (using e.g. Proposition 3.4 in [FJL10] or Lemma 2.5 in [GHLOW09]) we know that for any , there exists a such that for all

| (A-1) |

Re-arranging, we see that

or

, so this yields a lower bound for . Using a similar argument for the corresponding upper bound, we establish the leading order asymptotic behaviour for the implied variance as

| (A-2) |

Now let and note that as . Then for any , there exists a such that for we have

| (A-3) |

Re-arranging, we have

| (A-4) |

Using this bound and again equating small-time call prices under the Lévy model and the Black-Scholes model, we have that there exists a positive constant such that for small enough

where , which converges to as . Dividing both sides by we have

and re-arranging we obtain

Note that and since as . Solving the inequality , we find that

Since for sufficiently small, we conclude that . Proceeding similarly for the upper bound, we conclude that

as . ∎

Proof of Theorem 3.2.

Let and . In the light of Theorem 2.1, there exist constants and such that

for any . Next, conditioning on ,

Let denote the second term on the right-hand side, which we can bound as follows:

using a Chebyshev upper bound. Combining the previous bounds, we have

Next, (26) and Jensen’s inequality imply that

and (28) will follow. In order to show (29), consider now

and note that, in view of Theorem 2.1, there exist constants and such that

for any . As before,

The first term in the last expression can be bounded as follows:

Then, it is now clear that we can bound the expression

as follows

The third term on the right hand side of the above inequality is such that

which converges to as due to (iii) in (26). Hence, using (iv)-(v) in (27) and

we have

which implies (29) because is arbitrary. ∎

Proof of Lemma 4.3.

We start by introducing some notation. Suppose that, under , has Lévy-Itô decomposition

| (A-5) |

where is an independent Poisson measure on with mean measure , and . Next, for a given fixed , we set

| (A-6) |

hence, is a compound Poisson process with intensity and jumps with common distribution , while the remainder process is a Lévy process with triplet , where

Let us fixed . We first note that

for any and for some universal constant . Indeed, if we let denote the number of jumps before time of the compound Poisson process , then we have

We now estimate . First, note that, due to the symmetry of the Lévy measure ,

Thus, using concentration inequalities for centered random variable (e.g. [Hou02], Corollary 1), for ,

where . Since , there exists a universal constant such that

We conclude that for . This completes the proof, since

whenever . ∎

Proof of Proposition 4.2.

Without loss of generality, we assume . We break the proof into two parts:

(1) Let us assume through this part that is a symmetric CGMY process. Let . Obviously,

| (A-7) |

Next, we write

| (A-8) | ||||

| (A-9) |

Clearly, , so the first term converges to as because . From the inequality (A-7), we have

and using Lemma 4.3, we obtain that

which is integrable because . Hence, we can apply dominated convergence in the second term (A-9) and, using Proposition 4.1, we obtain that

(2) In this second part, we relax the symmetry restriction. The idea is to reduce the problem to the symmetric case by applying a change of probability measure.555A similar argument is applied in the proof of Proposition 5-(2) in [Tnkv10] but with a different aim. Concretely, let and, as in the proof of Proposition 2.2, define a probability measure on such that

| (A-10) |

for any . We can check that, under , is a symmetric CGMY model with , , and . Indeed, it follows that

Also, assuming ,

since the moment function and Theorem 1.1-(ii) in [FL08] can be applied. If , then

for the same reason. Then, we only need to consider the asymptotic behavior of as , because so the terms above are smaller than . However,

and thus, using the fact that is symmetric under and part (1) in this proof,

∎