A Functional Version of the ARCH Model

Siegfried Hörmann1,211footnotetext:

Corresponding author. E-mail address: shormann@ulb.ac.be

22footnotetext:

Research partially supported by the Banque National de Belgique and

Communauté française de Belgique - Actions de Recherche Concertées (2010–2015).

, Lajos Horváth3, and Ron Reeder333footnotetext: Research partially

supported by NSF grant DMS 0905400.

1 Départment de Mathématique,

Université Libre de Bruxelles,

CP 215,

Boulevard du Triomphe,

B-1050 Bruxelles,

Belgium

3 Department of Mathematics, University of Utah, Salt Lake City, UT-84112-0090, USA

Abstract

Improvements in data acquisition

and processing techniques have lead to an almost continuous flow of information for financial

data. High resolution tick data are available and can be quite conveniently described by a continuous time process. It is therefore natural to ask for

possible extensions of financial time series models to a functional setup.

In this paper we propose a functional version of the popular

ARCH model.

We will establish conditions for the existence of

a strictly stationary solution, derive weak dependence and moment conditions,

show consistency of the estimators

and perform a small empirical study demonstrating how our model matches with

real data.

Keywords: ARCH, financial data, functional time series, high-frequency data, weak-dependence.

MSC 2000: 60F05

1 Introduction

To date not many functional time series models exist to describe sequences of dependent observations. Arguably the most popular is the ARH(1), the autoregressive Hilbertian process of order . It is a natural extension of the scalar and vector valued AR(1) process (cf. Brockwell and Davis [8]). Due to the fact that the ARH(1) model is mathematically and statistically quite flexible and well established, it is used in practice for modeling and prediction of continuous-time random experiments. We refer to Bosq [6] for a detailed treatment of moving averages, autoregressive and general linear time series sequences. Despite the prominent presence in time series analysis it is clear that the applicability of moving average and autoregressive processes is limited. To describe nonlinear models in the scalar and vector cases, a number of different approaches have been introduced in the last decades. One of the most popular ones in econometrics is the ARCH model of Engle [14] and the more general GARCH model of Bollerslev [5] which have had an enormous impact on the modeling of financial data. For surveys on volatility models we refer to Silvennoinen and Teräsvirta [25]. GARCH-type models are designed for the analysis of daily, weekly or more general long-term period returns. Improvements in data acquisition and processing techniques have lead to an almost continuous flow of information for financial data with online investment decisions. High resolution tick data are available and can be quite conveniently described as functions. It is therefore natural to ask for possible extensions of these financial time series models to a functional setup. The idea is that instead of a scalar return sequence we have a functional time series , where are intraday (log-)returns on day at time . In other words if is the underlying price process, then for the desired time lag , where we will typically set . By rescaling we can always assume that and then the interval represents one trading day.

We notice that a daily segmentation of the data is natural and preferable to only one continuous time process , say, for all days of our sample (cf. Harrison et al. [18], Barndorff-Nielsen and Shephard [4], Zhang et al. [28], Barndorff-Nielsen et al. [3], and Jacod et al. [20]). Due to the time laps between trading days (implying e.g. that opening and closing prices do not necessarily coincide) one continuous time model might not be suitable for a longer period. Intraday volatilities of the euro-dollar rates investigated by Cyree et al. [10] empirically can be considered as daily curves. Similarly, Gau [17] studied the shape of the intraday volatility curves of the Taipei FX market. Angelidis and Degiannakis [1] compared predictions based on intra-day and inter-day data. Elezović [13] modeled bid and ask prices as continuous functions. The spot exchange rates in Fatum and Pedersen [16] can be considered as functional observations as well. Evans and Speight [15] uses 5-min returns for Euro-Dollar, Euro-Sterling and Euro-Yen exchange rates.

In this paper we propose a functional ARCH model. Usually time series are defined by stochastic recurrence equations establishing the relationship between past and future observations. The question preceding any further analysis is whether such an equation has a (stationary) solution. For the scalar ARCH necessary and sufficient conditions have been derived by Nelson [23]. Interestingly, these results cannot be transferred directly to multivariate extensions (cf. Silvennoinen and Teräsvirta [25]). Due to the complicated dynamics of multivariate ARCH/GARCH type models (MGARCH), finding the necessary and sufficient conditions for the existence of stationary solutions to the defining equations is a difficult problem. Also the characterization of the existence of the moments in GARCH equations is given by very involved formulas (cf. Ling, S. and McAleer [22]). It is therefore not surprising that in a functional setup, i.e. when dealing with intrinsically infinite dimensional objects, some balancing between generality and mathematical feasibility of the model is required.

In Section 2 we propose a model for which we provide conditions for the existence of a unique stationary solution. These conditions are not too far from being optimal. We will also study the dependence structure of the model, which is useful in many applications, e.g. in estimation which will be treated in Section 3. We also provide an example illustrating that the proposed functional ARCH model is able to capture typical characteristics of high frequency returns, see Section 4.

In this paper we use the following notation. Let denote a generic function space. Throughout this consists of real valued functions with domain . In many applications will be equal to = the Hilbert space of square integrable functions with norm which is generated by the inner product for . Another important example is . This is the space of continuous functions on equipped with the sup-norm By we denote the set of non-negative functions in . To further lighten notation we shall often write when we mean , or for integral kernels as well as for the corresponding operators. If then stands for pointwise multiplications, i.e. . Since integrals will always be taken over the unit interval we shall henceforth simply write . A random function with values in is said to be in if .

2 The functional ARCH model

We start with the following general definition.

Definition 2.1.

Let be a sequence of independent and identically distributed random functions in . Further let be a non-negative operator and let . Then an -valued process is called a functional ARCH(1) process in if the following holds:

| (2.1) |

and

| (2.2) |

The assumption for the existence of processes satisfying (2.1) and (2.2) depends on the choice of . So next we specify and put some restrictions on the operator . Our first result gives a sufficient condition for the existence of a strictly stationary solution when . We will assume that is a (bounded) kernel operator defined by

| (2.3) |

Boundedness is e.g. guaranteed by finiteness of the Hilbert-Schmidt norm:

| (2.4) |

Theorem 2.1.

It follows that and are not just strictly stationary but also ergodic (cf. Stout [26]). Let be the -algebra generated by the sequence . If (2.1) and (2.2) have a stationary solution and if we assume that , and for all , then due to (2.5) it is easy to see that

Since by our assumption is stationary, the conditional correlation is independent of and can be fully described by the covariance kernel . However, we have This is in accordance with the constant conditional correlation (CCC) multivariate GARCH models of Bollerslev [5] and Jeantheau [21].

Our next result shows that of (2.5) can be geometrically approximated with -dependent variables, which establishes weak dependence of the processes (2.1) and (2.2).

Theorem 2.2.

Assume that the conditions of Theorem 2.1 hold. Let be an independent copy of and define Then

| (2.6) |

with some and .

To better understand the idea behind our result we remark the following. Assume that we redefine

where are independent copies of . In other words, every gets its "individual" copy of to define the approximations. It can be easily seen that then for any fixed , form -dependent sequences, while the value on the left hand side in inequality (2.6) doesn’t change. As we have shown in our recent papers [2] and [19], approximations like (2.6) are particularly useful in studying large sample properties of functional data. We use (2.6) to provide conditions for the existence of moments of the stationary solutions of (2.1) and (2.2). It also follows immediately from (2.6), that if (2.1) and (2.2) are solved starting with some initial values and , then the effect of the initial values dies out exponentially fast.

In a finite dimensional vector space all norms are equivalent. This is no longer true in the functional (infinite dimensional) setup and whether a solution of (2.1) and (2.2) exists depends on the choice of space and norm of the state space. Depending on the application, it might be more convenient to work in a different space. We give here the analogue of Theorems 2.1 and 2.2 for a functional ARCH process in .

Theorem 2.3.

We continue with some immediate consequences of our theorems. We start with conditions for the existence of the moments of the stationary solution of (2.1) and (2.2).

Proposition 2.1.

Proposition 2.2.

We would like to point out that it is not assumed that the innovations have finite variance. We only need that have some moment of order , where can be as small as we wish.

Hence our model allows for innovations as well as observations with heavy tails.

According to Propositions 2.1 and 2.2, if the innovation has enough moments, then so does and . The next result shows a connection between the moduli of continuity of and . Let

denote the modulus of continuity of a function .

Proposition 2.3.

We assume that the conditions of Theorem 2.3 are satisfied with . If and then

According to Theorems 2.2 and 2.3, the stationary solution of (2.1) and (2.2) can be approximated with stationary, weakly dependent sequences with values in and in , respectively. We provide two further results which establish the weak dependence structure of .

Proposition 2.4.

We assume that the conditions of Theorem 2.1 are satisfied with and

| (2.11) |

Then

| (2.12) |

with some and , where .

It follows from the definitions that the distribution of the does not depend on . Hence the expected value in (2.12) does not depend on . A similar result holds in under the sup-norm.

Proposition 2.5.

3 Estimation

In this section we propose estimators for the function and the operator in model (2.1)–(2.2) which are not known in practice. The procedure is developed for the important case where and is given as in (2.3). We show that our problem is related to the estimation of the autocorrelation operator in the ARH(1) model which has been intensively studied in Bosq [6]. However, the theory developed in Bosq [6] is not directly applicable as it requires independent innovations in the ARH(1) process, whereas, as we will see below, we can only assume weak white noise (in Hilbert space sense).

We will impose the following

Assumption 3.1.

- (a)

-

for any .

- (b)

-

The assumptions of Theorem 2.2 hold with .

Assumption 3.1 (a) is needed to guarantee the identifiability of the model. Part (b) of the assumption guarantees the existence of a stationary solution of the model (2.1)–(2.2) with moments of order 4. It is necessary to make the moment based estimator proposed below working. An immediate consequence of Assumption 3.1 is that (2.4) holds, i.e. is a Hilbert Schmidt operator.

We let denote the mean function of the and introduce

Then by adding on both sides of (2.2) we obtain

Since is a linear operator we obtain after subtracting on both sides of the above equation

| (3.14) |

It can be easily seen that under Assumption 3.1 (where 0 stands for the zero function). Notice also that the expectation commutes with bounded operators, and hence that . Consequently, taking expectations on both sides of (3.14) yields that

| (3.15) |

Thus, (3.14) can be rewritten in the form

| (3.16) |

Model (3.16) is the autoregressive Hilbertian model of order 1, short ARH(1). For estimating the autocorrelation operator we may use the estimator proposed in Bosq [6, Chapter 8]. We need to be aware, however, that the theory in [6] has been developed for ARH processes with strong white noise innovations, i.e. independent innovations . In our setup the form only a weak white noise sequence, i.e. for any we have

and the covariance operator of is independent of . Thus the theory in [6] cannot be directly applied. We will study the estimation of in Section 3.1.

Once is estimated by some say, we obtain an estimator for via equation (3.15):

| (3.17) |

where we use

| (3.18) |

Let be the operator norm of . Recall that . The following Lemma shows that consistency of implies consistency of .

Proof.

We have

The result follows once we can show that . To this end we notice that by stationarity of

By construction and the approximation are independent. Repeated application of the Cauchy-Schwarz inequality together with Assumption 3.1 (a) yield that

Combining these estimates with Theorem 2.2 shows that . ∎

3.1 Estimation of

We now turn to the estimation of the autoregressive operator in the ARH(1) model (3.16). It is instructive to focus first on the univariate case , in which all quantities are scalars. We assume which implies . We also assume that , so that there is a stationary solution such that is uncorrelated with . Then, multiplying the AR(1) equation by and taking the expectation, we obtain , where . The autocovariances are estimated in the usual way by the sample autocovariances

so the usual estimator of is . This is the so-called Yule-Walker estimator which is optimal in many ways, see Chapter 8 of Brockwell and Davis [8].

In the functional setup we will replace condition with . Notice that this condition is guaranteed by Assumption 3.1 and that it will imply the existence of a weakly stationary solution of (3.16) of the form

where is the -times iteration of the operator and is the identity mapping. The estimator for the operator obtained in [6] is formally analogue to the scalar case. We need instead of and the covariance operator

and the cross-covariance operator

One can show by similar arguments as in the scalar case that

To get an explicit form let be the eigenvalues of and let be the corresponding eigenfunctions, i.e. . We assume that are normalized to satisfy . Then forms an orthonormal basis (ONB) of and we obtain the following spectral decomposition of the operator :

| (3.19) |

From (3.19) we get formally that

| (3.20) |

and hence

| (3.21) |

Using we obtain that the corresponding kernel is

| (3.22) |

If for all , then the covariance operator is finite rank and we can replace (3.19) and (3.20) by finite expansions with the sum going from to . In this case, all our mathematical operations so far are well justified. However, when all then we need to be aware that is not bounded on . To see this note that if (this follows from the fact that is a Hilbert-Schmidt operator). Consequently, for . It can be easily seen that this operator is bounded only on

Nevertheless, we can show that the representation (3.21) holds for all by using a direct expansion of . Since the eigenfunctions of form an ONB of it follows that () forms an ONB of . This is again a Hilbert space with inner product

Note that and hence the kernel function . (Be aware, that for the sake of a lighter notation we don’t distinguish between kernel and operator .) Consequently has the representation

As we can write

it follows that

and by taking expectations on both sides of the above equation that

Here we used the fact that is weak white noise. It implies that is zero for any bounded operator and all and all . Hence the expansion provides . This shows again (3.22).

We would like to obtain now an estimator for by using a finite sample version of the above relations. To this end we set

The estimator in [6] and the estimator we also propose here is of the form

where

| (3.23) |

are the eigenvalues (in descending order) and the corresponding eigenfunctions of and is the orthogonal projection onto the subspace . We notice that this estimator is not depending on the sign of the ’s. The corresponding kernel is given as

| (3.24) |

and the signs of the cancel out. In practice eigenvalues and eigenfunctions of an empirical covariance operator can be conveniently computed with the package fda for the statistical software R. The estimator (3.24) is the empirical version of the finite expansion

of (3.22).

If the innovations are i.i.d. Bosq [6] proves under some technical conditions consistency of the estimator (3.24) when :

The choice of depends on the decay rate of the eigenvalues, which is not known in practice. Empirical results (see Didericksonet al. [12]) show that in the finite sample case provides best results. The reason why choosing small is often favorable is due to a bias variance trade off. Note that the eigenvalues occur reciprocal in the estimator and thus larger accounts for larger instability if the eigenvalues are close to zero. A practical approach is to chose the largest integer for which , where is some threshold.

Theorem 3.1.

Fix some . Assume that the largest eigenvalues of the covariance operator of satisfy . Let and be the operators belonging to the kernel functions and , respectively. Let Assumption 3.1 hold with condition (b) strengthened to . Then we have

In Theorem (3.1) obviously denotes the sample size which is suppressed in the notation. The proof of the theorem is given in Section 5. Our conditions imply that . This assumption is probably more stringent than necessary and a relaxation would be desirable. Note however, that finite 4th moments are required in [6] even for i.i.d. .

3.2 Simulation study

In this section we demonstrate the capabilities of our estimators for and on simulated data. We proceed as follows: We will choose a simple and , simulate several days of observations using these parameters, and then use the estimation procedure given in Section 3.1 to obtain and from (3.24) and (3.17) respectively.

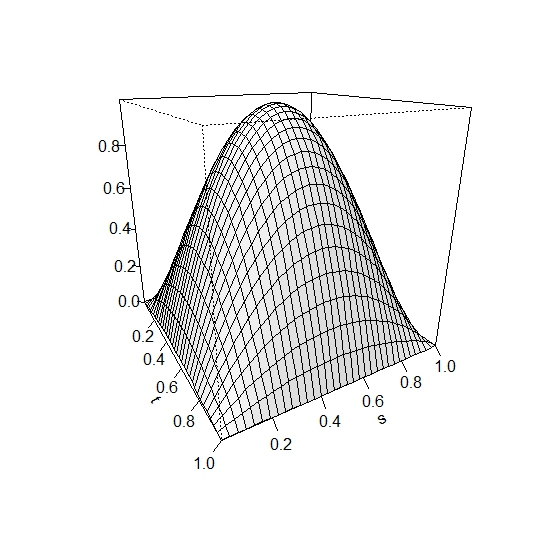

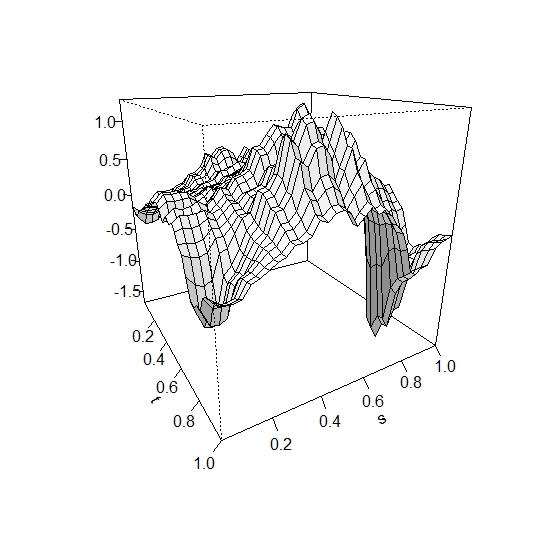

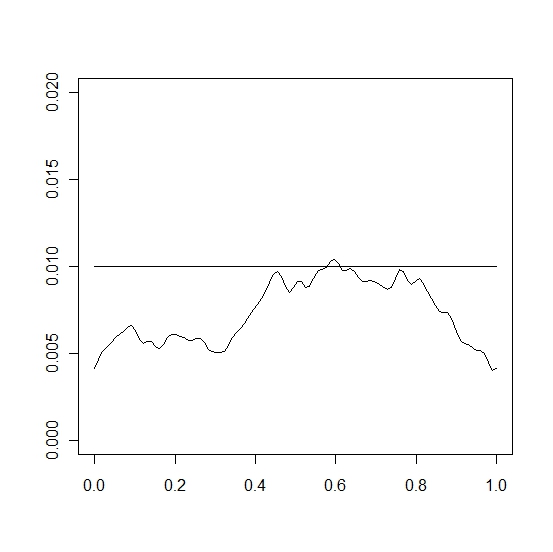

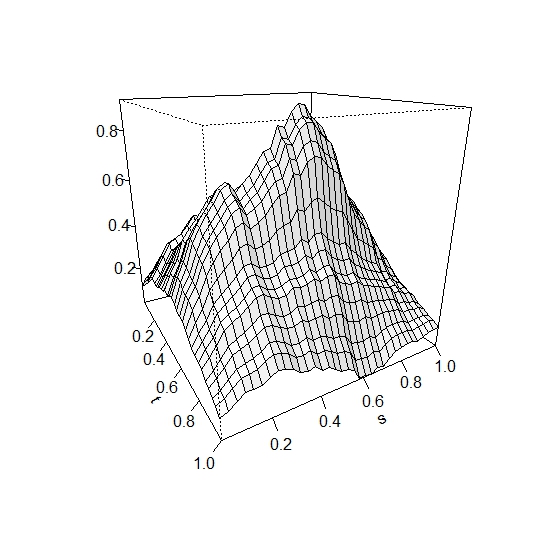

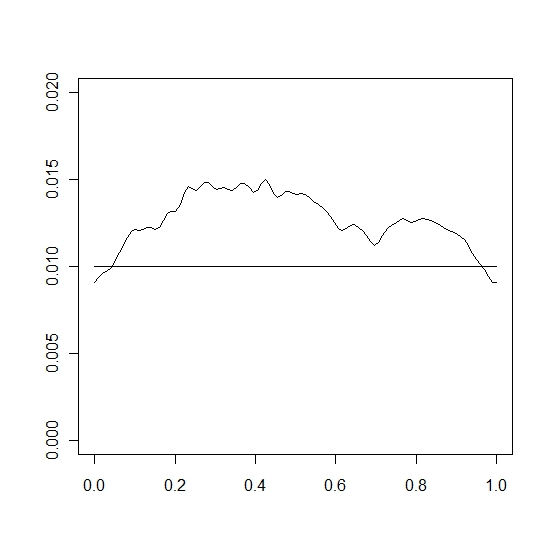

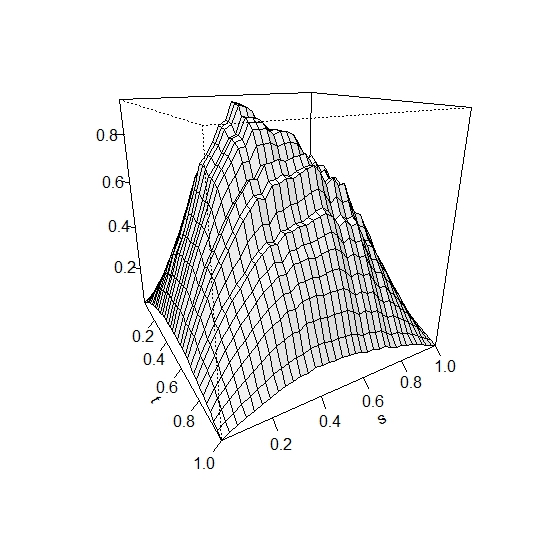

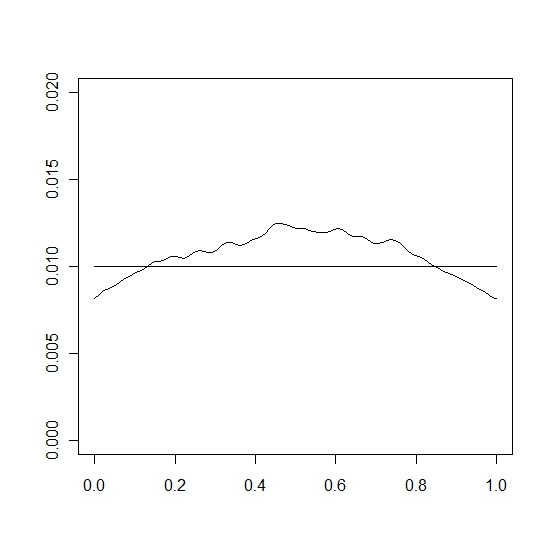

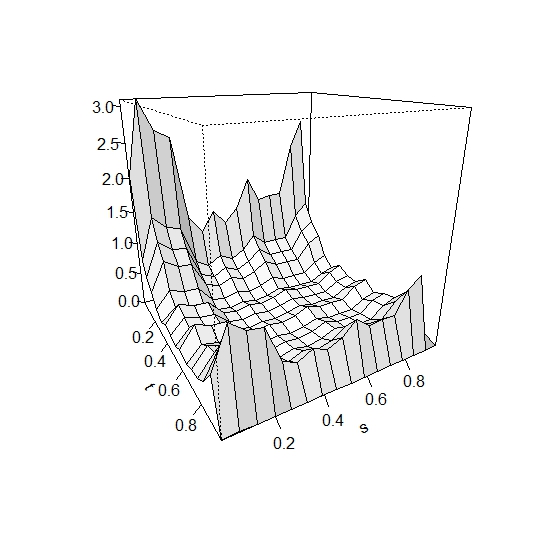

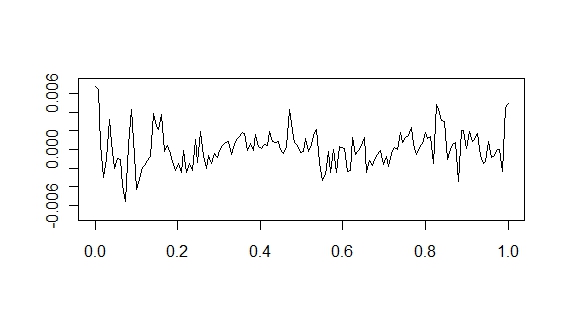

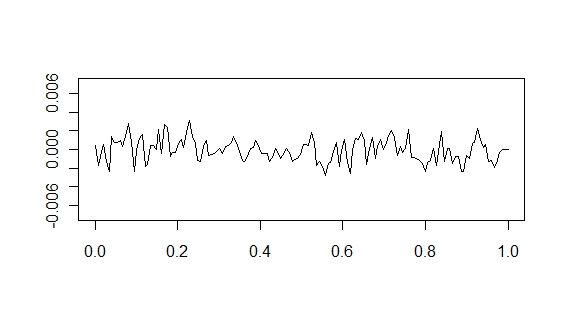

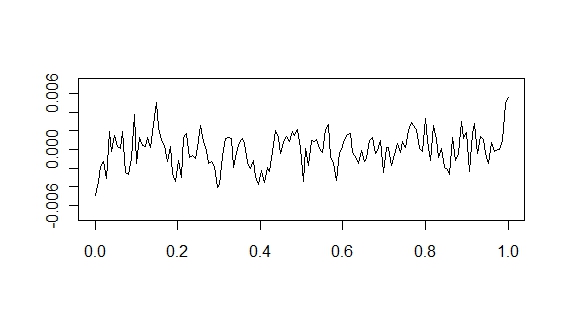

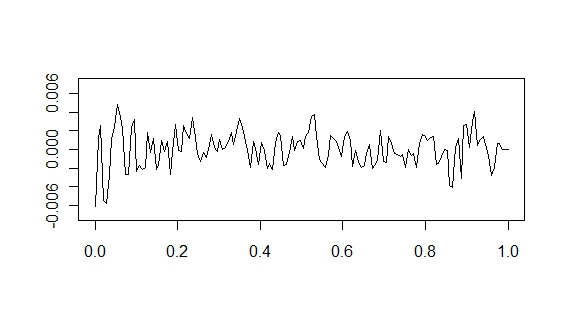

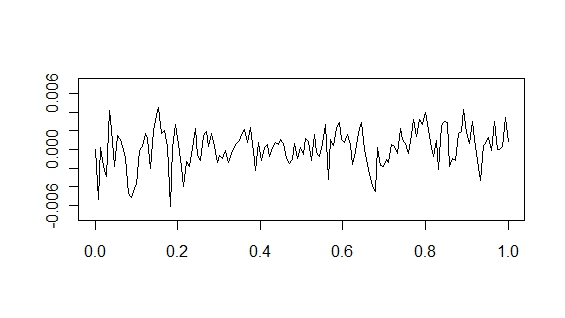

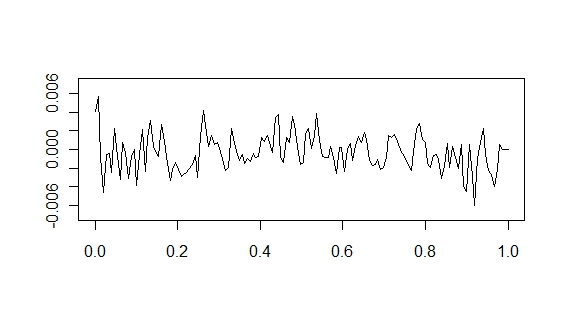

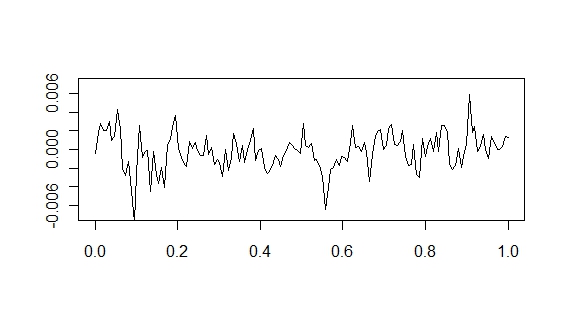

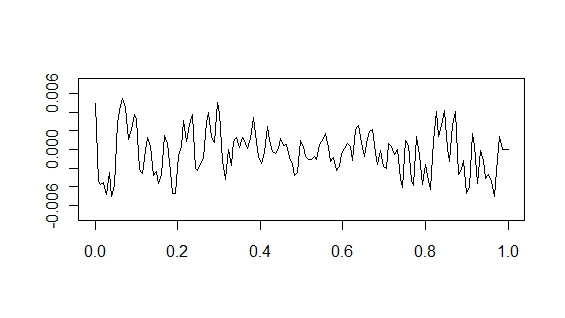

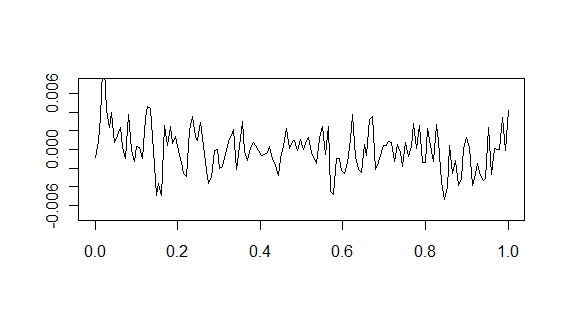

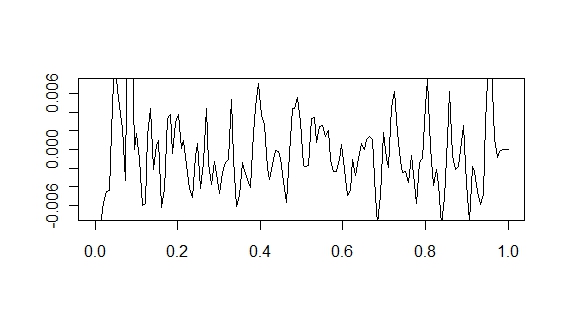

We will use and for our simulations. Now that we have chosen and we can simulate data according to (2.1) and (2.2). We will use for the error term, where are iid standard Brownian bridges and are iid standard normals. Note that this gives for all , which is assumed by our estimation procedure. After simulating days of data we compute and . Figures 2, 4, and 4 show the estimates when , , and , respectively. We see from these plots that the estimators described in Section 3.1 accurately estimate the parameters, and , when the sample size is sufficiently large. Note that each plot of has the true superimposed. A plot of the true is given in figure 2.

4 An example

In this section we show an example illustrating that our model captures the basic features of intraday returns. Let denote the price of a stock on day at time . Then can be viewed as the log-returns of the stock, , during period (cf. Cyree et al. [10]), where is typically 1, 5, or 15 minutes. We will use for -minute returns. The volatility of the stock is then represented by .

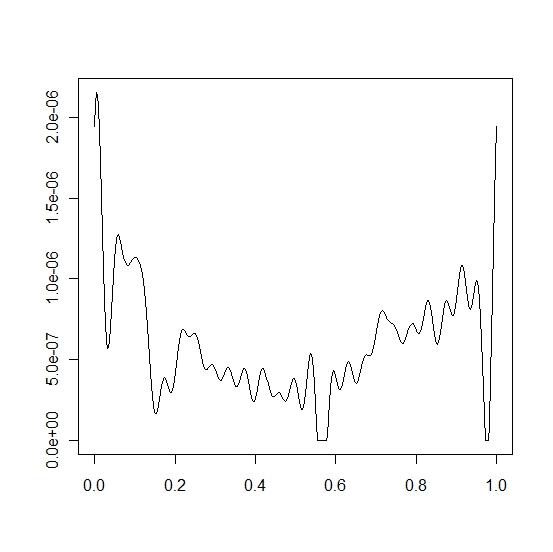

The first step to simulating the intraday returns is to estimate the parameters, and , as outlined in Section 3.1. These parameters were estimated for the S&P 100 index based on data from April 1, 1997 to March 30, 2007. The estimated functions, and , are shown in Figure 5.

Notice in Figure 5 that and are somewhat larger when is close to or . According to (2.2) this suggests that the volatility, , tends to be larger at the beginning and end of each trading day. Higher volatilities at the beginning and the end of the trading day have been observed by several authors (cf. Gau [17] and Evans and Speight [15]). This phenomenon is consistent with our observed log-return data based on the S&P 100 index and is captured by our model.

Having estimated the parameters, and , we can now simulate several days of observations according to (2.1) and (2.2). We will use for the error term, where are iid standard Brownian motions. Note that this gives for all , which is assumed by our estimation procedure.

We simulated 5 days of log-returns which we compare with the log-returns of the S&P 100 index. The right side of Figure 6 is the plot of the 5-minute returns on the S&P 100 index between April 11 and April 15, 2000. The left side of Figure 6 shows five consecutive days of simulated values for . The simulations show that our model empirically captures the main characteristics of financial data.

5 Proofs

The proofs of Theorems 2.1 and 2.3 are based on general results for iterated random functions as those in Wu and Shao [27] and Diaconis and Freedman [11]. For the convenience of the reader we shall repeat here the main ideas of [27].

Let be a complete, separable metric space. Let be another metric space and let be a measurable function. For a random element with values in , an iterated random function system is defined via the random mappings . More precisely it is assumed that

| (5.25) |

where is an i.i.d. sequence with values in . Thereby it is assumed that is independent of . For any we define

where denotes the composition of functions. We also introduce the backward version of , which is given by

The following theorem is a slight modification of Theorem 2 of [27], so that it is immediately applicable for our purposes.

Theorem 5.1.

(Wu and Shao, 2004.)

Assume that

(A)

there are and such that

and

(B) there are , , and

such that

for all and . Then for all we have converges almost surely to some which is independent of . Furthermore and

where and . Moreover, the process is a stationary solution of (5.25). Finally, if we let where is an independent copy of , then

with some and .

Proof of Theorem 2.1..

We need to show that the conditions of Theorem 5.1 are satisfied when the underlying space is with metric and

To demonstrate (A) of Theorem 5.1 we use , , and get

by assumption. Since for any we have

by the Cauchy-Schwarz inequality. Repeating the arguments above, we conclude

Taking expectations on both sides and using the independence of the proves (B). ∎

Theorem 2.2 is a simple corollary to Theorem 2.1 and Theorem 5.1. Theorem 2.3 can be proven along the same lines of argumentation and the proof is omitted.

Proof of Propositions 2.1 and 2.2..

First we establish (2.7). We follow the proof of Theorem 2.1. Since , according to the construction in the proof of Theorem 2.1 we have

where denotes the "zero function" on . According the proof of Theorem 2.1 and Theorem 5.1 the term . Furthermore, the term . To show (2.10), we note that

since and are independent processes. Proposition 2.1 is proven.

The proof of Proposition 2.2 only requires minor modifications and is therefore omitted. ∎

Proof of Proposition 2.3..

Using recursion 2.1 we have

The independence of and yields

Proposition 2.2 gives . This implies that and therefore

The identity , , implies

Recursion (2.2) gives

Hence

Proposition 2.2 yields that and . So by the independence of the processes and we conclude

completing the proof of Proposition 2.3. ∎

Proof of Theorem 3.1.

Under our assumptions it follows from Theorem 2.2 that for any

where and are the –dependent approximations of (constructed by using instead of in the definition of ). This shows that the notion of ––approximability suggested in Hörmann and Kokoszka [19] applies to the sequence . As consequence we have with that

and therefore that

(See [19, Theorem 3.2].) The random sign (which we cannot observe) accounts for the fact that can be only uniquely identified up to its sign. As our estimator doesn’t depend on the signs of the , this poses no problem. We define

and let

be the empirical counterpart. Then we have

The processes are strictly stationary for every choice of and and we can again define the approximations in the spirit of Section 2. We have by independence of and

Further we have by repeated application of the Cauchy-Schwarz inequality that

for some . This proves that the autocovariances of the process are absolutely summable. A well known result in time series analysis thus implies that

(see e.g. the proof of Theorem 7.1.1. in Brockwell and Davis [8]) where, as we have shown, the constant is independent of the choice of and in the definition of . Hence .

Using relation () above, one can show that also . We thus have

We have now the necessary tools to prove Theorem 3.1. By relations (), () and () we have that

The proof follows from ∎

References

- [1] Angelidis, T. and Degiannakis, S. (2008). Volatility forecasting: Intra-day versus inter-day models. Journal of International Financial Markets, Institutions & Money, 18, 449-465.

- [2] Aue, A., Hörmann, S., Horváth, L., Hǔsková, M., and Steinebach, J. (2010+). Sequential testing for the stability of high frequencey portfolio betas. Preprint.

- [3] Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A. and Shephard, N. (2008). Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise. Econometrica 76, 1481–1536.

- [4] Barndorff-Nielsen, O.E. and Shephard, N. (2004). Econometric analysis of realized covariation: High frequency based covariance, regression, and correlation in financial economics. Econometrica 72, 885–925.

- [5] Bollerslev, T. (1990). Modeling the coherence in short-run nominal exchange rates: multivariate generalized ARCH model. Review of Economics and Statistics, 74, 498–505.

- [6] Bosq, D. (2000). Linear Processes in Function Spaces. Springer, New York.

- [7] Bougerol, P. and Picard, N. (1992). Stationarity of GARCH processes and of some nonnegative time series. Journal of Econometrics, 52, 115–127.

- [8] Brockwell, P. J. and Davis, R. A. (1991). Time Series: Theory and Methods Springer.

- [9] Cardot, H., Ferraty, F. and Sarda, P. (1999). Functional linear model. Statistics & Probability Letters 45, 11-22.

- [10] Cyree, K. K., Griffiths, M. D. and Winters, D. B. (2004). An empirical examination of intraday volatility in euro-dollar rates. The Quaterly Review of Economics and Finance, 44, 44-57.

- [11] Diaconis, P. and Freedman, D. (1999). Iterated random functions. Siam Review, 41, 45–76.

- [12] Didericksen, D. and Kokoszka, P. and Zhang, X. (2010). Empirical properties of forecasts with the functional autoregressive model. Technical Report, Utah State University.

- [13] Elezović, S. (2009). Functional modelling of volatility in the Swedish limit order book. Computational Statistics & Data Analysis, 53, 2107-2118.

- [14] Engle, R. F. (1982). Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50, 987–1007.

- [15] Evans, K. P. and Speight, A. E. H. (2010). Intraday periodicity, calendar and announcement effects in Euro exchange rate volatility. Research in International Business and Finance, 24, 82-101.

- [16] Fatum, R. and Pedersen, J. (2009). Real-time effects of central bank intervention in the euro market. Journal of International Economics, 78, 11-20.

- [17] Gau, Y-F. (2005). Intraday volatility in the Taipei FX market. Pacific-Basin Finance Journal, 13, 471-487.

- [18] Harrison, J.M., Pitbladdo, R. and Schaefer, S.M. (1984). Continuous prices in frictionless markets have infinite variation. Journal of Business,57, 353–365.

- [19] Hörmann, S. and Kokoszka, P. (2010). Weakly dependent functional data. The Annals of Statistics, 38, 1845–1884.

- [20] Jacod, J., Li, Y., Mykland, P.A., Podolskij, M. and Vetter, M. (2009). Microstructure noise in the continuous case: the pre-averaging approach. Stochastic Processes and their Applications 119, 2249–2276.

- [21] Jeantheau, T. (1998). Strong consistency of estimators for multivariate ARCH models. Econometric Theory, 14, 70–86.

- [22] Ling, S. and McAleer, M. (2002). Necessary and sufficient moment conditions for the GARCH(p,q) and asymmetric power GARCH(p,q) models. Econometric Theory 18, 722-729.

- [23] Nelson, D. B. (1990). Stationarity and persistence in the GARCH () model. Econometric Theory, 6, 318–334.

- [24] Polyanin, A. and Manzhirov, A. (1998). Handbook of Integral Equations CRC Press, London.

- [25] Silvennoinen, A. and Teräsvirta, T. (2009). Multivariate GARCH models. In: Handbook of Financial Time Series (Eds: T.G. Anderson et al.) pp. 201-229. Springer-Verlag, New York.

- [26] Stout, W.F. (1974). Almost Sure Convergence. Acadamemic Press, New York.

- [27] Wu, W. and Shao, X. (2004). Limit theorems for iterated random functions. Journal of Applied Probability, 41, 425–436.

- [28] Zhang, L., Mykland, P.A. and Aït-Sahalia, Y. (2005). A tale of two time scales: determining integrated volatility with noisy high-frequency data. Journal of the American Statistical Association 100, 1394–1411.