Hedging of Game Options With the Presence of Transaction Costs

Abstract

We study the problem of super–replication for game options under proportional transaction costs. We consider a multidimensional continuous time model, in which the discounted stock price process satisfies the conditional full support property. We show that the super–replication price is the cheapest cost of a trivial super–replication strategy. This result is an extension of previous papers (see [3] and [7]) which considered only European options. In these papers the authors showed that with the presence of proportional transaction costs the super–replication price of a European option is given in terms of the concave envelope of the payoff function. In the present work we prove that for game options the super–replication price is given by a game variant analog of the standard concave envelope term. The treatment of game options is more complicated and requires additional tools. We combine the theory of consistent price systems together with the theory of extended weak convergence which was developed in [1]. The second theory is essential in dealing with hedging which involves stopping times, like in the case of game options.

Keywords: game options, optimal stopping, super–replication, transaction costs

AMS 2000 Subject Classifications: 91B28, 60F15, 91A05

1 Introduction

This paper deals with the super–replication of cash–settled game (Israeli) options in the presence of proportional transaction costs. A game contingent claim (GCC) or game option which was introduced in [9] is defined as a contract between the seller and the buyer of the option such that both have the right to exercise it at any time up to a maturity date (horizon) . If the buyer exercises the contract at time then he receives the payment , but if the seller exercises (cancels) the contract before the buyer then the latter receives . The difference is the penalty which the seller pays to the buyer for the contract cancellation. In short, if the seller will exercise at a stopping time and the buyer at a stopping time then the former pays to the latter the amount where

and we set if an event occurs and if not.

A hedge (for the seller) against a GCC is defined as a pair which consists of a self financing strategy and a stopping time which is the cancellation time for the seller. A hedge is called perfect if no matter what exercise time the buyer chooses, the seller can cover his liability to the buyer (with probability one). Since our contingent claim is cash–settled, we measure the portfolio value in cash, assuming that there are no liquidity costs for turning stocks into cash in the exercise moment of the options. The option price is defined as the minimal initial capital which is required for a perfect hedge, i.e. for any there is a perfect hedge with an initial capital .

We consider a general model of financial market which consists of a savings account with a stochastic interest rate and stocks which are given by a continuous stochastic process. We assume that the discounted stock price process satisfies the conditional full support property which was introduced in [7]. In general, the conditional full support property is quite general assumption. In particular, processes such as Markov diffusions, solutions of SDEs in the Brownian setup with path dependent coefficient (under some regularity conditions) and fractional Brownian motion satisfy this assumption (for details see [7] and [11]).

Our main result states that the super–replication price is the cheapest cost of a trivial perfect hedge. For game options a trivial hedge is a pair which consists of a buy–and–hold strategy and a hitting time of the stock process into a Borel set. Furthermore, we find explicit formulas for the cheapest perfect hedge, and characterize the super–replication value as the game analog of the standard concave envelope which appears in the European options case. We provide several examples for explicit calculations of the super–replication prices together with the optimal hedges.

These results are an extension of previous results which were obtained for European options, see for example, [3], [4], [7], [10] and [14]. The most general results were proved in [3] and [7] where the authors only assumed the conditional full support property of the (discounted) stock process. In all of the above papers the authors showed that the super–replication price is given in terms of the concave envelope of the payoff function, and the way to achieve this price is by using buy–and–hold strategies.

Our main tool is the consistent price systems approach which was proven to be very powerful for European options (see [3], [7]). We derive a family of consistent price systems which converge weakly to Brownian martingales of general type. This together with the theory of extended weak convergence allows us to bound from below the super–replication price by the value of some robust optimization problem on the Brownian probability space. The value of this robust optimization problem leads to the notion of game variant of the concave envelope. This notion is also appears naturally in the static super–replication of game options.

The paper is organized as follows. Main results of this paper are formulated in the next section, where we also give few examples of applications of these results. In Section 3 we derive a general family of consistent price systems. In Section 4 we treat a robust optimization problem and establish a connection between the value of this problem and the game analog of the concave envelope. Furthermore we use a convex analysis to show that the latter concept characterizes the static super–hedging price. In Section 5 we use the extended weak convergence theory in order to prove an essential limit theorem which evolve optimal stopping and consistent price systems. In Section 6 we complete the proof of Theorem 2.2 which is the main result of the paper.

2 Preliminaries and main results

Let be a complete probability space together with a filtration which satisfies the usual conditions where is a fixed maturity date. Our financial market consists of a bond (savings account) and of stocks given by a continuous adapted process which takes on values in . We will assume that the bond price is of the form

where is a non–negative adapted process which represents the interest rate of the savings account. Without loss of generality we assume that . As usual when we deal with hedging it is convenient to work with the discounted terms. Thus, we introduce the discounted stock price

Before introducing the assumption of conditional full support, we review some concepts. For any consider the space of all continuous functions endowed with the uniform topology. As usual, the support of a a probability measure on a separable space is denoted by and it is defined as the minimal closed set of measure . We will also use the notation for the space of all functions which start at , namely .

Assumption 2.1.

The process is satisfies the conditional full support property with respect to the filtration . Namely, for all

where denotes the –conditional distribution of the –valued random variable .

Again, let us emphasize that Markov diffusions, solutions of SDEs in the Brownian setup with path dependent coefficient (under some regularity conditions) and fractional Brownian motion satisfy the above assumption (for deteails see [7] and [11]).

We also assume that the interest rate process is bounded uniformly by some constant , i.e. , a.s, where is the Lebesgue measure on . In Example 2.8 we show that without this assumption our main results (which are formulated in Theorem 2.2) should not hold true.

Let be a convex Lipschitz continuous function and let be a constant. Consider a game option with the discounted payoff processes

Set

Observe that is the discounted reward that the buyer receives given that his exercise time is and the seller cancellation time is . Namely we consider game options with non path dependent payoffs and with constant penalty for the seller’s exercise. In general, for the case where the penalty is non constant, our results (which are formulated in Theorem 2.2) should not hold true. In particular, even the static super–replication price may depend on the interest rate process. This is illustrated in Example 2.9.

Next, let be a constant. We assume that an investor must purchase risky assets through his savings account, i.e. bartering between two risky assets is impossible. Consider a model in which for any , every purchase or sale of the –th risky asset at moment is subject to a proportional transaction cost of rate . A trading strategy with an initial capital is a pair where such that for any , is an adapted process of bounded variation with left continuous paths. The random variable denotes the number of shares of the –th asset in the portfolio at moment (before a transfer is made at this time). This is exactly the reason why we assume that the process is left continuous. The discounted portfolio value of a trading strategy is given by

where denotes the standard scalar product of and all the integrals in the above formula are Stieltjes integrals. As usual and , where , is the Jordan decomposition into a positive variation and a negative variation . Observe that we do not assume any semi–martingale structure of the risky assets. The term is the (discounted) portfolio value at time , before a transfer is made at this time. Indeed,

is the discounted value of the wealth which is held in the savings account, and is the discounted value of the wealth which is held in stocks. The set of all self financing strategies with an initial capital will be denoted by . Let be the set of all stopping times which take on values in . A pair of a self financing strategy and a stopping time will be called a hedge. A hedge will be called trivial if it is of the form

where is a Borel set. Namely we do not trade, and cancel the option at the first time that the stock process vector enters a Borel set. A hedge will be called perfect if for any , a.s. It is well known (see Theorem 12.16 in [12]) that a Stieltjes integral of a continuous function with respect to a left continuous function of bounded variation, is also left continuous. Thus the portfolio value process is left continuous and so, a hedge is perfect iff

The super–hedging price is defined by

| (2.1) |

where is the initial stock position. We set

| (2.2) |

Since for trivial hedges there are no transaction costs, does not depend on . Clearly, for any . Notice also that from the Lipschitz property of we have .

Before we formulate the main result of the paper,

we will need some preparations.

Let be the set of all functions

which satisfy the following conditions.

i. The function is continuous and for any , .

ii. Let be a convex set in which .

Then is concave in .

Clearly the function and so is a non empty set. It turns out (the proof will be given in Lemma 4.3) that has a minimal element which can be calculated explicitly, i.e. for any and . The function is the game variant of the standard concave envelope. Notice that if then equals to the concave envelop of . The function can be calculated as following. For any , define

where the appears in the –coordinate above. Introduce the terms

| (2.3) |

where is the sub–gradient of the convex function at . If , i.e. the set in (2.3) is empty then , (recall that is Lipschitz continuous). Observe that for the case , the linear function is the (unique) tangent from the point to the function . Set and define the function by

| (2.4) | |||

where and if the above set is empty. Observe that .

The following theorem is the main result of the paper and it says that the super–replication price is the cheapest cost of a trivial super–replication strategy, which is equal to , the game variant of the concave envelope.

Theorem 2.2.

For any and ,

| (2.5) |

Furthermore, let be an initial stock position. Define

a trivial hedge according to the following cases:

i. If ,

| (2.6) | |||

ii. If ,

| (2.7) |

Then is a perfect hedge with the smallest initial capital.

The second case in the above theorem corresponds to a situation where the initial capital is equal to the high payoff and so, the seller can cancel the contract at the initial moment of time and no actions are needed.

Remark 2.3.

We assume that at the initial moment of time the investor allowed to have holdings in stocks. Namely, is not necessary equal to . Furthermore, when we calculate the portfolio value at some , we do not take into account the liquidation price of the stocks into cash. The reason for this is that although our options are cash settled, in real market conditions the stocks can be delivered physically from the seller to the buyer, for example, for a Call option’s the seller can give the stock without liquidating it. In the papers [3] and [7] the authors assume that the investor starts with zero stock holdings and must liquidate his portfolio at the maturity date (the papers deal with European options). Thus in their setup even trivial strategies are subject to transaction costs, that is why the main results in these papers deal only with the asymptotic behaviour (as the rate of the transaction costs goes to ) of the super–replication prices.

Remark 2.4.

Consider a model with proportional transaction costs of the following type. The investor is allowed to transfer from the –th asset to the –th asset for any , where the –asset denotes the savings account. In time the above kind of transfer is subject to proportional transaction costs with a random coefficient . We still allow to the investor to hold stocks at the initial moment of time . If there exists such that , then there exists such that for any and . Thus the super–replication price is no less than , and so from Theorem 2.2 we get that the super–replication price in this general setup is again the cheapest cost of a trivial super–replication strategy.

Next, we give three examples for applications of Theorem 2.2.

Example 2.5 (Call option).

Let be a constant and (we have one risky asset which is denoted by ). Consider a game call option with the discounted payoffs

Namely, .

We need to split the analysis into two different cases.

i. . In this case we have

and (recall formulas (2.3)–(2.4)), and so

.

From (2.6) we get that for any initial stock position

the cheapest perfect hedge

is given by

where and .

ii. . In this case we have

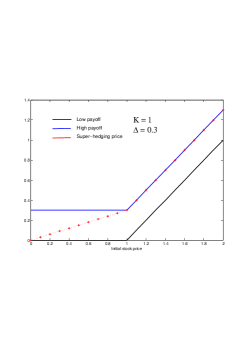

and . Thus (see Fig 1)

Let be an initial position of the stock. From (2.6) we obtain that if then the optimal perfect hedge is given by

From (2.7) we obtain that if then the optimal perfect hedge is given by .

Example 2.6 (Put option).

Let be a constant and . Consider a game put option with the discounted payoffs

We consider two different cases.

i. . In this case we have

and . Thus

and the cheapest perfect hedge is given by

and .

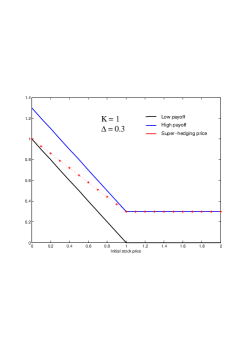

ii. . In this case we have

and .

This together with (2.4) yields (see Fig 2),

Let be an initial position of the stock. From (2.6) we obtain that if then the optimal perfect hedge is given by

From (2.7) we obtain that if then the optimal perfect hedge is given by .

Let us notice that in the above two examples, when the penalty , the investor does not use his right to cancel. Namely in this case the game option is essential a European/American option and the super–replication price is given in terms of the standard concave envelope. For the case where the super–replication price for game options is cheaper then in the European/American case and we arrive at the game variant of the concave envelope.

Example 2.7 (Call–Put options).

Let be a constant and . Consider a game option with the discounted payoffs

Namely, . Then

and , .

Again, we split the analysis into two different cases.

i. . In this case we have

, and .

From (2.4) we get

Let be an initial position of the stock. If then by (2.6) we get that the cheapest perfect hedge is

If then by (2.7) we get

that the optimal perfect hedge is given by

.

ii. . In this case we have

, , and .

Thus

The optimal perfect hedge for an initial position is given by

and .

Next, we show that for a non–bounded interest rate process, our results which are given by Theorem 2.2 should not necessarily hold.

Example 2.8.

Assume that our market consists of a bond given by the formula and of one stock given by the formula where is a standard one–dimensional Brownian motion. Consider a put option with the discounted payoffs and . From Lemma 4.5 in [7] it follows that the discounted stock price satisfies Assumption 2.1. Observe that , and so if then . Thus , . We conclude that the the super–replication price is not bigger than and so Theorem 2.2 does not hold true (compare with Example 2.6).

The following example illustrates that for non–constant penalty game options, Theorem 2.2 does not necessarily hold true.

Example 2.9.

Consider a game option with the discounted payoffs

Assume that the initial stock position is and the interest rate process is a constant . We want to calculate the static super–hedging price . Let be a perfect and a trivial hedge. If then the cheapest trivial hedge is achieved by holding one stock at the initial moment of time, and so the required initial capital is equal . If then also the required capital is . Suppose that we want to find a static perfect hedge with an initial capital less than . Clearly, the (constant) number of stocks in the corresponding portfolio should satisfy . And so, there is no sense for the investor to cancel the contract when the stock price is bigger than or smaller than . Thus, without loss of generality we assume that the investor cancelation time is of the form where . The discounted stock price satisfies the conditional full support property, and so we conclude that the super–replication property is given by

Since and then the above relations are equivalent to the inequality . Finally, from the inequality we get that the minimal value of is attained by taking and . Thus the cheapest cost of a trivial perfect hedge is given by . We conclude that the static super–replication price depends on the interest rate and so Theorem 2.2 does not hold true.

3 Consistent price systems

It is well known that consistent price systems play a key role in hedging with transaction costs. We start with the definition.

Definition 3.1.

Let . An absolutely continuous –consistent price system is a pair which consists of a probability measure (absolutely continuous with respect to ) and a –martingale with values in which satisfies

| (3.1) |

where recall that is the discounted stock process.

In this section we construct a general family of consistent price systems.

Before we state the main result of this section we need some preparations.

For a subset we denote by

and , the convex hull of and the interior of ,

respectively.

Next, let , and be a finite valued martingale

with values in . We assume the following conditions.

i. .

ii. For any the conditional distribution of

given is an atomic distribution which contains

exactly points and satisfies

iii. For any and

Observe that the martingale is defined on arbitrary probability space, not necessary the same probability space on which is defined.

The following lemma is the main result of this section.

Lemma 3.2.

There exists an absolutely continuous –consistent price system such that the distribution of the –martingale equals to the distribution of . Furthermore, for any

| (3.2) | |||

where recall, is the given filtration.

Proof.

Fix . We will assume that is sufficiently small such that the (Euclidean) distance between any two different values of the random variables is bigger than . We denote the Euclidean norm by . For and define the event

Denote by the (finite) set of all possible values of the random variable given that , . Define on the probability space the stochastic process and the events by the following recursive relations, , , and for

| (3.3) | |||

Observe that the sets , are disjoint. Clearly . Fix . Let be an event such that and the random variables are constants on . From the definitions it follows that on the event , we have . This together with the conditional full support property of yields that on the event , for any

From the second condition on the martingale we obtain (by induction) that a.s. on the event . Thus we conclude that

| (3.5) |

By using the Esscher transform in the same way that it was used in Lemma 3.1 of [7] we get that there exists a measurable random vector such that

| (3.6) |

where denotes the expectation with respect to . Set

| (3.7) |

From (3) it follows that on the event , a.s. Define the stochastic process

Observe that is a martingale with . Thus there exists a probability measure which satisfies

From (3.6) it follows that is a –martingale with respect to the filtration . Define a –martingale by

where denotes the expectation with respect to the probability measure . From the third condition on the martingale it follows that for any and

| (3.8) |

Let be the (finite) set of all possible values

of the random variables

. Since is finite we can choose

such that for any and

which satisfy , ,

we have the relation

This together with (3.3) and (3.8) yields that for any and

| (3.9) |

| (3.10) |

By combining (3.9)–(3.10) we arrive at (3.1). Finally, from the second assumption on we obtain that the distribution of (under ) equals to the distribution of and (3.2) holds true. ∎

4 Robust optimal stopping and related convex analysis

Let be a complete probability space together with a standard –dimensional Brownian motion and the right continuous filtration , where is the collection of all null sets. For any let be the set of all stopping times with respect to the Brownian filtration which take values in the interval . For any denote by the set of all bounded –dimensional Brownian martingales , such that for any , takes values in and satisfies . Define

| (4.1) |

where denotes the expectation with respect to the probability measure . We will prove that . In this section we show the inequality . First we prove that the right hand side of (4.1) does not depend on the maturity date .

Lemma 4.1.

For any ,

| (4.2) |

Proof.

Let and . Set . Consider the Brownian motion given by , . Let be the (usual) filtration which is generated by and let be the a set of all stopping times with values in with respect to this filtration. For any denote by the set of all martingales with respect to such that for any , takes values in and satisfies . Observe that for any , . Define the maps and by

Observe that and are bijections, and for any and . Thus

∎

In the next lemma we prove several properties of the function which will be essential in the Proof of Theorem 2.2.

Lemma 4.2.

The function is satisfying , where recall that was defined after (2.2).

Proof.

Consider the stopping time and the martingale . Clearly,

Next, for any define the bijection by . Since is a Lipschitz continuous function, there is a constant such that for any

Thus is continuous and satisfying . Finally, we prove that if in a convex region then is concave in . Let such that for some . Choose . From Lemma 4.1 it follows that there exist martingales , such that

| (4.3) |

For any let be a map such that depends only on the restriction of to the interval , and

Consider the Brownian motion , . Let be such that . Define the function by . Observe that the stochastic process defined by

is a martingale which satisfies . Next, define the stochastic processes

and

Define the stopping time by,

From the general theory of optimal stopping (see [13], Chapter I) it follows that

Fix . Define the Brownian motions , and , . Observe that for any , , and so we can define the martingale by

Clearly

From the fact that the Brownian motions, and are independent, and are independent, and and are independent, we obtain that

| (4.4) |

where

| (4.5) |

Since for any , from Lemma 4.1 and (4.4)–(4.5) we get that for any . Thus . This together with (4.3) and the fact that is independent of yields

and by taking we complete the proof. ∎

Next, we provide some convex analysis for the set and the static super–replication price .

Lemma 4.3.

The function which is defined by (2.4) is the minimal element of .

Proof.

We will use induction on the dimension . Let . From Lemma 2.4 in [6] it follows that has a minimal element and from the fact that is convex it follows that the minimal element is equal to which is given by (2.4). Next, we prove that if the result is true for any , then it is true for . Assume by contradiction that the claim is false. Thus there exists a function and such that . Set, and let . We argue that (where was defined after (2.4)). Indeed, if (by contradiction) , then and , thus . Define the function , . Since there exists some for which , then from the fact that is convex and we get that is a strictly increasing convex function on the interval , and so for sufficiently large we will get that , which is a contradiction to the fact that . Thus we conclude that , which means that there exist and such that

| (4.6) |

Let and consider the hyperplane , (where is the vector which is given by (2.3)). From (4.6) and the convexity of it follows that

| (4.7) |

Clearly, there is a point on of the form for some .

Consider the half–line .

Define

and , where ,

equal to if the corresponding sets are empty. We distinguish

between cases.

i. If , then

on the half–line , and so

by applying the induction assumption for we obtain

| (4.8) |

Since the function is concave

on the half–line , then from (4.7)–(4.8)

we get that

, which is a contradiction to (4.6).

ii. If and , then by using the fact that

and a similar argument to the one before (4.6) we obtain that

, in particular (4.8) is valid for this case as well. By

applying (4.7)–(4.8) together with the fact that is concave on the line segment

we get that

, which is a contradiction to (4.6).

iii. Let and . In this case (4.8) remains true. Since

then .

From the induction assumption we get that

. This together with

(4.8) and the fact

that is concave on the line segment

yields

,

which is a contradiction to (4.6).

iv. Finally, let .

From (4.7) and the induction assumption it follows that

| (4.9) | |||

Define . Since is concave on the line segments and , and on the line segment , then from (4.7) and (4.9) we obtain that on the line segment , which is a contradiction to (4.6). ∎

In the following lemma we show that there is a trivial perfect hedge with an initial capital , where is the initial stock position.

Lemma 4.4.

Proof.

Without loss of generality we assume that there exists such that if and only if . First we prove the following relations. For any ,

| (4.10) | |||

Indeed if then from the convexity of we obtain

This proves (by contradiction) the first statement in (4.10). Next, let . Fix . Consider the vector . From the convexity of it follows that

and by letting we obtain the second statement in (4.10). Now, we are ready to prove the lemma. Let be the hedge which is given by (2.6)–(2.7). If then the statement is trivial. Assume that , then from (4.10) we get

| (4.11) |

Let . Clearly, on the event we have

Consider the event . From (4.11) and the second statement in (4.10) it follows that for any , . Thus by applying the first statement in (4.10) we get

Since was arbitrary the proof is completed. ∎

5 Optimal Stopping and Price Consistent Systems

Let be the space of matrices with the operator norm . We denote by the unit matrix. For any , let be the unit vector where is in the –th place. For a matrix and a vector we denote by the matrix multiplication between and the column vector . First, we review some basic concepts from the weak convergence theory. For any stochastic process with values in some Euclidean space , denote by the distribution of on the canonical space equipped with the Skorohod topology (for details see [2]) i.e. for any Borel set , . The usual filtration which is generated by the process will be denoted by . For a sequence of ( valued) stochastic processes we will use the notation to indicate that the probability measures , converge weakly to on the space . For convergence of optimal stopping values we will need a stronger form of convergence, than the standard weak convergence. This form is called ”extended weak convergence” and was introduced in [1]. In [1] Aldous introduced the notion of ”extended weak convergence” via prediction processes. He showed that the original condition is equivalent to a more elementary condition which does not require the use of prediction processes (see [1], Proposition 16.15). We will use the latter condition as a definition.

Definition 5.1.

A sequence of , extended weak converges to a stochastic process if for any continuous bounded functions

on the space , where for any , and

denotes the expectation on the probability space on which is defined and denotes the expectation on the probability space on which is defined. We will denote extended weak convergence by .

Next, consider the Brownian probability space . Let be the set of all valued adapted processes (to the Brownian filtration) , given by , where is a continuous bounded function and satisfies if for any . The above condition guarantees that is an adapted (to the Brownian filtration) process. Observe that we consider as a random element in . Finally denote by as a set of all Brownian martingales of the form

Next, let be a orthogonal matrix such that its last column equals to . Let be the space of infinite sequences ; with the product probability . Define a sequence of i.i.d. random vectors by , . Denote by the set of all stopping times with respect to the filtration generated by , , with values in the set . Notice that the random vectors , have mean zero and a covariance matrix which is equals to . Choose . Let be a sequence such that for any the matrix is non–singular a.s. Clearly, there exists such sequence since the set of all eigenvalues of matrices of the form is countable. For any define the martingale by , and for

where is the –th row of the matrix . We assume that is sufficiently large such that takes on values in . Recall that is the initial stock position.

Lemma 5.2.

Set, , . We have

| (5.1) |

on the space (with the product topology).

Proof.

Define the ( valued) processes and , , . From [8] it follows that on the space . This together with Theorem 4.1 in [5] yields that on the space . Next, observe that the stochastic process , is the unique solution of the SDE, , and is the unique solution of the SDE, , . Thus by applying Theorem 4.4 in [5] we obtain (5.1). ∎

Next, we use the extended weak convergence theory in order to treat optimal stopping values.

Lemma 5.3.

For any there exists an absolutely continuous –consistent price system which satisfies

| (5.2) |

Proof.

Let . The processes and , are processes with independent increments and so, from Proposition 20.18 in [1] the usual weak convergence implies extended weak convergence . Since for any the process is adapted to the filtration generated by we get from Lemma 5.2 that . Now, that we established extended weak convergence, we apply Theorem 17.2 in [1] and obtain

| (5.3) | |||

where is the expectation with respect to . Assume that is Lipschizt continuous with a constant , namely Observe that for sufficiently large the martingale satisfies the three conditions before Lemma 3.2, where for the third condition we take . Thus from (5.3) it follows that we can choose which satisfies the above and the inequality

| (5.4) |

From Lemma 3.2 we obtain that there exists an absolutely continuous –price consistent system which satisfies this lemma for the martingale . Denote by the set of stopping times with values in the set . Observe that the fact that satisfies the second condition before Lemma 3.2 implies that the filtration which is generated by coincides with the filtration generated by . Thus from the standard dynamical programming for optimal stopping (see [13] Chapter I) and the equality (3.2) we obtain

| (5.5) |

Next, for any stopping time define the stopping time . Similarly to (3.10) we obtain , . This together with (5.4)–(5.5) yields

∎

By using standard density arguments it follows that is dense in . Namely, for any there exists a sub–sequence such that

Thus from Lemma 4.1 we obtain that for any

Next, we notice that if, in formula (5.2) we put some instead of then Lemma 5.3 still remains true (and can be proved in a similar way). In view of Lemma 4.1, we arrive at the following Corollary.

Corollary 5.4.

For any and there exists an absolutely continuous –price consistent system which satisfies

| (5.6) |

where is the set of all stopping times with respect to the filtration with values in the interval .

6 Proof of Main results

In this Section we complete the proof of Theorem 2.2. In view of Corollary 4.5 it remains to show that . Let be a perfect hedge. We want to show that , where is the initial stock position. Let be such that . Since the interest rate process is bounded there exists such that

| (6.1) |

From Corollary 5.4 we obtain that there exists an absolutely continuous price consistent system which satisfies (5.6). From (3.1) we get

| (6.2) |

Similarly

| (6.3) |

Next, for any define the stopping time

| (6.4) |

For any consider the partition , . From (6.2) and the dominated convergence theorem we obtain

| (6.5) | |||

In a similar way we obtain

| (6.6) |

From (6.5)–(6.6) it follows that

| (6.7) | |||

Since is a perfect hedge, the term in the brackets in formula (6.7) is non–negative. Thus, from (6.7), the Fatou’s lemma and the fact that as , we get

| (6.8) | |||

where the last inequality follows from the definition of a perfect hedge. From (3.1), (6.1) and the convexity of we get

Notice that in the last inequality we used the Lipschitz continuity of and the fact that is a martingale. This together with (5.6) and (6.8) yields

and by letting we obtain , as required.∎

Acknowledgements

I would like to thank Paolo Guasoni for insightful discussions.

References

- [1] D.Aldous, Weak convergence of stochastic processes for processes viewed in the strasbourg manner, Unpublished Manuscript, Statis. Laboratory Univ. Cambridge, 1981.

- [2] P. Billingsley, Convergence of Probability Measures, Wiley, New York, 1968.

- [3] B.Blum, The Face–Lifting Theorem for Proportional Transaction Costs in Multiasset Models, Statistics and Decisions. 27 (2009), 357–369.

- [4] B.Bouchard and N.Touzi, Explicit solution of the multivariate super-replication problem under transaction costs, Ann. Appl. Probab. 10 (2000), 685-708.

- [5] D.Duffie and P.Protter, From Discrete to Continuous Time Finance: Weak Convergence of the Financial Gain Process, Mathematical Finance. 2, 1–15, (1992).

- [6] E.Ekstrom and S.Villeneuve, On the value of optimal stopping games, Ann. Appl. Probab. 16 (2006), 1576-1596.

- [7] P.Guasoni, M.Rasonyi and W.Schachermayer, Consistent Price Systems and Face-Lifting Pricing under Transaction Costs, Ann. Appl. Probab. 18, 491–520, (2008).

- [8] H.He Convergence from discrete to continuous time contingent claim prices, Rev. Financial Stud. 3 (1990), 523 -546.

- [9] Yu.Kifer, Game options, Finance and Stoch. 4 (2000), 443–463

- [10] S.Levental and A.V.Skorohod, On the possibility of hedging options in the presence of transaction costs, Ann. Appl. Probab. 7 (1997), 410-443.

- [11] M.S.Pakkanen, Stochastic integrals and conditional full support, J.Appl.Probab. 47 (2010), 650–667.

- [12] M.H. Protter and C.B.Morrey, A First Course in Real Analysis, Springer-Verlag, (1991).

- [13] G.Peskir and A.N.Shiryaev, Optimal Stopping and Free-Boundary Problems, Lectures in Mathematics, ETH Zurich, Birkhauser, (2006).

- [14] H.M.Soner, S.E.Shreve and J.Cvitanic, There is no nontrivial hedging portfolio for option pricing with transaction costs, Ann. Appl. Probab. 5 (1995) 327–355.