On the Regular Variation of Ratios of Jointly Fréchet Random Variables

Abstract

We provide a necessary and sufficient condition for the ratio of two jointly -Fréchet random variables to be regularly varying. This condition is based on the spectral representation of the joint distribution and is easy to check in practice. Our result motivates the notion of the ratio tail index, which quantifies dependence features that are not characterized by the tail dependence index. As an application, we derive the asymptotic behavior of the quotient correlation coefficient proposed in Zhang (2008) in the dependent case. Our result also serves as an example of a new type of regular variation of products, different from the ones investigated by Maulik et al. (2002).

Keywords: Regular variation, multivariate Fréchet distribution, spectral representation, tail dependence index, logistic model, mixed model

AMS 2010 subject classifications: 62G32, 60G70

1 Introduction

Regular variation is often used to describe the tail behavior of random variables. A measurable function is regularly varying at infinity with index , written , if

When we say is slowly varying. A random variable is regularly varying with index , written , if the tail distribution is regularly varying: (see e.g. Resnick (1987)). For the sake of simplicity, we only consider non-negative random variables.

In extreme value theory, the notion of regular variation plays an important role in characterizing the domain of attraction of random variables. Namely, a random variable is regularly varying with index , if and only if

as , where is some normalizing sequence, are independent and identically distributed (i.i.d.) copies of , ‘’ stands for convergence in distribution and is a standard -Fréchet random variable with distribution

See e.g. Resnick (1987), Proposition 1.11. In this case, the random variable is said to be in the domain of attraction of . The notion of regular variation for multivariate random vectors and stochastic processes have also been investigated extensively. See e.g. Resnick (1987, 2007), de Haan and Ferreira (2006), Balkema and Embrechts (2007), and Hult and Lindskog (2005), among others. Other applications of regular variation include, just to mention a few, the domain of attraction of partial sums of i.i.d. random vectors (Rvačeva (1962)), large deviations of regularly varying random walks (Hult et al. (2005)) and finite-dimensional distributions of the stationary solution of stochastic recurrence equations (Kesten (1973) and Goldie (1991)).

In this paper, we consider the regular variation of ratios of two random variables and . From a practical point of view, the ratio can be seen as a random normalization of by . In extreme value theory, when modeling extremal behaviors, certain normalizations (thresholding) of values are often required. Random normalization sometimes has appealing theoretical properties and simplifies the statistical applications (see e.g. Heffernan and Resnick (2007), Section 4).

By viewing as the product of and , the problem is closely related to the regular variation of products of random variables. When the two random variables are independent, this problem has been addressed by Breiman (1965). On the other hand, Maulik et al. (2002) investigated certain dependence cases, which were then applied to the modeling of network traffic.

We address the regular variation of ratios in a specific case. Namely, we suppose that has a bivariate -Fréchet distribution (or, are jointly -Fréchet), i.e., for all , has -Fréchet distribution. To study the bivariate -Fréchet distributions, an efficient tool is the spectral representation introduced by de Haan (1984) and developed by Stoev and Taqqu (2005) (a brief review will be given in Section 2). Based on the spectral representation, we provide a necessary and sufficient condition for to be regularly varying (Theorem 1). If this is the case, then the regular variation index is referred to as the ratio tail index of . We demonstrate that our condition is easy to check through a few popular models.

Our specific setting provides examples that are not covered by the results in Breiman (1965) and Maulik et al. (2002). Furthermore, we show that the ratio tail index does not characterize the dependence between and in the traditional sense. We will compare the ratio tail index and the tail dependence index (see e.g. Sibuya (1960), de Haan and Resnick (1977) and Ledford and Tawn (1996)), which has been widely used to quantify asymptotic (in)dependence of random variables.

As the main application of our result, we derive the asymptotic behavior of the quotient correlation coefficient (Theorem 2) for jointly Fréchet distributions. This coefficient was proposed by Zhang (2008) and applied to test the independence of two random variables and . In this so-called gamma test, the quotient correlation coefficient is based on the independent samples of ratios and . The asymptotic behavior of the coefficient has so far been studied only in the case when and are independent Fréchet.

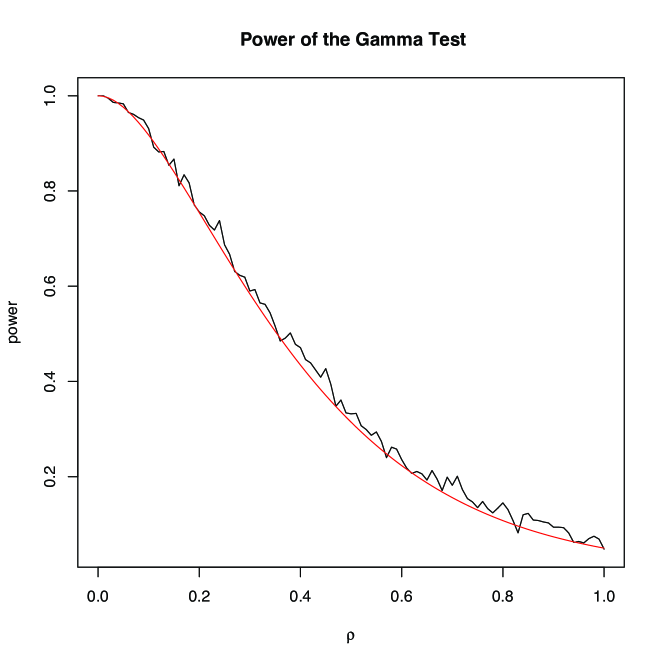

Our result provides new theoretical support for the gamma test. We show that, when is bivariate Fréchet, the power of the gamma test is high most of the time. Indeed, the asymptotic behavior of the quotient correlation coefficient is essentially determined by the ratio tail indices of and , if they exist. Furthermore, if the ratios have lighter tails than the single variables, then the gamma test rejects the null hypothesis with probability going to one as the sample size increases to infinity (Corollary 3). We also show that, when the ratios have tails equivalent to the ones of marginals, then in a ‘worst scenario’, the gamma test performs also reasonably well (Example 6).

The paper is organized as follows. Section 2 provides preliminaries on the regular variation and the spectral representations of bivariate -Fréchet random vectors. Section 3 is devoted to the characterization of regular variation of , based on the joint distribution of . Section 4 calculates the ratio tail indices for several well-known examples. In Section 5, we review Zhang’s gamma test and apply the result in Section 3 to derive the asymptotic behavior of the quotient correlation coefficient in the dependent case. Section 6 provides a proof of the joint distribution of , based on a result by Weintraub (1991). Finally, in Section 7 we briefly discuss the connection between our results and some related works.

2 Preliminaries

In this section, we review the spectral representation of bivariate -Fréchet distributions. We also introduce some notations that will be used in the rest of the paper.

We will focus on bivariate 1-Fréchet random vector . Every bivariate 1-Fréchet random vector has the following spectral representation:

| (1) |

Here, ‘’ stands for the extremal integral, is a standard Lebesgue space, for example, a Polish space with a -finite measure on its Borel sets , are measurable non-negative and integrable functions on , and is a 1-Fréchet random sup-measure on with control measure (see e.g. de Haan (1984) and Stoev and Taqqu (2005)). The functions and are called the spectral functions of and , respectively, and the joint distribution of can be expressed as follows:

| (2) |

The random vector in (1) is said to be standard, if it has standard 1-Fréchet marginals or equivalently, . It is well known that any bivariate -Fréchet random vector can be easily transformed into a standard 1-Fréchet random vector (see e.g. Stoev and Taqqu (2005), Proposition 2.9).

For the spectral representation of standard bivariate 1-Fréchet distribution (1), specific choices of and often appear in the literature (see e.g. de Haan and Ferreira (2006), Theorem 6.1.14). We will provide examples using the following one for our convenience. Set for , and , a probability distribution on with mean . In this case,

| (3) |

Many of our examples are constructed by choosing a specific , and their joint cumulative distribution functions often do not have simple forms.

The bivariate -Fréchet distributions arise as limits of i.i.d. bivariate regularly varying random vectors, and it is often convenient to use the notion of vague convergence, denoted by ‘’ (see e.g. Kallenberg (1986) and Resnick (1987)). In particular, a random vector is said to be regularly varying with index , if

| (4) |

in . Here, , , is the space of all nonnegative Radon measures on , the limit is non-zero and , for all . The measure is called the exponent measure, and it is said to have non-degenerate marginals, if and are non-degenerate in and , respectively. By Proposition 5.11 in Resnick (1987), when and has non-degenerate normalized marginals, one can write

such that . In this case, letting be i.i.d. copies of , the vague convergence (4) is equivalent to

| (5) |

with defined as in (3).

For any random vector , we say that and are asymptotically independent, if (5) holds with independent and . This corresponds to the case when and have disjoint supports in (1), or in (3) (after normalization), or the exponent measure in (4) concentrates on the two axes with non-degenerate marginals.

Throughout this paper, for all measurable functions and measurable sets , we write , and define

| (6) |

Here and in the sequel, we will use the convention . For any standard bivariate 1-Fréchet random vector as in (1), two important identities are

which follow from the dominated convergence theorem. Furthermore, the joint distribution (2) can be expressed as

| (7) |

Finally, for any random variable and , we consider a thresholded version of denoted by

| (8) |

as in Zhang (2008). We consider such thresholded random variables in order to analyze the quotient correlation coefficient ((21) below), although it will turn out that the threshold value does not play an essential role in the asymptotic behavior (see Remark 4 below). For a random vector in , let denote i.i.d. copies of .

3 Ratios of Fréchet Random Variables

In this section, we provide an explicit formula for the distribution of , . Here if . This leads to a necessary and sufficient condition for to be regularly varying. In the sequel, all the bivariate 1-Fréchet random vectors with representation (1) are assumed to be standard. We write if .

Our first result is an explicit formula for the joint distribution of .

Proposition 1.

Remark 1.

Proposition 1 can be seen as a special case of the conditional limit law established in Heffernan and Resnick (2007) (Propositions 4 and 5 therein), where are assumed to satisfy certain regular-variation type condition. Their results describe the asymptotic limit of as . Here, thanks to the spectral representation, we provide an explicit formula for the joint distribution of . In particular, our result readily implies that

which recovers Equation (32) in Heffernan and Resnick (2007). For a more general and geometric treatment of the conditional limit law, see Balkema and Embrechts (2007).

Now, the distribution of follows as a corollary.

Corollary 1.

Proof.

Inspired by (11), define

| (12) |

Clearly, . Then, provided , or equivalently, for all , (11) implies that for all ,

Therefore, we have thus proved the following result.

Theorem 1.

Consider given in (1) and suppose for all . Then,

| (13) |

In other words, for bivariate 1-Fréchet random vector , to study the regular variation of , it is equivalent to study the regular variation of in (12), based on the spectral functions. We will see in the next section that for many well-known examples, the regular variation of follows from simple calculations.

Remark 2.

When , or equivalently for large enough, we have by Proposition 1. This situation is relatively simple, and we do not study this case in this paper.

Remark 3.

From now on, we say has ratio tail index , if (13) holds. We immediately have the following consequences. In the sequel, for any non-decreasing function on , let denote the left-continuous inverse of .

Corollary 2.

Consider given in (1) and suppose for all . Suppose that has ratio tail index , then the following statements hold:

-

(i)

if and only if is slowly varying,

-

(ii)

for all and for all sequences ,

(14) where and is a standard -Fréchet random variables, and

-

(iii)

for any sequence such that , the convergence in (14) holds with replaced by and .

Proof.

Part (i) is trivial. Part (ii) follows from Proposition 1.11 in Resnick (1987) and part (iii) can be proved by a similar argument.∎

An important consequence of Theorem 1 is that, the tail of the ratio is always lighter than or equivalent to the tails of and . Indeed, (12) implies as , thus implies . The case includes the case when and are independent Fréchet random variables. This follows from Breiman (1965): if , has finite moment for some , and and are independent, then (here, has standard exponential distribution).

However, for dependent and , the ratio tail index can still equal 1. By Part (i) of Corollary 2, a simple case of is when . This is the case, in view of the spectral representation (3), when there is a point mass at , or equivalently when one can write , such that is 1-Fréchet or equal to 0 almost surely, is 1-Fréchet, and is independent of and . If in addition , then and are independent. We can also have examples such that and , by constructing to be slowly varying, in a similar way as in Example 2 below.

Next, we compare the ratio tail index and the tail dependence index defined by

| (15) |

provided the limit exists. The random variables and are asymptotically independent if , and asymptotically dependent if . The tail dependence index has been widely studied and applied. See e.g. Sibuya (1960), de Haan and Resnick (1977), Ledford and Tawn (1996), among others.

It is easy to see that when is bivariate 1-Fréchet, and are asymptotically independent if and only if they are independent, as is in its own domain of attraction. As a consequence, the tail dependence index (when ) measures the dependence strength of bivariate 1-Fréchet random vectors. To understand the difference between the tail dependence index and the ratio tail index, observe that in our case,

The tail dependence index is determined by the spectral measure on (excluding ), while the ratio tail index is determined by the behavior of on a small neighborhood of .

Example 1.

Consider given by

| (16) |

where and and are independent standard 1-Fréchet random variables. This corresponds, in (3), to choose

where is the unit point mass at . It is easy to see for . Therefore, , that is, the ratio tail index always equals 1 for .

Observe that in this model, however, the dependence strength between and varies for different choices of . Observe that , which increases from 0 to 1 as decreases from 1 to 0. By direct calculation, the tail dependence index equals , which reflects the dependence strength. The ratio tail index does not.

We conclude this section with a remark on role of the threshold value . The ratio tail indices of several concrete bivariate distributions are calculated in the following section.

Remark 4.

Theorem 1 and Corollary 2 indicate that the threshold value does not play an essential role in the asymptotic behavior of . Indeed, from (14), the limit, if it exists, is independent of , up to multiplicative constants. This suggests that letting is more interesting as , and part (iii) of Corollary 2 shows that this would change the convergence rate, but the limit is still the same.

4 Examples

In this section, we provide several examples on the ratio tail index. The first example is a concrete one where is not regularly varying.

Example 2.

We construct an example based on the spectral representation (3). We will find an such that as . Here is not regularly varying and therefore, by Theorem 1, is not regularly varying.

Suppose has Radon–Nikodym derivative w.r.t. the Lebesgue measure on . First, we need to find such that

for large enough and some constant to be chosen later. Solving the above equation, we obtain

One can choose a function and tune properly, such that

| (17) |

yields a probability measure on with mean . (For a simple choice, one can consider to be symmetric by setting for .) Thus, for corresponding to the spectral representation (3) with given in (17), the extremes of are compressed by the extremes of , resulting in an exponentially light tail of , which is not regularly varying.

The next example is the spectrally discrete bivariate 1-Fréchet random vectors.

Example 3.

A bivariate 1-Fréchet random vector is spectrally discrete, if it has the following representation

| (18) |

where are i.i.d. standard 1-Fréchet random variables, . This model corresponds, in (1), to choose , as the counting measure on , and .

Below, we calculate the ratio tail indices of two popular bivariate Fréchet distributions, the logistic model and the mixed model. These models have been studied carefully and applied widely to many real data analyses. See Beirlant et al. (2004) and the references therein for detailed results on these models and their modifications.

Example 4 (The logistic model (Gumbel (1960))).

Consider the bivariate 1-Fréchet distribution

| (19) |

for . Here, the parameter characterizes the dependence between and . The random variables and are independent, if = 1, and they are fully dependent, i.e., , if .

Example 5.13 in Resnick (1987) showed that this distribution has a representation (1) with, when ,

and . By straightforward calculation, we have

Therefore, writing ,

Theorem 1 implies that the logistic model (19) has ratio tail index . This provides a probabilistic interpretation of . Another way to interpret the parameter is provided by Ledford and Tawn (1998). Therein, it is shown that equals the limit probability that the component maxima do not occur at the same observation, i.e.,

Remark 5 (Estimation of the logistic model).

For the logistic model in Example 4, curiously one may want to apply the Hill estimator (Hill (1975)) on i.i.d. copies to estimate . Let be the order statistics of . Then, the Hill estimator is defined by

depending on a threshold integer value . This estimator is consistent in the sense that in probability, as long as and as (see e.g. de Haan and Ferreira (2006) Theorem 3.2.2). Furthermore, the asymptotic normality of is guaranteed by the second-order condition (see e.g. de Haan and Ferreira (2006), Definition 2.3.1, Theorem 3.2.5). Indeed, since the explicit formula of is available, after some calculation we can show

for , . When , the Hill estimator has the optimal rate (), but the limit will be a non-centered normal distribution.

However, applying the Hill estimator here has little practical interest, since in this parametric model the maximum likelihood estimator works well with better rate (): when , the estimation problem is regular and when , the non-regular behavior of the maximum likelihood estimator has been addressed by Tawn (1988).

Example 5 (The mixed model (Gumbel (1962))).

Consider the bivariate 1-Fréchet distribution

| (20) |

for . Here, corresponds to the independent case, though does not correspond to the full dependence case. By a similar calculation as in Example 5.13 in Resnick (1987), this distribution has a spectral representation (3) with

where and are unit point masses at and , respectively. Straightforward calculation shows

Therefore,

When , the ratio tail index equals , and

where is standard 2-Fréchet. When , the ratio tail index equals , and

where is standard 1-Fréchet. The asymptotic behavior of the maxima of the ratios changes dramatically at .

5 The Quotient Correlation and Independence Test

In this section, we apply our results on the ratio tail index to study the asymptotic behavior of a test statistic recently proposed by Zhang (2008). Therein, Zhang proposed the gamma test for testing the independence between two random variables, based on their ratios. A similar test was also proposed aiming at testing the asymptotic independence (tail independence). The asymptotic behavior of the test statistics proposed have so far been studied only for independent Fréchet random variables. Here, we establish asymptotic results for jointly Fréchet random variables with arbitrary dependence structure. We show that, in most of the dependence cases, the power of the hypothesis test goes to one as the sample size increases to infinity.

Zhang (2008) essentially focused on the test statistics of the form

| (21) |

where are i.i.d. copies of (recall (8)). When , is called the quotient correlation coefficient and when , is called the tail quotient correlation coefficient.

When and are independent, Zhang (2008) showed that

and

| (22) |

where and are independent standard 1-Fréchet random variables. Here stands for the gamma distribution, which equals the distribution of the sum of independent exponential random variables with mean . Recall that the inverse of a standard 1-Fréchet random variable has standard exponential distribution.

Based on (22) with , a hypothesis testing for independence was designed in Zhang (2008) with the following null and alternative hypothesis:

| (23) |

The test statistic then has gamma limit distribution as (22) under the null hypothesis, the test (23) is thus referred to as the gamma test. When , a similar hypothesis test was designed for testing asymptotic independence.

In this section, we address the asymptotic behavior of for dependent bivariate 1-Fréchet random vectors. Recall again that for jointly Fréchet random variables, the independence and the asymptotic independence are equivalent. Therefore, we will focus on the independence test (23) and in particular . This essentially requires to investigate the limit of the joint distributions

with as for some suitable sequence . However, all the asymptotic limits in this section would be the same for all , up to multiplicative constants depending on . We choose also for the sake of simplicity.

We first introduce some notations, since we need to deal with two groups of symbols, corresponding to and respectively. By default, the symbols with a sign ‘’ (‘’ resp.) correspond to the ratio ( resp.). In particular, for as in (1), write as in (12) and

We have shown in Section 4 how to calculate the regular variation of for several models. Here can be treated similarly. In particular, if for and is symmetric on , or equivalently in (3) is symmetric on , then . The following theorem and its corollary generalize Theorems 3.1 and 5.3 in Zhang (2008).

Theorem 2.

Proof.

As a corollary, we establish the asymptotic behavior of . The test statistic has different asymptotic limits, depending on different regular-variation type behaviors of . We write , if .

Corollary 3.

Proof.

Corollary 3 provides theoretical support for the gamma test. Indeed, it shows that as long as , then explodes quickly as . This means in this case, the gamma test rejects the null hypothesis with probability going to one as the sample size increases to infinity. Furthermore, the following example shows that when for some constants , the gamma test still performs reasonably well. In effect, this is indeed the ‘worst’ case that the gamma test could encounter, provided the ratio tail index exists.

Example 6.

Recall the model (16) considered in Example 1:

In this case, for , and the tail dependence index . Corollary 3 yields

Now, observe that in the strong tail dependence case, i.e., is close to 0, the power of the test is high. Consider a test of level . Let denote the lower quantile of the distribution of . For this model, the power converges to

| (29) |

Figure 1 illustrates the power of the test as a function of . We see that the test performs reasonably well as long as the tail dependence index is not too small. In addition, we also observe that the test statistic converges quickly. For , the power of the test is already close to the limit one in (29).

Remark 6.

In this experiment, we used a modified gamma test instead of the original one. Namely, instead of defined as in (21), we used a slightly different statistic with as in (27). We do not use the original test statistic because, in this example when is small and the sample size is small, with very high probability the would equal , which is not well defined.

Remark 7.

The model (16) represents the ‘worst’ case that the gamma test can encounter. This is the case when the power of the gamma test is low, but the tail dependence is the strongest possible.

To design such a scenario, we need to converge and to have the largest tail dependence index possible. To have to converge, by Corollary 3 we must have , which is equivalent to the fact that has point masses at and . Now, the tail dependence index is maximized by concentrating all the measure of on at .

In this example, the gamma test performs poorly when is close to 1. However, one should not expect any independent test to perform well, as as in (16) can be seen as a pair of independent random variables , slightly perturbed by (via the ‘max’() operation).

In Zhang (2008), other versions of were also proposed, aiming at dealing with arbitrary bivariate distributions. In principle, the data needs to be first transformed to have 1-Fréchet marginals. It is an intriguing problem to characterize how the dependence structure changes during such a transformation. The investigation along this line is out of the scope of this paper.

Remark 8.

Observe that for continuous random variables and with c.d.f. and , the joint distribution of will have marginal standard 1-Fréchet distributions. However, most of the time this transformation does not lead to a bivariate 1-Fréchet distribution. For studies on these distributions, see e.g. Ledford and Tawn (1996, 1997).

6 Proof of Proposition 1

We borrow a result from Weintraub (1991). Weintraub’s work is based on the min-stable distribution (processes), which can be equivalently transformed into our setting. Namely, if has a min-stable distribution with spectral functions and according to Weintraub (1991) (see also de Haan and Pickands (1986)), then is jointly 1-Fréchet with representation in (1).

Now, Lemma 3.4 in Weintraub (1991) becomes, for as in (1),

| (30) |

Then, letting denote the distribution of ,

Observe that . We have thus obtained (9). The proof is complete.

Remark 9.

Careful readers may find the difference between our definition of in (6) and the one in Weintraub (1991), Lemma 3.4 (where different symbols are used). Therein, , with the ‘’ in (6) replaced by ‘’. After reading the two paragraphs of the proof of Lemma 3.4, one should see that the correct definition of is as in (6) with ‘’. See also the proof of Lemma 3.5 in Weintraub (1991), where Lemma 3.4 was applied with ‘’.

An alternative way to see quickly it is not correct to choose the definition with ‘’ is given next. Note that, using ‘’ instead of ‘’ would only lead to a different formula when (or , resp.) is discontinuous at some . Consider

which has jumps at such that . In this case, the definition with ‘’ would cause to be right-discontinuous at . Indeed, both and would be right-discontinuous at . But , as a cumulative distribution function, should be right-continuous, which is a contradiction.

7 Discussion

Recently, several extensions of the notion of regular variation have been introduced. The main motivation behind them is to study in more details the asymptotic behaviors that are not captured by the standard multivariate regular variation.

In particular, Resnick (2002) introduced the notion of hidden regular variation, characterizing the dependence structure when components of the random vectors are asymptotically independent but not independent; Maulik et al. (2002) investigated the regular variation of products of random variables, and applied the result to model the network traffic.

We discuss our results from these perspectives.

Hidden regular variation.

Recall the definition of regular variation in the language of vague convergence (4). When the exponent measure concentrates on the two axes, the two random variables and are asymptotically independent. In this case,

does not provide useful information to characterize different dependence structures for asymptotically independent random variables. More sophisticated models are needed.

This problem was first investigated by Ledford and Tawn (1996, 1997), and their models later on were generalized under the framework of hidden regular variation by Resnick (2002, 2007, 2008). Hidden regular variation is present when the vague convergence (4) holds with concentrated on the axes, i.e., and are asymptotically independent, and in addition there exists , such that

in with . Intuitively, the notion of hidden regular variation involves normalizing the vector by sequences of constants of smaller order ) than required in (4). Thus, ignoring the two axes, certain dependence structure might appear in the limit. This dependence structure is not captured, therefore ‘hidden’, when the ‘standard’ rate is taken.

In our case, when is a bivariate 1-Fréchet random vector, we will see that are asymptotically independent, and there is no hidden regular variation. We first look at the convergence in form of

| (31) |

in with . Here, we are in a slightly different situation, as the normalizing sequences and are of different rates most of the time. In this case, we say and are asymptotically independent with different rates. The rates are the same, i.e., for some constant , if and only if , by Corollary 2, part (i). Otherwise, .

We first show below that and are asymptotically independent (with different rates if ). Indeed, for , Proposition 1 implies, writing for simplicity,

| (32) | |||||

It follows that for all rectangles in , . Recall also that by (14) (with ), . This together with (32) yields the following result.

Proposition 2.

Now, we examine the hidden regular variation of this model. Suppose that there exist sequences and , such that

| (33) |

in for some non-zero , i.e., is hidden-regularly varying. Then, by a similar calculation as in (32), we have

We see that cannot converge in . Therefore, we have proved the following.

Proposition 3.

There is no hidden regular variation for .

Regular variation of products. Maulik et al. (2002) proposed different generalizations of (4), for the purpose of characterizing the regular variation of the product of random variables. Their main results focus on two different situations.

First, if and

| (34) |

in , where and is a probability measure with . Then,

in with , determined by and (Maulik et al. (2002), Theorem 2.1). This case can be seen as a generalization of Breiman’s theorem, since has an equivalent tail as . Indeed, (34) is referred to as the (new) definition of asymptotic independence of and therein.

Second, suppose for some and and are asymptotically dependent with different rates, or equivalently,

in with . Then, . In this situation, the multiplication with a random variable changes the tail behavior.

Our asymptotic result on the bivariate Fréchet random variables (Theorem 1, with and ), does not fall into any of these situations. Indeed, if (13) holds with , then has a lighter tail than , which differs from the first situation; on the other hand, always has exponential distribution, which is not regularly varying, whence we are not in the second situation either. Therefore, the following question arises.

Question 1.

Let and be two nonnegative random variables. Suppose (but may not be regularly varying). Provide a sufficient condition on and such that is regularly varying with tail index .

Acknowledgements The author was grateful to Stilian Stoev for his careful reading of an early version of the paper, as well as many inspiring and helpful comments and suggestions. The author would also like to thank the Editor Jürg Hüsler and two anonymous referees for their helpful suggestions and comments, which significantly improved the paper. The author was partially supported by the National Science Foundation grant DMS–0806094 at the University of Michigan.

References

- Balkema and Embrechts (2007) Balkema, G., Embrechts, P., 2007. High risk scenarios and extremes. Zurich Lectures in Advanced Mathematics. European Mathematical Society (EMS), Zürich, a geometric approach.

- Beirlant et al. (2004) Beirlant, J., Goegebeur, Y., Teugels, J., Segers, J., 2004. Statistics of extremes. Wiley Series in Probability and Statistics. John Wiley & Sons Ltd., Chichester, theory and applications, With contributions from Daniel De Waal and Chris Ferro.

- Breiman (1965) Breiman, L., 1965. On some limit theorems similar to the arc-sin law. Theory of Probability and its Applications 10 (2), 323–331.

- de Haan (1984) de Haan, L., 1984. A spectral representation for max-stable processes. Ann. Probab. 12 (4), 1194–1204.

- de Haan and Ferreira (2006) de Haan, L., Ferreira, A., 2006. Extreme value theory. Springer Series in Operations Research and Financial Engineering. Springer, New York, an introduction.

- de Haan and Pickands (1986) de Haan, L., Pickands, III, J., 1986. Stationary min-stable stochastic processes. Probab. Theory Relat. Fields 72 (4), 477–492.

- de Haan and Resnick (1977) de Haan, L., Resnick, S. I., 1977. Limit theory for multivariate sample extremes. Z. Wahrscheinlichkeitstheorie und Verw. Gebiete 40 (4), 317–337.

- Goldie (1991) Goldie, C. M., 1991. Implicit renewal theory and tails of solutions of random equations. Ann. Appl. Probab. 1 (1), 126–166.

- Gumbel (1960) Gumbel, E. J., 1960. Bivariate exponential distributions. J. Amer. Statist. Assoc. 55, 698–707.

- Gumbel (1962) Gumbel, E. J., 1962. Multivariate extremal distributions. Bull. Inst. Internat. Statist. 39 (livraison 2), 471–475.

- Heffernan and Resnick (2007) Heffernan, J. E., Resnick, S. I., 2007. Limit laws for random vectors with an extreme component. Ann. Appl. Probab. 17 (2), 537–571.

- Hill (1975) Hill, B. M., 1975. A simple general approach to inference about the tail of a distribution. Ann. Statist. 3 (5), 1163–1174.

- Hult and Lindskog (2005) Hult, H., Lindskog, F., 2005. Extremal behavior of regularly varying stochastic processes. Stochastic Process. Appl. 115 (2), 249–274.

- Hult et al. (2005) Hult, H., Lindskog, F., Mikosch, T., Samorodnitsky, G., 2005. Functional large deviations for multivariate regularly varying random walks. Ann. Appl. Probab. 15 (4), 2651–2680.

- Kallenberg (1986) Kallenberg, O., 1986. Random measures, 4th Edition. Akademie-Verlag, Berlin.

- Kesten (1973) Kesten, H., 1973. Random difference equations and renewal theory for products of random matrices. Acta Math. 131, 207–248.

- Ledford and Tawn (1996) Ledford, A. W., Tawn, J. A., 1996. Statistics for near independence in multivariate extreme values. Biometrika 83 (1), 169–187.

- Ledford and Tawn (1997) Ledford, A. W., Tawn, J. A., 1997. Modelling dependence within joint tail regions. J. Roy. Statist. Soc. Ser. B 59 (2), 475–499.

- Ledford and Tawn (1998) Ledford, A. W., Tawn, J. A., 1998. Concomitant tail behaviour for extremes. Adv. in Appl. Probab. 30 (1), 197–215.

- Maulik et al. (2002) Maulik, K., Resnick, S. I., Rootzén, H., 2002. Asymptotic independence and a network traffic model. J. Appl. Probab. 39 (4), 671–699.

- Resnick (1987) Resnick, S. I., 1987. Extreme values, regular variation, and point processes. Vol. 4 of Applied Probability. A Series of the Applied Probability Trust. Springer-Verlag, New York.

- Resnick (2002) Resnick, S. I., 2002. Hidden regular variation, second order regular variation and asymptotic independence. Extremes 5 (4), 303–336 (2003).

- Resnick (2007) Resnick, S. I., 2007. Heavy-tail phenomena. Springer Series in Operations Research and Financial Engineering. Springer, New York, probabilistic and statistical modeling.

- Resnick (2008) Resnick, S. I., 2008. Multivariate regular variation on cones: application to extreme values, hidden regular variation and conditioned limit laws. Stochastics 80 (2-3), 269–298.

- Rvačeva (1962) Rvačeva, E. L., 1962. On domains of attraction of multi-dimensional distributions. In: Select. Transl. Math. Statist. and Probability, Vol. 2. American Mathematical Society, Providence, R.I., pp. 183–205.

- Sibuya (1960) Sibuya, M., 1960. Bivariate extreme statistics. I. Ann. Inst. Statist. Math. Tokyo 11, 195–210.

-

Stoev and Taqqu (2005)

Stoev, S. A., Taqqu, M. S., 2005. Extremal stochastic integrals: a parallel

between max-stable processes and -stable processes. Extremes 8 (4),

237–266 (2006).

URL http://dx.doi.org/10.1007/s10687-006-0004-0 - Tawn (1988) Tawn, J. A., 1988. Bivariate extreme value theory: models and estimation. Biometrika 75 (3), 397–415.

- Weintraub (1991) Weintraub, K. S., 1991. Sample and ergodic properties of some min-stable processes. Ann. Probab. 19 (2), 706–723.

- Zhang (2008) Zhang, Z., 2008. Quotient correlation: a sample based alternative to Pearson’s correlation. Ann. Statist. 36 (2), 1007–1030.