Close the Gaps: A Learning-while-Doing Algorithm for a Class of Single-Product Revenue Management Problems

Abstract

We consider a retailer selling a single product with limited on-hand inventory over a finite selling season. Customer demand arrives according to a Poisson process, the rate of which is influenced by a single action taken by the retailer (such as price adjustment, sales commission, advertisement intensity, etc.). The relationship between the action and the demand rate is not known in advance. However, the retailer is able to learn the optimal action “on the fly” as she maximizes her total expected revenue based on the observed demand reactions.

Using the pricing problem as an example, we propose a dynamic “learning-while-doing” algorithm that only involves function value estimation to achieve a near-optimal performance. Our algorithm employs a series of shrinking price intervals and iteratively tests prices within that interval using a set of carefully chosen parameters. We prove that the convergence rate of our algorithm is among the fastest of all possible algorithms in terms of asymptotic “regret” (the relative loss comparing to the full information optimal solution). Our result closes the performance gaps between parametric and non-parametric learning and between a post-price mechanism and a customer-bidding mechanism. Important managerial insight from this research is that the values of information on both the parametric form of the demand function as well as each customer’s exact reservation price are less important than prior literature suggests. Our results also suggest that firms would be better off to perform dynamic learning and action concurrently rather than sequentially.

1 Introduction

Revenue management is a central problem for many industries such as airlines, hotels, and retailers. In revenue management problems, the availability of products is often limited in quantity and/or time, and customer demand is either unknown or uncertain. However, demands can be influenced by actions such as price adjustment, advertisement intensity, sales person compensation, etc. Retailers are interested in methods to select an optimal action plan that maximizes their revenue in such environments.

Most existing research in revenue management assumes that the functional relationship between the demand distribution (or the instantaneous demand rate) and retailers’ actions is known to the decision makers. This relationship is then exploited to derive optimal policies. However, in reality, decision makers seldom possess such information. This is especially true when a new product or service is provided at a new location or the market environment has changed. In light of this, some recent research has proposed methods that allow decision makers to probe the demand functions while optimizing their policies based on learning.

There are two types of learning models: parametric and non-parametric. In parametric learning, prior information has been obtained about which parametric family the demand function belongs to. In this case, decision makers take actions “on the fly” while updating their estimations about the underlying parameters. On the other hand, non-parametric learning assumes no properties of the demand function except some basic regularity conditions, and it is the decision maker’s task to learn the demand curve with such limited information. Intuitively, non-parametric approaches are more complex than the parametric ones because the non-parametric function space is much larger. However, the exact performance difference between these two models is not clear and several questions are to be answered: First, what are the “optimal” learning strategies for each setting? Second, what are the minimal revenue losses that will be incurred over all possible strategies? Third, how valuable is the information that the demand function belongs to a particular parametric family? Moreover, it seems quite advantageous for the sellers to know each customer’s exact valuation rather than only observing “yes-or-no” purchase decisions. But exactly how much benefit is it?

In this paper, we provide answers to these questions using an example in which the retailer’s sole possible action is to control the price. In such a problem, a retailer sells a limited inventory over a finite sales season. The demand is a Poisson process whose intensity is controlled by the prevailing price posted by the retailer. The relationship between the price and the demand rate is not known to the retailer and she can only learn this information through observing realized demand at the price she sets. Specifically, we are interested in a non-parametric setting in which the retailer knows little about the demand function except some regularity conditions. The objective of the retailer is to maximize her revenue over the entire selling season.

As discussed in prior literature, the key of a good pricing algorithm under demand uncertainty lies in its ability to balance the tension between demand learning (exploration) and near-optimal pricing (exploitation). The more time one spends in price exploration, the less time remains to exploit the knowledge to obtain the optimal revenue. On the other hand, if exploration is not done sufficiently, then one may not be able to find a price good enough to achieve a satisfactory revenue. This is especially true in the non-parametric setting where it is harder to infer structural information from the observed demand. In prior literature, researchers have proposed price learning algorithms with separated learning and doing phases, in which a grid of prices are tested and then the optimal one is used for pricing. Theoretical results are established to show that those algorithms achieve asymptotic optimality at a decent rate, see Besbes and Zeevi [8].

The main contribution of our paper is to propose a dynamic price-learning algorithm that iteratively performs price experimentation within a shrinking series of intervals that always contain the optimal price (with high probability). We show that our dynamic price-learning algorithm has a tighter upper bound on the asymptotic regret (the relative loss to the clairvoyant optimal revenue) than the one-time grid learning strategy. By further providing a worst-case example, we prove that our algorithm provides the near best asymptotic performance over all possible pricing policies. Our result provides important managerial insights to revenue management practitioners: we should not separate price experimentation from exploitation, instead, we should combine “learning” and “doing” in a concurrent procedure to achieve the smallest revenue loss.

We further summarize our contributions in the following:

-

1.

Under some mild regularity conditions on the demand function, we show that our pricing policy achieves a regret of 111We use the notation to mean that for some constant and , ., uniformly across all demand functions. This result improves the best-known bound (of the asymptotic regret) by Besbes and Zeevi [8] for both the non-parametric learning (the best known bound was ) and the parametric learning (the best known bound was ) in this context. One consequence of our result is that it closes the efficiency gap between parametric and non-parametric learning, implying that the value of knowing the parametric form of the demand function in this problem is marginal when the best algorithm is adopted. In this sense, our algorithm could save firms’ efforts in searching for the right parametric form of the demand functions.

-

2.

Our result also closes the gap between two price revealing mechanisms in revenue management: the customer-bidding mechanism and the post-price mechanism. Agrawal et al [2] obtained a near-optimal dynamic learning algorithm with regret under the former mechanism (in a slightly different setting). However, in post-price models, the previous best algorithm by Besbes and Zeevi [8] achieves a regret of . It was unclear how large is the gap between the two pricing mechanisms. Surprisingly, our algorithm shows that although the post-price mechanism extracts much less information from each individual customer’s valuation of the product, it can achieve the same order of asymptotic performance as that of customer-bidding mechanisms. Therefore, our result reassures the usage of the post-price mechanism, which is much more widespread in practice.

-

3.

On the methodology side, our algorithm provides a new form of dynamic learning mechanism. In particular, we do not separate the “learning” and “doing” phases; instead, we integrate “learning” and “doing” together by considering a shrinking series of price intervals. This concurrent dynamic is the key to achieve a perfect balance between price exploration and exploitation, and thus achieve the near maximum efficiency. We believe that this method may be applied to problems with even more complex structures.

2 Literature Review

Pricing strategies have been an important research area in revenue management and there is abundant literature on this topic. We refer to Bitran and Caldentey [11], Elmaghraby and Keskinocak [17] and Talluri and van Ryzin [26] for a comprehensive review on this subject. Prior research has mostly focused on the cases where the functional relationship between the price and demand (also known as the demand function) is given to the decision maker. For example, Gallego and van Ryzin [19] presented a foundational work in such a setting where the structure of the demand function is exploited and the optimal pricing policies are analyzed.

Although knowing the exact demand function is convenient for analysis, decision makers in practice do not usually have such information. Therefore, much recent literature addresses the dynamic pricing problems with unknown demand function. The majority of these work take the parametric approach, e.g., Lobo and Boyd [24], Bertsimas and Parekis [7], Araman and Caldentey [3], Aviv and Pazgal [5], Carvalho and Puterman [14], Farias and Van Roy [18], Broder and Rusmevichientong [13], den Boer and Zwart [16, 15] and Harrison et al [20]. In these pieces of work, the demand function is assumed to take a certain parametric form, and the design of algorithm is revolved around learning and estimating the underlying parameters. Although such an approach simplifies the problem to some degree, the restriction to a certain demand function family may incur model misspecification risk. As shown in Besbes and Zeevi [8], misspecifying the demand family may lead to revenue that is far from the optimal. In such cases, a non-parametric approach would be preferred because it does not commit to a single family of demand functions.

The main difficulty facing the non-parametric approach is its tractability and efficiency. And most research revolves around this question. Several studies consider a model that the customers are chosen adversarially, e.g. Ball and Queyranne [6] and Perakis and Roels [25]. However, their models take a relatively conservative approach and no learning is involved. In another paper by Lim and Shanthikumar [23], they consider dynamic pricing strategies that are robust to an adversarial at every point in the stochastic process. Again, this approach is quite conservative and the main theme is about robustness rather than demand learning.

The work that is closest to our paper is that of Besbes and Zeevi [8] where the authors consider demand learning in both parametric and non-parametric cases. They propose learning algorithms for both cases and show that there is a gap in performance between them. They also provide lower bounds for the revenue loss in both cases. In this paper, we improve their bounds for both cases and close the gap between them. In particular, they consider algorithms that separate learning and doing phases where price experimentation is performed exclusively during the learning phase (except the parametric case with a single parameter). In our paper, learning and doing are dynamically integrated: we keep shrinking a price interval that contains the optimal price and keep learning until we guarantee that the revenue achieved by applying the current price is near-optimal. Although our model resembles theirs, our algorithm is quite different and the results are stronger.

More recently, Besbes and Zeevi [10] propose a new dynamic pricing algorithm, in which the seller pretends that the underlying demand function is linear and chooses price to maximize a proxy revenue function based on the estimated linear demand function. They show that although the model might be misspecified, one can still achieve a regret of . Their result is novel and important. However, they require a slightly stricter condition on the true underlying demand function than ours. Moreover, their model doesn’t allow inventory constraints and only considers a discrete time framework. As pointed out in [16] and shown in our paper, the presence of inventory constraints and the continuous time framework could bring significant differences to the analysis and performance of pricing algorithms. Similar differences also exist between our work and that of Kleinberg and Leighton [21].

Other related literature that focus on the exploration-exploitation trade-off in sequential optimization under uncertainty are from the study of the multi-armed bandit problem: see Lai and Robbins [22], Agrawal [1], Auer et al [4] and references therein. Although our study shares similarity in ideas with the multi-armed bandit problem, the problem we consider has a continuous learning horizon (the time is continuous), continuous learning space (the possible demand function is continuous) and continuous action space (the price set is continuous). These features with the presence of inventory constraint distinguish our algorithm and analysis from theirs.

3 Problem Formulation

3.1 Model and Assumptions

In this paper, we consider the problem of a monopolist selling a single product in a finite selling season . The seller has a fixed inventory at the beginning and no recourse actions on the inventory can be made during the selling season. During the selling season, customers arrive according to a Poisson process with an instantaneous demand rate at any time . In our model, we assume that is solely determined by the price offered at time , that is, we can write where is the price at time . At time , the sales will be terminated and there is no salvage value for the remaining items (as shown in [19], the zero salvage value assumption is without loss of generality).

We assume the set of feasible prices is an interval with an additional cut-off price such that . The demand rate function is assumed to be decreasing in and has an inverse function . The revenue rate function is assumed to be concave in . These assumptions are quite standard and such demand functions are called the “regular” demand functions in the revenue management literature [19].

In addition, we make the following assumptions

on the demand rate function and the revenue rate function :

Assumption 1. For some positive constants , , and ,

-

1.

Boundedness: for all ;

-

2.

Lipschitz continuity: and are Lipschitz continuous with respect to with a factor . Also, the inverse demand function is Lipschitz continuous in with a factor ;

-

3.

Strict concavity and differentiability: exists and for all in the range of for .

In the following, let denote the set of demand functions satisfying the above assumptions with the corresponding coefficients. Assumption 1 is quite mild and has been adopted in several prior revenue management literature, see, e.g., [13, 21]. It holds for many commonly-used demand function classes including linear, exponential, and logit demand functions.

In our model, the seller does not know the true demand function , the only knowledge she has is that it belongs to . Note that doesn’t need to have any parametric representation. Therefore, our model is robust in terms of the choice of the demand function family.

3.2 Minimax Regret Objective

To evaluate the performance of any pricing algorithm, we adopt the minimax regret objective formalized in [8]. We call a pricing policy admissible if it is a non-anticipating price process that is defined on , and satisfies the inventory constraint, that is

where denotes the cumulative demand up to time using policy .

We denote the set of admissible pricing policies by . The expected revenue generated by a policy is defined by

| (1) |

Here, the presence of in means that the expectation is taken with respect to the demand function . Given a demand function , we wish to find the optimal admissible policy that maximizes (1). In our model, since we don’t know the exact , we seek that performs as close to as possible.

However, even if the demand function is known, computing the expected value of the optimal policy is hard. It involves solving a Bellman equation resulting from a dynamic program. Fortunately, as shown in [8, 19], we can obtain an upper bound for the expected value for any policy via considering a full-information deterministic optimization problem. Define:

| (2) |

In (2) all the stochastic processes are substituted by their means. In [8], the authors showed that provides an upper bound on the expected revenue generated by any admissible pricing policy , that is, , for all and . With this relaxation, we can define the regret for any given demand function and policy by

| (3) |

Clearly, is always greater than . And by definition, the smaller the regret, the closer is to the optimal policy. However, since the decision maker does not know the true demand function, it is attractive to obtain a pricing policy that achieves small regrets across all the underlying demand function . To capture this, we consider the “worst-case” regret. That is, the decision maker chooses a pricing policy , and the nature picks the worst possible demand function for that policy:

Our goal is to minimize the worst-case regret:

| (4) |

Unfortunately, it is hard to evaluate (4) for any finite size problem. In this work, we adopt the widely-used asymptotic performance analysis. We consider a regime in which both the size of the initial inventory, as well as the potential demand, grow proportionally large. In a problem with size , the initial inventory and the demand function are given by222It is worth pointing out that one could also define the size problem by fixing while enlarging and by a factor of . Our proposed algorithm still works in that case, with the length of each learning period to be times the length of the learning period in the current algorithm. We choose the current way of presentation to maintain consistency with the literature.:

Define to be the deterministic optimal solution for the problem with size and to be the expected value of a pricing policy when it is applied to a problem with size . The regret for the size- problem is therefore defined by

| (5) |

and our objective is to study the asymptotic behavior of as grows large and design an algorithm with small asymptotic regret.

4 Main Results: Dynamic Pricing Algorithm

In this section, we introduce our dynamic pricing algorithm. Before we state our main results, it is useful to discuss some basic structural intuitions of this problem.

4.1 Preliminary Ideas

Consider the full-information deterministic problem (2). As shown in [8], the optimal solution to (2) is given by

| (6) |

where

| (7) |

| (8) |

Here, the superscript stands for “unconstrained” and superscript stands for “constrained”. As shown in (6), the optimal price is either the revenue maximizing price, or the inventory depleting price, whichever is larger. The following important lemma is proved in [19].

Lemma 1.

Let be the optimal deterministic price when the underlying demand function is . Let to be the pricing policy that uses the deterministic optimal price throughout the selling season until there is no inventory left. Then .

Lemma 1 says that if one knows , then simply applying this price can achieve asymptotically optimal performance. Therefore, the idea of our algorithm is to find an estimate close enough to the true one efficiently, using empirical observations on hand. In particular, under Assumption 1, we know that if , then

| (9) |

for close to while if , then

| (10) |

for close to . In the following discussion, without loss of generality, we assume . Note that this can always be achieved by choosing a large interval of .

4.2 Dynamic Pricing Algorithm

We first state our main results as follows:

Theorem 1.

Let Assumption 1 hold for . Then there exists an admissible policy generated by Algorithm DPA, such that for all ,

for some constant .

Here only depends on , the initial inventory and the length of time horizon . The exact dependence is quite complex and thus omitted. A corollary of Theorem 1 follows from the relationship between the non-parametric model and the parametric one:

Corollary 1.

Assume is a parameterized demand function family satisfying Assumption 1. Then there exists an admissible policy generated by Algorithm DPA, such that for all ,

for some constant that only depends on the coefficients in , and .

Now we describe our dynamic pricing algorithm. As alluded in Section 4.1, we aim to learn through price experimentations. Specifically, our algorithm will be able to distinguish whether “” or “” is optimal. Meanwhile we keep a shrinking interval containing the optimal price with high probability until a certain accuracy is achieved.

Algorithm DPA (Dynamic Pricing Algorithm) :

Step 1. Initialization:

- (a)

Step 2. Learn or determine :

For to do

-

(a)

Divide into equally spaced intervals and let be the left endpoints of these intervals;

-

(b)

Divide the time interval into equal parts and define

-

(c)

For from 1 to , apply from time to . If inventory runs out, then apply until time and STOP;

-

(d)

Compute

-

(e)

Compute

(11) -

(f)

If

(12) then break from Step 2, enter Step 3 and set ;

Otherwise, set . Define(13) and

(14) And define the price range for the next iteration

Here we truncate the interval if it doesn’t lie inside the feasible set ;

-

(g)

If , then enter Step 4(a);

Step 3. Learn when :

For to do

-

(a)

Divide into equally spaced intervals and let be the left endpoints of these intervals;

-

(b)

Define

-

(c)

For from to , apply from time to . If inventory runs out, then apply until time and STOP;

-

(d)

Compute

-

(e)

Compute

(15) Define

(16) and

(17) And define the price range for the next iteration

Here we truncate the interval if it doesn’t lie inside the feasible set of ;

-

(f)

If , then enter Step 4(b);

Step 4. Apply the learned price:

-

(a)

Define . Use for the rest of the selling season until the inventory runs out;

-

(b)

Define . Use for the rest of the selling season until the inventory runs out.

Now we explain the idea behind our algorithm before we proceed to proofs. In this algorithm, we divide the time interval into a carefully selected number of pieces. In each piece, we test a grid of prices on a certain price interval. Based on the empirical observations, we shrink the price interval to a smaller subinterval that still contains the optimal price (with high probability), and enter the next time interval with the smaller price range. We repeat the shrinking procedure until the price interval is small enough so that the desired accuracy is achieved.

Recall that the optimal deterministic price is equal to the maximum of and , where and are solved from (7) and (8) respectively. As shown in (9) and (10), the local behavior of the revenue rate function is quite different around and : the former one resembles a quadratic function while the latter one resembles a linear function. This difference requires us to use different shrinking strategies for the cases when and . This is why we have two learning steps (Step 2 and 3) in our algorithm. Specifically, in Step 2, the algorithm works by shrinking the price interval until either a transition condition (12) is triggered or the learning phase is terminated. We show that (in Lemma 3 in Section 5), when the transition condition (12) is triggered, with high probability, the optimal solution to the deterministic problem is . Otherwise, if we terminate learning before the condition is triggered, we know that is either the optimal solution to the deterministic problem or it is close enough so that using will also yield a near-optimal revenue. When (12) is triggered, we switch to Step 3, in which we use a new set of shrinking and price testing parameters. Note that in Step 3, we start from the initial price interval rather than the current interval obtained. This is not necessary but for the ease of analysis. Both Step 2 and Step 3 (if it is invoked) must terminate in a finite number of iterations (we prove this in Lemma 2).

In the end of the algorithm, a fixed price is used for the remaining selling season (Step 4) until the inventory runs out. In fact, instead of applying a fixed price in step 4, one may continue learning using our shrinking strategy. However, it will not further improve the asymptotic performance of our algorithm. Also in the algorithm, we always use as the target when learning (in (11) and (15)), but not the updated remaining inventory and time. The reason is explained by Lemma 1, which states that learning (thus using ) is sufficient to get an optimal performance. This in fact leads to an interesting observation, that is, capturing the fluctuation of the demand is a relative secondary consideration in pricing in an uncertain demand environment.

Another thing to note is that the “next” intervals defined in (13) and (14) in our algorithm are not symmetric about the current best estimate. Similarly in Step 4(a), we use an adjusted price for the remaining selling season. These adjustments are to make sure that the inventory consumption can be adequately upper bounded. Meanwhile the adjustments are kept small enough so that the revenue is maintained. The detailed reasoning of these adjustments will be illustrated in Section 5.

In the following, we define and . Without loss of generality, we assume and in the following discussion. We first provide a set of relationships we want and to satisfy. Then we explain the meaning of each relationship and derive a set of parameters that satisfy these relationships. We use the notation to mean that and are of the same order in .

The set of relationships that we want to satisfy are:

| (18) |

| (19) |

| (20) |

Also we define

| (21) |

Next we state the set of relationships we want to satisfy:

| (22) |

| (23) |

| (24) |

Also we define

| (25) |

To understand the above relationships, it is useful to examine the source of revenue losses in this algorithm. First, there is an exploration loss in each period - the prices tested are not optimal, resulting in suboptimal revenue rate or suboptimal inventory consumption rate. The magnitude of such losses in each period is roughly the deviation of the revenue rate (or the inventory consumption rate) multiplied by the time length of the period. Second, there is a deterministic loss due to the limited learning capacity - we only test a grid of prices in each period, and may never use the exact optimal price. Third, since the demand follows a stochastic process, the observed demand rate may deviate from the true underlying demand rate, resulting in a stochastic loss. Note that these three losses also exist in the learning algorithm proposed in [8]. However, in dynamic learning, the loss in one period does not simply appear once, it may have impact on all the future periods. The design of our algorithm tries to balance these losses in each step to achieve the maximum efficiency of learning. With these in mind, we explain the meaning of each equation above in the following:

-

•

The first relationship (18) ((22), resp.) balances the deterministic loss induced by only considering the grid points (the grid granularity is , resp.)) and the stochastic loss induced in the learning period which will be shown to be (, resp.). Due to the relationship in (9) and (10), the loss is quadratic in the price granularity in Step 2, and linear in Step 3.

- •

-

•

The third relationship (20) ((24), resp.) is used to bound the exploration loss for each learning period. This is done by considering the multiplication of the revenue rate deviation (also demand rate deviation) and the length of the learning period, which in our case can be upper bounded by (, resp.). We want this loss to be of the same order for each learning period (and all equal to the loss in the first learning period, which is ) to achieve the maximum efficiency of learning.

-

•

Formula (21) ((25), resp.) determines when the price we obtain is close enough to optimal such that we can apply this price in the remaining selling season. We show that (, resp.) is an upper bound of the revenue rate and demand rate deviation of price . When this is less than , we can simply apply and the loss will not exceed the loss of the first learning period.

Now we solve the relations (18)-(20) and obtain a set of parameters that satisfy them:

| (26) |

| (27) |

As a by-product, we have

| (28) |

Similarly, we solve the relations (22)-(24) and obtain a set of parameters that satisfy them:

| (29) |

| (30) |

and

| (31) |

Note that by (28) and (31), the price intervals defined in our algorithm indeed shrink in each iteration.

5 Outlines of the Proof of Theorem 1

In this section, we provide an outline of the proof of Theorem 1. We leave most of the technical details in the Appendix, only the major steps are presented.

We first show that our algorithm will stop within a finite number of iterations. We have the following lemma:

Lemma 2.

and defined in (21) satisfy: and , for .

Proof. See Appendix 10.2.

Lemma 2 provides an upper bound of the number of iterations of our algorithm. In our analysis, we frequently need to take a union bound over the number of iterations, and Lemma 2 will be used. For brevity, the condition that will be omitted in the future discussion.

In our algorithm, it is important to make sure that the deterministic optimal price is always contained in our price interval with high probability. This is because once our price interval does not contain the deterministic optimal price, a constant loss will be incurred for all periods afterwards, and the algorithm will not be asymptotic optimal. The next lemma ensures the inclusion of in all steps with high probability.

Lemma 3.

Assume is the optimal price for the deterministic problem and Assumption 1 hold for . Define to be the event satisfying the following conditions:

-

1.

If we never enter Step 3, then for all ;

-

2.

If Step 2 stops at and the algorithm enters Step 3, then , for all and for all .

Then .

Proof. Here we present a sketch proof to show that condition 1 holds with probability . The complete proof of this lemma is given in Appendix 10.3.

We first show that if , then with probability , . Define

Denote the unconstrained and constrained optimal solutions on the current interval to be and . We can show (the details are in Appendix 10.3) that with probability , and (in our analysis, for simplicity, we use to denote a generic constant which only depends on the coefficient in , and ). Therefore, with probability , . On the other hand, the next price interval is centered near with length of order greater than . Therefore, with probability , . Then we take a union bound over all ’s (at most of them) and condition 1 holds with probability .

A corollary of Lemma 3 is that if , then with probability , our algorithm will not enter Step 3. When , however, it is also possible that our algorithm will not enter Step 3, but we show in that case, must be very close to so that the revenue collected is still near-optimal.

Now we have proved that with high probability, will always be in our price interval. We next analyze the revenue collected by this algorithm and prove our main theorem.

We condition our analysis on the time the algorithm enters Step 3. Define the following events:

Define to be a Poisson random variable with parameter ; to be a Poisson random variable with parameter ; to be a Poisson random variable with parameter and to be a Poisson random variable with parameter . Define events

where is the event defined in Lemma 2. The expected revenue collected by DPA can be therefore bounded by

| (32) |

In (5), the first and third terms are lower bounds of the expected revenue collected in Step 2 and 3 of DPA, respectively. The second and fourth terms are lower bounds of the expected revenue collected in Step 4(a) and (b) respectively. In the following, we further analyze each term in (5). We show that, the revenue collected in each term is “close” to the revenue generated by the optimal deterministic price in the same period. We first prove the following lemma for the first term:

Lemma 4.

| (33) |

Lemma 4 says that the revenue collected in Step 2

is close to the revenue that would have been collected if one uses

the deterministic optimal price for the same time period. The

proof of the lemma consists of two main steps. The first step is to

show that one can remove the indicator function without

losing more than , this is done by bounding the

probability of and some basic probability inequalities. The

second step is to show that the difference between the revenue

earned at and can be adequately bounded. For this,

we use the local quadratic property of the revenue function at

. We give a sketch proof as follows.

Proof. First, the left hand side of (33) can be written as

| (34) |

For the first term, note that is independent of , therefore independent of . Thus

Also, as shown in Lemma 3, with probability , is within the current price interval, and by Assumption 1,

Therefore, we have

where the last term is because of (28).

For the second term in (34), we apply the Cauchy-Schwarz inequality:

Since is a Poisson random variable, we have

In Appendix 10.4, we show that . Therefore,

And thus Lemma 4 holds.

Next we study the second term in (5). We have the following lemma:

Lemma 5.

| (35) |

Lemma 5 says that the revenue earned at step 4(a)

is close to the revenue that would have been collected if one uses

the deterministic optimal price for the same time period. To

show this lemma, the key is to show that the situations when the

sale terminates early are rare. That is, with high probability,

. This is done by analyzing

the tail probability of Poisson random variables. The detailed

analysis is given as follows.

Proof. We start with the following transformation of the left hand side of (35)

We then show that

| (36) |

which means that the revenue collected in this period is close to the revenue generated using for this period of time. Also we show that

| (37) |

which means that the loss due to over-consumption of the inventory is small. The detailed proof of (36) and (37) can be found in Appendix 10.5. Combining (36) and (37), we prove Lemma 5.

For the third term in (5), we have

Lemma 6.

| (38) |

And for the last term in (5), we have

Lemma 7.

For each ,

| (39) |

6 Lower Bound Example

In Section 4 and 5, we have proposed a dynamic pricing algorithm and proved an upper bound of on its regret in Theorem 1. In this section, we show that there exists a class of demand functions satisfying our assumptions such that no pricing policy can achieve an asymptotic regret less than . This lower bound example provides a clear evidence that the upper bound is tight. Therefore, our algorithm achieves nearly the “best performance” among all possible algorithms and closes the performance gap for this problem. Because our algorithm can be applied for both parametric and non-parametric settings, it also closes the gap between parametric and non-parametric learning for this problem.

Theorem 2.

(Lower bound example) Let where is a parameter taking values in (we denote this demand function set by ). Assume that and . Also assume that and . Then we have

-

•

This class of demand function satisfies Assumption 1. Furthermore, for any , the optimal price always equals to and .

-

•

For any admissible pricing policy and all ,

We first explain some intuitions behind this example. Note that all the demand functions in cross at one common point, that is, when , . Such a price is called an “uninformative” price in [13]. When there exists an “uninformative” price, experimenting at that price will not gain information about the demand function. Therefore, in order to “learn” the demand function (i.e., the parameter ) and determine the optimal price, one must at least perform some price experiments at prices away from the uninformative price; on the other hand, when the optimal price is indeed the uninformative price, doing price experimentations away from the optimal price will incur some revenue losses. This tension is the key reason for such a lower bound for the loss and mathematically it is reflected in statistical bounds on hypothesis testing. In the rest of this section, we prove Theorem 2. The proof resembles the example discussed in [13] and [9]. However, since our model is different from that in [13] and [9], they differ in several ways. We will discuss the differences in the end of this section.

We first list some properties of the demand function set we defined in Theorem 2.

Lemma 8.

For the demand function defined in Theorem 2, denote the optimal price under parameter to be . We have:

-

1.

-

2.

for

-

3.

for all

-

4.

for all

-

5.

-

6.

for all .

For any policy , and parameter , let denote the probability measure associated with the observations (the process observed when using policy ) when the true demand function is with being the corresponding expectation operator. In order to quantify the tension mentioned above, we need a notion of “uncertainty” about the unknown demand parameter . For this, we use the Kullback-Leibler (K-L) divergence over two probability measures for a stochastic process.

Given and , the K-L divergence between the two measures and over time to is given by the following (we refer to [12] for this definition):

Note that the K-L divergence is a measure of distinguishability between probability measures: if two probability measures are close, then they have a small K-L divergence and vice versa. In terms of pricing policies, a pricing policy is more likely to distinguish between the case when the parameter is and the case when the parameter is if the quantity is large.

Now we show the following lemma, which gives a lower bound of the regret for any policy in terms of the K-L divergence; this means a pricing policy that is better capable to distinguish different parameters will also be more costly.

Lemma 9.

For any , and any policy , we have

| (41) |

where and is the regret function defined in (3) with being .

Now we have shown that in order to have a policy that is able to distinguish between two different parameters, one has to give up some portion of the revenue. In the following lemma, we show that on the other hand, if a policy is not able to distinguish between two close parameters, then it will also incur a loss:

Lemma 10.

Let be any pricing policy that sets prices in and . Define and (note for all ). We have for any

| (42) |

Proof. The proof uses similar ideas as discussed in [9] and [13]. Here we give a sketch of the proof. We define two non-intersecting intervals around and . We show that when the true parameter is , pricing using in the second interval will incur a certain loss and the same order of loss will be incurred if we use in the first interval when the true parameter is . At each time, we treat our policy as a hypothesis test engine, which maps the historic data to two actions:

-

•

Choose a price in the first interval

-

•

Choose a price outside the first interval

Then we can represent the revenue loss by the “accumulated probability” of committing errors in those hypothesis tests. By the theory of the hypothesis test, one can lower bound the probability of the errors for any decision rule. Thus we obtain a lower bound of revenue loss for any pricing policy. The complete proof is referred to Appendix 10.9.

Now we combine Lemma 9 and 10. By picking in Lemma 9 to be and add (41) and (42) together, we have:

The last inequality is because for any number , . Therefore, for any admissible pricing policy and any ,

and Theorem 2 is

proved.

Remark. Our proof is similar to the proof of the corresponding worst case examples in [8] and [13], but different in several ways. First, in [8], they considered only a finite number of possible prices (though their proof is for a high-dimensional case, for the sake of comparison, here we compare our theorem with theirs in the one dimensional case). In our case, a continuous interval of prices is allowed. Therefore, the admissible policy in our case is much larger. And the K-L divergence function is thus slightly more sophisticated than the one used in their proof. In fact, the structure of our proof more closely resembles the one in [13] where they consider a worst-case example for a general parametric choice model. However, in their model, the time is discrete. Therefore, a discrete version of the K-L divergence is used and the analysis is based on the sum of the errors of different steps. Our analysis can be viewed as a continuous-time extension of the proof in [13].

7 Numerical Results

In this section, we perform numerical tests to examine the performance of our dynamic pricing algorithm and compare it to other existing algorithms. We first provide some suggestions on the implementation of our algorithm.

7.1 Implementation Suggestions

The way the parameters of our DPA are defined in Section 4 is mainly for the ease of asymptotic analysis. In practice, we find several modifications to the algorithm that could improve its performance. In all our numerical tests in this section, we adopt the following modifications.

-

•

Definitions of and . The main concern in directly applying (26) - (31) in small-sized problems is that the factors would play an overly dominant role. In our numerical experiments, we find that by properly modifying these values, the performance could be significantly improved. In particular, we find the following set of values of and give consistently good results in all our numerical tests (for ranges from to ):

- •

- •

-

•

The starting interval in Step 3: In DPA, when we enter Step 3, we restart from the initial interval . This is only for the convenience of the proof and is not necessary. In practice, one should start with the interval . This will also improve the performance of the algorithm.

7.2 Sample Runs of the Algorithm

In this subsection, we show two sample runs of our algorithm to help the readers further understand its features. The underlying demand functions for these two examples are and . In both cases, we assume the initial inventory level , the selling horizon , and the initial price interval . We show the results for the case with in Table 1 and 2.

In Table 1 and 2, the second row corresponds to the current step in the algorithm while the third row represents the amount of time spent in this time period. The fourth and fifth rows show the current price interval and the number of prices tested in this period. The sixth and seventh rows correspond to the empirical optimal and in this time period. Note that after the algorithm enters Step 3, we no longer compute . The last row gives the cumulative revenue at the end of the corresponding period. The deterministic upper bounds of the expected revenue given by (2) for the two cases are and , respectively.

| Iter | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Step | Step 2 | Step 2 | Step 2 | Step 2 | Step 4 |

| 0.0032 | 0.0316 | 0.126 | 0.289 | 0.551 | |

| Apply | |||||

| 10 | 6 | 5 | 4 | N/A | |

| 3.07 | 3.93 | 4.49 | 4.94 | N/A | |

| 5.05 | 4.83 | 5.07 | 5.01 | N/A | |

| Cum. Rev. |

| Iter | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| Step | Step 2 | Step 3 | Step 3 | Step 3 | Step 3 | Step 3 | Step 4 |

| 0.0032 | 0.0032 | 0.0215 | 0.0774 | 0.182 | 0.321 | 0.392 | |

| [2.73,2.79] | [2.75, 2.78] | Apply | |||||

| 10 | 12 | 8 | 6 | 5 | 4 | N/A | |

| 3.07 | 2.58 | 2.74 | 2.75 | 2.78 | 2.77 | N/A | |

| 2.08 | N/A | N/A | N/A | N/A | N/A | N/A | |

| Cum. Rev. |

In the first example, , one can compute that . Our algorithm never enters Step 3. In the second example, , and . The switching condition in (12) is triggered at the first iteration and the algorithm enters Step 3 from then on. In fact, in nearly all of our experiments, our algorithm can distinguish these two scenarios immediately. That is, if , the switching condition will be triggered in the first few iterations; otherwise, the switching condition will never be triggered. In both examples, our algorithm runs 4-5 iterations of price learning and then enters the final step (Step 4) in which the estimated optimal price is applied for the remaining period. Several important observations can be made from these two examples:

-

1.

The time spent in each iteration is increasing (for the second example, it is increasing after the algorithm enters Step 3). This observation is consistent with our definition of and . It is also intuitive. At the beginning, we have a very loose price interval with some prices far from optimal, therefore, we cannot afford to spend too much time in these iterations. As we narrow down the price range for later iterations, we can spend more time on price experimentation without incurring too much revenue losses. This also allows us to test more intensely in the narrowed price interval , and therefore enables us to find the “optimal price” more accurately.

-

2.

The number of prices tested in each iteration is decreasing (for the second example, it is decreasing after the algorithm enters Step 3). There are two reasons for this. First, the length of the price interval is decreasing, therefore, we have a smaller ranges of price to test in each iteration. Second, as the price range shrinks towards the “optimal price” , we need to perform more intensive testing to distinguish the optimal price. Therefore, we want to allocate even more time (relative to the length of learning period) for each price and thus reduce the number of prices tested.

-

3.

In both examples, the learning periods account for about half of the entire time horizon. In particular, our algorithm can quickly shrink the price interval into less than of the optimal price within 1/10 of the total time horizon in both examples. All the remaining learning and doing are performed using close-to-optimal prices. This capacity of our algorithm is one main reason to guarantee good performances.

In summary, our algorithm first distinguishes whether or is optimal, then constructs a shrinking series of price intervals around the optimal price. In particular, as time evolves, our algorithm tests fewer prices with a longer time on each price. And finally, the estimated optimal price is applied approximately for the latter half of the time horizon.

7.3 Performance Analysis and Comparisons

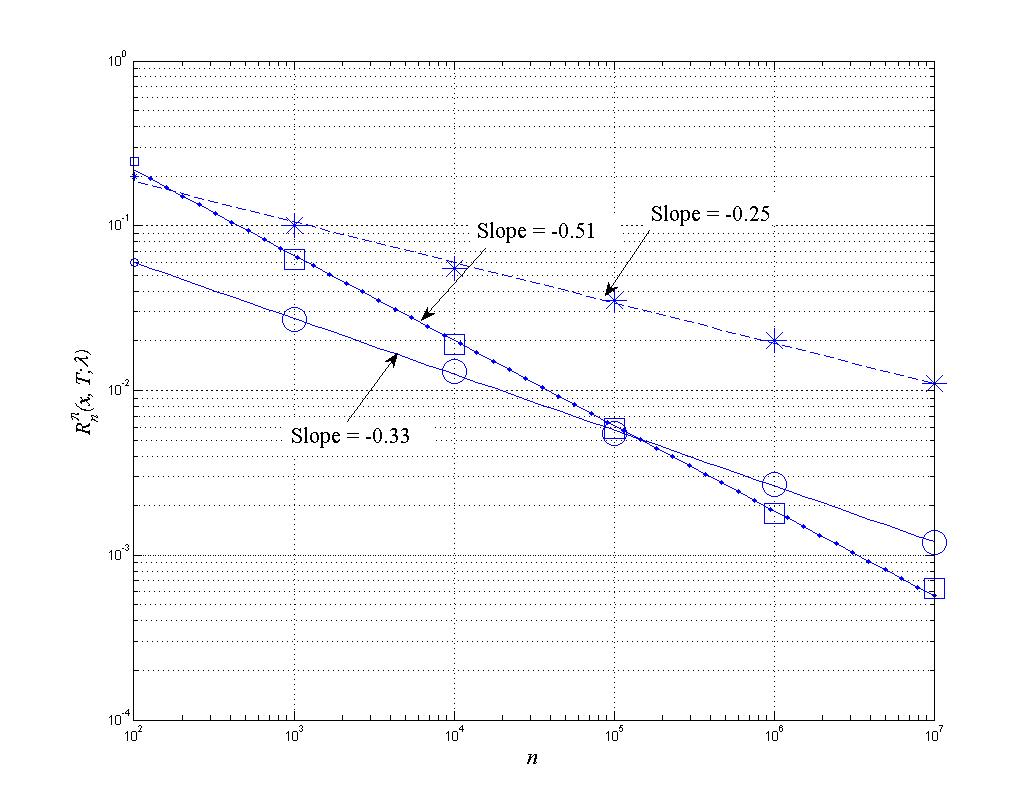

We now perform extensive numerical performance tests of DPA and compare against existing algorithms. Remember that the algorithms are measured by the magnitude of the regret . And by Theorem 1, . This implies that should be approximately a linear function of with slope close to . In Figure 1, we show a log-log plots of as a function of and compute a best linear trend line between and . In Figure 1, the squares show the performance of our dynamic pricing algorithm. Stars represent the regret of the non-parametric policy in [8]. Circles show the performance of the parametric policy in [8]. Lines represent the best line fit for the performance of each policy. Each point in our numerical experiments is computed by averaging regrets of 1000 repeated runs and the standard deviation at each point is less than of the mean value.

In Figure 1, we use the underlying demand function with initial inventory , the selling horizon , and the initial price interval . We can see that the asymptotic performance of our algorithm is indeed close to , which numerically proves the validity of Theorem 1. We also compare our algorithm to the nonparametric and parametric policies introduced in [8]. One can observe that our algorithm outperforms the nonparametric policies in [8] for all greater than . It also outperforms the parametric policy in [8] when , despite the fact that the parametric policy knows the form of the demand function while our algorithm has no information regarding the demand. This verifies the efficiency of our algorithm.

In the following, instead of specifying a certain underlying demand function, we assume that the demand function is drawn from a set of demand functions. We show that our algorithm behaves robustly under demand function uncertainty. In particular, we consider the set of demand functions consist of the two following families:

-

•

Family 1: with , .

-

•

Family 2: with , .

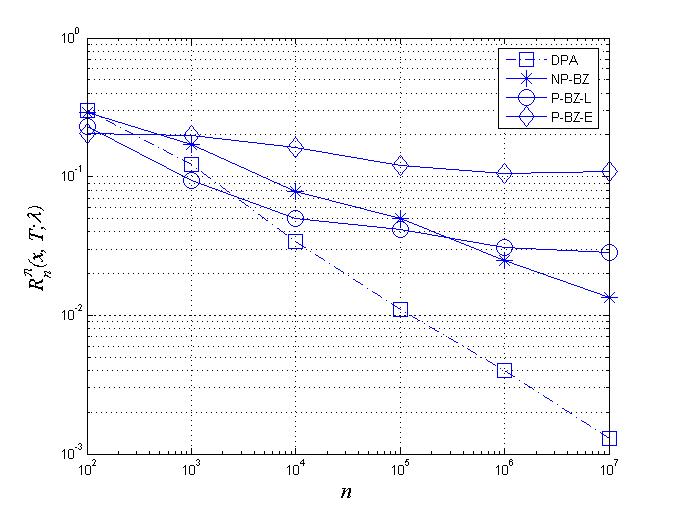

We compare our dynamic pricing algorithm (DPA) with 1) Nonparametric policy in [8] (NP-BZ); 2) Parametric policy in [8] with assuming a linear demand function (P-BZ-L) and 3) Parametric policy in [8] with assuming an exponential demand function (P-BZ-E). We still fix the initial inventory , the selling horizon , and the initial price interval and test for different values of . For each , we run 1000 experiments, in each of which the underlying demand function is chosen from family 1 and 2 each with probability . The parameters and are chosen uniformly at random within the ranges specified above. Note that the set of demand functions include both the cases when and . The results are shown in Table 3 and Figure 2 (the standard errors of the numbers in Table 3 are less than of its value).

| True Demand in Family 1 | True Demand in Family 2 | |||||||

|---|---|---|---|---|---|---|---|---|

| DPA | NP-BZ | P-BZ-L | P-BZ-E | DPA | NP-BZ | P-BZ-L | P-BZ-E | |

| 0.3478 | 0.2739 | 0.0868 | 0.3374 | 0.253 | 0.3034 | 0.3737 | 0.0698 | |

| 0.1601 | 0.1535 | 0.0705 | 0.3596 | 0.0845 | 0.1867 | 0.1158 | 0.0377 | |

| 0.0383 | 0.0645 | 0.0327 | 0.3080 | 0.0298 | 0.0918 | 0.0668 | 0.0178 | |

| 0.0127 | 0.0358 | 0.0111 | 0.2338 | 0.0101 | 0.0633 | 0.0725 | 0.0067 | |

| 0.0041 | 0.0217 | 0.0047 | 0.2073 | 0.0038 | 0.0297 | 0.0574 | 0.0034 | |

| 0.0013 | 0.0110 | 0.0021 | 0.2166 | 0.0013 | 0.0159 | 0.0548 | 0.0017 | |

In Table 3 and Figure 2, we can see that our dynamic pricing algorithm works robustly for all underlying demand functions in the family specified above. The log-regret still have a linear relationship with respect to with a slope roughly being . The nonparametric policy in [8] also gives decreasing regret as grows. However, the regret is much larger than ours. The performances of the parametric policies are divided. They work well when the model is well specified, that is, when the underlying demand function is indeed as assumed. However, when the underlying demand function does not belong to the assumed parametric family, the regrets typically do not converge to as grows. This means that the risk of model misspecification could be large. We also observe that the regrets of the parametric policies are sensitive to the choice of learning points. In the results presented, we choose learning points and , which yields the best performance among all the combinations we tested, yet it performs much worse than the DPA as grows large.

8 Conclusion and Future Work

In this paper, we present a dynamic pricing algorithm for a class of single-product revenue management problems. Our algorithm achieves an asymptotic regret of even if we have no prior knowledge on the demand function except some regularity conditions. By complementing with a worst-case bound, we show that the convergence rate of our algorithm is among the fastest of all possible algorithms in terms of asymptotic regret . Our result closes the performance gaps between parametric and non-parametric learning and between a post-price mechanism and a customer-bidding mechanism. Our dynamic pricing algorithm integrates learning and doing in a concurrent procedure and provides important operational insights to revenue management practitioners.

There are several future directions to explore. One possible direction is to weaken the assumptions. Right now we assume the revenue function has bounded second derivative. However, in practice, the demand function might have a kink point (e.g., the demand function is piecewise linear). In an extension of this work [28], we show that if we know the existence of such kinks, we can modify our dynamic learning algorithm to accommodate it, with the same asymptotic performance. Another direction is to extend this result to high-dimensional problems. In high-dimensional problems, the structure of the demand functions may be even more complicated and the extension of dynamic learning is not straightforward.

9 Acknowledgement

We would like to thank Professor Peter W. Glynn for useful discussions. We also thank two anonymous referees and the associate editor for the valuable comments and suggestions which help us greatly improve our paper.

References

- [1] R. Agrawal. The continuum-armed bandit problem. SIAM Journal of Control and Optimization, 33(6):1926–1951, 1995.

- [2] S. Agrawal, Z. Wang, and Y. Ye. A dynamic near-optimal algorithm for online linear programming. Working Paper, 2010.

- [3] V. F. Araman and R. A. Caldentey. Dynamic pricing for nonperishable products with demand learning. Operations Research, 57(5):1169–1188, 2009.

- [4] P. Auer, N. Cesa-Bianchi, Y. Freund, and R. E. Schapire. The non-stochastic multiarmed bandit problem. SIAM Journal on Computing, 32(1):48–77, 2002.

- [5] Y. Aviv and A. Pazgal. Pricing of short life-cycle products through active learning. Technical report, Washington University, 2002.

- [6] M. Ball and M. Queyranne. Towards robust revenue management competitive analysis of online booking. Operations Research, 57(4):950–963, 2009.

- [7] D. Bertsimas and G. Perakis. Dynamics pricing: A learning approach. In Mathematical and Computational Models for Congestion Charging, pages 45–79. Springer, 2006.

- [8] O. Besbes and A. Zeevi. Dynamic pricing without knowing the demand function: Risk bounds and near-optimal algorithms. Operations Research, 57(6):1407–1420, 2009.

- [9] O. Besbes and A. Zeevi. Blind network revenue management. Operations Research, 2012. forthcoming.

- [10] O. Besbes and A. Zeevi. On the surprising sufficiency of linear models for dynamic pricing with demand learning. Working Paper, 2012.

- [11] G. Bitran and R. Caldentey. An overview of pricing models for revenue management. Manufacturing and Service Operations Management, 5(3):203–229, 2003.

- [12] P. Bremaud. Point Process and Queues: Martingale Dynamics. Springer-Verlag, 1980.

- [13] J. Broder and P. Rusmevichientong. Dynamic pricing under a general parametric choice model. Operations Research, 60(4):965–980, 2012.

- [14] A. Carvalho and M. Puterman. Learning and pricing in an internet environment with binomial demands. Journal of Revenue and Pricing Management, 3(4):320–336, 2005.

- [15] A. den Boer and B. Zwart. Simultaneously learning and optimizing using controlled variance pricing. Working Paper, 2010.

- [16] A. den Boer and B. Zwart. Dynamic pricing and learning with finite inventories. Working Paper, 2011.

- [17] W. Elmaghraby and P. Keskinocak. Dynamic pricing in the presence of inventory considerations: Research overview, current practices, and future directions. Management Science, 49(10):1287–1309, 2003.

- [18] V. F. Farias and B. Van Roy. Dynamic pricing with a prior on market response. Operations Research, 58(1):16–29, 2010.

- [19] G. Gallego and G. van Ryzin. Optimal dynamic pricing of inventories with stochastic demand over finite horizons. Management Science, 40(8):999–1029, 1994.

- [20] J. M. Harrison, N. B. Keskin, and A. Zeevi. Bayesian dynamic pricing policies: Learning and earning under a binary prior distribution. Management Science, 58(3):570–586, 2012.

- [21] R. Kleinberg and T. Leighton. The value of knowing a demand curve: Bounds on regret for online posted-price auctions. In Proceedings of the 44th Annual IEEE Symposium on Foundations of Computer Science, FOCS ’03, pages 594–605, 2003.

- [22] T. L. Lai and H. Robbins. Asymptotically efficient adaptive allocation rules. Advances in Applied Mathematics, 6(1):4–22, 1985.

- [23] A. Lim and J. Shanthikumar. Relative entropy, exponential utility, and robust dynamic pricing. Operations Research, 55(2):198–214, 2007.

- [24] M. S. Lobo and S. Boyd. Pricing and learning with uncertain demand. Working Paper, 2003.

- [25] G. Perakis and G. Roels. The “price of information”: Inventory management with limited information about demand. Manufacturing and Service Operations Management, 8(1):98–117, 2006.

- [26] K. Talluri and G. van Ryzin. Theory and practice of revenue management. Springer-Verlag, 2005.

- [27] A. Tsybakov. Introduction to Nonparametric Estimation. Springer-Verlag, 2004.

- [28] Z. Wang. Dynamic Learning Mechanism in Revenue Management Problems. PhD thesis, Stanford University, Palo Alto, 2012.

10 Appendix

10.1 A Lemma on the Deviation of Poisson Random Variables

In our proof, we will frequently use the following lemma on the tail behavior of Poisson random variables:

Lemma 11.

Suppose that and with . If , then for all ,

We refer to Lemma 2 in the online companion of [8] for the proof of this lemma.

10.2 Proof of Lemma 2

10.3 Proof of Lemma 3

Part 1: We first prove that condition 1 holds with probability . To this end, we show that if , then with probability , . We assume . Now consider the next iteration. Define

First, we establish a bound on the difference in the revenue rate , where is the revenue maximizing price on and is the empirical revenue maximizing price defined in our algorithm. We assume is the nearest grid point to in this iteration. We consider three cases:

-

•

: This is impossible since we know that and by the induction assumption . Therefore we must have , and by definition, achieves a larger revenue rate than , which is contradictory to the definition of .

-

•

: In this case, by the granularity of the grid at iteration , we have and thus by our assumption that is bounded, we know that , therefore we have:

where is the observed demand rate and the last inequality is due to the definition of and that is among one of the .

By Lemma 11 in Appendix 10.1, we have

with some suitable constant . Therefore, with probability , . However, by our assumption that and that is Lipschitz continuous, with probability , .

Now we consider the distance between and (similar ideas can be found in Lemma 4 in the online companion of [8]). Assume is the nearest grid point to , we have:

And by the definition of , and must have the same sign, otherwise there exists a point in between that achieves a smaller value of . Therefore,

By the Lipschitz continuity of , we have

Also by Lemma 11 in Appendix 10.1, we have with probability ,

Therefore, with probability , and by the Lipschitz continuity of , this implies that with probability ,

(45) Therefore, we have

(46) Here we used the fact that:

Note that (46) is equivalent as saying that

Now also note that the interval in our algorithm is chosen to be

which is of order greater than (and according to the way we defined and , the two terms in are of the same order). Therefore we know that with probability , .

-

•

: In this case, . With the same argument as above with only the part, we know that with probability ,

Also, as claimed in the previous lemma, the number of steps is less than . Therefore, we can take a union bound over steps, and claim that with probability , , for all .

Part 2: Using the same argument as in Part 1, we know that with probability , for . Now at , condition (12) is triggered. We first claim that whenever (12) is satisfied, with probability , .

By the argument in Part 1, we know that with probability ,

Therefore, if

| (47) |

then with probability , holds. And when (47) holds, must not be the left end-point of and must not be the right end-point of , which means

Now we consider the procedure in Step 3 of our algorithm and show that with probability , for all .

We again prove that if , then with probability , . We consider (which is the optimal empirical solution in Step 3). Define in this case

Using the same discussion as in Part 1, we have with probability ,

However, in our algorithm, the next interval is defined as

which is of order larger than . Therefore with probability , . Finally, taking a union bound over these steps (no more than ) results in this lemma.

10.4 Proof of Lemma 4

We prove . Note that we have already proved in Lemma 2 that , therefore it suffices to show that . For this, define . By Lemma 11, we know that . On the other hand,

By our definition of , we know that (otherwise the algorithm would have stopped at the previous iteration). Therefore, when is large enough, . Thus

10.5 Proof of Lemma 5

We start with the following transformation of the left hand side of (35):

For the first term, we have

However, since and are independent. Also by Lemma 3, our assumption on the bound of the second derivative of , (20) and (21), we have with probability

Therefore,

On the other hand, we have

where the second inequality is because of Cauchy-Schwarz inequality and the last inequality is because is a Poisson random variable and as shown in Appendix 10.4. Therefore,

Next we consider

First we relax this to

We have the following claims

Claim 1.

where is a constant only depending on the coefficients in , and .

Claim 2.

If occurs, then

where is a constant only depending on the coefficients in , and .

Proof of Claim 1. We first show that with probability ,

| (48) |

Then by Cauchy-Schwarz inequality,

where the second to last inequality is because ’s are Poisson random variables. Therefore,

To show (48), we apply Lemma 11. For each given , we have

By taking a union bound over all , , we get

where the last step is because and .

On the other hand, by the definition of and , we have

where the last inequality follows from the definition of and in (26) and (27). We then consider . Again we use Lemma 11. We have

since , the

claim holds.

Proof of Claim 2. By definition, we have

where

When occurs, condition (12) doesn’t hold, i.e., . And as we showed in (45), . Also since , we must have . Therefore we have,

when . Using the Taylor expansion for , we have that

Therefore

10.6 Proof of Lemma 6

First, the left hand side of (38) can be written as

| (49) |

For the first term, note that is independent with . Therefore,

Also, by Lemma 3, with probability ,

Therefore, we have

where the last term is because of (31).

For the second term in (49), we apply Cauchy-Schwarz inequality:

Since is a Poisson random variable, we have

The remaining task is to show that . Once this holds, we have

and Lemma 6 will hold. To show , it suffices to show that

For this, define and . By Lemma 11, we know that , . On the other hand,

By our definition of and , we know that . Therefore, when is large enough,

Thus .

10.7 Proof of Lemma 7

First, by doing a similar transformation as in the proof of Lemma 5, we have

For the first term, we have

However, due to the independence between and . Also by Lemma 3, with probability ,

where the first inequality is because of the Lipschitz condition and the second one is because of the definition of . Therefore,

On the other hand, we have

Since is a Poisson random variable, we have and as have been proved in Appendix 10.6, . Therefore,

Next we consider

We first relax it to

By using the same arguments as Appendix 10.5, we know that

Therefore, we have

10.8 Proof of Lemma 9

Consider the final term in (6). Note that we have the following simple inequality:

Therefore, we have

Apply this relationship to the final term in (6) and note that for any and ,

| (50) |

we have

Also, for and , we have

Therefore, we have

However, under the case when the parameter is , we have and

where the first inequality follows from the definition of and that we relaxed the inventory constraint, and the second inequality is because of the 4th condition in Lemma 8. Therefore,

and Lemma 9 holds.

10.9 Proof of Lemma 10

We define two intervals and as follows:

Note that by the 5th property in Lemma 8, we know that and are disjoint.

By the 4th property in Lemma 8, we have for any ,

| (51) |

Also by the definition of the regret function, we have

| (52) | |||||

where the first inequality is because we relaxed the inventory constraint when using , and the second inequality is because of (51), the definition of and that the denominator is 1/2. In the last equality, is the probability measure under policy and up to time (with underlying demand function has parameter ). Similarly, we have

| (53) | |||||

where in the second inequality, we use the fact that the denominator is less than , and in the last equality, is defined similarly as the one in (52).

Now consider any decision rule that maps historical demands up to time into one of the following two sets:

By Theorem 2.2 in [27], we have the following bound on the probability of error of any decision rule:

However, by the definition of the K-L divergence (6), we know that

where the last inequality is because of (50). Therefore, we have

Now we add (52) and (53) together. We have

Thus, Lemma 10 holds.