Generalized extreme value regression for binary response data: An application to B2B electronic payments system adoption

Abstract

In the information system research, a question of particular interest is to interpret and to predict the probability of a firm to adopt a new technology such that market promotions are targeted to only those firms that were more likely to adopt the technology. Typically, there exists significant difference between the observed number of “adopters” and “nonadopters,” which is usually coded as binary response. A critical issue involved in modeling such binary response data is the appropriate choice of link functions in a regression model. In this paper we introduce a new flexible skewed link function for modeling binary response data based on the generalized extreme value (GEV) distribution. We show how the proposed GEV links provide more flexible and improved skewed link regression models than the existing skewed links, especially when dealing with imbalance between the observed number of 0’s and 1’s in a data. The flexibility of the proposed model is illustrated through simulated data sets and a billing data set of the electronic payments system adoption from a Fortune 100 company in 2005.

doi:

10.1214/10-AOAS354keywords:

.and

1 Introduction

During the past three decades of information system (IS) research, quite a rich but diverse body of theoretical and empirical work has accumulated on the adoption and diffusion of information technology (IT) based innovations. Technological advances and widespread uses of the internet are allowing businesses to automate a wide range of their business processes including payments. Electronic payments system (EPS) is an integrated process, in which payment data is sent and received electronically from accounts payable to accounts receivable without human intervention, and is a critical component of the information economy. Despite the tremendous benefits that EPS can offer, its adoption in business-to-business (B2B) transactions remains a challenge. In 2004, checks represented 81 percent of the typical organizations’ payments, according to the Association for Financial Professionals (AFP) 2004 survey. A more recent survey by AFP finds that, even though the payments are undergoing an unprecedented period of change because of the decline of the check in favor of electronic payments, a majority of B2B payments continue to be made by check. The 2007 AFP survey indicates that the typical organization is still making 74 percent of its B2B payments by check. Researchers have tested different proposed theories by showing the causal mechanism and identifying influential factors. A number of barriers have been identified that appear to obstruct the wider adoption of electronic payments [Stavins (2003); Chakravorti and Davis (2004)].

Though exploring association based on the past data is critical to understand the technology adoption behaviors, the ultimate objective of EPS adoption studies would be accurate prediction as the field directly aims at studying and solving practical problems. With no doubt, accurate prediction is a key concern for practitioners since it is anticipated future behavior that guides managerial action. The immediate motivation of Bapna et al. (2010)’s study, as quoted in their paper, was a problem asked by the company, “how can we predict the likelihood of a firm to adopt EPS promoted by the company so that we can target EPS promotions to only those firms that were more likely to adopt EPS for their payments?” Models with good prediction accuracy are also needed by theorists in the field since accurate prediction can serve as a direct “reality check” for the relevance of the theoretical models, thus providing a base for theory building, comparing and improving [Shmueli and Koppius (2009)]. A good statistical model for EPS adoption study needs to provide not only good fit to current data but also good prediction for future observations.

Currently, the logistic regression model, with its convenient interpretation and implementation, has been routinely employed to estimate and predict the EPS adoption or other new technology adoption in the literature [Chau and Jim (2002); Bapna et al. (2010); Gupta and Chintagunta (1994); Kamakura and Russell (1989); Wedel and DeSarbo (1993)]. When the logistic regression model is employed, it is assumed that the response curve between the covariates and the probability is symmetric. This assumption may not always be true, and it may be severely violated when the number of observations in the two response categories are significantly different from each other. This unbalance is not uncommon in the IS field, since in many cases the adoption of a new technology may be a “rare event,” which happens with only a small probability. Thus, the data in this area is usually complicated by the nature of the response variable being analyzed: significant difference between the number of firms adopting the technology and of those not adopting the technology and high skewness in the response curve. Applying a nonflexible link function to the data with this special feature may result in link misspecification.

Consequences of link misspecification have been studied by a number of authors in the literature. In particular, for independent binary observations, Czado and Santner (1992) show that falsely assuming a logistic link leads to a substantial increase in the bias and mean squared error of the parameter estimates as well as the predicted probabilities, both asymptotically and in finite samples. Moreover, these undesirable effects are of greater magnitude when the misspecification involves skewness than when it involves kurtosis (or tail weight). Wu, Chen and Dey (2002) show that under certain conditions there exists linear relationships between the regression coefficients, though the choice of links is important for goodness of fit.

There has been considerable work done in allowing flexibility in the link models used for categorical response data. The most intuitive approach to guard against link misspecification is to embed the symmetric links into a wide parametric class of links. Aranda-Ordaz (1981) introduces two separate one-parameter models for symmetric and asymmetric departures from the logistic model. Guerrero and Johnson (1982) suggest a one-parameter Box–Cox transformation of the odds. Morgan (1983) presents a one-parameter cubic logistic model to model symmetric departures from the logistic curve. It is a first-order approximation of the symmetric Aranda-Ordaz model.

Stukel (1988) proposes a class of generalized logistic models for modeling binary data with a two-parameter family. Stukel’s models are general, and several important and commonly used symmetric and asymmetric link models can be approximated by members of this family. However, in the presence of covariates, Stukel’s models yield improper posterior distributions for many types of noninformative improper priors, including the improper uniform prior for the regression coefficients [Chen, Dey and Shao (1999)]. Using a latent variable approach of Albert and Chib (1993), Chen, Dey and Shao (1999) propose another class of skewed links, which can lead to proper posterior distributions for the regression parameters using standard improper priors. However, the model has the limitation that the intercept term is confounded with the skewness parameter. This problem was overcome in Kim, Chen and Dey (2008) by a class of generalized skewed -link models (GT-link), though the constraint on the shape parameter as greatly reduces the possible range of skewness provided by this model.

To build an appropriate and extremely flexible model for the binary data and to overcome the constraint for the skewed generalized -link models, we propose the generalized extreme value (GEV) distribution as a link function. We would first distinguish our GEV model from a line of research on the discrete choice behavior initiated by McFadden (1978). Although their model is also termed as generalized extreme value models, it is totally different from the model we introduce here. In their definition, GEV distribution is a family of multivariate distribution functions whose marginal distribution is Type I extreme value distribution or Gumbel distribution [McFadden (1978)], which is a special case of the GEV distribution we use in with the shape parameter . Without a flexible shape parameter, their model does not incorporate the skewness of the response curve but mainly estimates the perceived similarity among alternatives [McFadden (1978)]. The advantage of the GEV link model we discuss here is that it incorporates a wide range of skewness with the unconstrained shape parameter. In fact, the complementary log–log (Cloglog) link, based on the Gumbel distribution as discussed in Section 3, is a special case of the proposed GEV link.

For model comparison, we use measures which have been suggested as a criterion when the goal is to select a model with best out-of-sample predictive power, including Deviance Information Criterion (DIC) [Spiegelhalter et al. (2002)], Bayesian Information Criterion (BIC) [Kass and Raftery (1995)] and marginal likelihood [Chib and Jeliazkov (2001); Chib (1995)]. These three measures are all in-sample predictive measures, which are computed using current data. Shmueli and Koppius (2009) suggest that it is more general to construct predictive accuracy measures based on out-of-sample metrics. Thus, we also calculate posterior predictive deviance based on the hold-out sample approach. Comparison of predictive performance also guards against overfitting. Overfitting is a concern when building a complicated and flexible model. Since an overfitting model accommodates more of random fluctuations instead of the underlying relationship, it will generally provide good fit to current data but have poor predictive accuracy for new data. Good prediction results provide evidence that overfitting has not occurred.

The rest of the paper is organized as follows. Section 2 describes the data set concerning the electronic system adoption of the customers of a Fortune 100 company, where the dominance of nonelectronic payment methods is particularly evident. Section 3 describes the GEV model and discusses its posterior propriety with Bayesian methodology. Section 4 demonstrates the flexibility of the GEV model by simulated data sets and the EPS data set described in Section 2. It concludes with a discussion in Section 5. The proof of the theorem and detailed results on simulated data examples are given in the Appendix. The computation for the GEV link described in this paper has been implemented in R. A sample code [Wang (2010)] is included as supplementary material.

2 The electronic payment system data set

To illustrate how the proposed GEV model may flexibly be used to model and to predict the EPS adoption, we consider a billing data set from a Fortune 100 companies (hereafter called the “vendor”). It provides information on individual transactions with firms who have financed purchases of large commercial equipment with the vendor before 2005. With a large amount to pay for the expensive commercial equipment, firms usually finance the purchases with the vendor by lease or loan ranging from a few months to more than 20 years. This brings in subsequently recurring payments every month. The vendor provides all client firms a voluntary free service of Automated Clearing House (ACH) debits. Firms have the option to make their payments using ACH or using conventional payment methods (such as a check). The data contains payments choices of each transaction in the first quarter of 2005 as well as firm-specific and transaction-specific information, including firm size, payment amount from the last bill, credit risk in terms of PayDex, finance option, geographical regions and industries. Firm size is measured by the total number of employees. The firm’s credit risk is based on a PayDex score, which is an indictor of a business’ payment performance evaluated on the total number of payment experiences over the past year. Higher PayDex scores indicate better payment performance. For each transaction, the firm has a financing option between lease and loan. Region is a geographic variable, while industry is a measure of firm demographics. Since these variables are easy to observe and often associated with usage behavior, they have been constantly used in marketing literature [Bapna et al. (2010)]. EPS is the electronic payment methods adopted by the firm, with EPS for ACH methods and EPS for traditional methods such as check. We have a total of 15,175 observations, with EPS for 10,784 observations. That is, more than 70% of the transactions used traditional methods (EPS ).

=240pt Variable Min Mean Max # of employees Payment amount PayDex

=290pt Variables EPS Counts % EPS Finance option Lease Loan Region Midwest Northeast South West Industry Agriculture Construction Finance Manufacturing Mining Public administration Retail trade Services Transportation Wholesale trade EPS

Summary statistics for this data set are reported in Tables 1 and 2. It provides a group of firms of different sizes, from different industries and regions, and various credit risk levels with different transaction amounts. As seen in Table 2, the proportions of EPS , which are almost all higher than 50%, vary within the subgroups based on finance option, region or industry.

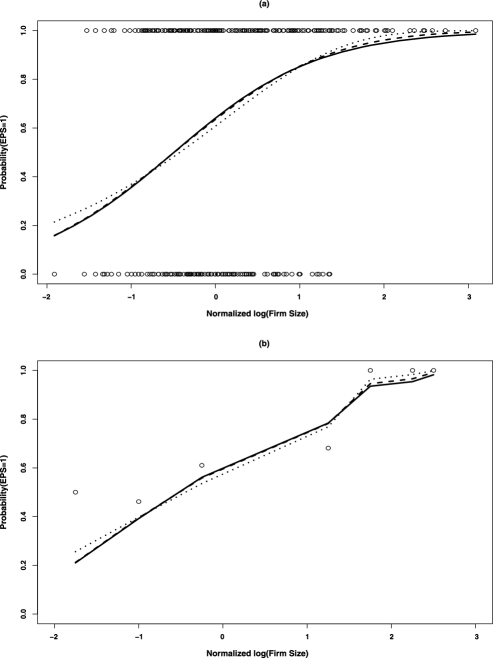

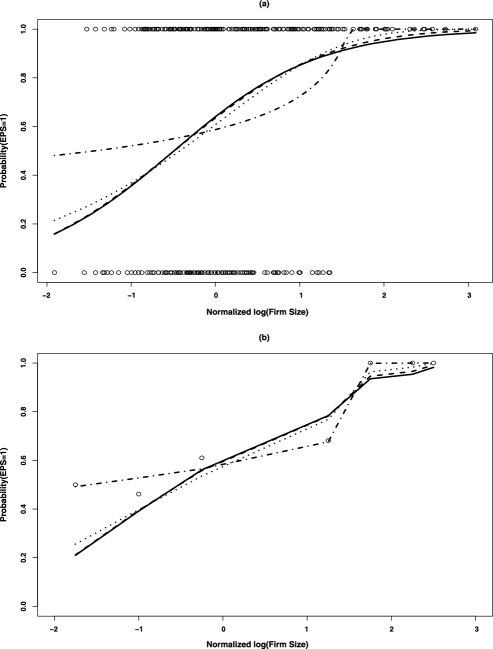

We focus on a reduced sample to show the motivation of our proposed model. The subset is selected from all transactions that involved Midwest firms in the manufacturing industry with lease as the financing option. This results in 1618 transactions. Out of these transactions, 1222 transactions have EPS . We model the probability of EPS with the normalized logarithm of firm sizes as the only convariate. This type of model would facilitate showing the response curves under different link models in graphs. Figure 1(a) shows the original data and the fitted probability of the logit, probit and Cloglog model, respectively. To view it more clearly, we collapse firm sizes into 7 categories as shown in Table 3. Also shown in Table 3 are the estimated number of EPS under different link models. Figure 1(b) shows the observed values and the fitted values under different link models. The positively skewed Cloglog link fits the data better than the two symmetric links, though there is still large discrepancy between the observed values and the estimated ones. This is because the skewness inherited in the data is much higher than that which can be provided by the Cloglog link, whose skewness is fixed as a constant. A link model that can automatically change its shape of the response curve based on the data would greatly improve the estimation and prediction power of the model.

3 Generalized extreme value link model

We first specify the notation we use through the paper. Let denote an vector of independent binary random variables. Also, let be a vector of covariates, . Suppose X denotes the design matrix with rows , and is a vector of regression coefficients. Assume that with probability and with probability . In the generalized linear model framework,

| (1) |

where is a cumulative distribution function (cdf) and determines the link function. The function gives the logit link, which is a symmetric link for binary response model. Another symmetric link model, the probit link, is achieved by setting , where is the inverse of distribution. The asymmetric Cloglog link is specified as .

| Normalized log(Firm size) | |||||||

|---|---|---|---|---|---|---|---|

| # of EPS | |||||||

| Logit | 0.84 | 76.40 | 139.73 | 471.90 | 468.56 | 44.83 | 19.64 |

| Probit | 0.85 | 76.90 | 139.00 | 470.89 | 473.85 | 45.39 | 19.84 |

| Cloglog | 1.02 | 77.49 | 133.36 | 462.61 | 482.75 | 46.21 | 19.98 |

3.1 The generalized extreme value distribution

The link models use the Generalized Extreme Value () distribution for . Extreme value theory begins with a sequence of independent and identically distributed random variables and, for a given asks about parametric models for its maximum . If the distribution of the is specified, the exact distribution of is known. In the absence of such specification, extreme value theory considers the existence of for two sequences of real numbers and If is a nondegenerate distribution function, it belongs to either the Gumbel, the Fréchet or the Weibull class of distributions, which can all be usefully expressed under the umbrella of the distribution with a cumulative distribution function as follows:

| (2) |

where is the location parameter, is the scale parameter, is the shape parameter and . A more detailed discussion on the extreme value distributions can be found in Coles (2001) and Smith (2003). Extreme value analysis finds wide application in many areas, including climatology [Coles, Pericchi and Sisson (2003); Sang and Gelfand (2009)], environmental science [Smith (1989); Thompson et al. (2001)], financial strategy of risk management [Dahan and Mendelson (2001); Morales (2005)] and biomedical data processing [Roberts (2000)].

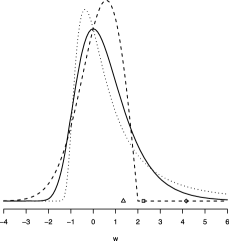

Its importance as a link function arises from the fact that the shape parameter in model purely controls the tail behavior of the distribution (see Figure 2). When , it gives the Gumbel distribution with , which is the least positively skewed distribution in the class when is nonnegative.

3.2 The generalized extreme value link model

In model we assume that involves the distribution as follows:

| (3) |

where represents the cumulative probability at for the distribution with , , and an unknown shape parameter .

Since the usual definition of skewness in and as does not exist for large positive values of ’s, we extend Arnold and Groeneveld (1995)’s skewness measure in terms of the mode to the distribution for skewness definition and comparison. Under certain conditions, the skewness of a random variable is defined as , where is the cumulative distribution of and is the mode of . Thus, the skewness of the link function can be found explicitly as , while Based on this skewness definition and on the fact that for , monotonically decreases with respect to in , we can show that the link model specified in is negatively skewed for , and positively skewed for .

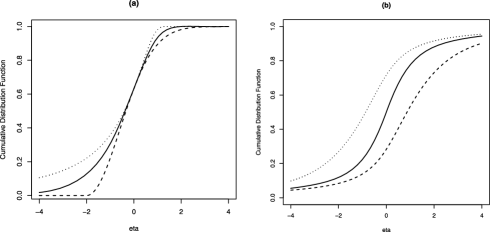

Figure 3(a) shows the response curves with equal to and . The solid line is the response curve corresponding to the Cloglog link for . As the values of the shape parameter change, so does the approaching rate to 1 and 0. A much wider range of skewness can be fitted compared to the commonly used Cloglog link. Figure 3(b) shows the distribution function of the skewed generalized -distribution of with , [Kim, Chen and Dey (2008)]. The distribution in the GT link is chosen as the standard exponential distribution () and the negative standard exponential distribution (). The skewness of the GT-link model is determined jointly by the constrained and the preassumed . Since is the maximum possible value for the shape parameter, Figure 3(b) in fact shows the two extreme cases of the GT-link with or , whose skewness is 0.4339 for the case and for the case by Arnold and Groeneveld (1995)’s measure. The range of skewness provided by the link models is not constrained. As shown in Figure 3(a), even with , the range of skewness provided by the links is much wider than that provided by the GT links with a specified .

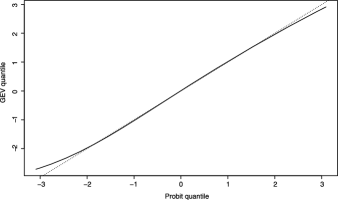

The class of the links also includes the symmetric link as a special case. For example, by matching the first 3 moments, the standard normal distribution can be approximated by the distribution with , and Figure 4 shows the quantile plots between the model and the probit model. The plot is approximately a straight line between 0.02 and 0.98 quantiles. The discrepancy lies mainly in the tail area.

3.3 Prior and posterior distributions for the generalized extreme value link model

It is possible to estimate the shape parameter in the link by the maximum likelihood method. However, there are a number of nonregular situations associated with in using likelihood methods which requires conditions for usual asymptotic properties associated with the maximum likelihood estimator to be valid. Smith (1985) studied the maximum likelihood estimation in nonregular cases in detail and obtained that when the regularity conditions are not satisfied by models. This violation of the usual regularity conditions means that the standard asymptotic likelihood results are not automatically applicable. This is one of the reasons for favoring a Bayesian analysis since Bayesian methods do not depend on the regularity assumptions required by the asymptotic theory of maximum likelihood. In particular, in the unusual situation where and the classical theory of maximum likelihood breaks down, Bayesian inference provides a viable alternative. Thus, here we follow the Bayesian methodology and fit the link model in a general setting.

Let denote the observed data. We assume that the prior of , , is proper. Then the joint posterior distribution of based on is given by

| (4) |

where and is the conditional prior of given . In Sections 4.2–4.4 we choose normal priors for with , , and for with , where priors on and are assumed independent.

Unlike Stukel’s generalized logistic regression model with covariates, the posterior distributions under the link are proper for many noninformative priors, including the Jeffreys’ prior and the improper uniform prior for the regression coefficients .

Jeffreys’ prior for this model has the form where the Fisher information matrix is with , and for The joint posterior is then given by

The posterior propriety under the uniform prior established in Theorem 1 below implies that the proposed link model is identifiable and the estimation of the regression coefficients can contain little subjective information in the Bayesian estimation. Let if and if . Define as the matrix with rows , , where . We are led to the following theorem concerning the propriety of the posterior distribution in when which is an improper uniform prior and , for , which corresponds to the uniform distribution . Even with this constraint, the links are still fairly flexible with skewness lying in the interval . The proof of Theorem 1 is given in the Appendix.

Theorem 1

Suppose that there exist , and positive vectors such that is of full rank and for and with 0 a -dimension zero vector. Under the improper uniform prior , the posterior is proper.

4 Applications of generalized extreme value link models

4.1 Model comparison criterion

To assess models under different links, we employ four measures, including Deviance Information Criterion (DIC), marginal likelihood, Bayesian Information Criterion (BIC) and posterior predictive deviance methods. The first three can be deemed as model adequacy measures penalized by model complexity. Also, they measure the expected loss on replicated data and can be used as model predictive power measures. However, they are constructed based on current data [Shmueli and Koppius (2009)]. Posterior deviance measures the prediction accuracy directly based on hold-out samples. We briefly discuss their computation and interpretation below.

Let denote the set of all parameters contained in the model under consideration. For example, in the model. The deviance is defined as times the log-likelihood, that is, The posterior mean deviance serves as a Bayesian measure of fit or “adequacy” of a model [Spiegelhalter et al. (2002)], where is the estimated average discrepancy for sampling points and is the th sampling value for the parameter . The DIC measure, which is proposed by Spiegelhalter et al. (2002), is then calculated as , where is the effective number of parameters of a Bayesian model. We calculated as , where and is the posterior mean of the Markov chain Monte Carlo (MCMC) simulation. The smaller the DIC value, the better the model fits the data.

The marginal likelihood method is closely related to the Bayes factor, which is given by with the marginal likelihood under model , . The calculation of the marginal likelihoods can be obtained by the MCMC method as presented in Chib (1995) and Chib and Jeliazkov (2001). Chib and Jeliazkov (2001)’s approach is more relevant here since our models involve the Metropolis–Hastings algorithm.

The calculation of marginal likelihood is sensitive to the choice of priors [Kass and Raftery (1995)], which may bring in potential problems when the priors provide little information relative to the information contained in the data. Under this situation, BIC is usually applied as an approximation and it does not require evaluation of the prior distributions [Kass and Raftery (1995)]. For a model with parameters and observations, BIC is given by

To assess the predictive power of the model, we aim at evaluating the posterior predictive density where is the future response data (the holdout data set) and are the posterior mean of the MCMC sampling from the training data. The posterior predictive density can then be evaluated by posterior deviance () as .

4.2 Simulated data examples

In the simulated data examples, we consider data sets simulated from the Cloglog and probit regression models. Our primary aim is to show the flexibility of the link in fitting the data generated from various models with unbalanced number of 0’s and 1’s. The true parameters are set such that the proportion of 1’s in the simulated data sets is around 70%, similar to the proportions in the AFP surveys and the EPS data set. We perform Bayesian analysis for a given simulated data set and assess the models using criteria stated in Section 4.1.

To match data scenario close to the EPS data, we generate 5 covariates in our model, including the intercept. The types of covariates represent those that occurred in the real data. It includes one intercept (), one continuous covariate generated from a standard normal distribution () and three discrete covariates. Among the three discrete covariates, two are dummies for nominal categorical data with 3 groups ( and ) and the other is binary categorical data (). All covariates are generated for sample sizes and , respectively. Then we generate two simulated data sets with independent Bernoulli response variables, , respectively from (a) the Cloglog regression model as Simulation , and (b) the probit regression model as Simulation . The linear components of all the above regression models are , where for the Cloglog model and for the probit model. For all the link models, we employ the Metropolis–Hasting algorithm with normal jumping kernels for the MCMC sampling. The convergence of all results is examined by the Bayesian Output Analysis (BOA) package in R.

Results are discussed in detail in the Appendix (Simulated Data Examples). The link performs better than the symmetric logit link even with small sample size () under Simulation . The estimated includes the true value 0 in its high posterior density (HPD) intervals. With increasing sample size, the variance of decreases, which provides more precise estimation of the shape parameter. In Simulation , the link approximates the symmetric probit link well, especially with large sample size. The impact of sample size on fitting the link model is also reflected by model selection based on BIC and marginal likelihood methods. These two criteria tend to select a simpler model and the link beats the logit link only when based on these two criteria under Simulation .

By the simulated examples, we also emphasize that the number of 1’s and 0’s is only an indicator of the possible skewness in the response curve, though unbalance is not unusual even with a symmetric link model, such as the probit link we used in Simulation . As suggested in Chen, Dey and Shao (1999), many factors, such as the distribution of covariates, may affect the choice of links of a given data set. This complexity is exactly why we propose a flexible link function like the link, such that the link function itself can automatically detect and fit the symmetry or asymmetry in the response curve along with parameter estimation. The probability of link misspecification is reduced compared to applying a link model with a fixed skewness parameter.

4.3 The motivation subset of the electronic payments system data

We first fit the model to the subset we discussed in Section 2. Figure 5 shows (a) the fitted response curve and (b) the fitted probability for the 7 categories based on the firm’s size. It is similar with Figure 1 but with the link added. As shown in Figure 5, the response curve under the link stretches significantly to fit the observed values. Table 4 shows the estimated number of EPS , where we can see that the model provides estimated values that are very close to the observed ones. Also, we carry out the cross validation analysis with randomly selected 10% of the data as the holdout part and the remaining data as the training part. The holdout part has 173 transactions with 135 transactions EPS . The number of observed EPS in each of the 7 categories based on firm sizes is shown in Table 5. Here we can predict the number of EPS in each category using the posterior mean estimates obtained from the training part. It enables us to tell the predictive power of different models more directly than the posterior deviance measure. The link still outperforms the other models and provides very good prediction for those firms with normalized logarithm sizes greater than 0.

| Standardized log(Firm size) | |||||||

|---|---|---|---|---|---|---|---|

| # of EPS | |||||||

| Logit | 0.84 | 76.40 | 139.73 | 471.90 | 468.56 | 44.83 | 19.64 |

| Probit | 0.85 | 76.90 | 139.00 | 470.89 | 473.85 | 45.39 | 19.84 |

| Cloglog | 1.02 | 77.49 | 133.36 | 462.61 | 482.75 | 46.21 | 19.98 |

| 102.96 | 140.76 | 407.10 | 500.41 | 47.00 | 20.00 |

| Standardized log(Firm size) | |||||||

|---|---|---|---|---|---|---|---|

| # of transactions | 0 | ||||||

| # of EPS | — | ||||||

| Logit | — | 7.20 | 12.20 | 49.71 | 57.93 | 5.74 | 0.97 |

| Probit | — | 7.23 | 12.13 | 49.57 | 58.58 | 5.81 | 0.98 |

| Cloglog | — | 7.23 | 11.63 | 48.64 | 59.73 | 5.91 | 1.00 |

| — | 9.37 | 12.25 | 42.92 | 61.94 | 6.00 | 1.00 |

4.4 The electronic payment system data set

To further illustrate the flexibility of the proposed link models, we apply the model to analyze the whole EPS data. The aims of the analysis are to examine the effects of various factors on EPS adoption and to evaluate the fitness of regression models under different link functions. The continuous variables, firm size and the payment amount, are very skewed to the right. We take the logarithm and standardize them by the sample mean and standard deviation. The credit risk by Paydex is simply standardized. Financing option is a binary variable with 1 indicating that the firm uses lease for financing its purchase and 0 indicating loan. We have three dummy variables for the four regions, and 9 dummy variables for the 10 industries, taking the values 0 and 1. Thus, there are a total of 16 covariates in the data for the response EPS.

Table 6 shows the parameter estimation, its standard deviation (SD), the average covariate effects (ACE), marginal likelihood, BIC-16000, DIC-16000 and for different link functions using the normal priors. The prior variances for ’s and are equal to . A factor of 10 changes in these variance settings led to almost identical posterior results.

We obtain with a standard deviation of 0.079 for the link model, which indicates that is significantly above 0. In fact, the value of DIC-16000 of the link model is 446.68 with the effective dimension , which is lower than 660.79 of the Cloglog link model with . Both skewed link models are better than the symmetric logit and probit link models. The consistent model comparison results are obtained by using the marginal likelihood and BIC criteria.

| Logit | Probit | Cloglog | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | est. | SD | ACE | est. | SD | ACE | est. | SD | ACE | est. | SD | ACE |

| Intercept | ||||||||||||

| Firm size | ||||||||||||

| Payment amount | ||||||||||||

| Credit risk | ||||||||||||

| Financing option | ||||||||||||

| Lease | ||||||||||||

| Region | ||||||||||||

| Mid west | ||||||||||||

| North east | ||||||||||||

| South | ||||||||||||

| Industry type | ||||||||||||

| Agri., forest, fish | ||||||||||||

| Consturction | ||||||||||||

| Fin., ins., reale. | ||||||||||||

| Manufacturing | ||||||||||||

| Mining | ||||||||||||

| Public adm. | ||||||||||||

| Retail trade | ||||||||||||

| Service | ||||||||||||

| Trans., ele., gas | ||||||||||||

| Shape parameter () | ||||||||||||

| Marginal likelihood | ||||||||||||

| BIC-16000 | ||||||||||||

| DIC-16000 | ||||||||||||

A closer look at the results from the widely used logit link regression model in the IS research and our regression model reveals some difference in the estimation of the covariates’ effects on EPS adoption. The changes in covariates include doubling the firm size, doubling the payment amount, 10 points decrease in the paydex measure, or moving from 0 to 1 for all the discrete covariates. The average covariate effects are calculated based on Chib and Jeliazkov (2006). A point to clarify is that the changes in the firm size, payment amount and the credit risk are on their original levels, while the regression itself has been run with these covariates standardized. The logit model suggests that transactions by firms in the southern region may have a lower probability employing EPS compared to those by firms in the western region with 1.9–2.8% changes in the probability, but the estimation from the model implies that there is no significant difference in these two regions with covariate effect approximately equal to a increase in the probability. Also, the model indicates that transactions by firms in the construction industry are significantly more likely to use EPS ( higher in probability) compared with those by firms in the wholesale trade industry, while the logit model suggests that it is not a statistically significant factor with the estimated average covariate effects around . Even when a parameter is significant in both models, the impact of changes in the covariate may be quite different. For example, firms in the Midwest are approximately more likely to use check compared to those in the west based on the logit model, while the probability is only around as estimated by the model.

To calculate the posterior deviance of the four different link models, we randomly divide the data into training and hold-out parts, with 10% or 1501 observations as the hold-out part and we calculate the posterior deviance (), which are 1653.40, 1643.04, 1637.92 and 1618.73 for logit, probit, Cloglog and links, respectively. The link model, with the lowest , outperforms the other three commonly used models in prediction. Thus, there is no indication of overfitting in the proposed model.

Since the assignment of 0 and 1 to the response variable is arbitrary, we can reverse the role of 0 and 1. It does not affect the fitness of the symmetric links, but it changes the asymmetry in the data. If we now define EPS if the transaction used the ACH service and 0 if it used the conventional payment method, we expect that a positively skewed link model like the Cloglog link is not appropriate anymore. In fact, we fitted the data using the same MCMC sampling method, and the values of DIC-16000 for the logit, the probit, the Cloglog and the link are 759.03, 733.1, 815.49 and 516.66, respectively. The Cloglog fits the data poorly, just as expected, since it is a positively skewed link function and the response function is now negatively skewed. This result shows that the determination of links should not just be a matter of choosing between a symmetric link and a skewed link, and that the direction of a skewed link indeed plays a more important role, since a wrong choice of direction gives an even worse fit than a wrong choice between symmetric and asymmetric. The flexibility of the link models is apparent here as it includes the shape parameter as a model parameter to be estimated through the data, instead of preassuming any direction of it. With the redefined 0 and 1 in the response variable, the link model has a negatively significant shape parameter of with a standard deviation of 0.05.

5 Conclusion and discussion

This paper introduced a new flexible skewed link model for analyzing binary response data with covariates in the EPS adoption setup. The proposed link model provided great flexibility in fitting skewness in the response curve. Although theoretically the GT link models in Kim, Chen and Dey (2008) would be rich enough to have similar flexibility, it is not easily implementable from a computational perspective. Moreover, the computation burden is much less for the link. For a simulated data with 2 covariates, it took approximately 2 minutes to fit the model in R, while it took approximately 8 hours to fit the GT model with codes in FORTRAN 95.

One existing problem in the link is that the shape parameter also affects the heaviness of the tail in the distribution. Its flexibility would be further improved if we can design a mechanism to modify the distribution such that one parameter would purely serve as skewness parameter while the other could purely control the heaviness of the tails.

Appendix

Proof of Theorem 1

Let be independent random variables with common distribution function , which is a distribution with , , and a shape parameter . For , it can be shown that for . Observing that and here is an indicator function. Now, we have and Let Using Fubini’s theorem, we obtain

| ((A.1)) | |||

Simulated data examples

We fit Cloglog, and logit models for Simulation . The model gives almost identical estimates of the regression coefficient as the true Cloglog regression model. The estimated shape parameter and its high posterior density intervals are and as and . The true value of is already contained in the HPD interval when . However, the variance in the estimation of the becomes smaller as the sample size increases, which implies that the links do require enough information contained in the data set for more efficient estimation of the shape parameter.

Czado and Santner (1992) emphasized that it is more appropriate to study the link misspecificaiton effects on the estimated probabilities since estimation of heavily depends on the chosen link function. They suggested that different link models can only be unambiguously compared in their estimation of event probabilities. Table 7 shows the average covariate effects. These effects are calculated by the method suggested in Chib and Jeliazkov (2006), where they marginalize out the covariates as a Monte Carlo average using their empirical distributions and integrate out the parameter by their posterior distribution. The third column in Table 7 indicates that the average covariate effect is measured as doubled, or or moving from 0 to 1. The values from the Cloglog model are in bold font. The average covariate effects estimated by the model are closer to those estimated by the Cloglog model than the logit model.

=270pt Covariate Sample size Parameter change Cloglog Logit double 0.2071 0.2033 0.1985 0.2409 0.2533 0.2191 0.1100 0.1150 0.0894 0.1332 0.1428 0.1300 double 0.1902 0.1889 0.1826 0.1771 0.1737 0.1624 0.0861 0.0844 0.0807 0.1306 0.1330 0.1460 double 0.1925 0.1924 0.1875 0.2082 0.2096 0.2152 0.1016 0.1021 0.1024 0.1122 0.1115 0.1067

=280pt Cloglog Logit 176.57 175.64 181.38 DIC 186.24 186.98 191.47 4.84 5.67 5.05 marginal likelihood 119.34 120.96 118.31 BIC 203.06 207.43 207.87 168.65 169.13 173.34 890.96 890.69 896.78 DIC 901.06 902.62 906.99 5.05 5.96 5.10 marginal likelihood 481.02 486.37 481.17 BIC 925.50 932.14 932.32 863.69 863.81 872.52 4388.53 4388.19 4427.16 DIC 4398.52 4399.88 4436.85 5.00 5.85 4.84 marginal likelihood 2233.73 2240.97 2250.31 BIC 4431.11 4439.29 4469.75 4418.96 4419.69 4473.86

Table 8 shows the model comparison results. We also include the effective number of parameters to show model complexity. To test the predictive power of different link models, for each simulated data set, we generate another data set of the same size with the same ’s as the hold-out part and the originally simulated data set as the training part. Based on the deviance in Table 8, the link outperforms both the Cloglog model and the logit model. The DIC measure allows us to take the model complexity into account. The DIC values for the model are very close to the Cloglog model and both the model and the Cloglog model provide better fit than the logit model based on the DIC measure. This result is consistent with the fact that the Cloglog model is a special case of the model. Simulation is in fact based on a regression model with . The comparison is consistent also in the aspect of the predictive power. In Table 8 the model has almost the same posterior deviance as the Cloglog model, while the logit model is worse than both models for different sample sizes. Comparison based on the marginal likelihood and BIC is only consistent with the above results when , which may suggest that benefits applying a model are more prominent with large sample size. The better predictive performance of the model suggests that there is no overfitting by the proposed model.

=280pt Covariate Sample size Parameter change Probit Logit Cloglog double 0.1757 0.1752 0.1757 0.1727 0.1619 0.1636 0.15443 0.1579 0.2867 0.2861 0.2871 0.2821 0.0328 0.03478 0.0123 0.0285 double 0.1892 0.1882 0.1925 0.1906 0.1756 0.1766 0.1838 0.1778 0.2630 0.2641 0.2512 0.2583 0.0683 0.0650 0.0689 0.0703 double 0.1871 0.1862 0.1866 0.1877 0.2254 0.2253 0.2253 0.2259 0.2859 0.2858 0.2825 0.2858 0.0420 0.0417 0.0403 0.0417

The results from Simulation are summarized in Tables 9 and 10. The main objective of Simulation is to show that the model can approximate a symmetric probit link model. The 95 HPD intervals of the estimated shape parameter are and for and , which all include the value at which the distribution approximates the standard normal distribution. A more precise estimation of does require larger sample size. The sample size also has impact on how the model compares with the other models. As shown in Table 10, only at all the model comparison criteria except the marginal likelihood method agree that the more complex link model exhibits some advantages compared to the logit and Cloglog links. The marginal likelihood method is affected by the flat priors on parameters. It requires an even larger sample size to select the link as a better model.

=280pt Probit Logit Cloglog 154.74 155.13 156.25 154.63 DIC 164.56 164.90 166.10 165.96 4.91 4.89 4.92 5.67 marginal likelihood 108.23 105.73 109.25 114.48 BIC 181.23 181.62 182.74 186.42 199.80 200.45 201.69 199.67 861.44 862.70 865.28 861.02 DIC 871.17 872.64 875.31 872.68 4.86 4.97 5.01 5.83 marginal likelihood 466.17 463.97 468.05 472.90 BIC 895.98 897.23 899.82 902.46 843.24 844.42 851.27 844.60 4219.46 4226.72 4238.51 4217.05 DIC 4229.43 4236.51 4248.40 4228.71 4.99 4.89 4.94 5.83 marginal likelihood 2149.16 2149.96 2158.67 2155.75 BIC 4262.04 4269.31 4281.09 4268.15 4190.66 4196.77 4228.71 4195.57

Acknowledgments

The research of Xia Wang was part of her dissertation at the Department of Statistics, University of Connecticut. The research of Dipak K. Dey was funded in part by SAMSI, Research Triangle Park, N.C., during his visit as part of his sabbatical. The authors wish to thank Dr. Zhongju Zhang for providing the data set. The authors gratefully acknowledge the insightful comments and constructive suggestions by the Associate Editor and two anonymous referees.

[id=suppA] \stitleR codes for GEV models with covariates \slink[doi]10.1214/10-AOAS354SUPP \slink[url]http://lib.stat.cmu.edu/aoas/354/supplement.txt \sdatatype.txt \sdescription The computation for the link described in this paper has been implemented in R which is available in this supplementary material.

References

- Albert and Chib (1993) Albert, J. H. and Chib, S. (1993). Bayesian analysis of binary and polychotomous response data. J. Amer. Statist. Assoc. 88 669–679. \MR1224394

- Aranda-Ordaz (1981) Aranda-Ordaz, F. J. (1981). On two families of transformations to additivity for binary response data. Biometrika 68 357–364. \MR0626394

- Arnold and Groeneveld (1995) Arnold, B. and Groeneveld, R. (1995). Measuring skewness with respect to the mode. Amer. Statist. 49 34–38. \MR1341197

- Bapna et al. (2010) Bapna, R., Goes, P., Wei, K. K. and Zhang, Z. (2010). A finite mixture logit model to segment and predict electronic payments system adoption. Information Systems Research DOI: 10.1287/isre.1090.0277.

- Chakravorti and Davis (2004) Chakravorti, S. and Davis, E. (2004). An electronic supply chain: Will payments follow. Chicago Federal Letter 206a.

- Chau and Jim (2002) Chau, P. and Jim, C. (2002). Adoption of electronic data interchange in small and medium-sized enterprises. Journal of Global Information Management 10 61–86.

- Chen, Dey and Shao (1999) Chen, M.-H., Dey, D. K. and Shao, Q.-M. (1999). A new skewed link model for dichotomous quantal response data. J. Amer. Statist. Assoc. 94 1172–1186. \MR1731481

- Chen and Shao (2000) Chen, M.-H. and Shao, Q.-M. (2000). Propriety of posterior distribution for dichotomous quantal response models with general link functions. Proc. Amer. Math. Soc. 129 293–302. \MR1694452

- Chib (1995) Chib, S. (1995). Marginal likelihood from the Gibbs output. J. Amer. Statist. Assoc. 90 1313–1321. \MR1379473

- Chib and Jeliazkov (2001) Chib, S. and Jeliazkov, I. (2001). Marginal likelihood from the Metropolis–Hastings output. J. Amer. Statist. Assoc. 96 270–281. \MR1952737

- Chib and Jeliazkov (2006) Chib, S. and Jeliazkov, I. (2006). Inference in semiparameteric dynamic models for binary longitudinal data. J. Amer. Statist. Assoc. 101 685–700. \MR2256181

- Coles (2001) Coles, S. G. (2001). An Introduction to Statistical Modeling of Extreme Values. Springer, New York. \MR1932132

- Coles, Pericchi and Sisson (2003) Coles, S., Pericchi, L. R. and Sisson, S. (2003). A fully probabilistic approach to extreme rainfall modeling. Journal of Hydrology 273 35–50.

- Czado and Santner (1992) Czado, C. and Santner, T. J. (1992). The effect of link misspecification on binary regression inference. J. Statist. Plann. Inference 33 213–231. \MR1190622

- Dahan and Mendelson (2001) Dahan, E. and Mendelson, H. (2001). An extreme-value model of concept testing. Management Science 47 102–116.

- Guerrero and Johnson (1982) Guerrero, V. M. and Johnson, R. A. (1982). Use of the Box–Cox transformation with binary response models. Biometrika 69 309–314. \MR0671968

- Gupta and Chintagunta (1994) Gupta, S. and Chintagunta, P. K. (1994). On using demographic variables to determine segment membership in logit mixture models. Journal of Marketing Research 31 128–136.

- Kamakura and Russell (1989) Kamakura, W. A. and Russell, G. (1989). A probabilistic choice model for market segmentation and elasticity structure. Journal of Marketing Research 26 379–390.

- Kass and Raftery (1995) Kass, R. E. and Raftery, A. E. (1995). Bayes factors. J. Amer. Statist. Assoc. 90 773–795.

- Kim, Chen and Dey (2008) Kim, S., Chen, M.-H. and Dey, D. K. (2008). Flexible generalized -link models for binary response data. Biometrika 95 93–106. \MR2409717

- McFadden (1978) McFadden, D. (1978). Modeling the choice of residential location. In Spatial Interaction Theory and Planning Models (A. Karlqvist, L. Lundqvist, F. Snickars and J. Weibull, eds.) 75–96. North Holland, Amsterdam.

- Morales (2005) Morales, C. F. (2005). Estimation of max-stable processes using Monte Carlo methods with applications to financial risk assessment. Ph.D. thesis, Dept. Statistics and Operations Research, Univ. North Carolina, Chapel Hill.

- Morgan (1983) Morgan, B. J. T. (1983). Observations on quantit analysis. Biometrics 39 879–886.

- Roberts (2000) Roberts, S. (2000). Extreme value statistics for novelty detection in biomedical data processing. Science, Measurement and Technology, IEE Proceedings 147 363–367.

- Sang and Gelfand (2009) Sang, H. and Gelfand, A. (2009). Hierarchical modeling for extreme values observed over space and time. Environmental and Ecological Statistics 16 407–426.

- Shmueli and Koppius (2009) Shmueli, G. and Koppius, O. (2009). The challenge of prediction in information systems research. Robert H. Smith School Research Paper No. RHS 06-058.

- Smith (1985) Smith, R. L. (1985). Maximum likelihood estimation in a class of non-regular cases. Biometrika 72 67–90. \MR0790201

- Smith (1989) Smith, R. L. (1989). Extreme value analysis of environmental time series: An application to trend detection in ground-level ozone (with discussion). Statist. Sci. 4 367–393. \MR1041763

- Smith (2003) Smith, R. L. (2003). Statistics of extremes, with applications in environment, insurance and finance. In Extreme Values in Finance, Telecommunications and the Environment (B. Finkenstadt and H. Rootzen, eds.) 1–78. Chapman and Hall/CRC Press, London.

- Spiegelhalter et al. (2002) Spiegelhalter, D. J., Best, N. G., Carlin, B. P. and Van Der Linde, A. (2002). Bayesian measures of model complexity and fit (with discussion). J. R. Stat. Soc. Ser. B Stat. Methodol. 64 583–639. \MR1979380

- Stavins (2003) Stavins, J. (2003). Perspective on payments: Electronic payments networks benefit banks, businesses, and consumers. Why do so few use them? Regional Review 13 6–9.

- Stukel (1988) Stukel, T. (1988). Generalized logistic models. J. Amer. Statist. Assoc. 83 426–431. \MR0971368

- Thompson et al. (2001) Thompson, M. L., Reynolds, J., Cox, L. H., Guttorp, P. and Sampson, P. D. (2001). A review of statistical methods for the meteorological adjustment of tropospheric ozone. Atmospheric Environment 35 617–630.

- Wang (2010) Wang, X. (2010). Supplement to “Generalized extreme value regression for binary response data: An application to B2B electronic payments system adoption.” DOI: 10.1214/10-AOAS354SUPP.

- Wedel and DeSarbo (1993) Wedel, M. and DeSarbo, W. (1993). A latent class binomial logit methodology for the analysis of paired comparison choice data: An application reinvestigating the determinants of perceived risk. Decision Sciences 24 1157–1170.

- Wu, Chen and Dey (2002) Wu, Y., Chen, M.-H. and Dey, D. (2002). On the relationship between links for binary response data. J. Stat. Stud. Special Volume in Honour of Professor Mir Masoom Ali’s 65th Birthday 159–172. \MR1970193