Nonparametric tests of the Markov hypothesis in continuous-time models

Abstract

We propose several statistics to test the Markov hypothesis for -mixing stationary processes sampled at discrete time intervals. Our tests are based on the Chapman–Kolmogorov equation. We establish the asymptotic null distributions of the proposed test statistics, showing that Wilks’s phenomenon holds. We compute the power of the test and provide simulations to investigate the finite sample performance of the test statistics when the null model is a diffusion process, with alternatives consisting of models with a stochastic mean reversion level, stochastic volatility and jumps.

doi:

10.1214/09-AOS763keywords:

[class=AMS] .keywords:

.T1Supported in part by NSF Grants SES-0850533, DMS-05-32370 and DMS-09-06482.

, and

1 Introduction

Among stochastic processes, those that satisfy theMarkov property represent an important special case. The Markov property restricts the effective size of the filtration that governs the dynamics of the process. In a nutshell, only the current value of is relevant to determine its future evolution. This restriction simplifies model-building, forecasting and time series inference. Can it be tested on the basis of discrete observations? It is not practical to approach the testing problem in the form of a restriction on the filtration, the size of any alternative filtration being essentially unrestricted. Furthermore, the continuous-time filtration is not observable on the basis of discrete observations, especially if we do not have high-frequency data, and asymptotically the sampling interval remains fixed.

Instead, we propose to test the Markov property at the level ofthe discrete-frequency transition densities of the process. Given atime-homogeneous stochastic process on , with the standard probability space and filtration , we consider families of conditional probability functions of given : for each Borel measurable function , .

If is time-homogeneous Markovian, then its transition densities satisfy the Chapman–Kolmogorov equation

| (1) |

for all and and in the support of Suppose that we collect observations on on sampled every units of time. We will assume that is fixed; asymptotics are therefore with . High-frequency asymptotics, by contrast, assume that , and can be fixed or diverges. This asymptotic setup could have been considered, but it is not necessary here as we are able to test the hypothesis on the basis of discrete data at a fixed interval with no requirement for high-frequency data; high-frequency asymptotics would, of course, also generate different asymptotic properties for the tests we propose.

If we set in (1), then we can estimate the transition densities at the desired frequencies on the basis of these discrete observations. On the left-hand side of the equation, the transition density at interval can be estimated simply by retaining every other observation in the same data sample. To avoid unnecessary restrictions on the data-generating process, we will employ nonparametric estimators of the transition densities. Given these, equation (1) then becomes a testable implication of the Markov property for .

Conversely, Kolmogorov’s construction (see, e.g., revuzyor , Chapter III, Theorem 1.5) allows one to parameterize Markov processes using transition functions. Namely, given a transition function and a probability measure on serving as the initial distribution, there exists a unique probability measure such that the coordinate process is Markovian with respect to , has transition function and has as its distribution. When is the invariant probability measure of , the process is a stationary Markov process. Therefore, given an initial distribution, a Markov process is determined by its transition densities.

Transition densities play a crucial role in many contexts. In mathematical finance, arbitrage considerations in finance make many pricing problems linear; as a result, they depend upon the computation of conditional expectations for which knowledge of the transition function is essential. Also, inference strategies relying on maximum-likelihood or Bayesian methods require the transition density of the process. Specification testing procedures for stochastic processes also make use of the transition densities (see, e.g., yacrfs96 , yacfanpeng09 , chengao04b , chengaotong08 , gaocasas08 and hongli05 ). All these models, estimation methods and tests assume that the process is Markovian.

Stochastic volatility models are a very broad class of non-Markovian models, due to the latency of the volatility state variable. They have been popular in financial asset pricing and modeling (see, e.g., fouquepapanicolaousircar00 ). Parameters in stochastic volatility models are much harder to estimate and the associated pricing formulas are also different from those based on Markovian diffusion models and depend on the assumptions made on the correlation structure between the innovations to prices and volatility (as in, e.g., heston93 ). Other examples include models for the term structure of interest rates, which may be Markovian or not (see, e.g., heathjarrowmorton92 ), and, in fact, one popular approach in mathematical finance consists of restricting term structure models to be Markovian (see, e.g., caverhill94 ). In other words, many financial econometrics models are based on the Markovian assumption and this fundamental assumption needs to be tested before they can be applied. In all these cases, testing whether the underlying process is Markovian is essential in helping to decide which family of models to use and whether a diffusion model is adequate.

We will propose test statistics for this purpose. Asymptotic null distributions of test statistics are established and we show that Wilks’s phenomenon holds for several of those test statistics. The power functions of the tests are also computed for contiguous alternatives. We find that the proposed tests can detect alternatives with an optimal rate in the context of nonparametric testing procedures.

The remainder of the paper is organized as follows. In Section 2, we briefly describe the nonparametric estimation of the transition functions of the process. In Section 3, we propose several test statistics for checking the Markov hypothesis. In Section 4, we establish their asymptotic null distributions and compute their power. Simulation results are reported in Section 5. Technical conditions and proofs of the mathematical results are given in Section 6.

2 Nonparametric estimation of the transition density and distribution functions

To estimate nonparametrically the transition density of observed process we use the locally linear method suggested by fanyaotong96 . The process is sampled at regular time points . We make the dependence on the transition function and related quantities on implicit by redefining

which is assumed to be a stationary and -mixing process.

For ease of exposition, we describe the estimation of the transition density and distribution when , that is, is a process on the line. We also define and . Let and denote two bandwidths and and two kernel functions. Observe that as

| (2) |

where and is the transition density of given . The left-hand side of (2) is the regression function of the random variable given . Hence, locally linear fit can be used to estimate this regression function. For each given , one minimizes

| (3) |

with respect to the the local parameters and , where . The resulting estimate of the conditional density is simply . The estimator can be explicitly expressed as

| (4) |

where is the effective kernel induced by the local linear fit. Explicitly, it is given by

where

Note that the effective kernel depends on the sampling data points and the location . This is the key to the design adaptation and location adaptation property of the locally linear fit.

3 Nonparametric tests for the Markov hypothesis in discretely sampled continuous-time models

The tests we propose are based on the fact that, for to be Markovian, its transition function must satisfy the Chapman–Kolmogorov equation in the form for densities equivalent to (1),

| (6) |

where

| (7) |

for all .

Under time-homogeneity of the process , the Markov hypothesis can then be tested in the form against where

| (8) |

This test corresponds to a nonparametric null hypothesis versus a nonparametric alternative hypothesis.

Both and can be estimated from data sampled at interval , thanks to time homogeneity. In fact, the successive pairs of observed data form a sample from the distribution with conditional density from which the estimator can be constructed, and then as indicated in equation (7) can be computed. Meanwhile, the successive pairs form a sample from the distribution with conditional density which can be used to form the direct estimator by drawing a parallel to (4)

where and are two bandwidths, localizing, respectively, the - and -domain.

In other words, the test compares a direct estimator of the -interval conditional density, , to an indirect estimator of the -interval conditional density, , obtained by (7). If the process is actually Markovian, then the two estimates should be close (for some distance measure) in a sense made precise by the use of the statistical distributions of these estimators.

If, instead of transitions, we test the replicability of transitions, where is an integer greater than or equal to , there is no need to explore all the possible combinations of these transitions in terms of shorter ones : verifying equation (6), for one combination is sufficient as can be seen by a recursion argument. In the event of a rejection of in (8), there is no need to consider transitions of order . In general, a vector of “transition equalities” can be tested in a single pass in a method of moments framework with as many moment conditions as transition intervals.

We propose two classes of tests for the hypothesis problem (8) based on nonparametric estimation of the transition densities and distributions. To be more specific, since

| (9) |

the function can also be estimated by regressing nonparametrically on . This avoids integration in (7) and makes implementation and theoretical studies easier. Employing the local linear smoother for (9), we obtain the following estimator:

where is a bandwidth in this smoothing problem. Under in (8), the logarithm of the likelihood function is estimated as

after ignoring the initial stationary density . This likelihood can be compared with

which leads to the generalized likelihood ratio (GLR) test statistic (see fanzhangzhang01 )

Since the nonparametric regression functions cannot be estimated well when is in the boundary region, the above GLR test statistic is reduced to

where is a weight function selected to reduce the influences of the unreliable estimates in the sparse region. Admittedly, is not the estimated log-likelihood under in (8), but is used to create a discrepancy measure. To see this, note that under , and are approximately the same. By Taylor’s expansion, we have

To avoid unnecessary technicalities, we ignore the first term and consider the second term

| (10) |

which is the -type of test statistics. A natural alternative statistic to is

| (11) |

The resulting test statistics and are discrepancy measures between and in the -distance. Discrepancy-measure based test statistics receive attention and achieve success in the literature. Other discrepancy norms such as the -distance can also be investigated in the current setting. See the seminal work by azzalinibowmanhardle89 , bickelrosenblatt93 and hardlemammen93 . They are not qualitatively different as shown in the classical goodness of fit tests.

Since the testing problem (8) is equivalent to the following testing problem:

| (12) |

with, in light of (9),

then transition distribution-based tests can be formulated too. Let be the direct estimator for the -transition distribution

| (13) |

Regressing the transition distribution on yields :

| (14) |

where Similarly to (11), for the testing problem (12), the transition distribution-based test will be

| (15) |

where the weight function is chosen to depend on only -variable, because is a nonparametric estimator of the conditional distribution function, and we need only to weight down the contribution from the sparse regions in the -coordinate.

Note that the test statistic involves only one-dimensional smoothing. Hence, it is expected to be more stable than , and the null distribution of can be better approximated by the asymptotic null distribution. This will be justified by the theorems in the next section.

The choice between the transition density and distribution-based tests reflects different degrees of smoothness of alternatives that we wish to test. In a simpler problem of the traditional goodness-of-fit tests, this has been thoroughly studied in fan96 . Essentially, the transition density-based tests are more powerful in detecting local deviations whereas the transition distribution-based tests are more powerful for detecting global deviations.

4 Asymptotic properties

4.1 Assumptions

We assume the following conditions. These conditions are frequently imposed for nonparametric studies for dependent data.

Assumption (A1).

The observed time series is strictly stationary with time-homogenous -transition density

Assumption (A2).

The kernel functions and are symmetric and bounded densities with bounded supports, and satisfy the Lipschitz condition.

Assumption (A3).

The weight function has a continuous second-order derivative with a compact support .

Assumption (A4).

The stationary process is -mixing with the exponential decay rate for some

Assumption (A5).

The functions and have continuous second-order partial derivatives with respect to and on the set The invariant density of has a continuous second-order derivative for , a project of the set onto the -axis. Moreover, , and for all and

Assumption (A6).

The joint density of for is bounded by a constant independent of . Put . The function satisfies the Lipschitz condition: for all and in ,

Assumption (A7).

The bandwidths s and are of the same order and satisfy and

Assumption (A8).

The bandwidth converges to zero in such a way that and

4.2 Asymptotic null distributions

To introduce our asymptotic results, we need the following notation. For any integrable function , let and

Note that the sampled observations are a reverse Markov process under the null model. We also use to denote the -transition density of the reverse process, and let

Denote by

For a kernel function , let and Denote by the conditional variance function of , given . Then it is easy to see that

Throughout the paper, we use the notation for a diverging sequence of constants to represent that

The test statistic , as far as its null distribution is concerned, can be regarded as a special case of , with the weight function . Correspondingly, let denote with replaced by and defined similarly. Then, we have

Corollary 1

Under the conditions in Theorem 1 with replaced by , where

The is asymptotically a constant depending on only the kernels and the weight function. The degree of freedom is independent of nuisance parameters. This reflects that the Wilks phenomenon continues to hold in the current situation.

Theorem 2

Comparing Theorems 1 and 2, it is seen that asymptotic variance of is an order of magnitude larger than that of . Therefore, the null distribution of can be more stably approximated than that of . On the other hand, the degrees of freedom in are larger than in , and the transition density-based tests are more omnibus, capable of testing a wider class of alternative hypothesis.

4.3 Power under contiguous alternative models

To assess the power of the tests, we consider the following contiguous alternative sequence for :

| (16) |

where satisfies and for a constant and a sequence going to zero as . Then the power of the test statistic can be approximated using the following theorem.

Using Theorem 1, one can construct an approximate level- test based on . Let be the critical value such that

Then we have the following result, which demonstrates that the test statistic can detect alternatives at rate .

Theorem 4

Similarly to (16), we consider the following alternative sequence to study of the power of the test statistic :

where satisfies and for a constant and a sequence tending to zero. Then using the following theorem one can calculate the power of the test statistic .

Theorem 5

In a manner parallel to Theorem 4, the following theorem demonstrates the optimality of the test.

From Theorem 6, can detect alternatives at rate . Using an argument similar to fanjiang05 , we can also establish the minimax rate, , of the test. Note that the rate is optimal according to ingster93 , lepskispokoiny99 and spokoiny96 . Compared with Theorem 4, it is seen that is more powerful than for testing the Markov hypothesis. This is due to the fact that the alternative under consideration for is global, namely, the density under the alternative is basically globally shifted away from the null hypothesis. On the other hand, and are more powerful than for detecting local features of the alternative hypothesis. We will now explore these features in simulations.

5 Simulations

An important application of our test methods is to verify the Markov property in the context where the null model is a diffusion process, since it is often assumed in modern financial theory and practice that the observation process comes from an underlying diffusion. Hence, we consider simulations for the diffusion models.

To use the test statistics, one needs to find their null distributions. Theoretically the asymptotic null distributions may be used to determine the -values of the test statistics. However, in practical applications the asymptotic distributions do not necessarily give accurate approximations, since the local sample size may not be large enough. This phenomenon is shared by virtually all nonparametric kinds of tests where some form of functional estimation is used.

We will mainly focus on the finite sample performance of the test statistic , since it possesses the Wilks property which facilitates bandwidth selection and determination of the null distribution using a bootstrap method. Since the asymptotic null distribution of is independent of nuisance parameters/functions under the null hypothesis, for a finite sample it does not sensitively depend on the nuisance parameters/functions. Therefore, the null distribution can be approximated by bootstraps, by fixing nuisance parameters/functions at their reasonable estimates, as in fanjiang07 in a different context.

In general, different bootstrap approximations to the null distributions are needed for different null models, partially due to the large family of null models with the Markov property. We will illustrate this method for the Ornstein–Uhlenbeck model, which in financial mathematics is used for instance as the vasicek77 model for interest rates. For other parametric models, our approach can similarly be applied.

The Ornstein–Uhlenbeck model employed as the null hypothesis is

| (17) |

where is a Brownian motion, and the parameters are set as , which are realistic for interest rates over long periods. We simulated the model times. In each simulation, we draw a sample with sample size and weekly sampling interval using for this purpose a higher frequency Euler approximation, or an exact discretization. The bandwidth selection for the test statistic is performed using the simple empirical rule proposed by hyndmanyao02 . Alternative methods include the cross-validation approaches of fanyim04 and hallracineli04 , but their computation is intensive especially when repeated many times in Monte Carlo.

Given a sample from the model, we fit the model using the least squares method and obtain the residuals of the fit, and then generate bootstrap samples using the residual-based bootstrap method. For each simulation, we obtained three bootstrap samples (this is merely for the reduction of computation cost; using more samples will not fundamentally alter the results) and computed the test statistic using the same bandwidths as the original sample in the simulation. Pooling together the bootstrap samples from each simulation, we obtained bootstrap statistics. Their sampling distributions, computed via the kernel density estimate, is taken as the distribution of the bootstrap method. By using the kernel density estimation method, the distribution of the realized values of the test statistic in simulations is obtained as the true distribution (except for the Monte Carlo errors).

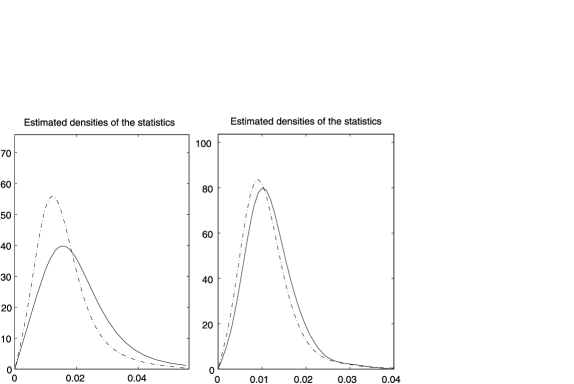

Figure 1 displays the estimated densities for . Not surprisingly, the bootstrapped distributions get much closer to the true ones as the sample sizes increase. In our experience, the bootstrap approximations start to become adequate for sample sizes starting at about .

| Parameter | |||||||

|---|---|---|---|---|---|---|---|

| Level | 0.0 | 0.2 | 0.4 | 0.6 | 0.8 | 1.0 | |

To investigate the power of the test statistics, we employ various sequences of alternatives indexed by a parameter . One of the main ways for an otherwise Markovian model to become non-Markovian is to restrict too much its state space. For instance, consider a bivariate diffusion model. Taken jointly, the two components are Markovian, but taken in isolation a single component may not be:

-

[1.]

-

1.

Alternative model with missing state variable in the drift: we first consider the situation where the null model (17) is missing a state variable, in this case mean-revers to the stochastic level under the alternative

where is the random process

with a the Brownian motion independent of , , , and , with and . When , the alternatives are non-Markovian. The results in the first part of Table 1 show that the test statistic rejects the null hypothesis when the observations are drawn under

Table 2: Power of the test against Parameter Level 0.0 0.2 0.4 0.6 0.8 1.0 -

2.

Alternative model with missing state variable in volatility: next, we consider alternative models where volatility is stochastic,

where is a random process following the cir85 model

where is a standard Brownian motion independent of , , and , with , and . When , the alternatives are also non-Markovian.

-

3.

Alternative model with missing state variable in jumps: finally, we consider a model with compound Poisson jumps

where is a Poisson process with stochastic intensity and jump size , while is a the jump size. We will consider two types of jump sizes:

-

[(ii)]

-

(i)

is independent of and follows with , which makes Markovian;

-

(ii)

follows the CIR model

where is a standard Brownian motion independent of , , and . Then is not independent of . This leads to alternatives which are not Markovian for .

-

The alternative models considered here are -mixing. For example, in the first alternative , the joint process is an affine process and it is -mixing. Hence, is -mixing. A similar argument applies to two other alternatives. In fact, for the first alternative , the time series can be written as a bivariate autoregressive model. Hence, it is -mixing with the choice of parameters. Note that for all of the above alternatives, when is small, the null and alternative models are nearly impossible to differentiate. In the limit where , the null and the alternative are identical. Therefore, it can be expected that, when , the power of test should be close to the significance level; and as deviates more from , the power should increase. Also we can expect that our tests will be able to detect only the type (ii) jumps but not the type (i) jump, since for the type (i) jump the alternatives are Markovian.

The simulated powers are reported in Tables 1–3. The null distribution of the normalized test statistics does not depend sensitively on choice of bandwidth, whereas the power depends on the choice of bandwidth and the alternative under consideration. As expected, our test is fairly powerful for detecting non-Markovian alternatives at least in situations where the alternative is sufficiently far from the null. For , the test has, as it should, no power to identify the type (i) alternatives but is powerful for discriminating against the type (ii) alternatives. This illustrates well the sensitivity and specificity of our tests.

| Parameter | |||||||

|---|---|---|---|---|---|---|---|

| Jump type | Level | 0.0 | 0.2 | 0.4 | 0.6 | 0.8 | 1.0 |

| (i) | |||||||

| (ii) | |||||||

6 Technical proofs

6.1 Technical lemmas

We now introduce some technical lemmas, the proofs of which can be found in the supplemental material of this paper. To save space, some notation in the lemmas will appear later in the course of proofs of the main theorems.

Lemma 1

Suppose that is symmetric and continuous with a bounded support. If and , then

uniformly for , where does not depend on , where .

6.2 Preliminaries

Since the test statistics and compare the difference between and , we derive an asymptotic expression for this difference under before giving the proofs of theorems. In addition, in order to streamline our arguments, we will introduce some technical lemmas and put them behind the proofs of theorems. The arguments employed here use techniques from the -statistic and nonparametric smoothing.

First let us introduce some notation. Let and . Denote by , , and .

Using an elementary property of the local linear smoother (see, e.g., fanyao03 ), we obtain that

| (18) |

where

By a second-order Taylor expansion,

where and lies between and . By fanyaotong96 , it is easy to show that

| (20) |

uniformly for By the definition of , we have

| (21) |

where

Subtracting (21) from (18), we obtain that, under

where

By the continuity of , it is easy to show that

| (23) |

Therefore, by (20), (6.2) and (23),

| (24) | |||

Let . Then it can be rewritten that

| (25) |

Note that . It follows that and uniformly for and . Applying Lemma 1 with and , we obtain that

| (26) | |||

uniformly for , where does not depend on . Therefore,

where

By Lemma 2(ii), we have and

uniformly for . Then

and , uniformly for . Then

uniformly for . Note that from (6.2) and (25)

| (28) | |||||

where

which is of order , uniformly for . Let Then, similarly to (18), we have

| (29) |

where , and, uniformly for . It follows from the definition of that

Using Lemma 1, we get

where

Using Lemma 2(i), we obtain that

and

uniformly for . Then

uniformly for . This, combined with (6.2) and Condition (A6), yields that

| (31) |

where ,

Note that, by Lemma 2(i), , uniformly for Using Lemma 1, we obtain that

| (32) |

where

Let

and . Then

By Lemma 3,

| (33) |

uniformly for Similarly to Lemma 2(iii), the first term on the right-hand side of (33) is , uniformly for . Hence,

Similarly, we have

By the symmetry of the kernel function and Taylor’s expansion, it can be shown that

uniformly for , where is the one- transition density of the reverse series , that is, the conditional density of given . Note that is a deterministic function. It follows that

| (34) |

where is -measurable and is of order for . This combined with (33) leads to

where . The first term in (6.2) is obviously

By Lemma 4, the second term in (6.2) is , uniformly for Then uniformly for ,

In the same argument, is dominated by and is of order

which combined with (31) leads to

uniformly for . This together with (6.2) and (28) yields the following asymptotic expression:

| (37) |

where

uniformly for .

6.3 Proofs of theorems

We now give the proofs of our main results.

Proof of Theorem 1 (i) Approximate by a -statistic. Let . By (37) and the definition of , we have

By Lemmas 1 and 2, . Note that , , uniformly for . It is straightforward to verify that , . Using the same argument as for (B.2) in yacfanpeng09 , we obtain and . Therefore,

Note that

and

It follows that

It can be rewritten that

where

and

Applying Lemmas 1 and 2 and using Condition (A5), we obtain that

where and

Hence,

Let and

where Then

(ii) Derive the asymptotics using the asymptotic theory for the U-statistic. Let

and

Then

| (38) |

Let . Then is symmetrical about , and hence Using Hoeffding’s decomposition, we obtain that

| (39) |

where

and is the distribution of . Applying the lemma with in gaoking04 , we can show that Therefore, the first term on the right-hand side of (39) is , so that

| (40) |

By the Markovian property of , . Hence, up to a ignorable term of order , is a -statistic with mean zero. Define , and . Then we have

Since is a symmetrical kernel, using the Hoeffding decomposition, we obtain that

By Lemma 5,

| (42) |

Note that . By straightforward calculation on the mean of , it can be shown that

| (43) |

Therefore, a combination of (38) and (40)–(43) leads to

| (44) |

By Lemma 6(i),

Applying Lemma 7(i), we obtain that

where Therefore, the result of this theorem holds.

(i) Asymptotic expression for . By the definitions in (13) and (14),

| (46) |

where and

| (47) |

Let . Then . By (5),

This can be rewritten as

| (48) |

where

By Lemma 1 and the symmetry of the kernel function , and by using Taylor’s expansion, it is easy to show that

| (49) |

uniformly for Hence,

| (50) |

uniformly for Then

| (51) |

uniformly for Using the same arguments as those for between (32) and (37), we obtain that

Rewrite as

where

By the continuity of and the same argument as that for (49), uniformly for . Let . Then , and

By (6.3) and (46), under , we have

| (54) |

where, with ,

Similarly to (49), the second term above is of order ,

| (55) |

uniformly for . A combination of (6.3)–(55) yields that

| (56) |

where

uniformly for , and

uniformly for .

(ii) Asymptotic normality of . Similar to (44), we have

| (57) |

where and are defined the same as and , respectively, but with replaced by

where

By Lemma 6(ii), we have

| (58) |

By Lemma 7(ii), we have

| (59) |

A combination of (57)–(59) completes the proof of the theorem.

Proof of Theorem 3 Under , Similarly to (6.2), we have under

where

Then

Since , it can be shown that

| (61) |

By (20) and (23), , and , uniformly for . It follows from the Hölder inequality that

| (62) | |||

A combination of (6.3)–(6.3) yields that

can be dealt with in the same way as in the proof of Theorem 1. It is asymptotically normal with mean and variance given in Theorem 1. By the definition, . We now study the third term . By (28) and (6.2), admits the following decomposition:

The first term above is a -statistic with the typical element . Let . Then is a symmetric kernel and

Put and Then by the Hoeffding decomposition, we have

It is easy to show that Therefore, applying the lemma with of gaoking04 , we obtain that

Therefore,

| (64) |

By the definition of , it can be written that

where

and Then by the Fubini theorem and by taking iterative expectation, . Using the central limit theorem for the -mixing process, we get

where . By directly calculating the integration, it can be shown that

and . Therefore,

By straightforward calculation, it can be shown that the covariance between and can be ignored. It follows that the result of the theorem holds.

Proof of Theorem 4 (i) For any given small , when is small enough, and Under , with the selected bandwidths,

Therefore, the sequence of critical values (depending on ) is bounded in probability. Similarly, under , with the selected bandwidths,

| (65) |

Note that

It follows from Theorem 3 and Slutsky’s theorem that

(ii) For any given , by taking sufficiently large, there exists an , when , Therefore,

By (65), we have

Acknowledgments

The authors thank the Associate Editor and the referees for constructive comments that substantially improved an earlier version of this paper.

References

- (1) Aït-Sahalia, Y. (1996). Testing continuous-time models of the spot interest rate. Review of Financial Studies 9 385–426.

- (2) Aït-Sahalia, Y., Fan, J. and Jiang, J. (2010). Supplement to “Nonparametric tests of the Markov hypothesis in continuous-time models.” DOI: 10.1214/09-AOS763SUPP.

- (3) Aït-Sahalia, Y., Fan, J. and Peng, H. (2009). Nonparametric transition-based tests for jump-diffusions. J. Amer. Statist. Assoc. 104 1102–1116.

- (4) Azzalini, A., Bowman, A. N. and Härdle, W. (1989). On the use of nonparametric regression for model checking. Biometrika 76 1–11. \MR0991417

- (5) Bickel, P. J. and Rosenblatt, M. (1973). On some global measures of the deviation of density function estimates. Ann. Statist. 1 1071–1095. \MR0348906

- (6) Caverhill, A. (1994). When is the short rate Markovian? Math. Finance 4 305–312. \MR1299241

- (7) Chen, S. X. and Gao, J. (2004). On the use of the kernel method for specification tests of diffusion models. Technical report, Iowa State Univ.

- (8) Chen, S. X., Gao, J. and Tang, C. (2008). A test for model specification of diffusion processes. Ann. Statist. 36 167–198. \MR2387968

- (9) Cox, J. C., Ingersoll, J. E. and Ross, S. A. (1985). A theory of the term structure of interest rates. Econometrica 53 385–408. \MR0785475

- (10) Fan, J. (1996). Test of significance based on wavelet thresholding and Neyman’s truncation. J. Amer. Statist. Assoc. 91 674–688. \MR1395735

- (11) Fan, J. and Jiang, J. (2005). Generalized likelihood ratio tests for additive models. J. Amer. Statist. Assoc. 100 890–907. \MR2201017

- (12) Fan, J. and Jiang, J. (2007). Nonparametric inference with generalized likelihood ratio tests (with discussion). Test 16 409–478. \MR2365172

- (13) Fan, J. and Yao, Q. (2003). Nonlinear Time Series: Nonparametric and Parametric Methods. Springer, New York. \MR1964455

- (14) Fan, J., Yao, Q. and Tong, H. (1996). Estimation of conditional densities and sensitivity measures in nonlinear dynamical systems. Biometrika 83 189–206. \MR1399164

- (15) Fan, J. and Yim, T.-H. (2004). A data-driven method for estimating conditional densities. Biometrika 91 819–834. \MR2126035

- (16) Fan, J., Zhang, C. and Zhang, J. (2001). Generalized likelihood ratio statistics and Wilks phenomenon. Ann. Statist. 29 153–193. \MR1833962

- (17) Fouque, J.-P., Papanicolaou, G. and Sircar, K. R. (2000). Derivatives in Financial Markets with Stochastic Volatility. Cambridge Univ. Press, London. \MR1768877

- (18) Gao, J. and Casas, I. (2008). Specification testing in discretized diffusion models: Theory and practice. J. Econometrics 147 131–140. \MR2472987

- (19) Gao, J. and King, M. (2004). Model specification testing in nonparametric and semiparametric time series econometrics. Technical report, Univ. Western Australia.

- (20) Hall, P., Racine, J. and Li, Q. (2004). Cross-validation and the estimation of conditional probability densities. J. Amer. Statist. Assoc. 99 1015–1026. \MR2109491

- (21) Härdle, W. and Mammen, E. (1993). Comparing nonparametric versus parametric regression fits. Ann. Statist. 21 1926–1947. \MR1245774

- (22) Heath, D., Jarrow, R. and Morton, A. (1992). Bond pricing and the term structure of interest rates: A new methodology for contingent claims evaluation. Econometrica 60 77–105.

- (23) Heston, S. (1993). A closed-form solution for options with stochastic volatility with applications to bonds and currency options. Review of Financial Studies 6 327–343.

- (24) Hong, Y. and Li, H. (2005). Nonparametric specification testing for continuous-time models with applications to term structure of interest rates. Review of Financial Studies 18 37–84.

- (25) Hyndman, R. and Yao, Q. (2002). Nonparametric estimation and symmetry tests for conditional density functions. J. Nonparametr. Statist. 14 259–278. \MR1905751

- (26) Ingster, Y. (1993). Asymptotically minimax hypothesis testing for nonparametric alternatives I–III. Math. Methods Statist. 2 85–114; 3 171–189; 4 249–268.

- (27) Lepski, O. and Spokoiny, V. (1999). Minimax nonparametric hypothesis testing: The case of an inhomogeneous alternative. Bernoulli 5 333–358. \MR1681702

- (28) Revuz, D. and Yor, M. (1994). Continuous Martingales and Brownian Motion, 2nd ed. Springer, Berlin. \MR1303781

- (29) Spokoiny, V. G. (1996). Adaptive hypothesis testing using wavelets. Ann. Statist. 24 2477–2498. \MR1425962

- (30) Vasicek, O. (1977). An equilibrium characterization of the term structure. Journal of Financial Economics 5 177–188.