1 Introduction

A classical problem in actuarial mathematics is to maximize the

cumulative expected discounted dividend pay-outs. In the

Cramér–Lundberg setting, this optimization problem was introduced

by De Finetti (1957); Gerber (1969) proved the

existence of an optimal dividend payment strategy and showed that it

has a band structure. The cumulative expected discounted dividend

pay-outs is a way to value a company as it can be seen, for instance, in

the classical paper by Miller and Modigliani (1961) for the

deterministic case and more recently in Sethi, Derzko and Lehoczky

(1984a, 1984b) and Sethi (1996)

for the stochastic case.

In this paper we consider this optimization problem in the classical

Cramér–Lundberg setting, but we allow the management the

possibility of

controlling the stream of dividend pay-outs and of investing part of the

surplus in a Black and Scholes financial market. We impose a borrowing

constraint: short-selling of stocks or to borrow money to buy stocks is not

allowed. Technically, the unconstrained optimization problem is simpler.

Azcue and Muler (2005) consider the problem of maximizing

the cumulative

expected discounted dividend pay-outs of an insurance company when the

management has the possibility of controlling the risk exposure by

reinsurance. In this case, the optimal value function was characterized

as the

smallest viscosity solution of the first-order integro-differential

Hamilton–Jacobi–Bellman equation, and the optimal dividend payment

strategy was found.

In this paper, the optimization problem is more complex than the one we

treated before. One difference is that the associated Hamilton–Jacobi–Bellman

equation is a nonlinear degenerate second-order integro-differential equation

subject to a differential constraint. The possibility that the

ellipticity of

the second-order operator involved in this equation can degenerate at any

point together with the fact that there is an integral term, makes it more

difficult to prove the existence and regularity of solutions. However,

when we

obtain the solution of this operator in Section 6, we see that the ellipticity

only degenerates at zero and so the degeneracy is not as serious as it could

be (the solution turns out to be twice continuous differentiable). Another

difference is that, since in this case the controlled surplus involves a

Brownian motion, there is not an optimal strategy. Nevertheless, we

prove that

the optimal value function can be written explicitly as a limit of value

functions of strategies. So, we introduce the notion of limit dividend

strategies and prove that the optimal limit strategy has a band

structure.

In a diffusion setting, which means that the surplus is modeled as a Brownian

motion, different cases were studied; we can mention, for instance,

Asmussen and

Taksar (1997) for the problem of dividend optimization and

Højgaard and

Taksar (2004) for the case of dividend, reinsurance and portfolio

optimization. The main difference between the two settings is that the HJB

equation in the diffusion case is a differential equation and not an

integro-differential one. Other differences are that in the diffusion setting

the optimal strategies are always barrier strategies, that there is a natural

boundary condition at zero for the associated HJB equation and that this

equation has always classical concave solutions; these properties might not

occur in the Cramér–Lundberg setting.

Avram, Palmowski and Pistorius (2007) study the problem of

maximizing the

discounted dividend pay-outs when the uncontrolled surplus of the company

follows a general spectrally negative Lévy process in absence of

investment. The HJB equation associated with this optimization problem

is also

a second-order integro-differential equation but its ellipticity does

not degenerate.

In both, Højgaard and Taksar (2004) and Avram, Palmowski

and Pistorius

(2007), the corresponding HJB equations are second-order

equations whose

ellipticity does not degenerate at zero, so to characterize the optimal value

function among the solutions of the HJB equation they use the natural boundary

condition at zero. In this paper, we do not have a natural condition at zero

but we do not need this boundary condition because the ellipticity of

the HJB

degenerates at this point. The lack of a boundary condition at zero

makes more

difficult to obtain a numerical scheme.

The main results of this paper are the following:

In the first part of the paper, we obtain the optimal value function as the

smallest viscosity solutions of the associated HJB equation, and we

prove a

verification theorem that allows us, since the optimal value function

has not

a natural boundary condition at zero, to recognize the optimal value function

among the many viscosity solutions of the associated HJB equation.

From Section 6 on, we assume that the claim-size distribution has a bounded

density; this allows us to show that the optimal value function is twice

continuously differentiable except possibly for some points. We find the

optimal value function for small surpluses, and we prove that the optimal

strategy is stationary, that is, the decision of what

proportion of

the surplus is invested in the risky asset, and how much to pay out as

dividends at any time depends only on the current surplus. We also

prove that

the optimal dividend payment policy has a band structure. In

particular, the

optimal dividend payment policy for large surpluses is to pay out immediately

the surplus exceeding certain level as dividends. We also obtain the best

barrier strategy and show both an example where the optimal dividend payment

policy is barrier as well as an example where it is not. The second example

shows that, even for claim-size distributions with bounded density, the

optimal value function could be neither concave nor twice continuously

differentiable.

This paper is organized as follows. In Section 2, we state the optimization

problem and prove some properties about the regularity and growth of the

optimal value function. In Section 3, we state the dynamic programming

principle and show that the optimal value function is a viscosity

solution of

the HJB equation associated with the optimization problem. In Section

4, we

prove the uniqueness of viscosity solutions of the HJB equation with a

boundary condition at zero. In Section 5, we prove that the optimal value

function is the smallest supersolution of the HJB equation and give a

verification theorem that states that a supersolution which can be

obtained as

a limit of value functions of admissible strategies is the optimal value

function. In Section 6, we construct via a fixed-point operator a classical

solution of the second-order integro-differential equation involved in

the HJB

equation. In Section 7, we use the solution obtained in Section 6 to obtain

the value function of the optimal barrier strategy. In Section 8, we

find the

optimal value function for small surpluses, show that the optimal

strategy is

stationary and prove that the optimal dividend payment policy has a band

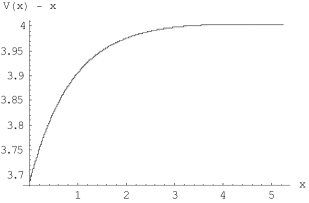

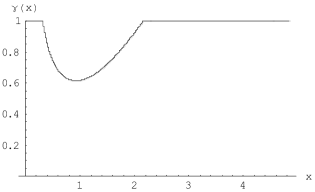

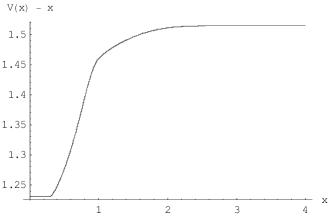

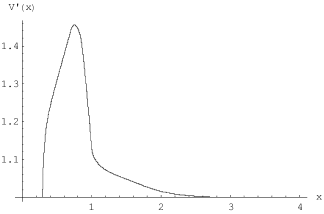

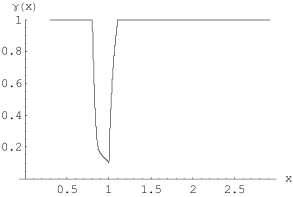

structure. In Section 9, we show some numerical examples. We have

placed some

technical lemmas in the Appendix to improve the

readability of the main text.

2 The stochastic control problem

We assume that the surplus of an insurance company in the absence of control

of dividends payment and investment follows the classical Cramér–Lundberg

process; that is, the surplus of the company is described by

|

|

|

(1) |

where is the initial surplus, is the premium rate, is a

Poisson process with claim arrival intensity and the claim sizes

are i.i.d. random variables with distribution . We assume

that the

distribution has finite expectation and satisfies .

We consider that the financial market is described as a classical

Black–Scholes model where we have a risk-free asset with price process and a risky asset with price process satisfying

|

|

|

where is a standard Brownian motion independent to the process .

We consider for simplicity .

We define as the set of paths with left and right limits and

as the complete probability space with filtration

generated by the processes

and . A control strategy is a process

where is the proportion of the surplus

invested in

stocks at time , and is the cumulative dividends the company has

paid out until time . The control strategy is

admissible if the process is predictable and the process

is predictable, nondecreasing and càglàd (left continuous

with right limits).

We are considering the case where because we

are allowing neither short-selling of stocks nor borrowing money from other

sources to buy stocks.

Denote by the set of all the admissible control strategies with

initial surplus . For any , the controlled risk process

can be written as

|

|

|

(2) |

All the jumps of the process are downward, if there is a claim at time and only at the discontinuities of . We also ask for any ; this means

that the

company cannot pay immediately an amount of dividends exceeding the surplus.

Given an admissible strategy , let be the ruin time of the

company, note

that it can only occur at the arrival of a claim. We define the value function

of by

|

|

|

(3) |

where is the discount factor. The integral is interpreted pathwise

in a

Lebesgue–Stieltjes sense.

We consider the following optimization problem:

|

|

|

(4) |

For technical reasons, we define for . We restrict

ourselves to

the case ; we will see in Remark 2.4 that in the case

, the optimal value function is infinite.

To show that the optimal value function is well defined and to describe

some of its basic properties, we first state some results of the related

controlled risk process without claims and without paying dividends.

Lemma 2.1

Given and any

admissible investment strategy consider

the process,

|

|

|

-

(a)

If , then .

-

(b)

If and , then .

-

(c)

If , then

for any .

{pf}

We can write where

|

|

|

(5) |

The process is a martingale [see, for instance, Karatzas and Shreve

(1991)]. Then the results follow using elementary

computations for linear

diffusion processes.

In the next two propositions, we prove that has linear growth, and

we give

bounds on the increments of using the value functions of some simple

admissible strategies.

Proposition 2.2

The optimal value function is well

defined and

satisfies

|

|

|

{pf}

Consider an initial surplus . Given any , consider the controlled process for , and

define for . Then

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consider the process defined as in Lemma 2.1 with

and the investment strategy corresponding to . Since

, we obtain from Lemma 2.1(a) that

. Since and is a positive and

decreasing function, we have that

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

So is well defined and

satisfies the second inequality.

Let us prove now the first inequality. Given an initial surplus ,

consider the admissible strategy which pays immediately the whole

surplus and then pays the incoming premium as dividends until the

first claim which in this strategy means ruin. Define as the time

arrival of the first claim; we have

|

|

|

but by definition , so we get the

result.

Proposition 2.3

If , the function satisfies:

(a) ;

(b) .

{pf}

(a) Given , consider an admissible strategy

with . We define a new strategy

in the following way, pay immediately as

dividends and then follow the strategy ; this new

strategy is

admissible. We have that

|

|

|

and the result follows.

(b) Given , take an admissible strategy such

that . Let us define the strategy

that starting at , pay no dividends and invest

all the surplus in bonds if and follow strategy

when the current surplus reaches . This strategy is

admissible. If

there is no claim up to time , the surplus . The probability of reaching before the first claim

is , so we obtain

|

|

|

and we get the result.

As a direct consequence of the previous proposition we have that

is increasing and locally Lipschitz in , this

implies that is absolutely continuous, that exists a.e.

and that at the points where the

derivative exists. We will prove later in this paper that is continuously

differentiable with bounded derivative and that the linear growth condition

given by Proposition 2.2 can be improved to for

.

3 The Hamilton–Jacobi–Bellman equation

In this section we associate a Hamilton–Jacobi–Bellman equation to the

optimization problem (4) and we prove that the optimal value function

is a viscosity solution of this equation.

The notion of viscosity solution was introduced by Crandall and Lions

(1983)

for first order Hamilton–Jacobi equations and by Lions (1983) for second-order

partial differential equations. Nowadays, it is a standard tool for studying

HJB equations [see, for instance, Fleming and Soner (1993)

and Bardi and

Capuzzo-Dolcetta (1997)].

We first state the dynamic programming principle; the proof is

similar to the one in Azcue and Muler (2005).

Proposition 3.1

For any and any stopping

time , we can write

|

|

|

The HJB equation associated to the optimization problem (4) is the

following fully nonlinear second-order degenerate integro-differential

equation with derivative constraint:

|

|

|

(6) |

where

|

|

|

(7) |

and

|

|

|

|

|

|

|

|

|

|

This equation is obtained assuming that the optimal value function is

twice continuously differentiable. We will show in Section 9 that this

is not

always the case, so we consider viscosity solutions of this equation.

Definition 3.2.

A continuous function

is a viscosity

subsolution of

(6) at if any twice continuously

differentiable function defined in

with such that

reaches the maximum at satisfies

,

and a continuous function is a viscosity supersolution of (6) at

if any twice continuously differentiable function

defined in with such that reaches the minimum at satisfies .

Finally, a continuous function is a viscosity solution of (6) if

it is both a viscosity subsolution and a viscosity supersolution at any

.

In addition to Definition 3.2, there are two other

equivalent formulations of viscosity solutions. The proof of the equivalence

of these definitions is standard [see, for instance, Benth, Karlsen and Reikvam

(2002)]. We use the three definitions indistinctly.

Definition 3.3.

Given a twice continuously differentiable

function and a continuous function , let us define

the operator,

|

|

|

|

|

|

|

|

|

|

A continuous function is a viscosity subsolution of (6) at

if any twice continuously differentiable function

defined in such that

reaches the maximum at satisfies

, , and a twice continuous

function is a viscosity supersolution of (6) at if any twice continuously differentiable function

defined in such that

reaches the minimum at satisfies

.

Definition 3.4.

Given any continuous function

and any ,

the set of second superdifferentials of at

is defined as

|

|

|

and the set of second subdifferentials of at

is defined as

|

|

|

Let us call

|

|

|

|

|

|

|

|

|

|

A continuous function is a viscosity subsolution of (6) at if for all and is a viscosity supersolution of

(6) at if for all .

The next proposition states the semiconcavity of the viscosity

solutions of

the HJB equation.

Proposition 3.5

Any absolutely continuous and nondecreasing

supersolution of in

is semiconcave in any interval .

{pf}

It is enough to prove that there exists a constant and a sequence of

semiconcave functions in such that a.e. and uniformly in .

Since is an absolutely continuous function, there exists

such that for all . Let us

define, for any ,

|

|

|

(11) |

It can be proved, as in Lemma 5.1 of Fleming and Soner (1993), that

is

semiconcave and the inequality holds for all , so uniformly. We have that if , then for . In effect, take such that , we have

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since is semiconcave, the set

|

|

|

has full measure.

We want to prove that

|

|

|

(12) |

Take , and consider such that

|

|

|

(13) |

It can be proved that

|

|

|

(14) |

By (11), we have

|

|

|

so we obtain from (13) that

|

|

|

|

|

|

Then we have that .

Since is a viscosity supersolution of (6) at

, we have from Definition 3.4

that

|

|

|

(15) |

If , inequality

(12) holds, and if , from (14) and (15) we get that

|

|

|

and so we have (12).

The next proposition states that the optimal value function of our control

problem is a viscosity solution of equation (6).

We will

show in the next section that this result is not enough to characterize

univocally the optimal value function.

Proposition 3.6

The optimal value function

is a viscosity solution of (6) in

.

{pf}

We prove first that is a viscosity supersolution. Let us call

and the time and the size of the first claim. For fixed

and , consider the admissible strategy .

Assume first that . Given any , consider the process

defined in Lemma 2.1 with and .

Let us consider . Using Proposition

3.1 with , we obtain that

|

|

|

(16) |

Note that , so we have

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

because for and for . Then, from (16), (3) and

(3), we get that

|

|

|

|

|

|

|

|

|

|

Assume now that , we obtain with a simpler argument that

|

|

|

|

|

|

|

|

|

|

Dividing by , we get from (3) and (3) that

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and so

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Let be a twice continuously

differentiable function such that reaches the minimum in

at with . Since , we can assume without

loss of generality that is defined in and that

for . From (3) we get

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

But, since is twice continuously, we get, from Itô’s formula,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note that the last term of (3) is a martingale. Letting

go to

in (3), we obtain from Lemma 2.1(b)

and (3) that

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since this inequality holds for all , we have that , and taking we get , so

|

|

|

and we have the result.

The proof that is a viscosity subsolution at any is similar

to the one of Proposition 3.8 of Azcue and Muler (2005), but

in this case we should also consider a martingale that involves the

Brownian motion .

From Propositions 3.5 and 3.6 we

get the following corollary.

Corollary 3.7.

The optimal value function is semiconcave in any interval

and so exists a.e.

4 Comparison principle for viscosity solutions

We prove in this section a comparison principle for viscosity

solutions of (6), and as a consequence we obtain the uniqueness

with the boundary condition among all the functions which

satisfy the

following regularity and growth assumptions:

(A.1) is locally Lipschitz.

(A.2) If , then .

(A.3) There exists a constant such that for

all .

Proposition 4.1

If is a subsolution

and is a supersolution of (6) in

with and they satisfy the conditions (A.1), (A.2)

and (A.3), then in

.

{pf}

The first part of this proof is similar to the proof of Proposition 4.2 of

Azcue and Muler (2005) although in this case we should also

use the tools

provided by Crandall, Ishii and Lions (1992) to prove

comparison principles

for second-order differential equations and adapt them to

integro-differential equations.

Assume that for some point

. It is straightforward to show that the functions with are also a supersolution and satisfy

. If is a continuously

differentiable function such that the minimum of is

attained at then . Let us take

with and

define

|

|

|

(24) |

From assumptions (A.2) and (A.3) we obtain, as in

Proposition 4.2 of Azcue and Muler (2005), that

|

|

|

(25) |

where . Call . Since

and satisfy assumption

(A.1), there exists a constant such that

|

|

|

(26) |

for .

Let us consider

|

|

|

and for any the functions

|

|

|

|

|

(27) |

|

|

|

|

|

(28) |

Calling and , we obtain that

and

so, from

(25) we get that for and

|

|

|

(29) |

Since , we have that

|

|

|

(30) |

As in Proposition 4.2 of Azcue and Muler (2005), we can show

that for any

the point .

Using Theorem 3.2 of Crandall, Ishii and Lions (1992), it

can be proved that for any

, there exist real numbers and such that

|

|

|

(31) |

and

|

|

|

(32) |

with

|

|

|

(33) |

where corresponds to the matrix of second

derivatives of

, and and are defined in Definition

3.4. The inequality in (33) means

that the matrix on the left-hand side is positive-semidefinite. So, we

obtain from

(31) and (32) that

|

|

|

(34) |

and

|

|

|

(35) |

From (33), we obtain that

|

|

|

|

|

|

(36) |

|

|

|

We also have from (27) that

|

|

|

(37) |

and

|

|

|

|

|

|

(38) |

|

|

|

But , so we obtain that , and so we

conclude from (34) and (37) that

|

|

|

(39) |

Therefore, taking we

get from (35) and (39) that

|

|

|

and so

|

|

|

|

|

|

|

|

|

(40) |

|

|

|

|

|

|

Using the inequality

|

|

|

we obtain that

|

|

|

then we have from (26) that

|

|

|

(41) |

We can find a sequence such that . From (41), we get that

and

this gives and so .

Taking , we get using that for all , (4),

(37), (4) and (4)

|

|

|

(42) |

where can be equal to either or .

From (29) and (42) we obtain . This is a contradiction because and .

From the previous proposition, we conclude the following corollary.

Corollary 4.2.

For any , there is at most one

viscosity solution of (6) in satisfying

assumptions (A.1), (A.2) and (A.3) with the boundary

condition .

5 Characterization of as the smallest supersolution and a

verification result

In Sections 2 and 3, we have proved that the optimal value function is

well defined and that it is a viscosity solution of (6). In

Section 4, we have proved that (6) has a comparison

principle that

gives us uniqueness of viscosity solutions with a given boundary

condition. As

it can be seen in the next remark there are infinitely many classical

solutions of the HJB equation satisfying (A.1), (A.2) and

(A.3).

Our main goal in this section is to characterize among all the viscosity

solutions of (6). We show that the optimal value function

is

the smallest of the absolutely continuous supersolutions of the HJB equation.

We use this result to prove a verification theorem that states that

if a supersolution of the HJB equation is obtained, either as a value function

of an admissible strategy, or as a limit of value functions of admissible

strategies, then this supersolution should be the optimal value function.

Later in this section, using the Corollary 4.2, we also

characterize as the viscosity solution of the HJB equation with the

smallest possible boundary condition at zero.

To prove Proposition 5.3 we need the following technical lemma.

Lemma 5.2

Let be an absolutely continuous

nonnegative supersolution of (6) in .

Given any pair of real numbers , we can find a

sequence of nonnegative functions

such that:

(a) is twice continuously differentiable,

(b) converges uniformly to

in ,

(c) in ,

(d)

for .

{pf}

Let us consider an even and twice-continuously differentiable function

with support included in , with integral one, such that in and in . Consider and define as the left-sided

convolution . The results (a) and (b) follow using standard techniques [see, for

instance, Wheeden and Zygmund (1977)]; (c) follows because

a.e.

Let us prove (d). By Proposition 3.5, is

semiconcave and so exists a.e., and the possible

jumps of are downward. So, the left-sided convolution

satisfies . The result (d) follows because

a.e. for any , and it can be shown that

|

|

|

for all .

Proposition 5.3

Let be an absolutely

continuous nonnegative supersolution of (6) in , then in .

{pf}

Let us define as the set of discontinuity points of the claim-size

distribution . Since is increasing is a countable set. Take ,

by Lemmas .1 and .2

(included in the Appendix), it is enough to prove that

for any pair

such that , we have

|

|

|

where and is the set of all the admissible strategies such

that the measure of

|

|

|

is zero.

Take . Consider the functions defined in Lemma 5.2; since

they are twice continuously differentiable, we can write

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for any .

Note that, since is nondecreasing and left-continuous, it can be

written as

|

|

|

(44) |

where is a continuous and nondecreasing function. Hence, using

expressions (2) and (44), we get

|

|

|

|

|

|

|

|

|

|

|

|

(45) |

|

|

|

|

|

|

|

|

|

We have that only at the discontinuities of

, so

and

|

|

|

|

|

|

From Lemma 5.2(c), , so we obtain

|

|

|

|

|

|

|

|

|

(46) |

|

|

|

|

|

|

Since only at the arrival of a claim, the process

|

|

|

|

|

|

|

|

|

|

is a martingale with zero-expectation.

From (5), (5), (5) and

(5), we obtain

|

|

|

|

|

|

(48) |

|

|

|

where

|

|

|

is a martingale with zero-expectation.

We have , and from Lemma 5.2(d), since , we have that

|

|

|

for all . Then, from Lemma 5.2(b), we obtain .

In order to state the verification theorem, we need to extend the

concept of strategies by the following definition.

Definition 5.4.

(a) Fix , let us define the map as . We give to the initial

topology of and define as the completion of under this topology [see,

for instance, Kelley (1955)]. We say that the elements of

are limit strategies.

(b) Given , there exists

a sequence such that , we define .

From Proposition 5.3, we get the following verification

theorem.

Theorem 5.5.

Let be a limit strategy

such that the corresponding value function

is an absolutely continuous supersolution of (6) in , then .

We conclude from Remark 5.1 and Proposition 5.3

that the optimal value function satisfies

|

|

|

(49) |

and so it satisfies (A.3). By Propositions 2.2 and

2.3, the

optimal value function also satisfies (A.1) and (A.2).

Therefore, from Corollary 4.2 and Proposition 5.3 we

get the following corollary.

Corollary 5.6.

The function can be also characterized as the unique

viscosity solution of (6) satisfying assumptions (A.1),

(A.2) and (A.3) with the boundary condition,

|

|

|

6 Solutions of the second-order differential equation

In the previous sections we have characterized the optimal value

function

without assuming any regularity conditions on the claim-size distribution

function . To find the optimal value function and the value

function of

barrier strategies, we need some technical results about the solutions

of

|

|

|

(50) |

on open sets. In order to have classical solutions of this equation, we assume,

from this section on, that the claim-size distribution function has a

bounded density. If we do not assume this, we would have to deal with

viscosity solutions of (50) and this adds some technical problems.

Equation (50) is similar to the HJB equation that arises in

the problem of maximizing the survival probability of an insurance company

whose uncontrolled reserve follows the classical Cramér–Lundberg process

and where the management has the possibility of investing in the financial

market. Azcue and Muler (2009) considered this problem and

showed that the

optimal survival probability function is a classical solution of

in , but with parameter equal

to zero.

The existence and uniqueness of classical solutions of (50) is

not straightforward since the ellipticity of degenerates

at and could degenerate at any positive point. However, we prove in this

section that the optimal in (50) is not zero for

positive points. On the other hand, the degeneracy of the ellipticity

of the

operator at zero gives the uniqueness of twice continuously differentiable

solutions of (50) in with only one

boundary condition at zero.

In the next proposition we construct, via a fixed-point argument, the unique

twice continuously differentiable solution of (50) in with the boundary condition .

Proposition 6.1

(a)

There exists a unique increasing classical solution

of (50) in with the boundary

condition, and , where

|

|

|

(51) |

(b) The function can be written as , where is the unique

nonnegative fixed point of the operator,

|

|

|

(52) |

Here

|

|

|

|

|

(53) |

|

|

|

|

|

|

|

|

|

|

and

|

|

|

{pf}

We give here a sketch of the proof and refer to Sections 3 and 4 in

Azcue and

Muler (2009) for details since the proof is similar.

It can be proved that if is any classical increasing solution of

(50) with , then is a fixed-point of

(52) and also that there is a unique continuous nonnegative

fixed-point of (52). It can be proved that is locally

Lipschitz, and so is semiconcave

in any

compact set included in . The next step consists of proving that

is twice continuously differentiable and so it is a classical

solution of

(50). To do that, we construct twice continuously differentiable

increasing solutions of the second-order integro-differential equations,

and , and show then that coincides

locally with

one or the other and also that is obtained by gluing smoothly

solutions of

these equations. Hipp and Plum (2000) and Schmidli (2002) studied and found

classical solutions of the equation with for the problem of minimizing

the ruin

probability of an insurance company without borrowing constraints.

Finally, since is a quadratic function on

and is increasing, the maximum is attained at

or at

the vertex .

It can

be shown that the vertex cannot be zero.

Proposition 6.3

(a) The function

defined in (51) can be written as

|

|

|

(b) There exists such that

for .

(c) and

.

{pf}

We obtain (a) by replacing the value of obtained

from the

equation in the definition

(51). To prove (b) and (c) consider the

unique increasing twice continuously differentiable solution of

. It can be proved using L’Hôpital’s rule that

|

|

|

and so

|

|

|

We conclude that there exists such that in .

Therefore, using that , we obtain that satisfies in and so for small

values of .

In an analogous way, given a positive and an increasing

continuous function defined in such that

is differentiable at , we can construct the unique twice

continuously differentiable solution of

|

|

|

(54) |

with boundary conditions and where

|

|

|

|

|

(55) |

|

|

|

|

|

(56) |

and

|

|

|

|

|

|

|

|

|

|

The next proposition is analogous to Propositions 6.1 and

6.3(a); the proof follows by using a fixed-point argument

similar to the one used in Proposition 6.1.

Proposition 6.4

Assume that is a

continuous, positive and increasing function in

and that is differentiable at .

(a) There exists a unique twice continuously differentiable solution

of (54) in with

and .

(b) If we define

|

|

|

we have that

|

|

|

7 Barrier strategies

A dividend payment policy is called barrier with level

when all

excess surplus above is paid out immediately as dividends, but

there is no

dividends payment when surplus is less than . In this section we

would like

to obtain the optimal barrier strategy, that is, the admissible

strategy that maximizes the cumulative expected discounted dividends

among all

the strategies whose dividend policies are barrier. We would also like to

prove that the optimal barrier strategy is stationary, in the sense

that the decision on how much dividend to pay and how to invest at any time

depends only on the current surplus. Note that a stationary strategy

determines an admissible strategy for each initial surplus

.

In the classical Cramér–Lundberg model without the possibility of

investment, there exists an optimal barrier strategy. Let be the

optimal level. It has been proved [for instance, in Azcue and Muler

(2005)]

that the optimal policy for current surplus is to pay all the

incoming premium as dividends in order to maintain the surplus at level

until the arrival of the next claim.

In the model with investment, it is possible to define similar barrier

strategies for any level (if the current surplus is , pay all the

incoming premium as dividends and keep all the surplus in bonds), but these

barrier strategies are never optimal. In fact there is not a stationary

barrier strategy which is optimal, since it is not possible to

determine the

dividends payment policy when the current surplus coincides with the threshold.

We construct in this section a candidate of optimal barrier strategy as an

explicit limit of stationary admissible barrier strategies and find its value

function. In the next sections we will prove that this strategy is

indeed the

optimal barrier strategy, also we will show that the optimal strategy in

(4) could be nonbarrier, but this optimal strategy and the optimal

barrier strategy coincide for small surpluses.

First in this section we use the function , constructed in Section

6, to

obtain the value function of a limit barrier strategy with a given

level

and the best investment policy. Later we find the optimal level of these

strategies. In all the cases, the optimal investment policy is

stationary in

the sense that the decision on how to invest depends only on the

current surplus.

Definition 7.1.

Given a predictable process

and points,

we define recursively for initial surplus , the

admissible strategy as:

-

1.

If , pay immediately the surplus

as dividends and follow the strategy .

-

2.

If , follow the admissible strategy

up to the exit time where

|

|

|

and is the ruin time. When , pay immediately as dividends and follow

the strategy with initial surplus

.

Let us call the set of all these

strategies, and

let us consider for all the function

|

|

|

(58) |

We define for . We first state some basic

properties of

the function . The proof of the next proposition is similar to the

proof of Propositions 2.2 and 2.3.

Proposition 7.2

(a) The value function is well defined.

(b) If , then

|

|

|

(c) .

(d) is increasing in .

(e) is absolutely continuous in

.

Let us state now a dynamic programming principle for these value functions.

Proposition 7.3

Given and any stopping time

, we have that

|

|

|

where is the stopping time defined in

Definition 7.1.

In the next proposition, we show that all the functions are

multiples of the function obtained in Proposition 6.1; this allows

us to describe the optimal investment policy for (58).

Proposition 7.4

(a) We have that

|

|

|

where is the function obtained in Proposition

6.1.

(b) is the value function of the admissible

stationary strategy , the optimal

investment policy depends only on the current surplus and it is given by where the function is defined in Proposition 6.1.

{pf}

We extend the definition of as for . Let us take any

admissible strategy and

consider the stopping times and defined in

Definition 7.1. Up to time , the

dividend payment policy is zero, so the strategy only depends

on the investment policy . To simplify notation, we

denote the corresponding controlled risk process

starting at

. This process satisfies up to the following stochastic

differential equation:

|

|

|

(59) |

Since the function is twice continuously differentiable, using the

expressions (59) and the Itô’s formula for semimartingales

[see Protter (1992)], it can be shown with arguments similar

to the

proof of

Proposition 5.3 that

|

|

|

(60) |

where

|

|

|

|

|

|

|

|

|

|

and

|

|

|

(62) |

are martingales with zero-expectation.

Note that we have

|

|

|

From (7), (62) and

(60), by Proposition 6.1, we get that

|

|

|

and so . The supremum is

reached at the process . On the

other hand, from Proposition 7.3, we obtain that

|

|

|

and the result follows from .

Note that the optimal investment policy of all the strategies defined above

does not depend on the value of . The corresponding controlled risk process

with initial surplus never exceeds the threshold . In the next

definition we define the limit dividend barrier strategies for any .

Definition 7.5.

Given a sequence

and any current surplus , take

. We define .

In the next proposition we obtain the expression for the limit value function;

the proof follows immediately from Proposition 7.4.

Proposition 7.6

We have that

|

|

|

Note that the function is twice continuously

differentiable in and

differentiable at . We show now that reaches

the minimum.

Proposition 7.7

Consider the function

defined in

Proposition 6.1, then

|

|

|

for some . Call .

{pf}

Define for , the function . Since is a continuous positive function,

then is continuous, nonincreasing and positive. We want to prove that

there exists such that is constant for . Suppose

that this is not the case, then there exists such that

. Consider

|

|

|

Note that . Let us consider the value functions

of the limit barrier strategies,

|

|

|

for .

We prove now that is a supersolution of (6)

in . Since is a solution of (50), for and in we only need to show that is a

supersolution of (50) in . Let us show

first that

is a supersolution at , take any , since is increasing and , we have that . Let us show now that is a supersolution at

. We have that , take such

that

|

|

|

|

|

|

|

|

|

|

Since is a supersolution for and

is continuous for we have that .

Since is the value function of a limit strategy

we have

that , and since is a

supersolution of (6), we have that .

Then for , and this is a

contradiction since

.

In the next proposition we see that the value defined in

Proposition 7.7 is the optimal threshold of the dividend

barrier strategies given in Definition 7.5. We also

give a

test to see whether the value function of the limit barrier strategy

is the optimal value function

at .

The proof follows directly from Proposition 7.7 and Theorem

5.5.

Proposition 7.8

Define as the value

function of the limit barrier strategy obtained in Proposition

7.6 with barrier . Then:

(a)

for all and the function is

twice continuously differentiable.

(b) If is a viscosity supersolution of

(6), then coincides with the optimal value

function .

In Remark 8.7 of the next section, we will see that

the limit stationary barrier strategy

defined as for any initial

surplus is the optimal barrier strategy. Note that the investment

policy corresponding to this strategy is stationary and it is given by

|

|

|

for any current surplus . Also note that, by

Proposition 6.3(b), for small surpluses.

This means that the whole surplus should be invested in stocks. In the

unconstrained case where it is allowed to borrow money to buy risky

assets, it

can be seen that optimal investment policy tends to infinite as the surplus

goes to zero, that is, for small surpluses the company should always

borrow money

to buy stocks.

8 Band structure of the optimal dividend strategy

We will show in Section 9 that the optimal value function is not always

the value function of a limit barrier strategy. Nevertheless, we prove

in this

section that the optimal dividend payment policy has a band structure.

As in

the case of the optimal barrier strategy, is not the value function

of a

stationary admissible strategy, but it can be written explicitly as a

limit of

value functions of admissible stationary strategies.

We have shown in Section 3 that is a viscosity solution of equation

(6). In this section we see that can be

obtained by

gluing, in a smooth way, classical solutions of on

an open set with solutions of on a set

. The set is a disjoint union of left-open,

right-closed intervals. These sets will be defined in Proposition

8.4.

When the current surplus is in the set , the optimal

dividend payment policy should be to pay out immediately a positive sum of

dividends, and when the current surplus is in the set ,

the optimal strategy should be to pay no dividends and to follow the

investment policy which depends only on the current surplus

. In the simplest case, when the optimal value function is the solution

of in and

in , the optimal dividend payment

policy is barrier.

We see that is continuously differentiable; it is twice continuously

differentiable in and , but at some points

outside , the second derivative

could not

exist. So we still need the notion of viscosity solutions to

characterize

as a solution of the associated HJB equation.

We also prove in this section that, for small surpluses, the optimal strategy

coincides with the optimal barrier obtained in Section 7, and for large

surpluses, the optimal strategy is to pay out as dividends the surplus

exceeding some level.

In the next proposition, we give conditions under which the optimal value

function is the supremum of the value functions corresponding to

admissible strategies with surplus not exceeding .

Proposition 8.1

Assume there exists

with ; then

|

|

|

{pf}

Given any , let us consider the twice continuously

differentiable solution of the equation

for the special case . From Proposition 7.7,

we get that for

some . So and we

can find a number such that

. Consider

, and define . Since , we

have that goes to as goes to infinity, and so we can

find an integer large enough such that

.

We can find points such that

and admissible

strategies

such that . Consider, for any ,

the point and the strategy which pays out immediately as dividends and then follows the

strategy . We obtain that for any .

For any , we define recursively strategies as follows. For , take . For

and for the initial surplus , follow the

strategy while , when the surplus

reaches , pay out immediately the difference

as dividend and then follow the strategy

. For and for the

initial surplus , pay out immediately the difference as dividend and then

follow the strategy .

With arguments similar to Lemma A.5 in Azcue and Muler (2005) it can be seen that, for any and

the strategy is admissible and

|

|

|

(63) |

Let us prove now that, for any , there

exists an

admissible strategy such that

|

|

|

(64) |

Let us define . Consider the process

defined in Lemma 2.1, as the process corresponding to without claims and without paying dividends, but starting

at . Since the process should pass at least times through the interval before surpassing , we obtain that

|

|

|

(65) |

To prove this, consider the

corresponding process without the dividends payment in

each step, then

|

|

|

|

|

|

and since and , we obtain that .

Since and we have, using Itô’s formula, that

|

|

|

So, we have from the fact that is increasing and (65)

that

|

|

|

|

|

|

|

|

|

|

Again, with arguments similar to Lemma A.5 in Azcue and Muler (2005),

we obtain

|

|

|

So using (8), we conclude (64). From

(63) and (64) we get the

result.

We have to introduce some auxiliary sets to define precisely the sets

and mentioned above.

Definition 8.2.

Let us define the continuous function

|

|

|

(67) |

where the operator is defined in (53),

and the sets:

-

•

,

-

•

,

-

•

.

Lemma 8.3

The following situations are not

possible:

-

1.

and .

-

2.

and .

So, we conclude that

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

{pf}

Let us prove first that given , if then

. Assume that , then we can find

such that for all . Let us

define

as the set of points in where and exist, since is semiconcave the set has full measure. The

function is a supersolution of (6), then for any we

have

|

|

|

and so .

Then, since

is semiconcave, we have that for any

|

|

|

and this is a contradiction because .

Let us prove now that if and , then is

differentiable at and . If we have that

, take any , then

|

|

|

and so, for any , we have that

|

|

|

and then, since , so

|

|

|

Since this holds for any , taking a sequence , we

obtain that for any . This

implies that and so , which is a contradiction.

Definition 8.4.

We define the sets , and as:

-

•

for some

,

-

•

for some ,

-

•

.

Proposition 8.5

The sets introduced in Definition

8.4 satisfy the following properties:

(a) is a disjoint union of

intervals that

are left-open and right-closed.

(b) If and

, then .

(c) There exists such that .

(d) is an open set in , that is, if , there exists

such that

and

if a positive there exists such that .

(e) Both and are nonempty.

{pf}

The proof follows immediately from Definition 8.4 and Lemmas

.5 and .6 included

in the Appendix.

From the previous proposition we can conclude that the upper boundary

of any

connected component of belongs to

and also

that the the lower boundary of any connected component of

belongs to .

The next proposition describes the optimal value function for small

initial surpluses.

Proposition 8.6

Consider the function defined in

Proposition 6.1 and the values and

defined in Proposition 7.7, then the optimal value

function coincides with for all

. In particular, is twice

continuously differentiable in .

{pf}

By Lemma .6(b) included in the Appendix,

is left closed, so there exists . Note that,

by Proposition 7.7, and are well defined.

Consider the value function of the limit strategy obtained in Proposition 7.6.

From (4), we have that .

If , we have from Proposition 5.3 that

in because

is a supersolution of (6). So in . Then and this implies

that ; this is a contradiction

since in

both cases there would exist a point in smaller that . In

particular, if , then .

If , since and in , we have that is a supersolution of

(6) in and since , by Proposition

8.1, in ,

but then and this

is a

again a contradiction because by definition of , .

Finally, in the case that , since we have from

(67) that , but from Proposition

6.3(c) we have that , and

so we

get . This implies that because if

were positive, we would obtain

|

|

|

Therefore, and in .

The previous proposition allows us to obtain for small surpluses using

only the function . In the case that , we only obtain

from this

proposition the value at zero, . Hence, using Corollary

4.2, we can conclude that is the unique viscosity

solution of

(6) with the boundary condition .

Let us show now that is a classical solution of

in .

Proposition 8.8

(a) Let with be a

connected component of . Consider the unique

classical solution of

|

|

|

(68) |

in with

and . Then in

.

(b) The optimal value function is a classical solution

of in the open set .

{pf}

Using Lemma .8 included in the Appendix, it

only remains to

prove that is twice continuously differentiable at the points

such that, there exists with . The number

|

|

|

is positive because and . Take any sequence with we

have from Propositions 6.1 and 6.4 that

|

|

|

where

|

|

|

Since is semiconcave we get that

|

|

|

so is twice continuously differentiable at .

We prove now that can be written as a limit of value functions of

admissible stationary strategies. All of these admissible strategies

coincide on

and . If the current surplus is in

, the optimal strategy is to pay out as dividends the amount

exceeding the lower boundary of the connected component of .

If the current surplus is , the optimal

strategy is

to pay no dividends and to invest . Finally, if the current

surplus is in , we need to consider a limit of admissible

strategies similar to the one we used to obtain barrier strategies in

Section 7.

We define admissible stationary strategies based upon the sets

, and introduced in

Definition 8.4. Since these strategies are

stationary, for

any we can denote the corresponding

strategy with

initial surplus .

Definition 8.10.

Given a finite subset

and a number

satisfying the following conditions:

-

1.

if then ,

-

2.

for all positive

,

we define recursively the admissible stationary strategy in the following way:

-

•

If the current surplus ,

pay no dividends and take

|

|

|

up to the exit time of .

Then follow the strategy where

.

-

•

If the current surplus ,

by Proposition 8.5(a) and (b), there exists

such that .

In this case pay out immediately as dividends, and

follow the strategy described

below.

-

•

If the current surplus , pay out immediately as

dividends where is the maximum element of smaller than , and then follow the strategy

.

-

•

If the current surplus is ,

pay out immediately as dividends and then follow

the strategy .

-

•

In the case that the current surplus is , pay out all the incoming premium as dividends up

to the

ruin time.

In the case that is finite, can be written as the limit

(with going to zero) of the value functions of the admissible strategies

defined above taking ; but in the case

that is infinite, we have to consider finite subsets

. This result is proved in the

next theorem.

Theorem 8.11.

Given , we can find a finite set and a number such that the

admissible stationary strategy introduced in Definition

8.10 satisfies for all . In

the case

that is finite, we can take .

{pf}

We assume that , in the case

the proof is similar. Let us consider and

the twice continuously differentiable solution of the equation

for the special case . From Proposition

7.7, we get that for some . Since , we can find a number such that

.

We can find such that, if then

|

|

|

(69) |

In effect, is absolutely continuous in ,

for all , and from

Proposition 8.5(b) and (c) we have that .

Given , take the finite set and the number

given by Lemma .9 included in the

Appendix, and take such that

|

|

|

(70) |

and

|

|

|

(71) |

for all . Take ,

|

|

|

(72) |

and admissible strategies with such that

|

|

|

(73) |

Let us define for all , then, by

(70), . Take the admissible

stationary strategy associated with and the finite set

given by Definition 8.10.

We define recursively a family of admissible strategies for all and , in the following way:

-

•

Take as the admissible strategy defined in (73) for all .

-

•

If the surplus , pay no dividends and take

|

|

|

up to the exit time of . Then follow the strategy

starting at where

.

-

•

If the surplus , by Proposition

8.5(a) and (b), there exists such that . In this case, pay

out immediately as dividends and follow the strategy described below.

-

•

If the surplus ,

pay out immediately as dividends where is the maximum element of

smaller than , and then follow the strategy

.

-

•

If the surplus is with ,

pay out

immediately as dividends and then follow the strategy

.

To simplify notation we write instead of

. Let us prove first that

|

|

|

(74) |

Given any initial surplus , note that all the processes with coincide for where is the time of arriving to

and the ruin time. So, using the dynamic programing

principle, we have that

|

|

|

|

|

|

|

|

|

(75) |

|

|

|

|

|

|

Consider , the processes starting at and the ruin time, we define as usual

for

. Let be the th time that reaches and let

|

|

|

Since the processes and coincide until , we have using

(73) and (71) that

|

|

|

|

|

|

(76) |

|

|

|

We denote . We define as the first time that leaves after ,

and we

denote . We

obtain,

using Itô’s formula, Proposition 8.8(b) and the definition

of ,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From (73), (70),

(71) and using that , we obtain that

|

|

|

|

|

|

(78) |

|

|

|

If and denote . We obtain that , and by

(73),

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note that , and so there is no

connected component of included in

with length greater than . In effect, if such

component exists, then , and this contradicts Lemma .9(b)

included in the Appendix. Then we can find

such that

and . So we get, by (69),

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From (8)–(8) and from

(73), (70) and (71) we obtain that

|

|

|

|

|

|

|

|

|

|

And so from (8) and (8), we

have using (72) and Lemma .9(c)

included in the Appendix, that

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

So we have proved (74).

Let us prove now that

|

|

|

(82) |

Given any initial surplus , consider the process

with initial value . Since the processes and coincide up to ,

|

|

|

|

|

|

|

|

|

(83) |

|

|

|

|

|

|

Consider the process defined in Lemma 2.1, as the

process corresponding to without claims and without paying

dividends, but starting at . When the process

arrives the th time to , it should have already

passed times through intervals of the form with . So

|

|

|

Let be the investment policy corresponding to the strategy

.

We have using Itô’s formula that

|

|

|

|

|

|

|

|

|

so we get

|

|

|

and from (8) we obtain (82).

We get the result combining (74) and (82).