High-dimensional Covariance Estimation Based On Gaussian Graphical Models

Abstract

Undirected graphs are often used to describe high dimensional distributions. Under sparsity conditions, the graph can be estimated using -penalization methods. We propose and study the following method. We combine a multiple regression approach with ideas of thresholding and refitting: first we infer a sparse undirected graphical model structure via thresholding of each among many -norm penalized regression functions; we then estimate the covariance matrix and its inverse using the maximum likelihood estimator. We show that under suitable conditions, this approach yields consistent estimation in terms of graphical structure and fast convergence rates with respect to the operator and Frobenius norm for the covariance matrix and its inverse. We also derive an explicit bound for the Kullback Leibler divergence.

Keywords: Graphical model selection, covariance estimation, Lasso, nodewise regression, thresholding

1 Introduction

There have been a lot of recent activities for estimation of high-dimensional covariance and inverse covariance matrices where the dimension of the matrix may greatly exceed the sample size . High-dimensional covariance estimation can be classified into two main categories, one which relies on a natural ordering among the variables [Wu and Pourahmadi, 2003; Bickel and Levina, 2004; Huang et al., 2006; Furrer and Bengtsson, 2007; Bickel and Levina, 2008; Levina et al., 2008] and one where no natural ordering is given and estimators are permutation invariant with respect to indexing the variables [Yuan and Lin, 2007; Friedman et al., 2007; d’Aspremont et al., 2008; Banerjee et al., 2008; Rothman et al., 2008]. We focus here on the latter class with permutation invariant estimation and we aim for an estimator which is accurate for both the covariance matrix and its inverse, the precision matrix . A popular approach for obtaining a permutation invariant estimator which is sparse in the estimated precision matrix is given by the -norm regularized maximum-likelihood estimation, also known as the GLasso [Yuan and Lin, 2007; Friedman et al., 2007; Banerjee et al., 2008]. The GLasso approach is simple to use, at least when relying on publicly available software such as the glasso package in R. Further improvements have been reported when using some SCAD-type penalized maximum-likelihood estimator [Lam and Fan, 2009] or an adaptive GLasso procedure [Fan et al., 2009], which can be thought of as a two-stage procedure. It is well-known from linear regression that such two- or multi-stage methods effectively address some bias problems which arise from -penalization [Zou, 2006; Candès and Tao, 2007; Meinshausen, 2007; Zou and Li, 2008; Bühlmann and Meier, 2008; Zhou, 2009, 2010b].

In this paper we develop a new method for estimating graphical structure and parameters for multivariate Gaussian distributions using a multi-step procedure, which we call Gelato (Graph estimation with Lasso and Thresholding). Based on an -norm regularization and thresholding method in a first stage, we infer a sparse undirected graphical model, i.e. an estimated Gaussian conditional independence graph, and we then perform unpenalized maximum likelihood estimation (MLE) for the covariance and its inverse based on the estimated graph. We make the following theoretical contributions: (i) Our method allows us to select a graphical structure which is sparse. In some sense we select only the important edges even though there may be many non-zero edges in the graph. (ii) Secondly, we evaluate the quality of the graph we have selected by showing consistency and establishing a fast rate of convergence with respect to the operator and Frobenius norm for the estimated inverse covariance matrix; under sparsity constraints, the latter is of lower order than the corresponding results for the GLasso [Rothman et al., 2008] and for the SCAD-type estimator [Lam and Fan, 2009]. (iii) We show predictive risk consistency and provide a rate of convergence of the estimated covariance matrix. (iv) Lastly, we show general results for the MLE, where only approximate graph structures are given as input. Besides these theoretical advantages, we found empirically that our graph based method performs better in general, and sometimes substantially better than the GLasso, while we never found it clearly worse. Moreover, we compare it with an adaptation of the method Space [Peng et al., 2009]. Finally, our algorithm is simple and is comparable to the GLasso both in terms of computational time and implementation complexity.

There are a few key motivations and consequences for proposing such an approach based on graphical modeling. We will theoretically show that there are cases where our graph based method can accurately estimate conditional independencies among variables, i.e. the zeroes of , in situations where GLasso fails. The fact that GLasso easily fails to estimate the zeroes of has been recognized by Meinshausen [2008] and it has been discussed in more details in Ravikumar et al. [2008]. Closer relations to existing work are primarily regarding our first stage of estimating the structure of the graph. We follow the nodewise regression approach from Meinshausen and Bühlmann [2006] but we make use of recent results for variable selection in linear models assuming the much weaker restricted eigenvalue condition [Bickel et al., 2009; Zhou, 2010b] instead of the restrictive neighborhood stability condition [Meinshausen and Bühlmann, 2006] or the equivalent irrepresentable condition [Zhao and Yu, 2006]. In some sense, the novelty of our theory extending beyond Zhou [2010b] is the analysis for covariance and inverse covariance estimation and for risk consistency based on an estimated sparse graph as we mentioned above. Our regression and thresholding results build upon analysis of the thresholded Lasso estimator as studied in Zhou [2010b]. Throughout our analysis, the sample complexity is one of the key focus point, which builds upon results in Zhou [2010a]; Rudelson and Zhou [2011]. Once the zeros are found, a constrained maximum likelihood estimator of the covariance can be computed, which was shown in Chaudhuri et al. [2007]; it was unclear what the properties of such a procedure would be. Our theory answers such questions. As a two-stage method, our approach is also related to the adaptive Lasso [Zou, 2006] which has been analyzed for high-dimensional scenarios in Huang et al. [2008]; Zhou et al. [2009]; van de Geer et al. [2010]. Another relation can be made to the method by Rütimann and Bühlmann [2009] for covariance and inverse covariance estimation based on a directed acyclic graph. This relation has only methodological character: the techniques and algorithms used in Rütimann and Bühlmann [2009] are very different and from a practical point of view, their approach has much higher degree of complexity in terms of computation and implementation, since estimation of an equivalence class of directed acyclic graphs is difficult and cumbersome. There has also been work that focuses on estimation of sparse directed Gaussian graphical model. Verzelen [2010] proposes a multiple regularized regression procedure for estimating a precision matrix with sparse Cholesky factors, which correspond to a sparse directed graph. He also computes non-asymptotic Kullback Leibler risk bound of his procedure for a class of regularization functions. It is important to note that directed graph estimation requires a fixed good ordering of the variables a priori.

Notation. We use the following notation. Given a graph , where is the set of vertices and is the set of undirected edges. we use to denote the degree for node , that is, the number of edges in connecting to node . For an edge set , we let denote its size. We use and to refer to the true precision and covariance matrices respectively from now on. We denote the number of non-zero elements of by . For any matrix , let denote the determinant of , the trace of . Let and be the largest and smallest eigenvalues, respectively. We write for a diagonal matrix with the same diagonal as and . The matrix Frobenius norm is given by . The operator norm is given by . We write for the norm of a matrix vectorized, i.e., for a matrix , and sometimes write for the number of non-zero entries in the matrix. For an index set and a matrix , write , where is the indicator function.

2 The model and the method

We assume a multivariate Gaussian model

| (1) |

The data is generated by . Requiring the mean vector and all variances being equal to zero and one respectively is not a real restriction and in practice, we can easily center and scale the data. We denote the concentration matrix by .

Since we will use a nodewise regression procedure, as described below in Section 2.1, we consider a regression formulation of the model. Consider many regressions, where we regress one variable against all others:

| (2) | |||

| (3) |

There are explicit relations between the regression coefficients, error variances and the concentration matrix :

| (4) |

Furthermore, it is well known that for Gaussian distributions, conditional independence is encoded in , and due to (4), also in the regression coefficients:

| (5) | |||||

For the second equivalence, we assume that and . Conditional (in-)dependencies can be conveniently encoded by an undirected graph, the conditional independence graph which we denote by . The set of vertices is and the set of undirected edges is defined as follows:

| there is an undirected edge between nodes and | (6) | ||||

Note that on the right hand side of the second equivalence, we could replace the word ”and” by ”or”. For the second equivalence, we assume following the remark after (5).

We now define the sparsity of the concentration matrix or the conditional independence graph. The definition is different than simply counting the non-zero elements of , for which we have . We consider instead the number of elements which are sufficiently large. For each , define the number as the smallest integer such that the following holds:

| (7) |

where essential sparsity at row describes the number of “sufficiently large” non-diagonal elements relative to a given pair and . The value in (8) is summing essential sparsity across all rows of ,

| (8) |

Due to the expression of , the value of depends on and . For example, if all non-zero non-diagonal elements of the th row are larger in absolute value than , the value coincides with the node degree . However, if some (many) of the elements are non-zero but small, is (much) smaller than its node degree ; As a consequence, if some (many) of are non-zero but small, the value of is also (much) smaller than , which is the “classical” sparsity for the matrix . See Section A for more discussions.

2.1 The estimation procedure

The estimation of and is pursued in two stages. We first estimate the undirected graph with edge set as in (6) and we then use the maximum likelihood estimator based on the estimate , that is, the non-zero elements of correspond to the estimated edges in . Inferring the edge set can be based on the following approach as proposed and theoretically justified in Meinshausen and Bühlmann [2006]: perform regressions using the Lasso to obtain vectors of regression coefficients where for each , ; Then estimate the edge set by the “OR” rule,

| (9) |

Nodewise regressions for inferring the graph. In the present work, we use the Lasso in combination with thresholding [Zhou, 2009, 2010b]. Consider the Lasso for each of the nodewise regressions

| (10) |

where is the same regularization parameter for all regressions. Since the Lasso typically estimates too many components with non-zero estimated regression coefficients, we use thresholding to get rid of variables with small regression coefficients from solutions of (10):

| (11) |

where is a thresholding parameter. We obtain the corresponding estimated edge set as defined by (9) using the estimator in (11) and we use the notation

| (12) |

We note that the estimator depends on two tuning parameters and .

The use of thresholding has clear benefits from a theoretical point of view: the number of false positive selections may be much larger without thresholding (when tuned for good prediction). and a similar statement would hold when comparing the adaptive Lasso with the standard Lasso. We refer the interested reader to Zhou [2009, 2010b] and van de Geer et al. [2010].

Maximum likelihood estimation based on graphs. Given a conditional independence graph with edge set , we estimate the concentration matrix by maximum likelihood. Denote by the sample covariance matrix (using that the mean vector is zero) and by

| (13) |

the sample correlation matrix. The estimator for the concentration matrix in view of (1) is:

| (14) |

defines the constrained set for positive definite . If where is the maximal clique size of a minimal chordal cover of the graph with edge set , the MLE exists and is unique, see, for example Uhler [2011, Corollary 2.3]. We note that our theory guarantees that holds with high probability for , where , under Assumption (A1) to be introduced in the next section. The definition in (2.1) is slightly different from the more usual estimator which uses the sample covariance rather than . Here, the sample correlation matrix reflects the fact that we typically work with standardized data where the variables have empirical variances equal to one. The estimator in (2.1) is constrained leading to zero-values corresponding to .

If the edge set is sparse having relatively few edges only, the estimator in (2.1) is already sufficiently regularized by the constraints and hence, no additional penalization is used at this stage. Our final estimator for the concentration matrix is the combination of (12) and (2.1):

| (15) |

Choosing the regularization parameters. We propose to select the parameter via cross-validation to minimize the squared test set error among all regressions:

where CV-score() of th regression is with respect to the squared error prediction loss. Sequentially proceeding, we then select by cross-validating the multivariate Gaussian log-likelihood, from (2.1). Regarding the type of cross-validation, we usually use the 10-fold scheme. Due to the sequential nature of choosing the regularization parameters, the number of candidate estimators is given by the number of candidate values for plus the number of candidate value for . In Section 4, we describe the grids of candidate values in more details. We note that for our theoretical results, we do not analyze the implications of our method using estimated and .

3 Theoretical results

In this section, we present in Theorem 1 convergence rates for estimating the precision and the covariance matrices with respect to the Frobenius norm; in addition, we show a risk consistency result for an oracle risk to be defined in (17). Moreover, in Proposition 4, we show that the model we select is sufficiently sparse while at the same time, the bias term we introduce via sparse approximation is sufficiently bounded. These results illustrate the classical bias and variance tradeoff. Our analysis is non-asymptotic in nature; however, we first formulate our results from an asymptotic point of view for simplicity. To do so, we consider a triangular array of data generating random variables

| (16) |

where and change with . Let . We make the following assumptions.

-

(A0)

The size of the neighborhood for each node is upper bounded by an integer and the sample size satisfies for some constant

-

(A1)

The dimension and number of sufficiently strong non-zero edges as in (8) satisfy: dimension grows with following for some constant and

-

(A2)

The minimal and maximal eigenvalues of the true covariance matrix are bounded: for some constants , we have

Moreover, throughout our analysis, we assume the following. There exists such that for all , and as defined in (3):

Before we proceed, we need some definitions. Define for

| (17) |

where minimizing (17) without constraints gives . Given (8), (7), and , define

| (18) |

We now state the main results of this paper. We defer the specification on various tuning parameters, namely, to Section 3.2, where we also provide an outline for Theorem 1.

Theorem 1

Consider data generating random variables as in (16) and assume that (A0), (A1), and (A2) hold. We assume for all . Then, with probability at least , for some small constant , we obtain under appropriately chosen and , an edge set as in (12), such that

| (19) |

and for and as defined in (15) the following holds,

where the constants hidden in the notation depend on , , as in (18), and constants concerning sparse and restrictive eigenvalues of (cf. Section 3.2 and B).

We note that convergence rates for the estimated covariance matrix and for predictive risk depend on the rate in Frobenius norm of the estimated inverse covariance matrix. The predictive risk can be interpreted as follows. Let with denoting its density. Let be the density for and denotes the Kullback Leibler (KL) divergence from to . Now, we have for ,

| (20) |

Actual conditions and non-asymptotic results that are involved in the Gelato estimation appear in Sections B, C, and D respectively.

Remark 2

Implicitly in (A1), we have specified a lower bound on the sample size to be . For the interesting case of , a sample size of

| (21) |

is sufficient in order to achieve the rates in Theorem 1. As to be shown in our analysis, the lower bound on is slightly different for each Frobenius norm bound to hold from a non-asymptotic point of view (cf. Theorem 19 and 20).

Theorem 1 can be interpreted as follows. First, the cardinality of the estimated edge set exceeds at most by a factor 4, where as in (8) is the number of sufficiently strong edges in the model, while the number of false positives is bounded by . Note that the factors and can be replaced by some other constants, while achieving the same bounds on the rates of convergence (cf. Section D.1). We emphasize that we achieve these two goals by sparse model selection, where only important edges are selected even though there are many more non-zero edges in , under conditions that are much weaker than (A2). More precisely, (A2) can be replaced by conditions on sparse and restrictive eigenvalues (RE) of . Moreover, the bounded neighborhood constraint (A0) is required only for regression analysis (cf. Theorem 15) and for bounding the bias due to sparse approximation as in Proposition 4. This is shown in Sections B and C. Analysis follows from Zhou [2009, 2010b] with earlier references to Candès and Tao [2007]; Meinshausen and Yu [2009]; Bickel et al. [2009] for estimating sparse regression coefficients.

We note that the conditions that we use are indeed similar to those in Rothman et al. [2008], with (A1) being much more relaxed when . The convergence rate with respect to the Frobenius norm should be compared to the rate in case is known, which is the rate in Rothman et al. [2008] for the GLasso and for SCAD [Lam and Fan, 2009]. In the scenario where , i.e. there are many weak edges, the rate in Theorem 1 is better than the one established for GLasso [Rothman et al., 2008] or for the SCAD-type estimator [Lam and Fan, 2009]; hence we require a smaller sample size in order to yield an accurate estimate of .

Remark 3

For the general case where are not assumed to be known, we could achieve essentially the same rate as stated in Theorem 1 for and under and following analysis in the present work (cf. Theorem 6) and that in Rothman et al. [2008, Theorem 2]. Presenting full details for such results are beyond the scope of the current paper. We do provide the key technical lemma which is essential for showing such bounds based on estimating the inverse of the correlation matrix in Theorem 6; see also Remark 7 which immediately follows.

In this case, for the Frobenius norm and the risk to converge to zero, a too large value of is not allowed. Indeed, for the Frobenius norm and the risk to converge, is to be replaced by:

In this case, we have

Moreover, in the refitting stage, we could achieve these rates with the maximum likelihood estimator based on the sample covariance matrix as defined in (3):

| (22) |

A real high-dimensional scenario where is excluded in order to achieve Frobenius norm consistency. This restriction comes from the nature of the Frobenius norm and when considering e.g. the operator norm, such restrictions can indeed be relaxed as stated above.

It is also of interest to understand the bias of the estimator caused by using the estimated edge set instead of the true edge set . This is the content of Proposition 4. For a given , denote by

where the second equality holds since . Note that the quantity is identical to on and on the diagonal, and it equals zero on . Hence, the quantity measures the bias caused by a potentially wrong edge set ; note that if .

Proposition 4

We note that we achieve essentially the same rate for ; see Remark 27. We give an account on how results in Proposition 4 are obtained in Section 3.2, with its non-asymptotic statement appearing in Corollary 17.

3.1 Discussions and connections to previous work

It is worth mentioning that consistency in terms of operator and Frobenius norms does not depend too strongly on the property to recover the true underlying edge set in the refitting stage. Regarding the latter, suppose we obtain with high probability the screening property

| (23) |

when assuming that all non-zero regression coefficients are sufficiently large ( might be an estimate and hence random). Although we do not intend to make precise the exact conditions and choices of tuning parameters in regression and thresholding in order to achieve (23), we state Theorem 5, in case (23) holds with the following condition: the number of false positives is bounded as

Theorem 5

It is clear that this bound corresponds to exactly that of Rothman et al. [2008] for the GLasso estimation under appropriate choice of the penalty parameter for a general with for all (cf. Remark 3). We omit the proof as it is more or less a modified version of Theorem 19, which proves the stronger bounds as stated in Theorem 1. We note that the maximum node-degree bound in (A0) is not needed for Theorem 5.

We now make some connections to previous work. First, we note that to obtain with high probability the exact edge recovery, , we need again sufficiently large non-zero edge weights and some restricted eigenvalue (RE) conditions on the covariance matrix as defined in Section A even for the multi-stage procedure. An earlier example is shown in Zhou et al. [2009], where the second stage estimator corresponding to (11) is obtained with nodewise regressions using adaptive Lasso [Zou, 2006] rather than thresholding as in the present work in order to recover the edge set with high probability under an assumption which is stronger than (A0). Clearly, given an accurate , under (A1) and (A2) one can then apply Theorem 5 to accurately estimate . On the other hand, it is known that GLasso necessarily needs more restrictive conditions on than the nodewise regression approach with the Lasso, as discussed in Meinshausen [2008] and Ravikumar et al. [2008] in order to achieve exact edge recovery.

Furthermore, we believe it is straightforward to show that Gelato works under the RE conditions on and with a smaller sample size than the analogue without the thresholding operation in order to achieve nearly exact recovery of the support in the sense that and is small, that is, the number of extra estimated edges at each node is bounded by a small constant. This is shown essentially in Zhou [2009, Theorem1.1] for a single regression. Given such properties of , we can again apply Theorem 5 to obtain under (A1) and (A2). Therefore, Gelato requires relatively weak assumptions on in order to achieve the best sparsity and bias tradeoff as illustrated in Theorem 1 and Proposition 4 when many signals are weak, and Theorem 5 when all signals in are strong.

3.2 An outline for Theorem 1

Let . We note that although sparse eigenvalues and restricted eigenvalue for (cf. Section A) are parameters that are unknown, we only need them to appear in the lower bounds for , , and hence also that for and that appear below. We simplify our notation in this section to keep it consistent with our theoretical non-asymptotic analysis to appear toward the end of this paper.

Regression. We choose for some , , and ,

Let be the optimal solutions to (10) with as chosen above. We first prove an oracle result on nodewise regressions in Theorem 15.

Thresholding. We choose for some constants to be defined in Theorem 15,

where depends on restrictive eigenvalue of ; Apply (11) with and for thresholding our initial regression coefficients. Let

where bounds on are given in Lemma 16. In view of (9), we let

| (24) |

Selecting edge set . Recall for a pair we take the OR rule as in (9) to decide if it is to be included in the edge set : for as defined in (24), define

| (25) |

to be the subset of pairs of non-identical vertices of which do not appear in ; Let

| (26) |

for as in (25), which is identical to on all diagonal entries and entries indexed by , with the rest being set to zero. As shown in the proof of Corollary 17, by thresholding, we have identified a sparse subset of edges of size at most , such that the corresponding bias is relatively small, i.e., as bounded in Proposition 4.

Refitting. In view of Proposition 4, we aim to recover given a sparse subset ; toward this goal, we use (2.1) to obtain the final estimator and . We give a more detailed account of this procedure in Section D, with a focus on elaborating the bias and variance tradeoff. We show the rate of convergence in Frobenius norm for the estimated and in Theorem 6, 19 and 20, and the bound for Kullback Leibler divergence in Theorem 21 respectively.

3.3 Discussion on covariance estimation based on maximum likelihood

The maximum likelihood estimate minimizes over all ,

| (27) |

where is the sample covariance matrix. Minimizing without constraints gives . We now would like to minimize (27) under the constraints that some pre-defined subset of edges are set to zero. Then the follow relationships hold regarding defined in (3) and its inverse , and : for as defined in (25),

Hence the entries in the covariance matrix for the chosen set of edges in and the diagonal entries are set to their corresponding values in . Indeed, we can derive the above relationships via the Lagrange form, where we add Lagrange constants for edges in ,

| (28) |

Now the gradient equation of (28) is:

where is a matrix of Lagrange parameters such that for all and otherwise.

Similarly, the follow relationships hold regarding defined in (2.1) in case for all , where is replaced with , and its inverse , and : for as defined in (25),

Finally, we state Theorem 6, which yields a general bound on estimating the inverse of the correlation matrix, when take arbitrary unknown values in . The corresponding estimator is based on estimating the inverse of the correlation matrix, which we denote by . We use the following notations. Let be the true correlation matrix and let . Let . Let us denote the diagonal entries of with where for all . Then the following holds:

Given sample covariance matrix , we construct sample correlation matrix as follows. Let and

| (29) |

where . Thus is a matrix with diagonal entries being all s and non-diagonal entries being the sample correlation coefficients, which we denote by .

The maximum likelihood estimate for minimizes over all ,

| (30) |

To facilitate technical discussions, we need to introduce some more notation. Let denote the set of symmetric positive definite matrices:

Let us define a subspace corresponding to an edge set :

| (31) |

Minimizing without constraints gives . Subject to the constraints that as defined in (31), we write the maximum likelihood estimate for :

| (32) |

which yields the following relationships regarding , its inverse , and . For as defined in (25),

Given and its inverse , we obtain

and therefore the following holds: for as defined in (25),

Theorem 6

Consider data generating random variables as in expression (16) and assume that and hold. Let and . Let be some event such that for a small constant . Let be as defined in (8). Suppose on event :

-

1.

We obtain an edge set such that its size is a linear function in .

- 2.

Let be as defined in (32) Suppose the sample size satisfies for ,

| (34) |

Then with probability , we have for

| (35) |

Remark 7

We note that the constants in Theorem 6 are by no means the best possible. From (35), we can derive bounds on and to be in the same order as in (35) following the analysis in Rothman et al. [2008, Theorem 2]. The corresponding bounds on the Frobenius norms on covariance estimation would be in the order of as stated in Remark 3.

4 Numerical results

We consider the empirical performance for simulated and real data. We compare our estimation method with the GLasso, the Space method and a simplified Gelato estimator without thresholding for inferring the conditional independence graph. The comparison with the latter should yield some evidence about the role of thresholding in Gelato. The GLasso is defined as:

where is the empirical correlation matrix and the minimization is over positive definite matrices. Sparse partial correlation estimation (Space) is an approach for selecting non-zero partial correlations in the high-dimensional framework. The method assumes an overall sparsity of the partial correlation matrix and employs sparse regression techniques for model fitting. For details see Peng et al. [2009]. We use Space with weights all equal to one, which refers to the method type space in Peng et al. [2009]. For the Space method, estimation of is done via maximum likelihood as in (2.1) based on the edge set from the estimated sparse partial correlation matrix. For computation of the three different methods, we used the R-packages glmnet [Friedman et al., 2010], glasso [Friedman et al., 2007] and space [Peng et al., 2009].

4.1 Simulation study

In our simulation study, we look at three different models.

-

•

An AR(1)-Block model. In this model the covariance matrix is block-diagonal with equal-sized AR(1)-blocks of the form .

-

•

The random concentration matrix model considered in Rothman et al. [2008]. In this model, the concentration matrix is where each off-diagonal entry in is generated independently and equal to 0 or 0.5 with probability or , respectively. All diagonal entries of are zero, and is chosen such that the condition number of is .

-

•

The exponential decay model considered in Fan et al. [2009]. In this model we consider a case where no element of the concentration matrix is exactly zero. The elements of are given by equals essentially zero when the difference is large.

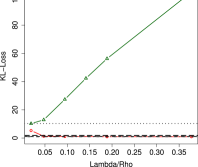

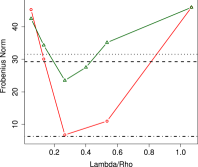

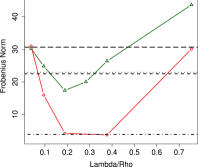

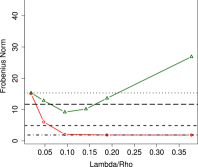

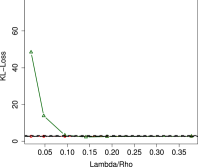

We compare the three estimators for each model with and . For each model we sample data i.i.d. . We use two different performance measures. The Frobenius norm of the estimation error and , and the Kullback Leibler divergence between and as defined in (20).

For the three estimation methods we have various tuning parameters, namely , (for Gelato), (for GLasso) and (for Space). We denote the regularization parameter of the Space technique by in contrary to Peng et al. [2009], in order to distinguish it from the other parameters. Due to the computational complexity we specify the two parameters of our Gelato method sequentially. That is, we derive the optimal value of the penalty parameter by 10-fold cross-validation with respect to the test set squared error for all the nodewise regressions. After fixing we obtain the optimal threshold again by 10-fold cross-validation but with respect to the negative Gaussian log-likelihood (, where is the empirical covariance of the hold-out data). We could use individual tuning parameters for each of the regressions. However, this turned out to be sub-optimal in some simulation scenarios (and never really better than using a single tuning parameter , at least in the scenarios we considered). For the penalty parameter of the GLasso estimator and the parameter of the Space method we also use a 10-fold cross-validation with respect to the negative Gaussian log-likelihood. The grids of candidate values are given as follows:

where and

.

The two different performance measures are evaluated for the estimators

based on the sample with optimal CV-estimated tuning

parameters , , and for each model from above. All

results are based on 50 independent simulation runs.

4.1.1 The AR(1)-block model

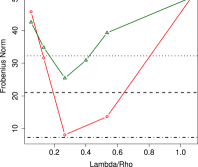

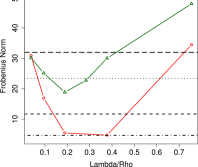

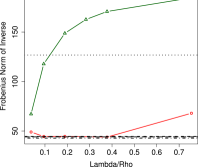

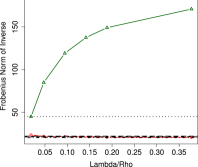

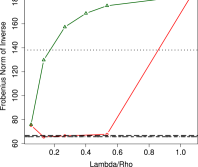

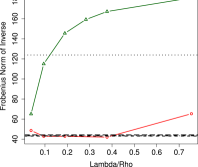

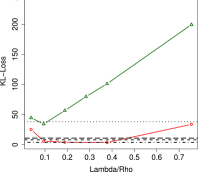

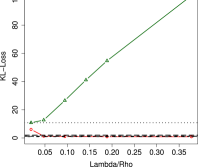

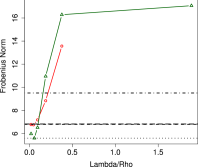

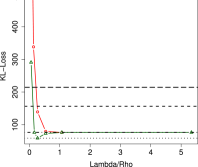

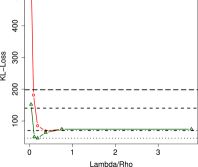

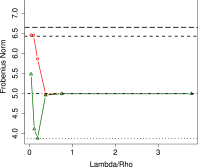

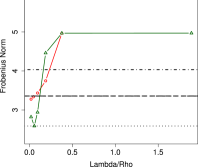

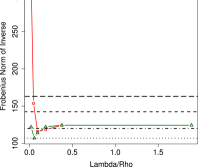

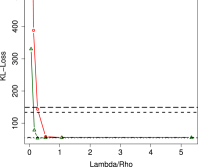

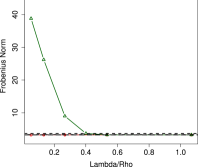

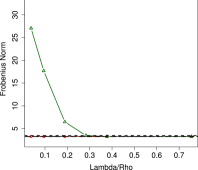

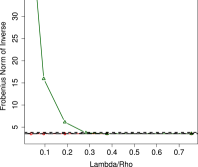

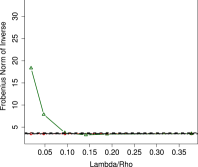

We consider two different covariance matrices. The first one is a simple auto-regressive process of order one with trivial block size equal to , denoted by . This is also known as a Toeplitz matrix. That is, we have . The second matrix is a block-diagonal matrix with AR(1) blocks of equal block size , and hence the block-diagonal of equals , . The simulation results for the AR(1)-block models are shown in Figure 1 and 2.

The figures show a substantial performance gain of our method compared to the GLasso in both considered covariance models. This result speaks for our method, especially because AR(1)-block models are very simple. The Space method performs about as well as Gelato, except for the Frobenius norm of . There we see an performance advantage of the Space method compared to Gelato. We also exploit the clear advantage of thresholding in Gelato for a small sample size.

4.1.2 The random precision matrix model

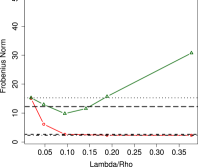

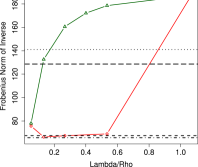

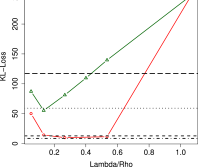

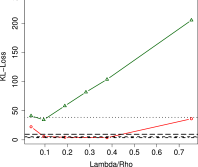

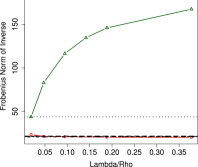

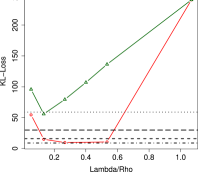

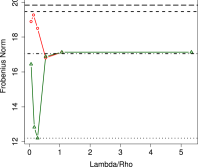

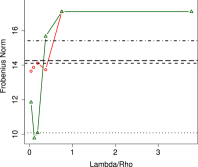

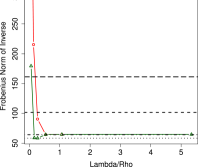

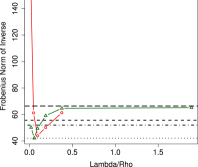

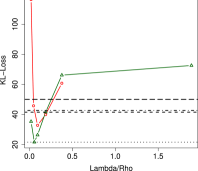

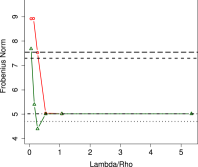

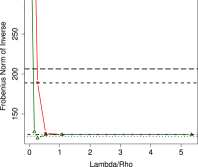

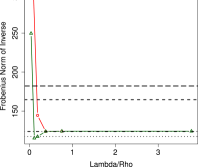

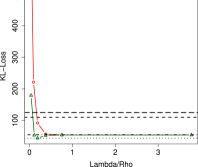

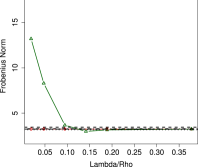

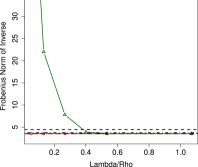

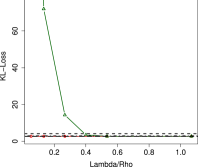

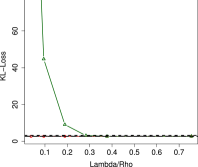

For this model we also consider two different matrices, which differ in sparsity. For the sparser matrix we set the probability to . That is, we have an off diagonal entry in of 0.5 with probability and an entry of 0 with probability . In the case of the second matrix we set to which provides us with a denser concentration matrix. The simulation results for the two performance measures are given in Figure 3 and 4.

From Figures 3 and 4 we see that GLasso performs better than Gelato with respect to and the Kullback Leibler divergence in both the sparse and the dense simulation setting. If we consider , Gelato seems to keep up with GLasso to some degree. For the Space method we have a similar situation to the one with GLasso. The Space method outperforms Gelato for and but for , Gelato somewhat keeps up with Space.

4.1.3 The exponential decay model

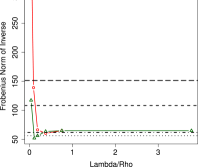

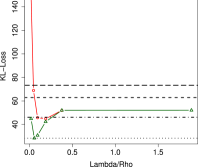

In this simulation setting we only have one version of the concentration matrix . The entries of are generated by . Thus, is a banded and sparse matrix.

Figure 5 shows the results of the simulation. We find that all three methods show equal performances in both the Frobenius norm and the Kullback Leibler divergence. This is interesting because even with a sparse approximation of (with GLasso or Gelato), we obtain competitive performance for (inverse) covariance estimation.

4.1.4 Summary

Overall we can say that the performance of the methods depend on the model. For the models and the Gelato method performs best. In case of the models and , Gelato gets outperformed by GLasso and the Space method and for the model none of the three methods has a clear advantage. In Figures 1 to 4, we see the advantage of Gelato with thresholding over the one without thresholding, in particular, for the simulation settings , and . Thus thresholding is a useful feature of Gelato.

4.2 Application to real data

4.2.1 Isoprenoid gene pathway in Arabidobsis thaliana

In this example we compare the two estimators on the isoprenoid

biosynthesis pathway data given in Wille et al. [2004].

Isoprenoids

play various roles in plant and animal physiological processes and

as intermediates in the biological synthesis of other important molecules.

In plants they

serve numerous biochemical functions in processes such as photosynthesis,

regulation of growth and development.

The data set consists of isoprenoid genes for which we have

gene expression patterns under various experimental conditions. In order to

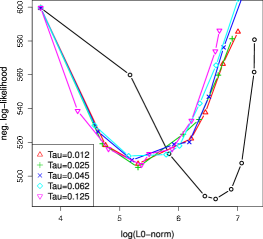

compare the two techniques we compute the negative log-likelihood via

10-fold cross-validation for different values of , and

.

In Figure 6 we plot the cross-validated negative log-likelihood against the logarithm of the average number of non-zero entries (logarithm of the -norm) of the estimated concentration matrix . The logarithm of the -norm reflects the sparsity of the matrix and therefore the figures show the performance of the estimators for different levels of sparsity. The plots do not allow for a clear conclusion. The GLasso performs slightly better when allowing for a rather dense fit. On the other hand, when requiring a sparse fit, the Gelato performs better.

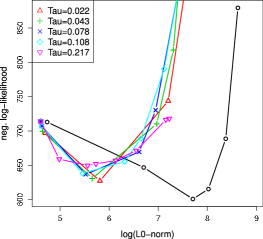

4.2.2 Clinical status of human breast cancer

As a second example, we compare the two methods on the breast cancer dataset from West et al. [2001]. The tumor samples were selected from the Duke Breast Cancer SPORE tissue bank. The data consists of genes with breast tumor samples. For the analysis we use the 100 variables with the largest sample variance. As before, we compute the negative log-likelihood via 10-fold cross-validation. Figure 6 shows the results. In this real data example the interpretation of the plots is similar as for the arabidopsis dataset. For dense fits, GLasso is better while Gelato has an advantage when requiring a sparse fit.

5 Conclusions

We propose and analyze the Gelato estimator. Its advantage is that it automatically yields a positive definite covariance matrix , it enjoys fast convergence rate with respect to the operator and Frobenius norm of and . For estimation of , Gelato has in some settings a better rate of convergence than the GLasso or SCAD type estimators. From a theoretical point of view, our method is clearly aimed for bounding the operator and Frobenius norm of the inverse covariance matrix. We also derive bounds on the convergence rate for the estimated covariance matrix and on the Kullback Leibler divergence. From a non-asymptotic point of view, our method has a clear advantage when the sample size is small relative to the sparsity : for a given sample size , we bound the variance in our re-estimation stage by excluding edges of with small weights from the selected edge set while ensuring that we do not introduce too much bias. Our Gelato method also addresses the bias problem inherent in the GLasso estimator since we no longer shrink the entries in the covariance matrix corresponding to the selected edge set in the maximum likelihood estimate, as shown in Section 3.3.

Our experimental results show that Gelato performs better than GLasso or the Space method for AR-models while the situation is reversed for some random precision matrix models; in case of an exponential decay model for the precision matrix, all methods exhibit the same performance. For Gelato, we demonstrate that thresholding is a valuable feature. We also show experimentally how one can use cross-validation for choosing the tuning parameters in regression and thresholding. Deriving theoretical results on cross-validation is not within the scope of this paper.

6 Acknowledgments

Min Xu’s research was supported by NSF grant CCF-0625879 and AFOSR contract FA9550-09-1-0373. Shuheng Zhou thanks Bin Yu warmly for hosting her visit at UC Berkeley while she was conducting this research in Spring 2010. SZ’s research was supported in part by the Swiss National Science Foundation (SNF) Grant 20PA21-120050/1. We thank delightful conversations with Larry Wasserman, which inspired the name of Gelato, and Liza Levina.

A Theoretical analysis and proofs

In this section, we specify some preliminary definitions. First, note that when we discuss estimating the parameters and , we always assume that

| (36) | |||

| (37) |

It is clear that these conditions are exactly that of (A2) in Section 3 with

where it is clear that for , we have the sum of eigenvalues of , . Hence it will make sense to assume that (37) holds, since otherwise, (36) implies that which is unnecessarily restrictive.

We now define parameters relating to the key notion of essential sparsity as explored in Candès and Tao [2007]; Zhou [2009, 2010b] for regression. Denote the number of non-zero non-diagonal entries in each row of by . Let denote the highest node degree in . Consider nodewise regressions as in (2), where we are given vectors of parameters for . With respect to the degree of node for each , we define as the smallest integer such that

| (38) |

where denotes as defined in (7).

Definition 8

We now define the following parameters related to . For an integer , we define the smallest and largest m-sparse eigenvalues of as follows:

Definition 9

(Restricted eigenvalue condition ). For some integer and a positive number , the following condition holds for all ,

| (40) |

where represents the subvector of confined to a subset of .

When and become smaller, this condition is easier to satisfy. When we only aim to estimate the graphical structure itself, the global conditions (36) need not hold in general. Hence up till Section D, we only need to assume that satisfies (40) for as in (38), and the sparse eigenvalue . In order of estimate the covariance matrix , we do assume that (36) holds, which guarantees that the condition always holds on , and are upper and lower bounded by some constants for all . We continue to adopt parameters such as , , and for the purpose of defining constants that are reasonable tight under condition (36). In general, one can think of

for as in (36) when is small.

Roughly speaking, for two variables as in (1) such that their corresponding entry in satisfies: , where , we can not guarantee that when we aim to keep edges for node . For a given , as the sample size increases, we are able to select edges with smaller coefficient . In fact it holds that

| (41) |

where is the indicator function, if we order the regression coefficients as follows:

in view of (2), which is the same as if we order for row of ,

| (42) |

This has been show in [Candès and Tao, 2007]; See also Zhou [2010b].

A.1 Concentration bounds for the random design

For the random design generated by (16), let for all . In preparation for showing the oracle results of Lasso in Theorem 33, we first state some concentration bounds on . Define for some

| (43) |

where are the column vectors of the design matrix . When all columns of have an Euclidean norm close to as in (43) , it makes sense to discuss the RE condition in the form of (44) as formulated in [Bickel et al., 2009]. For the integer as defined in (38) and a positive number , requires that the following holds for all ,

| (44) |

The parameter is understood to be the same quantity throughout our discussion. The following event provides an upper bound on for a given when satisfies condition:

| (45) |

For some integer , we define the smallest and largest -sparse eigenvalues of to be

| (46) | |||||

| (47) |

upon which we define the following event:

| (48) | |||

| (49) |

Formally, we consider the set of random designs that satisfy all events as defined, for some . Theorem 10 shows concentration results that we need for the present work, which follows from Theorem 1.6 in Zhou [2010a] and Theorem 3.2 in Rudelson and Zhou [2011].

Theorem 10

Remark 11

We note that the constraint , which has appeared in Zhou [2010a, Theorem 1.6] is unnecessary. Under a stronger condition on , a tighter bound on the sample size , which is independent of , is given in Rudelson and Zhou [2011] in order to guarantee . We do not pursue this optimization here as we assume that is a bounded constant throughout this paper. We emphasize that we only need the first term in (51) in order to obtain and ; The second term is used to bound sparse eigenvalues of order .

A.2 Definitions of other various events

Under (A1) as in Section 3, excluding event as bounded in Theorem 10 and events to be defined in this subsection, we can then proceed to treat as a deterministic design in regression and thresholding, for which holds with , We then make use of event in the MLE refitting stage for bounding the Frobenius norm. We now define two types of correlations events and .

Correlation bounds on and . In this section, we first bound the maximum correlation between pairs of random vectors , for all where , each of which corresponds to a pair of variables as defined in (2) and (3). Here we use and , for all , to denote both random vectors and their corresponding variables.

Let us define as a shorthand. Let be a standard normal random variable. Let us now define for all ,

where for all are independent standard normal random variables. For some , let event

| (52) |

Bounds on pairwise correlations in columns of . Let , where we denote . Denote by . Consider for some constant ,

| (53) |

We first state Lemma 12, which is used for bounding a type of correlation events across all regressions; see proof of Theorem 15. It is also clear that event is equivalent to the event to be defined in (54). Lemma 12 also justifies the choice of in nodewise regressions (cf. Theorem 15). We then bound event in Lemma 13. Both proofs appear in Section A.3.

Lemma 12

Suppose that . Then with probability at least , we have

| (54) |

where and . Hence

Lemma 13

For a random design as in (1) with , and for , where , we have

We note that the upper bounds on in Lemma 12 and 13 clearly hold given (A1). For the rest of the paper, we prove Theorem 15 in Section B for nodewise regressions. We proceed to derive bounds on selecting an edge set in Section C. We then derive various bounds on the maximum likelihood estimator given in Theorem 19- 21 in Section D, where we also prove Theorem 1. Next, we prove Lemma 12 and 13 in Section A.3.

A.3 Proof of Lemma 12 and 13

We first state the following large inequality bound on products of correlated normal random variables.

Lemma 14

Zhou et al. [2008, Lemma 38] Given a set of identical independent random variables , where , with and with being their correlation coefficient. Let us now define . Let . For ,

| (55) |

Proof of Lemma 12. It is clear that event (54) is the same as event . Clearly we have at most unique entries . By the union bound and by taking in (55) with , where for .

where we apply Lemma 14 with and use the fact that . Note that guarantees that . In order to bound the probability of event , we first state the following large inequality bound for the non-diagonal entries of , which follows immediately from Lemma 14 by plugging in and using the fact that , where is the correlation coefficient between variables and . Let . Then

| (56) |

We now also state a large deviation bound for the distribution [Johnstone, 2001]:

| (57) |

B Bounds for nodewise regressions

In Theorem 15 and Lemma 16 we let be as in (38) and denote locations of the largest coefficients of in absolute values. For the vector to be defined in Theorem 15, we let denote the largest positions of in absolute values outside of ; Let . We suppress the superscript in , and throughout this section for clarity.

Theorem 15

(Oracle inequalities of the nodewise regressions) Let . Let , where is the maximum node-degree in . Suppose holds for as in (39), where forall . Suppose . The data is generated by , where the sample size satisfies (51).

Suppose we choose for some constant and ,

where we assume that is reasonably bounded. Then

The choice of will be justified in Section F, where we also the upper bound on as above.

C Bounds on thresholding

Lemma 16

Suppose holds for be as in (39) and , where is the maximum node-degree in . Suppose . Let . Let be some absolute constant. Suppose satisfies (51). Let be an optimal solution to (10) with

Suppose for each regression, we apply the same thresholding rule to obtain a subset as follows,

where for some constant to be specified. Then we have on event ,

| (59) | |||||

| (60) |

where is understood to be and are the same constants as in Theorem 15.

We now show Corollary 17, which proves Proposition 4 and the first statement of Theorem 1. Recall . Let denote the submatrix of indexed by as in (24) with all other positions set to be 0. Let be the true edge set.

Corollary 17

Proof By the OR rule in (9), we could select at most edges. We have by (59)

where is an upper bound on by (63). Thus

Remark 18

Note that if is small, then the second term in will provide a tighter bound.

Proof of Lemma 16. Let denote the largest coefficients of in absolute values. We have

| (63) |

by (58), where is understood to be the same constant that appears in (58). Thus we have

Now the second inequality in (59) clearly holds given (63) and the following:

We now bound following essentially the arguments as in Zhou [2009]. We have

where for the second term, we have by definition of as in (38) and (41); For the first term, we have by the triangle inequality and (58),

D Bounds on MLE refitting

Recall the maximum likelihood estimate minimizes over all the empirical risk:

| (64) |

which gives the “best” refitted sparse estimator given a sparse subset of edges that we obtain from the nodewise regressions and thresholding. We note that the estimator (64) remains to be a convex optimization problem, as the constraint set is the intersection the positive definite cone and the linear subspace . Implicitly, by using rather than in (64), we force the diagonal entries in to be identically . It is not hard to see that the estimator (64) is equivalent to (2.1), after we replace with .

Theorem 19

Consider data generating random variables as in expression (16) and assume that , (36), and (37) hold. Suppose for all . Let be some event such that for a small constant . Let be as defined in (39); Suppose on event :

-

1.

We obtain an edge set such that its size is a linear function in .

-

2.

And for as in (26) and for some constant to be specified, we have

(65)

Let be as defined in (64). Suppose the sample size satisfies for ,

| (66) |

Then on event , we have for

| (67) |

We note that although Theorem 19 is meant for proving Theorem 1, we state it as an independent result; For example, one can indeed take from Corollary 17, where we have for some constant for . In view of (17), we aim to recover by as defined in (64). In Section D.2, we will focus in Theorem 19 on bounding for suitably chosen,

By the triangle inequality, we conclude that

We now state bounds for the convergence rate on Frobenius norm of the covariance matrix and for KL divergence. We note that constants have not been optimized. Proofs of Theorem 20 and 21 appear in Section D.3 and D.4 respectively.

Theorem 20

Theorem 21

D.1 Proof of Theorem 1

Clearly the sample requirement as in (51) is satisfied for some that is appropriately chosen, given (66). In view of Corollary 17, we have on : for as in (18)

| (71) | |||||

Clearly the last inequality in (65) hold so long as which holds given (66). Plugging in in (67), we have on ,

Now if we take , then we have (19) on event ; and moreover on ,

where . Similarly, we get the bound on with Theorem 20, and the bound on risk following Theorem 21. Thus all statements in Theorem 1 hold.

Remark 22

Suppose event holds. Now suppose that we take , that is, if we take the threshold to be exactly the penalty parameter :

Then we have on event by (61) and and on event on , for

It is not hard to see that we achieve essential the same rate as stated in Theorem 1, with perhaps slightly more edges included in .

D.2 Proof of Theorem 19

Suppose event holds throughout this proof. We first obtain the bound on spectrum of : It is clear that by (36) and (65), we have on ,

| (72) | |||||

| (73) |

Throughout this proof, we let . In view of (72), define . We use as a shorthand.

Given as guaranteed in (72), let us define a new convex set:

which is a translation of the original convex set . Let be a matrix with all entries being zero. Thus it is clear that given that . Define for as in expression (64)

For an appropriately chosen and a large enough , let

| (74) | |||||

| (75) |

It is clear that both and are convex. It is also clear that . Throughout this section, we let

| (76) |

Define for ,

| (77) |

It is clear that is a convex function on and .

Now, minimizes , or equivalently minimizes . Hence by definition,

Note that is non-empty, while clearly . Indeed, consider , where ; it is clear that and for . Note also if , then ; Thus we have and

| (78) |

We now show the following two propositions. Proposition 23 follows from standard results.

Proposition 23

Let be a matrix. If and , then for all .

Proof In view of Proposition 23, it is sufficient to show that for some . Indeed, by definition of , we have on event ; thus

for that is sufficiently small.

Thus we have that is infinitely

differentiable on the open interval of .

This allows us to use the Taylor’s

formula with integral remainder to obtain the following:

Lemma 25

On event , for all .

Proof Let us use as a shorthand for

where is the Kronecker product (if , , then ), and is vectorized. Now, the Taylor expansion gives for all ,

Hence for all ,

| (79) |

where we first bound as follows: by (65) and (72), we have on event

| (80) | |||||

Now, conditioned on event , by (89) and (66)

and thus on event , we have , where , and

| (81) |

Finally, we bound . First we note that for , we have on event ,

| (82) |

given (66): . Now we have by (73) and (37) following Rothman et al. [2008] (see Page 502, proof of Theorem 1 therein): on event ,

| (83) | |||||

Now on event , for all , we have by (79),(83), (81), and (80),

hence we have for large enough, in particular

suffices.

We next state Proposition 26, which follows

exactly that of Claim 12 of Zhou et al. [2008].

Proposition 26

Note that for , we have . By Proposition 26 and the fact that on event , we have the following: on event , if then , given that . Therefore

We thus establish that the theorem holds.

D.3 Frobenius norm for the covariance matrix

We use the bound on as developed in Theorem 19; in addition, we strengthen the bound on in (82) in (85). Before we proceed, we note the following bound on bias of .

Remark 27

Clearly we have on event , by (80)

| (84) |

Proof of Theorem 20. Suppose event holds. Now suppose

which clearly holds given (68). Then in addition to the bound in (82), on event , we have

| (85) |

for as in (76). Then, by Theorem 19, for the same as therein, on event , we have

given that sample bound in (66) is clearly satisfied. We now proceed to bound given (67). First note that by (85), we have on event for

Now clearly on event , (69) holds by (67) and

D.4 Risk consistency

We now derive the bound on risk consistency. Before proving Theorem 21, we first state two lemmas given the following decomposition of our loss in terms of the risk as defined in (17):

| (86) |

where clearly by definition. It is clear that for as defined in (31), and thus by definition of .

We now bound the two terms on the RHS of (86), where clearly .

Lemma 28

Proof of Lemma 28. For simplicity, we use as a shorthand for the rest of our proof:

We use as a shorthand for

where is the Kronecker product. First, we have for

where holds when , and in the last equation, we bound the difference between two terms using the Taylor’s formula with integral remainder following that in proof of Theorem 19; Indeed, it is clear that on , we have

given that and by (65). Thus is infinitely differentiable on the open interval of . Now, the Taylor expansion gives

We now obtain an upper bound on . Clearly, we have on event , Lemma 28 holds given that

where and

where clearly for all , we have , given and by (65).

Proof of Lemma 29. Suppose , then we are done.

E Proof of Theorem 6

We first bound in Lemma 30, which follows exactly that of Lemma 13 as the covariance matrix for variables satisfy the condition that .

Lemma 30

For , where , we have for as defined in (53)

On event , the following holds for , where we assume ,

| (87) | |||||

| (88) |

Let us first derive the large deviation bound for . First note that on event and for all

| (89) | |||||

Proof of Theorem 6. For as in (26), we define

where . Then clearly as . We first bound as follows.

Suppose event holds throughout this proof. We first obtain the bound on spectrum of : It is clear that by (36) and (33), we have on ,

| (90) | |||||

| (91) |

Throughout this proof, we let . In view of (90), define . Then

| (92) |

We use as a shorthand. Thus we have for ,

| (93) | |||||

Given as guaranteed in (93), let us define a new convex set:

which is a translation of the original convex set . Let be a matrix with all entries being zero. Thus it is clear that given that . Define for as in expression (30),

For an appropriately chosen and a large enough , let

| (94) | |||||

| (95) |

It is clear that both and are convex. It is also clear that . Define for ,

| (96) |

It is clear that is a convex function on and .

Now, minimizes , or equivalently minimizes . Hence by definition,

Note that is non-empty, while clearly . Indeed, consider , where ; it is clear that and for . Note also if , then ; Thus we have and

| (97) |

We now show the following proposition.

Proof In view of Proposition 23, it is sufficient to show that for some . Indeed, by definition of , we have on event ; thus

for that is sufficiently small.

Thus we have that is infinitely

differentiable on the open interval of .

This allows us to use the Taylor’s

formula with integral remainder to obtain the following:

Lemma 32

On event , for all .

Proof Let us use as a shorthand for

where is the Kronecker product (if , , then ), and is vectorized. Now, the Taylor expansion gives for all ,

Hence for all ,

| (98) |

where we first bound as follows: by (33) and (72), we have on event

| (99) | |||||

where we bound as follows:

Now, conditioned on event , by (89)

and thus on event , we have , where , and

| (100) |

Finally, we bound . First we note that for , we have on event ,

| (101) |

given (34): . Now we have by (91) and (37) following Rothman et al. [2008] (see Page 502, proof of Theorem 1 therein): on event ,

| (102) | |||||

Now on event , for all , we have by (98),(102), (100), and (99),

hence we have for large enough, in particular

suffices.

The rest of the proof follows that of Theorem 19, see

Proposition 26 and the bounds which follow.

We thus establish that the theorem holds.

F Oracle inequalities for the Lasso

In this section, we consider recovering in the following linear model:

| (103) |

where follows (16) and . Recall given , the Lasso estimator for is defined as:

| (104) |

which corresponds to the regression function in (10) by letting and where denotes columns of without . Define as the smallest integer such that

| (105) |

For as defined in (43), define

| (106) |

where , where . We have (cf. Lemma 34)

| (107) |

In fact, for such a bound to hold, we only need to hold in .

We now state Theorem 33, which may be of independent interests as the bounds on and loss for the Lasso estimator are stated with respect to the actual sparsity rather than as in Bickel et al. [2009, Theorem 7.2]. The proof is omitted as on event , it follows exactly that of Zhou [2010b, Theorem 5.1] for a deterministic design matrix which satisfies the RE condition, with some suitable adjustments on the constants.

Theorem 33

(Oracle inequalities of the Lasso) Zhou [2010b] Let , for being i.i.d. and let follow (16). Let be as in (105) and denote locations of the largest coefficients of in absolute values. Suppose that holds with and . Fix some . Let be an optimal solution to (104) with

| (108) |

where and . Let . Define

Suppose that satisfies (51). Then on , we have

Let denote the largest positions of in absolute values outside of ; Let . The proof of Theorem 33 yields the following bounds on : where

and

| (110) |

We note that implicit in these constants, we have used the concentration bounds for , and as derived in Theorem 10, given that (49) holds for , where we take . In general, these maximum sparse eigenvalues as defined above will increase with and ; Taking this issue into consideration, we fix for , where

where the second inequality holds for as desired, given .

Thus we have for

which holds given that , and , and thus as shown in Lemma 35; Hence

where for both , we have used the fact that

G Misc bounds

Lemma 34

For fixed design with , where , we have for as defined in (106), where ,

Proof Define random variables: Note that . We have and . Let . Obviously, has its tail probability dominated by that of :

We can now apply the union bound to obtain:

By choosing ,

the right-hand side is bounded by for .

Lemma 35

(Zhou [2010a]) Suppose that holds for , then for ,

References

- Banerjee et al. [2008] Banerjee, O., Ghaoui, L. E. and d’Aspremont, A. (2008). Model selection through sparse maximum likelihood estimation for multivariate Gaussian or binary data. Journal of Machine Learning Research 9 485–516.

- Bickel and Levina [2004] Bickel, P. J. and Levina, E. (2004). Some theory for Fisher’s linear discriminant function, ”naive Bayes”, and some alternatives when there are many morevariables than observations. Bernoulli 10 989–1010.

- Bickel and Levina [2008] Bickel, P. J. and Levina, E. (2008). Regulatized estimation of large covariance matrices. The Annals of Statistics 36 199–227.

- Bickel et al. [2009] Bickel, P. J., Ritov, Y. and Tsybakov, A. B. (2009). Simultaneous analysis of Lasso and Dantzig selector. The Annals of Statistics 37 1705–1732.

- Bühlmann and Meier [2008] Bühlmann, P. and Meier, L. (2008). Discussion: One-step sparse estimates in nonconcave penalized likelihood models. The Annals of Statistics 36 1534–1541.

- Candès and Tao [2007] Candès, E. and Tao, T. (2007). The Dantzig selector: statistical estimation when p is much larger than n. Annals of Statistics 35 2313–2351.

- Chaudhuri et al. [2007] Chaudhuri, S., Drton, M. and Richardson, T. S. (2007). Estimation of a covariance matrix with zeros. Biometrika 94 1–18.

- d’Aspremont et al. [2008] d’Aspremont, A., Banerjee, O. and Ghaoui, L. E. (2008). First-order methods for sparse covariance selection. SIAM Journal on Matrix Analysis and Applications 30 56–66.

- Fan et al. [2009] Fan, J., Feng, Y. and Wu, Y. (2009). Network exploration via the adaptive lasso and scad penalties. The Annals of Applied Statistics 3 521–541.

- Friedman et al. [2007] Friedman, J., Hastie, T. and Tibshirani, R. (2007). Sparse inverse covariance estimation with the graphical Lasso. Biostatistics 9 432–441.

- Friedman et al. [2010] Friedman, J., Hastie, T. and Tibshirani, R. (2010). Regularization paths for generalized linear models via coordinate descent. Journal of Statistical Software 33.

- Furrer and Bengtsson [2007] Furrer, R. and Bengtsson, T. (2007). Estimation of high-dimensional prior and posterior covariance matrices in Kalman filter variants. Journal of Multivariate Analysis 98 227–255.

- Huang et al. [2008] Huang, J., Ma, S. and Zhang, C.-H. (2008). Adaptive Lasso for sparse highdimensional regression. Statistica Sinica 18 1603–1618.

- Huang et al. [2006] Huang, J. Z., Liu, N., Pourahmadi, M. and Liu, L. (2006). Covariance matrix selection and estimation via penalised normal likelihood. Biometrika 93 85–98.

- Johnstone [2001] Johnstone, I. (2001). Chi-square oracle inequalities. In State of the Art in Probability and Statistics, Festchrift for Willem R. van Zwet, M. de Gunst and C. Klaassen and A. van der Waart editors, IMS Lecture Notes - Monographs 36 399–418.

- Lam and Fan [2009] Lam, C. and Fan, J. (2009). Sparsistency and rates of convergence in large covariance matrices estimation. The Annals of Statistics 37 4254–4278.

- Levina et al. [2008] Levina, E., Rothman, A. and Zhu, J. (2008). Sparse estimation of large covariance matrices via a nested Lasso penalty. The Annals of Applied Statistics 2 245–263.

- Meinshausen [2007] Meinshausen, N. (2007). Relaxed Lasso. Computational Statistics and Data Analysis 52 374–393.

- Meinshausen [2008] Meinshausen, N. (2008). A note on the Lasso for gaussian graphical model selection. Statistics and Probability Letters 78 880–884.

- Meinshausen and Bühlmann [2006] Meinshausen, N. and Bühlmann, P. (2006). High dimensional graphs and variable selection with the Lasso. The Annals of Statistics 34 1436–1462.

- Meinshausen and Yu [2009] Meinshausen, N. and Yu, B. (2009). Lasso-type recovery of sparse representations for high-dimensional data. Annals of Statistics 37 246–270.

- Peng et al. [2009] Peng, J., Wang, P., Zhou, N. and Zhu, J. (2009). Partial correlation estimation by joint sparse regression models. Journal of the American Statistical Association 104 735–746.

- Ravikumar et al. [2008] Ravikumar, P., Wainwright, M., Raskutti, G. and Yu, B. (2008). High-dimensional covariance estimation by minimizing -penalized log-determinant divergence. In Advances in Neural Information Processing Systems. MIT Press. Longer version in arXiv:0811.3628v1.

- Rothman et al. [2008] Rothman, A. J., Bickel, P. J., Levina, E. and Zhu, J. (2008). Sparse permutation invariant covariance estimation. Electronic Journal of Statistics 2 494–515.

- Rudelson and Zhou [2011] Rudelson, M. and Zhou, S. (2011). Reconstruction from anisotropic random measurements. ArXiv:1106.1151; University of Michigan, Department of Statistics, Technical Report 522.

- Rütimann and Bühlmann [2009] Rütimann, P. and Bühlmann, P. (2009). High dimensional sparse covariance estimation via directed acyclic graphs. Electronic Journal of Statistics 3 1133–1160.

- Uhler [2011] Uhler, C. (2011). Geometry of maximum likelihood estimation in gaussian graphical models. ArXiv:1012.2643v1.

- van de Geer et al. [2010] van de Geer, S., Bühlmann, P. and Zhou, S. (2010). The adaptive and the thresholded Lasso for potentially misspecified models. ArXiv:1001.5176v3.

- Verzelen [2010] Verzelen, N. (2010). Adaptive estimation of covariance matrices via cholesky decomposition. Electronic Journal of Statistics 4 1113–1150.

- West et al. [2001] West, M., Blanchette, C., Dressman, H., Huang, E., Ishida, S., Spang, R., Zuzan, H., Jr., J. O., Marks, J. and Nevins, J. (2001). Predicting the clinical status of human breast cancer by using gene expression profiles. PNAS 98 11462–11467.

- Wille et al. [2004] Wille, A., Zimmermann, P., Vranova, E., Fürholz, A., Laule, O., Bleuler, S., Hennig, L., Prelic, A., von Rohr, P., Thiele, L., Zitzler, E., Gruissem, W. and Bühlmann, P. (2004). Sparse graphical Gaussian modeling of the isoprenoid gene network in arabidopsis thaliana. Genome Biology 5 R92.

- Wu and Pourahmadi [2003] Wu, W. B. and Pourahmadi, M. (2003). Nonparametric estimation of large covariance matrices of longitudinal data. Biometrika 90 831–844.

- Yuan and Lin [2007] Yuan, M. and Lin, Y. (2007). Model selection and estimation in the gaussian graphical model. Biometrika 94 19–35.

- Zhao and Yu [2006] Zhao, P. and Yu, B. (2006). On model selection consistency of Lasso. Journal of Machine Learning Research 7 2541–2563.

- Zhou [2009] Zhou, S. (2009). Thresholding procedures for high dimensional variable selection and statistical estimation. In Advances in Neural Information Processing Systems 22. MIT Press.

- Zhou [2010a] Zhou, S. (2010a). Restricted eigenvalue conditions on subgaussian random matrices. Manuscript, earlier version in arXiv:0904.4723v2.

- Zhou [2010b] Zhou, S. (2010b). Thresholded Lasso for high dimensional variable selection and statistical estimation. ArXiv:1002.1583v2, University of Michigan, Department of Statistics Technical Report 511.

- Zhou et al. [2008] Zhou, S., Lafferty, J. and Wasserman, L. (2008). Time varying undirected graphs. In Proceedings of the 21st Annual Conference on Computational Learning Theory (COLT’08).

- Zhou et al. [2009] Zhou, S., van de Geer, S. and Bühlmann, P. (2009). Adaptive Lasso for high dimensional regression and gaussian graphical modeling. ArXiv:0903.2515.

- Zou [2006] Zou, H. (2006). The adaptive Lasso and its oracle properties. Journal of the American Statistical Association 101 1418–1429.

- Zou and Li [2008] Zou, H. and Li, R. (2008). One-step sparse estimates in nonconcave penalized likelihood models. The Annals of Statistics 36 1509–1533.