LABEL:sub@\par

Scaling and multiscaling

in financial series:

a simple model

Abstract.

We propose a simple stochastic volatility model which is analytically tractable, very easy to simulate and which captures some relevant stylized facts of financial assets, including scaling properties. In particular, the model displays a crossover in the log-return distribution from power-law tails (small time) to a Gaussian behavior (large time), slow decay in the volatility autocorrelation and multiscaling of moments. Despite its few parameters, the model is able to fit several key features of the time series of financial indexes, such as the Dow Jones Industrial Average, with a remarkable accuracy.

Key words and phrases:

Financial Index, Time Series, Scaling, Multiscaling, Brownian Motion, Stochastic Volatility, Heavy Tails, Multifractal Models.2010 Mathematics Subject Classification:

60G44, 91B25, 91G701. Introduction

1.1. Modeling financial assets

Recent developments in stochastic modelling of time series have been strongly influenced by the analysis of financial assets, such as exchange rates, stocks, and market indexes. The basic model, that has given rise to the celebrated Black & Scholes formula [22, 23], assumes that the logarithm of the price of the asset, after subtracting the trend, evolves through the simple equation

| (1.1) |

where (the volatility) is a constant and is a standard Brownian motion. It has been well-know for a long time that, despite its success, this model is not consistent with a number of stylized facts that are empirically detected in many real time series, e.g.:

-

•

the volatility is not constant and may exhibit high peaks, that may be interpreted as shocks in the market;

-

•

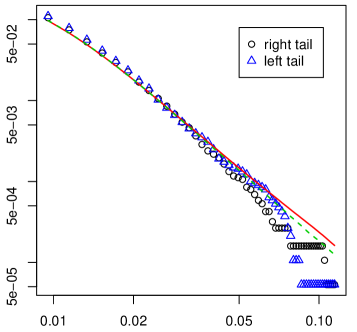

the empirical distribution of the increments of the logarithm of the price — called log-returns — is non Gaussian, displaying power-law tails (see Figure 4LABEL:sub@fig:dji_tails below), especially for small values of the time span , while a Gaussian shape is approximately recovered for large values of ;

-

•

log-returns corresponding to disjoint time-interval are uncorrelated, but not independent: in fact, the correlation between the absolute values and — called volatility autocorrelation — is positive (clustering of volatility) and has a slow decay in (long memory), at least up to moderate values for (cf. Figure 3LABEL:sub@fig:compdji_corr400log-LABEL:sub@fig:compdji_corr400loglog below).

In order to account for these facts, a very popular choice in the literature of mathematical finance and financial economics has been to upgrade the basic model (1.1), allowing to vary with and to be itself a stochastic process. This produces a wide class of processes, known as stochastic volatility models, determined by the process , which are able to capture (at least some of) the above-mentioned stylized facts, cf. [6, 29] and references therein.

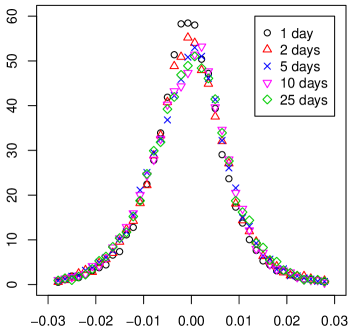

LABEL:sub@fig:diffusive The empirical densities of the log-returns over 1, 2, 5, 10, 25 days show a remarkable overlap under diffusive scaling.

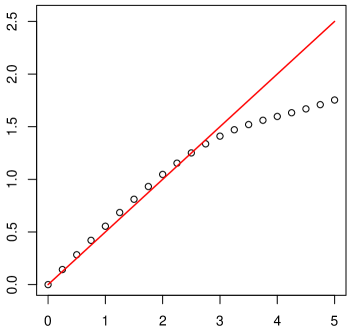

LABEL:sub@fig:multiscaling1 The scaling exponent as a function of , defined by the relation (cf. (1.4)), bends down from the Gaussian behavior (red line) for . The quantity is evaluated empirically through a linear interpolation of versus for (cf. section 7 for more details).

More recently, other stylized facts have been pointed out concerning the scaling properties of the empirical distribution of the log-returns. Given a daily time series over a period of days, denote by the empirical distribution of the (detrended) log-returns corresponding to an interval of days:

| (1.2) |

where is the local rate of linear growth of (see section 7 for details) and denotes the Dirac measure at . The statistical analysis of various financial series, such as the Dow Jones Industrial Average (DJIA) or the Nikkei 225, shows that, for small values of , obeys approximately a diffusive scaling relation (cf. Figure 1LABEL:sub@fig:diffusive):

| (1.3) |

where is a probability density with power-law tails. Considering the -th empirical moment , defined by

| (1.4) |

from relation (1.3) it is natural to guess that should scale as . This is indeed what one observes for moments of small order (with for the DJIA). However, for moments of higher order , the different scaling relation , with , takes place, cf. Figure 1LABEL:sub@fig:multiscaling1. This is the so-called multiscaling of moments, cf. [32, 21, 20, 17].

An interesting class of models that are able to reproduce the multiscaling of moments — as well as many other features, notably the persistence of volatility on different time scales — are the so-called multifractal models, like the MMAR (Multifractal Model of Asset Returns, cf. [14]) and the MSM (Markov-Switching Multifractal, cf. [13]). These models describe the evolution of the detrended log-price as a random time-change of Brownian motion: , where the time-change is a continuous and increasing process, sometimes called trading time, which displays multifractal features and is usually taken to be independent of the Brownian motion (cf. [12] for more details).

Modeling financial series through a random time-change of Brownian motion is a classical topic, dating back to Clark [15], and reflects the natural idea that external information influences the speed at which exchanges take place in a market. It should be stressed that, under the mild regularity assumption that the time-change has absolutely continuous paths a.s., any random time-change of Brownian motion can be written as a stochastic volatility model , and viceversa.111More precisely, “independent random time changes of Brownian motion with absolutely continuous time-change” — that is, processes such that , where is a Brownian motion and is an independent process with increasing and absolutely continuous paths a.s. — and “stochastic volatility models with independent volatility” — that is, processes such that , where is a Brownian motion and is an independent process with paths in a.s. — are the same class of processes, cf. [6, 29]. The link between the two representations and is given by and . However, a key feature of multifractal models is precisely that their trading time has non absolutely continuous paths a.s., hence they cannot be expressed as stochastic volatility models. This makes their analysis harder, as the standard tools available for Ito diffusions cannot be applied.

The purpose of this paper is to define a simple stochastic volatility model — or, equivalently, an independent random time change of Brownian motion, where the time-change process has absolutely continuous paths — which agrees with all the above mentioned stylized facts, displaying in particular a crossover in the log-return distribution from a power-law to a Gaussian behavior, slow decay in the volatility autocorrelation, diffusive scaling and multiscaling of moments. In its most basic version, the model contains only three real parameters and is defined as a simple, deterministic function of a Brownian motion and an independent Poisson process. This makes the process analytically tractable and very easy to simulate. Despite its few degrees of freedom, the model is able to fit remarkably well several key features of the time series of the main financial indexes, such as DJIA, S&P 500, FTSE 100, Nikkei 225. In this paper we present a detailed numerical analysis on the DJIA.

Let us mention that there are subtler stylized facts that are not properly accounted by our model, such as the multi-scale intermittency of the volatility profile, the possible skewness of the log-return distribution and the so-called leverage effect (negative correlation between log-returns and future volatilities), cf. [16]. As we discuss in section 3, such features — that are relevant in the analysis of particular assets — can be incorporated in our model in a natural way. Generalizations in this sense are currently under investigation, as are the performances of our model in financial problems, like the pricing of options (cf. A. Andreloli’s Ph.D. Thesis [2]). In this article we stick for simplicity to the most basic formulation.

Finally, although we work in the framework of stochastic volatility models, we point out that an important alternative class of models in discrete time, widely used in the econometric literature, is given by autoregressive processes such as ARCH, GARCH, FIGARCH and their generalizations, cf. [18, 8, 5, 9]. More recently, continuous-time versions have been studied as well, cf. [24, 25]. With no aim for completeness, let us mention that GARCH and FIGARCH do not display multiscaling of moments, cf. [12, §8.1.4]. We have also tested the model recently proposed in [10], which is extremely accurate to fit the statistics of the empirical volatility, and it does exhibit multiscaling of moments. The price to pay is, however, that the model requires the calibration of more than 30 parameters.

We conclude noting that long memory effects in autoregressive models are obtained through a suitable dependence on the past in the equation for the volatility, while large price variations are usually controlled by specific features of the driving noise. In our model, we propose a single mechanism, modeling the reaction of the market to shocks, which is the source of all the mentioned stylized facts.

1.2. Content of the paper

The paper is organized as follows.

-

•

In section 2 we give the definition of our model, we state its main properties and we discuss its ability to fit the DJIA time series in the period 1935-2009.

-

•

In section 3 we discuss some key features and limitations of our model, point out possible generalizations, and compare it with other models.

- •

-

•

In section 7 we discuss more in detail the numerical comparison between our model and the DJIA time series.

- •

1.3. Notation

Throughout the paper, the indexes run over real numbers while run over integers, so that means while means . The symbol “” denotes asymptotic equivalence for positive sequences ( if and only if as ) and also equality in law for random variables, like . Given two real functions and , we write as if there exists such that for in a neighborhood of , while we write if as ; in particular, (resp. ) is a bounded (resp. a vanishing) quantity. The standard exponential and Poisson laws are denoted by and , for : means that for all while means that for all . We sometimes write to denote a positive constant, whose value may change from place to place.

2. The model and the main results

We introduce our model as an independent random time change of a Brownian motion, in the spirit e.g. of [15] and [4]. An alternative and equivalent definition, as a stochastic volatility model, is illustrated in section 2.2.

2.1. Definition of the model

In its basic version, our model contains only three real parameters:

-

•

is the inverse of the average waiting time between “shocks” in the market;

-

•

determines the sub-linear time change , which expresses the “trading time” after shocks;

-

•

is proportional to the average volatility.

In order to have more flexibility, we actually let be a random parameter, i.e., a positive random variable, whose distribution becomes the relevant parameter:

-

•

is a probability on , connected to the volatility distribution.

Remark 1.

When the model is calibrated to the main financial indexes (DJIA, S&P 500, FTSE 100, Nikkei 225), the best fitting turns out to be obtained for a nearly constant . In any case, we stess that the main properties of the model are only marginally dependent on the law of : in particular, the first two moments of , i.e. and , are enough to determine the features of our model that are relevant for real-world times series, cf. Remark 10 below. Therefore, roughly speaking, we could say that in the general case of random our model has four “effective” real parameters.

Beyond the parameters , we need the following three sources of alea:

-

•

a standard Brownian motion ;

-

•

a Poisson point process on with intensity ;

-

•

a sequence of independent and identically distributed positive random variables with law (so that for all ); and for conciseness we denote by a variable with the same law .

We assume that are defined on some probability space and that they are independent. By convention, we label the points of so that . We will actually need only the points , and we recall that the random variables , , are independent and identically distributed with marginal laws . In particular, is the mean distance between the points in , except for and , whose average distance is . Although some of our results would hold for more general distributions of , we stick for simplicity to the (rather natural) choice of a Poisson process.

For , we define

| (2.1) |

so that is the location of the last point in before . Plainly, . Then we introduce the basic process defined by

| (2.2) |

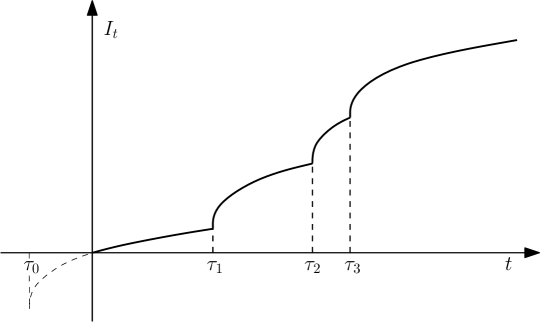

with the agreement that the sum in the right hand side is zero if . More explicitly, is a continuous process with and for . We note that the derivative is a stationary regenerative process, cf. [3]. See Figure 2 for a sample trajectory of when .

We then define our model by setting

| (2.3) |

In words: our model is an random time change of the Brownian motion through the time-change process . Note that is a strictly increasing process with absolutely continuous paths, and it is independent of .

When and is constant, we have and the model reduces to Black & Scholes with volatility . On the other hand, when , the paths of are singular (non differentiable) at the points in , cf. Figure 2. This suggests a possible financial interpretation of the instants in as the epochs at which big shocks arrive in the market, making the volatility jump to infinity. This will be more apparent in next subsection, where we give a stochastic volatility formulation of the model. We point out that the singularity is produced by the sub-linear time change , that was first suggested by F. Baldovin and A. Stella in [7, 31] (their model is described in appendix B).

2.2. Basic properties

Let us state some basic properties of our model, that will be proved in section 6.

-

(A)

The process has stationary increments.

-

(B)

The following relation between moments of and holds: for any

(2.4) -

(C)

The process can be represented as a stochastic volatility model:

(2.5) where is a standard Brownian motion and is an independent process, defined by (denoting )

(2.6) Note that, whenever , the volatility has singularities at the random times .

-

(D)

The process is a zero-mean, square-integrable martingale (provided ).

Remark 2.

Remark 3.

It follows from (2.4) that if is chosen as a deterministic constant, then admits moments of all order (actually, even exponential moments, cf. Proposition 11 in section 6). This seems to indicate that to see power-law tails in the distribution of — one of the basic stylized facts mentioned in the introduction — requires to take with power-law tails. This, however, is not true, and is one on the surprising features of the simple model we propose: for typical choices of the parameters of our model, the distribution of displays a power-law tail behavior up to several standard deviations from the mean, irrespective of the law of . Thus, the eventually light tails are “invisible” for all practical purposes and real heavy-tailed distributions appear to be unnecessary to fit data. We discuss this issue below, cf. Remark 5, after having stated some results; see also subsection 2.4 and Figure 4LABEL:sub@fig:dji_tails for a graphical comparisons with the DJIA time series.

Another important property of the process is that its increments are mixing, as we show in section 6. This entails in particular that for every , and for every choice of the intervals , …, and of the measurable function , we have almost surely

| (2.7) |

provided the expectation appearing in the right hand side is well defined. In words: the empirical average of a function of the increments of the process over a long time period is close to its expected value.

Thanks to this property, our main results concerning the distribution of the increments of the process , that we state in the next subsection, are of direct relevance for the comparison of our model with real data series. Some care is needed, however, because the accessible time length in (2.7) may not be large enough to ensure that the empirical averages are close to their limit. We elaborate more on this issue in section 7, where we compare our model with the DJIA data from a numerical viewpoint.

2.3. The main results

We now state our main results for our model , that correspond to the basic stylized facts mentioned in the introduction: diffusive scaling and crossover of the log-return distribution (Theorem 4); multiscaling of moments (Theorem 6 and Corollary 7); clustering of volatility (Theorem 8 and Corollary 9).

Our first result, proved in section 4, shows that the increments have an approximate diffusive scaling both when , with a heavy-tailed limit distribution (in agreement with (1.3)), and when , with a normal limit distribution. This is a precise mathematical formulation of a crossover phenomenon in the log-return distribution, from approximately heavy-tailed (for small time) to approximately Gaussian (for large time).

Theorem 4 (Diffusive scaling).

The following convergences in distribution hold for any choice of the parameters and of the law of .

-

•

Small-time diffusive scaling:

(2.8) where , and are independent random variables. The density is thus a mixture of centered Gaussian densities and, when , has power-law tails: more precisely, if for all ,

(2.9) -

•

Large-time diffusive scaling: if

(2.10) where denotes Euler’s Gamma function.

Remark 5.

We have already observed that, when has finite moments of all orders, for the increment has finite moments of all orders too, cf. (2.4), so there are no heavy tails in the strict sense. However, for small, the heavy-tailed density is by (2.8) an excellent approximation for the true distribution of up to a certain distance from the mean, which can be quite large. For instance, when the parameters of our model are calibrated to the DJIA time series, these “apparent power-law tails” are clearly visible for (daily log-returns) up to a distance of about six standard deviations from the mean, cf. subsection 2.4 and Figure 4LABEL:sub@fig:dji_tails below.

We also note that the moment condition (2.9) follows immediately from (2.8): in fact, when has finite moments of all orders,

| (2.11) |

which clearly happens if and only if . This also shows that the heavy tails of depend on the fact that the density of the random variable , which represents (up to a constant) the distance between points in , is strictly positive around zero, and not on other details of the exponential distribution.

The power-law tails of have striking consequences on the scaling behavior of the moments of the increments of our model. If we set for

| (2.12) |

the natural scaling as , that one would naively guess from (2.8), breaks down for , when the faster scaling holds instead, the reason being precisely the fact that the -moment of is infinite for . More precisely, we have the following result, that we prove in section 4.

Theorem 6 (Multiscaling of moments).

Let , and assume . The quantity in (2.12) is finite and has the following asymptotic behavior as :

The constant is given by

| (2.13) |

where denotes Euler’s Gamma function.

Corollary 7.

The following relation holds true:

| (2.14) |

The explicit form (2.13) of the multiplicative constant will be used in section 7 for the estimation of the parameters of our model on the DJIA time series.

Our last theoretical result, proved in section 5, concerns the correlations of the absolute value of two increments, usually called volatility autocorrelation. We start determining the behavior of the covariance.

Theorem 8.

Assume that . The following relation holds as , for all :

| (2.15) |

where

| (2.16) |

and is independent of .

We recall that is the correlation coefficient of two random variables . As Theorem 6 yields

where is independent of , we easily obtain the following result.

Corollary 9 (Volatility autocorrelation).

Assume that . The following relation holds as , for all :

| (2.17) |

where is defined in (2.16) and , , are independent random variables.

This shows that the volatility autocorrelation of our process decays exponentially fast for time scales larger than the mean distance between the epochs . However, for shorter time scales the relevant contribution is given by the function . By (2.16) we can write

| (2.18) |

where . When , as the two terms in the right hand side decay as

| (2.19) |

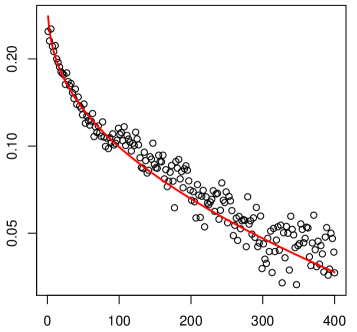

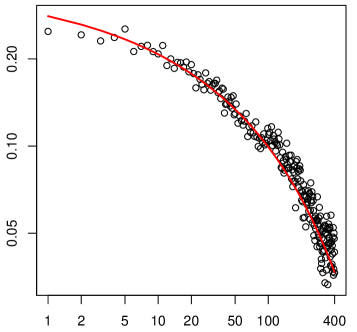

where are positive constants, hence has a power-law behavior as . For , which is the relevant regime, the decay of is, roughly speaking, slower than exponential but faster than polynomial (see Figures 3LABEL:sub@fig:compdji_corr400log and 3LABEL:sub@fig:compdji_corr400loglog).

2.4. Fitting the DJIA time series

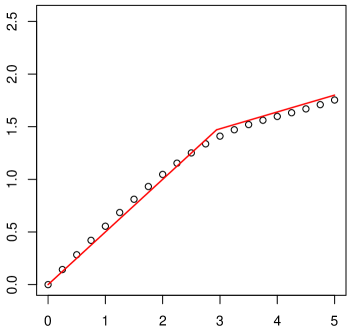

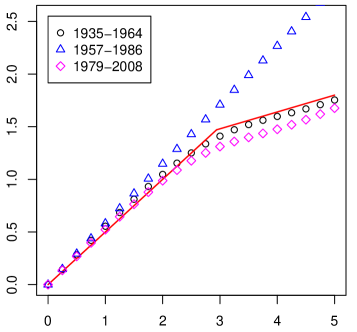

LABEL:sub@fig:compmultiscaling2 The DJIA empirical scaling exponent (circles) and the theoretical scaling exponent (line) as a function of .

LABEL:sub@fig:compdji_corr400log Log plot for the DJIA empirical 1-day volatility autocorrelation (circles) and the theoretical prediction (line), as functions of (days). For clarity, only one data out of two is plotted.

LABEL:sub@fig:compdji_corr400loglog Same as LABEL:sub@fig:compdji_corr400log, but log-log plot instead of log plot. For clarity, for only one data out of two is plotted.

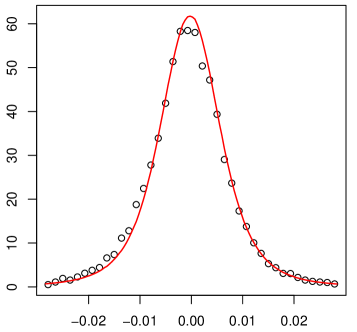

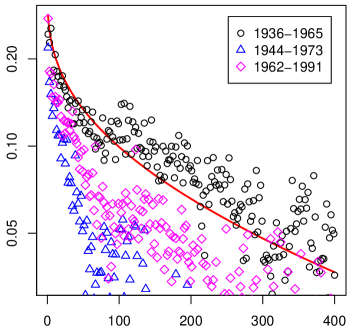

LABEL:sub@fig:dji_distr The density of the DJIA log-return empirical distribution (circles) and the theoretical prediction (line). The plot ranges from zero to about three standard deviations () from the mean.

LABEL:sub@fig:dji_tails Log-log plot of the right and left integrated tails of the DJIA log-return empirical distribution (circles and triangles) and of the theoretical prediction (solid line). The plot ranges from one to about twelve standard deviations from the mean. Also plotted is the asymptotic density (dashed line) defined in equation (2.8).

We now consider some aspects of our model from a numerical viewpoint. More precisely, we have compared the theoretical predictions and the simulated data of our model with the time series of some of the main financial indexes (DJIA, S&P 500, FTSE 100 and Nikkei 225), finding a very good agreement. Here we describe in detail the case of the DJIA time series over a period of 75 years: we have considered the DJIA opening prices from 2 Jan 1935 to 31 Dec 2009, for a total of 18849 daily data.

The four real parameters of our model have been chosen to optimize the fitting of the scaling function of the moments (see Corollary 7), which only depends on , and the curve of the volatility autocorrelation (see Corollary 9), which depends on (more details on the parameter estimation are illustrated in section 7). We have obtained the following numerical estimates:

| (2.20) |

Note that the estimated standard deviation of is negligible, so that is “nearly constant”. We point out that the same is true for the other financial indexes that we have tested. In particular, in these cases there is no need to specify other details of the distribution of and our model is completely determined by the numerical values in (2.20).

As we show in Figure 3, there is an excellent fitting of the theoretical predictions to the observed data. We find remarkable that a rather simple mechanism of (relatively rare) volatilty shocks can account for the nontrivial profile of both the multiscaling exponent , cf. Figure 3LABEL:sub@fig:compmultiscaling2, and the volatility autocorrelation , cf. Figure 3LABEL:sub@fig:compdji_corr400log-LABEL:sub@fig:compdji_corr400loglog.

Last but not least, we have considered the distribution of daily log-returns: Figure 4 compares both the density and the integrated tails of the log-return empirical distribution, cf. (1.2), with the theoretical predictions of our model, i.e., the law of . The agreement is remarkable, especially because the empirical distributions of log-returns was not used for the calibration the model. This accuracy can therefore be regarded as structural property of the model.

In Figure 4LABEL:sub@fig:dji_tails we have plotted the density of , represented by the red solid line, and the asymptotic limiting density appearing in equation (2.8) of Theorem 4, represented by the green dashed line. The two functions are practically indistinguishable up to six standard deviations from the mean, and still very close in the whole plotted range. We stress that is a rather explicit function, cf. equation (2.8). Also note that the log-log plot in Figure 4LABEL:sub@fig:dji_tails shows a clear power-law decay, as one would expect from (the eventually light tails of are invisible).

Remark 10.

We point out that, even if we had found (as could happen for different assets), detailed properties of the distribution of are not expected to be detectable from data — nor are they relevant. Indeed, the estimated mean distance between the successive epochs of the Poisson process is days, cf. (2.20). Therefore, in a time period of the length of the DJIA time series we are considering, only variables are expected to be sampled, which is certainly not enough to allow more than a rough estimation of the distribution of . This should be viewed more as a robustness than a limitation of our model: even when is non-constant, its first two moments contain the information which is relevant for application to real data.

3. Discussion and further developments

Now that we have stated the main properties of the model, we can discuss more in depth its strength as well as its limitations, and consider possible generalizations.

3.1. On the role of parameters

A key feature of our model is its rigid structure. Let us focus for simplicity on the case in which is a constant (which, as we have discussed, is relevant for financial indexes). Not only is the model characterized by just three real parameters : the role of and is reduced to simple scale factors. In fact, if we change the value of and in our process , keeping fixed, the new process has the same distribution as for suitable (depending of ), as it is clear from the definition (2.2) of . This means that is the only parameter that truly changes the shape (beyond simple scale factors) of the relevant quantities of our model, as it is also clear from the explicit expressions we have derived for the small-time and large-time asymptotic distribution (Theorem 4), mulstiscaling of moments (Theorem 6) and volatility autocorrelation (Theorem 8).

More concretely, the structure of our model imposes strict relations between different quantities: for instance, the moment beyond which one observes anomalous scaling, cf. (2.14), coincides with the power-law tail exponent of the (approximate) log-return distribution for small time, cf. (2.9), and is also linked (through ) to the slow decay of the volatility autocorrelation from short to moderate time of the, cf. (2.18) and (2.19). The fact that these quantitative constraints are indeed observed on the DJIA time series, cf. Figures 3 and 4, is not obvious a priori and is therefore particularly noteworthy.

3.2. On the comparison with multifractal models

As we observed in the introduction, the multiscaling of moments is a key feature of multifractal models. These are random time-changes of Brownian motion , like our model, with the important difference that the time-change process is rather singular, having non absolutely continuous paths. Since in our case the time-change process is quite regular and explicit, our model can be analyzed with more standard and elementary tools and is very easy to simulate.

A key property of multifractal models, which is at the origin of their multiscaling features, is that the law of has power-law tails, for every . On the other hand, as we already discussed, the law of in our model has finite moments of all orders — at least when for every , which is the typical case. In a sense, the source of multiscaling in our model is analogous, because (approximate) power-law tails appear in the distribution of in the limit , but the point is that “true” power-law tails in the distribution of are not necessary to have multiscaling properties.

We remark that the multiscaling exponent of our model is piecewise linear with two different slopes, thus describing a biscaling phenomenon. Multifractal models are very flexible in this respect, allowing for a much wider class of behavior of . It appears however that a biscaling exponent is compatible with the time series of financial indexes (cf. also Remark 14 below).

We conclude with a semi-heuristic argument, which illustrates how heavy tails and multiscaling arise in our model. On the event we can write, by (2.2), and therefore . Consequently we get the bound

| (3.1) |

which allows to draw a couple of interesting consequences.

-

•

Relation (3.1) yields the lower bound on the moments of our process. Since for , this shows that the usual scaling cannot hold for .

- •

3.3. On the stochastic volatility model representation

We recall that our process can be written as a stochastic volatility model , cf. (2.5). It is interesting to note that the squared volatility is the stationary solution of the following stochastic differential equation:

| (3.2) |

where we recall that is an ordinary Poisson process, while is a constant and is a piecewise-constant function, defined by

We stress that is a pathwise solution of equation (3.2), i.e., it solves the equation for any fixed realization of the stochastic processes and . The infinite coefficient of the driving Poisson noise is no problem: in fact, thanks to the superlinear drift term , the solution starting from infinity becomes instantaneously finite.222Note that the ordinary differential equation with has the explicit solution where .

The representation (3.2) of the volatility is also useful to understand the limitations of our model and to design possible generalizations. For instance, according to (3.2), the volatility has the rather unrealistic feature of being deterministic between jumps. This limitation could be weakened in various way, e.g. by replacing in (3.2) with a more general Levy subordinator, and/or adding to the volatility a continuous random component. Such addition should allow a more accurate description of the intermittent structure of the volatility profile, in the spirit of multifractal models.

In a sense, the model we have presented describes only the relatively rare big jumps of the volatility, ignoring the smaller random fluctuations that are present on smaller time scales. Besides obvious simplicity considerations, one of our aims is to point out that these big jumps, together with a nonlinear drift term as in (3.2), are sufficient to explain in a rather accurate way the several stylized facts we have discussed.

3.4. On the skewness and leverage effect

Our model predicts an even distribution for , but it is known that several financial assets data exhibit a nonzero skewness. A reasonable way to introduce skewness is through the so-called leverage effect. This can be achieved, e.g., by modifying the stochastic volatility representation, given in equations (2.5) and (3.2), as follows:

where . In other words, when the volatility jumps (upward), the price jumps downward by an amount . The effect of this extension of the model is currently under investigation.

3.5. On further developments

A bivariate version of our model, where the two components are driven by possibly correlated Poisson point processes , has been investigated by P. Pigato in his Master’s Thesis [27]. The model has been numerically calibrated on the joint time series of the DJIA and FTSE 100 indexes, finding in particular a very good agreement for the volatility cross-correlation between the two indexes: for this quantity, the model predicts the same decay profile as for the individual volatility autocorrelations, a fact which is not obvious a priori and is indeed observed on the real data.

We point out that an important ingredient in the numerical analysis on the bivariate model is a clever algorithm for finding the location of the relevant big jumps in the volatility (a concept which is of course not trivially defined). Such an algorithm has been devised by M. Bonino in his Master’s Thesis [11], which deals with portfolio optimization problems in the framework of our model.

4. Scaling and multiscaling: proof of Theorems 4 and 6

We observe that for all fixed we have the equality in law , as it follows by the definition of our model . We also observe that , as it follows from (2.1) and the properties of the Poisson process.

4.1. Proof of Theorem 4

Since as , we may focus on the event , on which we have , with . In particular,

Since , the convergence in distribution (2.8) follows:

Next we focus on the case . Under the assumption , the random variables are independent and identically distributed with finite mean, hence by the strong law of large numbers

Plainly, a.s., by the strong law of large numbers applied to the random variables . Recalling (2.2), it follows easily that

Since , we obtain the convergence in distribution

which coincides with (2.10).∎

4.2. Proof of Theorem 6

Since , we can write

| (4.1) |

where we set . We therefore focus on , that we write as the sum of three terms, that will be analyzed separately:

| (4.2) |

For the first term in the right hand side of (4.2), we note that as and that on the event . Setting with , we obtain as

| (4.3) |

Recalling that , we have

As we have and note that is finite if and only if , that is . Therefore the monotone convergence theorem yields

| (4.4) |

Next observe that, by the change of variables , we can write

| (4.5) |

Note that as and that if and only if . Therefore, again by the monotone convergence theorem, we obtain

| (4.6) |

Finally, in the case we have as and we want to study the integral in the second line of (4.5). Fix an arbitrary (large) and note that, integrating by parts and performing a change of variables, as we have

From this it is easy to see that as

Coming back to (4.5), noting that for , it follows that

| (4.7) |

Recalling (4.1) and (4.3), the relations (4.4), (4.6) and (4.7) show that the first term in the right hand side of (4.2) has the same asymptotic behavior as in the statement of the theorem, except for the regime where the constant does not match (the missing contribution will be obtained in a moment).

We now focus on the second term in the right hand side of (4.2). Note that, conditionally on the event , we have

where and (uniformly distributed on the interval ) are independent of and . Since as , we obtain

| (4.8) |

Since as , for every , by the dominated convergence theorem we have (for every )

| (4.9) |

This shows that the second term in the right hand side of (4.2) gives a contribution of the order as . This is relevant only for , because for the first term gives a much bigger contribution of the order (see (4.4) and (4.7)). Recalling (4.1), it follows from (4.9) and (4.6) that the contribution of the first and the second term in the right hand side of (4.2) matches the statement of the theorem (including the constant).

It only remains to show that the third term in the right hand side of (4.2) gives a negligible contribution. We begin by deriving a simple upper bound for . Since for all (we recall that ), when , i.e. , we can write

| (4.10) |

where we agree that the sum over is zero if . Since for all , by the definition (2.1) of , relation (4.10) yields the bound , which holds clearly also when . In conclusion, we have shown that for all

| (4.11) |

Consider first the case : by Jensen’s inequality we have

| (4.12) |

By (4.11) and (4.12) we obtain

| (4.13) |

A corresponding inequality for is derived from (4.11) and the inequality , which holds for every non-negative sequence :

| (4.14) |

For any fixed , by the Hölder inequality with and we can write for

| (4.15) |

because (recall that ) and as . Then it follows from (4.13) and (4.14) and (4.15) that

This shows that the contribution of the third term in the right hand side of (4.2) is always negligible with respect to the contribution of the second term (recall (4.9)).∎

5. Decay of correlations: proof of Theorem 8

Given a Borel set , we let denote the -algebra generated by the family of random variables . Informally, may be viewed as the -algebra generated by the variables for the values of such that . From the basic property of the Poisson process and from the fact that the variables are independent, it follows that for disjoint Borel sets the -algebras , are independent. We set for short , which is by definition the -algebra generated by all the variables and , which coincides with the -algebra generated by the process .

We have to prove (2.15). Plainly, by translation invariance we can set without loss of generality. We also assume that . We start writing

| (5.1) |

We recall that and the process is -measurable and independent of the process . It follows that, conditionally on , the process has independent increments, hence the second term in the right hand side of (5.1) vanishes, because a.s.. For fixed , from the equality in law it follows that , where . Analogously and (5.1) reduces to

| (5.2) |

Recall the definitions (2.1) and (2.2) of the variabes and . We now claim that we can replace by in (5.2). In fact from (2.2) we can write

where we agree that the sum in the right hand side is zero if . This shows that is a function of the variables with index . Since , this means that is -measurable, hence independent of , which is clearly -measurable. This shows that , therefore from (5.2) we can write

| (5.3) |

Now we decompose this last covariance as follows:

| (5.4) |

We deal separately with the two terms in the r.h.s. of (5.4). The first gives the dominant contribution. To see this, observe that, on

and

Since both and are independent of , we have

| (5.5) |

Since as , by monotone convergence we obtain

| (5.6) |

with and is defined in (2.16). Similarly

| (5.7) |

Therefore, if we show that

| (5.8) |

using (5.5), (5.6), (5.7), we have

| (5.9) |

To complete the proof of (5.9), we are left to show (5.8). But this is a nearly immediate consequence of Theorem 6: indeed, using (2.13) and the fact that ,

6. Basic properties of the model

In this Section we start by proving the properties (A)-(B)-(C)-(D) stated in section 2.2. Then we provide some connections between the tails of and those of , also beyond the equivalence stated in (2.4). Finally, we establish a mixing property that yields relation (2.7). One of the proofs is postponed to the Appendix.

We denote by the -field generated by the whole process , which coincides with the -field generated by the sequences and .

Proof of property (A). We first focus on the process , defined in (2.2). For let and denote the points in by . As before, let be the largest point of smaller that , i.e., . Recalling the definition (2.2), we can write

where we agree that the sum in the right hand side is zero if . This relation shows that and are the same function of the two random sets and . Since and have the same distribution (both are Poisson point processes on with intensity ), the processes and have the same distribution too.

We recall that is the -field generated by the whole process . From the definition and from the fact that Brownian motion has independent, stationary increments, it follows that for every Borel subset

where we have used the stationarity property of the process . Thus the processes and have the same distribution, which implies stationarity of the increments.∎

Proof of property (B). Note that , by the independence of and and the scaling properties of Brownian motion. We are therefore left with showing that

| (6.1) |

The implication “” is easy: by the definition (2.2) of the process we can write

therefore if then also .

The implication “” follows immediately from the bounds (4.13) and (4.14), which hold also without the indicator . ∎

Proof of property (C). Observe first that a.s. and for Lebesgue–a.e. . By a change of variable, we can rewrite the process defined in (2.6) as

which shows that relation (2.5) holds true. It remains to show that is indeed a standard Brownian motion. Note that

Therefore, conditionally on (the -field generated by ), is a centered Gaussian process — it is a Wiener integral — with conditional covariance given by

This shows that, conditionally on , is a Brownian motion. Therefore, it is a fortiori a Brownian motion without conditioning.∎

Proof of property (D). The assumption ensures that for all , as we have already shown. Let us now denote by the natural filtration of the process . We recall that denotes the -field generated by the whole process and we denote by the smallest -field containing and . Since for all , by the basic properties of Brownian motion, recalling that we obtain

Taking the conditional expectation with respect to on both sides, we obtain the martingale property for .∎

Let us state a proposition, proved in Appendix A, that relates the exponential moments of to those of . We recall that, when our model is calibrated to real time series, like the DJIA, the “observable tails” of are quite insensitive to the details of the distribution of , cf. Remarks 3 and 5.

Proposition 11.

Regardless of the distribution of , for every we have

| (6.2) |

On the other hand, for all and we have

| (6.3) |

and the same relation holds for provided .

Note that , because , so that for the distribution of has always tails heavier than Gaussian.

We finally show a mixing property for the increments of our process. In what follows, for an interval , we let

to denote the -field generated by the increments in of the process .

Proposition 12.

Let , , with . Then, for every and

| (6.4) |

As a consequence, equation (2.7) holds true almost surely and in , for every measurable function such that .

Proof.

We recall that denotes the set and, for , denotes the -algebra generated by the family of random variables , where is the sequence of volatilities. We introduce the -measurable event

(We recall that the -field was defined at the beginning of section 5.) We claim that, for , , we have

| (6.5) |

To see this, the key is in the following two remarks.

-

•

and are independent conditionally on . This follows immediately from the independence of and . As a consequence, a.s..

-

•

Conditionally to , the family of random variables is a Gaussian process whose covariances are measurable with respect to the -field generated by the random variables . In particular, is measurable with respect to this -field. Similarly for in place of . Note also that the increment is a measurable function of the random variables

It follows that the random variable is measurable, and it is therefore independent of , which is measurable.

Thus we have

where the two remarks above have been used. Thus (6.5) is established. Finally

We finally show that equation (2.7) holds true almost surely and in , for every measurable function such that . Consider the -valued stochastic process defined by

for fixed , and , …, . The process is stationary, because we have proven in section 6 that has stationary increments. Moreover, inequality (6.4) implies that is mixing, and therefore ergodic (see e.g. [30], Ch. 5, §2, Definition 4 and Theorem 2). The existence of the limit in (2.7), both a.s. and in , is then a consequence of the classical Ergodic Theorem, (see e.g. [30], Ch. 5, §3, Theorems 1 and 2). ∎

7. Estimation and data analysis

In this Section we present the main steps that led to the calibration of the model to the DJIA over a period of 75 years; the essential results have been sketched in Section 2.4. We point out that the agreement with the S&P 500, FTSE 100 and Nikkei 225 indexes is very good as well. A systematic treatment of other time series, beyond financial indexes, still has to be done, but some preliminary analysis of single stocks shows that our model fits well some but not all of them. It would be interesting to understand which of the properties we have mentioned are linked to aggregation of several stock prices, as in the DJIA.

The data analysis, the simulations and the plots have been obtained with the software R [28]. The code we have used is publicly available on the web page http://www.matapp.unimib.it/~fcaraven/c.html.

7.1. Overview

For the numerical comparison of our process with the DJIA time series, we have decided to focus on the following quantities:

-

(a)

The multiscaling of moments, cf. Corollary 7.

-

(b)

The volatility autocorrelation decay, cf. Corollary 9.

Roughly speaking, the idea is to compute empirically these quantities on the DJIA time series and then to compare the results with the theoretical predictions of our model. This is justified by the ergodic properties of the increments of our process , cf. equation (2.7).

The first problem that one faces is the estimation of the parameters of our model: the two scalars , and the distribution of . This in principle belongs to an infinite dimensional space, but in a first time we focus on the moments and . In order to estimate , we take into account four significant quantities that depend only on these parameters:

-

•

the multiscaling coefficients and (see (2.13));

-

•

the multiscaling exponent (see (2.14));

-

•

the volatility autocorrelation function (see (2.17)).

We consider a natural loss functional which measures the distance between these theoretical quantities and the corresponding empirical ones, evaluated on the DJIA time series, see (7.3) below. We then define the estimator for as the point at which attains its overall minimum, subject to the constraint .

It turns out that the estimated values are such that , that is is nearly constant and the estimated parameters completely specify the model. (The constraint is not playing a relevant role: the unconstrained minimum nearly coincides with the constrained one.) Thus, the problem of determining the distribution of beyond its moments and does not appear in the case of the DJIA. More generally, even we had found and hence is not constant, fine details of its distribution beyond the first two moments give a negligible contribution to the properties that are relevant for application to real data series, as we observed in Remark 10.

7.2. Estimation of the parameters

Let us fix some notation: the DJIA time series will be denoted by (where ) and the corresponding detrended log-DJIA time series will be denoted by :

where is the mean log-DJIA price on the previous 250 days. (Other reasonable choices for affect the analysis only in a minor way.)

The theoretical scaling exponent is defined in (2.14) while the multiscaling constants and are given by (2.13) for and . Since (we recall that ), we can write more explicitly

| (7.1) |

Defining the corresponding empirical quantities requires some care, because the DJIA data are in discrete-time and therefore no limit is possible. We first evaluate the empirical -moment of the DJIA log-returns over days, namely

By Theorem 6, the relation should hold for small. By plotting versus one finds indeed an approximate linear behavior, for moderate values of and when is not too large (). By a standard linear regression of versus for days we therefore determine the empirical values of and on the DJIA time series, that we call and .

For what concerns the theoretical volatility autocorrelation, Corollary 9 and the stationarity of the increments of our process yield

| (7.2) |

where is independent of and and where the function is given by

cf. (2.18). Note that, although does not admit an explicit expression, it can be easily evaluated numerically. For the analogous empirical quantity, we define the empirical DJIA volatility autocorrelation over -days as the sample correlation coefficient of the two sequences and . Since no limit can be taken on discrete data, we are going to compare with for day.

We can then define a loss functional as follows:

| (7.3) |

where the constant controls a discount factor in long-range correlations. Of course, different weights for the four terms appearing in the functional could be assigned. We fix (days) and we define the estimator of the parameters of our model as the point where the functional attains its overall minimum, that is

where the constraint is due to . We expect that such an estimator has good properties, such as asymptotic consistency and normality (we omit a proof of these properties, as it goes beyond the spirit of this paper).

7.3. Graphical comparison

Having found that , the estimated variance of is equal to zero, that is is a constant. In particular, the model is completely specified and we can compare some quantities, as predicted by our model, with the corresponding numerical ones evaluated on the DJIA time series. The graphical results have been already described in section 2.4 and show a very good agreement, cf. Figure 3 for the multiscaling of moments and the volatility autocorrelation and Figure 4 for the log-return distribution.

Let us give some details about Figure 4. The theoretical distribution of our model, for which we do not have an analytic expression, can be easily evaluated numerically via Monte Carlo simulations. The analogous quantity evaluated for the DJIA time series is the empirical distribution of the sequence :

| (7.5) |

In Figure 4LABEL:sub@fig:dji_distr we have plotted the bulk of the distributions and for (daily log-returns) or, more precisely, the corresponding densities, in the range , where is the standard deviation of (i.e., the empirical standard deviation of the daily log returns evaluated on the DJIA time series). In Figure 4LABEL:sub@fig:dji_tails we have plotted the tail of , that is the function (note that for our model) and the right and left empirical tails and of , defined for by

in the range .

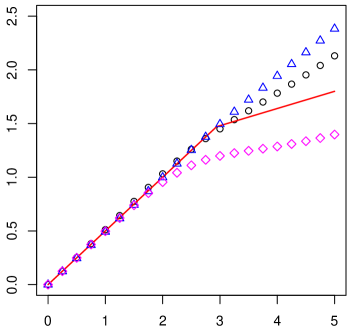

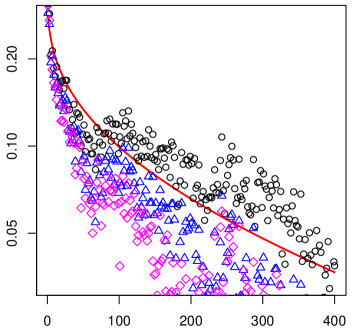

Empirical evaluation of the observables and in subperiods or 30 years for a 75-years-long time series, sampled from our model ( LABEL:sub@fig:sim_multiscaling-var and LABEL:sub@fig:sim_corr400-var) and from the DJIA time series (LABEL:sub@fig:multiscalingvar and LABEL:sub@fig:dji_corr400-var)

7.4. Variability of estimators

In this paper we have identified relatively rare but dramatic shocks in the volatility as the main common source of various stylized facts such as multiscaling, autocorrelations and heavy tails. As observed in Remark 10, the expected number of shocks in a period of 75 years is about 18, which is a rather low number; this means that empirical averages may be not very close to their ergodic limit or, in different words, estimators should have non-negligible variance. A way to detect this is to simulate data from our model for 75 years, and then compute estimators using data in different subperiods, that we have chosen of 30 years. Figure 5LABEL:sub@fig:sim_multiscaling-var and 5LABEL:sub@fig:sim_corr400-var show indeed a considerable variability of the values of the estimators for the multiscaling exponent and the volatility autocorrelations, when computed in different subperiods. We have then repeated the same computations on the DJIA time series, see Figure 5LABEL:sub@fig:multiscalingvar and 5LABEL:sub@fig:dji_corr400-var, and we have observed a similar variability. We regard this as a significant test for this model.

Remark 13.

We point out that, among the different quantities that we have considered, the scaling exponent appears to be the most sensitive. For instance, if instead of the opening prices one took the closing prices of the DJIA time series (over the same time period 1935-2009), one would obtain a different (though qualitatively similar) graph of .

Remark 14.

The multiscaling of empirical moments has been observed in several financial indexes in [17], where it is claimed that data provide solid arguments against model with linear or piecewise linear scaling exponents. Note that the theoretical scaling exponent of our model is indeed piecewise linear, cf. (2.14). However, Figure 5LABEL:sub@fig:sim_multiscaling-var shows that the empirical scaling exponent evaluated on data simulated from our model “smooths out” the change of slope, yielding graphs that are analogous to those obtained for the DJIA time series, cf. Figure 5LABEL:sub@fig:multiscalingvar. This shows that the objection against models with piecewise linear , raised in [17], cannot apply to the model we have proposed.

Appendix A Proof of Proposition 11

We first need two simple technical lemmas.

Lemma 15.

For , consider the function define by

Then there are constants , that depend on , such that for all

| (A.1) |

Proof.

We begin by observing that it is enough to establish the bounds in (A.1) for large enough. Consider the function of positive real variable . It is easily checked that is increasing for . Thus

with . The lower bound in (A.1) easily follows for large.

For the upper bound, by direct computation one observes that for . We have:

Since for a suitable , also the upper bound follows, for large. ∎

Lemma 16.

Let be independent random variables uniformly distributed in , and be the associated order statistics. For and , set .Then, for every

Proof.

This is a consequence of the following stronger result: for every , as we have the convergence in probability

see [33] for a proof. ∎

Proof of Proposition 11.

Since and have the same law, we can write

We begin with the proof of (6.3), hence we work in the regime , or and ; in any case, . We start with the “” implication. Since and are independent, it follows by Lemma 15 that

| (A.2) |

for some . For the moment we work on the event . It follows by the basic bound (4.10) that

| (A.3) |

where we set

Note that . By applying Hölder inequality to (A.3) with exponents , , we obtain:

By assumption , which is the same as . Thus

| (A.4) |

Now observe that if we have , hence (A.4) holds also when . Therefore, by (A.2)

| (A.5) |

where we have set

Therefore, if , the right hand side of (A.5) is finite, because has finite exponential moments of all order. This proves the “” implication in (6.3).

The “” implication in (6.3) is simpler. By the lower bound in Lemma 15 we have

| (A.6) |

for suitable . We note that

| (A.7) |

Under the condition

the last expectation in (A.7) is infinite, since almost surely and is independent of . Looking back at (A.6), we have proved the “” implication in (6.3).

Next we prove (6.2), hence we assume that . Consider first the case (which may happen only for ). By (A.6)

We note that, by the definition (2.1) of , we can write

| (A.8) |

where we agree that the sum is zero if . For , we let to denote the conditional probability and the corresponding expectation. Note that, under , the random variables have the same law of the random variables in Lemma 16, for . Consider the following events:

where is such that and will be chosen later. Note that while as , by Lemma 16. In particular, there is such that for every . Plainly, and are independent under . We have

| (A.9) |

Note that is equivalent to , therefore can be chosen small enough so that . It then follows by (A.9) that for every , for a suitable . Therefore

because and hence for all and .

Next we consider the case . Note that

| (A.10) |

hence if we have , because for every , almost surely and is independent of . On the other hand, if we must have (recall that we are in the regime ) and the steps leading to (A.9) have shown that in this case is unbounded. It then follows again from (A.10) that . ∎

Appendix B The model of Baldovin and Stella

Let us briefly discuss the model proposed by F. Baldovin and A. Stella [7, 31], motivated by renormalization group arguments from statistical physics. They first introduce a process which satisfies the scaling relation (1.3) for a given function , that is assumed to be even, so that its Fourier transform is real (and even). The process is defined by specifying its finite dimensional laws: for the joint density of is given by

| (B.1) |

where is the function whose Fourier transform is given by

| (B.2) |

Note that if is the standard Gaussian density, then is the ordinary Brownian motion. For a non Gaussian , the expression in (B.2) is not necessarily the Fourier transform of a probability on , so that some care is needed (we come back to this point in a moment). However, it is clear from (B.1) that the increments of the process corresponding to time intervals of the same length (that is, for fixed ) have a permutation invariant distribution and therefore cannot exhibit any decay of correlations.

For this reason, Baldovin and Stella introduce what is probably the most interesting ingredient of their construction, namely a special form of time-inhomogeneity. They define it in terms of finite dimensional distributions, bur it is simpler to give a pathwise construction: given a sequence of (possibly random) times and a fixed , they introduce a new process defined by

| (B.3) |

and more generally

| (B.4) |

For we have clearly , while for the process is obtained from by a nonlinear time-change, that is “refreshed” at each time . This transformation has the effect of amplifying the increments of the process for immediately after the times , while the increments tend to become small for larger .

Let us shed some light into the implicit relations (B.1)–(B.2). If a stochastic process is to satisfy these relations, it must necessarily have exchangeable increments: by this we mean (cf. [19, p.1210]) that, setting for short, the distribution of the random vector — where the ’s are intervals and ’s real numbers — does not depend on , as long as the intervals , …, are disjoint. If we make the (very mild) assumption that has no fixed point of discontinuity, then a continuous-time version of the celebrated de Finetti’s theorem ensures that is a mixture of Lévy processes, cf. Theorem 3 in [19] (cf. also [1]). Actually, more can be said: since by (1.3) the distribution of the increments of is isotropic, i.e., it has spherical symmetry in , by Theorem 4 in [19] the process is necessarily a mixture of Brownian motions. This means that we have the following representation:

| (B.5) |

where is a standard Brownian motion and is an independent real random variable (a random, but time-independent, volatility). Viceversa, if a process satisfies (B.5), then, denoting by the law of , it is easy to check that relations (B.1)–(B.2) hold with

| (B.6) |

or, equivalently,

This shows that the functions for which (B.1)–(B.2) provide a consistent family of finite dimensional distributions are exactly those that may be expressed as in (B.6) for some probability on .

Note that a path of (B.5) is obtained by sampling independently from and from the Wiener measure, hence this path cannot be distinguished from the path of a Brownian motion with constant volatility. In particular, the (possible) correlation of the increments of the process cannot be detected empirically, and the same observation applies to the time-inhomogeneous process obtained by through (B.3)–(B.4). In other words, the processes obtained through this construction have non ergodic increments.

Nevertheless, Baldovin and Stella claim to measure nonzero correlations from their samples: after estimating the function and the parameters and on the DJIA time series, their simulated trajectories show a good agreement with the clustering of volatility, as well as with the basic scaling (1.3) and the multiscaling of moments. The explanation of this apparent contradiction is that Baldovin and Stella do not simulate the process defined through the above construction, but rather an autoregressive approximation of it. In fact, besides making a periodic choice of the times , they fix a small time step and a natural number and they first simulate , , …, according to the true distribution of . Then they compute the conditional distribution of given , , …, — thus neglecting — and sample from this distribution. Similarly, is sampled from the conditional distribution of given , …, , , neglecting both and , and so on. It is plausible that such an autoregressive procedure may produce an ergodic process.

Acknowledgements

We thank Fulvio Baldovin, Massimiliano Caporin, Wolfgang Runggaldier and Attilio Stella for fruitful discussions. We are very grateful to the anonymous referee for several important remarks and suggestions.

References

- [1] L. Accardi, Y. G. Lu, A continuous version of de Finetti’s theorem, Ann. Probab. 21 (1993), 1478–1493.

- [2] A. Andreoli, Scaling and Multiscaling in Financial Indexes: a Simple Model, Ph.D. Thesis, University of Padova (2011). Available at the address http://www.matapp.unimib.it/~fcaraven/c.html.

- [3] S. Asmussen, Applied probability and queues, Second Edition, Application of Mathematics 51, Springer–Verlag, New York (2003).

- [4] T. Ané and H. Geman, Order Flow, Transaction Clock, and Normality of Asset Returns, The Journal of Finance, 55, No. 5 (2000), 2259-2284

- [5] R. T. Baillie, Long memory processes and fractional integration in econometrics, J. Econometrics 73 (1996), 5–59.

- [6] O. E. Barndorff-Nielsen, N. Shephard, Non Gaussian Ornstein-Uhlenbeck based models and some of their uses in financial economics, J. R. Statist. Soc. B 63 (2001), 167–241.

- [7] F. Baldovin, A. Stella, Scaling and efficiency determine the irreversible evolution of a market, PNAS 104, n. 50 (2007), 19741–19744.

- [8] T. Bollerslev, Generalized Autoregressive Conditional Heteroskedasticity, J. Econometrics 31 (1986), 307–327.

- [9] T. Bollerslev, H.O. Mikkelsen, Modeling and pricing long memory in stock market volatility, J. Econometrics 31 (1996), 151–184.

- [10] T. Bollerslev, U. Kretschmer, C. Pigorsch, G. Tauchen, A discrete-time model for daily S & P500 returns and realized variations: Jumps and leverage effects, J. Econometrics 150 (2009), 151–166.

- [11] M. Bonino, Portfolio allocation and monitoring under volatility shocks, Master’s Thesis, University of Padova (2011). Available at the address http://www.matapp.unimib.it/~fcaraven/c.html.

- [12] L.E. Calvet, A.J. Fisher, Multifractal Volatility, Academic Press (2008).

- [13] L.E. Calvet, A.J. Fisher, Forecasting multifractal volatility, Journal of Econometrics 105 (2001), 27-58.

- [14] L.E. Calvet, A. J. Fisher, B. B. Mandelbrot, Cowles Foundation Discussion Papers No. 1164-1166, Yale University (1997). Papers available from http://cowles.econ.yale.eduorhttp://www.ssrn.com.

- [15] P.K. Clark, A Subordinated Stochastic Process Model with Finite Variance for Speculative Prices, Econometrica 41 (1973), 135-155

- [16] R. Cont, Empirical properties of asset returns: stylized facts and statistical issues, Quantitative Finance 1 (2001), 223-236.

- [17] T. Di Matteo, T. Aste, M. M. Dacorogna, Long-term memories of developed and emerging markets: Using the scaling analysis to characterize their stage of development, J. Banking Finance 29 (2005), 827–851.

- [18] R. F. Engle, Autoregressive Conditional Heteroscedasticity with Estimates of Variance of United Kingdom Inflation, Econometrica 50 (1982), 987–1008.

- [19] D. A. Freedman, Invariants Under Mixing Which Generalize de Finetti’s Theorem: Continuous Time Parameter, Ann. Math. Statist. 34 (1963), 1194–1216.

- [20] S. Galluccio, G. Caldarelli, M. Marsili, Y. C. Zhang, Scaling in currency exchange, Physica A 245 (1997), 423-36.

- [21] S. Ghashghaie, W. Breymann, J. Peinke, P. Talkner, Y. Dodge, Turbulent cascades in foreign exchange markets, Nature 381 (1996), 767-70.

- [22] J. C. Hull, Options, Futures and Other Derivatives, Pearson/Prentice Hall (2009).

- [23] I. Karatzas, S. E. Shreve, Brownian Motion and Stochastic Calculus, Springer (1988).

- [24] C. Kluppelberg, A. Lindner, R. A. Maller, A continuous time GARCH process driven by a Lévy process: stationarity and second order behaviour, J. Appl. Probab. 41 (2004) 601–622.

- [25] C. Kluppelberg, A. Lindner, R. A. Maller, Continuous time volatility modelling: COGARCH versus Ornstein-Uhlenbeck models, in From Stochastic Calculus to Mathematical Finance, Yu. Kabanov, R. Lipster and J. Stoyanov (Eds.), Springer (2007).

- [26] Wolfram Research, Inc., Mathematica, Version 7.0, Champaign, IL (2008).

- [27] P. Pigato, A multivariate model for financial indexes subject to volatility shocks, Master’s Thesis, University of Padova (2011). Available at the address http://www.matapp.unimib.it/~fcaraven/c.html.

- [28] R Development Core Team (2009), R: A language and environment for statistical computing, R Foundation for Statistical Computing, Vienna, Austria, ISBN 3-900051-07-0. URL: http://www.R-project.org.

- [29] N. Shephard, T.G. Andersen, Stochastic Volatility: Origins and Overview, in Handbook of Financial Time Series, Springer (2009), 233-254.

- [30] A.N. Shiryaev, Probability, Graduate Texts in Mathematics, edition, Springer, 1995.

- [31] A. L. Stella, F. Baldovin, Role of scaling in the statistical modeling of finance, Pramana 71 (2008), 341–352.

- [32] J.C. Vassilicos, A. Demos, F. Tata, No evidence of chaos but some evidence of multifractals in the foreign exchange and the stock market, in Applications of Fractals and Chaos, eds. A.J. Crilly, R.A. Earnshaw, H. Jones, pp. 249-65, Springer (1993).

- [33] L. Weiss, The Stochastic Convergence of a Function of Sample Successive Differences, Ann. Math. Statist. 26 (1955), 532–536.