Competition with Dynamic Spectrum Leasing

Abstract

This paper presents a comprehensive analytical study of two competitive cognitive operators’ spectrum leasing and pricing strategies, taking into account operators’ heterogeneity in leasing costs and users’ heterogeneity in transmission power and channel conditions. We model the interactions between operators and users as a three-stage dynamic game, where operators make simultaneous spectrum leasing and pricing decisions in Stages I and II, and users make purchase decisions in Stage III. Using backward induction, we are able to completely characterize the game’s equilibria. We show that both operators make the equilibrium leasing and pricing decisions based on simple threshold policies. Moreover, two operators always choose the same equilibrium price despite their difference in leasing costs. Each user receives the same signal-to-noise-ratio (SNR) at the equilibrium, and the obtained payoff is linear in its transmission power and channel gain. We also compare the duopoly equilibrium with the coordinated case where two operators cooperate to maximize their total profit. We show that the maximum loss of total profit due to operators’ competition is no larger than . The users, however, always benefit from operators’ competition in terms of their payoffs. We show that most of these insights are robust in the general SNR regime.

I Introduction

Wireless spectrum is often considered as a scarce resource, and thus has been tightly controlled by the governments through static license-based allocations. However, several recent field measurements show that many spectrum bands are often under-utilized even in densely populated urban areas [2]. To achieve more efficient spectrum utilization, various dynamic spectrum access mechanisms have been proposed so that unlicensed secondary users can share the spectrum with the licensed primary users. One of the proposed mechanisms is dynamic spectrum leasing, where a spectrum owner dynamically transfers and trades the usage right of temporarily unused part of its licensed spectrum to secondary network operators or users in exchange of monetary compensation (e.g., [3, 4, 5, 6, 7]). In this paper, we study the competition of two secondary operators under the dynamic spectrum leasing mechanism.

Our study is motivated by the successful operations of mobile virtual network operators (MVNOs) in many countries today111There are over 400 mobile virtual network operators owned by over 360 companies worldwide as of February 2009 [8].. An MVNO does not own wireless spectrum or even the physical infrastructure. It provides services to end-users by long-term spectrum leasing agreements with a spectrum owner. MVNOs are similar to the “switchless resellers” of the traditional landline telephone market. Switchless resellers buy minutes wholesale from the large long distance companies and resell them to their customers. As intermediaries between spectrum owners and users, MVNOs can raise the competition level of the wireless markets by providing competitive pricing plans as well as more flexible and innovative value-added services. However, an MVNO is often stuck in a long-term contract with a spectrum owner and can not make flexible spectrum leasing and pricing decisions to match the dynamic demands of the users. The secondary operators considered in this paper do not own wireless spectrum either. Compared with a traditional MVNO, the secondary operators can dynamically adjust their spectrum leasing and pricing decisions to match the users’ demands that change with users’ channel conditions.

This paper studies the competition of two secondary operators (also called duopoly) who compete to serve a common pool of secondary users. The secondary operators will dynamically lease spectrum from spectrum owners, and then compete to sell the resource to the secondary users to maximize their individual profits. We would like to understand how the operators make the equilibrium investment (leasing) and pricing (selling) decisions, considering operators’ heterogeneity in leasing costs and wireless users’ heterogeneity in transmission power and channel conditions.

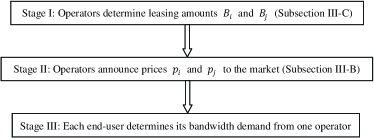

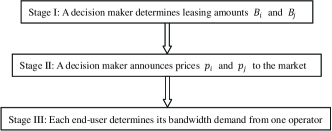

We adopt a three-stage dynamic game model to study the (secondary) operators’ investment and pricing decisions as well as the interactions between the operators and the (secondary) users. From here on, we will simply use “operator” to denote “secondary operator” and “users” to denote “secondary users”. In Stage I, the two operators simultaneously lease spectrum (bandwidth) from the spectrum owners with different leasing costs. In Stage II, the two operators simultaneously announce their spectrum retail prices to the users. In Stage III, each user determines how much resource to purchase from which operator. Each operator wants to maximizes its profit, which is the difference between the revenue collected from the users and the cost paid to the spectrum owner.

Key results and contributions of this paper include:

-

•

A concrete wireless spectrum sharing model: We assume that users share the spectrum using orthogonal frequency division multiplexing (OFDM) technology. A user’s achievable rate depends on its allocated bandwidth, maximum transmission power, and channel condition. This model is more concrete than several generic economic models used in related literature (e.g., [6, 9, 10, 11]), and can provide more insights on how the wireless technology impact the operators’ equilibrium economic decisions.

-

•

Symmetric pricing equilibrium: We show the two operators’ always choose the same equilibrium price, even when they have different leasing costs and make different equilibrium investment decisions. Moreover, this price is independent of users’ transmission power and channel conditions.

-

•

Threshold structures of investment and pricing equilibrium: We show that the operators’ equilibrium investment and pricing decisions follow simple threshold structures, which are easy to implement in practice.

-

•

Fair Quality of Service (QoS) of users: We show that each user achieves the same signal-to-noise (SNR) that is independent of the users’ population and wireless characteristics.

-

•

Impact of competition: We show that the operators’ competition leads to a maximum loss of 25% in terms of the two operators’ total profit compared with a coordinated case. The users, however, always benefit from the operators’ competition by achieving better payoffs.

Next we briefly discuss the related literature. In Section II, we describe the network model and game formulation. In Section III, we analyze the dynamic game through backward induction and calculate the duopoly leasing/pricing equilibrium. We discuss various insights obtained from the equilibrium analysis in Section IV. In Section VI, we show the impact of duopoly competition on the total operators’ profit and the users’ payoffs. We conclude in Section VII together with some future research directions.

I-A Related Work

The existing results on dynamic spectrum access mainly focused on the technical aspects of primary users’ spectrum sharing with secondary users. Two approaches are extensively studied: (1) spectrum underlay, which allows secondary users to coexist with primary users by imposing constraints on the transmission powers of secondary users (e.g., [12, 13, 14, 15]); (2) spectrum overlay, which allows secondary users to identify and exploit spatial and temporal spectrum availability in a nonintrusive manner (e.g., [16, 17, 18, 19, 20]). These results did not consider the spectrum owners’ economic incentive in sharing spectrum with secondary users.

Recently researchers started to study the economic aspect of dynamic spectrum access, such as the cognitive secondary operators’ strategies of spectrum acquisition from spectrum owners and service provision to the users. For example, several auction mechanisms have been proposed for the spectrum owner to allocate spectrum (e.g., [21, 9, 22, 23, 24, 25, 26]). Cognitive radio operators can also obtain spectrum by dynamically leasing from the spectrum owner (e.g., [3, 6, 7, 5, 27]).

For operators’ service provision, most related results looked at the pricing interactions between cognitive network operators and the secondary users (e.g., [28, 6, 9, 11, 10, 29]). Ref. [6] and [9] studied the pricing competition among two or more operators. Ref. [10] explored users’ demand functions in both quality-sensitive and price-sensitive buyer population models. Ref. [11] derived users’ demand functions based on the acceptance probability model. Ref. [28] considered users’ queuing delay due to congestion in spectrum sharing. Ref. [29] modeled the dynamic behavior of secondary users as an evolutionary game, and proposed an iterative algorithm for operators’ strategy adaption. Among these works, only [28, 29] studied practical wireless spectrum sharing models by modeling users’ wireless details. Many results have been obtained mainly through extensive simulations (e.g., [28, 29, 9, 11, 10]).

This work are related to our previous study[27], where we considered the optimal sensing and leasing decisions of a single secondary operator facing supply uncertainty. The focus of this paper is to study the competition between two operators.

Another closely related paper is [6], which also jointly considered the the spectrum acquisition and service provision for cognitive operators. The key difference here is that we present a comprehensive analytical study that characterizes the duopoly equilibrium investment and pricing decisions, with heterogeneous leasing costs for the operators and a concrete wireless spectrum sharing model for the users.

II Network Model

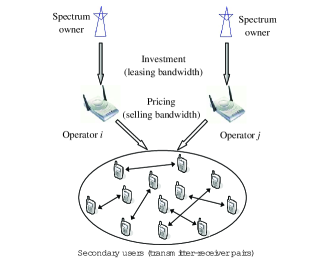

We consider two operators ( and ) and a set of users as shown in Fig. 1. The operators obtain wireless spectrum from different spectrum owners with different leasing costs, and compete to serve the same set of users. Each user has a transmitter-receiver pair. We assume that users are equipped with software defined radios and can transmit in a wide range of frequencies as instructed by the operators, but do not have the cognitive learning capacity. Such a network structure puts most of the implementation complexity for dynamic spectrum leasing and allocation on the operators, and thus is easier to implement than a “full” cognitive radio network especially for a large number of users. A user may switch among different operators’ services (e.g. WiMAX, 3G) depending on operators’ prices. It is important to study the competition among multiple operators as operators are normally not cooperative.

The interactions between the two operators and the users can be modeled as a three-stage dynamic game, as shown in Fig. 2. Operators and first simultaneously determine their leasing bandwidths in Stage I, and then simultaneously announce the prices to the users in Stage II. Finally, each user chooses to purchase bandwidth from only one operator to maximize its payoff in Stage III.

The key notations of the paper are listed in Table I. Some are explained as follows.

-

•

Leasing decisions and : leasing bandwidths of operators and in Stage I, respectively.

-

•

Costs and : the fixed positive leasing costs per unit bandwidth for operators and , respectively. These costs are determined by the negotiation between the operators and their own spectrum suppliers.

-

•

Pricing decisions and : prices per unit bandwidth charged by operators and to the users in Stage II, respectively.

-

•

The User ’s demand or : the bandwidth demand of a user from operator or . A user can only purchase bandwidth from one operator.

| Notations | Physical Meaning |

|---|---|

| Leasing bandwidths of operators and | |

| Costs per unit bandwidth paid by operators and | |

| Prices per unit bandwidth announced by operators and | |

| Set of the users in the cognitive network | |

| User ’s maximum transmission power | |

| User ’s channel gain between its transceiver | |

| Noise power per unit bandwidth | |

| User ’s wireless characteristic | |

| The users’ aggregate wireless characteristics | |

| User ’s bandwidth allocation from operator or | |

| User ’s data rate | |

| Preferred user sets of operators and | |

| Preferred demands of operators and | |

| Realized user sets of operators and | |

| Realized demands of operators and | |

| Revenues of operators and | |

| Profits of operators and | |

| Total profit of both operators |

III Backward Induction of the Three-Stage Game

A common approach of analyzing dynamic game is backward induction [30]. We start with Stage III and analyze the users’ behaviors given the operators’ investment and pricing decisions. Then we look at Stage II and analyze how operators make the pricing decisions taking the users’ demands in Stage III into consideration. Finally, we look at the operators’ leasing decisions in Stage I knowing the results in Stages II and III. Throughout the paper, we will use “bandwidth”, “spectrum”, and “resource” interchangeably.

III-A Spectrum Allocation in Stage III

In Stage III, each user needs to make the following two decisions based on the prices and announced by the operators in Stage II:

-

1.

Which operator to choose?

-

2.

How much to purchase?

OFDM has been deemed appropriate for dynamic spectrum sharing (e.g., [31, 32]). We assume that the users share the spectrum using OFDM to avoid mutual interferences. If a user obtains bandwidth from operator , then it achieves a data rate (in nats) of

| (1) |

where is user ’s maximum transmission power, is the noise power density, is the channel gain between user ’s transmitter and receiver[33]. The channel gain is independent of the operator, as the operator only sells bandwidth and does not provide a physical infrastructure.222We also assume that the channel condition is independent of transmission frequencies, such as in the current 802.11d/e standard[34] where the channels are formed by interleaving over the tones. As a result, each user experiences a flat fading over the entire spectrum. Here we assume that user spreads its power across the entire allocated bandwidth . To simplify later discussions, we let

thus is the user ’s SNR. The rate in (1) is calculated based on the Shannon capacity.

To better obtain insights through closed-form solutions, we first focus on the high SNR regime where . This will be the case where a user has limited choices of modulation and coding schemes, and thus can not decode a transmission if the SNR is below some threshold. In the high SNR regime, the rate in (1) can be approximated as

| (2) |

Although the analytical solutions in Section III are derived based on (2), we will show later in Section V that all major engineering insights remain true in the general SNR regime.

If a user purchases bandwidth from operator , it receives a payoff of

| (3) |

which is the difference between the data rate and the payment. The payment is proportional to price announced by operator . Payoff is concave in , and the unique demand that maximizes the payoff is

| (4) |

Demand is always positive, linear in , and decreasing in price . Since is linear in channel gain and transmission power , then a user with a better channel condition or a larger transmission power has a larger demand. It is clear that is upper-bounded by for any choice of price . In other words, even if operator announces a zero price, user will not purchase infinite amount of resource since it can not decode the transmission if is low.

Eqn (4) shows that every user purchasing bandwidth from operator obtains the same SNR

and obtains a payoff linear in

III-A1 Which Operator to Choose?

Next we explain how each user decides which operator to purchase from. The following definitions help the discussions.

Definition 1 (Preferred User Set)

The Preferred User Set includes the users who prefer to purchase from operator .

Definition 2 (Preferred Demand)

The Preferred Demand is the total demand from users in the preferred user set , i.e.,

| (5) |

The notations in (5) imply that both set and demand only depend on prices in Stage II and are independent of operators’ leasing decisions in Stage I. Such dependance can be discussed in two cases:

-

1.

Different Prices (): every user prefers to purchase from operator since

We have and , and

where represents the aggregate wireless characteristics of the users. This notation will be used heavily later in the paper.

-

2.

Same Prices (): every user is indifferent between the operators and randomly chooses one with equal probability. In this case,

Now let us discuss how much demand an operator can actually satisfy, which depends on the bandwidth investment decisions in Stage I. It is useful to define the following terms.

Definition 3 (Realized User Set)

The Realized User Set includes the users whose demands are satisfied by operator .

Definition 4 (Realized Demand)

The Realized Demand is the total demand of users in the Realized User Set , i.e.,

| (6) |

Notice that both and depend on prices in Stage II and leasing decisions in Stage I. Calculating the Realized Demands also requires considering two different pricing cases.

-

1.

Different prices (): The Preferred Demands are and .

-

•

If Operator has enough resource : all Preferred Demand will be satisfied by operator . The Realized Demands are

-

•

If Operator has limited resource : since operator cannot satisfy the Preferred Demand, some demand will be satisfied by operator if it has enough resource. Since the realized demand , then . The remaining users want to purchase bandwidth from operator with a total demand of . Thus the Realized Demands are

-

•

-

2.

Same prices (): both operators will attract the same Preferred Demand . The Realized Demands are

III-B Operators’ Pricing Competition in Stage II

In Stage II, the two operators simultaneously determine their prices considering the users’ preferred demands in Stage III, given the investment decisions in Stage I.

An operator ’s profit is

| (7) |

which is the difference between the revenue and the total cost. Since the payment is fixed at this stage, operator wants to maximize the revenue .

Game 1 (Pricing Game)

The competition between the two operators in Stage II can be modeled as the following game:

-

•

Players: two operators and .

-

•

Strategy space: operator can choose price from the feasible set . Similarly for operator .

-

•

Payoff function: operator wants to maximize the revenue . Similarly for operator .

At an equilibrium of the pricing game, , each operator maximizes its payoff assuming that the other operator chooses the equilibrium price, i.e.,

In other words, no operator wants to unilaterally change its pricing decision at an equilibrium.

Next we will investigate the existence and uniqueness of the pricing equilibrium. First, we show that it is sufficient to only consider symmetric pricing equilibrium for Game 1.

Proposition 1

Assume both operators lease positive bandwidth in Stage I, i.e., . If pricing equilibrium exists, it must be symmetric .

The proof of Proposition 1 is given in Appendix -A. The intuition is that no operator will announce a price higher than its competitor in a fear of losing its Preferred Demand. This property significantly simplifies the search for all possible equilibria.

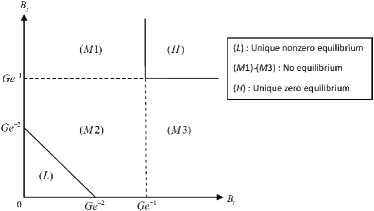

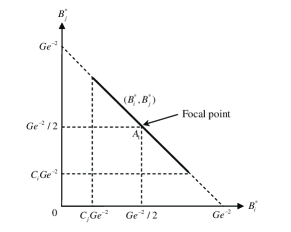

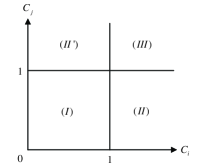

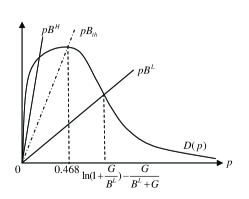

Next we show that the symmetric pricing equilibrium is a function of () as shown in Fig. 3.

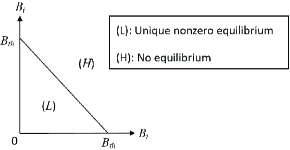

Theorem 1

The equilibria of the pricing game are as follows.

-

•

Low Investment Regime: ( as in region (L) of Fig. 3): there exists a unique nonzero pricing equilibrium

(8) The operators’ profits at Stage II are

(9) (10) -

•

Medium Investment Regime ( and as in regions (M1)-(M3) of Fig. 3): there is no pricing equilibrium.

-

•

High Investment Regime ( as in region (H) of Fig. 3): there exists a unique zero pricing equilibrium

(11) and the operators’ profits are negative for any positive values of and .

Proof of Theorem 1 is given in Appendix -B. Intuitively, higher investments in Stage I will lead to lower equilibrium prices in Stage II. Theorem 1 shows that the only interesting case is the low investment regime where both operators’ total investment is no larger than , in which case there exists a unique positive symmetric pricing equilibrium. Notice that same prices at equilibrium do not imply same profits, as the operators can have different costs ( and ) and thus can make different investment decisions ( and ) as shown next.

III-C Operators’ Leasing Strategies in Stage I

In Stage I, the operators need to decide the leasing amounts to maximize their profits. Based on Theorem 1, we only need to consider the case where the total bandwidth of both the operators is no larger than .

Game 2 (Investment Game)

The competition between the two operators in Stage I can be modeled as the following game:

-

•

Players: two operators and .

-

•

Strategy space: the operators will choose from the set . Notice that the strategy space is coupled across the operators, but the operators do not cooperate with each other.

- •

At an equilibrium of the investment game, , each operator has maximized its payoff assuming that the other operator chooses the equilibrium investment, i.e.,

To calculate the investment equilibria of Game 2, we can first calculate operator ’s best response given operator ’s (not necessarily equilibrium) investment decision, i.e.,

By looking at operator ’s profit in (9), we can see that a larger investment decision will lead to a smaller price. The best choice of will achieve the best tradeoff between a large bandwidth and a small price.

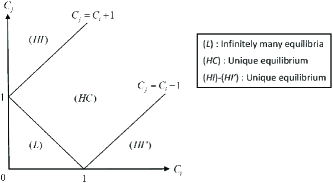

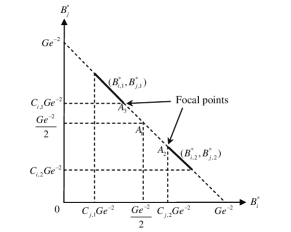

After obtaining best investment responses of duopoly, we can then calculate the investment equilibria, given different costs and .

Theorem 2

The duopoly investment (leasing) equilibria in Stage I are summarized as follows.

-

•

Low Costs Regime (, as region () in Fig. 4): there exists infinitely many investment equilibria characterized by

(12) where can be any value that satisfies

(13) The operators’ profits are

(14) (15) where “” denotes the low costs regime.

-

•

High Comparable Costs Regime ( and , as region () in Fig. 4): there exists a unique investment equilibrium

(16) (17) The operators’ profits are

(18) (19) where “” denotes the high comparable costs regime.

-

•

High Incomparable Costs Regime ( or , as regions () and () in Fig. 4): For the case of , there exists a unique investment equilibrium with

(20) i.e., operator acts as the monopolist and operator is out of the market. The operators’ profits are

(21) where “” denotes the high incomparable costs. The case of can be analyzed similarly.

The proof of Theorem 2 is given in Appendix -D. Let us further discuss the properties of the investment equilibrium in three different costs regimes.

| Costs regimes | Low costs: | High comparable costs: | High incomparable costs: |

| and | |||

| Number of equilibria | Infinite | Unique | Unique |

| Investment equilibria | |||

| with | |||

| Pricing equilibrium () | |||

| Profits () | , | ||

| User ’s bandwidth demand | |||

| User ’s SNR | |||

| User ’s payoff |

III-C1 Low Costs Regime ()

In this case, both the operators have very low costs. It is the best response for each operator to lease as much as possible. However, since the strategy set in the Investment Game is coupled across the operators (i.e., ), there exist infinitely many ways for the operators to achieve the maximum total leasing amount . We can further identify the focal point, i.e., the equilibrium that the operators will agree on without prior communications [30].

For our problem, the Focal Point should be Pareto efficient and fair to the operators. It is easy to check that all investment equilibria are Pareto efficient. And fairness can be interpreted as in terms of either equal investments or equal profits. Due to space limitations, we will discuss the choice of Focal Points to reach equal investments. The case of equal profits can be derived in a very similar fashion and is omitted here due to space limitations.

We illustrate two types of Focal Points in Fig. 5 and 6. The axes represent the equilibrium investment amounts for two operators. The solid line segments represent the set of infinitely many investment equilibrium. The constraints in (13) determine the starting and ending points of the segments.

-

•

Figure 5: when , equal leasing amount at point is one of the equilibria and thus is the Focal Point.

-

•

Figure 6: when , it is not possible for the two operators to lease the same amount at the equilibrium. The two separate solid line segments represent the two cases of and , respectively. For the case 1 of (the higher left solid line segment), the point that has the smallest difference between two equilibrium investment amounts is Focal Point, where we have . Similarly, point is another Focal Point for the case 2 of .

III-C2 High Comparable Costs Regime ( and )

First, the high costs discourage the operators from leasing aggressively, thus the total investment is less than . Second, the operators’ costs are comparable, and thus the operator with the slightly lower cost does not have sufficient power to drive the other operator out of the market.

III-C3 High Incomparable Costs Regime ( or )

First, the costs are high and thus the total investment of two operators is less than . Second, the costs of the two operators are so different that the operator with the much higher cost is driven out of the market. As a result, the remaining operator thus acts as a monopolist.

IV Equilibrium Summary

Based on the discussions in Section III, we summarize the equilibria of the three-stage game in Table II, which includes the operators’ investment decisions, pricing decisions, and the resource allocation to the users. Without loss of generality, we assume in Table II. The equilibrium for can be decribed similarly.

Several interesting observations are as follows.

Observation 1

The operators’ equilibrium investment decisions and are linear in the users’ aggregate wireless characteristics .

This shows that the operators’ total investment increases with the user population, users’ channel gains, and users’ transmission powers.

Observation 2

The symmetric equilibrium price does not depend on users’ wireless characteristics.

Observations 1 and 2 are closely related. Since the total investment is linearly proportional to the users’ aggregate characteristics, the “average” equilibrium resource allocation per user is “constant” and does not depend on the user population. Since resource allocation is determined by the price, this means that the price is also independent of the user population and wireless characteristics.

Observation 3

The operators’ equilibrium investment and pricing decisions follow simple linear threshold structures, which are easy to implement in practice.

For equilibrium investment decisions in Stage I, the feasible set of investment costs can be divided into three regions by simple linear thresholds as in Fig. 4. As leasing costs increase, operators invest less aggressively; as the leasing cost difference increases, the operator with a lower cost gradually dominates the spectrum market. For the equilibrium pricing decisions, the feasible set of leasing bandwidths is also divided into three regions by simple linear thresholds as well. A meaningful pricing equilibrium exists only when the total available bandwidth from the two operators is no larger than a threshold (see Fig. 3).

Observation 4

Each user ’s equilibrium demand is positive, linear in its wireless characteristic , and decreasing in the price. Each user achieves the same SNR independent of , and obtains a payoff linear in .

Observation 4 shows that the users receive fair resource allocation and QoS. Such allocation does not depend on the wireless characteristics of the other users.

Observation 5

In the High Incomparable Costs Regime, users’ equilibrium SNR increases with the costs and , and the equilibrium payoffs decrease with the costs.

As the costs and increase, the pricing equilibrium () increases to compensate the loss of the operators’ profits due to increased costs. As a result, each user will purchase less bandwidth from the operators. Since a user spreads its total power across the entire allocated bandwidth, a smaller bandwidth means a higher SNR but a smaller payoff.

Finally, we observe that the users achieve a high SNR at the equilibrium. The minimum equilibrium SNR that users achieve among the three costs regime is . In this case, the ratio between the high SNR approximation and Shannon capacity, , is larger than . This validates our assumption on the high SNR regime. The next section, on the other hand, shows that most of the insights remain valid in the general SNR regime.

V Equilibrium Analysis under the General SNR Regime

In Sections III and IV, we computed the equilibria of the three-stage game based on the high SNR assumption in (2), and obtained five important observations (Observations 1-5). The high SNR assumption enables us to obtain closed-form solutions of the equilibria analysis and clear engineering insights.

In this section, we further consider the more general SNR regime where a user’s rate is computed according to (1) instead of (2). We will follow a similar backward induction analysis, and extend Observations 1, 2, 4, 5, and pricing threshold structure of Observation 3 to the general SNR regime.

We first examine the pricing equilibrium in Stage II.

Theorem 3

Define . The pricing equilibria in the general SNR regime are as follows.

Proof of Theorem 3 is given in Appendix -E. This result is similar to Theorem 1 in the high SNR regime, and shows that the pricing equilibrium in the general SNR regime still has a threshold structure in Observation 3. Based on Theorem 3, we are ready to prove Observations 1, 2, 4, and 5 in the general SNR regime.

VI Impact of Operator Competition

We are interested in understanding the impact of operator competition on the operators’ profits and the users’ payoffs. As a benchmark, we will consider the coordinated case where both operators jointly make the investment and pricing decisions to maximize their total profit. In this case, there does not exists competition between the two operators. However, it is still a Stackelberg game between a single decision maker (representing both operators) and the users. Then we will compare the equilibrium of this Stackelberg game with that of the duopoly game as in Section IV.

VI-A Maximum Profit in the Coordinated Case

We analyze the coordinated case following a three stage model as shown in Fig. 8. Compared with Fig. 2, the key difference here is that a single decision maker makes the decisions in both Stages I and II. In other words, the two operators coordinate with each other.

Again we use backward induction to analyze the three-stage game. The analysis of Stage III in terms of the spectrum allocation among the users is the same as in Subsection III-A (still assuming the high SNR regime), and we focus on Stages II and I. Without loss of generality, we assume that .

In Stage II, the decision maker maximizes the following total profit by determining prices and :

where is given in (7) and can be obtained similarly.

Theorem 5

In Stage II, the optimal pricing decisions for the coordinated operators are as follows:

-

•

If and , then operator is the monopolist and announces a price

(25) Similar result can be obtained if and .

-

•

If , then both operator and announce the same price

(26)

Proof of Theorem 5 can be found in Appendix -G. Theorem 5 shows that both operators will act together as a monopolist in the pricing stage.

Now let us consider Stage I, where the decision maker determines the leasing amounts and to maximize the total profit:

| (27) |

where and are given in Theorem 5. In this case, operator will not lease (i.e., ) as operator can lease with a lower cost. Thus the optimization problem in (27) degenerates to

This leads to the following result.

Theorem 6

In Stage I, the optimal investment decisions for the coordinated operators are

| (28) |

and the total profit is

| (29) |

VI-B Impact of Competition on the Operators’ Profits

Let us compare the total profit obtained in the competitive duopoly case (Theorem 2) and the coordinated case (Theorem 6).

VI-B1 Low Costs Regime ()

First, the total equilibrium leasing amount in the duopoly case is , which is larger than the total leasing amount in the coordinated case. In other words, operator competition leads to a more aggressive overall investment. Second, the total profit at the duopoly equilibria is

| (30) |

where can be any real value in the set of . Each choice of corresponds to an investment equilibrium and there are infinitely many equilibria in this case as shown in Theorem 2. The minimum profit ratio between the duopoly case and the coordinated case optimized over is

| (31) |

Since is increasing in , the minimum profit ratio is achieved at

| (32) |

This means

| (33) |

Although (33) is a non-convex function of and , we can numerically compute the minimum value over all possible values of costs in this regime

| (34) |

This means that the total profit achieved at the duopoly equilibrium is at least 75% of the total profit achieved in the coordinated case under any choice of cost parameters in the Low Costs Regime.

VI-B2 High Comparable Costs Regime ( and )

First, the total duopoly equilibrium leasing amount is which is greater than of the coordinated case. Again, competition leads to a more aggressive overall investment. Second, the total profit of duopoly is

| (35) |

And the profit ratio is

| (36) |

which is a function of the cost difference . Let us write it as . We can show that it is a convex function and achieves its minimum at

| (37) |

VI-B3 High Incomparable Costs Regime ()

In this case, only one operator leases a positive amount at the duopoly equilibrium and achieves the same profit as in the coordinated case. The profit ratio is .

We summarize the above results as follows.

Theorem 7 (Operators’ Profit Loss)

Comparing with the coordinated case, the operator competition leads to a maximum total profit loss of in the low costs regime.

Since low leasing costs lead to aggressive leasing decisions and thus intensive competitions among operators, it is not surprising to see that the maximum profit loss happens in the low cost regime.

VI-B4 Further Intuitions of the Low Costs Regime

Next we explain the intuitions behind the profit ratio as in (33) in the low costs regime. We can summarize the impact of costs in this regime as two effects.

-

•

Excessive Investment (EI) effect: when the cheaper cost increases under a fixed cost difference , the competition between the operators become more intense due to the increase of both costs and . The ratio between the total leasing amount at the duopoly equilibrium and the coordinated case tends to increase with the costs. Such (relatively) excessive investment leads to a higher total payment of the operators to spectrum owners (than the coordinated case). Such effect tends to decrease the profit ratio with an increasing .

-

•

Cheaper Resource (CR) effect: when the cheaper cost increases under some fixed cost difference , the worst-case choice of in (32) also increases due to the increase of . This leads to more investment from the spectrum owner with cheaper cost , and is closer to the decision in the coordinated case where the operators only invest in the cheaper resource. Such effect tends to increase the profit ratio with an increasing .

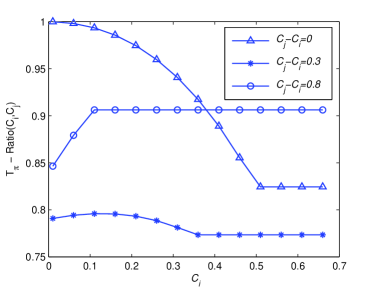

Figure 9 shows three total profit ratio curves (). For each curve, the constant part on the right hand side corresponds to the high comparable costs () regime as in (36), where is a function of the cost difference only. The nonlinear part on the left hand side corresponds to the low costs regime. The interactions between the EI and CR effects lead to different shapes of the three curves in the low costs regime.

-

•

Small cost difference (e.g., in Fig. 9): the Excessive Investment effect dominates. The profit ratio decreases monotonically with the cost .

-

•

Medium cost difference (e.g., in Fig. 9): both effects have comparable impacts. The profit ratio increases first and then decreases with cost .

-

•

Large cost difference ( in Fig. 9): the Cheaper Resource effect dominates. The profit ratio increases monotonically with the cost .

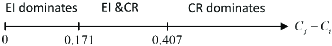

We can numerically calculate the thresholds that separate the three different effects interaction regions as in Fig. 10. Excessive Investment (EI) effect dominates if , and CR effect dominates if . The two effects have comparable impacts if .

VI-C Impact of Competition on the Users’ Payoffs

Theorem 8

Comparing with the coordinated case, users obtain same or higher payoffs under the operators’ competition.

By substituting (28) into (25), we obtain the optimal price in the coordinated case as . This means that user ’s payoff equals to in all three costs regimes. According to Table II, users in the duopoly competition case have the same payoffs as in coordinated case in the high incomparable costs regime. The payoffs are larger in the other two costs regimes with the competitor competition. The intuition is that operator competition in those two regimes leads to aggressive investments, which results in lower prices and higher user payoffs.

VII Conclusion And Future Work

Dynamic spectrum leasing enables the secondary cognitive network operators to quickly obtain the unused resources from the primary spectrum owner and provide flexible services to secondary end-users. This paper studies the competition between two cognitive operators and examines the operators’ equilibrium investment and pricing decisions as well as the users’ corresponding QoS and payoffs.

We model the economic interactions between the operators and the users as a three-stage dynamic game. Our concrete OFDM-based spectrum sharing model captures the wireless heterogeneity of the users in terms of maximum transmission power levels and channel gains. The two operators engage in investment and pricing competitions with asymmetric costs. We have discovered several interesting features of the game’s equilibria. For example, the duopoly’s investment and pricing decisions have nice linear threshold structures. We also study the impact of operator competition on operators’ total profit loss and the users’ payoff increases. Compared with the coordinated case where the two operators cooperate to maximize their total profit, we show that at the maximum profit loss due to competition is no larger than . We also show that the users always benefit from competition by achieving the same or better payoffs. Although we have focused on the high SNR regime when obtaining closed-form solutions, we show that most engineering insights summarized in Section IV still hold in the general SNR regime.

There are several possible ways to extend the results here. We can consider the case where the operators can also obtain resource through spectrum sensing as in [27]. Compared with leasing, sensing is cheaper but the amount of useful spectrum is less predictable due to the primary users’ stochastic traffic. With the possibility of sensing, we need to consider a four-stage dynamic game model. We can also consider the case where users might experience different channel conditions when they choose different providers, e.g., when they need to communicate with the base stations of the operators. Competition under such channel heterogeneity has been partially considered in [35] without considering the cost of spectrum acquisition.

-A Proof of Proposition 1

If the two operators announce different prices, then the operator with the lower price attracts all the users’ demand and essentially acts as a monopolist. We will first summarize the pricing behavior of a monopolist, and detailed derivations are given in [27]. After that, we will show the main proof.

-A1 Monopolist’s optimal pricing strategy

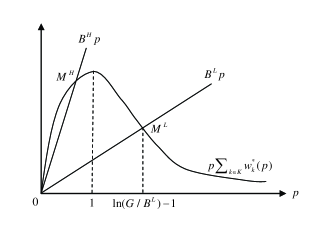

Given a fixed leasing amount , the monopolist wants to choose the price to maximize its revenue. Denote the demand of user as , and thus the total demand is . The revenue is . In Fig. 11, the nonlinear curve represents the function . The other two linear curves represent two representative values of . To maximize the revenue, we will have the following two cases:

-A2 Main proof

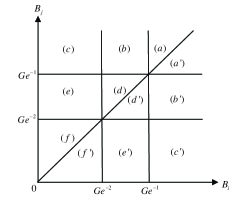

Now let us consider the two operator case. Suppose that there exists an equilibrium () where . Without loss of generality, we assume that . In the following analysis, we examine all possible () regions labeled (a)-(f) as shown in Fig. 12.

-

(a)

If , then both the operators have adequate bandwidths to cover the total preferred demand. This is because the total preferred demand to an operator has the maximum value of . Thus any operator announcing a lower price will attract all the demand. The operator charging a higher price has no realized demand , and thus has the incentive to reduce the price until no larger than other price. Thus unequal price is not an equilibrium.

-

(b)

If , operator will not announce a price higher than operator for the same reason as in case (). Furthermore, the operator will not announce a price . Otherwise, the operator will act like a monopolist by setting to maximize its revenue and leave no realized demand to operator . Thus we conclude that . But operator wants to set price where is infinitely small, and thus can not reach an equilibrium.

-

(c)

If , then operator will not announce a price higher than operator as in case (). Also operator will not charge a price , otherwise operator will act like a monopolist by setting to maximize its revenue and leave no realized demand to operator . Thus we conclude that . However, the operator wants to set price where is infinitely small, and thus can not reach an equilibrium.

-

(d)

If , duopoly will not announce price . Thus we have either or . In both cases, the operator with the higher price wants to reduce the price to be just a little bit smaller than the other operator’s, and thus can not reach an equilibrium.

-

(e)

If , then we have and . Thus we have either or . Similar as (d), an equilibrium can not be reached.

-

(f)

If , then we have and . Thus we have either or . In both cases, the operator with the higher price wants to reduce the price to be just a little bit smaller than the other operator’s, and thus can not reach an equilibrium.

Similar analysis can be extended to regions ()-() in Fig. 12. Thus in all all possible () regions, there doesn’t exist a pricing equilibrium such that .

-B Proof of Theorem 1

Assume, without loss of generality, that . Based on Proposition 1, in the following analysis we examine all possible () regions labeled (a)-(f) in Fig. 12, and check if there exists a symmetric pricing equilibrium (i.e., ) in each region.

-

(a)

If , both the operators have adequate bandwidths to cover the total preferred demand which reaches its maximum at zero price.

-

–

if , then operator attracts and realizes half of the total preferred demand. But when operator slightly decreases its price, it attracts and realizes the total preferred demand, and thus doubles its revenue.

-

–

if , any operator can not attract or realize any preferred demand by unilaterally deviating from (increasing) its price.

Hence, is the unique equilibrium in region ().

-

–

-

(b-c)

If or , operator has adequate bandwidth while operator only has limited bandwidth.

-

–

if , then operator will slightly reduce its price to attract and realize the total preferred demand.

-

–

if , then operator will increase its price and still have positive realized demand. This is because operator does not have enough supply to satisfy the total preferred demand.

Hence, there doesn’t exist an equilibrium in regions (b-c).

-

–

-

(d-e)

If or , we have shown in the proof of Proposition 1 that possible pricing equilibrium will not exceed 1. We find possible pricing equilibrium given operator ’s leasing amount.

-

–

if , then operator has enough bandwidth to cover the total preferred demand and it will slightly decrease its price to attract a larger preferred demand.

-

–

if , then operator has limited bandwidth and it will make decision depending on operator ’s supply.

-

*

if , then operator will slightly decrease its price if , or increase its price to if .

-

*

if , then operator will slightly reduce its price.

-

*

Hence, there doesn’t exist a pricing equilibrium in regions (d-e).

-

–

-

(f)

If , we will first show that total supply equals total preferred demand at any possible equilibrium (i.e., ).

-

–

Suppose that at an equilibrium and thus the total supply is less than the total preferred demand. Then operator will slightly increase its price without changing much its realized demand, and thus receive a greater revenue.

-

–

Suppose that at an equilibrium and thus the total supply is greater than the total preferred demand. Thus we have . Operator will slightly reduce its price to attract much more preferred demand and receive a greater revenue.

Thus we have at any possible equilibrium. Then we check if such () is an equilibrium for the following two cases.

-

–

If , then we have . Since operator already has its individual supply equal to its realized demand, then operator acts as a monopolist serving its own users in the monopolist’s high investment regime in the proof of Proposition 1. Then operator will increase its price to 1.

-

–

If , then we have . Each operator acts as a monopolist serving its own users in the monopolist’s low investment regime in the proof of Proposition 1. And it’s optimal for each operator to stick with its current price.

Thus there exists a unique pricing equilibrium for the low investment regime in region ().

-

–

The same results can be extended to symmetric regions ()-() in Fig. 12.

| Response | Low individual cost | High individual cost |

|---|---|---|

| Small competitor’s decision | the solution to | N/A |

| Large competitor’s decision | N/A | |

| Small competitor’s decision | N/A | the solution to |

| Large competitor’s decision | N/A |

-C The Operators’ Best Investment Responses with Proof

Due to the concavity of profit in , we can obtain the best response function (i.e., best choice of given fixed ) by checking the first order condition. The best response of operator depends on cost and the leasing decision of its competitor, . Operator ’s best response investment is summarized in Table III. Operator ’s best response can be calculated similarly.

Proof. Since in (9) is a concave function of , it is enough to check the first order condition as well as the boundary condition. We have

Its values at the boundary of operator ’s strategy space are

and

both of which are dependent on its competitor ’s strategy and the cost . Thus we derive operator ’s best response for different costs and operator ’s strategies as follows.

-

•

Low individual cost regime (), then

i.e., operator is encouraged to lease positive amount. This is because that in low investment regime the pricing equilibrium in (8) is always larger than 1 and thus larger than , and the profit per unit leased bandwidth is positive.

-

–

Large Competitor’s Decision (), then

i.e., the large leasing amount of operator already makes the pricing equilibrium in (8) very low (but still larger than 1). And operator ’s best response is to lease as much bandwidth as possible

which will only leads to a relatively small decrease of price.

-

–

Small Competitor’s Decision (), then

i.e., operator will not lease aggressively to avoid making the price too low. Its best response is the unique solution to

which lies in the strict interior of .

-

–

-

•

High individual cost regime (), then

i.e., the high cost makes operator not lease the maximum possible value.

-

–

If Large Competitor’s Decision (), then

i.e., the competitor ’s large leasing amount makes the price low. Together with the high leasing cost, it is optimal for operator not to lease anything. Thus we have

-

–

Small Competitor’s Decision (), then

i.e., operator ’s limited leasing amount enables operator to lease positive amount despite of the large leasing cost. And operator ’s best response is the unique solution to

which lies in the strict interior of .

-

–

-D Proof of Theorem 2

The best investment response of operator is summarized in Table III with detailed proof in Appendix -C.

An investment equilibrium () corresponds to a fixed iteration point of two functions and . In the following analysis, we examine all possible costs () regions labeled ()-() in Fig. 13, and check if there exists any equilibrium in each region.

-

(I)

If and , both the operators are in low individual cost regime.

- –

-

–

If and , then by solving equations and

we have and . But the value of is not smaller than .

-

–

If and , we can also show that there does not exist any equilibrium in this case by a similar argument as above.

- –

Hence, in region (), there exist infinitely many equilibria satisfying (12) and (13) when , and there exists a unique equilibrium satisfying (16) and (17) when .

-

(II)

If and , operator is in high individual cost regime and operator is in low individual cost regime.

-

–

If and , then we have and . But the value of is not greater than .

-

–

If and , then by solving equations and

we have and . But the value of is not less than .

-

–

If and , then by solving equations and

we have and . And is further required for existence of this equilibrium.

- –

Hence, in region (II), there exists a unique investment equilibrium () satisfying (16) and (17) when , and there exists a unique equilibrium satisfying and when .

-

–

-

(III)

If and , then both the operators are in high individual cost regime.

- –

-

–

If and , then by solving equations and

we have and . And is further required for existence of this equilibrium.

-

–

If and , then we can similarly show that there exists a unique equilibrium and only when

-

–

If and , then we have and . However, the value of is not greater than .

Hence, in region (III), there exists a unique equilibrium satisfying (16) and (17) when ; there exists a unique equilibrium satisfying and when ; and there exists a unique equilibrium with and when .

The same results can be extended to symmetric region () in Fig. 13.

-E Proof of Theorem 3

In the following analysis, we will first derive the users’ optimal behaviors in general SNR regime under a single operator case (monopoly), and then summarize the monopolist’s optimal pricing decision. After that, we prove the symmetric pricing structure for duopoly, and find the pricing equilibrium.

-E1 The users’ optimal behaviors in general SNR regime

Let us write the price announced by the monopolist by , and the investment amount by . By demanding bandwidth , a user ’s payoff function in the general SNR regime is

| (38) |

The optimal demand that maximizes (38) is

| (39) |

where is the unique positive solution to . The inverse function of is . By applying the implicit function theorem, we can obtain the first derivative of function over as

| (40) |

which is always positive. Hence, is increasing in .

User ’s optimal payoff is

| (41) |

As a result, user ’s optimal SNR equals and is user-independent.

-E2 Monopolist’s optimal pricing strategy

The users’ total preferred demand equals , and the operator’s pricing problem in Stage II is to maximize its revenue by optimally choosing a price. Let us define and .

The first derivative of over is

which is positive when and is negative when . Notice that approaches to positive infinity when goes to 0.

The second derivative of over can be shown to be negative when and positive when . Thus is concave in its increasing part with .

Fig. 14 illustrates the all possible relation between and which is a linear function of . The nonlinear curve represents the function . The two linear solid lines represent two representative values of . The other linear dashed line is with threshold slope that intersects at its maximum value. Note that always intersects since we have shown that the slope of at becomes positive infinity. To maximize the revenue, we will have the following two pricing cases:

-E3 Main proof of duopoly symmetric pricing structure

Now let us consider the two operator case based on the monopolist’s result. Suppose that there exists an equilibrium () with . The operator announcing lower price acts as a monopolist. Without loss of generality, we assume that . In the following analysis, we examine asymmetric pricing equilibrium in all () possibilities.

-

(a)

If , then any operator will not announce their prices higher than 0.468, in a fear of losing all its realized demand to its competitor. And the operator with the lower price will always increase its price to infinitely approach the other operator’s price, and thus no equilibrium can be obtained.

-

(b)

If , then operator will announce and operator will announce . And the operator with the lower price will always increase its price to infinitely approach the other operator’s price, and no equilibrium can be obtained.

-

(c)

If , then operator will announce , and operator will announce . And the operator with lower price will always increase its price to infinitely approach the other operator’s price, and thus no equilibrium can be obtained.

Thus there only exists possible symmetric pricing equilibrium.

-E4 Main proof of duopoly pricing equilibrium

Now we consider the duopoly pricing equilibrium () which should satisfy . Let us write symmetric price as . Since a user ’s demand is in (39), the users’ total preferred demand is . Following a similar analysis in Section III-A, the realized demands of the two operators are

Two operators’ revenues are and , respectively. Assume, without loss of generality, that . In the following analysis, we examine all () possibilities, and check if there exists any symmetric pricing equilibrium.

-

(a)

If , we have shown that . We investigate possible pricing equilibrium given operator ’s investment amount.

-

–

If , operator ’s investment is not enough to satisfy the total preferred demand.

-

*

If , operator can not realize even all its preferred demand.

-

·

If total supply is larger than total preferred demand (i.e., ), then operator will slightly decrease its price to attract much more preferred demand.

-

·

If total supply is smaller than total preferred demand (i.e., ), operator will slightly increase its price while its attracted preferred demand will not change.

-

·

-

*

If , operator ’s investment is enough to cover its preferred demand. Then operator will slightly decrease its price to attract much more preferred demand from its competitor.

-

*

-

–

If , operator ’s investment amount is enough to satisfy the total preferred demand. Then operator will slightly decrease its price to attract much more preferred demand.

Hence, there does not exist an equilibrium in case (a).

-

–

-

(b)

If , we have shown that and . Then we can show that there does not exist an equilibrium in case (b) by a similar argument as in case (a).

-

(c)

If , we will first show that total supply equals total preferred demand at any possible equilibrium (i.e., ).

-

–

Suppose that at an equilibrium and thus total supply is smaller than total preferred demand. Then operator will slightly increase its price while its attracted preferred demand will not change.

-

–

Suppose that at an equilibrium and thus total supply is larger than total preferred demand. Then operator will slightly decrease its price to attract much more preferred demand.

Thus total supply equals total preferred demand with for possible equilibrium. Let us check if this is indeed an equilibrium given total investment amount.

-

–

If , then we have . Operator gets its supply sold out, and essentially it acts as a monopolist in serving its realized users in monopolist’s high investment regime. Thus operator will increase its price to .

-

–

If , then we have . Operator gets its supply sold out, and essentially acts as a monopolist in serving its realized users in monopolist’s low investment regime. Thus it’s optimal to stick with current price. Similarly, operator will also stick with current price.

Thus there exists a unique pricing equilibrium with for low investment regime (i.e., ) only.

-

–

-F Proof of Theorem 4

-F1 Proof of Observation 1

The competition between two operators in Stage I can be modeled as the following investment game:

-

•

Players: operators and .

-

•

Strategy space: two operators will choose () from the set .

- •

The best response of operator (i.e., ) also equals . Notice that

| (44) |

where always appears together with . Thus is linear in and we can similarly show that is also linear in . Since the possible equilibrium is derived by joint solving equations and , and are both linear in the users’ aggregate wireless characteristics .

-F2 Proof of Observation 2

It is obvious that the symmetric pricing equilibrium in (22) is determined by and only. Since we have shown that operators’ equilibrium investment decisions are both linearly proportional to , thus the pricing equilibrium is independent of the users’ wireless characteristics.

-F3 Proof of Observation 4

Assume, without loss of generality, that a user purchases bandwidth from operator . We have shown in (39) that each user ’s equilibrium demand is always positive, linear in . And it is also decreasing in symmetric equilibrium price since positive function is increasing in .

And the SNR of user is , which also equals at symmetric pricing equilibrium. Thus each user achieves the same SNR independent of its wireless characteristic . And it is clear that user ’s payoff in (41) is independent of user ’s wireless characteristic .

-F4 Proof of Observation 5

It is clear that as duopoly’s symmetric price increases, the users’ achieved SNR increases but their payoffs decrease in general SNR regime. To prove Observation 5, we only need to show that as leasing cost or increases, equilibrium price will also increase. In the following analysis, we first show that symmetric equilibrium price increases as or decreases. Then we show that or decreases as leasing cost or increases.

-

•

It is easy to check that the first derivatives of over and are both negative, Thus duopoly’s symmetric equilibrium price increases as or decreases.

- •

Hence, users’ equilibrium SNR increases with the costs and , and their payoffs decrease with the costs.

-G Proof of Theorem 5

If and in the coordinated case, only operator will then participate in pricing stage and it becomes a monopolist. According to [27], the optimal leasing amount of monopolist is in low supply regime and the optimal price is to make the users’ total demand equal to its supply. Thus operator will announce the unique price

Similar result can be obtained for and

If , both the coordinated operators will participate in the pricing stage. Since the duopoly’s payments ( and ) are already determined, the two operators will cooperate to maximize their total revenue only in pricing stage. Without loss of generality, we assume , and find the optimal pricing strategies of coordinated duopoly as follows.

-

•

We first show the feasible range of and should be The reason is as follows. According to Proposition 1, duopoly will set the prices such that total supply equals to the users’ total demand and it is easy to check that

Then we conclude that and thus

-

•

Then we derive the relation between and . All the users have priority to purchase bandwidth from operator who charges less, and operator ’s revenue is . We then discuss different relation between operator ’s supply and preferred demand.

-

–

If , then operator ’s supply is excessive compared with the preferred demand. Due to Proposition 1, this will not happen in coordinated case.

-

–

If , then operator ’s supply is not enough to meet the preferred demand and we have . And the left demand going to operator will be . Since Proposition 1 requires total demand equals total supply, the operator should decide a price such that its supply equals the left demand, i.e.,

Thus we conclude that is a function of and rewrite it as

-

–

-

•

In pricing stage, the total profit maximization problem in coordinated case is equivalent to the total revenue maximization problem. And the total revenue can be expressed as a function of only. The solution to the total revenue maximization problem is

Since is an increasing function of on range , we have

By substituting the value of into we also obtain

Hence, the optimal pricing strategies of coordinated duopoly are

References

- [1] L. Duan, J. Huang, and B. Shou, “Competition with dynamic spectrum leasing,” in IEEE Symposium on New Frontiers in Dynamic Spectrum Access Networks (DySPAN), Singapore, Apr. 2010.

- [2] M. A. McHenry and D. McCloskey, “Spectrum occupancy measurements: Chicago, Illinois, november 16-18, 2005,” Shared Spectrum Company, Technical Report, 2005.

- [3] S. K. Jayaweera and T. Li, “Dynamic spectrum leasing in cognitive radio networks via primary-secondary user power control games,” IEEE Transactions on Wireless Communications, vol. 8(6), pp. 3300-3310, Jun. 2009.

- [4] Q. Zhao and B. Sadler, “A survey of dynamic spectrum access: signal processing, networking, and regulatory policy,” IEEE Signal Processing, vol. 24(3), pp. 78-89, May 2007.

- [5] O. Simeone, I. Stanojev, S. Savazzi, Y. Bar-Ness, U. Spagnolini, and R. Pickholtz, “Spectrum leasing to cooperating secondary ad hoc networks,” IEEE Journal of Selected Areas in Communications, vol. 26(1), pp. 203-213, Jan. 2008.

- [6] J. Jia and Q. Zhang, “Competitions and dynamics of duopoly wireless service providers in dynamic spectrum market,” in ACM MobiHoc 2008, 2008, pp. 313-322.

- [7] J. M. Chapin and W. H. Lehr, “Time-limited leases in radio systems,” IEEE Communications Magazine, vol. 45(6), pp. 76-78, Jun. 2007.

- [8] Wikipedia, “Mobile virtual network operator-wikipedia, the free encyclopedia,” 2009. [Online]. Available: http://en.wikipedia.org/wiki/Mobile_virtual_network_operator

- [9] D. Niyato and E. Hossain, “Competition pricing for spectrum sharing in cognitive radio networks: dynamic game, inefficiency of nash equilibrium, and collusion,” IEEE Journal of Selected Areas in Communications, vol. 26(1), pp. 192-202, 2008.

- [10] Y. Xing, R. Chandramouli, and C. Cordeiro, “Price dynamics in competitive agile spectrum access markets,” IEEE Journal on Selected Areas in Communications, vol. 25(3), pp. 613-621, 2007.

- [11] O. Ileri, D. Samardzija, T. Sizer, and N. B. Mandayam, “Demand responsive pricing and competitive spectrum allocation via a spectrum server,” in Proc. DySPAN 2005, 2005, pp. 194-202.

- [12] R. Etkin, A. Parekh, and D. Tse, “Spectrum sharing for unlicensed bands,” IEEE Journal on Selected Areas in Communications, vol. 25(3), pp. 517-528, 2007.

- [13] R. Menon, R. Buehrer, and J. Reed, “Outage probability based comparison of underlay and overlay spectrum sharing techniques,” in IEEE International Symposium on New Frontiers in Dynamic Spectrum Access Networks (DySPAN), 2005, pp. 101-109.

- [14] S. Huang, X. Liu, and Z. Ding, “Distributed power control for cognitive user access based on primary link control feedback,” in IEEE Infocom, 2010.

- [15] G. Scutari, D. Palomar, J.-S. Pang, and F. Facchinei, “Flexible design of cognitive radio wireless systems,” IEEE Signal Processing Magazine, vol. 26(5), pp. 107-123, Sept. 2009.

- [16] P. Papadimitratos, S. Sankaranarayanan, and A. Mishra, “A bandwidth sharing approach to improve licensed spectrum utilization,” IEEE Communications Magazine, vol. 43(12), pp. S10-S14, Dec. 2005.

- [17] Q. Zhao and A. Swami, “A decision-theoretic framework for opportunistic spectrum access,” IEEE Wireless Communications Magazine, vol. 14(4), pp. 14-20, Aug. 2007.

- [18] Q. Zhao, L. Tong, A. Swami, and Y. Chen, “Decentralized cognititve mac for opportunistic spectrum access in ad hoc networks: a pomdp framework,” IEEE Journal on Selected Areas in Communications, vol. 25(3), pp. 589-600, Apr. 2007.

- [19] S. Huang, X. Liu, and Z. Ding, “Optimal sensing-transmission structure for dynamic spectrum access,” in IEEE INFOCOM, 2009.

- [20] S. Huang, X. Liu, and Z. Ding, “Optimal transmission strategies for dynamic spectrum access in cognitive radio networks,” IEEE Transactions on Mobile Computing, vol. 8, no. 12, pp. 1636-1648, Dec. 2009.

- [21] J. Huang, R. A. Berry, and M. L. Honig, “Auction-based spectrum sharing,” ACM/Springer Mobile Networks and Applications Journal (MONET), vol. 24(5), pp. 1074-1084, 2006.

- [22] J. Jia, Q. Zhang, and M. Liu, “Revenue generation for truthful spectrum auction in dynamic spectrum access,” in Proc. ACM MobiHoc, 2009, pp. 3-12.

- [23] S. Gandhi, C. Buragohain, L. Cao, H. Zheng, and S. Suri, “Towards real-time dynamic spectrum auctions,” Computer Networks 52, pp. 879-897, 2008.

- [24] V. Rodriguez, K. Moessner, and R. Tafazolli, “Auction driven dynamic spectrum allocation: optimal bidding, pricing and service priorities for multi-rate, multi-class CDMA,” in Proc. 16th IEEE Int’l Symp. Personal, Indoor and Mobile Radio Comm. (PIMRC’05), vol. 3, Sept. 2005, pp. 1850-1854.

- [25] S. Wang, P. Xu, X. Xu, S.-J. Tang, X.-Y. Li, and X. Liu, “ODA: truthful online double auction for spectrum allocation in wireless networks,” in IEEE Symposia on New Frontiers in Dynamic Spectrum Access Networks (DySPAN), 2010.

- [26] X. Wang, Z. Li, P. Xu, Y. Xu, X. Gao, and H. Chen, “Spectrum sharing in cognitive radio networks-an auction-based approach,” IEEE Transactions on System, Man and Cybernetics–Part B: Cybernetics, to appear.

- [27] L. Duan, J. Huang, and B. Shou, “Cognitive mobile virtual network operator: optimal investment and pricing with unreliable supply,” in IEEE INFOCOM, San Diego, CA, USA, Mar. 2010.

- [28] S. Sengupta and M. Chatterjee, “An economic framework for dynamic spectrum access and service pricing,” IEEE/ACM Transactions on Networking, vol. 17(4), pp. 1200-1213, Aug. 2009.

- [29] D. Niyato, E. Hossain, and Z. Han, “Dynamics of multiple-seller and multiple-buyer spectrum trading in cognititve radio networks: a game-theoretic modeling approach,” IEEE Transactions on Mobile Computing, vol. 8, pp. 1009-1022, Aug. 2009.

- [30] R. B. Myerson, “Game Theory: Analysis of Conflict,” Cambridge, MA: Harvard University Press, 2002.

- [31] T. A. Weiss and F. K. Jondral, “Spectrum pooling: an innovative strategy for the enhancement of spectrum efficiency,” IEEE Communications Magazine, vol. 42, pp. S8-S14, Mar. 2004.

- [32] H. A. Mahmoud and H. Arslan, “Sidelobe suppression in OFDM-based spectrum sharing systems using adaptive symbol transition,” IEEE Communications Letters, vol. 12(2), pp. 133-135, Feb. 2008.

- [33] J. Bae, E. Beigman, R. A. Berry, M. L. Honig, and R. Vohra, “Sequential bandwidth and power auctions for distributed spectrum sharing,” IEEE Journal on Selected Areas in Communications, vol. 26(7), pp. 1193-1203, 2008.

- [34] IEEE 802.16 Working Group on Broadband Wireless Access Standards, “IEEE 802.16e-2005 and IEEE Std 802.16-2004/Cor1-2005,” 2005. [Online]. Available: http://www.ieee802.org/16/

- [35] V. Gajic, J. Huang, and B. Rimoldi, “Competition of wireless providers for atomic users: equilibrium and social optimality,” in Allerton Conference on Communication, Control, and Computing, Monticello, IL, USA, Sept. 2009.