Asymptotic and Exact Pricing of Options on Variance

Abstract.

We consider the pricing of derivatives written on the discretely sampled realized variance of an underlying security. In the literature, the realized variance is usually approximated by its continuous-time limit, the quadratic variation of the underlying log-price. Here, we characterize the small-time limits of options on both objects. We find that the difference between them strongly depends on whether or not the stock price process has jumps. Subsequently, we propose two new methods to evaluate the price of options on the discretely sampled realized variance. One of the methods is approximative; it is based on correcting prices of options on quadratic variation by our asymptotic results. The other method is exact; it uses a novel randomization approach and applies Fourier-Laplace techniques. We compare the methods and illustrate our results by some numerical examples.

Key words and phrases:

Realized variance, quadratic variation, option pricing, small-time asymptotics, Fourier-Laplace methods.1991 Mathematics Subject Classification:

91B28, 60G51We thank Richard Vierthauer for valuable discussions on the regularity of Laplace transforms and Marcel Nutz for comments on an earlier version. We are also very grateful to two anonymous referees, whose helpful comments significantly improved the present article.

1. Introduction

Consider a discounted asset and a time-interval subdivided into intervals of equal length with boundary points for . The corresponding (annualized) realized variance of over is then defined as

| (1.1) |

There exists a considerable number of financial instruments that are based on realized variance as an underlying (see, e.g., [5, 8] or [11, Chapter 11] for an overview). Well-known examples are variance and volatility swaps, as well as puts and calls on realized variance with payoffs resp. . By market convention, the length of a single interval typically corresponds to one business day for these derivatives (see [5, 18]). For puts and calls, the notion At-The-Money (henceforth ATM) refers to choosing the strike equal the to swap rate, which in turn equals the expectation under the pricing measure.

Given a stochastic model for resp. , the standard approach to pricing options on realized variance is to approximate realized variance by

| (1.2) |

where is the quadratic variation of the log-price . This approximation is motivated by the fact that – for fixed – realized variance (1.1) converges to in probability as the number of subdivisions tends to infinity (cf., e.g., [15, Theorem I.4.47]). The advantage of this approach is that for many stochastic processes, the quadratic variation is a well-studied object. For example, as recently shown by [16], the characteristic function of the quadratic variation in any affine stochastic volatility model111The class of affine stochastic volatility models includes exponential Lévy models, the Heston model with and without jumps, and many stochastic time-change models. can be computed as the solution of a generalized Riccati differential equation, such that in many cases methods based on Fourier-Laplace inversion (cf. [6, 22]) can be applied to compute option prices efficiently. Moreover, using quadratic variation in place of realized variance, allows – at least in diffusion models – for elegant replication arguments, such as the the representation of a variance swap as an infinite portfolio of European options (see [20]).

The quality of the approximation (1.2), or more precisely, the speed of convergence of realized variance to quadratic variation as the number of subdivisions increases has been studied extensively in the econometric literature. Barndorff-Nielsen and Shephard [2], for example, obtain a central limit law for the difference between realized variance and quadratic variation, scaled by the square root of , which holds in a large class of stochastic volatility models (compare also [14] for more general results).

However, an important difference from the econometric setting to the setting of variance options is that the sampling frequency for such options can not be chosen freely, but is determined by market convention. As mentioned above, daily sampling is the typical case. From an econometric point of view, this sampling frequency would most likely be considered insufficiently low to produce an acceptable estimate of quadratic variation over most reasonable time horizons . For variance options, though, not pointwise estimation under the physical measure is the goal, but the accurate risk-neutral pricing and hedging of options with specific payoffs. Therefore it is not clear to what extent findings from econometrics can be transferred. For this very reason several articles have considered the quality of the approximation (1.2) purely from the point of view of option pricing. Bühler [5] and Sepp [26], resp. Broadie and Jain [4] find via Monte-Carlo simulation resp. analytically that the approximation (1.2) for daily sampled realized variance works very well for claims with linear payoffs, like variance swaps. On the other hand, Bühler [5] observes that “while the approximation of realized variance via quadratic variation works very well for variance swaps, it is not sufficient for non-linear payoffs with short maturities. The effect is common to all variance curve models (or stochastic volatility models, for that matter).” In particular, he presents some numerical examples based on call options on realized variance in the Heston model, that indicate that the approximation by quadratic variation notably diverges from the true value for short maturities (cf. [5, p. 128]). This leads to the following questions considered in the present study:

-

(1)

To what extent is it indeed true that quadratic variation is not a good proxy for realized variance, when pricing short-dated options with non-linear payoffs?

-

(2)

How can options on the realized variance be valuated more accurately?

The remainder of the article is organized as follows. We first consider exponential Lévy models in Section 2 and compare the small-time limits of options on quadratic variation and on realized variance. Based on the results we propose a new method to approximatively evaluate prices of options on realized variance. In Section 3 we show that the results on exponential Lévy models can be transferred without modification to general semimartingale models. In Section 4 we propose a second – exact – pricing method for options on realized variance, which is based on Fourier-Laplace methods. We present numerical examples and compare the two methods in Section 5 and then conclude with some suggestions for future research.

2. Small-time asymptotics in exponential Lévy models

In this section, we derive the small-time asymptotics for options on variance in exponential Lévy models. That is, we suppose the asset price process is modeled as for a Lévy process . The latter is assumed to be square-integrable, such that the variance swap rate is always finite. The Lévy process will be characterized through its Lévy-Khintchine triplet with respect to the truncation function or, equivalently, by its Lévy exponent, i.e., the function

for which . We can decompose as

where is a standard Brownian motion and is an independent centered pure-jump Lévy process.

2.1. Options on quadratic variation

First, we consider the simpler case of options written on (annualized) quadratic variation.

Theorem 2.1.

Let be a square-integrable Lévy process with Lévy-Khintchine triplet and suppose the payoff functions , are continuous, uniformly bounded, and satisfy as . Then

The proof is based on the following auxiliary result, which is shown in the appendix.

Lemma 2.2.

Denote by the pure-jump component of . Then we have

2.2. Options on Realized Variance

Theorem 2.3.

Let be a square-integrable Lévy process with Lévy-Khintchine triplet and suppose that the payoff functions , are uniformly bounded and satisfy as for each . Then

| (2.1) |

where has gamma distribution with shape parameter and scale parameter .

Note that the distribution of the limiting random variable is determined solely by the number of sampling dates and the (annualized) variance of the continuous part of . The jump part of the process can only affect the value indirectly through the payoff functions , which usually depend on the swap rate and hence on the specification of . For the most important case of calls and puts on variance, it will turn out in Section 2.3 below that the final result indeed depends also on the jump part, namely through the (annualized) variance of the jump measure. For ATM calls and puts, the small-time limit will be determined completely by the value of .

To prove Theorem 2.3, we need the following two lemmas. The proof of the first one is similar to the proof of Lemma 2.2 and can be found in the appendix.

Lemma 2.4.

Denote by the pure-jump component of . Then we have

Lemma 2.5.

Let be the -algebra generated by the pure-jump component of . Then conditionally on , the rescaled realized variance follows a non-central chi-square distribution, with degrees of freedom and noncentrality parameter

Proof.

Conditionally on , the independent random variables , are normally distributed with

The rescaled realized variance is therefore non-central chi-square distributed with degrees of freedom, conditionally on . The noncentrality parameter of the distribution is given by

as claimed. ∎

Proof of Theorem 2.3.

Denote by

| (2.2) |

the density of the central chi-square distribution with degrees of freedom. The density of the non-central chi-squared distribution with degrees of freedom and non-centrality parameter can be expressed as an infinite weighted sum of densities of central chi-square distributions:

Finally, note that , with is the density of a gamma distribution with shape parameter and scale parameter . Using Lemma 2.5, we have

| (2.3) |

Let be the counting measure that assigns mass to each integer in . The last term in (2.3) can then be regarded as integrating the function

with respect to the product measure . We want to evaluate this integral as . By Lemma 2.4, -almost surely. Hence we may assume that is small enough to ensure , almost everywhere with respect to . In this case we can estimate the integrand using the explicit form (2.2) of the chi-square density:

Summing the right-hand side with respect to the counting measure we get , which is -integrable. Therefore, dominated convergence allows us to interchange limit and integration, and we obtain

Using the fact that a scaled chi-square distribution is a gamma distribution, the result follows. ∎

Having determined the small-time limit of option prices on both quadratic variation and realized variance, we now consider the difference between the two.

Definition 2.6.

Assume that the limiting payoff is the same for all options, i.e., there exists a function such that and as for all . Then we define

| (2.4) |

and call the discretization gap.

Corollary 2.7.

Suppose the prerequisites of Theorems 2.1 and 2.3 are satisfied. Then the discretization gap from Definition 2.6 is given by

| (2.5) |

where is a gamma-distributed random variable as in Theorem 2.3. If, in addition, the function is convex, has the following properties:

-

(a)

for all ,

-

(b)

if and only if or is affine-linear,

-

(c)

is decreasing in and converges to as .

Proof.

Since is convex and , Jensen’s inequality yields and (a) follows. Equality clearly holds if or is affine-linear, which yields the ‘if’-part of (b). For the ‘only if’-part assume that and that is not affine-linear. Then is strictly convex at least on some interval . Since the interval has strictly positive measure under the law of and the strict Jensen inequality implies that , completing the proof of (b). By [28, Example 1.5.1e] the gamma distributed random variables are decreasing in the convex stochastic order. In particular, is decreasing, too. Finally converges to in distribution as by elementary properties of the gamma distribution; hence , showing (c). ∎

The above corollary has some very interesting implications.

-

•

Assertion (a) shows that – at least asymptotically for small maturity – an option on quadratic variation is always cheaper than the option on realized variance with the same payoff, given that the payoff is convex.

-

•

Assertion (b) shows that the difference between the two option prices – the discretization gap – vanishes in two cases: The first case is when the payoff is linear; this confirms the observation of Bühler quoted in the introduction, and explains why for variance swaps realized variance can be substituted by quadratic variation even for short maturities. The second case in which the discretization gap vanishes is for Lévy processes without a diffusion component, (i.e., with ). This suggests that in a pure-jump Lévy model, quadratic variation should be a good proxy for realized variance, even when pricing short-dated options with non-linear (convex) payoffs. This assertion is confirmed by our numerical examples in Section 5.

Assertion (c), finally, is also quite intuitive. Since realized variance converges to quadratic variation as , also the discretization gap should vanish in the limit. It does, and in fact it does so monotonically in .

2.3. Applications to put and call options

Let us now examine the important special cases of put and call options. More specifically, denote by the variance swap rate, and consider the payoffs

for puts resp. calls with relative strike value . Setting yields ATM options. If the realized variance is approximated by quadratic variation, the swap rate is given by

where . We may apply Theorem 2.1 to the payoff

to obtain the small-time limit for put options. For call options we use put-call parity: The difference between a call and a put option with relative strike is times the swap rate.

Corollary 2.8.

Let be a square-integrable Lévy process with Lévy-Khintchine triplet , and define . Then the following holds:

-

(a)

Put options on quadratic variation satisfy

(2.6) -

(b)

Call options on quadratic variation satisfy

(2.7)

Note that in the ATM case both limits coincide and are equal to . In other words, the small-time limit of the price of an ATM option on quadratic variation is equal to the second moment of the jump measure and vanishes precisely in the Black-Scholes model. In the out-of-the-money case (puts with and calls with ) the limit may be zero even when jumps are present.

When the discretely sampled realized variance is used, calculations are a bit more involved. In this case, the swap rate is given by

| (2.8) |

In particular . For put options Theorem 2.3 can be applied directly, for call options we use again put-call parity.

Corollary 2.9.

Let be a square-integrable Lévy process with Lévy-Khintchine triplet , and define . Then the following holds:

-

(a)

Put options on realized variance satisfy

(2.9) -

(b)

Call options on realized variance satisfy

(2.10)

The functions resp. are strictly decreasing resp. increasing functions on given by

where denotes the (complete) gamma function and the lower incomplete gamma function.

Note that it follows from Corollary 2.7 that both (2.9) and (2.10) are decreasing functions of , which is illustrated by the numerical examples in Section 5. Also note that contrary to options on quadratic variation, the limiting value of a put or call option on realized variance is never zero, apart from the trivial case of deterministic .

Having derived the small-time limit for prices of puts and calls, both on realized variance and on quadratic variation, we can now consider the difference between the two, i.e., the discretization gap introduced in Definition 2.6. Simplifying the notation a bit, we write

| (2.11a) | ||||

| (2.11b) | ||||

which are the discretization gaps for put and call payoffs respectively. The following results can be derived from Corollary 2.7 or simply by combining Corollaries 2.8 and 2.9 above.

Corollary 2.10.

Let be a square-integrable Lévy process with Lévy triplet . Set and define the functions as well as as in Corollary 2.9. Then the following holds:

-

(a)

For , we have

-

(b)

For , we have

From Corollary 2.7 it follows that and are always positive and vanish if , i.e., in a pure-jump model. Suppose now that, in a certain Lévy model, we can easily calculate the prices of put and call options on quadratic variation222We discuss in Section 4 how – and in which models – this can be done.. Then the expressions for and can be used as correction terms to obtain an improved approximation for the price of the corresponding option on realized variance:

Approximation 2.11.

Let and be given by Corollary 2.7. Then the price of a put resp. call on quadratic variation can be approximated by

| (2.12a) | ||||

| (2.12b) | ||||

Remark 2.12.

An approximation of similar type has been proposed by Sepp [27] for the Heston model.

These approximations are exact in the limit (by definition of and ), and in the limit (since the -terms vanish, and realized variance converges to quadratic variation). We can therefore expect (2.12) to be good approximations for all maturities. The numerical results in Section 5 confirm convincingly that this is the case.

Similar approximations can of course be constructed for general payoffs , using the correction term from (2.5). According to Corollary 2.7, the discretization gap vanishes for linear payoffs, such that it can be interpreted as a convexity correction that corrects the basic approximation (1.2) depending on the convexity of the payoff.

So far, we have confined ourselves to Lévy models. It is a natural next step to examine whether our findings remain true when passing to more general asset price models incorporating, e.g., stochastic volatility. This is done in the following section.

3. Small-time asymptotics in semimartingale models

In this section, we show that – under very mild conditions – the small-time asymptotics of options on variance for general semimartingales coincide with those of a suitable Lévy approximation. Thus, the results derived in the previous section can be transferred directly and no new phenomena arise. Throughout, we suppose that the log-price is given by

| (3.1) |

for a standard Brownian motion , a Poisson random measure with absolutely continuous compensator (cf. [15, Section II.1] for more details), and predictable integrands . To ensure that the log-price process is a well-defined square-integrable semimartingale, we assume that

| (3.2) |

Remark 3.1.

In any reasonable application, (3.2) will imply

| (3.3) |

In this case, the process can be approximated for small by the square-integrable Lévy process

| (3.4) |

obtained from by “freezing” the coefficients of at time zero. Subject to weak regularity assumptions on the coefficients , , and , we then have the following small-time approximation results closely related to [19, Proposition 2.1].

Proof.

By [15, Theorems I.4.52 and II.1.8] and Fubini’s theorem, we have

Hence the assertion follows from the regularity assumptions on and . ∎

Lemma 3.3.

Proof.

First notice that the inequalities of Cauchy-Schwarz and Minkowski imply

| (3.5) | |||

For , the Burkholder-Davis-Gundy inequality as in [21, Theorem IV.48] as well as [15, Theorems I.4.52 and II.1.8] yield

for a constant which does not depend on . Arguing analogously for instead of , we obtain

| (3.6) |

Now notice that another application of the Burkholder-Davis-Gundy inequality and [15, Theorems I.4.52 and II.1.8] shows that, for ,

for a constant independent of . Under the stated assumptions, it follows that

For Lipschitz continuous payoffs, it now is an immediate consequence of Lemmas 3.2 and 3.3 that the small-time asymptotics for the semimartingale (3.1) and its Lévy approximation (3.4) coincide. Therefore they are determined by the formulas in Theorems 2.1 and 2.3, respectively.

Theorem 3.4.

Let be a semimartingale of the form (3.1) satisfying the prerequisites of Lemma 3.2 resp. Lemma 3.3.

-

(a)

Suppose that the payoff functions are continuous, uniformly bounded, and satisfy as . Moreover, suppose that is Lipschitz continuous. Then

-

(b)

Suppose that the payoff functions are uniformly bounded and satisfy as for each . Moreover, suppose that the are Lipschitz continuous. Then

where has gamma distribution with shape parameter and scale parameter .

Proof.

We decompose

where is the approximating Lévy process (3.4). The first term on the right-hand side can be bounded by and thus goes to zero as . The second term can be bounded by , where is the Lipschitz constant of . By Lemma 3.2, this term goes to , too. The third term also converges to , by Theorem 2.1, and the claim (a) follows. Assertion (b) is shown in the same way, substituting by and using Lemma 3.3 as well as Theorem 2.3. ∎

Consequently, Corollary 2.7 on the discretization gap, and Corollaries 2.8, 2.9 and 2.10 on put and call options on variance also hold in the present semimartingale setting if we substitute and . In particular, we find that the discussion following Corollary 2.7 can be completely transferred to the semimartingale setting, and that – again in an asymptotic sense – Bühler’s statement quoted in the introduction holds generically for semimartingales with non-vanishing diffusion component, where . More specifically, for a continuous semimartingale the small-time limit for ATM options on quadratic variation is zero, but its counterpart for realized variance is not. For semimartingales with jumps and a continuous martingale part, both limits are non-zero, but there is a non-trivial discretization gap. In pure-jump models however, where , the two small-time limits coincide, suggesting that quadratic variation should be a good approximation even for short maturities.

As an illustration, we show now how the prerequisites of Theorem 3.4 can be verified in some applications. For the sake of clarity, we do not strive for minimal conditions.

Corollary 3.5 (Lévy driven SDEs).

Let be bounded and Lipschitz continuous and let be a Lévy process with Lévy exponent , whose Lévy measure has bounded support. Then there exists a unique strong solution to the SDE

Moreover, is a martingale and the prerequisites of Theorem 3.4 are satisfied for the process

Proof.

The first part of the assertion follows from the standard existence and uniqueness theorem for SDEs as in [21, Theorem V.6], because is Lipschitz. Since the support of the Lévy measure is bounded, has finite moments and exponential moments of all order by [24, Corollary 25.8 and Theorem 25.17]. Hence is a local martingale by Itô’s formula and the true martingale property is a consequence of [15, Proposition I.4.50(c)]. Now notice that by definition of , the process is of the form (3.1) with

for the Lévy-Khintchine triplet of . Denote by the maximum of the Lipschitz constant and the uniform bound for the function . Then since a.s., for each , we have

Likewise, since is bounded and has compact support, there exists a constant such that

Finally,

is right-continuous. Combined with the Burkholder-Davis-Gundy inequality, similar arguments as above show that is also bounded in on any finite interval. Hence in and it follows that the conditions of Theorem 3.4 are satisfied. ∎

The next corollary of Theorem 3.4 covers many stochastic volatility models from the empirical literature as, e.g., the ones of Bates [3], where follows a square-root process, and of Barndorff-Nielsen and Shephard [2], where is given by a Lévy driven Ornstein-Uhlenbeck process.

Corollary 3.6 (Homogeneous jumps).

Let be time-homogeneous, deterministic, and such that and are finite. Then for

the stock price is a local martingale and the conditions of Theorem 3.4 hold, if is right-continuous and bounded in in some neighborhood of zero.

Proof.

Evidently, (3.2) is satisfied for sufficiently small under the stated assumptions. Moreover, Itô’s formula shows that is a local martingale. The regularity conditions on in Theorem 3.4 are trivially satisfied. The ones for follow, because the processes and are uniformly integrable and hence continuous in . ∎

4. Exact pricing methods for options on realized variance

In the previous sections, we examined the small-time limits for options written on the quadratic variation and on the discretely sampled realized variance. We have also proposed a method, Approximation 2.11, to approximate the price of an option on realized variance, given that the price of the corresponding option on quadratic variation is known. We first recall in this section how to compute these prices efficiently using Fourier-Laplace methods. We then propose a new randomization approach, that allows to use similar methods to directly determine the exact price of an option on realized variance in exponential Lévy models, without the use Approximation 2.11. The two methods will then be compared numerically in Section 5. Throughout the section we assume that the log-price follows a Lévy process with the same properties as in Section 2.

4.1. Option pricing using integral transform methods

We first recall how to price European-style options using the integral transform approach of [6, 22]. The key assumption is the existence of an integral representation of the option’s payoff function in the following sense:

for and such that is integrable.

Example 4.1.

In view of Fubini’s theorem, the valuation of options which can be represented like this boils down to the computation of the Laplace transform of the underlying. E.g., for the put on quadratic variation we have

Using the put-call parity , this leads to the analogous formula

for calls on variance, provided that is integrable. Evidently, one just has to replace the normalized quadratic variation by to come up with the corresponding formulas for options on discretely sampled realized variance. Summing up, it remains to compute the Laplace transforms of the objects of interest.

4.2. Options on quadratic variation

For exponential Lévy models, the quadratic variation process also follows a Lévy process (cf. [7] for the self-decomposable and [16] for the general case). More specifically, we have the following

Lemma 4.2.

Suppose the -price follows a Lévy process with Lévy-Khintchine triplet . Then also is a Lévy process and its Lévy-Khintchine triplet is given by relative to the truncation function , where,

Proof.

See [16, Lemma 4.1] . ∎

Combined with the Lévy-Khintchine formula [24, Theorem 8.1], this result immediately yields the required Laplace transform.

Corollary 4.3.

We have , for

Consequently, we obtain

| (4.1) |

for puts on quadratic variation. Likewise, for calls on quadratic variation,

| (4.2) |

provided that . Some examples from the literature where the Lévy exponent of can be computed in closed form are summarized in Section 5 below.

4.3. Options on realized variance

In this section we develop a corresponding integral transform pricing method for claims on the discrete realized variance (1.1) in exponential Lévy models, without any use of approximation. The method we present will in general be of similar computational complexity as the method based on quadratic variation, especially in cases where the Lévy exponent of is of more tractable form than the Lévy exponent of . Such cases include for example subordination-based processes like the normal inverse Gaussian or generalized hyperbolic process, see Remark 4.9 for more details.

As in the previous section, the crucial quantity is a Laplace transform, namely

where the equality is due to the independence and stationarity of the increments of the Lévy process . Consequently, if the Laplace transform of the squared process is known, the price of, e.g., puts and calls on discrete realized variance can be recovered by an inverse Laplace transform as above.

Our approach is based on the following identity: If is a normally distributed random variable, independent of , then using the characteristic function of the normal distribution it holds that

| (4.3) |

for all . Note that the first expectation is taken with respect to the law of the Lévy process , the middle expectation with respect to the product law of and , and the final expectation with respect to the law of the normal random variable only. The exchange in the order of integration is justified by the Fubini theorem, and the fact that the integrands on the left and right hand side are bounded by in absolute value. The benefit of formula (4.3) is to replace an integration with respect to the law of the Lévy process – which is typically not known explicitly – by an integration with respect to a standard normal distribution. The characteristic exponent which appears in the expectation on the right is in most cases analytically known and of considerably simpler form than the law of the Lévy process.

Let us remark here that the randomization approach of formula (4.3) can be extended to the Laplace transform of powers with , and consequently to the discrete realized -variation of a Lévy process . To this end, replace the standard normal variable by a symmetric -stable random variable with parameters (cf. [24, Theorem 14.15]). Using that we obtain

| (4.4) |

for all .

Remarks on Laplace Inversion

The integral in formula (4.2) can be considered as inverting a Laplace transform by integration along a contour in the complex plane. There are many alternatives to this inversion method, see, e.g., [10] for an overview. Some of these methods only require knowledge of the Laplace transform on the positive real line, and thus seem tailor-made for formula (4.3) which holds – unless further conditions are imposed – only on . The best-known such method is probably the Post-Widder inversion formula

| (4.5) |

where denotes the Laplace transform of a function , and its -th derivative. The Post-Widder method suffers from slow convergence and cancellation errors, and modifications such as the Gaver-Stehfest algorithm have been introduced to improve its performance. After implementing the Gaver-Stehfest algorithm and performing some numerical tests, we observed, however, that small errors in – which invariably result from the evaluation of (4.3) – are strongly amplified by this method and lead to huge errors in , probably due to the use of very high-order derivatives in (4.5). Moreover, as [10] shows, inversion algorithms that evaluate the Laplace transform in the complex half-plane are in general numerically superior to algorithms that evaluate the Laplace transform only on the positive half-plane. For these reasons we decided to concentrate on the contour integration formula (4.2), and as a next step, to extend (4.3) to the complex half plane . Note that this extension is also necessary for other more recent Laplace inversion algorithms like the methods proposed in [1].

Extension to the complex half plane

Extending (4.3) to the complex half plane will not be possible without imposing some conditions on . The following is sufficient:

Condition 4.4.

The characteristic exponent has an analytic extension from the imaginary halfline to the sector

Moreover, the extended function satisfies the growth bound

| (4.6) |

Remark 4.5.

An analytic function satisfying the growth bound (4.6) is often said to be of order and type in the sector .

An elementary symmetry argument shows that given the above condition, can also be analytically extended from the negative imaginary halfline to the conjugate sector .

Lemma 4.6.

Suppose satisfies Condition 4.4. Then it can also be analytically extended from the halfline to the conjugate sector . Overall, has a unique extension to the hourglass shaped region , which is analytic on both and and satisfies the growth bound

| (4.7) |

Proof.

Suppose that satisfies Condition 4.4, i.e., it is an analytic function defined on . For define . On the imaginary axis, this definition agrees with the Lévy-Khintchine representation of . The analyticity of on follows directly, e.g., by verifying the Cauchy-Riemann differential equations. The growth bound on is an immediate consequence of the construction of the extension. ∎

We can now establish the central result of this section:

Theorem 4.7.

Let be a Lévy process with characteristic exponent and let be an independent standard normal random variable. Then

| (4.8) |

holds for all on the positive real line. If satisfies Condition 4.4, then (4.8) holds for all in the positive half-plane , with denoting the unique analytic extension described in Lemma 4.6.

Remark 4.8.

The square root denotes the principal branch of the complex square root function with branch cut along the negative real line.

Remark 4.9.

For most Lévy processes proposed in the literature, the Lévy exponent can be computed in closed form. Hence, the evaluation of the Laplace transform of typically requires one numerical integration. The corresponding formula for the Laplace transform of in Corollary 4.3 is therefore simpler, if the integral can be computed in closed form. However, even if this is possible as, e.g., for CGMY processes and the models of Merton and Kou, one usually has to employ special functions (cf. Section 5) such that the numerical advantage is not too big. On the other hand, e.g., for NIG or generalized hyperbolic Lévy processes, has to be evaluated using numerical quadrature, such that both formulas turn out to be of a similar complexity.

Proof.

Let . The function (using the principal branch of the square root) is a single-valued analytic function on , mapping to , and thus to . With the normal random variable taking values in it follows that . Let . Then (4.7) implies that there exists such that

| (4.9) |

Thus

Note that follows a chi-square distribution with one degree of freedom. The right hand side thus has a finite expectation of value , whenever . Since was arbitrary, it can be chosen small enough to satisfy this condition. We have shown that

exists for all . Next we show that it is also analytic. Let be a sequence of truncations of and define

Since is continuous on , pointwise in . Moreover, since the integrand is absolutely bounded for in compacts, each is analytic in (cf. [23, Chapter 10, Exercise 15]). Let be a compact subset of . On the bound (4.9) can be turned into a uniform bound

where and depend only on , and we again use the continuity of on . By the Cauchy-Schwarz inequality, we obtain

for all . This shows that the convergence of to is uniform on compact subsets of . But analyticity is preserved by uniform convergence on compacts (cf. [23, Theorem 10.27]), such that is analytic. We have now shown that both sides of (4.8) are well-defined analytic functions on . Since they coincide on the positive real line, they must coincide on all of , and the proof is complete. ∎

The following example shows that Condition 4.4 can not be reduced to analyticity in the sector alone:

Example 4.10.

Let , where is a Poisson process with intensity , and , such that is a martingale. The Lévy exponent of this process is given by . Clearly, has an analytic extension to the whole complex plane and, in particular, to the sector . But , such that the growth condition (4.6) is not satisfied, e.g., in the direction . Finally the formula (4.8) is not well-defined on the whole complex half-plane . Indeed, a tedious calculation shows that is infinite for, e.g., and , such that does not exist.

Even though Theorem 4.7 fails in this simple case, Condition 4.4 holds for most Lévy processes used in applications.

Example 4.11.

Condition 4.4 is satisfied for the following Lévy processes.

-

(1)

Brownian motion: In this case, is an entire function. Moreover, for all .

-

(2)

The Kou model: This jump-diffusion process corresponds to

for and determined by the martingale condition . Again, obviously admits an analytic extension to and, in addition, for all .

-

(3)

The Merton model: For this jump-diffusion process, we have

for , , and determined by the martingale condition . Consequently, can be analytically extended to . Furthermore, since for sufficiently large , it follows that for all .

-

(4)

NIG processes: In this pure jump specification,

where , and is determined by the martingale condition . Once more, admits an analytic extension to . Moreover, for all .

-

(5)

CGMY processes: These generalizations of the VG process correspond to

for parameters and . In particular, can be analytically extended to and for all .

Based on these examples and the above counterexample we conjecture that Condition 4.4 is related to the absolute continuity or smoothness of the Lévy measure.

5. Numerical Illustration

We now consider three numerical examples. First, we take a look at the Black-Scholes model, then we turn to the pure-jump CGMY model. Finally, we also consider the jump-diffusion model of Kou.

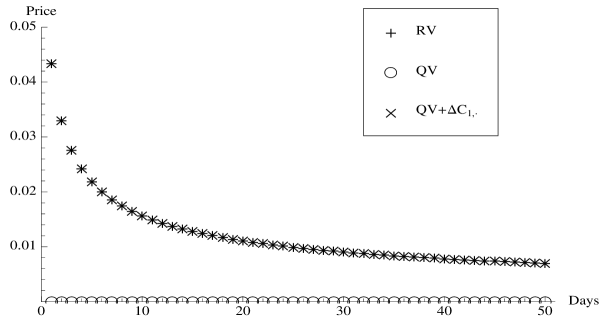

In the Black-Scholes model the distribution of realized variance is known explicitly; it is the non-central chi-square distribution. Thus neither Approximation 2.11 nor our exact method from Section 4 would be needed to compute prices of options on realized variance. Nevertheless, the Black-Scholes model can serve as a first test case to compare our two methods. Note that Approximation 2.11 amounts in this case to approximating the (true) noncentral chi-square distribution of realized variance by a central chi-square distribution. For a volatility parameter of , ATM call prices on realized variance, ATM call prices on quadratic variation and ATM call prices on quadratic variation corrected by the discretization gap are depicted in Figure 1 for maturities up to days.

Evidently, the prices of ATM calls on realized variance cannot be distinguished from the convexity corrected approximation (2.12) by eye, showing that Approximation 2.11 performs remarkably well.

Also note that the prices of calls on the realized variance and of convexity corrected calls on quadratic variation converge to the prices of calls on quadratic variation (which are zero) for increasing maturity, but the rate appears to be even slower than in the results for the Heston model reported in [5]. In particular, using quadratic variation as a proxy for realized variance does not work well here, unless one uses the convexity correction (2.12).

for the confluent hypergeometric -function . We use the calibrated (yearly) parameters

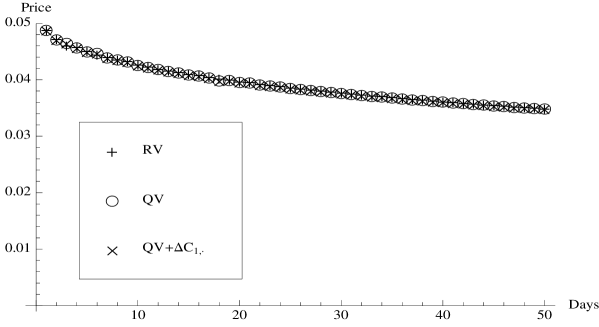

from [7, Table 1]. Corollary 4.3, Approximation 2.11, and Theorem 4.7 then lead to the results in Figure 2.

Evidently, the three price curves cannot be distinguished by eye. In particular, quadratic variation seems to serve as an excellent proxy for realized variance at all maturities here, which drastically differs from the results reported for the Heston model in [5], and also from the results for the Black-Scholes model shown in Figure 1. This reflects the fact that the discretization gap vanishes for pure-jump models according to Corollary 2.10. In particular, the convexity correction term is zero in this case.

As a third example we consider the model of Kou, which includes both jumps and a Brownian component. Similarly as above, the Lévy exponent of can again be expressed in terms of the confluent hypergeometric -function:

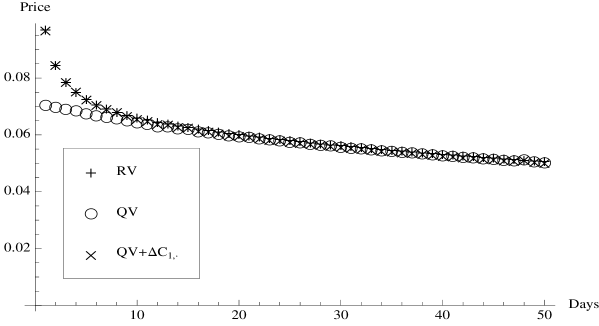

with the function from (5.1). In this jump-diffusion model, we have a non-vanishing discretization gap by Corollary 2.10. Using the calibrated yearly parameters

from [25, Section 7.3], we obtain the numerical results depicted in Figure 3.

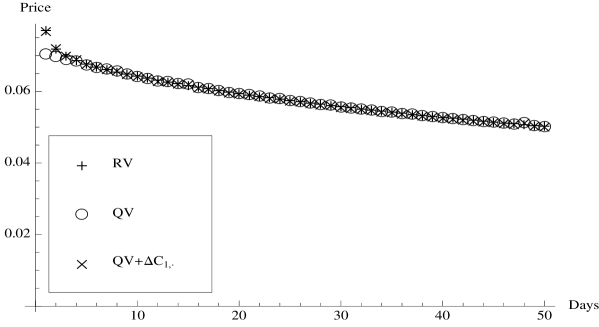

Again, first notice that the convexity corrected call prices on quadratic variation almost perfectly match the exact call prices on realized variance. Next, note that whereas quadratic variation appears to serve as a much better approximation than in the Black-Scholes model here, the discretization gap is still significant for short maturities, unlike in the pure-jump CGMY model. By Corollary 2.10 we would expect the gap to shrink for smaller values of . The effect of reducing to , while keeping all other parameters the same is shown in Figure 4 and agrees with this prediction.

6. Conclusions and Outlook

We have proposed two different methods to calculate prices of options on realized variance, that improve upon the standard approximation by quadratic variation.

The first method, Approximation 2.11, was found to work very well for ATM options in three different Lévy models with and without jumps. By the results in Section 3, it is also possible to apply the same approach to more general models, provided that prices of options on quadratic variation can still be computed efficiently. Hence one objective for future research will be to test its numerical performance for stochastic volatility models with and without jumps. For affine stochastic volatility models (see for example [16, 17]), a class which includes the Heston model, the SVJ and SVJJ models of [11] and most time-change based stochastic volatility models, the results of [16] could be used as a starting point. Since our approximation method “freezes” the stochastic volatility at time zero, one would expect it to perform worse for stochastic volatility models. On the other hand, Sepp [27] has obtained encouraging results for the Heston model with a similar method.

Our second method, the exact Fourier-Laplace approach from Section 4, could also be possibly extended to stochastic volatility models. Again the class of affine stochastic volatility models seems particularly suitable, since in such models the log-price and the stochastic variance process have a joint conditional characteristic function of the form

| (6.1) |

for . It seems thus possible to use a conditional version of the identity (4.8) in each time-step between business days, and to use the special form of (6.1) to convert this conditional identity into a recursive algorithm for the computation of the Laplace transform of realized variance. The delicate point is to find analyticity conditions analogous to Condition 4.4 that allow to extend the identity to the positive half-plane . A rigorous analysis of the necessary technical conditions as well as an efficient numerical implementation for this case is also deferred to future research.

Appendix A Proof of Lemma 2.2 and 2.4

Proof.

We first show Lemma 2.2. Lemma 2.4 follows then after minor modifications of the proof. Let be a sequence converging to zero and let . For sufficiently small , we have

| (A.1) |

Now notice that is a Lévy process with triplet relative to the truncation function , which can be used because is of finite variation. Hence it follows from [13, Formula (5.8)] that

Together with (A.1), this implies , because was arbitrary. As , thus converges to zero in probability, and hence a.s. along a further subsequence . This shows that on a set of probability one, the sequence has the cluster point and, moreover, that is the unique cluster point. Therefore a.s. and by the right-continuity of the claim follows.

To show Lemma 2.4, substitute by . Now note that is a Lévy process with triplet relative to the truncation function , which can be used because is integrable. Again using [13, Formula (5.8)], the above arguments show a.s. By independence and stationarity of the increments of , it follows that a.s.

∎

References

- [1] Abate, J. and Whitt, W. (1995). Numerical Inversion of Laplace Transforms of Probability Distributions. ORSA Journal on Computing 7 No. 1, 36-43.

- [2] Barndorff-Nielsen, O. E. and Shephard, N. (2002). Econometric analysis of realized volatility and its use in estimating stochastic volatility models. J. R. Statist. Soc. B 64 253-280.

- [3] Bates, D. S. (1996). Jumps and stochastic volatility: exchange rate processes implicit in Deutsche Mark options. Rev. Financ. Stud. 9 69-107.

- [4] Broadie, M. and Jain, A. (2008). The effect of jumps and discrete sampling on volatility and variance swaps. Int. J. Theor. Appl. Finance 11 761-797.

- [5] Bühler, H. (2006). Volatility Markets – Consistent modeling, hedging and practical implementation. PhD thesis, TU Berlin.

- [6] Carr, P. and Madan D. (1999). Option valuation using the fast Fourier transform. J. Comput. Finance 2 61-73.

- [7] Carr, P., Geman, H., Madan, D. and Yor, M. (2005). Pricing options on realized variance. Finance Stoch. 9 453-475.

- [8] Carr, P. and Lee, R. (2008). Robust replication of volatility derivatives. Preprint.

- [9] Cont, R. and Tankov, P. (2004). Financial Modelling with Jump Processes. Chapman & Hall/CRC, Boca Raton.

- [10] Davies, B. and Martin, B. (1979). Numerical inversion of the Laplace transform: a survey and comparison of methods. J. Comput. Phys. 33 1-32.

- [11] Gatheral, J. (2006). The Volatilty Surface. Wiley Finance, New York.

- [12] Jacod, J. (1979). Calcul Stochastique et Problèmes de Martingales. Springer, Berlin.

- [13] Jacod, J. (2007). Asymptotic Properties of power variations of Lévy processes. ESAIM Probab. Stat. 11 173–196.

- [14] Jacod, J. (2008). Asymptotic properties of realized power variations and related functionals of semimartingales. Stoch. Proc. Appl. 118 517–559.

- [15] Jacod, J. and Shiryaev, A. (2003). Limit Theorems for Stochastic Processes. Springer, Berlin, 2nd edn.

- [16] Kallsen, J., Muhle-Karbe, J. and Voß, M. (2009). Pricing options on variance in affine stochastic volatility models. Math. Finance. To appear.

- [17] Keller-Ressel, M. (2009). Moment explosions and long-term behavior of affine stochastic volatility models. Math. Finance. To appear.

- [18] Lee, R. (2010). Realized volatility options. Encyclopedia of Quantitative Finance. Ed. Rama Cont, Wiley, Chichester.

- [19] Muhle-Karbe, J. and Nutz, M. (2010). Small-time asymptotics of option prices and first absolute moments. Preprint, arXiv:1006.2294

- [20] Neuberger, A. (1992). Volatility trading. London Business School working paper.

- [21] Protter, P. E. (2005). Stochastic Integration and Differential Equations. Springer, New York, 2nd edn.

- [22] Raible, S. (2000). Lévy Processes in Finance: Theory, Numerics, and Empirical Facts. Dissertation Universität Freiburg i. Br.

- [23] Rudin, W. (1966). Real and Complex Analysis. McGraw-Hill, New York, 1st edn.

- [24] Sato, K. (1999). Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press, Cambridge.

- [25] Sepp, A. (2003). Analytical pricing of double-barrier options under a double-exponential jump diffusion process: applications of Laplace transform. Int. J. Theor. Appl. Finance 7 151-175.

- [26] Sepp, A. (2008). Pricing options on realized variance in Heston model with jumps in returns and volatility. J. Comput. Finance 11 33-70.

- [27] Sepp, A. (2010). Note on ’Pricing Options on Realized Variance in the Heston Model with jumps in returns and volatility’: An approximate distribution of the discrete variance. Preprint, SSRN:1664267.

- [28] Stoyan, D. (1983). Comparison Methods for Queues and Other Stochastic Models. Wiley, Chichester.