Testing for financial crashes using the Log Periodic Power Law model

Abstract

Many papers claim that a Log Periodic Power Law (LPPL) model fitted to financial market bubbles that precede large market falls or ‘crashes’, contain parameters that are confined within certain ranges. Further, it is claimed that the underlying model is based on influence percolation and a martingale condition. This paper examines these claims and their validity for capturing large price falls in the Hang Seng stock market index over the period 1970 to 2008. The fitted LPPLs have parameter values within the ranges specified post hoc by [Johansen and Sornette(2001)] for only seven of these 11 crashes. Interestingly, the LPPL fit could have predicted the substantial fall in the Hang Seng index during the recent global downturn. Overall, the mechanism posited as underlying the LPPL model does not do so, and the data used to support the fit of the LPPL model to bubbles does so only partially.

Keywords: Financial time series; bubbles and crashes; nonlinear time series; robustness; log periodic power law.

Classification codes: G17, G01, C46.

We acknowledge the great help provided by Anders Johansen particularly in answering the many queries that we had about his data analysis and in providing us with the program that he used to estimate the parameters of the LPPL.

1 Introduction

Financial crashes and the bubbles associated with them have generated much research interest particularly during the last few years. Since during bubbles prices appear to move away from the fundamental value of securities, financial bubbles are often attributed to the irrational exuberance of investors. If past earnings are high and investors use past earnings to predict future earnings, then it is likely that prices can contain long memory leading to stock price bubbles. However, the evidence for long memory in financial prices is essentially mixed (see, e.g., [Ambrose et al.(1993), Hays et al.(2010)]). Similarly, financial bubbles seem much more substantial than one would expect. The price falls and volatility that follow when prices are unsustainably high, lead to prices that are below fundamental value. Such extreme movements in prices have important implications for risk management and valuation of financial securities. Not surprisingly, there is ongoing debate in both the academic and business press on the extent to which financial regulation can curb such extreme price movements.

Two broad finance theories make predictions about stock price changes. They are the efficient market hypothesis (EMH) and the rational bubbles view (RBV). Both theories begin from the standpoint that an asset has a fundamental value, defined as the market’s expected discounted present value of the firm’s future cash flow that impacts on the value of the firm’s stock price. Empirical tests of both the EMH and the RBV often fail to explain large market price falls or ‘crashes’, since such financial crashes are not usually associated with any specific news item.111 Our definition of a stock market crash is similar to that of [Hong and Stein(2003)], in that they represent unusual large market falls that are not followed by large public news events and where such falls are market wide in nature. This definition accords with certain empirical work. For example, [Cutler et al.(1989)] find that of the 50 largest daily price falls in aggregate stock prices for the period 1946-1987, the majority are not accompanied by external news of specific importance.222 Recently, several specific theoretical models of stock market crashes have been put forward. In [Romer(2001)] symmetric rational asset-price model, neither rational behavior nor external news plays an important part in giving rise to stock market crashes. Both the [Hong and Stein(2003)] and [Barlevy and Veronesi(2003)] models assume that economically significant differences in the views of investors can lead to stock market crashes when they are revealed. However, recent empirical work shows that external news might have a role to play in giving rise to financial crashes. Indeed, in a related study, Rangel (2011) finds that it is the surprise element of macroeconomic announcements that gives rise to significant jumps and volatility intensity, but only in respect of inflation shocks represented in the Producer Price Index.

Empirical tests of the RBV have also had limited success in identifying price bubbles prior to large price falls (see [Blanchard and Watson(1982)] and [West(1987)]). [Donaldson and Kamstra(1996)] estimate a non-linear ARMA-ARCH artificial neural network model that enables them to reject the claim that the 1929 stock market crash was the outcome of a bubble. One reason for the failure of tests of the RBV is the difficulty of explicitly isolating an asset’s fundamental value from the component of the bubble tied to the asset’s market price. Recently, [Kaizoji(2010a)] put forward a theoretical explanation for the origin of bubbles, their persistence and the reason for the crash that follows. [Kaizoji(2010b)] demonstrates that financial crashes originate primarily from the herding behavior of noise traders and the increase/decrease in the associated momentum in noise trading during the life cycle of noise trading activity.

Empirical researchers employ a variety of approaches to model financial crashes or unusual price movements. [Bali(2007)] developed a conditional extreme value theory (EVT) in terms of value at risk (VaR) that appears to outperform traditional approaches that rely on the skewed t or normal distribution for modeling unusual price movements (see also [Harmantzis et al.(2006)]). However, the distributional form of EVT based on VaR does not lead to a semi-martingale process so that, when seeking to predict stock price movements, the model seems inappropriate. [Kim et al.(2011)] employ several different distributional assumptions for the conditional errors of their ARMA(1,1)-GARCH(1,1) model. They find that the predictive ability of their ARMA(1,1)-GARCH(1,1) model depends on the distributional assumptions that underly the conditional errors. Indeed, versions of the ARMA(1,1)-GARCH(1,1) model which assume non-normally distributed conditional errors performed better than those that assume a normal distribution. Specifically, their classical tampered stable distribution ARMA(1,1)-GARCH(1,1) model performs best, providing early warning signals of up to one year of financial crashes, including the September 29, 2008 crash. [Kumar et al.(2003)] apply logit models to both microeconomic and financial data and show that currency crashes can be predicted. Similarly, [Markwat et al.(2009)] use an ordered logit regression to predict financial crashes. Their results show that the global crashes tend to follow local and regional crashes in which interest rates and market volatility play an important part.

In this study we employ an alternative approach to model the financial bubbles prior to crashes. We fit a Log-Periodic Power-Law (LPPL), due to [Sornette et al.(1996)], to the Hang Seng index . The LPPL approach has attracted a lot of attention in recent years. An important advantage of the LPPL model relative to other approaches is that it seeks to predict both the continuation and termination of a bubble in the same estimation. The notion that financial crashes are manifestations of power law accelerations essentially suggests that endogenously induced stock market crashes might obey a particular power law, with log-periodic fluctuations. This approach contrasts with [Ragel(2011)] where crashes are considered to be exogenously induced. Following [Sornette et al.(1996)], and [Lillo and Mantegna(2004)], many papers claim to show that this model is able to capture a shift over time in the log-periodic oscillations of financial prices that are associated with market crashes. Given the manner in which the estimation is performed, shifts over time log-periodic oscillations are not directly captured but depend on the window that is searched.

The analogy of financial crashes as being similar in their statistical signatures to critical points as depicted in natural phenomena has, however, been argued to be unrealistic. [Laloux et al.(1999)] express doubts about the validity of fitting a seven-parameter model to highly noisy data. They argue that such a model would suffer from severe over-fitting. Also, some log-periodic precursors do not always lead to crashes but to a smooth draw-down or even a greater draw-up. This suggests that there is no universal manner in which financial bubbles manifest themselves. Indeed, some evidence (see, e.g., [Feigenbaum(2001)]) shows that the predicted time of a crash is sensitive to the size of the event-window used to predict the crash. We also find the size of the event-window places an important constraint on our empirical results.

Whilst the LPPL model is not perfect, it is empirically appealing as it provides a forecast of the date by which a financial crash might occur.333 [Laloux et al.(1999), p. 4] report two instances when financial crashes were predicted ex ante. The prediction was correct in one case but not in the other despite both predictions being published prior to the expected crash date. Indeed, they conclude that “…recent claims on the predictability of crashes are at this point not trust worthy.” This is an important attribute relative to other methods of financial risk assessment. For example, [Novak and Beirlant(2006), p. 461] argue that EVT provides a means of predicting “…the magnitude of a market crash but not the day of the event.” Furthermore, the LPPL model contains a component that captures the market’s excessive volatility prior to a crash. This feature is consistent with several theoretical models of financial crashes as well as with empirical results [Levy(2008), Choudhry(1996)]. Indeed, [Kaizoji and Kaizoji(2004)] show that the tail of the cumulative distribution function of ensembles of changes in stock prices is well described by a power-law distribution. As such, the LPPL model provides a reasonably good fit to the data (see also, [Kaizoji(2006)]). Overall, the LPPL model appears to contain important statistical attributes that require serious empirical consideration and we explore some of those features in this study.

There are several critical considerations associated with fitting an LPPL model to financial data: first, studies that support the LPPL model (see e.g., [Johansen et al.(2000)]) show that the parameter estimates of the LPPL model are confined within certain ranges and that it is these ranges that are the indicators of market crashes. This approach considerably restricts the number of classes of permissible LPPL fits to just those fits with parameters that fall within the specified ranges rather than to LPPLs with any values for their seven parameters. This means that the choice of the parameters for determining a crash does not rely on some p-value; this is an important weakness in using the LPPL to identify financial crashes.

Second, the mechanism underlying the LPPL model is such that prices must be expected to increase throughout the bubble, which is largely in line with the rational bubbles literature, but which is not what has been found in early empirical fits of the LPPL model (see Section 3.5). Finally, there has been neither sufficient critical analysis of the LPPL model nor sufficient assessment of its goodness-of-fit to available data. In particular, a goodness-of-fit test is rarely applied in empirical work and the sensitivity of the parameters of the fitted LPPL model is usually not reported (see Section 5.6).

The remaining main sections of this paper are as follows: Section 2 introduces the LPPL model; Section 3 describes the mechanism underlying the LPPL model and evaluates prior work; Section 4 gives some details of the procedure used for identifying the parameters of an LPPL that best fits the data; Section 5 presents the fits obtained for the pre-crash bubbles of the Hang Seng index, compares the parameters obtained with those of prior work as well as tests whether the parameters obtained have values that do in fact predict their following crashes. We provide a summary of our results and conclude in the last section.

2 The LPPL

The simplest form of the LPPL model can be written as:

| (1) |

where:

is the price (index), or the log of the price, at time ;

is the value that would have if the bubble were to last until

the critical time ;

is the decrease in over the time unit before the crash

if C is

close to zero

is the magnitude of the fluctuations around the exponential

growth, as a proportion;

is the critical time;

is any time into the bubble, preceding ;

is the exponent of the power law growth;

is the frequency of the fluctuations during the bubble;

is a shift parameter.

The ranges of values given for both and are based on the observed parameters of crashes for many stock markets [Johansen(2003)]. Researchers tend to rely on established ranges for and , rather than any goodness-of-fit test, to identify the bubbles that precede crashes.

Empirical studies that fit the LPPL model to financial data make a number of claims:

-

1.

The mechanism that characterizes traders on financial markets is one in which they mutually influence each other within local neighborhoods. This leads, in turn to coordinated behavior through a martingale condition, which in the extreme can lead to a bubble and then a crash (see e.g., [Johansen et al.(2000)]).

-

2.

Endogenously induced financial crashes are preceded by bubbles with fluctuations. Both the bubble and the crash can be captured by the LPPL model when specific bounds are imposed on the critical parameters and (see e.g., [Johansen(2003), Johansen and Sornette(2001)]).

-

3.

The values of the parameters and for the empirically fitted LPPL are sufficient to distinguish between LPPL fits that precede a crash from those that do not (see e.g., [Sornette and Johansen(2001)]).444 [Lin et al.(2009)] carried out such an evaluation on a variant of the LPPL model.

In this paper, we examine the first two of the above claims and suggest a new approach for testing them. The third claim is more controversial; it only makes sense to evaluate it once we have a positive evaluation of the second claim.

3 Is the Underlying Mechanism Correct?

3.1 The underlying mechanism

The mechanism driving the change in price during a bubble as posited in [Johansen et al.(2000)] is based on rational expectations, namely, that the expected price rise must compensate for the expected risk. The mechanism is a stochastic process such that the conditional expected value of the asset at time , given all previous data before and up to , is equal to its price at time . The martingale condition as formulated by [Johansen et al.(2000)] is:

| (2) |

| where: | is the expected change in price, conditional on no crash occurring | |

| over the next time interval , at equilibrium; | ||

| is the price at time ; | ||

| is the proportion by which the price is expected to drop during | ||

| a crash, if it were to occur; | ||

| is the hazard rate at time , i.e. the chance the crash will occur | ||

| in the next unit of time, given that it has not occurred already. |

Under this martingale condition, investors will buy shares at time if they expect the price at time will exceed the price at by more than the associated risk. That is: . This buying would drive up today’s price. So the expected rise in price between today and tomorrow will be less (assuming that the expected price tomorrow remains constant); this buying will continue until the expected rise is in line with the perceived risk according to Eq. 2. Alternatively, if investors believe that the expected rise in price tomorrow will be insufficient to compensate for the risk, i.e. , then they will sell today, going short if necessary, thus driving today’s price down.

Notice that all the terms on the right side of Eq. 2 are positive, so , i.e., the price must always be expected to be increasing during a bubble. This condition was not treated as a constraint in early work (see, e.g., [Johansen et al.(2000)]) and as such gives us the opportunity of treating this requirement as a testable prediction.555 [Sornette and Zhou(2006)] does treat this condition as a constraint on the permissible parameter values.

We now follow the consequences of Eq. 2 for the behavior of prices. Re-arranging Eq. 2 gives us:

| (3) |

To capture the behavior of the price, the hazard rate, , needs to be specified. Here, [Johansen et al.(2000)] posit a model in which each trader is in one of two states, either bull (+1) or bear (-1). At the next time step, the position of trader is given by:

| (4) |

| where: | is the coupling strength between traders; | |

| is the set of traders who influence trader ; | ||

| is the current state of trader ; | ||

| is the tendency towards idiosyncratic behavior for all traders; | ||

| is a random draw from a normal distribution with zero mean | ||

| unit variance. |

The relevant parameter determining the behavior of a collection of such traders is the ratio , which determines a critical value of , say . If then the collection is in a disordered state. However, as approaches order begins to appear in the collection, with a majority of traders having the same state. As the value of approaches from below, the system becomes more sensitive to small initial perturbations. At the critical value, , all the traders will have the same state, either +1 or -1. [Johansen et al.(2000)] further assume that: i) the coupling strength of increases smoothly over time up to ; and ii) the hazard rate is proportional to . They do not justify these assumptions but the first one might be based on assuming that, as the frequency of fluctuations increases, traders become less sure of their own judgment and rely more on the judgment of their neighbors. In the next sections, we consider the evolution of over time.

3.2 Simple power law hazard rate

In the simplest scenario, evolves linearly with time. Assuming that each trader has four neighbors arranged in a regular two dimensional grid, then the susceptibility of the system near the critical value, , can be shown to be given by the approximation:

| (5) |

where and (see [Johansen et al.(2000)]). The three assumptions taken together give:

| (6) |

3.3 Log periodic hazard rate

To introduce log periodic fluctuations into the growth function, we need a different form of interconnected structure. Such a structure is assumed to be equivalent to one created by: i) starting with a pair of linked traders; ii) replacing each link in the current network by a diamond with four links and two new nodes diagonally opposite each other. This process continues until some stopping criterion is met. Then (see [Johansen et al.(2000)]):

| (8) |

| (9) |

which is the LPPL of Eq. 1 with .

3.4 Index: raw versus log

Note from Eq. 9 that it is the log of the price index that needs to be fitted to the LPPL, although in practice the LPPL model has often been fitted to the raw index data. [Johansen and Sornette(2001)] recommend the use of the raw data when the price drop in the crash is proportional to the price over and above the fundamental value rather than being proportional simply to the price. That is, they replace the condition 2 by:

| (10) |

where is the fundamental value (which they do not further define).

[Johansen and Sornette(2001)] introduce the assumption that the rise in price since the beginning of the bubble is much less than the amount by which the price at the beginning of the bubble is above the fundamental value. Thus

| (11) |

where is the time of the beginning of the bubble. Even if the asset’s fundamental value is not estimated in the model, the above assumption is weakly testable. If the price rise during the bubble is greater than the price at the beginning of the bubble, i.e. , then the condition of Eq. 11 cannot be fulfilled unless the fundamental price is negative. We assume that this is not what is intended. So we can test whether or not this assumption is met.

Integrating Eq. 10 from the moment when the bubble starts, , and using Eq. 11 gives:

| (12) | |||||

Provided the assumption in Eq. 11 is met, Eq. 12 can be used to fit the LPPL to raw price (as done, e.g., in [Johansen and Sornette(2001)]) rather than the log price data.

3.5 Tests of the underlying mechanism

[Chang and Feigenbaum(2006)] tested the mechanism underlying the LPPL model using S&P index data for the bubble preceding the 1987 crash. They compared the predictions of a LPPL fitted to the data with a random walk model. To do so, they first extended the LPPL model as given in Eq. 1, by adding:

-

a random term with zero mean and variance estimated from the data. This noise term is necessary to compute a likelihood for the observed data deviations from the predicted LPPL model.

-

a positive upward drift term estimated from the data. This addition to the LPPL model, while frequently made in financial time series, is unnecessary here, as faster-than-exponential growth is posited in the LPPL model.

Then they estimated the likelihood of the observed change in price since the previous day, , and selected parameters that maximized the sum of these likelihoods over the entire bubble.

With a time series there is a choice of which next point to take as being the most likely: either the predicted value or the predicted change since . Using the model’s prediction of the value at ignores the value at ; this is what [Johansen et al.(2000)] implicitly assume when they minimize the root mean square error for the fitted LPPL against the data. On the other hand, using the predicted change since ignores any deviation that the price at already has, from the model’s prediction for . This is what [Chang and Feigenbaum(2006)] explicitly do to specify the mechanism underlying their adaptation of the LPPL model. Not surprisingly, when judged for each time point separately, their method is not to be preferred to the random walk model [Chang and Feigenbaum(2006)].

While most of the assumptions underlying the mechanism from which the LPPL model is derived are untestable (or even questionable), there is one that is testable: the hazard rate must be positive. This implies that the expected price must always rise. If the fitted LPPL does not have this property, then the assumption that in Eq. 2 is a probability, must be rejected.

As proposed by [Graf v. Bothmer and Meister(2003)], it is possible to force the hazard rate to be positive, . The condition for the hazard rate to be positive is, from Eq. 8, that:

| (13) | |||||

a condition that was used by [Sornette and Zhou(2006), equation 3]. Requiring the slope of , as given in Eq. 1, to be positive, i.e. , gives the same condition as Eq. 13. [Graf v. Bothmer and Meister(2003)], using a the three-year data window on the Dow Jones index between 1912 and 2000, found that the condition 13 together with , predicts that a crash would occur within a year on only a quarter (65/229) of the windows which were actually followed by a crash within a year. So forcing the hazard rate to be positive here led to poor predictions.

4 Fitting the LPPL Parameters

The seven parameters of the LPPL in Eq. 1 have to be estimated from the window of data points in the bubble. The chosen values of these parameters should be the ones that minimize the root mean squared error (RMSE) between the data and the LPPL model’s prediction for each day of the bubble. The squared error between the prediction from the fitted curve from Eq. 1 and the data is:

| (14) |

| where: | is the data point, either the price index or its log; | |

| is the data point as predicted by the model; | ||

| is the number of weekdays in the bubble; | ||

| is the calendar day date of the weekday | ||

| from the beginning of the bubble. |

Partially differentiating Eq. 14 with respect to the parameters and gives us three linear equations from which the values of and that minimize the RMSE are derived, given the other four parameters: and . To find suitable values for these four parameters a search method is required. This search method used in [Johansen and Sornette(2001)] and [Sornette and Johansen(2001)], hereafter collectively called the JS studies, was:

-

First to make a grid of points for the parameters and , from each of which a Taboo search was conducted to find the best value of and , i.e. the ones for which, with and chosen to minimize the RMSE, gave the lowest RMSE.

-

To select from these points those for which .

-

From these points, i.e. those points that were found to minimize the RMSE for which , conduct a [Nelder and Mead(1965)] Simplex search, with all the four search parameters free (and and chosen to minimize the RMSE).

We presume that the reason that any fit with was rejected is because the increase in the index is exponentially declining whereas the underlying mechanism requires it to be increasing. An alternative technique would have been to place no restriction on the value of , and if a value of is found, to reject the model, as we have done for the requirement that the fitted LPPL never decreases (see Section 5.1).

Similar to the JS studies, we use a preliminary search procedure based on a grid to provide seeds for the Nelder-Mead Simplex method, as implemented in Matlab [Lagarias et al.(1998)]. It is based on choosing different values for the two parameters and , as these are the critical parameters for determining whether the fitted LPPL model is a crash precursor or not (see Eq. 1). The algorithm and the parameter values used are shown in the Appendix. Note that instead of the crash date, , we use , the number of days between the day on which the estimate is being made and the predicted critical date.

5 Empirical Results

5.1 Test of the underlying mechanism

In this section we test whether or not the underlying mechanism, as described in Section 3.5, applies to the raw Hang Seng index data. The observations for the Hang Seng index were obtained from Datastream. We analyze the Hang Seng index since it is commonly believed that this stock market has had several crashes, thus giving us ample opportunity to test the LPPL model.666 This suggests that stock market crashes can be common. Indeed, using a statistical method to identify outliers, [Schluter and Trede(2008)] show that the 1987 stock market crash of the Dow Jones Industrial index was not a structurally unusual event.

As an initial test, we show the LPPL fitted to the raw Hang Seng index data for the bubble preceding the 1989 crash. We use this crash period for the Hang Seng index in order to closely match this part of our results with those of [Sornette and Johansen(2001)]. The plots of the LPPL model are shown in Figure 1. The fit of our LPPL model is similar to Figure 8 of [Sornette and Johansen(2001)]. Notice that the LPPL in Figure 1 has a negative slope some of the time. The same is true in 18 of the 30 cases reported in [Johansen and Sornette(2001)] and [Sornette and Johansen(2001)].777 These 16 pre-crash bubbles are: the Dow Jones (1929, ’62), S & P (’37, ’87), Hang Seng (’80, ’89, ’94, ’97), Argentina (’91, ’92, ’97) and various other stock market crashes of 1994 (Indonesia, Korea, Malaysia, Philippines) and 1997 (Indonesia, Mexico, Peru). That is, the fitted LPPL predicts that on average the price should decrease at some time points. This empirical fact is sufficient to reject the martingale condition as being the mechanism underlying the LPPL fit to pre-crash bubbles.

5.2 Data and descriptive statistics

| N | Mean | Variance | Skew | Kurtosis |

|

||

|---|---|---|---|---|---|---|---|

| 10152 | 0.00045b | 0.00035 | -1.25934a | 31.58011a | 424542.78.9a |

Note: The mean and variance are multiplied by 100

a denotes statistical significance at the 1 percent level

b denotes statistical significance at the 5 percent level

To perform more rigorous tests on the fits of the LPPL model, we extend the daily prices for the Hang Seng to cover the period 1 January 1970 to 31 December 2008. Descriptive statistics, shown in Table 1, reveal that the mean log changes of the Hang Seng index series are significantly different from zero. Both skewness and (excess) kurtosis are significant such that the Jarque-Bera test rejects the null of normality at a 1 percent level. Notice that skewness is highly significant and negative. This finding suggests that the Hang Seng stock market can be very sensitive to stock market crashes. That is, volatility feedback can increase the probability of large negative returns and in turn, increase the potential for crashes [Campbell and Hentschel(1992)].

5.3 Identifying a crash

To test whether or not the LPPL can predict crashes we first need to identify the crash itself. Usually a stock market crash is taken to mean a very large and unusual price fall. In our application, a crash can span more than one day. This is consistent with the October 1987 stock market crash.

There are two situations when we might falsely claim that a crash has occurred. One is when the index is on the way up in a bubble and then there is a large drop, but it turns out that the drop is temporary and the bubble continues. The other is when, on the way down during a crash, the index experiences a recovery and so we identify the beginning of a new bubble but the recovery is temporary and the anti bubble is still in effect. To avoid those situations, we identify a peak as one initiating a crash as follows:

-

a period of 262 weekdays prior to the peak for which there is no value higher than the peak,

-

a drop in price of 25%, i.e. down to 0.75 of the peak price, which is in line with the 1987 crash,

-

a period of 60 weekdays within which the drop in price needs to occur.

We first tested whether the application of these criteria enables us to capture the eight crashes on the Hang Seng index, as identified in the JS studies. Indeed, we identify crashes at the same time points as in the JS studies, except for one additional crash in 1981 (see Figure 2). To exclude the price fall in 1981 from being classified as a crash, we would have to increase the drop-to criterion or reduce the drop-by criterion. Doing either would also exclude some of the other peaks as initiating crashes, viz. those peaks that immediately preceded the crashes of 1978, 1994, 1997, all of which are identified as crash initiators in the JS studies (see Figure 3). Thus the rule they apply seems somewhat imprecise. It is true that the 1981 crash occurs shortly after the 1980 crash, so we might exclude the 1980 peak as initiating a crash, but rather being a part of the bubble preceding the 1981 crash, but this is not what was done in [Sornette and Johansen(2001)]. It would also be possible to exclude fitting an LPPL model to the bubble preceding the 1981 crash on the grounds that this bubble is too short – just 7 months long. However, another bubble (the one preceding the crash 1971) was fitted even though it lasted only 6 months. As such, the bubble preceding the 1981 crash should have been included in the JS studies, unless one insists on having more than say 7 months of data preceding a crash. On balance, we believe that it is appropriate to include the 1981 crash we have identified, giving us nine crashes for the period of the JS studies. Overall, the criteria for identifying a crash does not appear to be consistently applied in the JS studies.

In the period after the JS studies, i.e. between 2000 and 2008, our criteria identify two additional peaks as initiating crashes; these are in 2000 and in 2007. The two bubbles preceding these crashes provide a post-hoc test of the hypothesis underlying the LPPL model (see Eq. 1).

5.4 Troughs and bubble beginnings

Having decided that a peak is the initiator of a crash, the data window to be used for fitting the LPPL model to the preceding bubble needs to be carefully selected. In the JS studies the start of the data window is taken to be the day on which the index reaches its lowest value “prior to the change in trend” [Johansen and Sornette(2001)]. In real time matters are not so simple, since one does not know if the index will drop still further in the future. So for real time analysis we would need to take as the end of the previous crash the lowest point since the last crash, up until now.

Moreover, [Johansen and Sornette(2001)] sometimes move the beginning of the bubble from the lowest point since the previous crash to a later time as in their Asian and Latin-American study. This was done if “at the trough the next bubble had not yet begun” (Johansen, personal communication). From the JS studies, we deduce that this was done for four of the eight crashes they identified on the Hang Seng:

-

1971 crash: forward 2 months, from 5/1/1971 to 10/3/1971,

-

1978 crash: forward 3 years and 1 month, from 10/12/1974 to 13/1/1978,

-

1987 crash: forward 1 year and 8 months, from 2/12/1982 to 23/7/1984,

-

1994 crash: forward 2 years and 2 months, from 5/6/1989 to 19/8/1991.

These are indicated by squares in Figure 4.

It is clear why [Johansen and Sornette(2001)] moved the beginning of the bubbles for the 1978 and 1987 crashes to times later than the trough proceeding the crash. For 1978 there was a long period of stable prices which is clearly not part of a bubble. For 1987, the year and 8 months following the trough are characterized by two mini bubbles and two peaks (which with other crash criteria would themselves be considered initiators of crashes). It is not so clear why they moved the start points of the other two bubbles (preceding the 1971 and 1994 crashes) forward.

In the JS studies, a model fit is only made if there are at least 131 weekdays of data between the trough and the crash. Changing the number of days could lead to different bubbles being considered as crash precursors. To illustrate this for the Hang Seng data, there are only 155 weekdays between the end of the 1980 crash and the peak in 1981 when it appears that another crash occurred. To require (say) 262 weekdays would result in insufficient data, and thus exclude the bubbles before both the 1981 and the 1971 crashes, thus affecting the results. This means that one needs to be very careful in implementing the rule, given the data under consideration.

5.5 Fitting to the raw index

| Bubble: | Raw Hang Seng: | Ratio: | ||

|---|---|---|---|---|

| beginning at | ending on | |||

| *10-Mar-1971 | 20-Sep-1971 | 201 | 406 | 2.02† |

| 22-Nov-1971 | 09-Mar-1973 | 279 | 1775 | 6.36† |

| 13-Jan-1978 | 04-Sep-1978 | 383 | 707 | 1.85 |

| 20-Nov-1978 | 13-Nov-1980 | 468 | 1655 | 3.54† |

| 12-Dec-1980 | 17-Jul-1981 | 1222 | 1810 | 1.48 |

| 23-Jul-1984 | 01-Oct-1987 | 747 | 3950 | 5.29† |

| 07-Dec-1987 | 15-May-1989 | 1895 | 3310 | 1.75 |

| 19-Aug-1991 | 04-Jan-1994 | 3723 | 12201 | 3.28† |

| 23-Jan-1995 | 07-Aug-1997 | 6968 | 16673 | 2.39† |

| 13-Aug-1998 | 28-Mar-2000 | 6660 | 18302 | 2.75† |

| 23-Apr-2003 | 30-Oct-2007 | 8520 | 31638 | 3.71† |

Note: , the day the bubble began; , the last day of the bubble

* Bubble beginning moved to later than the trough between peaks

† , so the raw index should not be used

In the JS studies, for all but the 1973 crash, the LPPL model has been fitted to the bubble in the raw index rather than to the log of the index. For this to be justified, the inequality in Eq. 11 must hold. That is, the price rise during the bubble must be considerably less than the difference between the price at the beginning of the bubble and the fundamental price. If we make the reasonable assumption that the fundamental price cannot be negative, then at any time during the bubble the expected price must at the very least not be more than double that at the beginning of the bubble. This condition is met for only two of the eight bubbles found in the JS studies (see Table 2). For the remaining six bubbles this condition does not hold, i.e. the expected price more than doubled during the bubble, so the inequality in Eq. 11, which is the assumption upon which the raw rather than the log of the index can be chosen, was violated. Despite this, in the JS studies five of these six fits of the LPPL model are made to the raw index rather than to its log; they should not have been.

5.6 Sensitivity to search parameter values

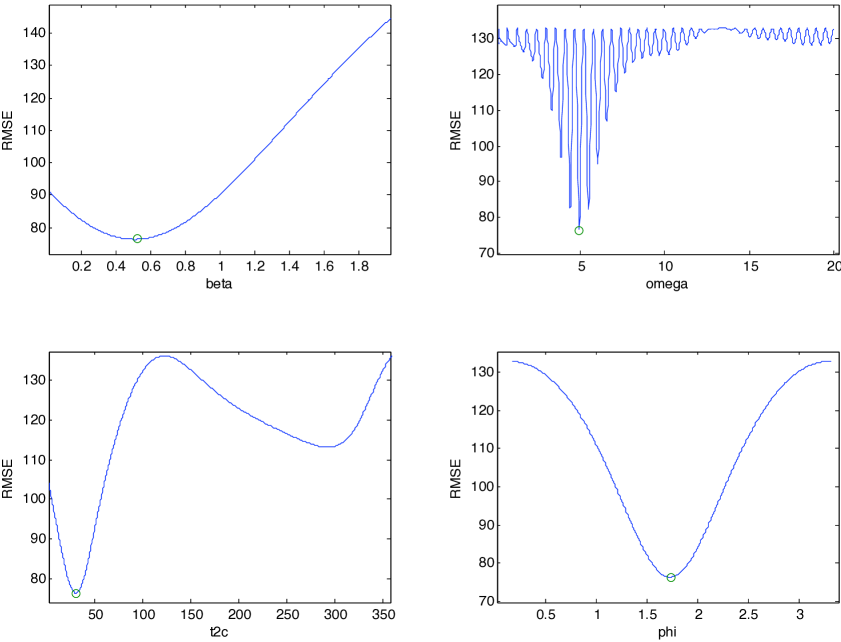

Identifying an LPPL model fit to a bubble as one that precedes a crash depends on the values found for the two critical parameters and ; so it is important to examine how sensitive the RMSE of the fit is to variations in these parameters. We use the bubble preceding the 1989 crash on the Hang Seng to examine the sensitivity of the LPPL fit to variations in each of the four search parameters ( and ); the other three parameters ( and ) are always set using these four (see Section 4). The results are shown in Figure 5. The circle indicates the chosen parameter value. While the chosen values of the search parameters are at global minima, the RMSE is highly sensitive to small fluctuations in the value chosen for [Brée et al.(in press)]. The sensitivity diagrams for the other Hang Seng bubbles listed in Table 2 are similar to those shown in Figure 5. Consequently the value found by the search procedure for may not be the one that leads to the minimum RMSE. It might be thought that the search space could nevertheless be smooth: if a local minimum has been found, small variations in one or more of the other parameters might lead to a smooth surface and avoid the search procedure getting trapped. However, the sensitivity to other search parameters would then have to also fluctuate greatly, and they do not. So the multi-dimensional surface is unlikely to be smooth. As the value of is used in predicting whether or not the bubble will be followed by a crash, this would be a serious problem.

| Parameter: | A | B | C | RMSE | |||||

| Units: | HSI | HSI | rads | days | rads | HSI | |||

| Predicted | low: | 0.15 | 4.80 | 1 | 0 | ||||

| range: | high: | 0 | 0.51 | 7.92 | ? | ||||

| From/to | Note | ||||||||

| 10-Mar-1971 | *[SJ] | 594 | -132 | -0.033 | 0.20 | 4.30 | 7 | 0.50 | 7.58 |

| 20-Sep-1971 | 539 | -101 | -0.047 | 0.22 | 4.30 | 3 | 0.25 | 6.11 | |

| 22-Nov-1971 | [SJ] | 11 | -3 | 0.003 | 0.11 | 8.70 | 2 | 0.05 | 0.0722 |

| 09-Mar-1973 | log | 65 | -56 | -0.001 | 0.01 | 11.1 | 20 | 1.32 | 0.0538 |

| log | 8 | -0 | -0.177 | 0.57 | 1.47 | 2 | 3.14 | 0.0549 | |

| raw | 2443 | -485 | -0.114 | 0.26 | 1.45 | 2 | 3.14 | 40.91 | |

| 13-Jan-1978 | *[SJ] | 816 | -50 | -0.053 | 0.40 | 5.90 | 6 | 0.17 | 10.09 |

| 04-Sep-1978 | 741 | -23 | 0.072 | 0.51 | 5.30 | 1 | 0.00 | 10.12 | |

| 20-Nov-1978 | [SJ] | 1998 | -231 | -0.044 | 0.29 | 7.24 | 3 | 1.80 | 46.72 |

| 13-Nov-1980 | 41164 | -38080 | 0.001 | 0.01 | 7.51 | 52 | 3.06 | 35.02 | |

| 7929 | -5352 | 0.008 | 0.05 | 6.79 | 26 | 1.55 | 35.55 | ||

| 1998 | -231 | -0.044 | 0.29 | 7.24 | 3 | 2.63 | 37.00 | ||

| 12-Dec-1980 | – | ||||||||

| 17-Jul-1981 | 1753 | -0 | -0.890 | 2.41 | 3.02 | 1 | 3.14 | 40.46 | |

| 1817 | -3 | -0.567 | 1 | 4.75 | 12 | 0.35 | 49.24 | ||

| 1946 | -11 | -0.399 | 0.76 | 5.89 | 36 | 0.00 | 54.95 | ||

| 23-Jul-1984 | *[JS] | 5262 | -542 | -0.007 | 0.29 | 5.60 | 22 | 1.60 | 133.86 |

| 01-Oct-1987 | 5779 | -711 | 0.048 | 0.27 | 5.68 | 34 | 2.63 | 68.47 | |

| 07-Dec-1987 | [SJ] | 3403 | -32 | -0.023 | 0.57 | 4.90 | 34 | 0.50 | 133.21 |

| 15-May-1989 | 3575 | -53 | -0.195 | 0.52 | 4.95 | 31 | 1.74 | 76.33 | |

| 19-Aug-1991 | *[JS] | 21421 | -7614 | 0.024 | 0.12 | 6.30 | 4 | 0.60 | 322.80 |

| 04-Jan-1994 | 212635 | -194575 | -0.002 | 0.27 | 5.95 | 1 | 3.13 | 272.82 | |

| 14038 | -1717 | -0.028 | 0.26 | 6.43 | 4 | 3.14 | 281.36 | ||

| 23-Jan-1995 | [JS] | 20359 | -1149 | -0.019 | 0.34 | 7.50 | 51 | 0.80 | 531.79 |

| 07-Aug-1997 | 20255 | -1201 | -0.048 | 0.33 | 7.47 | 51 | 2.29 | 438.79 | |

| 13-Aug-1998 | – | ||||||||

| 28-Mar-2000 | 21918 | -16 | 0.073 | 1.00 | 18.35 | 290 | 0.00 | 710.99 | |

| 24095 | -97 | -0.057 | 0.76 | 17.51 | 264 | 3.14 | 720.17 | ||

| 19503 | -372 | 0.111 | 0.52 | 5.7 | 9 | 2.07 | 744.15 | ||

| 23-Apr-2003 | – | ||||||||

| 30-Oct-2007 | 38940 | -6408 | 0.019 | 0.20 | 5.41 | 1 | 3.14 | 693.61 | |

| Notes: | * | Bubble beginning moved to a later time |

| [JS]/[SJ] | From [Sornette and Johansen(2001)]/[Johansen and Sornette(2001)] |

number of days from date of the fit until predicted crash date, - today

indicates that the optimal value of

Bold values of and are well outside the range specified in Eq. 1

5.7 The ‘best’ fits of the LPPL model

We now fit the LPPL model to the raw data for each of the bubbles preceding the 11 crashes identified for the Hang Seng index over the period 1970 to 2008 (as selected by the criteria in Section 5.3). We use the minimum RMSE as the criterion for best fit. For each crash:

-

The first line of Table 3 shows the parameters of the LPPL model fit as given in the JS studies, but with the linear parameters and recalculated for time expressed in days rather than years. As the RMSE was not reported for the JS studies (except for the LPPL fitted to the bubble preceding the 1997 crash) this too has been recalculated by us.

-

The second line shows the parameters for our best fit to the raw data. The results are based on the raw data, despite our reservations about its appropriateness (Section 5.5), because we want to compare our results with those of the JS studies.888 For the crash of 1973 [Johansen and Sornette(2001)] used the log instead of the raw index, so we report both log and raw fits specifically for that year.

-

If this is not within the bounds for a crash prediction, then subsequent lines show the next best fit that is (or might be).

Variation in the values of the critical parameters and sufficiently large to take them across their acceptable boundaries lead to only quite small fluctuations in the RMSE. This can bee seen, for example, for the crashes of 1973 and 1980 (see Table 3).

We were interested in comparing our LPPL fits to those found in the JS studies. However, given the high sensitivity of the RMSE to small changes in the value of (see Section 5.6) and as the values for and were reported to only one decimal place in the JS studies, our re-calculated RMSEs will be different from those that were obtained in these studies. We can see this in the bubble ending in the crash of 1997, where we have not only our recalculated RMSE using the parameters rounded to one decimal place, but also the RMSE using the unrounded parameter values as found by [Johansen et al.(2000)]; the latter fit is considerably better than our recalculation (RMSE=436 rather than 532 Hang Seng Index units). This improvement is almost certainly due to using the exact rather than the rounded value of . So caution needs to be taken when comparing the RMSEs for the fits reported in the JS studies and our fits.

Of the eight pre-crash bubbles fitted in the JS studies we find virtually the same parameters for the LPPL model for six of them; namely, those preceding the crashes of 1971, 1978, 1987, 1989, 1994 and 1997. However, for their other two bubbles we found different parameters as follows:

-

1973:

For this bubble, [Sornette and Johansen(2001)] report the fit to the log of the Hang Seng index, rather than to the raw index. We have used both the log and the raw index. When we fit the log of the index we find a better fit than that reported in [Sornette and Johansen(2001)] with values of both and outside their acceptable ranges. For comparison with other bubbles we also fitted the raw index; we find that the best fitting LPPL model has a value for , which is within the acceptable range of 0.15 – 0.51, but for , which is well below the lower bound of its critical range of 4.8 – 8.0 (see Equation 1).

-

1980:

We were able to reproduce the fit reported in [Sornette and Johansen(2001)], with a crash predicted 3 days later, but it was not the best fit that we found. Our best fit predicted a crash after 52 days, and had critical parameter values , which is acceptable, but , which is outside the acceptable range.

There are three pre-crash bubbles that were not considered in the JS studies; one, in 1981, they did not consider a crash (but see Section 5.3), and two others were later than their period:

-

1981:

We find a best fit for which both and are well outside their acceptable ranges. As , this fit would have been rejected by the criteria used in the JS studies (see Section 4). The first fit that has a has , which is just acceptable, but with a , i.e. no power law, so well outside its acceptable range. It might be argued that this peak was too soon (8 months) after the trough following the previous crash of 1980 for an LPPL model to be fitted on the grounds of there being insufficient data. But, as we have argued in Section 5.3, we believe it should have been.

-

2000:

Our best fit to the bubble has both critical parameters and well outside their respective acceptable ranges. There is a fit that does have these parameters within their acceptable ranges, and predicts a crash after only 9 days; but it is not the best fit.

-

2007:

Our best fit to this bubble has parameters well within the ranges required for a crash and the crash is predicted for the day it actually occurred.

6 Conclusion

The LPPL model for pre-crash bubbles on stock markets, as reported in the JS studies, has important consequences. Our analysis has led us to the following conclusions.

The mechanism proposed to lead to the LPPL fluctuations as reported in [Johansen et al.(2000)] must be incorrect as it requires the expected price to be increasing throughout the bubble (as recognized later by [Sornette and Zhou(2006)]). In about half the studies they reported the LPPL model fitted to the index (or its log) decreases at some point during the bubble. Hence, either another explanation is required or the fits have to be redone with a constraint on the parameters that leads to LPPL fits that never decrease. Also, in the JS studies the fits were made to the raw rather than the log of the index for all but one (1973) of the eight bubbles, even though the assumption upon which the use of the raw rather than the log should be used was certainly not met in six of these seven bubbles. So, on both counts, these studies should no longer be used to support a conclusion that the proposed mechanism underlies the LPPL model.

Identifying crashes and bubble beginnings was not well specified in the JS studies. In particular, it is not clear why one peak, that of 1981, was not identified as a crash initiator. Moreover, moving the trough that marks the beginning of a bubble forward by ‘eye’ in half the data sets is not really satisfactory. While we have taken more care in identifying those peaks that initiated crashes, we have still, for comparison, used the same bubble beginnings as used in the JS studies. In future, empirical studies need to establish a clear criterion for this procedure.

In the JS studies, the fits of the LPPL to the data were only accepted if the exponential parameter was . That is, the fits showed an exponential increase. It would be stronger to reject the LPPL model if a is found.

In our study the two critical parameters of the fitted LPPL models, and , do fall within acceptable ranges in 7 of the 11 bubbles. Of the remaining four bubbles, an LPPL model with critical parameters within their respective acceptable ranges could be found for all but one crash (1973). However, these LPPL models did not have the best fits (minimum RMSE). For one crash (1980) the best fit would be acceptable if the lower end of the acceptable range of was decreased, i.e. a range of 0.01 – 0.51. For another (1981), a fit with would also have to be ruled out to save the hypothesis. For two crashes (1973 and 2000), there seems to be no saving strategy. That the bubbles leading to the 1981 and 2000 crashes do not satisfy the criteria is particularly negative as these are two of the three crashes for which the ranges on the critical parameters were not set post hoc in the JS studies.

Finally, while the objection that with seven parameters a curve can be fitted to any data [Laloux et al.(1999)] is not directly relevant, since no goodness of fit is measured here, it is indirectly highly relevant. The RMSE of the fit of the LPPL model (Eq. 1) to the data is highly sensitive to small but not to large fluctuations in one of the critical parameters (); this makes the search for the LPPL that minimizes the RMSE unreliable. Moreover, substantial fluctuations in both parameters together can result in quite small changes in the RMSE [Brée et al.(in press)]. This suggests that the permissible ranges for these parameters should not be independent of one another.

Despite these criticisms, and because of the partial success of correctly predicting the 2007 crash, we believe that it is worth investigating whether fitted LPPL models with critical parameters in acceptable non-independent ranges can be used to give a probabilistic, rather than an all-or-none prediction of an impending crash. Furthermore, the use of the stock price alone is unlikely to be the only input for predicting stock market crashes. Using both trading volume and the log returns of stock prices in a spin model of heterogeneous agents, [Kaizoji et al.(2008)] are able to explain the origins of bubbles and crashes. Their approach, which appears promising, suggests a close correspondence between the magnetization of the spin model and trading volume, thereby enabling them to interpret the switch between bull and bear markets.

Appendices

Appendix A Derivation of Log Periodic Power Law

Substituting for and for and integrating gives:999Using Wolfram’s Mathematica online integrator

where and , which is the LPPL of Eq. 1 with .

Appendix B Search algorithm

0.

For each of the four parameters and , fix the lower and upper bounds for the seeds.

For a subset of selected parameters ( and ), fix the minimum width to continue searching.

1.

Choose as the current seed , the mid point of the current lower and upper bounds.

2.

Run the unbounded Nelder-Mead Simplex search from the current seed , which will return a solution .

3.

Construct a hypercube in the space of using and , with their minimum as the bottom corner: ;

and their maxima as the top corner: .

4.

For , i.e. for each of the selected parameters, do:

if

i.e. if there is too little space under the hypercube on the dimension in , set , i.e. set the bottom of the hypercube on the dimension to its lower bound,

else recursively search from step 1, with and , i.e. search under the hypercube;

if

, i.e. if there is too little space above the hypercube on the parameter, set , i.e. set the top of the hypercube on the parameter to its upper bound,

else recursively search from step 1, with and , i.e. search above the hypercube.

Initial bounds on the four parameters for selecting seeds

rads

days

rads

lower

0

0

1

0

upper

2

20

260

minimum width

0.2

2

-

-

References

- [Ambrose et al.(1993)] Ambrose, B., Ancel, E., Mark, M., 1993. Fractal structure in the capital markets revisited. Financial Analysts Journal 49, 73–77.

- [Bali(2007)] Bali, T., 2007. A generalized extreme value approach to financial risk measurement. Journal of Money, Credit and Banking 39, 1613–1649.

- [Barlevy and Veronesi(2003)] Barlevy, G., Veronesi, P., 2003. Rational panics and stock market crashes. J. Economic Theory 110, 234–263.

- [Blanchard and Watson(1982)] Blanchard, O., Watson, M., 1982. Bubbles, rational expectations, and financial markets. In: Wachtel, P. (Ed.), Crises in Economic and Financial Structure. Lexington Books, Lexington MA, pp. 295–315.

- [Brée et al.(in press)] Brée, D. S., Challet, D., Peirano, P. P., in press. Prediction accuracy and sloppiness of log-periodic functions. Quantitative Finance DOI: 10.1080/14697688.2011.607467.

- [Campbell and Hentschel(1992)] Campbell, J., Hentschel, L., 1992. No news is good news: an asymmetric model of changing volatility in stock returns. J. Financial Econ. 31, 281–318.

- [Chang and Feigenbaum(2006)] Chang, G., Feigenbaum, J., 2006. A Bayesian analysis of log-periodic precursors to financial crashes. Quant. Finance 6, 15–36.

- [Choudhry(1996)] Choudhry, C., 1996. Stock market volatility and the crash of 1987: evidence from six emerging market. J. International Money & Finance 15, 969–981.

- [Cutler et al.(1989)] Cutler, D., Poterba, J., Summers, L., 1989. What moves stock prices? J. Portfolio Management 15, 4–12.

- [Donaldson and Kamstra(1996)] Donaldson, R., Kamstra, M., 1996. A new dividend forecasting procedure that rejects bubbles in asset prices: the case of 1929 stock crash. Review of Financial Studies 9, 333–383.

- [Feigenbaum(2001)] Feigenbaum, J., 2001. A statistical analysis of log-periodic precursors to financial crashes. Quantitative Finance 1, 346–360.

- [Graf v. Bothmer and Meister(2003)] Graf v. Bothmer, H., Meister, C., 2003. Predicting critical crashes? a new restriction for the free variables. Physica A 320, 539–547.

- [Harmantzis et al.(2006)] Harmantzis, F., Miao, L., Chien, Y., 2006. Empirical study of value-at-risk and expected shortfall models with heavy tails. The Journal of Risk Finance 7, 117–135.

- [Hays et al.(2010)] Hays, P., Rajagopal, S., Schreiber, M., 2010. Evidence of long memory in u.s. stock returns: The case of the 1990s bubble. Quarterly Journal of Finance and Accounting 49, 5–18.

- [Hong and Stein(2003)] Hong, H., Stein, J., 2003. Differences of opinion, short-sales constraints, and market crashes. Rev. Financial Studies 16, 487–525.

- [Johansen(2003)] Johansen, A., 2003. Characterization of large price variations in financial markets. Physica A 234, 157–166.

- [Johansen et al.(2000)] Johansen, A., Ledoit, O., Sornette, D., 2000. Crashes as critical points. Internatioanl J. Theoretical & Applied Finance 3, 219–225.

- [Johansen and Sornette(2001)] Johansen, A., Sornette, D., 2001. Bubbles and anti-bubbles in Latin-American, Asian and Western stock markets: an empirical study. International J. Theoretical & Applied Finance 4, 853–920.

- [Kaizoji(2006)] Kaizoji, T., 2006. A precursor of market crashes: Empirical laws of japan s internet bubble. European Physical J. B 50, 123–127.

- [Kaizoji(2010a)] Kaizoji, T., 2010a. A behavioral model of bubbles and crashes, http://mpra.ub.uni-muenchen.de/20352/.

- [Kaizoji(2010b)] Kaizoji, T., 2010b. Stock volatility in the periods of booms and stagnations, http://mpra.ub.uni-muenchen.de/23727/.

- [Kaizoji et al.(2008)] Kaizoji, T., Bornholdt, S., Fujiwara, Y., 2008. Dynamics of price and trading volume in a spin model of stock markets with heterogeneous agents. arXiv:0207253v1.

- [Kaizoji and Kaizoji(2004)] Kaizoji, T., Kaizoji, M., 2004. Power law for ensembles of stock prices. Physica A 344, 240–243.

- [Kim et al.(2011)] Kim, Y., Rachev, S., Bianchi, M., Mitov, I., Fabozzi, F., 2011. Time series analysis for financial market meltdowns. J of Banking and Finance 35, 1879–1891.

- [Kumar et al.(2003)] Kumar, M., Moorthy, U., Perraudin, W., 2003. Predicting emerging market currency crashes. J. Empirical Finance 10, 427–454.

- [Lagarias et al.(1998)] Lagarias, J., Reeds, J., Wright, M., Wright, P., 1998. Convergence properties of the Nelder-Mead simplex method in low dimensions. SIAM J. Optimization 9, 112–147.

- [Laloux et al.(1999)] Laloux, L., Potters, M., Cont, R., 1999. Are financial crashes predictable? Europhysics Letters 45, 1–5.

- [Levy(2008)] Levy, M., 2008. Stock market crashes as social phase transitions. J. Economic Dynamics & Control 32, 137–155.

- [Lillo and Mantegna(2004)] Lillo, F., Mantegna, R., 2004. Dynamics of a financial market index after a crash. Physica A 338, 125–134.

- [Lin et al.(2009)] Lin, L., Ren, R., Sornette, D., 2009. A consistent model of ‘explorative’ financial bubbles with mean-reversing residuals. arXiv:0905.0128v1.

- [Markwat et al.(2009)] Markwat, T., Kole, E., van Dijk, D., 2009. Contagion as a domino effect in global stock markets. Journal of Banking and Finance 33, 1996–2012.

- [Nelder and Mead(1965)] Nelder, J., Mead, R., 1965. A simplex method for function minimization. Computer J. 7, 308–313.

- [Novak and Beirlant(2006)] Novak, S., Beirlant, J., 2006. The magnitude of a market crash can be predicted. J. Banking & Finance 30, 453–462.

- [Ragel(2011)] Ragel, J., 2011. Macroeconomic news, announcements, and stock market jump intensity dynamics. J. of Banking & Finance 35, 1263–1276.

- [Romer(2001)] Romer, D., 2001. Rational asset-price movements without news. American Economic Review 83, 1112–1130.

- [Schluter and Trede(2008)] Schluter, C., Trede, M., 2008. Identifying multiple outliers in heavy-tailed distributions with an application to market crashes. J. Empirical Finance 15, 700–713.

- [Sornette and Johansen(1997)] Sornette, D., Johansen, A., 1997. Large financial crashes. Physica A 245, 411–422.

- [Sornette and Johansen(2001)] Sornette, D., Johansen, A., 2001. Significance of log-periodic precursors to financial crashes. Quantitative Finance 1, 452–471.

- [Sornette et al.(1996)] Sornette, D., Johansen, A., Bouchaud, J.-P., 1996. Precursors and replicas. J. Physics I France 6, 167–175.

- [Sornette and Zhou(2006)] Sornette, D., Zhou, W.-X., 2006. Predictability of large future changes in major financial indices. International J. Forecasting 22, 153–168.

- [West(1987)] West, K., 1987. A specification test for speculative bubbles. Quart. J. Econ. 102, 553–580.