A Wiener–Hopf Monte Carlo simulation technique for Lévy processes

Abstract

We develop a completely new and straightforward method for simulating the joint law of the position and running maximum at a fixed time of a general Lévy process with a view to application in insurance and financial mathematics. Although different, our method takes lessons from Carr’s so-called “Canadization” technique as well as Doney’s method of stochastic bounds for Lévy processes; see Carr [Rev. Fin. Studies 11 (1998) 597–626] and Doney [Ann. Probab. 32 (2004) 1545–1552]. We rely fundamentally on the Wiener–Hopf decomposition for Lévy processes as well as taking advantage of recent developments in factorization techniques of the latter theory due to Vigon [Simplifiez vos Lévy en titillant la factorization de Wiener–Hopf (2002) Laboratoire de Mathématiques de L’INSA de Rouen] and Kuznetsov [Ann. Appl. Probab. 20 (2010) 1801–1830]. We illustrate our Wiener–Hopf Monte Carlo method on a number of different processes, including a new family of Lévy processes called hypergeometric Lévy processes. Moreover, we illustrate the robustness of working with a Wiener–Hopf decomposition with two extensions. The first extension shows that if one can successfully simulate for a given Lévy processes then one can successfully simulate for any independent sum of the latter process and a compound Poisson process. The second extension illustrates how one may produce a straightforward approximation for simulating the two-sided exit problem.

doi:

10.1214/10-AAP746keywords:

[class=AMS] .keywords:

.,

,

and

th3Supported by the

Natural Sciences and Engineering Research Council of Canada.

th1Supported by

EPSRC Grant EP/D045460/1.

th2Supported by the AXA Research Fund.

1 Introduction

Let us suppose that is a general Lévy process with law and Lévy measure . That is to say, is a Markov process with paths that are right continuous with left limits such that the increments are stationary and independent and whose characteristic function at each time is given by the Lévy–Khinchine representation

| (1) |

where

| (2) |

We have , and is a measure supported on with and . Starting with the early work of Madan and Seneta MD , Lévy processes have played a central role in the theory of financial mathematics and statistics (see, e.g., the books BL , CT , S , SC ). More recently, they have been extensively used in modern insurance risk theory (see, e.g., Klüppelberg, Kyprianou and Maller KKM , Song and Vondraček SV ). The basic idea in financial mathematics and statistics is that the logarithm of the stock price or risky asset follows the dynamics of a Lévy process whilst in insurance mathematics, it is the Lévy process itself which models the surplus wealth of an insurance company until ruin. There are also extensive applications of Lévy processes in queuing theory, genetics and mathematical biology as well as through their appearance in the theory of stochastic differential equations.

In both financial and insurance settings, a key quantity of generic interest is the joint law of the current position and the running maximum of a Lévy process at a fixed time if not the individual marginals associated with the latter bivarite law. Consider the following example. If we define , then the pricing of barrier options boils down to evaluating expectations of the form for some appropriate function and threshold . Indeed if then the latter expectation is related to the value of an “up-and-in” put. In credit risk, one is predominantly interested in the quantity as a function in and , where is the law of the dual process . Indeed it is as a functional of the latter probabilities that the price of a credit default swap is computed; see, for example, the recent book of Schoutens and Cariboni SC . One is similarly interested in in ruin theory as these probabilities are also equivalent to the finite-time ruin probabilities.

One obvious way to do Monte Carlo simulation of expectations involving the joint law of that takes advantage of the stationary and independent increments of Lévy processes is to take a random walk approximation to the Lévy process, simulate multiple paths, taking care to record the maximum for each run. When one is able to set things up in this way so that one samples exactly from the distribution of , the law of the maximum of the underlying random walk will not agree with the law of .

Taking account of the fact that all Lévy processes respect a fundamental path decomposition known as the Wiener–Hopf factorization, it turns out there is another very straightforward way to perform Monte Carlo simulations for expectations involving the joint law of which we introduce in this paper. Our method allows for exact sampling from the law of where is a random time whose distribution can be concentrated arbitrarily close around .

There are several advantages of the technique. First, when it is taken in context with very recent developments in Wiener–Hopf theory for Lévy processes, for example, recent advances in the theory of scale functions for spectrally negative processes (see Kyprianou, Pardo and Rivero KPR ), new complex analytical techniques due to Kuznetsov Kuz and Vigon’s theory of philanthropy (see V ), one may quickly progress the algorithm to quite straightforward numerical work. Second, our Wiener–Hopf method takes advantage of a similar feature found in the, now classical, “Canadization” method of Carr Carr for numerical evaluation of optimal stopping problems. The latter is generally acknowledged as being more efficient than appealing to classical random walk approximation Monte Carlo methods. Indeed, later in this paper, we present our numerical findings with some indication of performance against the method of random walk approximation. In this case, our Wiener–Hopf method appears to be extremely effective. Third, in principle, our method handles better the phenomena of discontinuities which can occur with functionals of the form at the boundary point . It is now well understood that the issue of regularity of the upper and lower half line for the underlying Lévy process (see Chapter 6 of Kypbook for a definition) is responsible the appearance of a discontinuity at in such functions (cf. AK ). The nature of our Wiener–Hopf method naturally builds the distributional atom which is responsible for this discontinuity into the simulations.

Additional advantages to the method we propose include its simplicity with regard to numerical implementation. Moreover, as we shall also see in Section 4 of this paper, the natural probabilistic structure that lies behind our so-called Wiener–Hopf Monte Carlo method also allows for additional creativity when addressing some of the deficiencies of the method itself.

2 Wiener–Hopf Monte Carlo simulation technique

The basis of the algorithm is the following simple observation which was pioneered by Carr Carr and subsequently used in several contexts within mathematical finance for producing approximate solutions to free boundary value problems that appear as a result of optimal stopping problems characterizing the value of an American-type option.

Suppose that are a sequence of i.i.d. exponentially distributed random variables with unit mean. Suppose they are all defined on a common product space with product law which is orthogonal to the probability space on which the Lévy process is defined. For all , we know from the Strong Law of Large Numbers that

| (3) |

-almost surely. The random variable on the left-hand side above is equal in law to a Gamma random variable with parameters and . Henceforth, we write it . Recall that is our notation for the law of the Lévy process . Then writing we argue the case that, for sufficiently large , a suitable approximation to is .

This approximation gains practical value in the context of Monte Carlo simulation when we take advantage of the fundamental path decomposition that applies to all Lévy processes over exponential time periods known as the Wiener–Hopf factorization.

Theorem 1.

For all and , define . Then

| (4) |

where and are defined iteratively for as

and . Here, , are an i.i.d. sequence of random variables with common distribution equal to that of and are another i.i.d. sequence of random variables with common distribution equal to that of .

The Wiener–Hopf factorization tells us that and are independent and the second of the pair is equal in distribution to . This will constitute the key element of the proof.

Fix . Suppose we define . Then it is trivial to note that

| (5) | |||

where . If we define and , then from (2) it follows that

Now noting that the process is independent of and has law and, moreover, recalling the distributional Wiener–Hopf decomposition described at the beginning of the proof, it follows that

where and defined as in the statement of the theorem. The conclusion of the theorem now follows immediately.

Note that the idea of embedding a random walk into the path of a Lévy process with two types of step distribution determined by the Wiener–Hopf factorization has been used in a different, and more theoretical context by Doney Don04 .

Given (3), it is clear that the pair converges in distribution to . This suggests that we need only to be able to simulate i.i.d. copies of the distributions of and and then by a simple functional transformation we may produce a realisation of the random variables . Given a suitably nice function , using standard Monte Carlo methods one estimates for large

| (6) |

where are i.i.d. copies of . Indeed the strong law of large numbers implies that the right-hand side above converges almost surely as to which in turn converges as to .

3 Implementation

The algorithm described in the previous section only has practical value if one is able to sample from the distributions of and . It would seem that this, in itself, is not that much different from the problem that it purports to solve. However, it turns out that there are many tractable examples and in all cases this is due to the tractability of their Wiener–Hopf factorizations.

Whilst several concrete cases can be handled from the class of spectrally one-sided Lévy processes thanks to recent development in the theory of scale functions, which can be used to described the laws of and (cf. HK , KR ), we give here two large families of two-sided jumping Lévy processes that have pertinence to mathematical finance to show how the algorithm may be implemented.

3.1 -class of Lévy processes

The -class of Lévy processes, introduced in Kuz , is a 10-parameter Lévy process which has characteristic exponent

with parameter range and . Here is the Beta function (see Jef2007 ). The density of the Lévy measure is given by

Although takes a seemingly complicated form, this particular family of Lévy processes has a number of very beneficial virtues from the point of view of mathematical finance which are discussed in Kuz . Moreover, the large number of parameters also allows one to choose Lévy processes within the -class that have paths that are both of unbounded variation [when at least one of the conditions , or holds] and bounded variation [when all of the conditions , and hold] as well as having infinite and finite activity in the jumps component [accordingly as both or not].

What is special about the -class is that all the roots of the equation are analytically identifiable which leads to semi-explicit identities for the laws of and as the following result lifted from Kuz shows.

Theorem 2.

For , all the roots of the equation

are simple and occur on the imaginary axis. They can be enumerated by on the positive imaginary axis and on the negative imaginary axis in order of increasing absolute magnitude where

Moreover, for ,

| (7) |

where

and

A similar expression holds for with the role of being played by and replaced by .

Note that when is irregular for the distribution of will have an atom at which can be computed from (7) and is equal to . Alternatively, from Remark 6 in Kuz this can equivalently be written as . A similar statement can be made concerning an atom at for the distribution of when is irregular for . Conditions for irregularity are easy to check thanks to Bertoin irreg ; see also the summary in Kyprianou and Loeffen KL for other types of Lévy processes that are popular in mathematical finance.

By making a suitable truncation of the series (7), one may easily perform independent sampling from the distributions and as required for our Monte Carlo methods.

3.2 Philanthropy and general hypergeometric Lévy processes

The forthcoming discussion will assume familiarity with classical excursion theory of Lévy processes for which the reader is referred to Chapter VI of Bertbook or Chapter 6 of Kypbook .

According to Vigon’s theory of philanthropy, a (killed) subordinator is called a philanthropist if its Lévy measure has a decreasing density on . Moreover, given any two subordinators and which are philanthropists, providing that at least one of them is not killed, there exists a Lévy process such that and have the same law as the ascending and descending ladder height processes of , respectively. (In the language of Vigon, the philanthropists and are friends.) Suppose we denote the killing rate, drift coefficient and Lévy measures of and by the respective triples and . Then V shows that the Lévy measure of satisfies the following identity:

| (8) |

where , , and is the density of . By symmetry, an obvious analogue of (8) holds for the negative tail , .

A particular family of subordinators which will be of interest to us is the class of subordinators which is found within the definition of Kuznetsov’s -class of Lévy processes. These processes have characteristics where , and . The Lévy measure of such subordinators is of the type

| (9) |

From Proposition 9 in Kuz , the Laplace exponent of a -class subordinator satisfies

| (10) |

for where is the drift coefficient and is the killing rate.

Let and be two independent subordinators from the -class where for with respective drift coefficients , killing rates and Lévy measure parameters . Their respective Laplace exponents are denoted by , . In Vigon’s theory of philanthropy, it is required that . Under this assumption, let us denote by the Lévy process whose ascending and descending ladder height processes have the same law as and , respectively. In other words, the Lévy process whose characteristic exponent is given by It is important to note that the Gaussian component of the process is given by ; see V . From (8), the Lévy measure of is such that

Assume first that , taking derivative in and computing the resulting integrals with the help of Jef2007 we find that for the density of the Lévy measure is given by

where . The validity of this formula is extended for by analytical continuation. The corresponding expression for can be obtained by symmetry considerations.

We define a General Hypergeometric process to be the 13 parameter Lévy process with characteristic exponent given in compact form

| (11) |

where . The two additional parameters are included largely with applications in mathematical finance in mind. Without these two additional parameters, it is difficult to disentangle the Gaussian coefficient and the drift coefficients from parameters appearing in the jump measure. Note that the Gaussian coefficient in (11) is now . The definition of General Hypergeometric Lévy processes includes previously defined Hypergeometric Lévy processes in Kyprianou, Pardo and Rivero KPR , Caballero, Pardo and Pérez CPP2 and Lamperti-stable Lévy processes in Caballero, Pardo and Pérez CPP .

Just as with the case of the -family of Lévy processes, because can be written as a linear combination of a quadratic form and beta functions, it turns out that one can identify all the roots of the equation which is again sufficient to describe the laws of and .

Theorem 3.

For , all the roots of the equation

are simple and occur on the imaginary axis. They can be enumerated by on the positive imaginary axis and on the negative imaginary axis in order of increasing absolute magnitude where

Moreover, for ,

| (12) |

where

and

A similar expression holds for with the role of replaced by and replaced by .

The proof is very similar to the proof of Theorem 10 in Kuz . Formula (11) and reflection formula for the Beta function (see Jef2007 )

| (13) |

tell us that as , and since we conclude that has a solution on the interval . Other intervals can be checked in a similar way [note that are Laplace exponents of subordinators, therefore they are positive for ]. Next, we assume that . Using formulas (11), (13) and the asymptotic result

which can be found in Jef2007 , we conclude that has the following asymptotics as :

Using the above asymptotic expansion and the same technique as in the proof of Theorem 5 in Kuz , we find that as there exists a constant such that

with a similar expression for . Thus, we use Lemma 6 from Kuz (and the same argument as in the proofs of Theorems 5 and 10 in Kuz ) to show that first there exist no other roots of meromorphic function except for , and secondly that we have a factorization

The Wiener–Hopf factoris are identified from the above equation with the help of analytical uniqueness result, Lemma 2 in Kuz . Formula (12) is obtained from the infinite product representation for using residue calculus.

| Case | |||

|---|---|---|---|

This ends the proof in the case , in all other cases the proof is almost identical, except that one has to do more work to obtain asymptotics for the roots of . We summarize all the possible asymptotics of the roots below

where the coefficients and are presented in Table 1. Corresponding results for can be obtained by symmetry considerations.

Remark 1.

Similar comments to those made after Theorem 2 regarding the existence of atoms in the distribution of and also apply here.

Remark 2.

It is important to note that the hypergeometric Lévy process is but one of many examples of Lévy processes which may be constructed using Vigon’s theory of philanthropy. With the current Monte Carlo algorithm in mind, it should be possible to engineer other favorable Lévy processes in this way.

4 Extensions

4.1 Building in arbitrary large jumps

The starting point for the Wiener–Hopf Monte Carlo algorithm is the distribution of and , and in Section 3 we have presented two large families of Lévy processes for which one can compute these distributions quite efficiently. We have also argued the case that one might engineer other fit-for-purpose Wiener–Hopf factorizations using Vigon’s theory of philanthropy. However, below, we present another alternative for extending the application of the Wiener–Hopf Monte Carlo technique to a much larger class of Lévy processes than those for which sufficient knowledge of the Wiener–Hopf factorization is known. Indeed the importance of Theorem 4 below is that we may now work with any Lévy processes whose Lévy measure can be written as a sum of a Lévy measure from the -family or hypergeometric family plus any other measure with finite mass. This is a very general class as a little thought reveals that many Lévy processes necessarily take this form. However, there are some obvious exclusions from this class, for example, cases of Lévy processes with bounded jumps.

Theorem 4.

Let be a sum of a Lévy process and a compound Poisson process such that for all ,

where is a Poisson process with intensity , independent of the i.i.d. sequence of random variables, , and . Define iteratively for

where , sequences and are defined in Theorem 1, and are an i.i.d. sequence of Bernoulli random variables such that . Then

| (14) |

where .

Consider a Poisson process with arrival rate such that points are independently marked with probability . Then recall that the Poisson Thinning theorem tells us that the process of marked points is a Poisson process with arrival rate . In particular, the arrival time having index is exponentially distributed with rate .

Suppose that is the first time that an arrival occurs in the process , in particular is exponentially distributed with rate . Let be another independent and exponentially distributed random variable, and fix and . Then making use of the Wiener–Hopf decomposition,

If we momentarily set , then by the Poisson Thinning theorem it follows that is equal in distribution to . Moreover, again by the Poisson Thinning theorem, is equal in distribution to . This proves the theorem for the case .

In the spirit of the proof of Theorem 1, the proof for can be established by an inductive argument. Indeed, if the result is true for then it is true for by taking then appealing to the lack of memory property, stationary and independent increments of and the above analysis for the case that . The details are left to the reader.

Remark 3.

A particular example where the use of the above theorem is of pertinence is a linear Brownian motion plus an independent compound Poisson process. This would include, for example, the so-called Kou model from mathematical finance in which the jumps of the compound Poisson process have a two-sided exponential distribution. In the case that is a linear Brownian motion, the quantities and are both exponentially distributed with easily computed rates.

4.2 Approximate simulation of the law of

Next, we consider the problem of sampling from the distribution of the three random variables . This is also an important problem for applications making use of the two-sided exit problem and, in particular, for pricing double barrier options. The following slight modification of the Wiener–Hopf Monte Carlo technique allows us to obtain two estimates for this triple of random variables, which in many cases can be used to provide upper and lower bounds for certain functionals of .

Theorem 5.

Given two sequences and introduced in Theorem 1 we define iteratively for

| (15) | |||||

where . Then for any bounded function which is increasing in -variable we have

| (16) | |||||

| (17) |

From Theorem 1, we know that has the same distribution as , and, for each , . The inequality in (16) now follows. The equality in (17) is the result of a similar argument where now, for each , and .

Theorem 5 can be understood in the following sense. Both triples of random variables and can be considered as estimates for , where in the first case has a positive bias and in the second case has a negative bias. An example of this is handled in the next section.

5 Numerical results

In this section, we present numerical results. We perform computations for a process in the -family with parameters

where the linear drift is chosen such that with , for no other reason that this is a risk neutral setting which makes the process a martingale. We are interested in two parameter sets. Set 1 has and Set 2 has . Note that both parameter sets give us proceses with jumps of infinite activity but of bounded variation, but due to the presence of Gaussian component the process has unbounded variation in the case of parameter Set 1.

As the first example, we compare computations of the joint density of for the parameter Set 1. Our first method is based on the following Fourier inversion technique. As in the proof of Theorem 1, we use the fact that and are independent, and the latter is equal in distribution to , to write

Writing down the inverse Laplace transform, we obtain

| (18) | |||

where is any positive number. The values of analytical continuation of for complex values of can be computed efficiently using technique described in Kuz . Our numerical results indicate that the integral in (5) can be computed very precisely, provided that we use a large number of discretization points in space coupled with Filon-type method to compute this Fourier type integral. Thus, first we compute the joint density of using (5) and take it as a benchmark, which we use later to compare the Wiener–Hopf Monte Carlo method and the classical Monte Carlo approach. For both of these methods, we fix the number of simulations and the number of time steps . For fair comparison, we use time steps for the classical Monte Carlo, as Wiener–Hopf Monte Carlo method with time steps requires simulation of random variables . All the code was written in Fortran and the computations were performed on a standard laptop (Intel Core 2 Duo 2.5 GHz processor and 3 GB of RAM).

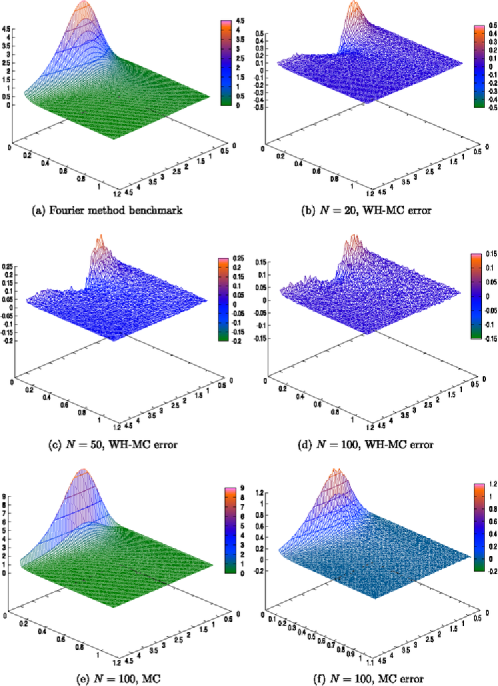

Figure 1 presents the results of our computations. In Figure 1(a), we show our benchmark, a surface plot of the joint probability density function of produced using Fourier method (5), which takes around 40–60 seconds to compute. Figure 1(b)–(d) show the difference between the benchmark and the Wiener–Hopf Monte Carlo result as the number of time steps increases from 20 to 50 to 100. The computations take around 7 seconds for , and 99% of this time is actually spent performing the Monte Carlo algorithm, as the precomputations of the roots and the law of take less than one tenth of a second. Figure 1(e) shows the result produced by the classical Monte Carlo method with (which translates into 200 random walk steps according to our previous convention); this computation takes around 10–15 seconds since here we also need to compute the law of , which is done using inverse Fourier transform of the characteristic function of given in (1). Finally, Figure 1(f) shows the difference between the Monte Carlo result and our benchmark.

The results illustrate that in this particular example the Wiener–Hopf Monte Carlo technique is superior to the classical Monte Carlo approach. It gives a much more precise result, it requires less computational time, is more straightforward to programme and does not suffer from some the issues that plague the Monte Carlo approach, such as the atom in distribution of at zero, which is clearly visible in Figure 1(e).

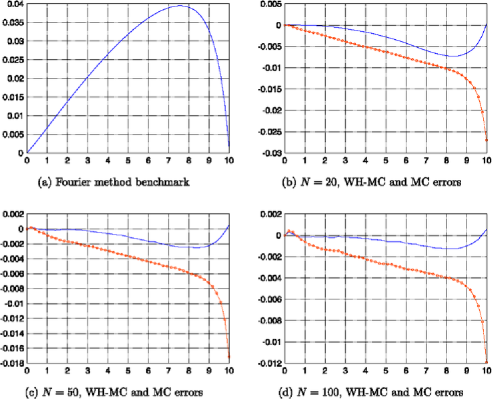

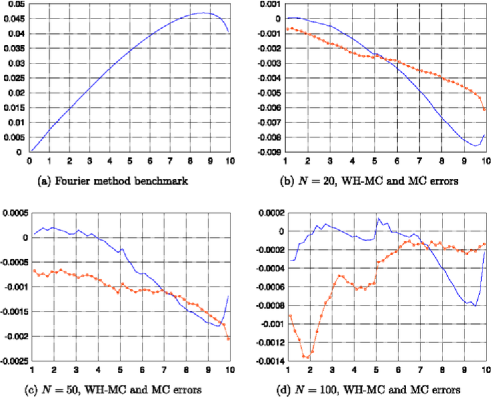

Next, we consider the problem of pricing up-and-out barrier call option with maturity equal to one, which is equivalent to computing the following expectation:

| (19) |

Here is the initial stock price. We fix the strike price , the barrier level . The numerical results for parameter Set 1 are presented in Figure 2. Figure 2(a) shows the graph of as a function of produced with Fourier method similar to (5), which we again use as a benchmark. Figure 2(b)–(d) show the difference between the benchmark and results produced by Wiener–Hopf Monte Carlo (blue solid line) and classical Monte Carlo (red line with circles) for . Again we see that Wiener–Hopf Monte Carlo method gives a better accuracy, especially when the initial stock price level is close to the barrier , as in this case the Monte Carlo approach produces an artificial atom in the distribution of at zero which creates a large error.

Figure 3 shows corresponding numerical results for parameter Set 2. In this case, we have an interesting phenomenon of a discontinuity in at the boundary . The discontinuity should be there and occurs due to the fact that, for those particular parameter choices, there is irregularity of the upper half line. Irregularity of the upper half line is equivalent to there being an atom at zero in the distribution of for any (also at independent and exponentially distributed random times). We see from the results presented in Figures 2 and 3 that Wiener–Hopf Monte Carlo method correctly captures this phenomenon; the atom at zero is produced if and only if the upper half line is irregular, while the classical Monte Carlo approach always generates an atom. Also, analyzing Figure 3(b)–(d), we see that in this case classical Monte Carlo algorithm is also doing a good job and it is hard to find a winner. This is not surprising, as in the case of parameter Set 2 the process has bounded variation, thus the bias produced in monitoring for supremum only at discrete times is smaller than in the case of process of unbounded variation.

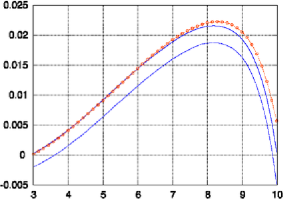

Finally, we give an example of how one can use Theorem 5 to produce upper/lower bounds for the price of the double no-touch barrier call option

| (20) |

First, we use identity and obtain

Function is increasing in both variables and , thus using Theorem 5 we find that

are the lower/upper bounds for . Figure 4 illustrates this algorithm for parameter Set 1, the other parameters being fixed at , , and the number of time steps (400 for the classical Monte Carlo). We see that the Monte Carlo approach gives a price which is almost always larger than the upper bound produced by the Wiener–Hopf Monte Carlo algorithm. This is not surprising, as in the case of Monte Carlo approach we would have positive (negative) bias in the estimate of infimum (supremum), and given that the payoff of the double no-touch barrier option is increasing in infimum and decreasing in supremum this amplifies the bias.

Acknowledgments

A. E. Kyprianou and K. van Schaik would also like to thank Alex Cox for useful discussions. All four authors are grateful to two anonymous referees for their suggestions which helped improved the presentation of this paper.

References

- (1) {barticle}[mr] \bauthor\bsnmAlili, \bfnmL.\binitsL. and \bauthor\bsnmKyprianou, \bfnmA. E.\binitsA. E. (\byear2005). \btitleSome remarks on first passage of Lévy processes, the American put and pasting principles. \bjournalAnn. Appl. Probab. \bvolume15 \bpages2062–2080. \biddoi=10.1214/105051605000000377, mr=2152253 \endbibitem

- (2) {bbook}[mr] \bauthor\bsnmBertoin, \bfnmJean\binitsJ. (\byear1996). \btitleLévy Processes. \bseriesCambridge Tracts in Mathematics \bvolume121. \bpublisherCambridge Univ. Press, \baddressCambridge. \bidmr=1406564 \endbibitem

- (3) {barticle}[mr] \bauthor\bsnmBertoin, \bfnmJean\binitsJ. (\byear1997). \btitleRegularity of the half-line for Lévy processes. \bjournalBull. Sci. Math. \bvolume121 \bpages345–354. \bidmr=1465812 \endbibitem

- (4) {bbook}[mr] \bauthor\bsnmBoyarchenko, \bfnmSvetlana I.\binitsS. I. and \bauthor\bsnmLevendorskii, \bfnmSergei Z.\binitsS. Z. (\byear2002). \btitleNon-Gaussian Merton–Black–Scholes Theory. \bseriesAdvanced Series on Statistical Science & Applied Probability \bvolume9. \bpublisherWorld Scientific, \baddressRiver Edge, NJ. \biddoi=10.1142/9789812777485, mr=1904936 \endbibitem

- (5) {barticle}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmCaballero, \bfnmM. E.\binitsM. E., \bauthor\bsnmPardo, \bfnmJ. C.\binitsJ. C. and \bauthor\bsnmPérez, \bfnmJ. L.\binitsJ. L. (\byear2011). \btitleExplicit identities for Lévy processes associated to symmetric stable processes. \bjournalBernoulli \bvolume17 \bpages34–59. \endbibitem

- (6) {barticle}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmCaballero, \bfnmM. E.\binitsM. E., \bauthor\bsnmPardo, \bfnmJ. C.\binitsJ. C. and \bauthor\bsnmPérez, \bfnmJ. L.\binitsJ. L. (\byear2010). \btitleOn the Lamperti stable processes. \bjournalProbab. Math. Statist. \bvolume30 \bpages1–28. \endbibitem

- (7) {barticle}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmCarr, \bfnmP.\binitsP. (\byear1998). \btitleRandomization and the American Put. \bjournalRev. Fin. Studies \bvolume11 \bpages597–626. \endbibitem

- (8) {bbook}[mr] \bauthor\bsnmCont, \bfnmRama\binitsR. and \bauthor\bsnmTankov, \bfnmPeter\binitsP. (\byear2004). \btitleFinancial Modelling with Jump Processes. \bpublisherChapman & Hall/CRC, \baddressBoca Raton, FL. \bidmr=2042661 \bptnotecheck year \endbibitem

- (9) {barticle}[mr] \bauthor\bsnmDoney, \bfnmR. A.\binitsR. A. (\byear2004). \btitleStochastic bounds for Lévy processes. \bjournalAnn. Probab. \bvolume32 \bpages1545–1552. \biddoi=10.1214/009117904000000315, mr=2060308 \endbibitem

- (10) {bmisc}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmHubalek, \bfnmF.\binitsF. and \bauthor\bsnmKyprianou, \bfnmA. E.\binitsA. E. (\byear2010). \bhowpublishedOld and new examples of scale functions for spectrally negative Lévy processes. In Sixth Seminar on Stochastic Analysis, Random Fields and Applications (R. Dalang, M. Dozzi and F. Russo, eds.). Progress in Probability 63 119–145. Birkhäuser, Basel. \endbibitem

- (11) {bbook}[mr] \beditor\bsnmJeffrey, \bfnmA.\binitsA., ed. (\byear2007). \btitleTable of Integrals, Series, and Products, \bedition7th ed. \bpublisherAcademic Press, \baddressAmsterdam. \endbibitem

- (12) {barticle}[mr] \bauthor\bsnmKlüppelberg, \bfnmClaudia\binitsC., \bauthor\bsnmKyprianou, \bfnmAndreas E.\binitsA. E. and \bauthor\bsnmMaller, \bfnmRoss A.\binitsR. A. (\byear2004). \btitleRuin probabilities and overshoots for general Lévy insurance risk processes. \bjournalAnn. Appl. Probab. \bvolume14 \bpages1766–1801. \biddoi=10.1214/105051604000000927, mr=2099651 \endbibitem

- (13) {barticle}[mr] \bauthor\bsnmKuznetsov, \bfnmAlexey\binitsA. (\byear2010). \btitleWiener–Hopf factorization and distribution of extrema for a family of Lévy processes. \bjournalAnn. Appl. Probab. \bvolume20 \bpages1801–1830. \biddoi=10.1214/09-AAP673, mr=2724421 \endbibitem

- (14) {bbook}[mr] \bauthor\bsnmKyprianou, \bfnmAndreas E.\binitsA. E. (\byear2006). \btitleIntroductory Lectures on Fluctuations of Lévy Processes with Applications. \bpublisherSpringer, \baddressBerlin. \bidmr=2250061 \endbibitem

- (15) {bincollection}[mr] \bauthor\bsnmKyprianou, \bfnmAndreas E.\binitsA. E. and \bauthor\bsnmLoeffen, \bfnmR.\binitsR. (\byear2005). \btitleLévy processes in finance distinguished by their coarse and fine path properties. In \bbooktitleExotic Option Pricing and Advanced Lévy Models (\beditor\binitsA. E. \bsnmKyprianou, \beditor\binitsW. \bsnmSchoutens and \beditor\binitsP. \bsnmWillmott, eds.) \bpages1–28. \bpublisherWiley, \baddressChichester. \bidmr=2343206 \endbibitem

- (16) {barticle}[mr] \bauthor\bsnmKyprianou, \bfnmA. E.\binitsA. E., \bauthor\bsnmPardo, \bfnmJ. C.\binitsJ. C. and \bauthor\bsnmRivero, \bfnmV.\binitsV. (\byear2010). \btitleExact and asymptotic -tuple laws at first and last passage. \bjournalAnn. Appl. Probab. \bvolume20 \bpages522–564. \biddoi=10.1214/09-AAP626, mr=2650041 \bptnotecheck year \endbibitem

- (17) {barticle}[mr] \bauthor\bsnmKyprianou, \bfnmA. E.\binitsA. E. and \bauthor\bsnmRivero, \bfnmV.\binitsV. (\byear2008). \btitleSpecial, conjugate and complete scale functions for spectrally negative Lévy processes. \bjournalElectron. J. Probab. \bvolume13 \bpages1672–1701. \bidmr=2448127 \endbibitem

- (18) {barticle}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmMadan, \bfnmD.\binitsD. and \bauthor\bsnmSeneta, \bfnmE.\binitsE. (\byear1990). \btitleThe variance gamma (V.G.) model for share market returns. \bjournalJournal of Business \bvolume63 \bpages511–524. \endbibitem

- (19) {bbook}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmSchoutens, \bfnmW.\binitsW. (\byear2003). \btitleLévy Processes in Finance: Pricing Financial Derivatives. \bpublisherWiley, \baddressChichester. \endbibitem

- (20) {bbook}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmSchoutens, \bfnmW.\binitsW. and \bauthor\bsnmCariboni, \bfnmJ.\binitsJ. (\byear2009). \btitleLévy Processes in Credit Risk. \bpublisherWiley, \baddressChichester. \endbibitem

- (21) {barticle}[mr] \bauthor\bsnmSong, \bfnmRenming\binitsR. and \bauthor\bsnmVondraček, \bfnmZoran\binitsZ. (\byear2008). \btitleOn suprema of Lévy processes and application in risk theory. \bjournalAnn. Inst. H. Poincaré Probab. Statist. \bvolume44 \bpages977–986. \biddoi=10.1214/07-AIHP142, mr=2453779 \endbibitem

- (22) {bmisc}[auto:STB—2010-11-18—09:18:59] \bauthor\bsnmVigon, \bfnmV.\binitsV. (\byear2002). \bhowpublishedSimplifiez vos Lévy en titillant la factorisation de Wiener–Hopf. Thèse. Laboratoire de Mathématiques de L’INSA de Rouen. \endbibitem