Tails of correlation mixtures of elliptical copulas

Abstract

Correlation mixtures of elliptical copulas arise when the correlation parameter is driven itself by a latent random process. For such copulas, both penultimate and asymptotic tail dependence are much larger than for ordinary elliptical copulas with the same unconditional correlation. Furthermore, for Gaussian and Student t-copulas, tail dependence at sub-asymptotic levels is generally larger than in the limit, which can have serious consequences for estimation and evaluation of extreme risk. Finally, although correlation mixtures of Gaussian copulas inherit the property of asymptotic independence, at the same time they fall in the newly defined category of near asymptotic dependence. The consequences of these findings for modeling are assessed by means of a simulation study and a case study involving financial time series.

keywords:

Copula, tail dependence, penultimate tail dependence, stochastic correlation, Gaussian copula, t-copula, stock market return, exchange rate return JEL Classification: C141 Introduction

It is a stylized fact that financial data such as stock or exchange rate returns exhibit a sizeable amount of tail dependence. For that reason, student t-copulas with low degrees of freedom are often used to model dependence for such data. Furthermore, in many instances cross-sectional correlations in multivariate financial time series have been observed to vary over time [1, 2, 3]. Consequently, in some recent studies the dependence between financial variables has been modeled via copulas whose parameters vary themselves according to a latent random process [4, 5, 6]. The unconditional copula is then a mixture over the underlying parametric family according to a certain probability distribution on the parameter.

In this paper we focus on the specific case of tails of correlation mixtures of elliptical copulas, and more specifically of Gaussian and t-copulas. This situation arises for instance in certain multivariate stochastic volatility models [7] and in the Stochastic Correlation Auto-Regressive (SCAR) model of [4]. In the latter model, the latent cross-sectional correlation at time is described by

| (1.1) |

where , , are independent standard normal variables, , and the inverse Fisher transform is chosen to keep in at all times. This specification is intuitively reasonable, analytically tractable and has been found to provide an excellent fit to financial data when used in conjunction with a Gaussian copula. Correlation mixtures over elliptical copulas being not necessarily elliptical anymore, the setting in our paper is not covered by the literature on tail behavior of elliptical distributions [8, 9, 10, 11, 12].

Let be a bivariate copula and let be a random pair with distribution function . Dependence in the tails can be measured by

and its limit , the coefficient of tail dependence. (Elliptical copulas being symmetric, it suffices to consider lower tail dependence.) We call the coefficient of penultimate tail dependence and we will argue that may be more informative than when their difference is large. The distinction between tail dependence at asymptotic and subasymptotic levels has already been made several times in the literature [13, 14, 15, 16].

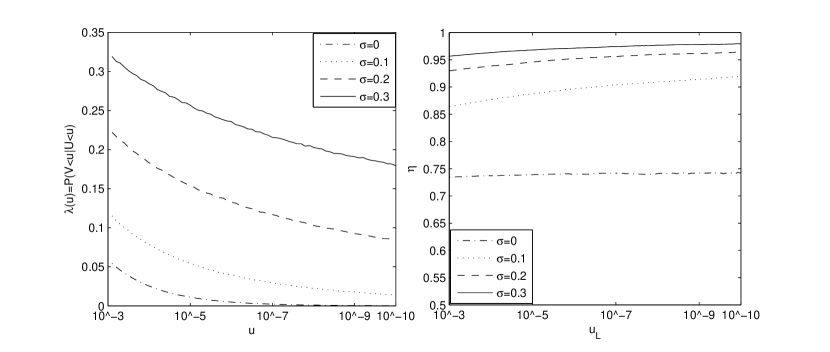

For t-copulas with correlations generated by (1.1), is plotted in Figure 1 for values of that go deep into the joint tail. The unconditional correlation is equal to for all cases. The figure illustrates our two main findings quite well:

-

1.

Allowing for random correlation greatly increases both and .

-

2.

The speed of convergence of to may be extremely slow, implying that tail dependence at penultimate levels may be significantly stronger than in the limit.

Similar effects can be observed for correlation mixtures of Gaussian copulas, for which is much larger than its limit even at levels that are several orders of magnitude smaller than the ones relevant for practice. Our findings underline the importance of proper modeling of correlation dynamics and of taking threshold sensitivity of tail dependence measures into account. A surprising consequence is that Gaussian copulas with time-varying correlations do a great job in capturing tail dependence at subasymptotic thresholds.

The rest of the paper is structured as follows. In Section 2 the impact of random variation in the correlation parameter on tail dependence measures of elliptical copulas is investigated. The (lack of) speed of convergence of to for correlation mixtures of Gaussian and t-copulas is studied in Section 3. In the Gaussian case, the rate of convergence to zero is so slow that it is actually appropriate to speak of near asymptotic dependence. Consequences of our results for modeling are discussed in Section 4 through a Monte Carlo study and a case study. Finally, Section 5 concludes. Proofs are relegated to the Appendix.

2 The impact of correlation dynamics

Let be a (standardized) bivariate elliptical random vector, that is,

| (2.1) |

where and where

| (2.2) |

the random variables and being independent with and uniformly distributed on ; see for instance [17, 18, 19]. Consider the distribution of the radius as fixed. Let be the copula of seen as parameterized by the correlation parameter , that is,

with and , where is the common marginal distribution function of , , and . Let

| (2.3) |

denote the coefficient of penultimate tail dependence and let denote its limit as , provided it exists.

As in the SCAR model (1.1), suppose now that in (2.1) is itself a (latent) random variable, independent of and . The copula of is then a -mixture of the copulas ,

| (2.4) |

with equal to the probability distribution of on . The penultimate coefficient of tail dependence of is simply given by

| (2.5) |

Let the average correlation parameter be denoted by

Provided second moments exist, is equal to the (unconditional) correlation between and . If for some the function is convex, then by Jensen’s inequality,

| (2.6) |

whatever the mixing distribution . As a consequence, when correlations are themselves driven by a latent random process, tail dependence may be larger than what one may expect. Taking limits as shows that this reasoning applies to the coefficient of tail dependence as well.

It remains to investigate the convexity of in .

Proposition 1.

Let be as in (2.3). For every , the function is convex in .

Graphs of for fixed (not shown) suggest that the restriction to cannot be avoided. Still, under some mild conditions on the distribution of , the convexity is actually true on for all sufficiently small .

Proposition 2.

Suppose that the distribution function of in (2.2) has unbounded support and is absolutely continuous with density . If

| (2.7) |

then there exists such that the function is convex in for every . If the limit exists, then is convex in .

Condition (2.7) is verified as soon as the radial density function is regularly varying at infinity of index for some , in which case the is actually a limit and is equal to . For the bivariate t-distribution with degrees of freedom, the radial density is given by for . Since as for some constant , we find as . Hence, condition (2.7) is satisfied if . For the bivariate Gaussian distribution, the radial density is given by for , which implies as , so that (2.7) is satisfied again.

The difference between and can be seen in Figure 1, whereas Figure 2 illustrates it for the coefficient of tail dependence . For the (static) t-copula with degrees of freedom and correlation parameter , the coefficient of tail dependence is given in [20, 21, 22] by

| (2.8) |

where denotes the cumulative distribution function of the t-distribution with degrees of freedom. In Figure 2, Student t-copulas are considered with stochastic and static correlations such that both have an unconditional correlation coefficient of . The degrees-of-freedom parameter varies from to . Two different correlation dynamics are considered: the SCAR process in (1.1), and the uniform distribution on . The dynamic models clearly lead to significantly higher tail dependence than the static ones.

3 Penultimate tail dependence

So far we have shown that correlation mixtures over elliptical copulas exhibit stronger tail dependence than static ones with the same unconditional correlation. For practical purposes, however, the penultimate coefficient is more suited to assess the risks of joint extremes than its limit , see for instance [13]. In this section we study the rate of convergence of to for correlation mixtures of the Student t-copula (Section 3.1) and the Gaussian copula (Section 3.2).

3.1 Correlation mixtures of t-copulas

Let and . Let be independent random variables such that the are standard normal and has a chi-square distribution with degrees of freedom. Put

The distribution of the random vector is bivariate t with degrees of freedom and correlation parameter . Its copula, , is the bivariate t-copula with parameters and .

Now suppose as in Section 2 that is itself a random variable with range in and independent of . The unconditional copula, , of is then a correlation mixture of bivariate t-copulas with fixed degrees-of-freedom parameter .

For nonrandom , the coefficient of tail dependence is given in (2.8). For general, random , we have , the expectation being with respect to .

Figure 1 suggests that the rate of convergence of to may be slow, especially when is large. This is confirmed in the following result. For real , let be its positive part.

Proposition 3.

Let be a correlation mixture of bivariate t-copulas with degrees-of-freedom parameter . We have

where is a positive constant depending on and the distribution of given in (A.3) below.

The rate of convergence of to its limit is of the order . The larger , the slower this rate. Since is positive, may therefore be (much) larger than . As a result, at finite thresholds, the tail may look much heavier than it is in the limit. This in turn may cause estimators of to be negatively biased.

3.2 Correlation mixtures of Gaussian copulas

Let be independent random variables, and being standard normal and taking values in . Put

| (3.1) |

Conditionally on , the distribution of is bivariate normal with zero means, unit variances, and correlation . The unconditional correlation of and is , and the copula of is a correlation mixture of Gaussian copulas:

| (3.2) |

the expectation being with respect to , and with denoting the bivariate Gaussian copula with correlation . As before, put and .

By the assumption that almost surely and since the coefficient of tail dependence of is equal to , the coefficient of tail dependence of is too. So just like Gaussian copulas, correlation mixtures of Gaussian copulas have asymptotically independent tails.

To measure the degree of tail association in case of asymptotic independence, Ledford and Tawn [16] introduced the coefficient

| (3.3) |

the existence of the limit being an assumption. In this case, one can write

| (3.4) |

the function satisfying , that is, for all we have

Typically, the function is slowly varying at zero: for all . The coefficient is related to the coefficient in [13] through .

The pair of coefficients measures the amount of tail dependence across the classes of asymptotic dependence and independence. The following two cases are most common:

-

1.

Asymptotic dependence: If , then necessarily .

-

2.

Asymptotic independence: If , then .

For the bivariate Gaussian copula with correlation , for instance, we have and , so . One may then be tempted to believe that for correlation mixtures of Gaussian copulas the coefficient is equal to . However, this is false. Instead, a new situation is encountered, one that is in between the two cases described in the preceding paragraph.

Proposition 4.

Let be as in (3.2). If almost surely but the upper endpoint of the distribution of is equal to , then for every ,

As a consequence, although we have (asymptotic independence), the Ledford–Tawn index is equal to ; likewise, .

According to Proposition 4, the rate of decay of to is slower than any positive power of . So even though the tails of are asymptotically independent, we are as close as one can get to the case of tail dependence. Therefore, we coin this type of tail behavior near asymptotic dependence. As far as we know, this situation has not yet been encountered in the literature; see for instance the extensive list of examples in [15]. Note that the function in (3.4) is equal to .

By way of example, the left-hand panel in Figure 3 shows for tail probabilities ranging from to , the correlation parameter being driven by the SCAR model (1.1) for various choices of the parameters, but always with . Especially when the variation in is large, the coefficient remains quite sizeable even very far in the tail. To investigate the speed of decline of numerically, we write

with and we treat as a constant, its rate of change being much slower than the one of . The slope can be estimated by a simple least squares regression, from which can be recovered. We estimated in this way by making vary over intervals for ranging from to with steps of size . The corresponding estimates of as a function of are depicted in the right-hand panel Figure 3. For the constant correlation case we find indeed . In contrast, when correlation is not constant, seems to be converging to as .

4 Consequences for modeling

In this section we illustrate the consequences of our results for modeling data with static versus dynamic t-copulas. Of particular interest is the effect on inference on tail dependence when correlation is falsely assumed to be constant. To fit a static t-copula, we estimate by maximum likelihood and by the method of moments, the likelihood function for being given by

| (4.1) |

where denotes the density of the bivariate t-distribution and is the empirical correlation of the pairs .

4.1 Simulation study

We simulated data from a t-copula with a fixed degrees-of-freedom parameter but stochastic correlations. The correlations were drawn from the SCAR process in (1.1). We chose and , whereas was chosen such that the unconditional correlation was in all cases equal to . The values for the degrees-of-freedom parameter were , , , and , the last case yielding the Gaussian copula. The sample size and the number of Monte Carlo replications were chosen to be equal to . For each of the simulated data sets we fitted a static t-copula and computed both the implied coefficient of tail dependence as well as the one of penultimate tail dependence at , a tail probability of potential practical interest.

| -0.011 | -0.001 | 0.002 | -0.022 | |

| -0.027 | 0.014 | 0.022 | 0.008 | |

| -0.082 | 0.005 | 0.029 | 0.031 | |

| -0.096 | 0.000 | 0.034 | 0.030 | |

| 0.002 | 0.029 | 0.029 | 0.012 | |

| 0.027 | 0.081 | 0.107 | 0.097 | |

| 0.039 | 0.142 | 0.213 | 0.235 | |

| 0.022 | 0.131 | 0.240 | 0.303 | |

| Note. This table reports on the bias for and for t-copulas when the correlation is assumed to be constant when they are in fact generated by the SCAR model (1.1). The sample size and the number of Monte Carlo replications are equal to 1000. | ||||

The bias for the estimates of and is reported in Table 1. Overall, is estimated much more accurately than and both are estimated best when is low. The bias generally increases in and for it also increases in the volatility of the correlation process. Notably, the estimates suggest quite strong tail dependence even when the true conditional copula is Gaussian. The estimates of and (not shown) show that the positive bias in is due a negative bias in , whereas the overall correlation is only slightly underestimated with average estimates ranging from to . It seems as though the estimate of the degrees-of-freedom parameter is such that the implied coefficient of penultimate tail dependence matches the true one and that the consequence of this is a severe underestimation of the coefficient of tail dependence .

These findings continued to hold for other sample sizes and other correlation-driving processes.

4.2 Application to stock market and exchange rate returns

We consider international stock market returns at daily and monthly frequencies and daily exchange rate returns. The data sets are daily returns of the Dow Jones industrial index (DJ) and the NASDAQ composite index (NQ) from March 26, 1990 until March 23, 2000, daily returns of the MSCI index for France (Fra) and Germany (Ger) from October 6, 1989 until October 17, 2008, monthly returns of the Datastream stock index for Germany, Japan (Jap), the UK and the US from January 1974 until May 2008, and daily exchange rate returns of the Euro (EUR), British pound (GBP) and Japanes Yen (JPY) against the US dollar from January 1, 2005 until December 31, 2008. Returns are calculated as 100 times the first difference of the natural logarithm of prices.

To model the marginal distributions, we opt for the stochastic volatility model [23, 24] because of its natural connection to the SCAR model for the correlation dynamics (1.1). The basic stochastic volatility model for the return at time is given by

where and are independent standard normal random variables, uncorrelated with the innovations driving the dependence process (1.1). Estimation of the model is done by simulated maximum likelihood using the efficient importance sampler [25]. The static t-copulas are fitted as described above, whereas for the time-varying model we condition the estimate of on the correlations estimated using the SCAR model, yielding estimates and respectively.

We also compute the implied coefficient of tail dependence and the coefficient of penultimate tail dependence at various economically interesting levels. In particular, the levels we consider correspond to exceedances that are expected to occur once a year, once a decade and once a century. We denote the corresponding estimates by , and . These can be interpreted as the probabilities that one market makes a certain large downward movement conditionally on the other market doing the same. The coefficient of tail dependence , on the other hand, denotes the probability of one market crashing completely, i.e. dropping to a level of zero, conditional on the same event for the other market. The latter scenario is economically rather unrealistic and is, in our view, relevant only for individual stocks, not for complete markets.

The results can be found at the end in Table 2. The most striking finding is that the estimated degrees-of-freedom parameter is significantly larger when correlations are allowed to be stochastic, and in many cases even virtually infinity, corresponding to the Gaussian copula (we report whenever the upper bound of in the optimization routine was obtained). This implies that a large part of the fat-tailedness can be captured by random correlations. For the estimated measures of tail dependence, two things are notable. First, the penultimate version is much larger than the limiting one . This suggests that may be a too optimistic measure for assessing the risk of spillovers of large downward movements across financial markets. Second, although the fitted models that allow for time-varying correlations have a lower limiting coefficient of tail dependence than the static ones, at practically relevant quantiles these models capture the dependence in the tails of the distribution quite well. So just like in the simulation above, the static and the dynamic models both do a good job in matching penultimate tail dependence, but the static t-copulas may lead to overestimation of the coefficient of tail dependence .

5 Conclusions

We have studied tail dependence properties of correlation mixtures of elliptical copulas, a situation which occurs when the correlation parameter is itself driven by a latent random process. We have shown that the coefficient of (penultimate) tail dependence is larger than for ordinary elliptical copulas with the same unconditional correlation. Furthermore, for Gaussian copulas and t-copulas, tail dependence at sub-asymptotic levels quantiles can be substantially larger than in the limit. In a simulation study we found that ignoring the dynamic nature of correlations when estimating t-copulas leads to biased estimates of the coefficient of tail dependence. Our empirical application showed that estimates of the degrees-of-freedom parameter of a t-copula are much lower when assuming a static correlation than when conditioning on dynamic correlations. At the same time the models based on dynamic correlations produce similar dependence in the tails at economically relevant quantiles, but lower tail dependence in the limit.

A notable discovery was that under some fairly weak conditions, correlation mixtures of Gaussian copulas have tails that are so close to being asymptotically dependent that they give rise to the newly defined category of near asymptotic dependence. In practice this implies that it is virtually impossible to distinguish such copulas from ones that have asymptotically dependent tails such as t-copulas.

These findings suggest that for practical purposes the Gaussian copula is more attractive than as often stated in the literature, as long as one accounts for the (empirically observed) fact that correlations vary over time. This finding can be seen as an analogue to the effect that conditionally Gaussian models for time-varying volatility such as GARCH and stochastic volatility models can create heavy tails in the margins. Thus, conditionally Gaussian models are more than just a simplifying approximation in a multivariate setting, as they are able to capture the tails both in the margins as in the copula.

Acknowledgments

We would like to thank the participants of the “Workshop on Copula Theory and Its Applications” (Warsaw, 2009) for comments. The first author gratefully acknowledges a PhD traveling grant from METEOR. The second authors’ research was supported by IAP research network grant nr. P6/03 of the Belgian government (Belgian Science Policy) and by contract nr. 07/12/002 of the Projet d’Actions de Recherche Concertées of the Communauté française de Belgique, granted by the Académie universitaire Louvain.

Appendix A Proofs

Proof of Proposition 1.

Write for . Then , so that

yielding the representation

Let be such that , where is the marginal distribution function of and . Since the distribution of is symmetric around zero and since and are independent,

with the distribution function of . As a consequence, it is sufficient to show that for fixed , the function

is convex in , where and with uniformly distributed on . Write , so . Then

whereas

Joining these two double inequalities and using the fact that yields

Since is convex in , the result follows. ∎

Proof of Proposition 2.

We keep the same notations as in the proof of Proposition 1. Now let so that . We have

where and . Observe that

We find

We have

Some goniometric juggling yields , whence

Writing , we conclude that

For , we have . If is small enough so that is large enough so that for all , then the factor between big brackets on the right-hand side of the last display is positive for all . Hence is convex in . ∎

Proof of Proposition 3.

Let . We have

Put and . Then we can rewrite the above equation as . We need precise information on the upper tail of : see Lemma 5. We can then proceed as follows:

The remainder term is

We find that, as ,

The marginal tail of can be represented in the same way: it suffices to replace in the preceding display by a standard normal random variable , that is, as ,

It follows that as ,

| (A.1) | ||||

As a consequence, the coefficient of tail dependence is given by

| (A.2) |

Moreover, the expansion in (A) gives us a handle on the rate of convergence of towards . Let be the quantile function of the t-distribution with degrees of freedom. By symmetry of the upper and lower tails,

Since as , we have

(By we mean that .) We obtain with

Equating (A.2) and (2.8) (for non-random ) we find

the latter expectation being with respect to the random variable . As a consequence,

the sign of which is positive, for is decreasing in . Furthermore, by (A.4) below and the identity ,

We obtain

| (A.3) |

with and given in (A.5) and

| (A.4) |

∎

Lemma 5.

For , let be a positive random variable such that has a chi-square distribution with degrees of freedom . Then for all ,

where

| (A.5) |

and for some positive constant .

Proof.

Since is chi-squared with degrees of freedom,

For , we have and thus . We find that

the constant depending on . The integral can be computed as follows:

with and as in (A.5). ∎

Proof of Proposition 4.

Fix . We have to prove that as . Recall the representation in (3.1). Fix . By symmetry, if ,

Let denote the standard normal density function and write . From Mill’s ratio, as , it follows that as and therefore

If is chosen such that , then is indeed of larger order than , as required. ∎

References

References

- [1] R. F. Engle, Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models, Journal of Business and Economic Statistics 20 (2002) 339–350.

- [2] C. B. Erb, C. R. Harvey, T. E. Viskante, Forecasting international equity correlations, Financial Analysts Journal 50 (1994) 32–45.

- [3] F. Longin, B. Solnik, Is the correlation in international equity returns constant: 1960-1990, Journal of International Money and Finance 14 (1995) 3–26.

- [4] C. M. Hafner, H. Manner, Dynamic stochastic copula models: Estimation, inference and applications, METEOR Research Memorandum RM/08/043, Maastricht University (2008).

- [5] C. M. Hafner, O. Reznikova, Efficient estimation of a semiparametric dynamic copula model, Manuscript, Institute of Statistics, UCL (2008).

- [6] A. Patton, Modelling asymmetric exchange rate dependence, International Economic Review 47 (2006) 527–556.

- [7] J. Yu, R. Meyer, Multivariate stochastic volatility models: Bayesian estimation and model comparison, Econometric Reviews 25 (2006) 361–384.

- [8] B. Abdous, A.-L. Fougères, K. Ghoudi, Extreme behaviour for bivariate elliptical distributions, The Canadian Journal of Statistics 33 (2005) 317–334.

- [9] A. V. Asimit, B. L. Jones, Extreme behavior of bivariate elliptical distributions, Insurance: Mathematics and Economics 41 (2007) 53–61.

- [10] E. Hashorva, Extremes of asymptotically spherical and elliptical random vectors, Insurance: Mathematics and Economics 36 (2005) 285–302.

- [11] E. Hashorva, Tail asymptotic results for elliptical distributions, Insurance: Mathematics and Economics 43 (2008) 158–164.

- [12] E. Hashorva, Conditional limit results for type i polar distributions, Extremes 12 (2009) 239–263.

- [13] S. Coles, J. Heffernan, J. Tawn, Dependence measures for extreme value analyses, Extremes 2 (1999) 339–365.

- [14] G. Frahm, M. Junker, R. Schmidt, Estimating the tail-dependence coefficient: Properties and pitfalls, Insurance: Mathematics and Economics 37 (2005) 80–100.

- [15] J. Heffernan, A directory of coefficients of tail dependence, Extremes 3 (2000) 279–290.

- [16] A. W. Ledford, J. A. Tawn, Statistics for near independence in multivariate extreme values, Biometrika 86 (1996) 169–187.

- [17] S. Cambanis, S. Huang, S. G, On the theory of elliptically contoured distributions, Journal of Multivariate Analysis 11 (1981) 368–385.

- [18] K.-T. Fang, S. Kotz, K.-W. Ng, Symmetric Multivariate and Related Distributions, Chapman and Hall, London, United Kingdom, 1990.

- [19] S. Kotz, N. Balakrishnan, N. L. Johnson, Continuous Multivariate Distributions, 2nd Edition, Wiley, New York, 2000.

- [20] S. Demarta, A. J. McNeil, The t copula and related copulas, International Statistical Review 73 (2005) 111–129.

- [21] P. Embrechts, A. McNeil, D. Straumann, Correlation and dependence in risk management: properties and pitfalls, in: M. Dempster (Ed.), Risk Management: Value at Risk and Beyond, Cambridge University Press, Cambridge, 2002, pp. 176–223.

- [22] R. Schmidt, Tail dependence for elliptically contoured distributions, Mathematical Methods of Operations Research 55 (2002) 301–327.

- [23] P. K. Clark, A subordinate stochastic process model with finite variance for speculative prices, Econometrica 41 (1973) 135–155.

- [24] S. J. Taylor, Modelling Financial Time Series, John Wiley and Sons, Chichester, 1986.

- [25] R. Liesenfeld, J. F. Richard, Univariate and multivariate stochastic volatility models: Estimation and diagnostics, Journal of Empirical Finance 10 (2003) 505–531.

| Static correlations | Dynamic correlations | |||||||||

| Data | ||||||||||

| Daily stock market | ||||||||||

| DJ-NQ | 6.06 | 0.36 | 0.33 | 0.32 | 0.31 | 0.26 | 0.18 | 0.13 | 0.00 | |

| Fra-Ger | 2.89 | 0.51 | 0.50 | 0.50 | 0.50 | 17.51 | 0.30 | 0.25 | 0.22 | 0.21 |

| Monthly stock market | ||||||||||

| Ger-Jap | 12.39 | 0.24 | 0.11 | 0.05 | 0.02 | 0.23 | 0.08 | 0.04 | 0.00 | |

| Ger-UK | 6.22 | 0.36 | 0.25 | 0.19 | 0.18 | 15.95 | 0.37 | 0.37 | 0.36 | 0.08 |

| Ger-US | 3.93 | 0.39 | 0.31 | 0.28 | 0.27 | 11.20 | 0.35 | 0.23 | 0.15 | 0.11 |

| Jap-UK | 10.32 | 0.26 | 0.13 | 0.07 | 0.04 | 41.03 | 0.25 | 0.10 | 0.03 | 0.00 |

| Jap-US | 9.91 | 0.26 | 0.13 | 0.07 | 0.05 | 0.26 | 0.11 | 0.06 | 0.00 | |

| UK-US | 14.85 | 0.41 | 0.25 | 0.14 | 0.07 | 0.47 | 0.43 | 0.42 | 0.00 | |

| Exchange rates | ||||||||||

| EUR-GBP | 8.03 | 0.37 | 0.33 | 0.31 | 0.28 | 39.62 | 0.31 | 0.23 | 0.18 | 0.03 |

| EUR-JPY | 5.51 | 0.20 | 0.18 | 0.17 | 0.16 | 0.14 | 0.09 | 0.06 | 0.00 | |

| GBP-JPY | 4.55 | 0.17 | 0.16 | 0.15 | 0.15 | 0.21 | 0.16 | 0.13 | 0.00 | |

| Note. This table reports on the estimates of the degrees-of-freedom parameter of a t-copula conditional on constant correlation (column 2) and on time-varying correlations driven by a SCAR process (column 7). The remaining columns show measures of tail dependence at finite and asymptotic quantiles. The margins are fitted via Gaussian stochastic volatility models. | ||||||||||