Early exercise boundary for American type of floating strike Asian option and its numerical approximation

Abstract

In this paper we generalize and analyze the model for pricing American-style Asian options due to (?) by including a continuous dividend rate and a general method of averaging of the floating strike. We focus on the qualitative and quantitative analysis of the early exercise boundary. The first order Taylor series expansion of the early exercise boundary close to expiry is constructed. We furthermore propose an efficient numerical algorithm for determining the early exercise boundary position based on the front fixing method. Construction of the algorithm is based on a solution to a nonlocal parabolic partial differential equation for the transformed variable representing the synthesized portfolio. Various numerical results and comparisons of our numerical method and the method developed by (?) are presented.

Keywords: option pricing, American-style of Asian options, early exercise boundary, limiting behavior close to expiry

AMS-MOS classification: 35K15, 35K55, 90A09, 91B28

1 Introduction

Evolution of trading systems influences the development of financial derivatives market. First, simple derivatives like forwards and plain vanilla options were used to hedge the risk of a portfolio. Progress in pricing these simple financial instruments pushed traders into inventing less predictable and more complex derivatives. Using financial derivatives with more complicated pay-offs brings into attention also new mathematical problems. Asian options belong to a group of the so-called path-dependent options. Their pay-off diagrams depend on the spot value of the underlying during the whole or some part(s) of the life span of the option. Usually Asian options depend on the (arithmetic or geometric) average of the spot price of the underlying. They can be also used as a useful tool for hedging highly volatile assets or goods. Since the price of an underlying varies during the life span of the option the holder of the Asian option can be secured for the risk a sudden price jumping to an undesirable region (too high for the call option holder or too low for the put option holder). Among path dependent options Asian options plays an important role as they are quite common in currency and commodity markets like e.g. oil industry (cf. (?, ?, ?, ?, ?, ?, ?, ?, ?, ?, ?)).

In this paper we focus on the so-called floating strike Asian call or put options whose strike price depends on the averaged path history of the underlying asset. More precisely, we are interested in pricing American-style Asian call and put options having the pay-off functions and , resp. The strike price is given as an average of the underlying over the time history . We are analyzing the early exercise boundary for American-style Asian option (cf. (?, ?, ?)). Recall that American-style options can be exercised at any time until the maturity . The holder of such an option has the right to exercise it or to keep it depending on the spot price of the underlying at time and its history prior the time . The boundary between ”continuation” and ”stopping” regions plays an important role in pricing American-style of options. It can be described by the mapping , where is the so-called early exercise boundary (cf. (?, ?, ?, ?, ?, ?, ?, ?, ?).

The paper is organized as follows. In the next section, we discuss the probabilistic model for valuation of American type Asian options with a floating strike given in the form of an average of the underlying asset price. The model is based on conditioned expected values and theory of martingales. In the third section, we present a general result enabling us to calculate the value of the limit of the early exercise boundary at expiry. We also calculate the analytical integral formula for an option with continuous geometric average and an approximation for the value of an option with a continuous arithmetic average. The main result of this section is the approximation formula for the first order Taylor series approximation of the early exercise boundary near to expiry. Similarly as in the case of plain vanilla call options, we show that the leading order of the expansion is the square root of the time remaining to maturity. In the fourth section, we present the fixed domain transformation method yielding a nonlocal nonlinear parabolic partial differential equation for pricing the synthesized portfolio for an Asian option. We also present an efficient and robust numerical scheme for construction of an approximation of the solution to the governing system consisting of a partial differential equation with an algebraic constraint. In the last part of this section we present also the results of the presented method on some examples.

2 A probabilistic approach for pricing of American-Style of Asian options

The main purpose of this section is to derive an integral equation for valuation of the early exercise boundary of an American-style Asian option paying continuous dividends. We follow the ideas of derivation due to (?). Their formula for a floating strike option was derived using the theory of martingales and conditioned expected values. We extend their formula to Asian options on underlying paying non-zero dividend yield and having a general form of floating strike averaging. In a more detail, we discuss geometric, arithmetic and weighted arithmetic averaging operator.

The pricing model is based on the assumption on the stochastic behavior of the underlying asset in time. Throughout the paper we shall assume that the underlying asset price is driven by a stochastic process satisfying the following stochastic differential equation

| (1) |

It starts almost surely from the initial price . Here the constant parameter denotes the risk-free interest rate whereas is a continuous dividend rate. The constant parameter stands for the volatility of the underlying asset returns and is a standard Brownian motion with respect to the standard risk-neutral probability measure . A solution to equation (1) corresponds to the geometric Brownian motion

We shall derive an integral equation determining the value of an American-style Asian option with a floating strike. If we define the optimal stopping time as , the pay-off of the option is set by

where is the value of the option at time , is a continuous average of the underlying asset value during the interval and for a call option and for a put option. We may consider several different types of continuous averages presented in Table 1.

| arithmetic average | geometric average | weighted arithmetic average |

|---|---|---|

In the case of a weighted arithmetically averaged floating strike Asian option the kernel function with the property is usually defined as where is constant.

According to (?), the American-style contingent claims can be priced by the conditioned expectations approach. The option price can be calculated by considering all possible stopping times in the interval

where denotes the set of all stopping times in the interval and is the conditioned expectation with information available at time (the information set is represented by the filtration of the -algebra where the Brownian motion is supported). To simplify the formula we change the probability measure by the martingale

the new probability measure being defined as . According to Girsanov’s theorem (?), the process

is a standard Brownian motion with respect to the measure . The value of the underlying asset price under this measure is defined by

| (2) |

All assets priced under this measure are -martingales when discounted by the underlying price. According to this fact, we can reduce the dimension of stochastic variables. We introduce a new variable . We obtain:

The last expression can be rewritten in terms of the new variable as follows:

| (3) |

where and the function describes the early exercise boundary.

Definition 2.1

The stopping region and continuation region for American-style Asian call and put options (3) are defined by

where is a continuous function determining the early exercise boundary. By we shall denote the indicator function of the set , i.e. for and otherwise.

In the following theorem we present a solution to the pricing problem with one stochastic variable formulated in (3). It is a generalization of the result by (?) and (?) for the case of a nontrivial dividend rate and a general form of the averaging of the floating strike price.

Theorem 2.1

The value of the American-style floating strike Asian call () or put option () on the underlying asset paying continuous dividends with a rate is given by , where

| (4) | |||

| (5) |

with the average given by the function and stopping region .

In the proof of Theorem 2.1 we shall use the next lemma.

Lemma 2.1

The auxiliary variable satisfies the following stochastic differential equation:

Notice that, when comparing to the original expression due to (?) with a zero dividend rate the only difference is that the parameter is replaced by the term .

The value of depends on the method of averaging of the underlying asset used in valuation. The expressions for continuous averages are presented in Table 2. In this table we present the value of the weighted arithmetic average restricted to the kernel .

| arithmetic average | geometric average | weighted arithmetic average |

|---|---|---|

P r o o f: [of Theorem 2.1] We follow the proof of the original result by (?) and we include necessary modifications related to the form of averaging and the fact that .

First, we suppose that . The option is held and so we can apply Itō’s lemma to calculate the differential

where the last equality holds true, because is -martingale.

Now we suppose that . The value of the option is defined by

Hence the differential has the form

For both regions we have the following equation

| (6) |

where is a -martingale. Integrating (6) from to and taking expectation we have

which completes the proof of Theorem 2.1.

It is worthwhile noting that the above expression for the value of an American-style Asian option can be restated as follows:

where stands for the price of the European-style Asian option and the term represents a surplus bonus for the difference between American and European-style of the Asian option.

3 Early exercise behavior close to expiry

3.1 Limit of the early exercise boundary at expiry

In this section we determine the position of the early exercise boundary at expiry . The result is stated for a wide class of integral equations for pricing American-style options.

Theorem 3.1

Consider an American-style (call or put) option on the underlying with the stopping and continuation regions defined by the sets , and , resp. Let for be the early exercise boundary function. Suppose that the value of is given by the equation

| (7) |

where denotes the price of the corresponding European-style option and is a continuous function representing the early exercise bonus such that the equation has a unique root . Furthermore we suppose that

and the function is continuous except of the set . Then only one of the following cases can occur:

-

1.

. In this case .

-

2.

. In this case .

Remark 3.1

The abbreviation ITM stands for the so-called in-the-money set whereas ATM (the boundary of ITM) denotes the so-called at-the-money set. We denote by OTM the out-the-money set - the complement of sets ITM and ATM, i.e. .

P r o o f: [of Theorem 3.1] We have

for any . In the limit , we can omit the conditioned expected value operator and we obtain Since and the function is continuous we obtain .

Part 1). Suppose that . We shall prove . Notice that in the stopping region we have the identity for any and, consequently, . Take any . Similarly as in above, in the limit we can omit the conditioned expected value operator to obtain

Since the function is assumed to be continuous in ITM and , we have .

On the other hand, take any . Since for any we obtain . Therefore, in the limit , we have

because . Due to continuity of for we finally obtain . Hence and the proof of Part 1) follows.

Part 2). It suffices to prove that the case cannot occur. Suppose to the contrary . Since the set OTM is open we can argue similarly as in the first part of the proof to obtain . Since we have assumed uniqueness of the root of the equation then, in some neighborhood of there exists such that and . We have

Thus . For any we have . Hence and for all , a contradiction. Thus and the proof of theorem follows.

As a consequence of Theorem 3.1 we obtain the starting position of the early exercise boundary for American-style of Asian options with various types of the strike price averaging method.

Corollary 3.1

The formula for the limit of the early exercise boundary at the expiry (8) for geometric averaging is the same as presented by (?) and (?, p. 69). Notice that the same values of the limit of early exercise boundary at expiry for the continuous arithmetic average type of an Asian option is derived also in (?).

| arithmetic average | geometric average | weighted arithmetic average | |

|---|---|---|---|

| put | |||

| call |

3.2 Integral equation for pricing Asian options

In this section we calculate the approximate formula for the American-style Asian option with various floating strike averages. The next lemma will be useful in calculations to follow.

Lemma 3.1

(?) Let and define , where . We have

where and and are standard normal cumulative distribution and density functions, resp.

3.2.1 Geometric average

In this section we recall the integral equation for pricing American-style of Asian geometrically averaged floating strike options. It was derived for the case by (?) and for the general case by (?).

Lemma 3.2

(?) In the case of geometric averaging, the variable has log-normal (conditioned) distribution , where and parameters and are defined by

Now one can apply Lemma 3.1 in order to calculate the formula for option with the geometric averaging. Recall that for the floating strike Asian call or put option, the stopping region , where is the exercise boundary and for the case of a call option whereas for a put option. If we insert the expression for the geometric average (see Table 1) into (4) and (5) we obtain the formula for the European-style option

and the value of the American early exercise bonus premium

where is the standard normal cumulative distribution function and

Returning to the original variables we obtain the formula of American-style floating strike Asian option with geometrically averaged floating strike:

If we formally set value of the continuous dividend rate to zero, i.e. , the result is identical to the expression obtained in the paper (?)).

3.2.2 Approximation for the arithmetic average

Unfortunately, in the case of an arithmetically averaged floating strike Asian option the probabilistic distribution function of the arithmetic average cannot be expressed in an explicit way. Following (?) we approximate the probabilistic distribution of the variable for the continuous arithmetic average by the log-normal conditioned distribution, i.e. at time , where

| (9) |

Lemma 3.3

P r o o f: Following the lines of the derivation of from (?) adopted for a general dividend yield we obtain the first moment

Although we follow the proof by (?), we have to make a slight correction in the derivation of the second conditioned moment. Using the definition of , we have, for all ,

We need to simplify the expression for the the second conditioned moment

Assuming that and let and , we have

We have calculated all expressions we need to evaluate the second conditioned moment. If we put all together and perform necessary calculation we obtain (3.3) and the proof of lemma follows.

Remark 3.2

If we formally set the value of the continuous dividend rate in Lemma 3.3 we obtain almost identical expression to that of (?) except of the second moment entering (9). The expression

by (?) differs from our (3.3) in the second summand where the term is replaced by in both in the denominator and exponent.

Now we can return to the problem of valuation of an Asian option. First we replace the general form of the average in (5) by the expression for the arithmetic average defined as arithmetic average in Table 1. The stopping region is the same as for the case of geometric averaging.

Using Lemma 3.1 we calculate the value of both (4) and (5). The European part of the option has value

and the American early exercise bonus premium

where is the standard normal cumulative distribution function and

Returning to the original variables we have the approximate value of American-style Asian option with a continuous arithmetic averaging

3.3 Expansion of the early exercise boundary close to expiry

Throughout this section we shall assume the structural assumption on the interest and dividend rates:

| (12) |

We shall calculate an approximation of the call option early exercise boundary function for a call option. The approximation is obtained by the first order Taylor series expansion in the variable, where is the time to expiry. To approximate the early exercise boundary function by the Taylor expansion, we need to calculate the first derivative of at expiry with respect to variable. Following (?, ?, ?) we propose an approximation of the early exercise boundary in the form

where is a constant. To calculate , we use the condition of smoothness of the early exercise boundary of the call option across the early exercise boundary - smooth pasting principle (c.f. (?, ?)). Since we have

| (13) |

In further derivation we use following limits (according to the Lemma 3.2, Lemma 3.3 and Table 3). We recall that , and .

| (14) | |||||

Since we have assumed we have (see Table 3). Notice that both and have polynomial order in and the derivative of the normal cumulative distribution function (i.e. the probability density function) has exponential order in variable. In both derivations we have used several properties of the derivative of normal cumulative distribution function , e.g. , and .

The following lemma will be useful in derivation of asymptotic behavior of the early exercise. Its proof is straightforward and follows from monotonicity of the right-hand side of equation (15) in the variable.

Lemma 3.4

The implicit equation

| (15) |

has the unique solution having its approximate value .

Notice that the first order asymptotic expansion as of the early exercise boundary for the American call option derived by (?, ?) contains the same constant where is a solution of (15).

Remark 3.3

For the early exercise boundary function as a function of the model parameters we have the following scaling property:

3.3.1 Geometric average

We calculate the derivative of the European part of the expression (for the call option). Recall that depends on the variable , but does not depend on this variable.

Now we calculate the derivative of the integral function of American-style option bonus:

We want to determine the behavior of the early exercise boundary near the expiry . The limit in the expression (13) leads to the trivial identity. By rearranging all of elements on the right side of the equation, we have an expression of order . We substitute and and divide the equation by . We have:

According to the Lemma 3.2 and Table 3 we have:

The only non-zero elements of the first partial limit are the elements multiplied by the cumulative distribution function.

The second term represents the limit of the integral part divided by . If we substitute , then we obtain

The last expression then can be simplified, using limits (3.3), equation (8) for the limit of early exercise boundary at expiry , i.e. , and by calculating the limit (using L’Hospital rule) of the expression multiplied by the derivative of the cumulative density function. The final limit of the integral has form

| (16) |

Integrating (3.3.1) with respect to , putting both partial limits together, dividing by the nonzero constant and by Lemma 3.4 and Table 3, we finally obtain

3.3.2 Arithmetic average

The derivation for the case of the arithmetic average is very similar to the geometric one. We calculate the derivatives of both parts of the value function. The European part

and the American-style bonus

The rest of derivation was performed following the same steps used in section 3.3.1. The main difference in the derivation is that for the arithmetic average also the expression depends on the variable . Thus, according to the Lemma 3.3 and Table 3 we need to calculate following limits

We recall that for the case of a continuous arithmetic average we have . Since we have assumed we obtain (see Table 3).

The derivation leads to the same equation as in Lemma 3.4 when multiplied by the constant . In summary, we obtain the following approximation of the limiting behavior of the early exercise boundary near expiry also for the arithmetic average.

| (17) |

4 Transformation method for Asian call options

The purpose of this section is to propose an efficient numerical algorithm for determining the free boundary position for American-style of Asian options. Construction of the algorithm is based on a solution to a nonlocal parabolic partial differential equation (PDE). The governing PDE is constructed for a transformed variable representing the so-called -synthetised portfolio. Furthermore, we employ a front fixing method (refereed also to as Landau’s fixed domain transformation) developed by (?, ?) for plain vanilla options as well as for a class of nonlinear Black–Scholes equations (?, ?). At the end of this section we present numerical results and comparisons achieved by these methods to the recent method developed by (?).

First, we recall the partial differential equation for pricing Asian options (cf. (?)). We assume the asset price dynamics follows a geometric Brownian with a drift , continuous dividend yield and volatility , i.e. where is the standard Wiener process. If we apply Itō’s formula to the function we obtain

| (18) |

Recall that for arithmetic, geometric or weighted arithmetic averaging we have where the function is defined as follows (see Tab. 2):

| (19) |

Inserting the expression into (18) and following standard arguments from the Black–Scholes theory we obtain the governing equation for pricing Asian option with averaging given by (19) in the form:

| (20) |

where (see e.g. (?, ?)). For the Asian call option the above equation is subject to the terminal pay-off condition . It is well known (see e.g. (?, ?)) that for Asian options with floating strike we can perform dimension reduction by introducing the following similarity variable:

where . It is straightforward to verify that is a solution of (20) iff is a solution to the following parabolic PDE:

| (21) |

where and . The initial condition for immediately follows from the terminal pay-off diagram for the call option, i.e.

4.1 American-style of Asian call options

Following (?) the set is the exercise region for American-style of Asian call options. In the case of a call option this region can be described by the early exercise boundary function such that . For American-style of an Asian call option we have to impose a homogeneous Dirichlet boundary condition . According to (?) the continuity condition at the point of a contact of a solution with its pay-off diagram implies the following boundary condition at the free boundary position :

| (22) |

for any and . It is important to emphasize that the free boundary function can be also reduced to a function of one variable by introducing a new state function as follows:

The function is a free boundary function for the transformed state variable . For American-style of Asian call options the spatial domain for the reduced equation (21) is given by Taking into account boundary conditions (22) for the option price we end up with corresponding boundary conditions for the function :

| (23) |

for any and the initial condition

| (24) |

4.2 Fixed domain transformation

In order to apply the Landau fixed domain transformation for the free boundary problem (21), (23), (24) we introduce a new state variable and an auxiliary function representing a synthetic portfolio. They are defined as follows:

Clearly, iff for . The value of the transformed variable corresponds to the value , i.e. when expressed in the original variable. On the other hand, the value corresponds to the free boundary position , i.e. . After straightforward calculations we conclude that the function is a solution to the following parabolic PDE:

where the term depends on the free boundary position . The terms are given given by

| (25) |

Notice that in the case of arithmetic averaging, i.e. .

The initial condition for the solution can be determined from (24)

Since and for and we conclude the Dirichlet boundary conditions for the transformed function

It remains to determine an algebraic constraint between the free boundary function and the solution . Similarly as in the case of a linear or nonlinear Black–Scholes equation (cf. (?)) we obtain, by differentiation the condition with respect to the following identity:

Since we have at . Assuming continuity of the function and its derivative up to the boundary we obtain

Passing to the limit in (21) we end up with the algebraic equation

| (26) |

for the free boundary position where . Notice that, in the case of arithmetic averaging where , we can derive an explicit expression for the free boundary position

as a function of the derivative evaluated at . The value can be deduced from Theorem 3.1. For the arithmetic averaging we have (see also (?)) the following expression:

In summary, we derived the following nonlocal parabolic equation for the synthesized portfolio :

| with an algebraic constraint | |||

| subject to the boundary and initial conditions | (27) | ||

| (30) | |||

| where and are given by (25), | |||

| and the starting point is given by Theorem 3.1. |

4.2.1 An equivalent form of the equation for the free boundary

Although equation (26) provides an algebraic formula for the free boundary position in terms of the derivative such an expression is not quite suitable for construction of a robust numerical approximation scheme. The reason is that any small inaccuracy in approximation of the value is transferred in to the entire computational domain making thus a numerical scheme very sensitive to the value of the derivative of a solution evaluated in one point . In what follows, we present an equivalent equation for the free boundary position which is more robust from the numerical approximation point of view.

4.3 A numerical approximation operator splitting scheme

Our numerical approximation scheme is based on a solution to the transformed system (4.2). For the sake of simplicity, the scheme will be derived for the case of arithmetically averaged Asian call option. Derivation of the scheme for geometric or weighted arithmetic averaging is similar and therefore omitted.

We restrict the spatial domain to a finite interval of values where is sufficiently large. For practical purposes it sufficient to take . Let denote by the time step, , and, by the spatial step. Here denote the number of time and space discretization steps, resp. We denote by the time discretization of and where . By we shall denote the full space–time approximation for the value . Then for the Euler backward in time finite difference approximation of equation (4.2) we have

where is an approximation of the value where the . The solution is subject to Dirichlet boundary conditions at and . We set (see (4.2)). In what follows, we make use of the time step operator splitting method. We split the above problem into a convection part and a diffusive part by introducing an auxiliary intermediate step :

(Convective part)

| (32) |

(Diffusive part)

| (33) |

Similarly as in (?) we shall approximate the convective part by the explicit solution to the transport equation for and subject to the boundary condition and the initial condition . It is known that the free boundary function need not be monotonically increasing (see e.g. (?, ?) or (?)). Therefore depending whether the value of is positive or negative the boundary condition at is either in–flowing () or out–flowing (). Hence the boundary condition can be prescribed only if . Let us denote by the primitive function to , i.e. . Solving the transport equation for subject to the initial condition we obtain: if and otherwise. Hence the full time-space approximation of the half-step solution can be obtained from the formula

| (34) |

In order to compute the value we make use of a linear interpolation between discrete values .

Using central finite differences for approximation of the derivative we can approximate the diffusive part of a solution of (33) as follows:

Therefore the vector of discrete values at the time level is a solution of a tridiagonal system of linear equations

| (35) |

| (36) |

The initial and boundary conditions at and can be approximated as follows:

for and for .

Finally, we employ the differential equation (31) to determine the free boundary position . Taking the Euler finite difference approximation of we obtain

(Algebraic part)

| (37) |

where stands for numerical trapezoid quadrature of the integral whereas is a trapezoid quadrature of the integral .

We formally rewrite discrete equations (34), (35) and (37) in the operator form:

| (38) |

where is the right-hand side of equation (37), is the transport equation solver given by the right-hand side of (34) and is a tridiagonal matrix with coefficients given by (36). The system (38) can be approximately solved by means of successive iterations procedure. We define, for . Then the -th approximation of and is obtained as a solution to the system:

| (39) | |||||

Supposing the sequence of approximate discretized solutions converges to the limiting value as then this limit is a solution to a nonlinear system of equations (38) at the time level and we can proceed by computing the approximate solution in the next time level .

4.4 Computational examples of the free boundary approximation

Finally we present several computational examples of application of the numerical approximation scheme (39) for the solution and the free boundary position of (4.2). We consider American-style of Asian arithmetically averaged floating strike call options.

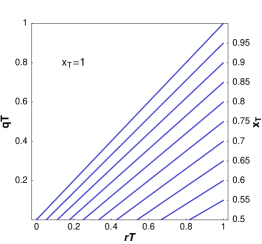

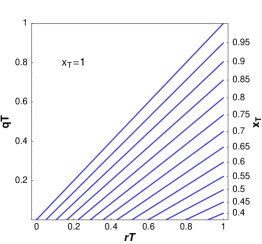

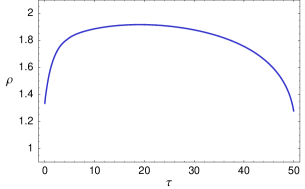

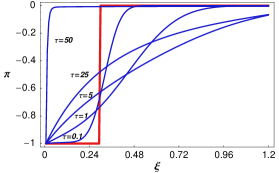

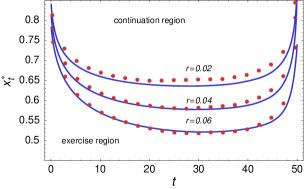

In Fig. 2 we show the behavior of the early exercise boundary function and the function . In this numerical experiment we chose and very long expiration time years. These parameters correspond to the example presented by (?). As far as other numerical parameters are concerned, we chose the mesh of spatial grid points and we have chosen the number of time steps in order to achieve very fine time stepping corresponding to 260 minutes between consecutive time steps when expressed in the original time scale of the problem.

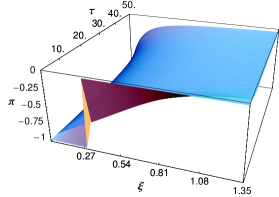

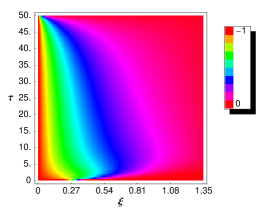

In Fig. 3 we can see the behavior of the transformed function in both 3D as well as contour plot perspectives. We also plot the initial condition and five time steps of the function for .

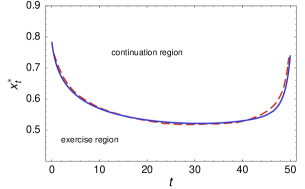

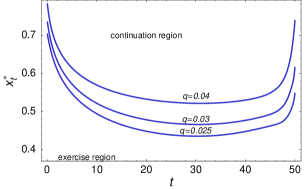

A comparison of early exercise boundary profiles with respect to varying interest rates and dividend yields is shown in Fig. 4. A comparison of the free boundary position obtained by our method (solid curve) and that of the projected successive over relaxation algorithm by (?) (dashed curve) for different values of the interest rate is shown in Fig. 4 (right). The algorithm of (?) is based on a numerical solution to the variational inequality for the function which a solution to (21) in the continuation region and it is smoothly pasted to its pay-off diagram (23). It is clear that our method and that of (?) give almost the same results. A quantitative comparison of both methods is given in Table 4 for model parameters and various interest rates . We evaluated discrete and norms of the difference between the numerical solution obtained by our method and that of (?) denoted by . We also show the minimal value of the early exercise boundary.

| 0.09769 | 0.03535 | 0.05359 | |

| 0.00503 | 0.00745 | 0.01437 | |

| 0.52150 | 0.57780 | 0.63619 |

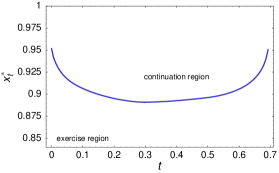

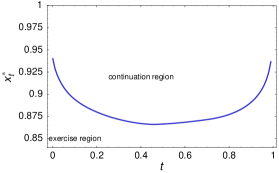

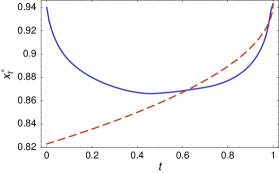

Finally, in Fig. 5 we present numerical experiments for shorter expiration times and (one year) with zero dividend rate and . We also present a comparison of the free boundary position and the analytic approximation (17) for parameters: and . It is clear that the analytic approximation (17) is capable of capturing the behavior of only for times close to the expiry . Moreover, the analytic approximation is a monotone function whereas the true early exercise boundary is a decreasing function for small values of and then it becomes increasing (see e.g. Fig. 5).

Conclusions

In this paper we analyzed American-style Asian options with averaged floating strike. We focused on arithmetic, geometric and weighted arithmetic averaging of the floating strike price. In the first part of the paper we derived an integral representation of the call and put option prices and we provided an integral equation for the free boundary position. We analyzed the behavior of the early exercise boundary close to expiry. We proposed a general methodology how to determine the early exercise position at expiry. We furthermore derived the asymptotic formula for the early exercise boundary close to the expiry. The second part of the paper was devoted to construction of a robust numerical scheme for finding an approximation of the early exercise boundary. Applying the front fixing method, we derived a nonlocal parabolic partial differential for the synthetised portfolio and the free boundary position. Using an idea of the operator splitting technique we moreover constructed a numerical scheme for numerical solution of the problem. The capability of the method has been documented by several computational examples.

Acknowledgments

This research was supported by VEGA 1/0381/09 and APVV SK-BG-0034-08 grants.

References

- [1]

- [2] [] Chadam, J.: 2008, Free boundary problems in mathematical finance, Progress in industrial mathematics at ECMI 2006, Vol. 12 of Math. Ind., Springer, Berlin, pp. 655–665.

- [3]

- [4] [] Dai, M. and Kwok, Y. K.: 2006, Characterization of optimal stopping regions of American Asian and lookback options, Math. Finance 16(1), 63–82.

- [5]

- [6] [] Detemple, J.: 2006, American-Style Derivatives: Valuation and Computation, Chapman and Hall/CRC.

- [7]

- [8] [] Dewynne, J. N., Howison, S. D., Rupf, I. and Wilmott, P.: 1993, Some mathematical results in the pricing of American options, European J. Appl. Math. 4(4), 381–398.

- [9]

- [10] [] Geske, R. and Johnson, H. E.: 1984, The American put option valued analytically, J. Finance 39, 1511–1524.

- [11]

- [12] [] Geske, R. and Roll, R.: 1984, On valuing American call options with the Black–Scholes European formula, J. Finance 89, 443–455.

- [13]

- [14] [] Hansen, A. T. and Jørgensen, P. L.: 2000, Analytical valuation of American-style Asian options, Management Science 46(8), 1116–1136.

- [15]

- [16] [] Hull, J. C.: 1997, Options, Futures and Other Derivative Securities, third edn, Prentice Hall.

- [17]

- [18] [] Karatzas, I.: 1988, On the pricing American options, Appl. Math. Optim. 17, 37–60.

- [19]

- [20] [] Kim, B. C. and Oh, S. Y.: 2004, Pricing of American-style fixed strike Asian options with continuous arithmetic average.

- [21]

- [22] [] Kuske, R. A. and Keller, J. B.: 1998, Optimal exercise boundary for an American put option, Applied Mathematical Finance 5, 107–116.

- [23]

- [24] [] Kwok, Y. K.: 1998, Mathematical models of financial derivatives, Springer Finance, Springer-Verlag Singapore, Singapore.

- [25]

- [26] [] Kwok, Y. K.: 2008, Mathematical models of financial derivatives, Springer Finance, second edn, Springer, Berlin.

- [27]

- [28] [] Linetsky, V.: 2004, Spectral expansions for Asian (average price) options, Operations Research 52(6), 856–867.

- [29]

- [30] [] Mallier, R.: 2002, Evaluating approximations for the American put option, Journal of Applied Mathematics 2, 71–92.

- [31]

- [32] [] Pascucci, A.: 2008, Free boundary and optimal stopping problems for American Asian options, Finance Stoch 12, 21–41.

- [33]

- [34] [] Revuz, D. and Yor, M.: 2005, Continuous martingales and Brownian motion, Vol. 293 of Grundlehren der Mathematischen Wissenschaften [A Series of Comprehensive Studies in Mathematics], corrected third edn, Springer-Verlag, Berlin.

- [35]

- [36] [] Ševčovič, D.: 2001, Analysis of the free boundary for the pricing of an American call option, European J. Appl. Math. 12(1), 25–37.

- [37]

- [38] [] Ševčovič, D.: 2007, An iterative algorithm for evaluating approximations to the optimal exercise boundary for a nonlinear Black-Scholes equation, Canad. Appl. Math. Quart. 15(1), 77–97.

- [39]

- [40] [] Ševčovič, D.: 2009, Transformation methods for evaluating approximations to the optimal exercise boundary for a linear and nonlinear Black-Scholes equation, in M. Ehrhardt (ed.), Nonlinear Models in Mathematical Finance: New Research Trends in Option Pricing, Nova Science Publishers, New York, pp. 153–198.

- [41]

- [42] [] Stamicar, R., Ševčovič, D. and Chadam, J.: 1999, The early exercise boundary for the American put near expiry: numerical approximation, Canad. Appl. Math. Quart. 7(4), 427–444.

- [43]

- [44] [] Wilmott, P., Howison, S. and Dewynne, J.: 1995, The mathematics of financial derivatives, Cambridge University Press, Cambridge. A student introduction.

- [45]

- [46] [] Wu, L., Kwok, Y. K. and Yu, H.: 1999, Asian options with the American early exercise feature, International Journal of Theoretical and Applied Finance 2(1), 101–111.

- [47]

- [48] [] Wu, R. and Fu, M. C.: 2003, Optimal exercise policies and simulation-based valuation for American-Asian options, Operations Research 51(1), 52–66.

- [49]

- [50] [] Wystup, U.: 2006, FX Options and Structured Products, www.mathfinance.com.

- [51]