Kernel estimators of asymptotic variance

for adaptive Markov

chain Monte Carlo

Abstract

We study the asymptotic behavior of kernel estimators of asymptotic variances (or long-run variances) for a class of adaptive Markov chains. The convergence is studied both in and almost surely. The results also apply to Markov chains and improve on the existing literature by imposing weaker conditions. We illustrate the results with applications to the Markov model and to an adaptive MCMC algorithm for Bayesian logistic regression.

doi:

10.1214/10-AOS828keywords:

[class=AMS] .keywords:

.T1Supported in part by NSF Grant DMS-09-06631.

1 Introduction

Adaptive Markov chain Monte Carlo (adaptive MCMC) provides a flexible framework for optimizing MCMC samplers on the fly (see, e.g., andrieuetthoms08 , atchadeetal09 , robertsetrosenthal06 and the reference therein). If is the probability measure of interest, then these adaptive MCMC samplers generate random processes that typically are not Markov, but they nevertheless satisfy a law of large numbers and the empirical average provides a consistent estimate of the integral , . A measure of uncertainty in approximating by the random variable is given by the variance . In particular, the asymptotic variance (also known as the long-run variance) plays a fundamental role in assessing the performances of Monte Carlo simulations. But the problem of estimating asymptotic variances for adaptive MCMC samplers has not been addressed in the literature.

We study kernel estimators of asymptotic variances for a general class of adaptive Markov chains. These adaptive Markov chains (the precise definition is given in Section 2 below), which include Markov chains, constitute a theoretical framework for analyzing adaptive MCMC algorithms. More precisely, if is an adaptive Markov chain and a function of interest, then we consider estimators of the form

where is the th order sample autocovariance of , is a kernel with support and is the bandwidth. These are well-known methods pioneered by M. S. Bartlett, M. Rosenblatt, E. Parzen and others (see, e.g., priestley81 for more details). But, with a few notable exceptions in the econometrics literature (see references below), these estimators have mostly been studied with the assumption of stationarity. Thus, more broadly, this paper contributes to the literature on the behavior of kernel estimators of asymptotic variances for ergodic nonstationary processes.

It turns out that, in general, the asymptotic variance does not characterize the limiting distribution of as, for example, with ergodic Markov chains. For adaptive Markov chains, we show that converges weakly to a mixture of normal distributions of the form for some mixing random variable , where is a standard normal random variable independent of . Under a geometric drift stability condition on the adaptive Markov chain and some verifiable conditions on the kernel and the bandwidth , we prove that the kernel estimator converges to in -norm, , and almost surely. For Markov chains, coincides with , the asymptotic variance of . Another important special case where we have is the one where the adaptation parameter converges to a deterministic limit as, for instance, with the adaptive Metropolis algorithm of haarioetal00 . The general case where is random poses some new difficulties to Monte Carlo error assessment in adaptive MCMC that we discuss in Section 4.3.

We derive the rate of convergence for which suggests selecting the bandwidth to be . When is admissible, we obtain the bandwidth , as in jonesetal09 .

The problem of estimating asymptotic variances is well known in MCMC and Monte Carlo simulation in general. Besides the estimator described above, several other methods have been proposed, including batch means, overlapping batch means and regenerative simulation (bratleyetal87 , damerdji95 , jonesetal09 , myklandetal95 ). For the asymptotics of kernel estimators, the important work of jonesetal09 proves the -consistency and strong consistency of kernel estimators for Markov chains under the assumption of geometric ergodicity and , , for some . We weaken these moment conditions to .

Estimating asymptotic variances is also a well-known problem in econometrics and time series modeling. For example, if is the ordinary least-squares estimator of in the simple linear model where is a dependent noise process, then, under some mild conditions on the sequence and on the noise process, converges weakly to a normal distribution where

Therefore, a valid inference on requires the estimation of the asymptotic variance . The multivariate version of this problem involves estimating the so-called heteroskedasticity and autocorrelation (HAC) matrices. Several authors have studied the kernel estimation of HAC matrices and attention has been paid to nonstationarity under various mixing assumptions or mixingale-type assumptions (andrew91 , dejong00 , dejongetdavidson00 , hansen92 ). But these results require mixing conditions that do not hold in the present setup.

On a more technical note, the proof of our main results (Theorems 4.1–4.3) is based on a martingale approximation approach adapted from wuetshao07 . The crux of the argument consists in approximating the periodogram of the adaptive Markov chain by a quadratic form of a martingale difference process which is then treated as a martingale array. As part of the proof, we develop a strong law of large numbers for martingale arrays which may also be of some independent interest. The approach taken here thus differs from the almost sure strong approximation approach taken in damerdji95 , jonesetal09 .

The paper is organized as follows. In Section 2, we define the class of adaptive Markov chains that will be studied. In Section 3, we give a general central limit theorem for adaptive Markov chains that sets the stage to better understand the limiting behavior of the kernel estimator . In Section 4, we state the assumptions and the main results of the paper. We also discuss some practical implications of these theoretical results. The proofs are postponed to Section 6 and to the supplementary paper atchadesuppl . Section 5 presents applications to generalized autoregressive conditional heteroscedastic () processes and to a Bayesian analysis of logistic regression.

We end this introduction with some general notation that will be used throughout the paper. For a Markov kernel on a measurable space say, we denote by , , its th iterate. Any such Markov kernel acts both on bounded measurable functions and on -finite measures , as in and . If is a function, then the -norm of a function is defined as . The set of measurable functions with finite -norm is denoted by . Similarly, if is a signed measure on , then the -norm of is defined as , where . If is a -finite measure on and , we denote by the space of all measurable functions such that . Finally, for , we define and .

2 Adaptive Markov chains

Let be a measure state space measure space endowed with a countably generated -field . Let be a measure space. In practice, we will take to be a compact subspace of , the -dimensional Euclidean space. Let be a family of Markov transition kernels on such that for any , is measurable. Let be a probability measure on . We assume that for each , admits as its invariant distribution.

The stochastic processes of interest in this work are defined as follows. Let be the product space equipped with its product -algebra and let be a probability measure on . Let be the probability measure on with associated expectation operator , associated process and associated natural filtration with the following properties: and, for each and any nonnegative measurable function ,

| (1) |

We call the -marginal process an adaptive Markov chain. In this definition, we have left the adaptation dynamics (i.e., the conditional distribution of given and ) unspecified. This can be done in many different ways (see, e.g., robertsetrosenthal06 ). But it is well known, as we will see later, that the adaptation dynamics needs to be diminishing in order for the adaptive Markov chain to maintain as its limiting distribution.

The simplest example of an adaptive Markov chain is the case where for all . Then is a Markov chain with transition kernel . In other words, our analysis also applies to Markov chains and, in particular, to Markov chain Monte Carlo.

Example 2.1.

To illustrate the definitions and, later, the results, we present a version of the adaptive Metropolis algorithm of haarioetal00 . We take equipped with its Euclidean norm and inner product, denoted by and , respectively. Let be a positive, possibly unnormalized, density (with respect to the Lebesgue measure). We construct the parameter space as follows. We equip the set of all -dimensional symmetric positive semidefinite matrices with the Frobenius norm and inner product . For , let be the compact subset of elements such that . Let be the ball centered at and with radius in . We then define for some constants .

We introduce the functions and defined as follows. For , and for , . Similarly, for , and for , .

For , let be the transition kernel of the random walk Metropolis (RWM) algorithm with proposal kernel and target distribution . The adaptive Metropolis algorithm works as follows.

Algorithm 2.1.

Initialization: Choose , . Let be a sequence of positive numbers (we use in the simulations).

Iteration: Given : {longlist}

generate ; with probability set and with probability , set ;

set

| (2) | |||||

| (3) |

Throughout the paper, we fix the initial measure of the process to some arbitrary measure and simply write and for and , respectively. We impose the following geometric ergodicity assumption.

For each , is phi-irreducible and aperiodic with invariantdistribution . There exists a measurable function with such that for any , there exist , such that for any ,

| (4) |

Furthermore, there exist constants such that for any ,

| (5) |

Condition (4) is a standard geometric ergodicity assumption. We impose (5) in order to control the moments of the adaptive process. Condition (5) is probably redundant since geometric ergodicity intuitively implies a drift behavior of the form (5). But this is rarely an issue because both (4) and (5) are implied by the following minorization and drift conditions.

Uniformly for , there exist , a probability measure on , and such that , and

| (6) |

This assertion follows from Theorem 1.1 of baxendale05 . DR is known to hold for many Markov kernels used in MCMC simulation (see, e.g., jonesetal09 for some references). Either drift condition (5) or (6) implies that (meynettweedie93 , Theorem 14.3.7). Therefore, under A1, if for some , then . Finally, we note that under A1, a law of large numbers can be established for the adaptive chain (see, e.g., atchadeetfort08 ). A short proof is provided here for completeness.

To state the law of large numbers, we need the following pseudo-metric on . For , , set

Proposition 2.1

Assume A1. Let and be a family of functions such that , is measurable and . Suppose also that

| (7) |

Then converges almost surely () to zero.

See Section 6.1.

3 A central limit theorem

Central limit theorems are useful in assessing Monte Carlo errors. Several papers have studied central limit theorems for adaptive MCMC (andrieuetal06 , atchadeetfort08 , saksmanvihola09 ). The next proposition is adapted from atchadeetfort09 . For , we introduce the resolvent functions

where . The dependence of on is omitted for notational convenience. We also define , where . Whenever is well defined, it satisfies the so-called Poisson equation

| (8) |

Proposition 3.1

Assume A1. Let and be such that . Suppose that there exists a nonnegative random variable finite -a.s., such that

| (9) |

Suppose also that

| (10) |

Then converges weakly to a random variable , where is a standard normal random variable independent of .

See Section 6.2.

Condition (10), which strengthens (7), is a diminishing adaptation condition and is not hard to check in general. It follows from the following assumption which is much easier to check in practice.

There exist and a nonincreasing sequence of positive numbers , , , such that for any , there exists a finite constant such that

| (11) |

andrieuetal06 establishes A2 for the random walk Metropolis and the independence sampler. A similar result is obtained for the Metropolis adjusted Langevin algorithm in atchade05 . The constant in A2 reflects the additional fluctuations due to the adaptation. For example, for a Metropolis algorithm with adaptation driven by a stochastic approximation of the form , is any nonnegative number such that .

Proposition 3.2

Under A1–A2, (10) holds.

Under A2, the left-hand side of (10) is bounded almost surely by , the expectation of which is bounded by the term according to Lemma A.1(a), assuming A1. Since , we conclude that (10) holds.

Equation (9) is also a natural assumption. Indeed, in most adaptive MCMC algorithms, we seek to find the “best” Markov kernel from the family to sample from . Thus, it is often the case that converges to some limit , say (see, e.g., andrieuetal06 , andrieuetthoms08 , atchadeetfort09 , atchadeetrosenthal03 ). In these cases, (9) actually holds.

Proposition 3.3

Assume A1–A2. Let , where is as in A2, and let be such that . Suppose that there exists a -valued random variable such that converges in probability to zero. Then (9) holds. Furthermore,

See Section 6.3.

Definition 3.1.

We call the random variable the asymptotic average squared variation of and the asymptotic variance of .

This definition is justified by the following result.

Proposition 3.4

Assume A1–A2. Let and be such that . Assume that (9) holds. Then

See Section 6.4.

4 Asymptotic variance estimation

Denote by the sample mean of and denote by the sample autocovariance: for , and for ,

Let be a function with support [ for ]. We assume that satisfies the following. {longlist}

The function is even [] and . Moreover, the restriction is twice continuously differentiable.

Typical examples of kernels that satisfy A3 include, among others, the family of kernels

| (12) |

for . The case corresponds to the Bartlett kernel. A3 is also satisfied by the Parzen kernel

| (13) |

Our analysis does not cover nontruncated kernels such as the quadratic spectral kernel. But truncated kernels have the advantage of being computationally more efficient.

Let be a nonincreasing sequence of positive numbers such that

| (14) |

We consider the class of kernel estimator of the form

| (15) |

The following is the main -convergence result.

Theorem 4.1

Assume A1–A3. Let and , where is as in A2. Then

| (16) |

The random process is such that for any such that , there exists a finite constant such that

In particular, if then

converges to zero in .

The proof is given in the supplementary article atchadesuppl .

Remark 4.1.

In Theorem 4.1, we can always take . In this case, the condition translates to . Therefore, if is close to , we need to choose small. This remark implies that in applying the above result, one should always try to find the smallest possible such that .

It can be easily checked that the choice of bandwidth with always satisfies Theorem 4.1. In fact, we will see in Section 4.2 that this choice of is optimal in the -norm, .

It is possible to investigate more carefully the rate of convergence of in Theorem 4.1. Indeed, consider the typical case where is admissible and we have . If we choose such that and then the slowest term in (4.1) is . By inspecting the proof of Theorem 4.1, the only term whose -norm enjoys such rate is

where

Now, is a martingale array and we conjecture that as ,

at least in the special case where converges to a deterministic limit. But we do not pursue this further since the issue of a central limit theorem for is less relevant for Monte Carlo simulation.

When is a Markov chain, Theorem 4.1 improves on jonesetal09 , as it imposes weaker moment conditions. Almost sure convergence is often more desirable in Monte Carlo settings, but typically requires stronger assumptions. One can impose either more restrictive growth conditions on (which translates into stronger moment conditions, as in jonesetal09 ) or one can impose stronger smoothness conditions on the function . We prove both types of results.

Theorem 4.2

Assume A1–A3 with , where is as in A2. Let and . Suppose that , where . Then

almost surely.

The proof is given in the supplementary article atchadesuppl .

We can remove the growth condition , and the constraint on in Theorem 4.2 if we are willing to impose a stronger smoothness condition on . To do so, we replace A3 with A4.

The function is even [] and . Moreover, the restriction is -times continuously differentiable for some .

Theorem 4.3

Assume A1–A2 and A4. Let and , where is as in A2. Let be such that . Suppose, in addition, that

The conclusion of Theorem 4.2 then holds.

The proof is given in the supplementary article atchadesuppl .

Remark 4.2.

In the next corollary, we consider the Markov chain case.

Corollary 4.1

Suppose that is a phi-irreducible, aperiodic Markov chain with transition kernel and invariant distribution . Assume that satisfies A1. Let and . Then is finite. Assume A3 and take with . Then

Supposing, in addition, that and or that A4 holds with , then the convergence holds almost surely () as well.

4.1 Application to the adaptive Metropolis algorithm

We shall now apply the above result to the adaptive Metropolis algorithm described in Example 2.1. We continue to use the notation established in that example. We recall that , where is the ball in with center and radius and is the set of all symmetric positive semidefinite matrices with . Define . We assume that:

is positive and continuously differentiable,

and

where is the gradient of .

B1 is known to imply A1 with , for any (andrieuetal06 , jarnerethansen98 ). We denote by and the mean and covariance matrix of , respectively. We assume that which can always be achieved by taking large enough.

By Lemma 12 of andrieuetal06 , for any ,

| (19) |

for any . Thus, A2 holds and can be taken to be arbitrarily small. We can now summarize Proposition 3.1 and Theorems 4.1–4.3 for the random Metropolis algorithm. We focus here on the choice of bandwidth , where but similar conclusions can be derived from the theorems for other bandwidths.

Proposition 4.1

Assume B1, let for and suppose that . Then converges in probability to . Let and . {longlist}

converges weakly to as , where and .

Suppose that A3 holds and we choose , . Then converges to in for . If we additionally suppose that and or that A4 holds with , then the convergence of holds almost surely () as well.

4.2 Choosing the bandwidth

Consider Theorem 4.1. Suppose that and that we take for some . Then . Similarly, . Thus, the -rate of convergence of is driven by and , and we deduce from equating these two terms that the optimal choice of is given by for . Equation (4.1) then gives that

In particular, if (and ), we can take and then which leads to

The same -rate of convergence was also derived in jonesetal09 .

Even with , the estimator is still very sensitive to the choice of . Choosing is a difficult issue where more research is needed. Here, we follow a data-driven approach adapted from andrew91 and neweyetwest94 . In this approach, we take , where

for some constants and , where is the th order sample autocorrelation of . neweyetwest94 suggests choosing . Our simulation results show that small values of yield small variances but high biases, and inversely for large values of . The value also depends on how fast the autocorrelation of the process decays. neweyetwest94 derives some theoretical results on the consistency of this procedure in the stationary case. Whether these results hold in the present nonstationary case is an open question.

4.3 Discussion

The above results raise a number of issues. On one hand, we note from Theorems 4.1–4.3 that the kernel estimator does not converge to the asymptotic variance , but rather to the asymptotic average squared variation . On the other hand, Proposition 3.1 shows that although the asymptotic variance controls the fluctuations of as , the limiting distribution of is not the Gaussian , but instead a mixture of Gaussian distribution of the form . With these conditions, how can one undertake a valid error assessment from adaptive MCMC samplers?

If the adaptation parameter converges to a deterministic limit , then one gets a situation similar to that of Markov chains. This is the ideal case. Indeed, in such cases, , converges weakly to a random variable and the kernel estimator converges to the asymptotic variance , where

This case includes the adaptive Metropolis algorithm of haarioetal00 , as discussed in Section 4.1.

However, in some other cases (see, e.g., andrieuetal06 , atchadeetfort08 ), what one can actually prove is that , where is a discrete random variable with values in a subset say, of . This is typically the case when the adaptation is driven by a stochastic approximation where the mean field equation has multiple solutions.

In these cases, clearly provides a poor estimate for , even though it is not hard to see that

Furthermore, a confidence interval for becomes difficult to build. Indeed, the asymptotic distribution is a mixture

where and . As a consequence, a valid confidence interval for requires the knowledge of the mixing distribution and the asymptotic variances , which is much more than one can obtain from . It is possible to improve on the estimation of by running multiple chains, but this takes away some of the advantages of the adaptive MCMC framework.

In view of this discussion, when Monte Carlo error assessment is important, it seems that the framework of adaptive MCMC is most useful when the adaptation mechanism is such that there exists a unique, well-defined, optimal kernel that the algorithm converges to. This is the case, for example, with the popular adaptive RWM of haarioetal00 discussed above and its extension to the MALA (Metropolis adjusted Langevin algorithm; see, e.g., atchade05 ).

5 Examples

5.1 The model

To illustrate the above results in the Markov chain case, we consider the linear model defined as follows: , and, for

where is i.i.d. and , , . We assume that satisfy the following.

There exists such that

| (20) |

It is shown by meitzetsaikkonen08 , Theorem 2, that under (20), the joint process is a phi-irreducible aperiodic Markov chain that admits an invariant distribution and is geometrically ergodic with a drift function . Therefore, A1 holds and we can apply Corollary 4.1. We write to denote expectation taken under the stationary measure. We are interested in the asymptotic variance of the functions . We can calculate the exact value. Define . As observed by bollerslev86 in introducing the models, if (20) hold with some , then

Also,

and we obtain

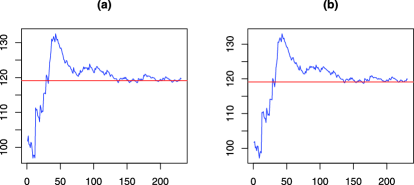

For the simulations, we set , , which gives . For these values, (20) holds with at least . We tested the Bartlett and the Parzen kernels for which A3 holds. We choose the bandwidth following the approach outlined in Remark 4.2 with . We run the Markov chain for 250,000 iterations and discard the first 10,000 iterations as burn-in. We compute at every 1000 along the sample path. The results are plotted in Figure 1.

5.2 Logistic regression

We also illustrate the results with MCMC and adaptive MCMC. We consider the logistic regression model

where and for a parameter and a covariate vector , where denotes the transpose of . is the Bernoulli distribution with parameter . The log-likelihood is

We assume a Gaussian prior distribution for some constant leading to a posterior distribution

The RWM algorithm described in Example 2.1 is a possible choice to sample from the posterior distribution. We compare a plain RWM with proposal density with and the adaptive RWM described in Algorithm 2.1 using the family where as defined in Example 2.1. It is easy to check that B1 holds. Indeed, we have

and . We deduce that

Similarly,

since as . Therefore, B1 holds. If we choose large enough so that then Proposition 4.1 holds and applies to any measurable function such that for some .

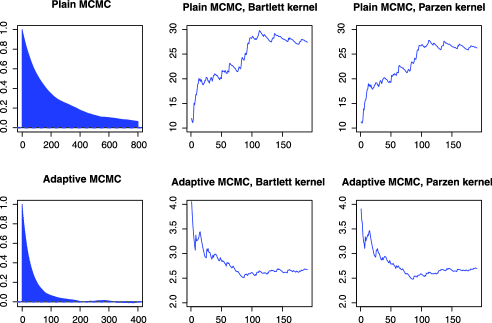

As a simulation example, we test the model with the Heart data set which has cases and covariates. The dependent variable is the presence or absence of a heart disease and the explanatory variables are relevant covariates. More details can be found in michieetal94 . We use Parzen and Bartlett kernels with for the Markov chain and for the adaptive chain. We run both chains for 250,000 iterations and discard the first 50,000 iterations as burn-in. The results are plotted in Figure 2 for the coefficient . We also report in Table 1 below the resulting confidence for the first four coefficients .

6 Proofs

This section contains the proofs of the statements from Sections 2–3. The remaining proofs are available in the supplementary paper atchadesuppl . Throughout this section, we shall use to denote a generic constant whose actual value might change from one appearance to the next. On multiple occasions, we make use of the Kronecker lemma and the Toeplitz lemma. We refer the reader to halletheyde80 , Section 2.6, for a statement and proof of these lemmata.

We shall routinely use the following martingale inequality. Let be a martingale difference sequence. For any ,

| (21) |

where can be taken as , .

=235pt Parameters Plain MCMC Adaptive RWM

We also notice that for any Lemma A.1(a)–(b) implies that

| (22) |

6.1 Proof of Proposition 2.1

Let . For , we define . When does not depend on , we obtain , as defined in Section 3. Similarly, we define . Using the Poisson equation , we rewrite as , where

and

Using Lemma A.1 and A1, we easily see that

For such that , . This is a consequence of Lemma A.1(a) and the Minkowski inequality. Thus, converges almost surely to zero. By (7) and the Kronecker lemma, the term converges almost surely to zero. We conclude that converges almost surely to zero.

is a martingale. Again, let be such that . Equation (21) and Lemma A.1(a) together imply that , which, combined with Proposition A.1 of atchadesuppl , implies that converges almost surely to zero.

6.2 Proof of Proposition 3.1

This is a continuation of the previous proof. In the present case, , so we write and instead of and , respectively. Again, let . We have , where and

is bounded in , thus converges in probability to zero. By (10) and the Kronecker lemma, the term converges almost surely to zero. We conclude that converges in probability to zero.

is a martingale. Since , (22) implies that is a square integrable martingale and also that we have

Equations (9) and (6.2) imply, by Theorem 3.2 of halletheyde80 , that converges weakly to a random variable , where and is independent of .

6.3 Proof of Proposition 3.3

We have

say. The term is an -martingale. Indeed, , -a.s. Furthermore, by (22), the martingale differences are -bounded for some . By halletheyde80 , Theorem 2.22, we conclude that converges in to zero.

6.4 Proof of Proposition 3.4

Appendix A Some useful consequences of A1

Lemma A.1.

Assume that satisfies A1. {longlist}

There exists a finite constant such that

| (24) |

Let and be such that , . The function is then well defined, , where the constant does not depend on . Moreover, we can take such that for any ,

| (25) |

Assume A2. Let and be such that . Define . Let . There then exists a finite constant that does not depend on or such that

Parts (a) and (b) are standard results (see, e.g., andrieuetal06 ). To prove (c), we use the Poisson equation (8) to write

By A1 and part (a), we have

By Burkholder’s inequality and some standard inequalities,

Part (b) and A2 together give

and, since we are done.

Acknowledgments

The author is grateful to Galin Jones for helpful discussions, and to Prosper Dovonon for pointing out some of the references in the econometrics literature and for helpful comments on an earlier version of this paper.

[id=suppA] \stitleSupplement to “Kernel estimators of asymptotic variance for adaptive Markov chain Monte Carlo” \slink[doi]10.1214/10-AOS828SUPP \sdatatype.pdf \sfilenameSuppl.pdf \sdescriptionThe proofs of Theorems 4.1–4.3 require some technical and lengthy arguments that we develop in this supplement.

References

- (1) Andrews, D. W. K. (1991). Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica 59 817–858. \MR1106513

- (2) Andrieu, C. and Moulines, É. (2006). On the ergodicity properties of some adaptive MCMC algorithms. Ann. Appl. Probab. 16 1462–1505. \MR2260070

- (3) Andrieu, C. and Thoms, J. (2008). A tutorial on adaptive MCMC. Statist. Comput. 18 343–373.

- (4) Atchade, Y. F. (2006). An adaptive version for the Metropolis adjusted Langevin algorithm with a truncated drift. Methodol. Comput. Appl. Probab. 8 235–254. \MR2324873

- (5) Atchadé, Y. F. (2010). Supplement to “Kernel estimators of asymptotic variance for adaptive Markov chain Monte Carlo.” DOI:10.1214/10-AOS828SUPP.

- (6) Atchade, Y. F. and Fort, G. (2009). Limit theorems for some adaptive MCMC algorithms with subgeometric kernels: Part II. Technical report, Univ. Michigan.

- (7) Atchade, Y. and Fort, G. (2010). Limit theorems for some adaptive MCMC algorithms with sub-geometric kernels. Bernoulli 16 116–154. \MR2648752

- (8) Atchade, Y. F., Fort, G., Moulines, E. and Priouret, P. (2009). Adaptive Markov chain Monte Carlo: Theory and methods. Technical report, Univ. Michigan.

- (9) Atchade, Y. F. and Rosenthal, J. S. (2005). On adaptive Markov chain Monte Carlo algorithm. Bernoulli 11 815–828. \MR2172842

- (10) Baxendale, P. H. (2005). Renewal theory and computable convergence rates for geometrically ergodic Markov chains. Ann. Appl. Probab. 15 700–738. \MR2114987

- (11) Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. J. Econometrics 31 307–327. \MR0853051

- (12) Bratley, P., Fox, B. and Schrage, L. (1987). A Guide to Simulation, 2nd ed. Springer, New York.

- (13) Damerdji, H. (1995). Mean-square consistency of the variance estimator in steady-state simulation output analysis. Oper. Res. 43 282–291. \MR1327416

- (14) de Jong, R. M. (2000). A strong consistency proof for heteroskedasticity and autocorrelation consistent covariance matrix estimators. Econometric Theory 16 262–268. \MR1763435

- (15) de Jong, R. M. and Davidson, J. (2000). Consistency of kernel estimators of heteroscedastic and autocorrelated covariance matrices. Econometrica 68 407–423. \MR1748008

- (16) Flegal, J. M. and Jones, G. L. (2009). Batch means and spectral variance estimators in Markov chain Monte Carlo. Available at http://www.citebase.org/ abstract?id=oai:arXiv.org:0811.1729. \MR2604704

- (17) Haario, H., Saksman, E. and Tamminen, J. (2001). An adaptive Metropolis algorithm. Bernoulli 7 223–242. \MR1828504

- (18) Hall, P. and Heyde, C. C. (1980). Martingale Limit Theory and Its Application. Academic Press, New York. \MR0624435

- (19) Hansen, B. E. (1992). Consistent covariance matrix estimation for dependent heterogeneous processes. Econometrica 60 967–972. \MR1168743

- (20) Jarner, S. F. and Hansen, E. (2000). Geometric ergodicity of Metropolis algorithms. Stocahstic Process. Appl. 85 341–361. \MR1731030

- (21) Meitz, M. and Saikkonen, P. (2008). Ergodicity, mixing, and existence of moments of a class of Markov models with applications to GARCH and ACD models. Econometric Theory 24 1291–1320. \MR2440741

- (22) Meyn, S. P. and Tweedie, R. L. (1993). Markov Chains and Stochastic Stability. Springer, London. \MR1287609

- (23) Michie, D., Spiegelhalter, D. and Taylor, C. (1994). Machine Learning, Neural and Statistical Classification. Prentice Hall, Upper Saddle River, NJ.

- (24) Mykland, P., Tierney, L. and Yu, B. (1995). Regeneration in Markov chain samplers. J. Amer. Statist. Assoc. 90 233–241. \MR1325131

- (25) Newey, W. K. and West, K. D. (1994). Automatic lag selection in covariance matrix estimation. Rev. Econom. Stud. 61 631–653. \MR1299308

- (26) Priestley, M. B. (1981). Spectral Analysis and Time Series: Volume 1: Univariate Series. Academic Press, London. \MR0628735

- (27) Roberts, G. and Rosenthal, J. (2009). Examples of adaptive MCMC. J. Comput. Graph. Statist. 18 349–367.

- (28) Saksman, E. and Vihola, M. (2009). On the ergodicity of the adaptive Metropolis algorithm on unbounded domains. Technical report. Available at arXiv:0806.2933v2.

- (29) Wu, W. B. and Shao, X. (2007). A limit theorem for quadratic forms and its applications. Econometric Theory 23 930–951. \MR2396738