Multifractal analysis and instability index of prior-to-crash market situations

Abstract

We take prior-to-crash market prices (NASDAQ, Dow Jones Industrial Average) as a signal, a function of time, we project these discrete values onto a vertical axis, thus obtaining a Cantordust. We study said cantordust with the tools of multifractal analysis, obtaining spectra by definition and by lagrangian coordinates. These spectra have properties that typify the prior-to-crash market situation. Any of these spectra entail elaborate processing of the raw signal data. With the unprocessed raw data we obtain an instability index, also with properties that typify the prior-to-crisis market situation. Both spectra and the instability index agree in characterizing such crashes, and in giving an early warning of them.

M. Piacquadio

Secretaría de Investigación y Doctorado, Facultad de Ingeniería, Universidad de Buenos Aires

Paseo Colón 850, Ciudad Autónoma de Buenos Aires, Argentina

F. O. Redelico

Laboratorio de Sistemas Complejos, Facultad de Ingeniería, Universidad de Buenos Aires

Paseo Colón 850, Ciudad Autónoma de Buenos Aires, Argentina

Facultad de Ciencias Fisicomatemáticas e Ingeniería, Universidad Católica Argentina

Alicia Moreau de Justo 1500, Ciudad Autónoma de Buenos Aires, Argentina

1 Introducion

We propose to apply some tools of multifractal analysis to the study of market crash situations (NASDAQ, Dow Jones Industrial Average). We take the data of market price fluctuations on a daily basis and we process it in two ways:

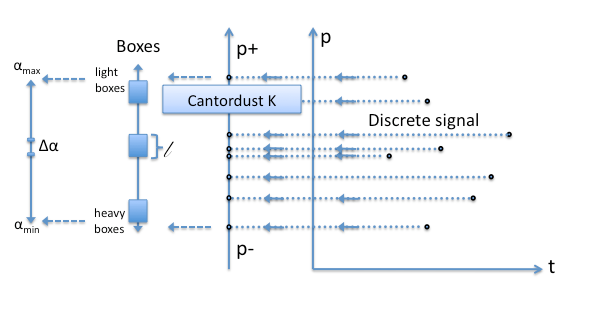

1) The prior-to-crash market prices are taken as a discrete one dimensional signal —this will be the Cantordust, covered with adjacent boxes with equal length . These boxes are intervals. The weight of box will be the number of days in which the market prices are in box . The weights are then normalized into probabilities , by dividing each by the total cardinality of the sample. Then, the concentration of a box is . Therefore, corresponds to the heaviest box(es), to the lightest one(s). The segment is divided into adjacent intervals of equal length , all ’s in a are identified, and is their number. We define . This spectrum-by-definition is hereby called in order to distinguish it from the usual lagrangian given by the thermodynamic algorithm: , and , small, a parameter, .

Notice that, in order to obtain and/or , we process weights , , and even , which is —for instance— always logarithmized and then divided by in order to produce .

2) In this paper, we —also— use the unprocessed data above: the unprocessed and the unlogarithmized , in order to define a market instability index as a quotient that characterizes the prior-to-crash market situation. Then we use the processeed and in order to strengthen the key properties of that reveal the market collapse situation.

Note: and do not always coincide.

2 A theoretical framework: the binomial case.

We consider the simplest of Cantordusts: the ternary of Cantor in the unit interval . We endow the subfractals —or ”subcantors”— in and with probability measures and respectively, , ; , , , and will be the weights of the subfractals of width in the second step of the construction of , …and so on. This simplest of cases ascribes probability measure to all subfractals of width in the th step, between 0 and .

Then (of such subfractal) , where , and an integer, .

The corresponding , the same as in this simplest case, is , where reaches its maximum for and is entirely symmetric for at left and right of . The concentration goes linearly with integer from an ”origin” (where ) to , where reaches its maximum, to , where is again zero. In this simplest binomial case, the increasing and decreasing branches of the curve are a mirror image of each other, like an inverted parabola. (In the case we work with below, such symmetry might be absent, still we will consider

as a constant, going linearly with integer ).

We will simplify this binomial case further, in order to be able to adapt it to our study of the market crash signal. The binomial case comes from the unfolding of , with and , and the symmetric properties of . We have a decreasing index for powers of ’s —i.e. for ’s— to wit: , , …coupled with an exponent increase for powers of —or —: , …; …the corresponding number of them.

Notice that the & structure above does not need the ternary of Cantor as a starting point: if we divide the unit invertal in halfs, in quarters, …where is the size of each interval-box in th step, then we simply replace ”3” by ”2” in the denominators of and above. In fact, if is the number of equal intervals dividing , we still have , with in the denominator of , in that of , and just as symmetric as above.

Next, consider a number instead of above, and the binomial expression , and . We now have a decreasing sequence of weights : …instead of has been replaced by 1. The total weight is now .

Now, in order to make probabilities out of these weights we have to write ; the corresponding number of them. With as before, large and fixed, the size of the sample, or total number of such elements, we still have, as above, , : ; and is just as symmetric as above. This will be our working structural framework.

2.1 The instability quotient

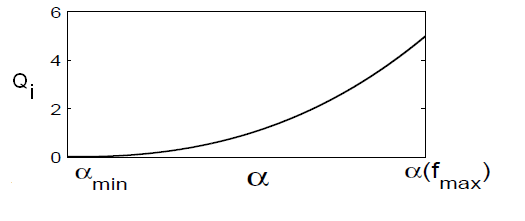

is a function of or of indistinctly, and will be, by definition, , an obviously increasing function of , i.e. of , between —or — and —or in our binomial case.

Notice that the instability quotient is made up of ”unprocessed” weights —not logarithms of probabilities— and ”unlogarithmized” , i.e. with the raw data which, once processed, yields and

3 Structural frame for the study of market crash situations

NQ1000 refers to the 1000 daily fluctuations before the April 2000 NASDAQ crash; DJIA1600, DJIA900, …etc. refer to the 1600, 900, …etc. daily fluctuations before the October 1997 Dow Jones market crash, i.e. 1600 days prior to crash, 900 days ditto, etc. (Rotundo, 2006). We start with NQ1000, and we represent (ditto for other cases) the graph of the closing market price as a function of time —one day at a time: one day a unit time. Time the horizontal axis, the corresponding price the vertical one. We take the signal and project these discrete values onto the vertical axis . This set of points is a cantordust contained in a vertical segment . We cover vertical with adjacent interval-boxes of equal size . The number of boxes should not exceed, ideally, the square root of the total points in the signal. Each point in vertical is a certain market price: the higher the point in —i.e. the higher the box that contains it— the higher the price . The weight of box is the number of days in which market prices fell between the vertical bounds or extremes of . Thus, each such box represents an increment in prices . Let and be the extremes of segment : the lower and upper prices. For NQ1000 as well as for the DJIA’s, we always notice a rather small set of very heavy boxes quite near . These heavy boxes represent many days in which market prices stood firm, with constant values, i.e. prices rather stable, not very expensive. The short lower subsegment in between and represents prices going down —hence its smallness: we will do without it, as generally, prices tend to go up. Hence, we will work with heavy boxes as the lowest boxes, and study the nature of price increase. The remaining vertical upper segment in , from heaviest boxes at the bottom to the lightest ones on top, will be normalized to be the unit segment , the cantordust thus reduced will be the fractal cantordust . Since the signal has a total of 1000 points, then —the number of boxes— should not exceed . The sum of all weights in all boxes is 1000. The situation at the top, near , presents a problem: there are boxes with just 1 point, on top of which we find a box with 0 points, then, on top, another box with 1 point…These isolated —and extremely light boxes— correspond to prices quite high…and most unstable, for they came to pass during 1 day (the weight of that box) only, a situation made worse by the upper empty box, followed by an even higher box again with 1 point —even higher market price, during one day, with an increase of : skipping the empty box…These abrupt jumps in prices not only reek of market crash, they pose a geometrical problem, for isolated and far away points do not belong to a fractal …a problem we will deal with below. The boxes at the bottom of vertical , being the heaviest, correspond to , the highest ones, being the lightest, to .

We have a number of things superimposed, illustrated in diagram D (Fig. 1) vertical cantordust in , the sequence of price increases (one such increase for each box with weight ), vertical axis with stable price for lower box and higher price for upper one, and the corresponding vertical interval , with somewhere in the middle.

We will concentrate our study of market crash situation in two separate parts: the analysis of what happens between and , and the study of the descending branch — and — of the spectrum.

The number of adjacent intervals , of equal size, covering vertical interval should —ideally— not exceed the square root of the number of boxes covering . That leaves us with six such intervals , four of which cover the interval .

4 Between and

The value is calculated in two ways that agree: it is the value of for which in the lagrangian coordinates. On the other hand, going to the spectrum-by-definition, it is in the fourth interval that all values of in that interval cram together around the value for which , as observed in a histogram that contains all ’s—one for each box . for that particular is no smaller than for any other , also: its values are the only ones quite near one another, crowded around the value of for which .

In the symmetric case above we had a decreasing sequence of weights …with , each weight corresponded to a certain , each was reduced to a point in that ideal case, with boxes .

Here we have the lowest , corresponding to , endowed with such boxes with weights and days, respectively, with an average of days, or months. In the same way in which we identify ’s in a certain — the number of such ’s— we will average weights ’s of boxes in that . We recall that each box —pertaining to an interval — represents a price increase inside pre-determined bounds given precisely by the extremes of interval .

The second , immediately above the lower , has boxes with weights and days, respectively, with an average of days or approx. 1.5 months. The third above has an average of 20 days or three weeks, and the fourth one, reaching , an average of 10 days. So we have a sequence of months, slightly more than months or weeks, weeks or 20 days, 10 days: it does look like with and slightly larger than —indeed, the average of these ”’s” is ; each is taken as the ratio of two consecutive average number of days above. (In fact, the two remaining ’s between and do continue with this division by : the average of 5th interval is slightly less than days, and the last one corresponds to the 1 or 2 days per box.)

We can now proceed in three different ways that indicate an early warning of the market crash situation. We call it ”early” because is situated far below , and is at the very top of the market price list: . So is midway between and , far below . The logic is that before prices reached values, on their way up, they passed through these critical values corresponding to : hence, what happens at this value is an early warning of future market collapse.

4.1 The instability index

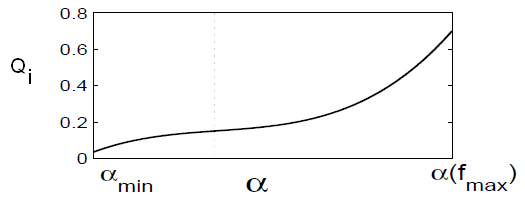

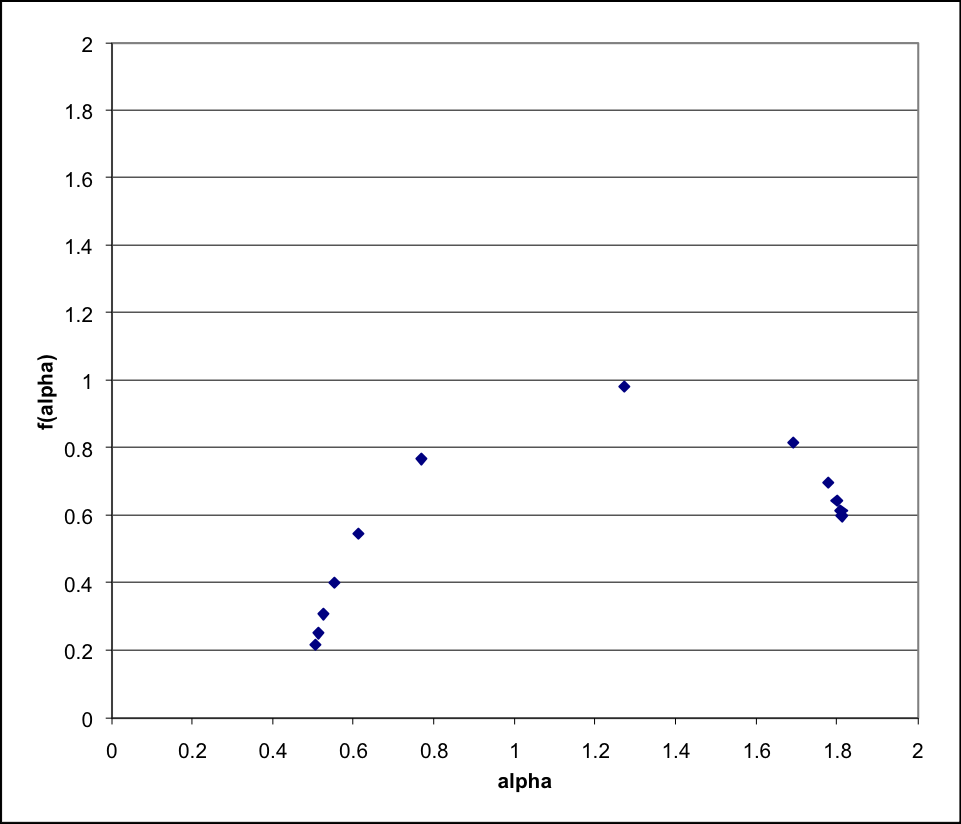

In Sec. 2.1 we defined the instability index We recall that , that was fixed, that , so we can write or ; that for the binomial case is steadily increasing with (or ), and that we are between and , which means . In this last ideal case, grows with no change of curvature between and (Fig. 2, out of scale). In the case of our NASDAQ signal, the weights are and days (Sec. 4, with a value of until we reach ; the four being , and boxes in the four intervals (Sec. 3) between and . The graph , in this case, plotted against four integer values of , shown in Fig. 3 (out of scale), has an inflection point, between and , near the latter.

Note: the values , do not imply that the second and fourth have maxima, for in the fourth the ’s are concentrated around , whereas in the second they are dispersed.

Let us interpet . The first is much smaller than the second one: : the instability increased. In the first instance, prices increased every 3.5 months, a rather stable situation, and they did so for 4 consecutive price increases. Next, the prices began to increase each month and a half, a situation that repeated itself seven times, that is why increased. The inflection point above is due to an anomaly in the evolution of the market: 5 consecutive price increases each 3 weeks are immediately followed by price increases each 10 days only! …and this abnormal jump takes place 7 consecutive times…The logic underneath is the following: we had a price increase each month and a half, 7 times. Next, we find a increase each 3 weeks, which is a much worse situation. But, if this situation is repeated a rather-large-than-7 times instead of 5 times, there is room for the system to adapt, there is valuable time to adjust to the new situation before time intervals between consecutive shorten again. This numerical anomaly in the values of causes the inflection point in the graph of .

So, real stability of the system does depend on remaining low, but if it grows, the occurrence of a crash depends on the geometry of its graph (inflection point), as described above.

4.2 The second way to study crash early warning: the lagrangian spectrum

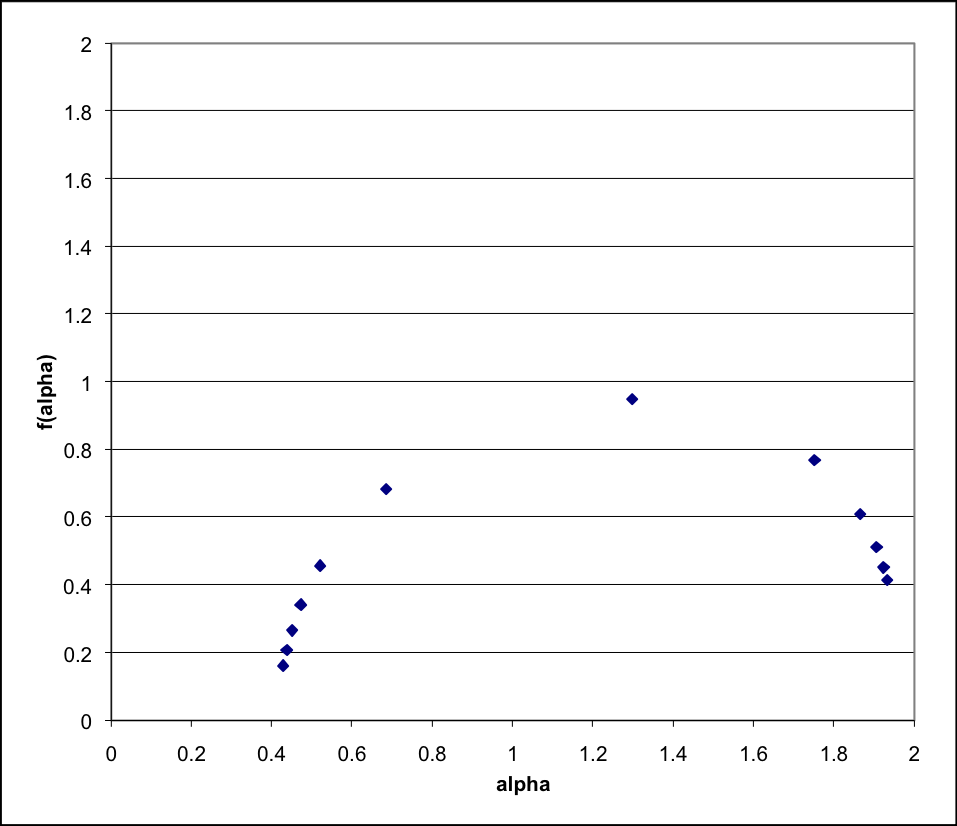

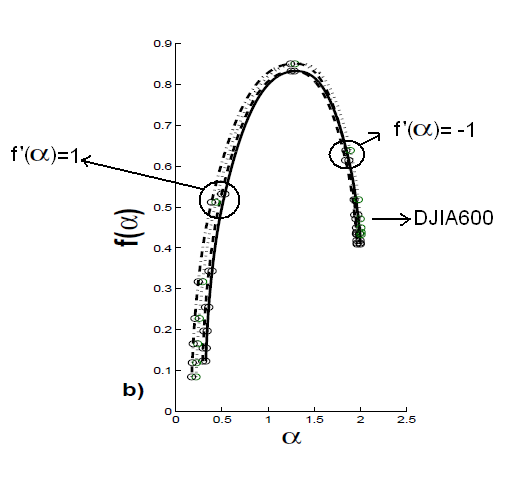

We continue with NASDAQ, we take boxes with weight , divide each by and obtain probabilities . Then we can apply the thermodynamical algorithm and obtain , as shown in Fig 4. Two observations: a) the curve is not symmetric —as is the binomial one; b) there is a noticeable gap between and —entirely in the interval .

Since means , we observe that the inflection point of , very near , is located precisely in that gap.

If we consider a time span where there is no important crash, e.g. the daily fluctuations of Dow Jones from 1st Jan. 1990 to 1st Jan. 1994, the corresponding curve is symmetric, as shown in Fig. 5. It should be noticed that symmetric spectra are quite rare. This case is, as far as we are aware, unique in empirical context —the binomial case is a purely mathematical one. Moreover, if we take the data from the DJIA1600 sample, still the corresponding curve mantains both the gap and the asymmetry (Fig. 6): enlarging the prior-to-crash sample does not ”dilute” these crash features.

Further, if we do the opposite, that is, take smaller and smaller samples prior to crash: DJIA900, 800, 700, 600, always maintaining ( = number of boxes, = size of the sample, all as above), we obtain the same as in Fig. 4 —with minute variations (Fig. 7): the process is strictly self similar (i.e. independent of size sample, or of scale) around market crash point.

Note: In order to plot the thermodynamical lagrangian spectra curve in each case throughout this section, we have used only integer values for , since they are enough to determine the key properties of : the graph dots for , would be deceiving, since the corresponding graph points at the extremes of the curve would simply pile up on top of each other, hence the upper gaps would fill up artificially, without adding any real meaning to the geometry of the lagrangian process.

4.3 A third way to study the early warning gap: the spectrum

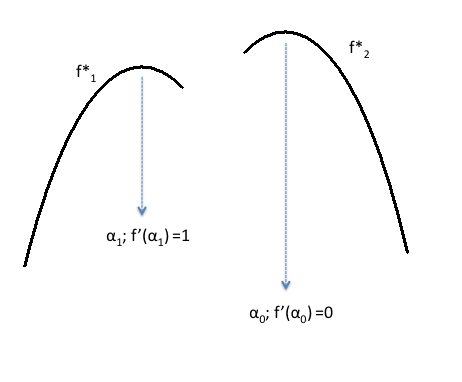

We continue with NASDAQ data. Recall that , and that we have between 30 and 40 ’s, from boxes grouped in 6 intervals , the first four span , the -interval of our study. We also recall that is the spectrum-by-definition and the lagrangian one. The first interval, the one corresponding to , has 4 ’s, more or less distributed evenly in the interval. The second adjacent (seven ’s) has its ’s not so dispersed, some are near the for which . The third has very few and dispersed ’s. So and share the same , then grows to a local maximum at an for which ,…then it goes down, and it does it in the gap between and . The fourth interval includes the particular for which . All its ’s are clustered around this particular , which implies that a spectrum (another one) should have an absolute maximum at that value of , just as does —in the 5th and 6th remaining intervals the number of ’s steadily decreases, and so does this last .

The picture corresponds to two : starts in , reaches a maximum for , and descends in the gap between and . The other, , goes from its own maximum at (for which ) and decreases as nears (shared by and ). By considering a larger sample prior to market crash, DJIA1600, we have one more , which clarifies the situation: starts with a low value in the gap between and (i.e. and ), then grows to an absolute maximum at , where , and then decreases as nears : clearly, two different (with negative second derivative), which seem to collide in ”the gap”; Fig. 8 shows a schematic diagram representing this situation. The two multifractal spectra —bi-multifractality— are two curves for which acts as an envelope, as a smooth upper ”roof” of both. According to Radon and Stoop (1996), this situation —bi-multifractality with an upper envelope— occurs when two different fractal measures are processed with one and the same multifractal algorithm.

5 The situation between and

As approaches , the market prices increase more and more, to the point in which they can be sustained during one day only. This situation, as we noticed before, is reflected in boxes with 1 or 0 points (days) near the top. We have several such boxes at the top prices, separated from each other by zero point empty boxes. This situation, which we call ”dispersion”, depicts a number of isolated points far away from the main body of the fractal cantordust, and, from the point of view of fractal geometry, they should be discarded —no isolated point contributes dimensionally: that is why we used several times the expression ”between 30 and 40 boxes”, for quite some such boxes have to be discarded when doing a spectrum-by-definition . Instead, the lagrangian process does not seem to care where the boxes are: isolated and far away or in the very midst of the cantordust, but how many they are, for each value of , regardless of their location. Of these two spectra, we choose in order to interpret and quantify the dispersion, since it takes into consideration all the dispersed boxes near . Near crash, prices jump so high, and so high, that we have many dispersed boxes: is large, and so is , as we observe for NASDAQ crash in Fig. 4, where the large dispersion in substantially contributes to the non-symmetry of the curve.

Carefully notice that, when we enlarge the prior-to-crash sample, e.g. DJIA 1600, Fig. 6, we slightly ”dilute” the crash effect on the descending right branch of the corresponding , for is much smaller —and the dots closing the right branch are much more separated than in the NASDAQ case, though they are drawn with the same parametric values as for NASDAQ. Also, Fig. 7 shows that as we take the sample nearer and nearer crashpoint, DJIA900, 800, 700, 600,…the higher the value of : the highest one corresponds to DJIA600 (the numerically smallest sample which still yields a cantordust). The economic interpretation: those extraordinarily high jumps in market prices —the dispersion— increase as the system destabilizes, as we get dangerously near its collapse.

Note: An observation on the inflection point in (Fig. 3): grows between and , since the numerator grows, and the denominator is a decreasing power. When grows (up to ) then grows, ditto when grows …but, in the middle of these two growing spectra, exactly between and , does not grow …but sits down, hence the inflection.

6 Conclusions

A prior-to-crash market signal is studied as a cantordust, its fractal properties, responsible for the crash situation, are studied with the tools of multifractal analysis. Two different multifractal spectra , and an instability quotient characterize and quantify an ”early warning” of market collapse, with market prices (not yet very high) corresponding to values of between and ; the study of the highest market prices, corresponding to values of near , is done by analysing the fractal dispersion of the cantordust prior-to-crash market signal.

7 References

Radon, G. and Stoop, R. (1996). ”Superpositons of multifractals: generator of phase transition in the generalized thermodynamic formalism”. J. Stat. Phys., Vol. 82, Nos. 3/4, 163-180.

Rotundo G. (2006). ”Logistic Function in Large Financial Crashes” in Logistic Map and the Route to Chaos. Springer NY.