Quasi-Proportional Mechanisms: Prior-free Revenue Maximization

Abstract

Inspired by Internet ad auction applications, we study the problem of allocating a single item via an auction when bidders place very different values on the item. We formulate this as the problem of prior-free auction and focus on designing a simple mechanism that always allocates the item. Rather than designing sophisticated pricing methods like prior literature, we design better allocation methods. In particular, we propose quasi-proportional allocation methods in which the probability that an item is allocated to a bidder depends (quasi-proportionally) on the bids.

We prove that corresponding games for both all-pay and winners-pay quasi-proportional mechanisms admit pure Nash equilibria and this equilibrium is unique. We also give an algorithm to compute this equilibrium in polynomial time. Further, we show that the revenue of the auctioneer is promisingly high compared to the ultimate, i.e., the highest value of any of the bidders, and show bounds on the revenue of equilibria both analytically, as well as using experiments for specific quasi-proportional functions. This is the first known revenue analysis for these natural mechanisms (including the special case of proportional mechanism which is common in network resource allocation problems).

1 Introduction

Consider the following motivating example. There is a single item (in our case, an ad slot) to be sold by auction. We have two bidders and , with valuation and with valuation . Who should we allocate the item and what is the price we charge? In the equilibrium of the first price auction, wins by bidding . We (the auctioneer) get revenue of for some small . In the second price auction, wins and pays for some and the revenue is , equivalent to the first price revenue. So, neither generates revenue anywhere close to the maximum valuation of . Is there a mechanism that will extract revenue close to the maximum valuation of bidders in equilibrium? What is the formal way to address this situation where valuations are vastly different? In this paper, we look at this problem in a general setting of prior-free auction design, and study revenue maximization. Further, we propose a class of natural allocations and analyze them for revenue and equilibrium properties under different pricing methods.

Our motivation arises from allocation of ad slots on the Internet. Consider the example of sponsored search where when a user enters a phrase in a search engine, an auction is run among advertisers who target that phrase to determine which ads will be shown to the user. There are several instances where the underlying value is vastly different for the different participating advertisers. For example, the phrase “shoes” may be targeted by both high end as well as low end shoe retailers and may have vastly different values, budgets or margins in their business. Thus their bids will likely be vastly different. In another example, we have display advertising, where users who visit certain web sites are shown “display” ads like images, banners or even video. Then, depending on the history of the user — e.g., someone who is new to the website versus one who has been previously — different display advertisers value the user significantly differently, and therefore their bid values will be vastly different. In both these motivating scenarios, there are other issues to model and this paper is not a study of these applications, but rather, a study of a fundamental abstract problem inherent in these applications.

Prior-free Auctions and Revenue Maximization.

Revenue Maximization is a central issue in mechanism design and has been studied extensively. A standard way for maximizing revenue is to derive some value profile from the bids, calculate bidder-specific reserve price, and run a second price auction [16, 2, 18]. In the example above, say both buyers’ value comes from some random distribution. Then, if we know this distribution, we can calculate a reserve price using this distribution, and run a second-price auction with this reserve price , i.e, allocate the item to the highest bidder and charge the if (else, the item remains unsold); here, and ’s are bids by and resp. Many such mechanisms are known; these mechanisms are incentive-compatible (that is, each bidder has no incentive to lie), and even additionally revenue-optimal, perhaps as the number of bidders goes to infinity. Such methods that rely on some assumptions over the values of bidders, i.e, that the values are drawn from some distribution (known or unknown), are called prior-aware mechanisms. Prior-aware mechanisms are popular in Economics. Still, from mathematical and practical point, the following questions arise:

1. Are there prior-free mechanisms that work independent of the value distributions of bidders?

This question is of inherent interest: what can be accomplished without knowledge of the value distributions. This is also a question that is motivated by practice. In practical applications, a way to use prior-aware mechanisms is to rely on running the same auction many times, and then use the history of bids to “machine learn” the values. Of course in practice the parameters of the auction change (users evolve), there is sparse data (query phrases are rare), advertisers strategize in complex ways and their values change over time (as they learn their own business feedbacks better), or worse, even if the machine learning methods converge, they provide “approximate” value distributions and we need to understand the mechanisms under approximate distributions. As a result, there are challenges in applying prior-aware mechanisms in practice and a natural question is if they can be avoided.

2. Are there prior-free mechanisms that work without reserve-prices?

This question is a more nuanced concern. First, when there is a reserve price, the item may remain unsold in instances when . This may not be desirable in general. For example, in display ads, if an ad slot is unsold, the webpage has to find a different template without that ad slot or fill in that space with backup ads. Also, when the item is not sold, the outcome is not efficient, since the value to the advertisers (defined the value of time to the winner) is not maximized. And in an ever more nuanced note, advertisers do not find it transparent when the mechanism has bidder-specific reserve prices, and often see it as a bias. This is more so when each advertiser may get many different bidder-specific reserve prices corresponding to different search phrases or display ad locations as implied by the general prior-aware mechanisms above. More discussions on mechanisms that always assign the item can be found in [14].

Prior-free revenue-maximizing mechanisms have been developed for various auction settings [7, 10, 15]. Lower bounds show that prior-free truthful auction cannot achieve revenue comparable to the revenue-optimal auctions with prior [7, 10, 15], and the mechanism in [15] achieves the best possible revenue among prior-free truthful mechanisms. Still, these mechanisms work by setting reserve prices, and do not address the second concern above.

Our Contribution. We study a simple, practical prior-free mechanism that always allocates the item. In contrast to the approaches described above that allocate the item to the highest bidder, but determine nontrivial prices, we focus on the allocation problem and allocate the item probabilistically. Our contributions are as follows.

1. We propose a quasi-proportional allocation scheme where the probability that a bidder wins the item depends (quasi-proportionally) on the bids.

As an example, for two bidders with bids and , we allocate the item to bidder A with probability , and to otherwise. More generally in the presence of bidders with bid vector , we consider a continuous and concave function , and set the probability of winning for bidder to . Thus the winner of the auction is not necessarily the bidder with the highest bid. The special case when is known as the proportional allocation scheme and has been studied previously e.g., in [11, 13, 9]. We study both payment methods that are common in auction theory, namely, all-pay (where all bidders pay their bid no matter if they win the item or not) as well as the winner-pay (only the winner pays her bid to the auctioneer) methods.

2. We study Nash equilibria of quasi-proportional mechanisms.

2.1. We prove that the corresponding games for both all-pay and winners-pay quasi-proportional mechanisms admit pure Nash equilibria and this equilibrium is unique. We also give an algorithm to compute this equilibrium in polynomial time.

2.2. We show that the revenue of the auctioneer is promisingly high, while not losing much in the efficiency of the allocation. More precisely, we compare the revenue of such mechanisms against the ultimate: , the highest value of any of the bidders, and show bounds on the revenue of equilibria in such mechanisms. For example, consider an auction among two bidders with values and respectively. The revenue of equilibria for both first-price and second-price auctions approaches . Instead, with quasi-proportional mechanisms, (i) for the all-pay mechanism with function where , the revenue of equilibrium is , and (ii) for winners-pay mechanism, where , we show that the revenue of all-pay and winners-pay mechanisms with functions and are and respectively. For the case of more than two bidders, we first show preliminary results for the revenue of various (specific) valuation vectors for the case that the number of buyers tends to , and then we present numerical results for the revenue of equilibria for some key example functions such as and . Taken together, these results give a set of analytical and experimental tools to bound the revenue of these mechanisms against the benchmark.

Proportional allocation, a special case of our quasi-proportional allocation, has been studied extensively in literature, in particular for efficiency analysis. But even for this rather natural allocation method, we do not know of any prior work on revenue analysis.

2 Preliminaries

Consider a sealed-bid auction of a single item for a set of potential buyers. Let the value of these buyers for the single item be . Throughout this paper, we assume that , and . Consider a concave function (e.g., ). Each buyer bids an amount to get the item. A quasi-proportional mechanism allocates the item in a probabilistic manner. In particular, the item is allocated to exactly one of the buyers, and the probability that buyer gets the item is . For a bid vector , let be the bid vector excluding the bid of buyer . We study the following two variants of quasi-proportional mechanisms with two payment schemes.

-

1.

All-pay Quasi-proportional Mechanisms. The allocation rule in this mechanism is described above. For the payment scheme in this mechanism, each buyer pays her bid (no matter if he receives the item or not). This mechanism is ex-ante individually rational, but not ex-post individually rational. Given the above payment scheme, in the all-pay mechanism, we can write the utility of buyer , as a function of the bids vector as follows:

-

2.

Winners-pay Quasi-proportional Mechanisms. The allocation rule in this mechanism is described above. For the payment scheme in this mechanism, the buyer who receives the item pays her bid, and the other buyers pay zero. This mechanism is ex-post individually rational. As a result buyer ’s utility as a function of the bids is

We are interested in Nash equilibria111Throughout this paper, we study pure Nash equilibria and not mixed Nash equilibria. of the above mechanisms. We consider Nash equilibria of normal-form games with complete information. In the corresponding normal-form game of the quasi-proportional mechanism, the strategy of each buyer is her bid. Formally, a bid vector is a Nash equilibrium if for any buyer and any bid , we have .

In addition, we study efficiency and revenue of quasi-proportional mechanisms: (i) the efficiency of a bid vector is the expected valuation of buyers, i.e., , and (ii) the revenue of a bid vector is the expected revenue for the auctioneer given this bid vector, i.e., , in the all-pay auction, and , in the winner-pay auction.

3 All-pay quasi-proportional mechanism: A warm-up example

To demonstrate the kind of analyses we do, and to develop the intuition, we present a study of revenue properties of an all-pay quasi-proportional mechanism for two buyers for functions where is a parameter. Let the bid of the first buyer be and the bid of the second buyer . As mentioned earlier, we assume and are the valuations of the two buyers. The expected utility of the second buyer is , and the utility of the first buyer is .

For a fixed , the second buyer’s utility is a concave and increasing function of his bid, in the region and similarly, for a fixed , the first buyer’s utility is concave and increasing in his bid. Hence, in equilibrium, both buyers have their first derivative nullified: , and Thus, we get that

From which it follows that in equilibrium . Now, combining with the second equality, we get that or , and we get that Hence,

Moreover, as , the probability that buyer receives the item is , and otherwise buyer gets the item. Thus, the efficiency of this mechanism is . In particular, as , the efficiency is arbitrarily close to . The most efficient allocation rule is to assign the item to buyer , and get efficiency . That completes the analysis and shows that

Theorem 3.1

The all-pay quasi-proportional mechanism with two buyers guarantees a total revenue of and expected efficiency of in equilibrium. In particular, for a large enough , the revenue is and efficiency is arbitrarily close to .

4 Equilibrium: Existence and Uniqueness

In this section, we establish the existence and uniqueness of Nash equilibria of both the all-pay and winners-pay quasi-proportional auctions.

Definition 1 (from [6])

A game is socially concave if the following holds:

-

1.

There exists a strict convex combination of the utility functions which is a concave function. Formally, there exists an -tuple , , and , such that is a concave function in .

-

2.

The utility function of each buyer , is convex in the actions of the other buyers. I.e., for every the function is convex in , where is the strategy space of agent , and .

Rosen [17] defined the diagonal concavity property for concave games, and showed that when it holds, the Nash equilibrium of the game is unique. Even Dar et al [6] showed that if one of the properties 1 and 2 holds with strict concavity or convexity, respectively, then the diagonal concavity property holds. Now, we show that a quasi-proportional auction is a socially concave game. The uniqueness of Nash equilibrium would follow as a corollary of [17] and [6].

Lemma 1

Let be an all-pay quasi-proportional auction, with utility functions for buyer , defined as above and assume that the weight function is a concave function, and that the strategy of each buyer is restricted to a compact set , where . Then is a socially-concave game.

Proof

To show property 1 holds, consider the weighted social welfare function , where the utility of buyer is weighted by .

| (4.1) |

The first term in 4.1 is a constant and the second term is linear in . Thus, is a concave (linear) function of . To show that property 2 holds, we first fix a buyer and an action . Now, consider the utility of buyer as a function of the actions , when buyer ’s action is :

To show that is a convex function, it suffices to show that the function

is a convex function of the vector . Let . The function is concave in as it is the sum of concave functions. Let . The function is convex in and decreasing in . The function is a convex function as a composition of a convex decreasing function with a concave function: For every two vectors and we have that , by the concavity of . Consequently, , where the first inequality follows from the fact is decreasing when , and the second inequality follows the convexity of .

A similar lemma holds for winner-pay auctions, with weight function of the form , where .

Lemma 2

Let be an winner-pay quasi-proportional auction, with utility functions for user , defined as above and assume that the weight function , where , and that the strategy of each user is restricted to a compact set , where . Then is a socially concave game.

5 Revenue of Quasi-proportional Mechanisms

In section 3, we computed the revenue of all-pay quasi-proportional mechanisms for two buyers, and functions . In this section, we first observe general properties for the revenue of equilibria of quasi-proportional mechanisms. Then, we focus on two special functions and prove tight bounds on the revenue of the winners-pay mechanisms. The utility function for both all-pay and winners-pay mechanisms is a strictly concave function of in the region (as it is a concave function minus a convex function). As a result, in an all-pay quasi-proportional auction, we have: . For a bid vector, , let . When clear from context, we let . As a result, in equilibrium,

| (5.1) |

Similarly, for winners-pay quasi-proportional mechanisms, the bid of each buyer satisfies the following:

| (5.2) |

We will use equations 5.1 and 5.2 in studying the revenue of the equilibrium for various functions. In both equations 5.1 and 5.2 for increasing concave functions like , increases as increases, i.e, fixing is monotonically increasing in terms of . This observation leads to the following fact: For increasing and concave functions , if , in the equilibrium bid vector , we have .

5.1 Revenue for Winners-pay: Two Bidders.

Here, we study winners-pay proportional mechanism for . The utility of bidder as a function of the bids is

Given this utility function, it is easy to see that for , in equilibrium . Let’s fix . In equilibrium, for every with bid ,

and we get that in equilibrium,

| (5.3) |

The revenue from the proportional mechanism as described above is

| (5.4) |

Consider a setting of two buyers with values . We can, without loss of generality, assume that .

Theorem 5.1

In the case of two buyers, the revenue from the winners-pay proportional mechanism is , where . Moreover, for arbitrarily large , the efficiency of this mechanism is arbitrarily close to .

Proof

Let denote the expected revenue of the auctioneer, when the values of the agents 1, and 2 are respectively. We assume without loss of generality that . In this case, notice that the revenue is dominated by the bid of the first buyer:

| (5.5) |

where the last inequality follows the observation that in equilibrium, . Hence, to get a lower bound on the revenue, it suffices to have a lower bound on .

Next, we show that in equilibrium, : First, note that using 5.3, we can easily show that for , the equilibrium is . In the equilibrium, . Consider the function . It is increasing in as

where the last inequality follows from

As a result, if we fix , then in equilibrium, when , we get . Therefore, which increases as a function of is always greater than in equilibrium. Also, since . Finally, we get , which proves the theorem. The claim about efficiency of the mechanism follows from the fact that tends to as tends to .

A similar technique can be used for showing a lower bound on the revenue in quasi-proportional winner-pay auctions, with weight function , which asymptotically yields a higher revenue. The proof is left to the appendix.

Theorem 5.2

The revenue from the winners-pay mechanism for two bidders, with weight function is , where . Moreover, for arbitrarily large , the efficiency of this mechanism is arbitrarily close to .

5.2 Revenue for many buyers.

Here, we analyze the revenue for two special valuation vectors for bidders, i.e, (i) uniform valuation vector, , and (ii) valuation vector , and for , for . The second type of valuation is important as it captures examples in which there is a large gap between the highest valuation and value of other buyers.

Theorem 5.3

For the uniform valuation vector where for all , the revenue in the equilibrium for function is for all-pay mechanism, and is for winners-pay mechanism. Moreover, the equilibrium revenue for uniform valuation vector for function for both all-pay and winners-pay mechanisms is asymptotically as .

Proof

Theorem 5.4

For the valuation vector , the revenue in the equilibrium of winners-pay quasi-proportional mechanism converges to a constant as goes to for a fixed . Moreover the revenue of all-pay quasi-proportional mechanism for function goes to zero as goes to for a fixed .

The above theorem shows some bounds on the revenue for a fixed and as tends to . It would be interesting to understand the trade-off between the revenue for large and . In particular, it would be interesting to compute the revenue for a fixed as tends to .

6 An Efficient Algorithm and Numerical Study

In this section, we present an efficient algorithm for computing Nash equilibria of quasi-proportional mechanisms and then using this algorithm, we present a family of plots showing the quality of the mechanisms.

6.1 A polynomial-time algorithm for equilibrium computation

In [6], Even Dar et. al. describe a natural process that converges to a Nash equilibrium in every socially concave game. This method is useful for computing Nash equilibrium of the all-pay and winner-pay auctions. The process considered is known as no-regret dynamics. Informally, a buyer’s update process is said to have no-regret, if in the long-run, it attains an average utility which is not significantly worse than that of the best fixed action in hindsight (in the context of auctions, the best fixed bid). Even Dar et. al. show that if every buyer uses an update process with no-regret property, in a repeated socially concave game, the joint average action profile converges to a Nash Equilibrium. Many efficient algorithms for attaining the no-regret property (also known as no-external-regret), exist [20, 1, 12]. In order to compute a Nash equilibrium of the all-pay auction, and the winner-pay auction, one could simulate the process of running a no-regret algorithm for every buyer that participates in the auction. The rate at which the average vector of bids converges to Nash equilibrium, depends on the vector , which existence is guaranteed in property 1. In particular, there exists no-regret algorithms (e.g., [20]), such that the rate of convergence to Nash equilibrium, for the quasi-proportional mechanisms, is , (I.e., at time of the simulation process, the average bids vector is an -Nash equilibrium, where . Algorithm 1 describes the simulation of running simultaneous no-regret for every buyer, where the actual no-regret algorithm used is GIGA [20].

Input: a vector .

Output: an -Nash Equilibrium, .

6.2 Numerical Revenue Computation

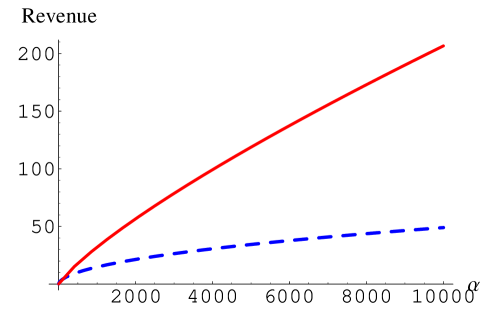

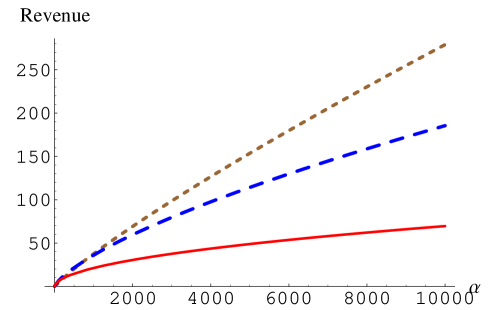

In this section, we present numerical results for the revenue of the all-pay and winners-pay quasi-proportional auctions with different weight functions and different number of buyers. Figures 1-4 describe the revenue as a function of the highest value for the item, over all the bidders, denoted by . Figure 1 describes the revenue in an all-pay auction with two bidders — one bidder has a ‘high’ value , and the other bidder has a value of 1. We consider two versions of the all-pay auctions. In the first, we used a weight function , and in the second we used a weight function . Next, in Figure 2, we consider the same setting as in Figure 1, for the winners-pay auction. The revenue in equilibrium is presented for three different versions of the winners-pay auction: The lowest curve describes the winner pay auction with the linear weight function . The middle curve describes the revenue when the weight function is and the upper curve describes the revenue when the weight function is .

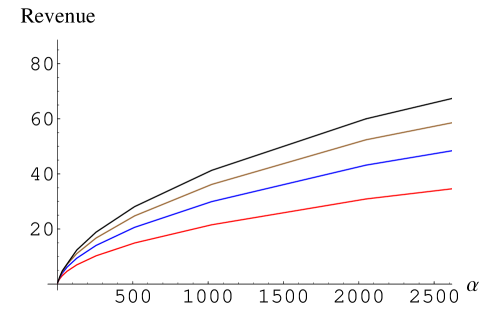

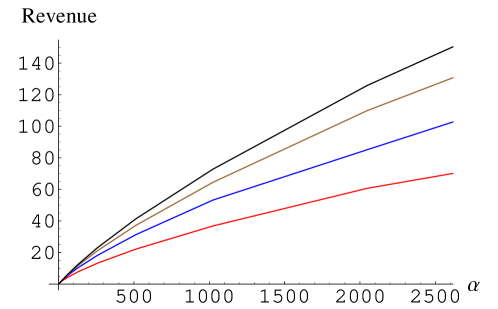

In Figures 3, and 4 we study numerically the revenue in a winners-pay auction when the number of bidders varies from to . The bidders’ private values are such that a single bidder has a high value , and the other bidders have a low value of 1. Each curve in Figures 3,4 describes the revenue in equilibrium as a function of , and each different curve corresponds to a different number of bidders. Figure 3 and 4 differ in the weight function used: in Figure 3 we used , and in Figure 4 we used . In Theorem 5.4, we show that the revenue in a winners-pay auction, with values profile asymptotically goes to 0, as the number of bidders with value 1 tends to . It is interesting however to notice that in both Figures 3 and 4, while the number of bidders is kept relatively small, the revenue actually increases with the number of low-value bidders.

7 Concluding Remarks

We study a natural class of quasi-proportional allocation mechanisms. Combined with all-pay or winner-pay methods, this gives a simple prior-free auction mechanism without any reserve prices. Our analytical and experimental study shows the revenue under various quasi-proportional functions in equilibrium, and we showed existence of a unique Nash equilibrium that can also be computed efficiently. We believe quasi-proportional mechanisms will find applications and a deeper understanding of their properties will be useful. An interesting open question is to design an auction for a single item that achieves a total revenue of constant factor of in equilibria. We proved that simple quasi-proportional mechanisms show promising revenue properties in equilibria, however none of our mechanisms achieve a constant approximation factor of (off by at least facor ). A main open problem is to design a mechanism for a single item that achieves a constant factor of in equilibria while not losing much in the efficiency of the allocation. Also as we discussed in Section 5.2, the promising revenue properties of quasi-proportional mechanisms for small number of buyers disappears as the number of buyers tends to . An interesting open question is to modify the mechanism to ensure good revenue properties when many buyers are in the system. A simple idea is that for any number of bidders, the auctioneer runs a quasi-proportional mechanism among the highest two bids. One hopes such mechanisms have good revenue properties, however, we can show that such mechanisms may not admit any pure Nash equilibria.

References

- [1] J. Abernethy, E. Hazan and A. Rakhlin. Competing in the Dark: An Efficient Algorithm for Bandit Linear Optimization. In COLT 2008.

- [2] Baliga and Vohra. Market Research and Market Design. http://www.kellogg.northwestern.edu/faculty/baliga/htm/mrandmd.pdf, 2003.

- [3] M. Baye and D. Kovenock and C. de Vried. The all-pay auction with Complete Information Economic Theory, 8, 291-305.

- [4] Y. Che and I. Gale. Expected revenue of all-pay auctions and first-price sealed-bid auctions with budget constraints. Economic Letters, 1996, 373-379.

- [5] E. Clarke. Multipart pricing of public goods. Public Choice, 11:17–33, 1971.

- [6] E. Even Dar, Y. Mansour, U. Nadav. Convergence in Proportional Games. STOC 2009.

- [7] Amos Fiat, Andrew V. Goldberg, Jason D. Hartline, and Anna R. Karlin, Competitive generalized auctions, STOC 2002, pages 72-81.

- [8] T. Groves. Incentives in teams. Econometrica, 41(4):617–631, 1973.

- [9] B. Hajek and G. Gopalakrishnan. Do greedy autonomous systems make for a sensible internet?, 2002. presented at the Conference on Stochastic Networks, Stanford University.

- [10] J. Hartline, A. Karline, Profit Maximization in Mechanism Design, In Algorithmic Game Theory, Editors: Noam Nisan, Tim Roughgarden, Eva Tardos, and Vijay Vizarani, October 2007.

- [11] R. Johari and J.N. Tsitsiklis. Efficiency loss in a network resource allocation game. Mathematics of Operations Research, 29(3):407 435, 2004.

- [12] A Kalai and S. Vempala. Efficient algorithms for online decision problems. In J. Comput. Syst. Sci. 71(3): 291-307, 2005.

- [13] F. Kelly. Charging and rate control for elastic traffic. European Transactions on Telecommunications, 8:33–37, 1997.

- [14] De Liu and Jianqing Chen Designing online auctions with past performance information, Decision Support Systems, 42 (2006) 1307 1320.

- [15] Pinyan Lu, Shang-Hua Teng, Changyuan Yu, Truthful Auctions with Optimal Profit. WINE 2006: 27-36

- [16] R. Myerson. Optimal auction design. Mathematics of Operations Research, 6:58–73, 1981.

- [17] J. Rosen. Existence and uniqueness of equilibrium points for concave n-person games, Econometrica, 520-534, 1965.

- [18] I. Segal. Optimal Pricing Mechanisms with Unknown Demand. American Economic Review, 93 (3) June 2003, pp.509 - 529. http://www.stanford.edu/ isegal/pricing.pdf.

- [19] W. Vickrey. Counterspeculation, auctions and competitive-sealed tenders. Finance, 16(1):8–37, 1961.

- [20] M. Zinkevich. Online convex programming and generalized infinitesimal gradient ascent. Twentieth International Conference on Machine Learning, 2003.

Appendix 0.A Proof Sketch of Theorem 5.2

Proof

The proof follows a similar line to that of Theorem 5.1. Here, we give a proof sketch. We start by taking the derivative of the utility function,

Assigning and , and re-ordering we get that in equilibrium:

Assuming that the lower value is , the proof continues by showing a lower bound on , which in return is used for showing that .

Appendix 0.B Revenue for other functions.

Theorem 0.B.1

For the function and for both all-pay and winners-pay mechanisms, the revenue of the equilibrium for two buyers with values where is at most for a constant .

Proof

Using Equation 5.1 for all-pay mechanism, we get that for , . Let the equilibrium be . Thus, for the first buyer,

Since, , we know that , and thus

Therefore, for a constant , .

Similarly, for winners-pay mechanism, using Equation 5.2 for , we observe that

And since , we can easily show that .

Remark 1

Using function , one can prove an upper bound for the revenue of . More generally, let be the function of consecutive application of function (i.e, ), be denoted by , then we can show that the revenue is at most

Appendix 0.C Proof Sketch of Theorem 5.4

Proof

We analyze the winners-pay mechanism first. Because of the valuation vector, we know that for , we can set and for . Therefore, using Equation 5.2 and the fact that , we get

Substituting, and , as , the second equation above implies that .

Using the above equations, by substituting one can show that as is fixed and , , and thus the revenue from this mechanism is

Using equation 5.1 and by setting and for , one can perform similar computations and show that , and as . As a result, the revenue of this mechanism tends to zero as tends to and is fixed.