Minority games, evolving capitals and replicator dynamics

Abstract

We discuss a simple version of the Minority Game (MG) in which agents hold only one strategy each, but in which their capitals evolve dynamically according to their success and in which the total trading volume varies in time accordingly. This feature is known to be crucial for MGs to reproduce stylised facts of real market data. The stationary states and phase diagram of the model can be computed, and we show that the ergodicity breaking phase transition common for MGs, and marked by a divergence of the integrated response is present also in this simplified model. An analogous majority game turns out to be relatively void of interesting features, and the total capital is found to diverge in time. Introducing a restraining force leads to a model akin to replicator dynamics of evolutionary game theory, and we demonstrate that here a different type of phase transition is observed. Finally we briefly discuss the relation of this model with one strategy per player to more sophisticated Minority Games with dynamical capitals and several trading strategies per agent.

1 Introduction

The statistical mechanics of the Minority Game (MG) in its original version is now well understood. Since its conception [1] sophisticated tools from equilibrium and non-equilibrium statistical physics have been applied to this simple model of inductive adaptation, and the phase diagram and behaviour in the ergodic regime have been thoroughly studied [2, 3], see also [4]. The model is now essentially considered to be solved and its key observables can be calculated either fully exactly or at least in good approximation, even though some challenging mathematical issues are still not fully resolved and deserve further attention [3]. These relate mainly to the development and refinement of dynamical theories to address MGs and related market models with so-called real histories and to the behaviour of the model in the non-ergodic, turbulent regime, where satisfactory analytical solutions are as yet still awaited.

With the main analytical tools to study MGs now well developed and in place one possible future direction appears to be the extension of present basic versions of the MG towards more realism as a market model while at the same time maintaining the analytical tractability of the original setup. The goal is here to study versions of the MG which are able to capture features of real market data, so-called stylised facts, such as non-Gaussian return distributions or volatility clustering.

The main drawback of the original MG, preventing the emergence of stylised facts, rests in the assumption all agents contribute equally to the total outcome, they trade one unit of the underlying asset at any time step of the dynamics, regardless of their success or otherwise in the trading. This results in a constant trading volume in time (given simply by the number of players). It has been demonstrated in that a modulation of the overall trading volume in the MG can suffice to obtain stylised facts. Two alternative approaches have been proposed to allow the trading value to be dynamic. In so-called grand-canonical MGs (GCMG) [5] agents are endowed with a null strategy and can decide not to trade at a given time step if they do not consider trading profitable. Hence the total trading value varies in time. The GCMG has been found to exhibit volatility clustering and non-Gaussian return distributions in a critical region around its phase transition. On the other hand GCMGS are tractable fully analytically and their phase diagrams and order parameters in the ergodic regime have been computed. A second option is to endow each agents in the MG with an individual capital, which may vary in time. Such MGs have been introduced in [6], here agents are equipped with multiple trading strategies and a dynamical capital, which evolves according to their success in trading. It is then assumed that any agent trades a constant fraction of his capital at any time-step, so that the overall trading volume again varies over time. The analysis of [6], based on numerical simulations, shows that such an MG with dynamical capitals and multiple strategies per player again exhibits stylised facts, provided model parameters are tuned suitably.

The aim of the present paper is to study the most simple MG with evolving capitals, namely one in which every agent only holds only one trading strategy, but in which at the same time the agent’s capital and her trading volume changes in time according to her success in the past. The traders are thus zero-intelligence agents, or simple automata following a strategy pre-set at the beginning of the game, and with no power to take any decisions or to alter their behaviour during the course of the game. Allowing for a dynamics of the weights of each trading strategy here introduces an evolutionary mechanism, selecting more successful strategies over time. We here address two different types of dynamics. The first part of the paper is concerned with a minority game with dynamical capitals. To obtain non-trivial dynamics we consider a setup in which agents with dynamical capitals (so-called ‘speculators’) are coupled to a background of ‘producers’, that is traders who trade constant volumes, even if in the long-run they run losses. The addition of producers to a population of speculators is common also in GCMGs [2, 3]. Secondly, we then focus on Majority Games within a similar setup of dynamical capitals (here there is no need to consider producers), and then finally we show that a close relation between replicator dynamics in evolutionary game theory [14] and the minority and majority games with dynamical capitals can be drawn. The payoff structure of the minority/majority game here leads to a replicator model with Hebbian/anti-Hebbian couplings. Extending the work of [7] we study these models by means of dynamical approaches of disordered systems theory, and derive the properties of their stationary fixed point states as well as their phase diagrams. We find that the common MG-phase transition between an efficient and a non-efficient phase persists in the setup of the MG with evolving capitals and only one trading strategy per player. The majority game with dynamical capitals is relatively featureless, but a different type of transition is found in the corresponding replicator dynamics. Ergodicity is broken in model the MG with evolving capitals and in the majority game replicator dynamics, but no divergence of the dynamic susceptibility is found in the latter case. While we focus on the statistical mechanics properties of both models, we also briefly address the emergence of stylised facts in this simple MG with dynamical capitals, and leave a more detailed discussion to future work [8].

2 Minority Game with dynamical capitals

2.1 Model

We consider a system of agents, labelled by . At each round of the game each agent makes a bid that can be either positive or negative, and which depends on a common external signal, which is available to all agents In the simple setup of one ‘trading strategy’ per agent, the sign of agent ’s action is determined by his strategy vector , which maps the value of an external piece of information onto the binary set . The common random external information is here represented by an integer number and is drawn from a flat distribution over this set at each time step without temporal correlations. Thus, each trading strategy , can be understood as a vector , mapping information onto a trading decision of sign . We will assume the amount agent trades at time step to be proportional to her capital at that time, denoted by . More specifically we will assume that agent trades a constant fraction of her capital. The total bid or so-called excess demand and the total trading volume at time are therefore given by

| (1) |

where is the piece of information presented to the agents at . From (1) a return and price process of the underlying asset and can be defined as follows [6]:

| (2) |

is here the price of the asset at time .

In a minority game setup the gain for agent can be written as

| (3) |

where we follow [6]. Other definitions have been proposed for example in [9, 10].

We now split the population of agents into two types, so-called speculators which we will label by , and producers, labelled by .

The capitals of the speculators will be assumed to evolve in time according to their trading success,

| (4) | |||||

where we again follow [6].

Producers are taken to be agents whose capitals are drawn from a fixed distribution at the start of the game, and which then do not evolve in time. The group of producers thus provides a background signal on which the speculators operate and try to make profit.

The evolution of the capitals of the speculators can then be written as follows

| (5) | |||

| (6) |

The capitals of the producers remain constant in time.

Finally, following the standard MG conventions we take the number of different values of the external information to be proportional to , the total number of players. The ratio will then be the key control parameter of the model, along with the fraction of producers among the total population of agents.

The key observables we will be interested in in the following are the average capital of the agents and the so-called predictability of the market. We will write and for averages over the speculators and producers in the following, i.e. for example

| (7) |

for the average capitals of the speculators and producers respectively. Since the capitals of the producers do not evolve in time, the latter quantity depends only on the distribution from which the producers weights are drawn at the start of the game.

Following the standard MG conventions [2, 3] the predictability will be defined as follows222In principle an additional normalisation with respect to the trading volume given might be desirable here. This would not however change the qualitative behaviour of as a function of the model parameters, so that we here stick to the definition (8).

| (8) |

where denotes an time-average conditional on the occurrence of information pattern . A non-vanishing value of thus indicates an inefficient market, in which the sign of the excess demand can be predicted statistically given the knowledge of the state of the world . corresponds to a situation where no such information can be extracted from the time series of price changes generated by the model.

2.2 Analytical solution

2.2.1 Effective macroscopic theory

An analytical solution of the model can be obtained using either a static approach based on replica techniques or secondly by directly studying the dynamics via generating functionals. Both approaches have been used extensively in the MG literature [2, 3], we here restrict the discussion to the dynamical approach, and quote only the main intermediate steps and final results.

The starting point is the so-called batch dynamics of the model

| (9) |

where an effective average of the on-line process Eq. (4) over all values of the external information has been performed at each time step, and where time has been re-scaled appropriately (see [3] for details regarding this batch limit). is a perturbation field introduced to generate response functions, and will be set to zero at the end of the calculation. in (9) is the (re-scaled) total trading volume at time

| (10) |

The final outcome of the generating functional analysis of this batch process is an effective theory valid in the limit (at fixed ) and characterised by a non-Markovian single-agent stochastic process of the form

| (11) |

from which the dynamical order parameters are to be determined self-consistently as

| (12) | |||||

| (13) | |||||

| (14) |

Here denotes average over the Gaussian noise , which in turn comes out to be correlated in time according to the following co-variance matrix

| (15) |

Since this matrix is defined through the above correlation and response functions and the set of equations (11-15) form a closed, but implicit characterisation of the dynamics of the model on the macroscopic level. This effective theory is exact in the thermodynamic limit in the sense that a combined site and disorder average in the original problem, is equivalent to the average in the resulting effective-agent description.

2.2.2 Fixed point analysis

We will now restrict the further analysis to an inspection of the fixed points of the effective process (11). At the fixed point the correlation function becomes flat

| (16) |

and we assume that the response function is invariant against time-translation in this regime. The static order parameters will be given by , the asymptotic average capital and the integrated response . The single-particle noise is then assumed to become static as well at the fixed point so that with a time-independent Gaussian random variable of zero mean and variance . For simplicity we will write in the following, with a standard Gaussian. Taking into account that all fixed points of (11) are to be non-negative, i.e , we find

| (17) |

with the step-function, for and otherwise. The perturbation field has been set to zero, as announced above. In particular we note that precisely half of the speculators will go bankrupt asymptotically (i.e. their capitals decay to zero), whereas the other half survives.

Recalling ) self-consistency demands

| (18) | |||||

| (19) | |||||

| (20) |

from which one finds

| (21) | |||||

| (22) | |||||

| (23) |

These equations fully characterise the statistics of the assumed fixed point, given the model parameters and and the first two moments of the capitals of producers. From these solutions, the predictability at the fixed point is then given by

| (24) |

for a derivation of analogous expressions in conventional MGs we refer to [2, 3]. With a suitable re-scaling and become independent of the distribution of producer wealth, in particular one has

| (25) | |||||

| (26) |

with as given in (23).

2.3 Phase transition and stationary states

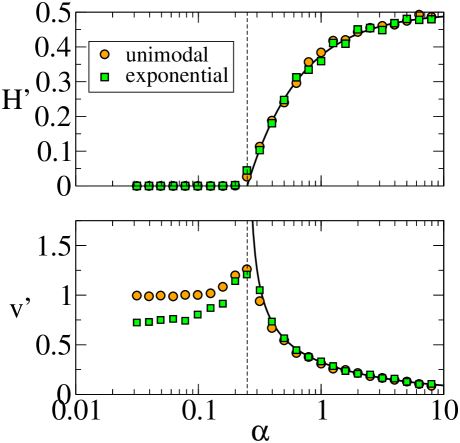

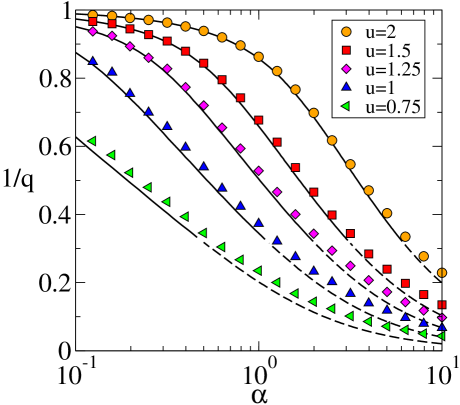

We will now briefly discuss the statistical properties of the stationary states of the model and its phase diagram. Our analytical predictions for the order parameters of the model in it ergodic stationary states are verified by numerical simulations in Fig. 1.

Firstly one notes that the phase transition observed in the standard versions of the MG [2, 3] also occurs in the present model. In particular we observe a phase with vanishing predictability at low , and a second phase with at values of above the transition point. Our theory predicts the integrated response to diverge at a critical value of

| (27) |

at which the predictability vanishes. Below this point the system remains in a state of zero predictability and divergent integrated response so that the predictions of the ergodic theory are no longer expected to be valid.

The occurrence this transition between a phase in which the market is predictable and a regime in which may be interpreted geometrically as follows: any stationary solution of the dynamics which renders to zero necessarily fulfills the conditions

| (28) |

for . The values on right-hand-sides are quenched random variables, as the only dynamical degrees of freedom are given by the capitals of the speculators. Within the ergodic theory of the variables are equal to zero as seen above, so that this defines a linear set of equations for unknowns. For the number of conditions thus outnumber the degrees of freedom so that no solution with can be found in this regime. Only as does the number of conditions become small enough to allow for solutions with vanishing predictability . Below such solutions will generally not be unique, hence the breaking of ergodicity as indicated by the divergence of the integrated response.

Some other observations can be made at this point

-

(i)

the numerical values of the order parameters and depend only on fraction of producers and show a simple dependency on the first two moments of wealth of the producers, apart from which the distribution of the weights of the producers is irrelevant. The location of the phase transition in turn only depends on the relative proportions of producers and speculators. This is consistent with [6] where no dependence of the critical point on the functional form of the distribution of producer wealth and only small qualitative variation of the order parameters was reported for the model with dynamical capitals and two trading strategies per agent.

-

(ii)

the analytical theory for the infinite system predicts the average capital of the speculators to diverge at the phase transition. In numerical simulations of finite-size systems we thus expect a rounded maximum, as confirmed in Fig. 1. We note that very similar behaviour is found in the model with two trading strategies per player [6].

-

(iii)

Inspection of Eq. (9) reveals that the role of in the batch dynamics is essentially to set the overall time scale. In simulations needs to be sufficiently small though to ensure that all capitals remain positive at all times. While the deterministic batch dynamics attains a fixed point in the long-run, this may not necessarily be true for the on-line game. Here dynamical fluctuations are to be expected due to the inherent stochasticity induced by the randomly chosen information patterns . The magnitude of these dynamical fluctuations in the agents’ capitals is here governed by .

2.4 Stylised facts

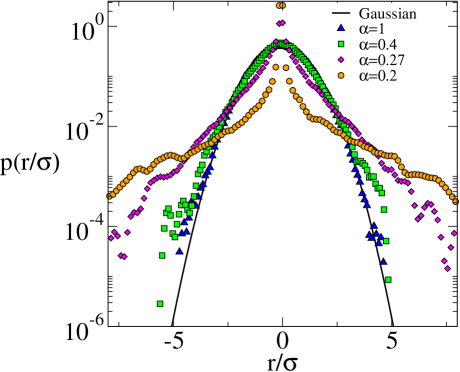

We now turn to a brief discussion of the statistics of the price time series generated by the model. In [6] it has been reported that an MG with dynamical capitals and two trading strategies per player leads to non-Gaussian price-return distributions close to criticality. This is confirmed in the present simpler model with only one trading strategy per player, as shown in Fig. 2. While the distribution of returns is essentially Gaussian far above the phase transition, extended tails of large price changes similar to those observed in real market data develop as is approached from above. In analogy to GCMGs in which stylised facts persists throughout an entire critical region, these non-Gaussian effects are observed throughout the efficient phase of the model at . We would here like to stress that the examination of the emergence of stylised facts in the simplified MG with evolving capitals is not the focus of this paper. We have therefore not studied the auto-correlation of price returns, or the question as to whether the above non-Gaussian return distributions are indeed a finite-size or transient effect. Further insight might here also be expected from a study of the on-line dynamics with evolving capitals [8].

3 Majority Game with dynamical capitals

A majority game with evolving capitals can be defined via the following process

| (29) |

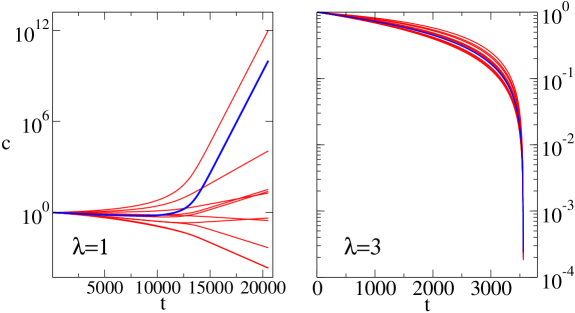

where the only difference compared to the above minority game is the sign of the interaction term. There is no need to introduce producers here, in fact the majority game is a positive-sum game by definition, and simulating the dynamics of (29) unsurprisingly does not produce much excitement. What is observed as that the total capital grows in time without bound, and simulations soon reach their limits and need to be abandoned after a relatively small number of time steps. One should note that this does not imply that the capitals of all traders grow to infinity, asymptotically, but rather we find that some capitals diverge, whereas others appear to tend to zero asymptotically 333Due to the discreteness of the dynamics at finite , some capitals will become negative eventually, and simulations are aborted at this point..

Introducing a forcing term, parametrized by as follows

| (30) |

yields a more interesting behaviour, see Fig. 3. At small, but non-zero values of the behaviour is as before, the total capital in the system diverges in time. If a large enough value of the limiting force is chosen, however, then simulations suggest an overall contraction of the total capital, i.e. . This suggests, that a non-trivial stationary regime may be possible, if is chosen appropriately to balance the forces between asymptotically diverging, and asymptotically vanishing total capital in the system. This then directly leads to so-called replicator dynamics, used frequently in evolutionary game theory and in population dynamics. We will therefore discuss the behaviour of these equations in the context of the majority game with evolving capitals, subject to an overall conservation, in the next section.

4 Replicator dynamics

4.1 Model definitions

Replicator equations are a common mathematical framework in evolutionary game theory [14], and generally describe the dynamics of populations of agents, in which each individual, carries one single (pure) strategy. We will label strategies by in the following. The interaction with the other players then leads to a fitness or payoff for strategy . Here a well-mixed interaction with all other members of the population is assumed. If is denotes the proportion of individuals carrying strategy in the population, then the replicator dynamics are given by

| (31) |

We have here explicitly included the frequency-dependence of (i.e. depends on the entire composition of the population). is the average fitness in the population, i.e. . Provided the concentration vector is normalised when the dynamics are started, i.e. , this normalisation will be maintained at all later times. Further details on replicator dynamics in the context of evolutionary game theory can be found for example in [14]. It is now not difficult to see the analogy with the dynamics discussed above in the context of the majority game with evolving capitals. The play the role of the concentrations , for convenience and consistency with the replicator literature, we will use from now on. The fitness of a given strategy in a population of composition is then given by

| (32) |

in the context of the majority game. Introducing

| (33) |

and the using the convention of vanishing diagonal elements , we then use

| (34) |

as a starting point for our analysis. Note here that the strategy concentrations have been re-scaled and normalised to . This guarantees a well-defined thermodynamic limit. The first term in the square brackets has been introduced following [15, 16, 17, 18, 7], and describes what is referred to as ‘co-operation pressure’. It has been seen in the context of [17, 7, 12] that large positive drive replicator systems towards the centre of the strategy simplex, and one expects a stable fixed point at which all strategies are played with equal frequency. For low values of the dynamics can approach the boundary of the simplex, and a sizable fraction of strategies is not used at all asymptotically. While we leave as a general model parameter, it is worth pointing out that for the choice , Eq. (34) is precisely the replicator dynamics corresponding to the majority game. is again the average fitness (now given by ), and can be treated as a general Lagrange multiplier maintaining the overall normalisation 444Strictly speaking the normalisation is only conserved as a soft constraint in our analytical calculation, i.e. holds as an average over the disorder. In our simulations the constraint is respected for each sample..

4.2 Analytical solution

The model defined above is closely related to that studied in [7], but with an opposite overall sign in the Hebbian-type dynamics. As we will see the resulting phase diagram is different from that of the model of [7] however. Analytical progress can be made using again the formalism of dynamical mean-field theory. Similar to [17, 7] we find the following effective single-species process:

| (35) |

where

| (36) |

and the corresponding self-consistency relations

| (37) |

Following [17, 7] we will next look for fixed points of this effective stochastic process. These fulfill

| (38) |

i.e. one has or

| (39) |

We will write with a standard Gaussian, and similar to what was proposed first in [17] for a replicator model with Gaussian couplings we use the physical ansatz

| (40) |

to proceed, i.e. one has

| (41) |

where . From this, following the lines of [17, 7] one derives the following self-consistent equations for the static order parameters (the integrated response as before), and the asymptotic disorder-averaged Lagrange multiplier

| (42) | |||||

| (43) | |||||

| (44) |

with . In the fixed-point regime and are time-independent, and is a stationary order parameter by definition. Using (42,43,44) these order parameters can be obtained numerically as functions of the model parameters and .

Before we present results in the next section, it is worth investigating the stability of the fixed-points which we have assumed to derive the above closed equations describing the stationary state. The stability can here be determined within a linear expansion about the assumed fixed-point. This is performed on the level of the effective process and follows the lines of [17, 18]. We will not present the details of the calculation here, a result similar to [7, 17] is found: at large values of greater than a critical value , the above solutions is indeed stable and valid. Below the system may still approach a fixed point asymptotically, but generally the dynamics allow for a large number of attractors and none of the fixed points is locally stable, as perturbations do generally not decay [16]. As in [17, 18], for each the transition point coincides with the point at which , i.e. one here has . Using this condition, is then determined numerically from (42,43,44) (solving these equations delivers at along with a value for at the transition, which we do not report here).

4.3 Stationary state and phase diagram

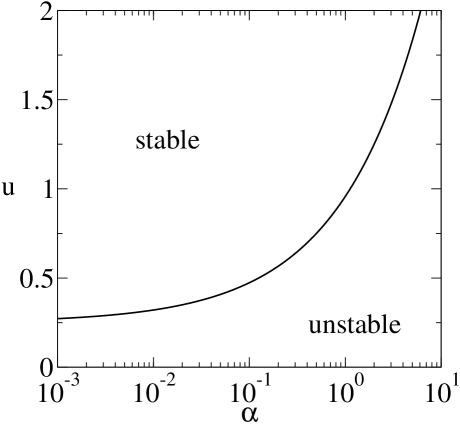

The resulting phase diagram is shown in Fig. 4. The line shows the onset of instability in the plane. It is here also worth noting that (42,43,44) do not allow for a divergence of the susceptibility . This is prevented for example by Eq. (42): given that is finite and bounded in the interval for all , assuming a divergence of , i.e. directly leads to . Given that an instability of the fixed point occurs at a positive value when the co-operation pressure is lowered from large positive values, such a divergence of never occurs in the physical system 555We here note that the transformation turns the present model into that discussed in [7], but with an overall minus sign in front of the right-hand side of the replicator dynamics (corresponding to ). In [7] a transition with a divergence of the integrated response was found at , in particular this transitions occurs when is lowered from a stable fixed point state at . Due to the inversion in signs, stability properties are also inverted in comparison to the model discussed here, so that what used to be a stable fixed point regime is now unstable, and no such transition is seen in the present model.

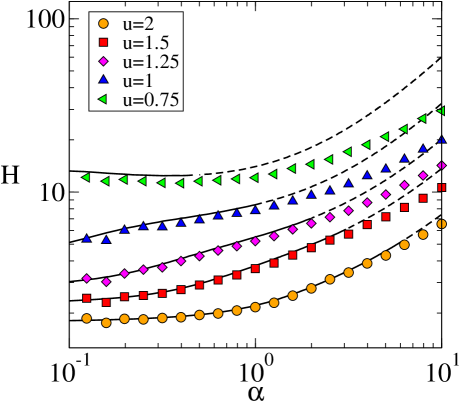

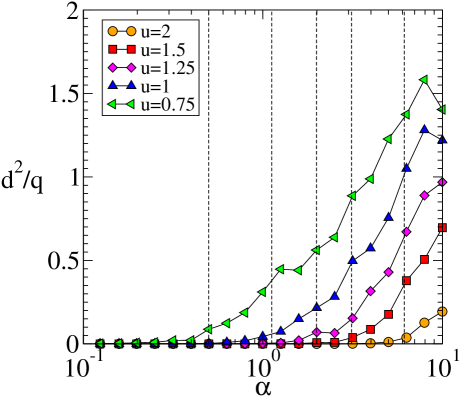

The validity of the generating functional theory is confirmed in Figs. 5 and 6, where we show results for the order parameters and as a function of for different choices of . At small values of , where the theory is predicted to be stable and accurate, near perfect agreement between theory and simulations is observed. Only at large value of does the fixed point ansatz become unstable, and we find systematic deviations. Fig. 5 here demonstrates that the asymptotic diversity of the system decreases as increases. To this end note that is similar to what is known as Simpson’s index [11] in ecology, and a measure of how many distinct species (i.e. strategies) survive in the long run. In the extreme case of only one surviving strategy (with concentration ) one has , so in the thermodynamic limit. On the other hand, if all species contribute at equal concentration, for all , then . Fig. 6 shows that the predictability remains strictly positive for all studied values of and , again confirming the absence of a transition with diverging integrated response and of a phase with vanishing predictability and optimal resource exploitation.

In Fig. 7 we characterise the nature of the instability transition depicted in the phase diagram of Fig. 4 further. To this end we have, for a fixed choice of the disorder (i.e. for fixed strategy assignments ) started the system from two different initial conditions and , and have then monitored the distance . The figure shows results at long times, and re-scaled suitably by a factor of . As seen in the diagram, the asymptotic distance vanishes at large values of , greater than the critical predicted by the theory, but remains non-zero below. We conclude that initial conditions are irrelevant in the stable phase, and that the replicator dynamics converges to a single unique fixed point for any realisation of the disorder. Below the transition, multiple attractors are possible, and which of these is chosen is determined by the initial conditions from which the dynamics is started. Transitions of this type have been related to what is called ‘memory onset’ in MGs [13] in [12, 7].

Finally, one may wonder whether it is possible to study the minority game with dynamical capitals as well in the context of replicator dynamics. This is of course the case, and leads to a replicator model, essentially with an inverted sign in front of the Hebbian interaction term in (34). This model, termed replicators with Hebbian interactions, has been studied in [7]666In light of the present study it would probably be more appropriate to refer to the model of [7] as replicator dynamics with anti-Hebbian couplings (corresponding to a minority game), and to the present model as one with Hebbian couplings (majority game)., so that we do not pursue this here, but only mention that both types of transitions (one with diverging integrated response, and one indicated by a continuous onset of memory) are observed in this case.

5 Discussion and concluding remarks

In summary our study demonstrates that the minority game with dynamical capitals put forward in [6] can be simplified to a model with only one trading strategy per player without losing many of the features of the more complicated model in which every agents holds two strategies. In particular the transition between a symmetric phase at low values number of available information patterns, and an asymmetric phase at large value of the key model parameter remains. The theoretical analysis of the simpler model is straightforward and can be performed without much technical effort based on the standard methods discussed in the literature[2, 3]. As in many other variants of the minority game the dynamic susceptibility (or integrated response) diverges at this transition. Simulations in both the simplified and the original model with evolving capitals reveal a maximum of the average wealth per speculator at the phase transition point. Our analytical calculations show that this quantity diverges in the infinite system at the transition, the maximum observed in simulations is a reflexion of this in finite systems. At the same time the model can lead to non-Gaussian wealth distributions around and below the transition.

We have then furthermore briefly discussed a majority game with evolving capitals. The dynamics of this model is relatively unspectacular, unless forced by an external decay term, the total capital in this positive-sum game grows without bounds, and diverges asymptotically. Unless a mixture of minority and majority game players is considered (which we have not done here) non-trivial dynamics in the majority game with evolving capitals can only be expected if a suitably chosen Lagrange multiplier is introduced, keeping the total wealth constant in time. This established an immediate connection to replicator dynamics with interactions of the Hebb type. Such models can be studied with the same analytical methods, and the analysis reveals that a different type of transition is observed in such circumstances. While no divergence of the integrated response and no symmetric phase with vanishing predictability is found, a dynamical instability separating a regime with one unique stable fixed point from a second phase with multiple attractors can be identified. Initial conditions are seen to be irrelevant in the stable phase, but determine the choice of attractor below the instability.

To conclude let us mention that future work might be concerned with the characterisations of the differences between on-line and batch minority game models with evolving capitals. The simple model discussed in the first part of this paper might provide a suitable starting point, and first steps in the direction of addressing the corresponding on-line game have been taken in [8]. Progress can here probably be made using the tools discussed in [3], where on-line versions of the minority game have been addressed, even though more basic approaches might suffice in the context of the simple model discussed here. Secondly, one may think of mixed minority and majority games [19] with dynamical capitals, and investigate whether these show a phase transition, even if each agent is equipped only with one strategy. Finally, the MG with dynamical capitals and multiple strategies per player can be expected to be accessible by dynamical and static methods as well as pointed out in [6], although the analysis appears here much more intricate due to the interplay of slowly-evolving capitals and fast spin degrees of freedom characterising which of their strategies the individual agents chose to play. While the derivation of a description of the effective dynamics within the generating functional formalism of dynamical mean field theory seems straightforward (but tedious) the subsequent analysis of the resulting effective process is likely to involve some type of adiabatic approximation to disentangle the different time-scales of the two types of degrees of freedom.

Acknowledgements

TG is supported through an RCUK Fellowship (RCUK reference EP/E500048/1). Earlier funding by the European Community’s Human Potential Programme under contract HPRN-CT-2002-00319, STIPCO, held at ICTP Trieste, is acknowledged. This work was finalised at the Research Centre for Complex Systems Science, University of Shanghai for Science and Technology, where TG was a visiting fellow of the Shanghai Academy of System Science. Its kind hospitality is appreciated. The authors would like to thank Damien Challet and Matteo Marsili for helpful discussions.

References

References

- [1] Challet D, Zhang Y-C 1997 Physica A 246, 407

- [2] Challet D, Marsili M and Zhang YC 2005 Minority Games. (Oxford University Press, Oxford, UK)

- [3] Coolen ACC 2005 The mathematical theory of Minority Games. (Oxford University Press, Oxford, UK)

- [4] De Martino A and Marsili M 2006 J. Phys. A 39 R465

- [5] Challet D and Marsili M 2003 Phys. Rev. E 68 036132

- [6] Challet D, Chessa A, Marsili M, Zhang Y-C 2001, Quant. Finance 1, 168

- [7] Galla T 2005, J. Stat. Mech. (2005) P11005

- [8] Galla T, Marsili M 2007 (unpublished)

- [9] Farmer JD, Joshi S 1999 Santa Fe Institute working paper 99-10-071

- [10] Johnson NF, Hart M, Hui PM, Zheng D 1999 cond-mat/9910072; Jefferies P, Hart ML, Hui PM, Johnson NF 2001 Eur. Phys. J. B 20, 493-501

- [11] Simpson E H 1949 Nature 163 688

- [12] Galla T 2006 J. Phys. A: Math. Gen. 39 3853-3869

- [13] Heimel JAF and De Martino A 2001 J. Phys. A 34 L539

- [14] Hofbauer J, Sigmund K 1988 Dynamical Systems and the Theory of Evolution (Cambridge University Press, Cambridge UK)

- [15] Peschel M, Mende W 1986 The Prey-Predator Model (Springer Verlag, Vienna)

- [16] Diederich S, Opper M 1989 Phys. Rev. A 39 4333

- [17] Opper M, Diederich S 1992 Phys. Rev. Lett. 69 1616

- [18] Opper M, Diederich S 1999 Comp. Phys. Comm. 121-122 141

- [19] De Martino A, Giardina I, Mosetti G 2003 J. Phys. A.: Math. Gen. 36 8935