SRB Measures for Certain Markov Processes

Abstract.

We study Markov processes generated by iterated function systems (IFS). The constituent maps of the IFS are monotonic transformations of the interval. We first obtain an upper bound on the number of SRB (Sinai-Ruelle-Bowen) measures for the IFS. Then, when all the constituent maps have common fixed points at 0 and 1, theorems are given to analyze properties of the ergodic invariant measures and . In particular, sufficient conditions for and/or to be, or not to be, SRB measures are given. We apply some of our results to asset market games.

Key words and phrases:

Iterated Function System, SRB-Measures1991 Mathematics Subject Classification:

Primary 37A05, 37E05, 37H991. Introduction

In the 1970’s, Sinai, Ruelle and Bowen studied the existence of an important class of invariant measures in the context of deterministic dynamical systems. These invariant measures are nowadays known as SRB (Sinai-Ruelle-Bowen) measures [14]. SRB measures are distinguished among other ergodic invariant measures because of their physical importance. In fact, from ergodic theory point of view, they are the only useful ergodic measures. This is due to the fact that SRB measures are the only ergodic measures for which the Birkhoff Ergodic Theorem holds on a set of positive measure of the phase space. In this note, we study SRB measures in a stochastic setting—Markov processes generated by iterated function systems (IFS).

An IFS111In some of the literature an IFS is called a random map or a random transformation. is a discrete-time random dynamical system [1, 10] which consists of a finite collection of transformations and a probability vector . At each time step, a transformation is selected with probability and applied to the process. IFS has been a very active topic of research due to its wide applications in fractals and in learning models. The survey articles [5, 13] contain a considerable list of references and results in this area.

The systems which we study in this note do not fall in the category of the IFS222 In most articles about IFS, the constituent maps are assumed to be contracting or at least contracting on average. Here we do not impose any assumption of this type. In fact the class of IFS which we study in Section 4 cannot satisfy such assumptions. considered in [5, 13] and references therein. Moreover, in general, our IFS do not satisfy the classical splitting333In particular, when all the maps have common fixed points at 0 and 1. See Section 4. condition of [7]. In fact, our aim in this note is to depart from the traditional goal of finding sufficient conditions for an IFS to admit a unique attracting invariant measure [7, 5, 13]. Instead, we study cases where an IFS may admit more than one invariant measure and aim to identify the physically relevant ones; i.e., invariant measures for which the Ergodic Theorem holds on a set of positive measure of the ambient phase space. We call such invariant measures SRB.

Physical SRB measures for random maps have been studied by Buzzi [3] in the context of random Lasota-Yorke maps. However, Buzzi’s definition of a basin of an SRB measure is different from ours. We will clarify this difference in Section 2. A general concept of an SRB measure for general random dynamical systems can be found in the survey article [11]. In this note we study physical SRB measures for IFS whose constituent maps are strictly increasing transformations of the interval. We obtain an upper bound on the number of SRB measures for the IFS. Moreover, when all the constituent maps have common fixed points at 0 and 1, we provide sufficient conditions for and/or to be, or not to be, SRB measures. To complement our theoretical results, we show at the end of this note that examples of IFS of this type can describe evolutionary models of financial markets [4].

In Section 2 we introduce our notation and main definitions. In particular, Section 2 includes the definition of an SRB measure for an IFS. In Section 3 we identify the structure of the basins of SRB measures and we obtain a sharp upper bound on the number of SRB measures. Section 4 contains sufficient conditions for and , the delta measures concentrated at and respectively, to be SRB. It also contains sufficient conditions for and not to be SRB measures. Our main results in this section are Theorems 4.3 and Theorem 4.7. In Section 5 we study ergodic properties of and without having any information about the probability vector of the IFS. In Section 6 we apply our results to asset market games. In particular, we find a generalization of the famous Kelly rule [9] which expresses the principle of “betting your beliefs”. The importance of our generalization lies in the fact that it does not require the full knowledge of the probability distribution of the random states of the system. Section 7 contains an auxiliary result which we use in the proof of Theorem 4.7.

2. Preliminaries

2.1. Notation and assumptions

Let be the measure space where is the Borel

-algebra on . Let denote Lebesgue measure on and denote the delta measure concentrated at point . Let be a finite set and , , be continuous transformations from the unit interval into itself. We assume:

(A) are strictly increasing.

Let be a probability vector on such that for all , . The collection

is called an iterated function system (IFS) with probabilities.

We denote the space of sequences , , by . The topology on is defined as the product of the discrete topologies on . Let denote the Borel measure on defined as the product measure . Moreover, we write

for the history up to time , and for any we write

Finally, by we denote the expectation with respect to , by the conditional expectation given the history up to time and by the variance with respect to .

2.2. Invariant measures

is understood as a Markov process with a transition function

where and is the characteristic function of the set . The transition function induces an operator on measures on defined by

| (2.1) |

Following the standard notion of an invariant measure for a Markov process, we call a probability measure on -invariant probability measure if and only if

Moreover, it is called ergodic if it cannot be written as a convex combination of other invariant probability measures.

2.3. SRB measures

Let be an ergodic probability measure for the IFS. Suppose there exists a set of positive Lebesgue measure in such that

| (2.2) |

Then is called an SRB (Sinai-Ruelle-Bowen) measure. The set of points for which (2.2) is satisfied will be called the basin444Our definition of a basin is different from Buzzi’s definition [3]. In his definition he defines random basins for an SRB measure. In particular, according to Buzzi’s definition, for the same SRB measure, basins corresponding to two different ’s may differ on a set of positive lebsegue measure of . See [3] for more detials. of and it will be denoted by . Obviously, if then is the unique SRB measure of .

3. Number of SRB measures and their basins

The basin of an SRB measure for the systems we are dealing with is described by the following two propositions.

Proposition 3.1.

Let be an SRB measure and be its basin. Let , . Then .

Proof.

When weak convergence is considered on an interval, then if and only if for any function555Here is a sketch of the proof of this claim: Assume for any . Let be a continuous function and let be a sequence of functions converging to in norm. We have Now, for any , we can find such that and then we can find such that for any we have .. Since every function is a difference of two continuous increasing functions, this means that if and only if for any continuous increasing function.

Let and . We will show that . Let assume that is continuous and increasing. Let us fix an for which

We have (since all are increasing) and

The averages on the left and on the right have common limit . Thus,

Since the event

occurs with -probability 1, the event

also occurs with -probability 1. ∎

Proposition 3.2.

Let be an SRB measure and be its basin, where denotes an interval closed or open at any of the endpoints. Then,

Proof.

We will prove only the second claim with . The first claim is proven analogously.

Assume that , for some . Then, we can find such that . For arbitrary continuous function , for with , we have

The set is also of -probability 1. Let and let denote the initial subsequences of length of . Then,

This shows that and contradicts the assumptions.

Now, we assume that , . Then, we can find such that for all . Let

We have for each . Hence, , where and . For arbitrary continuous function , for , if we have

where and are the initial subsequences of length of . This implies that . Since , this leads to a contradiction. ∎

We now state the main result of this section. Firstly, we recall that denotes an interval which is closed or open at any of the endpoints. Secondly, we define a set BS whose elements are intervals of the form with the following property:

if and only if

and

Theorem 3.3.

The number of SRB measures of is bounded above by the cardinality of the set BS. In particular, if and are the only fixed points of some , , then admits at most one SRB measure.

Proof.

The fact that number of SRB measures of is bounded above by the cardinality of the set BS is a direct consequence of Proposition 3.2. To elaborate on the second part of the theorem, assume without loss of generality that for all . Obviously, by Proposition 3.2, if all the other maps , has no fixed points in , then admits at most one SRB measure. So let us assume that there exists an such that has a finite or infinite number of fixed points in . In the case of finite number of fixed points, denote the fixed points of in [0,1] by , , such that . Since for all , the only possible basin for an SRB measure would be either or . In the case of infinite number of fixed points, let

If , then . By Proposition 3.2, is the only possible basin for an SRB measure. If , let denote the closure of the set of fixed points of and let be the minimal closed subset of which contains the point . is the only possible basin for an SRB measure. Moreover, it cannot be decomposed into basins of different SRB measures. Indeed, let such that with . Since , by Proposition 3.2, cannot be a basin of an SRB measure. Thus, admits at most one SRB measure. ∎

The following example shows that Proposition 3.2 can be used to identify intervals which are not in the basin of an SRB measure. In particular, it shows that the bound obtained on the number of SRB measures in Theorem 3.3 is really sharp.

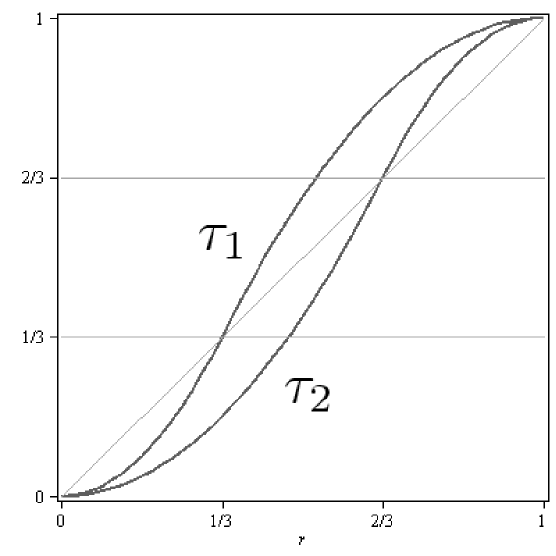

Example 3.4.

Let

and

The graphs of the above maps are shown in Figure 1. Using Proposition 3.2, we see that the points of the interval do not belong to a basin of any SRB measure. Moreover, by Theorem 3.3, admits at most two SRB measures. Indeed, one can easily check that and are the only SRB measures with basins and respectively. For any for all ’s the averages converge weakly to . For the only for which this does not happen is so again the averages converge weakly to with -probability 1. Similarly, we can show that . If , then with positive -probability the averages converge to and with positive -probability the averages converge to . Thus, these points do not belong to a basin of any SRB measure and there are only two SRB measures.

4. Properties of and

In addition to condition (A), we assume in this section that for all :

(B) and ;

Obviously by Condition (B) the delta measures and are ergodic probability measures for the IFS. We will be mainly concerned with the following question: When does have and/or as SRB measures? We start our analysis by proving a lemma which provides a sufficient condition for , the point measure concentrated at , to be an SRB measure.

Lemma 4.1.

Suppose that for all and that there exists an initial point of a random orbit , , for which with probability . Then is an SRB measure for and 666The notation here is for the case when ..

Proof.

Let be a continuous function on . Let and fix a history for which . Then

Consequently

Since the event

appears with probability one, the event

also appears with probability one. Thus, by Proposition 3.1, is an SRB measure for and . ∎

The following lemma, which is easy to prove, is a key observation for our main results in this section.

Lemma 4.2.

Each constituent map of the IFS can be represented as follows:

with satisfying:

-

(1)

in ;

-

(2)

increasing;

-

(3)

;

-

(4)

In the rest of this section, the following notation will be used:

Theorem 4.3.

Let be an IFS such that . Assume that for all .

-

(1)

If a.s., then a.s.

-

(2)

If a.s., then a.s.

-

(3)

If a.s., then a.s.

Proof.

Let us consider the sequence of random exponents

where with probability , and observe that

We have

and, with probability one,

Therefore, is a supermartingale. Moreover, because , . Hence is a supermartingale with bounded increments. Thus, using Theorem 5.1 in Chapter VII of [12], with probability one does not converge to . Consequently, with probability one, does not converge to zero.

We now prove the second statement of the theorem. Again we consider the sequence of random exponents

Let denote the martingale difference

We have and is uniformly bounded. Therefore, by the strong law of large numbers (see Theorem 2.19 in [8]), with probability one

| (4.1) |

Therefore, with probability one,

From this we can conclude that for large enough there is a positive random variable such that

Thus, since , for large enough we obtain

By taking the limit of to infinity we obtain

The proof of the third statement is very similar to the proof of the second one with slight changes. In particular, using (4.1), we see that, with probability one,

From this we can conclude that for large enough there is a positive random variable such that

Thus, since , for large enough we obtain

By taking the limit of to infinity we obtain

∎

Corollary 4.4.

Let be an IFS such that . Assume that for all .

-

(1)

If a.s., then is the unique SRB measure of with .

-

(2)

If a.s., then is the unique SRB measure of with .

Remark 4.5.

Remark 4.6.

In the proof of statement (1) of Theorem 4.3, we have with probability , . In general, it is not clear that this implies that is not an SRB measure. However, in the following theorem under additional natural assumption on the variance of we show that is indeed not an SRB measure.

Theorem 4.7.

If and , for all , then is not an SRB measure of .

Proof.

Consider the sequence of random exponents

where with probability , and observe that

Observe that

Since

and

the sequence forms a supermartingale with bounded increments. Doob’s decomposition theorem gives the representation

where is a decreasing predictable sequence and

is a 0 mean martingale with bounded increments. By Theorem 5.1 (Ch. VII) of [12] with probability 1 process either converges to finite limit or . In the first case the process is bounded from above. We will consider only the second case to show that with positive probability the process is bounded from above for a set of indices which has positive density in , i.e, there exist , such that

| (4.2) |

Let us denote

This sequence satisfies assumptions of Theorem 7.1, with . We have

Thus, the sequence satisfies assumptions of Proposition 7.2. In particular, (7.1) holds, i.e., if is the number of times for , then

where are some numbers in . This means that if is the number of times for , then

Now, we we show that

For we have . Let , . The set which contains points from infinitely many is and since the sequence is decreasing we have

Thus, with a positive probability , there exist a sequence such that or

Thus, is negative with positive density, i.e.,

with positive probability . This implies that with positive density and positive probability . We can construct a continuous function which is 0 around 0 and 1 above . The averages of this function satisfy

with nonzero probability which proves there is no weak convergence to . ∎

Remark 4.8.

If and , for all , using essentially the proof of Theorem 4.7, we obtain that is not an SRB measure of . In particular, if and , for all , we obtain that neither nor is an SRB measure.

5. Properties of and : The case when is unknown

In general, one cannot decide whether or is the unique SRB measure without having information about . We illustrate this fact in the following example.

Example 5.1.

Let where , and are unknown. Observe that the exponents, which are explicit in this case and independent of , are and . Then

By Corollary 4.4, if the measure is the unique SRB measure of ; however, if the measure is the unique SRB measure of . Thus, for this example, without having information about , no information about the nature of or can be obtained.

Although Example 5.1 shows that the analysis cannot be definitive in some cases without knowing the probability distribution on , our aim in this section is to find situations when and/or are not SRB. Moreover, in addition to studying the properties of and , we are going to study the case when the IFS admit an invariant probability measure whose support is separated from zero and is not necessarily concentrated at one. The definition of such a measure is given below.

Definition 5.2.

Let be a probability measure on , where is the Borel -algebra. We define the support of , denoted by supp(), as the smallest closed set of full measure. We say that supp() is separated from zero if there exists an such that .

In addition to properties (A) and (B), we assume in this section that:

(C) Every has a finite number of fixed points.

In this section, we use a graph theoretic techniques to analyze ergodic properties of

and . This approach is inspired by the concept of a Markov partition used in the

dynamical systems literature. For instance, in [2], the ergodic properties of a deterministic system which

admits a Markov partition is studied via a directed graph and an incidence matrix. In our approach we construct a

partition for our random dynamical system akin to that of a Markov partition and use two directed graphs to study

ergodic properties of the system.

We now introduce the two graphs, and , which we will use in our analysis.

-

(1)

Both and have the same vertices;

-

(2)

For , an interval is a vertex in and if and only if , and for all ;

-

(3)

Let and be two vertices of . There is a directed edge connecting to if and only if an , , and a such that .

-

(4)

Let and be two vertices of . There is a directed edge connecting to if and only if an , , and a such that .

-

(5)

By the out-degree of a vertex we mean the number of outgoing directed edges from this vertex in the graph, and by the in-degree of a vertex we mean the number of incoming directed edges incident to this vertex in the graph.

-

(6)

A vertex is called a source if it is a vertex with in-degree equals to zero. A vertex is called a sink if it is a vertex with out-degree equals to zero.

For the above graphs, one can identify two types of vertices: let be a vertex. If for all , then the vertex will be denoted by . If for all , then the vertex will be denoted by . When we prove a statement for a vertex (without a label), this means that the result holds for both types of vertices. The following lemma contains some properties of and .

Lemma 5.3.

Let and be defined as above.

-

(1)

If is a vertex in , then is a sink in .

-

(2)

Let and be two vertices in . There is a directed edge connecting to in if and only if . In particular for all there is no directed edge in connecting to for any and .

-

(3)

If is a vertex in , then is a sink in .

-

(4)

Let and be two vertices in . There is a directed edge connecting to in if and only if . In particular for all there is no directed edge in connecting to for any and .

Proof.

The proof of the first statement is straight forward. Indeed, let be any vertex in and such that . Then for all . The proof of the second statement follows from the fact that if then for we have . If , then there exits a such that . Proofs of the third and fourth statements are similar to the first two. ∎

For our further analysis we introduce the following notion.

Definition 5.4.

We say that a random orbit of stays above a point if all the points of the infinite orbit are bigger than or equal to with probability .

Lemma 5.5.

Let be a vertex in such that . If is a source in , then the random orbit of starting from stays above with probability .

Proof.

Suppose is a source in . Then for all , we have for all and . This means that if we have and and so on. ∎

Theorem 5.6.

Let be an IFS whose transformations satisfy the properties (A), (B) and (C).

-

(1)

If for all there is a vertex in with , then is an SRB measure, , where . In particular, for any , a.s.

-

(2)

If for all there is a vertex in with , then is an SRB measure. Moreover, , where . In particular, for any , a.s.

-

(3)

Let be a vertex in such that . If is a source in 777In the case where , even if other , with , receives a directed edge, the result still holds. Thus, to know the existence of an invariant probability measure whose support is separated from 0, it is enough to check that one vertex with which is a source in . Statements of Lemma 5.3 can be useful to visualize cases of this type. then preserves a probability measure whose support is separated from 0 888The invariant measure here is not necessarily ..

-

(4)

Let be a vertex in such that . If is a source in then preserves a probability measure whose support is separated from 1.

-

(5)

Let be a vertex with whose out-degree in is at least one. If a vertex in , and , which is a source in , then for any , a.s. Moreover, is not an SRB measure for .

-

(6)

Let be a vertex in such that and whose out-degree in is at least one. If a in , and , which is a source in , then for any , a.s. Moreover, is not an SRB measure for .

-

(7)

If for all the vertices whose are of the form and their are identical, then for any in , with probability one, . In particular, is an SRB measure with and is not an SRB measure.

-

(8)

If for all the vertices whose are of the form and their are identical, then for any in , with probability one, . In particular, is an SRB measure with and is not an SRB measure.

Proof.

We only prove the odd numbered statements in the theorem. Proofs of the even numbered statements are very similar.

(1) For any , any random orbit of will converge to zero. Using Lemma 4.1, this shows that is an SRB measure with .

(3) Let . Since is a compact metric space and for all is continuous, the average of the probability measures converges in the weak* topology to an invariant probability measure999This follows from a random version of the Krylov-Bogoliubov Theorem [1].. By Lemma 5.5, this measure is supported on .

(5) Let . For any , there exists a finite such

that . Since is a source in , by Lemma 5.5, stays above with probability . Therefore, for any , with positive probability, the random orbit of is bounded away from . Let us consider now the case of a starting point . Since all the transformations are homeomorphisms and is a common fixed point, for any and any , with positive probability, . Hence, for any , with strictly positive probability, . Moreover, with strictly positive probability, for any , there exists a such that

Therefore, with strictly positive probability, for any ,

| (5.1) |

Now, to show that is not an SRB measure, it is enough to find a continuous function on such that with positive probability, for any ,

Indeed, this is the case if we use the function and (5.1). Thus, is not an SRB measure..

(7) Obviously, for any , the random orbit of starting at will converge to . Using Lemma 4.1, this implies that is an SRB measure with . Moreover, since all the transformations are homeomorphisms with common fixed point at , for any , the random orbit of stays above . Thus, is not an measure.

∎

6. Asset Market Games

In this section, we apply our results to evolutionary models of financial markets. In particular, we will focus on the model introduced by [4]. First, we recall the model of [4].

6.1. The Model

Let is a finite set and , , be the “state of the world” at date . Let be a probability distribution on such that for all . We also assume that are independent and identically distributed.

In this model there are “short-lived” assets (live one period and are identically reborn every next period). One unit of asset issued at time yields payoff at time . It is assumed that

and

for each , where is the expectation with respect to the underlying probability . The total amount of asset available in the market is

In this model there are investors (traders) . Every investor at each time has a portfolio

where is the number of units of asset in the portfolio . We assume that for each moment of time and each random situation , the market for every asset clears:

| (6.1) |

Each investor is endowed with initial wealth Wealth of investor at time can be computed as follows:

| (6.2) |

Total market wealth at time is equal to

| (6.3) |

Investment strategies are characterized in terms of investment proportions:

of -dimensional vector functions satisfying Here, stands for the share of the budget of investor that is invested into asset at time . In general may depend on . Given strategies of investors , the equation

| (6.4) |

determines the market clearing price of asset . The number of units of asset in the portfolio of investor at time is equal to

| (6.5) |

Therefore

| (6.6) |

By using (6.6) and (6.2), we get

| (6.7) |

Since , we obtain for each . The main focus of the model is on the analysis of the dynamics of the market shares of the investors

Using (6.7) and (6.3), we obtain

| (6.8) |

where

are the relative (normalized) payoffs of the assets . We have and .

6.2. Performance of investment strategies and the Kelly rule

In the theory of evolutionary finance there are three possible grades for investor (or for the strategy she/he employs):

(i) extinction: ;

(ii) survival: but a.s.;

(iii) domination: a.s.

Definition 6.1.

An investment strategy is called completely mixed strategy if it assigns a positive percentage of wealth to every asset for all and moreover, it is called simple if

In this theory, the following simple portfolio rule has been very successful: define

so that are the expected relative payoffs of assets . The portfolio rule is called the Kelly rule which expresses the

investment principle of “betting your beliefs” [9]. In [4] under the following two conditions:

E1) There are no redundant assets, i.e. the functions of are linearly independent.

E2) All investors use simple strategies;

it was shown that investors who follow the Kelly rule survive and others who use a different simple strategy get extinct. In particular, If only one investor follows the Kelly rule, then this investor dominates the market.

The main challenge in using the Kelly rule lies in the fact that it requires from investors the full knowledge of the probability distribution . In Subsection 6.4, using an IFS representation of (6.8) and Theorem 4.3, we overcome this difficulty by finding another successful strategy which requires partial knowledge of the probability distribution .

6.3. An IFS realization of the model

In the rest of the paper, we are going to show how the above model can be represented by an IFS. We are going to apply the results of Sections 4 and 5 to study the dynamics of (6.8). As in [4], we assume here that all the investors use simple strategies. Further, we focus on the case101010This is the same as assuming that there are investors, , where investors use the same strategy and only one investor deviates from them. when . The market selection process (6.8) reduces to the following one dimensional system:

| (6.9) |

where is investor’s 1 relative market share at time and and are the investment strategies of investor 1 and 2 respectively. Then the random dynamical (6.9) of the market selection process can be described by an iterated function system with probabilities:

where

We first note that the transformations of the IFS of the market selection process are maps from the unit interval into itself and they satisfy assumptions (A), (B) and (C). In fact, the maps for this model have additional properties. For example, they are differentiable functions.

6.4. Investors with partial information on and a generalization of the Kelly rule

We use Theorem 4.3 to provide a rule for investors with partial information on . The investor who follows this rule cannot be driven out of the market; i.e., she/he either dominates or at least survives. The importance of this rule lies in the fact that investor 1 does not need to know the Kelly rule exactly111111It is often difficult for an investor to know the exact probability distribution of the states of the world.. She/he only needs to know a perturbation of the Kelly rule; for example, the Kelly rule plus some error bounds.

Firstly, we show in the following lemma that the logarithms of the exponents are uniformly bounded.

Lemma 6.2.

Let

and

where, for each we have , , and . Then for any , , is bounded.

Proof.

Without loss of generality, we assume that . We have , so

The minimum and maximum of can be attained at , or at a point of a local extremum. Using De L’Hospital rule we find

A point of local extremum in of is found by solving

Therefore, at the point of local extremum

Observe that the function

is continuous at . Thus, it attains its maximum and minimum on . This completes the proof of the lemma. ∎

Corollary 6.3.

Let

Then for , ,

Theorem 6.4.

If for each lies between and , then investor 1 cannot be driven out of the market; i.e., she/he either dominates or at least survives.

Proof.

Let us consider the function

where

and is a probability vector. We will find conditions on which ensure , . It is easy to see that

| (6.10) |

We also have

and

Thus, is a convex function and its derivative is increasing. If then is decreasing and because of (6.10) this implies that , . Observe that

It is easy to see that a sufficient condition for is

| (6.11) |

or, in short, for each , , should be between and .

Now, let us consider the expression

We have

| (6.12) |

with being the expected payoff for the asset, , .

A sufficient condition for is for :

We have shown before that a sufficient condition for this is (6.11) or placing each between the expected payoff and .

6.5. Incorrect beliefs

Our results in Section 5 are also interesting for studying the dynamics of (6.8). In fact, they can be used to study the dynamics in the situation where both players have ‘incorrect beliefs’; i.e., when players do not have the right information or partial information about . Thus, they either use wrong distributions to build their strategies or they arbitrarily choose their strategies. Consequently, their strategies are, in general, different from the Kelly rule and the generalization which we presented in Subsection 6.4. In this case, the results of Section 5 can be used to identify the exact outcome of the game in certain situations. In some situations, as in Example 5.1, one cannot know the outcome of the system without knowing .

7. Appendix

The following general arcsine law has been proved in [6].

Theorem 7.1.

[6] Let be a sequence of random variables adapted to the sequence of -algebras . Let , and assume

Let and . If

then the distributions of converge to the arcsine distribution.

Proposition 7.2.

References

- [1] (1723992) L. Arnold, “Random Dynamical Systems,” Springer Verlag, Berlin, 1998.

- [2] (1461536) A. Boyarsky and P. Góra, “Laws of Chaos,” Brikhaüser, Boston, 1997.

- [3] (1707698) J. Buzzi, Absolutely continuous S.R.B. measures for random Lasota-Yorke maps, Trans. Amer. Math. Soc., 352 (2000), 3289–3303.

- [4] (1926235) I. Evstigneev, T. Hens and K.R. Schenk-Hoppé, Market selection of financial trading strategies: Global stability, Math. Finance, 12 (2002), 329–339.

- [5] (1669737) P. Diaconis and D. Freedman, Iterated random functions, SIAM Rev., 41 (1999), 45–76.

- [6] (0303595) R. Drogin, An invariance principle for martingales, Ann. Math. Statist., 43 (1972), 602–620.

- [7] (0193668) L. Dubins and D. Freedman, Invariant probabilities for certain Markov processes, Ann. Math. Statist., 37 (1966), 837–848.

- [8] (0624435) P. Hall and C. Heyde, “Martingale Limit Theory and Its Application,” Academic Press, New York-London, 1980.

- [9] (0090494) J.L. Kelly, A new interpretation of information rate, Bell Sys. Tech. J., 35 (1956), 917–926.

- [10] (0874051) Y. Kifer, “Ergodic Theory of Random Transformations,” Birkhäuser, Boston, 1986.

- [11] (1855833) P-D. Liu, Dynamics of random transformations: smooth ergodic theory, Ergodic Theory Dynam. Syst., 21 (2001), 1279–1319.

- [12] (0737192) A.N. Shiryaev, “Probability,” Springer-Verlag, New York, 1984.

- [13] (1962693) Ö. Stenflo, Uniqueness of invariant measures for place-dependent random iterations of functions, in “Fractals in Multimedia” (eds. M.F. Barnsley, D. Saupe and E.R. Vrscay), Springer, (2002), 13–32.

- [14] (1933431) L-S. Young, What are SRB measures, and which dynamical systems have them?, J. Statist. Phys., 108 (2002), 733–754.