Dual Stochastic Transformations of Solvable Diffusions

Abstract

We present new extensions to a method for constructing several families of solvable one-dimensional time-homogeneous diffusions whose transition densities are obtainable in analytically closed-form. Our approach is based on a dual application of the so-called diffusion canonical transformation method

that combines smooth monotonic mappings and measure changes via Doob-h transforms.

This gives rise to new multi-parameter solvable diffusions that are generally divided into two main classes; the first is specified by having affine (linear)

drift with various resulting nonlinear diffusion coefficient functions, while the second class

allows for several specifications of a (generally nonlinear) diffusion coefficient with resulting nonlinear drift function. The theory is applicable to diffusions with either singular and/or non-singular endpoints.

As part of the results in this paper, we also present a complete boundary classification and martingale characterization of the newly developed diffusion families.

Keywords: solvable continuous-time stochastic processes; Bessel, CIR, and Ornstein-Uhlenbeck processes; nonlinear volatility diffusion models in finance; nonlinear mean-reverting drift models.

AMS Subject Classification: 60G51, 60H10, 91B70.

Introduction and Main Results

A solvable continuous-time stochastic process can be basically defined as a process for which transition probability density functions are obtainable in analytically closed-form. Such solvability permits us to precisely simulate paths of the process from its exact sample distribution and also to readily compute certain mathematical expectations. For solvable families of diffusion processes, solvability implies the existence of analytically closed-form spectral expansions for transition densities of the regular processes subject to appropriate boundary conditions. For certain classes of diffusion models, the spectral expansions can be readily derived in closed-form. For these same diffusion processes, the standard spectral methods show that analytical tractability also extends beyond transition densities. In particular, closed-form expressions exist for other fundamental quantities such as, for example, first-hitting time densities (or distributions) as well as joint probability densities for various extrema of the process, etc.

The set of diffusion processes that are, on the one hand, tractable and applicable for mathematical modeling and, on the other hand, exactly solvable in closed-form is not so vast. This known set of classical diffusions includes mostly linear diffusion processes or those whose drift and/or diffusion coefficients have a power or quadratic polynomial nonlinearity (see [5] and [16] for a comprehensive review of such diffusions; see also [11, 13]). An important goal is hence to extend solvability to other families that have useful applications. There are two main tools that allow us to construct new solvable diffusion processes. The first is related to a measure change on a chosen underlying diffusion and the second involves a change of variable or smooth monotonic mapping (the Itô formula). In recent years, a new approach that combines special measure changes, i.e. time-homogeneous Doob-h transforms, together with special types of nonlinear smooth monotonic mapping transformations was introduced for uncovering new families of exactly solvable driftless diffusion models [2, 3, 4, 6, 15]. These models exhibit nonlinear diffusion coefficients with multiple adjustable parameters and have seen some useful applications in financial derivative pricing [6, 9, 10]. The method has been coined as “diffusion canonical transformation”, wherein the solvability of a diffusion process, say , is essentially reduced to that of a simpler underlying diffusion .

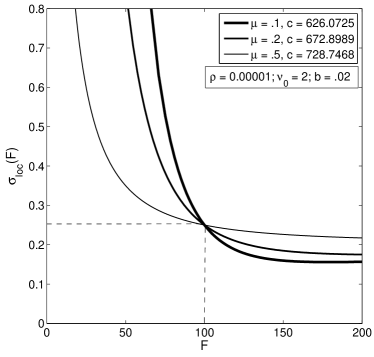

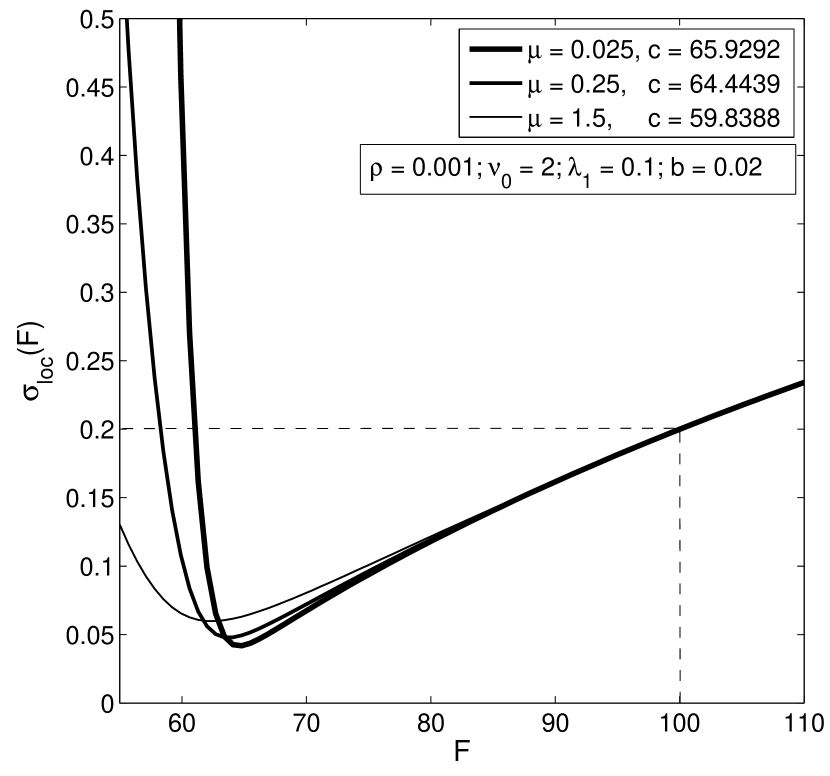

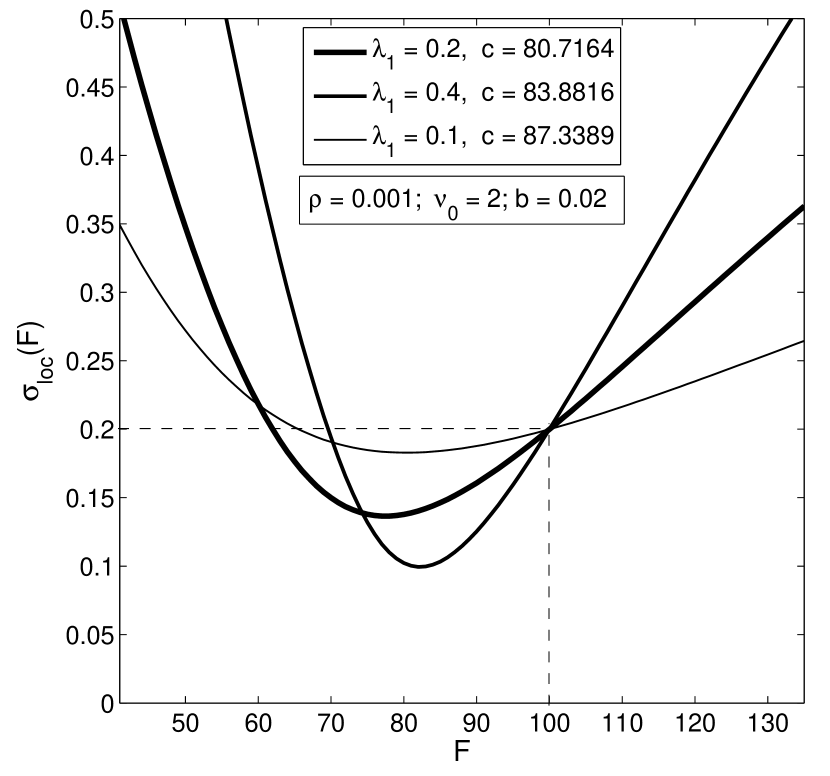

This paper provides the first formal extension of the diffusion canonical transformation method to include a substantially larger dual class of monotonic mappings and thereby constructs two new main classes of solvable diffusions . Throughout, these processes are also called -diffusions. In contrast to the previous related papers, the time-homogeneous Doob-h transform is now constructed more generally to include diffusions with any type of singular and/or non-singular endpoints. Hence, we also provide a complete boundary classification for all possible families of -diffusions. The first main class of -diffusions consists of families satisfying a time-homogeneous stochastic differential equation (SDE) of the form with an affine (linear) drift and multi-parameter nonlinear diffusion coefficient function. We therefore note that the affine drift models presented in this paper significantly extend and include those studied in [6]. As part of our new results, we present three explicitly solvable families of such -diffusions, named Bessel, confluent hypergeometric, and Ornstein-Uhlenbeck families. These processes arise via the diffusion canonical transformation method by respectively choosing a squared Bessel (SQB) process, CIR (squared radial Ornstein-Uhlenbeck) process, and Ornstein-Uhlenbeck process as underlying diffusions. The three new families include (recover) all the corresponding driftless -diffusions obtained previously (e.g. see [6]) as special subfamilies. Moreover, the new affine models inherit some of the important salient properties of their driftless counterparts. One immediate application of such diffusions is asset pricing in finance (when and is a constant such as a risk-free interest rate). In [6], we showed that these three families generate local volatility profiles with varied pronounced smiles and skews (see Figures 1 and 2). Three particular subfamilies named here as the Bessel-, confluent-, and OU models are of particular importance since, for each of them, there exists a risk-neutral probability measure such that the discounted asset price process is a martingale. As in the driftless case, these models are very amenable for pricing many standard financial derivatives since the transition densities (state price densities) for the asset or stock price (i.e. ) are given in closed form. Clearly, the pricing of standard European options is reduced to the evaluation of a definite integral (e.g. see [2, 6]). As well, these solvable models admit explicit closed-form spectral expansions for the transition densities with imposed killing at arbitrary levels, for the first hitting time densities, and for joint densities of the extrema and the price process. Hence, efficient pricing formulas of standard exotic options, such as barrier and lookback options, are also available [7]. Discretely-monitored path-dependent options can be evaluated by using a path integral approach, as was done with previously related state-dependent volatility models [8, 9]. Moreover, subfamilies of diffusions belonging to the Bessel and confluent hypergeometric families admit absorption at zero asset price, so they can naturally be used in derivatives pricing under credit (default) risk.

The second main class of solvable models presented here consists of diffusions with a nonlinear drift and with specification of a generally nonlinear diffusion coefficient. In particular, within this second class of diffusions we find some explicitly solvable diffusion families with a nonlinear mean-reverting drift. Mean-reverting models have useful applications in modeling interest rates. Traditional single-factor interest rate models only consider linear mean reversion, since such solvable models have analytically tractable solutions. As an example of an alternative one-factor nonlinear mean-reverting solvable model, a new family of -diffusions generated from the SQB Bessel process is introduced in this paper. For a particular subfamily of such processes, we use the closed-form transition probability densities for the Doob-h transformed processes and the fact that an underlying bridge process and its Doob-h transformed bridge process have equivalent probability laws, and hence derive some closed-form integral formulas for conditional expectations of functionals involving the discount factor of the process and the process terminal value. The formulas are applicable to standard bond and bond option pricing.

To summarize this introduction, we point out how the rest of the paper is organized. In Section 1, all of the necessary ingredients for constructing the newly solvable dual classes of -diffusions are presented. A useful Lemma 1 for the boundary classification of the families of transformed -diffusions and hence -diffusions is also given. Subsection 1.4 concludes this section with the basis of the dual smooth monotonic mapping transformations for generating the two main classes of solvable -diffusions . Section 2 presents three explicit -diffusions, i.e., Bessel, confluent hypergeometric, and Ornstein-Uhlenbeck families. For each, we give analytical expressions for various transition densities and also derive the boundary classification. In subfamilies where an endpoint is attainable (e.g. subfamilies (i) and (iii) of the Bessel and confluent -diffusions), we also derive in analytically closed-form the density for the first hitting time to the endpoint. The boundary classification and first hitting time densities then follow automatically for the -diffusions. Section 3 presents the construction of the mappings for generating the affine drift -diffusions. In Subsection 3.3, we analyze whether or not -diffusions with linear drift “preserve” the drift rate, i.e. whether , holds and thereby present a theorem that gives easy-to-implement limit conditions for verifying this property. This can be viewed as a generalization of the martingale property for driftless processes. Thus, for the special case with we are able to prove whether a discounted process is a martingale. Section 4.1 presents the three main families of affine drift -diffusions with their explicit multi-parameter nonlinear volatility specifications. We single out three subfamilies with this martingale property and two subfamilies in which is a strict supermartingale. In Section 4.2 we discuss all possible monotonic maps that lead to nonlinear -diffusions with affine drift , . Section 5 presents Bessel families of nonlinear mean-reverting diffusions that are obtained from subfamilies of the squared Bessel -process by applying a power- or exponential-type mapping function . Lemmas 9 and 10 give necessary conditions for the mean-reversion. The asymptotic behaviour of the drift and diffusion coefficients is analyzed. Moreover, we present a model that admits a closed-form expression for the expectation of a discount factor which can be used for bond and bond option pricing. In Appendix A, we derive new asymptotic properties of Wronskians of fundamental solutions used to construct solvable diffusions from the three main families considered here. Such properties allow us to easily analyze stochastic properties of the solvable diffusions.

1 Construction of Nonlinear Solvable Diffusions

1.1 Underlying Diffusion

Let be a one-dimensional time-homogeneous regular diffusion on , , defined by its infinitesimal generator:

| (1.1) |

The functions and denote, respectively, the (infinitesimal) drift and diffusion coefficients of the process. Throughout we assume that the functions , , and are continuous on the open interval and that is strictly positive on . The diffusion has speed measure and scale function (see, e.g., [5]) that are absolutely continuous with respect to the Lebesgue measure and have smooth derivatives. The scale and speed density functions are defined as follows:

| (1.2) |

Given an -diffusion, we can choose any pair of fundamental solutions to the differential equation , , that are denoted by and . For positive real values , and are linearly independent and respectively increasing and decreasing positive functions of . The Wronskian of these functions is given as:

| (1.3) |

where is a constant w.r.t. and for real .

We denote by a transition probability density function (PDF) for w.r.t. the Lebesgue measure, i.e. it is a fundamental solution to the Kolmogorov PDE where , , , . We recall that the Green function and the transition PDF are related via the Laplace inverse transform w.r.t. , i.e. . The Green function , for , is written in terms of a pair of functions and in the standard form [5]:

| (1.4) |

where and . The functions , that also solve , are generally not necessarily the same as the above chosen (elementary) pair. In particular, these functions are linear combinations of , i.e. , with coefficients , . The Wronskian factor is given by . The coefficients (where ) and hence the functions, are uniquely characterized (within a multiplicative constant) by requiring that, for real , and are respectively increasing and decreasing functions and by additionally posing boundary conditions at regular (non-singular) boundaries of (see [5]). For a regular left boundary , if is specified as killing or if is specified as reflecting and included in the state space. If is a singular boundary, the functions have the following boundary properties: If is entrance(entrance-not-exit), then ; if is exit(exit-not-entrance), then ; if is a natural boundary, then . Analogous conditions hold for the right boundary involving the right limits, i.e. and . Moreover, we note that if is singular then we can set and similarly if is singular then .

1.2 Change of Measure

Consider a class of one-dimensional time-homogeneous regular diffusions with infinitesimal generator

| (1.5) |

A strictly positive generating function , is a linear combination of the chosen fundamental pair :

| (1.6) |

with parameters and at least one of them being strictly positive. The speed and scale densities for an -diffusion are given in terms of those for the underlying -diffusion:

| (1.7) |

By comparing the generators (1.1) and (1.5), observe that -diffusions can also be viewed as arising from the underlying -diffusion by the application of a measure change. In fact, the -diffusion can be realized from the -diffusion upon employing a time-homogeneous space-time transform, i.e. a Doob- transform, where , which is -excessive (see [5]). Both processes are regular on the same state space .

Given a generating function , we define the pair and . By applying the differential operator , it follows that these functions solve , . From (1.3) and (1.7), the Wronskian of these solutions is given by

Hence, are a fundamental set of solutions that are linearly independent and strictly positive functions of for real values .

The Green function for -diffusions on then has the general form

| (1.8) |

where, in analogy with the -diffusion, solve and are linear combinations of , i.e. and with coefficients , . The Wronskian factor is then given by , where . These coefficients are uniquely characterized (within a multiplicative constant) by requiring that, for real , and are respectively increasing and decreasing functions and by additionally posing boundary conditions at regular boundaries of . For a regular left boundary , if is specified as killing or if is specified as reflecting and included in the state space. Note that this reflecting boundary condition is equivalently written as . If is a singular boundary, the functions have the following boundary properties: if is entrance, then ; if is exit, then ; if is a natural boundary, then . Analogous conditions hold for the right boundary involving the right limits, i.e. (or ) and (or ).

It clearly follows from (1.4) and (1.8) that any Green function for a diffusion can be related to some Green function for a diffusion by

| (1.9) |

For diffusion , a transition PDF is obtained from its corresponding Green function by Laplace inversion, i.e.

| (1.10) |

By Laplace inverting (1.9) we see that a transition density for a diffusion is related to a transition density for a diffusion by

| (1.11) |

1.3 Boundary Classification

Given an underlying -diffusion and , any regular diffusion with generator in (1.5) falls into one of three general families:

-

(i)

where ,

-

(ii)

where ,

-

(iii)

where .

For with positive real parts, we denote

We recall (see [5]) that for singular (non-regular) boundaries of , i.e. entrance (entrance-not-exit), exit (exit-not-entrance) or natural, we have and . For regular boundaries of it is also possible, depending on the choice of fundamental solutions and the type of boundary conditions imposed at , that is finite for all with positive real parts. In particular, we generally have and .

The fundamental solutions generally satisfy the square integrability conditions w.r.t. the speed measure: and for and . Throughout this paper we conveniently define the inner product of two functions , w.r.t. on a closed interval as and , , .

Lemma 1.

The above three families (i)–(iii) of regular diffusions on with generator , , defined by (1.5) and (1.6) have the following boundary classification:

-

(i)

: is attracting natural if , is exit (or attracting natural) when (or ) if and , and is otherwise regular if .

The boundary is non-attracting (or attracting) natural when (or ) if , and is entrance (or regular) when (or ) if .

-

(ii)

: is attracting natural if , is exit (or attracting natural) when (or ) if and , and is otherwise regular if .

The boundary is non-attracting (or attracting) natural when (or ) if , and is entrance (or regular) when (or ) if .

-

(iii)

: The boundary has the same classification as in (i) and has the same classification as in (ii).

Proof.

Let , , and denote the scale measure , , , and let

The proof now follows by applying the Feller conditions for the respective -diffusions (i)–(iii) with scale and speed densities in (1.7), That is, is regular if and , exit if and , entrance if and , and natural if and ; () is attracting if and only if () is finite. From (1.3) and (1.7), we have , if , and , if . Hence, , if ; , if . Consider family (i). Then, , so is attracting; , so is attracting if and only if . and . Hence, if and only if when and if and only if when , since , while if and only if and . and . Hence, if and only if , since , while if and only if , since . The above combined conditions are then summarized as stated in the Lemma for family (i). The stated boundary classification for families (ii) and (iii) is proven by applying similar steps as in family (i). ∎

1.4 Generating -Diffusions: Dual Transformations

We now consider -diffusions defined by strictly monotonic real-valued mapping with continuous on with unique inverse . Such an elementary (Itô) transformation gives a diffusion process with infinitesimal generator

| (1.12) |

where and are the respective drift and diffusion coefficients:

| (1.13) |

is a regular diffusion on with endpoints and .

The map can be specified so as to create a process with a desired drift or diffusion coefficient. To obtain a linear-drift -diffusion, the drift coefficient is specified by a linear function, i.e. we set . Hence, by the first relation in (1.13), with , , we see that is obtained by solving the 2nd order linear nonhomogeneous ODE:

| (1.14) |

Given any strictly monotonic smooth solution , then is a process with specified affine (linear) drift and having generally nonlinear diffusion coefficient with infinitesimal generator in (1.12), where follows automatically from the second relation in (1.13).

An alternative approach is to specify the diffusion coefficient rather than the drift function. One way is to directly specify a strictly positive function with continuous first derivative. Then, the second equation in (1.13), i.e. , is integrated to give , and its inverse relation , where allows for either a strictly increasing or a decreasing map. Another way is to explicitly specify a strictly nonzero continuously differentiable function , i.e. specify , and then integrate giving , with and as arbitrary constants. The diffusion function is then given by . Either way, the resulting strictly monotonic smooth map is used to produce -diffusions defined by the infinitesimal generator in (1.12) with a specified diffusion coefficient function and a resulting generally nonlinear drift function:

| (1.15) |

This expression follows from the first equation in (1.13) while using (1.5) where , .

By either of the above dual transformation approaches, several families of analytically solvable -diffusion models can be constructed using known solvable underlying -diffusion processes defined by (1.1). The -diffusion models given by (1.12) either have a nonlinear state dependent volatility with a specified affine (linear) drift or have nonlinear state dependent drift with a volatility that is specified as either affine or as nonlinear state dependent. We refer to the above general framework as the “diffusion canonical transformation” methodology.

Lemma 2.

The boundary classification for an -diffusion defined by with strictly monotonic mapping is equivalent to the corresponding -diffusion.

Proof.

This follows trivially by the diffeomorphism . ∎

2 Three Choices of Underlying Solvable Diffusions

2.1 The Squared Bessel Process

Consider a -dimensional squared Bessel (SQB) process obeying the SDE with constants and . This diffusion has regular state space with generator , and scale and speed densities and where . The origin is entrance if , regular if and exit if ; is natural (attracting for ). As a pair of fundamental solutions to , , for we choose

| (2.1) |

where and are the modified Bessel functions (of order ) of the first and second kind, respectively (see [1]). Note that by symmetry . The pair satisfies (1.3) where . For , all Wronskians and are readily obtained using differential recurrences and .

The well-known Green function in (1.4) for the SQB on is readily formed by taking appropriate linear combinations of giving

| (2.2) |

where if or if and 0 is reflecting, and if or if and 0 is killing. In all cases, the Wronskian factor is simply . Laplace inverting the Green function, while using (2.2) and the identity , for , , readily gives the known transition PDF for as

| (2.3) |

for all , and given as above for the respective cases.

The Bessel family of -diffusions has generator in (1.5) with and in defined by the functions in (2.1) for positive real values of and the following lemma gives the boundary classification for these processes.

Lemma 3.

The Bessel family of regular -diffusions on has the following boundary classification: The origin is entrance if , is regular if and , and is exit if and ; is non-attracting (or attracting) natural if (or ).

Proof.

Hence, in all subfamilies (i)–(iii) the point at infinity is a natural boundary. The Bessel subfamily of type (ii), where , is conservative with the origin as an entrance. For subfamilies (i) and (iii), where , the origin is attainable.

From the theory in Section 1.3, we can readily construct Green functions in the form of (1.8) and subsequently obtain the corresponding transition PDF by Laplace inversion. We now give some examples for the Bessel family of -diffusions on . For subfamily (ii), and, without loss of generality, we take , i.e. . The Green function in (1.8) is uniquely specified by

where in this case and . The transition PDF for the Bessel subfamily (ii) is given explicitly via (1.10), upon using the above Laplace inverse identity for order and the property ):

| (2.4) |

, , . We note that this has the form in (1.11) where is given by the r.h.s. of (2.3) for .

For subfamilies (i) and (iii), i.e. , the origin is exit for and regular for . In particular, by specifying the origin as killing for then the process is absorbed at the origin for all . In this case, the Green function in (1.8) is formed by taking and :

with Wronskian and . By using the same above Laplace inversion identities, the corresponding transition PDF is given explicitly via (1.10):

| (2.5) |

, , . Again, note that this has the form in (1.11).

For all processes with , i.e. subfamilies (i) and (iii), the origin is attainable and the distribution of the first-hitting time at the origin, , for the -diffusion started at is readily computed in closed form. Following the theory in [6, 7], the PDF of is given by the limit

| (2.6) |

By substituting (2.5) and making use of the small argument asymptotics of the modified Bessel functions, the above limit is computed explicitly to give

| (2.7) |

where , , , , and is the probability for eventually hitting the origin. For subfamily (i), i.e. , the point at infinity is non-attracting and hence . For subfamily (iii), , the point at infinity is attracting so . The first-hitting time at the origin has the generalized inverse Gaussian distribution. The above PDF generalizes that obtained in [6] where only was considered.

We simply note here that for and , the regular boundary at can also be specified as instantaneously reflecting. In this case, the function is still given as just above, whereas must now satisfy the reflecting condition: . The Green function in (1.8) can then be explicitly constructed from these functions and their Wronskian. Laplace inversion via (1.10) leads to the transition PDF for the Bessel family of -diffusions that are reflected at the origin.

2.2 The CIR Process

Consider the Cox-Ingerssol-Ross (CIR) process [12] on the regular state space with SDE , with parameters , , . By defining the parameters and , the generator for this diffusion is then given by . The respective scale and speed densities are and . [We note that this process is also the squared radial Ornstein-Uhlenbeck process. In fact, setting , and renaming the parameters , , recovers precisely the process discussed on pages 140–142 of [5].] The endpoint is natural. The origin is an entrance if , is a regular boundary if , and is an exit if .

We begin by fixing a suitable pair of fundamental solutions to such that, for positive real values of , and are respectively increasing and decreasing strictly positive functions of . We now choose such a pair of fundamental solutions as follows. For the case (a) (i.e. ) we take

| (2.8) |

and

| (2.9) | |||||

where is the negative part of . In what follows we also denote for the positive part of . The functions and are confluent hypergeometric functions, i.e. the standard Kummer and Tricomi functions, respectively. Note that the alternate forms in (2.8) and (2.9) follow from the relations and where and are the Whittaker functions (see [1]). The last expression in (2.9) follows from the Kummer transformation identity . For , and are obtained by using differential recurrences and . The above functions satisfy (1.3) where , i.e. for and for .

For case (b) (i.e. ) we take 111We note typographical errors at the bottom of page 142 in [5]. The factors and should instead be and in both Green functions for case (B) . Also, the parameter should be in the last Wronskian on page 142 and in the Green function on page 141.

| (2.10) |

and

| (2.11) |

The Wronskian between these two functions is given by (1.3) where , i.e. for and for .

The Green function in (1.4) for the CIR on , for the two cases and , is readily constructed by taking appropriate linear combinations of the functions . In all cases, since is a natural boundary. In case then

| (2.12) |

if or if and 0 is reflecting;

| (2.13) |

if or if and 0 is killing. The Wronskian factor is for the pair in (2.12) and for the pair in (2.13). For the case :

| (2.14) |

if or if and 0 is reflecting;

| (2.15) |

if or if and 0 is killing, where is defined in (2.2). The Wronskian factor for (2.14) and for (2.15).

In all of the above cases, the transition PDF for is readily obtained by Laplace inverting the relevant Green function with the use of the identity

| (2.16) |

for and the property for . In case , Laplace inversion of the Green function in (1.4) for , or and 0 as reflecting, gives the known transition PDF:

| (2.17) |

Similarly, the known transition PDF for in case and , or and 0 as killing, is given by

| (2.18) |

In case (), the transition PDFs follow similarly by Laplace inversion:

| (2.19) |

for , or and 0 as reflecting, and

| (2.20) |

for , or and 0 as killing.

The confluent hypergeometric (CIR) family of -diffusions has generator in (1.5) with respectively increasing and decreasing positive functions and defined by (2.8) and (2.9) for and by (2.2) and (2.2) for , where . The following lemma gives the boundary classification for these processes.

Lemma 4.

The confluent hypergeometric family of -processes on have the same boundary classification as the Bessel family of -processes, as stated in Lemma 3 in terms of the parameters and .

Proof.

As in the Bessel family of -processes, the point at infinity is a natural boundary. The confluent hypergeometric subfamily of type (ii), with , is conservative with the origin as an entrance. For subfamilies (i) and (iii), where , the origin is attainable (regular for and exit for ). Green functions in the form of (1.8) are readily obtained and the corresponding transition PDF for the confluent hypergeometric -processes are then given by Laplace inversion.

Consider case (a) . For subfamily (ii), and we take . The Green function in (1.8) is uniquely specified by and using (2.8) and (2.9):

where and . The transition PDF for the confluent subfamily (ii) follows explicitly by (1.10), using (2.2):

| (2.21) |

where is given by the expression in (2.2) where . Note that (2.2) has the form in (1.11).

For subfamilies (i) and (iii), i.e. , the origin is exit for and regular for . In particular, by specifying the origin as killing for then the process is absorbed at the origin for all . In this case, the Green function in (1.8) is formed by taking and using (2.8) and (2.9):

with Wronskian and speed measure . The transition PDF for this case is obtained in the same fashion as (2.2):

| (2.22) |

where is given by the expression in (2.2) for .

For subfamilies (i) and (iii), i.e. , the origin is attainable and the PDF of the first hitting time at the origin for the -diffusion started at is obtained in closed form by substituting the transition density in (2.22) into (2.6). The limit is computed explicitly by using the small argument asymptotics of the confluent hypergeometric functions and the Bessel- function. This gives the so-called Tricomi PDF:

| (2.23) |

where

| (2.24) |

is the corresponding PDF of the first hitting time at the origin for the (confluent-) subfamily (i) when ; , , , , , . The quantity is the probability for eventually hitting the origin. For subfamily (i), i.e. , the point at infinity is non-attracting and hence . Indeed, from the integral representation of the Tricomi function, we observe that the PDF integrates to unity, i.e. . However, if then since is attracting. The above first hitting time PDFs are valid for all and extend previously derived results for the case [6].

For case (b) the analysis follows in similar fashion as above. For subfamily (ii), , . The Green function in (1.8) is uniquely specified by and using (2.2) and (2.2):

, . The transition PDF for this confluent subfamily (ii) follows by (1.10). In this case,

| (2.25) |

where is given by (2.2) for . Note that (2.2) has the form in (1.11).

For subfamilies (i) and (iii), the origin is exit for and regular for . By specifying the origin as killing for then the process is absorbed at the origin for all . In this case, the Green function in (1.8) is formed by taking and using (2.2) and (2.2):

with Wronskian and speed measure . The transition PDF for this case follows as in (2.2):

| (2.26) |

where is given by (2.2), for , and hence (2.2) has the form in (1.11).

For , the origin is attainable for subfamilies (i) and (iii) with . The PDF of the first hitting time at the origin follows by a similar derivation to the above case for . Substituting (2.2) into (2.6) and computing the limit explicitly by using the small argument asymptotics of the confluent hypergeometric functions and the Bessel- function recovers (2.23) and (2.24), where (2.24) is the PDF of the first hitting time at the origin for the (confluent-) subfamily (i) when . However, now , , , , , . The quantity is again the probability for eventually hitting the origin. The above first hitting time PDFs for both cases (or ) can hence be combined into one expression for and where and with for and for .

2.3 The Ornstein-Uhlenbeck Process

Consider the Ornstein-Uhlenbeck (OU) process with SDE where . Both boundaries, and , of the state space are non-attracting natural. Without loss in generality, we set . Otherwise we can consider the shifted process and the formulas follow by simply shifting , . We define the positive constant so that the generator for the diffusion takes the form . The speed and scale densities are and We note that this corresponds to an OU process indexed by two positive parameters. For brevity, we omit the case where (i.e. ) as the analytical treatment follows very similarly (e.g. see page 137 of [5]). The case where simply corresponds to Brownian motion.

A pair of fundamental solutions to , such that for real values of are respectively increasing and decreasing positive functions for , are

| (2.27) |

where is Whittaker’s parabolic cylinder function (see [1] for definitions and properties). Note the symmetry The Wronskian constant in equation (1.3) is For , and are obtained using differential recurrences .

The boundaries are natural and hence the Green function in (1.4) for is uniquely given by taking and where . The well-known (Gaussian) transition PDF on follows by Laplace inverting the Green function with the use of the identity , for , , giving

| (2.28) |

The OU family of -diffusions has generator in (1.5) with given by (2.27) for real and the following lemma gives the boundary classification for these processes.

Lemma 5.

The OU family of regular diffusions , have the following boundary classification. The endpoint is non-attracting natural if and is attracting natural if . The endpoint is non-attracting natural if and is attracting natural if .

Proof.

3 -Diffusions with Linear Drift

3.1 Construction of the Mapping

We now consider -diffusions having infinitesimal generator (1.12). For driftless diffusions, see [2, 6, 8]. The diffusion coefficient function , as given by (3.6) below, is generally nonlinear and where and are arbitrary real constants such that implies .

The transition PDF for an -diffusion is related to the transition PDF for the underlying (or ) diffusion as follows:

| (3.1) |

where , . Here is the inverse map so that

This methodology was originally developed for driftless -diffusions where . For such cases, the volatility function has the form The map (that solves equation (1.14) for the special case ) admits the general quotient form:

| (3.2) |

where are parameters such that

Lemma 6.

Let and hold. Then the solution to equation (1.14) takes the general form

| (3.3) |

where and are arbitrary real constants.

Proof.

The numerator , defined in (3.3), is a linear combination of and hence solves . The denominator solves . Differentiating and using the identity readily gives

Hence, is a general solution to the corresponding homogeneous ODE (eq. (1.14) for ) since the Wronskian from (1.3). The constant function is a particular solution of (1.14). ∎

The derivative of the mapping in (3.3) is simply

| (3.4) |

where we define the Wronskian

| (3.5) |

Assuming is strictly monotonic, and given an -diffusion, the -diffusion coefficient function is then given by substituting (3.4) into , giving

| (3.6) |

We note that this expression holds for all parameter choices except when and . For the latter special case (i.e. constant nonzero drift function) equation (1.14) reads and hence simply reduces to a linear first order ODE in . Solving leads to various monotonic maps which in turn give rise to nonzero constant drift -diffusions with various nonlinear specifications for the diffusion coefficients. In this paper, we shall not discuss the details of such special families as we focus on linear drift functions with .

3.2 Monotonic Maps

The map in (3.3) does not generally satisfy . To guarantee that is a regular diffusion on the map has to be strictly monotonic. Then and hence the diffusion coefficient function is strictly positive on .

From (3.4) we observe that . Using the representations of and in terms of , gives

| (3.7) |

There are two important cases where is strictly monotonic. Recall that the fundamental solutions and are correspondingly strictly increasing and decreasing functions of . Therefore, the ratios are strictly increasing and decreasing functions, respectively. In particular, we have the strict inequalities and . Thus, the two choices of parameters or in equation (3.3) lead to dual subfamilies of strictly monotonic maps defined by :

| (3.8) |

where and is constant. Other parameter choices that lead to other families of monotonic maps are discussed in Section 4.2. The following propositions are useful in verifying whether or not , and hence , changes sign in .

Proposition 1.

in (3.5) satisfies , and for any the solution admits the following representation:

| (3.9) |

Proof.

The proof follows by direct verification upon using and . ∎

Note that for the driftless case, with , the function is constant and from (1.3) and (3.7): . Therefore, the equation defining for all families of driftless -diffusions is recovered as a particular case of the more general specification given by equation (3.6). Moreover, the specification in (3.6) gives rise to state dependent volatility functions that can also have a dependence on the drift parameters and .

Proposition 2.

Proof.

Under the assumed conditions on and , the function is either strictly positive or strictly negative on . Recall that is strictly positive. Hence, the function given by (3.9) is monotonic in and, since , has at most one zero in . Then implies , i.e. either or for all . ∎

Proposition 3.

Assume that and for the map in (3.3) are both nonzero and have opposite signs.

-

(i)

If , then is either strictly positive or negative on .

-

(ii)

Let and . If and , then . If and , then .

Proof.

By definition of , and the fact that and are respectively increasing and decreasing functions, we have (or ) when , (or , ), i.e. is either a strictly increasing (or decreasing) function. Moreover, it follows from such monotonicity and the boundary conditions of that has exactly one zero, at where . Then, is accordingly strictly positive (or negative). Setting in (3.9) now gives

where if (). Hence, if then either or , for all , in the respective cases. If , then , as given in the last expression, can either have no zeros or at most two zeroes in has no zeros if and only if . This hence proves part (ii) for the respective cases. ∎

From the above propositions, the monotonicity of a map is determined simply by examining the asymptotic behaviour of , as approaches endpoint or . Below we consider three families of -diffusions arising from the three separate underlying diffusions discussed in Sections 2.1 - 2.3; namely, the Bessel, the confluent hypergeometric and the OU families of process. For all these families, the asymptotic properties of the fundamental solutions and of the corresponding Wronskian functions, for the respective underlying -diffusions, are presented in Appendix A .

3.3 Martingale Property

For any time-homogeneous -diffusion defined by (1.12), we introduce the rate of change of the conditional expectation:

| (3.10) |

The transition PDF given by (3.1) satisfies the forward Kolmogorov equation

| (3.11) |

with scale and speed densities given in terms of those for the -diffusion:

| (3.12) |

Here we consider -diffusions with affine drift . Then, using (3.11) within (3.10), applying integration by parts twice and making use of the derivative , gives the rate in (3.10) expressed as a sum:

| (3.13) |

The “bias” term is given by the difference of two limits:

| (3.14) |

The last expression follows by changing variables () and by combining (3.12) and (3.1).

Consider the case where , for any . Then, for such diffusions one obtains a simple representation for the rate of change in (3.13) as

| (3.15) |

i.e. the rate of change of the conditional expectation equals the conditional expectation of the drift function for the process.

If conserves probability, i.e. for all , or if holds, then satisfies the trivial linear ODE , subject to . Let , then there exists a well-known geometric drift solution , i.e. In other words, the “discounted process” is a martingale in case and . Note also that the discounted process is a strict supermartingale (submartingale) when and () for all . Setting recovers the unconditional expectation .

The following theorem now gives necessary and sufficient conditions for the validity of the relation (3.15). These conditions involve limit expressions that can be readily evaluated from the boundary asymptotic properties of the fundamental solutions for the underlying -diffusion. It is implied that the diffusion process has the generator in (1.5) with boundary conditions specified via (1.8). Moreover, we assume that , i.e. , . The map is assumed to be monotonic and given by (3.3) for and by (3.2) for . We note that a similar result and proof for special cases of driftless -diffusions is given in [6].

Theorem 1.

The diffusion , conserves the expectation rate, i.e. the relation (3.15) is true if and only if the following boundary conditions hold:

| (3.16) |

for all complex-valued such that , for some real constant .

Proof.

Assume with sufficiently large such that is analytic in . The condition is then equivalent to the Laplace transform condition . Laplace transforming the second expression within the limits in (3.14), while changing the order of and differentiation, using (1.8) and (1.10), and finally combining both left and right limits gives the condition in the form:

| (3.17) |

For (3.17) to hold true, for all , the two limits must vanish since is a linearly independent pair on . ∎

Remark : We recall from (1.8) that the fundamental solutions for have the form and , where we conveniently define and . Hence, if the left boundary is singular (exit, entrance or natural) or regular killing then . Similarly, for a singular or regular killing right boundary we have .

An important general class of -diffusions follows by setting , i.e. with drift function is now . Such diffusions are useful, for example, for modelling asset prices and for equity option pricing in finance. The corollary below gives necessary and sufficient conditions for the discounted process to be a martingale when . As in Theorem 1, we assume is monotonic and that .

Corollary 1.

4 The Bessel, Confluent Hypergeometric, and Ornstein-Uhlenbeck Families of Affine-Drift -Diffusions

4.1 Three Main Families of Affine Drift Diffusions: Classification and Properties

Using the general construction presented in Section 1 and the three underlying -diffusions from Section 2, we can construct three new families of -diffusions with affine drift as defined by (1.12) and (3.6). For all such new families, the transition PDFs are given in analytically closed form. Generally, a transition PDF is given by (3.1). It is trivially related to the corresponding transition PDF of the -diffusion, where the monotonic map (with its inverse map ) is given in (3.3). In turn, the transition PDF for an -diffusion is expressible in terms of a transition PDF for the underlying via the generating function in (1.6). By choosing the SQB, CIR, or OU diffusions as underlying -diffusion, we respectively obtain the so-called Bessel, confluent hypergeometric, or Ornstein-Uhlenbeck (OU) families of -diffusions with affine drift. Some properties and classification of the corresponding driftless diffusions are discussed in [6]. In the respective sections 2.1–2.3, we have constructed analytically exact transition PDFs on the respective regular state spaces or for the corresponding three main families of -diffusions for subfamilies of type (i) , (ii) and (iii) . The fundamental elementary solutions used in generating these three main families of transformed processes are given by either (2.1), (2.8)–(2.9) or (2.2)–(2.2), or (2.27). The boundary classification for the three respective main families of processes is given in Lemmas 3, 4 and 5. Hence, the boundary classification for the Bessel, confluent hypergeometric and OU families of -diffusions follows immediately via Lemma 2.

Each -diffusion is described by the set of parameters that are inherited from the chosen underlying diffusion. In addition to that set, the nonnegative parameters , and are added due to the measure change . Two parameters and describe the affine drift coefficient in (1.12). Finally, up to two other parameters and are used in the map function. As observed from the diffusion coefficient function in (3.6), the combination of all such parameters make the new diffusions quite flexible for modelling various stochastic processes. Different choices of monotonic maps , , lead to different -diffusions. In any case, the diffusion function is specified by (3.6).

The choice leads to -diffusions that have applications in finance. In particular, the dual maps defined by (3.8) with give rise to sets of dual subfamilies (i) and (ii) of affine drift -diffusions with respective volatility specification:

| (4.1) |

where , with as unique inverse map for the respective subfamilies (i) and (ii) . Both subfamilies have regular state space . Computing the respective Wronskians in equation (4.1) gives the diffusion coefficient function for three main dual subfamilies (i) and (ii) as follows.

For the Bessel family, the maps are (i) and (ii) , where

| (4.2) |

For the confluent hypergeometric family, we define , , for the case , and , for . The dual maps are (i) and (ii) , where () for (). The respective volatility functions for the dual subfamilies are

| (4.3) |

For the OU family of -diffusions the dual subfamilies (i) and (ii) coalesce into a single family of processes. This follows by the reflection symmetry . In this case we have . Moreover, the respective maps of subfamilies (i) and (ii) coincide upon interchanging . Hence, the diffusion functions (i) and (ii) in (4.1) are identical. We can therefore consider a single map defined by the increasing function giving the volatility function

| (4.4) |

where , . In all of the above volatility functions, the value is given by the respective inverse map.

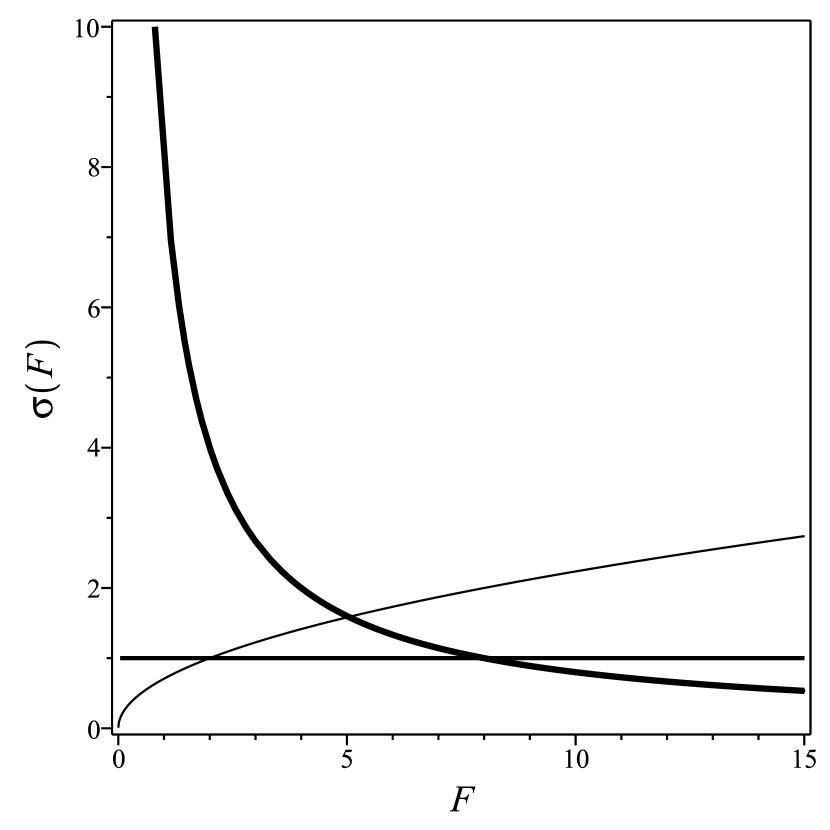

Subsets of these diffusion families with have regular state space and are useful for modelling asset prices in finance. Figures 1 and 2 display some computed curves of the local volatility function for the subfamilies in equations (4.2i), (4.3i) and (4.4) when . These three main subfamilies (respectively named here as the Bessel-, Confluent- and OU models) are of interest since, according to Proposition 4 below, the discounted processes obey the martingale property. By using the respective asymptotic properties of the fundamental functions provided in Appendix A, we derive the following asymptotic relations for the local volatility functions of these subfamilies. For :

where denote some positive constants. For the case , , as , for both Bessel- and Confluent- models where are positive constants. As duals to the Bessel- and Confluent- models, we refer to the respective subfamilies of type (ii) above as the the Bessel- and Confluent- models. By similar analysis, asymptotic expressions for the local volatility functions of such models can also be readily derived.

As seen in Figures 1 and 2, by adjusting parameters, the models are all readily calibrated to attain a prescribed level of local volatility for a given value of . The respective sets of freely adjustable model parameters for the Bessel, Confluent and OU subfamilies are: (), () and ().

The following proposition characterizes the Bessel, confluent hypergeometric, and Ornstein-Uhlenbeck families of -diffusions with linear drift in terms of the conservation of the expectation rate and the martingale property of the discounted process. This result generalizes the special results obtained previously for the driftless families of -diffusions (see [6]).

Proposition 4.

Consider the Bessel, Confluent and OU regular diffusions , with linear drift function and nonlinear diffusion functions defined by (4.2)–(4.4), respectively. Then,

-

(1)

the discounted processes of the Bessel- and Confluent- subfamilies (i), with origin specified as killing in case , are martingales for all allowable choices of the model parameters;

-

(2)

the discounted processes of the Bessel- and Confluent- subfamilies (ii), are strict supermartingales for all allowable choices of the model parameters;

-

(3)

the discounted processes of the OU family are martingales for all allowable choices of the model parameters.

Proof.

The martingale property, for the discounted Bessel and Confluent subfamilies (i) and for the discounted OU family, is proven by applying Corollary 1, where and , and , i.e. . The boundary conditions in (3.18) now read and , which hold true by letting in the asymptotic Wronskian relations in Appendix A for the respective SQB, CIR and OU processes (where for the SQB and CIR and for the OU). For the discounted Bessel and Confluent subfamilies (ii): , . In this case the left and right limits in (3.18) evaluate to and , for real values of . This implies that in (3.14), i.e. the strict supermartingale property holds. ∎

4.2 Classification of Monotonic Maps

In addition to the set of monotonic maps defined by (3.8), there are four other classes of maps, as follows:

| (4.5) | |||||

| (4.6) |

where , , and with the only exception of for which one of may be zero. Notice that we omit the additive term .

As follows from Proposition 2, a function for defines a monotonic map if and only if the Wronskian has the same sign in neighbourhoods of both endpoints and . For the map in (4.6), monotonicity follows from Proposition 3 when . If , then we again need to analyse the asymptotic behaviour of , and hence of , as and . The asymptotics of such Wronskians are given in Proposition 5 of Appendix A. The following lemma summarizes the monotonicity properties for all families of maps presented so far.

Lemma 7.

Let be the fundamental solutions for the SQB, CIR, or OU diffusion process. The maps , , defined in (3.8), (4.5) and (4.6), are strictly monotonic under the following conditions: — for all choices of parameters; — if ; — if ; — if and only if . The derivative , , has sign = . For cases 2 and 5 we have: and .

5 The Bessel Family of Mean-Reverting -Diffusions

Let us come back to the -process with generator (1.5). Consider a strictly monotonic twice continuously differentiable map with inverse . Such a map generates a diffusion process with generator in (1.12). We recall that a linear-drift -diffusion is obtained by requiring that solves equation (1.14). An alternative approach is to fix the diffusion coefficient and then find by integrating the derivative . For simplicity we assume that is a combination of elementary functions such as power and exponential functions.

Here we are interested in diffusions with nonlinear mean-reverting drift . That is there exists so that and for all with . The drift coefficient is a continuous function and it is sufficient to check whether and hold. To find maps that generate such diffusions, we analyze the asymptotic behavior of the function as approaches or . There are two cases. If (i.e. the mapping is increasing), then we need to verify that and . If (i.e. the mapping is decreasing), we verify that and . Here we assume that if (or ) as (where ), then (or ).

Below, as explicit examples, we consider families of nonlinear mean-reverting -diffusions generated from the SQB process. Clearly any other underlying diffusion generates its own family of models.

5.1 One Special Case with a Linear Mapping

Consider one special case where the derivative is constant, i.e. for some real and , with -process of subfamily (ii) generated from the SQB process with , . Without loss of generality, let and consider the case where , i.e. with map , . By (1.15), the drift is now , . By the differential recurrence property of the Bessel-K function, . Hence, the -diffusion satisfies the SDE

Using large and small argument asymptotic properties of the Bessel function gives the following limits for the drift coefficient:

Therefore, the above model admits a mean-reverting drift coefficient for all : the drift approaches a positive constant at the left endpoint and becomes increasingly negative in proportion to the square-root of the process value as it approaches the right endpoint . The diffusion coefficient is a square-root function: . Thus, this model can be viewed as a (nonlinear drift) modification of the CIR short-rate model.

We recall from Lemma 3 that the above process (with ) has origin as regular when and exit when . As an interest (short)-rate model with mean-reversion, we take . In this case, the origin is regular and may be specified as either killing or reflecting. Specifically, we now specify the origin as killing for . Hence, the transition PDF is given explicitly by (2.5), i.e. has the form in (1.11) with and given by (2.3) with . Based on this connection between the and SQB processes, the following result provides us with a closed-form integral expression for all that may be useful for pricing a zero-coupon bond in case and wherein the interest rate process is modeled as .

Lemma 8.

Consider the Bessel subfamily (ii) of -processes started at , with transition PDF in (2.5) where . Let and assume , , , then

| (5.1) |

where , .

Proof.

By conditioning on the terminal value, is given by

where the conditional expectation is equivalent to the expectation of the negative exponential of the time integrated Bessel Bridge -process that is started at and pinned at at time . Now, since has the form in (1.11), where is given by (2.3) with , it follows that the Bessel Bridge -process has the same probability law as the corresponding Squared Bessel (SQB) Bridge process. That is, given any partition , the path probability densities of the Bridge -process and corresponding SQB Bridge -process are equivalent: . Hence, the conditional expectation reduces to that of the SQB Bridge process, i.e. . The latter is given explicitly (e.g. see equation (2.m) in [19] or page 76 in [5], which we adapt for all ; see also [20]):

. Equation (5.1) is now obtained by inserting this expression and the explicit form of into the above integral. ∎

5.2 The Case with a Power Mapping

Let us consider the important case of a power-type mapping function. Suppose that with , , then the derivative of the mapping is

As is seen from the above equation, is monotonically increasing if ; it is monotonically decreasing if . Assume that since for the power-type mapping reduces to a linear mapping studied in Section 5.1. The mapping is then obtained by integration of over if is increasing (or over if is decreasing):

| (5.2) |

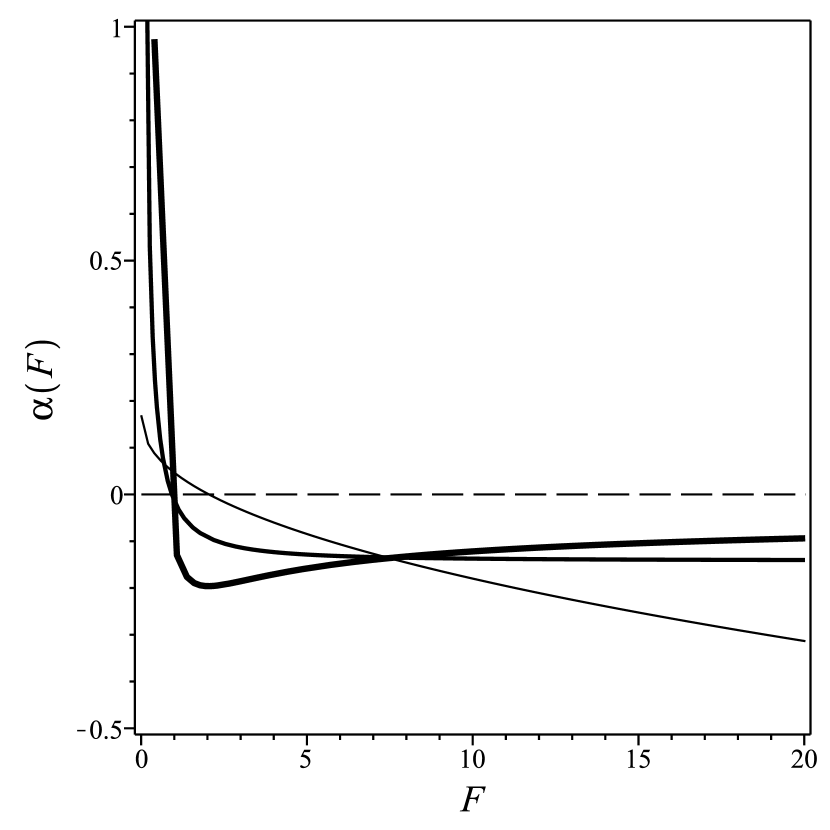

The condition guarantees that the function is monotonic. Such a mapping produces a mean-reverting model under the conditions stated in Lemma 9. Plots of typical drift and diffusion coefficients, and , are given in Figure 3.

Lemma 9.

-diffusions generated from the SQB -process with the use of the mapping function defined in (5.2) have the following properties.

-

(i)

: The diffusion is non-exploding and mean-reverting if , (i.e. is monotonically increasing), and . The diffusion coefficient is

The drift coefficient has the following asymptotic properties:

where and are positive constants.

-

(ii)

: The diffusion is not mean-reverting for every choice of .

Proof.

The proof follows directly from asymptotic properties provided in Appendix A. ∎

5.3 The Case with an Exponential Mapping

Another possible choice of the mapping is a combination of power and exponential functions. Let us consider a mapping with derivative

| (5.3) |

where and (otherwise this case reduces to that with a power-type mapping considered in Section 5.2). Here we assume that . The case with a purely exponential mapping can be studied similarly. The mapping is monotonically increasing if ; it is monotonically decreasing if . is obtained by integrating its derivative in (5.3). If is increasing () then obtains via integration of (5.3) over . Zero is an integrable singularity if either or . If is decreasing () then the mapping is given by integration of (5.3) over . The derivative is integrable at infinity if either or .

Therefore, to guarantee that the function with its derivative given in (5.3) is monotonic and maps onto , we have the following sets of conditions. For a monotonically increasing , , , and either or hold. For a monotonically decreasing , , , and either or hold. The resulting mapping has the following properties:

| (5.4) |

Lemma 10.

The -diffusion generated from the SQB -process with the use of the mapping function is non-exploding and mean-reverting in the following cases.

-

(i)

: The mapping is monotonically increasing with , , , and . The diffusion and drift coefficients, and , have the following asymptotic properties:

where , , , and are positive constants ( and are the same as those in Lemma 9).

-

(ii)

: The mapping is monotonically decreasing with , , , , and (hence, ). The coefficients and satisfy

where , , , and are positive constants ( is the same as in Lemma 9).

-

(iii)

: The mapping is monotonically increasing with , , , and . The coefficients and satisfy

where , , , and are positive constants ( is the same as in Lemma 9).

Proof.

The proof follows directly from asymptotic properties provided in Appendix A. ∎

6 Conclusions

By applying a diffusion canonical transformation method, which combines special classes of monotonic mappings and measure changes via Doob-h transforms, this paper developed various new families of exactly solvable multiparameter one-dimensional time-homogeneous diffusion models. These multiparameter families of solvable diffusions are generally divided into two main classes; the first class is specified by having affine (linear) drift with various resulting nonlinear diffusion coefficient functions, while the second class allows for various specifications of a (generally nonlinear) diffusion coefficient with a resulting nonlinear drift function. The present paper hence significantly extends the diffusion canonical transformation methodology to include all of the more restrictive families of driftless diffusions that were obtained and applied in previous literature (e.g., see [2, 6]). Moreover, the second main class of diffusions gives rise to various solvable models with both nonlinear diffusion and nonlinear drift coefficients. In particular, within this second class of diffusions we have found some explicitly solvable diffusion families with a nonlinear mean-reverting drift. By combining the closed-form transition probability densities for the Doob-h transformed processes and the fact that an underlying bridge process and its Doob-h transformed bridge process have equivalent probability laws, we derived some closed-form integral formulas for conditional expectations of functionals involving the discount factor of the process and the process terminal value. An explicit example involving the Squared Bessel process is given. The formulas are readily applicable to standard bond and bond option pricing.

This paper has also presented the construction of the Green functions for the Doob-h transformed processes and has given a complete boundary classification of such processes that can generally have singular and/or non-singular (regular) endpoints. Various closed-form transition densities for these transformed processes then followed simply by Laplace inverting the relevant Green functions. For Doob-h transformed processes with imposed boundary conditions (e.g. regular killing or reflecting) at any interior point(s) of the diffusion, the Laplace inversion formulation in this paper is also readily applicable. This method produces various closed-form spectral expansions of the transition densities for such cases. Moreover, solvability (e.g. closed-form spectral expansions) is not restricted to only transition densities. In fact, analytically closed-form spectral expansions of the densities and distributions for the first hitting (exit) times at any interior level(s), for the extrema of the process, and for various joint extrema and process terminal value, have recently been derived for all the families of Doob-h transformed processes developed in this paper. The derivations of such closed-form spectral expansions and their applications in finance is the subject of a related paper ([7]).

For the first class of affine drift diffusions, yet another important component of this paper is Theorem 1. In particular, Corollary 1 provides us with a simple way to classify the respective discounted processes in terms of the martingale property. This is of importance in the standard realm of arbitrage-free equity derivative pricing where discounted asset price processes are required to be martingales in a given (risk-neutral) equivalent martingale measure. We have presented three new explicit families of such solvable diffusions, named Bessel, confluent hypergeometric, and Ornstein-Uhlenbeck families. These affine drift processes, having nonlinear (skew and smile-like) local volatility functions, are useful for modeling asset prices and derivative pricing. In particular, for a number of subfamilies of these models the discounted asset prices are martingales while for other (dual) subfamilies the discounted asset prices are strict supermartingales. Analytically exact closed-form expressions for transition densities and state-price densities are obtained for these families of nonlinear local volatility models in terms of known special functions (i.e., modified Bessel, confluent hypergeometric, hypergeometric). Subfamilies of these new models nest the constant elasticity of variance (CEV) diffusion model and other related models as special cases, and have been shown to exhibit a wide range of implied volatility surfaces with pronounced smiles and skews (see [6, 8, 9] for further details). Moreover, exact path sampling methods are available for all models presented in this paper (see [8, 18]). Examples of actual calibrations of the affine Ornstein-Uhlenbeck family of affine drift diffusions to various market option data are contained in [10].

Appendix A Asymptotics of Fundamental Solutions and Wronskians

Throughout this appendix, we let , and be complex-valued parameters with positive real parts and obtain the leading term asymptotic expressions for , as approaches either left or right boundary point of the respective process. The expressions follow by using known asymptotic formulas for either the modified Bessel, confluent hypergeometric, or parabolic cylinder functions. The corresponding asymptotic forms for the Wronskians then follow: for the OU process in A.3, these obtain directly from the asymptotic expressions of and their derivatives, whereas for A.1 - A.2 we first make use of the differential recurrence relations of the modified Bessel (or Kummer functions) and then apply corresponding asymptotic forms of .

Throughout parts A.1, case (a) of A.2, and A.3 of this appendix we denote , , . Throughout this appendix we also adopt the usual notation , and is the standard digamma function.

A.1 The SQB process

-

(i)

Asymptotic forms of the fundamental solutions defined by (2.1):

-

(ii)

Asymptotic forms of the Wronskian functions as :

-

(iii)

Asymptotic forms of the Wronskian functions as :

Note that for power functions of the form , with and , the principal value is used.

A.2 The CIR process

Case: (a) ().

- (i)

-

(ii)

Asymptotic forms of the Wronskian functions as :

-

(iii)

Asymptotic forms of the Wronskian functions as :

Case: (b) (). In (i)–(iii) we denote , , .

A.3 The Ornstein-Uhlenbeck process

-

(i)

Asymptotic forms of the fundamental solutions:

-

(ii)

Asymptotic forms of the Wronskian functions as :

-

(iii)

Asymptotic forms of the Wronskian functions as :

A.4 Asymptotic Properties of Wronskians of the Fundamental Solutions

Proposition 5.

Let and be positive real parameters. For the three underlying diffusions, namely, the SQB, CIR, and OU diffusions defined in Sections 2.1–2.3, we have the following limits for the Wronskians of the fundamental solutions:

with constant for the SQB and CIR diffusions. Here for () and we define as well as . The convergences are monotonic, i.e. and (or and ) where (or ) as approaches an endpoint.

Proof.

Proposition 6.

is an increasing function of for any .

Proof.

First, notice that and for . We have that for . Therefore, is increasing on , since the digamma function is an increasing function on . Let , hence . Take the logarithmic derivative of to obtain . Thus, is increasing on . Since is a continuous function on , the assertion is proved. ∎

Acknowledgements

The authors acknowledge the support of the Natural Sciences and Engineering Research Council of Canada (NSERC) for discovery research grants.

References

- [1] Abramowitz, M. and Stegun, I. A. (1972). Handbook of Mathematical Functions, Dover, New York.

- [2] Albanese, C., Campolieti, G., Carr, P. and Lipton, A. (2001). Black-Scholes goes hypergeometric, Risk 14 99–103.

- [3] Albanese, C. and Campolieti, G. (2005). Advanced Derivatives Pricing and Risk Management: Theory, Tools, and Hands-on Programming Applications. Elsevier Academic Press.

- [4] Albanese, C. and Kuznetsov, A. (2009). Transformations of Markov processes and classification scheme for solvable driftless diffusions. Markov Process. Relat. Fields, 15(4) 563–574.

- [5] Borodin, A. N. and Salminen, P. (2002). Handbook of Brownian Motion – Facts and Formulae, Series: Probability and its Applications, 2nd ed. Birkhäuser Basel,

- [6] Campolieti, G. and Makarov, R. (2012). On properties of some analytically solvable families of local volatility diffusion models. To appear in Mathematical Finance 22(3).

- [7] Campolieti, G. (2011). Closed-form spectral expansions for new families of diffusions in finance: first-hitting time densities and lookback option pricing. Working paper.

- [8] Campolieti, G. and Makarov, R. (2007). Pricing path-dependent options on state dependent volatility models with a Bessel bridge, International Journal of Theoretical and Applied Finance 10 1–38.

- [9] Campolieti, G. and Makarov, R. (2008). Path integral pricing of Asian options on state dependent volatility models. Quantitative Finance 8(2) 147–161.

- [10] Campolieti, G., Makarov, R. and Vasiliev, A. (2011). Bridge copula model for option pricing. arXiv:1110.4669.

- [11] Carr, P., Laurence, P. and Wang, T.-H. (2006). Generating integrable one dimensional driftless diffusions. Comptes Rendus Mathematique 343(6) 393–398.

- [12] Cox, J. C., Ingersoll, J. E. and Ross, S. A. (1985) A theory of the term structure of interest rates. Econometrica 53 385–407.

- [13] Henry-Labordere, P. (2007). Solvable local and stochastic volatility models: supersymmetric methods in option pricing. Quantitative Finance 7(5) 525–535.

- [14] Karlin, S. and Taylor, H. E. (1981). A Second Course in Stochastic Processes. Academic Press.

- [15] Kuznetsov, A. (2004). Solvable Markov processes. Ph.D. thesis, University of Toronto.

- [16] Linetsky, V. (2004). The spectral decomposition of the option value. International Journal of Theoretical and Applied Finance 7 337–384.

- [17] Linetsky, V. (2004). Lookback options and diffusion hitting times: a spectral expansion approach. Finance and Stochastics 8 373–398.

- [18] Makarov R. N. and Glew, D. (2010). Exact simulation of Bessel diffusions. Monte Carlo Methods and Applications 16(3) 283–306.

- [19] Pitman, J. and Yor, M. (1982). A decomposition of Bessel bridges. Z. Wahrsch. Verw. Gebiete 59 425–457.

- [20] Revuz, D. and Yor, M. (1999). Continuous Martingales and Brownian Motion, 3rd ed. Springer, Berlin.