Cooperative Game Theoretic Bid Optimizer for Sponsored Search Auctions

Abstract

In this paper, we propose a bid optimizer for sponsored keyword search auctions which leads to better retention of advertisers by yielding attractive utilities to the advertisers without decreasing the revenue to the search engine. The bid optimizer is positioned as a key value added tool the search engine provides to the advertisers. The proposed bid optimizer algorithm transforms the reported values of the advertisers for a keyword into a correlated bid profile using many ideas from cooperative game theory. The algorithm is based on a characteristic form game involving the search engine and the advertisers. Ideas from Nash bargaining theory are used in formulating the characteristic form game to provide for a fair share of surplus among the players involved. The algorithm then computes the nucleolus of the characteristic form game since we find that the nucleolus is an apt way of allocating the gains of cooperation among the search engine and the advertisers. The algorithm next transforms the nucleolus into a correlated bid profile using a linear programming formulation. This bid profile is input to a standard generalized second price mechanism (GSP) for determining the allocation of sponsored slots and the prices to be be paid by the winners. The correlated bid profile that we determine is a locally envy-free equilibrium and also a correlated equilibrium of the underlying game. Through detailed simulation experiments, we show that the proposed bid optimizer retains more customers than a plain GSP mechanism and also yields better long-run utilities to the search engine and the advertisers.

Index Terms:

Bid Optimizer, Sponsored Search, Cooperative Game Theory, Nash bargaining, Nucleolus.I Introduction

Sponsored search auctions have been studied extensively in the recent years due to the advent of targeted advertising and its role in generating large revenues. With a huge competition in providing the sponsored search links, the search engines face an imminent problem which can be called as the retention problem. If an advertiser (or alternatively bidder) does not get satisfied because of not getting the right number of clicks or the anticipated payoff, he could drop out of the auction and try sponsored links at a different search engine.

I-A Motivation: Retention of Advertisers in Sponsored Search Auctions

Our motivation to study the retention problem is driven by the compulsions faced by both the search engine and the advertisers.

From the advertisers’ perspective, choosing their maximum-willingness-to-pay such that they get an attractive slot subject to their budget constraints is a challenging problem. The search engines can use various mechanisms for the sponsored search auction as described in [6, 11] but the most popular mechanism is the generalized second price (GSP) auction since it is simple and yields better revenue to the search engine. In the most simple version of GSP, where there are slots and advertisers (for simplicity assume ), the allocation and payment rule are as follows. The allocation rule is that advertisers are ranked in descending order based on their bids, with ties broken appropriately, and top advertisers’ advertisements are displayed. The payment rule is that every advertiser needs to pay bid amount of the advertiser who is just below his slot and last advertiser is charged the highest bid that has not won any slot. If the non-truthful GSP auction [13] is used by the search engine, the bidders will have an incentive to shade their bids. The bidders would not want to use complicated and computationally intensive bidding strategies as the bidding process is done many times (typically thousands of times) in a day. These advertisers generally build their own software agents or employ third party software agents, which adjust and readjust the bid values on behalf of these advertisers. The bidders typically specify their maximum willingness-to-pay for their keywords for any given day. Hence each keyword has a specific set of bidders bidding on it for the whole day. This scenario constitutes a repeated game between all the bidders bidding for that keyword. In this game, bidders who cannot plan their budget effectively may experience less utilities and thus may drop out of the system.

We now turn to the search engine’s perspective of the retention problem. When the bidders try to know each others’ valuations by submitting and resubmitting bids, they may find a set of strategy profiles which may yield all of them better payoffs. This may lead to collusion among the bidders. Folk theorems [4] suggest that players may be able to increase individual profits by colluding thereby decreasing the search engine’s revenue. Even though the bidders in the keyword auctions are competitors, this collusion against the search engine could be stable. Vorobeychik and Reeves [10] studied this phenomenon and illustrated a particular collusive strategy which is better for all the bidders (hence worst for the search engine) and can be sustainable over a range of settings. Feng and Zhang [3] showed that dynamic price competition between competing advertisers can lead to collusion among them. However, in this dynamic scenario, when the discounted payoffs of the bidders under the collusive strategy are considered, the stability of collusion depends inversely on the number of bidders [4]. That is, the lower the number of bidders in the system, the higher is the stability of the collusion. This motivates us to study the bidder retention problem for the search engine.

Also, due to exponential growth in the space of online advertising and intense competition among the search engine companies, the switching cost for the advertisers to change from one search engine to another is almost zero [6]. Hence, it is imperative for the search engine companies to retain their advertisers to safeguard their market share. Driven by this, the search engine companies have introduced many value added tools, such as bid optimizer, to maximize the bang-per-buck for the bidders. In what follows, we describe the bid optimizer’s role in solving the retention problem.

I-B Bid Optimizers

A bid optimizer is a software agent provided by the search engine in order to assist the advertisers. The bidders are required to provide to the bid optimizer a target budget for the day and a maximum willingness-to-pay. Bid optimizers, currently provided by the search engines, promise to maximize the revenue of advertisers by adjusting the bid amount in each round of the auction based on the projected keyword traffic and remaining budget.

It can be seen that the decisions made by the bid optimizer are crucial to both the search engine and the set of advertisers, who choose to use the bid optimizer. Hence, the objective of a typical bid optimizer is to strike a balance between reduction in revenue of the search engine company versus increase the retention of advertisers. This objective is achieved by providing enhanced utilities to the advertisers, thus ensuring retention of customers, thereby sustaining high levels of revenue to the search engine company in the long run. Designing such intelligent bid optimizers is the subject of this paper.

There are some problems involved in designing bid optimizers.

-

1.

For the search engine, maximizing its short-term revenue (that is, its payoff in a one-shot game) seems to be a viable option. But here, the lower valuation bidders are denied slots due to allocative efficiency concerns. For the bidders, as shown by Cary et al [1], where all the high valuation bidders use a particular greedy strategy, it has been proved that none of the bidders except the top bidders get the slots after a certain number of rounds of the auction. The above phenomenon can permanently drive away low valuation bidders from the search engine.

-

2.

Dropping out of the search engine to get better utilities in another search engine is a possible option for the bidders. The low valuation bidders drop out after not getting slots for a certain period of time. The higher valuation bidders can observe this trend and shade their maximum-willingness-to-pay or collude to get better utilities. This may result in the search engine losing revenue. This is a threat to the search engine from the bidders. However, if a large number of bidders remain in the system, the collusion is not stable. The intuition for this is that, high valuation bidders cannot reduce their bids sharply, since they will have the fear of undercutting the lower valuation bidders present in the system and thus losing out on their slots.

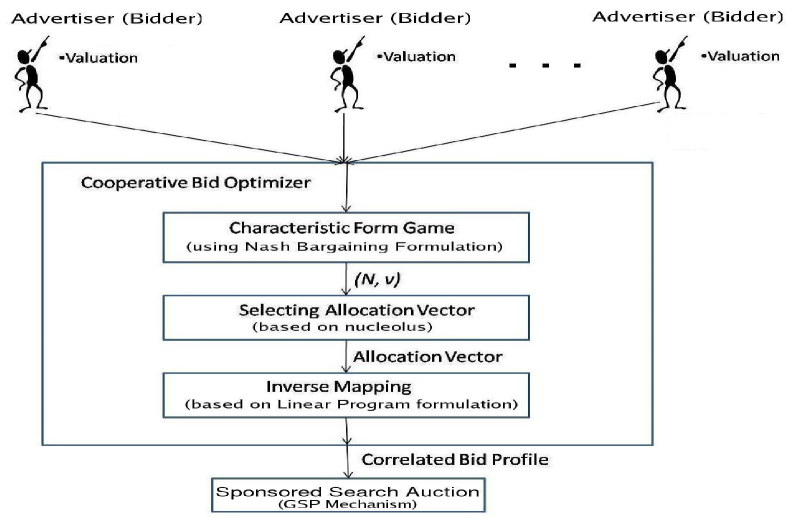

Hence, we propose that retaining more number of bidders solves all the problems discussed above. The dependence of the search engine and the bidders on each other for mutual benefit motivates us to use a cooperative approach in general. The above threat model naturally directs us towards using a Nash bargaining model in particular. Our solution can be seen as associating the bid optimizer to a keyword rather than bidders as done by the existing bid optimizers. The overall model of the bid optimizer is depicted in Figure 1.

I-C Contributions and Outline of the Paper

In this paper, we propose a bid optimizer that uses many ideas from cooperative game theory. The bid optimizer is shown in Figure 1.

-

•

The inputs to the bid optimizer are the willingness-to-pay values (or valuations) of the bidders.

-

•

The output of the bid optimizer is a correlated bid profile, which, when input to a standard GSP auction mechanism, yields utilities to the search engine and the advertisers satisfying the goals set forth in the paper.

-

•

The bid optimizer first formulates a characteristic form game involving the search engine and the advertisers. The value for each coalition is defined based on a novel Nash Bargaining formulation with the search engine as one player and a virtual player aggregating all advertisers in that coalition as the other player. The idea of using Nash Bargaining is to ensure a fair share for the search engine and the advertisers.

-

•

The nucleolus of the above characteristic form game is selected as the utility profile for the search engine and the advertisers. The choice of nucleolus is based on key considerations such as, bidder retention, stability, and efficiency.

-

•

The utility profile represented by the nucleolus is mapped to a correlated bid profile that satisfies individual rationality, retention, stability and efficiency. A linear programming based algorithm is suggested for this purpose.

We carry out experiments to demonstrate the viability and efficacy of the proposed bid optimizer. We show, using a credible bidder drop out model, that the proposed bid optimizer has excellent bidder retention properties and also yields higher long-run revenues to the search engine, when compared to the plain GSP mechanism.

The outline of the paper is as follows. Section II-A1 presents the details of the bid optimizer and introduces the model. In Section II-A3, we present a bid optimization algorithm which uses the Nash Bargaining approach for ensuring the retention of bidders in the system. We then map this fair share for the aggregated bidder to a correlated bid profile in Section II-C. We analyze the properties of our method in Section II-D. We present our experimental results in Section III and conclude the paper in Section IV.

II Our Approach to Bid Optimization

In this section, we present our algorithm for bid optimization. The algorithm can be divided into three phases as shown in Figure 1: (1) Characteristic form game definition using Nash bargaining, (2) Computing the utility vectors for the players and (3) Inverse mapping of the utility vector into a correlated bid profile. These are discussed in the following sections. The notation in the remainder of the paper is presented in Table I.

II-A Characteristic Form Game

II-A1 The Model

The sponsored search auction scenario we consider has bidders competing for slots of a keyword. We assume that the probability that a bidder gets clicked on the th slot (or the click-through rate ) is independent of the bidder ,that is, and we also assume that . Each bidder specifies his maximum willingness-to-pay to the bid optimizer. The bid optimizer takes as input all the ’s of the bidders and suggests them a correlated bid profile. This bid optimization algorithm needs to be invoked only when the number of bidders in the system or their willingness-to-pay change. We also assume that the bid of the player could be any real number in .

Given the above model, we define a bargaining problem 111Refer Appendix for the definition of Nash bargaining problem between the search engine and the aggregated bidder and analyze its properties which will help us in formulating a characteristic form game.

| Notation | Explanation |

|---|---|

| Auctioneer | |

| Aggregated bidder | |

| Total number of players | |

| Total number of slots. We assume | |

| Set of bidders | |

| Set of slots | |

| Maximum willingness-to-pay of advertiser | |

| Strategy set of bidder | |

| Set of all bid profiles | |

| Bid profile | |

| Utility of bidder on bid profile | |

| Utility of the auctioneer in the | |

| Nash bargaining formulation for bid profile | |

| Utility of the aggregated bidder in the | |

| Nash bargaining formulation for bid profile | |

| Click through rate of any bidder in the slot |

II-A2 Characterization of the Nash Bargaining Solution

The motivation for a cooperative approach is the dependence of the search engine and bidders on each other for their mutual benefit. Given this, the motivation behind choosing a bargaining approach is that the amount of short-term loss (or in other words, the investment of the search engine) for the auctioneer should be chosen based on the bidders present in the system. The Nash bargaining approach provides a framework for this amount to be chosen by the search engine by considering all the bidders as one aggregate agent whose bargaining power depends on all the maximum willingness-to-pay of all the bidders present in the system.

The utility of the aggregated bidder is the sum of the utilities of all the bidders over all possible allocations of slots (outcomes). Now, the bargaining utility space becomes the two dimensional Cartesian space which consists of the utility of auctioneer on one axis and the aggregate bidder’s utility on the other axis. Hence a bargaining solution on this space provides a good compromise for the search engine from its maximum possible revenue and thus gives the required investment of the search engine.

The bargaining space is defined in two dimensional Cartesian space, with utility of auctioneer along the axis and the utility of aggregated bidder along the axis. Let and be the maximum possible utilities of the auctioneer and the aggregated bidder respectively. It can be clearly seen that the value is attained for the bid profile for which the corresponding (say). Similarly, the bid profile yields the utility pair . Since it is theoretically possible that all the bidders can collude and bid , we choose the point in this Nash bargaining space as the disagreement point. Ramakrishnan et. al studied this problem in [8] and characterized the solution to this Nash bargaining(NBS) as

II-A3 Definition of the Characteristic Form Game

We use the above model to define Nash bargaining solution where is the set of bidders participating in the auction.

Let be the set of all bidders and let represent the search engine. The characteristic form game for each coalition is now defined as

where is defined as above. If the search engine is not a part of the coalition, its worth is zero since the players cannot gain anything without the search engine displaying their ads. Otherwise, we associate the sum of utilities in the corresponding Nash bargaining bid profile for that coalition with the search engine as the worth of each coalition. This characteristic function defines the bargaining power of each coalition with the search engine.

II-B Computing a Utility Vector for the Players: Use of Nucleolus

Since there is an aggregation of the bidders’ revenue taking place in the NBS, we map the utility of the aggregated bidder in the Nash bargaining solution to a correlated bid profile. The NBS gives an aggregate amount of investment the search engine has to make on all the bidders. This investment increases the utility of the aggregated bidder. This utility has to be distributed to the bidders in a way that our goal of retention is reached. Ideally, we would like the allocation to have the following properties.

-

•

The bidders must not have incentive for not participating in the bid optimizer (individual rationality-IR).

-

•

It must retain as many bidders as possible(retention).

-

•

The bidders must not have the incentive to shade their maximum willingness to pay (incentive compatibility).

-

•

It should be stable both in the one-shot game of GSP and in the cooperative analysis (stability).

-

•

It should divide the entire worth of the grand coalition among all the bidders (efficiency).

There are several solution concepts in cooperative game theory that one could employ here,for example, the core, the Shapley value, the nucleolus, etc. We believe the nucleolus is clearly the best choice that satisfies a majority of the above properties. Since nucleolus is defined as the unique utility vector which makes the unhappiest coalition as less unhappy as possible [9], and given that the nucleolus is always in a non-empty core, it is the utility vector that retains the most number of bidders if the core is empty and is the most stable one retaining all the bidders if the core is non-empty. We compute the nucleolus by solving a series of linear programs [4, 5] and obtain the utility vector for the players and the search engine ().

II-C Mapping the Utility Vector to a Correlated Bid Profile

II-C1 Obtaining a locally envy-free bid profile for each valid coalition

To satisfy the stability criterion in the non-cooperative sense, and ensure truthful participation of all the bidders in the proposed bid optimizer, we aim to find out locally envy-free bids for each of the possible sets of winning bidders. For finding these bids, consider a subset of bidders and allocate slots to the bidders in this subset in the sorted order of their willingness-to-pay values to satisfy the requirement for the locally envy-free equilibrium. Now, the bids can be calculated as follows. The bidder bids the reserve price (assumed to be here without loss of generality). The bid of the bidder (who pays ) is now calculated by solving for in to satisfy the envy-freeness. Once we obtain , we proceed recursively by replacing the by and by in the above equation to get and so on till we get the bids of all the players. Note that the bid of the first player does not have a role here as long as it is greater than the next highest bid. Thus we obtain a set of bids which are in locally envy-free equilibrium.

II-C2 Obtaining a correlated bid profile

The solution given by the nucleolus provides a utility for each bidder. This cannot be used directly in the GSP auction of the search engine. Towards this end, we map the nucleolus to a correlated bid profile which defines the required rotation among the bidders for occupying the slots. This correlated bid profile is what is finally suggested by the bid optimizer, which retains the maximum number of advertisers without hurting the search engine.

The characterization of a correlated bid profile corresponds to assigning the probabilities associated with each of the bid profiles associated with the bidders. There exist several algorithms in general, for finding the correlated bid profile. But we would like to exploit the structure of the problem and obtain a simpler solution without going into the complex details about modifying the ellipsoid algorithm as done in most of the work in this area. See [7] for example. Any correlated strategy we consider here has a subset of size bidders bidding their corresponding LEF (locally envy-free) bids (obtained in the previous section) and all other bidders bidding the reserve price. Considering only these strategy profiles corresponding to each subset of size bidders winning the slots would suffice since they exhaust all the possible outcomes of the underlying GSP auction.

The probability distribution which yields the utilities suggested by the nucleolus to the players is any distribution which satisfies the constraints that it is a probability distribution, it is individually rational for each player and it must yield the payoffs suggested by the nucleolus to the bidders subject to their budget constraints. This can be obtained by solving a linear program as follows.

subject to

where denotes the slot that player wins in a locally envy-free allocation if only the set of players were to win all the slots.

The linear program maps the utility vector suggested by the nucleolus into a correlated bid profile. The objective function minimizes the difference between the utility suggested by nucleolus and the expected utility in the correlated bid profile for each player. The minimization of difference leads to two constraints for each player. This is because for any two variables and ,

is the same as

subject to

In the minimization, the higher valuation bidders are given a preference over the lower valuation bidders. This is done by weighting each player’s difference from the nucleolus in the objective function by their valuation. This is a heuristic to ensure that the error in the inverse mapping of the utility vector to a correlated bid profile is biased towards the higher valuation bidders so that they voluntarily participate in the bid optimizer. Since the only problem to Individual rationality is when the higher valuation bidders shade their willingness-to-pay, this weighing gives the incentive for them to reveal their true valuations.

In the objective function, we minimize the difference (this is done by the first constraints of the linear program) between the utility vector and the obtained expected utility in the above linear program since the restriction of the bid profiles to the set of locally envy-free equilibria may not have a feasible correlated bid profile. The minimization is done in such a way that the higher valuation bidders obtain relatively higher utility (due to the weights given to the difference in the objective function) than the lower valuation bidders in case the optimal value of the objective function is non-zero. This is a heuristic to ensure that the error in the inverse mapping of the utility vector to a correlated bid profile is biased towards the higher valuation bidders so they voluntarily participate in the bid optimizer.

II-D Properties of the Proposed Solution

The properties of the proposed solution are as follows:

-

•

The proposed solution has the bidders participating voluntarily in the bid optimizer for the following reasons. (i) The auctioneer is benefited since he has a guaranteed revenue of at least what is suggested by the nucleolus. (ii) The high valuation bidders are benefited since they are offered the same slots at a relatively lower price. Also, since the nucleolus tries to retain the grand coalition intact, it will be individually rational for the high valuation bidders to participate in the bid optimizer rather than to deviate and bid higher. (iii) The lower valuation bidders are benefited because they get more slots and hence more clicks and their campaign is more effective. Thus, the utility of every player increases and the individual rationality (IR) condition is satisfied.

-

•

The bids suggested are in a locally envy-free equilibrium of the game and also are in the core since the nucleolus is always in core if the core is non-empty. This indicates that the proposed solution is strategically stable. In other words, no one can profitably deviate unilaterally from the solution proposed by the bid optimizer.

-

•

Retention and efficient division of the worth of the grand coalition are guaranteed by the nucleolus since it is the allocation which tries to retain the grand coalition.

-

•

Truthfulness is difficult to satisfy, given that the GSP mechanism is non-truthful. But note that the lower valuation bidders have no incentive to shade their bids. If they do so, they may lose their slots or run into negative utilities. Hence there is a problem only when the higher valuation bidders do not participate in the bid optimizer or they understate their willingness-to-pay. The higher valuation bidders cannot understate their valuations by a large amount since they have a threat of losing their slots to lower valuation bidders who are retained in the system. Also, the higher valuation bidders are given more benefits to participate in the bid optimizer and it is individually rational for them to participate in the bid optimizer.

Hence this solution satisfies all the properties which were mentioned in Section II-B.

III Experimental Results

This section presents simulation based experimental results to explore the effectiveness of the approach presented in the paper. First we start with a model for the drop outs of bidders.

III-A Bidder drop out model

The bidders drop out if they do not get enough slots (or alternatively clicks) consistently over a period of time. The conditional probability that a bidder drops out given that he did not get a slot in a round may vary from bidder to bidder. Also, the positions of slots occupied by the bidders in the previous few rounds of auction could play an important role in the dropping out of a bidder.

To model this behavior of the bidder dropping out based on the outcomes of the previous auctions and giving more importance to recent outcomes, we propose a discounted weighting of the outcomes of the previous auctions to compute the probability that a bidder will continue in the next round of the auction. This model also captures the myopic human behavior that the bidder’s choice is dependent on only the recent outcomes. That is, the history the bidder looks into, before taking a decision to continue or not for the next round is limited. The amount of history however depends on the bidder in the form of his discounting factor. Let denote the outcome of the previous round. A ““ denotes that the bidder received a click in the previous auction with a zero indicating otherwise. We propose that the probability that the bidder will participate in the next round is given by where is the discount factor of the bidder. To see how the myopic nature of the bidders is captured, suppose that the bidder’s discount factor . The discount factor for the round will be which is negligible. Hence the bidder’s decision is dependent on at most previous auctions. Thus, the discount factor decides the nature of the bidder.

III-B Experimental Setup

Given a fixed set of CTRs, the valuations of the bidders are chosen close enough to each other, to analyse our model in competitive environment. The retention problem, is fundamental in competitive environment, as search engine needs to retain the bidders and allow them compete in further auctions. The results indicate that the proposed bid optimizer not only retains a higher number of bidders than the normal GSP but also yields better cumulative revenue to the search engine in the long run.

III-C Cumulative Revenue of the Search Engine

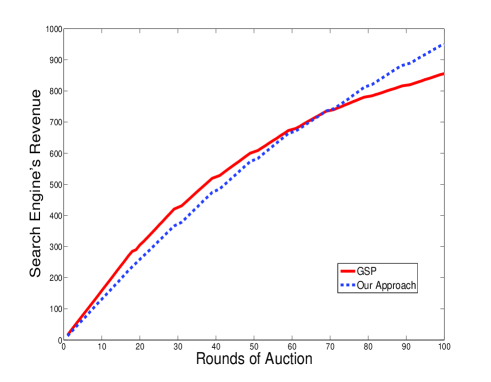

First we consider the cumulative revenue of the search engine for comparing the non-cooperative bidding and using cooperative bid optimizer. We consider advertisers with slots to be allocated.We run successive auctions and find the cumulative revenue of the search engine after each auction using the two approaches. We run this experiment until the change in the average cumulative revenue after each auction becomes acceptably small. Figure 2 shows a comparison of the cumulative revenue of the search engine under the proposed approach with that of a standard GSP auction.

It can be seen in Figure 2 that though initially the non-cooperative approach (GSP) yields more revenue, after a few runs, the cooperative bid optimizer, with all the solution vectors, starts outperforming. Initially the GSP outcome is better, as the advertisers are bidding their maximum willingness to pay, and hence the search engine gets high levels of revenue. However, as the utilities of the advertisers are less in the case of the non-cooperative approach, they start dropping out of the auction and hence in a long run, the cumulative revenue starts declining compared to the cooperative bid optimizer. This is the adverse effect of the dropping out of the advertisers leading to the retention problem.

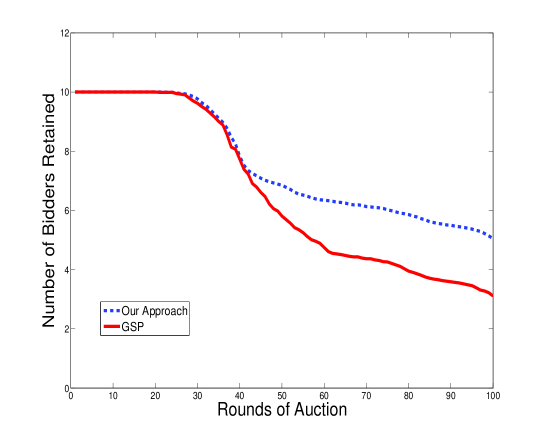

III-D Number of Bidders Retained in the System

After each auction, we compute the average number of advertisers retained, to analyze the retention dynamics in the system. Figure 3 gives a comparison between using the cooperative bid optimizer and the GSP approach.

In Figure 3, it can be observed that there are considerably more number of advertisers retained in the system when using the solution vector suggested by the cooperative bid optimizer in comparison to the GSP approach. This explains the reason for the dip in the non-cooperative cumulative revenue of the search engine.

Through experimentation, we are able to demonstrate revenue increase for the search engine in the long run and also reduction of the retention problem considerably. It should be noted that even though the raise is not substantial, its impact on retaining and attracting the advertisers and thereby other indirect advantages are immense.

IV Summary and Future Work

We have proposed a bid optimizer for sponsored keyword search auctions which leads to better retention of advertisers by yielding attractive utilities to the advertisers without decreasing the long-run revenue to the search engine. The bid optimizer is a value added tool the search engine provides to the advertisers which transforms the reported values of the advertisers for a keyword into a correlated bid profile. The correlated bid profile that we determine is a locally envy-free equilibrium and also a correlated equilibrium of the underlying game. Through detailed simulation experiments, we have shown that the proposed bid optimizer retains more customers than a plain GSP mechanism and also yields better long-run utilities to the search engine and the advertisers.

The experiments were carried out with a model that captures the phenomenon of customer drop outs and showed that our approach produces a better long run utility to the search engine and all the advertisers. The proposed bid optimizer is beneficial for both the bidders and the search engine in the long run.

We considered GSP auction, which is popularly run in most of the search engines, in our analysis. However, it would be interesting to look at the effects of other auction mechanisms like VCG auctions on the overall process.

The other important components like budget optimization and ad scheduling are involved in sponsored search auctions. We would further like to combine these components with our cooperative bid optimizer.

References

- [1] M Cary, A Das, B Edelman and I Giotis, K Heimerl, A R Karlin, C Mathieu, and M Schwarz. Greedy bidding strategies for keyword auctions. In Proceedings of the Eighth ACM Conference on Electronic Commerce, pages 57–58, 2007.

- [2] B Edelman and M Ostrovsky. Strategic bidder behavior in sponsored search auctions. Decision Support Systems, 43(1):192–198, 2007.

- [3] J Feng and X Zhang. Dynamic price competition on the Internet: advertising auctions. In Proceedings of the Eighth ACM Conference on Electronic Commerce, pages 57–58, 2007.

- [4] A Mas-Colell, M D Whinston, and J R Green. Microeconomic Theory. Oxford University Press, Oxford, 1995.

- [5] R B Myerson. Game Theory: Analysis of Conflict. Harvard University Press, Cambridge, Massachusetts, 1997.

- [6] N Nisan, T Roughgarden, E Tardos and V V Vazirani. Algorithmic Game Theory. Cambridge University Press, 2007.

- [7] C H Papadimitriou. Computing correlated equilibria in multi-player games. In Proceedings of the thirty-seventh annual ACM symposium on Theory of computing, Baltimore, MD, USA, May 22-24 2005.

- [8] K Ramakrishnan, D Garg, K Subbian, and Y Narahari. A Nash bargaining approach to retention enhancing bid optimization in sponsored search auctions with discrete bids. In Fourth Annual IEEE Conference on Automation Science and Engineering (IEEE CASE), Arizona, USA, 2008.

- [9] P D Straffin. Game Theory and Strategy. Mathematical Association of America, New York, 1993.

- [10] Y Vorobeychik and D M Reeves. Equilibrium analysis of dynamic bidding in sponsored search auctions. In Proceedings of Workshop on Internet and Network Economics (WINE), 2007.

- [11] Y Narahari, D Garg, R Narayanam, H Prakash. Game Theoretic Problems in Network Economics and Mechanism Design Solutions. Springer Series in Advanced Information and Knowledge Processing, 2009.

- [12] J F Nash Jr. The bargaining problem. Econometrica, 18:155–162, 1950.

- [13] B Edelman, M Ostrovsky, and M Schwarz. Internet advertising and the generalized second price auction: Selling billons of dollars worth of keywords. American Economic Review, 97(1):242–259, 2007.

Appendix

Nash [12] proposed that there exists a unique solution function for every two person bargaining problem, that satisfies the following 5 axioms - Pareto strong efficient, Individual Rationality, Symmetry, Scale Covariance, and Independence of Irrelevant Alternatives. The solution function is

where, and and the point is known as the point of disagreement. There are several possibilities for choosing the disagreement point . The three popular choices are those based on (1) a minimax criterion, (2) focal equilibrium, and (3) rational threats. As part of this paper, we use the rational threats to identify disagreement point [5]. For more details please refer to the books [5] [9].