Incentive Compatible Budget Elicitation in Multi-unit Auctions

Abstract

In this paper, we consider the problem of designing incentive compatible auctions for multiple (homogeneous) units of a good, when bidders have private valuations and private budget constraints. When only the valuations are private and the budgets are public, Dobzinski et al [6] show that the adaptive clinching auction is the unique incentive-compatible auction achieving Pareto-optimality. They further show that this auction is not truthful with private budgets, so that there is no deterministic Pareto-optimal auction with private budgets. Our main contribution is to show the following Budget Monotonicity property of this auction: When there is only one infinitely divisible good, a bidder cannot improve her utility by reporting a budget smaller than the truth. This implies that the adaptive clinching auction is incentive compatible when over-reporting the budget is not possible (for instance, when funds must be shown upfront). We can also make reporting larger budgets suboptimal with a small randomized modification to the auction. In either case, this makes the modified auction Pareto-optimal with private budgets. We also show that the Budget Monotonicity property does not hold for auctioning indivisible units of the good, showing a sharp contrast between the divisible and indivisible cases.

The Budget Monotonicity property also implies other improved results in this context. For revenue maximization, the same auction improves the best-known competitive ratio due to Abrams [1] by a factor of , and asymptotically approaches the performance of the optimal single-price auction.

Finally, we consider the problem of revenue maximization (or social welfare) in a Bayesian setting. We allow the bidders have public size constraints (on the amount of good they are willing to buy) in addition to private budget constraints. We show a simple poly-time computable -approximation to the optimal Bayesian incentive compatible mechanism, that is implementable in dominant strategies. Our technique again crucially needs the ability to prevent bidders from over-reporting budgets via randomization. We show the approximation result via designing a rounding scheme for an LP relaxation of the problem (related to Myerson’s LP), which may be of independent interest.

1 Introduction

In this paper, we consider the problem of designing incentive compatible auctions for multiple homogeneous units of a good. This problem has received significant attention in the non-Bayesian setting starting with the work of Goldberg et al [7]. We focus on the scenario where bidders not only have a private valuation per unit of the good, but also a private budget, that is the total amount of money they are able to pay. The budget constraint is hard; a bidder gets a utility of negative infinity if she has to pay a total price larger than her budget. In this model, the natural problems to consider are maximizing social welfare and the auctioneer’s revenue. Both these aspects have been considered in previous work [1, 3, 6] in an adversarial setting.

The key difficulty with budget constraints is that the utilities are no longer quasi-linear. This makes mechanisms such as VCG no longer applicable. Based on the random partitioning framework of Goldberg et al [7], Borgs et al [3] present a truthful auction whose revenue is asymptotically optimal compared to that of the optimal single-price mechanism. Using the same framework, Abrams [1] gives a different auction that improves this result for a range of parameters (but is not asymptotically optimal).

More recently, Dobzinski et al [6] presented the adaptive clinching auction based on the clinching auction of Ausubel [2]. This is an ascending price auction where each bidder maintains a demand, which is the amount of item she is willing to buy given the current price and her residual budget. Initially, the demand is larger than supply. If the total demand of the remaining bidders is less than the supply of items, the bidder clinches the difference at the current price. The bidder drops out of the auction if the price exceeds her valuation, and the auction stops when the total demand falls below total supply. Though the auction rules seem simple, it still defines a differential process for auctioning an infinitely divisible good with no closed form solution, except in special cases.

It is not difficult to show that this auction is incentive compatible when the budget constraints are public knowledge. Dobzinski et al [6] show that in the public budget setting, it is the only such auction that is Pareto-optimal (PO), meaning that no pair of agents (including the auctioneer) can simultaneously improve their utilities by trading with each other111In this setting, no truthful auction can maximize social welfare [3], hence the focus on Pareto-optimality.. They further show that with public budgets, this auction has better revenue properties than the auctions in [1] and [3]: It improves the former by a factor of , and like the latter, is asymptotically optimal. However, their main result is negative: This auction is not truthful when the budgets are private knowledge, so that there is no Pareto-optimal truthful auction in this case.

Our Results. The negative result in [6] holds for any auction with private budgets that needs to satisfy three properties ex-post222In this paper, ex-post will mean the property holds for randomized mechanisms regardless of the outcome of randomization.: Voluntary participation (VP), Incentive compatibility (IC), and No positive transfers (NPT). These properties are standard, and defined in Section 2. The main result in this paper is to show that there is indeed a Pareto-optimal randomized mechanism with private budgets. Here, the prices and quantities are random variables; the (IC) and (VP) properties are satisfied in expectation over these random variables; and (NPT) and (PO) are satisfied ex-post333In the case of one infinitely divisible good, the auction also needs to be anonymous for the negative result in [6] to hold, meaning that the auction is symmetric for bidders with identical types; our randomization can also easily be made anonymous.. The key to showing this result is to develop a novel structural characterization of the adaptive clinching auction in the case of one infinitely divisible good.

Budget Monotonicity and Randomization. We show an intuitive property of the adaptive clinching auction in the case of divisible goods: A bidder cannot gain utility by reporting budget lower than the truth. We term this property Budget Monotonicity. Though this property seems simple, there is no reason to assume it holds: In fact, this property is false for the adaptive clinching auction in the case of indivisible units (Theorem 2.2).The major difficulty in the proof is that the adaptive clinching auction continuously makes allocations at different prices, so that the utility is a complicated function of all the budgets and valuations. In fact, an analysis of this auction is left as an open question444Since the focus of [6] is to prove uniqueness and impossibility, they mainly analyze the auction for two bidders with carefully chosen valuations and budgets. In contrast, we need to develop characterizations for the general case. in [6]. We show this result by carefully coupling the behavior of two auctions that differ only in the reported budget of one bidder. The proof also establishes several structural results about this auction that are of independent interest.

Budget Monotonicity for an infinitely divisible good implies Pareto-optimality fairly directly, since all we need to prevent is a bidder over-reporting her budget. We can do this in several ways, the simplest being randomization. In the Randomized Extraction Scheme (see Section 2), the mechanism simply extracts the whole budget or zero price so that the expected price extracted is equal to the price charged by the deterministic auction. Therefore, if a bidder gets nonzero allocation by over-reporting her budget, then with non-zero probability, she pays her reported budget and her expected utility is . This scheme can be applied to any deterministic auction to prevent reporting larger budgets than the truth. We show in Section 2 that the randomized version preserves Pareto-optimality ex-post, and maintains (IC) and (VP) in expectation if the deterministic auction was monotone (and charges non-zero price for non-zero allocations).

The monotonicity result for the adaptive clinching auction holds only for one infinitely divisible good. In the case of finitely many indivisible units, we simply run the adaptive clinching auction assuming one infinitely divisible good, and perform a randomized allocation in the end (Corollary 2.5; also see [1, 3]). The resulting auction is (VP) and (IC) in expectation, and is also Pareto-optimal.

Though our mechanism is randomized, the randomness introduced in the price is quite small: It affects the price charged to only one bidder (Lemma 3.6). However, for the randomization to be (IC), we crucially need the assumption that the utility of a bidder for paying more than her true budget is . For smoother utility functions, the Budget Monotonicity property can be used in other ways to make the deterministic auction itself truthful and Pareto-optimal: For instance, a standard assumption in spectrum auctions [4] is that the bidder can be forced to show “proof of funds” for her reported budget (for instance, a bank statement), and this prevents her from over-reporting her budget regardless of her utility function.

Revenue Properties. As another consequence of Budget Monotonicity, the improved revenue properties of the adaptive clinching auction over the auctions in [1, 3] in the case of public budgets (shown in [6]) carry over to the randomized version of the auction even with private budgets, and hence, this auction improves the competitive ratio in [1] by a factor of , and like the auction in [3], is asymptotically optimal.

Bayesian Setting. In this setting, the auctioneer maintains independent discrete distributions on the possible valuations and budgets for each bidder, and is interested in designing a poly-time computable mechanism for optimizing expected revenue (resp. social welfare). In this setting, we allow the bidders to have a public size constraint on the amount of item they can buy in addition to a private valuation and private budget.

Variants of this model have been considered before [11, 12, 9, 10, 5, 8], and the optimal solution can indeed be encoded as an (exponential size) linear program. The key challenge now becomes designing polynomial time computable mechanisms. It is well-known [11, 12] that the optimal mechanism has a simple structure related to the VCG mechanism in the case of i.i.d. distributions and no size constraints. It is unlikely that such a structure holds in the general setting, and we instead consider designing approximately optimal mechanisms. The budget constraints however make a poly-time relaxation of the problem non-linear. However, if we only encode that utility decreases for under-reporting budgets, the program becomes linear; we again use randomization to prevent over-reporting budgets. Using this, we show a poly-size linear program relaxation with a rounding scheme that yields a approximation to the optimal Bayesian IC mechanism when the type space is discrete; this mechanism is implementable in dominant strategies. This rounding technique may be applicable in other related scenarios.

Organization of the Paper. In Section 2, we define the notions of truthfulness and Budget Monotonicity. In Section 3, we describe the adaptive clinching auction and show some basic properties in the infinitely divisible good case. In Section 4, we sketch the proof of Budget Monotonicity of this auction, which implies that the randomized version satisfies Pareto-optimality with private budgets. The proof of this claim very technical, and is hence presented in its entirety in Appendix A. In Section 5, we consider the Bayesian setting and show an LP rounding scheme that achieves a approximation to the expected revenue (resp. social welfare) even when bidders have public size constraints.

2 Preliminaries

We will mainly consider the case when there is one unit of infinitely divisible good and bidders. Bidder has a private valuation per unit quantity, and private budget . Suppose bidder reports valuation and budget . The auction is a (randomized) mechanism that (probabilistically) maps the into a quantity the bidder obtains and a total price the bidder pays; note that these quantities are allowed to be random variables in this paper. Since there is one unit of the good, we have .

The only difference in the case of auctioning indivisible copies of the good is that in this case, and . (The infinitely divisible good case is the limit when .) In the subsequent discussion we will assume one infinitely divisible good unless otherwise stated.

Let denote the reported valuations and budgets of bidders other than .

Bidder has the following utility function: If , then his utility is : this corresponds to the total price exceeding his budget. If , then his utility is .

The goal is to design a randomized auction that satisfies the following four properties. Note that in the (VP) and (IC) conditions, the expectation is over the randomness introduced by the mechanism.

- Voluntary Participation (VP):

-

If and , then regardless of , we have .

- Incentive Compatibility (IC):

-

Regardless of , is maximized when and .

- No Positive Transfers (NPT):

-

Regardless of , for any bidder , we have .

- Pareto-optimality (PO):

-

We must have (i) , i.e., the good is completely sold; and (ii) If and , then , i.e., if a bidder gets non-zero quantity then all bidders with higher valuations have exhausted their budgets. This property holds ex-post (regardless of randomization).

In the case of indivisible units, the only difference is in the (PO) condition. This gets modified as: ; further, if and , then . In both cases, this corresponds to the fact that no pair of agents can improve their utility by trading.

The main focus of this paper is to understand the behavior of the adaptive clinching auction, which is described in Section 3. For a more detailed description (especially for the indivisible units case), please see Dobzinski et al [6]. Their main result is the following:

Theorem 2.1 (Dobzinski et al [6]).

The adaptive clinching auction satisfies (VP), (NPT), and (PO) with private budgets and valuations. When the budgets are public knowledge, the auction also satisfies (IC), and it is the unique auction satisfying (VP), (NPT), (PO), and (IC) ex-post. Furthermore, there is no auction satisfying these four properties ex-post when the budgets are private.

Our main goal is to show several structural results about this auction, which will culminate in showing that there is indeed a randomized mechanism that is (VP) and (IC) in expectation, and also satisfies (NPT) and Pareto-optimality ex-post (regardless of the outcome of randomization), even with private budgets.

2.1 Budget Monotonicity and its Consequences

We will show that the adaptive clincing auction with one infinitely divisible good satsifies Budget Monotonicity, which states that a bidder cannot gain by reporting a lower budget.

Definition 1.

A deterministic auction is Budget Monotone if the following conditions hold for every bidder regardless of . For reported budget , where is the true budget:

-

1.

The bidder always maximizes utility by reporting , where is the true valuation.

-

2.

When , the utility of the bidder is monotonically non-decreasing in .

The more interesting condition in the above definition is the second one (the first one following from [6]). Though Budget Monotonicity is an intuitive property, there is no guarantee that it is satisfied even by reasonable auctions. In fact, quite surprisingly, it does not always hold for the adaptive clinching auction!

Theorem 2.2.

In the case of indivisible units of a good and bidders, the adaptive clinching auction described in [6] does not satisfy Budget Monotonicity.

Proof.

Consider bidders with the following values: , , and , and suppose these are the true budgets and valuations. It is easy to show that bidders and clinch one unit each at price . Bidder obtains zero utility since she can only clinch when price is . However, if bidder reports , she clinches one unit at price and obtains strictly positive utility. Therefore, the auction is not monotone. The details are easy to fill in using the description in [6]. ∎

In sharp contrast, our main result is to show that the adaptive clinching auction indeed satisfies the Budget Monotonicity property when there is one infinitely divisible good (which is the limiting case of indivisible goods). In particular, our main theorem is the following:

Theorem 2.3 (Budget Monotonicity Theorem).

The adaptive clinching auction satisfies Budget Monotonicity for one infinitely divisible good.

The key intuitive difference between the divisible and indivisible cases is that in the former case, there is a nice characterization of bidders receiving non-zero allocations as those with highest remaining budgets (refer Lemma 3.3). Budget Monotonicity is equivalent to saying that a bidder cannot gain by under-reporting her budget, i.e., reporting . We now show a simple way to remove the incentive to report .

Randomized Extraction: We run the deterministic adaptive clinching auction as in [6]. The allocation remains the same. However, the price extraction scheme is randomized as follows. If a bidder reports budget and is supposed to pay according to the deterministic mechanism, then with probability , we extract her reported budget , and with probability , we charge her zero price. Note that this randomization can be applied to any deterministic auction where implies ; the adaptive clinching auction [6] does satisfy this property. It is now easy to show:

Theorem 2.4.

For the case of one infinitely divisible good, the randomized adaptive clinching auction satisfies (NPT) always, (VP) and (IC) in expectation, and is Pareto-optimal ex-post.

Proof.

Clearly, (NPT) is always satisfied. The expected payment after randomization is precisely , which preserves (VP). To see (PO), observe that if before the randomization, the same is true after the randomization. To show (IC), note that the auction satisfies Budget Monotonicity by Theorem 2.3, so that for any bidder , we have and . Furthermore, if bidder reports a budget and recevies nonzero allocation, then the deterministic adaptive clinching auction charges her a price . The randomized auction extracts w.p. and in this scenario, the utility of the bidder is . Therefore, the bidder will not report . ∎

If the allocations generated by the auction for the infinitely divisible case are treated as probabilities of allocation instead (similar to [1, 3]), the same auction works for the case of indivisible units of the good.

Corollary 2.5.

There is a randomized auction satisfying (NPT) always, (VP) and (IC) in expectation, and is Pareto-optimal ex-post for indivisible units of the good.

Proof.

Run the randomized adaptive clinching auction assuming one infinitely divisible good, with the valuations scaled up by factor of . Modify the allocation step as follows. Suppose the auction should allocate to bidder . Choose bidder with probability and allocate all units to this bidder. The resulting auction always satisfies (NPT). Also note that the expected utility of a bidder is the same as the utility in the indivisible auction; further, the auction is (IC) by Theorem 2.4. To show (PO), note that the items are completely allocated by the auction. Next, since the infinitely divisible auction satisfies (PO), if the units are allocated to bidder , this bidder must have had in the infinitely divisible auction, so that for all with , we must have , so that . Therefore, the auction satisfies (PO) regardless of the outcome of randomization. ∎

3 The Adaptive Clinching Auction: Infinitely Divisible Case

We now describe the adaptive clinching auction in [6, 2] in the context of one infinitely divisible good, and show in the next section that it satisfies Budget Monotonicity (Theorem 2.3).

Intuitively, the auction is an ascending price auction. As the price per unit quantity is raised, bidders become inactive because the price has exceeded their valuation. For the remaining (active) bidders, the demand is the amount they are willing to buy given their remaining budget and the current price. Similarly, the supply is the amount of item remaining. For an active bidder, when the supply exceeds the total demand of the other bidders, this bidder clinches the difference at the current price. Since the price is increased continuously and the good is infinitely divisible, the auction defines a differential process.

We describe the clinching auction as a differential process indexed by time , where the price charged per unit quantity increases as time progresses, and the auction continuously allocates (part of) the item and extracts budget. We note that the traditional method is to describe it as a process indexed by the price; however, indexing by time lends itself to an easier analysis. After describing the auction, we present some new observations that characterize its behavior; these will be useful in later sections.

Formally, let denote the price per unit quantity at time . For bidder , let denote the quantity of the item allocated so far to , let denote the price extracted so far from , and let denote the effective budget of the bidder (defined later). Let denote the supply of item left with the auctioneer. Initially, , , and . In this section, we will denote the derivative of function w.r.t. as .

Denote the demand of the bidder as . If , this represents the amount of the item bidder is willing to buy at price . Let , i.e., the total demand excluding bidder .

Invariants. Denote the stopping time of the auction by . The adaptive clinching auction is defined by the following invariants for all :

- Supply Invariant:

-

For all bidders , we have .

- Clinching Invariant:

-

iff both (the bidder is active) and .

- Budget Invariant:

-

If , , the true residual budget of the bidder. If , . When , , and though the demand is well-defined, it will not correspond to any “real” demand, since the bidder will drop out of the auction.

We note that for all , we have . Furthermore, we also have , since the bidder is being charged price per unit quantity. The only exception to these conditions is at time when the auction makes some one-shot allocations; we will define .

3.1 Auction

In view of the above invariants, we partition the bidders into the following groups.

Definition 2.

Define active bidders as ; exiting bidders as ; and clinching bidders as .

The adaptive clinching auction is now simple to describe, and is described in Figure 1. We specify it in terms of the derivatives of the budget, allocation, and prices.

Adaptive Clinching Auction (I) (Stopping Condition555We show in Lemma 3.4 that the stopping condition is well-defined.) If then: At unit price , preserving the budget constraints allocate: 1. Amount to bidders in . 2. Amount to bidders in . (II) else if and then: 1. ; 2. For each set: ; ; and . (III) else if and : 1. . 2. For smallest index666Fix any ordering of bidders that is independent of the reported and . set: ; and . 3. For each set: ; ; and .

The total allocation and the total price can easily be derived from the description of the auction; we omit the details. Note that a bidder clinches items only when the allocation is made and he is in . Though the bidder may get some items in Step (I) when he is in , we do not consider this clinching, since the bidder gets utility zero from these items (assuming she reports the true valuation).

The key difference between the way we have described the auction and that in [6] is in Step (III). Here, we have chosen to gradually reduce the budgets of the bidders in , while if the auction were indexed by price, this step would lead to one-shot allocations. Our method makes the supply and the effective budgets continuous functions. The equivalent formulation of Step (III) in terms of price follows from maintaining the Supply Invariant and stopping condition of the auction (see also [6]), and is presented below.

Lemma 3.1.

If and , suppose , then bidder clinches quantity at price in Step (III). When and , bidder clinches a quantity at price that exhausts her remaining budget in Step (I).

The above lemma will be critically used in the proof of Budget Monotonicity later. The next theorem simply re-states the positive result in Theorem 2.1.

Theorem 3.2 (Dobzinski et al [6]).

The adaptive clinching auction satisfies (NPT), (VP), (PO). Furthermore, for reported budget where is the true budget, the bidder always maximizes utility by reporting the true valuation, .

3.2 Properties

We will now show some properties of this auction that will be useful later.

Definition 3.

Define . Recall that as the stopping time of the auction.

We first show that the auction satisfies the invariants. The last two invariants are easy to check: Whenever a bidder clinches the item at price , we have , so that . Further, note that if , the effective budget of this bidder reduces, so if the price increases beyond , the effective budget must be identically . Therefore, the budget invariant holds. The clinching invariant holds trivially by the description of the auction.

The next result shows the supply invariant, and characterizes the set of bidders that are clinching at any point in time, and a consequent stopping condition based on these bidders.

Lemma 3.3.

The following hold for the adaptive clinching auction: (1) If , then ; (2) the supply invariant holds for all ; and (3) when a bidder drops from , the auction stops at that time.

Proof.

First note that for , the functions and for any are continuous. At , the former is smaller than the latter. If for all , , then there is nothing to prove. Suppose be the first time instant when becomes equal to . If , then , the auction necessarily stops at time , that is, , a contradiction. Thus, bidder . Furthermore, has the largest budget in the set , since for all , we must have had by the definition of time . Therefore, Since , we have . For all , the set is empty by the clinching invariant. We now show that for all subsequent , as long as has not dropped out, we have ; ; and when drops out of the auction, the auction stops. This will show all parts of the lemma.

First note that if is non-empty, it necessarily has the bidders with highest budget in . Therefore, if , then is necessarily the same as . To show clinches continuously, we will show when , so that for all as long as bidder has not dropped out, , and hence bidder clinches continuously until she drops out.

Suppose at some point and . We therefore must have and . Note that decreases at the rate of precisely if there are clinching bidders at time .

There are two cases depending on whether or not. If , then for all :

Similarly, for , we have:

Note that . Since , we have:

Suppose now that and . Note that for some . We have: for . For we have:

Therefore, if , which shows bidder clinches continuously unless or . In both cases, so that Step (I) kicks in and the auction stops. ∎

The above characterization of holds only for infinitely divisible goods, and is the key reason Budget Monotonicity holds in this case and not in the case of indivisible units. Also note that the auction could stop even if no bidders drop from , but instead, some other set of bidders drop out; therefore, part (3) in the above lemma is a sufficient but not necessary condition for stopping.

The above lemma establishes that for , the function is continuous; further, the set , if non-empty, is composed of active bidders with . We now show that the stopping condition (Step (I)) is well-defined, and relate the prices charged to the stopping condition.

Lemma 3.4.

When the auction stops, the bidders in have sufficient budget to clinch the quantity at price .

Proof.

By defintion of the stopping time, for time approaching from below, we have . Note that . The lemma follows. ∎

Lemma 3.5.

If , then . If , then . Furthermore, if , then and .

The following lemma shows that the amount of randomness we need to add is small. In particular, we need to randomize the price charged to at most one bidder.

Lemma 3.6.

The allocations in Step (I) can be done in a fashion so that when the auction stops, there is at most one bidder with allocation and price .

Proof.

At time the only bidders who can have are bidders in . As approaches from below, suppose some bidder in dropped out causing the auction to stop. At time , the supply invariant holds from the perspective of this bidder who drops out, so that if this bidder is given lowest priority in allocating the remaining supply, the supply exhausts the budget of all bidders except this bidder. If no clinching bidder drops out or if , then all had , so that the budget can be extracted sequentially from bidders in . This satisfies the lemma. ∎

4 The Budget Monotonicity Theorem

In this section, we will provide a proof sketch of Theorem 2.3 for a canonical special case of budgets and valuations; the entire proof is complicated with many cases, and is presented in Appendix A. The observation that the bidder will always report follows from [6], re-stated in Theorem 3.2. We will now show that when , a bidder does not gain utility by reporting budget , where is the true budget. This will complete the proof of Theorem 2.3, and hence all the results in Section 2.1.

4.1 Notation

We fix a specific bidder, say Alice, and show monotonicity of her utility with reported budget. We will use sub-script to denote quantities for this bidder. Let and respectively denote her effective budget at time , and her valuation. Let represent the price extracted from her so far.

For convenience, we will use to denote the limit as approaches time from below. Since price increases continuously with time, we can easily replace by in any algebraic expression. However, if is the first time instant when the price becomes equal to the valuation of some bidder, then , and so on.

Formula for Utility. For times , let denote the utility gained by Alice as time increased from to . In the computation of utility, we can ignore the contribution from allocation made in Fig. 1 when Alice is in , since the allocation is obtained at a price equal to her valuation. If is the fraction of the item clinched by Alice until time , then, for in Steps (II) and (III) of the auction:

| (1) |

Moreover, when , the formula gets modified by the one-shot allocation in Step (I):

Define as the the total utility gained by Alice from the auction.

Two Auctions. We let Alice increase her reported budget by an amount , the budgets and valuations of other bidders and Alice’s valuation and true budget remaining the same. Suppose her original reported budget is , and her new reported budget is . Denote the former auction (with Alice’s reported budget being ) by Low and the latter auction by High. We will use superscripts and to denote quantities in these two auctions respectively. Note that for Alice, we have .

We will show the following theorem (proved in Appendix A), which will imply the proof of Theorem 2.3. This will also imply all results in Section 2.1.

Theorem 4.1.

, i.e., Alice’s utility from auction High is at least her utility from auction Low.

4.2 Proof Sketch

The proof of Theorem 4.1 is very technical and is hence relegated to Appendix A. We outline the basic argument for a special case where the valuations are sufficiently large so that Alice clinches for a finite amount of time in both the auctions. The following definition describes the times at which Alice starts and stops clinching, and the time at which the clinching set becomes nonempty.

Definition 4.

Let (resp. ) denote the first time instant at which some bidder enters the clinching set in auction Low (resp. High), that is, (resp. ) becomes nonempty. Similarly, define (resp. ) to be the first time when Alice enters the clinching set in auction Low (resp. High).

Simplifying Assumptions. The valuations of the bidders are sufficiently large so that Alice clinches in both auctions, i.e., and . Alice has the minimum valuation amongst all the bidders, so that no other bidder drops out before Alice, and by Lemma 3.3, the auction stops when Alice drops out, so that and . Moreover, the highest budgeted bidder (say bidder ) has larger budget than Alice in both the auctions Low and High, that is, .

We now track the two auctions simultaneously as time increases from zero. First note that since Step (III) in Figure 1 is never executed, and price increases at rate in Step (II), as long as both auctions run, the prices in the two auctions are coupled as time progresses, and further, the set is the set of all bidders. Therefore, we can use price and time interchangeably. Since Alice cannot gain any utility after dropping out, we have the following for the utilities of Alice in either auction: and . The main ingredient in the proof is to show the following relation, which implies that though Low starts clinching before High, Alice starts clinching in High earlier than when she starts clinching in Low:

Lemma 4.2.

.

Proof.

First note that since bidder has the maximum initial budgets in both the auctions, by Lemma 3.3, it must be the case that bidder starts clinching in Low at time , and in High at time . Beyond time in Low, the quantity decreases with time at rate equal to the supply, . Since , the rate of decrease is at most , which easily implies:

| (2) |

Next note that . Combining the above relations, we have and hence, by the Clinching Invariant, Alice is not clinching at time , so that by definition, . It is straightforward to see that , since the total of the budgets of bidders differs by exactly , and hence the Clinching Invariant kicks in time later. Therefore, .

We will next show that . Note that both auctions are clinching beyond . Using Equation (2) at , we must have . Next, we use the observation (Lemma 3.3) that the clinching sets in the two auctions are related to the value , which decreases at rate . The clinching set if non-empty is precisely . Therefore the auction with the larger has a smaller clinching set. Using this, we show that in the auction with larger , this value decreases at a faster rate. Specifically, if for , then for all bidders , , and hence, the demands are larger in auction High. By the Clinching Invariant, this implies the supply is larger in auction High, and hence, the rate of decrease of is larger.

Since , we must have for all : . Specifically, . Thus, , which completes the proof. ∎

This shows Alice is clinching in both auctions beyond , which helps us relate her utilities. Observe by Eq. (1) that the utilities are related to the rate of decrease of . Using a similar argument to the above:

We consider two cases. First, if , then we have , and for all . Applying Equation 1, we have:

If , then we need to take into account the utility gained by Alice in High during the time interval to complete the proof; details are in Appendix A.

The reason the general case is complicated is that we need to take care of two tricky issues: (1) One of the auctions can stop due to bidders dropping out. We need to account for this event in several of the proofs. (2) If , then Alice obtains only a one-shot allocation in Step (I) of the auction. In this case, we have an explicit formula for the utility of Alice in auction Low, and we essentially argue that the auction High derives at least that much utility at price . This shows Theorem 4.1 already holds in this case.

5 Bayesian Setting and Size Constraints

We now consider the case where the bidders have a public size constraint on the amount of item they want to buy in addition to a private valuation and private budget. In this setting, we consider optimizing social welfare and revenue. Performing this optimization in the adversarial setting is difficult: For instance, it is no longer true that the optimal single price auction yields a constant factor approximation to the revenue [7]; and further, the adaptive clinching auction could in fact yield zero revenue if the sum of the size constraints is less than one. Instead, we consider the Bayesian setting and assume the auctioneer maintains independent discrete distributions on the possible valuations and budgets for each bidder, and is interested in designing a (randomized) mechanism for optimizing the expected revenue (respectively social welfare).

Variants of this model have been considered before [11, 12, 9, 10, 5, 8], and the optimal solution can indeed be encoded as an (exponential size) linear program. The key challenge now becomes designing polynomial time computable mechanisms. It is well-known [11, 12] that the optimal mechanism has a simple structure related to the VCG mechanism in the case of i.i.d. distributions and no size constraints. It is unlikely that such a structure holds in the general setting, and we instead consider designing approximately optimal mechanisms. The budget constraints however make a poly-time relaxation of the problem non-linear. However, if we only encode that utility decreases for under-reporting budgets, the program becomes linear; we again use randomization to prevent over-reporting budgets. Using this, we show a poly-size linear program relaxation with a rounding scheme that yields a approximation to the optimal Bayesian IC mechanism when the type space is discrete; this mechanism is implementable in dominant strategies. This rounding technique may be applicable in other related scenarios.

We consider mechanisms that are implementable in dominant strategies, meaning that the bidders may or may not be aware of these densities, and are simply interested in maximizing utility, where the utility is in expectation over the randomness introduced by the mechanism. Note that while the auctioneer optimizes over the densities, the bidders simply optimize over the randomness introduced by the mechanism and not over the densities themselves.

Problem Statement. Formally, there are bidders, and one unit of an infinitely divisible good. Bidder has private valuation per unit for the good, which can take on values . Further, the bidder has a private budget and the budgets can take on values . The bidder is interested in acquiring a maximum amount of the item, and this value is public knowledge. The auctioneer maintains an independent discrete distribution over possible (valuation, budget) pairs of bidder . Let . The type space of a bidder is discrete and we will be interested in mechanisms that can be computed in time polynomial in the input size, i.e., in the quantities .

For reported bid vector , the auctioneer computes allocations and prices so that the resulting auction satisfies (VP), (NPT), and (IC). Since we will use randomness to force a bidder to not over-report the budget, these properties will be in expectation over the randomness introduced by the auction. In addition, the allocation satisfies the size constraints: . Subject to these constraints, the auctioneer is interested in maximizing either: (1) Revenue, , where the expectation is over the distributions from which the are drawn; or (2) Social welfare, , where the expectation is as before.

Preventing Over-reporting Budgets. We will again construct a deterministic auction that assumes bidders cannot over-report budgets, and introduce randomness so that (VP), (NPT), and (IC) hold in expectation over the randomness introduced. Since we can no longer guarantee that non-zero allocation implies non-zero price, the randomization is slightly different from the Randomized Extraction Scheme: Suppose the deterministic auction makes non-zero allocation and charges price (which could be zero). Then, extract price initially; then, with some probability , extract additional price , and independently with probability , give the bidder amount . This makes the expected price charged exactly ; however, since there is a non-zero probability of extracting , this prevents the bidder from reporting larger than the true budget constraint as this would make the expected utility . This also preserves (VP), (IC), and (NPT) in expectation over the randomness. We term this the Threat; the key difference from the randomized extraction scheme is that the Threat preserves (NPT) only in expectation.

Therefore, we can now restrict the bidder to not over-report her budget constraint and consider deterministic mechanisms that are ex-post (IC) subject to this restriction. The optimal mechanism maximizing expected revenue (resp. socially welfare) and satisfying the above constraints can be encoded as an LP of exponential size. We note that the optimal solution to the restricted mechanism design problem is also an upper bound on the revenue (resp. social welfare) that can be obtained for mechanisms that do not explicitly restrict bidders to not over-report budgets.

We now show a -approximation mechanism whose computation time is polynomial in the input size, i.e., in the quantities . In the rest of the discussion, we focus on revenue maximization; the results for social welfare are almost identical to derive.

5.1 Linear Programming Formulation

Let , and let . These are respectively the expected allocation and price charged for bidder if she reports , where the expectation is over the values revealed by the other bidders according to the distributions . Consider the following linear program, essentially due to Myerson [11].

We note that the above program linearizes the utility constraint by only encoding that the utility of under-reporting the budget is at most that of reporting the true budget. (The auction will finally introduce the Threat to prevent lying in the other direction.) Attempting to encode lying in both directions in the above program (as done by Pai and Vohra [12]) makes it non-linear.

Lemma 5.1.

The truthful deterministic auction maximizing revenue is feasible for the above constraints. Therefore, the LP value is an upper bound on the expected revenue

Proof.

Consider the optimal truthful auction. Since (VP), (NPT), (IC), and the budget and size constraints hold ex-post, they hold in expectation over any independent densities . The first, third, fourth, and fifth constraint simply encode feasibility and (VP). The second constraint maintains (IC), since otherwise, a bidder gains in utility by lying either on her valuation, or downward on her budget. Therefore, the optimal deterministic auction is feasible for the constraints of the LP. ∎

5.2 The Auction

The first step is to solve the linear program, which can be done in time polynomial in . The linear program does not directly yield a feasible auction. Consider any realization of the bids where bidder reports . The linear program indicates that amount of the item should be alloted to agent . However, it can happen that in this realization. Note that the LP only enforces the constraint in expectation over the reported , where the expectation is over the densities ; enforcing it for all would need exponentially many variables and constraints. We note that in the absence of budget constraints or in the presence of i.i.d. distributions with no size constraints, the optimal solution to the above LP has a very simple structure [11, 12] related to the VCG mechanism. It is not clear if the structure holds in the presence of budget and size constraints.

We now convert the LP solution into a feasible mechanism by losing a factor in the worst case. For any consider the following mechanism:

-

1.

Scale down all variables in the LP by a factor of . Let and .

-

2.

Consider the bidders in a fixed but arbitrary order . Suppose bidder reports :

-

3.

Let . If then allocate 0 and charge 0 to bidder ; if then:

-

(a)

Allocate units to bidder .

-

(b)

Charge price .

-

(a)

Theorem 5.2.

Let and denote the expected allocation and price in the above auction when agent bids , where the expectation is over the densities for . We have the following:

-

1.

; ; and .

-

2.

and .

-

3.

The auction satisfies (VP), (IC), and (NPT) ex-post assuming bidders cannot over-report budgets.

Therefore, when the above auction is randomized via the Threat, it is a approximation to the optimal expected revenue, implementable in dominant strategies, and satisfies (VP), (IC), and (NPT) in expectation over the randomness introduced by the Threat.

Proof.

The first part is straightforward from the description of the auction. To see the third part, note that the allocation and price for bidder are either both zero, or are and . The choice between zero and the latter cannot be affected by by changing its bid. Since satisfy the constraints of the LP, this shows the third part of the theorem.

We now show the second part. From the perspective of the auctioneer, the auction has a random outcome that depends on the densities . Let denote the random variable which is if , and otherwise. Let . We first show that . We have . By Markov’s inequality, . If this does not happen, we must have the event . Therefore, .

Note that in the event , the allocation to is . Next note that is independent of the bid reported by . Therefore, and , which shows the second part.

Note that the revenue generated is , which is a approximation by the above theorem. If we set , we obtain a approximation to the optimal expected revenue. ∎

References

- [1] Z. Abrams. Revenue maximization when bidders have budgets. In SODA ’06: Proceedings of the seventeenth annual ACM-SIAM symposium on Discrete algorithm, pages 1074–1082, 2006.

- [2] L. Ausubel. An efficient ascending-bid auction for multiple objects. American Economic Review, 94(5):1452–75, December 2004.

- [3] C. Borgs, J. Chayes, N. Immorlica, M. Mahdian, and A. Saberi. Multi-unit auctions with budget-constrained bidders. In EC ’05: Proceedings of the 6th ACM conference on Electronic commerce, pages 44–51, 2005.

- [4] S. Brusco and G. Lopomo. Simultaneous ascending bid auctions with privately known budget constraints. Journal of Industrial Economics, 56(1):113–142, 2008.

- [5] S. Chawla, J. D. Hartline, and R. D. Kleinberg. Algorithmic pricing via virtual valuations. In ACM Conference on Electronic Commerce, pages 243–251, 2007.

- [6] S. Dobzinski, R. Lavi, and N. Nisan. Multi-unit auctions with budget limits. In FOCS, pages 260–269, 2008.

- [7] A. V. Goldberg, J. D. Hartline, and A. Wright. Competitive auctions and digital goods. In SODA, pages 735–744, 2001.

- [8] J. D. Hartline and T. Roughgarden. Optimal mechanism design and money burning. In STOC, pages 75–84, 2008.

- [9] J.-J. Laffont and J. Robert. Optimal auctions with financially constrained buyers. Economics Letters, 52:181–186, 1996.

- [10] E.S. Maskin. Auctions, development and privatization: Efficient auctions with liquidity-constrained buyers. European Economic Review, 44:667–681, 2000.

- [11] R. B. Myerson. Optimal auction design. Mathematics of Operations Research, 6(1):58–73, 1981.

- [12] M. Pai and R. Vohra. Optimal auctions with financially constrained bidders. Working Paper, 2008. Available at: http://www.kellogg.northwestern.edu/faculty/Vohra/ftp/LR3.pdf.

Appendix A Proof of Budget Monotonicity: Theorem 4.1

This section is devoted to the proof of Theorem 4.1. We note that by Theorem 3.2, the reported valuations are always the truth, meaning that for all bidders .

Recall that bidder Alice increases her budget by a quantity in auction High as compared to auction Low. Also recall that the subscript is used to denote quantities for Alice, and the superscripts to denote quantities in auctions High and Low respectively. We will define the following starting and stopping times.

Definition 5.

Let (resp. ) denote the first time instant at which some bidder enters the clinching set in auction Low (resp. High), that is (resp. ) becomes nonempty. Similarly, define (resp. ) to be the first time instant when Alice enters the clinching set in auction Low (resp. High). If the required event does not happen, define these as (resp. ).

Recall that we will use to denote the limit as approaches time from below. Since price increases continuously with time, we can easily replace by in any algebraic expression. However, if is the first time instant when the price becomes equal to the valuation of some bidder, then , and so on.

A.1 Assumptions

We now show that the theorem is straightforward if some assumptions do not hold. First, note that if , Alice receives zero utility in Low, and Theorem 4.1 is trivially true. Thus, we must have:

Assumption 1.

Alice receives non-zero utility in auction Low. In other words, and .

Using this assumption, we show that the prices in the two auctions are coupled. Let and denote the prices at time in Low, High respectively.

Claim A.1.

For all ,

Proof.

At the beginning, . Simultaneously follow auction Low and High as time increases from zero. When the price is not equal to the valuation of any bidder, both and are increasing at unit rate. When the price hits the valuation of some bidder(s), two cases may occur. If the set has nonempty intersection with (resp. ), then auction Low (resp. High) necessarily stops at that time . Otherwise, if none of the bidders with valuation equal to belonged to , then price remains equal to in both the auctions for exactly amount of time. Note that in the later case, Alice cannot have a valuation equal to , else she receives zero utility in both the auctions and Theorem 4.1 is trivially true. ∎

From now on, we will use to denote both and . A direct consequence of the above proof is the following, whose proof is simple and omitted. Note that are coupled since the auctions do not stop (so that all bidders in could not have been clinching), and Step (III) reduces the budgets of these bidders in a fixed order.

Corollary A.2.

For all , . Further, .

We will now show another assumption whose violation easily implies Theorem 4.1.

Assumption 2.

Auction High stops at a time that is strictly greater than the price

at which Alice starts to clinch in auction Low, that is .

Proof.

Suppose . Clearly, . From Assumption 1, . From the Lemma 3.5, . In auction High, Alice receives at least fraction of the item at an average unit price that is at most . That is,

However, in auction Low, she can receive at most fraction of the item at an average unit price that is at least . That is,

Since and , we get . This implies Theorem 4.1. ∎

A.2 The Canonical Case: Alice Enters Set in Auction Low, that is

The argument consists of two stages. First we relate the times at which Alice starts to clinch in either auction, in particular, we show that Alice starts clinching in High no later than in Low. This statement is critically used in the next stage of our proof, where we compare the utilities gained by Alice in the two auctions, and show that her utility from Low is at most her utility from High.

Lemma A.4 (Structure Lemma).

The starting and stopping times in High and Low are related as:

Since , Assumption 2 immediately implies the last inequality. Most important part of the above lemma is the claim that , i.e., Alice joins the clinching set no later in High than in Low.

A.2.1 Proof of the Structure Lemma

Let bidder have the largest budget among all active bidders excluding Alice at the time when auction Low starts clinching. We first present a high-level idea of the proof. At any point in time, the set of clinching bidders, if non-empty, is the set of active bidders with ; furthermore, once the auction starts clinching, decreases continuously. We therefore relate the evolution of in the two auctions, and show the time at which in auction Low is at least the time at which in auction High. We use the following observations about the curves and in auctions Low and High respectively:

-

1.

The curves have downward slope at most , and are parallel.

-

2.

Auction High starts clinching at most time after Low starts clinching, where . In particular, High starts clinching before time ; and

-

3.

If , then decreases at a faster rate once both auctions are clinching.

Using these observations, the proof is simple geometry with two cases depending on whether or , i.e, whether or not Alice has the highest budget in auction High. We now present the proof in the following sequence of claims.

Claim A.5.

. Furthermore, for all , we have the following: If bidder is not Alice, then . In particular, when . For Alice, .

Proof.

As time increases gradually from , as long as no bidder is clinching in either auction (i.e., ), the current budget of every active bidder equals her original budget . Furthermore, Step (III) reduces the budgets of exiting bidders in a fixed order. We conclude that the current budget of every bidder other than Alice remains the same across the two auctions, and the current budget of Alice is greater in auction High than in Low. Thus, from the perspective of any bidder (including Alice), the total demand of the other bidders is no less in auction High than in auction Low. In particular, it implies Low starts clinching no later than High, that is, . ∎

Lemma A.6.

If Alice is the first bidder to join the clinching set in auction Low, i.e., if , then the Structure Lemma holds.

Proof.

Suppose . From Alice’s perspective, in both the auctions, total demand of other bidders is exactly equal to the initial supply at time (Claim A.5). Thus, Alice joins the clinching set in High at the same time instant as in Low. Hence and the Structure Lemma holds. ∎

For the rest of Section A.2.1, we assume that Alice is not the first bidder to start clinching in Low, so that . Therefore bidder with starts clinching in Low at time . So far, we have the following inequalities:

| (3) |

The above implies for some . Note that the active sets in the two auctions are identical at any point in time (Corollary A.2). Applying Lemma 3.3 and Assumption 1, we have that both Alice and bidder are active during the time interval . Furthermore, for all , bidder belongs to the clinching set in Low, and has the maximum budget amongst all the active bidders, that is, .

Claim A.7.

In auctions Low and High, decreases at a rate at most one, i.e., .

Proof.

If the clinching set is empty, then . Otherwise, by Lemma 3.3, either in Step (III), or in Step (II). Since , the claim follows. ∎

Claim A.8.

Recall . In auction Low, Alice starts clinching at least later than the time instant at which bidder starts clinching, i.e., .

Proof.

As time increases beyond , by Lemma 3.3, Alice starts clinching in Low when becomes equal to Alice’s reported budget . Since , and since decreases at a rate at most one, we have the claim. ∎

Claim A.9.

Suppose bidder has higher initial budget than Alice in High i.e., , then we have .

Proof.

Since , we have . Thus, the inequality follows from Claim A.8. Applying the Clinching Invariant and Claim A.5 in High, we have at :

As time increases beyond , as long as there is no clinching in High, either the LHS increases at rate in Step (II) or the RHS decreases at rate one in Step (III). In either case, at time , we must have , which implies . ∎

Claim A.10.

Suppose bidder has higher initial budget than Alice in auction High i.e., . If at some time instant , then .

Proof.

Note that clinching set is nonempty in both auctions in this time range. The active and exiting sets, and , in the two auctions are coupled (Corollary A.2). If the existing set is nonempty, then and are each decreasing at rate one in Step (III), and the claim is true. For rest of the proof, assume is empty.

We first show that compared to auction Low, every active bidder has larger remaining budget in auction High, i.e., . Since , the statement is clearly true for all bidders who are clinching either in High or in Low. For all other active bidders, the current budget equals the reported budget . Since Alice reports a higher budget in High and every other bidder reports the same budget in the two auctions, the statement is valid even for active bidders who are not clinching in both auctions.

Since Alice reports a lower budget than bidder in High, bidder is clinching in High the time range . Considering the Supply Invariant from the perspective of bidder , we conclude that

| (4) |

The above holds since the exiting set is empty and since all active bidders have larger remaining budget in High. The claim follows immediately from Step (II) of Figure 1. ∎

Lemma A.11 (Lemma A.4).

The starting and stopping times in High and Low are related as:

Proof.

All we need to show is . We split the proof into cases depending on whether Alice has the highest budget in High or not.

Case 1. :

At time , in both auctions the current budget of every active bidder equals her initial budget (Claim A.5). Since Alice reports a higher budget than bidder in High, Alice has the highest budget amongst all the active bidders in High at time . By Assumption 1 and Claim A.8, Alice is active during the time interval . As time increases beyond , as long as Alice is active, no other bidder can start clinching before Alice in auction High (Lemma 3.3). Considering the Clinching Invariant for auction Low, at time ,

The last equality follows from Claim A.5. In auction High, in the time range , either the LHS increases at rate in Step (II) or the RHS decreases at rate in Step (III), so that Alice must start clinching at . Combining this with Claim A.8, we have the proof.

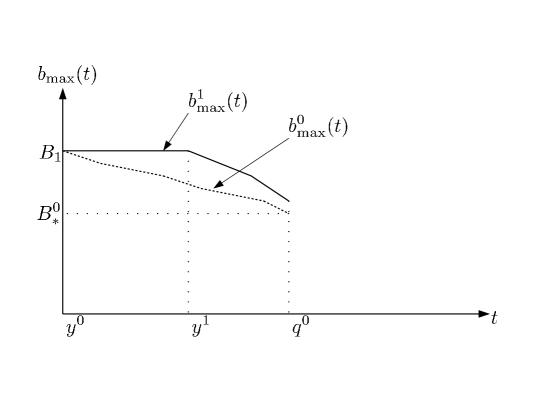

Case 2. :

Since Alice’s reported budget in High is less than that of bidder , bidder has the maximum budget amongst active bidders in High at time (Claim A.5). By Lemma 3.3, at every time instant , we have . Therefore, during the interval , in both auctions, is equal to the current budget of bidder . We simultaneously track of the two auctions in this time range (see Figure 2). At time , both and are equal to (initial budget of bidder ). Bidder starts clinching in Low at the same time instant. Thus, starts decreasing continuously as increases beyond . However, decreases below only after goes past the value (note that by Claim A.5). Claim A.9 shows that and differs by exactly amount. In particular, since , starts decreasing before Alice enters the clinching set in Low. Applying Claim A.7, at time time , the vertical distance between the curves and is no more than . Claim A.10 implies that in the time range , whenever the curve lies above , the former reduces at a larger rate. We thus have . Since Alice starts clinching in Low at time , equals her reported budget at that time instant. In other words, , and Alice must have joined the clinching set in High no later than . This completes the proof. ∎

Figure 2 illustrates the geometric intuition behind the above proof in the case .

A.2.2 Relating the Utilities in Auctions Low and High

By Lemma 3.3, Alice clinches in Low (resp. High) throughout the time interval (resp. ). During the next phase of our proof, we simultaneously track the two auctions as time increases from to and show that of one of the auctions dominates the other. This helps us compare the utilities gained by Alice during this phase, including the utilities from one-shot allocations at the stopping times.

Define . Note that the Structure Lemma implies . In particular, by Lemma 3.3, Alice clinches in auction High (resp. Low) during the time interval (resp. ). We will need the following two claims. The proofs are similar to that of Claim A.10. By the Structure Lemma, Alice is clinching in both auctions when , and we only need to replace bidder by Alice in Equation 4.

Claim A.12.

If at some time , then . Therefore, if , then for all , .

Claim A.13.

If at some time , then . Therefore, if , then for all , we have .

A.2.3 Case 1:

We will now prove Theorem 4.1 in two cases. We will first prove Theorem 4.1 under the assumption that .

Lemma A.14.

If , then .

Proof.

We first show . Suppose . If some bidder other than Alice is clinching in High just before time , then . Thus, . Also note that Alice . Thus, . If auction High stops at time because some bidder in drops out, then Low will also stop at , a contradiction. Thus, assume none of the bidders with valuation equal to is in the set . All those bidders will retain their initial budgets in both the auctions till time . Therefore the excess-demand (that is, ) will reduce by the same quantity in both the auctions at time . Now, by the clinching invariant, the difference between the excess demands between auctions High and Low at time is precisely , so that since , the excess-demand in Low is less than that of High. Since the excess demand in High becomes non-positive at (stopping condition), we conclude that excess-demand in Low will become non-positive at time so that Low will stop at that time, again a contradiction.

Since auction Low stops at time and Alice , we can bound the utility of Alice from the final one shot allocation in Low as

Assume , else we are already done. In this case, since Alice , we have

Following the proof of Claim A.10, we have for all bidders with . Therefore,

Since auction Low stops at time , we have:

Thus, by Lemma 3.1, in auction High, Alice gets at least fraction of the item at price , and hence:

Therefore, . This completes the proof. ∎

A.2.4 Case 2:

We will now prove Theorem 4.1 for the case when ; this will complete its proof assuming .

We now show a sequence of claims bounding the utility obtained in various phases of the auction.

Claim A.15.

If , then for all :

Claim A.16.

If , then:

Proof.

Consider auction High. Alice starts to clinch at time . As the price increased from to , her budget decreased by an amount . The price was always less than during this interval; thus she gets at least fraction of the item at an average unit price that is at most . We get

By definition, , and the claim is proved. ∎

Claim A.17.

If , then for all :

Lemma A.18.

If , then .

Proof.

If , then and Alice receives zero utility from the final one-shot allocations in both the auctions. Note that by Claim A.12, we have . Thus, and the lemma is true.

Now suppose . Alice’s utility from the final one-shot allocation in High is given by:

On the other hand, in Low, during the time interval , Alice can get at most fraction of the item at an average unit price that is at least . Thus,

Adding this to Equation 5, we get

This completes the proof. ∎

A.3 The Special Case: Alice Never Enters in Auction Low, that is

In this section, we prove Theorem 4.1 when , that is, in auction Low, Alice receives all her utility from the final one shot allocation in Step (I) of Figure 1. We will consider three mutually exclusive and exhaustive cases corresponding respectively to Low stopping: (i) before any bidder starts clinching; (ii) after some bidder starts clinching, but before any bidder starts clinching in High; and (iii) after some bidder starts clinching in High. We first show the following claim which gives a closed form expression for the utility gained by Alice in Low.

Claim A.19.

In auction Low, Alice only receives a one shot allocation of at price , and her utility is given by . Furthermore, in this case,

.

Proof.

Consider auction Low. Since , Assumption 1 implies , so that by Lemma 3.5, Alice’s budget is extracted completely at price . The first part of the claim follows.

To see the second part, first note that Supply Invariant holds just before the auction stops. At time , from the perspective of the active bidder with highest remaining budget (), total demand of other active bidders is no less than the available supply (). In other words:

At time , the auction stops because total demand of all the active bidders is no more than available supply, so that . Thus, total demand of active bidders drop by at least as time changes from to . This abrupt decrease in total demand is caused by the set of exiting bidders (that is, bidders with ). Therefore, we get: , completing the proof. ∎

A.3.1 Case 1:

We first consider the case where Low stops before any bidder starts clinching. We have . Using an argument similar to the proof of Claim A.5, it can be shown that Low starts clinching no later than High, that is, . Furthermore, just before Low starts clinching (at time ), the remaining budget of every active bidder equals her reported budget. In particular, every bidder other than Alice has the same remaining budget across the two auctions, that is, . For Alice, . Also note that . Since auction Low stops at time , we must have:

Comparing the LHS and the RHS, we see that in auction High,

Thus, Alice receives at least fraction of the item at unit price in auction High. Since , Claim A.19 implies her utility from High is no less than her utility from Low.

A.3.2 Case 2:

We next consider the case where Low stops after some bidder starts clinching, but before any bidder starts clinching in High. Let stands for “Alice”. Suppose . Since Low stops at ,

For all bidders with , we have , otherwise . Since in Low, clinching bidders clinched at price at most , we have

For all bidders with , we have . It follows that

Therefore, by Lemma 3.1, Alice clinches at least quantity in High at price , so that Theorem 4.1 holds.

A.3.3 Case 3:

We finally consider the case where Low stops after some bidder starts clinching in both auctions. We have (see Assumption 2). Since the second inequality is strict, we get .

Following an argument exactly similar to the one outlined in Section A.2.1, we have , and whenever , the former reduces at a larger rate. Therefore:

| (6) |

We will first show that , else Theorem 4.1 is true. Suppose . By Claim A.19, Alice gets a one shot allocation of at stopping price . We will show that Alice will also get at least at the same price in High. Now, since and , we must have:

Since auction Low stops at time , by Claim A.19, we must have

Note that a bidder with valuation equal to can never be in , otherwise we will have , a contradiction. Also note by Claim A.19 that Alice does not have valuation equal to . Thus, for all bidders , if , then . That is,

It follows that

The final inequality follows from Equation (6). Therefore, by Lemma 3.1, Alice clinches at least at price in High to maintain the Supply Invariant, and Theorem 4.1 is true.

Therefore, if Theorem 4.1 is not already true, we must have: . In particular, Alice is clinching in High during the time interval . Furthermore, we have and Alice . Similar to the argument above, we must have:

Since Alice , we have:

Therefore, in High, by Lemma 3.1, Alice gets at least fraction at unit price . Also note that Alice reduced her budget from to during the time interval . Thus, in this time interval, she clinched at least at an average unit price that is at most . Thus, we conclude:

The final inequality follows from Equation (6). This implies Theorem 4.1.