Quantum Neural Computation for Option Price Modelling

Abstract

We propose a new cognitive framework for option price modelling, using quantum neural computation formalism. Briefly, when we apply a classical nonlinear neural-network learning to a linear quantum Schrödinger equation, as a result we get a nonlinear Schrödinger equation (NLS), performing as a quantum stochastic filter. In this paper, we present a bidirectional quantum associative memory model for the Black–Scholes–like option price evolution, consisting of a pair of coupled NLS equations, one governing the stochastic volatility and the other governing the option price, both self-organizing in an adaptive ‘market heat potential’, trained by continuous Hebbian learning. This stiff pair of NLS equations is numerically solved using the method of lines with adaptive step-size integrator.

Keywords: Option price modelling, Quantum neural computation, nonlinear Schrödinger equations, leverage effect, bidirectional associative memory

1 Introduction

The celebrated Black–Scholes partial differential equation (PDE) describes the time–evolution of the market value of a stock option [1, 2]. Formally, for a function defined on the domain and describing the market value of a stock option with the stock (asset) price , the Black–Scholes PDE can be written (using the physicist notation: ) as a diffusion–type equation,111Recall that this similarity with diffusion equation led Black and Scholes to obtain their option price formula as the solution of the diffusion equation with the initial and boundary conditions given by the option contract terms. which also resembles the backward Fokker–Planck equation222Recall that the forward Fokker -Planck equation (also known as the Kolmogorov forward equation, in which the probabilities diffuse outwards as time moves forwards) describes the time evolution of the probability density function for the position of a particle, and can be generalized to other observables as well [3]. Its first use was statistical description of Brownian motion of a particle in a fluid. Applied to the option–pricing process with drift , diffusion and volatility , the forward Fokker–Planck equation reads: The corresponding backward Fokker–Planck equation (which is probabilistic diffusion in reverse, i.e., starting at the final forecasts, the probabilities diffuse outwards as time moves backwards) reads:

| (1) |

where is the standard deviation, or volatility of , is the short–term prevailing continuously–compounded risk–free interest rate, and is the time to maturity of the stock option. In this formulation it is assumed that the underlying (typically the stock) follows a geometric Brownian motion with ‘drift’ and volatility , given by the stochastic differential equation (SDE) [5]

| (2) |

where is the standard Wiener process.333The economic ideas behind the Black–Scholes option pricing theory translated to the stochastic methods and concepts are as follows (see [7]). First, the option price depends on the stock price and this is a random variable evolving with time. Second, the efficient market hypothesis [8, 9], i.e., the market incorporates instantaneously any information concerning future market evolution, implies that the random term in the stochastic equation must be delta–correlated. That is: speculative prices are driven by white noise. It is known that any white noise can be written as a combination of the derivative of the Wiener process [34] and white shot noise (see [10]). In this framework, the Black–Scholes option pricing method was first based on the geometric Brownian motion [1, 2], and it was lately extended to include white shot noise.The PDE (1) is usually derived from SDEs describing the geometric Brownian motion (2), with the solution given by: In mathematical finance, derivation is usually performed using Itô lemma [32] (assuming that the underlying asset obeys the Itô SDE), while in econophysics it is performed using Stratonovich interpretation (assuming that the underlying asset obeys the Stratonovich SDE [33]) [10, 7].

The solution of the PDE (1) depends on boundary conditions, subject to a number of interpretations, some requiring minor transformations of the basic BS equation or its solution.444The basic equation (1) can be applied to a number of one-dimensional models of interpretations of prices given to , e.g., puts or calls, and to , e.g., stocks or futures, dividends, etc. In the first (and most important) example, is a call on a European vanilla option with exercise price and maturity at ; then the solution to (1) is given by (see, e.g. [6]) In practice, the volatility is the least known parameter in (1), and its estimation is generally the most important part of pricing options. Usually, the volatility is given in a yearly basis, baselined to some standard, e.g., 252 trading days per year, or 360 or 365 calendar days. However, and especially after the 1987 crash, the geometric Brownian motion model and the BS formula were unable to reproduce the option price data of real markets.555Recall that Black–Scholes model assumes that the underlying volatility is constant over the life of the derivative, and unaffected by the changes in the price level of the underlying. However, this model cannot explain long-observed features of the implied volatility surface such as volatility smile and skew, which indicate that implied volatility does tend to vary with respect to strike price and expiration. By assuming that the volatility of the underlying price is a stochastic process itself, rather than a constant, it becomes possible to model derivatives more accurately. As an alternative, models of financial dynamics based on two-dimensional diffusion processes, known as stochastic volatility (SV) models [11], are being widely accepted as a reasonable explanation for many empirical observations collected under the name of ‘stylized facts’ [12]. In such models the volatility, that is, the standard deviation of returns, originally thought to be a constant, is a random process coupled with the return in a SDE of the form similar to (2), so that they both form a two-dimensional diffusion process governed by a pair of Langevin equations [11, 13, 14].

Using the standard Kolmogorov probability approach, instead of the market value of an option given by the Black–Scholes equation (1), we could consider the corresponding probability density function (PDF) given by the backward Fokker–Planck equation (see [10]). Alternatively, we can obtain the same PDF (for the market value of a stock option), using the quantum–probability formalism [39, 40], as a solution to a time–dependent linear Schrödinger equation for the evolution of the complex–valued wave function for which the absolute square, is the PDF (see [43]).

In this paper we go a step further and propose a novel general quantum–probability based,666Note that the domain of validity of the ‘quantum probability’ is not restricted to the microscopic world [41]. There are macroscopic features of classically behaving systems, which cannot be explained without recourse to the quantum dynamics. For example, a field theoretic model leads to the view of the phase transition as a condensation that is comparable to the formation of fog and rain drops from water vapor. According to such a model, the production of activity with long–range correlation in complex systems like financial markets takes place through the mechanism of spontaneous breakdown of symmetry, which has been shown to describe long–range correlation in condensed matter physics. The adoption of such approach enables modelling of a financial markets and its hierarchy of components as a fully integrated macroscopic quantum system, namely as a macroscopic system which is a quantum system not in the trivial sense that it is made, like all existing matter, by quantum components such as atoms and molecules, but in the sense that some of its macroscopic properties can best be described with recourse to quantum dynamics (see [42] and references therein). option–pricing model, which is both nonlinear (see [17, 18, 19, 20]) and adaptive (see [21, 6, 4, 35]). More precisely, we propose a quantum neural computation [25] approach to option price modelling and simulation. Note that this approach is in spirit of our adaptive path integral [29, 30] approach to human cognition.

2 The Model

2.1 Bidirectional, spatio-temporal, complex-valued associative memory machine

The new model is defined as a self-organized system of two coupled nonlinear Schrödinger (NLS) equations:777NLS can be viewed as a ‘deformation’ of the linear time-dependent Schrödinger equation from non-relativistic quantum mechanics. NLS no longer has a physical interpretation as the evolution of a quantum particle, but can be derived as a model for quantum media such as Bose–Einstein condensates (see e.g. [38]). In addition, for some values of parameters and initial/boundary conditions, the PDF–solution to NLS can be a soliton. This hypothetical option–price–soliton can potentially give a new light on financial markets simulation and will be explored elsewhere. one defining the option–price wave function , with the corresponding option–price PDF defined by , and the other defining the volatility wave function , with the corresponding volatility PDF defined by . The two focusing NLS equations are coupled so that the volatility PDF is a parameter in the option–price NLS, while the option–price PDF is a parameter in the volatility NLS. In addition, both processes evolve in a common self–organizing market heat potential.

Formally, we propose an adaptive, semi-symmetrically coupled, volatility + option–pricing model (with interest rate , imaginary unit and Hebbian learning rate ), which represents a bidirectional NLS–based spatio-temporal associative memory. The model is defined (in natural quantum units) by the following stiff NLS–system:888The proposed coupled NLS equations (4) and (5) are both examples of the standard focusing NLS equation (see, e.g. [47]): (3) where It is a well-known fact that this equation has both soliton and multisoliton solutions (see [50, 49]). Technically speaking, the NLS equation (3) is called ‘mass and energy sub–critical’ [48], ‘scattering–critical’ [51], ‘Galilean invariant’ and ‘completely integrable system’ [52, 53], arising from classical Hamiltonian energy function with the classical Poisson brackets Its quantum Hamiltonian operator has the form and the classical Poisson brackets are replaced by quantum Poisson brackets, or commutators: Linear component of (3) is the standard Schrödinger equation: The NLS equation (3) has a ‘blowup’ whenever the Hamiltonian is negative [54, 55] and in particular one has a blowup arbitrarily close to the ground state [56, 57].

| (4) | |||||

| (5) | |||||

| (6) |

In the proposed model, the –NLS (4) governs the short–range PDF–evolution for stochastic volatility, which plays the role of a nonlinear (variable) coefficient in (5); the –NLS (5) defines the long–range PDF–evolution for stock price, which plays the role of a nonlinear coefficient in (4). The purpose of this coupling is to generate a leverage effect, i.e. stock volatility is (negatively) correlated to stock returns999The hypothesis that financial leverage can explain the leverage effect was first discussed by F. Black [31]. (see, e.g. [15]). The ODE (6) defines the based continuous Hebbian learning [36, 37]. The adaptive volatility potential is defined as a scalar product of the weight vector and the Gaussian kernel vector and can be related to the market temperature (which obeys Boltzman distribution [16]). The Gaussian vector is defined as:

| (7) | |||

| (8) |

where , while represents the stock–price increment defined using the method of lines (where each NLS was decomposed into first-order ODEs; see Appendix).

Note that each of the NLS equations (4) and (5) individually resembles ‘quantum stochastic filtering/quantum neural network’ models of [22, 23, 24]. Thus, the whole model effectively performs quantum neural computation [25], by giving a spatio-temporal and quantum generalization of Kosko’s BAM family of neural networks [26, 27]. In addition, the solitary nature of NLS equations may describe brain-like effects frequently occurring in financial markets: volatility/price soliton propagation, reflection and collision (see [28]).

2.2 Simulation results

The model (4)–(6) has been numerically solved for the following initial conditions (IC) and repeatable boundary conditions (BC):

| (9) | |||||

| (10) |

using the method of lines [44] (with lines per NLS discretization, see Appendix) within the Cash–Karp version [45] of the adaptive step-size Runge-Kutta-Fehlberg 4/5th order algorithm [46]. The average simulation time (depending on the random initial weights and Gaussians) was 10–30 seconds on a standard Pentium 4 PC, using Visual C++ compiler101010In this respect it is important to note that in order to have a useful option pricing model, the speed of calculation is paramount. Especially for European options it is extremely important to have a fast calculation of the price and the hedge parameters, since these are the most liquidly traded financial options.

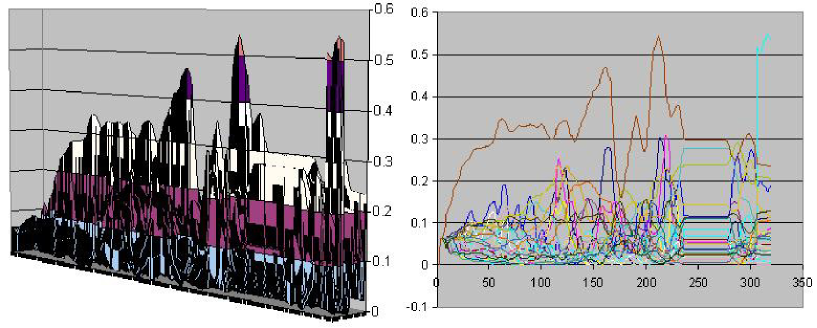

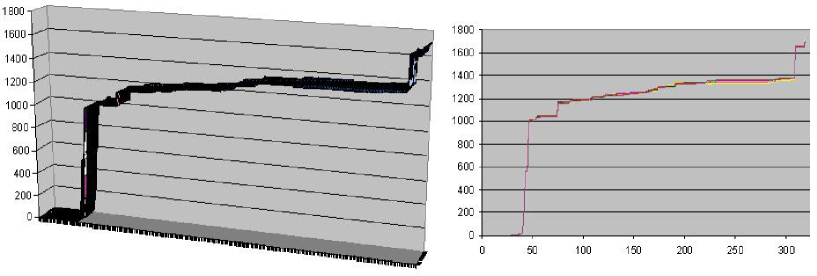

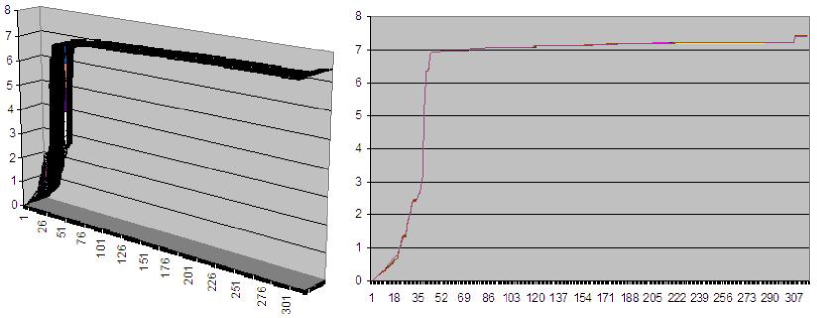

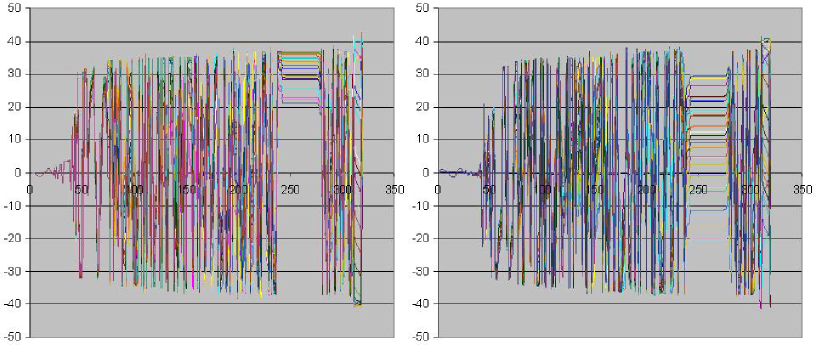

A sample daily evolution of the volatility PDF is given in Figure 1. The corresponding option-price PDF is given in Figure 2, with the Log-plot given in Figure 2. The corresponding Hebbian weights and Gaussian kernels are given in Figure 4.

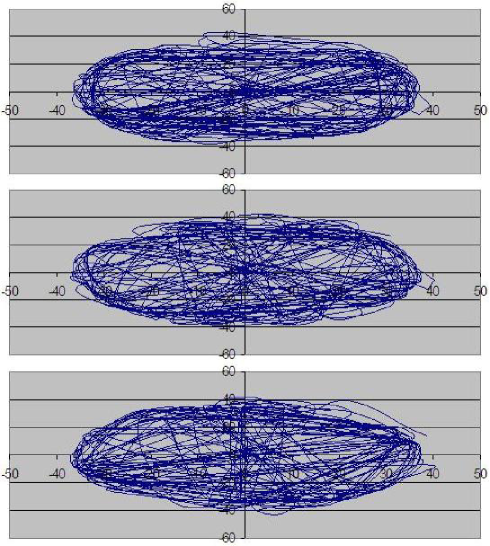

2.3 Complex-valued wave-function lines

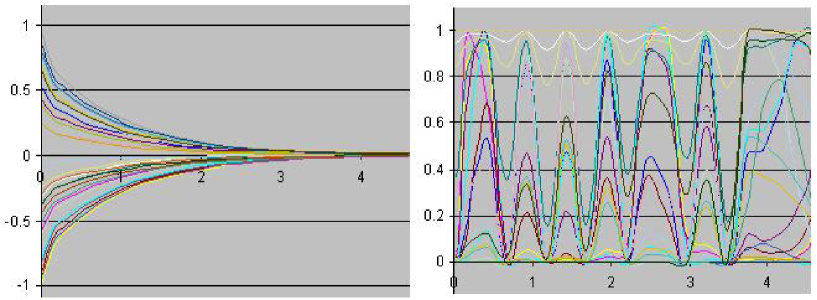

Complex-valued quantum probability lines for option price evolution have some interesting properties of their own. Imaginary and real wave-functions corresponding to the option-price PDF from Figure 2 are given in Figure 5. They can be combined in a phase-space fashion to give complex-plane plots, as in Figure 6. These complex phase plots of individual wave-function lines depict small fluctuations around circular periodic motions.

3 Conclusion

In this paper we have proposed a new cognitive formalism for option price modelling, based on quantum neural computation. The model consists of a pair of coupled nonlinear Schrödinger equations, representing quantum–stochastic volatility and option–price evolutions. The two equations create a leverage effect by self–organizing in a common market–heat potential, using continuous Hebbian learning. An efficient numerical solver for this bidirectional spatio-temporal associative memory is implemented in C++ using the method of lines and adaptive step-size algorithm. Sample simulations are provided as well as the outline of the algorithm.

4 Appendix: Method of Lines for Coupled NLS Eqs. (4)–(5)

Assuming that we already have a stable adaptive Runge-Kutta-Fehlberg (RKF) integrator for systems of ODEs, we can implement the powerful method of lines [44] for the coupled NLS pair (4)–(5) as follows. We start with the standard heat equation:

| (11) |

where is a real-valued function. Solution of this PDE can be found if we have one initial condition:

| (12) |

and two boundary conditions:

A commonly used second order/central finite difference approximation for is

where is an index designating a position along a grid in which has (e.g. 10) points and is the spacing in along the grid. In this way, the heat PDE (11) can be approximated as a system of ODEs

| (14) |

The set of ODEs (14) is then integrated, using the RKF integrator, subject to IC and BC.

Once we are able accurately solve the set of ODEs (14) with the conditions (12)–(4), we can add the potential term :

with the corresponding set of approximating ODEs:

| (15) |

Once we are able to solve the set of heat ODEs (15) with the real-valued conditions (12)–(4), we can move into the complex plane, by introducing the imaginary unit on the left and the minus sign on the right:

| (16) |

This is the linear time–dependent Schrödinger equation from non-relativistic quantum mechanics (in natural units, for which both the Planck constant and the particle mass are one, see [40]) for the complex–valued wave function. It has the corresponding set of approximating complex-valued ODEs:

| (17) |

Once we are able to solve the linear Schrödinger equation (16) with the complex-valued conditions similar to (12)–(4), as a set of complex-valued ODEs (17), we can replace the linear term on the right with the cubic nonlinearity:

| (18) |

This is the nonlinear Schrödinger equation (NLS). Its corresponding set of approximating complex-valued ODEs reads:

| (19) |

Finally, our option pricing model (4)–(5) represents a stiff pair of coupled complex-valued ODE–decompositions of the form of (19), together with the Hebbian learning ODE (6). Although the resulting ODE-system is stiff, the Cash–Karp version [45] of the adaptive step-size Runge-Kutta-Fehlberg algorithm [46] can efficiently solve it (in Visual C++) for various boundary conditions and random initial weights and Gaussian kernels.

References

- [1] F. Black, M. Scholes, The Pricing of Options and Corporate Liabilities, J. Pol. Econ. 81, 637-659, (1973)

- [2] R.C. Merton, Theory of Rational Option Pricing, Bell J. Econ. and Management Sci. 4, 141-183, (1973)

- [3] L.P. Kadanoff, Statistical Physics: statics, dynamics and renormalization. World Scientific, Singapore, (2000)

- [4] V. Ivancevic, T. Ivancevic, Geometrical Dynamics of Complex Systems. Springer, Dordrecht, (2006)

- [5] M.F.M. Osborne, Brownian Motion in the Stock Market, Operations Research 7, 145-173, (1959)

- [6] L. Ingber, High-resolution path-integral development of financial options. Physica A 283, 529-558, (2000)

- [7] J. Perello, J. M. Porra, M. Montero, J. Masoliver, Black-Scholes option pricing within Ito and Stratonovich conventions. Physica A 278, 1-2, 260-274, (2000)

- [8] E. Fama, The behavior of stock market prices. J. Business 38, 34-105, (1965)

- [9] M.C. Jensen, Some anomalous evidence regarding market efficiency, an editorial introduction, J. Finan. Econ. 6, 95-101, (1978)

- [10] C.W. Gardiner, Handbook of Stochastic Methods, Springer, Berlin, (1983)

- [11] J.-P. Fouque, G. Papanicolau, and K. R. Sircar, Derivatives in Financial Markets with Stochastic Volatility. Cambdrige Univ. Press, Cambridge, (2000)

- [12] R. Cont, Empirical properties of asset returns: stylized facts and statistical issues. Quant. Finance 1, 223 236, (2001).

- [13] J. Perello, R. Sircar, J. Masoliver, Option pricing under stochastic volatility: the exponential Ornstein-Uhlenbeck model. J. Stat. Mech. P06010, (2008)

- [14] J. Masoliver, J. Perello, The escape problem under stochastic volatility: the Heston model. Phys. Rev. E 78, 056104, (2008)

- [15] H.E. Roman, M. Porto, C. Dose, Skewness, long-time memory, and non-stationarity: Application to leverage effect in financial time series. EPL 84, 28001, (5pp), (2008)

- [16] H. Kleinert, H. Kleinert, Path Integrals in Quantum Mechanics, Statistics, Polymer Physics, and Financial Markets (3rd ed), World Scientific, Singapore, (2002)

- [17] R.R. Trippi, Chaos & Nonlinear Dynamics in the Financial Markets. Irwin Prof. Pub. (1995)

- [18] P. Rothman, Nonlinear Time Series Analysis of Economic and Financial Data. Springer, (1999)

- [19] M. Ammann, C. Reich, VaR for nonlinear financial instruments – Linear approximation or full Monte-Carlo? Fin. Mark. Portf. Manag. 15(3), (2001)

- [20] V. Ivancevic, T. Ivancevic, High-Dimensional Chaotic and Attractor Systems. Springer, Dordrecht, (2007)

- [21] Tse, W.M., Policy implications in an adaptive financial economy. J. Eco. Dyn. Con. 20(8), 1339-1366, 1996.

- [22] L. Behera, I. Kar, Quantum Stochastic Filtering. In: Proc. IEEE Int. Conf. SMC 3, 2161–2167, (2005)

- [23] L. Behera, I. Kar, and A.C. Elitzur, Recurrent Quantum Neural Network Model to Describe Eye Tracking of Moving Target, Found. Phys. Let. 18(4), 357-370, (2005)

- [24] L. Behera, I. Kar, and A.C. Elitzur, Recurrent Quantum Neural Network and its Applications, Chapter 9 in The Emerging Physics of Consciousness, J.A. Tuszynski (ed.) Springer, Berlin, (2006)

- [25] V. Ivancevic, T. Ivancevic, Quantum Neural Computation, Springer, Berlin, (submitted)

- [26] B. Kosko, Bidirectional Associative Memory. IEEE Trans. Sys. Man Cyb. 18, 49 60, (1988)

- [27] B. Kosko, Neural Networks, Fuzzy Systems, A Dynamical Systems Approach to Machine Intelligence. Prentice Hall, New York, (1992)

- [28] S.-H. Hanm I.G. Koh, Stability of neural networks and solitons of field theory. Phys. Rev. E 60, 7608–7611, (1999)

- [29] V. Ivancevic, E. Aidman, Life-space foam: A medium for motivational and cognitive dynamics. Physica A 382, 616–630, (2007)

- [30] V. Ivancevic, E. Aidman, E., L. Yen, Extending Feynman’s Formalisms for Modelling Human Joint Action Coordination. Int. J. Biomath. (in press), (2009)

- [31] F. Black, Studies of Stock Price Volatility Changes Proc. 1976 Meet. Ame. Stat. Assoc. Bus. Econ. Stat. 177 -181, (1976)

- [32] K. Itô, On Stochastic Differential Equations, Mem. Am. Math. Soc. 4, 1-51, (1951)

- [33] R.L. Stratonovich, A new representation for stochastic integrals and equations. SIAM J. Control 4, 362-371, (1966)

- [34] N. Wiener, Differential space. J. Math. Phys. 2, 131 174, (1923)

- [35] V. Ivancevic, T. Ivancevic, Complex Nonlinearity: Chaos, Phase Transitions, Topology Change and Path Integrals, Springer, (2008)

- [36] V. Ivancevic, T. Ivancevic, Neuro-Fuzzy Associative Machinery for Comprehensive Brain and Cognition Modelling. Springer, Berlin, (2007)

- [37] V. Ivancevic, T. Ivancevic, Computational Mind: A Complex Dynamics Perspective. Springer, Berlin, (2007)

- [38] H. Spohn, Kinetic equations from Hamiltonian dynamics: Markovian limits. Rev. Mod. Phys. 52, 569 615, (1980)

- [39] V. Ivancevic, T. Ivancevic, Complex Dynamics: Advanced System Dynamics in Complex Variables. Springer, Dordrecht, (2007)

- [40] V. Ivancevic, T. Ivancevic, Quantum Leap: From Dirac and Feynman, Across the Universe, to Human Body and Mind. World Scientific, Singapore, (2008)

- [41] H. Umezawa, Advanced field theory: micro macro and thermal concepts. Am. Inst. Phys. New York, (1993)

- [42] W.J. Freeman, G. Vitiello, Nonlinear brain dynamics as macroscopic manifestation of underlying many–body field dynamics. Phys. Life Rev. 3(2), 93–118, (2006)

- [43] J. Voit, The Statistical Mechanics of Financial Markets. Springer, (2005)

- [44] W.E. Schiesser, The Numerical Method of Lines: Integration of Partial Differential Equations, Academic Press, San Diego, (1991)

- [45] J.R. Cash, A.H. Karp, A variable order Runge-Kutta method for initial value problems with rapidly varying right-hand sides, ACM Trans. Math. Soft. 16, 201-222, (1990)

- [46] E. Fehlberg, Low-order classical Runge-Kutta formulas with step size control and their application to some heat transfer problems. NASA Tech. Rep. 315, (1969)

- [47] T. Tao, On the asymptotic behavior of large radial data for a focusing non-linear Schrödinger equation, Dynamics of PDE 1, 1 48, (2004)

- [48] T. Tao, M. Visan, X. Zhang, Global well-posedness and scattering for the mass-critical nonlinear Schrödinger equation for radial data in high dimensions, (to appear in Duke Math. J.), (2008)

- [49] T. Tao, Why are solitons stable? Bull. AMS, S 0273-0979(08)01228-7, (2008)

- [50] H. Hasimoto, A soliton on a vortex filament, J. Flu. Mech. 51, 477-485, (1972)

- [51] J. Ginibre, G. Velo, Scattering Theory in the Energy Space for a Class of Nonlinear Schrödinger Equations, J. Math. Pure Appl. 64, 363-401, (1985)

- [52] T. Cazenave, F.B. Weissler, The Cauchy problem for the critical nonlinear Schrödinger equation, Non. Anal. TMA, 14, 807-836, (1990)

- [53] T. Kato, On nonlinear Schrödinger equations II. solutions and unconditional well-posedness, J. Anal. Math. 67, 281-306, (1995)

- [54] R.T. Glassey, On the blowing up of solutions to the Cauchy problem for nonlinear Schrödinger operators, J. Math. Phys. 8, 1794-1797, (1977)

- [55] T. Ogawa, Y. Tsutsumi, Blow-up of solution for the nonlinear Schrödinger equation. J. Dif. Eqs. 92(2) 317-330, (1991)

- [56] J. Shatah, W. Strauss, Instability of nonlinear bound states. Comm. Math. Phys. 100, 173-190, (1985)

- [57] J. Zhang, Sharp conditions of global existence for nonlinear Schrödinger and Klein-Gordon equations. Nonlinear Analysis: Theory Methods and Applications, 48, 191-207, (2002)