ALGORITHMS FOR MARKETING-MIX OPTIMIZATION

Abstract

Algorithms for determining quality/cost/price tradeoffs in saturated markets are considered. A product is modeled by real-valued qualities whose sum determines the unit cost of producing the product. This leads to the following optimization problem: given a set of customers, each of whom has certain minimum quality requirements and a maximum price they are willing to pay, design a new product and select a price for that product in order to maximize the resulting profit.

An time algorithm is given for the case, , of linear products, and time approximation algorithms are given for products with any constant number, , of qualities. To achieve the latter result, an bound on the complexity of an arrangement of homothetic simplices in is given, where is the maximum number of simplices that all contain a single points.

1 Introduction

Revealed preference theory [10] is a method of determining a course of business action through the review of historical consumer behaviour. In particular, it is a method of inferring an individual’s or a group’s preferences based on their past choices. The marketing mix [9] of a product consists of the 4 Ps: Product, price, place, and promotion. In the current paper, we present algorithms for optimizing the first two of these by using data about consumer’s preferences. That is, we show how, given data on consumer preferences, to efficiently choose a product and a price for that product in order to maximize profit.

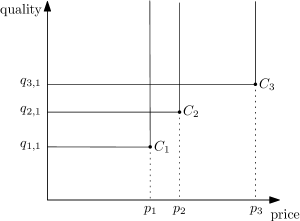

Refer to Figure 1. A product is defined by a real-valued price, , and a number of real-valued orthogonal qualities, . The market for a product is a collection of customers , where . A customer will purchase the least expensive product that meets all their minimum quality requirements and whose price is below their maximum price. That is, the customer will consider the product if and for all . The customer will purchase the product if has minimum price among all available products that considers.

We consider markets that are saturated. That is, for every customer there is an existing product that satisfies ’s requirements and among all products that satisfy ’s requirements, will choose the least expensive product. From the point of view of a manufacturer introducing one or more new products, this means that all customers are Pareto optimal, i.e., there are no two customers and such that for all and . This is because, in a saturated market, and will purchase the same product, namely the lowest-priced product that satisfies ’s (and therefore also ’s) requirements. When modelling a saturated market, there is no need to explicitly consider existing products since these can be encoded into the customers themselves.

As an example, consider a market for computers in which an example customer may be looking for a computer with a minimum of 8 GB of RAM, a CPU benchmark score of at least 3000, a GPU benchmark score of at least 2000, and be willing to pay at most $1500. In addition, there is already a computer on the market which meets these requirements and retails for $1200. Thus, this customer would be described by the vector . If a manufacturer introduces a new product (a computer with 8 GB of RAM, a CPU benchmark score of 3500 and a GPU benchmark score of 2000 retailing for $1199) then this customer would select this new product over their current choice.

By appropriately reparameterizing the axes, we can assume that the cost, , of manufacturing a product is equal to the sum of its qualities

The profit per unit sold of is therefore

In this paper we consider algorithms that a manufacturer can use when a choosing new product to introduce into an existing saturated market with the goal being to maximize the profit obtained. More precisely, given a Pareto-optimal market of customers , each have qualities, the problem is to find a product such that

is maximized. To the best of our knowledge, this is the first time a problem like this has been considered from an algorithmic perspective.

2 Linear products

In this section, we consider the simplest case, when a manufacturer wishes to introduce a new product in which the quality of a product has only one dimension. Examples of such markets include, for example, suppliers to the construction industry in which items (steel I-beams, finished lumber, logs) must have a certain minimum length to be used for a particular application. An overly long piece can be cut down to size, but using two short pieces instead of one long piece is not an option.

Throughout this section, since , we will use the shorthand for the product being designed and for . Thus, we have a set of customers and we are searching for a point that maximizes

Our algorithm is an implementation of the plane-sweep paradigm [3]. The correctness of the algorithm relies on two lemmas about the structure of the solution space. The first lemma is quite easy:

Lemma 1.

The value that maximizes is obtained when and for some .

Proof.

First, observe the obvious bounds on and :

and

Consider the arrangement of lines obtained by drawing a horizontal and vertical line through each customer for . Within each cell of this arrangement, the function is a linear function of and and it is bounded. Therefore, within a particular cell, the function is maximized at a vertex. Since each vertex is the intersection of a horizontal and vertical line through a pair of customers, the lemma follows. ∎

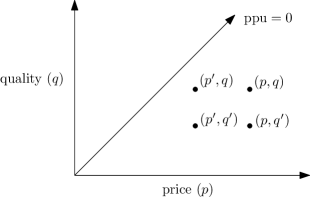

The following lemma, illustrated in Figure 2, is a little more subtle and illustrates a manufacturer’s preference for lower-quality products:

Lemma 2.

Let and let be such that . Then, for any , .

Proof.

By definition, and , where and are the number of customers who would consider and , respectively. These customers are all taken from the set .

Now, consider the customers in the set . By the assumption that customers are Pareto optimal, any customer in has , so all of these customers will consider either or if either one is offered. Therefore,

| since | |||||

| since and | |||||

| by assumption | |||||

as required. ∎

Lemma 2 allows us to apply the plane sweep paradigm with a sweep by decreasing price. It tells us that, if a product gives better profit than the higher-quality product at the current price , then it will always give a better profit for the remainder of the sweep. In particular, there will never be a reason to consider a product with quality for the remainder of the algorithm’s execution.

Let the customers be labelled in decreasing order of , so that for all . At any point in the sweep algorithm, there is a current price , which starts at and takes on the values , successively, during the execution of the algorithm. At all times, the algorithm maintains a list of qualities such that . The quality is the optimal quality for the current price, . By the time the algorithm terminates, the quality of the globally-optimal solution will have appeared as the first element in .

To complete the description of the algorithm, all that remains is to show how is updated during the processing of a sweep line event. For this, the algorithm uses an auxiliary structure to efficiently identify items in that need to updated. Consider a consecutive pair of the elements and in . When and became adjacent in , it was at some price such that . Let and be the number of customers who would consider and , respectively. Then,

and

Now, looking forward in time to a later step in the execution of the algorithm, when , with , we find that

and

We are interested in identifying when the inequality changes to . That is, we need to identify all indices for which,

| (1) |

at which point should be removed from . Observe that the values of , , , , and are all fixed at the time and become adjacent in and the only values that change are those of and . Thus, (1) defines a halfplane in the plane with axes and .

The auxiliary data structure used by the algorithm must therefore be able to store halfplanes and handle insertions, deletions, and queries of the form “Given a point return all halfplanes that contain .” There are several data structures that solve this problem, but the most suitable for the current application is the recent dynamic convex hull data structure of Brodal and Jacob [4].111This data structure is infamously complicated. It’s use in our application can, however, be replaced with a much simpler semi-dynamic data structure [6]. So as not to distract from the problem at hand, we defer the discussion on how to do this until Section 5. Their data structure allows for the insertion and deletion of halfplanes in time. Given a query point , the data structure is able to, in time, find a single halfplane (if one exists) that contains .

The data structure is used as follows. When the sweep line is advanced to a new price , the value is appended to and the halfplane defined by and its predecessor in is inserted into . Next, the data structure is repeatedly queried with the point . This returns a halfplane (if any exists) that corresponds to a pair of consecutive elements such that . The halfplane is then deleted from , is deleted from , and a new halfplane corresponding to the (now adjacent) elements and is inserted into . This process is repeated until querying with the value returns no result.

Note that, after all the processing associated with updating the price , the first element, , in is the value that maximizes . Thus, the algorithm need only keep track, throughout its execution, of the highest profit obtained from the first element of , and output this value at the end of its execution. This completes the description of the algorithm.

Theorem 1.

There exists an time algorithm for ProductDesign.

Proof.

The correctness of the algorithm described above follows from 2 facts: Lemma 1 ensures that the optimal solution is of the form for some , and Lemma 2 ensures that the optimal solution appears at some point as the first element of the list .

The running time of the algorithm can be bounded as follows: Presorting the customers by decreasing order of price can be done in time using any time sorting algorithm. Each sweep line event involves 1 insertion into plus some number of deletions, and insertions, and queries. Note that each deletion in corresponds to a deletion in , and each element of is inserted into at most once. Therefore, the total number of such deletions during the entire execution of the algorithm does not exceed , and each such insertion/deletion pair takes time. Since there are events, we conclude that the total running time of the algorithm is , as claimed. ∎

The following theorem shows that a running time of is inherent in this problem, even when considering approximation algorithms.

Theorem 2.

Let be an instance of ProductDesign(1) and be a solution that maximizes . In the algebraic decision tree model of computation, any algorithm that can find a solution such that has running time in the worst-case.

Proof.

We reduce from the integer Element-Uniqueness problem, which has an lower bound in the algebraic decision tree model [11]: Given an array containing integers, are all the elements of unique?

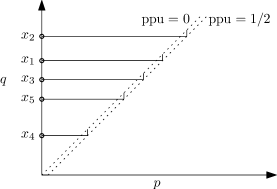

We convert into an instance of in time as follows (refer to Figure 3). For each , we introduce a customer with and . If there exists a value in that occurs or more times, then the product gives a value . On the other hand, if there is no such , then

-

1.

any product with can not be sold to any customers and

-

2.

any product with can be sold to at most customer.

Therefore, if all the elements of are unique, then , otherwise . The result follows. ∎

3 A near-linear approximation algorithm for bidimensional products

In this section, we consider algorithms for , in which products have 2 qualities. As a baseline, we first observe that, if we fix the value of , then the optimal solution of the form can be found using a single application of the algorithm in Theorem 1. Therefore, by successively solving the problem for each and taking the best overall solution we obtain an time algorithm for .

More generally, can be solved using applications of Theorem 1 resulting in an time algorithm. Unfortunately, these are the best results known for , and, as discussed in Section 5, we suspect that an algorithm with running time will be difficult to achieve using existing techniques. Therefore, in this section we focus our efforts on obtaining a near-linear approximation algorithm.

Fix some constant . Given an instance of , a point is a -approximate solution for if for all . An algorithm is a (high probability) Monte-Carlo -approximation algorithm for if, given an instance of size , the algorithm outputs a -approximate solution for with probability at least for some constant .

Let and observe that is the maximum profit per unit that can be achieved in this market. Let and let and observe that .222This can be seen by taking the limit using one application of L’Hôpital’s Rule. For each , define the plane . The following lemma says that a search for an approximate solution can be restricted to be contained in one of the planes .

Lemma 3.

For any product , there exists a product such that for some and .

Proof.

There are two cases to consider. If then , in which case we set where , so that and , as required.

Otherwise, . In this case, consider the plane where . Notice, that for any point , . More specifically, the orthogonal projection of onto is a product with , , and . Therefore, any customer who would consider would also consider , so , as required. ∎

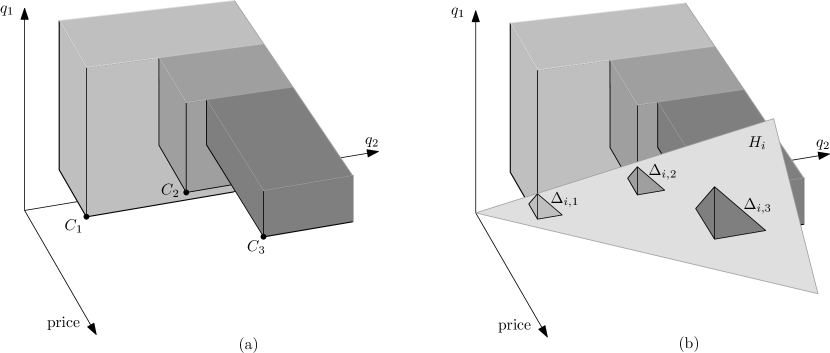

Lemma 3 implies that the problem of finding an approximate solution to can be reduced to a sequence of problems on the planes . Refer to Figure 4. Each customer considers all products in a quadrant whose corner is . The intersection of this quadrant with is a (possibly empty) equilateral triangle . The customer will consider a product in if and only is in . Thus, the problem of solving restricted to the plane is the problem of finding a point contained in the largest number of equilateral triangles from the set .

Note that the elements in are homothets (translations and scalings) of an equilateral triangle, so they form a collection of pseudodisks and we wish to find the deepest point in this collection of pseudodisks. No algorithm with running time is known for solving this problem exactly, but Aronov and Har-Peled [1] have recently given a Monte-Carlo -approximation algorithm for this problem that runs in time . By applying this algorithm to each of for , we obtain the following result:

Theorem 3.

For any , there exists an time (high-probability) Monte-Carlo -approximation algorithm for .

4 A near-linear approximation algorithm for constant

In this section we extend the algorithm from the previous section to (approximately) solve for any constant value of . The algorithm is more or less unchanged, except that the proof requires some new results on the combinatorics of arrangements of homothets.

As before, let and let . For each , define the hyperplane . The following lemma has exactly the same proof as Lemma 3.

Lemma 4.

For any product , there exists a product such that for some and .

Again, each customer defines a regular simplex in such that will consider if and only if . In this way, we obtain a set of homothets of a regular simplex in and we require an algorithm to find a (-approximation to) the point that is contained in the largest number of these simplices. The machinery of Aronov and Har-Peled [1] can be used to help solve this problem, but not before we prove some preliminary results, the first of which is a combinatorial geometry result.

Lemma 5.

Let be a set of homothets of a regular simplex in , for , and such that no point in is contained in more than elements of . Then, the total complexity of the arrangement, , of the simplices in is .

Proof.

We first consider the simpler case in which the elements of are translates (without scaling) of a regular simplex. Suppose that the total complexity of is . Then, by the pigeonhole principle, there is some element in that is involved in features of . Note that this implies that intersects all the elements of a set with , since otherwise there are not enough elements in to generate features on the surface of .

Observe that, since the elements of are all unit size and they all intersect , that they are all contained in a ball of radius centered at the center of . Furthermore, since each element of has volume this implies that some point must be contained in elements of . Thus, we obtain the inequality , or, equivalently, , as required.

Now, for the case where the elements of are homothets (translations and scalings) of a regular simplex, we proceed as follows. Assume, by way of contradiction, that for some to be defined later. Label the elements of in increasing order of size and consider the smallest element such that contributes at least features to . Such a is guaranteed to exist, since otherwise .

Now, intersects all the elements in some set with . Shrink each element in so as to obtain an element such that (a) the size of is equal to the size of and (b) . Call the resulting set of shrunken elements . Condition (a) and the packing argument above imply that there is a point that is contained in elements of . Condition (b) implies that is contained in elements of and hence also . Therefore, we conclude, as before that . Thus, for a sufficiently large constant , setting yields a contradiction to the assumption that . We conclude that , as required. ∎

Remark.

The proof of Lemma 5 makes almost no use of the assumption that the elements of are regular simplices other than using the property that their volume is related to their diameter. Thus, a version of this lemma holds for collections of fat objects, a result that will probably be of independent interest.

Remark.

Lemma 5 is somewhat surprising, since the union of homothets of a regular tetrahedron in, for example, can easily have complexity . This fact makes it impossible to apply the “usual” Clarkson-Shor technique [5] that relates the complexity of the first levels to that of the boundary of the union (the 0-level).

Lemma 6.

Let be a set of homothets of the regular simplex in such that no point of is contained in more than simplices of . Then the arrangement of can be computed in time.

Proof.

Computing the arrangement can be done in the following way. Sort the elements of by decreasing size and construct incrementally by inserting the elements one by one. When inserting an element , use a data structure (described below) to retrieve the elements of that intersect and discard the elements that are smaller than . The proof of Lemma 5 implies that there will be at most such elements. The intersection of the surfaces of these elements with the surface of has size and can be computed in time using applications of the standard algorithm for computing an arrangement of hyperplanes in [7, 8]. Thus, ignoring the cost of finding the elements that intersect , the overall running time of the algorithm is .

All that remains is to describe a data structure for retrieving the elements that intersect a given simplex . In the following we describe a data structure that can be constructed in time and can answer queries in time, where is the size of the output. This data structure will be constructed once and queried times. The total size of the outputs over all queries will be the .

Since the elements of are homothets, each element of can be described concisely by the lexicographically smallest of its coordinates and one real number describing its size. In this way, each element of can be represented as a point in and thus can be represented as a set of points .

Observe that, given a half space in , the set of elements of intersected by is given by the set of points of contained in some halfspace in . Furthermore, the transformation preserves parallel halfspaces. That is, if are halfspaces that have the same inner normal then and also have the same inner normal.

Now, observe that any simplex can be expressed as the intersection of closed halfspaces, all of whose inner normals are taken from the set of of inner normals of the facets of a regular simplex. Let denote the inner normal of a halfspace , where is a halfspace whose inner normal is .

The data structure for storing is a layer range tree [2] in which the th layer, for , stores its points ordered by their projection onto . In this way, the range tree can return the set of all simplices in that intersect . The size of this range tree is and it can answer queries in time where is the size of the query result. Since each simplex in is passed as a query to this data structure exactly once, the total sizes of outputs over all queries is equal to the number of pairs such that . But the number of such pairs is certainly a lower bound on so it must be at most . This completes the proof. ∎

Lemma 6 can be used as a subroutine in the algorithm of Aronov and Har-Peled [1, Theorem 3.3], to obtain the following Corollary.

Corollary 1.

Let be a set of homothets of a regular simplex in such that some point is contained in elements of . Then there exists an algorithm whose running time is and that, with high probability, returns a point contained in at least elements of .

As before, an approximate solution to problem reduces to finding deepest point in each of the sets where is a set of -simplices in . By using the algorithm of to do this we obtain the following result:

Theorem 4.

For any , there exists an time (high-probability) Monte-Carlo -approximation algorithm for .

5 Conclusions

We have given an time exact algorithm for solving and time approximation algorithms for solving . The running time of the exact algorithm is optimal and no algorithm that produces a -approximation, for any , can run in time.

In developing these algorithms, we gave a proof (the proof of Lemma 5) that shows that an arrangement of fat convex objects in has complexity where is the maximum number of objects that contain any given point. We expect that this result, and the algorithm for approximate depth that arise from it [1], will find other applications.

Our exact algorithm for the case uses the recent dynamic convex hull data structure of Brodal and Jacob [4], which is quite complicated. We observe that the use of this structure can be avoided by using the (much simpler) semi-dynamic data structure of Dobkin and Suri [6]. To use this structure, we need to specify, each time a point is inserted, the time at which that point will be deleted. In our case, Lemma 2 implies that this deletion time can be computed by a binary search on using (1).

An exact near-linear time algorithm for the case seems to be out of reach. It appears as if this problem requires (at least) a solution to the problem of finding a point contained in the largest number of homothets of an equilateral triangle, a problem for which no subquadratic time algorithm is known. Is it possible to prove some kind of a lower bound? The related problem of finding the point contained in the largest number of unit disks is 3-Sum hard [1] providing some evidence that this problem will be difficult to solve in subquadratic time.

In this paper we considered the case where the problem is parameterized by the number, , of orthogonal qualities that a product may have. Another case to consider is the case in which a manufacturer wishes to introduce some number, , , of new products into a market. Is this problem NP-hard? Does it have a polynomial time approximation algorithm?

Acknowledgement

The authors would like to thank Gautam Das for bringing this class of problems to our attention and Timothy Chan for helpful discussions on the subject of approximate depth.

References

- [1] B. Aronov and S. Har-Peled. On approximating the depth and related problems. SIAM Journal on Computing, 38(3):899–921, 2008.

- [2] J. L. Bentley. Multidimensional binary search trees used for associative searching. Communications of the ACM, 18:509–517, 1975.

- [3] J. L. Bentley and T. A. Ottman. Algorithms for reporting and counting geometric intersections. IEEE Transactions on Computing, C-28:643–647, 1979.

- [4] G. S. Brodal and R. Jacob. Dynamic planar convex hull. In IEEE Symposium on Foundations of Computer Science (FOCS 2002), pages 617–626, 2002.

- [5] K. Clarkson and P.W. Shor. Applications of random sampling in computational geometry, ii. Discrete & Computational Geometry, 4:387–421, 1989.

- [6] D. Dobkin and S. Suri. Maintenance of geometric extrema. Journal of the ACM, 38:275–298, 1991.

- [7] H. Edelsbrunner, J. O’Rourke, and R. Seidel. Constructing arrangements of lines and hyperplanes with applications. SIAM Journal on Computing, 15:341–363, 1986.

- [8] H. Edelsbrunner, R. Seidel, and M. Sharir. On the Zone Theorem for hyperplane arrangements. SIAM Journal on Computing, 22(2):418–429, 1993.

- [9] P. Kotler and K. Lane. Marketing Management. Prentice-Hall, 2005.

- [10] H. R. Varian. Revealed preference. In Michael Szenberg, Lall Ramrattan, and Aaron A. Gottesman, editors, Samuelsonian Economics in the 21st Century, chapter 6, pages 99–115. Oxford University Press, New York, 2006.

- [11] A. C. Yao. Lower bounds for algebraic computation trees with integer inputs. SIAM Journal on Computing, 20(4):655–668, 1991.