731-0192 Hiroshima, Japan

takaishi@hiroshima-u.ac.jp

Lecture Notes in Business Information Processing \tocauthorAuthors’ Instructions

An Adaptive Markov Chain Monte Carlo Method for GARCH Model

Abstract

We propose a method to construct a proposal density for the Metropolis-Hastings algorithm in Markov Chain Monte Carlo (MCMC) simulations of the GARCH model. The proposal density is constructed adaptively by using the data sampled by the MCMC method itself. It turns out that autocorrelations between the data generated with our adaptive proposal density are greatly reduced. Thus it is concluded that the adaptive construction method is very efficient and works well for the MCMC simulations of the GARCH model.

Keywords:

Markov Chain Monte Carlo, Bayesian inference, GARCH model, Metropolis-Hastings algorithm1 Introduction

It is well known that financial time series of asset returns show various interesting properties which can not be explained from the assumption that the time series obeys the Brownian motion. Those properties are classified as stylized factsCONT . Some examples of the stylized facts are (i) fat-tailed distribution of return (ii) volatility clustering (iii) slow decay of the autocorrelation time of the absolute returns. The true dynamics behind the stylized facts is not fully understood. There are some attempts to make physical models based on spin dynamicsIori -POTTS and they are able to capture some of the stylized facts.

In finance volatility is an important quantity to measure risk. To forecast volatility, various empirical models to mimic the properties of the volatility have been proposed. In 1982 EngleARCH proposed Autoregressive Conditional Heteroskedasticity (ARCH) model where the present volatility is assumed to depend on squares of the past observations. Later BollerslevGARCH proposed Generalized ARCH (GARCH) model which includes additional past volatility terms to the present volatility estimate.

A conventional approach to infer GARCH model parameters is the Maximum Likelihood (ML) estimation where the GARCH parameters are obtained as the values which maximaize the likelihood function of the GARCH model. The maximization of the likelihood function can be done by the maximization tool available in computer libraries. A practical difficulty of the maximization procedure is that the output results are often sensitive to starting values.

An alternative approach, which recently becomes popular, is the Bayesian inference. Usually the Bayesian inference procedure is performed by MCMC methods. There is no unique way to implement MCMC methods. So far a variety of methods to MCMC procedure have been developedBauwens -HMC . In a recent surveyASAI it is shown that Acceptance-Rejection/Metropolis-Hastings (AR/MH) algorithm works better than other algorithms. In the AR/MH algorithm the proposal density is assumed to be a multivariate Student’s t-distribution and its parameters are estimated by the ML technique. Here we develop a method to determine parameters of a multivariate Student’s t-distribution, which does not rely on the ML method. In our method the proposal density is also assumed to be a multivariate Student’s t-distribution but the parameters are determined by an MCMC simulation. During the MCMC simulation, the parameters are updated adaptively using the data generated so far. We test our method using artificial GARCH data and show that the method substantially reduces the correlations between the sampled data and works well for GARCH parameter estimations.

2 GARCH Model

The GARCH(p,q) model to the time series data is given by

| (1) |

| (2) |

where , and to ensure a positive volatility. Furthermore the stationary condition given by

| (3) |

is also required. is an independent normal error . In many empirical studies it is shown that () GARCH model well captures the properties of the financial time series volatility. Thus in this study we use GARCH(1,1) model for our testbed. The volatility of the GARCH model is now written as

| (4) |

where and are the parameters to be estimated.

Let be a parameter set of the GARCH model. The likelihood function of the GARCH model is written as

| (5) |

This function plays a central role in ML estimations and also for the Bayesian inference.

3 Bayesian inference

In this section we briefly describe the Bayesian inference which estimates the GARCH parameters numerically by using the MCMC method. From the Bayes’ theorem the posterior density with data is given by

| (6) |

where is the likelihood function. is the prior density for . The functional form of is not known a priori. Here we assume that the prior density is constant. gives a probability distribution of when the data are given.

With this values of the parameters are inferred as the expectation values of given by

| (7) |

where

| (8) |

is a normalization constant irrelevant to MCMC estimations.

3.1 MCMC

In general the integral of eq.(7) can not be performed analytically. The MCMC technique gives a method to estimate eq.(7) numerically. The basic procedure of the MCMC method is as follows. First we sample drawn from the probability distribution . Sampling is done by a technique which produces a Markov chain. After sampling some data, we obtain the expectation value as an average value over the sampled data ,

| (9) |

where is the number of the sampled data. The statistical error for independent data is proportional to . In general, however, the data generated by the MCMC method are correlated. As a result the statistical error will be proportional to where is the autocorrelation time between the sampled data. The autocorrelation time depends on the MCMC method we employ. Thus it is desirable to choose an MCMC method generating data with a small .

3.2 Metropolis-Hastings algorithm

The most general and simple method to draw values from a given probability distribution is the Metropolis methodMETRO or its generalized version, Metropolis-Hastings methodMH . Let is a probability distribution from which data shall be sampled. First starting from , we propose a candidate which is drawn from a certain probability distribution which we call proposal density. Then we accept the candidate with a probability as the next value of the Markov chain:

| (10) |

If is rejected we keep the previous value .

When , eq.(10) reduces to the Metropolis accept probability:

| (11) |

4 Adaptive construction of proposal density

Disadvantages of the MH method are that the candidate drawn as the next value is not always accepted and in general the data sampled by the Markov chain are correlated, which results in increasing statistical errors.

If the proposal density is close enough to the posterior density the acceptance in the MH method can be high. The posterior density of GARCH parameters often resembles to a Gaussian-like shape. Thus one may choose a density similar to a Gaussian distribution as the proposal density. Following WATANABE ; ASAI , in order to cover the tails of the posterior density we use a (p-dimensional) multivariate Student’s t-distribution given by

| (12) |

where and are column vectors,

| (13) |

and . is the covariance matrix defined as

| (14) |

is a parameter to tune the shape of Student’s t-distribution. When the Student’s t-distribution goes to a Gaussian distribution. At small Student’s t-distribution has a fat-tail.

For our GARCH model and , and thus is a matrix. We determine these unknown parameters and by MCMC simulations. First we make a short run by the Metropolis algorithm and accumulate some data. Then we estimate and from the data. Note that there is no need to estimate and accurately. Second we perform an MH simulation with the proposal density of eq.(12) with the estimated and . After accumulating more data, we recalculate and , and update and of eq.(12). By doing this, we adaptively change the shape of eq.(12) to fit the posterior density. We call eq.(12) with the estimated and ”adaptive proposal density”.

5 Numerical simulations

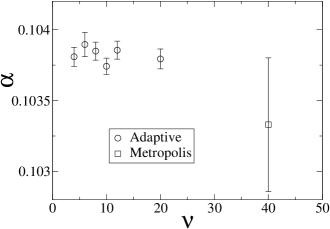

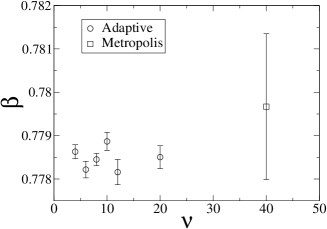

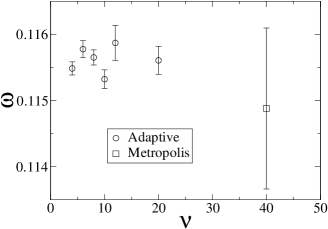

In order to test the adaptive construction method we use artificial GARCH data generated with a known parameter set and try to infer the parameters of the GARCH model from the artificial GARCH data. The GARCH parameters are set to , and . Then using these parameters we generated 2000 data. For this artificial data we perform MCMC simulations by the adaptive construction method.

Implementation of the adaptive construction method is as follows. First we start a run by the Metropolis algorithm. The first 3000 data are discarded as burn-in process or in other words thermalization. Then we accumulate 1000 data for and estimations. The estimated and are substituted to of eq.(12). We re-start a run by the MH algorithm with the proposal density . Every 1000 update we re-calculate and and update . We accumulate 199000 data for analysis. To check parameter dependence on the MCMC estimations we use and perform the same MCMC simulation for each . Later we find that dependence on the MCMC results is weak. Therefore the results from simulations will be mainly shown.

| Adaptive () | 0.10374 | 0.7789 | 0.11532 |

|---|---|---|---|

| standard deviation | 0.019 | 0.045 | 0.034 |

| statistical error | 0.00006 | 0.0002 | 0.00014 |

| Metropolis | 0.1033 | 0.7797 | 0.1149 |

| standard deviation | 0.019 | 0.045 | 0.034 |

| statistical error | 0.0005 | 0.0017 | 0.0012 |

For comparison we also make a Metropolis simulation and accumulate 600000 data for analysis. In this study the Metropolis algorithm is implemented as follows. We draw a candidate by adding a small random value to the present value :

| (15) |

where . is a uniform random number in and is a constant to tune the Metropolis acceptance. We choose so that the acceptance becomes greater than .

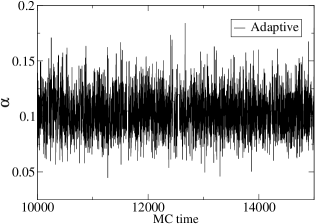

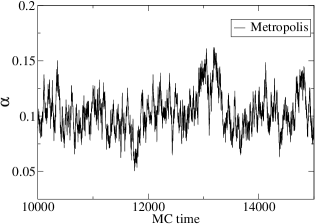

Fig. 1 compares the Monte Carlo history of generated by the adaptive construction method with that by the Metropolis algorithm. It is clearly seen that the data generated by the Metropolis algorithm are very correlated. For other parameters and we also see similar behavior.

To quantify the correlation we measure the autocorrelation function (ACF). The ACF of certain successive data is defined by

| (16) |

where and are the average value and the variance of respectively.

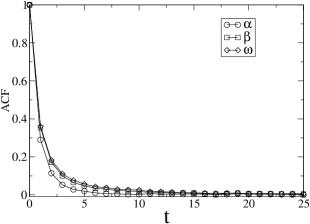

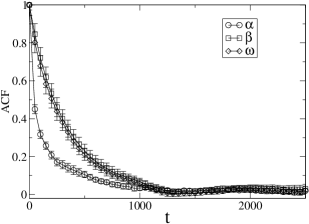

Fig. 2 shows the ACF for the adaptive construction method and the Metropolis algorithm. The ACF of the adaptive construction method decreases quickly as Monte Carlo time increases. On the other hand the ACF of the Metropolis algorithm decreases very slowly which indicates that the correlation between the data is very large.

Using the ACF, the autocorrelation time is calculated as

| (17) |

Results of are summarized in Table 1. The values of from the Metropolis simulations are very large, typically several hundreds. On the other hand we see very small correlations, for the adaptive construction method. Thus the adaptive construction method works well for reducing correlations between the sampled data.

We examine how the covariance matrix varies during the simulations. Here let us define a symmetric matrix as

| (18) |

and . Instead of , we analys this since should be same for all and it is easy to see the convergence property.

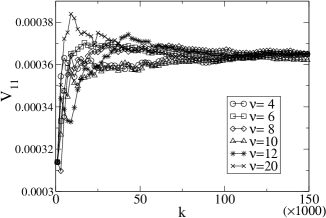

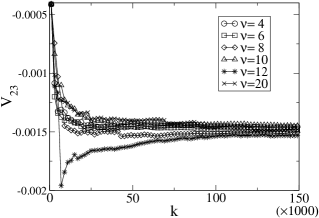

In Fig. 3 we show how and change as the simulations are proceeded. We see that and converge to some values. We also find similar behavior for other . The final output of the matrix elements of from the simulations is as follows.

| (19) |

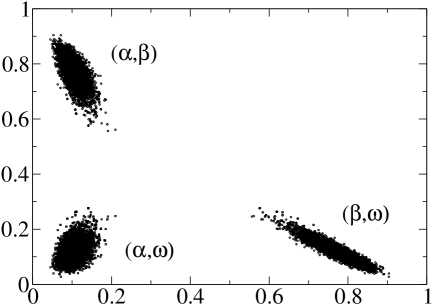

From this result we find that and are negative, and is positive. Fig. 4 also displays these correlation properties.

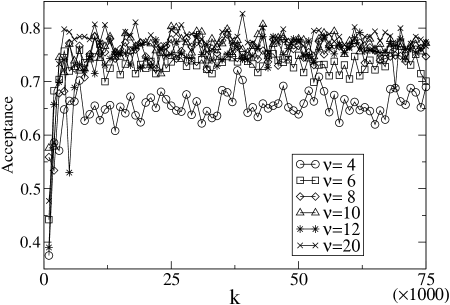

Fig. 5 shows values of the acceptance at the MH algorithm with the adaptive proposal density of eq.(12). Each acceptance is calculated every 1000 updates and the calculation of the acceptance is based on the latest 1000 data. At the first stage of the simulation the acceptance is low because and are not calculated accurately as shown in Fig. 3. However the acceptances increase quickly as the simulations are proceeded and reaches plateaus. Typically the acceptances are more than except for . Probably proposal density is less efficient because the tail of the proposal density is too heavy to cover the tail of the posterior density.

Fig. 6 shows results of the GARCH parameters estimated by the MCMC methods. The values of the GARCH parameters are summarized in Table 1. The results from the adaptive construction method have much smaller error bars and are consistent each other. On the other hand the Metropolis results have larger error bars although the number of the sampled data is larger than that of the adaptive construction method. This is because the data sampled by the Metropolis algorithm are long-correlated. The all results with standard deviations agree with the input GARCH parameters (, and ). This indecates that the MCMC estimations are correctly done.

6 Summary

We proposed a method to construct a proposal density used in the MH algorithm. The construction of the proposal density is performed using the data generated by MCMC methods. During the MCMC simulations the proposal density is updated adaptively. The numerical results show that the adaptive construction method significantly reduces the correlations between the sampled data. The autocorrelation time of the adaptive construction method is calculated to be . This autocorrelation time is similar to that of the AR/MH methodASAI which uses the ML estimation. Thus the efficiency of the adaptive construction method is comparable to that of the AR/MH method. This is not surprising because both methods construct the essentially same proposal density in different ways. Therefore the adaptive construction method serves as an alternative efficient method for GARCH parameter inference without using ML estimations.

Acknowledgments

The numerical calculations were carried out on Altix at the Institute of Statistical Mathematics and on SX8 at the Yukawa Institute for Theoretical Physics in Kyoto University.

References

- (1) See e.g., Cont, R.: Empirical Properties of Asset Returns: Stylized Facts and Statistical Issues. Quantitative Finance 1, 223–236 (2001)

- (2) Iori, G.: Avalanche dynamics and trading friction effects on stock market returns. Int. J. Mod. Phys. C 10, 1149–1162 (1999)

- (3) Bornholdt, S.: Expectation bubbles in a spin model of markets. Int. J. Mod. Phys. C 12, 667–674 (2001)

- (4) Yamano, T.: Bornholdt’s spin model of a market dynamics in high dimensions. Int. J. Mod. Phys. C 13, 89–96 (2002)

- (5) Sznajd-Weron, K., Weron, R.: A simple model of price formation. Int. J. Mod. Phys. C 13, 115–123 (2002)

- (6) Sanchez, J.R: A simple model for stocks markets. Int. J. Mod. Phys. C 13, 639–644 (2002)

- (7) Yamano, T.: A spin model of market dynamics with random nearest neighbor coupling. Int. J. Mod. Phys. C 13, 645–648 (2002)

- (8) Kaizoji, T., Bornholdt, S., Fujiwara, Y.: Dynamics of price and trading volume in a spin model of stock markets with heterogeneous agents. Physica A 316, 441–452 (2002)

- (9) Takaishi, T.: Simulations of financial markets in a Potts-like model. Int. J. Mod. Phys. C 16, 1311–1317 (2005)

- (10) Engle, R.F.: Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of the United Kingdom inflation. Econometrica 50, 987–1007 (1982)

- (11) Bollerslev, T.: Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31, 307–327 (1986)

- (12) Metropolis, N., Rosenbluth, A.W., Rosenbluth, M.N., Teller, A.H., Teller, E.: Equations of State Calculations by Fast Computing Machines. J. of Chem. Phys. 21, 1087–1091 (1953)

- (13) Hastings, W.K.: Monte Carlo Sampling Methods Using Markov Chains and Their Applications. Biometrika 57, 97–109 (1970)

- (14) Bauwens, L., Lubrano, M.: Bayesian inference on GARCH models using the Gibbs sampler. Econometrics Journal 1, c23-c46 (1998)

- (15) Kim. S., Shephard, N., Chib, S.: Stochastic volatility: Likelihood inference and comparison with ARCH models. Review of Economic Studies 65, 361–393 (1998)

- (16) Nakatsuma, T.: Bayesian analysis of ARMA-GARCH models: Markov chain sampling approach. Journal of Econometrics 95, 57–69 (2000)

- (17) Mitsui, H., Watanabe, T.: Bayesian analysis of GARCH option pricing models. J. Japan Statist. Soc. (Japanese Issue) 33, 307–324 (2003)

- (18) Asai, M.: Comparison of MCMC Methods for Estimating GARCH Models. J. Japan Statist. Soc. 36, 199–212 (2006)

-

(19)

Takaishi, T.: Bayesian Estimation of GARCH model by Hybrid Monte Carlo.

Proceedings of the 9th Joint Conference on Information Sciences 2006, CIEF-214

doi:10.2991/jcis.2006.159