A method of moments approach to pricing double barrier

contracts driven by a general class of jump diffusions111

Research supported by EPSRC grant EP/D039053/1

The

research was largely carried out while the authors were based at

King’s College London.

Acknowledgement: We thank Mihail Zervos for useful suggestions

and helpful conversations.

Abstract

We present the method of moments approach to pricing barrier-type options when the underlying is modelled by a general class of jump diffusions. By general principles the option prices are linked to certain infinite dimensional linear programming problems. Subsequently approximating those systems by finite dimensional linear programming problems, upper and lower bounds for the prices of such options are found. As numerical illustration we apply the method to the valuation of several barrier-type options (double barrier knockout option, American corridor and double no touch) under a number of different models, including a case with deterministic interest rates, and compare with Monte Carlo simulation results. In all cases we find tight bounds with short execution times. Theoretical convergence results are also provided.

Keywords: Method of Moments, Jump Diffusion, Lévy process, Polynomial interest rate, Linear Programming, Double Barrier option

1 Introduction

Barrier and barrier-type options are among the most widely and frequently traded exotic options, especially in the area of Foreign Exchange, which makes their valuation an important topic. For example, a double barrier option is cancelled depending on whether or not two levels have been crossed before maturity. Since the pay-off of a barrier option depends on the entire path of the underlying, it is clear that its valuation is more involved than that of a standard European type option.

A well-documented empirical observation is that financial returns data typically possess features such as asymmetry, heavy tails and excess kurtosis, which cannot be captured by the classical geometric Brownian motion model (GBM). Related is the well known fact that under the GBM model it is not possible to calibrate option prices to the volatility surface. One of the successful modifications that has been proposed is to introduce jumps in the evolution and work with Lévy models. Popular examples of such Lévy models are VG, CGMY, NIG, GH and KoBoL. This approach is classical by now and we refer to the standard references [16], [3] and [1] for further financial motivations for the use of jump models, background and references. In a separate development (see e.g. [4] and [9]) it was noted that commodity prices often display features such as mean-reversion and jumps that are clearly not captured by the geometric Brownian motion model, and it was proposed to employ jump-diffusion models to incorporate those effects.

The valuation of barrier options has attracted a good deal of attention and there exists currently a body of literature dealing with different aspects of pricing barrier options. In particular, for double barrier options, [10] and [15] developed a Laplace transform approach in the geometric Brownian motion setting. [17] derived semi-analytical expressions in a jump-diffusion setting with exponential jumps, also using a transform approach. [2] considered double no touches in a setting with exponential jumps, allowing the process dynamics to change after a barrier is breached. [7] used eigenfunction expansions to price double barrier options in a CEV setting.

The mentioned papers exploit specific features of the model under consideration and can therefore not be readily generalized and applied to a different settings. A general approach, based on a characterization of the moments of the underlying process, was followed by [13] to price a class of exotic options. In a diffusion setting [13] derived upper and lower bounds for the price of exotic options in terms of semidefinite programs, and provided theoretical and numerical convergence results for these bounds. Before that, using linear programming, [11] developed a method of moments algorithm to calculate first exit time probabilities and moments of a diffusion.

In this paper we will follow a method of moments approach to price double barrier options in a general setting of a polynomial-type jump-diffusion. We will also allow the rate of discounting, which is typically taken to be constant, to be a function of time and underlying. We will now briefly describe the method of moments approach. The first step is to express the option price as an integral with respect to two measures, the (discounted) expected exit measure and the (discounted) expected occupation measure. The former describes the law of the underlying at expiration or at crossing the barrier, while the latter described the law of the process until this moment. Restricting ourselves to pay-offs that are piecewise polynomial functions of the underlying, the value can then be expressed as a linear combination of moments of these two measures. The moments of those two measures are subsequently shown to satisfy an infinite dimensional linear system. To the price can thus be associated the two linear programming problems of minimization and maximization of the latter criterion over the spaces of measures. By adding conditions on the moments that guarantee that a given sequence is equal to the moments of a measure, one is led to an infinite dimensional linear programming problem or a semi-definite programming problem. By restricting to a finite number of moments we arrive at a finite dimensional linear programming problem or a semi-definite programming problem.

We will numerically illustrate this method for a American corridor and double no touch and double knock-out option under different models, by solving linear programming problems. In all cases we find tight bounds, with short execution times. We also provide a convergence proof to show that the values of the linear programming problems converge monotonically to the value of the option if the number of moments employed is increased.

The remainder of the paper is organized as follows. In Section 2 we specify the model and the problem setting. Section 3 is devoted to the method of moments, describes the algorithm and provides a convergence proof. Section 4 provides the implementation and numerical examples. Proofs are deferred to the Appendix.

2 Problem setting

Assume that the underlying evolves according to the SDE

| (1) |

where is a Brownian motion and is a pure jump Lévy process (that is, a process with independent stationary increments without Gaussian component), and ,, and are given functions that will be specified below. In this setting we will value a barrier option of knock-out type with pay-off at the maturity time if the underlying has not left a set before time and that pays a stream of payments until the first moment that leaves or time , whichever comes earlier. Modelling the risk neutral discounting as a function of and it follows by standard arbitrage pricing principles that the value of this contract is given by

| (2) |

where and

| (3) |

We will restrict ourselves to the case that the functions are piecewise polynomial functions, that is, for some partitions and of ,

| (4) |

where are polynomials in . Note that many contracts have a pay-off function that is of this form, including call and put options and straddles. We observe that we will then be able to express the value in terms of moments of certain probability measures, reducing the calculation of to the calculation of these moments. Further, we will assume that is a ‘polynomial’ process, that is, in eqs. (1) and (3)

| , , and are polynomials, |

such that (1) admits a unique (weak) solution. Associated to is the infinitesimal generator that acts on functions in its domain as

| (5) |

where is an integro-differential operator given by

| (6) |

where denotes the Lévy jump measure of . Note that the operator maps polynomials to polynomials, which is an essential property needed in the moment approach, as shown in the next section.

We next present some models that are included in our setting.

Examples.

-

•

The classical geometric Brownian motion satisfies the SDE

where denotes a one-dimensional Brownian motion, and has the infinitesimal generator

(7) - •

-

•

Additive processes with polynomial time-dependent coefficients (see e.g. [3] for background), obtained by taking , and to be polynomials of only. For example, evolving according to for a Lévy process and a polynomial .

-

•

Affine processes, obtained by taking constant and , affine functions in , independent of (see e.g. [5] for applications of affine models in finance). An example of an affine diffusion is the Cox Ingersoll Ross (CIR) model, which is a mean-reverting diffusion satisfying the SDE

(10) with the infinitesimal generator

(11)

3 Method of moments

Denoting by and the discounted exit location measure and the discounted occupation measure given by

for Borel sets , the value of the contract can be expressed as

| (12) |

The measure describes the distribution of the process before the stopping time whereas the measure describes the distribution upon termination at . For example, in the case of a up-and-out barrier option at level , termination occurs if the barrier is crossed or the maturity is reached.

In view of the form (4) of and , can be expressed in terms of the moments of and , as follows:

| (13) |

where we denote by the th moment of a measure and by and the restrictions of and to and , and where and are some constants.

3.1 The adjoint equation

The measures and are closely related to each other and to the generator of the underlying process . Informally, for suitably regular and all bounded stopping times Dynkin’s lemma yields that

| (14) |

where is given in (5), which can be expressed in terms of the measures and as

| (15) |

The identity (15) is called the basic adjoint equation (See e.g. [11]). As noted before, a formal application of the generator shows that maps polynomials to polynomials. More specifically, by applying (15) to a monomial we obtain the following infinite system of equations linking the moments of and :

| (16) |

where , or equivalently, in compact notation,

| (17) |

The following result provides sufficient conditions to justify this informal analysis:

Proposition 1

The proof is deferred to the Appendix.

Remark. Partial barrier or forward starting barrier options can also be included in this setting by slightly adapting the definitions. With it holds that

which leads to the adjoint equation

3.1.1 Truncation

We restrict ourselves now to contracts that are knocked out if leaves a finite interval, so that is given by (2) with for . If the minimum of over is strictly positive, it is possible to derive for such double knock out contracts a modification of the adjoint equations that is valid without integrability restrictions. To that end, note that a double knock-out option becomes worthless at the first time that a jump occurs of size larger than or smaller than , since any such jump will take out of the interval . As such jumps occur at a rate , independent of the smaller size jumps and the diffusion part, it follows that the value of the contract does not change if we replace and by

which corresponds to replacing the underlying by the process that is ‘killed’ when the first jump occurs with size larger than or smaller than . In summary, using , to denote the th moments of the exit and occupation measures , of the killed process , we have the following result (with a proof in the Appendix):

3.2 Linear programs

By optimizing over the pair of measures that satisfies the adjoint equations, the value can be bounded, as follows:

| (20) |

which concerns linear programs over the measures, since is the linear functional of the moments of and given by

and the infimum and the supremum are taken over the pairs of measures supported on that satisfy the linear adjoint equations derived before. To formulate these optimization problems completely in terms of moment sequences, we need to express the condition that and be measures in terms of their moments, as in general there is no guarantee that any solution of the system (17) is the moment sequence of some measure. The problem to determine whether a given sequence is the moment sequence of some measure and, if so, whether this measure is uniquely determined (in which case the measure is called moment-determinate) has been extensively studied. It is known, see [19], that the Cramér condition

is a sufficient condition for a measure to be moment determinate. In particular, any measure with compact support is moment-determinate. Further, the following Hausdorff conditions are necessary and sufficient for a given sequence to correspond to a moments of a measure with support on the interval (see e.g. [8]):

| (21) |

where the are linear combinations of the , as follows:

In fact, the are themselves the moments of a measure that is the affine transformation of supported on . That these conditions are necessary immediately follows by observing that is non-negative and by expressing in terms of . More generally, given an array , the two dimensional Hausdorff-conditions (e.g. [18])

| (22) |

where the are related to the by

are necessary and sufficient conditions to guarantee that there exists a measure supported on such that . See [18] for proofs and further background on problems of moments.

3.2.1 Unbounded support

In the case that the measure has unbounded support there also exists conditions to characterize a sequence of moments. These conditions are no longer linear but can be conveniently be formulated in terms of so-called moment and localizing matrices (their definitions are recalled in the appendix). For a sequence to be equal to the moments of some measure it is necessary and sufficient that these matrices are positive definite. See [12] or [6] for a proof of this fact.

3.3 Approximations and convergence

To be able to calculate lower and upper bounds for the value we approximate the optimization problems in (20) by restricting the total number of moments used to . If is a finite interval, employing the moment conditions (21) and (22) results in the following (finite) linear programming problems:

In the case that the set is a half-line, the measures in question will not have bounded support and as a consequence in the above optimization problem the linear moment conditions (21)/(22) are replaced by the quadratic moment conditions described in Section 3.2.1. The resulting optimization problems are then semi-definite programming problems. [13] provided convergence results for this SDP approach in a diffusion setting for Asian, European and single barrier options. Restricting to the case that is a finite interval we show that the values of the linear programs converge:

Proposition 2

Remark. The presented approach can in principle be extended to a multi-dimensional jump-diffusion with polynomial coefficients. For example, if is a hyper-cube the adjoint equations and the moment conditions take analogous forms. The limitation in practice will be the capacity of the LP and SDP solvers to deal with large size programs.

4 Numerical examples

For the numerical examples we have used Matlab and the LP solver lp_solve. The problems were set up in Matlab and then solved using the Matlab interface to lp_solve. The numerical outcomes were compared with Monte Carlo results, implemented in Matlab using the Euler scheme.

We will illustrate the method by valuing four different options.

4.1 A double knockout barrier option driven by the Geometric Brownian motion.

In this benchmark example we consider a European double knock-out call option with underlying assumed to evolve as a geometric Brownian motion. The value of such an option is given by

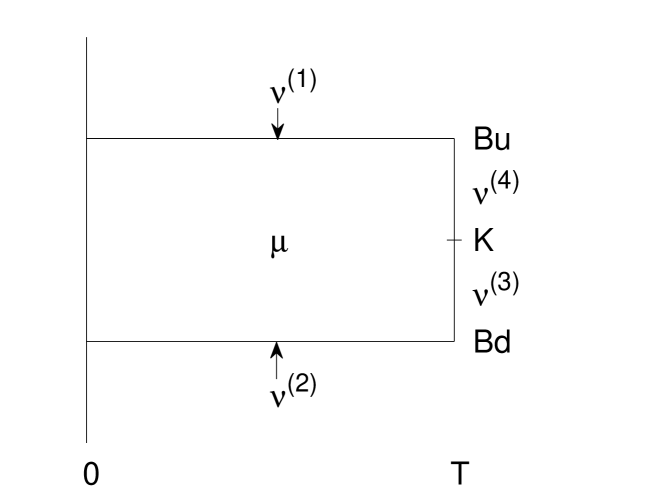

For the ease of notation we will now drop the discounting . As a geometric Brownian motion has continuous paths, we know that the time-space process will exit either if hits one of the barriers or or maturity is reached, so that the support for the exit location measure is

The set is partitioned into four parts with the restricted measures

The expected occupation measure is supported on the domain – See also Figure 1 for an illustration.

Here the line-segments and were chosen in such a way that the pay-off function restricted to each of those line segments is zero or linear. Further note that the measures can all be characterized by Hausdorff moment conditions, since they are supported on line-segments. The value of the option is then given by

Using the form (7) of the infinitesimal generator of the Geometric Brownian motion, the basic adjoint equation for this problem can be seen to be

This is valid for all such that , when we are using all moments up to degree . To complete the setup of the problem we add the LP moment conditions for the measures and with support as given above.

The numerical results for two given sets of parameter values are given in Table 1. We can see that we get fast convergence to the exact solution, which was calculated using the formula from [15].

| Case 1 | ||||

|---|---|---|---|---|

| Degree of moment | 9 | 10 | 11 | 12 |

| Upper Bound | 0.9250 | 0.9211 | 0.9182 | 0.9161 |

| Relative Error | 1.61% | 1.18% | 0.86% | 0.64% |

| Lower Bound | 0.9096 | 0.9100 | 0.9102 | 0.9103 |

| Relative Error | 0.08% | 0.03% | 0.02% | 0.01% |

| Exact solution | 0.9103 | |||

| Case 2 | ||||

| Degree of moment | 8 | 9 | 10 | 11 |

| Upper Bound | 1.1656 | 1.1611 | 1.1569 | 1.1534 |

| Relative Error | 2.06% | 1.66% | 1.29% | 0.99% |

| Lower Bound | 1.1064 | 1.1163 | 1.1256 | 1.1293 |

| Relative Error | 3.13% | 2.26% | 1.45% | 1.13% |

| Exact solution | 1.1421 |

4.2 A double knockout barrier option driven by the Variance gamma process.

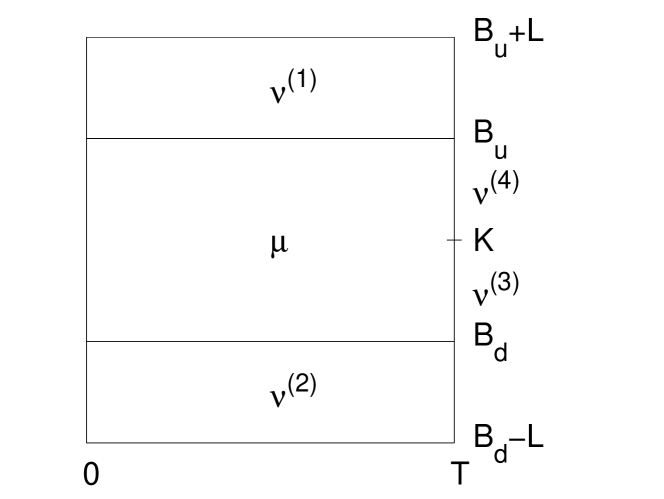

In this example we consider again a double knock-out option but now driven by a Variance Gamma process, which as described in Section 2. Since the Variance Gamma process is a finite activity jump process, it will not hit the barrier but jump across it. As a consequence the exit location measure is supported on

In order to be able to calculate the value of the option using the LP moment conditions, we will adjust the Lévy measure as described in Section 3.1, to achieve bounded support. In this case we observe that any jump with absolute size larger than will trigger an immediate knock-out. We note that the probability that no such a jump occurs before maturity is where with the Variance Gamma Lévy measure given in (8). We thus truncate the Lévy measure by restricting it to absolute jump-sizes smaller :

The value of the option in terms of moments of these measures is then

where the support of the truncated exit location measure is

and the four restrictions of are

The domain of the truncated measures is shown in Figure 2.

Denoting by

| (23) |

the moments of the truncated Lévy measure and taking note of the form (9) the infinitesimal generator, we find the basic adjoint equation

for all such that . As before, to complete the LP problem we add the appropriate LP moment conditions for the measures and with support as given above.

Numerical results can be found in the Table 2. The relative error was calculated using the arithmetic mean of the upper and lower bounds and the Monte Carlo outcome (taking the latter as the ‘true’ result). Studying the results we see that we get tight bounds within 8 or 9 moments. Beyond 10 or 11 moments we experienced instabilities with the LP solver.

In Case 1 the execution times are shown, which should be compared to the execution time for the Monte Carlo simulation that was around 52 minutes. As we employed a basic Euler scheme for the Monte Carlo simulation the speed of convergence of the Monte Carlo simulation could be improved by using more specialised Monte Carlo schemes and also by changing to a compiling programming language. However considering the time difference, it should be clear that the method of moments will still be considerably faster.

| Case 1 | ||||

|---|---|---|---|---|

| Degree of moment | 7 | 8 | 9 | 10 |

| Upper Bound | 0.5045 | 0.5030 | 0.5022 | 0.5017 |

| Lower Bound | 0.4946 | 0.4983 | 0.4987 | 0.4994 |

| Relative Error | 0.13% | 0.09% | 0.05% | 0.07% |

| Cpu Time | 1.262s | 3.245s | 6.236s | 17.936s |

| Monte Carlo | 0.5002 | Std Error | 0.0005 | |

| Case 2 | ||||

| Degree of moment | 6 | 7 | 8 | 9 |

| Upper Bound | 0.5158 | 0.5151 | 0.5135 | 0.5115 |

| Lower Bound | 0.4857 | 0.4886 | 0.4943 | 0.4958 |

| Relative Error | 0.39% | 0.17% | 0.24% | 0.19% |

| Monte Carlo | 0.5027 | Std Error | 0.0008 | |

| Case 3 | ||||

| Degree of moment | 5 | 6 | 7 | 8 |

| Upper Bound | 0.5133 | 0.5078 | 0.5049 | 0.5033 |

| Lower Bound | 0.4682 | 0.4894 | 0.4917 | 0.4957 |

| Relative Error | 1.71% | 0.14% | 0.20% | 0.04% |

| Monte Carlo | 0.4993 | Std Error | 0.0006 | |

| Case 4 | ||||

| Degree of moment | 6 | 7 | 8 | 9 |

| Upper Bound | 0.5277 | 0.5237 | 0.5197 | 0.5182 |

| Lower Bound | 0.4672 | 0.4720 | 0.4745 | 0.4772 |

| Relative Error | 1.32% | 1.24% | 1.39% | 1.27% |

| Monte Carlo | 0.5041 | Std Error | 0.0011 |

4.3 The American Corridor under a CIR model with constant interest rate

An American corridor is a contract traded in the Foreign exchange markets that pays a continuous rate until either the underlying leaves the corridor or maturity is reached, whichever comes earlier (see for example [20] or [21] for background). The value of this contract is given by

with . We will model the underlying as a Cox Ingersoll Ross (CIR) process, evolving according to the SDE (10). Since the CIR model is continuous the supports of the different measures are given as follows:

In view of the form of the infinitesimal generator for the CIR process (11) we can now assemble the basic adjoint equation for this problem,

for all such that , and add appropriate LP moment conditions as before.

The results are reported in Table 3. We observe that tight bounds are achieved, and that in cases 1 and 2 the upper bounds are accurate for 9-10 moments, with relative errors and . We also see that the speed of convergence varies with the particular parameter values.

| Case 1 | ||||

|---|---|---|---|---|

| Degree of moment | 10 | 11 | 12 | 13 |

| Upper Bound | 0.9516 | 0.9516 | 0.9516 | 0.9516 |

| Lower Bound | 0.9274 | 0.9345 | 0.9391 | 0.9421 |

| Relative Error | 1.12% | 0.74% | 0.50% | 0.34% |

| Monte Carlo | 0.9501 | Std Error | 0.0002 | |

| Case 2 | ||||

| Degree of moment | 9 | 10 | 11 | 12 |

| Upper Bound | 0.9754 | 0.9754 | 0.9754 | 0.9754 |

| Lower Bound | 0.9394 | 0.9504 | 0.9577 | 0.9624 |

| Relative Error | 1.73% | 1.16% | 0.79% | 0.54% |

| Monte Carlo | 0.9742 | Std Error | 0.0002 | |

| Case 3 | ||||

| Degree of moment | 11 | 12 | 13 | 14 |

| Upper Bound | 0.9343 | 0.9325 | 0.9315 | 0.9307 |

| Lower Bound | 0.8961 | 0.9024 | 0.9067 | 0.9095 |

| Relative Error | 0.76% | 0.52% | 0.34% | 0.29% |

| Monte Carlo | 0.9222 | Std Error | 0.0011 |

4.4 Double No Touch option under the exponential Variance Gamma process with a non constant interest rate

A double no touch option pays one unit at maturity if the underlying has not crossed either of the barriers or . Its value can be expressed as

Letting the underlying be an exponential Variance Gamma process we note that the stopping time is equivalent to

where is a Variance Gamma process. Under no-arbitrage pricing the process needs to be a martingale which is equivalent to the requirement that

so that is determined by our choice of . For the Variance Gamma process

With these points in mind we find,

We have chosen to study interest rates of the type

Since there is no need too split the exit location measure at maturity, the domain of only needs to be split into three parts , and , so that in this case the value of the option can be expressed in terms of moments as follows

where as before . In terms of moments the basic adjoint equation is then given by

where is given in (23).

The numerical results are presented in Table 4. In all cases we see tight bounds nicely agreeing with the Monte Carlo simulation result. We also observe that the upper bound is very accurate already for a small number of moments. For example, for 7 moments, the relative errors of the upper bounds in the three different cases are 0.032%, 0.076% and 0.069%, respectively.

| Case 1 | ||||

|---|---|---|---|---|

| Degree of moment | 6 | 7 | 8 | 9 |

| Upper Bound | 0.9356 | 0.9355 | 0.9355 | 0.9355 |

| Lower Bound | 0.8453 | 0.8757 | 0.9042 | 0.9143 |

| Relative Error | 4.79% | 3.17% | 1.64% | 1.10% |

| Monte Carlo | 0.9352 | Std Error | 0.0002 | |

| Case 2 | ||||

| Degree of moment | 6 | 7 | 8 | 9 |

| Upper Bound | 0.9203 | 0.9201 | 0.9200 | 0.9200 |

| Lower Bound | 0.8196 | 0.8533 | 0.8836 | 0.8957 |

| Relative Error | 5.38% | 3.56% | 1.91% | 1.26% |

| Monte Carlo | 0.9194 | Std Error | 0.0002 | |

| Case 3 | ||||

| Degree of moment | 7 | 8 | 9 | 10 |

| Upper Bound | 0.8752 | 0.8752 | 0.8752 | 0.8752 |

| Lower Bound | 0.7980 | 0.8319 | 0.8449 | 0.8565 |

| Relative Error | 6.68% | 4.73% | 2.84% | 2.09% |

| Monte Carlo | 0.8746 | Std Error | 0.0002 |

5 Conclusion

We have presented a method of moments approach that can be used to price double barrier-type options driven by ‘polynomial’ jump-diffusions, allowing for a non-constant (deterministic or stochastic) interest rate. An infinite-dimensional linear program was derived, which was then approximated, depending on the choice of moment conditions, either by a sequence of LP problems, or by a sequence of SDP problems. Although the SDP-type problems may be theoretically more appealing as the SDP method naturally handles measures with unbounded support, further development of stable SDP solvers would be needed for this method to be truly usable in practice. Since, on the other hand, the LP solvers are in a more advanced state of development and several (commercial) LP solvers are available capable of solving (large scale) LP problems, we focussed on the LP approach. We formulated the approximating programs as LP problems by using truncation, and provided theoretical convergence results for this approach. We illustrated the method with numerical examples, using the Matlab interface of the solver lp_solve, and compared the outcomes with Monte Carlo simulation results. We found that accurate results with tight upper and lower bounds were obtained with a small number of moments in most of the examples, and observed that the algorithm was significantly faster than Monte Carlo simulation.

References

- [1] S. I. Boyarchenko and S. Levendorskii. Non-Gaussian Merton-Black-Scholes Theory. World Scientific Publishing Co Pte Ltd, 2002.

- [2] P. Carr and J Crosby. A class of Lévy process models with almost exact calibration to both barrier and vanilla fx options. Working paper available September 2008 at http://www.john-crosby.co.uk/pdfs/Carr_Crosby_DNT&Vanilla_Levy_PDF.pdf, 2008.

- [3] R. Cont and P. Tankov. Financial Modelling With Jump Processes. Chapman & Hall/CRC, 2004.

- [4] J. Crosby. A multi-factor jump-diffusion model for commodities. Quantitative Finance, 8(2):181–200, 2008.

- [5] C. Cuchiero, D. Filipović, and J. Teichmann. Affine Models. Working paper available September 2008 at http://www.vif.ac.at/filipovic/PAPERS/vif8.pdf, 2008.

- [6] R.E Curto and L.A. Fialkow. Recursivness, Positivity and Truncated Moment Problems. Houston J. Math., 17(4), 1992.

- [7] D. Davydov and V. Linetsky. Pricing Options on Scalar Diffusions: An Eigenfunction Expansion Approach. Operations Research, 51(2), 2003.

- [8] W. Feller. An Introduction to Probability Theory and Its Applications, volume 2. Wiley, 2 edition, 1971.

- [9] H. Geman. Commodities and commodity derivatives. Wiley, 2005.

- [10] H. Geman and M. Yor. Pricing and Hedging Double-Barrier Options: A Probabilistic Approach. Mathematical Finance, 6(4), 1996.

- [11] K. Helmes, S. Röhl, and R.H. Stockbridge. Computing Moments of the Exit Time Distribution for Markov Processes by Linear Programming. Operations Research, 49(4), 2001.

- [12] M. Krein and A. Nudel’man. The Markov Moment Problem and Extremal Problems. In Transl. Math. Monograps, volume 50. American Mathematical Society, 1977.

- [13] J.B. Lasserre, T. Prieto-Rumeau, and M. Zervos. Pricing a class of Exotic Options via Moments and SDP Relaxations. Mathematical Finance, 16(3), 2006.

- [14] D.B. Madan, P. Carr, and E. Chang. The Variance Gamma process and option pricing model. Eur. Finance Rev., 2:79–105, 1998.

- [15] A. Pelsser. Pricing double barrier options using Laplace transforms. Finance and Stochastics, 4(1), 2000.

- [16] W. Schoutens. Lévy Processes in Finance: Pricing Financial Derivatives. Wiley, 2003.

- [17] A. Sepp. Analytical Pricing of Double-Barrier Options Under A Double-Exponential Jump Diffusion Process: Applications of Laplace Transform. International Journal of Theoretical and Applied Finance, 7(2), 2004.

- [18] J. A. Shohat and J. D. Tamarkin. The Problem of Moments. American Mathematical Society, 1943.

- [19] J. Stoyanov. Moment Problems Related to the Solutions of Stochastic Differential Equations. In Stochastic Theory and Control: Proceedings of a Workshop held in Lawrence, Kansas, volume 280, pages 459–469. Springer, 2002.

- [20] T. Weithers. Foreign Exchange: A Practical Guide to the FX Markets. Wiley, 2006.

- [21] U. Wystup. FX Options and Structured Products. Wiley, 2007.

Appendix A Proofs

A.1 Proof of Proposition 2

Since the number of equations grows with , it follows that is monotone increasing, since the minimum taken over a smaller set of elements is larger.

Note that is a finite linear combination of moments. Because of the fact that the support of the different measures is compact, if follows that each moment is bounded, so that is bounded and is the minimization of a linear function over a bounded set. Thus, the minimum is finite and attained at a vector that satisfies the corresponding linear system of equations. Thus, for each fixed there exists a such that, for along a subsequence, . In fact, by a diagonal argument it follows that there exists a subsequence such that, as ,

Clearly, satisfies the infinite system and thus under the assumption that there exists a unique sequence that solves the infinite system, it follows that must be equal to . Moreover, and are the unique measures corresponding to these moments, as they are both moment-determinate. Thus, and

The proof of the convergence of the sequence is similar and omitted.

A.2 Proof of Proposition 1

We will show the following lemma:

Lemma 1

The proposition is a direct consequence of this lemma, since under the condition (18) the integrability conditions are satisfied for each monomial .

Proof of Lemma 1: Applying (a general form of) Itô’s lemma to the stochastic process (which is justified as ) shows that

| (25) |

where is given in (5) and is the local martingale given by

where denotes the compensated jump measure associated to (with compensator ). Note that the identity (25) remains valid with replaced by with a local martingale. Under the integrability conditions (24) it holds that that is a zero mean martingale. Taking expectations in (25) shows thus that

which shows that (15) is valid.

A.3 Proof of Corollary 1

Since the jump-diffusion with drift , volatility , Lévy measure and discounting satisfies (18), Proposition 1 yields that the measures and corresponding to satisfy

where

with . To complete the proof we will now show that

| (26) |

Denoting by the first time that a jump of of size smaller than or larger than and let

Then, if it holds that for all and in particular

Also, since it is assumed that for , we have that . Taking note of these observations, it follows that

where and we used that follows an exponential distribution with mean , independent of . Similarly,

The two identities imply that (26) holds true, and the proof is complete.

Appendix B Semi-definite moment conditions

The moment matrices are defined as follows:

Moment Matrices

Let

| (27) |

be the usual basis of polynomials in variables with degree at most .

Given a series of moments of a measure let be that sequence ordered in accordance with (27). The Moments matrix is then defined as

where is the -entry of the matrix .

Localising Matrices

Given a polynomial with coefficients () in the basis (27). If is the subscript of the -entry of the moment matrix then the localising matrix is defined by

The choice of the function depends on the support of the measure. For example, in the one-dimensional setting we have three cases,

-

1.

Support on , with function

-

2.

Support on , with function

-

3.

Support on , with function

In terms of moment and localizing matrices the characterization is then as follows: Given the condition that and are positive semi-definite are sufficient conditions for the elements of to be the first moments of a measure supported on the appropriate interval.