Updated version to appear in Mathematical Finance

—

An exact formula for default swaptions’ pricing in the SSRJD stochastic intensity model††thanks: We are grateful to Tomasz R. Bielecki and an anonymous referee for reading this paper and for helpful comments and suggestions.

We develop and test a fast and accurate semi-analytical formula for single-name default swaptions in the context of a shifted square root jump diffusion (SSRJD) default intensity model. The model can be calibrated to the CDS term structure and a few default swaptions, to price and hedge other credit derivatives consistently. We show with numerical experiments that the model implies plausible volatility smiles.

KEY WORDS: Credit derivatives, Credit Default Swap, Credit Default Swaption, Jump-diffusion, Stochastic intensity, Doubly stochastic poisson process, Cox process, Semi-Analytic formula, Numerical integration

1 Introduction

Default swaptions are options on default swaps, hence they are often treated by drawing analogies with interest rates swaptions, especially as far as their Black-like market pricing formula is concerned. Indeed, the most widely discussed model for their valuation, the Log-normal Default Swap Market (LDSM) model is similar to the Log-normal Swap Market (LSM) model used in interest rates derivatives markets.

Schönbucher (2000) introduces the notion of survival pricing measures by conditioning on no-default up to a given maturity, although in contrast with the interest rate models this measure is not equivalent to the risk neutral one. The standard market formula for default swaptions is obtained by modeling the default swap spread directly as a geometric brownian motion, as summarized in Schönbucher (2004). The convenient pricing measure is termed the survival swap measure whose associated “numéraire” is the defaultable annuity which may vanish.

Jamshidian (2004) partly addresses this problem, presenting a more formalized setup of the LDSM model, and generalizes the theory to semi-martingales driven money market account and conditional survival probabilities. Hull and White (2003) presents practical aspects for the implementation of the Black market formula and provides empirical estimates of default swap spread volatilities for actively traded A-rated names that ranges from %67 to %130 in the period from end 1999 to mid-2002. Brigo (2005) introduces various different candidate formulations by using alternative definitions of defaultable forward rates and develops a market model leading to the standard Black formula under equivalent pricing measures, showing market implied volatilities of the order of %50 .

The variants of the Black (1976) formulae obtained for the LDSM model, by their inherent simplicity are particularly convenient for quoting single default swaptions by selecting an appropriate volatility parameter. However, quoting default swaptions for different sets of maturities and strikes or more complex instruments consistently with just the implied volatilities given by the formula inversion becomes problematic. One is confronted with the need to develop a fully specified dynamical model to impose a structure on the joint dynamics of one-period rates or credit default swap spreads as it is done in the interest rates derivatives markets with the LFM, or the LSM.

In particular, the valuation of more exotic instruments like Bermudan default swaptions requires the use of a model that accurately incorporates the term structure of default swap rates, as well as the dynamical deformations and movements of this term structure. Indeed, default swap rates are subject to large jumps and possibly stochastic volatility effects. In the interest rates derivatives models, these features are incorporated more or less successfully by specifying richer joint dynamics of the forward LIBOR rates, leading to an explosion of the number of parameters in the models. However, contrary to the interest rate markets with their huge number of caps/floors and swaptions, the single-name default swap markets are most famous by the very small number of traded instruments, rendering the calibration or estimation of any model with a large number of parameters unfeasible.

An alternative approach, more suitable for the current state of the default swaptions markets that is explored in this paper calls for modeling the default intensity instead. This is the approach followed in Brigo and Alfonsi (2003) with a stochastic default intensity model where both the short rate and the default intensity are driven by shifted square root diffusion processes. Brigo and Cousot (2006) examines implied volatilities generated by this two-factor shifted square root model and characterizes the qualitative behavior of the implied volatilities with respect to the stochastic intensity model parameters. The numerical experiments conducted with stylized parameter values suggested that this model might be unable to generate large enough implied volatilities.

Modeling the intensity process automatically imposes a strong structure on the default swap spread joint dynamics across different maturities, simplifying the achievement of consistency across instruments. Judicious choices of the intensity process can also incorporate jumps and some stochastic volatility effects in default swap spreads, and possibly generate plausible defaultable term structure evolutions.

In this paper, we extend the SSRD model of Brigo and Alfonsi (2003) and Brigo and Cousot (2006) by allowing for positive jumps in the process driving the default intensity, consistently with empirical evidence. We develop and test a semi-analytical formula for single-name default swaptions allowing for fast and accurate pricing. The semi-analytical formula is based on the celebrated decomposition due to Jamshidian (1989) for the valuation of options on coupon bonds in one-factor affine models. We show with numerical experiments that the model generates plausible volatility smiles. Given its relative tractability, the model can thus be calibrated to vanilla default swaptions in order to price more exotic products. A first attempt at Bermudan default options pricing for example is in Ben Ameur et al (2006), where the basic SSRD model is used. The jump-extended SSRJD introduced here could be used as an improved version.

2 The SSRJD default intensity model

Default swap rates time series can hardly be reconciled with a geometric brownian motion. Furthermore, forward default swaps underlying default swaptions are not traded as such, and hence delta-hedging can only be done approximately with spot default swap term structures. For risk management and control purposes, it is important to recognize the relation between different default swaps and swaptions referencing the same credit name.

Jumps and stochastic volatility could potentially be introduced in the market model by postulating more appropriate dynamics for the default swap rate. However, this would quickly destroy the main feature of the model: its simplicity. Also, in order to value more exotic options, it becomes important to incorporate the whole term structure of the default swap rates as well as postulating dynamics that can yield appropriate deformations of this term structure in the future.

A relatively simple candidate for these tasks is the stochastic default intensity approach we adopt in this paper. It models the default intensity process instead of the default swap rate, providing a plausible approach to consistently model the default swap rates of different maturities. Following this approach, Brigo and Alfonsi (2003) proposes a two-factor shifted square root diffusion model, where both the short rate and the default intensity are assumed to follow possibly correlated shifted square root diffusions. The processes are modeled as a sum of a deterministic function and a square root diffusion.

Comparing numerical examples in Brigo and Cousot (2006) and Brigo (2005) we see that it is difficult to produce large enough implied volatilities compared to what is implied from default swaptions market data or historical volatilities of default swap spreads. Hereafter we present an extension to this model, by allowing for positive jumps in the process driving the default intensity.

We denote the market filtration by and let be a risk-neutral probability measure. We follow the intensity based approach to default risk modeling and introduce the default time as a totally inaccessible stopping time We further assume the usual structure for , namely that , where is the filtration generated by the stochastic market variables (interest rates, default intensities, etc) except default events and is the filtration generated by the default process: . It is also assumed that there exists a strictly positive adapted process such that the process given by:

| (2.1) |

is a uniformly integrable martingale under . The process is referred to as the marginal intensity of the stopping time under or risk-neutral pre-default intensity. This setup is commonly referred to as a doubly stochastic Poisson default process or the Cox process framework. In the SSRJD model, the intensity is written as the sum of a positive deterministic function and of a positive stochastic process :

| (2.2) |

where is a deterministic function of time, and is integrable on finite intervals. The dynamics of are an example of an Affine Jump Diffusion (AJD) (see Duffie et al. (2000), Duffie et al. (2003) ):

| (2.3) | |||||

with the following condition to ensure the process cannot reach zero:

| (2.4) |

is a Wiener process and is a pure jump process with jumps arrival rate and exponentially distributed jump sizes with mean preserving the attractive feature of positive default intensity. In other terms,

where is a Poisson process with intensity , the s are independent of and also i.i.d. exponentially distributed with mean . All the parameters are also constrained to positive values. Since this model belongs to the tractable AJD class of models, the survival probability has the typical “log-affine” shape before default:

| (2.5) | |||||

where:

| (2.6) | |||||

| (2.7) |

with and given by:

| (2.8) | |||||

| (2.9) |

and where .

Note that when , the denominator in the exponent of goes to zero, i.e. , leading to potential numerical instabilities due to division by zero. However, one can check in this case that the base of is then equal to one. Thus for robustness of the implementation, it is necessary to set when .

The SSRD model is a diffusion-only restriction of the SSRJD model obtained by setting the jump intensity to zero, also resulting in in the survival probability formula.

For default swap computations we also make use of the formula for the following transform:

| (2.10) |

which can be expressed after differentiation as:

| (2.11) |

where:

Again for the SSRD model, the corresponding formulae can be obtained by simply using the fact that and .

3 Pricing equations for default swaps and swaptions

3.1 Credit Default swaps

In this section, we briefly review default swaps pricing and refer to Brigo and Alfonsi (2003) for further details. A (credit) default swap is a financial instrument used by two counterparties to buy or sell protection against the default risk of a reference credit name. In a default swap signed at time starting at time with maturity , the protection buyer pays a periodic fee or spread at the payment dates (typically quarterly) as long as the reference entity does not default. In case of a default occurring at time with , the protection seller compensates the protection buyer for his loss given default that we assume to be a known constant . In addition, the protection seller receives from the protection buyer the spread accrued since the last payment date before default. In the case where , the contract is a forward default swap, while if we are dealing with a spot default swap.

Default swaps have been shown in Brigo and Alfonsi (2003) to be relatively insensitive to the correlation between brownians driving the intensity and interest rate processes when both are modeled as SSRD processes, while Brigo and Cousot (2006) confirms that it is also relatively insignificant for default swaptions. Furthermore, Brigo and Cousot (2006) finds that the short rate volatility has relatively little impact on the valuation of typically traded default swaptions characterized by short maturities, thus concluding that the randomness of the short rate adds little value to stochastic intensity models for default swaptions. Therefore, we assume a deterministic term structure of interest rates, and denote the price at time of the default-free discount factor for maturity or risk-free -zero coupon bond by .

From the perspective of a protection buyer, the value at time denoted by of a default swap with a payment schedule , a spread and a loss given default is given by the following expression:

| (3.1) |

where

| (3.2) |

and is the first date in the set that follows and is the year fraction between and .

Hence, the fair spread as long as default has not occurred can be computed as the value of that equates the default swap value to zero:

| (3.3) |

3.2 Credit Default swaptions

A default swaption is an option written on a default swap. In the sequel, we will restrict the analysis to European payer default swaptions. A payer default swaption entitles its holder the right but not the obligation to become a protection buyer in the underlying default swap at the expiration of the option, paying a protection fee equal to the strike spread. Most traded single name default swaptions are canceled (or knocked out) at default of the underlying reference name if this occurs before the option’s maturity. The maturity of the option will typically be equal to the starting date of the underlying default swap . That is, the default swaption holder enters a spot default swap if she chooses to exercise the option at maturity.

For the pricing of a default swaption at a valuation date , the underlying is thus the maturity forward default swap with payment dates . The strike specified in the contract is the periodic fixed rate that is to be paid in exchange for the default protection in case of exercise, instead of the fair market spread that will be available at time only. The defaultable payoff can be valued at time by taking the risk-neutral expectation of its discounted value, where the discounting is done using the default adjusted stochastic discount factor as shown in Duffie et al (1996). Hence, the payer default swaption can be valued as in Brigo and Alfonsi (2003) and Brigo and Cousot (2006):

| (3.4) |

A single dynamics for leading to a market formula analogous to the one for interest rate swaptions is derived, under different assumptions, in Schönbucher (2004) and Jamshidian (2004). Brigo (2005) derives the same formula under different assumptions and sketches the construction of a whole market model for a joint family of default swap rates. Assuming that the default swap rate follows a geometric brownian motion with volatility , the above approaches allow to price the default swaptions using Black-style formulas. Here, we recall the formula for a payer default swaption, with self-evident notation:

| (3.5) | |||||

When faced with the requirement of marking a default swaption position to market or when hedging a book of default swaptions, the need for a different model becomes apparent. Indeed the market model requires one to input a volatility parameter. If the model could be trusted as providing an appropriate description of the world, this parameter (constant across maturities and strikes) could be implied from currently traded options. Recognizing that the model is a rather primitive approximation, one would expect to observe different volatility parameters for different strikes and maturities resulting in a volatility smile (or skew or smirk).

However, for a given underlying reference name, there are often only very few different default swaptions traded, and quite often the market is limited to the At-The-Money (ATM) options. Deducing patterns in a market model context can then be difficult. On the other hand, the SSRJD model can be calibrated to a default swap rates term structure and very few default swaptions, and the fitted values of the parameters can be used to value different default swaptions consistently, under the condition that the model implies meaningful patterns of implied volatilities.

To derive a semi-analytical formula for default swaptions in the SSRJD model, we use the following equivalent (to (3.4)) valuation equation:

| (3.6) |

Brigo and Alfonsi (2003) proposes a formula for solving this pricing equation in the case of the SSRD model. The formula is based on the insightful decomposition of Jamshidian (1989), where in a 1-factor yield curve model, an option on a portfolio of cash flows is decomposed in a portfolio of options on each cash flow, where the strike for each option is judiciously adjusted. In the next section, we prove and extend this formula for the SSRJD model.

4 Analytical formula for default swaptions pricing

The derivation of the formula follows three main steps. In proposition 4.1, we rewrite the pricing equation (3.6) in a suitable form for the application of the decomposition, i.e. as an option on an integral of multiples of survival probabilities. Then we use our decomposition in corollary 4.1, resulting in the appearance of an integral of terms that are akin to options on survival probabilities. And lastly, we give an explicit formula for these options in proposition 4.2. Note that proposition 4.1 and corollary 4.1 are model-independent in the following sense. Proposition 4.1 holds for any nonnegative default intensity process and corollary 4.1 requires the additional assumption of a survival probability function that is monotonic in . We only really use the SSRJD dynamics to derive the formula in proposition 4.2.

Proposition 4.1.

The default swaption price satisfies the following formula:

| (4.1) |

where is defined as:

| (4.2) |

with the Dirac delta function centered at .

Proof.

Starting from equation (3.6), we substitute the default swap value from equations (3.1) and (3.2) resulting in the following formula:

We can integrate by parts the last integral of the above expression:

For the other integral appearing in the default swaption price, we first decompose it in a sum of integrals where the limits of integration are the default swap payment dates:

where we used the fact that for , . And we can now integrate by parts these integrals:

Using the fact that , we obtain after summation:

Note that , substitute the expressions obtained for the integrals back in the original formula, using

and finally, using the formula

(see for example Bielecki and Rutkowski (2001), Corollary 5.1.1 p.145), we obtain the result of the proposition after rearranging. ∎

Jamshidian (1989) decomposes an option on a portfolio of zero-coupon bonds in a portfolio of options on the zero-coupon bonds. The rewriting of the pricing problem as in equation (4.1) will now allow us to achieve a similar result. Indeed, the term is akin to a portfolio of survival probabilities of infinitely many maturities. We also note that survival probabilities satisfy the same formulas as zero-coupon bonds where the default intensity plays the role of the short rate. Hence, the expectation in equation (4.1) can be seen as a put option on a portfolio of zero-coupon bonds (although with infinitely many) where the strike is and the interest rate is given by the default intensity . Therefore, it is only natural that we are able to decompose it as a portfolio of infinitely many options on survival probabilities.

Corollary 4.1.

Assume the short rate is nonnegative and bounded by : and that the spread payments occur at least once a year11endnote: 1Usually spreads are paid quarterly. such that . If the following integral is positive

| (4.3) |

then the default swaption price is the solution to the following formula:

| (4.4) |

where satisfies:

| (4.5) |

Otherwise, the default swaption price is simply given by the corresponding forward default swap value:

Proof.

Recall the definition of :

Since and , it follows that

Also note that is a deterministic function that does not depend on , while the survival probability given by equation (2.5) is clearly monotonically decreasing in for all and . Hence,

is a monotonically decreasing function of . Furthermore, it is easy to see from equation (2.5) that

or just recall that is a survival probability and is the initial value of the stochastic process driving the default intensity.

We are interested in finding if there exists satisfying equation (4.5). Now, recall that

and note that (integrating by parts):

Hence, substituting back in the original integral, we obtain the following:

so that:

Note that is nonnegative since and . And since and are both nonnegative being respectively the survival probability and the discount factor at time for maturity , it follows that:

On the other hand, since the survival probability is decreasing with maturity.

We can then consider two cases depending on whether the integral

is negative or not.

In the first case, i.e. when the integral is negative:

and then the equation (4.5) does not admit a solution in . However, in this case the payoff of the option is strictly positive and hence the payoff of the option simplifies to a forward default swap payoff.

In the other case (i.e. when the integral is nonnegative), by the intermediate value theorem the equation (4.5) admits a unique solution by continuity and monotonicity, and we can replace by in (4.1). Since is a monotonic function in , then the terms will be all of the same sign for all values of , and therefore:

which we can substitute back in the expression (4.1) for the default swaption value, and use Fubini’s theorem to change the order of the integrations, resulting in equation (4.4), thus completing the proof. ∎

Having decomposed the default swaption price in terms of options on survival probabilities, we are left with the task of computing these option values. Indeed, to further compute the quantity given in equation (4.4), recall that:

and that the survival probabilities satisfy equation (2.5). Substituting these in formula (4.4) results in the following expression for the default swaption:

| (4.6) | |||

The above expression is analytic up to an integral if we are able to find a formula for the expectation involved. We take up that task in the next proposition where:

with nonnegative and .

Proposition 4.2.

| (4.7) |

where

| (4.8) |

with

| (4.9) | |||||

| (4.10) | |||||

and

Proof.

First note the equivalence between the following events:

Hence:

We define as follows:

Christensen (2002) derived a formula for that is analytic up to an integral. His formula is also reported in Lando (2004) Appendix E. We recall it below:

with

where and satisfy formulae (4.10) and (4.9) respectively. The imaginary part appearing above admits an explicit expression as given in the statement of the proposition.

Since the process is a homogenous and markovian jump-diffusion

∎

In summary, if

then it is possible to solve for a positive satisfying , and such that the default swaption price is given by:

On the other hand, if

the default swaption is so deeply in the money that the probability of it moving out of the money is null. Therefore, in this case the default swaption is equivalent to a forward default swap, hence it can be valued by computing the price of the equivalent forward default swap.

5 Implementation and numerical results

To implement the formula presented in the previous section, we need to compute the relevant integrals numerically. We first focus on deriving a quadrature formula for computing the integral appearing in the formula for :

| (5.1) |

Define . In the following lemma22endnote: 2The detailed proof is tedious but straightforward. It is omitted here but is available upon request., we confirm that our integrand is continuous and bounded on the interval with finite limits on both ends of the interval.

Lemma 5.1.

The function is continuous and bounded for . Moreover,

| (5.2) | |||||

| (5.3) |

where is a constant depending on the model parameters.

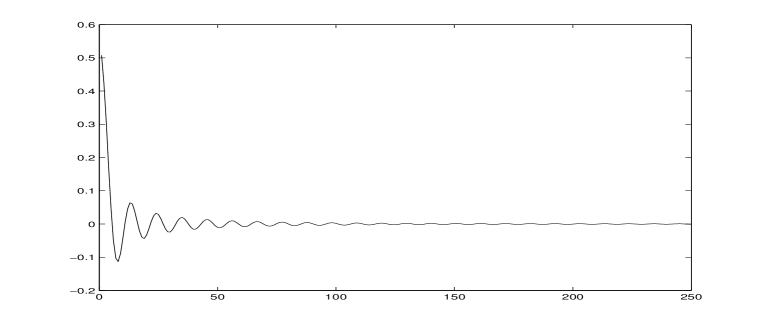

For a visual view of the integrand , we plot it for a given set of parameter values in figure (1). For the numerical computation of the integral we use the four-point adaptive Gauss-Lobatto quadrature with seven point Kronrod refinement provided by Matlab’s ”quadl” routine based on Gander and Gautschi (2000). Numerical convergence can be verified in table (1). Experiments -not reported here- against a mid-point trapezoidal and Simpson’s quadratures confirmed the accuracy of the faster and more convenient adaptive Gauss-Lobatto algorithm. For the outer integral appearing in the formula (4.4), some experimentation shows that Simpson’s rule with at worst two quadrature points per quarterly spread payment period is usually enough for convergence of the numerical approximation, while using the spread payment dates as the only quadrature points in most cases leads to a good accuracy.

| Integral bound: N | ||||||

|---|---|---|---|---|---|---|

| Numerical integral | -0.75859 | -0.76983 | -0.77173 | -0.77178 | -0.77178 | -0.77178 |

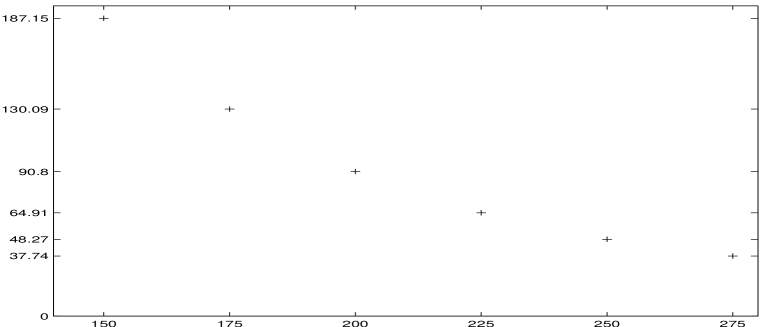

In figure (2) we present some numerical results for payer default swaption prices for different strikes, obtained using the quasi-analytic formula developed33endnote: 3Notice that the jumps in the intensity process can only take positive values. If one thinks in terms of zero-mean shocks, the long term mean reversion level of the process including jumps is no longer the purely diffusive long term mean but the larger as summarized in the following equivalent way of writing the dynamics of the process : where the jump increment has been centered by subtracting its mean. This is why, in particular, we find a fair value of the underlying forward default swap rate about 204 bps when both the initial condition and the basic long term mean are much smaller. . These are for a homogenous non-shifted version of the model with constant short rate. The set of parameters used are reported on the figure.

5.1 Consistency with volatility smile

In this section, we present some numerical results concerning the behavior of the model for some parameter values. Our main focus is on the implied volatility smile that can be generated by the model. The model potentially allows one to mark-to-market (or rather mark-to-model) non-ATM default swaptions that may be present on a trading book. This task cannot be fulfilled with the market model unless we use ATM implied volatility to value all options, which should not be acceptable from a risk management perspective. On the other hand, our intensity model can be calibrated to the default swap term structure and traded ATM default swaptions to price other default swaptions more consistently.

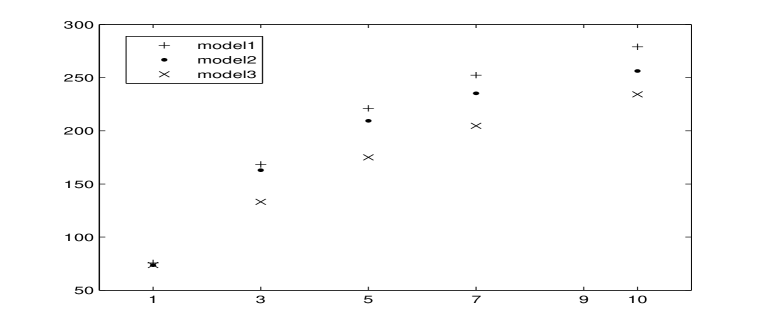

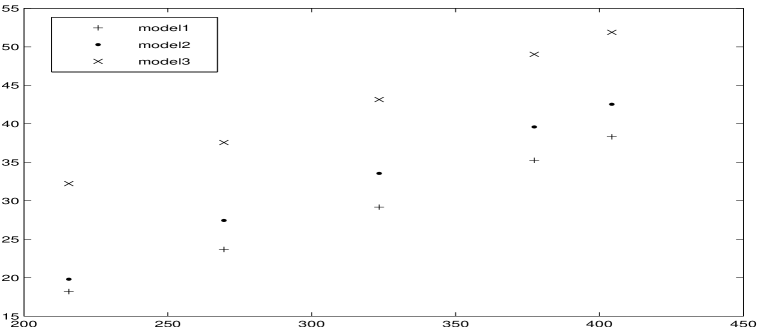

To visualize the implied volatility pattern that can be generated by the model, we present the numerical results obtained with three different values of the vector of parameters. The parameters values are collected in table (2).

| Reference | ||||||

|---|---|---|---|---|---|---|

| Model1 | 0.0007 | 0.4066 | 0.0515 | 0.1507 | 0.5009 | 0.0050 |

| Model2 | 1.3E-06 | 0.4851 | 0.0457 | 0.2000 | 0.5009 | 0.0050 |

| Model3 | 0.005 | 0.2281 | 0.0134 | 0.0782 | 1.5000 | 0.0067 |

We plot in figure (3) the CDS term structures generated by the different models.

Implied volatility smiles generated from model prices of payer default swaptions with various strikes for these models are in figure (4). Note that the model implies a plausible upward sloping volatility smile. It is also noticeable that the presence of a significant jump component can result in higher implied volatilities than a model with a less important jump component even when the last one results in a steeper CDS term structure.

6 Concluding remarks

The SSRJD model can fit the current default swap term structure while being consistent with some dynamic future deformations and implying a volatility smile for default swaptions. The quasi-analytic formula presented in this paper permits fast and accurate pricing of default swaptions. Hence, the model could be calibrated to the CDS term structure and a few default swaptions, to price and hedge other credit derivatives consistently.

References

- (1) Ben Ameur, H., Brigo, D., and Errais, E. (2005): Pricing credit default swaps Bermudan options: An approximate dynamic programming approach. Working paper.

- (2) Bielecki, T., and M. Rutkowski (2001): Credit risk: Modeling, Valuation and Hedging. Springer.

- (3) Black, F. (1976): The pricing of commodity contracts, Journal of Financial Economics Vol. 3, pp. 167-179.

- (4) Brigo, D. (2005): Market models for CDS options and callable floaters, Risk, January issue. Also in: Derivatives Trading and Option Pricing, Dunbar N. (Editor), Risk Books.

- (5) Brigo, D., and A. Alfonsi (2003): Credit default swaps calibration and option pricing with the SSRD stochastic intensity and interest-rate model. Available at http://www.damianobrigo.it/cirppcredit.pdf.

- (6) Brigo, D., and L. Cousot (2006): A Comparison between the SSRD Model and the market model for CDS options pricing, International Journal of Theoretical and Applied Finance, Vol. 9, n. 3, pp. 315-339.

- (7) Brigo, D., and Pallavicini, A. (2006): Counterparty risk valuation under correlation between interest-rates and default. Working paper.

- (8) Christensen, J. H. (2002): Kreditderivater og deres prisfastsættelse. Thesis, Institute of Economics, University of Copenhagen.

- (9) Cox, J.C., Ingersoll, J.E., and Ross, S.A. (1985): A theory of the term structure of interest rates, Econometrica Vol. 53, pp. 385-407.

- (10) Duffie, D., Filipovic, D. and Schachermayer, W. (2003): Affine processes and applications in finance, Annals of Applied Probability, Vol. 13, n. 3, pp. 984-1053.

- (11) Duffie, D., and Garleanu, N. (2001): Risk and valuation of collateralized debt obligations, Financial Analysts Journal, Vol. 57, n. 1, pp. 41-59.

- (12) Duffie, D., Pan, J., and Singleton, K. (2000): Transform analysis and asset pricing for affine jump-diffusions, Econometrica Vol. 68, n. 6, pp. 1343-1376.

- (13) Duffie, D., Schroder, M., and Skiadas, C. (1996): Recursive valuation of defaultable securities and the timing of resolution of uncertainty. Annals of Applied Probability, Vol. 6, n. 4, pp. 1075-1090.

- (14) Gander, W., and W. Gautschi (2000): Adaptive Quadrature - Revisited, BIT Numerical Mathematics, Vol. 40, n. 1, pp. 84-101.

- (15) Hull, J. White, A. (2003): The Valuation of credit default swap options. Journal of Derivatives, Vol. 10, n. 3, pp. 40-50.

- (16) Jamshidian, F. (1989): An Exact Bond Option Formula, Journal of Finance, Vol. 44, pp. 205-209.

- (17) Jamshidian, F. (2004): Valuation of credit default swaps and swaptions. Finance and Stochastics Vol. 8, pp. 343-371.

- (18) Lando, D. (2004): Credit risk modeling: theory and applications. Princeton University Press.

- (19) Pedersen, C. M. (2003): Valuation of portfolio credit default swaptions, Lehman Brothers Quantitative Credit Research.

- (20) Schönbucher, P. (2000): A Libor market model with default risk. Working paper.

- (21) Schönbucher, P. (2004): A measure of survival, Risk, August issue, pp. 79-85.