Ramanujan sums analysis of long-period sequences

and noise

Abstract

Ramanujan sums are exponential sums with exponent defined over the irreducible fractions. Until now, they have been used to provide converging expansions to some arithmetical functions appearing in the context of number theory. In this paper, we provide an application of Ramanujan sum expansions to periodic, quasi-periodic and complex time series, as a vital alternative to the Fourier transform. The Ramanujan-Fourier spectrum of the Dow Jones index over years and of the coronal index of solar activity over years are taken as illustrative examples. Distinct long periods may be discriminated in place of the spectra of the Fourier transform.

pacs:

02.10.De, 05.45.Tp, 89.20-a1 Introduction

Signal processing of complex time-varying series is becoming more and more fashionable in modern science and technology. Indices arising from the stock market, changing global climate, communication networks such as the Internet etc. are widely used tools for business managers or governmental representatives. There already exists a plethora of useful approaches for signal processing of complex data. The oldest and perhaps most widely used method is a Fourier analysis and its “fast” implementation: the fast Fourier transform (or FFT). Other complementary techniques such as wavelet transforms, fractal analysis and autoregressive moving average models (ARIMA) were developed with the aim of identifying useful patterns and statistics in otherwise seemingly random sequences [1].

Ramanujan sums are defined as power sums over primitive roots of unity. One can use an orthogonal property of these sums (closely related to the orthogonal property of trigonometric sums) to form convergent expansions of some arithmetical functions related to prime number theory [2, 3]. Following the ideas of Gadiyar and Padma [4], the first author proposed to expand the domain of application of Ramanujan sum analysis from number theory to arbitrary real time series and introduced the concept of a Ramanujan-Fourier transform [5]. This earlier work remained quite ambiguous about the detection of isolated periods. Ramanujan sum expansions of divisor sums, sums of squares, and the Mangoldt function are well known. Surprisingly, the detection of a singly periodic signal by the Ramanujan sum analysis has not been considered before. But the Ramanujan-Fourier amplitude corresponding to a single cosine function of period is extremely simple: as we shall see, the amplitude of the cosine function is simply scaled by the cosine of the delay and the inverse of the Euler totient function . Similarly to the standard discrete Fourier transform, there are spurious signals of magnitude , depending of the length of the averaging spectrum.

In the discrete Fourier transform, a sample to be analyzed is discretized into pieces of length and the expansion is performed over the -th complex dimensional vectors of the orthogonal basis , (). The orthogonal property reads , where is the Kronecker symbol. The expansion of a time series is with Fourier coefficients , where the summation runs from to . In the Ramanujan-Fourier transform, the expansion over the Ramanujan sums (see Sec. 2) involves the resolution at every single scale from to . The deep principle behind rests on a very intricate link between the properties of irreducible fractions and prime numbers [2]-[5]. As a result, one finds a much finer structure of time series, with a variety of novel features.

The paper is organized as follows. In Sec. 2, we remind the reader with the arithmetical properties of Ramanujan sums, provide the definition of the Ramanujan-Fourier transform and examine the detection of a cosine signal. In Sec. 3, the use of the method is illustrated on the data from the stock market and solar activity.

2 Ramanujan sums and the Ramanujan-Fourier transform

Ramanujan sums are real sums defined as -th powers of -th primitive roots of the unity,

where the summation runs through the ’s that are coprime to (hence the use of the symbol “′”), being first introduced in the context of number theory [2, 3] for obtaining convergent expansions of some arithmetical functions such as the relative sum of divisors of an integer number ,

They are multiplicative when considered as a function of for a fixed value of , which can be used to prove an important relation

In the above relation, the Euler totient function is the number of positive integers less than and coprime to it. The Möbius function, , vanishes if contains a square in its (unique) prime number decomposition ( a prime number), and is equal to if is the product of distinct primes. One can readily checks the following orthogonal property

For an arithmetical function possessing a Ramanujan-Fourier expansion

with Ramanujan-Fourier coefficients , one can write a Wiener-Khintchine formula, relating the autocorrelation function of and its Ramanujan-Fourier power spectrum,

This relation was used for counting the number of prime pairs within a given interval [4]. A similar formula has been proposed for the convolution and cross-correlation [6].

Clearly, the Ramanujan sum analysis of an arithmetical function looks like the Fourier signal processing of a time series at discrete time intervals . This formal analogy was developed in [5] for the processing of time series with a rich low frequency spectrum [7]. Ramanujan signal processing was further developed in the context of quantum information theory [8] eventually leading to an original approach of quantum complementarity [9]. The Ramanujan-Fourier transform was also used for processing time series of the shear component of the wind at airports [10], the structure of amino-acid sequences [11] and in relation to the fast Fourier transform [12]. All these applications make use of the property that for arithmetical functions possessing a mean value

one can write the inversion formula

Ramanujan-Fourier transform of a cosine function

Let us consider now the Ramanujan signal processing of a periodic (cosine) function of period

The Ramanujan-Fourier coefficients read

in which the order of summations is reversed and “c.c.” stands for the complex conjugate. Assume first that is a multiple of the period . Then the -th summation is zero unless is a positive integer. For instance, can be non-zero if under the conditions that divides and , i. e. (otherwise , which is outside the range of summation of the sum). One then gets

The -th summation equals zero unless divides , otherwise it equals to . As a result, the amplitude of the -th line reflects the amplitude of the periodic signal as

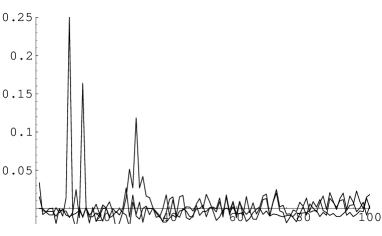

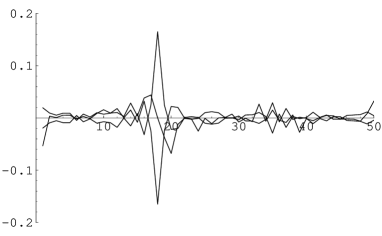

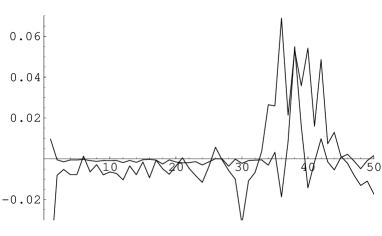

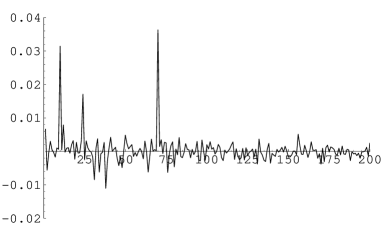

In general, is not a multiple of so that there exists an extra contribution to the amplitude, of order of magnitude . As long as the period is much smaller than the length of the sample, i. e. , one observes a single line at ; otherwise bursts of non-zero amplitudes emerge in the vicinity of the lines — see Figs. 1–3.

Thus, there are two significant differences when compared to a period analysis by the standard discrete Fourier transform. First, the amplitude of the line at the period is scaled by a factor of . Second, the Ramanujan-Fourier analysis is sensitive to the delay . The latter feature may, at first sight, seem as a drawback since some period of the signal to be analyzed may be hidden by the dephasing effect. One method to circumvent this difficulty is to average the spectra corresponding to several shifted samples of the signal.

Ramanujan-Fourier transform of a period modulated cosine function

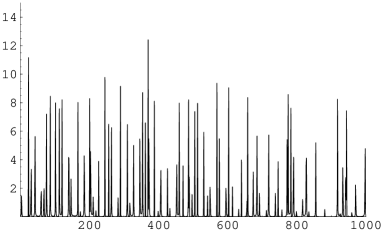

Let us now apply the approach to a period modulated cosine function. We intentionally select a period modulation with a large index (equal to ). The selected modulation is

with and . The sample length is . Due to a high modulation index, the FFT analysis (shown in Fig. 4) does not easily allow to recover the constituent integer periods and . In contrast, the Ramanujan sum analysis is very powerful in this context. From Fig. 5 one clearly identifies (positive) large amplitudes at the periods , , and (LCM being the least common multiple). Thus, for an input signal of the period and period modulation , the FFT exhausts all lines at ( and integers), eventually leading to a continuous spectrum in the limit of incommensurate periods and . In contrast, the Ramanujan-Fourier transform is straightforward in identifying the input modulation.

3 Ramanujan sums analysis of some complex systems

As a nice illustration of the above-outlined properties the Ramanujan sum analysis, we shall analyze a couple of complex time series taken form the stock market and solar activity.

The Dow Jones index of the stock market

The first time series deals with the Dow Jones index and has been downloaded from

http : // www.optiontradingtips.com/resources/historical - data/dow-jones30.html.

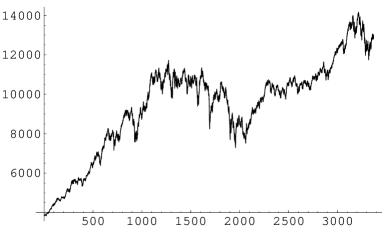

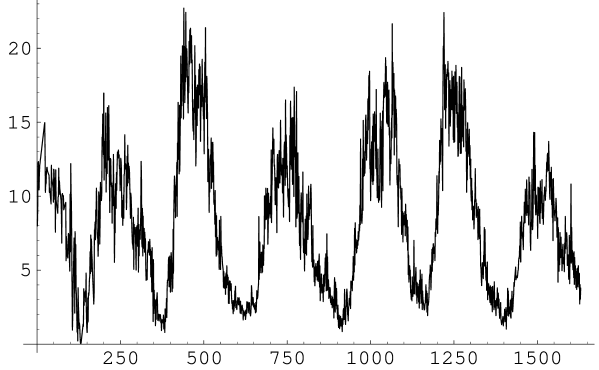

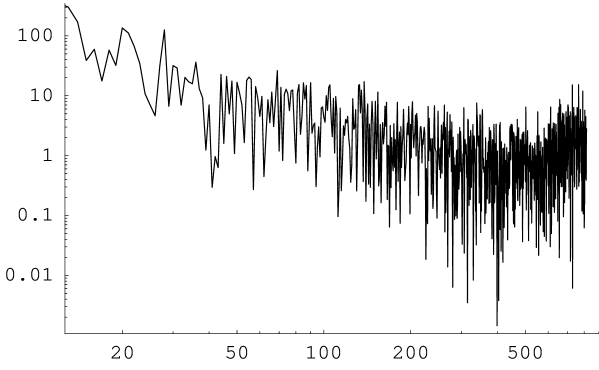

Fig. 6 depicts the evolution of Dow Jones 30 Industrials stock

price over about years. The power spectral density of the

prices (Fig. 8) approximately follows a law versus the

Fourier frequency , compatible with a

Brownian-motion-based model [13, 14]. The

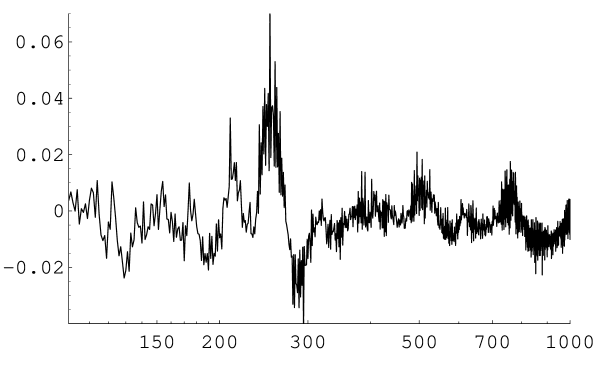

Ramanujan-Fourier analysis shown in Fig. 7 yields a more detailed

structure with many (positive or negative) peaks centered at

well-identified frequencies. There exists a sensitivity of the

amplitude of the peaks (not shown) on the number of data, but

the position of the peaks, as well as their statistics, is not

dependent on . Since both spectra in Figs. 6 and 7 are given in

a logarithmic time-scale, it follows that the Ramanujan sum

analysis provides a clear advantage over the standard Fourier

analysis in offering a rich and structured signature. Here, we

shall not delve any further into the origin of this structure,

which will be a topic of a separate paper.

The coronal index of the solar activity

The second time series has been picked up from

http : // www.ngdc.noaa.gov/stp/SOLAR/ftpsolarcorona.html#index.

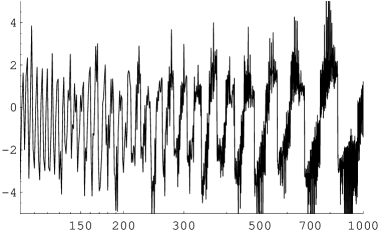

It represents the Green Line (FeXIV 530.3 nm) Coronal Index of

solar activity from 1939 to 2008. One easily recognizes from Figs.

9 and 10 that the coronal index is approximately periodic, with a

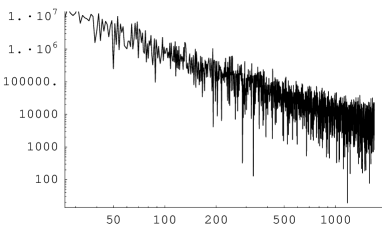

period about 10 years. The whole FFT spectrum shown in Fig 11

exhibits a dependence characteristic of many physical,

biological, arithmetical [7, 5, 15] and

other complex systems [15].

Perspectives and Conclusion

It is a widely shared belief that noises are so random that non-statistical models of them are currently out of reach. A counterexample to this belief can be found in [7], in which an arithmetical approach to noise was suggested. In the present paper, we offer another perspective by analyzing the data from an arithmetical magnifying glass built on Ramanujan sums. The Ramanujan-Fourier transform is able to extract quasi-periodic features which are characteristic of number theoretical functions [2]-[5], as well as fine periodic features that the standard Fourier transform may hide. A Ramanujan sums analysis is a multi-scale prism with scales related to each other by the properties of irreducible fractions. It is particularly well-suited for analyzing rich time series showing a () FFT dependence. We selected two specific complex systems to illustrate the power of this new method: the data from the stock market (for which the price index FFT follows a -law) and those from solar cycle activity (for which the coronal index follows a -law). A more detailed examination of the latter will be given in a separate paper.

Bibliography

References

- [1] J D Hamilton 1994 Time series analysis Princeton University Press (Princeton).

- [2] S Ramanujan 1918 On certain trigonometrical sums and their applications in the theory of numbers Trans Camb Phil Soc 22 259.

- [3] G H Hardy 1921 Note on Ramanujan’s trigonometrical function and certain series of arithmetical functions Proc Camb Phil Soc 20 263.

- [4] H G Gadiyar and R Padma 1999 Ramanujan-Fourier series, the Wiener-Khintchine formula and the distribution of prime pairs Physica A 269, 503-510; 2006 Linking the circle and the sieve: Ramanujan-Fourier series Preprint math/0601574.

- [5] M Planat, H Rosu and S Perrine 2002 Ramanujan sums for signal processing of low frequency noise Phys Rev E 66, 056128.

- [6] J Washburn 2008 Convolution and cross-correlation of Ramanujan-Fourier series Preprint 0805.0284 [math.NT].

- [7] M Planat 2001 noise, the measurement of time and number theory Fluc and Noise Lett 1 R65.

- [8] M Planat and H Rosu 2003 The hyperbolic, the arithmetic and the quantum phase J Opt B 6, S583; Cyclotomy and Ramanujan sums in quantum phase-locking Phys Lett A 315, 1-5; M Planat 2006 Huyghens, Bohr, Riemann and Galois: phase-locking Int J Mod Phys B 20, 1833.

- [9] M Planat and H Rosu 2005 Mutually unbiased phase states, phase uncertainties, and Gauss sums Eur Phys J D 36, 133-139.

- [10] M Lagha and M Bensebti 2006 Doppler spectrum estimation by Ramanujan-Fourier transform Preprint cs/0610108.

- [11] L T Mainardi, L Pattini and S Cerutti 2007 Application of the Ramanujan-Fourier transform for the analysis of secondary structure content in amino acid sequences Methods in Med 46 126-9.

- [12] S Samadi, M O Ahmad and M N S Swamy 2005 Ramanujan sums and discrete Fourier transforms IEEE Signal Proc Letters 12, 293-96.

- [13] M F M Osborne 1959 Brownian motion in the stock market Operations Research 7, 145-173.

- [14] J P Bouchaud and M Potters 2000 Theory of financial risk Cambridge University Press (Cambridge).

- [15] W Li A bibliography on noise http://www.nslij-genetics.org/wli/1fnoise/